Table of Contents

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 |

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) | |

Table of Contents

2023 | Proxy Statement

Notice of Annual Meeting of Stockholders

Tuesday, May 16, 2023 ● 12:30 p.m. (Eastern Time) |

Table of Contents

Letter to the Stockholders

Carrie Eglinton Manner Chief Executive Officer (“CEO”) | April 14, 2023

Dear Fellow Stockholders:

As a Company, we are committed to accelerating the shift in healthcare delivery – connecting people to care wherever they are and increasing access, quality, and affordability of healthcare with effortless solutions in point-of-care and self-testing diagnostics, sample collection innovation and services.

Since my arrival in June, we have been focused on our three-part transformation journey and have delivered significant progress on the priority to Strengthen our Foundation. To this end we had many successes in 2022 including making major improvements in our manufacturing operations to scale InteliSwab® COVID-19 self-testing while improving gross margins, re-setting our cost structure to potentially achieve cash flow breakeven ahead of schedule, and consolidating our two business units into One OraSure to unlock further efficiencies. These improvements have allowed us to begin generating significant cash in 2023 and have put us on the path to achieving cash flow breakeven for our core business, which is expected by the end of 2024.

Our stronger foundation sets the stage for us to increasingly Elevate our Core business through enhancing our existing product portfolio and launching new innovation. We are making progress in strategic partnerships, as well, and the future could include inorganic expansion opportunities as we look to utilize the cash generated from InteliSwab® to further Accelerate Profitable Growth.

While we are in the early stages of our strategic transformation, I am increasingly confident in our trajectory for success given our strong strategic position enabling decentralized healthcare, the commitment of our talented team, and the quality of our solutions and their underlying science and technology. Underpinning all of our actions, we will continue to adhere to our mantra of innovating and operating with disciplined execution and accountability. We will be holding our 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of OraSure Technologies, Inc. (the “Company”) on Tuesday, May 16, 2023 at 12:30 p.m. Eastern Time. Once again, this year’s Annual Meeting will be a virtual meeting, conducted as a live webcast. You will be able to attend the Annual Meeting online, vote your shares electronically if you wish, and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OSUR2023.

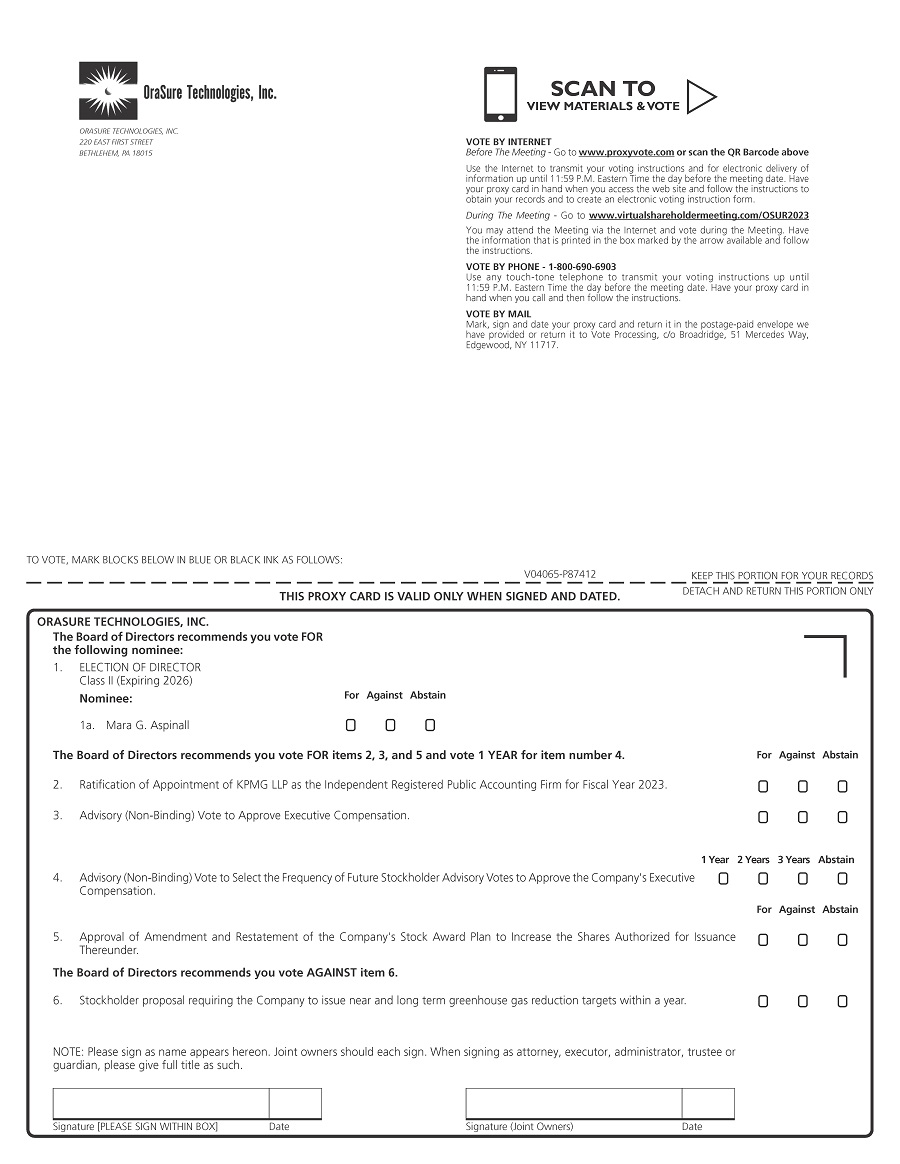

On or about April 20, 2023, the Company will mail to its stockholders of record as of March 23, 2023, the record date for the Annual Meeting, a copy of this Proxy Statement, including the Notice of Annual Meeting of Shareholders (the “Notice”) and the proxy card, as well as the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Annual Report”). At the Annual Meeting, you will be asked to (i) elect one Class II Director to serve on the Board of Directors until the Annual Meeting of Stockholders in 2026; (ii) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year; (iii) approve, by an advisory (non-binding) vote, the compensation of the Company’s named executive officers as disclosed in the proxy materials; (iv) approve, by an advisory (non-binding) vote, the frequency of future stockholder advisory votes on executive compensation; (v) approve an amendment and restatement of the OraSure Technologies, Inc. Stock Award Plan to increase the number of shares to be authorized for grant under the Plan by 3,000,000 shares and require that all awards granted thereunder generally be subject to a minimum vesting period of one year; (vi) to act on a stockholder proposal if properly presented at the Annual Meeting; and (vii) transact such other business as may properly come before the meeting, and any adjournment(s) or postponement(s) thereof.

The Board of Directors has approved a nominee for the Class II Director and recommends that you vote FOR her election to the Board of Directors. In addition, the Board of Directors recommends that you vote FOR the ratification of KPMG LLP’s |

Table of Contents

appointment, FOR the approval of the Company’s executive compensation, FOR the approval of holding future advisory votes on executive compensation EVERY YEAR, and FOR the approval of the amendment and restatement of the Company’s Stock Award Plan. The Board of Directors recommends that you vote AGAINST the stockholder proposal.

Your vote is very important, regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting online, we urge you to submit your vote as soon as possible. You will have the option to vote by telephone, via the internet, or by completing, signing, dating and returning a paper proxy card. Additional details on these options can be found in the Notice sent to you and in the other proxy materials. You may, of course, attend the Annual Meeting online and vote your shares during the meeting regardless of whether you have previously voted by phone, the internet or mail.

Thank you for your cooperation and your ongoing support of, and continued interest in, OraSure Technologies, Inc.

Sincerely yours,

Carrie Eglinton Manner CEO & President |

Table of Contents

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

OF ORASURE TECHNOLOGIES, INC.

DATE AND TIME

Tuesday, May 16, 2023

12:30 p.m. (Eastern Time)

To be held virtually by visiting:

www.virtualshareholdermeeting.com/OSUR2023

ITEMS OF BUSINESS

The 2023 Annual Meeting of Stockholders will be held for the following purposes:

• | To elect one (1) Class II Director to serve for a term expiring at the Company’s Annual Meeting of Stockholders in 2026; |

• | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023; |

• | To approve, by an advisory (non-binding) vote, the compensation of the Company’s named executive officers as disclosed in the Proxy Statement accompanying this Notice; |

• | To approve, by an advisory (non-binding) vote, the frequency of future stockholder advisory votes on executive compensation; |

• | To approve an amendment and restatement of the Company’s Stock Award Plan to increase the number of shares of Common Stock authorized to be granted under the Plan; |

• | To act on a stockholder proposal if properly presented at the Annual Meeting; and |

• | To consider such other business as may properly come before the meeting, and any adjournment(s) or postponement(s) thereof. |

HOW TO VOTE

Via the Internet. Go to www.proxyvote.com to vote your shares online prior to the Annual Meeting. Have the control number that is printed in your Notice of Internet Availability of Proxy Materials or Proxy Card available and follow the instructions. You may also vote online during the Annual Meeting by going to www.virtualshareholdermeeting.com/OSUR2023 and following the instructions.

By Phone. Call the toll-free number on your Notice of Internet Availability of Proxy Materials or Proxy Card and follow the prompts.

By Mail. You can vote by mail by requesting a paper copy of the materials, which will include a Proxy Card. Please review your Notice of Internet Availability of Proxy Materials for instructions on how to request a paper copy of the materials. Mark, sign and date your Proxy Card and return it as indicated on the Proxy Card.

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS OF ORASURE TECHNOLOGIES, INC.

|

Who Can Vote: Only holders of shares of the Company’s Common Stock of record at the close of business on March 23, 2023 will be entitled to vote at the Annual Meeting of Stockholders and any adjournment(s) or postponement(s) thereof. Additional information is included in the Proxy Statement accompanying this Notice.

A complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose germane to the meeting beginning 10 days before the meeting at the Company’s headquarters at 220 East First Street, Bethlehem, PA 18015 during ordinary business hours. In addition, such list will be available for inspection during the meeting in the virtual meeting room at: www.virtualshareholdermeeting.com/OSUR2023.

|

By Order of the Board of Directors,

Stefano Taucer

Secretary

April 14, 2023

Table of Contents

Proxy Statement Table of Contents

|

| 1 | ||

| 1 | ||

| 1 | ||

| 4 | ||

| 5 | ||

| 5 | ||

Questions And Answers About the 2023 Annual Meeting And Voting | 6 | |

| 6 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

What If I Have Technical Difficulties or Trouble ACCESSING The Virtual Meeting | 9 | |

| 9 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 18 | ||

| 18 | ||

| 19 | ||

| 20 | ||

| 20 | ||

| 21 | ||

Report of the Audit Committee for the year ended December 31, 2022 | 21 | |

| 22 | ||

Table of Contents

Table of Contents

PROXY STATEMENT SUMMARY

We are providing these proxy materials to stockholders of OraSure Technologies, Inc., a Delaware corporation (as used herein, “we,” “us,” “our”, “OraSure” or the “Company”), and we are first making available or mailing the materials on or about April 20, 2023, in connection with the Company’s solicitation of proxies (each, a “Proxy”) for use at the Annual Meeting of Stockholders to be held on May 16, 2023 at 12:30 p.m. Eastern Time, and at any adjournment(s) or postponement(s) thereof (the “Annual Meeting”).

As a stockholder, you are invited to participate in the Annual Meeting and are requested to vote on the matters described in this Proxy Statement. The Annual Meeting will be

conducted in a completely virtual manner through a live webcast that you can access online by going to www.virtualshareholdermeeting.com/OSUR2023. The webcast will not include a presentation by management. A question and answer session will be provided at the Annual Meeting only for questions that are germane to the matters being discussed and voted on at the meeting.

This summary highlights information contained elsewhere in this Proxy Statement but does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting your shares.

| 2023 ANNUAL MEETING INFORMATION |

• | Date and Time: Tuesday, May 16, 2023 at 12:30 p.m. (ET) |

• | Location: Online by visiting www.virtualshareholdermeeting.com/OSUR2023 |

• | Record Date: March 23, 2023 |

| PROPOSALS FOR STOCKHOLDER CONSIDERATION |

| Proposals | Board Recommendation | Page Reference for More Detail | ||||

1.) | Election of one Class II Director | FOR | 68 | |||

2.) | Ratification of Appointment of Independent Registered Public Accounting Firm for 2023 | FOR | 72 | |||

3.) | Advisory (Non-Binding) Vote to Approve Executive Compensation | FOR | 72 | |||

4.) | Advisory (Non-Binding) Vote to Select the Frequency of Future Stockholder Advisory Votes to Approve the Company’s Executive Compensation | EVERY YEAR | 73 | |||

5.) | Approval of Amendment and Restatement of our Stock Award Plan To Increase the Shares Authorized for Issuance Thereunder | FOR | 74 | |||

6.) | Stockholder Proposal Regarding Greenhouse Gas Reduction Targets | AGAINST | 79 |

Proposal No. 1 – Election of Directors

The table below provides summary information about our nominee for Class II Director, whose new term will expire at the 2026 Annual Meeting of Stockholders. The Board of Directors (the “Board”) is recommending that stockholders vote for the Director nominee.

| Committee Memberships1 | Other Public Boards | |||||||||||||

| Name and Principal Occupation | Age | Director Since | Independent | AC | CC | N& CG | ||||||||

Mara G. Aspinall | 60 | 2017 | Yes | C | √ | No | No | |||||||

1 AC = Audit Committee; CC = Compensation Committee; N&CG = Nominating & Corporate Governance Committee; C = Chairperson; √ = Member.

1

Table of Contents

Proposal No. 2 – Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has selected KPMG LLP (“KPMG”) to be our independent registered public accounting firm for the 2023 fiscal year. The Board believes KPMG is well qualified to serve in this capacity

and is recommending that the engagement of KPMG be ratified by our stockholders. The Board is recommending that stockholders vote for the appointment of KPMG as provided above.

Proposal No. 3 – Advisory (Non-Binding) Vote to Approve Executive Compensation

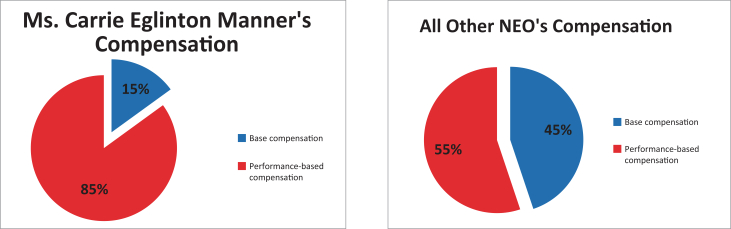

Our compensation program is designed to focus and reward our executives for balancing both short and long-term priorities. To fulfill this mission, we have adopted a pay-for-performance philosophy that forms the foundation for executive compensation decisions made by our Board and the Compensation Committee of the Board (the “Compensation Committee”).

The Compensation Discussion and Analysis portion of this Proxy Statement (the “CD&A”) contains a detailed description of our executive compensation philosophy and program, the compensation decisions the Board and Compensation Committee have made under that program and the factors considered in making those decisions, focusing on the compensation of our named executive officers (“NEOs”) for the year ended December 31, 2022, who were:

| Name | Position(s) | |

Carrie Eglinton Manner1 | President and CEO | |

Nancy J. Gagliano2 | Former Interim CEO | |

Stephen S. Tang3 | Former President and CEO | |

Kenneth McGrath4 | Chief Financial Officer | |

Scott Gleason5 | Former Interim Chief Financial Officer, Current Senior Vice President Corporate Communications & Investor Relations | |

Agnieszka Gallagher6 | Former Executive Vice President, General Counsel and Chief Compliance Officer | |

Lisa Nibauer7 | Former President of Diagnostics | |

Kathleen G. Weber | Chief Product Officer |

1 | Ms. Eglinton Manner was appointed as the President and CEO effective June 4, 2022. |

2 | Effective April 1, 2022, Nancy J. Gagliano, M.D., M.B.A. was appointed to replace Dr. Tang as the Company’s Interim CEO. Dr. Gagliano resigned effective June 4, 2022 from her position as the Company’s Interim CEO. |

3 | Stephen Tang, Ph.D. served as the Company’s CEO until March 31, 2022. |

4 | Mr. McGrath was appointed as the Chief Financial Officer effective August 8, 2022. |

5 | Mr. Gleason joined the Company in May 2021 as the Senior Vice President Corporate Communications & Investor Relations and assumed the role of Interim Chief Financial Officer in September 2021. Mr. Gleason served as the Interim Chief Financial Officer until Mr. McGrath’s appointment on August 8, 2022 and served as our Principal Financial Officer until August 10, 2022. On March 15, 2023, Mr. Gleason notified the Company of his resignation, effective May 26, 2023, in order to pursue another opportunity. |

6 | Ms. Gallagher resigned effective June 25, 2022. |

7 | Ms. Nibauer resigned effective November 11, 2022. |

As described further in the CD&A and elsewhere in this Proxy Statement, the following should be considered by stockholders in evaluating the compensation of our NEOs for 2022:

• | OraSure is a diverse and growing business operating in highly competitive and evolving markets; this has proven especially true throughout 2022 given the challenges and opportunities presented by the ongoing COVID-19 pandemic. |

• | We achieved record revenue during 2022, with our total company growing at a 36% compound annual growth rate since the pre-pandemic period in 2019. |

• | The Compensation Committee applied no positive discretion in determining performance and payouts for our NEOs. |

2

Table of Contents

• | We annually solicit input from our stockholders on executive compensation matters. The 2022 Say-on-Pay results (97% approval), combined with feedback from stockholders, suggest strong support for our programs and policies. |

• | We maintain and adhere by a full suite of good governance policies and processes. |

The Board is recommending that stockholders vote in favor of the compensation of our NEOs, as described in this Proxy Statement.

Proposal No. 4 – Non-binding Advisory Vote to Select the Frequency of Future Stockholder Advisory Votes to Approve the Corporation’s Executive Compensation

Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), provides that every six (6) years we must provide our stockholders with an opportunity to cast a separate advisory (non-binding) vote on the frequency of future advisory votes on executive compensation. Stockholders may indicate whether they would prefer that we conduct future advisory votes every year, every two (2) years or every three (3) years. At our Annual Meeting of Stockholders held in May 2017, a majority of our stockholders cast their vote in favor of holding an advisory vote on executive compensation each year. The Board has determined that an annual advisory vote on executive compensation will permit our stockholders to continue to provide direct input on our executive compensation philosophy and practices as disclosed in our proxy statement each year and is consistent with our efforts to engage in an ongoing dialogue with our stockholders on executive compensation and corporate governance matters.

The Board is recommending that stockholders vote in favor of annual advisory votes to approve the Company’s executive compensation, as described in this Proxy Statement.

Proposal No. 5 – Amendment and Restatement of Stock Award Plan

In order to enable the Company to continue to attract qualified directors, officers, employees and outside advisors, and to compensate these individuals in a manner that is competitive with compensation provided by other medical diagnostic and healthcare companies, the Board has determined that additional shares of Common Stock are needed to be available for grants under the Company’s Stock Award Plan. In addition, the Board wants to ensure that sufficient shares are available, if needed, to provide retention or other equity awards in connection with potential acquisitions or other business development activities. Finally, the Board believes it to be in the best interests of the Company’s stockholders to require a minimum vesting period of one year for all awards granted under the Stock Award Plan.

Accordingly, subject to stockholder approval, the Board approved an amendment and restatement of the OraSure Technologies, Inc. Stock Award Plan (last amended and restated, April 1, 2022) (the “Stock Award Plan” or the “Plan”) to both (i) increase the number of shares to be authorized for grant under the Plan by 3,000,000 shares. As a result of this increase there will be a total of 4,457,131 shares available in the Plan for future issuance on or after March 31, 2023, and (ii) generally require a minimum vesting period of one year for all awards granted under the Plan, subject to stockholder approval. A copy of the Amended and Restated Stock Award Plan reflecting this amendment is attached as Exhibit A to this Proxy Statement.

Proposal No. 6 – Stockholder Proposal Regarding Greenhouse Gas Reduction Targets

Nia Community Foundation, a holder of shares of the Company’s Common Stock with a value in excess of $25,000 for at least one year as of the date hereof, has given notice that, on behalf of Nia Community Foundation, a representative from Nia Impact Capital intends to present for action at the Annual Meeting a proposal requesting the Company issue near and long-term science-based greenhouse gas (“GHG”) reduction targets that are aligned with the Paris Agreement’s ambition of maintaining global temperature rise to 1.5°C and summarize plans to achieve them.

The Company has a shared interest in good environmental stewardship and has made great strides in environmental, social and governance (“ESG”) initiatives as described in greater detail in the Section of this Proxy Statement entitled, “Environmental, Social and Governance Issues.” While we are committed to furthering our sustainability efforts, our strategic priorities and core values guide how we approach fulfilling that commitment. We believe it would be imprudent to commit to the proponent’s requested actions before completing the necessary foundational steps, many of which were underway before we received the proponent’s proposal. As such, we do not believe it is in the Company’s or our stockholders’ best interests to commit to the actions in the proposal at this time, and we recommend a vote against the

3

Table of Contents

proposal. Additional information regarding this proposal, including the Board’s statement in opposition, can be found in the

“Proposals Requiring Your Vote – Proposal No. 6 – Stockholder Proposal Regarding Greenhouse Gas Reduction Targets” section below.

| 2022 PERFORMANCE HIGHLIGHTS |

Our business previously consisted of two segments: our “Diagnostics” segment, and our “Molecular Solutions” segment. In February 2023, we announced a corporate restructuring to combine the commercial and innovation teams across the two segments into one business unit with sales, marketing, product development and research teams aligned across multiple product portfolios. This change is intended to accelerate innovation, enhance customer experience and result in operational synergies.

We bolstered our management team with the addition of Carrie Eglinton Manner, who brings more than 25 years of healthcare leadership and transformation expertise to the company, as our new Chief Executive Officer and Kenneth McGrath, who joins the Company with over 20 years of financial leadership experience in the healthcare field, as our new Chief Financial Officer.

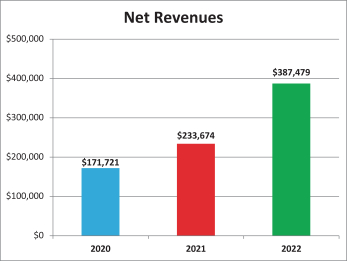

In 2022, we delivered record revenues, with our total company growing at a 36% compound annual growth rate since the pre-pandemic period in 2019. We achieved significant business milestones that we believe position the Company for growth in 2023 and beyond.

First, we continue to advance our InteliSwab® COVID-19 test, which received two new federal government contracts. The first procurement contract runs through November 2023; and, under the terms of the award, is estimated to account for 18 million InteliSwab® COVID-19 tests, with a maximum award of 36 million tests and a guaranteed minimum award of 3.6 million tests. The second contract was awarded for 3.2 million tests in December of 2022. We have also received approval from the U.S. Food and Drug Administration (the “FDA”) for a new packaging and labeling configuration for our InteliSwab® COVID-19 tests. The packaging changes are expected to drive per-test cost savings of approximately $0.40, which includes the impact from lower shipping costs based upon the smaller packaging configuration which should reduce total truckloads by approximately 50%. We also significantly scaled up manufacturing capacity in the United States for our InteliSwab® COVID-19 test and have achieved manufacturing capacity targets under our 2021 contract with the United States Department of Defense, in coordination with the United States Department of Health and Human Services.

We also continued to advance our innovation growth strategy in 2022 with the development of several new products in our diagnostics business including our four

newly-launched CE-IVD Colli-Pee® urine collection products to support growing interest in non-invasive HPV and STI screening diagnostics and liquid biopsy from first-void urine samples. Included among these launches is a product with a proprietary chemistry for cell-free DNA and extra-cellular vesicles for oncology applications. We believe these products will be an important contributor to our future molecular solutions business.

Our consolidated revenues of $387.5 million in 2022 represented a 66% increase over 2021. Net product and services revenues increased 67% when compared to the same period of 2021, largely due to $233.7 million of InteliSwab® COVID-19 test revenue recorded in 2022, compared to $22.7 million in 2021. Also contributing to the increased revenues were higher sales of our hepatitis C and substance abuse testing products. Declines in sales of our molecular sample collection kits for COVID-19 testing due in part to the reduction in PCR lab testing, lower genomics product revenue, lower laboratory services revenue and a decline in international sales of our HIV products offset these positive drivers of revenue. Other revenues for 2022 were $9.4 million compared to $6.8 million in the same period of 2021. This increase was largely due to increased research and development funding associated with our InteliSwab® COVID-19 test offset by a decrease in royalty income.

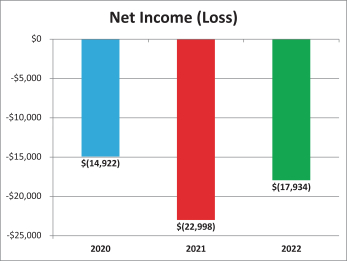

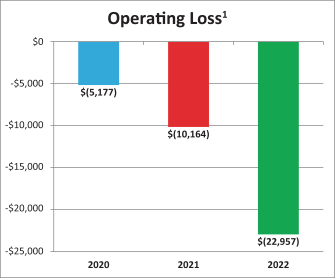

Our consolidated net loss was $17.9 million, or $0.25 per share on a fully diluted basis, compared to a net loss of $23.0 million, or $0.32 per share on a fully diluted basis, for 2021. Results for the full-year 2022 benefitted from the increased revenues in 2022 compared to 2021 offset by the negative impact of $17.1 million of impairment charges taken for idle manufacturing lines and goodwill. There were no similar charges in 2021. 2022 results also included higher spending in operating expenses across all categories.

Cash used in operating activities was $47.2 million compared to $35.4 million used in 2021. This increase reflected the significant investment in inventory purchases in anticipation of future demand of our COVID-19 testing products as well the increase in our accounts receivable balances resulting largely from COVID-19 shipments made toward the end of the fourth quarter of 2022. During 2022 we achieved cash flow breakeven in the third quarter ahead of our previously stated guidance. We ended the year with approximately $110.8 million in cash, cash equivalents, and available-for-sale securities, compared to $170.0 million in 2021.

4

Table of Contents

| MOST SIGNIFICANT COMPENSATION COMPONENTS |

We have structured the components of our executive compensation program to be directly tied to the performance of both the Company and our executives and aligned with the best interests of our stockholders. These components consist of the following:

Base Salary | Salaries are based on the individual executive’s position relative to market and the executive’s individual performance and contribution.

| |

Annual Cash Incentive Plan Bonuses | Annual incentive cash bonuses, our OraSure Technologies Incentive Plan (“OTIP”) reflect market-based targets with individual bonus payouts and are contingent upon (i) our achievement of corporate financial and/or strategic objectives, which are used to determine overall bonus pool funding, and (ii) the executive’s individual performance against pre-determined objectives.

| |

Equity Awards under our Long-Term Incentive Policy (“LTIP”) | Long-term incentive equity compensation reflects market-based targets with the value of individual awards contingent upon each executive’s individual performance against pre-determined objectives during the fiscal year prior to award. Fifty percent (50%) of each NEO’s annual LTIP award consists of performance-vested restricted units (“PRUs”) which require achievement of certain financial performance measures selected by the Board and Compensation Committee and the satisfaction of a 3-year service period for vesting of the award. The other fifty percent (50%) consists of time-vested restricted stock (“RS”) which vests in equal installments over a three-year service period.

|

| KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM |

Key features of our compensation program illustrate our commitment to pay-for-performance, the strong alignment of our executives’ interests with those of our stockholders and strong corporate governance. Several of the more significant of these features are summarized below:

• Compensation is market driven with total compensation of our executives targeted at the 50th percentile of the Company’s peer group (as set forth in the CD&A) (the “Peer Group”). | • Regular stockholder outreach on compensation/ governance matters. | |

• Compensation is predominantly variable or performance-based. | • Use of a third-party compensation consultant to provide executive compensation market assessment and independent advice on compensation matters. | |

• Balanced mix of cash/equity, fixed/variable, short- term/long-term compensation components. | • Strong stock ownership/retention requirements for executives and Directors. | |

• In order to incentivize growth, performance objectives for annual bonus pool funding target key financial measures and/or important strategic goals. |

• As a general matter, no perquisites for NEOs that are not offered to all employees of the Company. | |

• The Board’s discretionary ability to adjust annual incentive bonus pool funding is limited to +/- 10% of pool amount in order to avoid excessive discretionary bonus pool adjustments. In 2022, the Compensation Committee and Board included a condition that the annual incentive bonus pool funding may be further adjusted downward based on profitability and cash liquidity needs of the Company. | • Use of peer company benchmarking. | |

• Long-term equity incentive awards include 50% PRUs that vest based on (i) three-year cumulative revenue, (ii) three-year relative total stockholder return (“TSR”) and (iii) three years of continued service. | • Compensation recoupment or “clawback” policy, under which we may recover excess compensation paid to an executive if our financial statements are restated. | |

• No excise tax gross-up in any of our NEO employment agreements and no “single trigger” change-in-control severance in any of our new executive employment agreements. | • No hedging or pledging of our Common Stock. |

5

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE 2023 ANNUAL MEETING AND VOTING

1. WHY DID I RECEIVE THESE PROXY MATERIALS? |

Our Board of Directors (the “Board”) is furnishing proxy materials, including this Proxy Statement, a Proxy Card and the Company’s Annual Report to Stockholders for the year ended December 31, 2022 (the “2022 Annual Report”), to our stockholders in order to solicit proxies to be voted at the Annual Meeting (each, a “Proxy”). On or about April 20, 2023, we will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to each stockholder at the holder’s address of record, indicating that this Proxy Statement is now available to our stockholders of record entitled to vote at the Annual Meeting. Please carefully review this Proxy for information on the matters to be presented at the Annual Meeting and for instructions on how to vote your shares. Our 2022 Annual Report, including financial statements for such

period, does not constitute any part of the material for the solicitation of proxies, but copies are available to stockholders upon request.

Securities and Exchange Commission (“SEC”) rules permit us to deliver only one copy of the Notice or a single set of proxy materials to multiple stockholders sharing the same address. Upon written or oral request, we will deliver separate Notices and/or copies of our 2022 Annual Report and/or this Proxy Statement to any stockholder at a shared address to which a single copy of the Notice was delivered. Stockholders may notify the Company of their requests by calling or writing us at OraSure Technologies, Inc., 220 East First Street, Bethlehem, Pennsylvania 18015, Attention: Corporate Secretary; (610) 882-1820.

2. WHAT IS A PROXY |

A Proxy is your legal designation of another person to vote the shares of Common Stock you own. That other person is called a “proxy.” If you designate someone as your proxy in a written document, that document also is called a Proxy or a Proxy Card.

Carrie Eglinton Manner and Stefano Taucer, each of whom are officers of the Company, have been designated by the Board of Directors as proxies to vote on behalf of stockholders for the Annual Meeting.

3. WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN? |

The record date for the Annual Meeting is March 23, 2023 (the “record date”). The record date is established by the Board as required by Delaware law. Only stockholders of record at the close of business on the record date are entitled to:

(a) | receive notice of the Annual Meeting; and |

(b) | vote at the Annual Meeting and any adjournment(s) or postponement(s) of the meeting. |

Each stockholder of record on the record date is entitled to one vote for each share of Common Stock held.

On the record date, there were 75,914,622 shares of our Common Stock outstanding and entitled to vote at the Annual Meeting.

A list of stockholders will be open for examination by any stockholder for any purpose germane to the Annual Meeting for a period of 10 days prior to the meeting at our principal executive offices at 220 East First Street, Bethlehem, PA 18015, and electronically during the Annual Meeting at www.virtualshareholder-meeting.com/OSUR2023 when you enter the control number provided in the Notice sent to you.

4. WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A STOCKHOLDER WHO HOLDS STOCK IN STREET NAME? |

If your shares of stock are registered in your name on the books and records of our transfer agent, Computershare, Inc., you are a stockholder of record.

If your shares of stock are held for you in the name of your broker, bank or other nominee, your shares are held in “street name.” The answer to Question 7 describes brokers’ discretionary voting authority and when your

broker, bank or other nominee is permitted to vote your shares of stock without instructions from you.

It is important that you vote your shares if you are a stockholder of record and, if you hold shares in street name, that you provide appropriate voting instructions to your broker, bank or other nominee as discussed in the answer to Question 7.

6

Table of Contents

5. HOW CAN I VOTE MY SHARES FOR THE ANNUAL MEETING? |

All stockholders have a choice of voting via the internet, over the telephone or by completing and mailing a paper Proxy Card, as described below.

Voting via the Internet or by Telephone. Stockholders of record desiring to vote online via the internet or by telephone prior to the Annual Meeting, should go to www.proxyvote.com or call the toll free number indicated on the Proxy Card or Notice. You may vote via the internet or by telephone provided you do so by 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time) on May 15, 2023. Stockholders who attend the Annual Meeting via the internet may vote their shares at that time up to and during the Annual Meeting by following the instructions at www.virtualshareholdermeeting.com/OSUR2023.

Street name holders may vote via the internet or by telephone if their brokers, banks or other nominees make those methods available. If that is the case, each broker, bank or nominee will include instructions with the Notice or Proxy Statement.

The telephone and internet voting procedures, including the use of control numbers, are designed to

authenticate your identity, to allow you to give your voting instructions and to confirm that your instructions have been recorded properly.

If you vote via the internet, you should understand that you will be responsible for any costs associated with this method of voting, such as usage charges from internet access providers and telephone companies.

Voting by Mail. If you desire to vote prior to the Annual Meeting by mail by using a paper Proxy Card instead of by telephone or via the internet, you will need to follow the instructions in your Notice that will be mailed to you. You will then need to complete, sign, date and return the Proxy Card, as described on the Proxy Card. Street name holders should complete and return the voting card provided by their broker, bank or nominee.

Voting at the Annual Meeting. All stockholders of record may vote online during the Annual Meeting, as described above. Submitting a Proxy via the internet, over the telephone or by mail will not affect your right to withdraw your Proxy and vote during the Annual Meeting.

6. HOW WILL MY SHARES BE VOTED IF I SEND IN A PROXY |

If you are represented by a properly executed Proxy, whether delivered by phone, the internet or mail, your shares will be voted in accordance with your instructions.

If you do not provide instructions with your Proxy, your shares will be voted according to the recommendations of our Board as stated on the Proxy.

7. WILL MY SHARES BE VOTED IF I DO NOT PROVIDE MY PROXY? |

Stockholders of Record: If you are a stockholder of record, your shares will not be voted if you do not provide your Proxy, unless you vote online during the Annual Meeting. It is, therefore, important that you vote your shares.

Street Name Holders: If your shares are held in street name and you do not provide your signed and dated voting instruction form to your bank, broker or other nominee, your shares may be voted by your broker, bank or other nominee but only under certain circumstances. Specifically, under rules of the New York Stock Exchange, which also apply to companies listed on the Nasdaq Stock Exchange (“Nasdaq”), shares held in the name of your broker, bank or other nominee may be voted by your broker, bank or other nominee on certain “routine” matters if you do not provide voting instructions.

At the upcoming Annual Meeting, only the ratification of the selection of KPMG LLP as the Company’s

independent registered public accounting firm is considered a “routine” matter for which brokers, banks or other nominees may vote uninstructed shares. The other proposals to be voted on at our Annual Meeting (specifically, the election of the Director nominee, the advisory vote to approve the compensation of the Company’s NEOs, the advisory vote on the frequency of future stockholder advisory votes on executive compensation and the vote to approve the amendment and restatement of the Company’s Stock Award Plan are not considered “routine”, so the broker, bank or other nominee cannot vote your shares on any of these proposals unless you provide to the broker, bank or other nominee voting instructions for each of these matters. If you do not provide voting instructions on these matters, your shares will not be voted on the matter, which is referred to as a “broker non-vote.” It is, therefore, important that you vote your shares.

7

Table of Contents

8. HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING? |

Your shares are counted as present at the meeting if you attend the meeting and vote online or if you properly return a Proxy by internet, telephone or mail. In order for us to conduct our Annual Meeting, a majority of our outstanding shares of Common Stock as of the record

date, must be present online or by Proxy at the meeting. This is referred to as a quorum. Broker non-votes, votes withheld and abstentions are included in determining whether there are a sufficient number of shares present to constitute a quorum.

9. HOW CAN I REVOKE A PROXY |

You can revoke a Proxy before the completion of voting at the Annual Meeting by:

(a) | Giving written notice to the Corporate Secretary of the Company to revoke your Proxy; or |

(b) | Delivering a later-dated Proxy that indicates the change in your vote; or |

(c) | Logging on to www.proxyvote.com in the same manner you would to submit your Proxy electronically or calling the telephone number indicated in your Notice, and in each case, following the instructions to revoke or change your vote; or |

(d) | Attending the Annual Meeting online and voting, which will automatically cancel any Proxy previously given. Attendance alone will not revoke any Proxy that you have given previously. |

If you choose any of the first three methods, you must take the described action no later than 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time) on May 15, 2023. Once voting on a particular matter is completed at the Annual Meeting, you will not be able to revoke your Proxy or change your vote. If your shares are held in street name by a broker or other nominee, you must contact that institution to change or revoke your vote.

10. WHAT ITEMS WILL BE VOTED ON AT THE ANNUAL MEETING? |

At the Annual Meeting, action will be taken on the matters set forth in the accompanying Notice and described in this Proxy Statement. The Board knows of no other matters to be presented for action at the Annual Meeting.

If any other matters do properly come before the Annual Meeting, the persons named in the Proxy Card will have discretionary authority to vote on those matters in accordance with their best judgment.

11. WHO WILL PAY THE COST OF THIS PROXY SOLICITATION? |

Solicitation of Proxies is made on behalf of the Board. The cost of soliciting Proxies will be borne by the Company. In addition to solicitations by e-proxy and/or by mail, certain of our Directors, officers and regular employees may solicit Proxies personally or by telephone or other means without additional compensation.

We have also engaged Morrow Sodali LLC, 333 Ludlow street, 5th Floor, South Tower, Stamford, CT

06902, and Alliance Advisors, LLC, 200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003, to provide proxy solicitation services at an estimated fee of $7,500 and $15,000 respectively, plus expenses. Arrangements will be made with brokerage firms and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of stock held of record by such persons, and we will, upon request, reimburse them for their reasonable expenses in so doing.

12. HOW CAN I PARTICIPATE IN THE ANNUAL MEETING? |

This year’s Annual Meeting will be a virtual meeting of stockholders, and will be conducted via live webcast on the Internet. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on March 23, 2023, the record date for the meeting, or if you hold a valid Proxy for the Annual Meeting.

You will be able to participate in the Annual Meeting online and submit your questions during the meeting by

visiting https://www.virtualshareholdermeeting.com/OSUR2023. To participate in the Annual Meeting, you will need the control number that is included on your Notice, on our Proxy Card or on the instructions that accompanied your proxy materials. The Annual Meeting will begin promptly at 12:30 p.m. Eastern Time, and you should allow ample time to complete the online check-in procedures.

8

Table of Contents

13. WHAT IF I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE VIRTUAL MEETING |

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call

the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

14. ARE VOTES CONFIDENTIAL? |

We will continue our long-standing practice of holding the votes of each stockholder in confidence from Directors, officers and employees, except: (a) as necessary to meet applicable legal requirements and to assert or defend claims for or against the Company; (b) in

the case of a contested proxy solicitation; (c) if a stockholder makes a written comment on the Proxy Card or otherwise communicates his or her vote to the Company; or (d) as needed to allow the independent inspectors of election to certify the results of the vote.

15. WHO COUNTS THE VOTES? |

We will continue, as we have for many years, to retain an independent inspector of election to receive and

tabulate the Proxies and certify the results. These activities will be handled electronically.

16. MAY STOCKHOLDERS ASK QUESTIONS AT THE ANNUAL MEETING? |

Yes. The CEO will answer stockholders’ written questions submitted during the question and answer period of the meeting. Stockholders should confine their questions to matters that relate to the business of the meeting. The CEO will determine which questions are appropriate to answer during the meeting.

We reserve the right to edit or reject any questions we deem profane or otherwise inappropriate. Detailed guidelines for submitting written questions during the meeting are available at www.virtualshareholdermeeting.com/OSUR2023.

9

Table of Contents

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of the March 23, 2023 record date (except for Dr. Tang, Ms. Gallagher and Ms. Nibauer, each as described below), regarding the beneficial ownership of the Company’s Common Stock by (a) each person who is known by us to be the beneficial owner of more than five percent of the Common Stock outstanding; (b) each Director and nominee for election as Director; (c) each of our executive officers named in the Summary Compensation Table in this Proxy Statement; and (d) all of our Directors, the nominee for election as Director and executive officers as a group. Unless otherwise indicated, the address of each person identified below is c/o OraSure Technologies, Inc., 220 East First Street, Bethlehem, Pennsylvania 18015.

Pursuant to Rule 13d-3 under the Exchange Act, shares of Common Stock which a person has a right to acquire pursuant to the exercise of stock options held by that person that are exercisable within 60 days of March 23, 2023 are deemed to be outstanding for the purpose of computing the ownership percentage of that person, but are not deemed outstanding for computing the ownership percentage of any other person.

Name and Address of Beneficial Owner | Amount and Nature of the Beneficial Ownership1,2 | Percent of Class | ||

Black Rock, Inc.3 | 13,718,269 | 18.1% | ||

The Vanguard Group4 | 5,129,077 | 6.8% | ||

Camber Capital Management, LP5 | 4,250,000 | 5.6% | ||

Carrie Eglinton Manner | 1,398,827 | 1.8% | ||

Stephen S. Tang, Ph.D.6 | 349,793 | * | ||

Kathleen G. Weber | 289,233 | * | ||

Kenneth McGrath | 185,512 | * | ||

Agnieszka Gallagher7 | 147,308 | * | ||

Lisa Nibauer8 | 123,479 | * | ||

Mara G. Aspinall | 117,218 | * | ||

Scott Gleason | 114,634 | * | ||

James Datin | 60,925 | * | ||

Nancy Gagliano, M.D. | 42,160 | * | ||

Lelio Marmora | 30,935 | * | ||

Anne Whitaker | 30,563 | * | ||

David J. Shulkin, M.D. | 30,550 | * | ||

All Directors, the nominee for election as Director, and executive officers as a group (13 people) | 2,921,137 | 3.8% |

* | Less than 1%. |

1 | Subject to community property laws where applicable, beneficial ownership consists of sole voting and investment power except as otherwise indicated. |

2 | Includes shares subject to options exercisable within 60 days of March 23, 2023, as follows: Ms. Weber, 14,533 shares; Ms. Gallagher 56,724; and Ms. Aspinall, 40,000 shares; and all Directors, the nominee for election as Director and executive officers as a group, 111,257 shares. Also includes unvested RS, as follows: Ms. Eglinton Manner, 1,398,827 shares; Ms. Weber, 115,752 shares; Mr. McGrath, 185,512, shares; Mr. Gleason, 92,686 shares; Ms. Aspinall, 20,000 shares; Mr. Datin, 20,000 shares; Dr. Shulkin, 20,000 shares; Mr. Marmora, 20,000 shares; Dr. Gagliano, 10,563 shares; and Ms. Whitaker 30,563 shares; and all Directors, the nominee for election as Director and executive officers as a group, 1,913,903 shares. Does not include unvested PRUs. |

10

Table of Contents

3 | Based on information contained in a Schedule 13G/A filed January 23, 2023. The filing person has sole voting power with respect to 13,341,530 shares and sole dispositive power with respect to all of the indicated shares. |

4 | Based on information contained in a Schedule 13G/A filed February 9, 2023. The filing person has shared voting power with respect to 46,749 shares, sole dispositive power with respect to 5,025,049 shares and shared dispositive power with respect to 104,028 shares. |

5 | Based on information contained in a Schedule 13G filed February 2, 2023. The filing person has sole voting power with respect to 4,250,000 shares |

6 | Dr. Tang’s employment as President and CEO of the Company ended on March 31, 2022. The indicated shares reflect Dr. Tang’s ownership as of his resignation date. |

7 | Ms. Gallagher’s employment as Executive Vice President, General Counsel and Chief Compliance Officer of the Company ended on June 25, 2022. The indicated shares reflect Ms. Gallagher’s ownership as of her resignation date. |

8 | Ms. Nibauer’s employment as President of Diagnostics of the Company ended on November 11, 2022. The indicated shares reflect Ms. Nibauer’s ownership as of her resignation date. |

CORPORATE GOVERNANCE

| BOARD RESPONSIBILITIES, OPERATION AND COMPOSITION |

The primary responsibility of the Board of Directors is to promote the long-term success of the Company. In fulfilling this role, each Director must exhibit good faith business judgment as to what is in the best interests of the Company. The Board is responsible for establishing broad corporate policies, setting strategic direction and overseeing management. The Company’s management is responsible for the day-to-day operations of the Company.

Currently, the Board is divided into three classes with Class I consisting of two Directors, Class II consisting of two Directors and Class III consisting of three Directors. There are currently seven Directors serving on the Board. The Board has determined that Ms. Whitaker, a current Class II member of the Board, will not stand for re-election at the Annual Meeting, and her service as a member of the Board will end effective as of the Annual Meeting. Accordingly, Ms. Whitaker’s seat shall remain vacant until filled in accordance with our Bylaws. At each annual meeting of stockholders, the nominees for the class of Directors whose term is expiring at that annual meeting are elected for a three-year term. A Director holds office until the annual meeting of stockholders for the year in which his or her term expires or until his or her successor is elected and duly qualified, subject to prior death, resignation, retirement, disqualification or removal. Each nominee for election at our upcoming Annual Meeting currently serves as a Director.

The Board typically holds regular meetings in February, May, August and November of each year, with additional meetings held as needed. The Board’s organizational meeting follows the annual meeting of stockholders. The Board usually meets in executive session at all regularly scheduled meetings. The Board held 15 meetings and acted by written consent on eight occasions during the fiscal year ended December 31, 2022. Each member of the Board attended more than 75 percent of the combined total of meetings of the Board and of the Committees of the Board on which such member served during the period in the year in which he or she served as a Director. |

The Board holds four regularly scheduled meetings each year and special meetings as needed. Directors attended greater than 75% of all Board and Committee meetings during 2022. | |

| GOVERNANCE GUIDELINES AND CODE OF CONDUCT |

The Board has adopted Corporate Governance Principles which, along with the Charters for each of its Committees and the Company’s Amended and Restated Code of Business Conduct and Ethics, provide a framework for the governance of the Company. The Company’s Corporate Governance Principles address matters such as the responsibilities and composition of the Board, Director independence and the conduct of Board and Committee meetings. The Company’s Amended and Restated Code of Business Conduct and Ethics sets forth guiding principles of business ethics and certain legal requirements applicable to all Company employees, contractors and non-employee Directors. Copies of the current Corporate Governance Principles and Amended and Restated Code of Business Conduct and Ethics are available on the Investor Relations — Corporate Governance section of the Company’s website, https://orasure.gcs-web.com/governance. Upon request, the Company will provide a copy of each policy free of charge to any stockholder.

11

Table of Contents

If we make substantive amendments to or grant any waiver from the Amended and Restated Code of Business Conduct and Ethics applicable to our directors or executive officers, we will disclose the nature of such amendments or waiver to our stockholders to the extent and in the manner required by applicable exchange listing standards or any other regulation. For conduct involving an executive officer or Board member, only the Board of Directors or the Audit Committee of the Board has the authority to waive a provision of the Amended and Restated Code of Business Conduct and Ethics. Should the Company grant a waiver to its Amended and Restated Code of Business Conduct and Ethics, the Company intends to post notice of the waiver to its website at https://orasure.gcs-web.com/governance. Any waivers granted to the Amended and Restated Code of Business Conduct and Ethics will be available on the website for at least a 12-month period.

| We operate under a Code of Business Conduct and Ethics and Corporate Governance Principles, which apply to all employees, contractors and non-employee Board members. |

| ENVIRONMENTAL, SOCIAL AND GOVERNANCE ISSUES |

We believe that conducting our business in a socially, environmentally and ethically responsible manner, and in compliance with applicable legal requirements, is important to our long-term success and the health and well-being of our employees, customers, the communities that we serve and other stakeholders. As a result, ESG issues have become an increasingly important focus for our management team and our Board.

On March 21, 2022, the SEC proposed extensive and comprehensive new rules that, if adopted, would require us to provide detailed climate-related disclosures. These disclosures would include information about material climate-related risks, financial statement disclosures, together with detail relating to our governance of climate-related risks and risk-management processes, the likelihood of those risks having a material impact on our business and financial statements, among others. Additionally, the proposed rules would require us to disclose information about our Scope 1 and Scope 2 greenhouse gas emissions.

Though these changes have not yet been implemented, and their full scope remains unclear, we are focused on remaining apprised of their status, understanding the requirements and planning for any impact they could impose on our business.

ESG Oversight

Historically, ESG issues have been addressed by the management teams in our various companies with the primary focus on regulatory and legal compliance, ethical operations and development of our human capital resources. Material risks in these areas have been regularly reviewed with our Board, either directly or through the Audit Committee. Our management previously formed a cross-functional team to consistently and more formally review ESG issues in order to identify material ESG risks impacting our business and determining appropriate mitigation and corrective strategies. These risks were discussed by the Board in 2022 and will be discussed by the Board at least annually as part of the Board’s oversight of risk management.

In 2022, we released our first “OraSure Cares” ESG report, which provides a snapshot of the many ways that we are preserving the environment, empowering our people, modeling integrity and positively impacting the communities that we serve and in which we are located. A copy of the report may be accessed on our website at www.orasure.com. We intend to issue our second ESG report later in 2023.

Environmental

We endeavor to implement responsible and sustainable environmental practices throughout our organization. Our goal is to eliminate or minimize any harm to our employees, the communities that we serve and the environment. We follow practices to reduce our energy usage and operate more efficiently, including through the use of motion detectors and timers to reduce electricity usage. We also have implemented a Company-wide waste recycling program under which recyclable materials are segregated for removal and appropriate handling. Hazardous and medical waste is also segregated and disposed of in accordance with applicable laws and regulations.

12

Table of Contents

Formed in 2020, our Sustainability Initiative focuses on identifying additional steps we can take to reduce our carbon footprint, including through the use of solar and renewable energy sources and promoting clean communities and positive environmental stewardship. Some of the key highlights of work completed by our Sustainability Committee include:

1. | Manufacturing programs that reduced our scrap rates from 30% to less than 1% over the course of 2022 resulting in net savings of 3.5 tons of plastic |

2. | The purchase of carbon-free energy for our corporate headquarters and some Bethlehem based manufacturing sites |

3. | The introduction of an on-site composting program at our Ottawa and Minneapolis locations to reduce material waste |

4. | Sponsored company-wide neighborhood and site clean-up events during Earth Day 2022 |

5. | Completed Amazon web service migration initiative lowering our digital footprint and using approximately one third less electricity by our servers |

6. | Purchased 232 tons of carbon offsets against corporate air travel |

7. | Published our 2022 “OraSure Cares” Environmental, Social, and Governance (ESG) report highlighting the Company’s ESG initiatives |

Additionally, in 2022, our Sustainability Initiative engaged an advisory firm to create a Greenhouse Gas (“GHG”) Emissions Inventory Report (the “GHG Report”) for our Bethlehem, Pennsylvania sites covering emissions for the 2021 calendar year. The GHG Report, which contains a detailed accounting of our Scope 1, Scope 2 and Scope 3 GHG emissions associated with those sites, provides us with a data-focused foundation for effective management of our GHG emissions. We conducted this study independently given our stated goal of positive environmental stewardship. In 2022, we undertook several programs, which significantly lessened our emissions.

Based upon the results of this study, we concluded that the largest source of emissions associated with our InteliSwab manufacturing process was tied to supplier materials. Consequently, we redesigned the packaging of our InteliSwab COVID-19 Rapid Tests, which we estimate will save 90 tons of plastic and 1,500 tons of paper in addition to reducing required delivery truckloads by approximately 50%. This initiative is estimated to have reduced total CO2 emissions by 20,000 tons. These numbers are based upon projected InteliSwab volumes as of December 31, 2022.

We consistently examine our operations and strive to find additional ways to lessen our impact on the environment, and our Sustainability Committee remains dedicated to researching, designing and implementing new and innovative ways to reduce our carbon footprint to benefit our employees, the communities that we serve and the environment. The Company is also evaluating proposed U.S. Security and Exchange Commission (SEC) rules issued on March 21, 2022 which could require public companies to disclose certain climate related metrics including greenhouse gas emissions data in the Company’s annual report on form 10-K. Under the current proposed rules, OraSure would be required to make these disclosures as a non-accelerated filer in calendar year 2025 as part of its 2024 annual report filing. Final guidance on these requirements has not been issued by the SEC but is anticipated in calendar year 2023. OraSure believes it is prudent to wait for these rules to be finalized before allocating additional resources to monitor environmental outcomes.

Healthcare

We are committed to improving healthcare and making it more accessible in all parts of the world. For several years, we worked with Population Services International (“PSI”), a leading global health organization, along with UNITAID, the WHO and health officials from several African countries to deploy our Self-Test through the UNITAID-PSI HIV Self-Testing in Africa (“STAR”) project. The OraQuick® Self-Test has labeling and instructions specifically tailored for each market in which it is sold. The purpose of the STAR project was to generate crucial information about how best to deliver HIV self-testing, how to generate demand for HIV testing in this manner and what the potential public health impact of self-testing will be. Our OraQuick® Self-Test was chosen by PSI because of its quality, ease-of-use and proven acceptability in lay person testing. The STAR project has largely been completed.

13

Table of Contents

Social

We believe our employees are our most important resource and are critical to our continued success. The health and safety of our workforce is a critical priority across our organization. We safeguard our people, projects and reputation by striving for zero employee injuries and illnesses, while operating and delivering our work responsibly and sustainably. We provide our employees upfront and ongoing safety training to ensure that safety policies and procedures are

effectively communicated and implemented. Personal protective equipment is provided to those employees where needed for the employees to safely perform their job function. We have formed a Safety Committee consisting of employees from various functional departments to administer our internal safety inspection program, monitor compliance, investigate safety incidents and oversee the effectiveness of our safety procedures and policies.

As part of our compensation philosophy, we believe that we must offer and maintain market competitive compensation and benefits programs for our employees in order to attract and retain superior talent. In addition to competitive base wages, additional programs include annual bonus opportunities, a Company matched 401(k) Plan or other savings plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, flexible work schedules, and employee assistance programs.

We focus significant attention on attracting and retaining talented and experienced individuals to manage and support our operations, and our management team routinely reviews employee turnover rates at various levels of the organization. Management also reviews employee engagement and satisfaction surveys to monitor employee morale and receive feedback on a variety of issues.

The OraSure family of companies is committed to creating and fostering a diverse, equitable, and inclusive workplace that reflects and contributes to the global communities in which we do business and the customers and partners we serve. This includes all communities impacted by our corporate presence. Our management teams and our employees are expected to exhibit and promote honest, ethical and respectful conduct in the workplace. All of our employees must adhere to a Code of Business Conduct and Ethics that sets standards for appropriate behavior and includes required annual training on preventing, identifying, reporting and stopping any type of unlawful discrimination. We strive to recruit the best people for the job regardless of gender, ethnicity or other protected trait and it is our policy to fully comply with all laws (domestic and foreign) applicable to discrimination in the workplace. We have established a hotline and other communication methods that employees can use to anonymously submit discrimination or other complaints.

We have an active Diversity, Equity and Inclusion Council that strives to drive diversity, equity and inclusion within the workplace. At the end of 2022, the composition of the Board of Directors was 57% female and 43% male while the executive leadership team was 50% female and 50% male. We believe a variety of perspectives are critical to achieving success, and that diversity, equity and inclusion are key drivers to growth-based innovation and profitability. We are committed to creating a culture where all people feel valued, supported, and inspired to be themselves fearlessly, without judgement. We believe that when all voices are heard, we honor and exemplify our core values and best serve our customers and communities.

Governance

Our overall corporate mission is to do good and help solve the world’s greatest health challenges. We believe that our point-of-care and self-testing diagnostics and specimen collection innovation have significantly contributed to public health on a global basis. Through these efforts, we are committed to making a difference in the world of individual and public health by helping to increase access, affordability and quality of care.

In pursuing our mission, we are committed to operating our business in accordance with the highest moral, legal and ethical standards. As previously mentioned, we have adopted an Amended and Restated Code of Business Conduct and Ethics in order to define the high standards under which all members of our Board and all of our employees are expected to operate. We also have an Anti-Corruption Policy, a Policy on Interactions with Healthcare Professionals and other policies which further require honest, ethical and lawful behavior. These policies are part of a broader compliance program designed to ensure that all policies and legal requirements are followed, that we make and sell high-quality products in accordance with applicable regulatory requirements and that we otherwise operate in a responsible, ethical and compliant manner.

14

Table of Contents

| INDEPENDENT BOARD CHAIRPERSON |

The positions of Chairman of the Board and CEO of the Company are held by different individuals, with the Chairman being independent of management.

| The Board has carefully considered its leadership structure and believes that the Company and its stockholders are best served by having the positions of Chairperson and CEO filled by different individuals. This allows the CEO to, among other things, focus on the Company’s day-to-day business, while allowing the Chairperson to lead the Board in its fundamental role of providing strategic advice and oversight of management. |

| DIRECTOR INDEPENDENCE |

Our Corporate Governance Guidelines require, among other things, that a majority of the members of the Board meet the independence requirements of the SEC and Nasdaq, on which our Common Stock is listed. Each year our Board, with assistance from the Nominating and Corporate Governance Committee, conducts a review of Director independence. The most recent annual review occurred in the first quarter of 2023, during which the Board considered | A majority of our Directors are independent as required under applicable SEC and Nasdaq rules. All standing Board Committees consist of independent Directors.

| |

transactions and relationships, if any, between each Director and any member of such Director’s immediate family and the Company. As a result of this review, the Board determined that Mara G. Aspinall, Dr. Nancy J. Gagliano, M.D., M.B.A., James A. Datin, Lelio Marmora, David J. Shulkin, M.D. and Anne C. Whitaker, are “independent,” as that term is defined in the applicable rules of Nasdaq and the SEC. Ms. Carrie Eglinton Manner was determined by the Board not to be independent because she is serving as an executive officer employed by the Company. Based on the foregoing, the Board of Directors is comprised of a majority of independent Directors. The Audit Committee, the Nominating and Corporate Governance Committee and Compensation Committee of the Board are also comprised solely of independent Directors. | ||

| OVERSIGHT OF RISK MANAGEMENT |

As part of its oversight of the Company’s operations, the Board and Audit Committee monitor the management of risks by the Company’s executives. The Audit Committee reviews the risks that the Company may face and receives reports from senior management on the nature of these risks and the procedures and processes implemented by processes in place to manage and mitigate such risks. Substantive areas of risk reviewed by the Audit Committee include financial, legal, regulatory, operational, information technology, cybersecurity and employment | The Board and Audit Committee

|

matters. The Audit Committee provides a report to the full Board on the matters covered during each of its meetings, including its risk monitoring activities. In addition, senior management provides periodic reports to the full Board on the major risks facing the Company and the processes and procedures in place to manage such risks. Management also conducts a risk assessment of the Company’s compensation policies and practices, including its executive compensation program, as described in greater detail in the Section of this Proxy Statement entitled, “Compensation Committee Matters.”

| ANNUAL MEETING ATTENDANCE AND STOCKHOLDER COMMUNICATIONS |

The Board has approved a policy concerning Board members’ attendance at our Annual Meeting of Stockholders and a process for security holders to send communications to members of the Board. A description of the Board’s policy on Annual Meeting attendance is provided on our website, at www.orasure.com. As a general matter, each Board member is required to attend each Annual Meeting of Stockholders. Our 2022 Annual Meeting was attended by all members of the Board.

Security holders may communicate with the Board by sending their communications to OraSure Technologies, Inc., 220 East First Street, Bethlehem, Pennsylvania 18015, Attention: Corporate Secretary, fax: (610) 882-2275, email: corporatesecretary@orasure.com.

All Board members are required to attend each Annual Meeting of Stockholders. The entire Board attended the 2022 Annual Meeting. |

15

Table of Contents

| COMMITTEES OF THE BOARD |

The Board currently has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Members of the Audit Committee, Compensation Committee, and the Nominating and Corporate Governance Committee are each “independent,” as defined in the Exchange Act and Nasdaq rules applicable to such Committees. In addition, the Board has determined that Mara G. Aspinall is an “audit committee financial expert,” as that term is defined by applicable rules of the SEC. Each committee operates pursuant to a written charter, copies of which are available on our website, at www.orasure.com. Additional information on each standing committee is provided below:

| AUDIT COMMITTEE |

Committee Members*:

| Responsibilities:

• Oversees accounting and financial reporting process, internal controls and audits.

• Consults with management and the Company’s independent registered public accounting firm on, among other items, matters related to the annual audits, the published financial statements and the accounting principles applied.

• Appoints, evaluates and retains our independent registered public accounting firm.

• Responsible for the compensation, termination and oversight of our independent registered public accounting firm. | |||

Mara G. Aspinall(1)

| (C, I)

| |||

James A. Datin

| (I)

| |||

Lelio Marmora

| (I)

| |||

Anne C. Whitaker(2)

| (I)

| |||

Number of Meetings during

|

• Evaluates the independent registered public accounting firm’s qualifications, performance and independence.

• Approves all services provided by the independent registered public accounting firm.

• Monitors the Company’s major risk exposures and reviews risk assessment and mitigation policies and determines the appropriate levels and types of insurance policies to be purchased by the Company.

• Maintains procedures for the receipt, retention and treatment, on a confidential basis, of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters.

• Reviews the Company’s cybersecurity program and risks, as identified by Company management, and the steps that the Company management has taken to protect against threats to the Company’s assets including information systems and data security. | |||

C | – Committee Chairperson |

I | – Determined by the Board to be independent under applicable SEC and Nasdaq rules. |

(1) | – Determined by the Board to be an audit committee financial expert as defined under applicable SEC Rules. |

(2) | – The Board has determined that Ms. Whitaker will not stand for re-election at the Annual Meeting, and her service as a member of the Board will end effective as of the Annual Meeting. |

16

Table of Contents

| COMPENSATION COMMITTEE | ||||

Committee Members*:

|

Responsibilities:

• Oversees compensation for executives and non-employee Directors.

• Reviews and recommends to the Board for approval the performance criteria, goals and objectives for CEO compensation.

• In consultation with other independent non-employee Directors, evaluates the CEO’s annual performance. | |||

Mara G. Aspinall

| (I)

| |||

James A. Datin

| (C, I)

| |||

David J. Shulkin, M.D.

| (I)

| |||

Number of Meetings during fiscal 2022: 5 |

• Evaluates and recommends the CEO’s compensation to the Board for approval.

• In consultation with the CEO, reviews and approves the compensation of other executive officers.

• Establishes performance measures and goals and evaluates the attainment of such goals under performance-based incentive compensation plans.

• Reviews compensation and benefits issues relating to the Company.

• Reviews and recommends for Board approval, the terms of any employment agreements between the Company and each executive officer.

• Periodically reviews and administers the Company’s Compensation Recoupment Policy for executive officers and non-employee Directors.

• Reviews compliance with the Company’s Stock Ownership Guidelines. | |||

C | – Committee Chairperson |

I | – Determined by the Board to be independent under applicable SEC and Nasdaq rules. |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||||

Committee Members:

|

Responsibilities:

• Identifies, evaluates and recommends candidates for nomination or re-election to the Board.

• Reviews and makes recommendations to the Board on the range of skills, qualifications and expertise required for service as a Director.

• Reviews and recommends for Board approval the appropriate structure of the Board and Board committees.

| |||

Nancy J. Gagliano, M.D., M.B.A.

| (C, I)

| |||

Lelio Marmora

| (I)

| |||

David J. Shulkin, M.D.

| (I)

| |||

Number of Meetings during fiscal 2022: 3 | ||||

• Recommends committee assignments and candidates for the position of Chairperson of each committee.

• Develops and recommends for Board approval Corporate Governance Guidelines and a Code of Business Conduct and Ethics, and procedures for the implementation thereof.

• Periodically reviews and recommends for Board approval the Board’s leadership structure, including whether the same person should serve as both CEO and Chairperson of the Board.

• Assists in the development of succession plans for the Company’s CEO and other executives.

• Assists the Board in evaluating the independence of individual Directors for purposes of Board and committee service.

• Develops and implements an annual self-evaluation process for the Board and its committees

| ||||

C | – Committee Chairperson |

I | – Determined by the Board to be independent under applicable SEC and Nasdaq rules. |

17

Table of Contents

| NOMINATION OF DIRECTORS |

Our Bylaws provide that nominations for election to the Board may be made by the Board or by any stockholder entitled to vote for the election of Directors at the Annual Meeting. A stockholder’s notice of nomination must be made in writing to the Company’s Corporate Secretary and must be delivered to or received at our principal executive offices not less than ninety (90) days nor more than one hundred twenty (120) days prior to the meeting. | Stockholders can nominate individuals to serve on the Board by the following procedures described in our Bylaws.

| |