ATTORNEYS AT LAW

THE CHRYSLER BUILDING

405 LEXINGTON AVENUE

NEW YORK, NEW YORK 10174

www.troutmansanders.com

TELEPHONE: 212-704-6000

FACSIMILE: 212-704-6288

Uri Doron

uri.doron@troutmansanders.com | Direct Dial:212-704-6027

Fax:212-704-6288 |

August 5, 2005

Mr. H. Roger Schwall

Assistant Director

Securities and Exchange Commission

450 Fifth Street, N.W.

Washington, D.C. 20549-0405

Re: Trend Mining Company

Registration Statement on Form SB-2, Filed April 18, 2005

Commission File No. 333-124144

Dear Mr. Schwall:

On behalf of Trend Mining Company (the “Company”), set forth herein are the Company’s responses to the comments contained in the comment letter of the staff of the Securities and Exchange Commission (the “Staff”) dated May 19, 2005, with respect to the Form SB-2, filed with the Commission on April 18, 2005 (the “Form SB-2”). Attached hereto, as Exhibit A, is a clean version of Amendment No. 1 to the Form SB-2 (the “Form SB-2 Amendment”).

Courtesy copies of this letter and clean and marked versions of the Form SB-2 Amendment have been sent to the Staff’s examiners via courier. The marked copy of the Form SB-2 Amendment indicates the changes from the SB-2 as previously filed with the Commission.

All responses provided herein are based solely on information provided by the Company.

For your convenience, we have reprinted the Staff’s written comments below prior to the Company’s responses.

Form SB-2

General

| 1. | Where comments on one section or document also relate to disclosure in another section or document, please make parallel changes to all affected disclosure. This will eliminate the need for us to repeat similar comments. |

Any changes to the disclosures made in the Form SB-2 Amendment have been made in all appropriate sections and documents in order to eliminate the need to repeat similar comments.

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 2

| 2. | You also will need to file as exhibits, or incorporate by reference, all material contracts. We may have additional comments once you provide updated information and file all omitted exhibits. |

All material contracts of the company have been incorporated by reference or filed as an exhibit to the Form SB-2 Amendment.

Prospectus Summary, page 2

The Company

| 3. | You state that the company is “earning” a 50% interest in a platinum-palladium-copper-nickel project in Montana while noting that the property is not in production. Given that you have received no revenues, explain how you are receiving “earnings.” |

| | Here, the term “earning” is not used in the traditional way that relates to revenues and earnings. The Company uses the term “earning” to indicate that it is acquiring a portion of the ownership of such project through the performance of work. In order to avoid confusion, the Company amended its disclosure in the Form SB-2 Amendment to state that the Company is “acquiring” a 50% interest. |

Risk Factors, page 2

Our future activities could be subject to environmental laws and regulations..., page 3

| 4. | Please indicate when the Bureau of Land Management’s surface management regulation you are referring to in this section became effective. We note that you indicated in the fifth amendment to your Form 10-SB filed on May 25, 2001 that the Bureau of Land Management regulations became effective on January 21, 2001. As such, your representation that the regulations were “recently” finalized should be revised. |

| | The Company revised its disclosure in the Form SB-2 Amendment to delete the statement that the regulations have been adopted “recently.” |

Title to our mineral properties may be defective..., page 4

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 3

| 5. | We note your disclosure indicating that, unless you are in actual possession and diligently working the claim, the property is open to “location” by other parties. Define the phrase “location” as used in this context. In addition, identify all properties upon which you are not “diligently working and in actual possession.” |

“Location” is the act of physically going onto the land and making a claim by putting stakes in the ground. The Company is diligently working and in actual possession of all its properties. These disclosures have been added to the risk factor on page 5 of the Form SB-2 Amendment.

We may not be able to raise the funds necessary..., page 6

| 6. | Quantify the amount of funds you will need and provide a cross-reference to more detailed disclosure in the prospectus. |

| | The Company added the required disclosure on page 13 in the Management’s Plan of Operation section of the Form SB-2 Amendment. |

We have one full-time employee..., page 6

| 7. | If true, include a risk factor indicating the limited time your officers spend on your operations. |

The Company added the following language to this risk factor on page 7 of the Form SB-2 Amendment: “Because these individuals work only part-time, instances may occur where the appropriate individuals are not immediately available to provide solutions to problems or address concerns that arise in the course of us conducting our business and thus adversely affect our business.”

Risk Related to Ownership of Our Stock..., page 6

| 8. | Disclose your history of issuing stock to satisfy your obligations and the dilutive impact this has on current shareholders and the possible impact it could have on stock price. |

| | The Company added the required disclosure in the risk factor dealing with dilution on page 9 of the Form SB-2 Amendment. |

Your ownership interest, voting power and..., page 8

| 9. | Expand this risk factor to specifically address the adoption of the company’s 2000 Stock Option and Stock Award Plan and the potential dilutive effect of the shares and options that were awarded under the plan. |

| | The Company added the following language to the risk factor on page 9 of the Form SB-2 Amendment: “In 2000, we adopted our 2000 Stock Option and Stock Award Plan pursuant to which up to 5,000,000 shares of our common stock could be awarded as share awards or options. As of September 30, 2004, 1,200,000 shares or options have been awarded under this plan, 700,000 of which were outstanding and exercisable at September 30, 2004. Upon exercise of these options, the ownership interests and voting power of existing shareholders may be diluted.” |

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 4

Management’s Plan of Operation, page 10

| 10. | We note your disclosure at page 11 that some of the amounts due to shareholders are due upon completion of a private equity placement. Since you have just recently completed a private placement, disclose in this section whether those obligations have come due. If so, discuss whether the proceeds of the offering were sufficient to satisfy your obligations. |

Although the $1,450,000 financing completed during the January 2005 may technically trigger all Kaplan Group loans as immediately due and payable, Thomas Kaplan, as the Company’s largest shareholder, has not exercised his option to collect on the loans outstanding nor does the Company’s management anticipate that he will exercise such option in the near future. The Company has added language to this effect in the risk factor dealing with going concern on page 7 of the Form SB-2 Amendment.

| 11. | Expand this section to address your going concern uncertainty as indicated in the notes to the auditor’s report at F-16. Specifically, disclose that there is substantial doubt about your ability to continue as a going concern. Discuss the pertinent conditions and events that give rise to this assessment, the possible effects of such conditions and events and management’s plans to address such conditions and events. |

The requested disclosure has been included starting on page 11 of the Form SB-2 Amendment.

| 12. | Revise your filing to provide the disclosures regarding off-balance sheet commitments as required by S-B Item 303(c). |

The requested disclosure regarding off-balance sheet transactions has been included on page 13 of the Form SB-2 Amendment.

| 13. | Revise your filing to discuss the reporting requirements of recent accounting pronouncements and the impact the adoption of these pronouncements will have on your financial condition, results of operations and cash flows when adopted in a future period. Please refer to Staff Accounting Bulletin Topic 11M. |

The requested disclosure has been included starting on page 13 of the Form SB-2 Amendment.

Properties, page 14

| 14. | Consider including a column in your Properties table that indicates the percentage of the company’s interest in each property and the type of interest held. |

The requested data has been added to the properties table on page 18 of the Form SB-2 Amendment.

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 5

| 15. | Please include a glossary of technical terms that includes those geologic or technical terms not understood by the average investor that cannot be defined in the text. |

A glossary of technical terms that was filed as part of the Company’s annual report on Form 10-KSB has been included starting on page 17 of the Form SB-2 Amendment.

| 16. | The statement that the company “is earning a 50% interest” in a 3rd PGE project and Note 5 to the Properties table indicating that the company “may earn 50% interest” appear to be referring to the same subject or property. If so, please reconcile. |

| | The foregoing statements were reconciled and reworded the language on page 18 of the Form SB-2 Amendment to state that “Trend…is acquiring a 50% interest...” |

| 17. | In Note 6 to the Properties table, you state that the company controls “100% of the mineral rights” in the property interests that the company holds in the United States. Nevertheless, in Note 5, you indicate that the company may earn “50%” in the Stillwater project, which is located in Montana. Please revise to reduce, if appropriate, the percentage of control that the company holds in its property interests located in the United States. |

The Company owns 100% of the mineral rights to properties in which it has an ownership interest. The Company currently does not own any property interest in the Stillwater project, but will acquire a 50% ownership interest in the future. The footnotes to the properties table have been revised to clarify the ownership of the various properties.

| 18. | Your table also includes amounts for the 2004-2005 exploration budget. Based on your financial position, results of operations, and cash flows as reported elsewhere in the filing, please provide additional disclosure that explains how you plan to fund these expenditures. |

| | The Company plans to fund these expenditures from revenues, if any, or from future financings of the Company. Disclosure to that effect was added in the footnotes to the properties table. |

Management, page 20

| 19. | Disclose how much of his time each executive officer devotes to your business and affairs. |

| | The requested disclosure has been added on page 26 of the Form SB-2 Amendment. |

Executive Compensation, page 22

Summary of Cash and Certain Other Compensation

| 20. | In the paragraph above the summary compensation table, you note that the table sets forth the compensation of the company’s chief executive officer and of two other executive officers. The table provides information concerning the compensation of only two officers. Please revise the paragraph or table to accurately indicate whose compensation information you are providing in this section. |

| | The Company revised the paragraph above the summary compensation table in the Form SB-2 Amendment to reflect that the compensation table sets forth only the compensation of the Company’s current CEO and previous CEO. No other officer of the Company received a total annual salary and bonus in 2004 that exceeded $100,000. |

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 6

| 21. | Explain why the compensation of John P. Ryan, the company’s chief financial officer, should not be included in your summary compensation table. |

| | The compensation of John P. Ryan, the Company’s Chief Financial Officer, should not be included in the summary compensation table because his annual bonus and salary received during 2004 did not exceed $100,000 (see Instructions to Item 402(a)(2) of Regulation S-B). |

Selling Shareholders, page 25

| 22. | On page 26, you state that the selling shareholders were granted a security interest in all of Trend’s assets. Please consider adding a risk factor that addresses that fact. |

The requested risk factor was added on page 9 of the Form SB-2 Amendment.

| 23. | Please specify the date by which the registration must be filed and declared effective, so the liquidated damages clause found in the pledge and security agreement is not triggered. |

| | The dates that trigger the liquidated damages which are set forth in the Subscription Agreement with the selling shareholders have been specified on page 31 of the Form SB-2 Amendment. |

| 24. | We note that the selling shareholders may engage in short sales of your common stock. Please see Corporation Finance Telephone Interpretation A.65 in that regard. |

| | Statements that such short sales can be done only after the Registration Statement is effective were added on page 33 of the Form SB-2 Amendment. |

Plan of Distribution, page 27

| 25. | Identify any selling shareholders who are broker-dealers or affiliates of broker-dealers. If the former, state they “are,” rather than “may be deemed to be,” underwriters. |

Based on information provided by the investors, none of the investors are broker-dealers or affiliates of broker-dealers.

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 7

Related Party Transactions, page 29

| 26. | While you note in this section that the company’s focus is on the exploration of palladium and platinum, the filing indicates that the company is also interested in the exploration of uranium. Expand the first paragraph to address Mr. Ryan’s relationship with High Plains Uranium, Inc. and explain why such relationship should not result in a conflict of interest. |

High Plains Uranium, Inc. operates only in the United States while the Company explores for uranium only in Canada. Thus, there is no conflict of interest between Mr. Ryan’s activities in the Company and in High Plains Uranium, Inc. Since no such conflict exists, the Company does not believe additional disclosure is necessary.

| 27. | Address the business purpose for the January transaction with Mr. Ryan. |

| | The business purpose of the January transaction with Mr. Ryan was to exchange our less liquid shares for shares of issuers that are more liquid and trade in a more viable trading market. This added liquidity allowed the Company to subsequently sell a portion of these securities for cash. Disclosure to that effect has been added on page 34 of the Form SB-2 Amendment. |

| 28. | In the fifth paragraph, it is not clear which “loans” you are referring to. If you are referring to loans previously discussed, provide clarifying disclosure. |

| | The requested clarifying disclosure has been added on page 34 of the Form SB-2 Amendment. |

Recent Sales of Unregistered Securities, page 69

| 29. | Pursuant to Item 701 of Regulation S-B, identify the persons or class of persons to whom you sold the securities and provide more detail as to the facts relied upon to make the exemption available. |

The requested disclosures have been added in Part II of the Form SB-2 Amendment.

Index to Financial Statements, page F-1

| 30. | Revise the index to name only the financial statements provided in the filing. |

The requested revisions have been made on page F-1 of the Form SB-2 Amendment.

General

| 31. | To the extent our comments on your annual financial statements included in this Form SB-2 result in revisions to these statements, you should also file an amended Form 10-KSB to reflect corresponding changes. |

Revisions to the Company’s financial statements for the year ended September 30, 2004, will be filed on an amended Form 10-KSB.

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 8

Audited Financial Statements for the year ended September 30, 2004

Statements of operations and comprehensive loss, page F-18

| 32. | Please support your accounting for gain on sale of internal securities. |

The Company has added additional language to Note 4 of the financial statements to provide how it accounted for its gain on sale of internal securities.

Statement of Stockholders’ Equity (Deficit), page F-23

| 33. | We note the amount of additional paid in capital and value of options and warrants does not agree with the amount disclosed in the table provided in Note 4 to the financial statements. Please revise the statement or the notes to bring these disclosures into agreement and provide to us an explanation for the changes made. |

The table in Note 4 originally included an incorrect amount for “expired options and warrants.” This has been corrected to match the Balance Sheet amounts.

Note 1 — Organization and description of business, page F-25

| 34. | We have reviewed your response to prior comment number 4. As previously requested, revise your disclosure to discuss the accounting effects of the reincorporation on March 28, 2001. We may have further comment. |

There were no appreciable accounting effects other than the issue of net operating losses allocable to the Company’s prior state of incorporation. The Company changed its state of incorporation from Montana to Delaware as a Type F reorganization under the federal tax code for a change of state of incorporation.

An additional sentence stating that the re-incorporation had no accounting impact has been added on Note 2 of the Notes to the Financial Statements included in the Form SB-2 Amendment.

Note 2— Summary of Significant Accounting Policies

Employee and Non-Employee Stock Compensation, page F-27

| 35. | Your disclosure indicates how you value unrestricted stock issued to employees and non-employees for services, property and investments. Revise your disclosure to address how you account for unrestricted stock issued in these circumstances. |

The Company added the following language to Note 2 of the Notes to the Financial Statements included in the Form SB-2 Amendment: “These stock issuances [of unrestricted stock to employees and non-employees for service, property and investments] are accounted for in the statement of stockholders’ equity and as expenses, if the stock was issued for services or exploration costs, and as assets, if the stock was issued for investments or real property.”

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 9

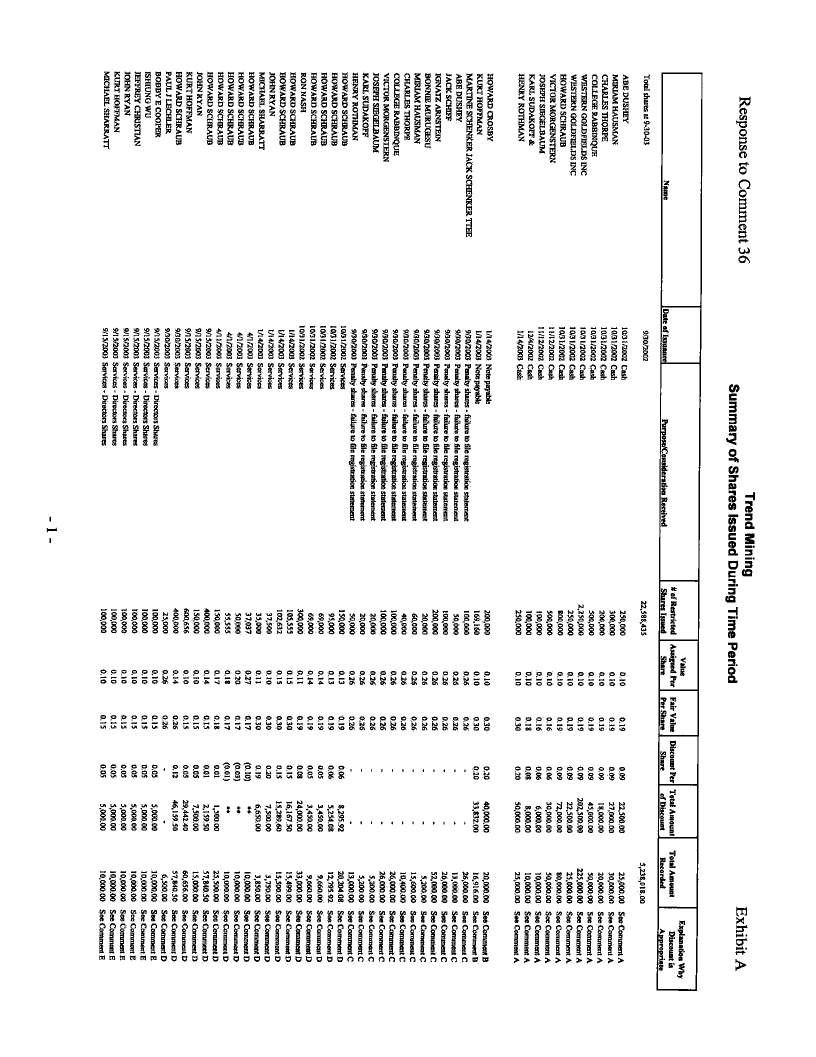

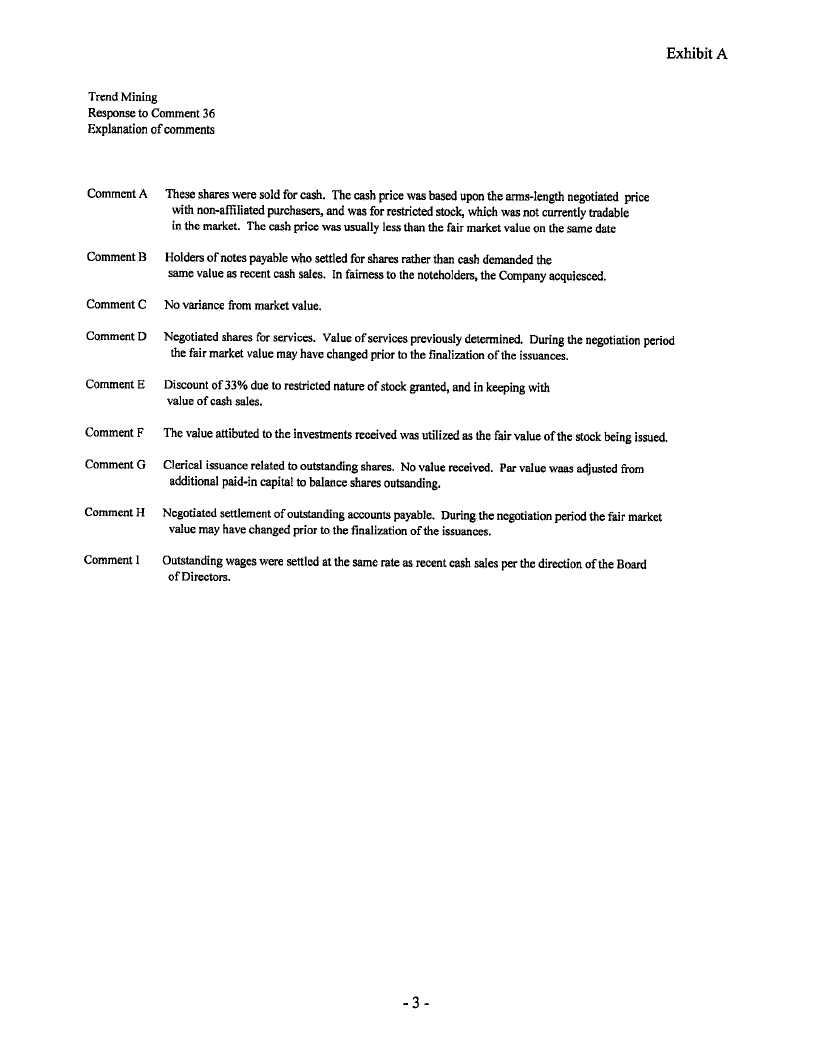

| 36. | Please also disclose, if true, that restricted stock may be issued at a reasonable discount to other values. Tell us why this policy is appropriate, given that the requirement under SFAS 123, paragraph 9, is that fair value shall be used as the basis for measurement. |

During the periods under review, the Company issued restricted stock for cash, services, property, investments, and in settlement of debt. Where appropriate, the Company issued shares at the market value or in relationship to the market value during the periods under negotiation. All similar transactions were handled in appropriate relationship to each other. Because of the Company’s limited staff, some of the work to finalize certain issuances was delayed and therefore there is a greater discrepancy from the daily fair market value. Explanations as to the differences are provided in the accompanying supplemental schedules.

The Company has added language to Note 2 of the Notes to the Financial Statements included in the Form SB-2 Amendment disclosing that its restricted stock may be issued at a reasonable discount.

Tell us on a supplemental basis for each transaction in which restricted stock was issued:

| a. | the date and purpose of the issuance, |

| b. | the number of restricted shares issued, |

| c. | the per-share fair value of an unrestricted share on the date the restricted shares were issued, |

| d. | the per-share value assigned to the restricted shares issued, |

| e. | the total dollar amount of the discount, |

| f. | the methodology used to determine the amount of the discount, and, |

| g. | an explanation of why such discount is appropriate. |

The requested information is set forth in Exhibit A hereto.

Impaired Asset Policy, page F-28

| 37. | Revise the disclosure of your impairment loss policy to indicate, if true, that the carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset, and that the impairment loss shall be measured as the amount by which the carrying amount exceeds its fair value, in accordance with FAS 144 paragraph 7. |

The Company believes that the current language contained in Note 2 of the Notes to the Financial Statements adequately describes that a long-lived assets is not recoverable if the carrying value exceeds the undiscounted cash flows expected from the use and eventual disposition of the asset.

The Company added the following language to Note 2 of the Notes to the Financial Statements included in the Form SB-2 Amendment: “The amount of loss, if any, is measured by the amount that the carrying value of the long-lived asset exceeds its fair value in accordance with SFAS No. 144.”

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 10

Mineral Properties, page F-29

| 38. | We note your business plan does not contemplate the operation of mining properties and that none of your current portfolio of properties are in the production stage. Please remove the reference to the accounting policy with regard to production stage properties to avoid investor confusion. |

As requested, the reference to production stage properties was removed.

Recent Accounting Pronouncements, page F-29

| 39. | We note that you describe the impact of recent accounting pronouncements in various ways, such as having no impact on the Company, its financial statements, or your financial position or results of operations. Revise these disclosures for each pronouncement to address the expected impact on the Company’s financial position, results of operations and cash flows. Refer to SAB Topic 11:M, Question 1 which can be found on our web site at . |

The recent accounting pronouncements did not and will not, as applicable, have any material effect on the Company’s financial statements. The Company has revised its disclosures related to recent accounting pronouncements to communicate this position.

Note 4— Capital Stock, page F-34

| 40. | We note your disclosure that as of September 30, 2004, you had 8,868,174 warrants outstanding. Provide the disclosures required under FAS 129, paragraphs 4 and 5 with respect to all warrants outstanding as of September 30, 2004 and 2003. |

The Company added the following language to Note 5 of the Notes to the Financial Statements included on the Form SB-2 Amendment: “Upon exercise of options and warrants, all common stock shares issued thereunder will have the same rights and privileges as other common stock outstanding.”

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 11

Note 5— Common Stock Options and Warrants, page F-41

| 41. | We have reviewed your response to prior comment numbers 8 and 12. Please also revise your disclosure to indicate the method used to account for employee stock options as required by FAS 123 paragraph 45(a), and the fair value of the grants as required by FAS paragraph 47(b). If you follow the intrinsic value method, provide the disclosures required under FAS 123, paragraph 45(c) as part of your Note 2. |

The Company has revised its disclosure to include reference to the use of the Black Scholes valuation model for valuation of all option and warrant grants in accordance with FAS 123.

Note 6— Related Party Transactions, page F-42

| 42. | We have reviewed your response to prior comment number 19. Revise the disclosure of loan amounts due to related parties to include the detail of the loan amounts as of September 30, 2003. Expand the disclosure to describe the nature of the relationship of each identified related party to the registrant as required by FAS 57, paragraphs 2-3. |

The Company has added the amounts due to related parties to include the detail of the loan amounts as of September 30, 2003 and has disclosed that all such loans are due to shareholders.

Unaudited Financial Statements for the three months ended December 31, 2004

General

| 43. | Update your financial statements to include unaudited interim financial statements as of March 31, 2005, as required by Rule 3-10(g) of Regulation SB as part of your amended SB-2 filing in response to these comments. |

The unaudited financial statements as of March 31, 2005 have been added to the Form SB-2 Amendment.

Note 4 — Convertible Bridge Loans, page F-13

| 44. | We note the terms of this financing included warrants and a beneficial conversion feature. We note similar terms for the convertible debt issued in January 2005. In your updated interim financial statements, include a footnote disclosure of your accounting policy for the treatment of convertible debt, beneficial conversion features and debt issued with stock purchase warrants. |

The Company has included a disclosure in Note 3 of the March 31, 2005 Notes to the Financial Statements, providing accounting policies pertaining to convertible debt, beneficial conversion features and debt issued with stock purchase warrants.

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 12

Engineering Comments

General

| 45. | Insert a small-scale map showing the location and access to your properties. Note that SEC’s EDGAR program now accepts digital maps; so please include these in any future amendments that are filed on EDGAR. It is relatively easy to include automatic links at the appropriate locations within the document to GIF or JPEG files, which will allow the figures and/or diagrams to appear in the right location when the document is viewed on the Internet. For more information, please consult the EDGAR manual, and if you need addition assistance, please call Filer Support at 202-942-8900. Otherwise provide the map to the engineering staff for our review. |

The requested maps have been added to the Form SB-2 Amendment.

| 46. | You make references to mines and other mineral properties that exist in the area of your property. This may lead investors into inferring that your property may have commercial mineralization, because of its proximity to these mines and properties. Remove information about mines, prospects or companies operating in or near to your property. Focus your disclosure on your property. |

The requested changes have been made in the Form SB-2 Amendment.

Risk Factors, page 1

| 47. | Provide subheadings for each risk factor to facilitate investor review of your document. |

Subheadings for risk factors have been added on the Form SB-2 Amendment to the extent necessary.

| 48. | Add a risk factor that addresses that fact that the probability of an individual prospect ever having “reserves” that meet the requirements of Industry Guide 7 is extremely remote, in all probability your properties do not contain any reserves, and any funds spent on exploration will probably not be recovered. |

The requested risk factor has been added on page 7 of the Form SB-2 Amendment.

****

Troutman Sanders LLP

Mr. H. Roger Schwall

August 5, 2005

Page 13

Thank you for your assistance in this matter. Please feel free to call me at 212-704-6027 if you have any questions about this letter.

Sincerely,

Uri Doron, Esq.

cc: Mr. Thomas A. Loucks

Trend Mining Company

Mr. John Ryan

Trend Mining Company

Henry I. Rothman, Esq.

Troutman Sanders LLP

Ms. Carmen Moncada-TerryU.S. Securities and Exchange Commission

Mr. Gary Newberry

U.S. Securities and Exchange Commission

Ms. Jill Davis

U.S. Securities and Exchange Commission

Mr. Roger Baer

U.S. Securities and Exchange Commission