QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Issuer

PURSUANT to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the Month of December, 2005

Commission File Number 0-30860

Axcan Pharma Inc.

(Exact Name of Registrant)

597, boul. Laurier, Mont-Saint-Hilaire (Québec), Canada J3H 6C4

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also hereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

EXPLANATORY NOTE

This Form 6-K/A amends the Form 6-K filed by Axcan Pharma Inc. on December 28, 2005 (the "Original Filing") to correct the list of the Board of Directors and the list of the Management Team on pages 71 and 72, respectively, of Axcan Pharma Inc.'s Annual Report for the fiscal year ended September 30, 2005. There are no other additions, deletions or changes to the Original Filing.

AXCAN PHARMA

Annual Report

| 05 |

OUR EXPERTISE

Focus on gastroenterology, our core area of knowledge

OUR PEOPLE

Foundation of our future success

OUR PIPELINE

Promise for better treatments

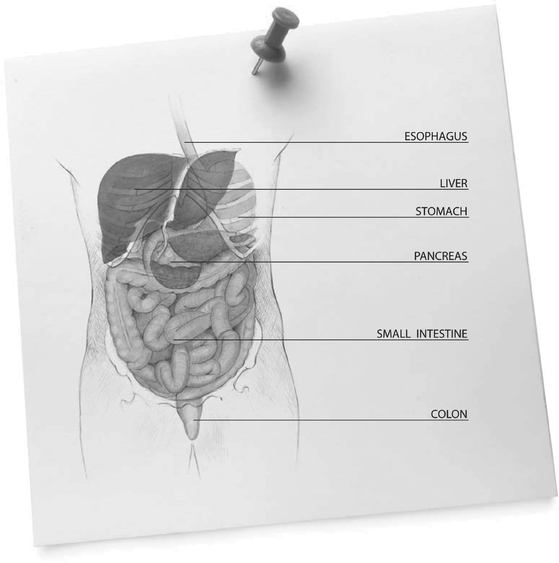

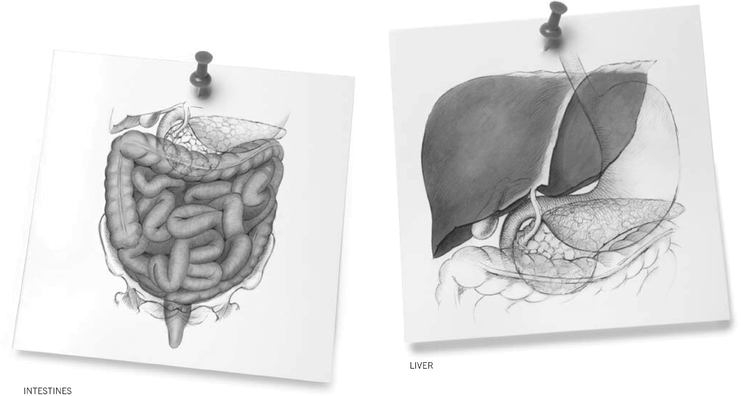

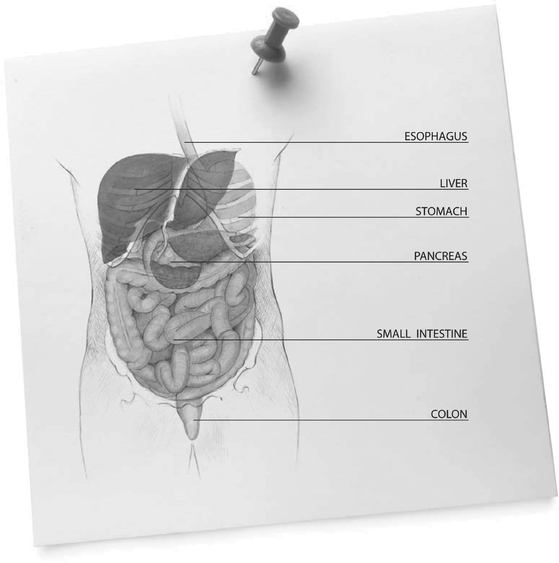

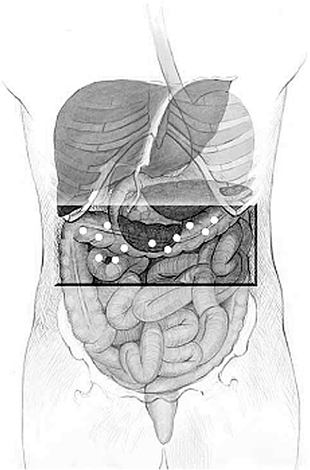

GASTROENTEROLOGY

Gastroenterology is the study of the normal function and diseases of the esophagus, stomach, small intestine, colon and rectum, pancreas, gallbladder, bile ducts and liver.

It involves a detailed understanding of the normal action of the gastrointestinal organs, including the movement of material through the stomach and intestine, the digestion and absorption of nutrients into the body, and the function of the liver as a digestive organ.

Gastroenterology includes the study of common and widespread conditions, such as Inflammatory Bowel Diseases (Crohn's Disease and colitis), biliary tract disease, pancreatitis, Irritable Bowel Syndrome, colon polyps and cancer, hepatitis, gastroesophageal reflux (heartburn), peptic ulcer disease and nutritional problems.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements for either the Company or certain of its subsidiaries. These forward-looking statements, by their nature, necessarily involve risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. The Company considers the assumptions on which these forward-looking statements are based to be reasonable at the time they were prepared, but cautions the reader that these assumptions regarding future events, many of which are beyond the control of the Company and its subsidiaries, may ultimately prove to be incorrect.

Factors and risks, which could cause actual results to differ materially from current expectations, are discussed on page * of this Annual Report as well as in the Company's Annual Information Form for the year ended September 30, 2005. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise, except as required by law.

ESOPHAGUS

Muscular tube that transports food by peristalsis from the pharynx to the stomach. Both ends are closed off by sphincters (muscular constrictions), which relax to let food through and close to keep it from backing up.

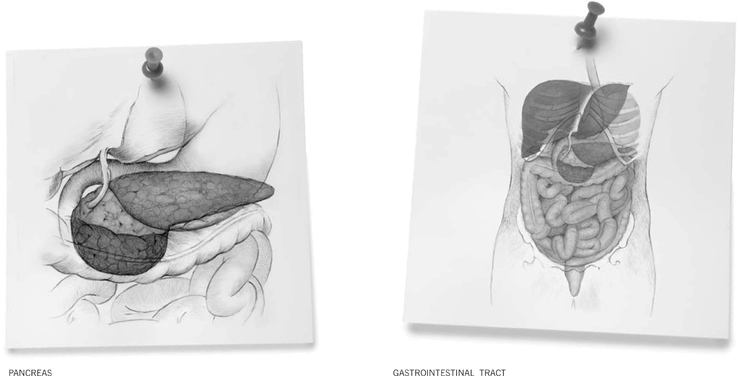

LIVER AND BILIARY SYSTEM

The liver is the body's largest internal organ, weighing about 1.5 kilogram, or 2.5 percent of body weight. The liver and biliary system produce bile and transport it to the small intestine, where it breaks up fats and other components of diet, and aids the digestion and absorption of nutrients. About a liter of bile is produced daily and enters the small intestine.

PANCREAS

The pancreas is a digestive and endocrine organ located behind the stomach in the upper abdomen. The pancreas secretes digestive juices containing enzymes into the duodenum, to help break down food into smaller molecule that can be absorbed. It also secretes insulin into the bloodstream to maintain the appropriate concentrations of glucose in the blood.

STOMACH

The stomach is a digestive sac in the left upper abdominal cavity, which expands or contracts with the amount of food in it. It has four regions: the cardia leads down from the esophagus; the fundus curves above it; the body is the largest part; and the antrum narrows to join the duodenum at the pyloric valve. Iron and very fat-soluble substances (e.g., alcohol and some drugs) are absorbed in the stomach. Peristalsis mixes food with enzymes and hydrochloric acid from glands in its lining and moves the resulting chyme toward the small intestine. The vagus nerve and sympathetic nervous system control the stomach's secretions and movements.

SMALL INTESTINE

The small intestine is the longest section of the digestive tract, with an average length of about 6 meters. Although only 2.5 centimeters in diameter—which is why it is called the small intestine—its surface area for absorption covers the size of a tennis court. Large quantities of nutrients and water can be absorbed in the small intestine. Daily, it is capable of absorbing: several kilograms of carbohydrate; up to 1 kilogram of fat; 500 grams of protein; and 20 liters of water.

The surface cells of the small intestine are highly specialized for digestion and absorption of nutrients. Almost all the body's nutrient absorption occurs in the small intestine, along its three sub-divisions: the duodenum, the jejunum and the ileum.

COLON

The colon—also known as the large intestine—is the final organ of the digestive process. It is responsible for drying out indigestible food residues by absorbing fluid and producing solid waste (feces) for elimination. Approximately 1.5 meter long, the colon has six distinct regions leading from the junction with the small intestine: caecum, ascending colon, transverse colon, descending colon, sigmoid colon and rectum.

ABOUT AXCAN

AXCAN IS A LEADING SPECIALTY PHARMACEUTICAL COMPANY FOCUSED ON GASTROENTEROLOGY

The Company markets a broad line of prescription products sold for the treatment of symptoms in a number of gastrointestinal diseases and disorders such as Inflammatory Bowel Disease, Irritable Bowel Syndrome, cholestatic liver diseases, and complications related to Cystic Fibrosis.

Axcan's products are marketed by its own sales force in North America and Europe. Today, the Company has approximately 450 employees worldwide.

Headquartered in Mont-Saint-Hilaire, Quebec, Canada, Axcan's common shares are traded on the Toronto Stock Exchange under the symbol "AXP" and on the NASDAQ National Market under the symbol "AXCA".

Axcan's Mission is toimprove the quality of care and health of patients suffering from gastrointestinal diseases and disorders by providing effective therapies for patients and specialized caregivers.

Axcan's Vision is to becomethe reference gastroenterology specialty pharmaceutical Company.

Our goal is to achieve these objectives by:

- •

- Providing value-added therapeutics for a broad spectrum of unmet needs in gastroenterology

- •

- Achieving a leadership position in our targeted gastroenterology segments

- •

- Delivering a competitive shareholder return

- •

- Offering stimulating and rewarding opportunities for our employees

TABLE OF CONTENTS

| | PAGES

|

|---|

| Sales Highlights | | 2 |

| Financial Highlights | | 3 |

| Message to Our Shareholders | | 6-13 |

| Our Core Therapeutic Areas | | 16-17 |

| Our Products | | 18-19 |

| Our Research and Development Portfolio | | 22-27 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 29-42 |

| Consolidated Financial Statements | | 43-69 |

| Corporate Governance | | 70 |

| Board of Directors | | 71 |

| Management Team | | 72 |

| Corporate Information | | 73 |

1

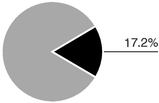

SALES

HIGHLIGHTS

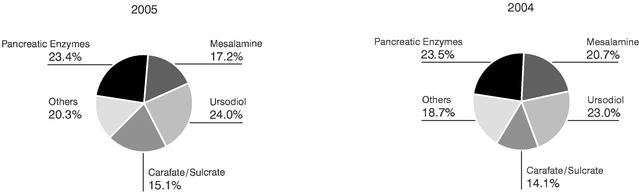

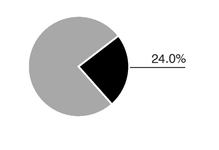

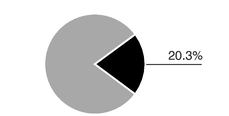

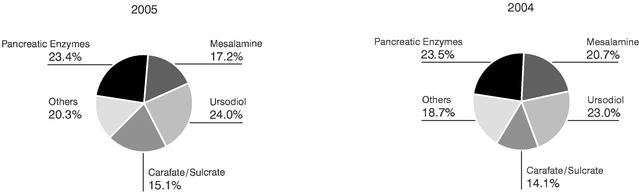

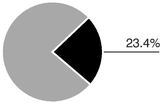

Breakdown by

Product Category

Our diverse product portfolio enables us to minimize the risks often associated with companies that have a limited number of products on the market.

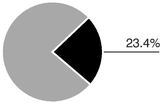

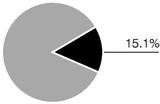

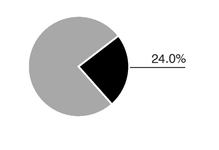

Breakdown by

Geographic Area

We have been able to successfully integrate acquisitions in both North America and Europe. Our goal now is to transform Axcan from a North American company with international operations to a truly multinational company.

2

FINANCIAL

HIGHLIGHTS

Years ended September 30

(All amounts are stated in thousands of U.S. dollars, except share related data, percentages and ratios)

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

|

|---|

| | $

| | $

| | $

| | $

| | $

|

|---|

| Operating Data | | | | | | | | | | |

| Revenue | | 251,343 | | 243,634 | | 179,084 | | 132,404 | | 103,814 |

Expenses |

|

|

|

|

|

|

|

|

|

|

| | Cost of goods sold | | 71,534 | | 54,247 | | 44,459 | | 34,039 | | 26,381 |

| | Research and development | | 31,855 | | 19,866 | | 12,098 | | 8,855 | | 7,243 |

| | Selling and administrative | | 85,997 | | 76,365 | | 63,084 | | 49,392 | | 38,185 |

| | Depreciation and amortization | | 21,532 | | 16,359 | | 8,063 | | 7,546 | | 11,829 |

Operating income |

|

40,425 |

|

76,797 |

|

39,380 |

|

32,572 |

|

20,176 |

| Net income | | 26,425 | | 48,728 | | 19,925 | | 21,188 | | 11,825 |

| Net income, excluding one-time charges(1) | | 26,425 | | 48,728 | | 33,350 | | 21,188 | | 11,825 |

Per share data, excluding one-time charges(1) |

|

|

|

|

|

|

|

|

|

|

| | Basic net income | | 0.58 | | 1.08 | | 0.74 | | 0.51 | | 0.32 |

| | Diluted net income | | 0.56 | | 0.96 | | 0.70 | | 0.50 | | 0.32 |

| Weighted average number of common shares outstanding (000s) (diluted) | | 55,219 | | 55,031 | | 50,814 | | 42,528 | | 36,531 |

Financial Position |

|

|

|

|

|

|

|

|

|

|

| |

Cash, cash equivalents and short-term investments |

|

97,588 |

|

37,901 |

|

170,885 |

|

80,717 |

|

16,515 |

| | Total assets | | 641,407 | | 609,644 | | 545,349 | | 367,006 | | 246,484 |

| | Long-term debt (including convertible subordinated notes) | | 127,829 | | 129,694 | | 131,002 | | 8,603 | | 2,919 |

| | Shareholders' equity | | 417,604 | | 392,076 | | 331,011 | | 294,787 | | 200,431 |

Common Share Performance(2) |

|

|

|

|

|

|

|

|

|

|

| |

Market capitalization |

|

590,214 |

|

708,494 |

|

612,059 |

|

430,238 |

|

411,010 |

| | Closing share price on NASDAQ National Market | | 12.92 | | 15.55 | | 13.60 | | 9.59 | | 10.70 |

| | Closing share price on Toronto Stock Exchange (CDN$) | | 14.95 | | 19.62 | | 18.28 | | 15.11 | | 16.95 |

| | Closing number of common shares issued and outstanding (000s) | | 45,682 | | 45,562 | | 45,004 | | 44,863 | | 38,412 |

Cash Flows |

|

|

|

|

|

|

|

|

|

|

| |

Cash flows from operating activities |

|

67,745 |

|

23,360 |

|

51,496 |

|

35,331 |

|

16,390 |

| | Acquisition of intangible assets | | 51 | | 149,628 | | 76,093 | | 1,561 | | 1,892 |

| | Net issuance of common shares | | 1,071 | | 4,900 | | 1,103 | | 65,039 | | 30,969 |

| | Issuance of long-term debt | | — | | 2,212 | | 126,064 | | 1,506 | | — |

| | Net increase (decrease) in cash and cash equivalents | | 57,990 | | (15,794 | ) | 17,796 | | 3,462 | | 5,391 |

Ratios |

|

|

|

|

|

|

|

|

|

|

| |

Gross margin |

|

71.5% |

|

77.7% |

|

75.2% |

|

74.3% |

|

74.6% |

| | Operating margin | | 16.1% | | 31.5% | | 22.0% | | 24.6% | | 19.4% |

| | Net margin | | 10.5% | | 20.0% | | 11.1% | | 16.0% | | 11.4% |

| | Revenue growth | | 3.2% | | 36.0% | | 35.3% | | 27.5% | | 19.5% |

- (1)

- One-time charges consisting of take-over bid expenses, acquired in-process research and related income taxes, a non-GAAP measure (see page 36).

- (2)

- As of September 30

3

OUR EXPERTISE

Focus on gastroenterology, our core of area of knowledge

4

In May 2005, Léon F. Gosselin, who founded Axcan in 1982, announced the separation of the roles of Chairman of the Board from that of President and Chief Executive Officer, and the appointment of Frank A.G.M. Verwiel, M.D., to the latter role. Mr. Gosselin will continue to serve Axcan as Chairman of the Board.

5

MESSAGE TO

OUR SHAREHOLDERS

DEAR FELLOW SHAREHOLDERS:

As we look back at fiscal 2005, we would like to highlight the accomplishments of what, in many ways, was our best year ever. Not only did we achieve record sales of $251.3 million for the year, we also established Axcan's place in the gastroenterology community more solidly than ever. We have a core group of products, an enviable product pipeline, and a team of people dedicated to patients, physicians, and stakeholders.

When Axcan was created in 1982, we never dreamed of being as successful as we have been these past 23 years. Initially, our goal was to register a handful of products in Canada and create a company to sell them. Thanks to years of hard work, careful planning and a number of bold strategic moves, Axcan has greatly surpassed these objectives. Throughout the process, no resource was more important to us than the many people who worked so hard and cared so much for the patients we strived to help. From the original few to the now almost 450 employees who espouse the values of Axcan and dedicate their efforts to all patients who suffer from gastrointestinal diseases and disorders around the globe, we would like to extend a sincere "thank you".

In addition to our people, our success is also due to the decision to focus strictly within the therapeutic area where we excel—gastroenterology. In fact, the increasingly competitive environment in which the pharmaceutical industry has evolved has proven to be an asset for Axcan. Our strategy has been to enhance a growing pipeline by accessing products through selective strategic acquisitions that fueled both our business base and our research and development pipeline. In the pharmaceutical industry, a company must have the financial resources, internal capabilities, and a robust pipeline to drive sustainable growth. Today, as a fully integrated specialty pharmaceutical company in the field of gastroenterology, Axcan has internal capabilities that span research, development, manufacturing, sales and marketing. We also have the necessary elements in place, as well as a determined work ethic, that will enable us to create and maximize opportunities to drive the Company to the next level of success for the good of our patients and their physicians.

We celebrated the 20th anniversary of Axcan three years ago by entering the U.S. pharmaceutical and financial marketplace. With many opportunities ahead of us now, there could be no better 25th anniversary gift than the launch of ITAX (itopride), Axcan's drug for the treatment of functional dyspepsia. Once more we would be privileged to serve patients and physicians by addressing an unmet medical need of huge proportions. A series of important steps brought us closer to this goal during fiscal 2005. Success now depends on the ongoing efforts of our dedicated team throughout fiscal 2006; we strongly believe that 2006 will be another year of great progress with many achievements and significant milestones.

On the financial front in 2005, Axcan, as well as many of its peer companies, faced a new challenge. Several major drug wholesalers chose to change their business models by adopting a fee-for-service approach. This led the wholesalers to lower their inventory levels, resulting in a revenue decline for the Company during the first three quarters of the fiscal year. Fortunately inventories stabilized during the fourth quarter of fiscal 2005. During the last three months of the fiscal year, less than $1 million in sales were estimated to be related to inventory level adjustments and we are now confident that sales should move more closely in line with prescription trends. This bodes well for the future as we are firmly convinced that the strength of a pharmaceutical company is reflected in solid prescription trends.

In spite of this inventory challenge, the Company completed fiscal 2005 reporting record results.

Revenue from all operations rose 3.2% to $251.3 million in fiscal 2005, versus $243.6 million a year earlier, continuing the constant increase experienced by Axcan since it was founded in 1982.

Cash flows from operating activities increased by 189% this fiscal year, to $67.7 million.

6

At the completion of fiscal 2005, long-term debt, except for the convertible subordinated notes, was negligible. Our strong balance sheet and healthy core business will now allow us to move forward to meet exciting new challenges in the future.

By continuing to advance our research and development pipeline and execute on the acquisition front, both in North America and in the rest of the world, we are taking steps that will drive future growth for many years.

We take pride in the fact that we have managed our business well on behalf of all our stakeholders, and most importantly, those of you who are shareholders. A $1,000 investment on the Toronto Stock Exchange at the time of our initial public offering in December 1995, increased to more than $3,241 at our stock's highest level in fiscal 2005, an increase of 224%. Shareholders who invested in Axcan in our June 2000 issue on the NASDAQ National Market saw the value of those shares more than double. We are confident that our value-enhancing strategies will lead to continued strong performance in the future.

We conclude by expressing our appreciation to our employees. Their contributions have been invaluable and have led to the extraordinary results we have achieved since our Company began in 1982. Our performance reflects the capabilities, energy, determination and dedication that exist throughout the Company. Compassion and commitment continue to be important core values at Axcan, yielding a wide range of benefits to patients and caregivers. Our employees subscribe to these values and have contributed significantly in our efforts to improve the quality of life of patients suffering from debilitating gastrointestinal diseases and disorders. As a strong team, we have proven we can build a winning Company. We are confident that as we reach the next level of our growth, we will realize our primary goal of becoming the world's reference gastroenterology specialty pharmaceutical company.

We would also like to note that our success could not have been possible without the encouragement of our loyal customers and the worldwide gastroenterology community. Their constant support and growing recognition have been vitally important to us as we maintains leading-edge services and promote the development of new products to help those who need them live a better life.

Finally, we would like to extend a special word of appreciation to our Board of Directors and shareholders for their continued support and confidence in our Company and its future.

Léon F. Gosselin

Chairman of the Board | | |

| | | |

Frank A.G.M. Verwiel, M.D.

President and Chief Executive Officer | | |

7

Frank A.G.M. Verwiel, M.D.

President and Chief Executive Officer

"All the ingredients like our expertise, our people, and our pipeline are there to accelerate Axcan's growth and take it to the next level of success—becoming the reference gastrointestinal specialty pharmaceutical company."

8

OUR INVESTMENT

IN AXCAN'S FUTURE

Axcan's 2005 performance was strong and will serve as a springboard for continued success. We made significant progress toward meeting our goal of becoming the world's reference gastroenterology specialty pharmaceutical company. Because of our heavy investment in the Company in 2005, we believe we are well positioned to maximize future opportunities.

Revenue grew3.2%.

Prescriptions for products that we promote and for which prescription data is available, revealed overall prescription growth of approximately8%.

Cash flows from operating activities grew189%.

As proud as we are of these past achievements, we know that our stakeholders care most about our future. Given Axcan's consistent record of growth in a difficult market environment, I am pleased to address questions on how we intend to expand on Axcan's success as one of the world's leading gastroenterology specialty pharmaceutical companies.

9

A QUESTION AND ANSWER SESSION

WITH FRANK A.G.M. VERWIEL, M.D.

- Q:

- What attracted you to Axcan Pharma?

My attraction to Axcan grew from an understanding that the Company consists of an outstanding group of people. I was also impressed by the business model that Axcan had developed as a specialty pharmaceutical company focused on gastroenterology and by the research and development pipeline that was and continues to be one of the best in our industry. This, coupled with the opportunity to develop a product like itopride, convinced me that Axcan has all the elements it needs for outstanding growth.

- Q:

- What is your main challenge?

The main challenge we will all face as a team will be to maintain the entrepreneurial spirit that has made Axcan successful, and at the same time, develop the focus and structure necessary to take the Company to the next level.

- Q:

- What are your objectives?

My first objective is to focus on itopride in all its dimensions, including clinical development, partnerships, regulatory, and marketing programs. We will need all these assets to introduce this very important drug to the marketplace. The second point of focus is Axcan's product portfolio, both current and future. We have a tremendous opportunity with our current portfolio, and we need to make sure we make the right choices to leverage our portfolio for future growth. The third is the international dimension of the organization. It is vitally important that we build a European structure that is as solid as the one we have in North America. Our long-term goal is to essentially transform Axcan from a North American company with international operations to a truly multinational company.

- Q:

- Most of Axcan's products are mature. How will you sustain growth?

We will sustain the Company's growth by focusing on our competitive strengths, particularly our intricate knowledge of the gastroenterology market and our strong physician relationships. We intend to utilize these quality attributes to create long-term value through a solid core business and a deep development pipeline. When we invest in these core strengths with dollars generated from top-line growth, we will sustain a value cycle for our shareholders. In essence, using capital to invest in products like itopride that will drive top-line growth.

10

- Q:

- How much longer will you be able to maintain your focus on the gastroenterology market before you run out of products or the ability to expand?

We believe that we still have many opportunities in the gastroenterology area. Sales from the worldwide gastroenterology market total approximately $30 billion. We are active in a select segment of that market. Our growth strategy is based on the strength of our core business, on a robust research and development portfolio that includes itopride and other products, on acquisitions of products and/or companies, and on international expansion. We believe we still have many opportunities to grow in the field of gastroenterology.

- Q:

- How much do you intend to invest in research and development in fiscal 2006 and beyond?

As we complete the itopride program, it is reasonable to expect that research and development expenses will remain significant. We consider research and development to be a strategic investment and vital in taking Axcan to its next level of growth.

- Q:

- What are your thoughts on the gaps in the portfolio? Do you feel you can diversify the Axcan portfolio? Are there any significant opportunities beyond itopride?

As a specialty pharmaceutical company, we are always looking for opportunities to add to or enhance our pipeline. Our growth strategy is based on a robust research and development portfolio. As I mentioned, our growth strategy is also based on the growth of our current core business, as well as acquisitions of products and/or companies, and international expansion. We are confident that we have many opportunities to grow the portfolio, as well as and the Company, beyond where we are today.

11

Q: Historically, Axcan has focused on North America. How important is the international market?

Our international business is vitally important to us and a major part of our growth strategy. For the moment, U.S. revenues comprise the largest portion of our top-line growth. However, for the long-term, we believe we can grow our international business by leveraging our current international operations and by completing new acquisitions of products and/or companies in North America and abroad. We have been able to successfully integrate past acquisitions in France and to launch products in other European markets, and we are confident that we have the capability to take our international operations to the next level, thus transforming Axcan into a multinational company.

Q: What are your priorities for 2006?

Since my appointment in July 2005, we have completed a thorough review of our business plan and growth strategy in order to clearly focus on the opportunities ahead. We are now focused on the following four priorities:

- •

- First, we mustgrow our current solid business base. The products that we promote, and for which prescription data is available, show overall prescription growth of approximately 8 percent in 2005. We want to continue to focus on this core business because it represents the stability and the foundation of the Company.

- •

- Second, we want to continue to move forward on an aggressive timeline toward thecommercialization of itopride, our lead product, for the treatment of Functional Dyspepsia. We are advancing the two Phase III pivotal clinical trials for itopride and we anticipate finalizing this program in the first half of calendar 2006 in order to submit a New Drug Application to the U.S. Food and Drug Administration in Summer 2006.

- •

- Third, we plan toenhance our product pipeline. We are pursuing an aggressive timeline with respect to the rest of our pipeline and are encouraged by the potential of several products, such as HELIZIDE for the eradication of theHelicobacter pylori bacterium and CANASA rectal gel for distal ulcerative colitis, which should both be on the market in fiscal 2007. Another potential product is ursodiol disulfate, a drug formulation for the prevention of the recurrence of colorectal adenomateous polyps, which we believe will be the Company's next potentially significant drug, after itopride.

- •

- Last, but certainly not least, we willcontinue to build our infrastructure in North America, Europe, and the rest of the world, by targeting product or company acquisitions in the field of gastroenterology that offer a competitive advantage, growth potential, and an accretive impact on earnings.

12

Q: Does Axcan have the ability to achieve its goals?

I think Axcan has the vision, the products, the pipeline, the leadership, the commitment and the capability to become the world's reference gastroenterology specialty pharmaceutical company. I feel confident that we will meet this goal because we have the people needed to help us get where we want to be. People are, in fact, our most important asset. One of our strengths has been our ability to grow and attract a talented workforce. We want to invest in our people and that is why we will continue to provide the training tools and support necessary for developing tomorrow's leaders.

Q: Where will Axcan be in five years?

Our goal is to improve the quality of care and the health of individuals who suffer from gastrointestinal diseases and disorders by providing effective therapies to patients and their specialized caregivers. Over the next five years, we will work towards becoming the world's reference gastroenterology specialty pharmaceutical company. We plan to achieve this as we provide value-added therapeutics for a broad spectrum of unmet needs in gastroenterology. We expect this to result in enhanced shareholder investment in our Company and provide our employees with a stimulating place to work with opportunities for personal and career growth.

Q: Is there anything you would like to add before we conclude?

As I look to the future, I see not only a great gastroenterology company, but a leading specialty pharmaceutical company. Our vision is clear. We want to become the world's reference gastroenterology specialty pharmaceutical company. Reaching this milestone will, over the long term, result in an excellent return on investment for our shareholders.

13

OUR PEOPLE

Foundation for our future success

14

The people of Axcan are the driving force behind our success. Through their unwavering commitment and talent, we are able to better serve and help patients and physicians.

Our highly specialized sales force, both in North America and Europe, focuses on building relationships with physicians, opinion leaders, and leading patient organizations in gastroenterology, our core area of focus.

15

OUR CORE

THERAPEUTIC AREAS

Through relationships with physicians and patients, we succeed in delivering care and therapies for the following conditions:

Inflammatory Bowel Disease, such as Crohn's Disease or Ulcerative Colitis, are believed to be caused by an immune-system-induced inflammation.

Crohn's Disease can affect any part of the alimentary canal, from the mouth to the anus, but commonly affects the small and large intestines. The wall of the intestine becomes inflamed, irritated, and ulcerated. This disease most commonly involves the lower part of the small intestine called the ileum.

In Ulcerative Colitis, the inner lining of the large intestine (colon or bowel) and rectum becomes inflamed. The inflammation may involve the rectum alone (proctitis), the rectum and sigmoid colon (distal colitis), the rectum and a large part of the colon (sub-total colitis), or the rectum and the entire colon (total or universal colitis).

Irritable Bowel Syndrome is characterized by functional irritability of the intestine. It reveals abnormalities including constipation, diarrhea, bloating, abdominal pain and similar symptoms in the digestive tract caused by excessive intestinal motion, stress, and enhancement of secretory functions.

Diseases of the liver are often congenital, although some can be prevented. Whatever their origin, these diseases can be devastating to one's health and may require professional care.

Primary Biliary Cirrhosis is a chronic, cholestatic liver disease. Such liver conditions also include Primary Sclerosing Cholangitis and pediatric cholestatic disorders. Primary Biliary Cirrhosis can eventually lead to cirrhosis, liver failure, and other life-threatening complications.

16

Pancreatic diseases and disorders include inflammation (pancreatitis), infections, tumors, and cysts. If more than 80 percent to 90 percent of the pancreas must be removed (pancreatectomy) or if normal activity of the pancreas is impaired, patients will need to take insulin and pancreatic extracts. Patients often endure pain and malnutrition, and are most likely left with a higher risk for pancreatic cancer.

Cystic Fibrosis is, by far, the most commonly inherited pancreatic disease of childhood. It accounts for about 90 percent of childhood pancreatic disorders. The small tubes inside the pancreas, which allow digestive enzymes to reach the intestine, become blocked with mucus and protein and the pancreas becomes badly scarred and shrinks. Many children with Cystic Fibrosis show evidence of severe pancreatic failure immediately following birth, and by two years of age 90 percent of Cystic Fibrosis patients are diagnosed, usually with severe malnutrition. Approximately 85 percent of all people with Cystic Fibrosis have pancreatic insufficiency and need to take pancreatic enzymes with meals.

Duodenal ulcer is caused by the way the lining of the duodenum copes with acid. The duodenum makes chemicals and mucus that cover the surface and protect the tissues from acid. An ulcer occurs if acid breaks through the protective lining. The causes of duodenal ulcers includeHelicobacter pylori infection or the intake of anti-inflammatory medicines.

Other gastrointestinal diseases and disorders. Axcan also markets other products for the treatment of gastrointestinal diseases and disorders including gastric hyperacidity, heartburn, constipation, diarrhea, gastric ulcer, oesophagitis, and palliative and curative treatments for various forms of cancer.

17

OUR PRODUCTS

Through acquisitions of products and/or companies, we have a diversified product portfolio, thus minimizing the risks often associated with smaller companies.

For fiscal 2005, revenue totalled $251.3 million. Sales for our main products, as a percentage of revenue, were divided as follows:

MESALAMINE

In the United States, Axcan markets 1000-milligram CANASA suppositories as indicated for Ulcerative Proctitis. This new dosage form launched in the United States in February 2005, complements the CANASA 500-milligram suppositories already on the market and provides convenient, once-per-day dosing. For fiscal 2005, sales of CANASA totalled $28.7 million.

In Canada, Axcan markets the SALOFALK product line (tablets, suspensions and suppositories) for the treatment of certain Inflammatory Bowel Diseases, including Ulcerative Colitis and Crohn's Disease. For fiscal 2005, sales of SALOFALK totalled $14.5 million.

PANCREATIC ENZYMES

In the United States and Canada, Axcan markets ULTRASE to help patients with exocrine pancreatic insufficiency, as associated with but not limited to Cystic Fibrosis, to better digest food. The Company also markets VIOKASE as a digestive aid for the treatment of exocrine pancreatic insufficiency and pancreatic enzyme deficiency as associated with, but not limited to, chronic pancreatitis and surgical ablation of the pancreas. For fiscal 2005, sales of ULTRASE in North America amounted to $36.0 million and sales of VIOKASE were $7.9 million.

In Europe, Axcan markets PANZYTRAT for the treatment of exocrine pancreatic insufficiency and pancreatic enzyme deficiency. For fiscal 2005, PANZYTRAT generated sales of $14.8 million.

18

We have made continued progress in building relationships and increasing recognition in our targeted markets.

URSODIOL

In the United States, Axcan markets URSO 250 and URSO Forte for the treatment of Primary Biliary Cirrhosis. Sales of URSO 250 and URSO Forte amounted to $36.0 million for fiscal 2005.

In Canada, Axcan markets URSO and URSO DS for the treatment of cholestatic liver diseases and disorders, including Primary Biliary Cirrhosis. Sales of URSO and URSO DS were $11.1 million for fiscal 2005.

In France, Axcan markets DELURSAN for the treatment of cholestatic liver diseases, including Primary Biliary Cirrhosis, Primary Sclerosing Cholangitis, and liver disorders related to Cystic Fibrosis. Sales of DELURSAN totalled $13.1 million for fiscal 2005.

CARAFATE-SULCRATE

CARAFATE and SULCRATE are indicated for the treatment of gastric duodenal ulcers. CARAFATE is sold in the United States and SULCRATE is sold in Canada. For fiscal 2005, combined sales of CARAFATE and SULCRATE were $38.1 million.

OTHER GASTROINTESTINAL PRODUCTS

Axcan markets other products such as MODULON, LACTÉOL, TAGAMET, PROCTOSEDYL, BENTYL/BENTYLOL, ADEKs, SCANDISHAKE, SCANDICAL, FLUTTER and CORTENEMA for the treatment of various gastrointestinal diseases and disorders. For fiscal 2005, combined sales of these products reached $51.1 million.

19

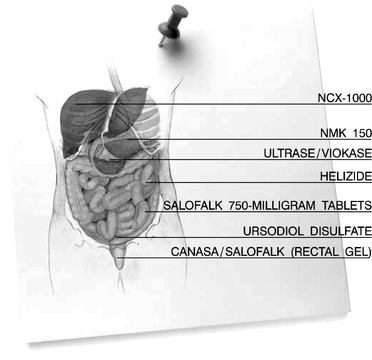

OUR PIPELINE

Promise for better treatments

20

We aspire to make Axcan the world's reference gastroenterology specialty pharmaceutical company. One way to achieve this is to offer value-added therapeutics for a broad spectrum of unmet needs in gastroenterology for patients and physicians. Our goal is within reach because we have a robust pipeline and a commitment to excellence in the development of gastrointestinal products that will have a profoundly positive impact on patients with debilitating diseases.

21

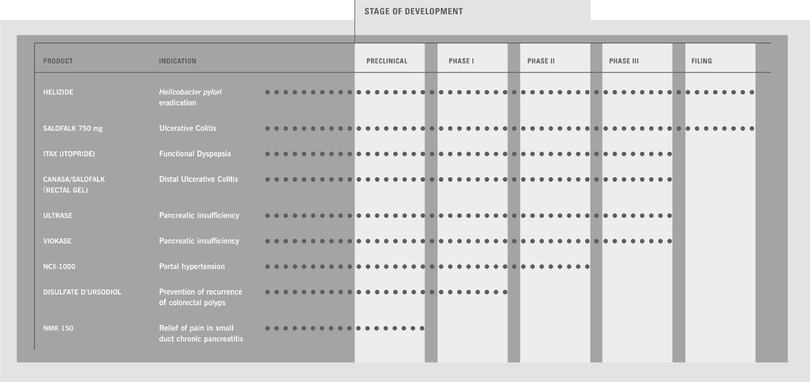

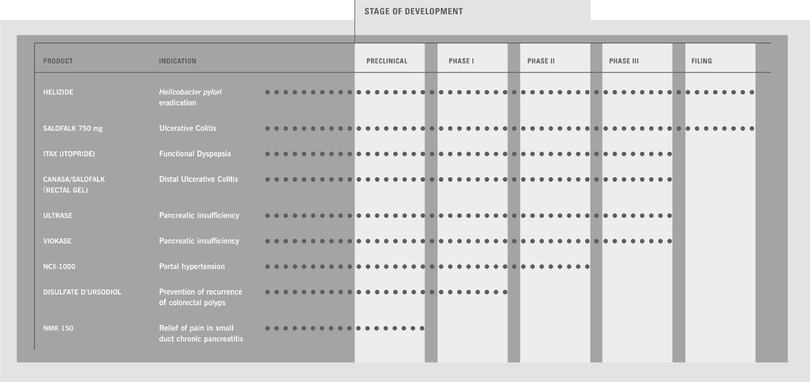

OUR RESEARCH

AND DEVELOPMENT PORTFOLIO

By combining the successes of our internal research and development efforts with our product-licensing strategy, we have built a strong research and development pipeline filled with promising products. Our diverse pipeline mitigates the risks of drug development because we have a balanced mix of both short-and long-term opportunities in the development of products for various functions of the gastrointestinal system.

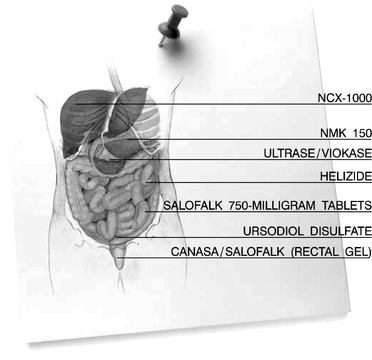

The management team at Axcan recently conducted a thorough review of the Company's product pipeline to reprioritize projects and focus resources on highest-value opportunities. An update on Axcan's most important projects follows:

22

R&D

ITOPRIDE

ITAX (ITOPRIDE)

Functional Dyspepsia, a disorder of the upper gastrointestinal tract, affects up to 25 percent of the North American population annually and accounts for up to 5 percent of all visits to primary care physicians. Dyspepsia can be defined as pain or discomfort centered in the upper abdomen, characterized by abdominal fullness, early satiety, bloating, or nausea. The term functional or non-ulcer dyspepsia refers to relapsing or chronic dyspepsia in patients without evidence of organic disease to explain the symptoms.

Currently, there is no approved product in North America for the treatment of Functional Dyspepsia. To date, patients living with these distressing symptoms have no satisfying therapeutic option available to them.

Itopride is a gastroprokinetic drug effective through a dual mechanism of action. First, it acts as a dopamine antagonist on D2-receptors thereby increasing the secretion of acetylcholine; and secondly, it prevents hydrolysis of the released acetylcholine by the acetylcholinesterase enzyme in the smooth muscles. Acetylcholine is an important endegenois substance involved in the motor activity of the gastrointestinal tract. Itopride has also been shown to have anti-emetic properties.

23

Axcan is conducting two pivotal Phase III trials, one in North America and the other internationally, aimed at demonstrating the efficacy of itopride in the treatment of Functional Dyspepsia. At the end of calendar 2005, all patients required in both the International and North American trials had been randomized. In addition, all patients required for the supplementary 6-month and 1-year safety studies had been enrolled.

Axcan expects to release the overall outcome of the international Phase III trial during the first half of calendar 2006, followed shortly by that of the North American Phase III trial. Assuming a positive outcome of the trials, the Company intends to submit this product candidate for Food and Drug Admnistration approval in Summer 2006.

In addition to Phase III trials, a cardiac safety study to examine itopride in doses of up to four times the proposed therapeutic dose was completed, and results showed no cardiac adverse drug reaction.

Finally, the clinical work on most of the additional Phase I studies required to complement the New Drug Application for submission to the Food and Drug Admnistration is now complete. Data are currently being analyzed.

We also implemented a core team responsible for planning, directing and coordinating the development and commercialization of itopride, to ensure that we effectively and successfully bring this product to market. This team will also manage and coordinate the complete life cycle of itopride, from Phase III to launch and immediate post-launch activities.

24

R&D

HELIZIDE

The discovery in 1983 of theHelicobacter pylori organism was one of the major advances in gastroenterology in recent decades, as it has revolutionized the approach to many upper gastrointestinal disorders.Helicobacter pylori is believed to cause a spectrum of diseases in humans, including gastritis, ulcer disease (gastric and duodenal), gastric cancer, and gastric lymphoma.

Axcan conducted a 275-patient Phase III trial comparing the HELIZIDE regimen (three single-triple capsules given four times per day, plus omeprazole 20-milligram twice per day) to the widely used OAC (omeprazole, amoxicillin and clarithromycin) combination. Results confirmed that HELIZIDE is statistically and clinically comparable to OAC and that HELIZIDE has the potential as a first-line therapy for the eradication ofHelicobacter pylori.

A New Drug Application has been filed in the United States. The Food and Drug Administration has raised bismuth-related manufacturing issues in connection with the approval of HELIZIDE, which must be resolved before approval is granted. Axcan has successfully qualified a manufacturer of bismuth salt, a component of the HELIZIDE combination therapy for the eradication of theHelicobacter pylori bacterium. Final results of stability tests on the bismuth salt should be available during the first quarter of fiscal 2006, which should allow Axcan to file an amendment to the New Drug Application during the second quarter of fiscal 2006.

SALOFALK 750-MILLIGRAM TABLETS

Axcan completed a 114-patient Phase III trial, for the Canadian market, on the efficacy and safety of a new 750-milligram mesalamine tablet for the oral treatment of ulcerative colitis. Axcan submitted a Supplemental New Drug Submission in Canada during the first quarter of fiscal 2004. The Company received, and responded to, questions in a non-approvable letter from Health Canada and anticipates a response in the first half of fiscal 2006.

CANASA/SALOFALK (RECTAL GEL)

Axcan in-licensed from Gentium SpA, an Italian company, exclusive rights to develop and market in North America a new mesalamine rectal gel to be developed for the treatment of distal ulcerative colitis. Axcan completed an open-label, randomized 180-patient Phase III study to assess the evolution of the clinical symptoms of the disease during the induction of remission by this new formulation. The data from this study are currently being analyzed. The Company plans to submit regulatory filings for approvals in the United States and Canada in the first half of calendar 2006.

25

ULTRASE AND VIOKASE

Axcan already markets in the United States ULTRASE and VIOKASE for the treatment of pancreatic insufficiency. In April 2004, the Food and Drug Administration formally notified manufacturers of pancreatic insufficiency products that these drugs must receive approval before 2008 in order to remain on the market. The Food and Drug Administration decided to require New Drug Applications for all pancreatic extract drug products after reviewing data that showed substantial variation among currently marketed products. Axcan has completed a Phase III study of VIOKASE that will serve as the basis of the New Drug Application it expects to submit by Spring 2007. The data from this study are currently being analyzed. The study on ULTRASE is in process and is anticipated to be completed and submitted by Spring 2007.

NCX-1000

NCX-1000, a nitric oxide-releasing derivative of ursodiol, is in preclinical development for the treatment of portal hypertension, a complication of chronic liver diseases. Several animal studies have already shown the pharmacological effects of NCX-1000 on portal hypertension. Experimental models of cirrhosis demonstrated that this compound reduces portal pressure by decreasing intrahepatic resistance, rather than through direct effects on the portal vasculature. A Phase I clinical study involving 16 subjects was successfully completed, demonstrating tolerability and safety. The protocol of a pilot, therapeutic, proof-of-concept Phase II a study was approved by the relevant Ethical Review Board. The center where the study will be conducted has started the identification of potential patients. The study should be completed by the end of fiscal 2006.

URSODIOL DISULFATE

Axcan is currently studying the use of a new ursodiol derivative, ursodiol disulfate, in the prevention of the recurrence of colorectal adenomateous polyps. Preliminary results of studies conducted with ursodiol disulfate showed that ursodiol disulfate reduces the number of aberrant crypts in a rat model of colon cancer. Aberrant crypts are considered early abnormal changes in the intestinal lining that are precursors to colon cancer. In a small pilot study, where rats were injected with the carcinogen azoxymethane, a 56 percent reduction in the total number of aberrant crypts in the colon was observed after four weeks in those animals treated with this new ursodiol formulation compared with control models. URSODIOL DISULFATE alone fed to rats had no adverse effects on the appearance of the lining of the colon. Long-term animal studies are ongoing to determine the effect of ursodiol disulfate on the time of appearance, the number, and the size of colonic tumors in the azoxymethane rat model of chemically-induced colon cancer. Positive results of this proof-of-concept study were announced during the first half of fiscal 2004 and animal toxicity studies were then initiated. Both acute and subchronic toxicity studies have been completed and confirmed that the compound is safe and has no toxicity effect. Clinical Phase I studies should be initiated in the first half of fiscal 2006.

NMK 150

Axcan and Nordmark GmbH, a German pharmaceutical firm, are collaborating in the development of NMK 150, a new high-protease pancrelipase preparation for the relief of pain in small duct chronic pancreatitis. NMK 150 is expected to enter dose-ranging preclinical studies in the first quarter of fiscal 2006 to confirm the absence of mucosal irritation associated with the use of high doses of the drug. Phase I clinical trials should begin in the second quarter of fiscal 2006.

26

OUR COMMITMENT

COMMUNITY INVOLVEMENT

We have managed to grow without ever losing our fundamental quality of being a Company with a human face by remaining true to our core values and by keeping our doors wide open, both inside the organization and outwards to the community.

Axcan takes its role as a corporate citizen very seriously. Every year, we support a variety of social and charitable causes. Throughout our history, we have shown a commitment to promoting the human, economic and cultural development of the municipalities and regions where we operate.

SOCIAL RESPONSIBILITY

We are committed to offering our employees a high quality working environment with opportunities for satisfaction and personal development. Our management philosophy is based on respect for the individual; each employee is important, and we make every effort to ensure that employee contributions are identified and acknowledged. As a result, Axcan is able to rely on a motivated team of individuals who are dedicated to our success. Our flat and flexible organizational structure has always kept us close to our employees, and through various programs, they become real partners in the Company, which enhances their feelings of belonging and accountability. Equally important, Axcan offers employees opportunities to grow within the Company through professional development and training programs.

ENVIRONMENTAL PROTECTION

Because environmental protection is important, we at Axcan are constantly working to improve environmental friendliness and sustainable development.

Axcan generates a small amount of hazardous waste that is disposed of by certified third-party carriers. We believe that compliance with environmental regulations has no material impact on capital expenditures, earnings, or Axcan's competitive position. We periodically require reviews of our compliance with environmental laws and regulations to ensure continued cooperation with applicable norms.

We want environmental protection to become a way of life, a way of thinking, a way of managing our Company, and an everyday concern that involves more than simply achieving the main objectives of our environmental policy. We want to do everything possible to improve the environment.

27

MANAGEMENT'S DISCUSSION

and analysis of financial condition and

results of operations

28

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

This discussion should be read in conjunction with the information contained in Axcan's consolidated financial statements and the related notes thereto. All amounts are in U.S. dollars.

OVERVIEW

Axcan is a leading speciality pharmaceutical company concentrating in the field of gastroenterology, with operations in North America and Europe. Axcan markets and sells pharmaceutical products used in the treatment of a variety of gastrointestinal diseases and disorders. The Company seeks to expand its gastrointestinal franchise by in-licensing products and acquiring products or companies, as well as developing additional products and expanding indications for existing products. Axcan's current products include ULTRASE, PANZYTRAT and VIOKASE for the treatment of certain gastrointestinal symptoms related to cystic fibrosis in the case of ULTRASE and PANZYTRAT; URSO / URSO 250, URSO FORTE / URSO DS and DELURSAN for the treatment of certain cholestatic liver diseases; SALOFALK and CANASA for the treatment of certain inflammatory bowel diseases; and CARAFATE / SULCRATE for the treatment of gastric duodenal ulcers. Axcan has a number of pharmaceutical projects in all phases of development, including ITAX for the treatment of functional dyspepsia. In the first quarter of fiscal 2004, Axcan filed a supplemental New Drug Submission for a new 750-milligram mesalamine (5-ASA) tablet for the oral treatment of ulcerative colitis. On March 24, 2005, Axcan received a non-approval letter from the Therapeutic Products Directorate of Health Canada containing a list of questions and comments for both the clinical and Chemistry, Manufacturing and Controls aspects of the original New Drug Submission. Axcan responded to all questions in the nonapprovable letter during the third quarter of fiscal 2005 and expects to obtain a final response in the first half of fiscal 2006.

For the year ended September 30, 2005, revenue was $251.3 million, operating income was $40.4 million and net income was $26.4 million. Revenue from sales of Axcan's products in the United States was $159.7 million (63.5% of total revenue) for the year ended September 30, 2005, compared to $166.7 million (68.4% of total revenue) for fiscal 2004 and $113.9 million for fiscal 2003. In Canada, revenue was $34.4 million (13.7% of total revenue) for the year ended September 30, 2005, compared to $28.0 million (11.5% of total revenue) for fiscal 2004 and $20.6 million for fiscal 2003. In Europe, revenue was $57.1 million (22.7% of total revenue) for the year ended September 30, 2005, compared to $48.7 million (20.0% of total revenue) for fiscal 2004 and $44.5 million for fiscal 2003.

Axcan's revenue historically has been and continues to be principally derived from sales of pharmaceutical products to large pharmaceutical wholesalers and large chain pharmacies. Axcan utilizes a "pull-through" marketing approach that is typical of pharmaceutical companies. Under this approach, Axcan's sales representatives demonstrate the features and benefits of its products to gastroenterologists who may write their patients' prescriptions for Axcan's products. The patients, in turn, take the prescriptions to pharmacies to be filled. The pharmacies then place orders with the wholesalers or, in the case of large chain pharmacies, their distribution centers, to whom Axcan sells its products.

Axcan's expenses are comprised primarily of selling and administrative expenses (including marketing expenses), cost of goods sold (including royalty payments to those companies from whom Axcan licenses some of its products), research and development expenses as well as depreciation and amortization.

Axcan's annual and quarterly operating results are primarily affected by three factors: wholesaler buying patterns; the level of acceptance of Axcan's products by gastroenterologists and their patients; and the extent of Axcan's control over the marketing of its products.

Historically, wholesalers' business models in the U.S. were dependent on drug price inflation. Their profitability and gross margins were directly tied to purchasing several months of inventory at pre-price increase prices and selling the inventory to the trade at the new higher price. This inventory price arbitrage was predominantly how wholesalers were compensated for the distribution services they provided and had a dramatic effect on wholesaler buying patterns as they invested in inventories in anticipation of generating higher gross margins from price increases from manufacturers. More recently, for a number of reasons, pharmaceutical manufacturers have not been increasing drug prices as frequently and the increases, as a percentage, have been lower. For these and other reasons, some wholesalers moved to a fee-for-service type arrangement where fees are now typically expressed as a percentage of the wholesaler's purchases from the manufacturer or as an amount per piece per unit. For wholesalers, fee-for-service means their compensation will be periodic and volume activity based as opposed to price increase based.

As a result of the move to a fee-for-service business model, wholesalers are no longer investing in inventory ahead of anticipated price increases and are reducing their carrying levels of inventory from their historical norms. Under the new model, manufacturers will now realize the benefit of price increase more rapidly and pay wholesalers for the services they provide on a fee for service basis. This change in wholesaler's business model affected Axcan's revenue in fiscal 2005.

29

The level of patient and physician acceptance of Axcan's products, as well as the availability of similar therapies, which may be less effective but also less expensive than some of Axcan's products, impact Axcan's revenues by driving the level and timing of prescriptions for its products.

CRITICAL ACCOUNTING POLICIES

Axcan's consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America ("U.S. GAAP"), applied on a consistent basis. Axcan's critical accounting policies include the use of estimates, revenue recognition, the recording of research and development expenses and the determination of the useful lives or fair value of goodwill and intangible assets. Some of our critical accounting policies require the use of judgment in their application or require estimates of inherently uncertain matters. Although our accounting policies are in compliance with U.S. GAAP, a change in the facts and circumstances of an underlying transaction could significantly change the application of our accounting policies to that transaction, which could have an effect on our financial statements. Discussed below are those policies that we believe are critical and require the use of complex judgment in their application.

USE OF ESTIMATES

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the recorded amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of financial statements and the disclosure of recognized amounts of revenues and expenses during the year. Significant estimates and assumptions made by management include the allowance for accounts receivable and inventories, reserves for product returns, rebates and chargebacks, the classification of intangible assets between finite and indefinite life, useful lives of long-lived assets, the expected cash flows used in evaluating long-lived assets, goodwill and investments for impairment, contingency provisions and other accrued charges. These estimates were made using the historical information and various other factors related to each circumstance available to management. The Company reviews all significant estimates affecting the financial statements on a recurring basis and records the effect of any adjustments when necessary. Actual results could differ from those estimates based upon future events, which could include, among other risks, changes in regulations governing the manner in which we sell our products, changes in health care environment and managed care consumption patterns.

REVENUE RECOGNITION

Revenue is recognized when the product is shipped to the Company's customer, provided the Company has not retained any significant risks of ownership or future obligations with respect to the product shipped. Provisions for sales discounts and estimates for chargebacks, managed care and Medicaid rebates and product returns are established as a reduction of product sales revenues at the time such revenues are recognized. These revenue reductions are established by us as our best estimate at the time of sale based on historical experience adjusted to reflect known changes in the factors that impact such reserves. These revenue reductions are generally reflected as an addition to accrued expenses.

We do not provide any forms of price protection to our wholesale customers and permit product returns only if the product is returned within 12 months of expiration. Credit for returns is issued to the original purchaser at current net pricing less 10%. Accrued liabilities include reserves of $7.5 million and $6.1 million as of September 30, 2005, and September 30, 2004, respectively for estimated product returns.

In the United States, we establish and maintain reserves for amounts payable by us to managed care organizations and state Medicaid programs for the reimbursement of portions of the retail price of prescriptions filled that are covered by the respective programs. We also establish and maintain reserves for amounts payable by us to wholesale distributors for the difference between their regular sale price and the contract price for the products sold to our contract customers. The amounts estimated to be paid relating to products sold are recognized as revenue reductions and as additions to accrued expenses at the time of sale based on our best estimate of the product's utilization by these managed care and state Medicaid patients and sales to our contract customers, using historical experience adjusted to reflect known changes in the factors that impact such reserves. Accrued liabilities include reserves of $4.8 million and $2.8 million as of September 30, 2005, and September 30, 2004, respectively, for estimated rebates and chargebacks.

30

If the levels of chargebacks, managed care and Medicaid rebates, product returns and discounts fluctuate significantly and / or if our estimates do not adequately reserve for these reductions of net product revenues, our reported revenue could be negatively affected.

GOODWILL AND INTANGIBLE ASSETS

We have in the past acquired products and businesses that include goodwill, trademarks, license agreements and other identifiable intangible assets. Axcan's goodwill and intangible assets are stated at cost, less accumulated amortization. Since October 1, 2001, the Company does not amortize goodwill and intangible assets with an indefinite life. However, management assesses the impairment of goodwill and intangible assets at least annually and whenever events or changes in circumstances indicate that the carrying amounts of these assets may not be recoverable, by comparing the carrying value of the unamortized portion of goodwill and intangible assets to the future benefits of the Company's activities or expected sales of pharmaceutical products. Should there be a permanent impairment in value or if the unamortized balance exceeds recoverable amounts, a write-down will be recognized, for the current year. To date, Axcan has not recognized any significant impairment in value.

Intangible assets with finite life are amortized over their estimated useful lives according to the straight-line method at annual rates varying from 4 to 15%. The straight-line method of amortization is used because it reflects, in the opinion of management, the pattern in which the intangible assets with finite life are used. In determining the useful life of intangible assets, the Company considers many factors including the intention of management to support the asset on a long-term basis by maintaining the level of expenditure necessary, the use of the asset, the existence and expiration date of a patent, the existence of a generic or competitor and any legal or regulatory provisions that could limit the use of the asset.

As a result of acquisitions, we included $27.5 million of goodwill on our consolidated balance sheets as of September 30, 2005, and September 30, 2004.

Also as a result of acquisitions of product rights and other identifiable intangible assets, we included $388.9 million and $407.9 million as net intangible assets on our consolidated balance sheets as of September 30, 2005, and September 30, 2004. Estimated annual amortization expense for intangible assets with a finite life, which have a weighted-average remaining amortization period of approximately 17 years, for the next five fiscal years, is approximately $16.6 million.

RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses are charged to operations in the year they are incurred. Acquired in-process research and development having no alternative future use is written off at the time of acquisition. The cost of intangibles that are acquired from others for a particular research and development project, with no alternative use, is written off at the time of acquisition.

ACQUISITION OF PRODUCTS

On November 18, 2003, the Company acquired the rights to a group of products from Aventis Pharma S.A. ("Aventis"). The $145.0 million purchase price was paid out of Axcan's cash on hand. These products are CARAFATE and BENTYL for the U.S. market and SULCRATE, BENTYLOL and PROCTOSEDYL for the Canadian market (collectively, "AVAX" product line).

On August 29, 2003, the Company acquired an exclusive license for North America, the European Union and Latin America, from Abbott Laboratories ("Abbott") to develop, manufacture and market ITAX, a patented gastroprokinetic drug. Under the terms of this license agreement, the Company paid $10.0 million in cash and assumed $2.0 million in research contract liability.

On December 10, 2002, the Company acquired the rights to the Ursodiol 250 mg tablets DELURSAN for the French market from Aventis, for a cash purchase price of $22.8 million.

On December 3, 2002, the Company acquired the worldwide rights to the PANZYTRAT enzyme product line from Abbott for a cash purchase price of $45.0 million.

31

During a transition period ended during the 2005 fiscal year, the seller in certain of these acquisition transactions acted as selling agent for the management of these products. For the year ended September 30, 2005, sales of some of these products were still managed in part by the sellers. Axcan included in its revenue the net sales from such products less corresponding cost of goods sold and other seller related expenses. Consequently, although net sales of such products for the year ended September 30, 2005, were $2,431,789 ($7,667,940 in 2004 and $14,255,979 in 2003), the Company only included in its revenue an amount of $949,866 ($4,685,673 in 2004 and $9,463,645 in 2003) representing the net sales less cost of goods sold and other seller related expenses.

RESULTS OF OPERATIONS

The following table sets forth, for the years indicated, the percentage of revenue represented by items in Axcan's consolidated statements of operations:

For the years ended September 30

| | 2005

| | 2004

| | 2003

| |

|---|

| | %

| | %

| | %

| |

|---|

| Revenue | | 100.0 | | 100.0 | | 100.0 | |

| Cost of goods sold | | 28.5 | | 22.2 | | 24.8 | |

| Selling and administrative expenses | | 34.2 | | 31.4 | | 35.2 | |

| Research and development expenses | | 12.7 | | 8.2 | | 6.8 | |

| Acquired in-process research | | — | | — | | 6.7 | |

| Depreciation and amortization | | 8.6 | | 6.7 | | 4.5 | |

| | |

| |

| |

| |

| | | 84.0 | | 68.5 | | 78.0 | |

| | |

| |

| |

| |

| Operating income | | 16.0 | | 31.5 | | 22.0 | |

| | |

| |

| |

| |

| Financial expenses | | 2.8 | | 2.8 | | 2.4 | |

| Interest income | | (0.5 | ) | (0.3 | ) | (0.9 | ) |

| Loss (gain) on foreign exchange | | (0.1 | ) | (0.1 | ) | — | |

| Takeover-bid expenses | | — | | — | | 2.1 | |

| | |

| |

| |

| |

| | | 2.2 | | 2.4 | | 3.6 | |

| | |

| |

| |

| |

| Income before income taxes | | 13.8 | | 29.1 | | 18.4 | |

| Income taxes | | 3.3 | | 9.1 | | 7.3 | |

| | |

| |

| |

| |

| Net income | | 10.5 | | 20.0 | | 11.1 | |

| | |

| |

| |

| |

QUARTERLY RESULTS

(amounts in thousands of dollars, except share related data)

YEAR ENDED SEPTEMBER 30, 2005, COMPARED TO YEAR ENDED

SEPTEMBER 30, 2004

| |

| |

| | Net income per share

|

|---|

Quarter

| |

| | Net

income

|

|---|

| | Revenue

| | Basic

| | Diluted

|

|---|

| | $

| | $

| | $

| | $

|

|---|

| 2005 | | | | | | | | |

| First | | 61,583 | | 7,754 | | 0.17 | | 0.16 |

| Second | | 63,364 | | 5,425 | | 0.12 | | 0.12 |

| Third | | 59,409 | | 4,097 | | 0.09 | | 0.09 |

| Fourth | | 66,987 | | 9,149 | | 0.20 | | 0.19 |

2004 |

|

|

|

|

|

|

|

|

| First | | 57,565 | | 10,435 | | 0.23 | | 0.21 |

| Second | | 63,192 | | 12,421 | | 0.27 | | 0.24 |

| Third | | 62,005 | | 12,552 | | 0.28 | | 0.25 |

| Fourth | | 60,872 | | 13,320 | | 0.29 | | 0.26 |

REVENUE

For the year ended September 30, 2005, revenue was $251.3 million compared to $243.6 million for the preceding fiscal year, an increase of 3.2%.This increase in revenue primarily resulted from higher sales in Canada and Europe partly offset by lower sales in the United States following an announced intention from major wholesalers to reduce their inventory levels. The end-customer prescription demand continues to show positive growth for most of our products sold in the United States which leads us to believe that this reduction in revenue is only temporary and that sales should increase when our major wholesalers reach their targeted inventory levels.

32

Revenue is stated net of deductions for product returns, chargebacks, contract rebates, discounts and other allowances of $39.4 million (13.6% of gross revenue) in fiscal 2005, and $28.8 million (10.6% of gross revenue) in fiscal 2004. This increase of total deductions as a percentage of gross revenue is primarily due to an increase in returns and chargebacks in fiscal 2005.

PRODUCT SALES

Key sales figures for fiscal 2005 are as follows:

- •

- Sales of pancreatic enzymes (ULTRASE, PANZYTRAT and VIOKASE) amounted to $58.7 million, an increase of 2.5% over fiscal 2004 sales of pancreatic enzymes.

- •

- Sales of ursodiol (URSO / URSO 250, URSO FORTE / URSO DS and DELURSAN) increased 7.3% to $60.2 million.

- •

- Sales of mesalamine (CANASA and SALOFALK) amounted to $43.2 million, a 14.1% decrease from the prior year. This decrease was caused by larger than usual wholesaler orders in the last quarter of fiscal 2004, which resulted in a 92% increase in sales of fiscal 2004 compared to the prior fiscal year. Often, customers will buy in advance of pre-announced price increases or in anticipation of a price increase, thus shifting revenue from one period to another.

- •

- Sales of the AVAX product line amounted to $44.6 million, an increase of 6.7% over the previous fiscal year.

- •

- Sales of PHOTOFRIN and other products in North America amounted to $14.0 million, a 6.9% increase from the prior year.

- •

- Sales of other products in Europe, mainly LACTÉOL and TAGAMET, amounted to $29.4 million, a 19.0% increase over the prior year. This increase is mainly due to higher sales of LACTEOL.

COST OF GOODS SOLD

Cost of goods sold consists principally of costs of raw materials, royalties and manufacturing costs. Axcan outsources most of its manufacturing requirements. For the year ended September 30, 2005, cost of goods sold increased $17.3 million (31.9%) to $71.5 million from $54.2 million for the preceding fiscal year. As a percentage of revenue, cost of goods sold for the year ended September 30, 2005, increased as compared to the preceding fiscal year from 22.2% to 28.5%. This increase in the cost of goods sold as a percentage of revenue was due mainly to the write-down of inventory of finished goods with less than twelve months of shelf life, an increase in sales of products with a lower margin and a reduction in sales of products with a higher margin. Cost of goods sold for the year ended September 30, 2005, includes $4.7 million related to the write-down of inventory of finished goods for one product line sold in the United States.

SELLING AND ADMINISTRATIVE EXPENSES

Selling and administrative expenses consist principally of salaries and other costs associated with Axcan's sales force and marketing activities. Selling and administrative expenses increased $9.6 million (12.6%) to $86.0 million for the year ended September 30, 2005, from $76.4 million for the preceding fiscal year. This increase is mainly due to an increase in our sales force in preparation for additional products to be marketed, including ITAX, additional marketing efforts on our current products, increased distribution cost following the signing of a new agreement with a major wholesaler and consulting fees for Information Technology implementation and regulatory compliance.

RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses consist principally of fees paid to outside parties that Axcan uses to conduct clinical studies and to submit governmental approval applications on its behalf as well as the salaries and benefits paid to its personnel involved in research and development projects. Research and development expenses increased $12.0 million (60.3%) to $31.9 million for the year ended September 30, 2005, from $19.9 million for the preceding fiscal year. This increase is mainly due to the Phase III development of ITAX, acquired in August 2003, for the treatment of functional dyspepsia. Phase III is the most expensive stage of clinical development.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization consists principally of the amortization of intangible assets with a finite life. Intangible assets include trademarks, trademark licenses and manufacturing rights. Depreciation and amortization increased $5.1 million (31.1%) to $21.5 million for the year ended September 30, 2005, from $16.4 million for the preceding fiscal year. The increase is mainly due to the amortization of the AVAX product line acquired from Aventis on November 18, 2003, and of PANZYTRAT which was reclassified from intangible assets with an indefinite life to intangible assets with a finite life on October 1, 2004.

33

FINANCIAL EXPENSES

Financial expenses consist principally of interest and fees paid in connection with money borrowed for acquisitions. Financial expenses increased $0.2 million (2.9%) to $7.1 million for the year ended September 30, 2005, from $6.9 million for the preceding fiscal year.

INCOME TAXES

Income taxes amounted to $8.4 million for the year ended September 30, 2005, compared to $22.3 million for the preceding fiscal year. The effective tax rates were 24.1% for the year ended September 30, 2005, and 31.4% for the year ended September 30, 2004. The decrease in effective tax rate is mainly due to research and development tax credits, deducted from the income tax expense, of $2.6 million for the year ended September 30, 2005, compared to $1.2 million for the preceding fiscal year.

The income tax expense and corresponding tax rate are summarized in the following tables:

For the years ended September 30

| | 2005

| | 2004

| |

|---|

| | $

| | $

| |

|---|

| Income tax expense | | | | | |

| Income tax | | 11,032 | | 23,416 | |

| Research and development tax credits | | (2,619 | ) | (1,163 | ) |

| | |

| |

| |

| Income tax expense | | 8,413 | | 22,253 | |

| | |

| |

| |

For the years ended September 30

| | 2005

| | 2004

| |

|---|

| | %

| | %

| |

|---|

| Income tax rate | | | | | |

| Income tax | | 31.7 | | 33.0 | |

| Research and development tax credits | | (7.6 | ) | (1.6 | ) |

| | |

| |

| |

| Effective tax rate | | 24.1 | | 31.4 | |

| | |

| |

| |

NET INCOME

Net income was $26.4 million or $0.58 of basic income per share and $0.56 of diluted income per share, for the year ended September 30, 2005, compared to $48.7 million or $1.08 of basic income per share and $0.96 of diluted income per share for the preceding year. The reduction in net income for the year ended September 30, 2005, resulted mainly from an increase in revenue of $7.7 million, an increase in operating expenses totalling $44.1 million and a decrease in income taxes of $13.8 million. The weighted average number of common shares outstanding used to establish the basic per share amounts increased from 45.3 million for the year ended September 30, 2004, to 45.6 million for the year ended September 30, 2005, following the exercise of options previously granted pursuant to Axcan's stock option plan. The weighted average number of common shares used to establish the diluted per share amounts increased from 55.0 million for the year ended September 30, 2004 to 55.2 million for the year ended September 30, 2005.

YEAR ENDED SEPTEMBER 30, 2004, COMPARED TO YEAR ENDED

SEPTEMBER 30, 2003

REVENUE

For the year ended September 30, 2004, revenue was $243.6 million compared to $179.1 million for the preceding fiscal year, an increase of 36.0%. This increase in revenue primarily resulted from $41.8 million in U.S. and Canadian sales of the AVAX product line which was acquired in November 2003 and strong sales of CANASA in the U.S. Revenues from sales made by the French subsidiary, following the acquisition of DELURSAN as well as the PANZYTRAT product line, also contributed to the increase.

34

PRODUCT SALES

Key sales figures for fiscal 2004 are as follows:

- •

- Sales of pancreatic enzymes (ULTRASE, PANZYTRAT and VIOKASE) amounted to $57.3 million, a decrease of 1.0% over fiscal 2003 sales of pancreatic enzymes. PANZYTRAT acquired in the first quarter of fiscal 2003, accounted for $10.2 million of these sales in fiscal 2003 and $13.5 million in fiscal 2004;

- •

- Sales of ursodiol (URSO 250, URSO DS and DELURSAN) increased 4.0% to $56.1 million. DELURSAN acquired in the second quarter of fiscal 2003, accounted for $6.9 million of these sales in fiscal 2003, and $10.8 million in fiscal 2004;

- •

- Sales of mesalamine (CANASA and SALOFALK) amounted to $50.3 million, a 92.0% increase from the prior year. The increase offsets the 24% decrease announced in fiscal 2003 and reflects not only the increase in prescriptions but also the fluctuations in wholesalers buying patterns. Often, customers will buy in advance of pre-announced price increases or in anticipation of a price increase, thus shifting revenue from one period to another.

- •

- Sales of the AVAX product line amounted to $41.8 million. The AVAX product line was acquired in November 2003.

- •

- Sales of PHOTOFRIN and other products in North America amounted to $14.1 million, the same total as for the prior year.

- •

- Sales of other products in Europe, mainly LACTÉOL and TAGAMET, amounted to $23.7 million, a 14% decrease over the prior year. This decrease is mainly due to lower sales of TAGAMET following changes in the regulatory rules applicable to this product.

COST OF GOODS SOLD

Cost of goods sold increased $9.7 million (21.8%) to $54.2 million for the year ended September 30, 2004, from $44.5 million for the preceding fiscal year. As a percentage of revenue, cost of goods sold for the year ended September 30, 2004, decreased as compared to the preceding fiscal year from 24.8% to 22.2%. This decrease in the cost of goods sold as a percentage of revenue was due to the increase in sales of products with a higher margin in the United States and an improved margin in Europe.

SELLING AND ADMINISTRATIVE EXPENSES