EXHIBIT 99

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Orient-Express Hotels Ltd

Investor Presentation

New York

June 3, 2003

Orient-Express Hotels

• Global Hospitality and Leisure Company

• Exclusive focus on deluxe luxury market

• 31 Hotels, 4 Restaurants, 5 Trains, 1 River Vessel

• Distinguished Luxury Brand Names

• Orient-Express, Cipriani, Copacabana Palace

• ‘21’ Club, Windsor Court, Ritz Madrid

• Focus on Ownership

• Irreplaceable assets, high barriers to entry

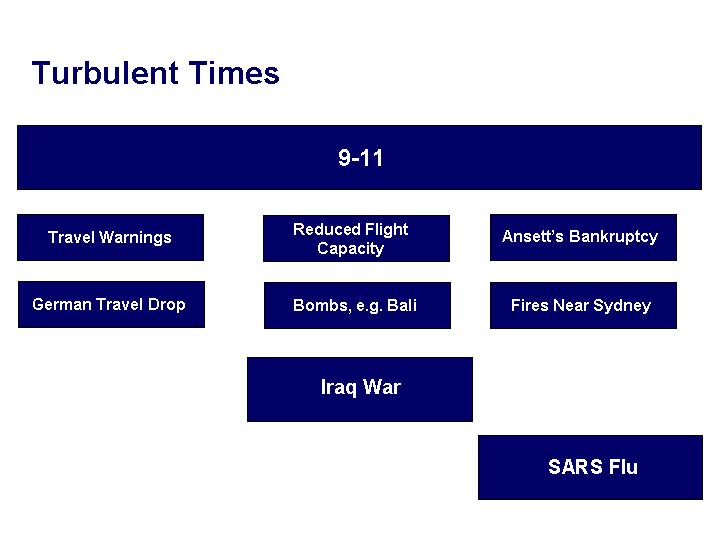

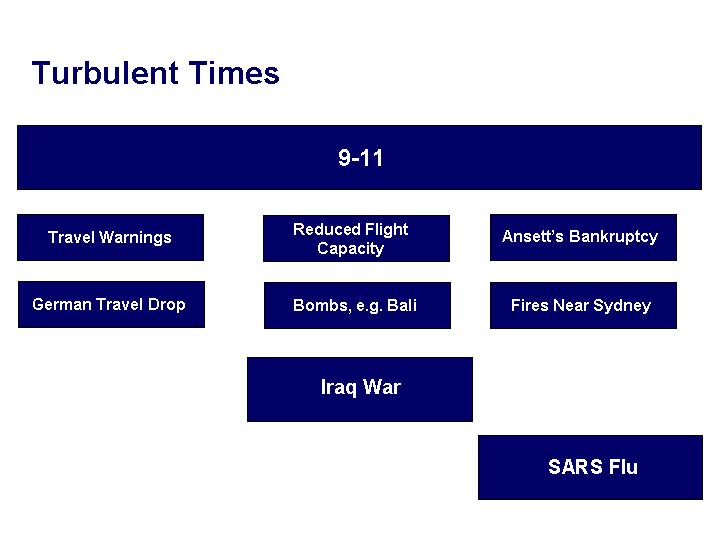

Turbulent Times

[CHART]

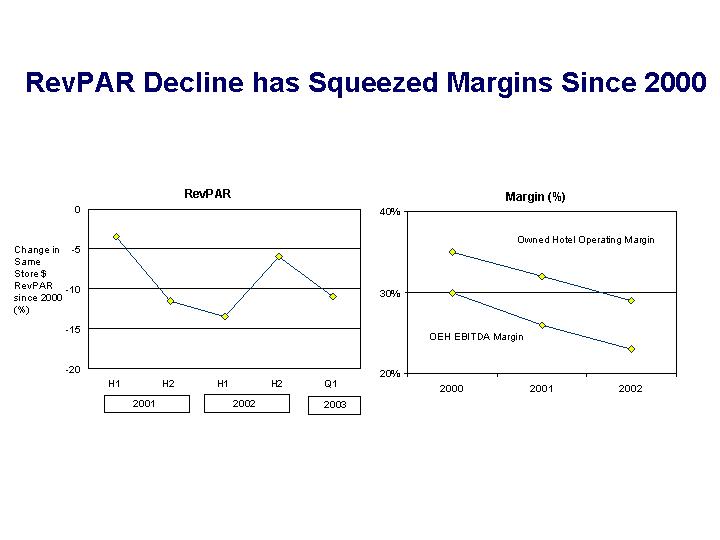

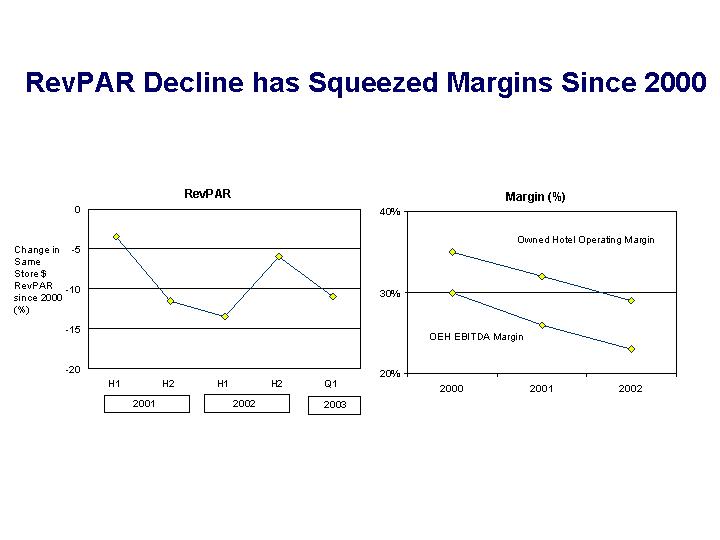

RevPAR Decline has Squeezed Margins Since 2000

RevPAR

[CHART]

Margin (%)

[CHART]

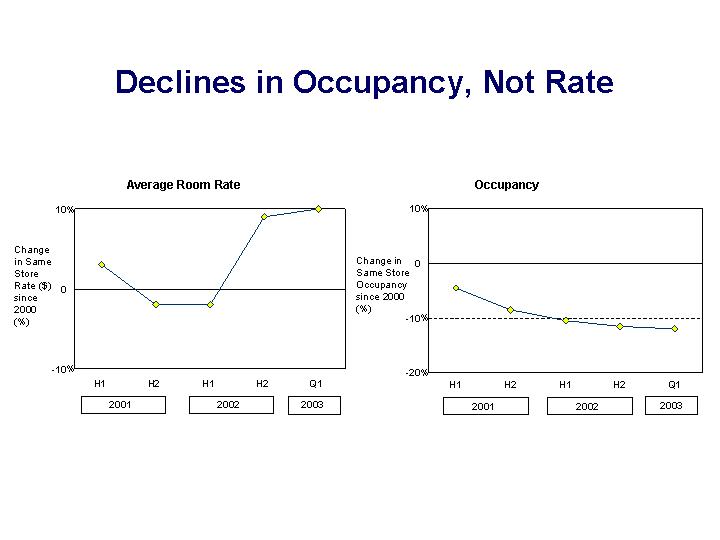

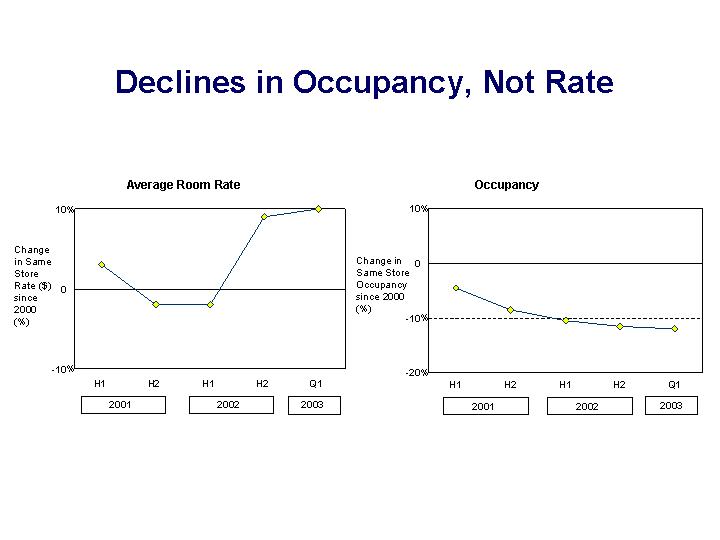

Declines in Occupancy, Not Rate

Average Room Rate

[CHART]

Occupancy

[CHART]

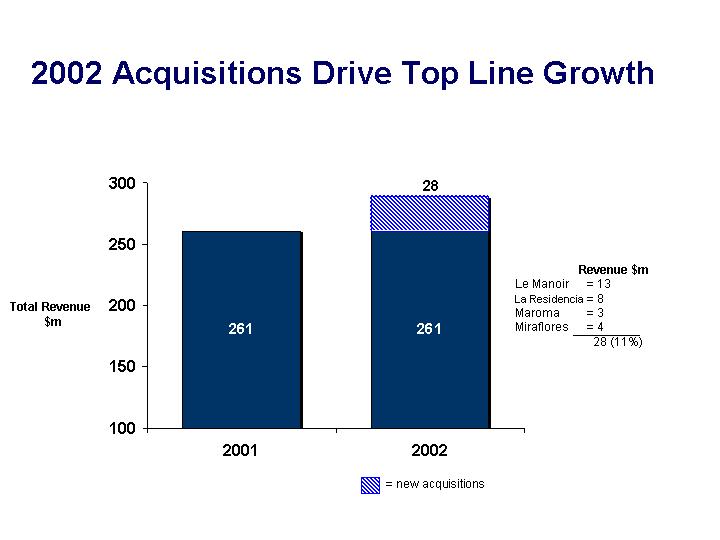

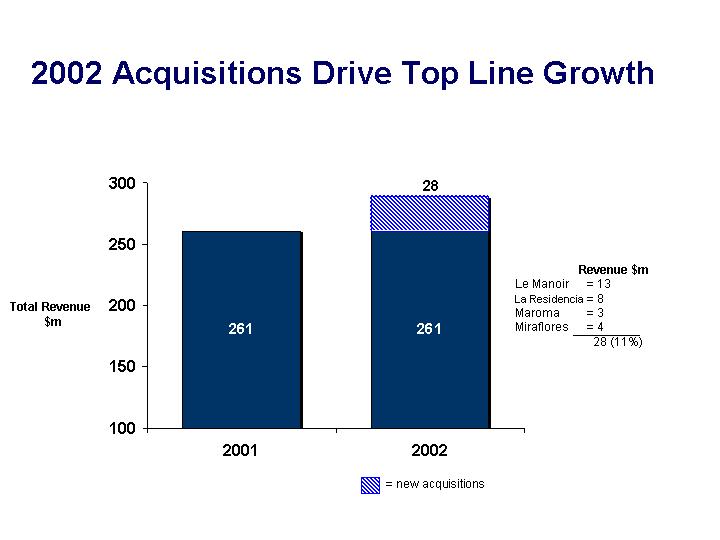

2002 Acquisitions Drive Top Line Growth

[CHART]

| Revenue $m |

Le Manoir | = | 13 | |

La Residencia | = | 8 | |

Maroma | = | 3 | |

Miraflores | = | 4 | |

| | 28 | (11%) |

Acquisitions Build EBITDA Platform for Strong Recovery

[CHART]

Recent

Acquisitions | | EBITDA

Multiple | |

| | | |

Le Manoir | | 7 | x |

La Residencia | | 7 | x |

Maroma | | 10 | x |

Miraflores | | 10 | x |

Weighted Av= 8x

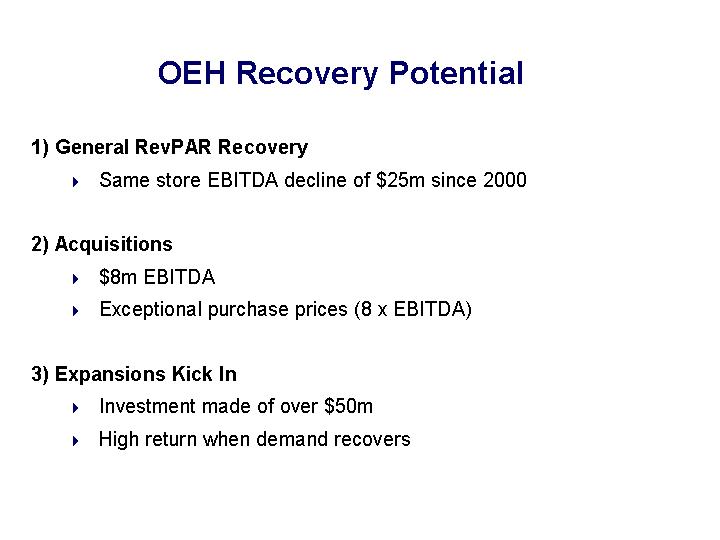

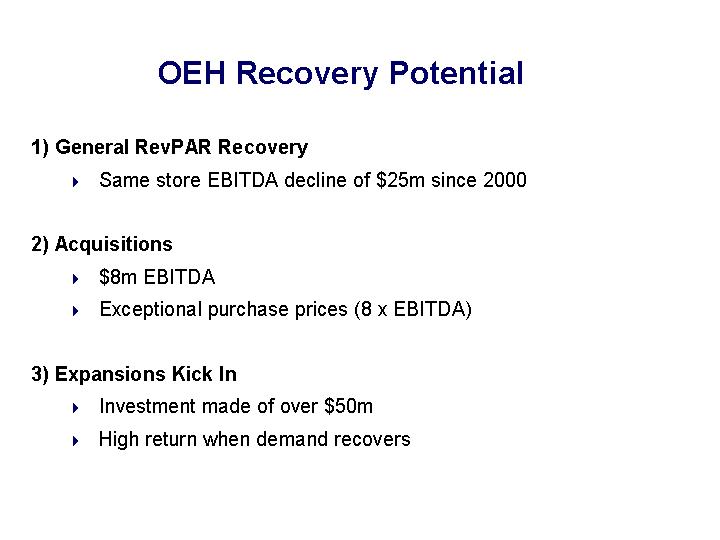

OEH Recovery Potential

1) General RevPAR Recovery

• Same store EBITDA decline of $25m since 2000

2) Acquisitions

• $8m EBITDA

• Exceptional purchase prices (8 x EBITDA)

3) Expansions Kick In

• Investment made of over $50m

• High return when demand recovers

Over $50 Million Recent Expansion

Investments with Good Potential

Inn at Perry Cabin | | 41 new keys, pool, new restaurant and new meeting room |

| | |

Maroma | | 20 additional keys completed |

| | |

Villa San Michele | | 8 additional keys |

| | |

La Residencia | | 2 new presidential suites |

| | |

Cipriani | | New banqueting room and master suite |

| | |

Peru | | New luxury train |

| | |

La Cabana | | Construction of new restaurant |

| | |

Caruso | | Hotel closed pending refurbishment |

| | |

Westcliff | | New conference centre opening soon |

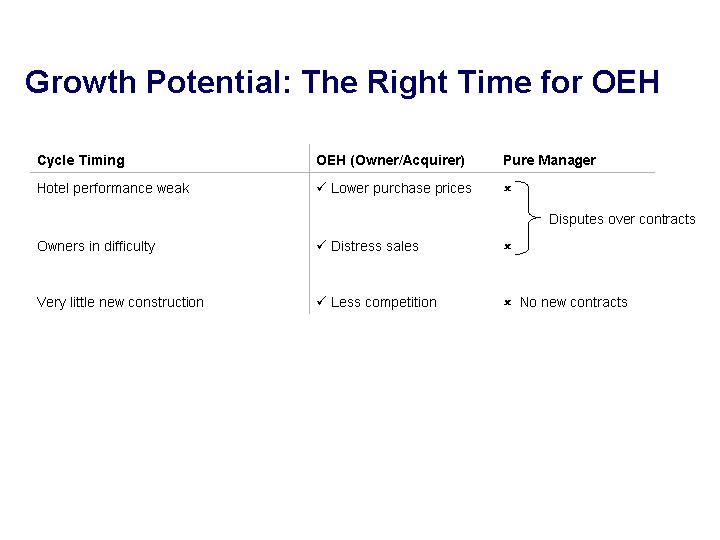

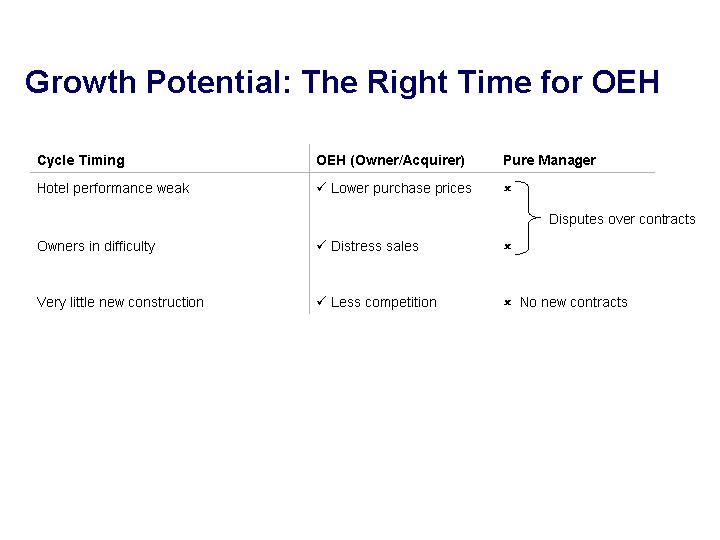

Growth Potential: The Right Time for OEH

Cycle Timing | | OEH (Owner/Acquirer) | | Pure Manager |

Hotel performance weak | | • Lower purchase prices | | • | } | |

| | | | | Disputes over contracts |

Owners in difficulty | | • Distress sales | | • | |

| | | | | |

Very little new construction | | • Less competition | | • | No new contracts |

| | | | |

| | | | |

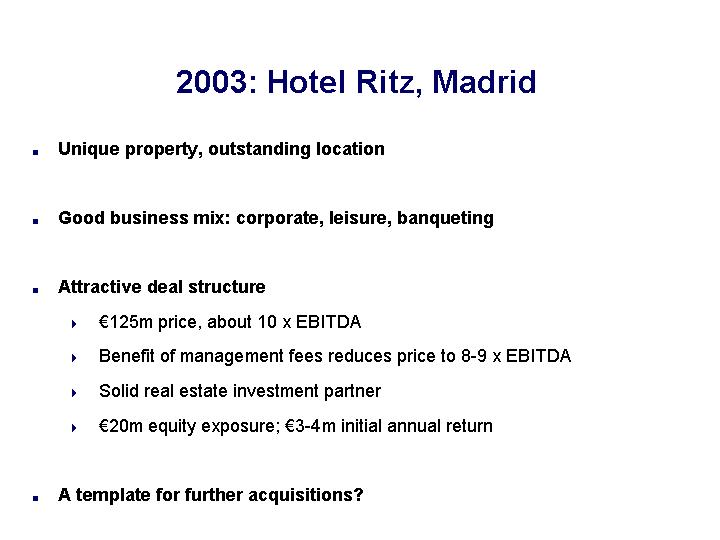

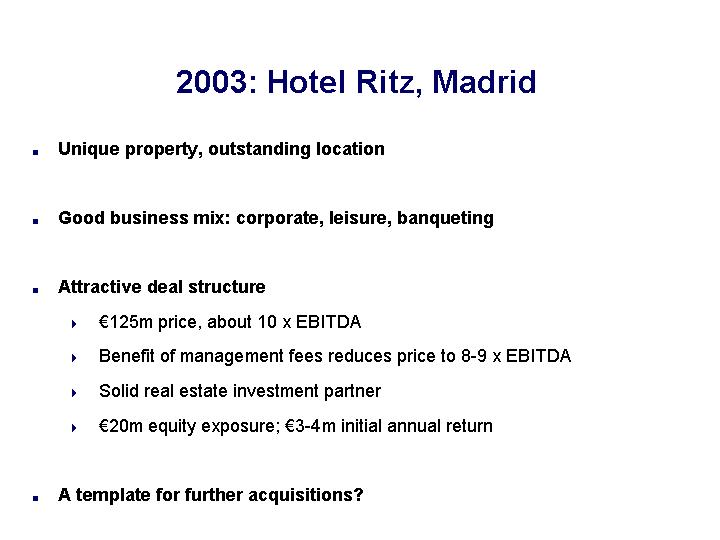

2003: Hotel Ritz, Madrid

• Unique property, outstanding location

• Good business mix: corporate, leisure, banqueting

• Attractive deal structure

• €125m price, about 10 x EBITDA

• Benefit of management fees reduces price to 8-9 x EBITDA

• Solid real estate investment partner

• €20m equity exposure; €3-4m initial annual return

• A template for further acquisitions?

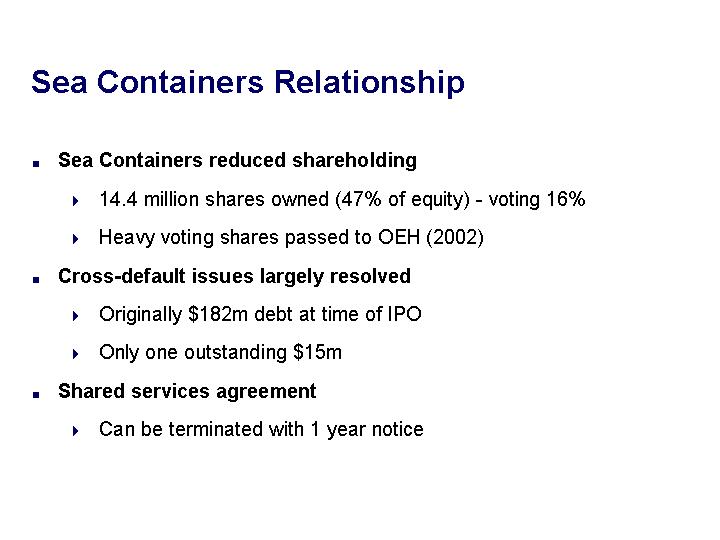

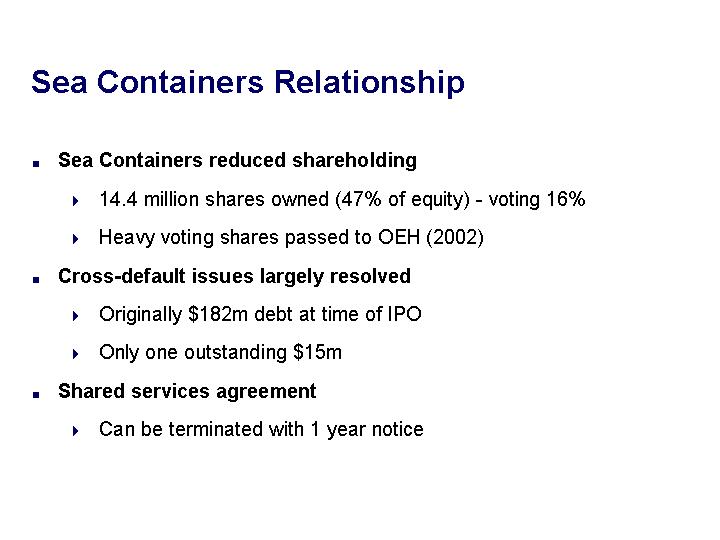

Sea Containers Relationship

• Sea Containers reduced shareholding

• 14.4 million shares owned (47% of equity) - voting 16%

• Heavy voting shares passed to OEH (2002)

• Cross-default issues largely resolved

• Originally $182m debt at time of IPO

• Only one outstanding $15m

• Shared services agreement

• Can be terminated with 1 year notice

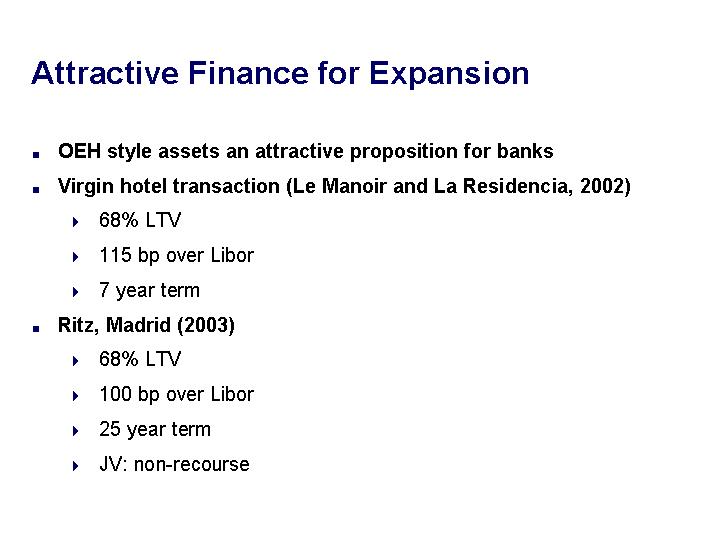

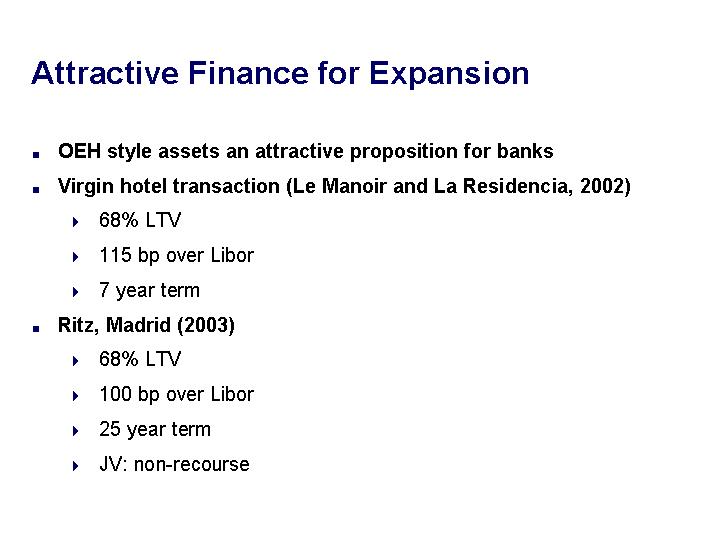

Attractive Finance for Expansion

• OEH style assets an attractive proposition for banks

• Virgin hotel transaction (Le Manoir and La Residencia, 2002)

• 68% LTV

• 115 bp over Libor

• 7 year term

• Ritz, Madrid (2003)

• 68% LTV

• 100 bp over Libor

• 25 year term

• JV: non-recourse

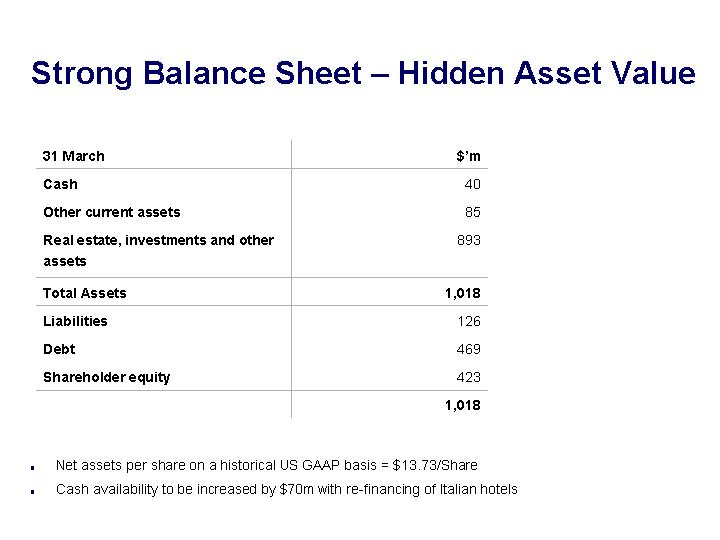

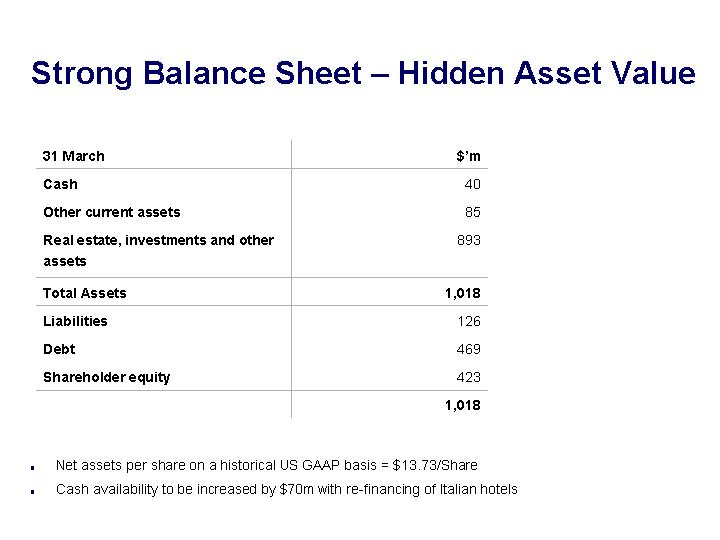

Strong Balance Sheet – Hidden Asset Value

31 March | | $’m | |

| | | |

Cash | | 40 | |

| | | |

Other current assets | | 85 | |

| | | |

Real estate, investments and other assets | | 893 | |

| | | |

Total Assets | | 1,018 | |

| | | |

Liabilities | | 126 | |

| | | |

Debt | | 469 | |

| | | |

Shareholder equity | | 423 | |

| | | |

| | 1,018 | |

• Net assets per share on a historical US GAAP basis = $13.73/Share

• Cash availability to be increased by $70m with re-financing of Italian hotels

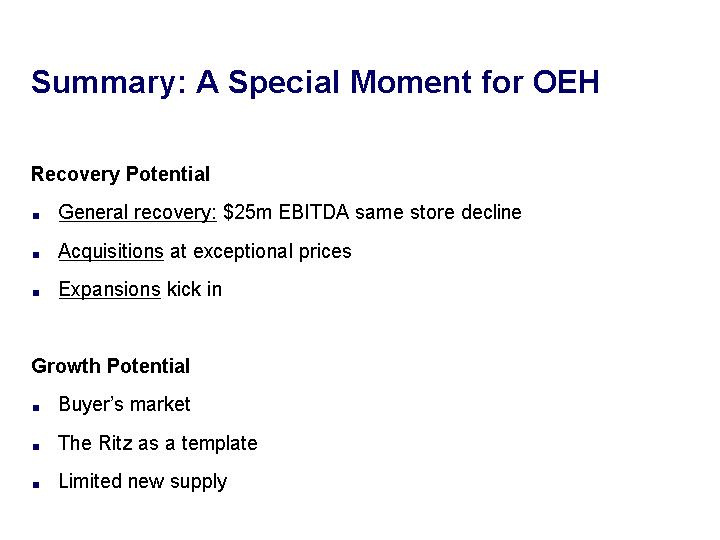

Summary: A Special Moment for OEH

Recovery Potential

• General recovery: $25m EBITDA same store decline

• Acquisitions at exceptional prices

• Expansions kick in

Growth Potential

• Buyer’s market

• The Ritz as a template

• Limited new supply

PSLRA

ORIENT-EXPRESS HOTELS LTD.

Management believes that EBITDA (earnings before interest, tax, depreciation and amortization) is a useful measure of operating performance, used by management and investors to help determine the ability of a company or property to service or incur indebtedness, because it is not affected by non-operating factors such as leverage and the historic cost of assets. EBITDA is also a financial measure commonly used in the hotel and leisure industry. However, EBITDA does not represent cash flow from operations as defined by U.S. generally accepted accounting principles, is not necessarily indicative of cash available to fund all cash flow needs and should not be considered as an alternative to earnings from operations under U.S. generally accepted accounting principles for purposes of evaluating results of operations.

This presentation and accompanying oral remarks by management contain, in addition to historical information, forward-looking statements that involve risks and uncertainties. These include statements regarding earnings growth, investment plans and similar matters that are not historical facts. These statements are based on management’s current expectations and are subject to a number of uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that may cause a difference include, but are not limited to, those mentioned in the presentation and oral remarks, unknown effects on the travel and leisure markets of terrorist activity and any police or military response (including the recent Iraqi war and its aftermath), the unknown effects on those markets of the current SARS epidemic, varying customer demand and competitive considerations, realization of bookings and reservations as actual revenue, inability to sustain price increases or to reduce costs, interest rate and currency value fluctuations, uncertainty of negotiating and completing proposed capital expenditures and acquisitions, adequate sources of capital and acceptability of finance terms, shifting patterns of business travel and tourism and seasonality of demand, adverse local weather conditions, changing global and regional economic conditions, and legislative, regulatory and political developments. Further information regarding these and other factors is included in the filings by the company and Sea Containers Ltd. with the U.S. Securities and Exchange Commission.