Filed Pursuant to Rule 424(b)(3)

Registration File No. 333-124144

This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

TREND MINING COMPANY

16,239,008 Shares of Common Stock

$0.01 par value

We are registering up to 16,239,008 shares of our common stock for sale by certain of our shareholders from time to time. 189,000 of the shares have already been issued, 6,000,003 of the shares are issuable upon conversion of notes, 7,050,003 of the shares are issuable upon exercise of warrants and 3,000,002 of the shares may be issuable upon conversion of the notes as a result of conversion price adjustments. The selling security holders will receive all the proceeds from the sale of the offered shares. See “Selling Shareholders” on page 31 of this prospectus.

Our common stock is traded on the OTC Bulletin Board under the symbol “TRDM.OB.” The last reported bid price of the common stock on February 28, 2006 was $0.18 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 3 to read about certain risks you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Our principal executive offices are located at 5439 South Prince Street, Littleton, Colorado 80120. Our telephone number is (303) 798-7363.

The date of this Prospectus is March 13, 2006.

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 2 |

| USE OF PROCEEDS | 8 |

| MARKET FOR OUR COMMON STOCK AND RELATED SHAREHOLDER MATTERS | 9 |

| FORWARD-LOOKING STATEMENTS | 9 |

| MANAGEMENT’S PLAN OF OPERATION | 10 |

| BUSINESS AND PROPERTIES | 14 |

| MANAGEMENT | 29 |

| EXECUTIVE COMPENSATION | 30 |

| PRINCIPAL SHAREHOLDERS | 33 |

| SELLING SHAREHOLDERS | 34 |

| PLAN OF DISTRIBUTION | 36 |

| RELATED PARTY TRANSACTIONS | 38 |

| DESCRIPTION OF SECURITIES | 39 |

| TRANSFER AGENT AND REGISTRAR | 40 |

| LEGAL MATTERS | 40 |

| EXPERTS | 40 |

| WHERE YOU CAN FIND MORE INFORMATION | 40 |

PROSPECTUS SUMMARY

This prospectus is part of a registration statement we filed with the U.S. Securities and Exchange Commission. You should rely on the information provided in this prospectus. Neither we nor the selling security holders listed in this prospectus have authorized anyone to provide you with information different from that contained in this prospectus. The selling security holders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. Applicable SEC rules may require us to update this prospectus in the future.

The Company

Trend Mining Company was first incorporated in Montana in 1968, under the name Silver Trend Mining Company. We reincorporated in Delaware on March 28, 2001, when Trend Mining Company, a Montana corporation, merged with and into New Trend of Montana Company, a Delaware corporation and a wholly-owned subsidiary of Trend Mining Company, pursuant to an agreement and plan of merger. The surviving Delaware corporation changed its name to Trend Mining Company.

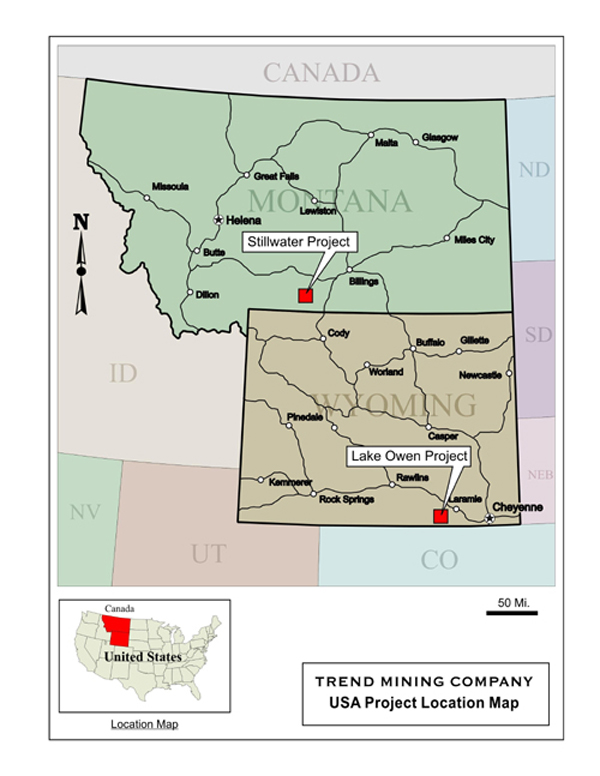

We are an exploration company and have been engaged since 1998 in the acquisition and exploration of diverse metal properties, primarily in the United States and Canada. During the period 2004-2005, we commenced uranium exploration activities in Canada and acquired a gold royalty interest in Chile. Our plan is to acquire and explore mineral properties that have sufficient merit and potential to subsequently vend them to larger companies, such that we ourselves do not intend to be an operating miner in the near term. Rather, we seek to create passive interests in high quality projects which become managed by other, larger firms. Currently, we control exploration properties which are prospective for copper-nickel, platinum-palladium, and uranium mineralization in Saskatchewan and Wyoming. At present, none of our exploration projects is known to contain commercially viable ore reserves, and none of our exploration properties is in production. Consequently, we have no source of current operating income or cash flow. We acquired a royalty on a developmental gold mine which should commence commercial production of gold bullion during the second calendar quarter of 2006. The gold royalty may provide approximately $1.25 million in revenues over the next several years, about 75% of which could occur during 2006-mid 2008. Our present business objectives for the near term are to focus on raising sufficient capital to retain and advance our mineral properties.

Our principal executive offices are located at 5439 South Prince Street, Littleton, Colorado 80120, and our telephone number is (303) 798-7363.

The Offering

Common stock offered by the selling security holders: | 16,239,008 |

| | |

Common stock outstanding as of February 28, 2006: | 40,424,081 |

| | |

Use of Proceeds: | We will not receive any of the proceeds from the sale of the shares owned by the selling security holders. We may receive proceeds in connection with the exercise of warrants, the underlying shares of which may be sold by the selling security holder under this prospectus. |

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this prospectus and in the documents incorporated by reference before deciding to invest in our common stock.

Risks Related to our Business

We have had no production history since the 1980s. As such we do not know if we will ever generate revenues. If we do not, you may lose your investment.

While we were incorporated in 1968, we have no history of producing minerals. We have not developed or operated a mine since the 1980’s, and we have no operating history upon which an evaluation of our future success or failure can be made. We currently have no mining operations of any kind. Our ability to achieve and maintain profitable mining operations is dependent upon a number of factors, including:

| · | our ability to locate an economically feasible mineral property; and |

| · | our ability to either attract a partner to operate, or to successfully build and operate mines, processing plants and related infrastructure ourselves. |

We are subject to all the risks associated with establishing new mining operations and business enterprises. We may not successfully establish mining operations or profitably produce platinum group or other metals at any of our properties. As such, we do not know if we will ever generate revenues. If we do not generate revenues, you may lose your investment in our common stock.

We have a history of losses which we expect to continue into the future. If we do not begin to generate revenues or find alternate sources of capital, we will either have to suspend or cease operations, in which case you will lose your investment.

As an exploration company that has no production history, we continue to incur losses and expect to incur losses in the future. As of December 31, 2005, we had an accumulated deficit during our exploration stage of $12,396,003, and a pre-exploration stage deficit of $558,504. We may not achieve or sustain profitability in the future. If we do not begin to generate revenues or find alternate sources of capital, we will either have to suspend or cease operations, in which case you will lose your investment.

Because we are an exploration stage company, we are sensitive to risks inherent in the mining industry, we may have to suspend or cease operations in which case you will lose your investment.

As an exploration stage company, our work is highly speculative and involves unique and greater risks than are generally associated with other businesses. We cannot know if our properties contain commercially viable ore bodies or reserves until additional exploration work is done and an evaluation based on such work concludes that development of and production from the ore body is technically, economically and legally feasible. We are subject to all of the risks inherent in the mining industry, including, without limitation, the following:

| · | Success in discovering and developing commercially viable quantities of minerals is the result of a number of factors, including the quality of management, the interpretation of geological data, the level of geological and technical expertise and the quality of land available for exploration; |

| · | Exploration for minerals is highly speculative and involves substantial risks, even when conducted on properties known to contain significant quantities of mineralization, and most exploration projects do not result in the discovery of commercially mineable deposits of ore; |

| · | Operations are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air and water quality standards, pollution and other environmental protection controls, all of which are subject to change and are becoming more stringent and costly to comply with; |

| · | A large number of factors beyond our control, including fluctuations in metal prices and production costs, inflation, the proximity and liquidity of precious metals and energy fuels markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection, and other economic conditions, will affect the economic feasibility of mining; |

| · | Substantial expenditures are required to establish proven and probable ore reserves through drilling, to determine metallurgical processes to extract the metals from the ore and, in the case of new properties, to construct mining and processing facilities; and |

| · | If we proceed to the development stage of a mining operation, our mining activities could be subject to substantial operating risks and hazards, including metal bullion losses, environmental hazards, industrial accidents, labor disputes, encountering unusual or unexpected geologic formations or other geological or grade problems, encountering unanticipated ground or water conditions, cave-ins, pit-wall failures, flooding, rock falls, periodic interruptions due to inclement weather conditions or other unfavorable operating conditions and other acts of God. Some of these risks and hazards are not insurable or may be subject to exclusion or limitation in any coverage which we obtain or may not be insured due to economic considerations. |

As a result of all of these factors, we may run out of money, in which case we will have to suspend or cease operations which could result in the loss of your investment.

Our future activities could be subject to environmental laws and regulations which may materially adversely affect our future operations in which case our operations could be suspended or terminated and you could lose your investment.

We, like other exploration companies doing business in the United States and Canada, are subject to a variety of federal, provincial, state and local statutes, rules and regulations designed:

| · | to protect the environment, including the quality of the air and water in the vicinity of exploration, development and mining operations; |

| · | to remediate the environmental impacts of those exploration, development and mining operations; |

| · | to protect and preserve wetlands and endangered species; and |

| · | to mitigate negative impacts on certain archeological and cultural sites. |

We are required to obtain various governmental permits to conduct exploration at our properties. Obtaining the necessary governmental permits is often a complex and time-consuming process involving numerous U.S. or Canadian federal, provincial, state, and local agencies. The duration and success of each permitting effort is contingent upon many variables not within our control. In the context of permitting, including the approval of reclamation plans, we must comply with known standards, existing laws, and regulations that may entail greater or lesser costs and delays depending on the nature of the activity to be permitted and the interpretation of the laws and regulations implemented by the permitting authority. Currently, three or four months are generally required to obtain the necessary permits required to conduct small-scale drilling operations. The failure to obtain certain permits or the adoption of more stringent permitting requirements could have a material adverse effect on our business, operations, and properties in that we may not be able to proceed with our exploration program which will result in the loss of your investment.

Federal legislation and implementing regulations adopted and administered by the U.S. Environmental Protection Agency, Forest Service, Bureau of Land Management, Fish and Wildlife Service, Mine Safety and Health Administration, and other federal agencies, and legislation such as the Federal Clean Water Act, Clean Air Act, National Environmental Policy Act, Endangered Species Act, and Comprehensive Environmental Response, Compensation, and Liability Act, have a direct bearing on U.S. exploration, development and mining operations. For example, Bureau of Land Management regulations applicable to activities and operations on unpatented mining claims make small-scale (disturbing less than 5 acres of surface) exploration activities more expensive, by requiring bonding in the amount of 100% of the anticipated reclamation costs. The enactment of these regulations will make the process for preparing and obtaining approval of a plan of operations much more time consuming, expensive, and uncertain. New plans of operation will be required to (i) include detailed baseline environmental information, and (ii) address how detailed reclamation performance standards will be met. In addition, all activities for which plans of operation are required will be subject to a new standard of review by the Bureau of Land Management, which must make a finding that the conditions, practices or activities do not cause substantial irreparable harm to significant scientific, cultural, or environmental resource values that cannot be effectively mitigated. Due to the uncertainties inherent in the permitting process, and particularly as a result of the enactment of the new regulations, we cannot be certain that we will be able to timely obtain required approvals for proposed activities at any of our properties in a timely manner, or that our proposed activities will be allowed at all.

These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations. Although some mines continue to be approved for development in the United States, the process is increasingly cumbersome, time-consuming, and expensive, and the cost and uncertainty associated with the permitting process could have a material effect on exploring, developing or mining our properties. We expect that laws and regulations designed to minimize the impact of exploration, development and mining activities on the environment and human health and safety will likely have a similar effect on any activities we undertake in Canada.

Compliance with statutory environmental quality requirements described above may require significant capital outlays, significantly affect our earning power, or cause material changes in our intended activities. Environmental standards imposed by federal, state, or local governments may be changed or become more stringent in the future, which could materially and adversely affect our proposed activities. As a result of these matters, our operations could be suspended or cease entirely, in which case you could lose your investment.

Title to our mineral properties may be defective. If our title is defective we will not be able to explore for mineralized material. This could cause us to cease operations or terminate operations in their entirety in which case you will lose your investment.

The interests in our properties located in the United States are generally (Stillwater comes with patented claims) in the form of unpatented mining claims. Unpatented mining claims are unique property interests, in that they are subject to the paramount title of the United States of America and rights of third parties to certain uses of the surface and to minerals within their boundaries, and are generally considered to be subject to greater title risk than other real property interests. The validity of all unpatented mining claims is dependent upon inherent uncertainties and conditions. These uncertainties relate to matters such as:

| · | The existence and sufficiency of a discovery of valuable minerals, required under the U.S. 1872 Mining Law to establish and maintain a valid unpatented mining claim; |

| · | Proper posting and marking of boundaries in accordance with the 1872 Mining Law and applicable state statutes; |

| · | Whether the minerals discovered were properly locatable as a lode claim or a placer claim; |

| · | Whether sufficient annual assessment work has been timely and properly performed; and |

| · | Possible conflicts with other claims not determinable from descriptions of record. |

The validity of an unpatented mining claim also depends on the claim having been located on unappropriated federal land open to appropriation by mineral location (the act of physically going onto the land and making a claim by putting stakes in the ground), compliance with the 1872 Mining Law and applicable state statutes in terms of the contents of claim location notices or certificates and the timely filing and recording of the same, and timely payment of annual claim maintenance fees (and the timely filing and recording of proof of such payment). In the absence of a discovery of valuable minerals, the ground covered by an unpatented mining claim is open to location by others unless the owner is in actual possession of and diligently working the claim. We are diligently working and are in actual possession of all our properties. The unpatented mining claims we own or control may be invalid or the title to those claims may not be free from defects. In addition, the validity of our claims may be contested by the federal government or challenged by third parties. If any of the foregoing occur, we may not be able to proceed with our exploration program. This means that our operations could be suspended or terminate in which case you will lose your investment.

Future legislative and administrative changes to the mining laws could prevent us from exploring our properties which could result in termination of our operations and a loss of your investment.

New laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration, development, and mining activities. For example, during the 1999 legislative session, legislation was considered in the U. S. Congress which proposed a number of modifications to the Mining Law of 1872, which governs the location and maintenance of unpatented mining claims and related activities on federal land. Among these modifications were proposals which would have imposed a royalty on production from unpatented mining claims, increased the cost of holding and maintaining such claims, and imposed more specific reclamation requirements and standards for operations on such claims. None of these proposed modifications was enacted into law, but the same or similar proposals could be enacted by Congress in the future. In addition, as discussed above, the Bureau of Land Management finalized revised federal regulations which govern surface activities (including reclamation and financial assurance requirements) on unpatented mining claims (other than those located in a National Forest, which are governed by separate, but similarly stringent, Forest Service regulations). Those regulations are more stringent than past regulations, and may result in a more detailed analysis of, and more challenges to, the validity of existing mining claims; will impose more complex permitting requirements earlier in the exploration process; and will be more costly and time-consuming to comply with than existing previous regulations. Further, the new regulations could cause us to terminate our operations and you could lose your investment. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations, resulting in a loss of your entire investment.

Use of the surface of our unpatented mining claims is subject to regulation, the cost of compliance with which could prohibit us from proceeding with exploration.

Any activities which we conduct on the surface of our unpatented mining claims are subject to compliance with and may be constrained or limited by Bureau of Land Management or Forest Service surface management regulations (in addition to the environmental and other statutes and regulations discussed above). In addition, there are limits to the uses of the surface of unpatented mining claims, particularly for the types of facilities which would be ancillary to our mining operations, and both the Bureau of Land Management and the Forest Service have some degree of discretion in allowing the use of federal lands that might adjoin any of our unpatented mining claims for surface activities which we would need for exploration, development and mining operations. For example, in the past the Forest Service considered adoption of a "Roadless Initiative" which would have prohibited the construction of new roads or the re-construction of existing roads in 43 million acres of inventoried roadless areas within the National Forest System. All of our Wyoming and Montana properties (Lake Owen and Stillwater Spruce Mountain, and Albany) are located in the National Forest and may be impacted by such “Roadless Initiatives.” As a result, there can be no guarantee that we will be able to obtain the access necessary to conduct required exploration, development or ultimately mining activities on those properties. In addition, to the extent we progress towards the development of a mine at any of our properties, there may not be sufficient surface land available for the ancillary facilities necessary to develop the mine. Compliance with the foregoing regulations could be expensive, causing us to not develop certain areas.

We are insured against losses from our exploration programs when they involve the use of heavy equipment such as drill programs, but not for general reconnaissance. In the latter instance, if we are sued for damages as a result of our activities we may not be able to defend against such suits or have funds available to pay any judgment rendered against us.

We insure our exploration programs when heavy equipment is used, such as drill rigs. In other instances such as general reconnaissance programs, we do not insure against most commercial losses or liabilities which may arise from our exploration and other activities. Even if we obtain additional insurance in the future, we may not be insured against all losses and liabilities which may arise from our activities, either because such insurance is unavailable or because we have elected not to purchase such insurance due to high premium costs or for other reasons. Therefore, if a proceeding is initiated or a judgment is rendered against us, we may have to cease operations due to our inability to pay for such legal expenses or judgment.

We may not be able to raise the funds necessary to explore our mineral properties. If we are unable to raise such additional funds, we will have to suspend or cease operations in which case you will lose your investment.

We estimate that approximately $1,000,000 will be required to fund our operations for the next 12 months assuming minimal exploration activities and excluding the cost of acquisitions (see “Management’s Plan of Operation”). We need to seek additional financing from the public or private debt or equity markets to continue our business activities. We have borrowed from our principal shareholder, Thomas Kaplan, to fund certain of our activities. We do not know that our principal shareholder will continue to advance funds to us or that our efforts to obtain financing will be successful. In addition, Mr. Kaplan and his affiliates are entitled to and can demand repayment of their notes outstanding. However, management does not anticipate that they will exercise that right (see “Management’s Plan of Operation”).

We will need to seek additional financing to complete our exploration of any target properties. Sources of such external financing include future debt and equity offerings, and possible joint ventures with another exploration or mining company. Additional financing may not be available on terms acceptable to us. The failure to obtain such additional financing could have a material adverse effect on our results of operations and financial condition. We may not be able to secure the financing necessary to retain all of our property interests our properties or to sustain exploration activities in the future. If we cannot raise the necessary money to explore our properties, we will have to suspend or cease operations and you could lose your investment.

We have one full-time employee and are dependent on our directors, officers and third-party contractors.

We have one full time employee and rely heavily and are wholly dependent upon the personal efforts and abilities of our officers and directors, most of whom devotes less than all of his time and efforts to our operations. Because these individuals work only part-time, instances may occur where the appropriate individuals are not immediately available to provide solutions to problems or address concerns that arise in the course of us conducting our business and thus adversely affect our business. The loss of any one of these individuals could adversely affect our business. We do not maintain insurance on any of our officers or directors. We may not be able to hire and retain such personnel in the future.

Because the price of metals fluctuate, if the price of metals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those metals and we will cease operations.

Prices of metals are determined by some of the following factors:

| · | expectations for inflation; |

| · | the strength of the United States dollar; |

| · | global and regional supply and demand; and |

| · | political and economic conditions and production costs in major platinum group metals producing regions of the world, particularly Russia and South Africa. |

The aggregate effect of these factors on metals prices is impossible for us to predict. In addition, the prices of platinum group metals are sometimes subject to rapid short-term and/or prolonged changes because of speculative activities. The current demand for and supply of platinum group metals affect platinum group metal prices, but not necessarily in the same manner as current supply and demand affect the prices of other commodities. The supply of platinum group metals primarily consists of new production from mining. If the prices of platinum group metals are, for a substantial period, below our foreseeable cost of production, we could cease operations and you could lose your entire investment.

The probability of an individual prospect having reserves, as defined under the Securities Act Industry Guide 7, is extremely remote.

“Material reserves” is defined under Securities Act Industry Guide 7 as “that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.” The probability that an individual prospect will have material reserves, is extremely remote. There is a probability that all of our interests in prospects will not contain any material reserves and that all our exploration expenses may not be recovered.

As lenders, our principal shareholder and his affiliates are entitled to and can demand immediate repayment of their notes outstanding.

The terms of all loans from the Kaplan Group (as defined below under ‘Management’s Plan of Operation’) provide that they are due and payable immediately upon the completion of a private placement of shares of our stock in the minimum amount of $1,000,000. Our private placement completed in January 2005 of $1,300,000 in convertible promissory notes triggers the Kaplan Group’s right to demand immediate payment of all loans made to us. If the Kaplan group chooses to exercise this right, we may be unable to procure the cash necessary and may need to liquidate all our assets in order to make such payment and as a result may cease to continue operations.

Risks Related to the Ownership of our Stock

We may experience volatility in our stock price, which could negatively affect your investment, and you may not be able to resell your shares at or above the offering price.

The offering price of our common stock may vary from the market price of our common stock after the offering. If you purchase shares of common stock, you may not be able to resell those shares at or above the offering price. The market price of our common stock may fluctuate significantly in response to a number of factors, some of which are beyond our control, including:

| · | quarterly variations in operating results; |

| · | changes in financial estimates by securities analysts; |

| · | changes in market valuations of other similar companies; |

| · | announcements by us or our competitors of new products or of significant technical innovations, contracts, acquisitions, strategic partnerships or joint ventures; |

| · | additions or departures of key personnel; |

| · | any deviations in net sales or in losses from levels expected by securities analysts; and |

| · | future sales of common stock. |

In addition, the stock market has experienced volatility that has often been unrelated to the performance of particular companies. These market fluctuations may cause our stock price to fall regardless of our performance.

Because our securities trade on the OTC Bulletin Board, your ability to sell your shares in the secondary market may be limited.

The shares of our common stock are listed and principally quoted on the Nasdaq OTC Bulletin Board. Because our securities currently trade on the OTC Bulletin Board, they are subject to the rules promulgated under the Securities Exchange Act of 1934, as amended, which impose additional sales practice requirements on broker-dealers that sell securities governed by these rules to persons other than established customers and "accredited investors" (generally, individuals with a net worth in excess of $1,000,000 or annual individual income exceeding $200,000 or $300,000 jointly with their spouses). For such transactions, the broker-dealer must determine whether persons that are not established customers or accredited investors qualify under the rule for purchasing such securities and must receive that person's written consent to the transaction prior to sale. Consequently, these rules may adversely affect the ability of purchasers to sell our securities and otherwise affect the trading market in our securities.

Because our shares are deemed "penny stocks," you may have difficulty selling them in the secondary trading market.

The Securities and Exchange Commission has adopted regulations which generally define a "penny stock" to be any equity security that has a market price (as therein defined) of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. Additionally, if the equity security is not registered or authorized on a national securities exchange or Nasdaq, the equity security also would constitute a "penny stock." As our common stock falls within the definition of penny stock, these regulations require the delivery, prior to any transaction involving our common stock, of a risk disclosure schedule explaining the penny stock market and the risks associated with it. Disclosure is also required to be made about compensation payable to both the broker-dealer and the registered representative and current quotations for the securities. In addition, monthly statements are required to be sent disclosing recent price information for the penny stocks. The ability of broker/dealers to sell our common stock and the ability of shareholders to sell our common stock in the secondary market would be limited. As a result, the market liquidity for our common stock would be severely and adversely affected. Trading in our common stock may be subject to these or other regulations in the future, which would negatively affect the market for our common stock.

A large number of shares will be eligible for future sale and may depress our stock price.

Our shares that are eligible for future sale may have an adverse effect on the price of our stock. As of February 28, 2006 there were 40,424,081 shares of our common stock outstanding. We are registering up to 16,239,008 shares of our common stock for sale by certain of our shareholders from time to time. The average trading volume for the three months prior to February 28, 2006 was less than 100,000 shares per day. Sales of substantial amounts of common stock, or a perception that such sales could occur, and the existence of options or warrants to purchase shares of common stock at prices that may be below the then current market price of the common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities.

Your ownership interest, voting power and the market price of our common stock may decrease because we have issued, and may continue to issue, a substantial number of securities convertible or exercisable into our common stock.

We have issued common stock and options, warrants, and convertible notes to purchase our common stock to satisfy our obligations and fund our operations (see “Management’s Plan of Operation”). In the future we may issue additional shares of common stock, options, warrants, preferred stock or other securities exercisable for or convertible into our common stock to raise money for our continued operations. We continue to seek additional investors. If additional sales of equity occur, your ownership interest and voting power in us will be diluted and the market price of our common stock may decrease. In 2000, we adopted our 2000 Stock Option and Stock Award Plan pursuant to which up to 5,000,000 shares of our common stock could be awarded as share awards or options. As of December 31, 2005, 4,000,000 shares or options have been awarded under this plan, 3,450,000 of which were outstanding and exercisable at December 31, 2005. Upon exercise of these options, the ownership interests and voting power of existing shareholders may be further diluted.

We do not have cumulative voting and a small number of existing shareholders control our company, which could limit your ability to influence the outcome of shareholder votes.

Our shareholders do not have the right to cumulative votes in the election of our directors. Cumulative voting, in some cases, could allow a minority group to elect at least one director to our board. Because there is no provision for cumulative voting, a minority group will not be able to elect any directors. Accordingly, the holders of a plurality of the shares of common stock, present in person or by proxy, will be able to elect all of the members of our board of directors.

Our Articles of Incorporation contain provisions that discourage a change of control.

Our articles of incorporation contain provisions that could discourage an acquisition or change of control without our board of directors’ approval. Our articles of incorporation authorize our board of directors to issue preferred stock without shareholder approval. If our board of directors elects to issue preferred stock, it could be more difficult for a third party to acquire control of us, even if that change of control might be beneficial to shareholders.

Our assets are subject to a security interest.

Pursuant to a Pledge and Security Agreement, dated as of January 27, 2005, we granted to certain selling stockholders a security interest in all of our assets to secure the obligations under the promissory notes issued on January 27, 2005. If we default on the notes, under certain circumstances those selling stockholders may foreclose on our assets. In that instance, we may be unable to continue operations and the value of your common stock will be significantly diminished.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the shares owned by the selling security holders. We may receive proceeds in connection with the exercise of warrants, the underlying shares of which may in turn be sold by selling security holder. Although the amount and timing of our receipt of any such proceeds are uncertain, such proceeds, if received, will be used for general corporate purposes.

MARKET FOR OUR COMMON STOCK AND RELATED SHAREHOLDER MATTERS

Market for our common stock

Our common stock trades under the symbol TRDM.OB on the Over-the-Counter Bulletin Board Electronic Quotation System maintained by the National Association of Securities Dealers, Inc. Following is information about the range of high and low bid prices for our common stock for each fiscal quarter in the last two fiscal years and the first fiscal quarter of the current fiscal year. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

| Quarter Ended | | High Bid Quotation | | Low Bid Quotation | |

| December 31, 2003 | | $ | 0.58 | | $ | 0.23 | |

| March 31, 2004 | | $ | 0.45 | | $ | 0.23 | |

| June 30, 2004 | | $ | 0.45 | | $ | 0.23 | |

| September 30, 2004 | | $ | 0.29 | | $ | 0.16 | |

| December 31, 2004 | | $ | 0.33 | | $ | 0.23 | |

| March 31, 2005 | | $ | 0.36 | | $ | 0.205 | |

| June 30, 2005 | | $ | 0.31 | | $ | 0.19 | |

| September 30, 2005 | | $ | 0.28 | | $ | 0.20 | |

| December 31, 2005 | | $ | 0.21 | | $ | 0.11 | |

| March 31, 2006 (through February 28, 2006) | | $ | 0.25 | | $ | 0.15 | |

Holders

As of February 28, 2006, there were 920 holders of record of our common stock, however, we believe that there are additional beneficial owners of our common stock who own their shares in “street name.”

Dividends

There have been no cash dividends declared on our common stock since our company was formed. Dividends are declared at the sole discretion of our board of directors. It is not anticipated that any dividends will be declared for the foreseeable future on our common stock.

FORWARD-LOOKING STATEMENTS

This prospectus, supplements to this prospectus and the documents incorporated by reference contain certain forward-looking statements about our financial condition, results of operations and business. These statements may be made expressly in this document or may be “incorporated by reference” to other documents we filed with the Securities and Exchange Commission. You can find many of these statements by looking for words such as “believes,” “expects,” “anticipates,” “estimates” or similar expressions used in this prospectus, supplements to this prospectus or documents incorporated by reference.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties. Factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by us in those statements include, among others, the following:

| · | the quality of our properties with regard to, among other things, the existence of reserves in economic quantities; |

| · | our ability to increase our production and income through exploration and development; |

| · | the number of locations to be drilled and the time frame within which they will be drilled; |

| · | future prices of the minerals we sell; |

| · | anticipated domestic demand for our products; and |

| · | the adequacy of our capital resources and liquidity. |

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. You are cautioned not to place undue reliance on such statements, which speak only as of the date of this prospectus or supplements to this prospectus or, in the case of documents incorporated by reference, as of the date of such document.

We do not undertake any responsibility to release publicly any revisions to these forward-looking statements to take into account events or circumstances that occur after the date of this prospectus or supplements to this prospectus. Additionally, we do not undertake any responsibility to update you on the occurrence of any unanticipated events which may cause actual results to differ from those expressed or implied by the forward-looking statements.

MANAGEMENT’S PLAN OF OPERATION

We are an exploration stage company. Our primary expenditures at this stage consist of payment of various governmental fees to maintain the priority of our unpatented mining claims, payment of our debt service, payment of accounting and legal fees, and general office expenses.

Our losses for the three months ended December 31, 2005 were $498,904 and for the year ended September 30, 2005 were $2,180,851. As of December 31, 2005, our total loss since inception of the current exploration stage is $12,396,003, our loss for the year ended September 30, 2005 is primarily due to operating expenses in five categories: general and administrative expenses of $588,809; officers and directors compensation of $427,476; legal and professional fees of $272,520; and exploration expenses of $215,246. Our loss for the three months ended December 31, 2005 is primarily due to operating expenses in three categories: general and administrative expenses of $58,518; officers and directors compensation of $140,938; and legal and professional fees of $168,433.

Our primary, near term business objective is to raise sufficient capital to retain our current mineral properties, to explore such properties and acquire additional projects, and to pay general and administrative expenses. On August 23, 2004, we made land payments and paid filing fees of about $76,000 to retain control of our Lake Owen, Wyoming property. We spent approximately $500,000 on exploration programs in 2005. We estimate that approximately $1,000,000 will be required to fund our operations for the next 12 months assuming minimal exploration activities and excluding the cost of acquisitions, if any. We will hold sufficient capital to continue current operations through fiscal 2006. We believe that we now have capital and quality projects to become more active in our exploration and are seeking additional capital to extend our operations into and through 2006.

On January 27, 2005, we executed a convertible debt financing agreement that had commitments for approximately $1.3 million. Of the total amount, we used $250,000 to pay off a previous bridge loan. The financing was amended on July 28, 2005, for an additional commitment of $350,000. The offering, as amended, was funded by a group of institutional and accredited investors. We have since used the funds to settle trade accounts payable of approximately $250,000 and utilized the balance of the proceeds to pay our overhead, fund land payments, to fund exploration work on our mineral projects in North America and fund the initial down payment of the Andacollo, Chile acquisition. In March 2005, we received $150,000 in a convertible debt financing on the same terms as the January 27, 2005 convertible debt financing agreement from an accredited investor. On July 28, 2005, we received an additional $350,000 in an amendment to the January 27, 2005 convertible debt financing. We plan to use these funds to pay our overhead, fund land payments, and to fund exploration work on our mineral projects in North America.

In June 2005, we received $660,000 in a debt financing from two accredited investors. As part of the financing, we issued 66,000 shares of common stock. The funds from this financing were used to acquire the Andacollo, Chile project. As of December 31, 2005, $300,000 plus accrued interest remains outstanding.

On December 12, 2005, we received $150,000 in equity financing from an accredited investor in exchange for 1,500,000 shares of common stock. We used these funds for purposes of working capital.

The completion of further equity or debt financings depends on our ability to find suitable investors and will also depend on the agreement of the investors in the January 27, 2005 financing to accept the terms and agree to any new financing.

We have substantial operational commitments to fund in order to maintain our land holdings. This includes work commitments or a fee of $C237,504 ($US204,000) on our claims at Peter Lake to keep these claims in good standing, although no additional work or fees are required to be spent at Peter Lake during 2006. Approximately $77,000 in combined annual BLM fees and Albany County filing fees is needed for us to maintain Lake Owen. For Stillwater Montana, the total fees and taxes owed is approximately $8,900 because the leased property at Stillwater is comprised of patented mining claims. Moreover, we have a work commitment of $400,000 on the Stillwater property, in accordance with a joint venture agreement with Aurora, although, due to our having spent approximately $260,000 last year against a work commitment of $100,000, we will only be obligated to spend $240,000 to satisfy our obligation for calendar 2006. The underlying claim to our Diabase Peninsula property at Cree Lake in Saskatchewan carries a minimum work commitment of $C20,172 ($US17,350) per year. Trend paid this amount in the first year but that work commitment is now carried by our partner, Nuinsco Resources, who under terms of their earn-in arrangement are obligated to make all work commitments and/or property payments. Terms of the Diabase Peninsula lease require that, in addition to the work commitment or government fee, we are to make property payments to the owner of $C15,000, $C20,000, and $C30,000 in each of the first three years, respectively, beginning September 2004. However, also under terms of the farm-in agreement under which Nuinsco can earn an interest in our arrangement, Nuinsco will pay us 250,000 shares of freely trading Nuinsco stock, currently valued at $C.22/share or $C55,000, to offset these leasehold costs.

We will continue to incur costs and expenses relating to accounting and legal services in connection with our obligations as a public company, raising additional capital, and other general corporate matters.

Our trade payables due as of December 31, 2005, total $184,611.

Beginning in November 2000 and through June 2002, we borrowed funds principally from our major shareholder, Thomas Kaplan, and his affiliates (the “Kaplan Group”), to fund our minimum activities. As of September 30, 2005, we have debts owed of approximately:

| · | $670,000 to Electrum LLC, our largest stockholder and a company owned by Mr. Kaplan; |

| · | $233,000 to LCM Holdings, LDC, a large shareholder and an affiliate of Mr. Kaplan; and |

| · | $130,000 to two individuals introduced to us by Mr. Kaplan. |

For each dollar borrowed from the people and entities described in this paragraph, we issued a warrant to purchase one share of our common stock. In total, we borrowed $1,032,857 from Mr. Kaplan and his affiliates. This amount bears interest at the rate of 8% per annum.

Pursuant to an amendment to the above loan agreements made as of January 30, 2003, we agreed to adjust the conversion terms of the loans and warrants described in the paragraph immediately preceding this one. As a result of this agreement, the loans became convertible into "units" at $0.50 per unit. Each unit is comprised of one share of common stock and one warrant to acquire one share of common stock for $1.00, exercisable through September 30, 2006. In connection with the agreement, we also changed the exercise price of the warrants issued for each dollar borrowed to purchase our common stock from $1.50 to $1.00 per share and extended their respective terms by one year.

On February 12, 2004, we and Electrum and LCM Holdings reached an agreement to adjust both the conversion terms on approximately $902,000 worth of debt outstanding to the lenders and the exercise prices and terms of related warrants. Electrum and LCM Holdings can now convert each $1.25 of loans into a unit consisting of one share of common stock and one warrant. The warrant is exercisable for a period of five years from the date of conversion and is exercisable at a price of $1.50. Additionally, terms of existing outstanding warrants were modified. Such modifications generally increased the exercise price and shortened the expiration dates.

The terms of all loans from the Kaplan Group provide that they are due and payable immediately upon the completion of a private placement of shares of our common stock in the minimum amount of $1,000,000. It is assumed by our officers that the Kaplan Group could demand repayment of the notes outstanding if the conditions calling for such repayment were deemed to have been met. Our private placement completed in January 2005 of $1,300,000 in convertible promissory notes triggers the Kaplan Group’s right to demand immediate payment of all loans made to us.

In January 2005, we entered into a joint venture agreement with Aurora. The agreement provides that we will explore for platinum group metals on portions of an Aurora claim known as the “Stillwater intrusive complex in Montana.” We will be the operator during the exploration stage and will acquire 50% in the project by spending $2 million over next 5 years ($100,000 in year 1; $400,000 in year 2; and $500,000 in each of years 3, 4 and 5). Additionally, we issued 50,000 shares of our common stock on commencement of the agreement; we will issue 20,000 shares and pay $20,000 in cash in the first year; and pay $20,000 in cash or stock each year thereafter until we have spent the agreed upon sum of $2 million, at which time an equally-owned joint venture will be formed.

In September 2004, we entered into a program to explore for uranium in Saskatchewan by acquiring exploration rights in the Cree Lake area of the Athabasca Basin. The Athabasca Basin hosts uranium deposits that are among the highest grade in the world, and is the site for intensive uranium exploration activity. In December 2004, we announced that we acquired additional lands located farther to the southwest along the same mineralized trend. We also announced in December 2004 that Nuinsco Resources Limited entered into an agreement with us pursuant to which Nuinsco could acquire up to 50% in our interests by spending $C1 million over three years and taking over the day to day management of the exploration of these claims. We are obligated to make property payments to the owner of the property of $C15,000, $C20,000, and $C30,000 in each of the first three years, respectively (and Nuinsco will pay us 250,000 shares of freely trading Nuinsco stock, currently valued at $C.27/share or $C67,500, to offset this cost). We (and partner Nuinsco if Nuinsco vests its interest) may exercise our right to purchase the claims for $CDN 1 million any time during the first eight years of the option, at which time the property remains subject to a 3% gross royalty on any and all minerals produced. Under the terms of the agreement with Nuinsco, should Nuinsco acquire its 50% interest, Nuinsco will become obligated to maintain the lease. In the meantime, Nuinsco has agreed to pay us 250,000 shares of Nuinsco common stock to offset the cost of our three annual payments to the underlying landowner.

On June 21, 2005, we and Pacific Rim Mining Corporation, a Canadian based company (“Pacific Rim”) entered into an option agreement to acquire the Andacollo gold mine in Chile by acquisition of DMC Cayman Inc., a Cayman Island corporate subsidiary that owns the mine. We initially paid Pacific Rim $300,000 of the $5,400,000 total purchase price. Since the transaction did not close within 30 days of signing the Letter of Intent, as contemplated therein, we paid an additional $300,000 to extend the option purchase period.

On September 20, 2005 we sold 70% of our interests in DMC to an investor, David H. Russell, for a purchase price of $2,100,000. On December 5, 2005, we sold our remaining 30% interest in return for reimbursement of all of our acquisition costs related to purchase of the 30% interest as well as our diligence costs and out of pocket expenses, plus a 1% net smelter returns royalty on any and all mineral production from the mine, and a back-in right to acquire a 30% working interest any time through April 1, 2006. The royalty should commence paying us one percent of revenues from the mine at some point during the 2nd or 3rd quarter of 2006.

Our primary, near-term business objective is to raise sufficient capital to retain our current mineral properties, to explore them and acquire additional projects, and to pay our general and administrative expenses. As reflected in our accompanying financial statements, we have limited cash, negative working capital, no revenues and an accumulated deficit of $12,954,507. These factors indicate that we may be unable to continue in existence in the absence of receiving additional funding. Our operating expenses average approximately $40,000 per month, consisting of our accounting and legal fees and general and administrative expenses. We may also enter into payment arrangement plans with creditors which could add between $50,000 and $60,000 per month to this monthly budget figure. In that case, our monthly budget would rise to between $90,000 and $100,000 per month. Moreover, management’s plans for the next twelve months include approximately $600,000 of cash expenditures for exploration activity on the Lake Owen, Peter Lake and new Stillwater properties. To fund our operations, we are actively seeking additional capital. We believe that we will generate sufficient cash from the Andocollo royalty and a public or private debt or equity financing in order for us to continue to operate based on current expense projections and exploration plans. Nevertheless, we are unable to provide assurances that we will be successful in obtaining sufficient sources of capital. There can be no assurance that Electrum, LCM Holdings, or others will continue to advance us funds or that our efforts to obtain additional financing will be successful. Further, there can be no assurance that additional financing will be available on terms acceptable to us. If we fail to raise the necessary funds to continue operations we may be required to significantly reduce our scope or completely cease our operations.

Off-Balance Sheet Arrangements

None.

Recent Accounting Pronouncements

In May 2005, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 154, “Accounting Changes and Error Corrections,” (hereinafter “SFAS No. 154”) which replaces Accounting Principles Board Opinion No. 20, “Accounting Changes,” and SFAS No. 3, “Reporting Accounting Changes in Interim Financial Statements - An Amendment of APB Opinion No. 28.” SFAS No. 154 provides guidance on accounting for and reporting changes in accounting principle and error corrections. SFAS No. 154 requires that changes in accounting principle be applied retrospectively to prior period financial statements and is effective for fiscal years beginning after December 15, 2005. Management does not expect SFAS No. 154 to have a material impact on our financial position, results of operations, or cash flows.

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No.153, “Exchanges of Nonmonetary Assets - an Amendment of APB Opinion No. 29,” (hereinafter “SFAS No. 153”). This statement eliminates the exception to fair value for exchanges of similar productive assets and replaces it with a general exception for exchange transactions that do not have commercial substance, defined as transactions that are not expected to result in significant changes in the cash flows of the reporting entity. This statement is effective for financial statements for fiscal years beginning after June 15, 2005. Management believes the adoption of this statement will have no impact on our financial condition or results of operations.

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 152, “Accounting for Real Estate Time-Sharing Transactions - an amendment of FASB Statements No. 66 and 67” (hereinafter “SFAS No. 152”), which amends FASB Statement No. 66, “Accounting for Sales of Real Estate,” to reference the financial accounting and reporting guidance for real estate time-sharing transactions that is provided in AICPA Statement of Position 04-2, “Accounting for Real Estate Time-Sharing Transactions”(hereinafter “SOP 04-2”). This statement also amends FASB Statement No. 67, “Accounting for Costs and Initial Rental Operations of Real Estate Projects,” to state that the guidance for (a) incidental operations, and (b) costs incurred to sell real estate projects does not apply to real estate time-sharing transactions. The accounting for those operations and costs is subject to the guidance in SOP 04-2. This statement is effective for financial statements for fiscal years beginning after June 15, 2005. Management believes the adoption of this statement will have no impact on our financial condition or results of operations.

In November 2004, the Financial Accounting Standards Board (FASB) issued SFAS No. 151, “Inventory Costs— an amendment of ARB No. 43, Chapter 4.” This Statement amends the guidance in ARB No. 43, Chapter 4, “Inventory Pricing,” to clarify the accounting for abnormal amounts of idle facility expense, freight, handling costs, and wasted material (spoilage). Paragraph 5 of ARB 43, Chapter 4, previously stated that “. . . under some circumstances, items such as idle facility expense, excessive spoilage, double freight, and rehandling costs may be so abnormal as to require treatment as current period charges. . . .” This Statement requires that those items be recognized as current-period charges regardless of whether they meet the criterion of “so abnormal.” In addition, this Statement requires that allocation of fixed production overheads to the costs of conversion be based on the normal capacity of the production facilities. This statement is effective for inventory costs incurred during fiscal years beginning after June 15, 2005. Management does not believe the adoption of this Statement will have a material impact on us as we do not anticipate maintaining inventory.

In December 2004, the Financial Accounting Standards Board issued a revision to Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based Payments” (hereinafter “SFAS No. 123 (R)”). This statement replaces FASB Statement No. 123, “Accounting for Stock-Based Compensation,” and supersedes APB Opinion No. 25, “Accounting for Stock Issued to Employees.” SFAS No. 123 (R) establishes standards for the accounting for share-based payment transactions in which an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments. This statement covers a wide range of share-based compensation arrangements including share options, restricted share plans, performance-based award, share appreciation rights and employee share purchase plans. SFAS No. 123 (R) requires a public entity to measure the cost of employee services received in exchange for an award of equity instruments based on the fair value of the award on the grant date ( with limited exceptions). That cost will be recognized in the entity’s financial statements over the period during which the employee is required to provide services in exchange for the award. We currently report stock issued to employees under the rules of SFAS No. 123. Therefore, our management expects no material impact to our financial statements from the adoption of this statement.

BUSINESS AND PROPERTIES

Overview

Trend Mining Company was first incorporated in Montana in 1968, under the name Silver Trend Mining Company. We reincorporated in Delaware on March 28, 2001, when Trend Mining Company, a Montana corporation, merged with and into New Trend of Montana Company, a Delaware corporation and a wholly-owned subsidiary of Trend Mining Company, pursuant to an agreement and plan of merger. The surviving Delaware corporation changed its name to Trend Mining Company.

We are an exploration company and has been engaged since 1998 in the acquisition and exploration of diverse metal properties, primarily in the United States and Canada. During the period 2004-2005, we commenced uranium exploration activities in Canada and acquired a gold royalty interest in Chile. Our plan is to acquire and explore mineral properties that have sufficient merit and potential to subsequently vend them to larger companies, such that we ourselves do not intend to be an operating miner in the near term. Rather, we seek to create passive interests in high quality projects which become managed by other, larger firms. Currently, we control exploration properties which are prospective for copper-nickel, platinum-palladium, and uranium mineralization in Saskatchewan and Wyoming. At present, none of our exploration projects is known to contain commercially viable ore reserves, and none of our exploration properties is in production. Consequently, we have no source of current operating income or cash flow. We have acquired a royalty on a developmental gold mine which should commence commercial production of gold bullion during the second calendar quarter of 2006. The gold royalty may provide approximately $1.25 million in revenues over the next several years, about 75% of which could occur during 2006-mid 2008. Our present business objectives for the near term are to focus on raising sufficient capital to retain and advance our mineral properties.

OUR EXPLORATION PROCESS

Our exploration program is designed to acquire projects of merit that could attract a larger partner. To do so, we will explore, develop, and evaluate such exploration properties, and then vend them if merited, or abandon them. We need to balance our capital requirements so that we have sufficient funds on hand to maintain our existing projects, to evaluate and advance them with appropriate exploration programs, and also to maintain additional funds to take on new projects when such opportunities are deemed appropriate.

As more fully described below, we have formulated specific exploration plans for our exploration projects at Stillwater, and Lake Owen. As to the other projects, Diabase Peninsula (uranium) is being explored by our partner, Nuinsco Resources, such that we face no immediate capital requirements relating to this project, and we plan to market our Peter Lake project although we have spent sufficient funds on this project to hold it for another year. Exploration generally proceeds in three phases, and our approach is typical. Phase One of exploration normally begins with recognition that a property has merit, acquisition of rights to explore said property, and then follow up consisting of detailed geologic mapping and sampling of the rocks to verify if they contain anomalous concentrations of metals indicative of mineral potential. If after a preliminary evaluation a project still has apparent potential, considerable sums of money may be spent in the first phase to determine from surface geology and assaying of surface rocks whether the subsurface is worth testing; geochemical surveys will contribute to such elevated costs, but we may embark on geophysical surveys to learn more about the subsurface before drilling. Careful interpretation of the data collected from the various tests would then be used to determine whether further exploration is warranted.

Phase Two of an exploration program may involve an initial examination of the subsurface, third dimensional characteristics of the mineralization target. This phase is intended to identify either the extent of any near surface mineralization, or the location and extent of subsurface, blind targets, and usually involves limited drill testing. None of our properties have reached the second phase. Once potentially economic mineralization has been encountered, Phase Three entails detailed infill drilling and sampling aimed at precisely defining depth, width, length, tonnage and grade so as to ascertain the economic potential of the deposit.

The magnitude of our exploration budget - for existing projects as well as business development, will vary from project to project depending on the size of the project, our remoteness or accessibility, the quality and quantity of existing information, and the cost of appropriate next steps in advancing any given project. By way of example, it may cost well over $200,000 for a reconnaissance program at Peter Lake, where we control a very large claim block (approximately 76 square miles) over geologically attractive and yet very remote and underexplored ground; fees required to hold all of this ground for another year to 2007 would cost us more than an equivalent amount, ~$200,000. In contrast, we spent approximately $9,000 for ground magnetic studies at Lake Owen - our second most advanced exploration project - because that is all that it cost for the next level of evaluation at this very accessible Wyoming property (along with approximately $78,000 in additional expenses for Bureau of Land Management holding fees, county filing fees, and related expenses).

Our ability to maintain and develop our mineral properties fully depends on our ability to raise sufficient capital to continue to fund our planned activities. Should we not be able to raise such capital, we will have to reevaluate whether we can continue to (1) pay the fees and costs of maintaining our property positions, and/or (2) undertake our planned exploration work.

COMPETITION

We compete with other exploration and mining companies to acquire and maintain favorable land positions. Our method of competition in this regard is to protect the properties we own by complying with regulations and staying current on all fee requirements relating to our properties.

LICENSE AND ROYALTY AGREEMENTS

We own a 1% net smelter return royalty on the Andacollo gold mine in Chile which is being taken off of care and maintenance and placed back into commercial production by a group of private investors. We expect to begin receiving royalties on this property during the second quarter of fiscal 2006. We expect to receive sufficient revenues from the Chilean royalty to offset much of our corporate costs during the second half of fiscal 2006.

We own a 1.5% net smelter return royalty on the Pyramid project, an exploration property consisting of five unpatented mining claims in Churchill County, Nevada which we sold to Western Goldfields, Inc. in August 2002.

We also own a 2.5% net smelter returns royalty on patented mining claims located north of Anchorage, Alaska, that are owned by the Rae Wallace Company, a former subsidiary. As of December 31, 2005, we have not received any revenues as a result of these royalties.

GOVERNMENT COMPLIANCE

Our activities are subject to extensive federal, state/provincial and local regulations in both the United States and Canada. These statutes regulate the mining of and exploration for mineral properties, and also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development of our properties, the extent of which cannot be predicted. Also, permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards, existing laws and regulations that may entail greater or lesser costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraint affecting our properties that would preclude the economic development or operation of any specific property.

If we become more active on our United States or Canadian properties, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties.

Our primary, near term cost of compliance with applicable environmental laws during exploration is likely to arise in connection with the reclamation of drill holes and access roads. Drill holes typically can be reclaimed for nominal costs. For example, the Bureau of Land Management (“BLM”), an agency of the U.S. Department of Interior, has promulgated surface management regulations which govern drill hole and access road reclamation on BLM lands. Similar regulations can be expected to be complied with on our lands which are on U.S. Forest Service lands, or state property for which we have been issued mineral licenses, as well as Canadian mining claims.

Costs for reclaiming roads for access and drill programs can become expensive, but to date our programs have been small and helicopter-supported, obviating the need for access roads. However, should we mount larger programs, such costs could vary from a few hundred to a few thousand dollars per drill hole site. Whereas roads will not be built until our exploration programs are more advanced, drill road reclamation costs will vary according to the amount of road construction, which we cannot estimate at this time. Once a plan of exploration has been submitted and where drill holes or access roads will be undertaken, we will be required to post reclamation bonds. It is difficult to estimate what the cost of such bonds will be, since the bonding requirements are unique to the proposed exploration plan. However, it is a reasonable assumption that in some circumstances these bonds may be a significant percentage of the exploration costs.

WEATHER

Our properties are located in the northern United States and Canada, and thus weather may play a role in the cost of implementing an exploration program. In the United States, our properties are located in National Forests, where access roads are often poorly maintained. With high rainfall, for example, there may be some chance of washouts occurring on roads, which could prevent access to some of, or portions of, the properties. Forest fires could lead to government agencies’ restricting or even closing access to our properties. Such closures would prevent us from undertaking planned exploration programs and require those programs to be postponed. Harsh winter conditions may preclude planned winter access of our properties and/or reduce the effective summer field season. In Canada, mild winter conditions could preclude us from performing winter work programs where such programs depend upon a winter freeze up of lakes to provide access to the property (especially for drilling purposes).

EMPLOYEES

We have one full time employee, our President & CEO, Thomas Loucks.

PROPERTIES

Certain terms used in this section are defined in the following glossary.

GLOSSARY OF TERMS

ANOMALY: a deviation from uniformity or regularity, a local feature distinguishable in geophysical or geochemical measurement.

ARCHEAN: geologic age older than 2,500,000,000 (2.5 billion) years, a term applied to the oldest rocks of Precambrian time.

DEVELOPMENT: work carried out for the purpose of opening up a mineral deposit and making the actual extraction possible.

DIP: the angle at which a vein, structure or rock bed is inclined from the horizontal as measured at right angles to the strike.

EXCHANGE RATE - $C/$US: Many of our expenses occur in Canadian dollars. Where obligations are cited herein, the Canadian obligation will be quoted and then translated into US currency at the rate prevailing on or about September 30th, 2005: $C1.16 per US dollar.

EXPLORATION: work involved in searching for ore by geological mapping, geochemistry, geophysics, drilling, and other methods.

GABBRO: coarse-grained, dark colored igneous rocks. Intrusive equivalent of volcanic basalt (intrusive rocks cool within the earth’s crust, as opposed to extrusive, or volcanic, rocks which cool in the atmosphere).

GEOCHEMISTRY: study of relative and absolute abundances of chemical elements and atomic species (isotopes) in rocks, soils, water, or atmosphere.

GEOPHYSICS: study of the earth by quantitative physical methods.

HECTARE: metric measure of area, equivalent to 2.47105 acres or 0.003861 square miles.

HYDROTHERMAL: pertaining to hot water, especially with respect to its action in dissolving, re-depositing, and otherwise producing mineral changes within the earth’s crust.

INTRUSION/INTRUSIVE: a volume of igneous rock that was injected, while still molten, into the earth’s crust or other rocks and solidified before reaching the surface as (opposed to extrusive or volcanic).

LITHOLOGY: the physical character of a rock described in terms of its structure, color, mineral composition, and grain size.

MAFIC: a rock dominantly composed of ferromagnesian silicates; used to describe some dark igneous rocks and their dark constituent minerals (e.g., gabbro and pyroxenite, as opposed to light colored rocks (“felsic”) such as granite).

METAMORPHISM: the process by which consolidated rocks are altered in composition, texture, or structure as a result of the earth’s application of heat and/or pressure at depth over time.

METALLIFEROUS: bearing or producing metal.

MINERALIZATION: as applied to mineral deposits, the process of adding concentrations of metals to rocks.

NET PROFITS INTEREST ROYALTY: a share of net profits generated from a mining operation.

NET SMELTER RETURNS ROYALTY: a share of net revenues generated from the sale of metal produced by a mine, net after certain deductions for the cost of transporting, insuring, and refining the metal.

OCCURRENCE: site or area where detectable mineralization is known. May or may not be economic.

ORE: material that can be mined from an ore body and processed at a profit.

ORE BODY: a continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible; or a reserve.

OUTCROP: the exposure of bedrock or strata projecting through the overlying cover of soil.

PGE: platinum group element.

PGM: Six metals comprise the platinum group metals (“PGMs”): platinum, palladium, rhodium, iridium, ruthenium, and osmium. Platinum group metals are rare precious metals with unique physical properties that are used in diverse industrial applications and in the jewelry industry. The largest and fastest growing use for platinum group metals is in the automotive industry for the production of catalysts that reduce automobile emissions. Palladium is also used in the production of electronic components for personal computers, cellular telephones, facsimile machines and other devices, as well as dental applications and jewelry. Industrial uses for platinum include the production of data storage disks, glass, paints, nitric acid, anti-cancer drugs, fiber optic cables, fertilizers, unleaded and high-octane gasoline and fuel cells.

PYROXENITE: An igneous rock predominantly composed of the minerals from the pyroxene family (such rocks can be indicative of copper-nickel and/or platinum-palladium mineralization.

RECLAMATION: the restoration of a site after exploration activity or mining is completed.

REEF: a mining term for a metalliferous mineral deposit, usually tabular and relatively narrow in nature.

REMOBILIZATION: term describing a mineral (or rock) that has become mobile again and/or relocated after initial solidification, often forming a mineral deposit.

SEDIMENTARY ROCKS: rocks resulting from the consolidation of loose detritus of older rock.

SHEAR: a zone of deformation caused the by lateral movement along numerous parallel planes.

SULFIDE: a metallic mineral composed of sulfur combined with base metals.

STRIKE: the bearing of a vein or a layer of rock.

ULTRAMAFIC: said of an igneous rock composed chiefly of mafic materials and which contains less than 45% silica (and therefore virtually no quartz or feldspar).