Searchable text section of graphics shown above

Orient-Express Hotels

Overview

2005/6 Highlights

Major investments in 2005/6

Acquisitions

Expansions

Real Estate Update

2006 Outlook

[LOGO]

Orient-Express Hotels

[LOGO]

• Global hospitality and leisure company

• Exclusive focus on deluxe luxury market

• 39 Hotels, 3 Restaurants, 6 Trains, 2 River Cruise Operations

• Distinguished luxury brand names

• Orient-Express, Hotel Cipriani, Copacabana Palace, ‘21’ Club, Mount Nelson, The Ritz

• Benefits of ownership

• Irreplaceable assets, high barriers to entry

Global and Expanding

Acquisitions since 2002

[GRAPHIC]

N. AMERICA

• ‘21’ Club, New York

• Windsor Court Hotel, Louisiana

• Charleston Place, South Carolina

• The Inn at Perry Cabin, Maryland

• Keswick Hall, Virginia

• El Encanto, Santa Barbara

• La Samanna (Caribbean)

• Maroma Resort and Spa (Mexico)

• Casa Sierra Nevada

EUROPE

• Hotel Cipriani & Palazzo Vendramin, Italy

• Hotel Splendido & Splendido Mare, Italy

• Villa San Michele, Italy

• Hotel Caruso, Italy

• Grand Hotel Europe, Russia

• The Ritz, Madrid, Spain

• La Residencia, Mallorca, Spain

• Reid’s Palace, Madeira, Portugal

• Lapa Palace, Lisbon, Portugal

• Le Manoir aux Quat’Saisons, England

• Harry’s Bar, England

• Hôtel de la Cité, France

S.E ASIA

• The Governor’s Residence, Yangon,

• La Résidence d’Angkor, Siem Reap

• La Résidence, Luang Prabang

• Jimbaran Puri Bali

• Ubud Hanging Gardens, Bali

• Napasai, Koh Samu, Thailand

REST OF THE WORLD

• Copacabana Palace, Brazil

• Mount Nelson Hotel, South Africa

• Orient-Express Safaris, Botswana

• The Westcliff, South Africa

• The Observatory Hotel, Australia

• Lilianfels Blue Mountains, Australia

• Hotel Monasterio, Peru

• Machu Picchu Sanctuary Lodge, Peru

• Miraflores Park Hotel, Peru

• Bora Bora Lagoon Resort, South Pacific

• La Cabaña, Argentina

TRAINS & CRUISES

• Venice Simplon-Orient-Express, Europe

• British Pullman, UK

• Northern Belle, UK

• Royal Scotsman, UK

• Eastern & Oriental Express, Asia

• Road To Mandalay, Myanmar (River Vessel)

• Peru Rail, Peru

• Hiram Bingham Train, Peru

• Afloat in France

Highlights in 2005/6

• Good financial results

• EBITDA up 37%; Net earnings up 44%

• EBITDA margin up 3%

• Grand Hotel Europe acquisition

• $17.4m EBITDA in 2005

• Acquired at 6x multiple

• Overhang and free float

• SC shareholding reduced to 0% from 42%

• Free float increased 2x from 19.9m to 39.3m

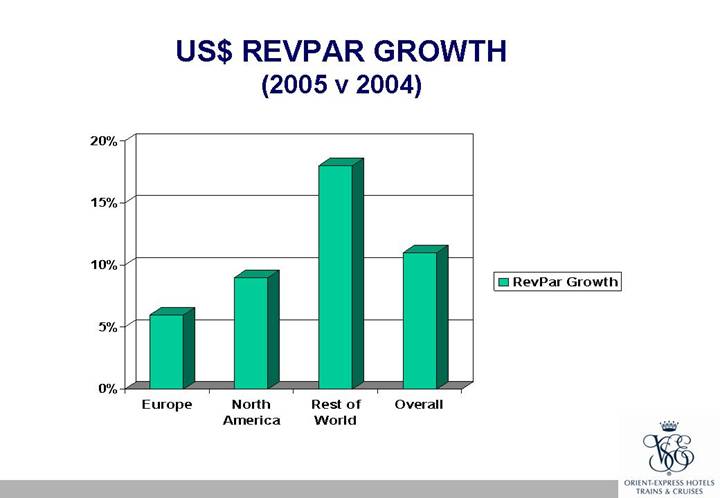

US$ REVPAR GROWTH

(2005 v 2004)

[CHART]

Margin Recovery

1% improvement is $4m impact on annual EBITDA

[CHART]

2006 EBITDA margin on track for 27% (up 300bp)

* Excludes gain on sale of Hotel Quinta do Lago

Major Investments

in 2005/6

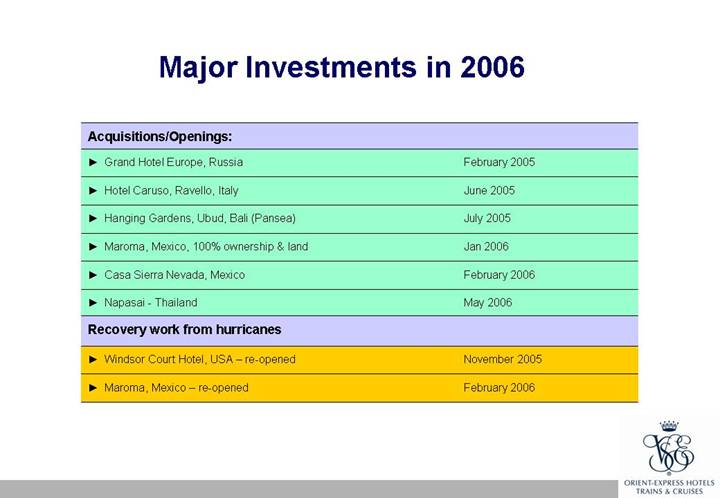

Major Investments in 2006

Acquisitions/Openings: | | |

• Grand Hotel Europe, Russia | | February 2005 |

• Hotel Caruso, Ravello, Italy | | June 2005 |

• Hanging Gardens, Ubud, Bali (Pansea) | | July 2005 |

• Maroma, Mexico, 100% ownership & land | | Jan 2006 |

• Casa Sierra Nevada, Mexico | | February 2006 |

• Napasai - Thailand | | May 2006 |

Recovery work from hurricanes | | |

• Windsor Court Hotel, USA – re-opened | | November 2005 |

• Maroma, Mexico – re-opened | | February 2006 |

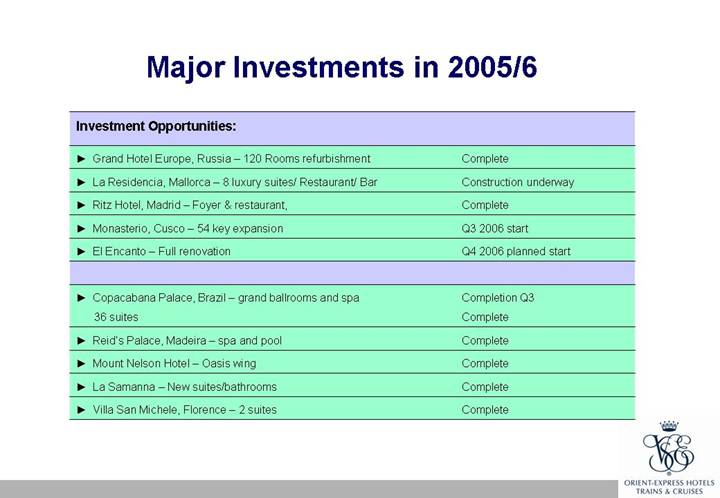

Major Investments in 2005/6

Investment Opportunities: | | |

• Grand Hotel Europe, Russia – 120 Rooms refurbishment | | Complete |

• La Residencia, Mallorca – 8 luxury suites/ Restaurant/ Bar | | Construction underway |

• Ritz Hotel, Madrid – Foyer & restaurant, | | Complete |

• Monasterio, Cusco – 54 key expansion | | Q3 2006 start |

• El Encanto – Full renovation | | Q4 2006 planned start |

| | |

• Copacabana Palace, Brazil – grand ballrooms and spa 36 suites | | Completion Q3 Complete |

• Reid’s Palace, Madeira – spa and pool | | Complete |

• Mount Nelson Hotel – Oasis wing | | Complete |

• La Samanna – New suites/bathrooms | | Complete |

• Villa San Michele, Florence – 2 suites | | Complete |

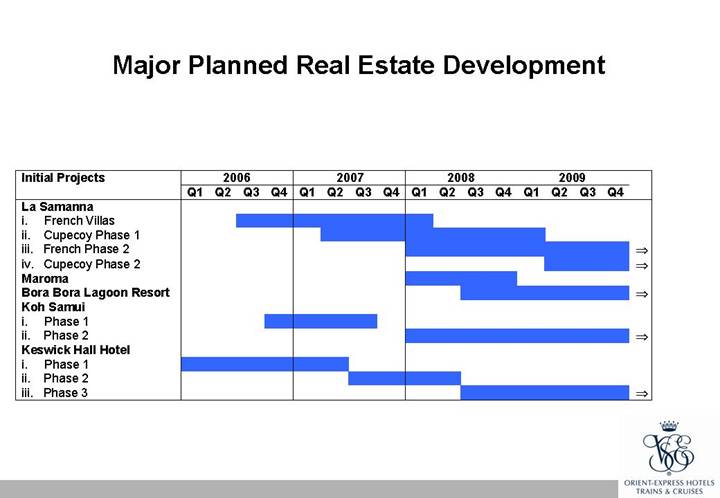

Major Planned Real Estate Development

[CHART]

| | 2006 | | 2007 | | 2008 | | 2009 | |

Initial Projects | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | |

La Samanna | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

i. | | French Villas | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ii. | | Cupecoy Phase 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

iii. | | French Phase 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

iv. | | Cupecoy Phase 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Maroma | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bora Bora Lagoon Resort | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Koh Samui | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

i. | | Phase 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ii. | | Phase 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Keswick Hall Hotel | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

i. | | Phase 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ii. | | Phase 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

iii. | | Phase 3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Outlook - 2006

• KEY DRIVERS

• Demand growth continues

• Demographics favour industry

• Limited supply

• Year on year bookings ahead by 5% (as at April 2006)

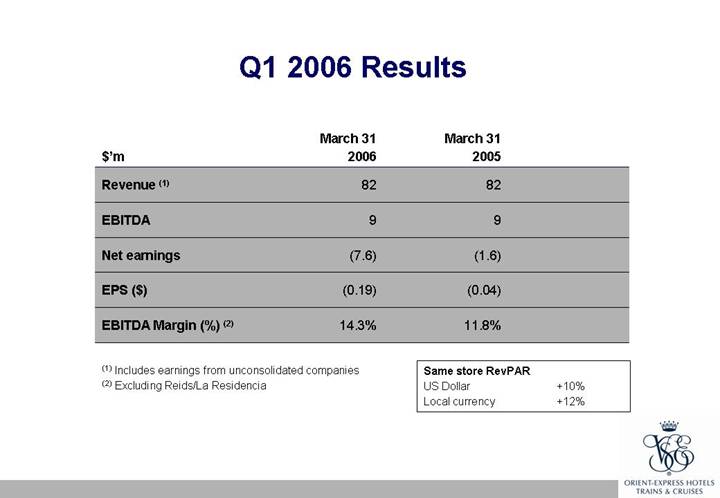

Q1 2006 Results

$’m | | March 31

2006 | | March 31

2005 | |

Revenue (1) | | 82 | | 82 | |

EBITDA | | 9 | | 9 | |

Net earnings | | (7.6 | ) | (1.6 | ) |

EPS ($) | | (0.19 | ) | (0.04 | ) |

EBITDA Margin (%) (2) | | 14.3 | % | 11.8 | % |

(1) Includes earnings from unconsolidated companies

(2) Excluding Reids/La Residencia

Same store RevPAR

US Dollar | | +10% |

Local currency | | +12% |

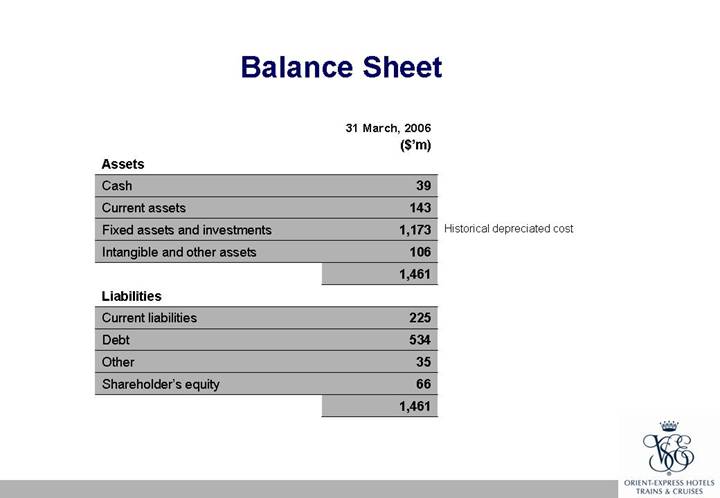

Balance Sheet

| | 31 March, 2006

($’m) | |

Assets | | | |

Cash | | 39 | |

Current assets | | 143 | |

Fixed assets and investments | | 1,173 | |

Intangible and other assets | | 106 | |

| | 1,461 | |

Liabilities | | | |

Current liabilities | | 225 | |

Debt | | 534 | |

Other | | 35 | |

Shareholder’s equity | | 66 | |

| | 1,461 | |

Summary

• Solid Performance in 2005

• Financial performance

• Acquisitions and expansions

• Free float

• Encouraging Outlook

• Q1 performance – no surprises

• Strong demand, limited supply

• Bookings pace strong

• Continuing Opportunities

• Acquisition and Expansion

ORIENT-EXPRESS HOTELS LTD.

Management believes that EBITDA (net earnings adjusted for interest expense, foreign currency, tax, depreciation and amortization) is a useful measure of operating performance, for example to help determine the ability to incur capital expenditure or service indebtedness, because it is not affected by non-operating factors such as leverage and the historic cost of assets. EBITDA is also a financial performance measure commonly used in the hotel and leisure industry, although the company’s EBITDA may not be comparable in all instances to that disclosed by other companies. EBITDA does not represent net cash provided by operating, investing and financing activities under U.S. generally accepted accounting principles, is not necessarily indicative of cash available to fund all cash flow needs, and should not be considered as an alternative to earnings from operations or net earnings under U.S. generally accepted accounting principles for purposes of evaluating operating performance.

This presentation and the accompanying oral remarks by management contain, in addition to historical information, forward-looking statements that involve risks and uncertainties. These include statements regarding earnings growth, investment plans and similar matters that are not historical facts. These statements are based on management’s current expectations and are subject to a number of uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that may cause a difference include, but are not limited to, those mentioned in the presentation and oral remarks, unknown effects on the travel and leisure markets of terrorist activity and any police or military response, varying customer demand and competitive considerations, realization of hotel bookings and reservations and planned property development sales as actual revenue, inability to sustain price increases or to reduce costs, fluctuations in interest rates and currency values, adequate sources of capital and acceptability of finance terms, possible loss or amendment of planning permits and delays in construction schedules for expansion or development projects, delays in reopening properties closed for repair or refurbishment and possible cost overruns, shifting patterns of tourism and business travel and seasonality of demand, adverse local weather conditions, uncertainty of collecting insurance claims for property damage and lost earnings, changing global and regional economic conditions, and legislative, regulatory and political developments. Further information regarding these and other factors is included in the filings by the company with the U.S. Securities and Exchange Commission.