- PI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-I Filing

Impinj (PI) SC TO-IIssuer tender offer statement

Filed: 18 Apr 18, 12:00am

Stock Option Exchange Program April 18, 2018 Exhibit (a)(1)(H)

What is the Offer? Why is Impinj making the Offer? Am I eligible to participate? Which of my options are eligible? What will I receive if I participate? When will the new options vest? When must I decide? How do I learn more? How do I make the election? What are the tax implications of participating in the Offer? Important considerations Questions Agenda Appendix Offer Website Questions/Examples

1. What is the offer? A one-time, voluntary opportunity for eligible employees who hold underwater, eligible options to exchange them for: new options reduced by fixed ratios, that have an exercise price per share equal to the closing price of Impinj stock on the date the offer expires, and that are subject to a new vesting schedule and term

Many of our employees are holding options with exercise prices significantly above the current market price for shares of Impinj stock The exchange program is meant to improve the retention and incentive value of Impinj’s equity compensation 2. Why is Impinj making the Offer?

You are eligible if: you are an employee of Impinj as of the date the Offer starts (April 18, 2018), you remain employed until the Offer expires (May 16, 2018, unless the offering period is extended) and you hold eligible options (“eligible employees”) 3. Am I eligible to participate? Members of our board of directors, including the CEO, are not eligible employees

Stock options to purchase shares of Impinj common stock that: have a per share exercise price equal to $21.72 or higher, are outstanding and unexercised as of the expiration date (May 16, 2018, unless the offering period is extended), and were granted under Impinj’s 2016 Equity Incentive Plan Vested and unvested options are eligible You can view your eligible options on our Offer website 4. Which of my options are eligible?

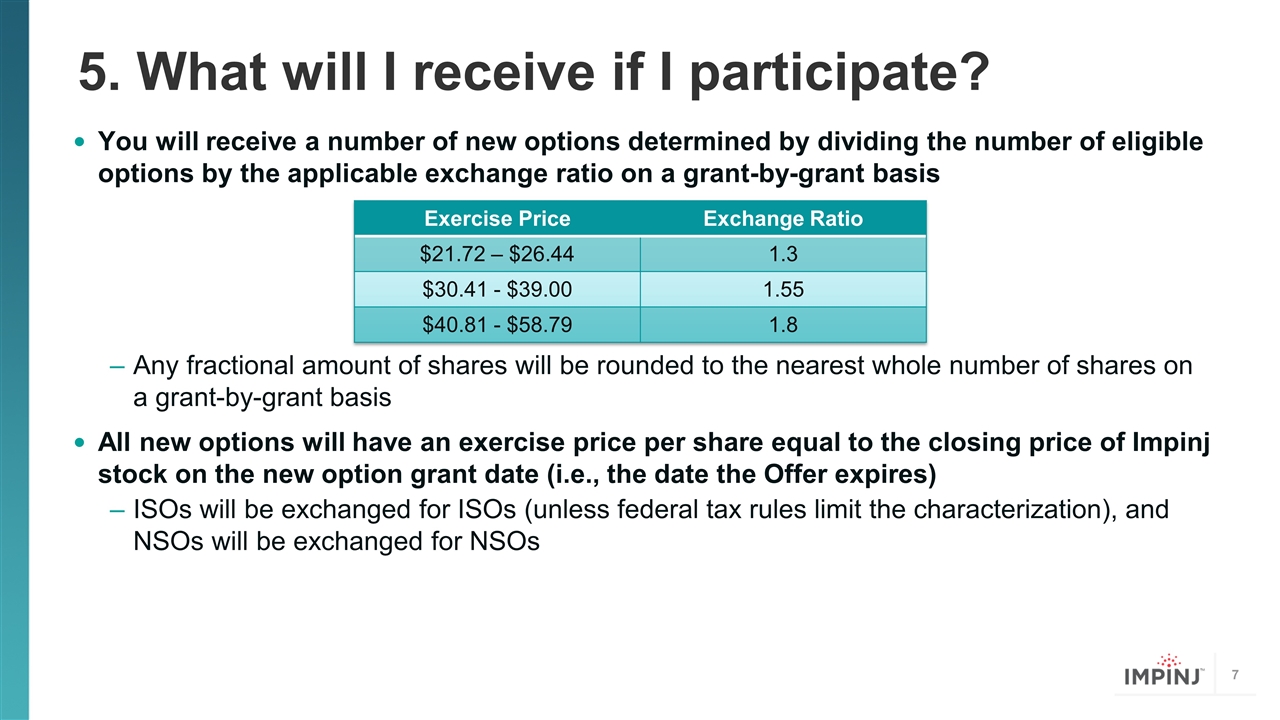

You will receive a number of new options determined by dividing the number of eligible options by the applicable exchange ratio on a grant-by-grant basis Any fractional amount of shares will be rounded to the nearest whole number of shares on a grant-by-grant basis All new options will have an exercise price per share equal to the closing price of Impinj stock on the new option grant date (i.e., the date the Offer expires) ISOs will be exchanged for ISOs (unless federal tax rules limit the characterization), and NSOs will be exchanged for NSOs 5. What will I receive if I participate? Exercise Price Exchange Ratio $21.72 – $26.44 1.3 $30.41 - $39.00 1.55 $40.81 - $58.79 1.8

All new options will be unvested on the new option grant date The new option grant date will be the Offer expiration date (May 16, 2018, unless the offering period is extended) All new options will be subject to a new vesting schedule Vesting is subject to your continued service with Impinj through the applicable vesting dates The maximum term for the new options will be 10 years 6. When will the new options vest? Exchanged Options Extended vesting of new options Old Options Vested as of the new option grant date Unvested as of the new option grant date New Options Will vest on six-month anniversary of the new option grant date Will vest six months after original vesting schedule

7. When must I decide? If you choose to participate, you must elect by May 16, 2018 at 9:00 pm PT (unless extended) (the “expiration date”) You may change or withdraw your election at any point before the expiration date. All valid elections made as of the expiration date are final. New options are scheduled to be granted on the same calendar day as the expiration date

Read the launch email from Chris (“Launch Email”) Contains a link to the Impinj Offer website with login information Includes as attachments the Offer to Exchange Certain Outstanding Stock Options for New Stock Options (“Offer to Exchange”) and election form Review the Offer to Exchange, election form, and Launch Email These comprise the terms of the Offer Review materials on the Offer website, and ask questions. The Offer website includes personalized information about eligible options and other aspects of the Offer Contact the legal department if you have a request or additional questions 8. How do I learn more?

Participation is voluntary; you can choose not to participate If you do nothing, you will be deemed not to have participated in the Offer – no changes will be made to your eligible options If you choose to participate, you must complete the election process as described in the Offer documents By 9:00 pm PT on Offer expiration date, currently May 16, 2018 On the Offer website, or by fax See the Launch Email for login details for the website, and for the correct fax number You can change your election and even withdraw from participation via the Offer website or fax, by delivering a new election form which must be received by 9:00 pm PT on the Offer expiration date Elections, changes or withdrawals submitted by any other means, e.g., email, hand delivery, interoffice, U.S. mail, Federal Express, are not permitted 9. How do I make the election?

For U.S. taxpayers, the exchange generally should not be subject to tax at the time of the exchange For non-U.S. taxpayers, tax implications may differ A summary of expected tax implications outside of the US can be found in the schedules to the Offer to Exchange document You should consult your tax advisor to determine the personal tax consequences to you of participating in the exchange If you are a taxpayer in more than one country, there may be additional or different tax and social insurance consequences that apply to you 10. What are the tax implications of participating in the Offer?

Participation is voluntary There are risks; review the “Risks of Participating” in the Offer information Cannot guarantee any particular benefit or return Vested options will be exchanged for unvested options Does not guarantee future employment - if you resign or are terminated for any reason and your exchanged option is not vested, it will be canceled Consult your financial, legal and/or tax advisors to weigh the benefits and risks involved in participating in the Offer Impinj does not make any recommendation as to whether you should participate in the Offer 11. Important Considerations

Review the information provided in the Launch Email, the election form and the Offer to Exchange Visit the Offer website at https://impinj.equitybenefits.com, which includes the Offer to Exchange, the election form and the Launch Email You should direct questions about this Offer to the legal department at corplegal@impinj.com or +1 206 812 9776 12. Questions?

Appendix

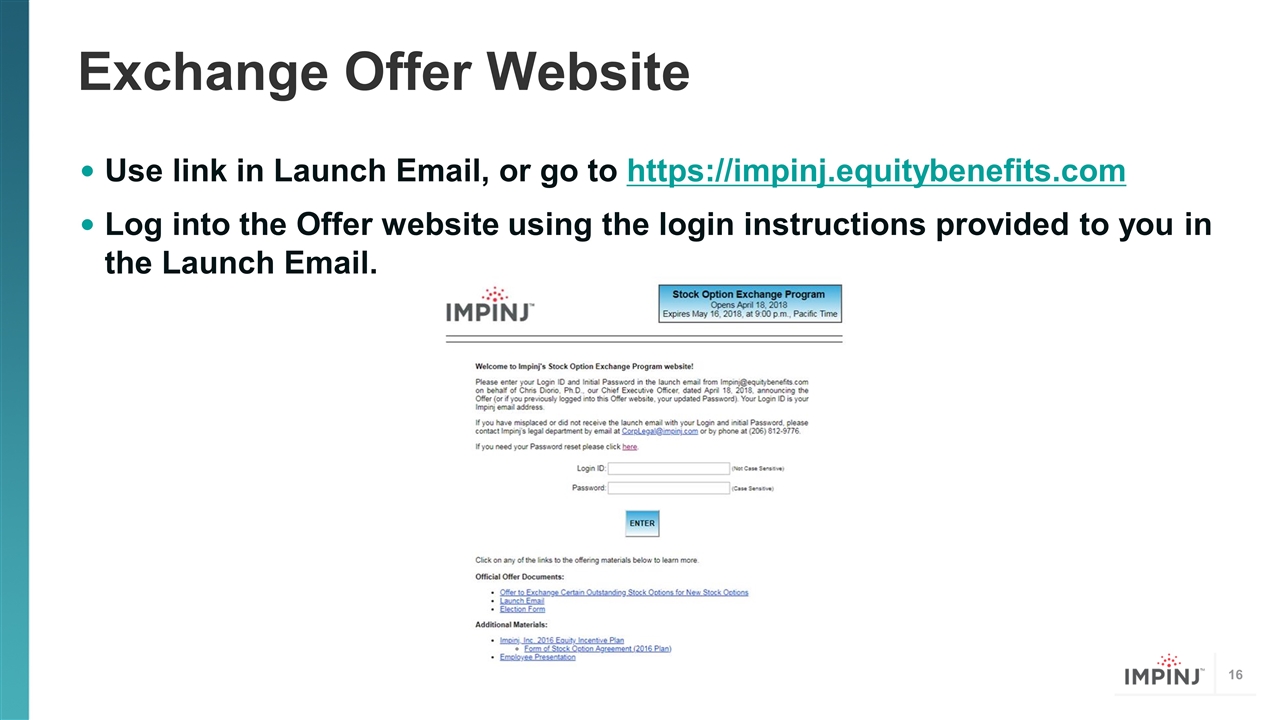

Use link in Launch Email, or go to https://impinj.equitybenefits.com Log into the Offer website using the login instructions provided to you in the Launch Email. Exchange Offer Website

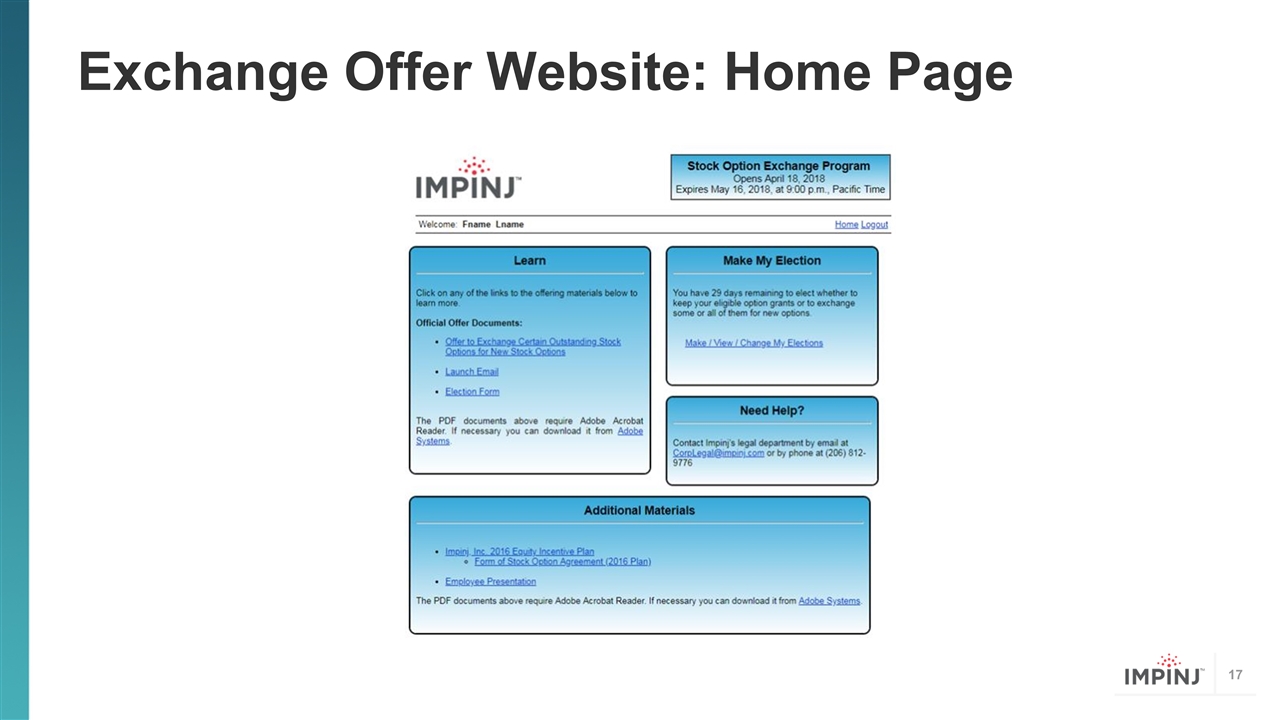

Exchange Offer Website: Home Page

Exchange Offer Website Step 1 – Make My Election

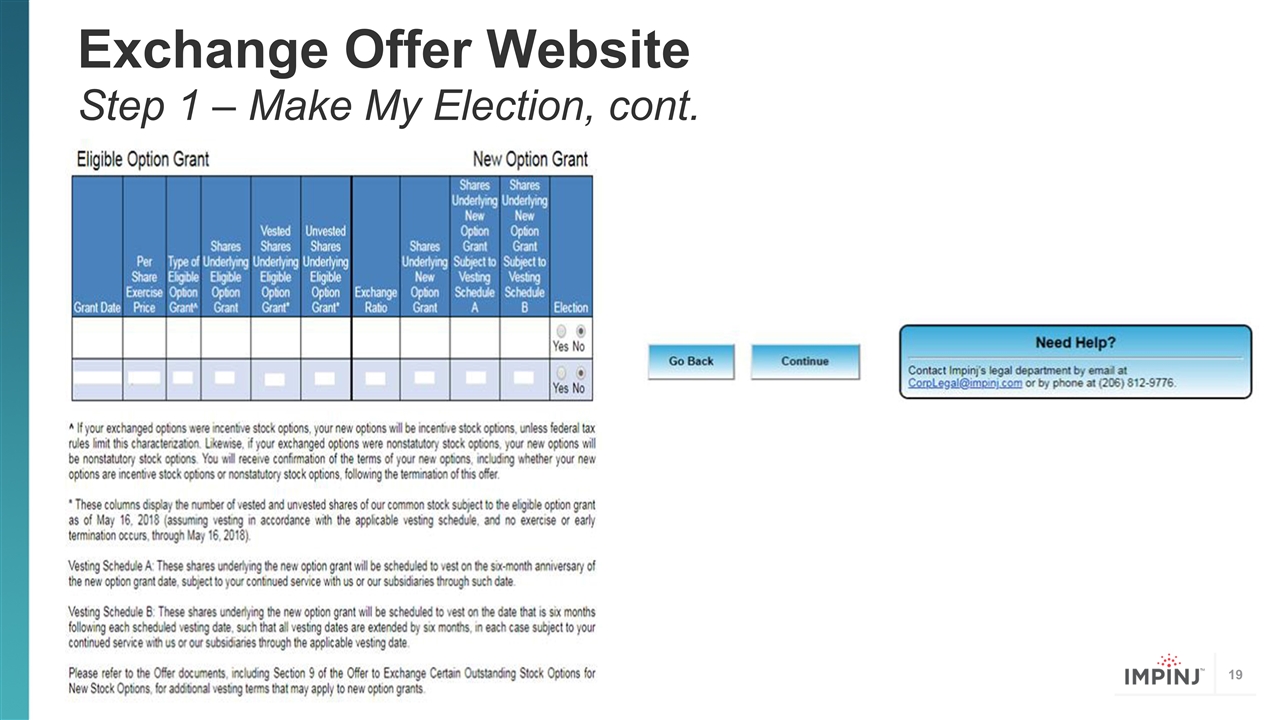

Exchange Offer Website Step 1 – Make My Election, cont.

20

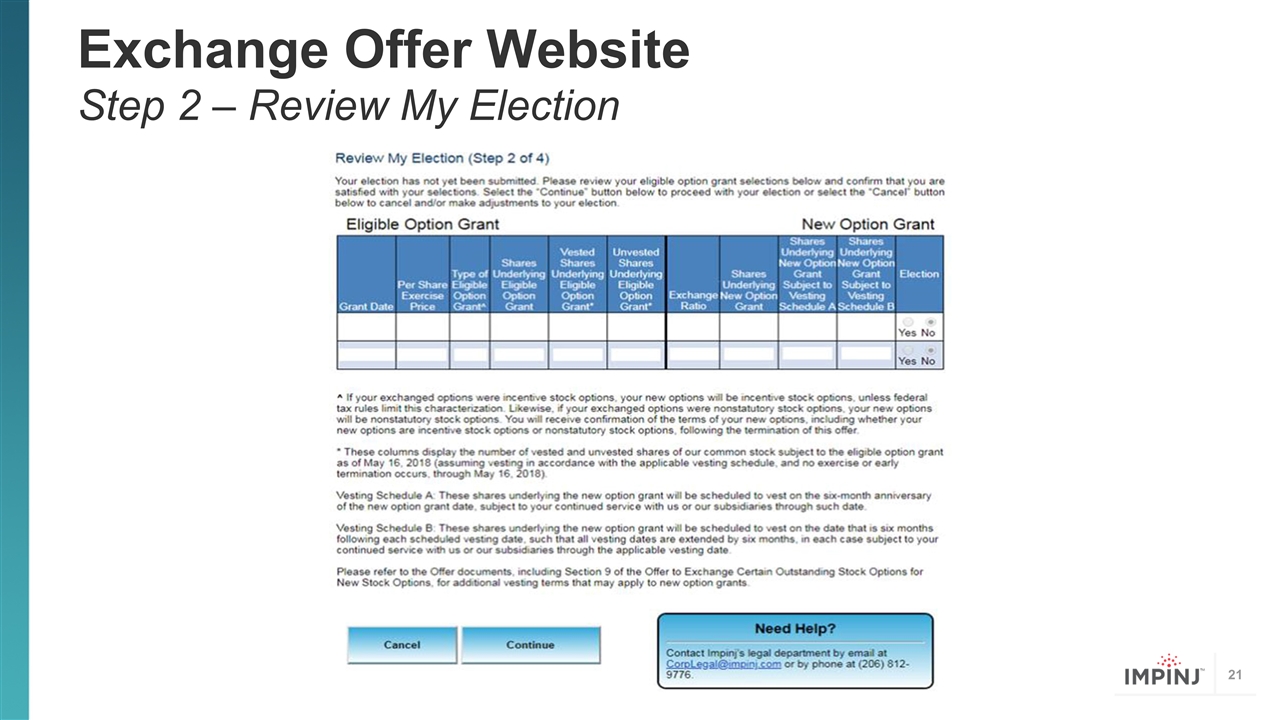

Exchange Offer Website Step 2 – Review My Election

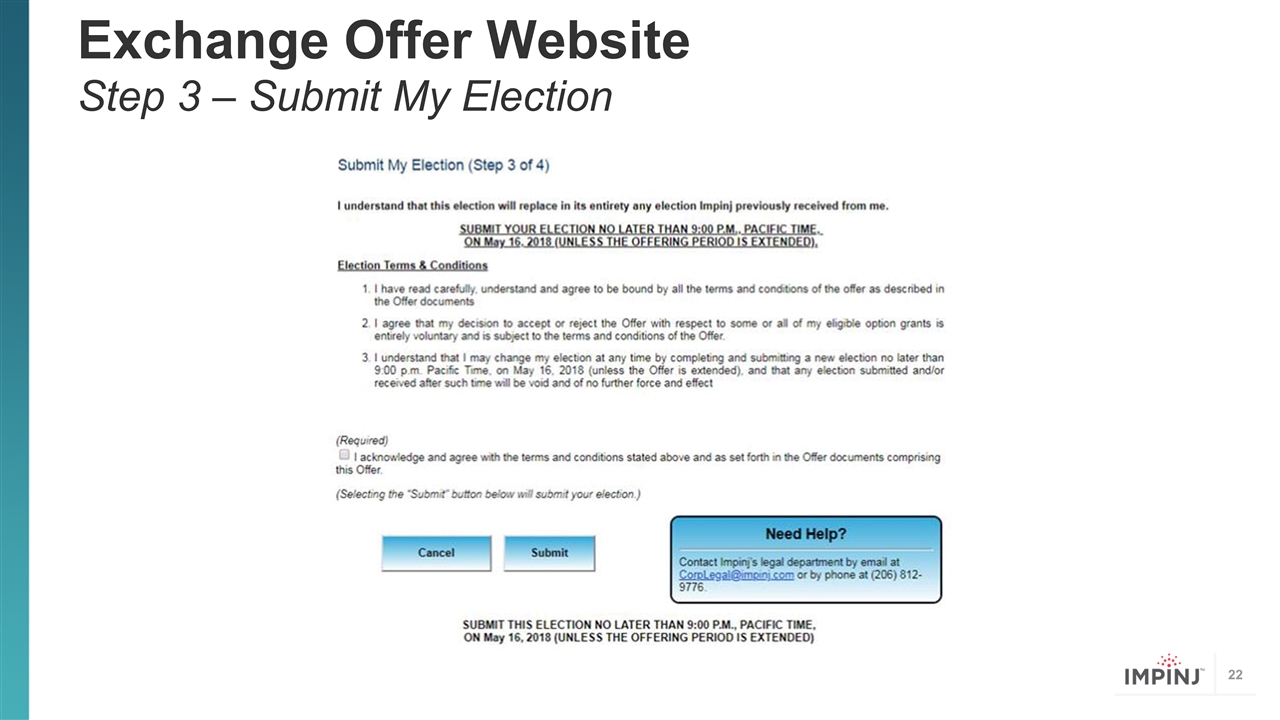

Exchange Offer Website Step 3 – Submit My Election

Exchange Offer Website Step 4 – Print My Election Confirmation

Exchange Offer Website Step 4 – Print My Election Confirmation, cont.

You may elect to exchange any, all or none of your eligible options grants However, with respect to each grant, you must exchange the entire outstanding and unexercised balance of the grant If you have exercised a part of a grant, only the remaining unexercised balance is eligible to be exchanged You may not elect to exchange only a portion (such as the vested portion, the unvested portion, or otherwise) of the eligible options in an individual grant Questions/Examples Do I have to exchange all of my eligible options? 25

Example: You hold eligible option grants (i) to purchase 1,000 shares of our common stock, 200 of which you have already exercised, (ii) to purchase 1,000 shares of our common stock, no portion of which has been exercised, and (iii) to purchase 2,000 shares of our common stock, no portion of which has been exercised You may elect to exchange: The first eligible option grant, covering the entire remaining 800 shares The second eligible option grant, covering 1,000 shares The third eligible option grant, covering 2,000 shares One, two or all three of your three eligible option grants None of your eligible option grants You may not elect to exchange: Less than all of the eligible options in each of your eligible option grants (e.g., with respect to, say, 500 shares in any one of your first, second or third eligible option grants) Questions/Examples How do I change or withdraw my election?

You can change or withdraw your elections with respect to all or some of your eligible option grants at any time before the expiration date, currently expected to be 9:00 pm PT, on May 16, 2018 by submitting a new election form: On the Offer website, log in and proceed to Make My Election, and follow the instructions through to the steps of Review, Submit and Print My Election You can also change/withdraw by submitting a new election form via fax The last election properly received as of the expiration date will be the recorded election Questions/Examples How do I change or withdraw my election?

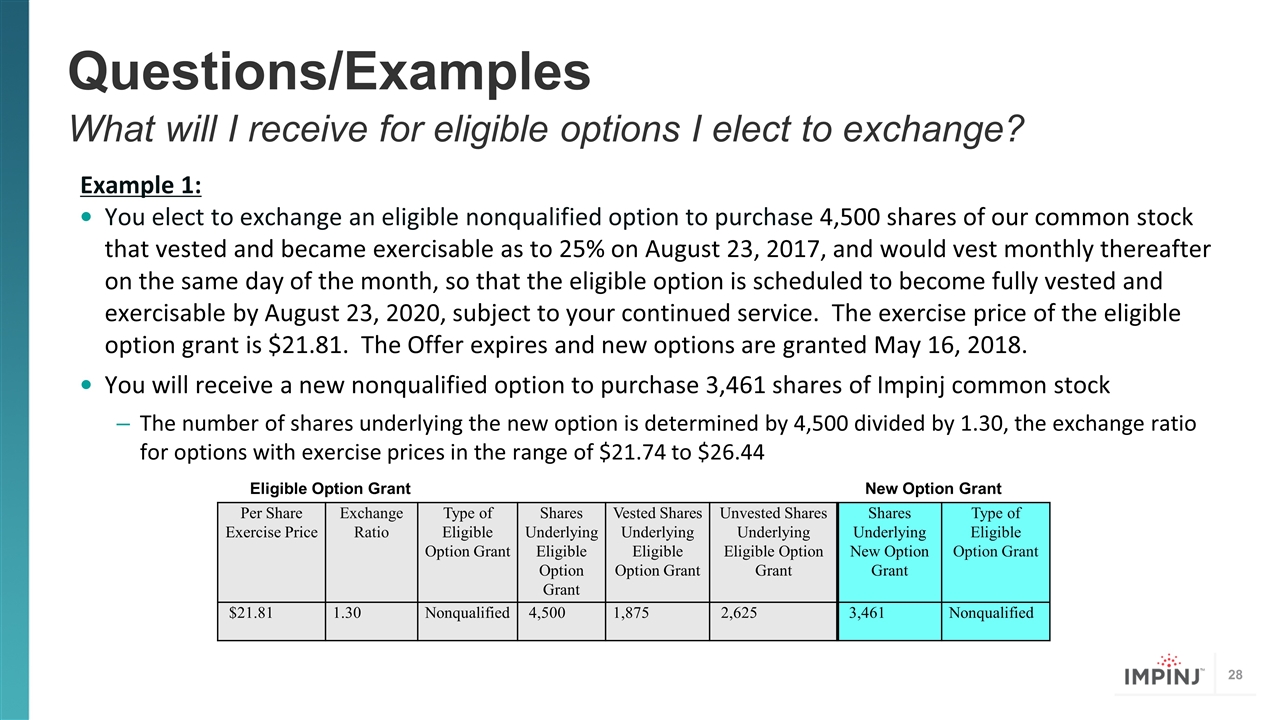

Questions/Examples What will I receive for eligible options I elect to exchange? Example 1: You elect to exchange an eligible nonqualified option to purchase 4,500 shares of our common stock that vested and became exercisable as to 25% on August 23, 2017, and would vest monthly thereafter on the same day of the month, so that the eligible option is scheduled to become fully vested and exercisable by August 23, 2020, subject to your continued service. The exercise price of the eligible option grant is $21.81. The Offer expires and new options are granted May 16, 2018. You will receive a new nonqualified option to purchase 3,461 shares of Impinj common stock The number of shares underlying the new option is determined by 4,500 divided by 1.30, the exchange ratio for options with exercise prices in the range of $21.74 to $26.44 Eligible Option Grant New Option Grant Per Share Exercise Price Exchange Ratio Type of Eligible Option Grant Shares Underlying Eligible Option Grant Vested Shares Underlying Eligible Option Grant Unvested Shares Underlying Eligible Option Grant Shares Underlying New Option Grant Type of Eligible Option Grant $21.81 1.30 Nonqualified 4,500 1,875 2,625 3,461 Nonqualified

Example 1 (cont.): The exercise price of the new option will be the closing price of Impinj stock on the Offer expiration date The new vesting schedule of the new option will be: Scheduled Vesting Date for Eligible Option Scheduled Vesting Date for New Option Number of Shares of our Common Stock Subject to New Option Grant November 16, 2018 1,442 May 23, 2018 November 23, 2018 72 June 23, 2018 December 23, 2018 72 July 23, 2018 January 23, 2019 72 August 23, 2018 February 23, 2019 72 September 23, 2018 March 23, 2019 72 October 23, 2019 April 23, 2019 72 November 23, 2018 May 23, 2019 72 December 23, 2018 June 23, 2019 72 January 23, 2019 July 23, 2019 72 February 23, 2019 August 23, 2019 73 March 23, 2019 September 23, 2019 72 April 23, 2019 October 23, 2019 72 May 23, 2019 November 23, 2019 72 June 23, 2019 December 23, 2019 72 July 23, 2019 January 23, 2020 72 August 23, 2019 February 23, 2020 72 September 23, 2019 March 23, 2020 72 October 23, 2019 April 23, 2020 72 November 23, 2019 May 23, 2020 72 December 23, 2019 June 23, 2020 73 January 23, 2020 July 23, 2020 72 February 23, 2020 August 23, 2020 72 March 23, 2020 September 23, 2020 72 April 23, 2020 October 23, 2020 72 May 23, 2020 November 23, 2020 72 June 23, 2020 December 23, 2020 72 July 23, 2020 January 23, 2021 72 August 23, 2020 February 23, 2021 73

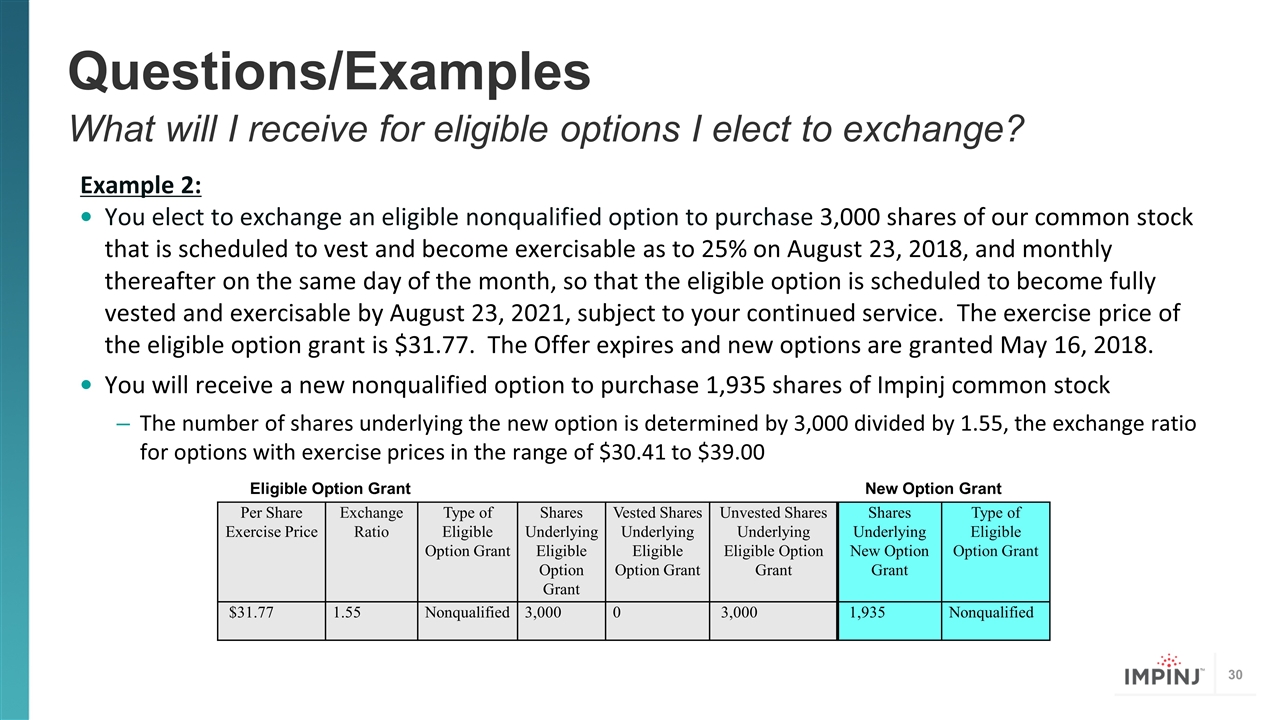

Questions/Examples What will I receive for eligible options I elect to exchange? Example 2: You elect to exchange an eligible nonqualified option to purchase 3,000 shares of our common stock that is scheduled to vest and become exercisable as to 25% on August 23, 2018, and monthly thereafter on the same day of the month, so that the eligible option is scheduled to become fully vested and exercisable by August 23, 2021, subject to your continued service. The exercise price of the eligible option grant is $31.77. The Offer expires and new options are granted May 16, 2018. You will receive a new nonqualified option to purchase 1,935 shares of Impinj common stock The number of shares underlying the new option is determined by 3,000 divided by 1.55, the exchange ratio for options with exercise prices in the range of $30.41 to $39.00 Eligible Option Grant New Option Grant Per Share Exercise Price Exchange Ratio Type of Eligible Option Grant Shares Underlying Eligible Option Grant Vested Shares Underlying Eligible Option Grant Unvested Shares Underlying Eligible Option Grant Shares Underlying New Option Grant Type of Eligible Option Grant $31.77 1.55 Nonqualified 3,000 0 3,000 1,935 Nonqualified

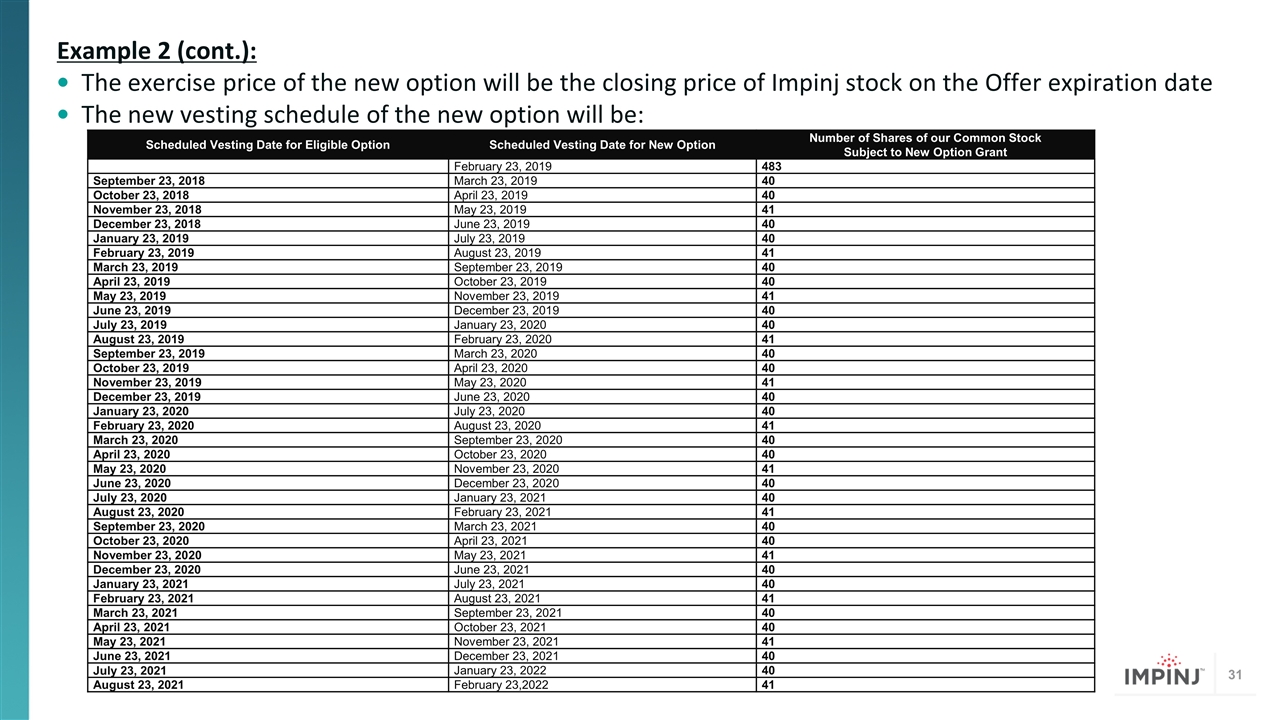

Example 2 (cont.): The exercise price of the new option will be the closing price of Impinj stock on the Offer expiration date The new vesting schedule of the new option will be: Scheduled Vesting Date for Eligible Option Scheduled Vesting Date for New Option Number of Shares of our Common Stock Subject to New Option Grant February 23, 2019 483 September 23, 2018 March 23, 2019 40 October 23, 2018 April 23, 2019 40 November 23, 2018 May 23, 2019 41 December 23, 2018 June 23, 2019 40 January 23, 2019 July 23, 2019 40 February 23, 2019 August 23, 2019 41 March 23, 2019 September 23, 2019 40 April 23, 2019 October 23, 2019 40 May 23, 2019 November 23, 2019 41 June 23, 2019 December 23, 2019 40 July 23, 2019 January 23, 2020 40 August 23, 2019 February 23, 2020 41 September 23, 2019 March 23, 2020 40 October 23, 2019 April 23, 2020 40 November 23, 2019 May 23, 2020 41 December 23, 2019 June 23, 2020 40 January 23, 2020 July 23, 2020 40 February 23, 2020 August 23, 2020 41 March 23, 2020 September 23, 2020 40 April 23, 2020 October 23, 2020 40 May 23, 2020 November 23, 2020 41 June 23, 2020 December 23, 2020 40 July 23, 2020 January 23, 2021 40 August 23, 2020 February 23, 2021 41 September 23, 2020 March 23, 2021 40 October 23, 2020 April 23, 2021 40 November 23, 2020 May 23, 2021 41 December 23, 2020 June 23, 2021 40 January 23, 2021 July 23, 2021 40 February 23, 2021 August 23, 2021 41 March 23, 2021 September 23, 2021 40 April 23, 2021 October 23, 2021 40 May 23, 2021 November 23, 2021 41 June 23, 2021 December 23, 2021 40 July 23, 2021 January 23, 2022 40 August 23, 2021 February 23,2022 41