Exhibit 99.4

ANNUAL INFORMATION FORM

FOR FISCAL YEAR ENDED SEPTEMBER 30, 2007

DECEMBER 28, 2007

TABLE OF CONTENTS

INTERPRETATION | 3 |

DOCUMENTS INCORPORATED BY REFERENCE | 3 |

CAUTION REGARDING FORWARD-LOOKING INFORMATION | 3 |

PART I – CORPORATE STRUCTURE | 5 |

1. | Jurisdiction of Incorporation and Articles | 5 |

2. | Current Organization | 5 |

PART II – DESCRIPTION OF THE BUSINESS | 6 |

1. | Overview | 6 |

2. | Growth Strategy | 6 |

3. | Customers | 7 |

4. | Significant Customers | 7 |

PART III - GENERAL DEVELOPMENT OF THE BUSINESS | 8 |

1. | Recent Industry Developments | 8 |

2. | Change in Wholesaler’s Business Models | 8 |

3. | Financial Developments | 9 |

4. | License and Development Agreement | 9 |

PART IV - BUSINESS OF AXCAN | 10 |

1. | Main Marketed Products | 10 |

2. | Products in Development | 16 |

3. | Regulatory Affairs and Quality Assurance | 19 |

4. | Regulation | 19 |

5. | Patents and Proprietary Rights | 21 |

6. | Employees | 24 |

7. | Environmental Protection, Health and Safety | 25 |

8. | Facilities | 25 |

PART V - RISK FACTORS | 26 |

PART VI - SELECTED CONSOLIDATED FINANCIAL INFORMATION | 42 |

PART VII - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND OPERATING RESULTS | 43 |

PART VIII - DIVIDEND POLICY | 43 |

PART IX – DESCRIPTION OF CAPITAL STRUCTURE | 44 |

1. | Common Shares | 44 |

2. | Preferred Shares | 44 |

PART X - MARKET FOR SECURITIES | 45 |

1. | Market for Securities | 45 |

2. | Trading History | 45 |

PART XI - DIRECTORS AND OFFICERS | 46 |

1. | Directors | 46 |

2. | Senior Officers | 46 |

PART XII - ADDITIONAL DISCLOSURE FOR DIRECTORS AND EXECUTIVE OFFICERS | 46 |

PART XIII - LEGAL PROCEEDINGS | 48 |

PART XIV – TRANSFER AGENTS AND REGISTRARS | 48 |

PART XV - MATERIAL CONTRACTS | 49 |

PART XVI - INTERESTS OF EXPERTS | 49 |

PART XVII - ADDITIONAL INFORMATION | 49 |

SCHEDULE A - GLOSSARY OF TECHNICAL TERMS | 50 |

ii

INTERPRETATION

In this Annual Information Form (“AIF”), “we”, “us”, “our”, “Axcan”, and “the Company” are used to refer to Axcan Pharma Inc., its predecessors and its direct and indirect subsidiaries and their predecessors, collectively, unless the context otherwise requires.

In this AIF, all references to specific years are references to the fiscal year ended September 30. Unless otherwise stated, all dollar amounts appearing in this AIF are stated in U.S. dollars, and all financial data included in this AIF has been prepared in accordance with U.S. generally accepted accounting principles.

Unless otherwise stated, all market size information appearing in this AIF has been provided by IMS Health Ltd., a widely accepted provider of information services specializing in medical research information.

Certain terms and abbreviations used in this AIF are defined in “Schedule A – Glossary of Technical Terms”.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference into this AIF:

1. The audited consolidated financial statements of Axcan Pharma Inc. for the years ended September 30, 2007, September 30, 2006, and September 30, 2005, reported on by Raymond Chabot Grant Thornton Chartered Accountants (the “2007 Financial Statements”); and

2. The Management’s Discussion and Analysis of financial condition and results of operations of Axcan Pharma Inc. (the “2007 MD&A”).

Please note that both of these documents are available on SEDAR on www.sedar.com.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

From time to time, we make written or oral forward-looking statements, as defined under applicable securities laws. We may make such statements in this document, in other filings with Canadian regulators or the United States Securities and Exchange Commission, in reports to shareholders or in other communications. These forward-looking statements include, among others, statements with respect to our objectives for 2008, our medium-term goals, and strategies to achieve those objectives and goals, as well as statements with respect to our beliefs, plans, objectives, expectations, anticipations, estimates and intentions. The words “may”, “could”, “should”, “would”, “suspect”, “outlook”, “believe”, “plan”, “anticipate”, “estimate”, “expect”, “intend”, “forecast”, “objective”, and words and expressions of similar import are intended to identify forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, which give rise to the possibility that predictions, forecasts, projections, and other forward-looking statements will not be achieved. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, levels of activity, performance or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) our ability to obtain and maintain United States Food and Drug Administration (“FDA”) and other regulatory approvals for our products for the indications and on the timetables specified herein, (ii) our ability to obtain and protect our intellectual property, including market exclusivity (where applicable) related to our products and product candidates; (iii) our potential for future growth and the development of our product pipeline, including our ability to identify and acquire, on commercially attractive terms, additional products, (iv) our ability to form and maintain collaborative relationships to develop and commercialize our product candidates; and (v) general economic and business conditions.

3

Other factors that may cause actual results to differ materially from current expectations include, but are not limited to, management of credit, market, liquidity and funding and operational risks; the strength of the Canadian and United States economies and the economies of other countries in which we conduct business; the impact of the movement of the Canadian dollar relative to other currencies, particularly the US dollar and the Euro; the effects of changes in monetary policy, including changes in interest rate policies of the Bank of Canada and the Board of Governors of the Federal Reserve System in the United States; the effects of competition in the markets in which we operate; the impact of changes in the laws and regulations and enforcement thereof; judicial judgments and legal proceedings; our ability to obtain accurate and complete information from or on behalf of our customers and counterparties; our ability to successfully realign our organization, resources and processes; our ability to complete strategic acquisitions and to integrate our acquisitions successfully; changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates; operational and infrastructure risks; other factors that may affect future results including changes in trade policies, timely development and introduction of new products, changes in our estimates relating to reserves and allowances, changes in tax laws, natural disasters such as hurricanes, the possible impact on our businesses from public health emergencies, international conflicts and other developments including those relating to the war on terrorism; and our success in anticipating and managing the foregoing risks.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. Axcan undertakes no obligation to update or revise any forward-looking statement, unless obligated to do so pursuant to applicable securities laws and regulations. When relying on our forward-looking statements to make decisions with respect to the Company, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. We do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

4

PART I – CORPORATE STRUCTURE

1. JURISDICTION OF INCORPORATION AND ARTICLES

Axcan was incorporated under the Canada Business Corporations Act on May 6, 1982 under the name 115391 Canada Inc. On February 14, 1983, Axcan changed its name to Interfalk Canada Inc. and on October 1, 1993, it amalgamated with Axcan Holdings Ltd., its parent corporation, under the name Interfalk Canada Inc., which was changed to Axcan Pharma Inc. on July 12, 1994. On October 30, 1995, the Company’s Articles were amended to delete the private company restrictions, re-designate the existing Class “A” shares and Class “B” shares as common shares and preferred shares, respectively, and consolidate the common shares on a 0.44 for one basis. On June 6, 2000, the Company’s Articles were amended again to create 14,175,000 Series A preferred shares and 12,000,000 Series B preferred shares.

The head office of Axcan, and its principal place of business is located at 597, Laurier Boulevard, Mont-Saint-Hilaire, Quebec, J3H 6C4, Canada.

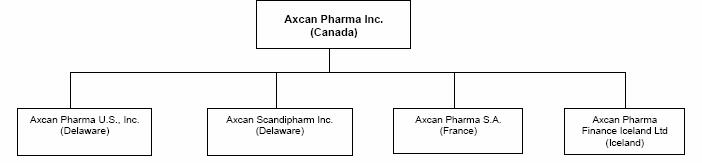

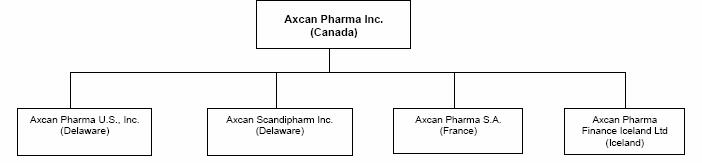

2. CURRENT ORGANIZATION

Significant operating subsidiaries are defined as those companies that contribute 10% or more of the consolidated revenues or consolidated operating income of the Company or account for 10% or more of the consolidated total assets of the Company. The following chart shows the jurisdictions of incorporation of Axcan and those principal operating subsidiaries. All of the outstanding shares of such operating subsidiaries or associated corporations are owned directly or indirectly by Axcan.

5

PART II – DESCRIPTION OF THE BUSINESS

1. OVERVIEW

Axcan is a leading specialty pharmaceutical company concentrating in the field of gastroenterology, with operations in North America and Europe. Axcan markets and sells pharmaceutical products used in the treatment of a variety of gastrointestinal diseases and disorders. The Company’s main products include pancreatic enzymes (ULTRASE, PANZYTRAT and VIOKASE) for the treatment of pancreatic insufficiency; bile acid (URSO/URSO 250, URSO FORTE/URSO DS and DELURSAN) for the treatment of certain cholestatic liver diseases; mesalamine (SALOFALK and CANASA) for the treatment of certain inflammatory bowel diseases; a Helicobacter pylori eradication drug (PYLERA) for the eradication of the cause of gastric and duodenal ulcers; and sucralfate (CARAFATE and SULCRATE) for the treatment of gastric and duodenal ulcers. Axcan also has a number of projects in all phases of clinical development, further described in the section “Products in Development” of this AIF.

In addition to its marketing activities, Axcan carries out research and development activities on products at various stages of development. These activities are carried out primarily with respect to product candidates, which are acquired or licensed from third parties. By combining its marketing expertise with its research and development experience, Axcan distinguishes itself from specialty pharmaceutical companies that focus solely on distribution of products and offers licensors the prospect of rapidly expanding the potential market for their products. As a result, Axcan is presented with opportunities to acquire or in-license products that have been advanced to the later stages of development by other companies. This focus on products in late-stage development enables Axcan to reduce risks and expenses associated with new drug development.

2. GROWTH STRATEGY

Given the highly competitive industry in which the Company operates, Axcan is pursuing a number of strategic options to drive sustainable growth, including 1) growing its base business; 2) launching new products; 3) making strategic acquisitions; 4) advancing its research and development portfolio; and 5) expanding internationally.

Base Business and New Products: | | Axcan’s intention is to grow sales by building on its solid base business and introducing new products on to the market. The Company’s strategy brings together its focus on product differentiation and a competitive time-to-market for its products, combined with astute portfolio management and a heightened sales focus. |

| | |

Strategic Acquisitions: | | Axcan’s goal is to build on its proven acquisition strategy and continue to aggressively seek products and/or companies to fuel future growth. By capitalizing on its current business model, the Company seeks to leverage its strengths and capabilities in order to develop and acquire products that have significant market potential and complement its area of focus. |

| | |

Research and Development: | | Axcan’s products continue to provide great benefit to patients. The Company will sustain investment into research and development, in order to develop the next generation of products to address unmet needs in gastroenterology. |

| | |

International Expansion: | | Axcan’s current infrastructure, both in North America and Europe, will form the basis of the Company’s international expansion, as management believes that it will serve as a springboard to increase Axcan’s multinational sales and marketing footprint. |

6

3. CUSTOMERS

Axcan’s revenue has historically been and continues to be principally derived from sales of pharmaceutical products to large pharmaceutical wholesalers. Axcan utilizes a “pull-through” marketing approach that is typical of pharmaceutical companies. Under this approach, Axcan’s sales representatives demonstrate the features and benefits of its products to physicians, in particular, gastroenterologists who may write their patients prescriptions for Axcan’s products. The patients, in turn, take the prescriptions to pharmacies to be filled. The pharmacies then place orders with the wholesalers, to whom Axcan sells its products.

4. SIGNIFICANT CUSTOMERS

The following table identifies external customers that accounted for 10% or more of the Company’s total revenue:

| | Percentage

of Total Revenue | |

| | 2007 | | 2006 | | 2005 | |

| | % | | % | | % | |

McKesson Corporation | | 41.2 | | 39.0 | | 30.2 | |

Cardinal Health | | 25.0 | | 24.4 | | 20.9 | |

Amerisource Bergen | | 11.1 | | 11.4 | | 11.0 | |

TOTAL | | 77.3 | | 74.8 | | 62.1 | |

7

PART III - GENERAL DEVELOPMENT OF THE BUSINESS

1. RECENT INDUSTRY DEVELOPMENTS

The pharmaceutical industry is highly competitive and subject to rapid and significant changes.

These changes include:

1. rising healthcare costs;

2. intensifying cost containment pressures;

3. rapid growth in demand for services due to aging population bases;

4. rapid innovation in technology, increasing the availability of sophisticated treatment options;

5. growing consumer awareness of healthcare choices; and

6. growing awareness within emerging and developing countries of the benefits of adequate healthcare systems and the improving ability to pay for improved healthcare solutions.

Our products face competition from both branded and generic products, sold by other pharmaceutical companies. Many of these competitors have greater financial resources and marketing capabilities than Axcan. Our competitors in the United States and abroad are numerous and include major pharmaceutical companies, and some of the manufacturers of our products. We believe that our focus on gastroenterology, combined with our strategy of funding and controlling all or most aspects of our business, will provide the cost savings, efficiencies in product development and acceleration of regulatory filings necessary for us to compete effectively with such companies.

Our competitors, however, may succeed in developing products that are as, or more, clinically or cost-effective than any that are being developed or licensed by Axcan, or that would render our products obsolete or uncompetitive. In addition, certain of our competitors have greater experience than our Company in clinical testing and human clinical trials of pharmaceutical products and in obtaining FDA and other regulatory approvals.

2. CHANGE IN WHOLESALER’S BUSINESS MODELS

Historically, wholesalers’ business models in the United States were dependent on drug price inflation. Their profitability and gross margins were directly tied to the speculative purchasing of pharmaceutical products at pre-increase prices, and the selling of their product inventory to their customers at the increased price. This inventory price arbitrage accounted for a predominant portion of wholesalers’ compensation for their distribution services and had a dramatic effect on wholesaler buying patterns, as they invested in inventories in anticipation of generating higher gross margins from manufacturer price increases. More recently, pharmaceutical manufacturers have not been increasing drug prices as frequently, and the percentage increases have been lower. For these and other reasons, some wholesalers have changed their business model to a fee-for-service arrangement, whereby manufacturers pay wholesalers a fee for inventory management and other services. These fees typically are a percentage of the wholesaler’s purchases from the manufacturer or a fixed charge per item or per unit. The fee-for-service approach results in wholesalers’ compensation being more stable and volume-based as opposed to price-increase based.

As a result of the move to a fee-for-service business model, many wholesalers are no longer investing in inventory ahead of anticipated price increases and are reducing their inventories from their historical levels. Under the new model, the consequence of manufacturers using wholesalers is that they now realize the benefit of price increases more rapidly in return for paying wholesalers for the services they

8

provide, on a fee-for-service basis. This change in wholesalers’ business models negatively affected Axcan’s revenue since fiscal 2005, as the resulting distribution services agreement (“DSA”) fees are deducted from gross sales and as wholesale distributors reduce inventory levels.

We entered into a DSA with Cardinal Health in 2005, one of our pharmaceutical wholesale distributors. We anticipate that we will enter into DSA’s with McKesson Corporation and Amerisource Bergen, our two other main pharmaceutical wholesale distributors. Once our DSA’s are put in place, it is possible that such pharmaceutical wholesale distributors could reduce their inventory levels (as DSA’s normally provide for lower targeted inventory levels). Such a reduction in inventory levels by a pharmaceutical wholesale distributor could result in a one-time reduction in our sales to such wholesale distributor for the period during which the reduction occurs, and could have a negative effect on our results of operations for this period.

3. FINANCIAL DEVELOPMENTS

On March 5, 2003, Axcan completed a $125.0 million 4.25% Notes (the “Notes”) financing due 2008. During the third quarter of fiscal 2007, the Company called for redemption all of its Notes and the holders of all of the Notes exercised their right to convert their Notes, in lieu of redemption, by June 28, 2007. The Company completed the conversion of the Notes by issuing an aggregate of 8,924,080 common shares. Long-term debt was consequently reduced by $125.0 million and capital stock increased by the same amount.

The Company has a standby 5 year credit facility with a syndicate of lenders led by the National Bank of Canada for an amount of up to $125.0 million. The amount of this facility may be drawn-down by the Company, subject to fulfilment of certain conditions specified in the credit agreement with its syndicate of lenders, until 2012. The availability of funding may be extended annually with the consent of a specified majority of Lenders and the facility matures on April 30, 2012. Under certain conditions, the amount of the credit can be increased up to an additional $100.0 million and the maturity date extended.

4. LICENSE AND DEVELOPMENT AGREEMENT

On September 30 2007, Axcan entered into an exclusive license and development agreement with Cellerix SL (“Cellerix”) of Spain, for the North American (United States, Canada and Mexico) rights to Cx401, an innovative biological product in development for the treatment of perianal fistulas. Cx401 uses non-embryonic stem-cells to treat perianal fistulas in Crohn’s and non-Crohn’s diseased patients. A Phase II clinical trial has demonstrated the efficacy and confirmed the safety of Cx401 in the treatment of perianal fistulas. Patent applications have been submitted, which, if granted, could provide protection until 2025. Under the terms of the agreement, Axcan made a $10.0 million upfront payment to Cellerix (which was charged to expense in the fourth quarter of 2007), and will make regulatory milestone payments that could total up to $30.0 million. Furthermore, Axcan will pay scaled royalties based on the net sales of Cx401. Axcan has also agreed to make an equity investment of up to $5.0 million in Cellerix, should Cellerix complete its initial public offering by September 30, 2010.

9

PART IV - BUSINESS OF AXCAN

Axcan’s focus is in the field of gastroenterology. Our current portfolio of commercial products includes a number of gastrointestinal products, for the treatment of a range of gastrointestinal diseases and disorders such as inflammatory bowel disease, irritable bowel syndrome, cholestatic liver diseases and complications related to pancreatic insufficiency.

According to IMS Health Ltd., a widely accepted provider of information services specializing in medical research information, the U.S. market for gastrointestinal products was valued at approximately $20 billion in 2006, of which approximately $14 billion was represented by proton-pump inhibitors.

While our business focus is to sell products in the United States, Canada and Europe, several of our products have been commercialized globally through licensing agreements with strategic marketing partners with expertise in their local markets.

We also have various products in development, both in North America and Europe. A discussion on these projects and on the regulatory process follows under the headings “Products in Development” and “Regulatory Environment”.

1. MAIN MARKETED PRODUCTS

The majority of the products that Axcan markets do not benefit from extensive patent protection. The Company believes however that certain of its products benefit from other barriers to the entry of competitors or generics. The Company’s products nevertheless remain subject to competition and generic product entries into their respective markets, which could significantly and negatively affect Axcan’s revenues including, in the case of generics, since they are typically sold at a significant discount to reference drug prices. Intellectual property protection, regulatory exclusivities and certain other barriers to entry are discussed below on a product-by-product basis. As of September 30, 2007, Axcan’s main products are ULTRASE, CANASA, URSO 250/URSO FORTE, PYLERA and CARAFATE in the United States, SALOFALK, SUCRALFATE and URSO in Canada and LACTEOL, DELURSAN and PANZYTRAT in Europe. Since the end of fiscal 2007, the patent covering URSO 250/URSO FORTE’s use in the treatment of Primary Biliary Cirrhosis (“PBC”) has expired in the United States (November 19, 2007) and the market exclusivity obtained on CANASA pursuant to the clinical investigation exclusivity provisions of the Hatch-Waxman Act, covering a change in the formulation of this drug from a 500mg formulation to a 1,000mg suppository formulation, has expired (November 5, 2007).

Axcan’s main marketed products, their sales, prescriptions and patent/regulatory protection are discussed below.

PANCREATIC ENZYMES

ULTRASE

Axcan markets under the trademark ULTRASE certain pancreatic enzyme microsphere (ULTRASE MS) and mini-tablet (ULTRASE MT) formulations designed to help patients with exocrine pancreatic insufficiency, (including pancreatic insufficiency associated with Cystic Fibrosis) better digest food. ULTRASE is marketed in the United States, Canada and a few export markets but this product is actively promoted by Axcan solely in the United States.

For the year ended September 30, 2007, Axcan reported sales of $47.9 million ($39.1 million in 2006 and $36.0 million in 2005) for ULTRASE. ULTRASE competes with a number of pancreatic enzyme formulations including PANCREASE® (Ortho-McNeil Pharmaceutical), CREON® (Solvay Pharmaceuticals, Inc.) and PANCRECARB® (Digestive Care, Inc.), as well as with various other unbranded products.

10

ULTRASE is licensed exclusively from Eurand International S.p.A (“Eurand”) under an exclusive license and supply agreement. This agreement, which was entered into in 2000, initially was for a period of ten years with automatic renewals for subsequent periods of two years. This agreement was amended in 2007 and extended to 2015. Axcan has paid Eurand licensing fees totalling $3.5 million, and Axcan agreed to pay to Eurand royalties of 6% on annual net sales.

In April 2004, the FDA formally notified manufacturers of pancreatic insufficiency products that these drugs, which include ULTRASE, must receive regulatory approval under a New Drug Application (“NDA”), before April 2008, in order to remain on the market. The FDA recently extended this deadline to April 2010. Axcan completed the submission of its NDA for ULTRASE MT in the fourth quarter of fiscal 2007, which filing was accepted by the FDA in December 2007.

ULTRASE MT was also granted a priority review or accelerated approval (as defined by the FDA) designation by the FDA. Under the Prescription Drug User Fee Act, the file must be reviewed by the FDA by a target date of April 2008.

ULTRASE does not currently benefit from patent protection. The Company believes that it will be entitled to receive New Product Exclusivity pursuant to the Hatch-Waxman Act upon approval of its NDA. This exclusivity is expected to prohibit the FDA from approving abbreviated new drug applications for products containing the same active moiety, for a period of five years. Further in its guidelines (“Guidance for Industry - Exocrine Pancreatic Insufficiency Drug Products - Submitting NDAs”; April 2006), the FDA has stated that because of their complexity, pancreatic enzyme extract products are not likely to be appropriate for Abbreviated NDA filings (“ANDAs”).

Other manufacturers currently pursuing approval for porcine derived pancreatic enzyme products are Eurand International S.p.A. (“Eurand”) and Solvay Pharmaceuticals, Inc. Eurand announced on December 20, 2007 that it had completed its NDA submission for its ZENTASE® product line and was granted priority review. Solvay Pharmaceuticals submitted an NDA for its CREON® Product Line in 2003. Solvay reported that it received a letter from the FDA in August 2007 citing certain chemistry, manufacturing and control data work and clinical concerns. Solvay has not reported further on its application.

Of the other pancreatic enzyme products currently on the market PANCRECARB® (Digestive Care, Inc.) and PANCREASE® (Ortho-McNeil Pharmaceutical), we are not aware that any NDA filings were made for these products. Digestive Care Inc. has initiated a Phase III clinical trial for PANCRECARB® (completion was expected June 2007). Although, Johnson & Johnson of which Ortho-McNeil Pharmaceutical is a subsidiary had completed a Phase II for PANCREASE® in 2006, we are not aware of a Phase III ongoing at this time. We are currently not aware of any clinical trial activities being conducted by any generic manufacturers.

VIOKASE

Axcan markets under the brand name VIOKASE non-enteric coated pancreatic replacement enzymes for the treatment of exocrine pancreatic insufficiency. VIOKASE, although not actively promoted, is sold in the United States and Canada.

For the year ended September 30, 2007, Axcan reported sales of $11.2 million ($7.6 million in 2006 and $7.8 million in 2005) for VIOKASE. VIOKASE is the only branded non-enteric coated replacement enzyme and competes with a number of generic products.

In April 2004, the FDA formally notified manufacturers of pancreatic insufficiency products that these drugs, which include VIOKASE, must receive regulatory approval under a New Drug Application (“NDA”), before April 2008, in order to remain on the market. The FDA recently extended this deadline to April 2010. Axcan is currently advancing the completion of its NDA for VIOKASE.

11

VIOKASE does not currently benefit from patent protection. The Company believes that it will be entitled to receive New Product Exclusivity pursuant to the Hatch-Waxman Act upon approval of its NDA. This exclusivity prohibits the FDA from approving abbreviated new drug applications for products containing the same active moiety, for a period of five years. Further in its guidelines, entitled “Guidance for Industry - Exocrine Pancreatic Insufficiency Drug Products - Submitting NDAs” dated April 2006, the FDA stated that because of their complexity, pancreatic enzyme extract products are not likely to be appropriate for ANDA filings.

The Company believes that VIOKASE is currently the only branded uncoated pancreatic enzyme formulation commercially available in the United States.

PANZYTRAT

PANZYTRAT consists of enteric coated microtablets for use in the treatment of exocrine pancreatic insufficiency and pancreatic enzyme deficiency. PANZYTRAT is marketed in several countries, mainly Germany and the Netherlands as well as a few export markets. For the year ended September 30, 2007, Axcan reported sales of $14.8 million ($12.1 million in 2006 and $14.8 million in 2005) for PANZYTRAT, including $1.4 million ($0.8 million in 2006 and $2.9 million in 2005) in export markets. Sales in Germany and the Netherlands represent 80% of the total sales of PANZYTRAT and the main competitor in these territories is CREON® (Solvay Pharmaceuticals, Inc.).

PANZYTRAT does not benefit from any patent protection, nor any other form of regulatory exclusivity in the main countries in which it is marketed, namely Germany and the Netherlands.

URSODIOL

URSO 250 and URSO FORTE - (United States)

In the United States, Axcan has been marketing URSO 250, a 250-milligram ursodiol tablet for the treatment of PBC, since May 1998. URSO FORTE, a 500-milligram ursodiol tablet, was launched in November 2004.

For the year ended September 30, 2007, Axcan reported sales of $68.1 million ($49.3 million in 2006 and $36.0 million in 2005) for URSO250 / URSO FORTE in the United States.

In the United States, there is currently no therapy specifically approved to be marketed for the treatment of PBC other than URSO 250/URSO FORTE. However, other ursodiol products, approved and prescribed for gallstone dissolution as associated with active weight loss, are sometimes used for the treatment of various liver diseases, including PBC. These products include ACTIGALL™ (Watson Pharmaceuticals) and generic versions of ACTIGALL™.

In addition, on November 19, 2007 the FDA Orange book listed patent covering the use of URSO 250/USO FORTE, expired. URSO 250/URSO FORTE does not benefit from any other patent protection or other form of regulatory exclusivity in the United States. As a result, if a generic ursodiol tablet were to be launched, it could have a significant negative impact on sales of URSO 250/ URSO FORTE in the United States.

In order to minimize the impact of any potential generic competition for URSO in the United States, the Company has undertaken, and plans to continue to undertake, certain strategic and tactical measures, including the sequential modification and improvements to URSO’s attributes and specifications. For example in July 2007, the Company introduced a scored tablet version of URSO FORTE (which differentiates URSO from its competitors by giving physicians more flexible dosing options).

The Company believes that these sequential modifications and improvements coupled with URSO’s recognized brand name, its specific approval for the treatment of PBC, its similar pricing compared to

12

comparable generics of ACTIGALL™, and its targeted marketing approach aimed at hepatology specialists, provide a competitive advantage to URSO 250 and URSO FORTE in the United States.

URSO and URSO DS - (Canada)

In Canada, Axcan markets URSO (250 mg) and URSO DS (500 mg) for the treatment of cholestatic liver diseases, which include PBC and Primary Sclerosing Cholangitis (“PSC”). URSO/URSO DS were covered by a patent relating to the use ursodiol for the treatment of PBC in Canada, which was to expire in 2010. However, in 2006, the generic product manufacturer, Pharmascience Inc. successfully challenged the validity of this patent under the Notice of Compliance Regulation procedures of Health Canada. In May 2006, generic versions of URSO and URSO DS received approval for sale in Canada and were launched in fiscal 2007. The launch of these generic products has had a negative impact on sales of URSO/URSO DS in the second half of fiscal 2007 and is expected to continue to negatively impact sales going forward.

URSO/URSO DS does not benefit from any other patent protection or other form of regulatory exclusivity in Canada.

For the year ended September 30, 2007, Axcan reported sales of $9.0 million ($11.4 million in 2006 and $11.1 million in 2005) for URSO/URSO DS in Canada.

DELURSAN

DELURSAN is an ursodiol preparation marketed in France and indicated for the treatment of cholestatic liver diseases, including PBC, PSC and liver disorders related to Cystic Fibrosis.

DELURSAN does not have any patent protection or any regulatory exclusivity in France. For the year ended September 30, 2007, Axcan reported sales of $16.7 million ($13.9 million in 2006 and $13.1 million in 2005) for DELURSAN. As a result, if a generic ursodiol preparation were to be launched, it could have a significant negative impact on sales of DELURSAN in France.

In France, DELURSAN currently competes mainly with URSOLVAN® (Sanofi-Aventis S.A.).

MESALAMINE

CANASA

CANASA is a mesalamine suppository sold by Axcan in the United States for the treatment of distal ulcerative proctitis (UP). The Company believes that CANASA currently is the only commercially available mesalamine suppository in the United States.

For the year ended September 30, 2007, Axcan reported sales of $65.1 million ($53.1 million in 2006 and $28.7 million in 2005) for CANASA in the United States.

CANASA competes with topical corticosteroid enemas and suppositories, as well as mesalamine enemas.

CANASA does not have any patent protection in the United States. On November 5, 2007 the previously granted clinical investigation exclusivity pursuant to the Hatch-Waxman Act, covering a change in the formulation of this drug from a 500mg formulation to a 1,000mg suppository formulation, expired. As a result, if a generic mesalamine suppository were to be launched, it could have a significant negative impact on sales of CANASA in the United States.

However, in June 2007, the FDA published draft guidance on the requirements it expects manufacturers seeking approval of a mesalamine suppository to meet, in order to obtain approval for such a product. The guidance specifies, among other things, that a request of approval must be supported by placebo

13

and reference-drug controlled clinical studies demonstrating efficacy in patients with UP.

The Company believes that it is unlikely that generic competitors will be able to meet the requirements of this FDA guidance, since ethical review boards in the United States may not allow companies to conduct the FDA required placebo-controlled studies on their UP patients. However, the Company cannot provide assurances that any potential generic competitor will not be able to meet such requirements.

Moreover, on July 27, 2007, the Company filed a Citizen’s Petition asking the FDA to require manufacturers seeking approval of mesalamine rectal suppositories to perform an adequate and well-controlled clinical safety and efficacy trial that provides substantial evidence that the generic product demonstrates therapeutic equivalence to CANASA in patients with UP, and to perform a pharmacokinetic study to evaluate the systemic exposure in patients with UP. This petition has not yet been heard. The Company believes this request to be consistent with the standards the FDA has previously applied to other topically acting or non-systemically absorbed drugs and with the above referenced draft guidance published in June, 2007; but cannot provide assurances that its request will be granted.

SALOFALK

SALOFALK is a mesalamine-based product line (tablets, suspensions and suppositories) sold by Axcan in Canada, for the treatment of certain inflammatory bowel diseases, such as ulcerative colitis, ulcerative proctitis and Crohn’s Disease. In Canada, SALOFALK does not have any patent protection, or any regulatory exclusivity.

For the year ended September 30, 2007, Axcan reported sales of $19.3 million ($16.5 million in 2006 and $14.5 million in 2005) for SALOFALK.

Several products containing mesalamine in controlled-release tablets or capsules are available on the Canadian market, including ASACOLTM (The Proctor & Gamble Company) and DIPENTUMTM (UCB Pharma).

SUCRALFATE

CARAFATE / SULCRATE

CARAFATE / SULCRATE line of products is indicated for the treatment of gastric and duodenal ulcers. CARAFATE is sold in the United States as oral tablets and an oral suspension and SULCRATE oral suspensions in Canada, where it is not actively promoted.

For the year ended September 30, 2007, Axcan reported combined sales of $52.2 million ($43.1 million in 2006 and $37.7 million in 2005) for CARAFATE / SULCRATE. CARAFATE / SULCRATE do not have any patent protection or any regulatory exclusivity in their respective markets. Patent protection for CARAFATE in fact lapsed in 2001. Currently, no generic versions of CARAFATE / SULCRATE oral suspension are available in the United States or Canada. If a generic version of these drugs were to be launched, it could have a significant negative impact on sales of CARAFATE / SULCRATE oral suspension in the United States and Canada.

The Company believes, but cannot provide assurances, that due to the mode of absorption of CARAFATE oral suspension, the FDA will require manufacturers seeking an ANDA approval for a generic version of CARAFATE oral suspension to conduct clinical trials in order to demonstrate therapeutic equivalence, which would likely be a barrier to the introduction of a competing generic product in the United States.

14

HELICOBACTER PYLORI ERADICATION

PYLERA

Since May 7, 2007, Axcan has been marketing under the trademark PYLERA a 3-in-1 capsule therapy for the eradication of Helicobacter pylori, a bacterium recognized as being the main cause of gastric and duodenal ulcers. PYLERA is protected by patent claims covering triple and quadruple therapies for Helicobacter pylori eradication. These claims cover the treatment of duodenal ulcer disease (and in some countries reflux esophagitis and gastric ulcer) through the eradication of Helicobacter pylori using a bismuth compound together with two or more antibiotics. The expiry dates of these patents vary depending on the jurisdiction. In the United States, they expire in March 2010. The double capsule formulation of this product and its use in multiple therapies is also covered by patent in a number of countries. The US patent expires in December 2018.

Since its launch in May 2007, sales of PYLERA in the United States have amounted to $1.8 million for the year ended September 30, 2007.

However, as PYLERA is considered by the FDA as pre-1997 antibiotic, the U.S. patent claims covering triple and quadruple therapies for Helicobacter pylori eradication and claims covering the capsule formulation, are not listable in the FDA’s Orange Book and may thus not be eligible to benefit from the automatic stay provisions, nor market exclusivities pursuant to the Hatch-Waxman Act.

PYLERA competes with PREVPAC® (TAP Pharmaceutical Products Inc.), the market leader and HELIDAC® (Prometheus, Inc.)

OTHER PRODUCTS

LACTEOL

LACTEOL is a product containing a specific proprietary strain of Lactobacillus Acidophilus in a lyophilized powder form. It is available in a number of dosage forms, including capsules, and is primarily indicated for the treatment of diarrhoea. LACTEOL, which is mainly sold in France and in over 40 export markets, does not have any patent protection, or any regulatory exclusivity. However, the product is derived from a proprietary strain of bacterium for which the ultimate parent organism is protected by a number of security safeguards, such that access by third parties seeking to reproduce it for competitive or other purposes is limited and controlled.

For the year ended September 30, 2007, Axcan reported sales of $16.3 million ($18.1 million in 2006 and $20.3 million in 2005) for LACTEOL, including $9.9 million ($9.1 million in 2006 and $8.8 million in 2005) outside of France. Sales significantly decreased in the last two years since, as part of new measures designed to reduce healthcare cost associated with the reimbursement of prescription drugs, the French government decided to stop the reimbursement of approximately 200 drugs, including LACTEOL.

LACTEOL competes with a number of generic products on most markets. As LACTEOL has been marketed for several decades, the brand name LACTEOL constitutes a definite marketing advantage wherever the product is sold.

PHOTOFRIN / PHOTOBARR

Axcan markets (directly or through distributors) PHOTOFRIN / PHOTOBARR in North America, Europe, and other selected markets, for the treatment of High-Grade Dysplasia associated with Barrett’s Esophagus, obstructing esophageal cancer and non small cell lung cancer, as well as certain types of gastric cancers and cervical dysplasia. PHOTOFRIN / PHOTOBARR is a photo-sensitizer approved for use in photodynamic therapy, an innovative medical therapy based on the use of light-activated drugs. PHOTOFRIN / PHOTOBARR is covered by a number of patents claiming compositions (including product by process claims), methods of use in approved indications, methods of manufacture, as well as patents

15

for certain devices used in connection with treatment with these products. In the United States, this product’s main market, patent expiries range from June 2009 to May 2016.

For the year ended September 30, 2007, Axcan reported sales of $5.9 million ($5.5 million in 2006 and $7.7 million for 2005) for PHOTOFRIN / PHOTOBARR.

To the Company’s knowledge, there are currently no other photo-sensitizers approved as drugs in Canada, the United States and Europe for the treatment of High-Grade Dysplasia associated with Barrett’s Esophagus, obstructing esophageal cancer and lung cancer, gastric cancer or cervical dysplasia.

2. PRODUCTS IN DEVELOPMENT

Our Scientific Affairs team leverages its expertise in the field of gastroenterology to develop high-value products as well as enhancements and modifications to new and existing products, consistent with our research and development growth strategy. We mainly consider the development of late-stage (Phase II and beyond) novel molecules and innovative product candidates that provide an acceptable risk/return ratio.

We also seek to enhance and extend exclusivity through the staged introduction of product enhancements. These may include improvements in the frequency of administration of drug products, improvements in the convenience of administration, reduction in dose, reduction in side effects (improved tolerability), or improved therapeutic effect/benefit.

Our staff of research scientists has expertise in all aspects of the drug-development process, from pre-formulation studies and formulation development, to scale-up and manufacturing. In fiscal 2007, our development efforts resulted in the approval of PYLERA in the United States, for the eradication of the Helicobacter pylori bacterium.

As part of our business strategy, we enter into licensing agreements with companies that are developing compounds and innovative products in the field of gastroenterology. These compounds and products are typically in-licensed with some combination of upfront payments, development milestone payments and/or royalty payments. In some cases, we have an option to acquire an ownership position in the company.

We currently have development efforts ongoing for 8 products that we believe may, upon regulatory approval, provide clinically meaningful benefits to patients.

Our pipeline products are in various stages of development. Despite the reduced risk profile of our pipeline programs (relative to New Chemical Entities), they do carry development risk, and as such, we do not anticipate the commercialization of all of these products. In addition, we routinely review and prioritize our pipeline as new product candidates are added, which can result in the discontinuation or delay in other ongoing development programs which offer, in our estimation, a less attractive risk/return profile. This is normal practice in the pharmaceutical industry.

Given that the successful development of any pipeline program is dependent on a number of variables, it is difficult to accurately predict timelines for regulatory approval and accordingly clinical development expenses. In fiscal 2007 our research-and-development expenses were approximately $28.6 million or 8.2% of our total revenues (excluding acquired research-and-development expenses from the Cellerix acquisition).

The following is a description of our active and disclosed pipeline projects. Intellectual Property around each of this project is discussed in section “Licensing and Intellectual Property Protection”.

PANCREATIC ENZYMES

16

ULTRASE and VIOKASE

In April 2004, the FDA formally notified manufacturers of pancreatic insufficiency products that these drugs, which include ULTRASE and VIOKASE, must receive NDA approval before April 2008, in order to remain on the market. This deadline was recently extended to April 2010. The FDA has also published final guidelines aimed at assisting manufacturers of exocrine pancreatic insufficiency drug products in preparing and submitting these New Drug Applications. Axcan completed all the clinical trial and the chemistry, manufacturing and control data work required for the submission of its NDA for ULTRASE MT in the fourth quarter of fiscal 2007, which filing was accepted by the FDA in the first quarter of fiscal 2008. The work required to submit VIOKASE is currently ongoing.

We believe that some of the manufacturers of pancreatic enzyme insufficiency products that are currently on the market in the United States may not be able to satisfy the FDA’s requirements for NDAs for these products, which could create a significant growth opportunity for Axcan.

NMK 150

Axcan is developing NMK 150, a new high protease pancrelipase preparation developed for the relief of pain in small duct chronic pancreatitis, which represents an unmet medical need. A dose-ranging, animal study assessing the toxicity of NMK 150, which paid special attention to duodenal irritation, confirmed the safety profile of this compound. A Phase I, ascending, multiple-dose clinical study was also completed and confirmed the safety and tolerability of this compound alone and in combination with a PPI. Results of the pharmacodynamics part of the studies are currently being analyzed.

URSODIOL

SUDCA (Ursodiol Disulfate)

Axcan is currently studying the use of SUDCA, a new ursodiol derivative, in the prevention of the recurrence of colorectal adenomateous polyps, considered to be a pre-cancerous stage of colorectal cancer.

The Company had previously completed a Phase II study of the effectiveness of URSO 250 in preventing the recurrence of colorectal adenomateous polyps in the United States and Canada, for which 792 patients were randomized. The final analysis confirmed a trend in the sub-group of patients suffering from early stage colorectal cancer at baseline: a 26% reduction of polyp recurrence rate occurred in the URSO 250 group when compared to placebo, both in terms of mean number of recurring polyps at one year (0.67 vs. 0.90) and the average size of the polyps (0.23 vs. 0.31). However, in the overall study population, no statistically significant difference between the two groups was observed in terms of mean number of recurring polyps (0.97 vs. 1.04) and average polyp size (0.30 vs. 0.28).

Preliminary results of studies conducted with SUDCA showed that ursodiol disulfate reduces the number of aberrant crypts in a rat model of colon cancer. Aberrant crypts are considered to be early abnormal changes in the intestinal lining that are precursors to colon cancer. In a small pilot study, where rats were injected with the carcinogen azoxymethane, a 56% reduction in the total number of aberrant crypts in the colon was observed after four weeks in those animals treated with this new ursodiol formulation compared to control models. Ursodiol disulfate alone fed to rats had no adverse effects on the appearance of the lining of the colon. Long-term animal studies are ongoing to determine the effect of ursodiol disulfate on the timing of appearance, the number, and the size of colonic tumours in the azoxymethane rat model of chemically-induced colon cancer.

In addition to these animal studies, a single, ascending-dose Phase I clinical study was completed in early 2006, and a multiple, ascending-dose Phase I study was completed in September 2006, to evaluate the safety, tolerability and preliminary pharmacokinetics of SUDCA. Both studies confirmed the safety and tolerability of this compound. Results of the pharmacokinetics part of the studies are currently being analyzed.

17

MESALAMINE

CANASA Max-002

Axcan has initiated the CANASA MAX-002 program, a Phase III clinical trial to evaluate the efficacy and safety of a novel, high-concentration, 1-gram mesalamine suppository for the treatment of ulcerative proctitis.

Ulcerative proctitis is a subgroup of ulcerative colitis, one of the most common inflammatory bowel diseases. For approximately 30% of patients with ulcerative colitis, the illness begins as ulcerative proctitis where bowel inflammation is limited to the rectum. Currently, it is estimated that there are 1 million cases of inflammatory bowel disease in the U.S., with approximately 400,000 new cases every year.

In June 2007, the FDA issued draft guidance on the type of clinical program required for the approval of mesalamine suppositories. Based on this guidance, Axcan temporarily suspended the recruitment of this trial and expects to resume it in the first half of calendar 2008, upon completion of ongoing discussions with the FDA.

HELICOBACTER PYLORI ERADICATION

PYLERA

Axcan intends to initiate a Phase III clinical program with PYLERA in Europe to obtain approval to market this therapy for the eradication of Helicobacter pylori. This Phase III clinical trial in Europe is expected to be conducted on approximately 400 patients and is intended to compare Axcan’s PYLERA regimen given in combination with omeprazole, to the widely used OAC triple therapy (20 mg of omeprazole, 1 g of amoxicillin and 500 mg of clarithromycin, all given twice a day). The trial is expected to be completed in the second half of calendar 2009. PYLERA was successfully launched in the United States in fiscal 2007.

OTHERS

AGI-010

Axcan and AGI Therapeutics, plc (“AGI”) are co-developing AGI-010, a delayed/controlled release formulation of the Proton Pump Inhibitor (“PPI”) drug omeprazole, which is being developed for the treatment of gastro-esophageal reflux disease (“GERD”), and in particular to address the control of night-time gastric acidity, known as Nocturnal Acid Breakthrough (“NAB”). NAB remains a significant unmet medical need, and is estimated to occur in more than 50% of GERD patients on a PPI therapy.

Development of the final formulation for this compound is ongoing and once completed, will allow both companies to make a decision on the most appropriate development and filing strategy for this product.

CX401

On September 30, 2007, Axcan entered into an exclusive license and development agreement with Cellerix of Spain, for the North American (United States, Canada and Mexico) rights to Cx401, an innovative biological product in development for the treatment of perianal fistulas.

A Phase II trial conducted in 50 patients in Europe demonstrated the efficacy and safety of Cx401. This randomized, open-label, parallel assignment study evaluated the safety and efficacy of Cx401 in the treatment of perianal fistulas in Crohn’s and non-Crohn’s Disease patients. The primary endpoint for this study was photographically assessed complete closure and healing, and showed a 71% response rate in the acute phase, both in Crohn’s and non-Crohn’s Disease patients. Results of this study were presented at Digestive Disease Week in May 2007 (Garci-Olmo D. et al., “Expanded Adipose-Derived Stem Cells (Cx401) for the Treatment of Complex Perianal Fistula. A Phase II Clinical Trial” (Digestive Disease Week 2007; Abstract: 492)) and are pending publication.

18

Axcan will be responsible for the development of this product in North America. The Company expects to initiate a Phase IIb study in North America in fiscal 2008, and details of this study are expected to be communicated to the market upon its initiation. Depending on the outcome of further discussions with the FDA, filing could occur as early as 2011.

3. REGULATORY AFFAIRS AND QUALITY ASSURANCE

Our Regulatory Affairs Department is involved in the development and registration of all products and has prepared product submissions for regulatory agencies in the United States, Canada and Europe. This group also coordinates all data and document management for submissions, including amendments, supplements and adverse events reporting. Our Quality Assurance Departments seek to ensure that all stages of product development and manufacturing fully comply with applicable good clinical, laboratory and manufacturing practices.

4. REGULATION

The research and development, manufacture, and marketing of pharmaceutical products are subject to regulation by U.S., Canadian and foreign governmental authorities and agencies. Such national agencies and other federal, state, provincial and local entities regulate the testing, manufacturing, safety and promotion of our products. The regulations applicable to our products may be subject to change as regulators acquire additional experience in the specific area.

UNITED STATES REGULATIONS

New Drug Application

With the exception of the pancreatic enzyme products which require an NDA approval before April 2010, we are required by the FDA to comply with NDA procedures for our branded products prior to commencement of marketing. New drug compounds and new formulations for existing drug compounds which cannot be filed as ANDAs are subject to NDA procedures. These procedures include: (1) preclinical laboratory and animal toxicology tests; (2) submission of an Investigational New Drug Application (‘‘IND’’), and its required acceptance by FDA before any human clinical trials can commence; (3) adequate and well-controlled replicate human clinical trials to establish the safety and efficacy of a drug for its intended indication; (4) the submission of an NDA to the FDA; and (5) FDA approval of an NDA prior to any commercial sale or shipment of the product, including pre-approval and post-approval inspections of its manufacturing and testing facilities. When all data in a product application are owned by the applicant, the FDA will issue its approval.

Abbreviated New Drug Application

In certain cases, where the objective is to develop a generic version of an approved product already on the market, an ANDA may be filed in lieu of filing an NDA. Under the ANDA procedure, the FDA waives the requirement to submit complete reports of preclinical and clinical studies of safety and efficacy, and instead, requires the submission of bioequivalency data, that is, demonstration that the generic drug produces the same blood levels of drug in the body as its brand-name counterpart. It is mandatory that it have a comparable pharmacokinetic profile, or change in blood concentration over time.

505(b)(2) Application Process In certain cases, pharmaceutical companies may also submit a 505(b)(2) NDA application for marketing approval of a drug. This mechanism essentially relies upon the same FDA conclusions that would support the approval of an ANDA available to an applicant who develops a modification of a drug that is not supported by a suitability petition. Relative to normal regulatory requirements for a 505(b)(1) NDA, regulation may permit a 505(b)(2) applicant to forego costly and time-consuming drug development studies by relying on the FDA’s finding of safety and efficacy for a previously approved drug product.

19

Under some circumstances the extent of this reliance approaches that permitted under the generic drug approval provisions. This approach is intended to encourage innovation in drug development without requiring duplicative studies to demonstrate what is already known about a drug, while protecting the patent and exclusivity rights for the approved drug.

CANADIAN REGULATIONS

The requirements for selling pharmaceutical drugs in Canada are substantially similar to those of the U.S. described above, with the exception of the 505(b)(2) route, and marketing exclusivity under the Hatch-Waxman provisions of the FDA in the U.S.

EUROPEAN ECONOMIC AREA (“EEA”)

A medicinal product may only be placed on the market in the EEA, composed of the 27 EU member states, plus Norway, Iceland and Lichtenstein, when a marketing authorization has been issued by the competent authority of a member state. There are essentially three community procedures created under prevailing European pharmaceutical legislation that, if successfully completed, allow an applicant to place a medicinal product on the market in the EEA.

Centralized Procedure

Centralized procedure exists when a marketing authorization is granted by the European Commission, acting in its capacity as the European Licensing Authority on the advice of The European Medicines Agency. That authorization is valid throughout the entire community and directly or indirectly (Norway, Iceland and Liechtenstein) allows the applicant to place the product on the market in all member states of the EEA. The European Medicines Agency is the administrative body responsible for coordinating the existing scientific resources available in the member states for evaluation, supervision and pharmacovigilance of medicinal products.

Mutual Recognition and Decentralized Procedures

The competent authorities of the member states are responsible for granting marketing authorizations for medicinal products that are placed on their markets. If the applicant for a marketing authorization intends to market the same medicinal product in more than one member state, the applicant may seek an authorization progressively in the community under the mutual recognition or decentralized procedure.

Mutual Recognition

Mutual recognition is used if the medicinal product has already been authorized in one member state. In this case, the holder of this marketing authorization requests the member state where the authorization has been granted to act as reference member state by preparing an updated assessment report that is then used to facilitate mutual recognition of the existing authorization in the other member states in which approval is sought (the so-called concerned member state(s)). The reference member state must prepare an updated assessment report which, together with the approved Summary of Product Characteristics, or SmPC (which sets out the conditions of use of the product), and a labelling and package leaflet are sent to the concerned member states for their consideration. The concerned member states are required to approve the assessment report, the SmPC and the labelling and package leaflet within 90 days of receipt of these documents.

The decentralized procedure

This procedure is used in cases where the medicinal product has not received a marketing authorization in the EU at the time of application. The applicant sends its application simultaneously to all concerned member states and requests a member state of its choice to act as reference member state to prepare an assessment report that is then used to facilitate agreement with the concerned member states and the

20

grant of a national marketing authorization in all of these member states. In this procedure, the reference member state must prepare, for consideration by the concerned member states, the draft assessment report, a draft SmPC and a draft of the labelling and package leaflet within 120 days after receipt of a valid application. As in the case of mutual recognition, the concerned member states are required to approve these documents within 90 days of their receipt.

INTERNATIONAL REGULATIONS

Sales of our products outside the United States, Canada and Europe are subject to local regulatory requirements governing the testing, registration and marketing of pharmaceuticals, which vary widely from country to country.

In addition to the regulatory approval process, pharmaceutical companies are subject to regulations under provincial, state and federal laws, including requirements regarding occupational safety, laboratory practices, environmental protection and hazardous substance control, and may be subject to other present and future local, provincial, state, federal and foreign regulations, including possible future regulations of the pharmaceutical industry. We believe that we are in compliance in all material respects with such regulations as are currently in effect.

5. PATENTS AND PROPRIETARY RIGHTS

We believe that trademark protection is an important part of establishing product and brand recognition. We own a number of registered trademarks and trademark applications and have acquired the rights to several trademarks by license. Axcan maintains trademarks registrations in a number of jurisdictions where it sells its products. In the United States, trademark registrations remain in force for ten years and may be renewed every ten years after issuance, provided the mark is still being used in commerce.

A patent is a statutory private right that grants to the patentee exclusive rights to exclude others from using the patented invention during the term of the patent. A patent is territorial and may be sought in many jurisdictions. In the United States, as in most other countries, the term of patent protection is 20 years from the date the patent application was filed. An invention may be patentable if it meets the criteria of being “new,” “useful” and “non-obvious.” Depending upon whether a particular drug is patentable and the relative cost associated with obtaining its issuance in a given jurisdiction, an inventor will either apply for a patent in order to protect the invention or maintain the confidentiality of the information to rely on the common law protection afforded to trade secrets.

A company may also enter into licensing agreements with third-party licensors in order to obtain the right to make, use and sell certain products, thereby gaining access to know-how, secret formulas and patented technology. The value of a license is generally enhanced by the existence of one or more patents. A license gives the licensee access to developed and, in many cases, tested technology and provides the licensee faster and often less expensive entry into the market. Licensing also establishes relationships, which may provide access to additional products or technology or may lead to joint ventures or alliances affording the licensor and the licensee an opportunity to evaluate each other’s products and technology. This is also true, to a lesser extent, for distribution relationships.

Pursuant to license agreements with third parties, we have acquired rights to manufacture, use or market certain of our existing products, as well as many of our development products and technologies. Such agreements typically contain provisions requiring us to use commercially reasonable efforts or otherwise exercise diligence in pursuing market development for such products in order to maintain the rights granted under the agreements, and may be cancelled upon our failure to perform our payment or other obligations.

21

We further rely and expect to continue to rely upon unpatented proprietary know-how and technological innovation in the development and manufacture of many of our principal products. Our policy is to require all our employees, consultants and advisors to enter into confidentiality agreements with us.

Axcan has entered into several of these types of collaborative agreements with licensors, licensees and other third parties and will continue to do so. The following agreements have been entered into in connection with products marketed by Axcan or under development.

ULTRASE

Axcan is the owner of the trademark ULTRASE and markets certain pancreatic enzyme based microspheres and mini-tablets under the ULTRASE brand in North and Latin America, under an exclusive development, license and supply agreement with Eurand International S.p.A. This agreement was entered into in 2000, and was initially for a period of ten years with automatic renewals for subsequent periods of two years. This agreement was recently amended in 2007, including to provide for an extension of its term to 2015. Axcan has paid Eurand licensing fees totalling $3.5 million, and Axcan agreed to pay to Eurand royalties of 6% on its annual net sales of ULTRASE.

URSODIOL

Axcan developed URSO for the Canadian market in collaboration with Falk Pharma GmbH (“Falk”) and acquired the rights to manufacture, use and market URSO in the United States on March 23, 1993 through the acquisition of the shares of Axcan Pharma U.S., Inc. that it did not already own. In April 1999, Axcan entered into two agreements with Sanofi-Synthélabo S.A. of France (now, Sanofi-Aventis) that secured Axcan’s right to manufacture, use and market URSO for the treatment of PBC in Canada and the United States. For the United States, Axcan licensed the rights to the treatment of PBC under a patent, which expired on November 19, 2007. For Canada, Axcan acquired full ownership of the patent relating to the use of ursodiol for the treatment of PBC, which expires in 2010. However, in May 2006, the Canadian PBC patent was held to be invalid for the purposes of opposing the issuance of a Notice of Compliance for a generic version of URSO 250mg, under proceedings pursuant to the Canadian Patented Medicines (Notice of Compliance) Regulations.

In October 2000, Axcan entered into a licensing agreement with the Children’s Hospital Research Foundation, an operating division of Children’s Hospital Medical Centre of Cincinnati, Ohio, for a series of patented sulfated derivatives of ursodeoxycholic acid compounds (“SUDCA” or “ursodiol disulfate”). According to the terms of this agreement, Axcan has exclusive worldwide rights to commercially exploit formulations of SUDCA under the licensed patents and know-how developed by Children’s Hospital Research Foundation.

PHOTOFRIN

In May 2000, Axcan purchased from QLT Inc. (“QLT”) the trademark “PHOTOFRIN” for the United States, Canada and all other countries where it has been registered as a trademark or used in marketing. Axcan also purchased, licensed or sublicensed from QLT, as the case may be, the worldwide rights of other assets and intellectual property related to PHOTOFRIN. As part of the transaction, Axcan acquired a European subsidiary of QLT, which holds the European regulatory approvals for PHOTOFRIN. The last of the patents, which form part of the acquired assets, expires in April 2013. As part of the acquisition, Axcan agreed to assume QLT’s obligation to pay royalties of up to 5% on net sales of PHOTOFRIN to Health Research Inc. (“Health Research”), pursuant to arrangements under which Axcan is a sub-licensee of the technology that QLT licensed from Health Research. Pursuant to the terms of the transaction between Axcan and QLT, Axcan has paid to QLT milestone cash payments of CAN $20.0 million (representing the maximum potential aggregate amount of milestone cash payments under the terms of the transaction).

PANZYTRAT

In December 2002, Axcan acquired from an affiliate of Abbott Laboratories (‘‘Abbott’’) certain assets related to the distribution, marketing and sale of a line of pancreatic enzyme products used to enhance the digestion of fats. This pancreatic enzyme product line is commonly marketed under the trademark

22

PANZYTRAT. The product line is subject to patents assigned to Axcan directly from Abbott, the last of which expires in 2008. The know-how and trade secrets associated with these products and their manufacture are the object of a perpetual unrestricted license from Abbott. The PANZYTRAT and related trademark portfolio, was assigned directly from Abbott to Axcan’s French subsidiary, Axcan Pharma S.A. This portfolio contains trademarks associated with the product line for a number of countries throughout the world.

PYLERA

In January 2000, Axcan entered into a worldwide (excluding Australia and New Zealand) licensing agreement (which was amended in November 2000 and August 2001) with Exomed Australia PTY Limited, Gastro Services PTY Limited, Ostapat PTY Limited, and Capability Services PTY Ltd. This agreement, as amended, provides Axcan with exclusive rights in a number of countries, including Canada and the United States, to a series of patents covering triple and quadruple therapies for Helicobacter pylori eradication. These patents cover the treatment of duodenal ulcer disease (and in some countries reflux esophagitis and gastric ulcer) through the eradication of Helicobacter pylori using a bismuth compound together with two (2) or more antibiotics. Axcan paid approximately $1.64 million cash for the license and will pay a 5.5% royalty based on sales. The expiry dates of these patents vary depending on the jurisdiction and expire in March 2010 in the United States.

In May 1999, Axcan acquired the rights to a double capsule delivery technology to be used for PYLERA from Gephar S.A. (“Gephar”), in an asset swap transaction, whereby Axcan sold to Gephar its interest in Axcan Ltd., a manufacturer and distributor of the PROTECTAID™ contraceptive sponge. This patent expires in December 2018 in the United States.

LACTEOL and LACTEOL FORT

In April 2002, Axcan acquired all of the shares of Laboratoire du Lactéol du Docteur Boucard which is the owner of all of the intellectual property rights to the antibacterial composition marketed by Le Laboratoire du Lactéol under different trademarks, including the trademark LACTEOL. The antibacterial composition is also subject to a patent in France and to an international patent application. These patents rights are owned by Axcan and a French research institute.

AGI-010

On September 25, 2006, the Company entered into a license and co-development agreement with AGI. Pursuant to this agreement, AGI and the Company will co-develop a controlled release omeprazole product (“AGI-010”) for the treatment of Gastro-esophageal Reflux Disease and a better control of Nocturnal Acid Breakthrough. Under the agreement, the Company has licensed exclusive rights to patent applications and know-how related to AGI-010 and will retain rights to any improvements to the product for North America and, if extended by Axcan, to other territories. However, the Company cannot provide assurances that such patent will be granted. The Company and AGI have further agreed to share certain development expenses, and the Company paid a $1.5 million upfront fee (which was charged to expense in fiscal 2006) and may be required to make specified milestone payments that could total up to $17.5 million at various stages of development, up to and including regulatory approvals. The Company also agreed to pay royalties on net sales.

23

Cx401

Under the terms of the agreement signed with Cellerix on September 30, 2007, Axcan made a $10.0 million upfront payment to Cellerix (which was charged to expense in the fourth quarter of 2007), and will make regulatory milestone payments that could total up to $30.0 million. In addition, patent applications were submitted, which, if granted, could provide protection until 2025. However, the Company cannot provide assurances that such patent will be granted.

In addition, under the terms of the agreement with Cellerix, Axcan will pay scaled royalties based on the net sales of Cx401. Axcan has also agreed to make an equity investment of up to $5.0 million in Cellerix, should Cellerix complete its initial public offering by September 30, 2010.

6. EMPLOYEES

As at September 30, 2007, the end of Axcan’s most recently completed fiscal year, Axcan employed 480 persons. Of these employees, 154 are located in the United States, 169 are located in Canada and 157 are located in Europe. In Canada, Axcan is a party to a collective bargaining agreement, which was recently renewed and expires March 24, 2011. This agreement covers 60 employees, all of whom are non-management employees. In France, Axcan’s employees are subject to the Convention Collective Nationale de l’Industrie Pharmaceutique, a collective bargaining agreement which applies to the entire pharmaceutical industry. Axcan believes that relations with both its unionized and non-unionized employees are good.

In the United States, Axcan sells its products to most major wholesale drug companies and distributors, which in turn distribute Axcan’s products to chain and independent pharmacies, hospitals and mail order organizations. Our 83 sales representatives, 10 regional sales managers (managed by 2 zone directors) and 5 national account managers in our managed care group, all located in the United States, call on high-volume prescribing gastroenterology physicians, cystic fibrosis centres, hepatologists and transplant centres, potential and current PHOTOFRIN centres as well as third-party payors, clinical pharmacists and formularies administrators. Since the launch of PYLERA, in May 2007, sales representatives also visit general practitioners known to be high-prescribers of Helicobacter pylori eradication therapies.

Increasingly, in North America, third-party payors, such as private insurance companies and drug plan benefit managers, aim to rationalize the use of pharmaceutical products and medical treatments, in order to ensure that prescribed products are necessary for the patients’ conditions. Moreover, large drug store chains now account for an increasing portion of the retail sales of prescription medicines. The pharmacists and store managers of such retail outlets are under pressure to reduce the number of items in inventory in order to reduce costs.

In Canada, Axcan sells its products to hospitals and wholesale drug companies, which in turn distribute Axcan’s products to pharmacies. Axcan’s major products are included in most provincial drug benefit formularies and are promoted by Axcan’s 10 sales representatives, under the supervision of the regional sales manager, to gastroenterologists and internal medicine specialists with a particular interest in gastrointestinal diseases, as well as to colorectal surgeons.

In France, Axcan sells its products to distributors, which in turn distribute them to wholesale drug companies, which in turn distribute them to pharmacies. The 43 sales representatives under the supervision of 5 regional sales directors regularly visit high-prescribing physicians to promote Axcan’s other products.

This international sales structure is complemented by Axcan’s sponsorship of high-level international medical meetings on topics related to Axcan’s products and research activities. These events are recognized by leading institutions, and continuing medical education credits are awarded to attendees. As a consequence, Axcan is recognized not only as a supplier of quality products, but also as an important link in the continuous medical education process.

24

7. ENVIRONMENTAL PROTECTION, HEALTH AND SAFETY

Axcan is committed to environmental protection and the promotion of environmental issues. This includes a safe, healthy and secure environment for its employees, subcontractors and customers and the community in which the Company operates.

The Company has established a series of policies to facilitate compliance with applicable environmental laws and regulations. These policies require that business units conduct regular environmental assessments of Company activities, establish remedial and contingency plans to deal with any incidents, and establish regular processes to review and report to senior corporate management on the environmental status of the Company and its subsidiaries.

Axcan generates a small amount of hazardous waste that is disposed of by certified third-party carriers. Axcan believes its approach to environmental compliance meets applicable regulatory requirements and it is not expected that its policies or practices will have a significant impact on capital expenditures, consolidated earnings or our competitive position.

8. FACILITIES

We own and lease space for manufacturing, warehousing, research, development, sales, marketing, and administrative purposes. All these facilities are inspected on a regular basis by regulatory authorities, and our own internal auditing team ensures compliance on an ongoing basis with such standards.