Exhibit 99.3

Audited Financial Statements from Annual Report – U.S. GAAP

CONSOLIDATED

FINANCIAL STATEMENTS

TABLE OF CONTENTS

| Management Report | | 44 |

| Report of Independent Registered Public Accounting Firm | | 45 |

| Financial Statements | | |

| | Consolidated Balance Sheets | | 46 |

| | Consolidated Operations | | 47 |

| | Consolidated Shareholders' Equity | | 48 |

| | Consolidated Cash Flows | | 49 |

| | Notes to Consolidated Financial Statements | | 50 |

43

MANAGEMENT'S REPORT

The consolidated financial statements of Axcan Pharma Inc. and the other financial information included in this annual report are the responsibility of the Company's management.

These consolidated financial statements and the other financial information have been prepared by management in accordance with accounting principles generally accepted in the United States of America. This responsibility includes the selection of appropriate accounting principles and methods in the circumstances and the use of careful judgement in establishing reasonable accounting estimates.

Management maintains internal control systems designed among other things, to provide reasonable assurance that the Company's assets are adequately safeguarded and that the accounting records are a reasonable basis to prepare relevant and reliable financial information.

The Audit Committee is composed solely of external directors. This Committee meets with the external auditors and management to discuss matters relating to the audit, internal control and financial information. The Committee also reviews the consolidated quarterly and annual financial statements.

These consolidated financial statements have been audited by Raymond Chabot Grant Thornton LLP, whose report indicating the scope of their audits and their opinion on the consolidated financial statements is presented below.

The Board of Directors has approved the Company's financial statements on the recommendation of the Audit Committee.

Frank A.G.M. Verwiel, M.D.

President and

Chief Executive Officer | |

David W. Mims

Executive Vice President

and Chief Operating Officer | |

Jean Vézina

Vice President, Finance and

Chief Financial Officer |

Mont-Saint-Hilaire, Quebec, Canada

November 10, 2005

44

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Axcan Pharma Inc.

We have audited the consolidated balance sheets of Axcan Pharma Inc. and subsidiaries ("Company") as at September 30, 2005 and 2004 and the consolidated statements of operations, shareholders' equity and cash flows for each of the years in the three-year period ended September 30, 2005. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States) and with generally accepted auditing standards in Canada. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at September 30, 2005 and 2004 and the results of its operations and its cash flows for each of the years in the three-year period ended September 30, 2005 in accordance with accounting principles generally accepted in the United Sates of America.

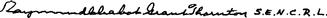

Raymond Chabot Grant Thornton LLP

Chartered Accountants

| | |

Montreal, Quebec, Canada

November 10, 2005

45

CONSOLIDATED BALANCE SHEETS

September 30

| | 2005

| | 2004

|

|---|

in thousands of U.S. dollars, except share related data

| | $

| | $

|

|---|

| Assets | | | | |

| Current assets | | | | |

| | Cash and cash equivalents | | 79,969 | | 21,979 |

| | Short-term investments available for sale (Note 5) | | 17,619 | | 15,922 |

| | Accounts receivable, net (Note 6) | | 37,587 | | 46,585 |

| | Income taxes receivable | | 8,351 | | 9,196 |

| | Inventories (Note 7) | | 36,016 | | 37,270 |

| | Prepaid expenses and deposits | | 1,771 | | 3,494 |

| | Deferred income taxes (Note 8) | | 9,044 | | 4,586 |

| | |

| |

|

| Total current assets | | 190,357 | | 139,032 |

| Property, plant and equipment, net (Note 9) | | 31,673 | | 31,252 |

| Intangible assets, net (Note 10) | | 388,921 | | 407,875 |

| Goodwill, net (Note 11) | | 27,467 | | 27,467 |

| Deferred debt issue expenses, net | | 2,577 | | 3,088 |

| Deferred income taxes (Note 8) | | 412 | | 930 |

| | |

| |

|

| Total assets | | 641,407 | | 609,644 |

| | |

| |

|

| Liabilities | | | | |

| Current liabilities | | | | |

| | Accounts payable and accrued liabilities (Note 13) | | 52,990 | | 47,917 |

| | Income taxes payable | | 3,247 | | 731 |

| | Instalments on long-term debt | | 1,497 | | 1,778 |

| | Deferred income taxes (Note 8) | | 602 | | 936 |

| | |

| |

|

| Total current liabilities | | 58,336 | | 51,362 |

| Long-term debt (Note 14) | | 126,332 | | 127,916 |

| Deferred income taxes (Note 8) | | 39,135 | | 38,290 |

| | |

| |

|

| Total liabilities | | 223,803 | | 217,568 |

| | |

| |

|

| Commitments and contingencies (Note 21) | | | | |

Shareholders' Equity |

|

|

|

|

| Capital stock (Note 15) | | | | |

| | Preferred shares, without par value; unlimited shares authorized; no shares issued | | — | | — |

| | Series A preferred shares, without par value; shares authorized: 14,175,000; no shares issued | | — | | — |

| | Series B preferred shares, without par value; shares authorized: 12,000,000; no shares issued | | — | | — |

| | Common shares, without par value; unlimited shares authorized; issued and outstanding: 45,682,175 and 45,562,336 as at September 30, 2005 and 2004, respectively | | 261,714 | | 260,643 |

| Retained earnings | | 138,787 | | 112,362 |

| Additional paid-in capital | | 1,329 | | — |

| Accumulated other comprehensive income | | 15,774 | | 19,071 |

| | |

| |

|

| Total shareholders' equity | | 417,604 | | 392,076 |

| | |

| |

|

| Total liabilities and shareholders' equity | | 641,407 | | 609,644 |

| | |

| |

|

The accompanying notes are an integral part of the consolidated financial statements.

On behalf of the Board,

Léon F. Gosselin

Director | |

Dr. Claude Sauriol

Director |

46

CONSOLIDATED OPERATIONS

Years ended September 30

| | 2005

| | 2004

| | 2003

| |

|---|

in thousands of U.S. dollars, except share related data

| | $

| | $

| | $

| |

|---|

| Revenue | | 251,343 | | 243,634 | | 179,084 | |

| | |

| |

| |

| |

| Cost of goods sold excluding depreciation and amortization | | 71,534 | | 54,247 | | 44,459 | |

| Selling and administrative expenses | | 85,997 | | 76,365 | | 63,084 | |

| Research and development expenses | | 31,855 | | 19,866 | | 12,098 | |

| Acquired in-process research | | — | | — | | 12,000 | |

| Depreciation and amortization | | 21,532 | | 16,359 | | 8,063 | |

| | |

| |

| |

| |

| | | 210,918 | | 166,837 | | 139,704 | |

| | |

| |

| |

| |

| Operating income | | 40,425 | | 76,797 | | 39,380 | |

| | |

| |

| |

| |

| Financial expenses | | 7,140 | | 6,885 | | 4,283 | |

| Interest income | | (1,340 | ) | (756 | ) | (1,639 | ) |

| Loss (gain) on foreign currency | | (213 | ) | (313 | ) | 122 | |

| Takeover-bid expenses | | — | | — | | 3,697 | |

| | |

| |

| |

| |

| | | 5,587 | | 5,816 | | 6,463 | |

| | |

| |

| |

| |

| Income before income taxes | | 34,838 | | 70,981 | | 32,917 | |

| Income taxes (Note 8) | | 8,413 | | 22,253 | | 12,992 | |

| | |

| |

| |

| |

| Net income | | 26,425 | | 48,728 | | 19,925 | |

| | |

| |

| |

| |

| Income per common share | | | | | | | |

| | Basic | | 0.58 | | 1.08 | | 0.44 | |

| | Diluted | | 0.56 | | 0.96 | | 0.44 | |

| Weighted average number of common shares | | | | | | | |

| | Basic | | 45,617,703 | | 45,286,199 | | 44,914,944 | |

| | Diluted | | 55,219,202 | | 55,031,184 | | 45,607,992 | |

The accompanying notes are an integral part of the consolidated financial statements and note 16 presents additional information on consolidated operations.

47

CONSOLIDATED SHAREHOLDERS' EQUITY

Years ended September 30

| | 2005

| | 2004

| | 2003

| |

|---|

in thousands of U.S. dollars, except share related data

| |

| |

| |

| |

|---|

| Common shares (number) | | | | | | | |

| Balance, beginning of year | | 45,562,336 | | 45,004,320 | | 44,863,198 | |

| Shares issued pursuant to the stock option plan for cash | | 119,839 | | 558,016 | | 141,122 | |

| | |

| |

| |

| |

| Balance, end of year | | 45,682,175 | | 45,562,336 | | 45,004,320 | |

| | |

| |

| |

| |

|

|

$

|

|

$

|

|

$

|

|

|---|

| Common shares | | | | | | | |

| Balance, beginning of year | | 260,643 | | 255,743 | | 254,640 | |

| Shares issued pursuant to the stock option plan for cash | | 1,071 | | 4,900 | | 1,103 | |

| | |

| |

| |

| |

| Balance, end of year | | 261,714 | | 260,643 | | 255,743 | |

| | |

| |

| |

| |

| Retained earnings | | | | | | | |

| Balance, beginning of year | | 112,362 | | 63,634 | | 43,709 | |

| Net income | | 26,425 | | 48,728 | | 19,925 | |

| | |

| |

| |

| |

| Balance, end of year | | 138,787 | | 112,362 | | 63,634 | |

| | |

| |

| |

| |

| Additional paid-in capital | | | | | | | |

| Balance, beginning of year | | — | | — | | — | |

| Income tax deductions on stock options exercise | | 1,329 | | — | | — | |

| | |

| |

| |

| |

| Balance, end of year | | 1,329 | | — | | — | |

| | |

| |

| |

| |

| Accumulated other comprehensive income (loss) | | | | | | | |

| Balance, beginning of year | | 19,071 | | 11,634 | | (3,562 | ) |

| Foreign currency translation adjustments | | (3,297 | ) | 7,437 | | 15,196 | |

| | |

| |

| |

| |

| Balance, end of year | | 15,774 | | 19,071 | | 11,634 | |

| | |

| |

| |

| |

| Total shareholders' equity | | 417,604 | | 392,076 | | 331,011 | |

| | |

| |

| |

| |

| Comprehensive income | | | | | | | |

| Foreign currency translation adjustments | | (3,297 | ) | 7,437 | | 15,196 | |

| Net income | | 26,425 | | 48,728 | | 19,925 | |

| | |

| |

| |

| |

| Total comprehensive income | | 23,128 | | 56,165 | | 35,121 | |

| | |

| |

| |

| |

The accompanying notes are an integral part of the consolidated financial statements.

48

CONSOLIDATED CASH FLOWS

Years ended September 30

| | 2005

| | 2004

| | 2003

| |

|---|

in thousands of U.S. dollars

| | $

| | $

| | $

| |

|---|

| Operations | | | | | | | |

| Net income | | 26,425 | | 48,728 | | 19,925 | |

| Non-cash items | | | | | | | |

| | Non-controlling interest | | — | | — | | (103 | ) |

| | Amortization of deferred debt issue expenses | | 1,100 | | 1,144 | | 646 | |

| | Other depreciation and amortization | | 21,532 | | 16,359 | | 8,063 | |

| | Loss (gain) on disposal of assets | | — | | (5 | ) | 1,130 | |

| | Foreign currency fluctuation | | (84 | ) | 342 | | 305 | |

| | Deferred income taxes | | (3,261 | ) | 6,625 | | 1,848 | |

| | Share in net loss of joint ventures | | — | | 455 | | 106 | |

| | Changes in working capital items (Note 17) | | 22,033 | | (50,288 | ) | 19,576 | |

| | |

| |

| |

| |

| Cash flows from operating activities | | 67,745 | | 23,360 | | 51,496 | |

| | |

| |

| |

| |

| Financing | | | | | | | |

| Long-term debt | | — | | 2,212 | | 126,064 | |

| Repayment of long-term debt | | (1,857 | ) | (3,842 | ) | (4,687 | ) |

| Deferred debt issue expenses | | (589 | ) | — | | (4,589 | ) |

| Issue of shares | | 1,071 | | 4,900 | | 1,103 | |

| | |

| |

| |

| |

| Cash flows from financing activities | | (1,375 | ) | 3,270 | | 117,891 | |

| | |

| |

| |

| |

Investment |

|

|

|

|

|

|

|

| Acquisition of short-term investments | | (14,519 | ) | (20,936 | ) | (133,112 | ) |

| Disposal of short-term investments | | 12,822 | | 138,074 | | 60,740 | |

| Disposal of investments | | — | | 1,876 | | 637 | |

| Acquisition of property, plant and equipment | | (6,330 | ) | (13,409 | ) | (4,291 | ) |

| Disposal of property, plant and equipment | | — | | 405 | | — | |

| Acquisition of intangible assets | | (51 | ) | (149,628 | ) | (76,093 | ) |

| Disposal of intangible assets | | — | | 917 | | — | |

| | |

| |

| |

| |

| Cash flows from investment activities | | (8,078 | ) | (42,701 | ) | (152,119 | ) |

| | |

| |

| |

| |

| Foreign exchange gain (loss) on cash held in foreign currencies | | (302 | ) | 277 | | 528 | |

| | |

| |

| |

| |

| Net increase (decrease) in cash and cash equivalents | | 57,990 | | (15,794 | ) | 17,796 | |

| Cash and cash equivalents, beginning of year | | 21,979 | | 37,773 | | 19,977 | |

| | |

| |

| |

| |

| Cash and cash equivalents, end of year | | 79,969 | | 21,979 | | 37,773 | |

| | |

| |

| |

| |

The accompanying notes are an integral part of the consolidated financial statements.

49

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30

Amounts in the tables are stated in thousands of U.S. dollars, except share related data.

1. GOVERNING STATUTES AND NATURE OF OPERATIONS

The Company, incorporated under the Canada Business Corporations Act, is involved in the research, development, production and distribution of pharmaceutical products, mainly in the field of gastroenterology.

2. CHANGES IN ACCOUNTING POLICIES

a) Year ended September 30, 2005

Effect of contingently convertible instruments on diluted earnings per share

During the September 2004 meeting of the Emerging Issues Task Force ("EITF") a consensus was reached on EITF Issue 04-8,"The Effect of Contingently Convertible Instruments on Diluted Earnings per Share". The EITF 04-8 requires companies to include certain convertible instruments, that were previously excluded, into their calculations of diluted earnings per share. The EITF concluded that Issue 04-8 is effective for periods ending after December 15, 2004, and must be applied by restating all periods during which time the applicable convertible instruments were outstanding. The common shares issuable under the 4.25% convertible subordinated notes issued in 2003, are therefore included in the Company's diluted income per share calculation. For the year ended September 30, 2004, the weighted number of common shares used in the calculation of the diluted income per share has been increased from 52,787,964 to 55,031,184 and the diluted income per share has been reduced from $0.98 to $0.96. This change in accounting policies did not have an impact on the diluted income per share for the year ended September 30, 2003.

b) Year ended September 30, 2004

Disclosure of information about capital structure

In April 2004, the Financial Accounting Standards Board ("FASB") issued FASB Staff Position ("FSP") to Statement of Financial Accounting Standards ("SFAS") No. 129-1,"Disclosure Requirements under FASB Statement No. 129, Disclosure of Information about Capital Structure, Relating to Contingently Convertible Securities" to provide disclosure guidance for contingently convertible securities, including those instruments with contingent conversion requirements that have not been met and otherwise are not required to be included in the computation of diluted earnings per share. The FSP addresses concerns that disclosures relating to contingently convertible securities are inconsistent between companies or may be inadequate. FSP SFAS No. 129-1 states that to comply with the requirements of SFAS No. 129, the significant terms of the conversion features of the contingently convertible security should be disclosed to enable users of financial statements to understand the circumstances of the contingency and the potential impact of conversion. The Company evaluated the impact of this pronouncement and has enhanced its disclosures as required.

Consolidation of variable interest entities

In January 2003, the FASB issued Interpretation ("FIN") No. 46,"Consolidation of Variable Interest Entities, an interpretation for Accounting Research Bulletin No. 51." FIN No. 46 requires certain variable interest entities, or VIEs, to be consolidated by the primary beneficiary of the entity if the equity investors in the entity do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. FIN No. 46 is effective for all VIEs created or acquired after January 31, 2003. For VIEs created or acquired prior to February 1, 2003, the provisions of FIN No. 46 must be applied for the first interim or annual period beginning after December 15, 2003.

The Company currently has no contractual relationship or other business relationship with a variable interest entity and therefore the adoption of FIN No. 46 did not have an effect on the Company's consolidated balance sheets or statements of operations, shareholders' equity and cash flows.

c) Year ended September 30, 2003

Basis of presentation

The Company decided, for the year beginning October 1, 2002, to switch from Canadian generally accepted accounting principles ("GAAP") to the United States of America ("U.S.") GAAP as its primary reporting convention. The change in GAAP was influenced by the Company's desire to better meet the needs of its shareholders by applying accounting rules that are consistent with the majority of its customers and peer companies.

Guarantor's accounting and disclosure requirements for guarantees

In November 2002, the FASB issued FIN No. 45,"Guarantor's Accounting and Disclosure Requirements for Guarantees." FIN No. 45 requires a guarantor to recognize, at the inception of a guarantee, a liability for the fair value of the obligation it has undertaken in issuing the guarantee. FIN No. 45 also requires guarantors to disclose certain information for guarantees, including product warranties, outstanding at the end of the reporting period. At adoption, FIN No. 45 did not have any impact on the Company's consolidated statements of income or financial position.

Impairment or disposal of long-lived assets

SFAS No. 144,"Accounting for the Impairment or Disposal of Long-lived Assets" provides guidance on how assets are grouped when testing for and measuring impairment and proposes a two-step process for first determining when an impairment loss is recognized and then measuring that loss. The adoption of this new standard had no impact on the consolidated financial statements.

50

Stock-based compensation

In December 2002, the FASB issued SFAS No. 148,"Accounting for Stock-Based Compensation—Transition and Disclosure". SFAS No. 148 amends SFAS No. 123,"Accounting for Stock-Based Compensation", to provide alternative methods of transition to SFAS No. 123's fair value method of accounting for stock-based employee compensation. SFAS No. 148 also amends the disclosure provisions of SFAS No. 123 and Accounting Principles Board Opinion ("APB") No. 28,"Interim Financial Reporting", to require disclosure in the summary of significant accounting policies of the effects of an entity's accounting policy with respect to stock-based employee compensation on reported net income and earnings per share in annual and interim financial statements. While SFAS No. 148 does not amend SFAS No. 123 to require companies to account for employee stock options using the fair value method, the disclosure provisions of SFAS No. 148 are applicable to all companies with stock-based employee compensation, regardless of whether they account for that compensation using the fair value method of SFAS No. 123 or the intrinsic value method of APB No. 25. As allowed by SFAS No. 123, the Company elected to continue to utilize the accounting method prescribed by APB No. 25 and applies the disclosure requirements of SFAS No. 123.

d) Standards applicable for the year 2006

Share-based payment

In December 2004, the FASB issued SFAS No. 123R,"Share-Based Payment". SFAS No. 123R requires all entities to recognize compensation cost for share-based awards, including options, granted to employees. The Statement eliminates the ability to account for share-based compensation transactions using APB No. 25,"Accounting for Stock Issued to Employees", and generally requires instead that such transactions be accounted for using a fair-value based method. Public companies are required to measure stock-based compensation classified as equity by valuing the instrument the employee receives at its grant-date fair value. Currently such awards are measured at intrinsic value under both APB No. 25 and SFAS 123,"Accounting for Stock-Based Compensation". The Company will apply the Statement beginning in fiscal 2006 using the modified prospective transition approach and expects the implementation to have a material impact on the Company's consolidated balance sheets and results of operations. For the historical impact of stock-based compensation expense measured using the fair-value based method, see Note 3.

Inventory costs

In November 2004, the FASB issued SFAS No. 151 "Inventory Costs, an Amendment of ARB No. 43, Chapter 4." SFAS No. 151 clarifies the accounting for abnormal amounts of idle facility expense, freight, handling costs and wasted material and requires that such items be recognized as current-period charges regardless of whether they meet the criterion of "so abnormal". In addition, SFAS No. 151 requires that allocation of fixed production overheads to the costs of conversion be based on the normal capacity of the production facilities. The Company is required to adopt the provisions of SFAS No. 151 beginning October 1, 2005 and does not anticipate a material effect.

Accounting changes and error corrections

In May 2005, the FASB issued SFAS No. 154 "Accounting Changes and Error Corrections" which provides guidance on the accounting for and reporting of accounting changes and correction of error. This statement changes the requirements for the accounting for and reporting of a change in accounting principle and applies to all voluntary changes in accounting principle. It also applies to changes required by an accounting pronouncement in the unusual instance that the pronouncement does not include specific transition provisions. This statement is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. The Company does not anticipate a material effect upon the adoption of this statement.

3. ACCOUNTING POLICIES

Basis of presentation

The Company has prepared these consolidated financial statements in U.S. dollars and in accordance with U.S. GAAP. The Company has disclosed in note 22 the summary of differences between generally accepted accounting principles in the United States and in Canada.

Accounting estimates

The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the recorded amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and recognized amounts of revenues and expenses during the year. Significant estimates and assumptions made by management include allowances for accounts receivable and inventories, reserves for product returns, rebates and chargebacks, the classification of intangible assets between finite life and indefinite life, the useful lives of long-lived assets, the expected cash flows used in evaluating long-lived assets, goodwill and investments for impairment, pending legal settlements, the realizability of deferred tax assets and the allocation of the purchase price of acquired assets and businesses. The estimates are made using the historical information and various other expected factors related to each circumstances, available to management. The Company reviews all significant estimates affecting the financial statements on a recurring basis and records the effect of any adjustments when necessary. Actual results could differ from those estimates based upon future events, which could include, among other risks, changes in regulations governing the manner in which the Company sells its products, changes in health care environment and managed care consumptions patterns.

Principles of consolidation

These financial statements include the accounts of the Company and its subsidiaries, the most important being Axcan Scandipharm Inc., Axcan Pharma U.S. Inc., and Axcan Pharma S.A. (the result of the merger of Laboratoires Entéris S.A.S. with Laboratoires du Lactéol du Docteur Boucard S.A.). Significant intercompany transactions have been eliminated in consolidation.

51

Revenue recognition

Revenue is recognized when the product is shipped to the Company's customers, provided the Company has not retained any significant risks of ownership or future obligations with respect to the product shipped. Provisions for sales discounts and estimates for chargebacks, managed care and Medicaid rebates and products returns are established as a reduction of product sales revenues at the time such revenues are recognized. These revenue reductions are established by the Company at the time of sale based on historical experience adjusted to reflect known changes in the factors that impact such reserves. In certain circumstances, returns or exchange of products are allowed under the Company's policy and provisions are maintained accordingly. Amounts received from customers as prepayments for products to be shipped in the future are reported as deferred revenue.

Cash and cash equivalents

The Company includes in cash and cash equivalents cash and all highly liquid short-term investments with initial maturities of three months or less.

Short-term investments

The Company classifies its short-term investments as available for sale. These investments are recorded at their fair value, unrealized gains or losses are recorded as comprehensive income (loss). As at September 30, 2005, 2004 and 2003 there is no material unrealized gain or loss.

Accounts receivable

The majority of the Company's accounts receivable are due from companies in the pharmaceutical industry. Credit is extended based on evaluation of a customers' financial condition and, generally, collateral is not required. Accounts receivable are due within 30 days and are stated at amounts due from customers net of an allowance for doubtful accounts. Accounts outstanding longer than the contractual payment terms are considered past due. The Company determines its allowance by considering a number of factors, including the length of time trade accounts receivable are past due, the Company's previous loss history, the customer's current ability to pay its obligation to the Company, and the condition of the general economy and the industry as a whole. The Company writes off accounts receivable when they become uncollectible, and payments subsequently received on such receivables are credited to the bad debts expenses.

Inventory valuation

Inventories of raw materials and packaging material are valued at the lower of cost and replacement cost. Inventories of work in progress and finished goods are valued at the lower of cost and net realizable value. Cost is determined by the first-in, first-out method. Cost for work in progress and finished goods includes raw materials, direct labour, subcontracts and an allocation for overhead. Allowances are maintained for slow-moving inventories based on the remaining shelf life of and estimated time required to sell such inventories. Obsolete inventory and rejected products are written off to cost of goods sold.

Research and development

Research and development expenses are charged to operations in the year they are incurred. Acquired in-process research and development having no alternative future use is written off at the time of acquisition. The cost of intangibles that are purchased from others for a particular research and development project that have no alternative future use are written off at the time of acquisition.

Depreciation and amortization

Property, plant and equipment and intangible assets with a finite life are reported at cost, less accumulated depreciation and are depreciated or amortized over their estimated useful lives according to the straight-line method at the following annual rates:

| Buildings | | 4 to 10% |

| Furniture and equipment | | 10 to 20% |

| Computer equipment | | 20 to 50% |

| Automotive equipment | | 20 to 25% |

| Leasehold and building improvements | | 10 to 20% |

| Trademarks, trademark licenses and manufacturing rights | | 4 to 15% |

Depreciation or amortization commences when an asset is substantially completed and becomes available for productive commercial use.

Goodwill and intangible assets with indefinite life are not amortized since October 1, 2001.

Deferred debt issue expenses are amortized on a straight-line basis over the terms of the debts, until 2008.

Impairment of long lived-assets

The value of goodwill and intangible assets with indefinite life are subject to an annual impairment test and the intangible assets with definite life and property plant, and equipment are subject to an impairment test whenever events or changes in circumstances indicate that the carrying amounts of these assets may not be recoverable. The Company compares the carrying value of the unamortized portion of property, plant and equipment and intangible assets with definite life to the future benefits of the Company's activities or expected sales of pharmaceutical products. For goodwill and intangible assets with indefinite life, the test is based on the comparison of the fair value of the asset with its carrying amount. Should there be a permanent impairment in value, a write-down will be recognized for the current year to reflect the assets at fair value. To date, the Company has not recognized any material permanent impairment in value.

52

Income taxes

Income taxes are calculated based on the liability method. Under this method, deferred income tax assets and liabilities are recognized as estimated taxes for recovery or settlement arising from the recovery or settlement of assets and liabilities recorded at their financial statement carrying amounts. Deferred income tax assets and liabilities are measured based on enacted tax rates and laws at the date of the financial statements for the years in which the temporary differences are expected to reverse. A valuation allowance is provided for the portion of deferred tax assets that is more likely than not to remain unrealized. Adjustments to the deferred income tax asset and liability balances are recognized in net income as they occur.

Stock-based compensation

Under the provision of SFAS No. 123,"Accounting for Stock- Based Compensation", companies can either measure the compensation cost of equity instruments issued under employee compensation plans using a fair value-based method or can continue to recognize compensation cost using the intrinsic value method under the provisions of APB No. 25,"Accounting for Stock Issued to Employees". However, if the provisions of APB No. 25 are applied, pro-forma disclosure of net income and income per share must be presented in the financial statements as if the fair value method had been applied. For all periods presented, the Company recognized compensation costs under the provisions of APB No. 25, and the Company has provided the expanded disclosure required by SFAS No. 123. The Company has elected to continue to measure compensation costs related to awards of stock options using the intrinsic value-based method of accounting. No stock-based employee compensation cost is reflected in net income.

The following table illustrates the effect on net income and income per share if the Company had applied the fair value recognition provisions of SFAS No. 123 to stock-based compensation.

| | 2005

| | 2004

| | 2003

|

|---|

| | $

| | $

| | $

|

|---|

| Net income as reported | | 26,425 | | 48,728 | | 19,925 |

| Less: Total stock-based compensation expenses determined under fair value-based method, net of income taxes | | 4,274 | | 4,286 | | 3,369 |

| | |

| |

| |

|

| Pro-forma net income | | 22,151 | | 44,442 | | 16,556 |

| | |

| |

| |

|

| Basic income per share | | | | | | |

| | As reported | | 0.58 | | 1.08 | | 0.44 |

| | Pro-forma | | 0.49 | | 0.98 | | 0.37 |

Diluted income per share |

|

|

|

|

|

|

| | As reported | | 0.56 | | 0.96 | | 0.44 |

| | Pro-forma | | 0.48 | | 0.88 | | 0.36 |

Selling and administrative expenses

Selling and administrative expenses include shipping and handling expenses and advertising expenses.

Foreign currency translation

The current rate method of translation of foreign currencies is followed for subsidiaries, or joint ventures considered financially and operationally self-sustaining. Therefore, all gains and losses arising from the translation of the financial statements of subsidiaries or joint ventures are deferred in a cumulative foreign currency translation adjustments account reported as a component of accumulated other comprehensive income in shareholders' equity.

For the operations in Canada and the United States of America, monetary assets and liabilities in currency other than U.S. dollars are translated into U.S. dollars, the functional currency of the Company, at the exchange rates in effect at the balance sheet date whereas other assets and liabilities are translated at exchange rates in effect at transaction dates. Revenue and operating expenses in foreign currency are translated at the average rates in effect during the year, except for depreciation and amortization, translated at historical rates. Gains and losses are included in net income for the year.

Income per share

Basic income per share is calculated using the weighted average number of common shares outstanding during the year. The treasury stock method is to be used for determining the dilution effect of options. The dilutive effect of convertible subordinated notes, balance of purchase price payable in shares and convertible preferred shares is determined using the "if-converted" method.

53

4. ACQUISITIONS

Product acquisitions

On November 18, 2003, the Company acquired the rights to a group of products from Aventis Pharma S.A. ("Aventis") for a cash purchase price of $145,000,000. The acquired products are CARAFATE and BENTYL for the U.S. market and SULCRATE, BENTYLOL and PROCTOSEDYL for the Canadian market.

On August 29, 2003, the Company acquired an exclusive license for North America, the European Union and Latin America, from Abbott Laboratories ("Abbott") to develop, manufacture and market ITAX, a patented gastroprokinitic drug. Under the terms of this license agreement, the Company paid $10,000,000 and assumed $2,000,000 in research contract liability. This product in development had not reached technological feasibility and had no known alternative uses, it was therefore considered to be acquired in-process research and was expensed in the period of acquisition. The agreement also provides for milestone payments upon certain events.

On December 10, 2002, the Company acquired the rights to the Ursodiol 250 mg tablets DELURSAN for the French market, for a cash purchase price of 22,300,000 Euros ($22,800,000) from Aventis. On December 3, 2002, the Company acquired the worldwide rights to the PANZYTRAT enzyme product line from Abbott for a cash purchase price of $45,000,000.

During a transition period ended during the year, the sellers may act as Axcan's agents for the management of sales of some of these products. For the year ended September 30, 2005, a portion of the sales of these products is still managed by the sellers. Axcan includes in its revenue the net sales from such products less corresponding cost of goods sold and other seller related expenses. Consequently, although net sales of such products of the year ended September 30, 2005 were $2,431,789 ($7,667,940 in 2004 and $14,255,979 in 2003), the Company only included in its revenue an amount of $949,866 ($4,685,673 in 2004 and $9,463,645 in 2003) representing the net sales less cost of goods sold and other seller related expenses.

5. SHORT-TERM INVESTMENTS

As at September 30, 2005, short-term investments include short-term notes, mutual funds and debt securities. Two short-term notes represent approximately 56% (one mutual fund for 64% in 2004) of the Company's total short-term investments. Interest rates on short-term notes and debt securities vary from 2.356% to 3.402% (0.975% to 3.315% in 2004).

6. ACCOUNTS RECEIVABLE

| | 2005

| | 2004

|

|---|

| | $

| | $

|

|---|

| Trade accounts, net of allowance for doubtful accounts of $575,000 ($876,000 in 2004)(a) | | 37,186 | | 44,320 |

| Taxes receivable | | 45 | | 1,978 |

| Other | | 356 | | 287 |

| | |

| |

|

| | | 37,587 | | 46,585 |

| | |

| |

|

The Company believes that there is no unusual exposure associated with the collection of these accounts receivable.

- (a)

- As at September 30, 2005, the accounts receivable include amounts receivable from three major customers which represent approximately 48% (51% in 2004) of the Company's total accounts receivable (see Note 19).

54

7. INVENTORIES

| | 2005

| | 2004

|

|---|

| | $

| | $

|

|---|

| Raw materials and packaging material | | 18,710 | | 10,311 |

| Work in progress | | 1,547 | | 1,781 |

| Finished goods | | 15,759 | | 25,178 |

| | |

| |

|

| | | 36,016 | | 37,270 |

| | |

| |

|

8. INCOME TAXES

The deferred income tax assets and liabilities result from differences between the tax value and book value of the following items:

| | 2005

| | 2004

|

|---|

| | $

| | $

|

|---|

| Short-term deferred income tax assets | | | | |

| | Inventories | | 4,187 | | 376 |

| | Prepaid expenses and deposits | | — | | 167 |

| | Accounts payable and accrued liabilities | | 3,755 | | 2,941 |

| | Pending legal settlements | | 1,102 | | 1,102 |

| | |

| |

|

| | | 9,044 | | 4,586 |

| | |

| |

|

| Long-term deferred income tax assets | | | | |

| | Share issue expenses | | 412 | | 930 |

| | |

| |

|

| | | 412 | | 930 |

| | |

| |

|

| Short-term deferred income tax liabilities | | | | |

| | Accounts receivable | | 409 | | 379 |

| | Inventories | | — | | 109 |

| | Prepaid expenses and deposits | | 193 | | 434 |

| | Investments | | — | | 14 |

| | |

| |

|

| | | 602 | | 936 |

| | |

| |

|

| Long-term deferred income tax liabilities | | | | |

| | Property, plant and equipment | | 2,381 | | 2,484 |

| | Intangible assets | | 34,341 | | 34,619 |

| | Goodwill | | 682 | | 682 |

| | Long-term debt | | 627 | | — |

| | Research and development expenses | | 1,104 | | 505 |

| | |

| |

|

| | | 39,135 | | 38,290 |

| | |

| |

|

55

| | 2005

| | 2004

| | 2003

| |

|---|

| | $

| | $

| | $

| |

|---|

| Current | | 11,674 | | 15,628 | | 11,144 | |

| | |

| |

| |

| |

| Deferred | | | | | | | |

| | Creation and reversal of temporary differences | | (3,054 | ) | 6,625 | | 2,678 | |

| | Change in promulgated rates | | (207 | ) | — | | (830 | ) |

| | |

| |

| |

| |

| | | (3,261 | ) | 6,625 | | 1,848 | |

| | |

| |

| |

| |

| | | 8,413 | | 22,253 | | 12,992 | |

| | |

| |

| |

| |

| Domestic | | | | | | | |

| | Current | | (2,734 | ) | (338 | ) | (1,763 | ) |

| | Deferred | | (941 | ) | 2,756 | | 574 | |

| | |

| |

| |

| |

| | | (3,675 | ) | 2,418 | | (1,189 | ) |

| | |

| |

| |

| |

| Foreign | | | | | | | |

| | Current | | 14,408 | | 15,966 | | 12,907 | |

| | Deferred | | (2,320 | ) | 3,869 | | 1,274 | |

| | |

| |

| |

| |

| | | 12,088 | | 19,835 | | 14,181 | |

| | |

| |

| |

| |

| | | 8,413 | | 22,253 | | 12,992 | |

| | |

| |

| |

| |

The Company's effective income tax rate differs from the combined statutory federal and provincial income tax rate in Canada (31.02% for 2005, 31.52% for 2004 and 33.59% for 2003). This difference arises from the following:

| | 2005

| | 2004

| | 2003

| |

|---|

| | %

| | $

| | %

| | $

| | %

| | $

| |

|---|

| Combined basic rate applied to pre-tax income | | 31.02 | | 10,807 | | 31.52 | | 22,373 | | 33.59 | | 11,057 | |

| Increase (decrease) in taxes resulting from: | | | | | | | | | | | | | |

| | Large corporations tax | | 0.17 | | 60 | | 0.04 | | 29 | | — | | — | |

| | Change in promulgated rates | | (0.59 | ) | (207 | ) | — | | — | | (2.52 | ) | (830 | ) |

| | Difference with foreign tax rates | | (0.73 | ) | (255 | ) | (2.47 | ) | (1,752 | ) | 4.54 | | 1,495 | |

| | Non-deductible items | | 4.51 | | 1,570 | | 1.79 | | 1,268 | | 2.90 | | 953 | |

| | Non-taxable items and other | | (2.71 | ) | (943 | ) | (0.65 | ) | (460 | ) | (1.35 | ) | (445 | ) |

| | Foreign withholding taxes | | — | | — | | 2.76 | | 1,958 | | 3.80 | | 1,250 | |

| | Investment tax credits | | (7.52 | ) | (2,619 | ) | (1.64 | ) | (1,163 | ) | (1.49 | ) | (488 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | | 24.15 | | 8,413 | | 31.35 | | 22,253 | | 39.47 | | 12,992 | |

| | |

| |

| |

| |

| |

| |

| |

No provision has been made for income taxes on the undistributed earnings of the Company's foreign subsidiaries as at September 30, 2005 which the Company intends to indefinitely reinvest.

56

9. PROPERTY, PLANT AND EQUIPMENT

| | 2005

|

|---|

| | Cost

| | Accumulated

depreciation

| | Net

|

|---|

| | $

| | $

| | $

|

|---|

| Land | | 2,097 | | — | | 2,097 |

| Buildings | | 20,319 | | 3,374 | | 16,945 |

| Furniture and equipment | | 15,612 | | 8,599 | | 7,013 |

| Automotive equipment | | 65 | | 34 | | 31 |

| Computer equipment | | 10,248 | | 5,484 | | 4,764 |

| Leasehold and building improvements | | 1,039 | | 216 | | 823 |

| | |

| |

| |

|

| | | 49,380 | | 17,707 | | 31,673 |

| | |

| |

| |

|

| | 2004

|

|---|

| | Cost

| | Accumulated

depreciation

| | Net

|

|---|

| | $

| | $

| | $

|

|---|

| Land | | 1,581 | | — | | 1,581 |

| Buildings | | 20,311 | | 3,413 | | 16,898 |

| Furniture and equipment | | 15,751 | | 7,975 | | 7,776 |

| Automotive equipment | | 65 | | 14 | | 51 |

| Computer equipment | | 7,542 | | 3,126 | | 4,416 |

| Leasehold and building improvements | | 810 | | 280 | | 530 |

| | |

| |

| |

|

| | | 46,060 | | 14,808 | | 31,252 |

| | |

| |

| |

|

Acquisitions of property, plant and equipment amount to $5,997,554 ($14,288,431 in 2004 and $4,291,768 in 2003).

The cost and accumulated depreciation of equipment under capital leases amount to $5,195,119 and $2,300,375, respectively ($5,351,295 and $1,659,955, respectively in 2004).

57

10. INTANGIBLE ASSETS

| | 2005

|

|---|

| | Cost

| | Accumulated

amortization

| | Net

|

|---|

| | $

| | $

| | $

|

|---|

| Trademarks, trademark licenses and manufacturing rights with a: | | | | | | |

| | Finite life | | 334,749 | | 45,841 | | 288,908 |

| | Indefinite life | | 112,430 | | 12,417 | | 100,013 |

| | |

| |

| |

|

| | | 447,179 | | 58,258 | | 388,921 |

| | |

| |

| |

|

| | 2004

|

|---|

| | Cost

| | Accumulated

amortization

| | Net

|

|---|

| | $

| | $

| | $

|

|---|

| Trademarks, trademark licenses and manufacturing rights with a: | | | | | | |

| | Finite life | | 280,034 | | 29,869 | | 250,165 |

| | Indefinite life | | 170,127 | | 12,417 | | 157,710 |

| | |

| |

| |

|

| | | 450,161 | | 42,286 | | 407,875 |

| | |

| |

| |

|

The cost of the product PANZYTRAT has been transferred on October 1, 2004 from intangible assets with an indefinite life to intangible assets with a finite life following changes in the regulatory rules applicable to this product and resulting in the modification of its useful life. The net cost of this product as of October 1, 2004, which amounted to $56,817,802, is therefore amortized over a 25-year period.

Acquisitions of intangible assets amount to $51,103 ($149,627,653 in 2004 and $76,092,927 in 2003). The current intangible assets with a finite life have a weighted-average remaining amortization period of approximately 17 years (18 years as of September 30, 2004).

The annual amortization expenses without taking into account any future acquisitions expected for the years 2006 through 2010 are as follows:

| | $

|

|---|

| 2006 | | 16,551 |

| 2007 | | 16,551 |

| 2008 | | 16,551 |

| 2009 | | 16,551 |

| 2010 | | 16,551 |

58

11. GOODWILL

| | 2005

| | 2004

|

|---|

| | $

| | $

|

|---|

| Cost | | 31,073 | | 31,073 |

| Accumulated amortization | | 3,606 | | 3,606 |

| | |

| |

|

| Net | | 27,467 | | 27,467 |

| | |

| |

|

12. AUTHORIZED LINE OF CREDIT

The Company has a credit agreement relative to a $125,000,000 financing. The credit agreement consists of a 364-day extendible revolving facility with a two-year term-out option maturing on September 21, 2008 (September 22, 2007 in 2004). The termout option provides for quarterly instalments equal to 8.57% of the amount then outstanding on the facility with a final instalment of 40%.

The Company's credit facility is secured by a first security interest on all present and future acquired assets of the Company and its material subsidiaries, and provides for the maintenance of certain financial ratios. Cash dividends, repurchase of shares (other than redeemable shares issued in connection with a permitted acquisition) and similar distributions to shareholders are limited to 10% of the Company's net income for the preceding fiscal year.

The interest rate varies depending on the Company's leverage between 25 basis points and 100 basis points over prime rate and between 125 basis points and 200 basis points over the LIBOR rate or bankers acceptances. The line of credit also provides for a stand-by fee of between 25 and 37.5 basis points. The credit facility may be drawn in U.S. dollars, in Canadian dollars or in Euros equivalent. As at September 30, 2005 and 2004 there was no amount outstanding under the line of credit.

13. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

| | 2005

| | 2004

|

|---|

| | $

| | $

|

|---|

| Accounts payable | | 14,808 | | 13,259 |

| Contract rebates, product returns and accrued chargebacks | | 12,886 | | 9,430 |

| Accrued interest on subordinated notes | | 2,447 | | 2,530 |

| Accrued royalty fees | | 5,584 | | 5,340 |

| Accrued salaries | | 2,202 | | 3,228 |

| Accrued bonuses | | 2,637 | | 2,804 |

| Accrued research and development expenses | | 5,207 | | 3,447 |

| Other accrued liabilities | | 4,319 | | 4,979 |

| Pending legal settlements | | 2,900 | | 2,900 |

| | |

| |

|

| | | 52,990 | | 47,917 |

| | |

| |

|

59

14. LONG-TERM DEBT

| | 2005

| | 2004

|

|---|

| | $

| | $

|

|---|

| Convertible subordinated notes, 4.25%, interest payable semi-annually starting October 15, 2003, convertible into 8,924,113 common shares, maturing April 15, 2008.(a) | | 125,000 | | 125,000 |

| Bank loans 3.80% (secured by immovable hypothecs on land and buildings having a net book value of $6,826,494 in 2004), payable in quarterly instalments of $194,400, principal and interest, maturing in 2007. | | 1,310 | | 2,174 |

| Obligations under capital leases, interest rates varying between 3.81% and 6.2% payable in monthly instalments, principal and interest, maturing on different dates until 2009. | | 1,519 | | 2,520 |

| | |

| |

|

| | | 127,829 | | 129,694 |

| Instalments due within one year | | 1,497 | | 1,778 |

| | |

| |

|

| | | 126,332 | | 127,916 |

| | |

| |

|

- (a)

- The noteholders may convert their notes during any quarterly conversion period if the closing price per share for at least 20 consecutive trading days during the 30 consecutive trading-day period ending on the first day of the conversion period exceeds 110% of the conversion price in effect on that thirtieth trading day. The noteholders may also convert their notes during the five business-day period following any 10 consecutive trading-day period in which the daily average of the trading prices for the notes was less than 95% of the average conversion value for the notes during that period. Finally, the noteholders may also convert their notes upon the occurrence of specified corporate transactions or, if the company has called the notes for redemption. On or after April 20, 2006, the Company may at its option, redeem the notes, in whole or in part at redemption prices varying from 101.70% to 100.85% of the principal amount plus any accrued and unpaid interest to the redemption date. The notes also include provisions for the redemption of all the notes for cash at the option of the Company following some changes in tax treatment.

As at September 30, 2005, minimum instalments on long-term debt for the next years are as follows:

| | Obligations

under capital

leases

| | Other long

term loans

|

|---|

| | $

| | $

|

|---|

| 2006 | | 814 | | 738 |

| 2007 | | 469 | | 572 |

| 2008 | | 257 | | 125,000 |

| 2009 | | 89 | | — |

| | |

| | |

| | | 1,629 | | |

| Interest included in the minimum lease payments | | 110 | | |

| | |

| | |

| | | 1,519 | | |

| | |

| | |

60

15. CAPITAL STOCK

Preferred shares

The Company has an unlimited number of authorized preferred shares without par value, issuable in series, rights, privileges and restrictions determined at the creation date.

Two series of preferred shares have been created as follows:

Series A, shares authorized:14,175,000 non-voting, annual preferential cumulative dividend of 5%, redeemable on or prior to June 8, 2001 at CDN$1.00 per share payable at the option of the Company in cash or by the issuance of common shares or in any combination of cash and common shares.

Series B, shares authorized 12,000,000 non-voting, redeemable on the fifth anniversary of their issuance at CDN$1.00 per share payable in cash or by the issuance of common shares at the option of the Company, convertible into common shares at the holder's option on the basis of one common share for each 15 Series B preferred shares.

Common stock option plan

The common stock option plan is intended for eligible directors, principal senior executives and employees. The number of stock options that can be granted under this plan cannot exceed 4,500,000. Options are granted at the fair market value of the common stock on the last trading day prior to the granting date. Options may be exercised at a rate of 20% per year and expire ten years after the granting date except for the annual options granted to outside directors which may be exercised one year after the granting date.

The changes to the number of stock options outstanding are as follows:

| | 2005

| | 2004

| | 2003

|

|---|

| | Number of options

| | Weighted average exercise price

| | Number of options

| | Weighted average exercise price

| | Number of options

| | Weighted average exercise price

|

|---|

| |

| | $

| |

| | $

| |

| | $

|

|---|

| Balance, beginning of year | | 2,600,556 | | 11.86 | | 2,681,840 | | 10.12 | | 2,429,078 | | 9.67 |

| Granted | | 692,100 | | 16.19 | | 738,350 | | 15.44 | | 531,850 | | 11.36 |

| Exercised | | (119,839 | ) | 8.93 | | (558,016 | ) | 8.78 | | (141,122 | ) | 7.82 |

| Cancelled | | (186,069 | ) | 13.96 | | (261,618 | ) | 11.23 | | (137,966 | ) | 10.73 |

| | |

| |

| |

| |

| |

| |

|

| Balance, end of year | | 2,986,748 | | 12.87 | | 2,600,556 | | 11.86 | | 2,681,840 | | 10.12 |

| | |

| |

| |

| |

| |

| |

|

| Options exercisable at end of year | | 1,409,939 | | 10.97 | | 954,459 | | 9.93 | | 965,909 | | 9.00 |

| | |

| |

| |

| |

| |

| |

|

Stock options outstanding at September 30, 2005 are as follows:

| | Options outstanding

| | Options exercisable

|

|---|

Exercise price

| | Number

| | Weighted average remaining contractual life

| | Weighted average exercise price

| | Number

| | Weighted average exercise price

|

|---|

| |

| |

| | $

| |

| | $

|

|---|

| $4.06 — $5.00 | | 10,000 | | 4.22 | | 4.06 | | 10,000 | | 4.06 |

| $5.01 — $7.00 | | 23,100 | | 3.87 | | 6.51 | | 23,100 | | 6.51 |

| $7.01 — $10.00 | | 724,007 | | 4.73 | | 8.52 | | 652,489 | | 8.36 |

| $10.01 — $13.00 | | 656,981 | | 6.62 | | 11.62 | | 384,980 | | 11.76 |

| $13.01 — $16.00 | | 865,710 | | 7.95 | | 14.06 | | 231,570 | | 13.80 |

| $16.01 — $19.00 | | 619,450 | | 8.98 | | 16.98 | | 36,300 | | 18.30 |

| $19.01 — $19.99 | | 87,500 | | 8.39 | | 19.99 | | 71,500 | | 19.99 |

| | |

| |

| |

| |

| |

|

| | | 2,986,748 | | 7.06 | | 12.87 | | 1,409,939 | | 10.97 |

| | |

| |

| |

| |

| |

|

61

The weighted average fair value of granted stock options was $7.01, $6.80 and $5.41 for the years ended September 30, 2005, 2004 and 2003.

The fair values of all stock options granted during 2005, 2004 and 2003 were estimated as of the date of grant using the Black-Scholes option pricing model with the following weighted average assumptions:

| | 2005

| | 2004

| | 2003

|

|---|

| Expected option life (years) | | 6 | | 6 | | 6 |

| Volatility | | 43% | | 44% | | 46% |

| Risk-free interest rate | | 3.94% | | 4.17% | | 4.43% |

| Expected dividend | | — | | — | | — |

The Black-Scholes model, used by the Company to calculate option values, as well as other currently accepted option valuation models, were developed to estimate the fair value of freely tradable, fully transferable options without vesting restrictions, which significantly differ from the Company's stock option awards. These models also require highly subjective assumptions, including future stock price volatility and expected time until exercise, which greatly affect the calculated values. Accordingly, management believes that these models do not necessarily provide a reliable single measure of the fair value of the Company's stock option awards.

16. FINANCIAL INFORMATION INCLUDED IN THE CONSOLIDATED STATEMENT OF OPERATIONS

| | 2005

| | 2004

| | 2003

|

|---|

| | $

| | $

| | $

|

|---|

| Interest on long-term debt | | 5,542 | | 5,614 | | 3,340 |

| Bank charges | | 165 | | 127 | | 297 |

| Financing fees | | 333 | | — | | — |

| Amortization of deferred debt issue expenses | | 1,100 | | 1,144 | | 646 |

| | |

| |

| |

|

| | | 7,140 | | 6,885 | | 4,283 |

| | |

| |

| |

|

| | 2005

| | 2004

| | 2003

| |

|---|

| | $

| | $

| | $

| |

|---|

| Non-controlling interest | | — | | — | | (103 | ) |

| Rental expenses | | 1,148 | | 1,216 | | 1,228 | |

| Shipping and handling expenses | | 4,901 | | 4,349 | | 3,477 | |

| Advertising expenses | | 16,592 | | 15,155 | | 10,524 | |

| Depreciation of property, plant and equipment | | 5,339 | | 3,720 | | 3,467 | |

| Amortization of intangible assets | | 16,193 | | 12,639 | | 4,596 | |

| Share in net loss of joint ventures | | — | | (455 | ) | (106 | ) |

The Company incurred professional fees with entities, in which directors of the Company are partner or shareholder, totalling $400,396 for the year ended September 30, 2005 ($556,724 in 2004 and $385,862 in 2003). These transactions were concluded in the normal course of operations, at the amount agreed to by related parties.

62

c) Income per common share

The following table reconciles the numerators and denominators of the basic and diluted income per share computations.

| | 2005

| | 2004

| | 2003

|

|---|

| | $

| | $

| | $

|

|---|

| Net income available to common shareholders | | | | | | |

| | Basic | | 26,425 | | 48,728 | | 19,925 |

| | Interest and amortization of deferred debt issue expenses relating to the convertible subordinated notes, net of income taxes | | 4,257 | | 4,200 | | — |

| | |

| |

| |

|

| | Net income available to common shareholders on a diluted basis | | 30,682 | | 52,928 | | 19,925 |

| | |

| |

| |

|

|

|

2005

|

|

2004

|

|

2003

|

|---|

| Weighted average number of common shares | | | | | | |

| | Weighted average number of common shares outstanding | | 45,617,703 | | 45,286,199 | | 44,914,944 |

| | Effect of dilutive stock options | | 677,386 | | 820,872 | | 472,599 |

| | Effect of dilutive purchase price | | — | | — | | 220,449 |

| | Effect of dilutive convertible subordinated notes | | 8,924,113 | | 8,924,113 | | — |

| | |

| |

| |

|

| | Adjusted weighted average number of common shares outstanding | | 55,219,202 | | 55,031,184 | | 45,607,992 |

| | |

| |

| |

|

Number of common shares outstanding as at November 4, 2005 |

|

45,686,544 |

|

|

|

|

| | |

| | | | |

Options to purchase 706,950 common shares (283,000 for 2004 and 754,100 for 2003) were outstanding but were not included in the computation of diluted income per share as the exercise price of the options was greater than the average market price of the common shares. As of September 30, 2003, the subordinated notes convertible into 8,924,113 common shares had no effect on the diluted income per share.

17. FINANCIAL INFORMATION INCLUDED IN THE CONSOLIDATED STATEMENT OF CASH FLOWS

| | 2005

| | 2004

| | 2003

| |

|---|

| | $

| | $

| | $

| |

|---|

| Accounts receivable | | 8,648 | | (27,795 | ) | 5,569 | |

| Income taxes receivable | | 1,610 | | (3,773 | ) | (4,438 | ) |

| Inventories | | 1,490 | | (17,157 | ) | (417 | ) |

| Prepaid expenses and deposits | | 1,861 | | (703 | ) | (892 | ) |

| Accounts payable and accrued liabilities | | 4,429 | | 3,191 | | 16,547 | |

| Income taxes payable | | 3,995 | | (4,051 | ) | 3,207 | |

| | |

| |

| |

| |

| | | 22,033 | | (50,288 | ) | 19,576 | |

| | |

| |

| |

| |

| | 2005

| | 2004

| | 2003

|

|---|

| | $

| | $

| | $

|

|---|

| Interest received | | 1,256 | | 1,035 | | 1,427 |

| Interest paid | | 5,626 | | 6,122 | | 342 |

| Income taxes paid | | 6,984 | | 23,620 | | 12,417 |

63

18. JOINT VENTURES

The Company's interest in the joint ventures is accounted for by the equity method. During fiscal 2004, the Company wrote off its investment in these joint ventures for an amount of $511,233.

19. SEGMENTED INFORMATION

The Company considers that it operates in a single field of activity, the pharmaceutical industry.

No customer represents more than 10% of the Company's revenue except for three major customers for which the sales represented 62.1% of revenue for the year ended September 30, 2005 (55.8% and 49.6% in 2004 and 2003) and are detailed as follows:

| | 2005

| | 2004

| | 2003

|

|---|

| | %

| | %

| | %

|

|---|

| Customer A | | 30.2 | | 18.4 | | 18.6 |

| Customer B | | 20.9 | | 24.3 | | 15.6 |

| Customer C | | 11.0 | | 13.1 | | 15.4 |

| | |

| |

| |

|

| | | 62.1 | | 55.8 | | 49.6 |

| | |

| |

| |

|

Purchases from one supplier represent approximately 15% of the cost of goods sold for the year ended September 30, 2005 (15% in 2004 and 26% in 2003).

The Company purchases its inventory from third party manufacturers, many of whom are the sole source of products for the Company. The failure of such manufacturers to provide an uninterrupted supply of products could adversely impact the Company's ability to sell such products.

The Company operates in the following geographic segments:

| | 2005

| | 2004

| | 2003

|

|---|

| | $

| | $

| | $

|

|---|

| Revenue | | | | | | |

| | Canada | | | | | | |

| | | Domestic sales | | 34,412 | | 28,002 | | 20,555 |

| | | Foreign sales | | — | | — | | — |

| | United States | | | | | | |

| | | Domestic sales | | 155,261 | | 162,810 | | 113,875 |

| | | Foreign sales | | 4,394 | | 3,921 | | — |

| | Europe | | | | | | |

| | | Domestic sales | | 46,225 | | 43,830 | | 39,971 |

| | | Foreign sales | | 10,857 | | 4,846 | | 4,531 |

| | Other | | 194 | | 225 | | 152 |

| | |

| |

| |

|

| | | 251,343 | | 243,634 | | 179,084 |

| | |

| |

| |

|

| Property, plant, equipment, intangible assets and goodwill | | | | | | |

| | Canada | | 39,506 | | 40,401 | | |

| | United States | | 127,915 | | 131,242 | | |

| | Europe | | 252,509 | | 265,417 | | |

| | Other | | 28,131 | | 29,534 | | |

| | |

| |

| | |

| | | 448,061 | | 466,594 | | |

| | |

| |

| | |

64

20. FINANCIAL INSTRUMENTS

Currency risk

The Company is exposed to financial risk arising from fluctuations in foreign exchange rates and the degree of volatility of the rates. The Company does not use derivative instruments to reduce its exposure to foreign currency risk. As of September 30, 2005, the financial assets totalling $135,130,000 include cash and cash equivalent and accounts receivable for CDN$4,294,426 and 13,834,975 Euros respectively (CDN$4,013,755 and 10,159,531 Euros in 2004). The financial liabilities totalling $180,819,000 include accounts payable and accrued liabilities and long-term debt for CDN$10,865,290 and 13,723,991 Euros respectively (CDN$9,468,703 and 14,194,159 Euros in 2004).

Fair value of the financial instruments on the balance sheet

The estimated fair value of the financial instruments is as follows:

| | 2005

| | 2004

|

|---|

| | Fair value

| | Carrying

amount

| | Fair value

| | Carrying

amount

|

|---|

| | $

| | $

| | $

| | $

|

|---|

| Assets | | | | | | | | |

| | Cash and cash equivalents | | 79,969 | | 79,969 | | 21,979 | | 21,979 |

| | Short-term investments | | 17,619 | | 17,619 | | 15,922 | | 15,922 |

| | Accounts receivable | | 37,542 | | 37,542 | | 44,607 | | 44,607 |

| Liabilities | | | | | | | | |

| | Accounts payable and accrued liabilities | | 52,990 | | 52,990 | | 47,917 | | 47,917 |

| | Long-term debt | | 132,870 | | 127,829 | | 162,674 | | 129,694 |

The following methods and assumptions were used to calculate the estimated fair value of the financial instruments on the balance sheet.

a) Financial instruments valued at carrying amount

The estimated fair value of certain financial instruments shown on the balance sheet is equivalent to their carrying amount because they are realizable in the short-term or because their carrying amount approximates the fair value. These financial instruments include cash and cash equivalents, short-term investments, accounts receivable and accounts payable and accrued liabilities.

b) Long-term debt

The fair value of long-term debt has been established by discounting the future cash flows at interest rates corresponding to those the Company would have obtained at year end date for loans with similar maturity dates and terms. The fair value of the convertible subordinated notes is equivalent to the trading price at the end of the year.

21. COMMITMENTS AND CONTINGENCIES

a) Commitments

The Company has entered into non-cancelable operating leases and service agreements expiring on different dates until September 30, 2010 for the rental of office space, automotive equipment and other equipment and for sales management and research and development services. One of the office space leases contains an escalation clause providing for payment of additional rent.

Minimum future payments under these commitments are as follows:

| | $

|

|---|

| 2006 | | 1,908 |

| 2007 | | 891 |

| 2008 | | 912 |

| 2009 | | 291 |

| 2010 | | 6 |

| | |

|

| | | 4,008 |

| | |

|

65

The Company entered into an agreement with Nordmark Arzneimittel GmbH & Co to create a joint venture to develop patentprotected novel enzyme preparations. Under the terms of this agreement, the Company agreed to contribute up to a cumulative amount of $1,500,000 to the joint venture. As at September 30, 2005, a total amount of $1,100,000 ($600,000 in 2004) has been contributed.

b) Contingencies

The subsidiary Axcan Scandipharm has been named as a defendant in several legal proceedings related to the products line it markets under the name ULTRASE. Of the 12 lawsuits to date, Axcan Scandipharm was dismissed from one, nonsuited in another and settled ten. These lawsuits were filed against Axcan Scandipharm and certain other named defendants, including the enzyme manufacturer, stemming from allegations that, among other things, Axcan Scandipharm's enzyme products caused colonic strictures. At this time, it is difficult to predict if there will be other claims or their number and because of the young age of the patients involved, Axcan Scandipharm's product liability exposure for this issue in the United States will remain for a number of years. Axcan Scandipharm's insurance carriers have defended the lawsuits to date and Axcan expects them to continue to defend Axcan Scandipharm (to the extent of its product liability insurance) should other lawsuits be filed in the future.

In addition, the enzyme manufacturer and certain other companies have claimed a right to recover amounts paid defending and settling these claims as well as a declaration that Axcan Scandipharm and another named defendant must provide indemnification against future claims. This lawsuit is based on contractual and indemnity issues and the parties have agreed to settle their dispute through binding arbitration. The arbitration was decided in part on September 19, 2005, in Axcan Scandipharm's favour and plaintiff's claims were rejected. On October 20, 2005, plaintiffs filed before the same arbitrator a motion in which they claim that the arbitrator failed to address the matter of the defense costs incurred by plaintiffs in defending the relevant product liability cases or in the alternative that the arbitrator failed to address this matter in his reasoned opinion. In this motion, the plaintiffs allege that the amount at issue may be in excess of $3,700,000. Axcan Scandipharm denies that such reimbursement is owed. The arbitrator has not yet ruled upon this new motion. Also, Axcan Scandipharm had brought counterclaims against the plaintiffs in the original proceedings, and the arbitrator has not yet ruled upon these counterclaims.

As at September 30, 2005 and 2004, the Company has accrued $2,900,000 to cover any future settlements in connection with the indemnification claim and the lawsuits discussed above that may not be covered by, or exceed, applicable insurance proceeds. While the Company believes that the insurance coverage and provisions taken to date are adequate, an adverse determination of present or future claims could exceed insurance coverage and amounts currently accrued.

c) Milestone payments

The agreements with QLT PhotoTherapeutics Inc. ("QLT") relating to the purchase of PHOTOFRIN provided for milestone payments to be made by Axcan to QLT that could reach a maximum of CDN$20,000,000 upon receipt of certain regulatory approvals for specific or additional indication for PHOTOFRIN or other conditions. Each milestone payment shall be made at the option of the Company either in cash or in Series B preferred shares or in a combination of cash and preferred shares provided that at least one-half of the milestone payable shall be paid in cash. During the years 2004, 2003 and 2000 CDN$5,000,000, CDN$5,000,000 and CDN$5,000,000 ($3,919,417, $3,646,973 and $3,378,378) was paid by Axcan in cash upon receipt of regulatory approvals and was recorded in intangible assets.

The agreement to acquire the exclusive license for North America, the European Union and Latin America to develop, manufacture and market ITAX provides for milestone payments for an amount of $20,000,000 upon regulatory submission and an amount of $45,000,000 upon regulatory approval. The Company will also pay royalties of 9% of net sales from the date of first commercial sale until the expiration of the patent and 6% for ten years then after.

d) Royalties

Net sales of certain products of the Company are subject to royalties payable to unrelated third parties.

In particular, the Company must pay, since October 2003, a 6% royalty on the first $30,000,000 of annual net sales of ULTRASE and 5% on annual net sales in excess of $30,000,000 subject to a minimum of $750,000, $1,000,000 and $1,500,000 in the first three years of the agreement and a 5% royalty on the net sales of ADEK's respectively covered under agreements for the exclusive rights to market these products.

Axcan has to pay 5% of worldwide sales of PHOTOFRIN with a maximum of $500,000 per year and a maximum total aggregate of $3,108,245 until December 2007. As of September 30, 2005, an amount of $1,828,636 has been accounted for ($1,420,419 in 2004 and $1,032,777 in 2003). Axcan also has to pay 5% of net sales of PHOTOFRIN for use in the therapeutic treatment of cancer and 2% of net sales for other uses until December 2009. Axcan also has to pay a 2% royalty on net sales of URSO in the United States.

Royalties amounting to $3,695,087, $3,760,945 and $4,387,092 respectively for years ended September 30, 2005, 2004 and 2003 were charged to operations.

66

e) Licensing

Axcan entered into a licensing agreement with the Children's Hospital Research Foundation for a serie of sulfated derivatives of ursodeoxycholigic acid compounds" ("SUDCA"). Axcan has, as at September 30, 2005, paid $814,000 in cash. The Company will also pay milestones for a maximum amount of $200,000 when SUDCA will be validated and a bonus when certain conditions are met; finally, Axcan will pay royalties based on sales.

In May 2002, the Company signed a co-development and licensing agreement with NicOx S.A. ("NicOx") for NCX-1000, a nitric oxide-donating ursodiol derivative, for the treatment of chronic liver diseases including portal hypertension and Hepatitis "C". Under the terms of this agreement, the Company has obtained from NicOx an exclusive license to commercialize NCX-1000 in Canada and Poland as well as an option to acquire the same exclusive rights for the United States market. The Company and NicOx will share the cost of the future development of NCX-1000 jointly through the completion of Phase II clinical studies. The Company will thereafter conduct the required Phase III clinical studies and be responsible for regulatory filings in the exclusively licensed territories. The Company will pay NicOx options or milestone payments totalling up to $17,000,000 at various stages of development. An amount of $2,000,000 has been paid in 2003. The Company also agreed to pay royalties of up to 12% on net sales of the product.

On October 10, 2002, the Company acquired from Gentium S.p.A., an Italian company, exclusive rights to develop and market in North America, a patented 4 gram rectal gel formulation of mesalamine (5-ASA) for the treatment of active distal ulcerative colitis. In return the Company will make milestone payments totalling approximately $1,500,000, the majority of which will be paid upon approval in the United States. An amount of approximately $200,000 has been paid in 2003. The Company will also pay a royalty of 4% on net sales for a ten-year period from product's launch.

On July 22, 2003, the Company acquired from Merz Pharmaceutical GmbH ("Merz") an exclusive licence to use, develop and submit for approval of injectable and oral granule formulations containing L-ornithine and L-aspartate. In consideration of the rights and licenses granted by Merz under this agreement, the Company shall pay a royalty of 6% of net sales or 4% of net sales if the Company develops any patentable invention or improvement and Merz incorporates such invention or improvement into its products.

On February 22, 2005, the Company signed a license agreement with Lisapharma S.p.A., an Italian company, to submit for approval and commercialize, in North America, products in gel sachet and tablet dosage forms that contain sucralfate as the main active ingredient. Under the agreement, the Company shall pay license fees of up to $2,000,000 over a period of a maximum of four years (as of September 30, 2005 an amount of $1,000,000 has been recorded as expense) and make milestone payments totalling up to $3,000,000 upon regulatory approvals. The Company also agreed to pay royalties of 6% of net sales of products enjoying patent protection and 3% of net sales of products not enjoying patent protection for up to five years from a first commercial sale.

On May 1, 2005, the Company signed a license and technology agreement with Howard J. Smith & Associates PTY LTD ("HSA") an Australian company, to develop and market products for the treatment of viral hepatitis. The Company will make milestone payments totalling up to $17,000,000 at various stages of development or commercialization. The Company also agreed to pay royalties of 4.5% of net sales in countries where an HSA patent is in force and 2.25% of net sales in countries where no HSA patent is in force for a maximum of ten years after the first commercial sale of a product in the relevant country.