OraSure 2Q21 Earnings August 3, 2021 EXHIBIT 99.3

Forward-Looking Statements Disclaimer This presentation contains certain forward-looking statements, including with respect to expected revenues and earnings/loss per share. Forward-looking statements are not guarantees of future performance or results. Known and unknown factors that could cause actual performance or results to be materially different from those expressed or implied in these statements include, but are not limited to: ability to successfully manage and integrate acquisitions of other companies in a manner that complements or leverages our existing business, or otherwise expands or enhances our portfolio of products and our end-to-end service offerings, and the diversion of management’s attention from our ongoing business and regular business responsibilities to effect such integration; the expected economic benefits of acquisitions (and increased returns for our stockholders), including that the anticipated synergies, revenue enhancement strategies and other benefits from the acquisitions may not be fully realized or may take longer to realize than expected and our actual integration costs may exceed our estimates; impact of increased or different risks arising from the acquisition of companies located in foreign countries; ability to market and sell products, whether through our internal, direct sales force or third parties; impact of significant customer concentration in the genomics business; failure of distributors or other customers to meet purchase forecasts, historic purchase levels or minimum purchase requirements for our products; ability to manufacture products in accordance with applicable specifications, performance standards and quality requirements; ability to obtain, and timing and cost of obtaining, necessary regulatory approvals for new products or new indications or applications for existing products; ability to comply with applicable regulatory requirements; ability to effectively resolve warning letters, audit observations and other findings or comments from the U.S. Food and Drug Administration (“FDA”) or other regulators; the impact of the novel coronavirus (“COVID-19”) pandemic on our business and our ability to successfully develop new products, validate the expanded use of existing collector products and commercialize such products for COVID-19 testing; changes in relationships, including disputes or disagreements, with strategic partners or other parties and reliance on strategic partners for the performance of critical activities under collaborative arrangements; ability to meet increased demand for the Company’s products; impact of replacing distributors; inventory levels at distributors and other customers; ability of the Company to achieve its financial and strategic objectives and continue to increase its revenues, including the ability to expand international sales; ability to identify, complete, integrate and realize the full benefits of future acquisitions; impact of competitors, competing products and technology changes; reduction or deferral of public funding available to customers; competition from new or better technology or lower cost products; ability to develop, commercialize and market new products; market acceptance of oral fluid or urine testing, collection or other products; market acceptance and uptake of microbiome informatics, microbial genetics technology and related analytics services; changes in market acceptance of products based on product performance or other factors, including changes in testing guidelines, algorithms or other recommendations by the Centers for Disease Control and Prevention (“CDC”) or other agencies; ability to fund research and development and other products and operations; ability to obtain and maintain new or existing product distribution channels; reliance on sole supply sources for critical products and components; availability of related products produced by third parties or products required for use of our products; impact of contracting with the U.S. government; impact of negative economic conditions; ability to maintain sustained profitability; ability to utilize net operating loss carry forwards or other deferred tax assets; volatility of the Company’s stock price; uncertainty relating to patent protection and potential patent infringement claims; uncertainty and costs of litigation relating to patents and other intellectual property; availability of licenses to patents or other technology; ability to enter into international manufacturing agreements; obstacles to international marketing and manufacturing of products; ability to sell products internationally, including the impact of changes in international funding sources and testing algorithms; adverse movements in foreign currency exchange rates; loss or impairment of sources of capital; ability to attract and retain qualified personnel; exposure to product liability and other types of litigation; changes in international, federal or state laws and regulations; customer consolidations and inventory practices; equipment failures and ability to obtain needed raw materials and components; the impact of terrorist attacks and civil unrest; and general political, business and economic conditions. These and other factors that could affect the Company’s results are discussed more fully in the Company’s Securities and Exchange Commission (“SEC”) filings, including our registration statements, Annual Report on Form 10-K for the year ended December 31, 2020, Quarterly Reports on Form 10-Q, and other filings with the SEC. Although forward-looking statements help to provide information about future prospects, readers should keep in mind that forward-looking statements may not be reliable. The forward-looking statements are made as of the date of this presentation and OraSure Technologies undertakes no duty to update these statements.

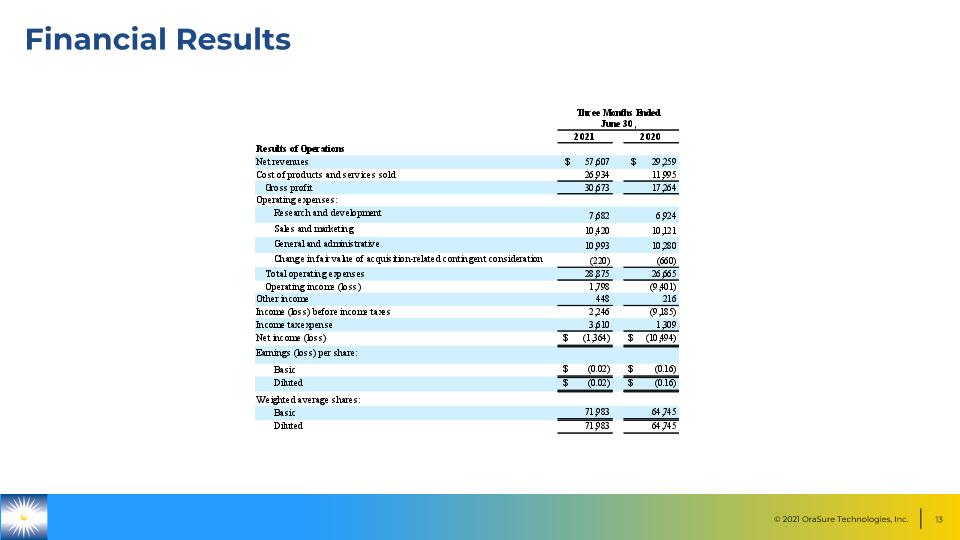

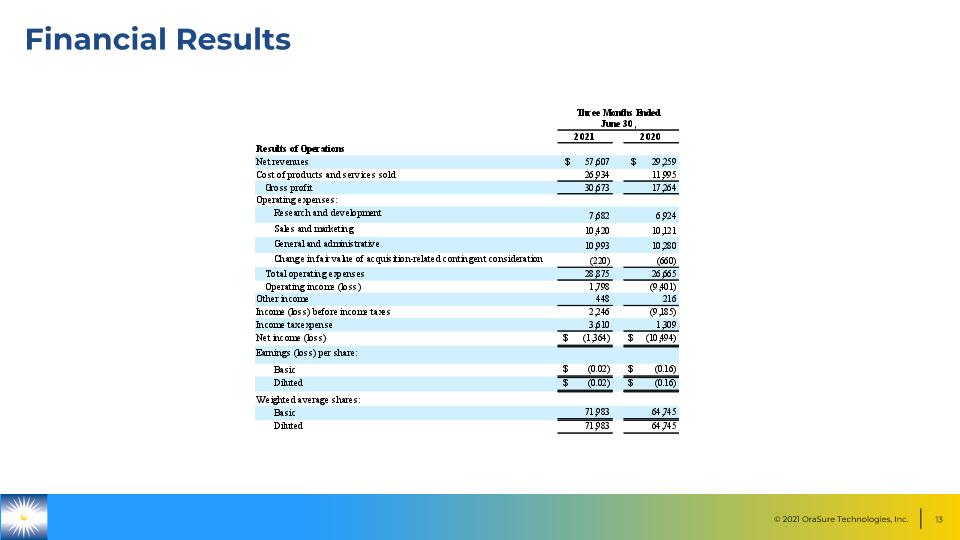

2Q21 Financial Results FINANCIAL METRIC 2Q21 RESULTS 2Q20 RESULTS GROWTH RATE 2Q21 Total Revenue $57.6 million $29.3 million 97% 2Q21 Total Revenue Excluding COVID-19 Product Revenue $46.0 million $20.8 million 122% 2Q21 COVID-19 Product Revenue $11.6 million $8.5 million 36%

Key Focus Areas to Drive Shareholder Value Expand Global Commercial Capabilities and Reach Drive Higher Growth Through Expanded R&D and M&A Expand Into New Sample Types and New Testing Modalities in Molecular Solutions Capitalize on COVID-19 Testing Opportunity To Fund Future Growth

InteliSwab™: Designed to be the Simplest �COVID-19 Test on the Market Authorized by FDA for OTC, Prescription Home Use and Professional Point-of-Care CLIA-Waived use Accuracy comparable to other point-of-care offerings (84% sensitivity / 98% specificity) Convenient sample collection with <1 min. of hands on time; results in 30 min. More than 98% of users find InteliSwab™ easy to use Visually read, lateral flow test; No instrumentation, internet access or laboratory analysis needed to interpret results Swab is fully integrated into the test stick eliminating dependence on nasal swabs SWAB both nostrils SWIRL in the tube SEE your results 1 2 3

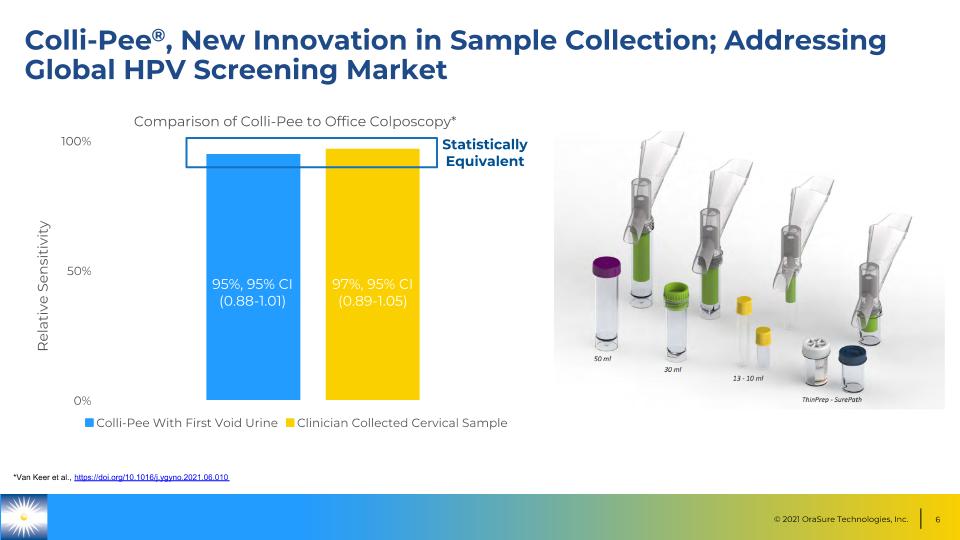

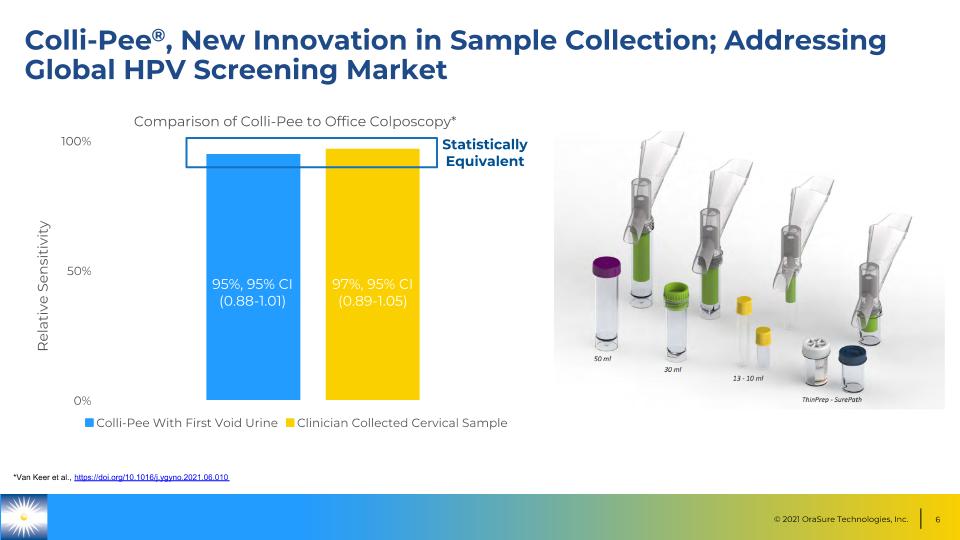

Colli-Pee®, New Innovation in Sample Collection; Addressing Global HPV Screening Market 95%, 95% CI (0.88-1.01) 97%, 95% CI (0.89-1.05) Relative Sensitivity Statistically Equivalent *Van Keer et al., https://doi.org/10.1016/j.ygyno.2021.06.010

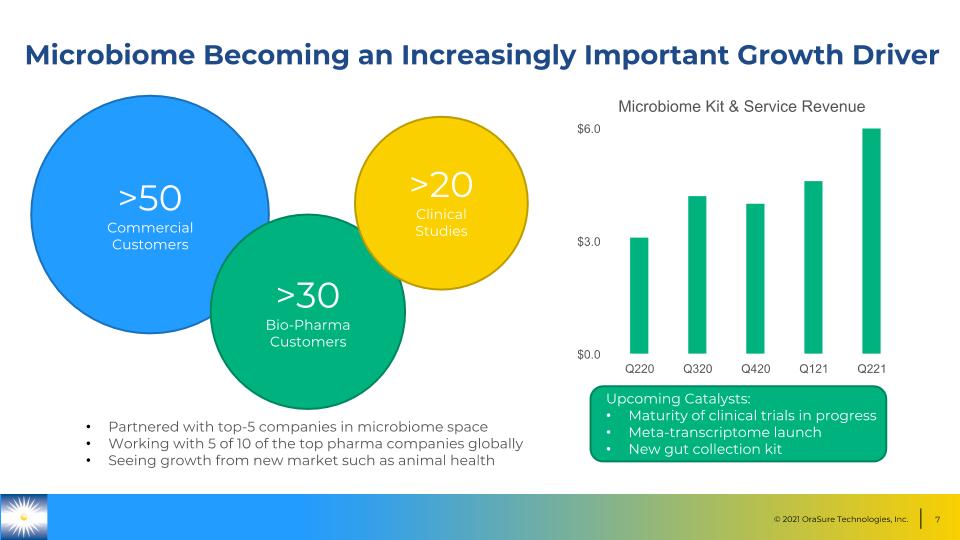

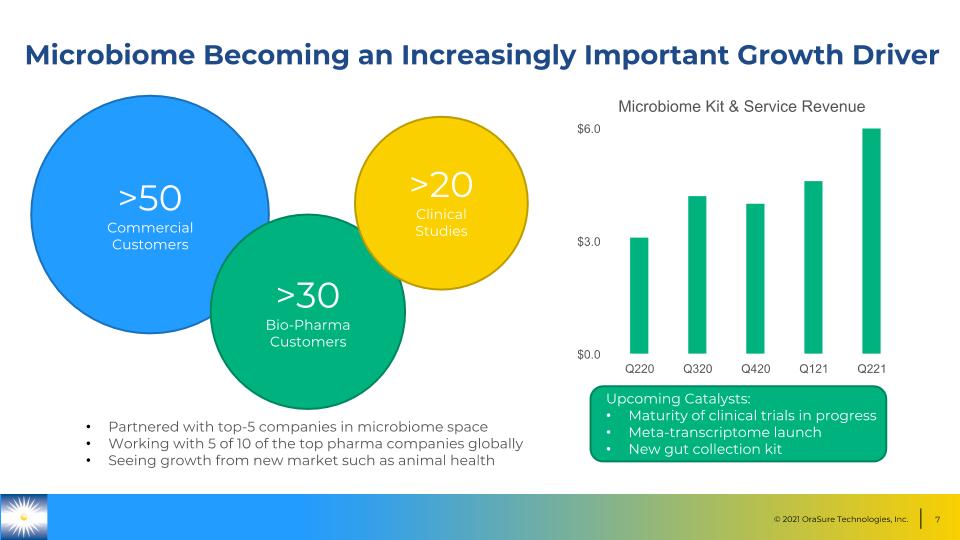

Microbiome Becoming an Increasingly Important Growth Driver Upcoming Catalysts: Maturity of clinical trials in progress Meta-transcriptome launch New gut collection kit >50 Commercial Customers >30 Bio-Pharma Customers >20 Clinical Studies Partnered with top-5 companies in microbiome space Working with 5 of 10 of the top pharma companies globally Seeing growth from new market such as animal health

Expanding Molecular Collection Device Competitiveness Through Multiple Strategies Expanding intellectual property portfolio through filed patents and technology acquisitions (38 patents filed to date on collection devices) Long-term contracts with major customers providing forward visibility Increased regulatory approvals in conjunction with commercial partners Customer kit specialization and increased service scope 1 2 3 4

Expanding Global Reach To Broaden Market Access We now have over 400 product registrations in 95 countries globally

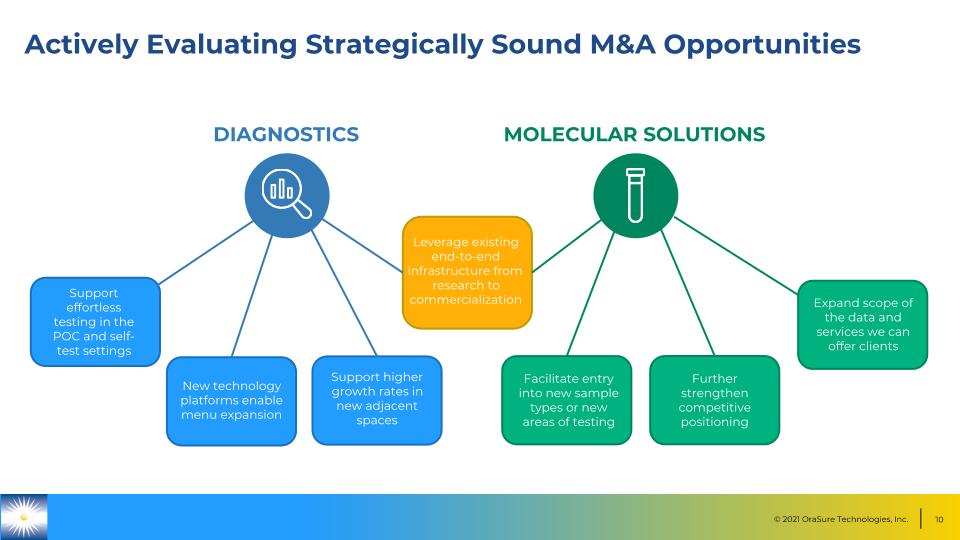

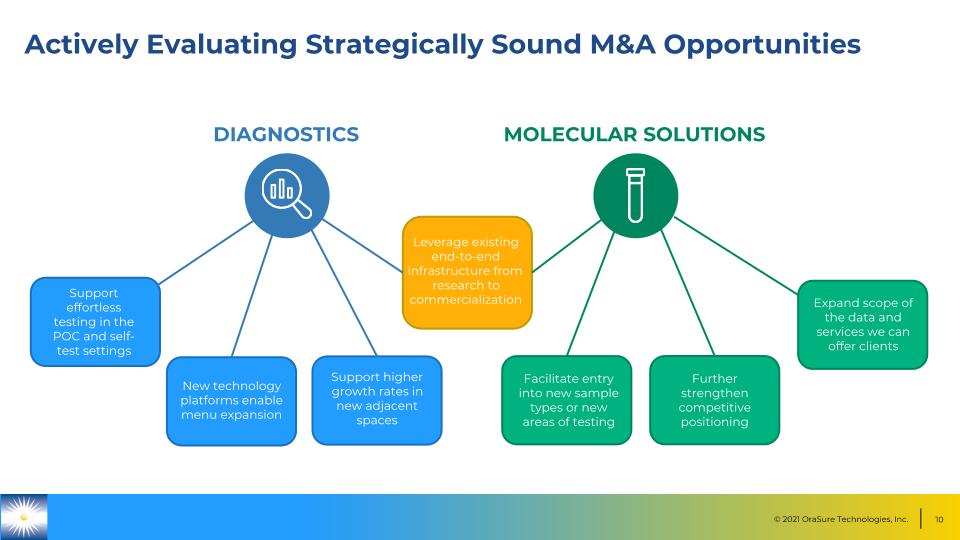

Actively Evaluating Strategically Sound M&A Opportunities DIAGNOSTICS MOLECULAR SOLUTIONS Leverage existing end-to-end infrastructure from research to commercialization Support effortless testing in the POC and self-test settings New technology platforms enable menu expansion Support higher growth rates in new adjacent spaces Facilitate entry into new sample types or new areas of testing Further strengthen competitive positioning Expand scope of the data and services we can offer clients Facilitate entry into new sample types or new areas of testing

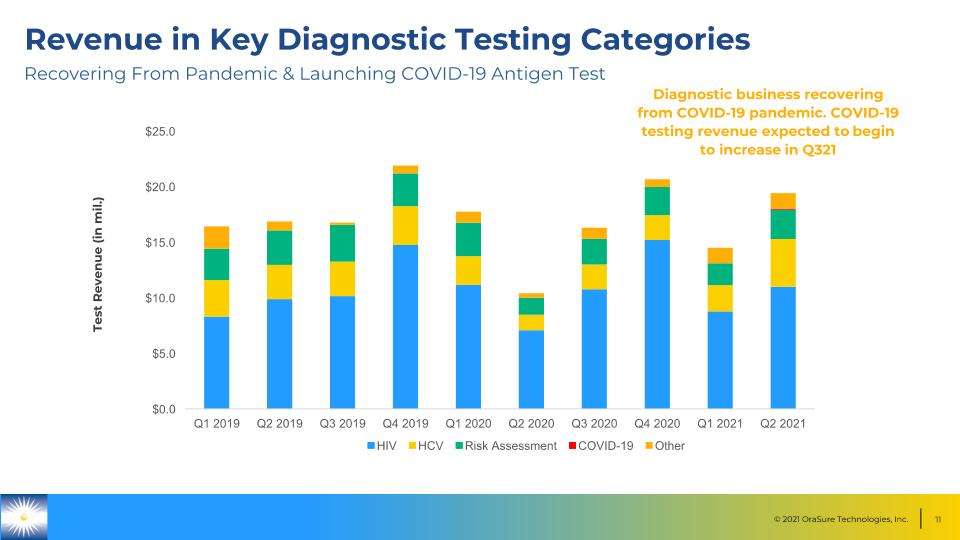

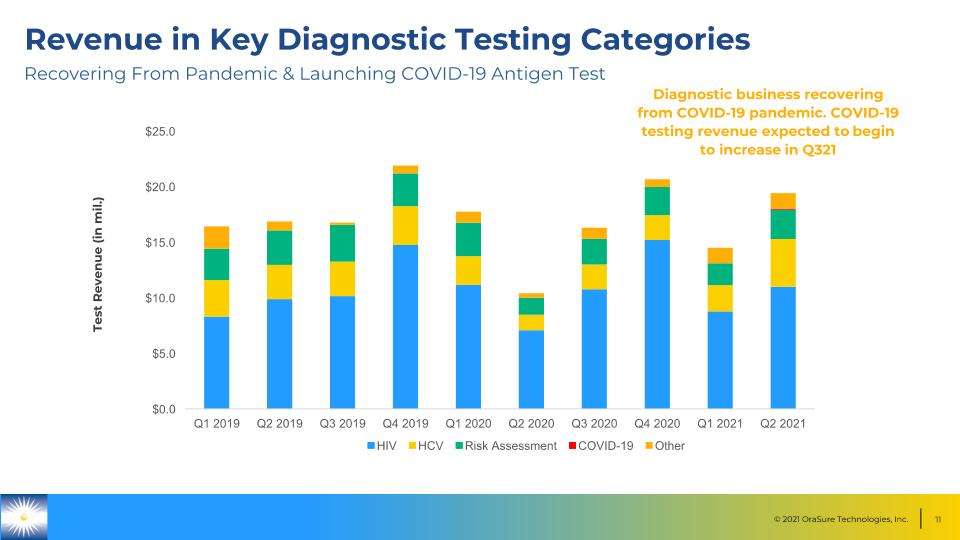

Revenue in Key Diagnostic Testing Categories Test Revenue (in mil.) Diagnostic business recovering from COVID-19 pandemic. COVID-19 testing revenue expected to begin to increase in Q321 Recovering From Pandemic & Launching COVID-19 Antigen Test

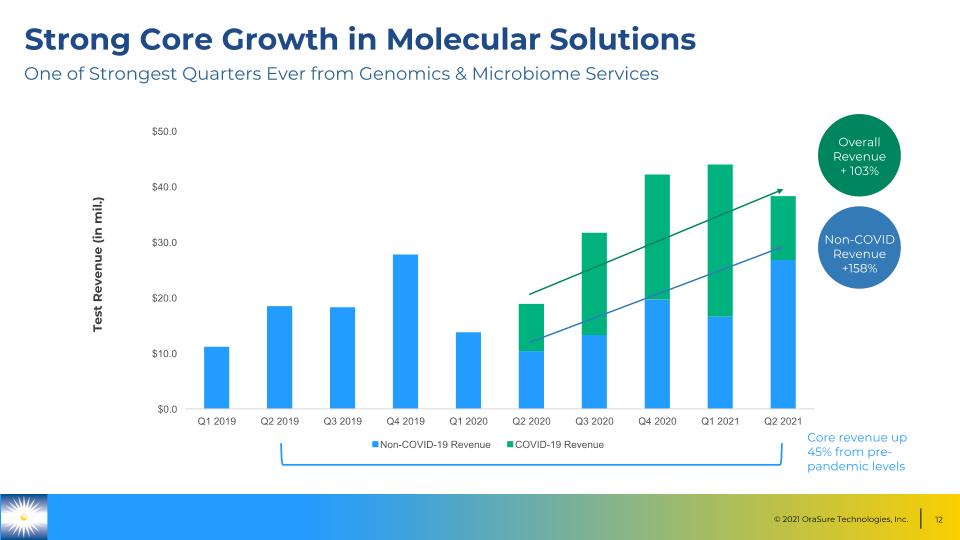

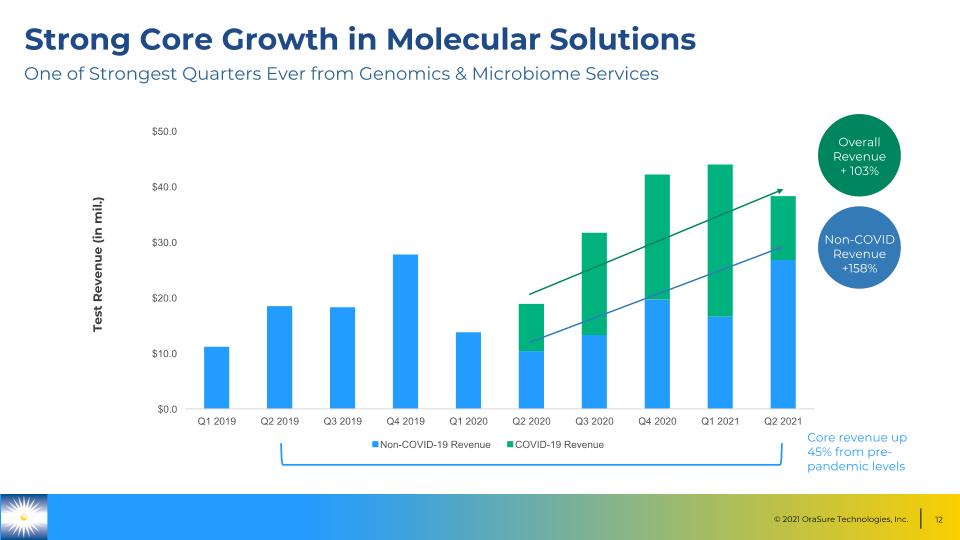

Strong Core Growth in Molecular Solutions Test Revenue (in mil.) Overall Revenue + 103% Non-COVID Revenue +158% One of Strongest Quarters Ever from Genomics & Microbiome Services Core revenue up 45% from pre-pandemic levels

Financial Results

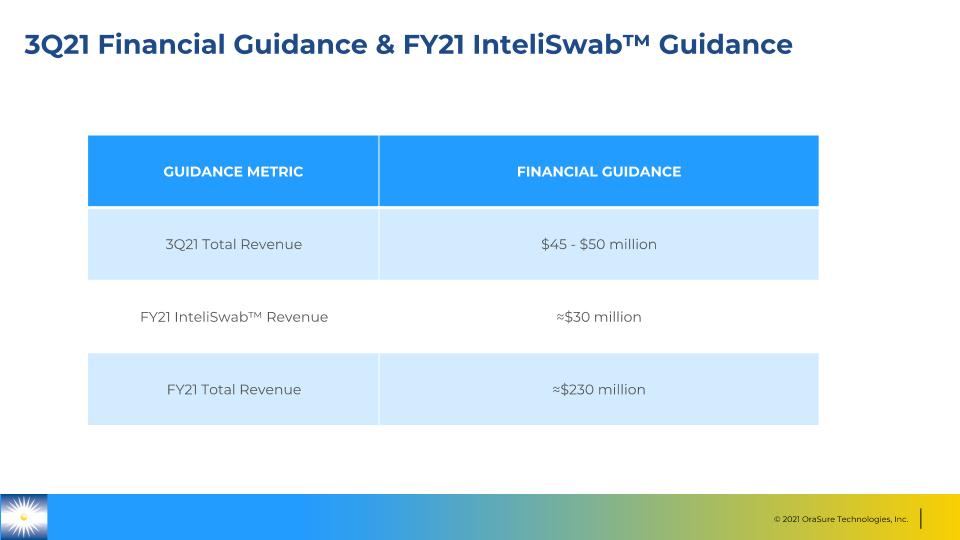

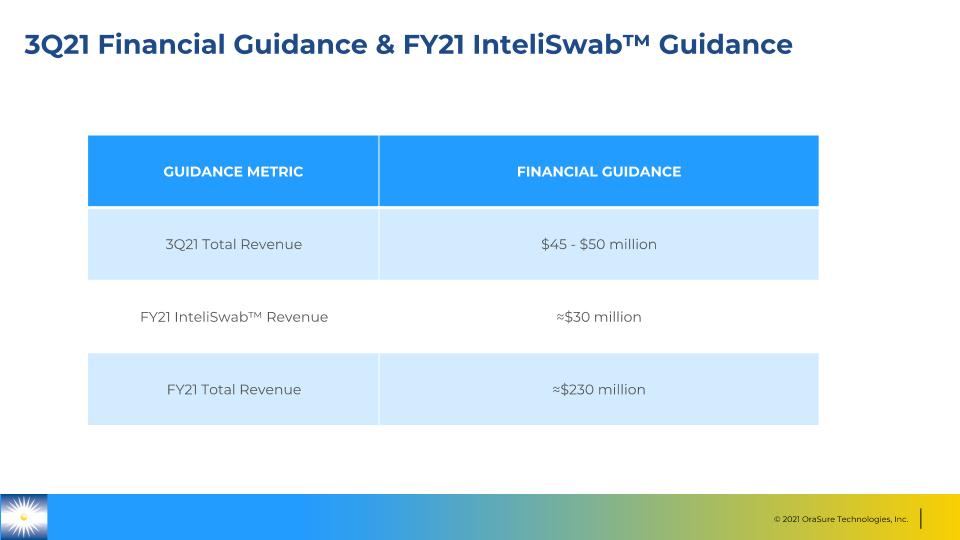

3Q21 Financial Guidance & FY21 InteliSwab™ Guidance GUIDANCE METRIC FINANCIAL GUIDANCE 3Q21 Total Revenue $45 - $50 million FY21 InteliSwab™ Revenue ≈$30 million FY21 Total Revenue ≈$230 million

Summary Commercially tied to high growth areas of healthcare such as consumer/clinical genomics and shift to direct-to-patient/near patient testing Increased investment in internal R&D pipeline and reinvigorating innovation Significant opportunity with COVID-19 testing solutions to drive growth and fund additional investment Strong balance sheet with focus on deploying capital to drive growth and leverage infrastructure Smart Science Made Simple

Q&A