Exhibit 1.5

MEMORANDUM

AND

ARTICLES OF ASSOCIATION

OF

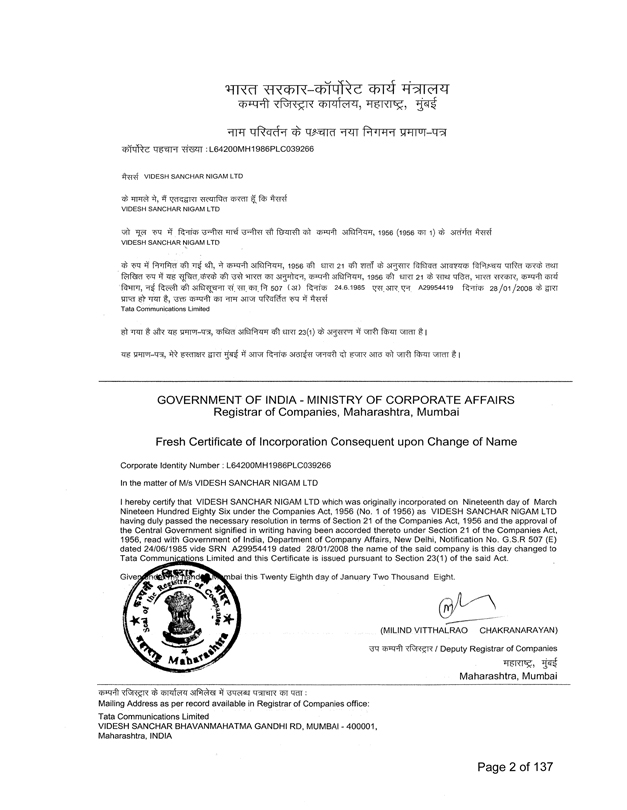

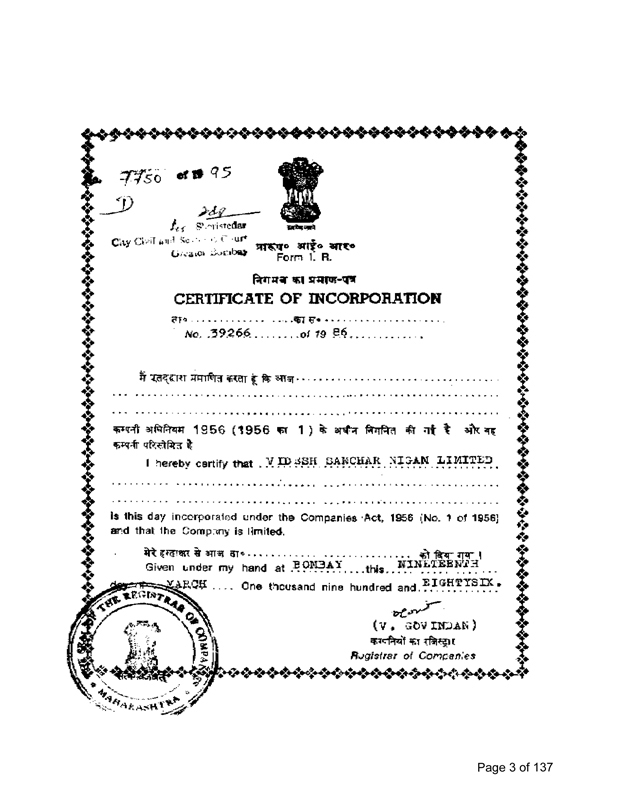

TATA COMMUNICATIONS LIMITED

Registered office :

TATA Communications Limited

VSB, Mahatma Gandhi Road,

Fort, Mumbai – 400001.

3 APRIL 2008

Page 1 of 137

| Tata Communications Limited | Memorandum of Association |

(THE COMPANIES ACT, 1956)

COMPANY LIMITED BY SHARES

MEMORANDUM OF ASSOCIATION

OF

TATA COMMUNICATIONS LIMITED

| 1[I. | The name of the Company isTATA COMMUNICATIONS LIMITED.] | |

| II | The registered office of the Company will be situated in the State of Maharashtra. | |

| III | Objects for which the Company is established are: | |

| A. | THE MAIN OBJECTS OF THE COMPANY TO BE PURSUED BY THE COMPANY ON ITS INCORPORATION ARE: | |

| 1. | Pursuant to an agreement to be entered into to take over the entire management, control, operations and maintenance of the Overseas Communications Service (OCS) of the Department of Telecommunications, Ministry of Communications, Government of India, with all its assets and liabilities including contractual rights and obligations on such terms and conditions as may be prescribed by the Government of India from time to time. | |

| 2. | To plan, establish, develop, provide, operate and maintain all types of international telecommunication net-works, systems and services including Telephone, Telex, Message Relay, Data transmission, Facsimile, Television, Telematics, Value Added Network Services, New Business Services, Audio and Video Services, Maritime and Aeronautical Communication Services and other international telecommunications services as are in use elsewhere or to be developed in future. | |

| 1 | Amended vide Special Resolution of Shareholders passed at the Extraordinary General Meeting held on 14 December 2007. |

| 1 | Page 5 of 137 |

| Tata Communications Limited | Memorandum of Association |

| 3. | To plan, establish, develop, provide, operate and maintain telecommunications systems and networks within India as are found necessary for international telecommunications. | |

| 4. | To provide and maintain international leased telecommunication services. | |

| 2[5. | To design, develop, install, maintain, operate long distance domestic and international basic and value added telecommunications, global mobile telecommunications, electronic mail services, globally managed data networks, data telecom networks, video conferencing, international gateway networks, satellite networks in and outside India by way of Joint Venture partnerships which should be in conformity with overall licensing conditions defined from time to time by Government of India.] | |

| 6. | To raise necessary financial resources for its development needs for telecommunication services/facilities. | |

| B. | THE OBJECTS INCIDENTAL OR ANCILLARY TO THE ATTAINMENT OF THE MAIN OBJECTS ARE AS FOLLOWS: | |

| 7. | To collect and settle revenue, rental, leased charges and other charges payable to the Company by persons, companies, agencies and administrations for the services provided and to utilise the same for furtherance of activities of the Company. | |

| 3{8. | To participate in seminars, expositions and exhibitions and attend meetings of the technical, planning, financial, maintenance, management and administrative committees of international organisations, like International Telecommunication Union, INTELSAT, INMARSAT, CTO, Asia Pacific Telecommunity, Indian Ocean Commonwealth Cable, and India-UAE Cable. | |

| 9 | To acquire from any person, firm or body corporate whether in India and/or outside India in the public or private sector, technical information, know-how, process engineering, manufacturing and operating data, plans, layouts and blue prints | |

| 2 | Clause 5 inserted and subsequent clauses 5 - 57 renumbered as 6 - 58 as per Special Resolution passed at the 13th AGM held on 30 September 1999. |

| 3 | Clause 8 & 9 deleted and subsequent clauses 10 to 58 renumbered as 8 to 56 as per Special Resolution passed at the 16th AGM held on 20 August 2002. |

| 2 | Page 6 of 137 |

| Tata Communications Limited | Memorandum of Association |

| useful for design, erection, construction, commissioning, operation and maintenance of plant and equipment required for any of the business of the Company and to acquire any grant or licence and other rights and benefits in the foregoing matters and things. | ||

| 10. | To buy in India or outside India any plants, equipments and auxiliaries which can be advantageously utilised by the Company to attain its objects and carry on operations or business of any nature which the Company from time to time may deem fit or expedient to carry on in connection with its business at any time being conducted. | |

| 11. | To build, construct, maintain, enlarge, pull down, remove or replace, dispose off, improve or develop and work, manage, and control any buildings, offices, godowns, warehouses, shops, machinery and plant and telephone exchanges, telex exchanges, message relay systems, microwave stations, repeater stations, telecommunications lines, cables, towers, or any other equipment, plant and machinery connected with design, development, construction, maintenance and operation of telecommunications services and conveniences, which may seem calculated directly or indirectly to advance the interests of the Company and to subsidise, contribute to or otherwise assist or take part in doing any of these things, and/or to join with any other person and/or company and/or with any Governmental authority in doing any of these things. | |

| 12. | To establish/construct and maintain or wind up branch offices and/or new offices in and outside India as may be necessary to protect and promote the interests of the Company. | |

| 13. | To carry on the business of manufacture of the equipment required for telecommunication systems, networks and services. | |

| 14. | To purchase or sell, take or give on lease or licence or in exchange, hire or otherwise acquire or dispose any immovable and/or movable property and any rights or privileges which the Company may think necessary or convenient for the purposes of its business or may enhance the value of any other property of the Company and in particular, any land (freehold, leasehold, or other tenure) buildings, easements, machinery, plant and stock-in-trade and on any such lands to erect and to | |

| 3 | Page 7 of 137 |

| Tata Communications Limited | Memorandum of Association |

| lend/advance money for the erection of buildings, factories, sheds, godowns or other structures for the works, for purposes of the Company and also for the residence and amenity of its employees, staff and other workmen and erect and install machinery and plant and other equipment deemed necessary or convenient or profitable for the purposes of the Company. | ||

| 15. | To engage in research, development, study and experiments relating to all the aspects of telecommunications, to collect, prepare and distribute information and statistics relating to any of the aspects pertaining to telecommunications working in India or outside India and to promote or propose such methods, studies and measures as may be considered desirable by or beneficial to the interests of the Company. | |

| 16. | To receive or pay remuneration, assist and finance in India and/or outside India any industrial undertaking, project or enterprise, whether owned or run by Government, Statutory Body, private company, firm or individual with capital credit or resources for execution of its work and business by or to the Company. | |

| 17. | To design, establish, provide, maintain and perform engineering, technical and consultancy services for any administration, person, firm or body corporate, for development of telecommunications projects of all types/descriptions in India and outside India including but not limited to surveys of all types, feasibility reports, detailed project reports, techno-economic investigations, supply of basic engineering and detailed design and making drawings, layouts and blue prints for construction of telecommunication facilities, preparation of tender documents, tender evaluation, purchase assistance, construction, supervision, project management, acceptance testing, commissioning, maintenance, training of personnel and such other services. | |

| 18. | To receive engineering, technical and management consultancy services for telecommunications but not limited to engineering, commercial, and operational management of telecommunications systems, market research and personnel management. | |

| 4 | Page 8 of 137 |

| Tata Communications Limited | Memorandum of Association |

| 19. | (a) To pay for any rights, facilities and property acquired by the Company and to remunerate any person, company, administration, or body whether by cash payment or by allotment of shares, debentures or other securities of the Company credited as paid up in full or in part or otherwise. | |

| (b) To receive payment for any rights, facilities and property provided by the Company and to receive remuneration from any person, company, administration or body either by cash payment, allotment of share, debentures or other securities. | ||

| 20. | Subject to the provisions of the Companies Act, 1956 and directives of Reserve Bank of India, to borrow or raise money or to receive money on deposit or loan including public deposit at interest otherwise in such manner as the Company may think fit and in particular by the issue of the debentures or debenture stock or bonds, perpetual or otherwise, and which may or may not be convertible into shares, in this or any other company, and to secure the repayment of any such money borrowed, raised or received, or owing by mortgage, pledge, charge or lien upon all or any of the property, assets, or revenue of the Company (both present and future) including its uncalled capital and to give the lenders or creditors the power of sale and other powers as may seem expedient to purchase, redeem or pay off any such securities and also by a similar mortgage, charge of lien to secure and guarantee the performance of the company or any person, firm or company or any obligation undertaken by the Company of any other person, firm or company as the case may be. | |

| 21. | To issue or guarantee the issue of or the payment of interest on debentures or other security or obligations of any company or association and to pay or provide for brokerage, commission and underwriting in respect of such issue. | |

| 22. | Subject to the provisions of the Companies Act, 1956 and directives of the Reserve Bank of India, to receive money on deposits for interest or otherwise and to lend or advance money with or without security to such companies, firms or persons and Government departments and on such terms and conditions as may seem expedient and in particular to customers, suppliers and others having dealings with this Company and to guarantee the performance of contracts or obligations by any such persons, companies and firms, provided that the company shall not carry on the business of Banking as defined by the Banking Regulations Act, 1949. | |

| 5 | Page 9 of 137 |

| Tata Communications Limited | Memorandum of Association |

| 23. | To invest and deal with the moneys of the Company not immediately required in such manner as may be thought fit and as determined by the Board of Directors of the Company from time to time. | |

| 24. | To enter into any contracts or arrangements for the more efficient conduct of the business of the Company or any part thereof and to sublet any contracts from time to time. | |

| 4[25. | (i) To negotiate and/or enter into agreements and contracts with individuals, companies, corporations, bodies corporate and/or such other organisations in India and abroad including governments and governmental or semi-governmental bodies of other sovereign states, for obtaining or providing know-how or technical and/or financial collaboration or any other such assistance for carrying out any business or transactions which the Company is authorised to carry on and also for the purpose of activating research and development and to acquire or provide, exploit, use necessary formulae inventions, utility models and patent rights for furthering the objects of the Company. | |

| (ii) Subject to Section 391, 394, and 394A of the Companies Act, 1956, to amalgamate or take over or merge with or reconstruct the business of the Company with any other person, organisation, firm, company, body corporate whether incorporated or not and whether registered in India or otherwise, or enter into partnership or into any other arrangement for sharing of profits, union of interest, co-operation, joint venture, reciprocal concession or co-operation or for limiting competition or otherwise, with any person, persons or company or body corporate or other organisations carrying on or engaged in or about to carry on, or engage in or being authorized to carry on or to bifurcate one or more units of the Company in one or more companies for the interest of the Company and to give or accept by way of consideration for any of the acts or things aforesaid or property acquired, any shares, debentures, debenture-stock or other debt instruments or securities including futures, options, derivatives that may be agreed upon, and to hold and retain, sell, mortgage, pledge, encumber and deal with any shares, debentures, debenture-stock or securities, options, futures, derivatives, instruments so received or offered. Provided that such arrangement is for the purpose of business which the Company is authorised to carry on.] | ||

| 4 | Clause 25 (i) & (ii) amended as per Special Resolution passed at the 16th AGM held on 20 August 2002. |

| 6 | Page 10 of 137 |

| Tata Communications Limited | Memorandum of Association |

26. | To distribute or otherwise as may be resolved, any property or assets of the company or any proceeds of sale or disposal of any property or assets of the company in case of winding up of the company, including the shares, debentures or other securities or any other securities of any other company formed to take over the whole or any part of the assets or liability of the company so that no distribution amounting to a reduction of capital may be made except with the sanction of (if any) for the time being required by law and subject to the provisions of the Companies Act in the event of winding up. | |

27. | To vest any immovable or movable property, rights or interests acquired by or belonging to the company in any person or company on behalf of or for the benefit of the company and with or without any declared trust in favour of the company. | |

5[28. | To carry on the business which the Company is authorised to carry on by means or through the agency of any subsidiary company or other associate or affiliate companies or other business organisation in India or abroad and to enter into any arrangement with any such company for taking the profits and bearing the losses of any business so carried on or for financing any such company or business organisation or guaranteeing its liabilities or obligations or to make any other arrangements which may seem desirable with reference to any other business so carried on by the Company with a power at any time to close any such business either temporarily or permanently and or to appoint Directors or Managers or administrators of any such company or business organisations.] | |

29. | To generally do and perform all the above acts and such other things as may be deemed incidental or conducive to the attainment of the above objects or of any of them. | |

| 5 | Amended as per Special Resolution passed at the 13th AGM held on 30 September 1999. |

| 7 | Page 11 of 137 |

| Tata Communications Limited | Memorandum of Association |

30. | To buy, sell and deal in minerals, plant, machinery, implements, conveniences, provisions and things capable of being used in connection with the business of the company. | |

31. | To purchase, create, generate, or otherwise acquire, use, sell or otherwise dispose of, electric current and electric, steam and water power of every kind and description, and to sell, supply or otherwise dispose of, light, heat and power of every kind and description. | |

32. | To acquire and take over all or any part of the business, goodwill, property and other assets, and to assume or undertake the whole or any part of the liabilities and obligations of any person, form, association or corporate body or Government department carrying on a business which the company is or may become authorised to carry on, and to pay for the same in cash, shares, stocks, debentures or bonds of the company, or otherwise and to hold, manage, operate, conduct, and dispose of in any manner, the whole or any part of any such acquisitions and to exercise all the powers necessary or convenient in and about the conduct and management thereof. | |

33. | To merge, amalgamate or consolidate with any corporate body heretofore or hereafter create in such manner as may be permitted by law. | |

34. | To cause the company to be registered or recognised in any part of the world. | |

35. | To make, draw, accept, endorse, discount, execute and issue cheques, promissory notes, hundies, bills of exchange, bills of ladings, warrants, debentures, and other negotiable or transferable instruments/securities. | |

36. | To do all or any of the above things and all such other things as are incidental or may be thought conducive to the attainment of the above objects or any of them and as principals, agents, contractors, trustees or otherwise and either along or in conjunction with others. | |

37. | To carry out or to have carried out experiment and research in laboratory, pilot plant and on industrial scale, and to incur expenses necessary therefor with a view to improve on the present method and process of working the several business activities which the company is authorised to carry on. | |

| 8 | Page 12 of 137 |

| Tata Communications Limited | Memorandum of Association |

38. | To apply for purchase, or otherwise acquire, and protect and renew in any part of the world any patents, patent rights, bravet d’inventions, trade marks, designs, licences, concessions and the like, conferring any exclusive or non-exclusive or limited rights, their use, or any secret or other information as to any invention which may seem capable of being used for any of the purposes of the company or the acquisition of which may seem calculated directly or indirectly to benefit the company, and to use, exercise, develop or grant licences in respect of, or otherwise turn to account the property, rights or information so acquired, and to expend money in experimenting upon, testing or improving any such patents, inventions or rights and without prejudice to the generality of the above, any contracts, or in relation to the supply and sale of any materials, articles or things for or in relation to the construction, execution, carrying out, improvement, management, administration or control of any works and conveniences required for the purpose of carrying out any of the aforesaid business and to undertake, execute, carry out, dispose of or otherwise turn to account such contracts. | |

39. | To sell, dispose of or transfer any building, industrial undertaking, projects or factory to any company or association or concern carrying on similar business on such terms and conditions as may be determined by the company. | |

40. | To acquire from any Government (Central, State, Local or Foreign) or public body, persons, authority, or from any private individual any concessions, grants, decrees, rights, powers and privileges whatsoever which may seem to the company directly or indirectly conducive to any of its objects or capable of being carried on in connection with its business and to work, develop, carry out, exercise and turn to account the same and to oppose any proceedings or applications which may seem calculated directly or indirectly, to prejudice the company’s interests. | |

41. | To provide against payment of charges or fees as may be prescribed from time to time, residential and/or resting accommodation, medical and welfare facilities for the employees of the company and in connection therewith to afford to such persons, facilities and conveniences for transport, washing, bathing, cooking, reading, writing and for the purchase, sale and consumption of provisions, both liquid and solid and for the safe custody of goods. | |

| 9 | Page 13 of 137 |

| Tata Communications Limited | Memorandum of Association |

42. | To exchange, sell, convey, assign or let on lease or grant licence for the whole or any part of the company’s immovable properties and to accept as consideration or in lieu thereof other land or cash or Government securities, or securities guaranteed by Government or shares in joint stock companies or partly the one and partly the other or such other property or securities as may be determined by the company and to take back or re-acquire any property so disposed of by repurchasing or obtaining a licence or lease on such price or prices and on such terms and conditions as may be agreed upon. | |

43. | To employ foreign or other technicians, experts, advisers, or consultants, or to lend the services or the employees of the company on a contract basis for the furtherance of company’s objectives aforesaid. | |

44. | (a) To train and pay for the training in India or abroad of any of the company’s employees under such terms and conditions as may be prescribed from time to time, and to establish, maintain and operate training institutions for its employees. | |

| (b) To provide attachment or training facilities to Indian or foreign nationals on the terms and conditions agreed upon. | ||

45. | To improve, manage, develop, grant rights or privileges in respect of, or otherwise deal with, all or any part of the property and rights of the company. | |

46. | To promote and form and to be interested in and take hold and dispose of shares in other companies having objects in whole or in part similar to those of the company and to transfer to any such company any property of this company, and to take or otherwise acquire, hold and dispose of shares, debentures and other securities in or of any such company and to subsidise or otherwise assist any such company. | |

47. | To pay out of the funds of the company all costs, charges and expenses which the company may lawfully incur with respect to the promotion, formation and registration of the company or which the company shall consider to be preliminary including therein the cost of advertising, printing and stationery, expenses attendant upon the formation of agencies, branches and local boards. | |

| 10 | Page 14 of 137 |

| Tata Communications Limited | Memorandum of Association |

48. | To establish and maintain or procure the establishment and maintenance of any contributory provident funds, contributory or non-contributory pension or superannuation funds for the benefit of, and give or procure the giving of donations, gratuities, pension, bonus, annuities or other allowances or emoluments to any persons who are or were at any time in the employment and/or service of the company, or of any company which is a subsidiary of the company or is allied to or associated with the company or with any such subsidiary company or who are or were at any time the Directors or officers or staff of the company or of any such other company as aforesaid, and the employees or ex-employees of the company or Government department formerly engaged in any business acquired by the company and the wives, widows, families and dependants of any such persons, and also establish and subsidise and subscribe to any charitable or public object, institutions, society, associations, clubs or funds and by providing or subscribing or contributing toward places of instruction and recreation, hospitals and dispensaries, medical and other attendance and by building or contributing to the building of houses, dwellings, calculated to the benefit of or to advance the interests and well being of the company or of any such other company or department as aforesaid or its employees and to make payment to or towards the insurance of any such person as aforesaid and to any of the matters aforesaid either alone or in conjunction with any such other company as aforesaid. | |

49. | To create any depreciation fund, reserve fund, sinking fund or any other special fund, whether for depreciation or for repairing, improving, extending or maintaining any of the property of the company or for any other purpose conducive to the interest of the company. | |

50. | To adopt such means of making known the business of the company or in which the company is interested as may seem expedient and in particular by advertising in the press, circulars, publication of books and periodicals, audio and audio-visual media, exhibitions and by granting prizes, rewards and concessions. | |

| 11 | Page 15 of 137 |

| Tata Communications Limited | Memorandum of Association |

51. | To enter into, make and perform contracts and arrangements of every kind and description for any lawful purpose with any person, firm, association, corporate body, municipality, body politic, territory, province, state, Government or colony or dependency thereof, without limit as to amount, and to obtain from any Government or authority any rights, privileges, contracts and concessions which the company may deem desirable to obtain, and to carry out, exercise or comply with any such arrangements, rights, privileges, contracts and concessions. | |

52. | To subscribe or guarantee money for any national, charitable, benevolent, public, general or useful object or for any exhibition, or for any purpose which may be considered likely directly or indirectly to further the objects of the company or the interest of its members. | |

53. | To layout and prepare any land for any kind of athletics, sports and for the playing of such sports or kind of amusement or entertainment and to construct the stands and buildings and conveniences for use in connection therewith. | |

54. | To act as agents and as trustees for any person or company and to undertake and perform sub-contracts and to do all or any of the above things in any part of the world and as principals, agents, contractors, trustees or otherwise and by or through agents, sub-contractors, trustees or otherwise and either alone or jointly with others in connection with the business of the company. | |

C. | OTHER OBJECTS: | |

55. | To purchase or otherwise acquire and to hold, own, invest, trade and deal in, mortgage, pledge, assign, sell, transfer or otherwise dispose of goods, equipment, machinery, wares, merchandise and personal property of every class and description and to transport the same in any manner. | |

56. | To carry on the business of a store keeper in all its branches and in particular, to buy, sell and deal in goods, stores, consumable articles, chattels and effects of all kinds, both wholesale and retail.}2 | |

IV. | The liability of the members is limited. | |

| 2 | Clause 8 & 9 deleted and subsequent clauses 10 to 58 renumbered as 8 to 56 as per Special Resolution passed at the 16th AGM held on 20 August 2002. |

| 12 | Page 16 of 137 |

| Tata Communications Limited | Memorandum of Association |

| 6[V. | The authorised Share Capital of the Company is Rs. 300,00,00,000/- (Rupees Three Hundred Crore) divided into 30,00,00,000 (Thirty Crore) Equity Shares of Rs. 10/- (Rupees Ten) each with the rights, privileges and conditions attaching thereto as may be provided by the Articles of Association of the Company for the time being.] |

| 6 | Amended vide Ordinary Resolution passed by the shareholders at 14th AGM held on 26 September 2000. |

| 13 | Page 17 of 137 |

| Tata Communications Limited | Memorandum of Association |

We, the several persons whose names and addresses are subscribed, are desirous of being formed into a company in pursuance of this Memorandum of Association and we respectively agree to take the number of shares in the capital of the company set opposite our respective names.

Name | Address, Description and Occupation | Signature of Subscribers | No. of Shares Equity | Name, Signature, Address, Description & Occupation of witness | ||||

| 1. President of India Through Devendra Kumar Sangal (S/o. Shri Hardhian Singh Jain) Secretary, Telecommunications. | Secretary, Department of Telecommunications, Sanchar Bhavan, New Delhi. | Sd/- | 100 | Daljit Singh, S/o. Shri Jogendar Singh, Dy. Director General, OCS, VSB, New Delhi. | ||||

| 2. Shree Shankar Sharan, S/o. Late Shri Shambhu Sharan | Additional Secretary, Dept. of Telecommunications, Sanchar Bhavan, 20, Ashoka Road, New Delhi | Sd/- | 10 | - DO - | ||||

| 3. V. Devarajan, S/o. Late Shri N. Venkataramanan | Additional Secretary and Financial Adviser, Dept. of Telecommunications, Sanchar Bhavan, New Delhi. | Sd/- | 10 | - DO - | ||||

| 4. K.C. Katiyar, S/o. Bhajanlal Katiyar | Director General, Overseas Communications Service, Bombay. | Sd/- | 1 | V.D. Kulkarni, S/o. D.G. Kulkarni, Director (Admn), OCS, VSB, M.G. Road, Bombay - 400 001. | ||||

| 5. A.W. Furtado, S/o. Late Shri R.T. Furtado | Addl. Director General, Overseas Communications Service, VSB, Bombay. | Sd/- | 1 | Daljit Singh, S/o. Shri Jogendar Singh, Dy. Director General, OCS, VSB, New Delhi. | ||||

| 6. J.K. Chhabra, S/o. Shri D.N. Chhabra | Director, Dept. of Telecommunications, Sanchar Bhavan, 20, Ashoka Road, New Delhi. | Sd/- | 1 | - DO - | ||||

| 7. S.D. Raheja, S/o. Late Shri S.R. Raheja | Dy. Financial Adviser, Dept. of Telecommunications, Sanchar Bhavan, 20, Ashoka Road, New Delhi. | Sd/- | 1 | - DO - | ||||

| 8. R.R. Anand, S/o. Late Shri Gopal Das Anand | Under Secretary, Dept. of Telecommunications, Sanchar Bhavan, 20, Ashoka Road, New Delhi. | Sd/- | 1 | - DO - | ||||

| 9. K.P. Radhakrishnan Kidave, S/o. Shri K.G. Kidave | Under Secretary, Dept. of Telecommunications, Sanchar Bhavan, New Delhi. | Sd/- | 1 | - DO -. | ||||

| 126 ONE HUNDRED TWENTY SIX EQUITY | ||||||||

Dated this 12TH DAY OF MARCH, 1986.

Place - Bombay.

| 14 | Page 18 of 137 |

| Tata Communications Limited | Articles of Association |

(THE COMPANIES ACT, 1956)

COMPANY LIMITED BY SHARES

ARTICLES OF ASSOCIATION

OF

TATA COMMUNICATIONS LIMITED

| Interpretation Clause. | Article 1 - In the interpretation of the Memorandum of Association and these Articles, the following expressions shall have the following meanings, unless repugnant to the subject or context. | |

| The Act/or the said Act. | (a) “The Act” or “the said Act” means “The Companies Act, 1956”, for the time being in force. | |

| These Articles. | (b) “These Articles” means these Articles of Association as originally framed or as from time to time altered by Special Resolution. | |

| 7[Beneficial Owner. | (bB) “Beneficial Owner” means the beneficial owner as defined in clause(a) of sub-section (1) of Section 2 of the Depositories Act, 1996.] | |

| 8[The Company. | (c) “The Company” means TATA COMMUNICATIONS LIMITED.] | |

| The Directors. | (d) “The Directors” means the Directors for the time being of the Company and includes persons occupying the position of Directors by whatever name called. | |

| 9[Depositories Act, 1996 | (dD) “Depositories Act, 1996” includes any statutory modification or re-enactment thereof and | |

| Depository | (dDD) “Depository” means a Depository as defined under clause (e) of sub-section (1) of Section 2 of the Depositories Act, 1996.] | |

| 7 | Inserted vide special resolution passed by the shareholders at 12th AGM held on 21 September 1998. |

| 8 | Amended vide Special Resolution passed by the Shareholders at the Extraordinary General Meeting held on 14 December 2007. |

| 9 | Inserted vide special resolution passed by the shareholders at 12th AGM held on 21 September 1998. |

| 15 | Page 19 of 137 |

| Tata Communications Limited | Articles of Association |

| The Board or Board of Directors. | (e) “The Board,” or the “Board of Directors” means a meeting of the Directors duly called and constituted or as the case may be, the Directors assembled at a Board, or the requisite number of Directors entitled to pass a circular resolution in accordance with the Act. | |

| The Chairman. | (f) “The Chairman” means the Chairman of the Board of Directors for the time being of the Company. | |

| The Managing Director. | (g) “The Managing Director” includes one or more persons appointed as such or any of such persons or Directors for the time being of the Company who may for the time being be the Managing Director of the Company. | |

| The Office. | (h) “The Office” means the Registered Office for the time being of the Company. | |

| The President. | (i) “The President” means the President of India. | |

| Capital. | (j) “Capital” means the Share Capital for the time being raised or authorised to be raised for the purpose of the Company. | |

| Register. | (k) “Register” means the Register of Members of the Company required to be kept pursuant to the Act. | |

| The Registrar. | (l) “The Registrar” means the Registrar of Companies, of the State where the registered office of the Company is situated. | |

| Dividend. | (m) “Dividend” includes bonus shares. | |

| Month. | (n) “Month” means a calendar month. | |

| Seal. | (o) “Seal” means the Common Seal for the time being of the Company. | |

| Proxy. | (p) “Proxy” includes Attorney duly constituted under a Power-of-Attorney. | |

| In writing. | (q) “In writing” and “written” shall include printing, lithography and other modes of representing or reproducing words in a visible form. | |

| Plural Number. | (r) Words importing the singular number also include the plural number and vice versa. | |

| Persons. | (s) Words importing persons include corporations and firms as well as individuals. | |

| Gender. | (t) Words importing masculine gender shall also include the feminine gender. | |

| 16 | Page 20 of 137 |

| Tata Communications Limited | Articles of Association |

| 10[Government of India Government. | (u) “Government of India or Government” means the President of India, as represented by and acting through the Ministry of Communications and Information Technology, Government of India.] | |

| 11[Strategic Partner. | (v) “Strategic Partner” means Panatone Finvest Limited, a company duly incorporated and existing under the provisions of the Companies Act, 1956 and who has purchased 25% of the equity shareholding of the Company from the Government of India, in the year 2002. | |

| Shareholder(s). | (w) “Shareholder(s)” means the Strategic Partner and the Government. | |

| Other Shareholders. | (x) “Other Shareholders” means the shareholders of the Company other than the Strategic Partner and the Government. | |

| All Shareholders. | (y) “All Shareholders” means collectively the Strategic Partner, Government and Other Shareholders. | |

| Parties. | (z) “Parties” means collectively the Government and the Strategic Partner and Party means either of them. | |

| Affiliate. | (aa) “Affiliate”, with respect to a specified Person, means any other Person (a) directly or indirectly Controlling, Controlled by or under common Control with such specified Person; and/or (b) which is a holding company or subsidiary of such specified Person; provided, however, that for the purposes of this Agreement: | |

(i) the terms “holding company” and “subsidiary” shall have the meanings set forth in Section 4 of the Act and; | ||

(ii) in no event shall the Company be deemed an Affiliate of either the Government or the Strategic Partner; | ||

| Controlling, Controlled by or Control. | (bb) “Controlling”, “Controlled by” or “Control”, with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management, business or policies or actions of such Person, whether through the ownership of voting securities, by contract or otherwise, or the power to elect or appoint at least 50% of the directors, managers, partners or other individuals exercising similar authority with respect to such Person(s); | |

| Person. | (cc) “Person” means any individual, sole proprietorship, unincorporated association, unincorporated organization, body corporate, corporation, company, partnership, limited liability company, joint venture, Government Authority or trust or any other entity or organization; | |

| 10 | Modified vide special resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 11 | Inserted vide special resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 17 | Page 21 of 137 |

| Tata Communications Limited | Articles of Association |

| Audited Financial Statement. | (dd) “Audited Financial Statement” shall mean the accounts of the Company as on 31 March 2001 prepared and audited by M/s. Khandelwal Jain & Co. and M/s. Kalyaniwala & Mistry and that have been made available to the Strategic Partner; | |

| Principal(s). | (ee) “Principal(s)” means a Person or Person(s), other than the Government, who Control(s) a Shareholder (other than the Government) in relation to the Strategic Partner; | |

| Shareholders’ Agreement. | (gg) “Shareholders’ Agreement” means the agreement dated 13thFebruary 2002, entered into between the Government and the Strategic Partner, to record the manner in which the business of the Company is to be conducted as between the Government and the Strategic Partner.] | |

| 12[Expression in the Act to bear same meaning in Articles. | (hh) Subject as aforesaid, any words or expressions defined in the Act, shall, except where the subject or context forbids, bear the same meaning in these Articles. | |

| Marginal Notes. | (ii) The marginal notes hereto shall not affect the construction of the Articles.] | |

| Table “A” not to apply. | Article 2- The regulations contained in Table “A” in the first Schedule to the Act shall not apply to the Company. | |

| Company to be governed by these Articles. | Article 3- The regulations for the management of the Company and for the observance of the members thereof and their representatives shall, subject to any exercise of the statutory powers of the Company in reference to the repeal or alternation of or addition to its regulations by special resolution as prescribed or permitted by the Act, be such as are contained in these Articles. | |

| Company’s shares not to be purchased. | Article 4- No part of the funds of the Company shall be employed directly or indirectly in the purchase of or in loans upon the security of the Company’s shares. | |

| CAPITAL AND SHARES | ||

| 13[Share Capital. | Article 5- Authorised share capital of the Company shall be Rs.300,00,00,000 (Rupees Three hundred crores only) divided into 30,00,00,000 (Thirty crores) equity shares of Rs.10/- (Rupees Ten only) each.] | |

| 14[Power to increase share capital. | Article 6- The Board may, from time to time, with the sanction of the Company in a general meeting, increase the share capital by such sum to be divided into shares of such amounts as the resolution shall prescribe.] | |

| 12 | Renumbered vide special resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 13 | Amended vide special resolution passed by the shareholders at 14th AGM held on 26 September 2000. |

| 14 | Amended vide special resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 18 | Page 22 of 137 |

| Tata Communications Limited | Articles of Association |

| Commission. | Article 7- The Company may, at any time, pay commission to any person for subscribing or agreeing to subscribe (whether absolutely or conditionally) for any shares, debentures, or debenture stock of the Company or procuring or agreeing to procure subscription (whether absolute or conditional) for any shares, debentures or debenture stock of the Company but so that if the commission in respect of shares shall be paid or payable out of capital the statutory conditions and requirements shall be observed and complied with and the amount or rate of commission shall not exceed 5% on the price of shares and 2 1/2 % on the price of debentures or debenture stock, in each case subscribed or to be subscribed. The commission may be paid or satisfied in cash or in shares, debentures or debenture stock of the Company. | |

| 15[On what condition new shares may be issued. | Article 8- New shares shall be issued upon such terms and conditions and with such rights and privileges annexed thereto as the general meeting resolving upon the creation thereof shall direct and if no direction be given as the Board shall determine. | |

| How far new shares to rank with existing shares. | Article 9- Except so far as otherwise provided by the conditions of issue, or by these Articles, any capital raised by the creation of new shares shall be considered part of the original capital and shall be subject to the provisions herein contained with reference to the payment of calls and installments, transfer and transmission, lien, voting, surrender and otherwise. Such new shares shall rank pari passu with the existing shares in all respect except for the purposes of dividend that shall be pro rated to the period for which such newly issued shares are in existence. | |

| Reduction of capital. | Article 10- Subject to the provisions of Section 100 to 104 of the Act, the Company may, from time to time, by special resolution reduce its capital by paying off capital or canceling capital which has been lost or is unrepresented by available assets, or is superfluous by reducing the liability on the shares or otherwise as may be expedient, and capital may be paid off upon the footing that it may be called up again or otherwise; and the Board may, subject to the provisions of the Act, accept surrender of shares. | |

| Sub-division and consolidation of shares. | Article 11- The Company in general meeting may, from time to time, sub-divide or consolidate its shares or any of them and exercise any of the other powers conferred by Section 94 of the Act and shall file with the Registrar such notice of exercise of any such powers as may be required by the Act. | |

| Provided however that the provision relating to progressive numbering shall not apply to the shares of the Company which have been dematerialised.] | ||

| Power to modify. | Article 12- If at any time, the capital of the Company by reason of the issue of preference shares or otherwise, is divided into different classes of shares, all or any of the rights attached to the shares of | |

| 15 | Amended vide special resolution passed by the shareholders at 16thAGM held on 20 August 2002. |

| 19 | Page 23 of 137 |

| Tata Communications Limited | Articles of Association |

| each class may, subject to the provisions of Section 106 and 107 of Act be varied with the consent in writing of the holders of at least three-fourth of the issued shares of that class or with the sanction of a special resolution passed at a separate meeting of the holders of issued shares of that class and all the provisions hereinafter contained as to general meeting shall, mutatis mutandis, apply to every such meeting. | ||

| 16[Allotment of shares. | Article 13- Subject to the provisions of these Articles, the shares shall be under the control of the Board of Directors who may allot or dispose of the same, or any of them, to such persons, upon such terms and conditions, at such times, and upon such consideration as the Board may think fit. Provided that option or right to call of shares shall not be given to any person or persons without the sanction of the company in General Meeting.] | |

| Instalments of shares to be duly paid. | Article 14- If by the conditions of allotment of any share, the whole or part of the amount or issue price thereof shall be payable by instalments, every such instalment shall, when due, be paid to the Company by the person who, for the time being, shall be the registered holder of the shares or by his executor or administrator. | |

| Liability of joint-holders of shares. | Article 15- The Joint Holders of a share shall be severally as well as jointly liable for the payment of all instalments and calls due in respect of such share. | |

| How shares may be registered. | Article 16- Shares may be registered in the name of any person, company or other body corporate. Not more than four persons shall be registered as joint-holders of any share. | |

| 17[Share Certificates. | Article 17A- Subject to the provisions of Articles 17B and 17C every person whose name is entered as a member in the register shall, without payment, be entitled to a certificate or more certificates in marketable lot under the common seal of the company specifying the share or shares held by him and the amount paid thereon. Provided that, in respect of a share or shares held jointly by several persons, the Company shall not be bound to issue more than one certificate and delivery of a certificate for a share to one of several joint holders shall be sufficient delivery to all. | |

| 17B - Save as herein otherwise provided, the Company shall be entitled to treat the person whose name appears on the Register of Members as holder of any share or whose name appears as the beneficial owner of shares in the records of the Depository as the absolute owner thereof and accordingly shall not (except as ordered by a Court of competent jurisdiction or as by law required) | ||

| 16 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 17 | Amended vide Special Resolution passed by the shareholders at 12th AGM held on 21 September 1998. |

| 20 | Page 24 of 137 |

| Tata Communications Limited | Articles of Association |

| be bound to recognise any benami trust or equity or equitable, contingent or other claim or interest in such share on the part of any other person whether or not it, shall have express or implied notice thereof. | ||

| 17C - Notwithstanding anything contained herein, the Company shall be entitled to dematerialise pursuant to the provisions of the Depositories Act, 1996 its shares debentures and other securities for subscription in a dematerialised form. The Company shall further be entitled to maintain a Register of Members with the details of Members holding shares both in material and dematerialised form in any media as permitted by law including any form of electronic media.] | ||

| Issue of new share certificate(s) in place of worn out, defaced, lost or destroyed. | Article 18- If a share certificate is worn out, defaced, lost, or destroyed, it may be renewed in accordance with the Share Certificate Rules under the Act on payment of fee not exceeding Rupee one and on such terms, if any, as to evidence and indemnity and the payment of out-of-pocket expenses incurred by the Company in investigating evidence as the Board may think fit. | |

| CALL ON SHARES | ||

| Board of Directors to make calls. | Article 19- (1) The Board of Directors, may from time to time, by a resolution passed at a meeting of the Board (and not by a resolution by circulation) make such call as it thinks fit upon the members in respect of moneys unpaid on the shares held by them respectively, by giving not less than 15 days notice for payment and each member shall pay the amount of every call so made on him to the persons and at the times and places appointed by the Board of Directors. A call may be made payable by instalments. The Board may, at their discretion, extend the time for payment of such calls. | |

| Calls to carry interest. | (2) If any member fails to pay any call due from him on the day appointed for payment thereof or any such extension thereof as aforesaid, he shall be liable to pay interest on the same from the day appointed for the payment thereof to the time of actual payment, at such rate as shall from time to time be fixed by the Board of Directors, but nothing in this Article shall render it compulsory for the Board of Directors to demand or recover any interest from any such member. | |

| Sums payable on allotment or at fixed date to be paid on due dates. | Article 20- (1) Any sum which by the terms of issue of a share becomes payable on allotment or at any fixed date, whether on account of the nominal value of the share or by way of premium, shall for the purposes of these regulations be deemed to be a call duly made and payable on the date on which by the terms of issue such sum becomes payable. | |

| Voluntary advances of uncalled share capital. | (2) (a) The Board may, if it thinks fit, receive from any member willing to advance the same, all or any part of the moneys uncalled and unpaid upon any shares held by him. | |

| 21 | Page 25 of 137 |

| Tata Communications Limited | Articles of Association |

| 18[Interest payable on calls in advance. | (2) (b) Upon all or any of the moneys so advanced may, until the same would, but for such advance, become presently payable, pay interest at such rate not exceeding, unless the Company in general meeting shall otherwise direct, six percent per annum as may be agreed upon between the Board and the member paying the sum in advance and the Board of Directors may, at any time, repay the amount so advanced upon giving to such members three months notice in writing. Moneys paid in advance of calls shall not in respect thereof confer a right to dividend or to participate in the profits of the Company.] | |

| Calls to date from resolution. | Article 21- A call shall be deemed to have been made at the time when the resolution authorising such call was passed at a meeting of the Board of Directors. | |

| Forfeiture of shares. | Article 22- (1) If a member fails to pay any call, or installment of a call, on the day appointed for payment thereof, the Board may, at any time thereafter during such time as any part of the call or installment remains unpaid, serve a notice on him requiring payment of so much of the call or installment as is unpaid together with any interest which may have accrued. | |

| (2) The notice aforesaid shall: | ||

(a) name a further day (not being earlier than the expiry of fourteen days from the date of service of the notice) on or before which the payment required by the notice is to be made; and, | ||

(b) state that, in the event of non-payment on or before the day so named, the shares in respect of which the call was made will be liable to be forfeited. | ||

| (3) If the requirements of any such notice as aforesaid are not complied with, any share in respect of which the notice has been given may, at any time thereafter before the payment required by the notice has been made, be forfeited by a resolution of the Board to that effect. | ||

| (4) A forfeited share may be sold or otherwise disposed of on such terms and in such manner as the Board thinks fit. | ||

| (5) At any time before a sale or disposal as aforesaid, the Board may cancel the forfeiture on such terms as it thinks fit. | ||

| Liability to pay money owing at the time of forfeiture. | Article 23- (1) A person whose shares have been forfeited shall cease to be a member in respect of the forfeited shares, but shall, notwithstanding the forfeiture, remain liable to pay to the Company all moneys which at the date of forfeiture, were presently payable by him to the Company in respect of the shares. | |

| 18 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 22 | Page 26 of 137 |

| Tata Communications Limited | Articles of Association |

| (2) The liability of such persons shall cease if and when the Company shall have received payment in full of all such moneys in respect of the shares. | ||

| Declaration of forfeiture. | Article 24- (1) A duly verified declaration in writing that the declarant is a Director, the Manager or the Secretary, of the Company, and that a share in the Company has been duly forfeited on a date stated in the declaration, shall be conclusive evidence of the facts therein stated as against all persons claiming to be entitled to the share. | |

| (2) The Company may receive the consideration, if any, given for the share on any sale or disposal thereof and may execute a transfer of the share in favour of the person to whom the share is sold or disposed of. | ||

| (3) The transferee shall thereupon be registered as the holder of the share. | ||

| (4) The transferee shall not be bound to see to the application of the purchase money, if any, nor shall his title to the share, be affected by any irregularity or invalidity in the proceedings in reference to or disposal of the share. | ||

| Provisions regarding forfeiture to apply in the case of non-payment of sums payable at a fixed time. | Article 25- The provisions of these Articles as to forfeiture shall apply in the case of non-payment of any sum which by terms of issue of a share, becomes payable at a fixed time, whether on account of the nominal value of the shares or by way of premium, as if the same had been payable by virtue of a call duly made and noticed. | |

| 19[Company’s lien on shares. | Article 26- The Company shall have a first and paramount lien upon every share not being fully paid up, registered in the name of each member (whether solely or jointly with others), and upon the proceeds of sale thereof for moneys called or payable at a fixed time in respect of such shares whether the time for the payment thereof shall have actually arrived or not and no equitable interest in any share shall be created except upon the footing and condition that this Article is to have full effect. Such lien shall extend to all dividends and bonuses from time to time declared in respect of such shares. Unless otherwise agreed, the registration of a transfer of a share shall operate as a waiver of the Company’s lien, if any, on such shares.] | |

| Enforcement of lien on sale of shares. | Article 27- The Company may sell, in such manner as the Board thinks fit, any shares on which the Company has lien, but no sale shall be made unless a sum in respect of which the lien exists is presently payable or until the expiration of fourteen days after a notice in writing stating and | |

| 19 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 23 | Page 27 of 137 |

| Tata Communications Limited | Articles of Association |

| demanding payment of such part of amount in respect of which lien exists as is presently payable, has been given to the registered holder for the time being of the share, or the person entitled thereto by reason of his death or insolvency. | ||

| Application of proceeds of sales. | Article 28- The proceeds of the sale shall be received by the Company and shall be applied in payment of such part of the amount in respect of which lien exists as is presently payable and the residue shall (subject to a like lien for sums not presently payable as existed upon the shares prior to the sale) be paid to the persons entitled to the shares at the date of the sale. The purchaser shall be registered as the holder of the share and he shall not be bound to see to the application of the purchase money, nor shall his title to the shares be affected by any irregularity or invalidity in the proceedings in reference to the sale. | |

| Transfer and transmission of shares. | Article 29- Subject to the provisions of Article 3, the right of members to transfer their shares shall be restricted as follows: | |

| 20[(a) A share may be transferred by a member or other person entitled to transfer to a person approved by the Board.] | ||

| (b) Subject to the Act and subject as aforesaid, the Board may, in their absolute and uncontrolled discretion, refuse to register any proposed transfer of shares. | ||

| 21[(c) If the Board refuse to register transfer of any shares, the Board shall, within one month of the date on which the instrument of transfer is delivered to the Company, send to the transferee and the transferor notice of the refusal. Provided that registration of a transfer shall not be refused on the ground of the transferor being either alone or jointly with any other person or persons indebted to the company on any account whatsoever except a lien on the shares.] | ||

| (d) Subject to the provisions of the Act and save as herein otherwise provided, the Board shall be entitled to treat the person whose name appears on the register of members as the holder of any share as the absolute owner thereof and accordingly shall not (except as ordered by court of competent jurisdiction or as by law required) be bound to recognise any benami, trust or equity or equitable contingent or other claim to or interest in such share on the part of any person whether or not it shall have express or implied notice thereof. | ||

| 20 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 21 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 24 | Page 28 of 137 |

| Tata Communications Limited | Articles of Association |

| 22[Transmission by operation of law. | (e) In the case of transfer of shares or other marketable securities where the company has not issued any certificates and where such shares or securities are being held in an electronic and fungible form the provisions of the Depositories Act, 1996 shall apply.] | |

| Execution of transfer. | Article 30- The instrument of transfer of any share in the Company shall be executed both by the transferor and transferee and the transferor shall be deemed to remain holder of the share until the name of the transferee is entered in the register of members in respect thereof. | |

| Register of transfers. | Article 31- The Company shall keep a book, to be called the “Register of Transfers” and therein shall be fairly and distinctly entered particulars of every transfer or transmission of any share. | |

| Instrument of transfer to be left at office and evidence of titles to be given. | Article 32- Every instrument of transfer shall be delivered to the Company at the office for registration accompanied by any certificate of the shares to be transferred and such evidence as the Company may require to prove the title of the transferor, or his right to transfer the shares. All instruments of transfer shall be retained by the Company, but any instrument of transfer which the Board may decline to register shall on demand, be returned to the person depositing the same. | |

| 23[Form of transfer. | Article 33- The instrument of transfer shall be in writing and all the provisions of Section 108 of the Companies Act and of any statutory modification thereof for the time being shall be duly complied with in respect of all transfers of shares and registration thereof.] | |

| Closing of Registers of members and Debenture holders. | Article 34- The Register of Members or the Register of Debenture-holders may be closed for any period or periods not exceeding 45 (forty five) days in each year but not exceeding 30 (thirty) days at any onetime after giving not less than 7 (seven) days previous notice by advertisement in some newspaper circulating in the district in which the registered office of the Company is situated. | |

| Article 35 - deleted vide Special Resolution passed by the Shareholders at 6thAGM held on 29 September 1992. | ||

| Board’s right to refuse registration. | Article 36- The Board shall have the right to refuse to register a person entitled by transmission to any shares or his nominee, as if he were the transferee named in an ordinary transfer presented for registration. | |

| 24[How far new shares to rank with share in original capital. | Article 37- Except so far as otherwise provided by the conditions of issue, or by these Articles, any capital raised by the creation of new shares shall be considered part of the original capital and shall | |

| 22 | Amended vide Special Resolution passed by the shareholders at 12th AGM held on 21 September 1998. |

| 23 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 24 | Amended vide Special Resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 25 | Page 29 of 137 |

| Tata Communications Limited | Articles of Association |

| be subject to the provisions herein contained with reference to the payment of calls and instalments, transfer and transmission, lien, voting, surrender and otherwise. Such new shares shall rank pari passu with the existing Shares in all respects except for the purposes of dividend that shall be pro rated to the period for which such newly issued shares are in existence. | ||

| New Shares to be offered to Members. | Article 38(a)-If the Board, in exercise of good faith and in its reasonable judgement, determines that the Company requires additional funds, the Board may request, by issuance of a notice (the “Funding Notice”) to All Shareholders of the Company, to contribute, within 90 Business Days after the issuance of the Funding Notice (the “Funding Period”), additional capital to the Company, on a pro rated basis depending upon the number of voting shares of the Company then held by such shareholders, by way of subscription for additional voting equity shares in accordance with Section 81(1) of the Act or provide a loan to the Company, all as determined by the Board and set forth in the Funding Notice. | |

| (b) If additional capital is to be contributed pursuant to Article 38(a) by way of subscription for additional voting equity shares of the Company, then the subscription price for each such additional voting equity share shall be determined by the Board and set out in the Funding Notice. The Company shall, promptly upon the receipt of such subscription amount, issue to All Shareholders the appropriate number of voting equity shares based upon the payment received from each such shareholder. | ||

| (c) If any offer to subscribe for voting equity shares of the Company pursuant to Article 38(a) (such offer, the “Right”) includes a right to renounce the Right in favour of any other Person, then, no Shareholder shall renounce such Right in favour of any other Person (other than an Affiliate of the renouncing Shareholder) without first giving the other Shareholder a reasonable opportunity to acquire such Right, either directly or through its nominees on the same terms and conditions that such Right is proposed to be renounced in favour of any other Person (other than an Affiliate of the renouncing Shareholder).] | ||

| BORROWING POWERS | ||

| Power of borrowing. | Article 39- (1) Subject to the provisions of Sections 292 and 293 (1) (d) of the Act, the Board may by means of a resolution passed at a meeting of the Board from time to time, borrow and/or secure the payment of any sum or sums of money for the purposes of the Company. | |

| Conditions on which money may be borrowed. | (2) The Board may secure the repayment of such moneys in such manner and upon such terms and conditions in all respects as they think fit and in particular by the issue of bonds, perpetual or | |

| 26 | Page 30 of 137 |

| Tata Communications Limited | Articles of Association |

| redeemable debentures, or debenture - stock or any mortgage, charge or other security on the undertaking of the whole or any part of the property of the Company (both present and future) including its uncalled capital for the time being. | ||

| How debentures etc. shall be transferred. | (3) Debentures, bonds etc. of the Company shall be transferred or transmitted in accordance with the procedure prescribed for shares in Section 108 of the Companies Act and the prevailing rules made thereunder by Central Government from time to time, unless different provisions are made specifically in the terms of issue governing such debentures, bonds etc. | |

| Securities may be assignable free from equities. | Article 40- Debentures, debenture stock, bonds or other securities may be made assignable free from any equities between the company and the person to whom the same may be issued. | |

| 25[Issue at discount etc. or with special privileges. | Article 41- Subject to Sections 79 and 117 of the Act, any debentures, debenture stock, bonds or other securities may be issued at a discount, premium or otherwise, and with any special privileges to redemption, surrender, drawings, allotment of shares, appointment of Directors and otherwise. Debentures, Debenture-Stock, Bonds or other securities with the right to allotment of or conversion into shares shall be issued only with the consent of the company in General Meeting.] | |

| Inviting/accepting deposits. | Article 42- Subject to the provisions of Sections 58A and 58 B, 292 and 293 of the Companies Act and the rules made thereunder from time to time, the Board of Directors may, from time to time, invite and/or accept deposits from members of the public and/or employees of the Company/or otherwise at such interest rates as may be decided by the Board. Board may also pay commission to any person for subscribing or agreeing to subscribe or procure or agree to procure these deposits. | |

| GENERAL MEETINGS | ||

| Notice of General Meeting. | Article 43- (1) A general meeting of the Company may be called by giving not less than twenty one days notice in writing. | |

| (2) A general meeting may be called after giving shorter notice than that specified in clause (1) of this Article if consent is accorded thereto : | ||

(i) in the case of an annual general meeting, by all the members entitled to vote thereat; and, | ||

| 25 | Amended vide Special Resolution passed by the shareholders at 6th AGM held on 29 September 1992. |

| 27 | Page 31 of 137 |

| Tata Communications Limited | Articles of Association |

(ii) in the case of any other meeting subject to the provisions of Section 171 of the Act, by members of the Company holding not less than ninety five percent of such part of the paid-up sharecapital of the Company as gives a right to vote at meeting. | ||

| Business of meeting. | Article 44- The ordinary business of an annual general meeting shall be to receive and consider the profit and loss account, the balance sheet, and the report of the Board of Directors and of the Auditors, and to declare dividends. All other business transacted at such meeting and all business transacted at an extra ordinary meeting shall be deemed special. | |

| 26[Quorum. | Article 45- (1) No business shall be transacted at any general meeting unless a quorum of members is present at the time when the meeting proceeds to business. | |

| (2) The quorum requirement for the general meeting of the Company shall be governed by the provisions of the Act. | ||

| (3) Notwithstanding the provisions of Article 45(2), at least one authorised representative each of the Government and the Strategic Partner, in case of a general meeting, shall be necessary to constitute quorum for any meeting in which a resolution for any of the matters specified in Article 69(2) is to be passed and a notice of not less than 21 (twenty one) days shall be given to the Government and the Strategic Partner for any such meeting.] | ||

| General Meetings. | Article 46- The first annual general meeting of the Company shall be held within eighteen months of its incorporation and thereafter, the annual general meeting shall be held within six months after the expiry of each financial year, except in the case when, for any special reason time for holding any annual general meeting (not being the first annual general meeting) is extended by the Registrar under Section 166 of the Act, no greater interval than fifteen months shall be allowed to elapse between the date of one annual general meeting and that of the next. Every annual general meeting shall be held during business hours on a day other than a public holiday either at the registered office of the company or at some other place as the Central Government may direct, and the notice calling the meeting shall specify it as the annual general meeting. All other meetings of the Company shall be called “Extraordinary General Meeting”. | |

| When Extra-ordinary meeting to be called. | Article 47- The Board may, whenever they think fit and shall, on the requisition of the holders of not less than one tenth of the paid-up-capital of the Company upon which all calls or other sums then due have been paid, as at the date carry the right of voting in regard to that matter forthwith proceed to convene an extraordinary meeting of the Company, and in the case of such requisition, the following provisions shall have effect: | |

| (1) The requisition must state the objects of the meeting and must be signed by the requisitionists and deposited at the office and may consist of several documents, in like-form each signed by one or more requisitionists. | ||

| 26 | Amended vide Special Resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 28 | Page 32 of 137 |

| Tata Communications Limited | Articles of Association |

| (2) If the Board of Directors of the Company do not proceed within twenty one days from the date of the requisition being so deposited to cause meeting to be called on a day not later than 45 days from the date of deposit of the requisition, the requisitionists or a majority of them in value may themselves convene the meeting, but any meeting so convened shall be held within three months from the date of the deposits of the requisition. | ||

| (3) Any meeting convened under this Article by the requisitionists shall be convened in the same manner as nearly as possible as that in which meetings are to be convened by the Board. | ||

| If, after a requisition has been received, it is not possible for a sufficient number of Directors to meet in time so as to form a quorum, any Director may convene an extraordinary general meeting in the same manner as early as possible as that in which meetings may be convened by the Board. | ||

| Omission to give notice. | Article 48- The accidental omission to give any such notice or the non-receipt of any such notice by any member shall not invalidate the proceedings at any meeting. | |

| Chairman of General Meeting. | Article 49- The Chairman of the Board shall be entitled to take the Chair at every general meeting or if there be no such Chairman, or if at any meeting he shall not be present within fifteen minutes after the time appointed for holding such meeting or is unwilling to act as Chairman, the members present shall choose another Director as Chairman, and, if no Director shall be present, or if all the Directors present decline to take the chair then, the members present shall choose one of their number to be the Chairman. | |

| 27[When, if quorum not present, meetings to be dissolved and when to be adjourned. | Article 50- (1) If within half an hour from the time appointed for the meeting a quorum is not present, the meeting if convened upon such requisition as aforesaid, shall be dissolved. | |

| (2) In the event that no authorised representative of either the Government or the Strategic Partner is present at a meeting referred to in Article 45(3) above, such meeting shall stand adjourned to the same day in the next week, at the same time and place, or to such later day as may be notified to the Government or the Strategic Partner as the case may be. | ||

| 27 | Amended vide Special Resolution passed by the shareholders at 16th AGM held on 20 August 2002. |

| 29 | Page 33 of 137 |

| Tata Communications Limited | Articles of Association |

| (3) In the event that no authorised representative of the same Shareholder, whose authorised representative was not present in the meeting referred to in Article 45(3), is present at the adjourned meeting referred to in Article 50(2) above, such meeting shall stand adjourned to the same day in the next week, at the same time and place, or to such later day as may be notified to such Shareholder. | ||

| (4) Notwithstanding anything to the contrary in Article 45(3) above, in the event that no authorised representative of the same Shareholder, whose authorised representative was not present in the meetings referred to in Articles 45(3) and 50(2), is present at the adjourned meeting referred to in Article 50(3), it shall be deemed that the presence of the authorised representatives of such Shareholder is not required for such meeting and the shareholders present at such adjourned general meeting shall be entitled to proceed with the items on the agenda in such manner as they deem fit even though such items may be relating to matters listed in Article 69(2).] | ||

| Right of President to appoint any person as his representative. | Article 51- (1) The President, so long as he is a shareholder of the Company, may, from time to time, appoint one or more persons (who need not be a member or members of the Company) to represent him at all or any meeting of the Company. | |

| (2) Any one of the persons appointed under sub clause (1) of this Article shall be deemed to be a member of the Company and shall be entitled to vote and be present in person and exercise the same rights and powers (including the right to vote by proxy) as the President could exercise as a member of the Company. | ||

| (3) The President may, from time to time, cancel any appointment made under sub clause (1) of this Article and make fresh appointment. | ||

| (4) The production at the meeting of an order of the President evidenced as provided in the Constitution, shall be accepted by the Company as sufficient evidence of any such appointment or cancellation as aforesaid. | ||

| Adjournment of meeting. | Article 52- (1) The Chairman may, with the consent of any meeting at which a quorum is present and shall, if so directed by the meeting, adjourn the meeting from time to time and place to place. | |

| Business at adjourned meeting. | (2) No business shall be transacted at any adjourned meeting other than the business left unfinished at the meeting from which the adjournment took place. | |

| 30 | Page 34 of 137 |

| Tata Communications Limited | Articles of Association |

| Notice of adjourned meeting. | (3) When a meeting is adjourned for 30 days or more, notice of the adjourned meeting shall be given as was given in the case of an original meeting. | |

| (4) Save as aforesaid, it shall not be necessary to give any notice of an adjournment or of the business to be transacted at an adjourned meeting. | ||

| 28[How questions to be decided at meetings. | Article 53- (1) Every question submitted to a meeting shall be decided in the first instance by a show of hands.] | |

| Evidence of a resolution where poll not demanded. | (2) At any general meeting a resolution put to vote of the meeting shall be decided on a show of hands, unless a poll is, before or on the declaration of the result of the show of hands, demanded by a member present in person or proxy or by duly authorised representative, and unless a poll is so demanded, a declaration by the Chairman that a resolution has, on a show of hands, been carried or carried unanimously or by a particular majority or lost, and an entry to that effect in the book of proceedings of the Company, shall be conclusive evidence of the fact, without proof of the number or proportion of the vote recorded in favour of or against that resolution. | |

| Poll how to be taken. | (3) If a poll is duly demanded, it shall be taken in such manner and at such time and place as the Chairman of the meeting directs and either at once or after an interval or adjournment or otherwise, and the result of the poll shall be deemed to be the resolution of the meeting at which the poll was demanded. The demand of a poll may be withdrawn. | |

| Poll when to be taken at the meeting. | (4) Subject to the provisions of Section 180 of the Act, any poll duly demanded on the election of a Chairman of a meeting or on any question of adjournment shall be taken at the meeting and without adjournment. | |

| Business may proceed notwithstanding demand of poll. | (5) The demand of a poll shall not prevent the continuance of a meeting for the transaction of any business other than the question on which a poll has been demanded. | |

| Chairman’s decision conclusive. | (6) The Chairman of any meeting shall be the sole judge of the validity of every vote tendered at such meeting. The Chairman present at the taking of a poll shall be the sole judge of the validity of every vote tendered at such poll. | |

| Objection to vote. | (7) No objection shall be raised as to the qualification of any voter except at the meeting or adjourned meeting at which the vote objected to is given or tendered and every vote not disallowed at such meeting shall be valid for all other purposes. | |

| Chairman to judge validity. | (8) Any such objection made in due time shall be referred to the Chairman of the meeting whose decision shall be final and conclusive. | |

| 28 | Amended vide Special Resolution passed by the shareholders at 16thAGM held on 20 August 2002. |

| 31 | Page 35 of 137 |

| Tata Communications Limited | Articles of Association |

| Vote of Members. | Article 54- Upon a show of hands every member present in person or by proxy, or by duly authorised representative shall have one vote and upon a poll every such member shall have one vote for every share held by him. | |