QuickLinks -- Click here to rapidly navigate through this documentExhibit 99.10

ANNUAL INFORMATION FORM

FOR FISCAL YEAR ENDED SEPTEMBER 30, 2004

FEBRUARY 20, 2005

TABLE OF CONTENTS

| GLOSSARY OF TECHNICAL TERMS | | II |

| TRADEMARKS | | V |

| AXCAN | | 1 |

| GENERAL DEVELOPMENT OF THE BUSINESS | | 1 |

| BUSINESS OF AXCAN | | 5 |

| SELECTED CONSOLIDATED FINANCIAL INFORMATION | | 20 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND OPERATING RESULTS | | 29 |

| DIVIDEND POLICY | | 29 |

| DIRECTORS AND OFFICERS | | 30 |

| MARKET FOR SECURITIES | | 32 |

| SHAREHOLDER RIGHTS PLAN | | 33 |

| ADDITIONAL INFORMATION | | 38 |

i

GLOSSARY OF TECHNICAL TERMS

The text following the technical terms reproduced in this glossary is explanatory only and does not in any way modify the meanings of such terms.

Adenomatous Polyp: Benign growth (tumor) arising from the inner layer of the gastrointestinal tract and protruding into the lumen of the gastrointestinal tract.

Barrett's Esophagus: Condition that results from prolonged heartburn, which causes the lining of the esophagus to be converted into tissue similar to that which lines the stomach.

Bile Ducts: Channels that collect bile from the liver and deliver it to the intestine.

Cervical Dysplasia: Modification of the size, shape and organization of cells in the cervix. Dysplasia is generally considered to be a pre-cancerous condition.

Cholestatic Diseases of the Liver: Conditions in which the bile flow from the liver is impaired.

Cholestasis: Combined conditions causing the reduction of bile flow and the retention of bile acids.

Cirrhosis: Disease of the liver, originating from many causes and characterized by a progressive replacement of liver cells by scarring tissue.

CMC: Chemistry, manufacturing and control data. Data describing the method of synthesis of a new drug as well as the method of manufacture and the controls applied to the drug substance and drug product.

Colorectal Adenomateous Polyps: Polyps which are considered precursors to colorectal cancer.

Crohn's Disease (CD): Inflammatory bowel disease that affects the wall of the gastrointestinal tract. CD can affect any part of the gastrointestinal tract but mostly affects the ileum, the last portion of the small bowel and the colon.

Cystic Fibrosis (CF): Congenital disease characterized by excessive secretions of certain glands, resulting in pancreatic insufficiency and pulmonary disorders. The average lifespan of CF patients is approximately 32 years.

Distal: The part of the colon closest to the rectum.

Double Blind Study: An experiment designed to test the effect of a treatment or substance using groups of experimental and control subjects in which neither the subjects nor the investigators know which treatment or substance is being administered to which group.

Duodenum: Part of the small intestine attached to the end of the stomach.

Exocrine Pancreatic Insufficiency: Decreased production and release of the enzymes produced in the pancreas, which leads to digestive problems.

Fibrosis: Formation of excess fibrous tissue characterized by increased collagen concentrations, which gives a rigid consistence to the affected tissue (scar tissue consists mainly of fibrosis).

Food and Drug Administration (FDA): Regulatory body for the development, manufacture, sale and use of drugs in the United States.

Gastric Cancer: Cancer of the cell lining of the gastric mucosa.

Helicobacter Pylori (Hp): Bacterium with a spiral tail which lives under the gastric mucosa layer. The presence ofHp is correlated with gastritis, as well as gastric and duodenal ulcers.Hp is considered to be the most important factor in the cause of peptic ulceration and is formally classified as a Category 1 (definite) human carcinogen by the World Health Organization. Once a diagnosis ofHp infection has been established, eradication of the bacterium should be prescribed in all peptic ulcer patients to reduce the rate of ulcer recurrence.

ii

Hepatitis: Inflammation of the liver due to infection or toxins.

High-Grade Dysplasia: As associated with Barrett's Esophagus, High-Grade Dysplasia is a condition that results from prolonged acid reflux (heartburn) which causes the lining of the esophagus to be converted into tissue similar to that which lines the stomach. This transformation makes the esophageal tissue more susceptible to cancer.

Hypertriglyceridemia: Abnormally elevated blood levels of triglyceride, a compound composed of fatty acids.

Inflammatory Bowel Diseases (IBDs): Chronic diseases of unknown cause characterized by inflammation of portions of the gastrointestinal tract. Ulcerative colitis, ulcerative proctitis (a distal form of ulcerative colitis) and Crohn's Disease constitute the group of illnesses referred to as idiopathic inflammatory bowel diseases. The course of IBDs is a succession of acute attacks followed by periods of remission. There are no cures for IBDs and the goals of therapy are to reduce symptoms during acute attacks and to maintain remission when the disease is under control.

Initial New Drug Application: Document containing all available data gathered during pre-clinical testing as well as a comprehensive description of the proposed study to be conducted in humans.

Intent-to-Treat Basis: A statistical analysis approach based on real life condition of use of a drug being tested (i.e., all data included, associated with the correct or incorrect use of the drug).

Irritable Bowel Syndrome (IBS): Functional bowel disorder which primarily affects gastrointestinal motility.

Jaundice: Yellowing of the skin caused by a build-up of a chemical called bilirubin, normally excreted in bile.

Liver: Organ located in the top right portion of the abdominal cavity connected to the digestive tract. It secretes bile that is excreted in the duodenum, thus facilitating digestion of food in the small intestine. The liver plays a key role in the processing and storage of various products of absorption.

Marketing Authorization Application (MAA): Document containing all pre-clinical, clinical and CMC data collected on a drug. MAAs are submitted to regulatory authorities by manufacturers in order to obtain approval to market new chemical entities in the European Union.

Mesalamine: 5 aminosalicylic acid (5-ASA).

Motility: Ability of the gastrointestinal tract to undergo rhythmic muscular contractions.

Mucosa: Thin sheets of tissue that cover or line various parts of the body such as the mouth or digestive tract.

New Drug Application (NDA): A document containing all pre-clinical, clinical and CMC data collected on a drug. NDAs are submitted to the FDA by manufacturers in order to obtain approval to market New Chemical Entities (NCE) in the United States.

New Chemical Entities (NCE): Chemical substances of synthetic or biological origin which have not been tested for pharmacological activity.

New Drug Submission (NDS): A document containing all pre-clinical, clinical and CMC data collected on a drug. NDSs are submitted to the Therapeutic Products Directorate of Health Canada by manufacturers in order to obtain approval to market new chemical entities in Canada.

Orphan Drug: Designation granted by the FDA. This process is designed to encourage development of drugs intended for the treatment of rare diseases or conditions (affecting less than 200,000 patients for the disease in the United States). The measures include the grant of a seven-year exclusivity in the marketing of a qualified product.

Pancreas: Abdominal gland located behind the stomach and connected to the gastrointestinal tract that secretes pancreatic juice to aid digestion (pancreatic enzymes) and insulin, an essential hormone for the metabolism of sugars.

iii

Pancreatic Juice: Alkaline secretion of the pancreas containing enzymes that aid in the digestion of protein, carbo-hydrates, and fats.

Pancreatitis: Inflammation of the pancreas.

Per Protocol Basis: A statistical analysis approach based on the optimal use of a drug being tested (i.e., in full accordance with the protocol established for the study)

Placebo: Inactive substances used in experimental, blinded drug studies.

Polyp: Small tumor-like growth that projects from a mucus membrane surface (i.e. colon or rectum).

Primary Biliary Cirrhosis (PBC): A chronic cholestatic liver disease that progresses slowly towards a terminal phase characterized by jaundice, signs of decompensated cirrhosis, ascites and variceal bleeding. The prognosis averages 7 to 12 years from diagnosis to death or liver transplant.

Primary Sclerosing Cholangitis (PSC): A liver disorder characterized by an inflammatory and sclerosing process leading to a progressive reduction in the diameter of the bile ducts. Its progressive course generally leads to liver cirrhosis, portal hypertension and often death, as the bile that normally flows out of the liver instead accumulates there, resulting in an alteration of liver cells. The average survival is 4 to 10 years following diagnosis.

Supplemental New Drug Application (sNDA): Document containing all clinical and CMC data collected on a drug already on the market, but for an new indication. sNDAs are submitted to the FDA by manufacturers in order to obtain approval to market a drug for a new indication in the United States.

Supplemental New Drug Submission (sNDS): Document containing all clinical and CMC data collected on a drug already on the market, but for an new indication. sNDSs are submitted to the Therapeutic Products Directorate by manufacturers in order to obtain approval to market a drug for a new indication in Canada.

Steatorrhea: Abnormally high fecal excretion of non-digestive fat.

Therapeutic Products Directorate (TPD): Regulatory body for the development, manufacture, sale and use of drugs in Canada.

Ulcer: Necrotic lesion characterized by a crater-like erosion of the wall of the stomach (gastric ulcer) or the duodenum (duodenal ulcer), often associated with painful symptoms.

Ulcerative Colitis/Proctitis: Chronic inflammatory disease which affects the inner mucus membrane of the colon, more often the distal portions of the colon (i.e., the rectum and sigmoid).

Ursodiol (ursodeoxycholic acid): Naturally occurring bile acid present as a minor fraction of the total human bile acids, and in greater concentrations, in the bile of certain animal species such as bears. Ursodiol is a drug indicated for the treatment of different diseases such as dissolution of gallstones, primary biliary cirrhosis and other cholestatic liver diseases.

iv

TRADEMARKS

The names AXCAN, AXCAN PHARMA, BENTYL, BENTYLOL, CANASA, CARAFATE, DELURSAN, FLUTTER, HELIZIDE, HEPENAX, ITAX, LACTÉOL, MODULON, PHOTOBARR, PHOTOFRIN, PANZYTRAT, PROCTOSEDYL, SALOFALK, SCANDICAL, SCANDISHAKE, SULCRATE, TAGAMET, TRANSITOL, TRANSULOSE, ULTRASE, URSO, URSO DS, URSO Forte and VIOKASE appearing in this Annual Information Form are trademarks of Axcan or one of its subsidiaries.

The following names appearing in this Annual Information Form are trademarks used under license by Axcan:

- •

- ADEKs is a registered trademark of Carlsson-Rensselaer Corporation.

- •

- CORTENEMA is a registered trademark of Reid Rowell Inc.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this Annual Information Form, and in certain documents incorporated or deemed to be incorporated by reference in this Annual Information Form, constitute "forward-looking statements." When used in this document, the words "anticipate," "believe," "estimate," "expect," "plan," "future," "intend," "may," "will," "should," "predicts," "potential," "continue," and similar expressions, as they relate to Axcan or its management, are intended to identify forward-looking statements. Such statements reflect the current views of Axcan with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. These statements should not be relied upon. Many factors could cause the actual results, performance or achievements of Axcan to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, those which are discussed under the heading "Risk Factors" in this Annual Information Form. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated or expected. Axcan does not intend, and does not assume any obligation, to update these forward-looking statements.

Unless otherwise stated, all market size information appearing in this Annual Information Form have been provided by IMS Health Ltd., a widely accepted provider of information services specializing in medical research information.

Unless otherwise stated, all dollar amounts appearing in this Annual Information Form are stated in U.S. dollars, and all financial data included in this Annual Information Form has been prepared in accordance with U.S. generally accepted accounting principles.

v

AXCAN PHARMA INC.

Axcan Pharma Inc. ("Axcan") was incorporated under theCanada Business Corporations Act on May 6, 1982 under the name 115391 Canada Inc. On February 14, 1983, Axcan changed its name to Interfalk Canada Inc. and on October 1, 1993, it amalgamated with Axcan Holdings Ltd., its parent corporation, under the name Interfalk Canada Inc. which was changed to Axcan Pharma Inc. on July 12, 1994. On October 30, 1995, Axcan's Articles were amended to delete the private company restrictions, redesignate the existing Class "A" shares and Class "B" shares as common shares and preferred shares, respectively, and consolidate the common shares on a 0.44 for one basis. On June 6, 2000 Axcan's Articles were amended again to create 14,175,000 Series A preferred shares and 12 million Series B preferred shares. Axcan's head office is located at 597 Laurier Blvd., Mont Saint-Hilaire, Quebec, J3H 6C4, Canada.

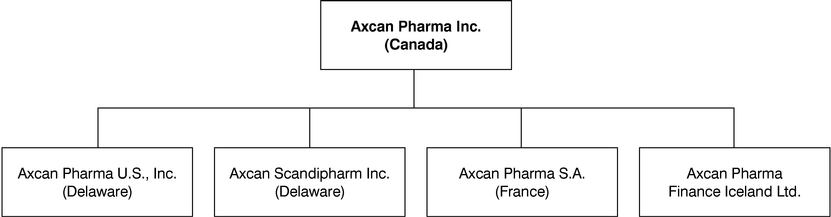

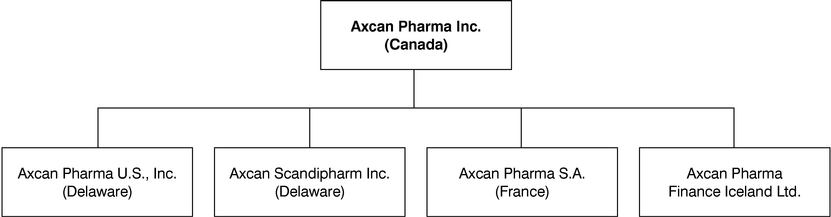

Where reference is made to Axcan in this Annual Information Form, the term includes Axcan Pharma Inc., its predecessors and its direct and indirect subsidiaries and their predecessors collectively, unless the context otherwise requires. The following chart shows the jurisdictions of incorporation of Axcan and its principal subsidiaries. All of the outstanding shares of such subsidiaries or associated corporations are owned directly or indirectly by Axcan.

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

Axcan is a leading specialty pharmaceutical company concentrating in the field of gastroenterology, with operations in North America and Europe. Axcan markets and sells pharmaceutical products used in the treatment of a variety of gastrointestinal diseases and disorders. The Company seeks to expand its gastrointestinal franchise by in-licensing products and acquiring products or companies, as well as developing additional products and expanding indications for existing products. Axcan's current products include ULTRASE, VIOKASE and PANZYTRAT for the treatment of certain gastrointestinal symptoms related to cystic fibrosis in the case of ULTRASE and to pancreatic insufficiency in the case of VIOKASE and PANZYTRAT; URSO 250, URSO Forte and DELURSAN for the treatment of certain cholestatic liver diseases; SALOFALK and CANASA for the treatment of certain inflammatory bowel diseases; and PHOTOFRIN for the treatment of certain types of gastrointestinal and other conditions. In addition, as at September 30, 2004, Axcan had one product pending approval, a new formulation for a product currently marketed in the United States. Axcan also has a number of pharmaceutical projects in all phases of development, including ITAX for the treatment of functional dyspepsia. Axcan reported revenue of $243.6 million and operating income of $76.8 million for the year ended September 30, 2004.

1

Much of Axcan's recent sales growth is derived from sales in the United States and from sales by its French subsidiary, following recent acquisitions. During the first quarter of fiscal 2003, Axcan acquired the worldwide rights to the PANZYTRAT enzyme product line from Abbott Laboratories ("Abbott") and the rights to DELURSAN, an ursodiol 250 mg tablet, from Aventis Pharma S.A. ("Aventis") for the French market. During the first quarter of fiscal 2004, Axcan acquired the rights to a group of products from Aventis for a cash purchase price of $145.0 million. These products are CARAFATE and BENTYL for the U.S. market and SULCRATE, BENTYLOL and PROCTOSEDYL for the Canadian market (collectively, "AVAX" product line). Revenue from sales of Axcan's products in the United States was $166.7 million (68.4% of total revenue) for the year ended September 30, 2004, compared to $113.9 million (63.6% of total revenue) for fiscal 2003 and $100.1 million for fiscal 2002 (75.6% of total revenue). In Canada, revenue was $28.0 million (11.5% of total revenue) for the year ended September 30, 2004, compared to $20.6 million (11.5% of total revenue) for fiscal 2003 and $17.4 million for fiscal 2002 (13.1% of total revenue). In Europe, revenue was $48.7 million (20.0% of total revenue) for the year ended September 30, 2004, compared to $44.5 million (24.8% of total revenue) for fiscal 2003 and $14.8 million for fiscal 2002 (11.2% of total revenue).

Axcan's revenue historically has been and continues to be principally derived from sales of pharmaceutical products to large pharmaceutical wholesalers and large chain pharmacies. Axcan utilizes a "pull-through" marketing approach that is typical of pharmaceutical companies. Under this approach, Axcan's sales representatives demonstrate the features and benefits of its products to gastroenterologists who may write their patients prescriptions for Axcan's products. The patients, in turn, take the prescriptions to pharmacies to be filled. The pharmacies then place orders with the wholesalers or, in the case of large chain pharmacies, their distribution centres, to whom Axcan sells its products.

Axcan's expenses are comprised primarily of selling and administrative expenses (including marketing expenses), cost of goods sold (including royalty payments to those companies from whom Axcan licenses some of its products), research and development expenses as well as depreciation and amortization.

Axcan's annual and quarterly operating results are primarily affected by three factors: wholesaler buying patterns; the level of acceptance of Axcan's products by gastroenterologists and their patients; and the extent of Axcan's control over the marketing of its products. Wholesaler buying patterns, including a tendency to increase inventory levels prior to an anticipated or announced price increase, affect Axcan's operating results by shifting revenue between quarters. To maintain good relations with wholesalers, Axcan typically gives prior notice of price increases. The level of patient and physician acceptance of Axcan's products, as well as the availability of similar therapies, which may be less effective but also less expensive than some of Axcan's products, impact Axcan's revenues by driving the level and timing of prescriptions for its products.

In addition to its marketing activities, Axcan carries out research and development of products at an advanced stage of development which it acquires or licenses from third parties. By combining its marketing expertise with its research and development experience, Axcan distinguishes itself from specialty pharmaceutical companies that focus solely on distribution of products and offers potential licensors the prospect of rapidly expanding the potential market for their products. As a result, Axcan is presented with opportunities to profitably acquire or in-license products that have been advanced to the late stages of development by other companies. This focus on products in late-stage development enables Axcan to avoid the significant risks and expenses associated with new drug development.

Over the past several years, Axcan has experienced rapid growth by acquiring several products and businesses. (See "Acquisitionof Companies" and"Acquisition of Products").

Acquisition of Companies

Lactéol

On April 17, 2002, Axcan acquired all of the outstanding shares and certain related assets of Laboratoire du Lactéol du Docteur Boucard ("Lactéol"), which subsequently changed its name to Axcan Pharma S.A. and has been merged with Entéris acquired earlier in 2001. This company specializes in the manufacturing and distribution of gastrointestinal products in France including LACTÉOL (for the treatment of diarrhea) and owns the proprietaryLactobacillus strain. The acquisition cost, including transaction expenses was $13.1 million, and was paid through the issuance of 365,532 Axcan's common shares and payment of $8.4 million in cash.

Entéris

On November 7, 2001, Axcan acquired Laboratoires Entéris ("Entéris"), a company specializing in the distribution of gastrointestinal products in France. Entéris has since been merged with Lactéol and is now known as Axcan Pharma S.A. The products marketed by Entéris include TAGAMET (for the treatment of gastric or duodenal ulcers), TRANSITOL and TRANSULOSE (both of which are for the treatment of constipation). The purchase price was $23 million and was paid using Axcan's available cash and funds drawn under Axcan's existing credit facilities. Management believes that this acquisition broadened Axcan's product portfolio and established an operating base and platform from which to sell certain of its products into France and, eventually, expand in Western Europe.

2

Acquisition of Products

Group of products from Aventis

On November 18, 2003, the Company announced the closing of an agreement to acquire the rights to a group of products from Aventis. Under the terms of this agreement, the Company acquired CARAFATE and BENTYL for the U.S. market and SULCRATE, BENTYLOL and PROCTOSEDYL for the Canadian market. The $145 million purchase price was paid out of Axcan's available cash.

ITAX

On August 29, 2003, the Company acquired an exclusive license for North America, the European Union and Latin America, from Abbott to develop, manufacture and market ITAX, a patented gastroprokinetic drug. Under the terms of this license agreement, the Company paid out of is available cash $10 million and assumed $2 million in research contract liabilities. This amount was expensed in the fourth quarter of the year ended September 30, 2003.

DELURSAN

On January 20, 2003, Axcan acquired various marketing authorizations and intellectual property rights including trademarks to DELURSAN (250 mg ursodiol tablets), for the French market, from Aventis. DELURSAN is indicated for the treatment of cholestatic liver diseases, including Primary Biliary Cirrhosis, Primary Sclerosing Cholangitis and liver disorders related to Cystic Fibrosis.

The purchase price of $22.8 million was paid using Axcan's cash on hand.

PANZYTRAT

On November 29, 2002, Axcan acquired various marketing authorizations and intellectual property rights, including patents and trademarks related to the PANZYTRAT pancreatic enzyme product line from Abbott Laboratories. PANZYTRAT products consist of enterically coated microtablets for the treatment of exocrine pancreatic insufficiency and are marketed in several countries. The greater portion of PANZYTRAT sales is reported in Germany, the third largest pharmaceutical market worldwide, as well as in the Netherlands.

The purchase price of $45 million was paid using Axcan's cash on hand.

Convertible debenture offering

On March 5, 2003, Axcan completed a $125 million offering of 41/4% convertible subordinated notes due 2008. Proceeds were used for general corporate purposes, including acquisitions of products. The notes are convertible into 8,924,113 common shares during any quarterly conversion period if the closing price per share for at least 20 consecutive trading days during the 30 consecutive trading-day period ending on the first day of the conversion period exceeds 110% of the conversion price in effect on that thirtieth trading day. Since this trigger event occurred during the second, third and fourth quarter of the year ended September 30, 2004, the 8,924,113, common shares are included in the weighted average number of common shares outstanding for these periods. The notes are also convertible during the five business-day period following any 10 consecutive trading-day period in which the daily average of the trading prices for the notes was less than 95% of the average conversion value for the notes during that period. The noteholders may also convert their notes upon the occurrence of specified corporate transactions or if the Company has called the notes for redemption. On or after April 20, 2006, the Company may at its option, redeem the notes, in whole or in part at redemption prices varying from 101.7% to 100.85% of the principal amount plus any accrued and unpaid interest to the redemption date. The notes also include provisions for the redemption of all the notes for cash at the option of the Company following certain changes in tax treatment.

3

Takeover-bid

On April 10, 2003, Axcan made an unsolicited cash tender offer of $8.75 per share for all of the outstanding shares of common stock of Salix Pharmaceuticals Inc. ("Salix"), which was subsequently increased to $10.50 per share. On June 27, 2003, the offer for all outstanding shares of Salix expired without acceptance or extension. Total costs related to the offer were $3.7 million and were expensed during the quarter ended June 30, 2003, thus reducing net income by approximately $2.4 million, or $0.05 per share for the year ended September 30, 2003.

4

BUSINESS OF AXCAN

Axcan Products

Axcan's focus is in the field of gastroenterology, which includes gastrointestinal diseases and disorders. A discussion of the regulatory process follows under the heading "Regulatory Environment".

The following table presents an overview of Axcan's principal products approved or under development, setting forth for each product, (1) the indication for which each product in a product line is approved or under development, (2) the territory where Axcan is focusing its marketing of the product and (3) the regulatory status of the product:

Product/Indication

| | Territory

| | Regulatory Status

|

|---|

| CARAFATE/SULCRATE(1) | | | | |

| | Active duodenal ulcers | | United States, Canada | | Marketed |

BENTYL/BENTYLOL(1) |

|

|

|

|

| | Irritable Bowel Syndrome | | United States, Canada | | Marketed |

PROCTOSEDYL(1) |

|

|

|

|

| | Hemorrhoids and rectal lesions | | Canada | | Marketed |

ITAX |

|

|

|

|

| | Functional dyspepsia | | United States, Canada, Latin America, Europe | | Phase III studies |

HEPENAX |

|

|

|

|

| | Hepatic encephalopathy | | United States, Canada, Europe (Italy, France) | | Phase II studies planned |

ULTRASE |

|

|

|

|

| | Exocrine pancreatic insufficiency | | United States, Canada, Latin America (non-exclusive basis) | | Marketed |

URSO and related products |

|

|

|

|

| |

URSO 250 |

|

|

|

|

| | Cholestatic liver diseases (including Primary Biliary Cirrhosis and Primary Sclerosing Cholangitis) | | Canada | | Marketed |

| | Primary Biliary Cirrhosis | | United States | | Marketed |

| |

URSO DS, URSO Forte |

|

|

|

|

| | Cholestatic liver diseases (including Primary Biliary Cirrhosis and Primary Sclerosing Cholangitis) | | Canada | | Marketed |

| | Primary Biliary Cirrhosis | | United States | | Marketed |

| |

Ursodiol Disulfate |

|

|

|

|

| | Prevention of the recurrence of colorectal polyps | | United States, Canada, Europe | | Preclinical |

- (1)

- Acquired November 18, 2003.

5

Product/Indication

| | Territory

| | Regulatory Status

|

|---|

| | NCX-1000 (ursodiol derivative) | | | | |

| | Portal hypertension | | United States (under option), Canada, Poland and France | | Phase I studies |

SALOFALK (tablets, suspensions, suppositories) |

|

|

|

|

| |

SALOFALK |

|

|

|

|

| | Inflammatory bowel diseases (distal ulcerative colitis, ulcerative proctitis, ulcerative colitis and Crohn's Disease) | | Canada | | Marketed |

| |

SALOFALK 750 mg tablets |

|

|

|

|

| | Ulcerative colitis | | Canada | | sNDS filed |

CANASA |

|

|

|

|

| |

CANASA 1000 mg suppositories |

|

|

|

|

| | Ulcerative proctitis | | United States | | Approved |

| |

CANASA 500 mg suppositories |

|

|

|

|

| | Ulcerative proctitis | | United States | | Marketed |

| | Ulcerative proctitis (pediatric study) | | United States | | Phase IV studies |

CANASA / SALOFALK rectal gel |

|

|

|

|

| | Distal ulcerative colitis | | United States, Canada | | Phase III studies |

VIOKASE |

|

|

|

|

| |

VIOKASE |

|

|

|

|

| | Exocrine pancreatic insufficiency | | United States, Canada | | Marketed |

PHOTOFRIN |

|

|

|

|

| |

PHOTOFRIN |

|

|

|

|

| | Esophageal cancer | | United States, Canada, Japan, United Kingdom, France, Portugal, Poland, Ireland, Austria, Israël, Korea | | Marketed |

| | | Netherlands, Finland, Iceland, Denmark, Italy, Belgium, Sweden, Norway, Luxembourg, Bulgaria | | Approved |

| | | China, Czech Republic, Spain, Taiwan | | Marketing Authorization Application submitted |

| | High-Grade Dysplasia associated with Barrett's Esophagus | | United States

Canada | | Approved

Approved |

| | Bladder cancer | | Canada | | Approved |

| | Gastric and cervical cancers and cervical dysplasia | | Japan | | Marketed |

6

Product/Indication

| | Territory

| | Regulatory Status

|

|---|

| | Lung cancer | | United States, Canada, Japan, France, United Kingdom, Portugal, Austria, Poland, Germany, Israël, Korea | | Marketed |

| | | Netherlands, Finland, Iceland, Denmark, Italy, Ireland, Belgium, Sweden, Greece, Norway, Luxembourg, Bulgaria | | Approved |

| | | China, Czech Republic, Spain, Taiwan | | Marketing Authorization Application submitted |

| | Cholangiocarcinoma | | United States, Canada, Europe | | Phase III studies |

| |

PHOTOBARR |

|

|

|

|

| | High-Grade Dysplasia associated with Barrett's Esophagus | | Europe | | Approved |

PANZYTRAT |

|

|

|

|

| | Exocrine pancreatic insufficiency and pancreatic enzyme deficiency | | Argentina, Brazil, Bulgaria, Columbia, Czech Republic, Germany, Greece, Hungary, Italy, Luxembourg, Netherlands, Poland, Romania, Russian Federation, Slovak Republic, Switzerland | | Marketed |

DELURSAN |

|

|

|

|

| | Cholestatic liver diseases (including Primary Biliary Cirrhosis and Primary Sclerosing Cholangitis) | | France | | Marketed |

|

|

|

|

|

| MODULON | | | | |

| | Relief of symptoms associated with Irritable Bowel Syndrome (IBS) | | Canada

Worldwide | | Marketed

Preclinical |

HELIZIDE |

|

|

|

|

| |

HELIZIDE |

|

|

|

|

| | Helicobacter pylori eradication | | United States

Canada

Europe | | NDA re-submission planned

NDS re-submission planned

Phase III studies completed |

NMK 150 |

|

|

|

|

| | Pancreatitis | | United States, Canada, Europe | | Phase II studies planned |

NMK 250 |

|

|

|

|

| | Steatorrhea | | United States, Canada, Europe | | Phase II studies planned |

7

Market sizes appearing in the descriptions below refer to actual or potential annual aggregate sales for the relevant drug and not actual or potential annual sales of Axcan. The market size data below does not represent Axcan's expected sales figures, as important factors must be considered, including successful product development, competition, the degree of Axcan's market penetration and the dilution of revenues resulting from royalty and other payments under licenses or agreements with third parties. Axcan believes that prescription trends indicate potential future sales trends, since prescriptions drive the demand for Axcan's products, and has therefore included such figures for products when available.

ULTRASE

Axcan markets under the trademark ULTRASE certain pancreatic enzyme microspheres and minitablet formulations designed to help patients with exocrine pancreatic insufficiency, as associated with, but not limited to, cystic fibrosis, to better digest food.

In the United States, the total market for coated pancreatic enzymes is estimated to be $110 million and ULTRASE has approximately 29% in the Cystic Fibrosis component of this market. Sales of ULTRASE in the United States were approximately $36.0 million for fiscal 2004 and $37.9 million for fiscal 2003.

In Canada, the total market for pancreatic enzymes is estimated to be $9.4 million; ULTRASE has approximately 4% of this market.

ULTRASE competes with a number of pancreatic enzyme formulations including PANCREASE® (Ortho-McNeil Pharmaceutical) and CREON® (Solvay Pharmaceuticals, Inc.).

In anticipation of new FDA regulations, Axcan has completed a Phase III study of ULTRASE, which may serve as the basis of an NDA submission for the treatment of exocrine pancreatic insufficiency, once FDA regulations are issued.

URSO 250 and Related Products

Existing Indications

In the United States, Axcan is marketing URSO 250 for the treatment of Primary Biliary Cirrhosis ("PBC"). URSO 250 was granted an orphan drug status by the FDA in December 1997, giving Axcan seven-year marketing exclusivity for the treatment of PBC. In Canada, Axcan is marketing URSO 250/URSO DS for the treatment of cholestatic liver diseases and disorders, including PBC.

In the United States, the total market for ursodiol (ursodeoxycholic acid — the active ingredient in URSO 250) is approximately $105 million. URSO 250 had approximately 41.4% of the GI market in total retail sales for fiscal 2004. Sales of URSO 250 in the United States amounted to approximately US$36.4 million for fiscal 2004 and US$40.2 million for fiscal 2003.

8

In Canada, the total market for ursodiol is estimated to be $11.7million.

In the United States there is currently no therapy specifically approved to be marketed for the treatment of PBC other than URSO 250 and URSO Forte. However, other products are being prescribed. ACTIGALL™ (Watson Pharmaceuticals), a product currently approved and marketed for gallstone dissolution as associated with active weight loss, is being prescribed for the treatment of various liver diseases including PBC. Generic versions of ACTIGALL™, an FDA-approved product, are being marketed for the dissolution of gallstones but can also be prescribed for PBC. In Canada, Axcan is the only company which markets ursodiol for the treatment of cholestatic liver diseases.

New Formulations

Axcan developed a new formulation containing 500 mg of ursodiol in each tablet called URSO DS in Canada and URSO Forte in the United States. URSO DS was launched in Canada in the first half of 2003 for the treatment of cholestatic liver diseases. In November 2004, URSO Forte was launched in the United States for the treatment of Primary Biliary Cirrhosis (PBC).

New Generation of Ursodiol

Ursodiol disulfate: Axcan is currently studying the use of a new ursodiol derivative, ursodiol disulfate, in the treatment of recurring colorectal adenormateous polyps. Preliminary results of studies conducted with ursodiol disulfate showed that it reduces the number of aberrant crypts in a rat model of colon cancer. Aberrant crypts are considered early abnormal changes in the intestinal lining that are precursors to colon cancer. In a small pilot study, where rats were injected with the carcinogen azoxymethane, a 23% reduction in the total number of aberrant crypts in the colon was observed after four weeks in those animals treated with this new ursodiol formulation compared to control models. Ursodiol disulfate alone fed to rats had no adverse effects on the appearance of the lining of the colon. Long-term animal studies are ongoing to determine the effect of ursodiol disulfate on the time of appearance, the number, and the size of colonic tumors in the azoxymethane rat model of chemically-induced colon cancer. Positive results of this proof-of-concept study were announced during the first half of fiscal 2004 and Axcan initiated animal toxicity studies in the last quarter of fiscal 2004, which will be followed by Phase I studies. See "Business of Axcan — Licensing and Intellectual Property Protection".

NCX-1000: NCX-1000, a nitric oxide-releasing derivative of ursodiol, is in preclinical development for the treatment of portal hypertension, a complication of chronic liver diseases. Several animal studies have already shown the pharmacological effects of NCX-1000 on portal hypertension. Experimental models of cirrhosis demonstrated that this compound reduces portal pressure by decreasing intrahelpatic resistance, rather than through direct effects on the portal vasculature. A Phase I clinical study involving 16 subjects was successfully completed in April 2003, demonstrating tolerability and safety. Phase II studies are planned to begin during calendar year 2005. See "Business of Axcan — Licensing and Intellectual Property Protection".

SALOFALK and CANASA

Existing Indications

SALOFALK and CANASA are mesalamine-based products sold by Axcan for the treatment of certain inflammatory bowel diseases, such as Crohn's Disease and ulcerative colitis.

In Canada, Axcan markets the SALOFALK product line (tablets, suspensions and suppositories) for the treatment of certain IBDs, including ulcerative colitis and Crohn's Disease. In Canada, the market for existing mesalamine therapeutic products totals approximately $59 million. SALOFALK is estimated to have 29.9% of this market in total sales.

In the United States, CANASA is being marketed for the treatment of ulcerative proctitis. The total market for rectal mesalamine is approximately $90 million. CANASA has approximately 55% of this market in total prescriptions and approximately 55% of this market in total sales for fiscal 2004. The discrepancy is mainly due to the fact that the price of suppositories is less than the price of enemas that compose the other segment of the rectal mesalamine market. As agreed with the FDA at the time of approval of this product in the United States, Axcan is conducting a Phase IV pediatric study on the use of CANASA suppositories in children for the treatment of active ulcerative proctitis. This 50-patient study should be completed during fiscal 2006.

9

Competition comes from oral or topical corticosteroids and steroid enemas. Since these competing drugs are associated with significant side effects, other agents have been used. Sulfasalazine, for example, has been shown to be effective in preventing relapses in both ulcerative colitis and Crohn's Disease. However, it has been associated with a significant incidence of side effects. Free 5-aminosalicylic acid (5-ASA, also known as mesalamine) is a safer therapy for the treatment of IBDs and is being used as a single entity in controlled-release dosage forms. As the use of mesalamine for the treatment of IBDs is not patented, several products containing mesalamine in controlled-release tablets or capsules are available on the Canadian market, including Asacol™ (The Proctor & Gamble Company), Mesasal™ (SmithKline Beecham Plc), and Dipentum™ (UCB Pharma).

New Formulations

Axcan recently completed a 114-patient Phase III trial, for the Canadian market, on the efficacy and safety of a new 750-mg mesalamine (5-ASA) tablet for the oral treatment of ulcerative colitis. Axcan submitted an sNDS in Canada during the first quarter of fiscal 2004.

Axcan also completed the clinical portion of a 100-patient Phase III trial in North America on a new 1gram formulation of mesalamine suppositories for the treatment of ulcerative colitis. This new formulation is administered once a day and should improve the convenience to patients who would normally need a twice a day regimen with the current 500 mg suppositories. In November 2004, the new 1 gram mesalamine suppository was approved in the United States Axcan in-licensed from Gentium SpA ("Gentium"), an Italian company, exclusive rights to develop and market in North America a new mesalamine rectal gel to be developed for the treatment of distal ulcerative colitis. Axcan initiated an open-label, randomized 180-patient Phase III study to assess the evolution of the clinical symptoms of the disease during the induction of remission by this new formulation. This study will be supported by two 50-patient placebo-controlled studies. Results should be available in the second half of fiscal 2005. Assuming the results of the Phase III studies are positive, Axcan plans to submit regulatory filings for approvals in the United States and Canada. See "Business of Axcan — Licensing and Intellectual Property Protection".

VIOKASE

Existing Indications

Axcan markets under the brand name VIOKASE non-enterically coated pancreatic replacement enzymes, both in the United States and in Canada, as digestive aids for the treatment of exocrine pancreatic insufficiency and pancreatic enzyme deficiency as associated with, but not limited to, chronic pancreatitis and surgical ablation of the pancreas.

In the United States, the total market for uncoated pancreatic enzymes is estimated to be approximately $62 million, and Axcan sales of VIOKASE represent approximately 11% of this market. In Canada, the total market for pancreatic enzymes is estimated to be approximately $2.1 million, and Axcan has approximately 34% of total prescriptions in this market. Axcan does not actively market VIOKASE in Canada.

There are a number of competing pancreatic enzyme formulations, including PANCREASE® (Ortho-McNeil Pharmaceutical) and CREON® (Solvay Pharmaceuticals, Inc.).

10

PHOTOFRIN

Existing Indications

Axcan markets (directly or through distributors) PHOTOFRIN in North America, Europe, and other selected markets, for the treatment of esophageal and non small cell lung cancer, as well as certain types of gastric cancers and cervical dysplasia. PHOTOFRIN is the first photosensitizer commercially approved for use in photodynamic therapy, an innovative medical therapy based on the use of light-activated drugs. As a treatment for cancer, PHOTOFRIN is injected into a patient intravenously and after a short period of time, selectively accumulates in tumor cells. Activation of PHOTOFRIN by a non-thermal laser light at the tumor site produces a toxic form of oxygen that destroys cancer cells. Unlike other currently available therapies, PHOTOFRIN offers a lower risk of damage to adjacent healthy tissue thereby allowing for repeated treatment without limiting future therapeutic options.

There are currently no other photosensitizers approved in the United States, Canada or Europe for the treatment of esophageal and lung cancer, gastric cancer or cervical dysplasia.

New Indications

High Grade Dysplasia associated with Barett's Esophagus — Based on scientific studies completed to date, Axcan estimates that approximately 20 million Americans suffer from chronic heartburn and that approximately 10% to 20% of these Americans are likely to develop Barrett's Esophagus. Of these, approximately 90% are likely to have metaplasia, an early-stage abnormal transformation of tissue and approximately 10% are likely to have dysplasia. These scientific studies also indicate that patients with Barrett's Esophagus have a probability of developing esophageal cancer at a 50% greater rate than people without this condition. There is currently no approved treatment to reverse the condition and decrease the risk of developing this cancer. Symptoms can be treated with a variety of acid suppressants, but surgical removal of the esophagus, called an esophagectomy, is currently the only curative treatment for patients with High-Grade Dysplasia (HGD) associated with Barrett's Esophagus.

Barrett's Esophagus is the term given to a change that occurs in the lining of the lower esophagus in a proportion of patients with longstanding gastro-esophageal reflux. Normally, the esophagus is lined with squamous (flat) cells which makes the esophagus smooth and slippery to aid the passage of food. For reasons that are not understood, in some patients with longstanding reflux, the squamous cell lining is replaced by columnar (tall) cells, similar to those which are normally found in the stomach. This change can be identified histologically by taking biopsies of this area at the time of upper gastrointestinal endoscopy. It is thought that approximately 20 million people in the United States experience acid reflux problems. People with severe reflux problems are more likely to have Barrett's Esophagus, which is estimated to affect approximately 700,000 adults in the United States. A small proportion of patients with Barrett's Esophagus develop cancer (adenocarcinoma) in the esophagus. This usually develops over a period of years and can be predicted by the finding of pre-cancerous changes (dysplasia) on biopsies, thus allowing treatment at an early stage before the cancer spreads.

Axcan conducted a 208-patient study, and compared PHOTOFRIN Photodynamic ("PDT") in combination with omeprazole (2 mg/kg intravenously followed by laser light-delivery at a wavelength of 630 nm within 48-72 hours up to a maximum of 3 courses followed by oral administration of omeprazole), to the administration of omeprazole alone. In this analysis, 138 patients in the PHOTOFRIN PDT group and 70 patients in the comparative group were followed for a minimum 2-year period (between 2 and 3.6-years).

The primary efficacy endpoint, assessed after a minimum follow-up of 24 months, was the complete ablation of High-Grade Dysplasia. The use of PHOTOBARR/PHOTOFRIN PDT resulted in the complete ablation of High-Grade Dysplasia in 77% of the patients treated with this therapy, while the treatment with omeprazole alone resulted in 39%, which represents a statistically significant difference.

Secondary efficacy endpoint analysis showed that the median duration of the ablation of HGD was 987 days in the PHOTOBARR/PHOTOFRIN PDT group and 98 days in the omeprazole-only group; 2) the proportion of patients who progressed to oesophageal cancer was about twice as high in the omeprazole-only group compared to PHOTOBARR/PHOTOFRIN photodynamic therapy group (p=0.006). The absolute risk reduction of progression to cancer of 14% would suggest that the number of patients needed to be treated to prevent 1 patient from progressing to to esophageal cancer is only 7.

11

In August 2003, Axcan received approval from the FDA for the use of PHOTOFRIN PDT in the ablation of High-Grade Dysplasia Barrett's Esophagus patients who do not undergo esophagectomy. PHOTOFRIN PDT was also granted orphan drug designation for this indication, which guarantees a 7-year marketing exclusivity.

In March 2004, the European Commission granted Axcan market authorization for use in the European Union of PHOTOBARR PDT for the ablation of High-Grade Dysplasia associated with Barrett's Esophagus. PHOTOBARR was also granted orphan medical product status at the time of its submission, which guarantees Axcan exclusive marketing rights for PHOTOBARR in the European Union for a ten-year period from March 2004. This represented a significant milestone for Axcan, because this was its first European regulatory approval.

Cholangiocarcinoma — Cholangiocarcinoma affect approximately 2,500 persons each year in the United States. Approximately 90% of patients with this condition are not suitable for curative surgical resection either due to the presence of extensive local or metastatic disease or because the patients are old and frail with high operative and post-operative mortality and morbidity. Because most patients are not eligible for curative resection, the media survival rate is low. The worst prognosis is amongst patients with the so-called Bismuth type III tumours (tumours occluding the common hepatic duct and either the right or the left hepatic duct) and Bismuth type IV tumours (tumours that are multi-centric or that involve the confluence and both right and left hepatic ducts). In these patients, endoscopic insertion of stents is the method of choice to relieve obstructive jaundice, which is a distressing problem in subjects with cholangiocarcinoma.

Preclinical studies on human cholangiocarcinoma cell line models, as well as small clinical pilot studies, have indicated that PHOTOFRIN PDT can induce significant tumour reduction and growth rate delay, These encouraging findings led Axcan to initiate a more rigorous research program on the use of PDT PHOTOFRIN in the palliative treatment of advanced cholangiocarcinomas.

Axcan intiated a Phase II study of PDT PHOTOFRIN in patients with non-resectable cholangiocarcinoma. This trial is currently ongoing and Axcan expects to start a Phase III study during the first half of fiscal 2005.

PANZYTRAT

PANZYTRAT products consist of enterically coated microtablets for the treatment of exocrine pancreatic insufficiency and pancreatic enzyme deficiency and are marketed in several countries. Most sales of PANZYTRAT are in Germany, the third largest pharmaceutical market worldwide, and in the Netherlands.

On December 3, 2002, the Company acquired the worldwide rights to the PANZYTRAT enzyme product line from Abbott. During a transition period, Abbott may act as Axcan's agent for the management of sales of this product. For the year ended September 30, 2004, a portion of PANZYTRAT sales is still managed by Abbott. Axcan includes in its revenue the net sales from PANZYTRAT less corresponding cost of goods sold and other Abbott's related expenses. For the year ended September 30, 2004, Axcan reported sales of $13.5 million for PANZYTRAT.

The primary markets for PANZYTRAT are Germany and the Netherlands (80% of PANZYTRAT total sales), where it mainly competes with CREON® (Solvay Pharmaceuticals, Inc.).

DELURSAN

DELURSAN, which was acquired on January 20, 2003, is an ursodiol preparation marketed in France and is indicated for the treatment of cholestatic liver diseases, including Primary Biliary Cirrhosis, Primary Sclerosing Cholangitis and liver disorders related to Cystic Fibrosis.

In France, DELURSAN mainly competes with URSOVAN® (Pfizer, Inc.).

MODULON

MODULON, a motility regulator (trimebutine), is Axcan's product candidate for the treatment of the relief of symptoms associated with IBS. In Canada, MODULON mainly competes with DICETEL® (Solvay Pharmaceutical, Inc.), ZELNORM® (Novartis Pharmaceutical Inc.) and generics.

12

HELIZIDE

Existing Formulation

HELIZIDE is Axcan's product candidate for the eradication of theHelicobacter pylori (Hp) bacterium. It is a patented bismuth-based single capsule triple therapy that has the potential to be used for the eradication ofHp. It contains the equivalent of 40 mg of bismuth biskalcitrate (bismuth), 125 mg of metronidazole and 125 mg of tetracycline hydrochloride (tetracycline), and is administered in combination with a proton pump inhibitor.

The discovery in 1983 of theHelicobacter pylori organism is one of the major advances in gastroenterology in recent decades. This discovery has revolutionized the approach to many upper gastrointestinal disorders, especially the peptic ulcer disease.Helicobacter pylori causes a spectrum of disease in humans, including gastritis, ulcer disease (gastric and duodenal), gastric cancer and gastric lymphoma. Thus,Helicobacter pylori infection is a condition of enormous importance throughout the world. It is estimated that approximately 10% of the world's population will develop peptic ulcer disease at some time in their lives, and more than 90% of duodenal ulcers and as many as 70% of gastric ulcers, are due toHelicobacter pylori infection.

Axcan conducted a 275-patient Phase III trial comparing the HELIZIDE regimen (3 single-triple capsules given 4-times a day, plus omeprazole 20 mg twice a day) to the widely used OAC combination (i.e., omeprazole, amoxicillin and clarithromycin). On a Per-Protocol Basis (results in full accordance with the protocol established for the study), the eradication rates observed were 92% for the group treated with HELIZIDE versus 87% for the group treated with OAC. On an Intent-To-Treat basis (results including all data associated with the correct or incorrect use of the drug), the eradication rates were 88% and 83%, for HELIZIDE and OAC, respectively. In addition, although at baseline, 40% of all patients in the study had a metronidazole-resistant strain, and 11% had a clarithromycin-resistant strain, metronidazole resistance was overcome, andHelicobacter pylori eradication was achieved in 86% of metronidazole-resistant patients treated with HELIZIDE on a per-protocol basis, and in 80% on an intent-to-treat basis. On the other hand, only 23% of clarithromycin-resistant patients were successfully treated with OAC on a per-protocol basis and 21% on an intent-to-treat basis. These results confirm that HELIZIDE is statistically and clinically comparable to OAC and that HELIZIDE has the potential to be used as a first-line therapy for the eradication ofHelicobacter pylori.

An NDA has been filed in the United States, but Axcan received a second non-approvable letter from the FDA in September 2003. The FDA has raised manufacturing issues in connection with the approval of HELIZIDE, which must be resolved before approval is granted. Axcan is currently working to resolve all remaining issues and expects to re-submit by the middle of the calendar year 2005.

Other Drugs Marketed by Axcan

Axcan markets SCANDISHAKE and SCANDICAL, two high-energy caloric supplements which help cystic fibrosis patients gain and maintain their weight. Axcan also markets ADEKs, a fat-soluble multivitamin supplement marketed in chewable tablets and pediatric drops, and FLUTTER, a mucus clearing device that aids pulmonary ventilation and expectoration by loosening mucus and liquefying mucus secretions that obstruct the airway of cystic fibrosis patients.

In France, Axcan also markets TAGAMET, which is indicated for the symptomatic treatment of gastric or duodenal ulcers, TRANSULOSE and TRANSITOL, both of which are indicated for the symptomatic treatment of constipation and LACTÉOL, which is indicated for the treatment of diarrhea.

Sales and Marketing

Axcan's sales and marketing force is comprised of 203 professionals, of which 163 are sales representatives, managers and sales support and 40 are in marketing. Of these 203 professionals, 32 are located in Canada, 108 in the United States and 63 in France.

In Canada, Axcan sells its products to approximately 200 hospitals and 160 wholesale drug companies, who in turn distribute Axcan's products to pharmacies. Axcan's major products are included in most provincial drug benefit formularies and are promoted by Axcan to gastroenterologists and internal medicine specialists with a particular interest in gastrointestinal diseases, as well as to colorectal surgeons. The 12 sales professionals located in Canada visit each doctor in their territory an average of ten times per year and attend many of the educational seminars and international medical meetings organized by Axcan and co-sponsored by the Canadian Association of Gastroenterology.

13

In the United States, Axcan sells its products to most major wholesale drug companies and distributors, who in turn distribute Axcan's products to chain and independent pharmacies, hospitals and mail order organizations. The 106 sales professionals located in the United States operate in specialty groups. The first group of professionals calls on high-volume prescribing physicians and cystic fibrosis centers; the second group visits potential and current PHOTOFRIN centers, hepatologists and transplant centers; and the third group, a team of managed care specialists, targets third-party payors, clinical pharmacists and formularies administrators.

No customer represented more than 10% of the Company's revenue except for three customers, for which the sales represented 55.7% of revenue for the year ended September 30, 2004 (49.6% and 52.3% in 2003 and 2002).

Increasingly, in North America, third-party payors, such as private insurance companies and drug plan benefit managers, aim to rationalize the use of pharmaceutical products and medical treatments, in order to ensure that prescribed products are necessary for patients' condition. Moreover, large drug store chains now account for an increasing portion of the retail sales of prescription medicines. The pharmacists and store managers of such retail outlets are under pressure to reduce the number of items in inventory in order to reduce costs. As a result of these recent changes to the marketing environment for prescription pharmaceutical drugs, Axcan enters into retail distribution agreements for its prescription products with pharmacies and other retail outlets that provide for minimum inventory levels of Axcan's products, and, thereby ensure proper inventory levels at the point of sale. These changes have had no material effect on Axcan.

In France, Axcan sells its products to distributors, who in turn distribute them to wholesale drug companies, who in turn distribute them to pharmacies. Axcan's major products are included in the national drug benefit formularies, and the 63 sales professionals located in France regularly visit high-prescribing physicians to promote Axcan's products.

This international sales structure is complemented by Axcan's sponsorship of high-level international medical meetings on topics related to Axcan's products and research activities. Most such medical meetings are organized by Axcan and sponsored by the Canadian Association of Gastroenterology. Two of these medical meetings, "Trends in Inflammatory Bowel Disease Therapy" and "Helicobacter pylori: Basic Mechanisms to Clinical Cure" have gained worldwide recognition and allow researchers and gastroenterologists from around the world to meet and exchange information. These events are recognized by leading institutions and continuing medical education credits are awarded to attendees. As a consequence, Axcan is recognized not only as a supplier of quality products, but also as an important link in the continuous medical education process. These events are summarized in hardcover publications that are distributed to healthcare providers in Canada, the United States and elsewhere around the world.

Finally, Axcan founded and continues to provide a literature service for the medical community. These publications are aimed at providing pharmaceutical and medical specialists with a means of keeping in touch with the scientific community and advances in research and development. This service, which is comprised of abstracts taken from over 650 medical journals published in approximately 50 countries, is published on a regular basis and covers topics pertaining to basic research, diagnoses, and various therapies related to gastroenterology and cystic fibrosis.

Research and Development

Axcan's research and development strategy concentrates on two main areas: further development of acquired products and development of existing products, including testing the efficacy of such products in other indications. This strategy allows Axcan to minimize the level of risk associated with new drug development and also to reduce the amount of time typically required to develop and obtain new product approvals.

Axcan typically uses its own scientific affairs staff to carry out clinical trial protocol development, validate case report forms, and monitor clinical trial sites. Axcan also coordinates the financial aspects of clinical studies conducted by third parties. Specific tasks, such as data entry and the compilation of biostatistics are contracted out to third parties. Pre-clinical toxicology and pharmacology studies are also contracted to research organizations. The preparation and submission of INDs or NDAs is contracted out to a consulting firm with whom Axcan's research and development personnel maintains an open and frequent line of communication.

14

Research and development expenses were $19.8 million for fiscal 2004, compared to approximately $12.1 million for fiscal 2003 and approximately $8.9 million for fiscal 2002.

Licensing and Intellectual Property Protection

A patent is a statutory private right that grants to the patentee exclusive rights to exclude others form using the patented invention during the term of the patent. A patent is territorial and may be sought in many jurisdictions. In Canada and the United States, as in most other countries, the term of patent protection is 20 years from the date the patent application was filed. A drug is patentable if it meets the criteria of being "new," "useful" and "non-obvious." Depending on whether a particular drug is patentable and the relative costs associated with obtaining the patent in each jurisdiction sought, an inventor will either apply for a patent in order to protect the drug or maintain the confidentiality of the information to rely on the common law protection afforded to trade secrets.

A company may also enter into licensing agreements with third-party licensors in order to obtain the right to make, use and sell certain products, thereby gaining access to know-how, secret formulas and patented technology. The value of a license is generally enhanced by the existence of one or more patents. A license gives the licensee access to developed and, in many cases, tested technology and provides the licensee faster and often less expensive entry into the market. Licensing also establishes relationships, which may provide access to additional products or technology or may lead to joint ventures or alliances affording the licensor and the licensee an opportunity to evaluate each other's products and technology. This is also true, to a lesser extent, for distribution relationships. Axcan has entered into several of these types of agreements.

ULTRASE: Axcan is the owner of the trademark ULTRASE and markets in North and Latin America, particular pancrelipase microspheres and minitablets as ULTRASE and ULTRASE MT. Under an exclusive Development, License and Supply Agreement ("New Product Agreement") with Eurand. This agreement, which came into force in 2003, is for a period of 10 years with automatic renewals for subsequent periods of two years. Axcan has paid Eurand licensing fees totalling $3.5 million; Axcan will pay to Eurand royalties of 6% on the first $30 million of annual net sales by and 5% on annual net sales in excess of $30 million, subject to minimum royalty payments of $750,000, $1 million and $1.5 million in the first three years.

Ursodiol: Axcan developed ursodiol for the Canadian market in collaboration with Falk Pharma GmbH ("Falk") and acquired the rights to manufacture, use and market ursodiol in the United States on March 23, 1993 through the acquisition of the shares of Axcan Pharma U.S., Inc. that it did not already own. In April 1999, Axcan entered into two agreements with Sanofi-Synthélabo S.A. of France ("Synthélabo") that secured Axcan's right to manufacture, use and market ursodiol as URSO 250 for the treatment of Primary Biliary Cirrhosis in Canada and the United States. These agreements effectively renew Axcan's rights over this drug, which were the result of a previous 10-year agreement with Synthélabo, which expired in 2000. For Canada, Axcan acquired full ownership of the patent relating to ursodiol for the treatment of PBC, which expires in 2010. The new license agreement for the United States is valid until the expiration of the U.S. patents in 2007.

In 1994, Axcan, Mitsubishi-Tokyo Pharmaceuticals, Inc., a Japanese pharmaceutical company that manufactures ursodiol, and a research institute, entered into an agreement to undertake various research projects with respect to ursodiol. Thus far, these projects have resulted in Axcan being granted an exclusive license (except for Japan) to (1) use ursodiol with respect to the treatment of a cholestatic liver disease (which is the object of a United States patent) and (2) use, subject to the payment of royalties, ursodiol for the treatment of colorectal cancer (which is also the object of a United States patent and of patent application in several other countries, including in Canada and Europe). In both instances, the term of the license is the greater of 10 years or the life of such patent, and the research institute reserves the right to terminate the license if it is not confident of Axcan's intent to develop ursodiol commercially for the treatment of the diseases.

In October 2000, Axcan entered into a licensing agreement with the Children's Hospital Research Foundation ("CHRF"), an operating division of Children's Hospital Medical Centre of Cincinnati, Ohio, for a series of sulfated derivatives of ursodeoxycholic acid compounds ("SUDCA" or "ursodiol disulfate"). According to the terms of this agreement, Axcan has the exclusive worldwide rights to commercially exploit a series of patented SUDCA developed by CHRF in consideration of (i) a one-time licensing fee of $589,000 which was paid in full; (ii) various milestone payments of up to $525,000; (iii) royalties based on a certain percentage of sales; and (iv) bonus payments upon achievement of certain milestones. Proof-of-concept has been validated and CHRF's ursodiol disulfate is currently in pre-clinical trials and may constitute a significant improvement over regular ursodiol for the prevention of recurrence of colorectal adenomateous polyps. These compounds could also be a useful means in connection with liver transplants and to prevent cholestasis induced by total parenteral malnutrition. Axcan believes that one of the main advantages of these sulfated compounds is that they can be delivered in high concentrations to the colon. They also have a powerful stimulatory effect on bile flow and their high water solubility could make them particularly well-suited for intravenous administration for the treatment of liver-related cholestatic diseases.

15

In May 2002, Axcan signed a co-development and licensing agreement with NicOx S.A. ("NicOx") for NCX-1000, a nitric oxide-donating ursodiol derivative, for the treatment of chronic liver diseases including portal hypertension and Hepatitis "C". Under the terms of this agreement, Axcan has obtained from NicOx an exclusive license to commercialize NCX-1000 in Canada and Poland as well as an option to acquire the same exclusive rights for the United States. Axcan and NicOx will jointly share the cost of the future development of NCX-1000 until the completion of Phase II clinical studies. Axcan will thereafter conduct the required Phase III clinical studies and will be responsible for regulatory filings in the exclusively licensed territories. Axcan has paid NicOx an upfront milestone of $2 million and will pay other option or milestone payments totalling up to $18.5 million at various stages of development, the majority being payable upon approval. Axcan also agreed to pay royalties on net sales of the product.

SALOFALK and CANASA: Axcan developed SALOFALK in collaboration with Falk. Axcan owns the trademark SALOFALK in Canada and CANASA in the United States.

In October 2002, Axcan acquired from Gentium exclusive rights to develop and market in North America a patented 4-gram rectal gel formulation of mesalamine for the treatment of active distal ulcerative colitis. In return, Axcan will make milestone payments totalling approximately $1.5 million the majority of which will be paid upon approval in the United States. Axcan will also pay a royalty of 4% on net sales of the product for a 10-year period from the date of the product's launch.

VIOKASE: In 1996, Axcan acquired from Wyeth worldwide rights to VIOKASE and the right to market the product in Canada. In 1997, Axcan also acquired the VIOKASE marketing rights for the United States and the trademark VIOKASE for Canada, the United States and certain other countries from American Home Products Corp. ("AHP") and A.H. Robins Company, Inc. Axcan owns the trademark VIOKASE for North, Central and South America. The product is not subject to a patent.

PHOTOFRIN: In June 2000, Axcan purchased from QLT Inc. ("QLT") the trademark "PHOTOFRIN" for the United States, Canada and all other countries where it has been registered as a trademark or used in marketing. Axcan also purchased, licensed or sublicensed from QLT, as the case may be, the worldwide rights of QLT to PHOTOFRIN. As part of the transaction, Axcan acquired a European subsidiary of QLT, which holds the European registration rights for PHOTOFRIN. The last of the patents, which form part of the acquired assets, expires in April 2013. As part of the acquisition, Axcan agreed to assume QLT's obligation to pay royalties of up to 5% on net sales of PHOTOFRIN to Health Research Inc. ("Health Research"), pursuant to arrangements under which Axcan is a sublicensee of the technology that QLT licensed from Health Research.

In August 2000, Axcan and Diomed Holdings, Inc. ("Diomed") entered into a five-year exclusive development and supply agreement following FDA clearance of a new laser developed by Diomed. According to the terms of this agreement, Diomed is to supply 630 nanometer wavelength PDT diode lasers for use in photodynamic therapy ("PDT") in conjunction with PHOTOFRIN. The FDA clearance of the Diomed laser is the first approval of a diode laser for use with PHOTOFRIN in PDT. Pursuant to the terms of the transaction between Axcan and QLT, Axcan has paid to QLT milestone cash payments of $10 million.

PANZYTRAT: In November 2002, Axcan acquired from Abbott certain assets related to the distribution, marketing and sale of a pancreatic enzyme product used to enhance the digestion of fats. This pancreatic enzyme product is commonly marketed under the trademark PANZYTRAT. The product is subject to patents assigned to Axcan directly from Abbott. The know-how and trade secrets are the object of a perpetual unrestricted license from Abbott. The trademark PANZYTRAT and related marks, were assigned directly from Abbott to Axcan Pharma S.A.

16

DELURSAN: In December 2002, Axcan acquired from Laboratoire Aventis and Aventis Pharma S.A. certain intellectual property rights (including the rights to the trademarks in France) and commercial rights to ursodeoxycholic acid-based products marketed under the trademark "DELURSAN" for France and Morocco. The product is not subject to any patent.

MODULON: In 1997, Axcan acquired gastroenterology products previously marketed in Canada by Jouveinal Canada Inc. ("Jouveinal"), which included MODULON. Axcan owns the trademark, and the product is not subject to a patent.

HELIZIDE: In January 2000, Axcan entered into a worldwide (excluding Australia and New Zealand) licensing agreement (which was amended in November 2000) with Exomed Australia PTY Limited, Gastro Services PTY Limited, Ostapat PTY Limited, and Capacility Services PTY Ltd. This agreement, as amended, provides Axcan with exclusive rights in a number of countries, including Canada and the United States, to a series of patents covering triple and quadruple therapies forHp eradication. These patents cover the treatment of duodenal ulcer disease (and in some countries reflux esophagitis and gastric ulcer) through the eradication ofHp using a bismuth compound together with two (2) or more antibiotics. Axcan paid approximately $1.64 million cash for the license and will pay a royalty based on sales once the product is approved.

In May 1999, Axcan acquired the rights to a single capsule technology to be used for HELIZIDE from Gephar S.A. ("Gephar"), in an asset swap transaction, whereby Axcan sold to Gephar its interest in Axcan Ltd., a manufacturer and distributor of the PROTECTAID™ contraceptive sponge.

Other drugs marketed by Axcan: Axcan acquired distribution rights to SCANDISHAKE, SCANDICAL, FLUTTER and ADEKs for Canada in 1997 from Jouveinal. In 1999, Axcan acquired the rights to these products for the United States by acquiring Scandipharm. Axcan owns these trademarks, and except for FLUTTER, none of these products is subject to patent protection. FLUTTER is subject to patent protection in several countries, including the United States.

As a part of its acquisition of Entéris in February 2001, Axcan acquired the rights to Entéris' gastrointestinal products. These products include TAGAMET (for the treatment of gastric or duodenal ulcers), TRANSITOL and TRANSULOSE (both of which are for the treatment of constipation). Axcan owns the trademark "TAGAMET" for France and the Principality of Monaco. Axcan also owns the trademarks TRANSITOL and TRANSULOSE. TAGAMET is the subject of a patent held by SmithKline Beecham Laboratories, which is licensed to Axcan. TRANSULOSE and TRANSITOL are the subjects of patents held by Schwarz Pharma S.A. ("Schwarz"). In April 2002, Axcan acquired all of the shares of Lactéol, which is the owner of all of the intellectual property rights to the antibacterial composition marketed by Lactéol under different trademarks, including the trademark LACTÉOL. The antibacterial composition is subject to a patent in France and to an international patent application. These patents rights are owned by Axcan and a French research institute. Certain know-how and trade secrets regarding theLactobacillus Acidophilus strain were also acquired by Axcan as part of the acquisition of Lactéol.

In 2003, Axcan and Nordmark Arzneimittel GmbH created a joint venture to develop novel enzyme preparations, NMK 150 and NMK 250. The joint venture will hold the right to manufacture the bulk active ingredients, while Axcan will hold worldwide marketing rights for all finished dosage forms. In July 2003, under an agreement with Merz Pharmaceuticals GmbH ("Merz"), Axcan was granted an exclusive license to use, develop and submit HEPENAX for approval in a number of countries, including the United States and Canada, for the treatment of hepatic encephalopathy. Such agreement also grants Axcan the right to develop the product for other indications. Axcan agreed to fund clinical studies and to pay Merz a royalty on net sales once the product is marketed. Trademark applications for HEPENAX have been recently filed in several countries, including Canada and the United States. HEPENAX is not subject to patents.

In August 2003, Abbott granted Axcan exclusive rights for North America, the European Union and Latin America to develop manufacture and market ITAX (itopride hydrochloride) for a number of gastrointestinal indications. Trademark applications for ITAX have been filed in several countries including Canada and the United States. This compound is subject to patents in numerous countries, including Canada, the United States and countries of Europe.

In November 2003, Axcan acquired the rights to a group of gastro-intestinal products from Aventis. CARAFATE and BENTYL are marketed in the United States and SULCRATE, BENTYLOL and PROCTOSEDYL are marketed in Canada. In connection with such transaction, Axcan acquired all the trademarks related thereto. These products are not subject to patents.

17

Human Resources

As of September 30, 2004, the end of Axcan's most recently completed fiscal year, Axcan employed 429 persons, of whom 120 work in production and quality control, 36 in research and development, 163 in sales, 40 in marketing, and the balance in administration. Of these employees, 132 are located in Canada, 135 are located in the United States and 162 are located in Europe. In Canada, Axcan is a party to a collective agreement, which expires in March 2007 and which covers 42 employees, all of whom are non-management employees. Pursuant to the terms of the collective agreement, salary disputes are settled through binding arbitration. Salary levels were last reviewed in March 2002. In France, Axcan's employees are subject to theConvention Collective Nationale de l'Industrie Pharmaceutique, a collective agreement which applies to the entire pharmaceutical industry. Axcan believes that relations with both its unionized and non-unionized employees are good.

Facilities

In 2004, Axcan completed an expansion of its corporate headquarters, adding 55,000 square foot of office and warehousing to it existing 31,000 square foot building in Mont-Saint-Hilaire, Quebec. The building houses administrative, marketing and pharmaceutical manufacturing operations as well as the research and development facilities of Axcan. Axcan further owns property next to its corporate headquarters which can be used to expand. The building and real estate owned by Axcan is subject to a hypothec in favour of its lenders, pursuant to the credit facilities described under "Selected Consolidated Financial Information — Liquidity and Capital Resources."

Axcan leases approximately 20,000 square feet of office space in Birmingham, Alabama under a lease expiring in December 2005. Under this lease, Axcan pays annual rent which escalates over the term of the lease and averages between $345,000 and $385,000 per year, plus an amount equal to apro rata share of operating expenses.

Axcan owns 606,837 square feet of office space in Houdan, France.

Environment