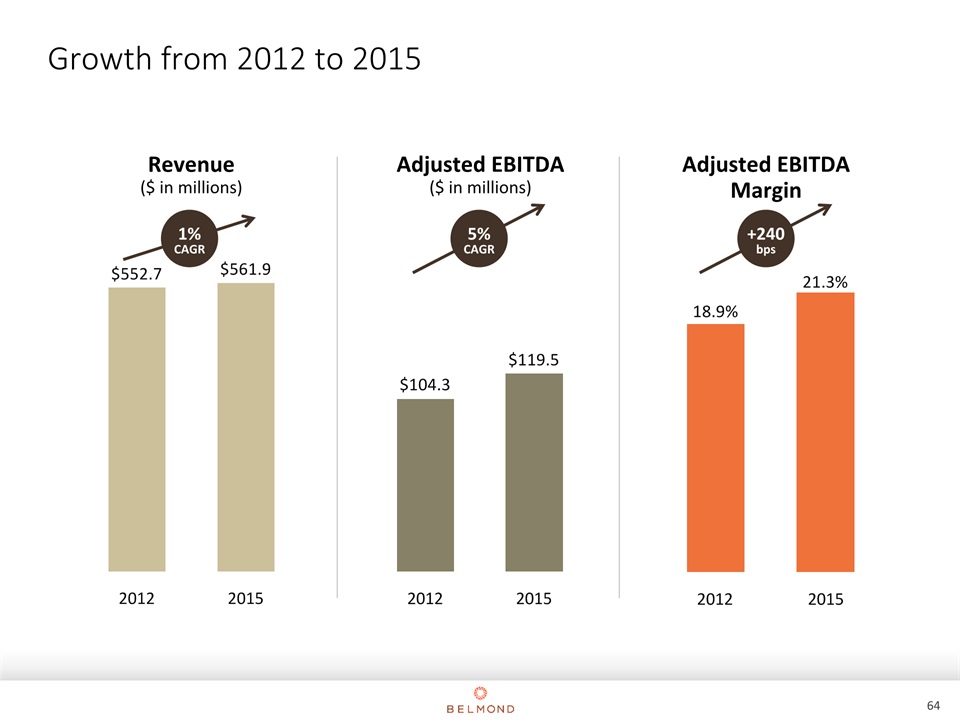

Cautionary StatementsThis Investor and Analyst Meeting presentation and related oral presentations by management contain, in addition to historical information, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements regarding the Company’s three-point growth strategy, future revenue, earnings, RevPAR, EBITDA, statement of operations and cash flow outlook, investment plans, debt financings and refinancings, asset acquisitions, leases and sales, entry into third-party management contracts, benefits of the Company’s brand and similar matters that are not historical facts and therefore involve risks and uncertainties. These statements are based on management’s current expectations and beliefs regarding future developments, are not guarantees of performance and are subject to a number of uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that may cause actual results, performance and achievements to differ from those express or implied in the forward-looking statements relating to the Company’s ability to execute and achieve its three-point growth strategy, as discussed in this presentation, include, but are not limited to, those mentioned in the Investor and Analyst Meeting presentation slides and oral presentations, our ability to hire and retain the development, property and corporate staff necessary to identify and effect portfolio growth opportunities, our ability to enter additional markets, our ability to finance the three-point growth strategy, management’s assumptions and estimates underpinning forecasts on future performance, the risks of varying customer demand and competitive considerations, future effects, if any, on the travel and leisure markets of terrorist activity and any police or military response, failure to realize expected hotel bookings and reservations, inability to sustain price increases or to reduce costs, rising fuel costs adversely impacting customer travel and the Company’s operating costs, fluctuations in interest rates and currency values, uncertainty of negotiating and completing any future asset acquisitions, leases, sales and third-party management contracts, debt financings and refinancings, capital expenditures and acquisitions, inability to reduce funded debt as planned or to obtain bank agreement to any future requested loan agreement waivers or amendments, adequate sources of capital and acceptability of finance terms, possible loss or amendment of planning permits and delays in construction schedules for expansion projects, delays in reopening properties closed for repair or refurbishment and possible cost overruns, shifting patterns of tourism and business travel and seasonality of demand, adverse local weather conditions, possible challenges to the Company’s ownership of its brands, the Company’s reliance on technology systems and its development of new technology systems, changing global or regional economic conditions and weakness in financial markets which may adversely affect demand, legislative, regulatory and political developments (including the evolving political situation in Ukraine and Brazil and their impact on current and future demand), the threat or current transmission of epidemics, infectious diseases, and viruses, such as the Zika virus which may affect demand in South America and elsewhere, and possible challenges to the Company’s corporate governance structure. Further information regarding these and other factors that could cause management’s current expectations and beliefs not to be realized is included in the filings by the Company with the U.S. Securities and Exchange Commission. Except as otherwise required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statement, whether due to new information, future events or otherwise.Use of Non-GAAP Financial Measures and DefinitionsManagement analyzes the operating performance of the Company on the basis of earnings before interest, foreign exchange, tax (including tax on unconsolidated companies), depreciation and amortization (EBITDA), and believes that EBITDA is a useful measure of operating performance, for example to help determine the ability to incur capital expenditure or service indebtedness, because it is not affected by non-operating factors such as leverage and the historical cost of assets. EBITDA is also a financial performance measure commonly used in the hotel and leisure industry, although the Company’s EBITDA may not be comparable in all instances to that disclosed by other companies. EBITDA does not represent net cash provided by operating, investing and financing activities under U.S. generally accepted accounting principles (U.S. GAAP), is not necessarily indicative of cash available to fund all cash flow needs, and should not be considered as an alternative to earnings from operations or net earnings under U.S. GAAP for purposes of evaluating operating performance.Adjusted EBITDA and adjusted EBITDA margin of the Company are non-GAAP financial measures and do not have any standardized meanings prescribed by U.S. GAAP. They are, therefore, unlikely to be comparable to similar measures presented by other companies, which may be calculated differently, and should not be considered as an alternative to net earnings, cash flow from operating activities or any other measure of performance prescribed by U.S. GAAP. Management considers adjusted EBITDA and adjusted EBITDA margin to be meaningful indicators of operations and uses them as measures to assess operating performance. Adjusted EBITDA and adjusted EBITDA margin are also used by investors, analysts and lenders as measures of financial performance because, as adjusted in the foregoing manner, the measures provide a consistent basis on which the performance of the Company can be assessed. Cautionary Statements and Use of Non-GAAP Financial Measures and Definitions 2