Exhibit 99.1 As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations REVENUE Products 749$ -$ 749$ 637$ -$ 637$ 634$ -$ 634$ 652$ -$ 652$ Services 638 40 598 620 38 582 616 38 578 625 36 589 1,387 40 1,347 1,257 38 1,219 1,250 38 1,212 1,277 36 1,241 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 311 - 311 280 - 280 271 - 271 283 - 283 Amortization of acquired technology intangible assets 50 - 50 49 - 49 47 - 47 46 - 46 Services 322 30 292 315 28 287 309 28 281 302 28 274 683 30 653 644 28 616 627 28 599 631 28 603 GROSS PROFIT 704 10 694 613 10 603 623 10 613 646 8 638 OPERATING EXPENSES Selling, general and administrative 433 4 429 414 3 411 405 3 402 378 3 375 Research and development 111 - 111 117 - 117 116 - 116 120 - 120 Amortization of intangible assets 56 (1) 57 56 - 56 57 - 57 57 - 57 Restructuring and impairment charges, net 21 21 90 90 21 - 21 15 - 15 Acquisition-related costs 1 - 1 2 - 2 1 - 1 - - - 622 3 619 679 3 676 600 3 597 570 3 567 OPERATING INCOME (LOSS) 82 7 75 (66) 7 (73) 23 7 16 76 5 71 Interest expense (109) - (109) (108) - (108) (107) - (107) (107) - (107) Other (expense) income, net (1) - (1) (12) - (12) 6 - 6 (13) - (13) (28) 7 (35) (186) 7 (193) (78) 7 (85) (44) 5 (49) Benefit from income taxes of continuing operations 2 1 1 24 (5) 29 (88) (2) (86) 54 (6) 60 (LOSS) INCOME FROM CONTINUING OPERATIONS (26) 8 (34) (162) 2 (164) (166) 5 (171) 10 (1) 11 - 8 8 - 2 2 - 5 5 - (1) (1) NET (LOSS) INCOME (26)$ -$ (26)$ (162)$ -$ (162)$ (166)$ -$ (166)$ 10$ -$ 10$ INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF INCOME TAXES LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Avaya Inc. Consolidated Statements of Operations (Adjusted for ITPS Discontinued Operations) Three Months Ended December 31, 2011 Three Months Ended March 31, 2012 Three Months Ended June 30, 2012 Three Months Ended September 30, 2012 (Unaudited; in millions)

As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations REVENUE Products 631$ -$ 631$ 529$ -$ 529$ 560$ -$ 560$ 617$ -$ 617$ Services 609 33 576 589 32 557 590 34 556 583 31 552 1,240 33 1,207 1,118 32 1,086 1,150 34 1,116 1,200 31 1,169 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 261 - 261 236 - 236 234 - 234 232 - 232 Amortization of acquired technology intangible assets 22 - 22 14 - 14 13 - 13 14 - 14 Services 291 26 265 282 25 257 276 25 251 273 24 249 574 26 548 532 25 507 523 25 498 519 24 495 GROSS PROFIT 666 7 659 586 7 579 627 9 618 681 7 674 OPERATING EXPENSES Selling, general and administrative 384 3 381 381 2 379 380 1 379 375 3 372 Research and development 118 - 118 113 - 113 112 - 112 102 - 102 Amortization of intangible assets 57 (1) 58 57 - 57 57 - 57 56 - 56 Goodwill impairment - - - 89 89 - - - - - - - Restructuring and impairment charges, net 84 - 84 18 - 18 63 - 63 35 - 35 Acquistion-related costs - - - - - - 1 - 1 - - - 643 2 641 658 91 567 613 1 612 568 3 565 OPERATING INCOME (LOSS) 23 5 18 (72) (84) 12 14 8 6 113 4 109 Interest expense (108) - (108) (116) - (116) (122) - (122) (121) - (121) Loss on extinguishment of debt (3) - (3) (3) - (3) - - - - - - Other (expense) income, net (6) - (6) 2 - 2 (5) - (5) (5) - (5) (94) 5 (99) (189) (84) (105) (113) 8 (121) (13) 4 (17) Benefit from (provision for) income taxes of continuing operat 9 (1) 10 (3) 4 (7) 3 - 3 36 7 29 LOSS FROM CONTINUING OPERATIONS (85) 4 (89) (192) (80) (112) (110) 8 (118) 23 11 12 - 4 4 - (80) (80) - 8 8 - 11 11 NET (LOSS) INCOME (85)$ -$ (85)$ (192)$ -$ (192)$ (110)$ -$ (110)$ 23$ -$ 23$ LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF INCOME TAXES Three Months Ended September 30, 2013Three Months Ended December 31, 2012 Avaya Inc. Consolidated Statements of Operations (Adjusted for ITPS Discontinued Operations) (Unaudited; in millions) Three Months Ended March 31, 2013 Three Months Ended June 30, 2013

As Previously Reported Discontinued Operations Adjusted for Discontinued Operations REVENUE Products 574$ -$ 574$ Services 584 27 557 1,158 27 1,131 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 228 - 228 Amortization of acquired technology intangible assets 14 - 14 Services 271 22 249 513 22 491 GROSS PROFIT 645 5 640 OPERATING EXPENSES Selling, general and administrative 395 2 393 Research and development 95 - 95 Amortization of intangible assets 57 (1) 58 Restructuring charges, net 7 - 7 554 1 553 OPERATING INCOME 91 4 87 Interest expense (119) - (119) Other income, net 1 - 1 LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (27) 4 (31) Provision for income taxes of continuing operations (27) (1) (26) LOSS FROM CONTINUING OPERATIONS (54) 3 (57) INCOME FROM DISCONTINUED OPERATIONS, NET OF INCOME TAXES - 3 3 NET LOSS (54)$ -$ (54)$ Avaya Inc. Consolidated Statements of Operations (Adjusted for Discontinued Operations) Three Months Ended December 31, 2013 (Unaudited; in millions)

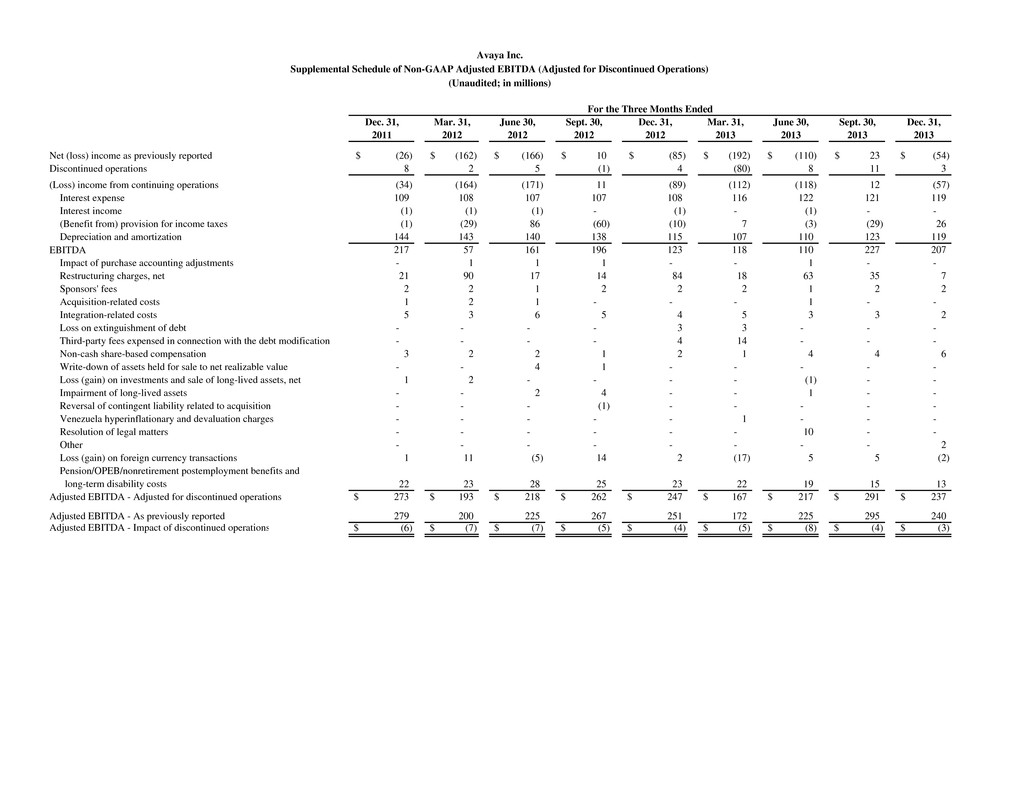

Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, 2011 2012 2012 2012 2012 2013 2013 2013 2013 Net (loss) income as previously reported (26)$ (162)$ (166)$ 10$ (85)$ (192)$ (110)$ 23$ (54)$ Discontinued operations 8 2 5 (1) 4 (80) 8 11 3 (Loss) income from continuing operations (34) (164) (171) 11 (89) (112) (118) 12 (57) Interest expense 109 108 107 107 108 116 122 121 119 Interest income (1) (1) (1) - (1) - (1) - - (Benefit from) provision for income taxes (1) (29) 86 (60) (10) 7 (3) (29) 26 Depreciation and amortization 144 143 140 138 115 107 110 123 119 217 57 161 196 123 118 110 227 207 Impact of purchase accounting adjustments - 1 1 1 - - 1 - - Restructuring charges, net 21 90 17 14 84 18 63 35 7 Sponsors' fees 2 2 1 2 2 2 1 2 2 Acquisition-related costs 1 2 1 - - - 1 - - Integration-related costs 5 3 6 5 4 5 3 3 2 Loss on extinguishment of debt - - - - 3 3 - - - Third-party fees expensed in connection with the debt modification - - - - 4 14 - - - Non-cash share-based compensation 3 2 2 1 2 1 4 4 6 Write-down of assets held for sale to net realizable value - - 4 1 - - - - - Loss (gain) on investments and sale of long-lived assets, net 1 2 - - - - (1) - - Impairment of long-lived assets - - 2 4 - - 1 - - Reversal of contingent liability related to acquisition - - - (1) - - - - - Venezuela hyperinflationary and devaluation charges - - - - - 1 - - - Resolution of legal matters - - - - - - 10 - - Other - - - - - - - - 2 Loss (gain) on foreign currency transactions 1 11 (5) 14 2 (17) 5 5 (2) Pension/OPEB/nonretirement postemployment benefits and long-term disability costs 22 23 28 25 23 22 19 15 13 Adjusted EBITDA - Adjusted for discontinued operations 273$ 193$ 218$ 262$ 247$ 167$ 217$ 291$ 237$ 279 200 225 267 251 172 225 295 240 (6)$ (7)$ (7)$ (5)$ (4)$ (5)$ (8)$ (4)$ (3)$ EBITDA For the Three Months Ended Adjusted EBITDA - As previously reported Adjusted EBITDA - Impact of discontinued operations Avaya Inc. Supplemental Schedule of Non-GAAP Adjusted EBITDA (Adjusted for Discontinued Operations) (Unaudited; in millions)

Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, 2011 2012 2012 2012 2012 2013 2013 2013 2013 Gross Profit - Adjusted for discontinued operations 694$ 603$ 613$ 638$ 659$ 579$ 618$ 674$ 640$ Gross Margin - Adjusted for discontinued operations 51.5% 49.5% 50.6% 51.4% 54.6% 53.3% 55.4% 57.7% 56.6% Items excluded: Amortization of acquired technology intangible assets 50 49 47 46 22 14 13 14 14 Impairment of capitalized software development costs - - 2 4 - - 1 - - Share-based compensation 1 1 1 1 1 - 2 2 3 Purchase accounting adjustments to revenue - 1 1 1 - - 1 - - Non-GAAP Gross Profit - Adjusted for discontinued operations 745$ 654$ 664$ 690$ 682$ 593$ 635$ 690$ 657$ Non-GAAP Gross Margin - Adjusted for discontinued operations 55.3% 53.6% 54.7% 55.6% 56.5% 54.6% 56.8% 59.0% 58.1% Reconciliation of Non-GAAP Operating Income Operating Income (Loss) - Adjusted for discontinued operations 75$ (73)$ 16$ 71$ 18$ 12$ 6$ 109$ 87$ Percentage of Revenue 6% -6% 1% 6% 1% 1% 1% 9% 8% Items excluded: Amortization of acquired assets 107 105 104 103 80 71 70 70 72 Restructuring and impairment charges, net 21 90 21 15 84 18 63 35 7 Acquisition/integration-related costs 6 6 6 6 5 6 5 4 3 Share-based compensation 3 2 2 1 2 1 4 4 6 Impairment of capitalized software development costs - - 2 4 - - 1 - - Incremental accelerated depreciation associated with vacating facilities - - - - - - 3 18 16 Other - - - - - - - - 2 Resolution of legal matters - - - - - - 10 - - Purchase accounting adjustments to revenue - 1 1 1 - - 1 - - Non-GAAP Operating Income - Adjusted for discontinued operations 212$ 131$ 152$ 201$ 189$ 108$ 163$ 240$ 193$ Percentage of Revenue 15.7% 10.7% 12.5% 16.2% 15.7% 9.9% 14.6% 20.5% 17.1% Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliations (Adjusted for Discontinued Operations) (Unaudited; in millions) Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin For the Three Months Ended

Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, 2011 2012 2012 2012 2012 2013 2013 2013 2013 Revenue 749$ 637$ 634$ 652$ 631$ 529$ 560$ 617$ 574$ Costs (exclusive of amortization of acquired technology intangible assets) 311 280 271 283 261 236 234 232 228 Amortization of acquired technology intangible assets 50 49 47 46 22 14 13 14 14 Gross Profit 388 308 316 323 348 279 313 371 332 Gross Margin 51.8% 48.4% 49.8% 49.5% 55.2% 52.7% 55.9% 60.1% 57.8% Items excluded: Amortization of technology intangible assets 50 49 47 46 22 14 13 14 14 Impairment of capitalized software development costs - - 2 4 - - 1 - - Purchase accounting adjustments to revenue - 1 1 1 - - 1 - - Non-GAAP Gross Profit 438$ 358$ 366$ 374$ 370$ 293$ 328$ 385$ 346$ Non-GAAP Gross Margin 58.5% 56.1% 57.6% 57.3% 58.6% 55.4% 58.5% 62.4% 60.3% Revenue 598$ 582$ 578$ 589$ 576$ 557$ 556$ 552$ 557$ Costs 292 287 281 274 265 257 251 249 249 GAAP Gross Profit 306 295 297 315 311 300 305 303 308 GAAP Gross Margin 51.2% 50.7% 51.4% 53.5% 54.0% 53.9% 54.9% 54.9% 55.3% Items excluded: Share-based compensation 1 1 1 1 1 - 2 2 3 Non-GAAP Gross Profit 307$ 296$ 298$ 316$ 312$ 300$ 307$ 305$ 311$ Non-GAAP Gross Margin 51.3% 50.9% 51.6% 53.7% 54.2% 53.9% 55.2% 55.3% 55.8% For the Three Months Ended Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliation of Gross Profit and Gross Margin by Portfolio (Adjusted for Discontinued Operations) (Unaudited; in millions) Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products (Adjusted for discontinued operations) Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services (Adjusted for discontinued operations)