Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[logo]

Acquisition

of

Salix Pharmaceuticals

[graphic]

[logo]

The Offer

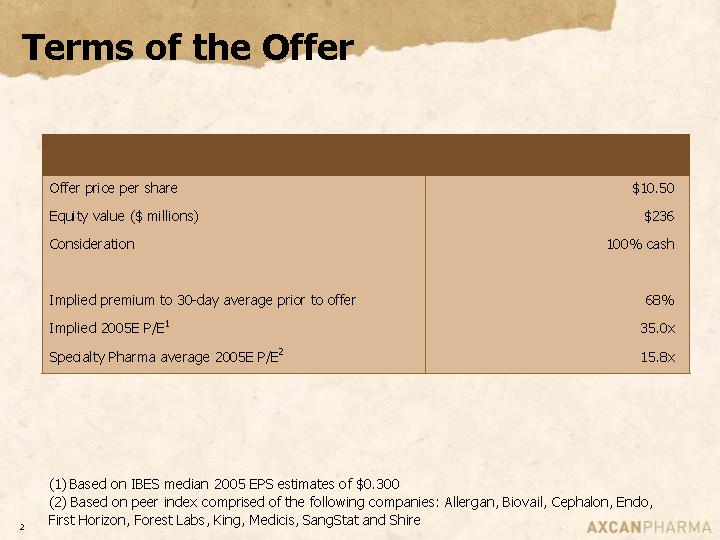

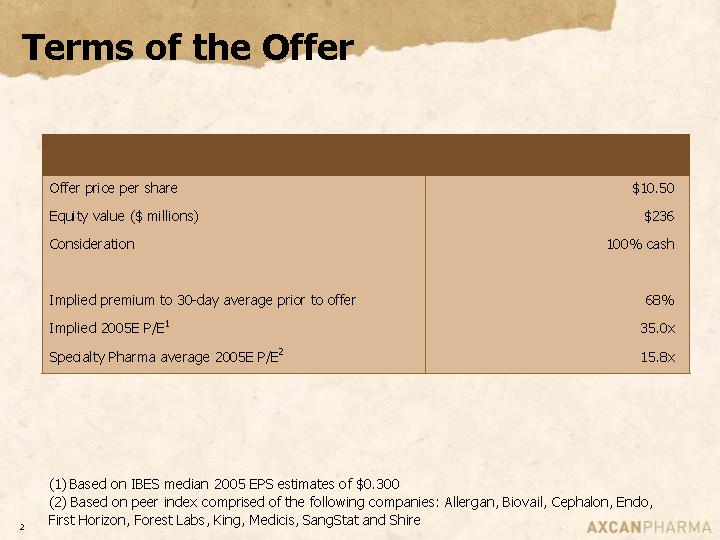

Terms of the Offer

Offer price per share | | $ | 10.50 | |

Equity value ($ millions) | | $ | 236 | |

Consideration | | 100% cash | |

| | | |

Implied premium to 30-day average prior to offer | | 68 | % |

Implied 2005E P/E(1) | | 35.0x | |

Specialty Pharma average 2005E P/E(2) | | 15.8x | |

(1) Based on IBES median 2005 EPS estimates of $0.300

(2) Based on peer index comprised of the following companies: Allergan, Biovail, Cephalon, Endo, First Horizon, Forest Labs, King, Medicis, SangStat and Shire

[LOGO]

2

Why vote for the independent nominees?

• Remove barriers to the tender offer; let Salix stockholders decide

• Management has a history of over-promising and under-delivering

• Profitability

• Launch of Rifaximin

• Salix stock price has been driven and supported by our offer

3

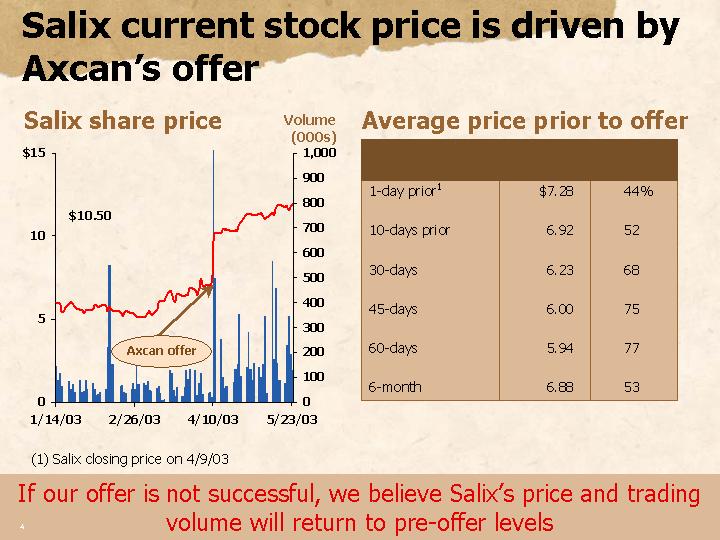

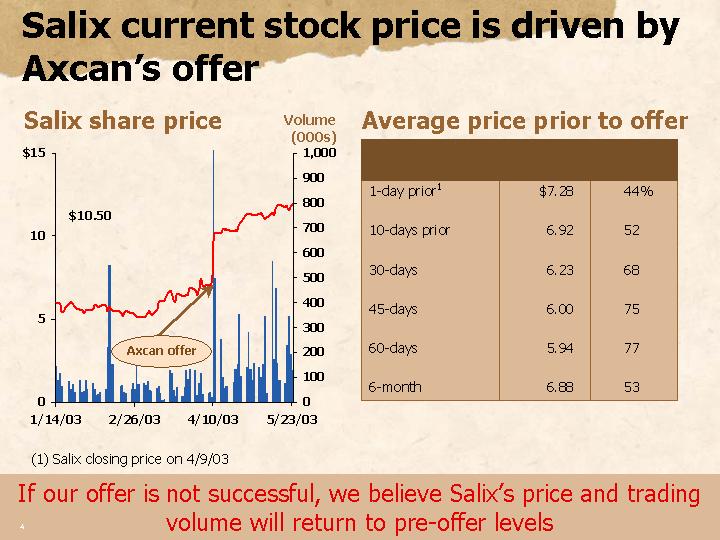

Salix current stock price is driven by Axcan’s offer

Salix share price

[CHART]

Average price prior to offer

1-day prior(1) | | $ | 7.28 | | 44 | % |

| | | | | |

10-days prior | | 6.92 | | 52 | |

| | | | | |

30-days | | 6.23 | | 68 | |

| | | | | |

45-days | | 6.00 | | 75 | |

| | | | | |

60-days | | 5.94 | | 77 | |

| | | | | |

6-month | | 6.88 | | 53 | |

(1) Salix closing price on 4/9/03

If our offer is not successful, we believe Salix’s price and trading volume will return to pre-offer levels

4

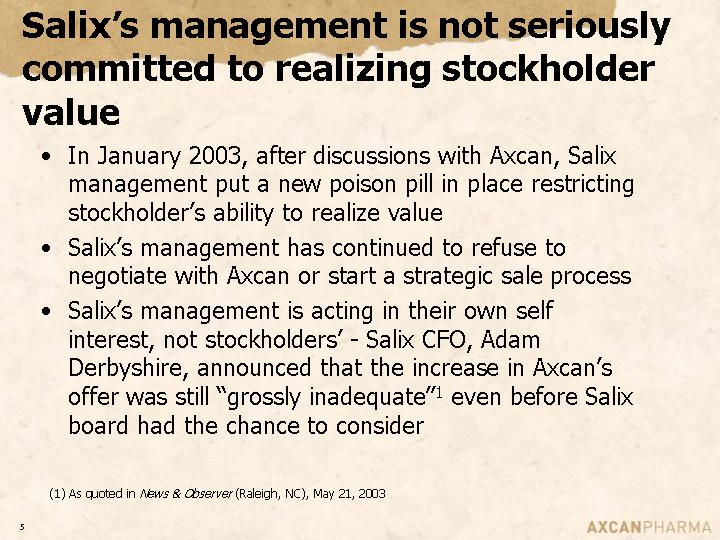

Salix’s management is not seriously committed to realizing stockholder value

• In January 2003, after discussions with Axcan, Salix management put a new poison pill in place restricting stockholder’s ability to realize value

• Salix’s management has continued to refuse to negotiate with Axcan or start a strategic sale process

• Salix’s management is acting in their own self interest, not stockholders’ - Salix CFO, Adam Derbyshire, announced that the increase in Axcan’s offer was still “grossly inadequate”(1) even before Salix board had the chance to consider

(1) As quoted in News & Observer (Raleigh, NC), May 21, 2003

5

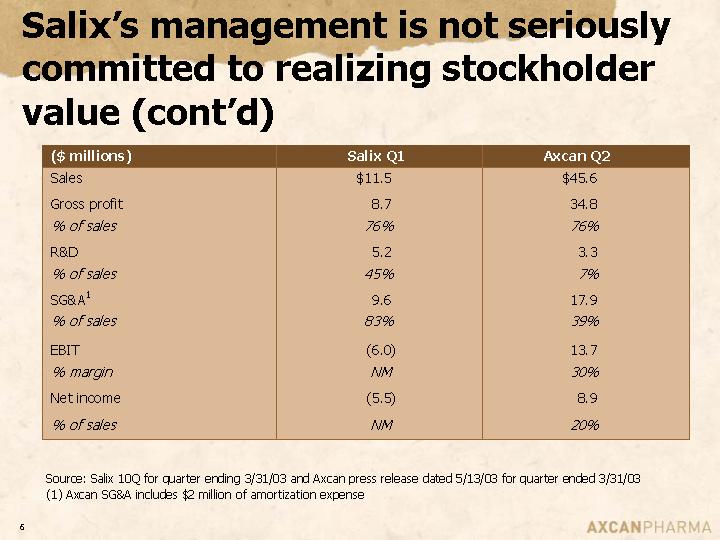

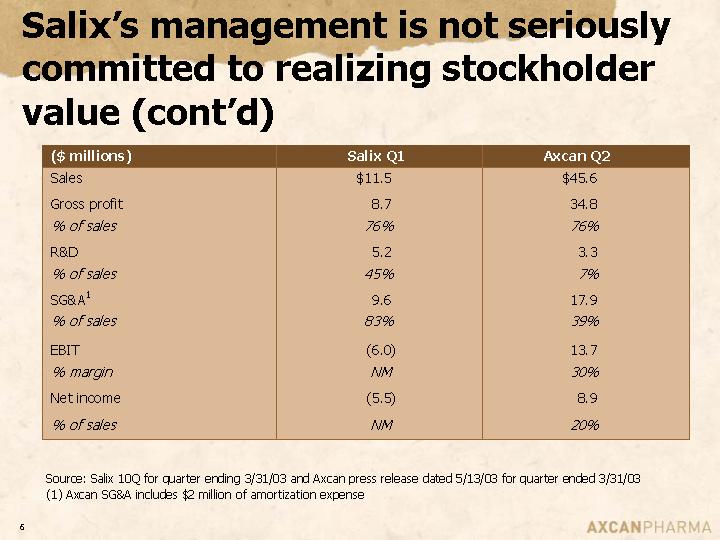

Salix’s management is not seriously committed to realizing stockholder value (cont'd)

($ millions) | | Salix Q1 | | Axcan Q2 | |

Sales | | $ | 11.5 | | $ | 45.6 | |

Gross profit | | 8.7 | | 34.8 | |

% of sales | | 76 | % | 76 | % |

R&D | | 5.2 | | 3.3 | |

% of sales | | 45 | % | 7 | % |

SG&A(1) | | 9.6 | | 17.9 | |

% of sales | | 83 | % | 39 | % |

| | | | | |

EBIT | | (6.0 | ) | 13.7 | |

% margin | | NM | | 30 | % |

Net income | | (5.5 | ) | 8.9 | |

% of sales | | NM | | 20 | % |

| | | | | | | |

Source: Salix 10Q for quarter ending 3/31/03 and Axcan press release dated 5/13/03 for quarter ended 3/31/03

(1) Axcan SG&A includes $2 million of amortization expense

6

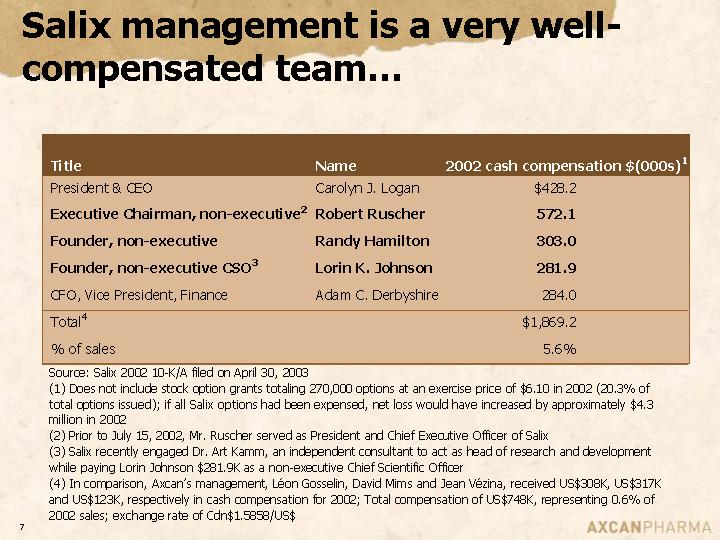

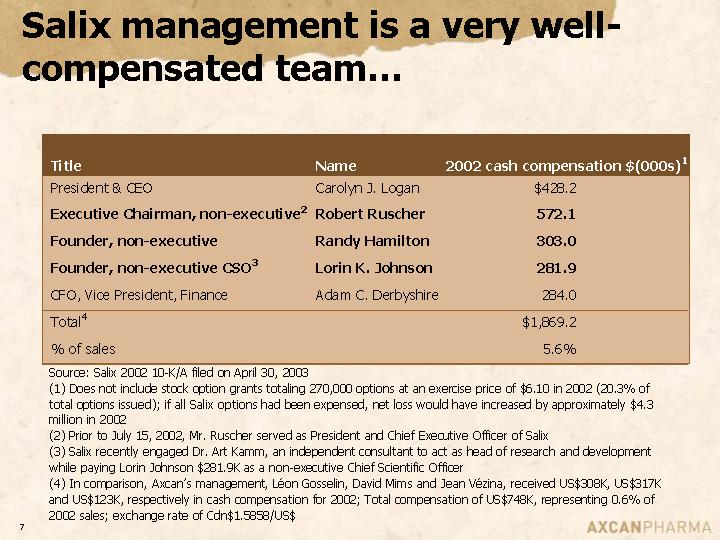

Salix management is a very well-compensated team…

Title | | Name | | 2002 cash

compensation

$(000s)(1) | |

President & CEO | | Carolyn J. Logan | | $ | 428.2 | |

Executive Chairman, non-executive(2) | | Robert Ruscher | | 572.1 | |

Founder, non-executive | | Randy Hamilton | | 303.0 | |

Founder, non-executive CSO(3) | | Lorin K. Johnson | | 281.9 | |

CFO, Vice President, Finance | | Adam C. Derbyshire | | 284.0 | |

Total(4) | | | | $ | 1,869.2 | |

% of sales | | | | 5.6 | % |

Source: Salix 2002 10-K/A filed on April 30, 2003

(1) Does not include stock option grants totaling 270,000 options at an exercise price of $6.10 in 2002 (20.3% of total options issued); if all Salix options had been expensed, net loss would have increased by approximately $4.3 million in 2002

(2) Prior to July 15, 2002, Mr. Ruscher served as President and Chief Executive Officer of Salix

(3) Salix recently engaged Dr. Art Kamm, an independent consultant to act as head of research and development while paying Lorin Johnson $281.9K as a non-executive Chief Scientific Officer

(4) In comparison, Axcan’s management, Léon Gosselin, David Mims and Jean Vézina, received US$308K, US$317K and US$123K, respectively in cash compensation for 2002; Total compensation of US$748K, representing 0.6% of 2002 sales; exchange rate of Cdn$1.5858/US$

7

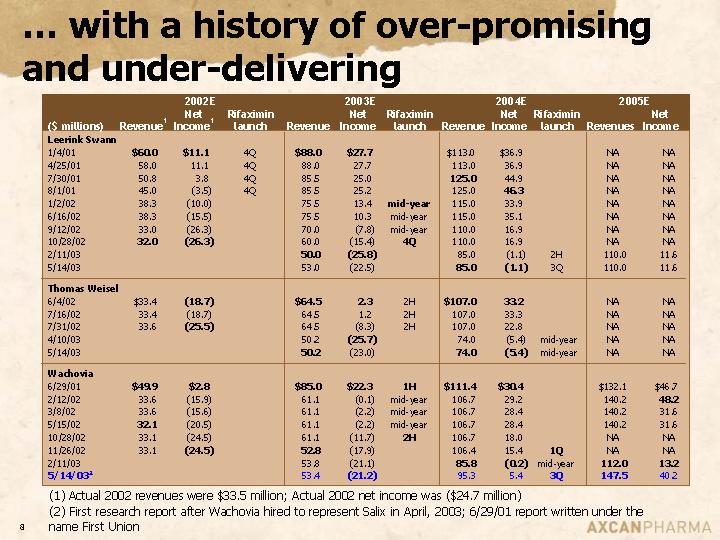

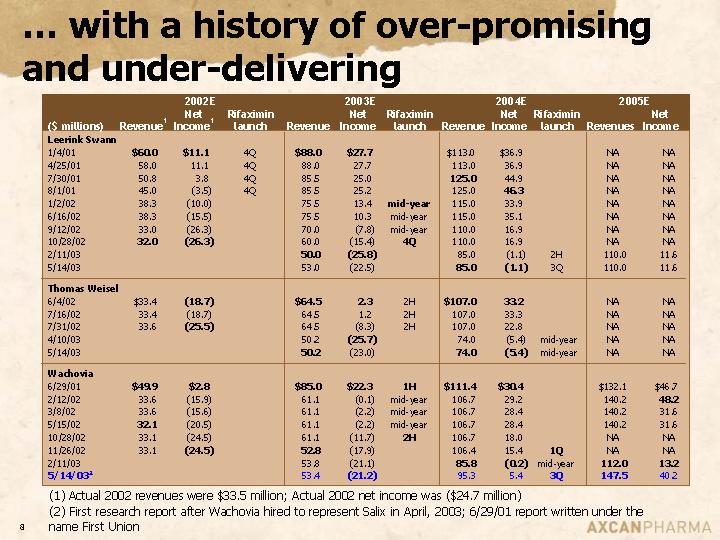

… with a history of over-promising and under-delivering

| | 2002E | | 2003E | | 2004E | | 2005E | |

| | | | Net | | Rifaximin | | | | Net | | Rifaximin | | | | Net | | Rifaximin | | | | Net | |

($ millions) | | Revenue(1) | | Income(1) | | launch | | Revenue | | Income | | launch | | Revenue | | Income | | launch | | Revenues | | Income | |

Leerink Swann | | | | | | | | | | | | | | | | | | | | | | | |

1/4/01 | | $ | 60.0 | | $ | 11.1 | | 4Q | | $ | 88.0 | | $ | 27.7 | | | | $ | 113.0 | | $ | 36.9 | | | | NA | | NA | |

4/25/01 | | 58.0 | | 11.1 | | 4Q | | 88.0 | | 27.7 | | | | 113.0 | | 36.9 | | | | NA | | NA | |

7/30/01 | | 50.8 | | 3.8 | | 4Q | | 85.5 | | 25.0 | | | | 125.0 | | 44.9 | | | | NA | | NA | |

8/1/01 | | 45.0 | | (3.5 | ) | 4Q | | 85.5 | | 25.2 | | | | 125.0 | | 46.3 | | | | NA | | NA | |

1/2/02 | | 38.3 | | (10.0 | ) | | | 75.5 | | 13.4 | | mid-year | | 115.0 | | 33.9 | | | | NA | | NA | |

6/16/02 | | 38.3 | | (15.5 | ) | | | 75.5 | | 10.3 | | mid-year | | 115.0 | | 35.1 | | | | NA | | NA | |

9/12/02 | | 33.0 | | (26.3 | ) | | | 70.0 | | (7.8 | ) | mid-year | | 110.0 | | 16.9 | | | | NA | | NA | |

10/28/02 | | 32.0 | | (26.3 | ) | | | 60.0 | | (15.4 | ) | 4Q | | 110.0 | | 16.9 | | | | NA | | NA | |

2/11/03 | | | | | | | | 50.0 | | (25.8 | ) | | | 85.0 | | (1.1 | ) | 2H | | 110.0 | | 11.6 | |

5/14/03 | | | | | | | | 53.0 | | (22.5 | ) | | | 85.0 | | (1.1 | ) | 3Q | | 110.0 | | 11.6 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Thomas Weisel | | | | | | | | | | | | | | | | | | | | | | | |

6/4/02 | | $ | 33.4 | | (18.7 | ) | | | $ | 64.5 | | 2.3 | | 2H | | $ | 107.0 | | 33.2 | | | | NA | | NA | |

7/16/02 | | 33.4 | | (18.7 | ) | | | 64.5 | | 1.2 | | 2H | | 107.0 | | 33.3 | | | | NA | | NA | |

7/31/02 | | 33.6 | | (25.5 | ) | | | 64.5 | | (8.3 | ) | 2H | | 107.0 | | 22.8 | | | | NA | | NA | |

4/10/03 | | | | | | | | 50.2 | | (25.7 | ) | | | 74.0 | | (5.4 | ) | mid-year | | NA | | NA | |

5/14/03 | | | | | | | | 50.2 | | (23.0 | ) | | | 74.0 | | (5.4 | ) | mid-year | | NA | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | |

Wachovia | | | | | | | | | | | | | | | | | | | | | | | |

6/29/01 | | $ | 49.9 | | $ | 2.8 | | | | $ | 85.0 | | $ | 22.3 | | 1H | | $ | 111.4 | | $ | 30.4 | | | | $ | 132.1 | | $ | 46.7 | |

2/12/02 | | 33.6 | | (15.9 | ) | | | 61.1 | | (0.1 | ) | mid-year | | 106.7 | | 29.2 | | | | 140.2 | | 48.2 | |

3/8/02 | | 33.6 | | (15.6 | ) | | | 61.1 | | (2.2 | ) | mid-year | | 106.7 | | 28.4 | | | | 140.2 | | 31.6 | |

5/15/02 | | 32.1 | | (20.5 | ) | | | 61.1 | | (2.2 | ) | mid-year | | 106.7 | | 28.4 | | | | 140.2 | | 31.6 | |

10/28/02 | | 33.1 | | (24.5 | ) | | | 61.1 | | (11.7 | ) | 2H | | 106.7 | | 18.0 | | | | NA | | NA | |

11/26/02 | | 33.1 | | (24.5 | ) | | | 52.8 | | (17.9 | ) | | | 106.4 | | 15.4 | | 1Q | | NA | | NA | |

2/11/03 | | | | | | | | 53.8 | | (21.1 | ) | | | 85.8 | | (0.2 | ) | mid-year | | 112.0 | | 13.2 | |

5/14/03(2) | | | | | | | | 53.4 | | (21.2 | ) | | | 95.3 | | 5.4 | | 3Q | | 147.5 | | 40.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Actual 2002 revenues were $33.5 million; Actual 2002 net income was ($24.7 million)

(2) First research report after Wachovia hired to represent Salix in April, 2003; 6/29/01 report written under the name First Union

8

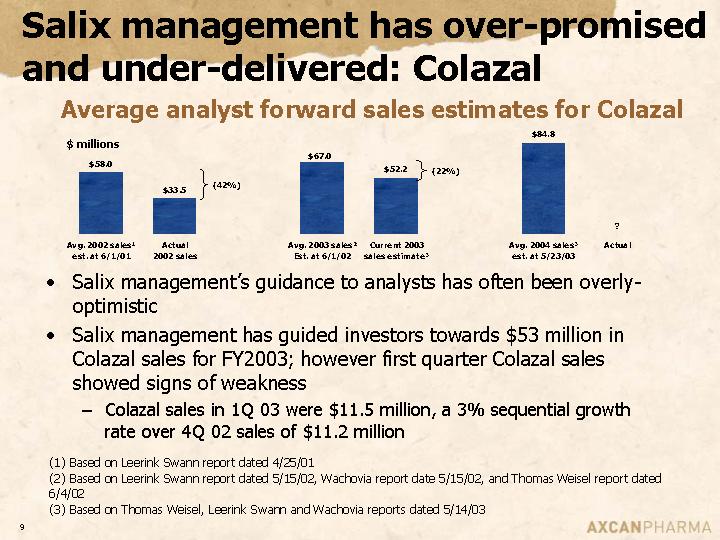

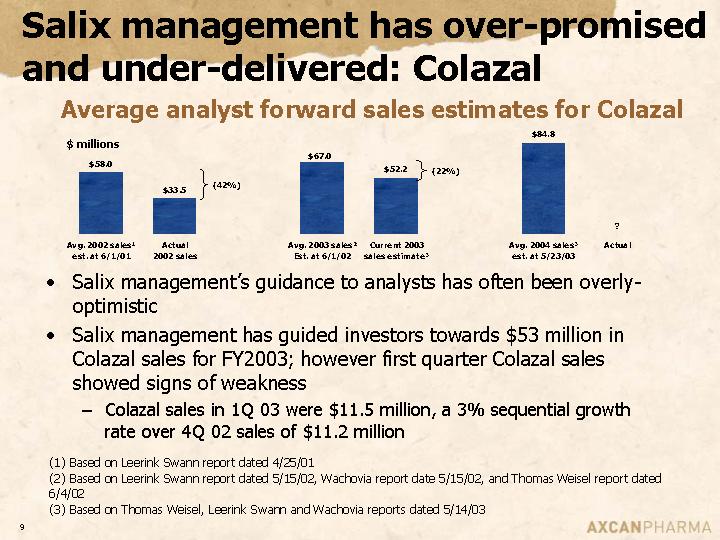

Salix management has over-promised and under-delivered: Colazal

Average analyst forward sales estimates for Colazal

[CHARTS](1)(2)(3)

• Salix management’s guidance to analysts has often been overly-optimistic

• Salix management has guided investors towards $53 million in Colazal sales for FY2003; however first quarter Colazal sales showed signs of weakness

• Colazal sales in 1Q 03 were $11.5 million, a 3% sequential growth rate over 4Q 02 sales of $11.2 million

(1) Based on Leerink Swann report dated 4/25/01

(2) Based on Leerink Swann report dated 5/15/02, Wachovia report date 5/15/02, and Thomas Weisel report dated 6/4/02

(3) Based on Thomas Weisel, Leerink Swann and Wachovia reports dated 5/14/03

9

Colazal sales trends and DSOs

Colazal sales and growth per quarter

[CHART]

Days sales outstanding

[CHART]

Source: Salix public filings

10

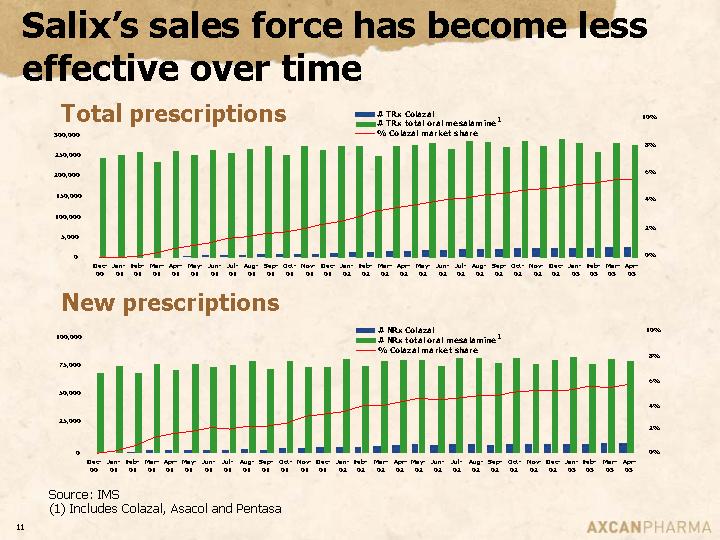

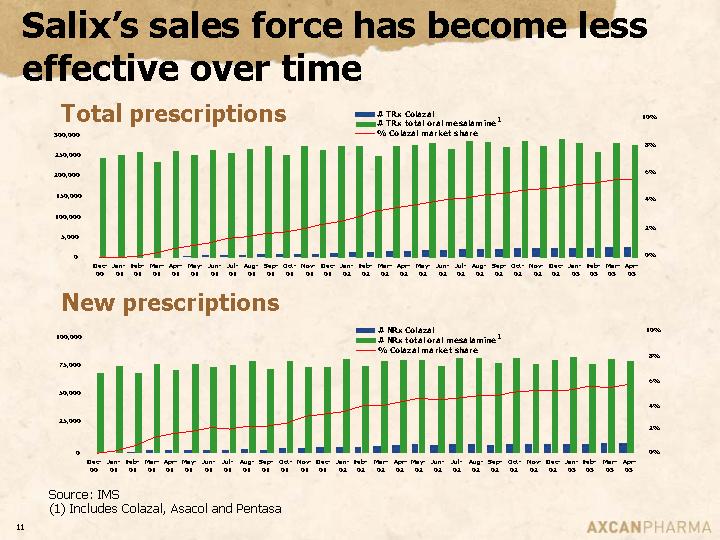

Salix’s sales force has become less effective over time

Total prescriptions

[CHART](1)

New prescriptions

[CHART](1)

Source: IMS

(1) Includes Colazal, Asacol and Pentasa

11

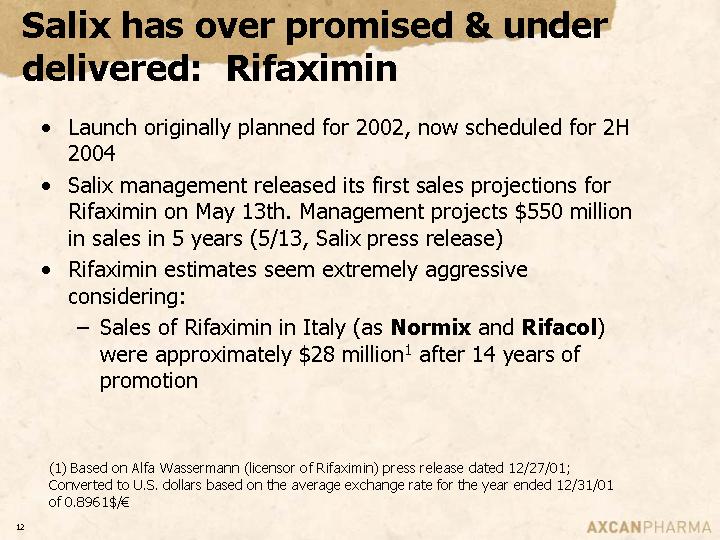

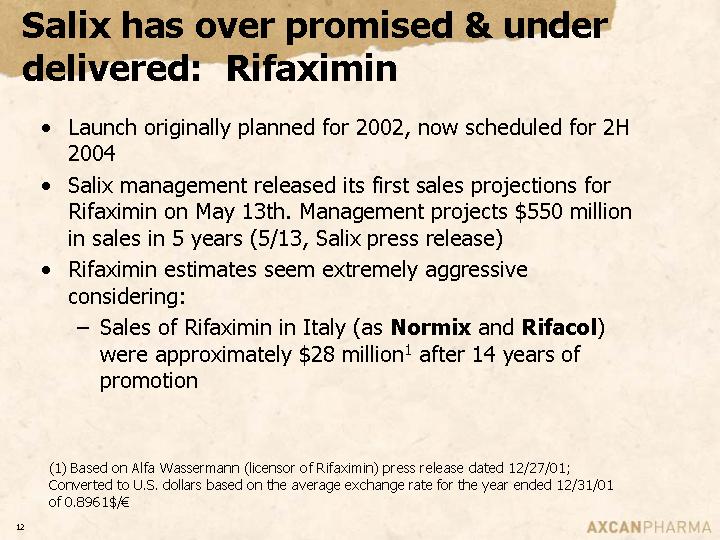

Salix has over promised & under delivered: Rifaximin

• Launch originally planned for 2002, now scheduled for 2H 2004

• Salix management released its first sales projections for Rifaximin on May 13th. Management projects $550 million in sales in 5 years (5/13, Salix press release)

• Rifaximin estimates seem extremely aggressive considering:

• Sales of Rifaximin in Italy (as Normix and Rifacol) were approximately $28 million(1) after 14 years of promotion

(1) Based on Alfa Wassermann (licensor of Rifaximin) press release dated 12/27/01;

Converted to U.S. dollars based on the average exchange rate for the year ended 12/31/01 of 0.8961$/€

12

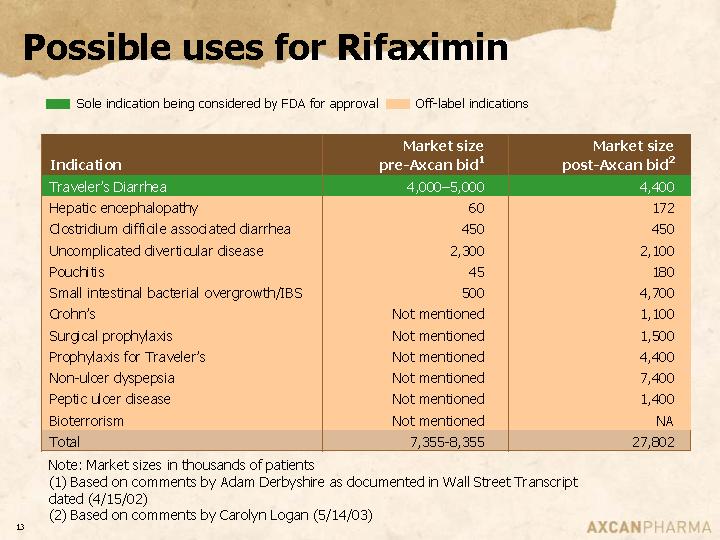

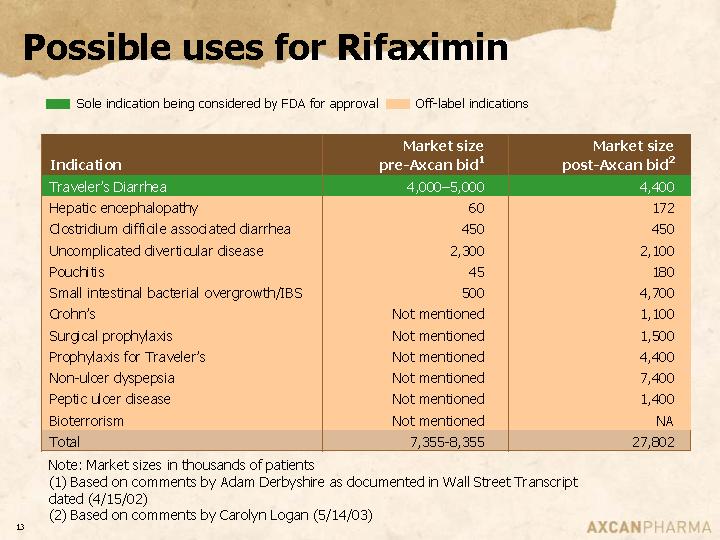

Possible uses for Rifaximin

[GRAPHIC KEY]

| | Market size | | Market size | |

Indication | | pre-Axcan bid(1) | | post-Axcan bid(2) | |

Traveler’s Diarrhea | | 4,000-5,000 | | 4,400 | |

Hepatic encephalopathy | | 60 | | 172 | |

Clostridium difficile associated diarrhea | | 450 | | 450 | |

Uncomplicated diverticular disease | | 2,300 | | 2,100 | |

Pouchitis | | 45 | | 180 | |

Small intestinal bacterial overgrowth/IBS | | 500 | | 4,700 | |

Crohn’s | | Not mentioned | | 1,100 | |

Surgical prophylaxis | | Not mentioned | | 1,500 | |

Prophylaxis for Traveler’s | | Not mentioned | | 4,400 | |

Non-ulcer dyspepsia | | Not mentioned | | 7,400 | |

Peptic ulcer disease | | Not mentioned | | 1,400 | |

Bioterrorism | | Not mentioned | | NA | |

Total | | 7,355-8,355 | | 27,802 | |

Note: Market sizes in thousands of patients

(1) Based on comments by Adam Derbyshire as documented in Wall Street Transcript dated (4/15/02)

(2) Based on comments by Carolyn Logan (5/14/03)

13

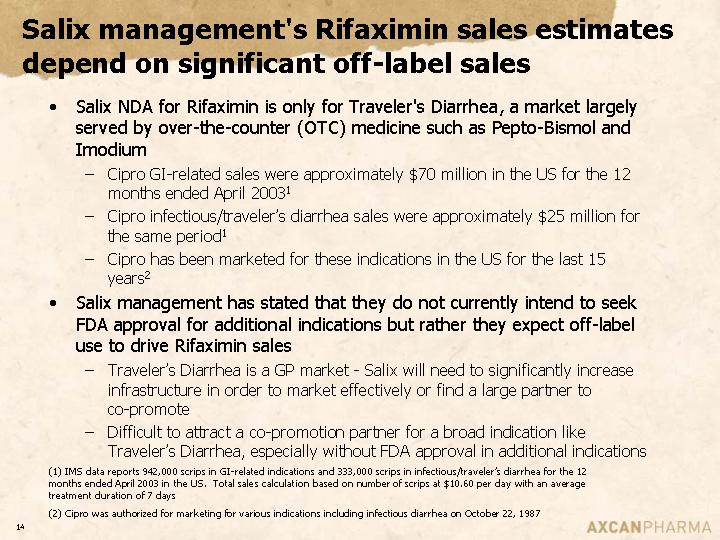

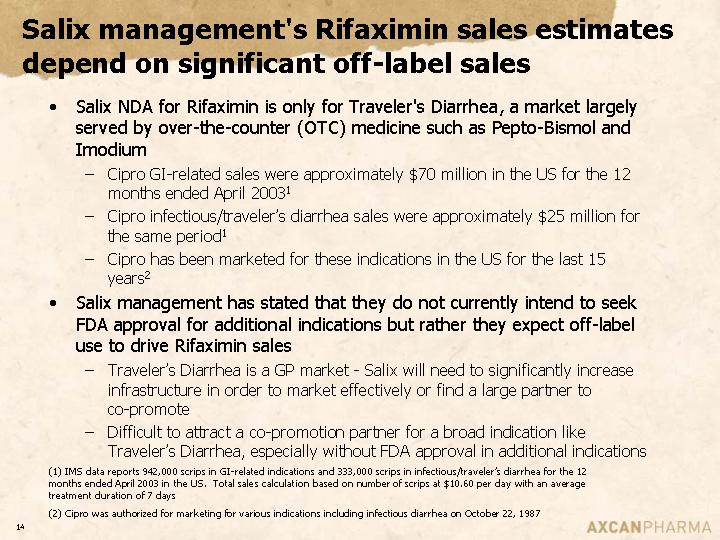

Salix management’s Rifaximin sales estimates depend on significant off-label sales

• Salix NDA for Rifaximin is only for Traveler’s Diarrhea, a market largely served by over-the-counter (OTC) medicine such as Pepto-Bismol and Imodium

• Cipro GI-related sales were approximately $70 million in the US for the 12 months ended April 2003(1)

• Cipro infectious/traveler’s diarrhea sales were approximately $25 million for the same period(1)

• Cipro has been marketed for these indications in the US for the last 15 years(2)

• Salix management has stated that they do not currently intend to seek FDA approval for additional indications but rather they expect off-label use to drive Rifaximin sales

• Traveler’s Diarrhea is a GP market - Salix will need to significantly increase infrastructure in order to market effectively or find a large partner to co-promote

• Difficult to attract a co-promotion partner for a broad indication like

Traveler’s Diarrhea, especially without FDA approval in additional indications

(1) IMS data reports 942,000 scrips in GI-related indications and 333,000 scrips in infectious/traveler’s diarrhea for the 12 months ended April 2003 in the US. Total sales calculation based on number of scrips at $10.60 per day with an average treatment duration of 7 days

(2) Cipro was authorized for marketing for various indications including infectious diarrhea on October 22, 1987

14

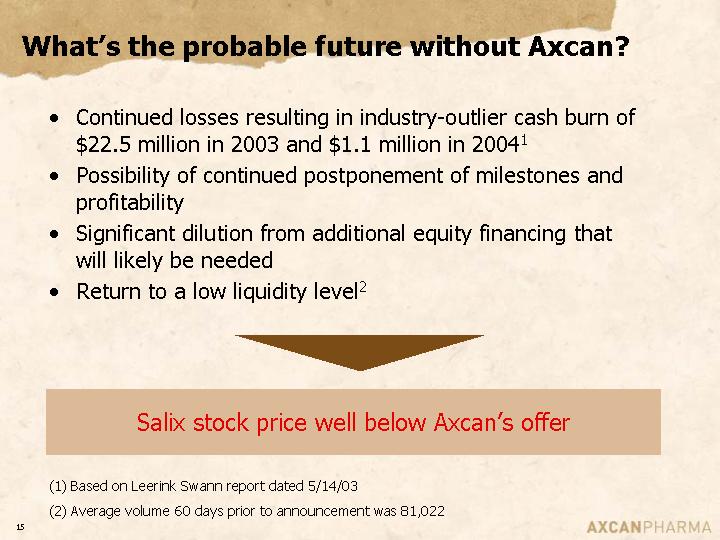

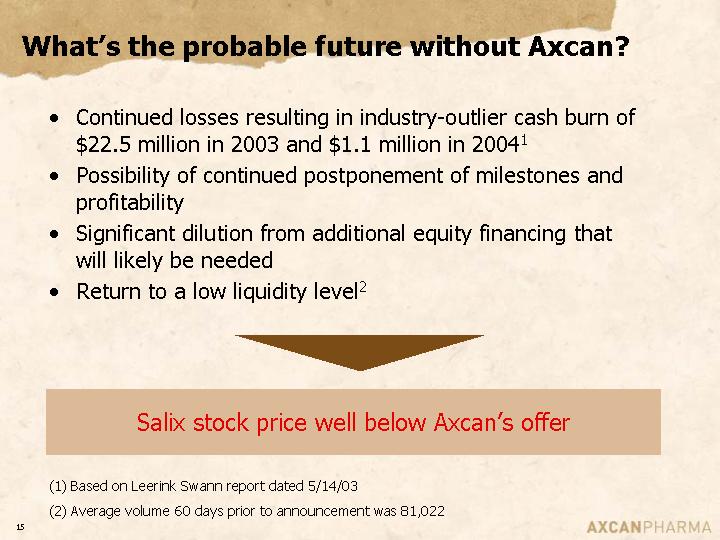

What’s the probable future without Axcan?

• Continued losses resulting in industry-outlier cash burn of $22.5 million in 2003 and $1.1 million in 2004(1)

• Possibility of continued postponement of milestones and profitability

• Significant dilution from additional equity financing that will likely be needed

• Return to a low liquidity level(2)

[Graphic]

Salix stock price well below Axcan’s offer

(1) Based on Leerink Swann report dated 5/14/03

(2) Average volume 60 days prior to announcement was 81,022

15

Axcan’s Strengths

• Axcan has a demonstrated track record of acquiring and integrating products and companies efficiently and profitably

• Axcan has a strong balance sheet and access to capital

• Axcan is best positioned to accelerate Salix’s current sales and realize synergies

16

Axcan’s proposal

• Axcan has proposed a slate of directors for election at the annual meeting schedule for June 19th

• If elected, Axcan expects the directors, consistent with the exercise of their fiduciary duties, to remove Salix’s poison pill and clear the way for stockholders to consider Axcan’s offer or any superior offer

• Axcan has increased its all-cash tender offer to $10.50 per share and has extended the expiration date to June 27th, 2003

• Axcan requests that you

• Deliver your gold proxy card to Axcan by June 13, 2003

• Tender your shares to Axcan by June 13, 2003

17

Axcan’s independent nominees

Name | | Credentials |

Gideon Argov | | • | | Partner at Parthenon Capital since 2001 |

Age 46 | | • | | Former Chairman, President and Chief Executive Officer of Kollmorgen Corporation |

| | • | | Director of Transtechnology Corporation and Amazys Holding Company |

Scott Bice | | • | | Professor of Law of the University of Southern California Law School since 1974 |

Age 60 | | • | | Former Dean of the University of Southern California Law School |

| | • | | Director of Western Mutual Insurance Company and Residence Mutual Insurance |

Gerald Bruno, Ph.D | | • | | President of SL Ventures, a private investment and consulting firm since 1996 |

Age 67 | | • | | Former Chairman of Health Resources Group since 1999 |

| | • | | Former director of Triosyn Corp. since 2000 |

| | • | | Founder of BioTrax International, Inc.; President & CEO from 1985 to 1995 |

John Coates | | • | | Professor of Law at Harvard Law School since 1997 |

Age 38 | | • | | Former partner in the law firm of Wachtell, Lipton, Rosen & Katz in New York City, |

| | | | specializing in securities, mergers and acquisitions and general corporate transactions |

Richard Williams | | • | | Founder and President of Conner-Thoele Limited since 1989 |

Age 59 | | • | | Vice Chairman and Director of King Pharmaceuticals, Inc. from 2000 to April 2001 |

| | • | | Former Chairman and Director of Medco Research, Inc. |

| | • | | Former Co-Chairman and Director of Vysis from 1997 to 1999 |

| | • | | Director of EP Med Systems and ISTA Pharmaceuticals |

18

Why vote for the independent nominees?

• Remove barriers to the tender offer; let Salix stockholders decide

• Management has a history of over-promising and under-delivering

• Profitability

• Launch of Rifaximin

• Salix stock price has been driven and supported by our offer

19

[LOGO]

CERTAIN FORWARD LOOKING STATEMENTS

To the extent any statements made in this document contain information that is not historical, including statements related to the expected benefits to Axcan of the Salix acquisition, these statements are essentially forward looking and are subject to risks and uncertainties, including the difficulty of predicting FDA approvals, acceptance and demand for new pharmaceutical products, the impact of competitive products and pricing, new product development and launch, reliance on key strategic alliances, availability of raw materials, the regulatory environment, fluctuations in operating results and other risks detailed from time to time in Axcan’s filings with the Securities and Exchange Commission (the “Commission”).

INFORMATION CONCERNING THE OFFER AND THE PROXY SOLICITATION

Saule Holdings Inc. (“Saule”), a wholly owned subsidiary of Axcan Pharma Inc. (“Axcan”), has commenced a tender offer for all the outstanding shares of common stock of Salix Pharmaceuticals, Ltd. (“Salix”) at US$10.50 per share, net to the seller in cash, without interest. The offer currently is scheduled to expire at 5:00 p.m., New York City time, on June 27, 2003. The offer is subject to a number of conditions described in the Offer to Purchase, dated April 10, 2003, as amended, and the Supplement to the Offer to Purchase, dated May 20, 2003. Subject to the requirements of applicable law, all of the conditions to the offer may be waived and the offer period may be further extended. The complete terms and conditions of the offer are set forth in the Offer to Purchase, as amended, the Supplement to the Offer to Purchase, and related revised Letter of Transmittal. The Offer to Purchase is attached as an exhibit to Tender Offer Statement on Schedule TO filed by Axcan and Saule with the Commission on April 10, 2003, as the same has been and may be amended or supplemented from time to time. The Supplement to the Offer to Purchase and the related revised Letter of Transmittal are attached as exhibits to the amendment to the Tender Offer Statement on Schedule TO/A filed by Axcan and Saule with the Commission on May 20, 2003, as the same may be amended or supplement from time to time.

On May 20, 2003, Axcan and Saule filed with the Commission a preliminary proxy statement in connection with the election of the nominees of Axcan and Saule (the “Director Nominees”) to the Salix board of directors at the Salix 2003 annual meeting of shareholders. Axcan expects to file other proxy solicitation materials regarding the election of the Director Nominees or the proposed business combination between Axcan and Salix. Investors and security holders are urged to read the definitive proxy statement and other proxy materials (when they become available), because they contain or will contain important information. The definitive proxy statement was first mailed on or about May 20, 2003 to all stockholders of Salix of record as of April 25, 2003. Detailed information regarding the names, affiliations and interests of individuals who may be deemed participants in the solicitation of proxies of Salix stockholders by Axcan is available in the definitive proxy statement on Schedule 14A filed on May 20, 2003 by Axcan with the Securities and Exchange Commission.

Investors and security holders may obtain a free copy of the Offer to Purchase, the Supplement thereto, the Proxy Statement and other documents filed by Axcan with the Securities and Exchange Commission at the Commission’s website at http://www.sec.gov. The Offer to Purchase, the Supplement thereto, the Proxy Statement and these other documents may also be obtained free of charge by directing a request to the Information Agent for the offer, MacKenzie Partners, Inc. at (800) 322-2885, or by email at proxy@mackenziepartners.com.

20