ENODIS PLC

OFFER TO PURCHASE FOR CASH ALL OF THE OUTSTANDING

£100,000,000 103/8% SENIOR NOTES DUE 2012

AND

SOLICITATION OF CONSENTS TO PROPOSED AMENDMENTS

TO THE RELATED INDENTURE

________________________

Enodis plc, a public limited company organized under the laws of England and Wales (the"Company"), hereby offers to purchase for cash, on the terms and subject to the conditions set forth in this Offer to Purchase and Consent Solicitation Statement (this"Statement") all of its outstanding 103/8% Senior Notes Due 2012, ISIN Nos. XS0149951294, XS0144950028 and XS0144949871 and Common Codes 014995129, 014495002 and 014494987 (the"Notes").

Concurrently with the offer to purchase the Notes, the Company is soliciting (the"Solicitation" and, together with the offer to purchase the Notes, the"Offer") consents (the"Consents") from Holders (as defined in the indenture governing the Notes (the"Indenture")) to amendments to the Indenture that will eliminate substantially all of the restrictive covenants, certain events of default and certain additional covenants and rights contained in the Notes and the Indenture (the"Proposed Amendments").

The Company's obligation to accept for payment, and to pay for Notes validly tendered pursuant to the Offer is conditioned upon the satisfaction of the Supplemental Indenture Condition, the Minimum Tender Condition and the Financing Condition (each as defined herein). See"Conditions to the Offer".

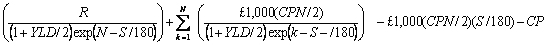

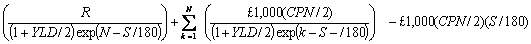

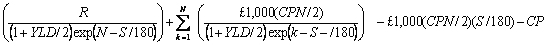

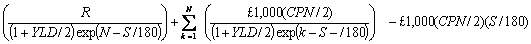

The consideration for each £1,000 principal amount of Notes tendered and accepted for payment pursuant to the Offer shall be the price (calculated as described in Schedule I to this Statement) equal to (i) the present value on the Payment Date (as defined herein) of all future cash flows on the Notes to April 15, 2007 (the"Earliest Redemption Date"), based on the assumption that the Notes will be redeemed in full at £1,051.88 per £1,000 principal amount (the"Redemption Price") on the Earliest Redemption Date and that the yield (the"Tender Offer Yield") to the Earliest Redemption Date is equal to the sum of (a) the yield to maturity (the"Reference Yield") of the U.K. Treasury 4.50% Gilt due March 7, 2007 (the"Reference Security"), calculated as described herein, as of 2:00 p.m. London time, on the second business day immediately preceding the Expiration Date (as defined below) (the"Price Determination Date"), plus (b) 50 basis points (the"Fixed Spread"), minus accrued and unpaid interest to, but not including, the Payment Date (the total consideration referred to in this clause (i) is referred to as the"Total Consideration"), (ii) less £30 per £1,000 principal amount of Notes (the"Consent Payment"; the Total Consideration minus the Consent Payment is referred to as the"Tender Offer Consideration") plus (iii) any Accrued Interest (as defined herein) payable on the Payment Date. In addition, the Company is offering to pay on the Payment Date, if the Notes are accepted for payment pursuant to the terms of the Offer, for each £1,000 principal amount of the Notes for which Consents have been validly delivered and not validly revoked at or prior to 4:00 p.m., London time, on the Consent Date (as defined below), the Consent Payment.

If the Offer is extended from the currently scheduled Expiration Date (as defined below), a new Price Determination Date may be (but is not required to be) established, in which case the Total Consideration and the Tender Offer Consideration shall be calculated based on the Tender Offer Yield on such new Price Determination Date.

Outstanding Aggregate Principal Amount | | Security Description | | Earliest Redemption Date | | Redemption Price | | Consent Payment | | Reference Security | | Fixed Spread |

| £100,000,000 | | 103/8% Senior Notes due 2012 | | April 15, 2007 | | £1,051.88 | | £30 | | U.K. Treasury 4.50% Gilt due March 7, 2007 | | 0.50% |

This Offer will expire at 4:00 p.m., London time, on June 15, 2005 unless extended or earlier terminated (such date, as the same may be extended, the "Expiration Date"). Holders must tender their Notes on or prior to the Expiration Date in order to receive the Tender Offer Consideration. The time by which Holders must tender their Notes in order to be eligible to receive the Total Consideration (which includes the Consent Payment) is 4:00 p.m., London time, on June 1, 2005 (the "Consent Date") or, if on such date the Company has not received duly executed and unrevoked Consents to the Proposed Amendments representing not less than a majority in aggregate principal amount of the Notes then outstanding (the "Requisite Consents"), then the Consent Date shall be such later date on which the Company shall have first received the Requisite Consents. Holders who desire to receive the Total Consideration must validly consent to the proposed amendments by validly tendering their Notes in accordance with the requirements of the Clearing Systems (as defined herein) on or prior to the Consent Date. Holders who tender their Notes after the Consent Date will be eligible to receive only the Tender Offer Consideration. Tendered Notes may be withdrawn and Consents may be revoked at any time prior to 4:00 p.m., London time, on the Consent Date, but not thereafter (except as otherwise expressly provided herein). Notes tendered after the Consent Date may not be withdrawn.

In deciding whether to participate in the Offer, each Holder should carefully consider the factors set forth under "Certain Significant Considerations" on page 11.

_______________________

The Dealer Manager for the Offer is:

Credit Suisse First Boston

May 17, 2005

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS STATEMENT AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY OR ANY OF ITS AGENTS.

NONE OF THE COMPANY, THE DEALER MANAGER OR THE TENDER AGENTS MAKES ANY RECOMMENDATION AS TO WHETHER OR NOT HOLDERS SHOULD TENDER NOTES IN RESPONSE TO THE OFFER OR DELIVER CONSENTS TO THE PROPOSED AMENDMENTS. OTHER THAN AS CONTAINED HEREIN, NO PERSON HAS BEEN AUTHORIZED TO MAKE ANY RECOMMENDATION ON BEHALF OF THE COMPANY AS TO WHETHER HOLDERS SHOULD TENDER NOTES OR DELIVER CONSENTS PURSUANT TO THE OFFER.

Notes accepted for payment by the Company will be paid for in immediately available (same-day) funds delivered to The Bank of New York, acting as the tender agent (the"Tender Agent"), and The Bank of New York (Luxembourg) S.A., acting as Luxembourg tender agent (the"Luxembourg Tender Agent" and, together with the Tender Agent, the"Tender Agents"). Payment for Notes accepted by the Company will be made on a date promptly after the Expiration Date (the"Payment Date"). The Company currently expects the Payment Date to be June 21, 2005. The Holder of each Note validly tendered and accepted for payment will receive interest thereon from the most recent payment of semi-annual interest preceding the Payment Date up to, but excluding, the Payment Date, upon the terms and subject to the conditions described herein (the"Accrued Interest"). Any Accrued Interest payable on the Notes accepted for payment in the Offer will be paid in cash in immediately available (same-day) funds concurrently with the payment of the Tender Offer Consideration therefor on the Payment Date. Under no circumstances will any interest be payable because of any delay in the transmission of funds to Holders. Upon the terms and subject to the conditions set forth in this Statement, the Company hereby offers to pay each Holder who validly consents to the Proposed Amendments at or prior to 4:00 p.m., London time, on the Consent Date, the Consent Payment, with such payment to be made on the Payment Date if, but only if, the Notes to which such Consents relate are accepted for payment pursuant to the terms of the Offer.

Tenders of Notes pursuant to the Offer will be deemed to constitute delivery of Consents to the Proposed Amendments with respect to the Notes tendered. Holders may not deliver Consents without tendering the Notes in the Offer, and may not revoke Consents without withdrawing the previously tendered Notes to which such Consents relate from the Offer. Similarly, a valid withdrawal of tendered Notes will constitute the revocation of the related Consents.

Tenders of Notes may be withdrawn at any time at or prior to 4:00 p.m., London time, on the Consent Date but not thereafter. Withdrawal rights will not be reinstated if the Offer is extended at any time after the Consent Date (except as otherwise expressly provided herein). If, after the Consent Date, the Company increases or decreases either (i) the principal amount of Notes subject to the Offer or (ii) the Tender Offer Consideration, then previously tendered Notes may be validly withdrawn until the expiration of ten business days after the date that notice of any such reduction is first published, given or sent to Holders by the Company.

In the event that the Offer is withdrawn or otherwise not completed, the Tender Offer Consideration and Consent Payments will not be paid or become payable to Holders who have validly tendered their Notes and delivered Consents in connection with the Offer. In the event of a termination of the Offer, the Notes tendered pursuant to the Offer will be promptly returned to the tendering Holder. The Notes that are not tendered and accepted for payment pursuant to the Offer will remain obligations of the Company.

Notwithstanding any other provision of the Offer, the Company's obligation to accept for payment, and to pay for, Notes validly tendered pursuant to the Offer is conditioned upon (i) the execution by The Bank of New York, as trustee (the"Trustee"), of the Supplemental Indenture (as defined below) to the Indenture implementing the Proposed Amendments in the manner set forth below following receipt of the Requisite Consents (as defined below) to the Proposed Amendments (the"Supplemental Indenture Condition"), (ii) there having been validly tendered (and not withdrawn) prior to the Expiration Date at least a majority in aggregate principal amount of the Notes then outstanding (the"Minimum Tender Condition") and (iii) the Company having received, on terms and conditions satisfactory to it, funds sufficient to satisfy its obligations under the Offer on the Payment Date from either the sources specified herein (see"Source and Amount of Funds") or from such other sources as the Company may elect, in its sole discretion (the"Financing Condition"). See"Conditions to the Offer".

The Proposed Amendments will be effected by a supplemental indenture (the"Supplemental Indenture") to the Indenture, which is to be executed by the Company and the Trustee on the Consent Date. The"Consent Date" is June 1, 2005, or, if on such date the Company has not received the Requisite Consents to the Proposed Amendments, then the"Consent Date" shall be such later date on which the Company shall have first received the Requisite Consents."Requisite Consents" means Consents of Holders who hold not less than a majority in aggregate principal amount of the Notes then outstanding (excluding for such purposes any Notes owned at the time by the Company or any of its affiliates). The Supplemental Indenture will enter into effect upon satisfaction of the Supplemental Indenture Condition although the Proposed Amendments will not become operative until the Company accepts for payment all the Notes validly tendered (and not withdrawn). In the event the Company does not accept and pay promptly for all of the validly tendered Notes after the expiration of the Offer on the Expiration Date, the Supplemental Indenture will at such time cease to be in effect.

Adoption of the Proposed Amendments may have adverse consequences for Holders who elect not to tender Notes in the Offer because Holders of Notes outstanding after consummation of the Offer will not be entitled to the benefit of substantially all of the restrictive covenants, certain event of default provisions presently contained in the Indenture, or certain protections afforded to Holders in connection with a legal defeasance of the Notes. In addition, the trading market for any Notes not tendered in response to the Offer is likely to be significantly more limited. See"Proposed Amendments to Indenture" and"Certain Significant Considerations".

The Offer, including the Solicitation, is not being made to (nor will the surrender of Notes for purchase be accepted from or on behalf of) Holders in any jurisdiction in which the making or acceptance of the Offer, including the Solicitation, would not be in compliance with the laws of such jurisdiction. The Company is not aware of any jurisdiction in which the making of the Offer is not in compliance with or permitted by applicable law. If the Company becomes aware of any jurisdiction where the making of the Offer would not be in compliance with or permitted by applicable law, the Company will make a good faith effort to comply with any such applicable law or seek to have such law declared inapplicable to the Offer. If, after a good faith effort, the Company cannot comply with any such applicable law, the Offer will not be made to (nor will tenders be accepted from or on behalf of) the Holders residing in such jurisdiction. In those jurisdictions where the securities, "blue sky" or other laws require the Offer to be made by a licensed broker or dealer, the Offer shall be deemed to be made on behalf of the Company by the Dealer Manager or one or more registered brokers or dealers licensed under the law of such jurisdiction.

This Statement has not been filed with or reviewed by any U.S. federal or state securities commission or regulatory authority of any other country, nor has any such commission or authority passed on the accuracy or adequacy of this Statement. Any representation to the contrary is unlawful and may be a criminal offence.

See"Certain Significant Considerations" and"Certain Tax Consequences" for discussions of certain factors that should be considered in evaluating the Offer, and also see"Proposed Amendments to the Indenture" for a description of the Proposed Amendments.

Subject to applicable securities laws and the terms and conditions set forth in the Offer, the Company expressly reserves the right in its sole and absolute discretion (i) to waive any and all conditions to the Offer, (ii) to extend or terminate the Offer, or (iii) otherwise to amend the Offer in any respect. The Company intends to extend the Offer, if necessary, so that the Expiration Date occurs no earlier than five business days following the Consent Date.

The Company expressly reserves the absolute right in its sole and absolute discretion to purchase from time to time any Notes after the Expiration Date, through open market or privately negotiated transactions, one or more additional tender or exchange offers or otherwise on terms that may or may not differ materially from the terms of the Offer, or to effect legal defeasance, covenant defeasance and/or satisfaction and discharge with respect to all outstanding Notes pursuant to the Indenture.

IMPORTANT

Any Holder desiring to tender Notes and deliver Consents should request such Holder's broker, dealer, commercial bank, trust company or other nominee to effect the transaction for such Holder. A beneficial owner who has Notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee must contact such broker, dealer, commercial bank, trust company or nominee if such beneficial owner desires to tender Notes and deliver Consents for Notes so registered. To be valid, tenders must be received by one of the Tender Agents at or prior to 4:00 p.m., London time, on the Expiration Date. However, to receive the Consent Payment, valid tenders must be received at or prior to 4:00 p.m., London time on the Consent Date. See"Procedures for Tendering Notes and Delivering Consents".

This Statement contains important information which should be read before any decision is made with respect to either a Tender of Notes or a Consent to the Proposed Amendments. Neither the delivery of this Statement nor any acceptance for payment of, or payment for, Notes shall under any circumstances create any implication that the information contained herein is correct as of any time subsequent to the date hereof or that there has been no change in the information set forth herein or in any attachments hereto or in the affairs of the Company or any of its subsidiaries or affiliates since the date hereof.

This Statement contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the"Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the"Exchange Act"). All statements regarding the Company's plans and prospects are forward-looking statements. These forward-looking statements speak only as of the date stated, or if no date is stated, as of the date hereof, and the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, even if experience or future events make it clear that any expected results expressed or implied by those forward-looking statements will not be realized. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from such expectations ("Cautionary Statements") are disclosed in this Statement, including, without limitation, in conjunction with the forward-looking statements included in this Statement and under"Background and Purpose of the Offer","Certain Significant Considerations" and"Certain Information Concerning the Company". All subsequent written and oral forward-looking statements attributable to the Company, its subsidiaries or persons acting on its behalf are expressly qualified in their entirety by the Cautionary Statements.

__________________________

Important information for United Kingdom recipients of the Statement

This Statement has been issued by and is the sole responsibility of the Company and for the purposes of the United Kingdom's financial promotion regime is only being communicated to persons in the United Kingdom who hold the Notes and so fall within Article 43 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001, as amended (the"Order") and to any other persons to whom it may lawfully be communicated in the United Kingdom in accordance with the Order (all such persons being referred to as"relevant persons"). This Statement must not be acted on or relied on by persons who are not relevant persons. Holders should seek advice from an independent financial advisor as to whether they should tender the Notes and deliver related Consents.

TABLE OF CONTENTS

| Section | |

| | |

| SUMMARY | 1 |

| TERMS OF THE OFFER AND SOLICITATION | 6 |

| CERTAIN SIGNIFICANT CONSIDERATIONS | 11 |

| PURPOSE AND BACKGROUND OF THE OFFER | 13 |

| SOURCE AND AMOUNT OF FUNDS | 15 |

| CERTAIN INFORMATION CONCERNING THE COMPANY | 16 |

| AVAILABLE INFORMATION | 16 |

| PROPOSED AMENDMENTS TO THE INDENTURE | 17 |

| ACCEPTANCE FOR PAYMENT AND PAYMENT FOR NOTES; ACCEPTANCE OF CONSENTS | 20 |

| PROCEDURES FOR TENDERING NOTES AND DELIVERING CONSENTS | 21 |

| WITHDRAWAL OF TENDERS AND REVOCATION OF CONSENTS | 24 |

| CONDITIONS TO THE OFFER | 25 |

| CERTAIN TAX CONSEQUENCES | 26 |

| THE DEALER MANAGER AND THE TENDER AGENTS | 31 |

| FEES AND EXPENSES | 31 |

| MISCELLANEOUS | 31 |

| ANNEX A - IRS SUBSTITUTE FORM W-9 | 33 |

SUMMARY The following summary is provided solely for the convenience of the Holders. This summary is not intended to be complete and is qualified in its entirely by reference to the full text and more specific details contained elsewhere in this Statement. Holders are urged to read this Statement in its entirety. Each of the capitalized terms used in this summary and not defined herein has the meaning set forth elsewhere in this Statement. The Tender Offer |

The Company: | Enodis plc, a public limited company organized under the laws of England and Wales (the"Company", and, together with its subsidiaries, the"Group"), is the issuer of the Notes. |

Purpose and Background of the Offer: | The purpose of the Offer is to acquire all of the outstanding Notes and to obtain the related Consents to effect the Proposed Amendments. The Offer is being made in connection with a capital restructuring program by the Company designed to allow the reinstatement of dividends and the termination of its U.S. Securities and Exchange Commission ("SEC") reporting obligations. The capital restructuring program is also designed to simplify the Company's debt financing and reduce its interest and compliance costs. In addition to the Offer, the program includes a capital reduction of the Company and termination of the Company's New York Stock Exchange listing and American Depositary Receipt program. The Offer is to be financed by the increase from $225 million to $400 million in the facility available under a multicurrency revolving credit facility, dated September 17, 2004, between certain of the Company's subsidiaries, the lenders named therein and The Royal Bank of Scotland plc, as agent (the"Agent"), which was amended and restated on May 6, 2005 (the"Restated Senior Credit Agreement"). |

Securities Tendered For: | The following table sets forth, for the Notes, outstanding aggregate principal amount, security description, Earliest Redemption Date, Redemption Price, Consent Payment, Reference Security and Fixed Spread to be used to calculate the Total Consideration payable pursuant to the Offer: |

Outstanding Aggregate Principal Amount | Security Description | Earliest Redemption Date | Redemption Price | Consent Payment | Reference Security | Fixed Spread |

£100,000,000 | 103/8% Senior Notes due 2012 | April 15, 2007 | £1,051.88 | £30 | U.K. Treasury 4.50% Gilt due March 7, 2007 | 0.50% |

| | | | | | | |

Expiration Date: | The Expiration Date of the Offer will be 4:00 p.m., London time, on June 15, 2005, unless extended or earlier terminated. The Company intends to extend the Offer, if necessary, so that the Expiration Date occurs no earlier than five business days following the Consent Date. For the purposes of the Offer, the term"business day" means any day, other than a Saturday, Sunday or other day on which commercial banking institutions are authorized or required to close in the United States and the United Kingdom. |

Total Consideration and Tender Offer Consideration: | The consideration for each £1,000 principal amount of Notes tendered and accepted for payment pursuant to the Offer shall be the price (calculated as described in Schedule I to this Statement) equal to (i) the present value on the Payment Date (as defined below) of all future cash flows on the Notes to April 15, 2007 (the"Earliest Redemption Date"), based on the assumption that the Notes will be redeemed in full at £1,051.88 per £1,000 principal amount (the"Redemption Price"') on the Earliest Redemption Date and that the yield (the"Tender Offer Yield") to the Earliest Redemption Date is equal to the sum of (a) the yield to maturity (the"Reference Yield") of the U.K. Treasury 4.50% Gilt due March 7, 2007(the"Reference Security"), calculated as described herein as of 2:00 p.m., London time, on the second business day immediately preceding the Expiration Date (the"Price Determination Date"), plus (b) 0.50% basis points (the"Fixed Spread"), minus accrued and unpaid interest to, but not including, the Payment Date (the total consideration referred to in this clause (i) is referred to as the"Total Consideration"), (ii) less £30 per £1,000 principal amount of Notes (the"Consent Payment"; the Total Consideration minus the Consent Payment is referred to as the"Tender Offer Consideration") plus (iii) any Accrued Interest (as defined below) payable on the Payment Date. In addition, the Company is offering to pay, on the Payment Date, if the Notes are accepted for payment pursuant to the terms of the Offer, for each £1,000 principal amount of the Notes for which Consents have been validly delivered and not validly revoked at or prior to 4:00 p.m., London time, on the Consent Date (as defined below), the Consent Payment. |

Accrued Interest: | The Holder of each Note validly tendered and accepted for payment will receive interest thereon from the most recent payment of semi-annual interest preceding the Payment Date up to, but excluding, the Payment Date, upon the terms and subject to the conditions described herein (the"Accrued Interest"). Any Accrued Interest payable on the Notes accepted for payment in the Offer will be paid in cash in immediately available (same-day) funds concurrently with the payment of the Tender Offer Consideration therefor on the Payment Date. Under no circumstances will any interest be payable because of any delay in the transmission of funds to Holders. |

Payment Date: | The Payment Date is the date on which the Company will deposit funds with the Tender Agents for payment to tendering Holders. Pursuant to applicable U.S. federal securities laws, the Company is required to pay for or return all tendered Notes promptly after the expiration of the Offer. The Company currently expects the Payment Date to be June 21, 2005. |

Conditions to Offer: | The Company's obligation to accept for purchase, and to pay for, Notes validly tendered pursuant to the Offer is conditioned upon (i) the Supplemental Indenture Condition, (ii) the Minimum Tender Condition and (iii) the Financing Condition. See"Conditions to the Offer". The Company reserves the right in its sole and absolute discretion prior to the expiration of the Offer on the Expiration Date to waive any and all conditions to the Offer. |

| How to Tender Notes or Deliver Consents: | See"Procedures for Tendering Notes and Delivering Consents". For further information contact the Dealer Manager or the Tender Agents at their respective telephone numbers and addresses set forth on the back cover of this Statement or consult your broker, dealer, commercial bank, trust company or custodian for assistance. |

Brokerage Commissions: | No brokerage commissions are payable by Holders who tender their Notes directly pursuant to the Offer. Holders who hold their Notes through a broker, bank or other nominee should check with that institution as to whether it will charge service fees. |

Tax Consequences | For a discussion of certain U.S. and U.K. tax consequences of the Offer which may be relevant to Holders, see"Certain Tax Consequences". |

The Solicitation |

Terms of Solicitation: | The Company is also soliciting Consents to the Proposed Amendments from Holders of Notes, and the Company is offering to pay each such Holder who validly consents to the Proposed Amendments at or prior to 4:00 p.m., London time, on the Consent Date, the Consent Payment in cash, equal to £30 per £1,000 principal amount of Notes for which Consents have been validly delivered, with such payment to be made on the Payment Date if, but only if, the Notes are accepted for payment pursuant to the terms of the Offer. |

The Consent Date: | The Consent Date is June 1, 2005, or, if on such date the Company has not received the Requisite Consents, then it shall be such date on which the Company shall have first received the Requisite Consents. The Company intends to execute the Supplemental Indenture on or promptly after 4:00 p.m., London time, on the Consent Date. |

Consent Payment: | £30 per £1,000 principal amount of Notes for which Consents have been validly delivered on or prior to the Consent Date. |

Requisite Consents: | Duly executed (and not revoked) Consents to the Proposed Amendments from Holders representing at least a majority in aggregate principal amount of the then outstanding Notes (excluding for such purposes any Notes owned at such time by the Company or any of its affiliates). |

Withdrawal Rights: | Tenders of Notes may be validly withdrawn and Consents may be validly revoked at any time prior to 4:00 p.m., London time, on the Consent Date by following the procedures described herein. Withdrawals after that time are not permitted.Withdrawal rights will not be reinstated if the Offer is extended at any time after the Consent Date (except as specified below).A valid withdrawal of tendered Notes will constitute the concurrent valid revocation of such Holder's related Consent. In order for a Holder to revoke a Consent such Holder must withdraw the related tendered Notes. See"Withdrawal of Tenders and Revocation of Consents". If, after the Consent Date, the Company increases or decreases either (i) the principal amount of Notes subject to the Offer or (ii) the Tender Offer Consideration, then previously tendered Notes may be validly withdrawn until the expiration of ten business days after the date that notice of any such reduction is first published, given or sent to Holders. |

Purpose of the Solicitation: | The purpose of the Solicitation and the Proposed Amendments is to eliminate, modify or waive compliance by the Company and its subsidiaries with substantially all of the covenants and certain other provisions contained in the Indenture. If the Proposed Amendments become effective, they will apply to all Notes issued under the Indenture, and each Holder of Notes that are not properly tendered and accepted for payment hereunder will be bound by the Proposed Amendments regardless of whether such Holder consented to the Proposed Amendments. Notes that are not tendered or accepted for payment pursuant to the Offer will remain obligations of the Company. |

Effects of the Proposed Amendments: | If the Proposed Amendments become effective, Notes that are not purchased pursuant to the Offer will remain outstanding and will be subject to the terms of the Indenture as modified by the Supplemental Indenture. As a result of the adoption of the Proposed Amendments, Holders of Notes not purchased pursuant to the Offer will no longer be entitled to the benefits of substantially all of the covenants applicable to the Company and its subsidiaries that are currently contained in the Indenture. In addition, certain events which would have constituted a violation of such covenants will no longer constitute Events of Default (as defined in the Indenture) and, upon the occurrence of such events, Holders of Notes not tendered will no longer be entitled to exercise certain rights currently exercisable upon the occurrence of an Event of Default, including the right to accelerate payment of the Notes. See"Certain Significant Considerations". The Proposed Amendments also will allow the Company to legally defease the Remaining Notes without being required to obtain certain legal opinions and an auditor's certificate. If the Company elects to legally defease Notes that are not purchased in the Offer (the"Remaining Notes") in accordance with the Indenture, such defeasance will constitute a taxable event for Holders under U.S. and U.K. tax laws and, therefore, Holders of the Remaining Notes will be required to recognize a gain or loss on the Notes for U.S. federal and U.K. tax purposes. The tax laws of other jurisdictions may provide for a similar tax treatment of a legal defeasance of the Notes. Holders should consult their own legal advisors regarding the tax consequences of a legal defeasance. Non-tendering Holders are cautioned that they may risk the tax consequences of a legal defeasance following consummation of the Offer. See"Certain Significant Considerations - Legal Defeasance" and"Certain Tax Consequences". In the event the Company does not legally defease the Remaining Notes, the Remaining Notes will effectively be subordinate in right of payment to the lenders under the Restated Senior Credit Agreement because a number of the Company's principal subsidiaries are borrowers and guarantors thereunder. |

Effectiveness of Proposed Amendments: | The Supplemental Indenture will enter into effect upon satisfaction of the Supplemental Indenture Condition, although the Proposed Amendments will not become operative until the Company accepts for payment all the Notes validly tendered (and not withdrawn). In the event the Company does not accept and pay promptly for all of the validly tendered Notes after the expiration of the Offer on the Expiration Date, the Supplemental Indenture will at such time cease to be in effect. |

Persons Assisting in the Offer and Solicitation |

Dealer Manager: | Credit Suisse First Boston (Europe) Limited. |

Tender Agents: | The Bank of New York and The Bank of New York (Luxembourg) S.A. |

Clearing Systems: | Clearstream Banking, Societe Anonyme, and Euroclear Bank S.A./N.V.,as operator of the Euroclear System (together, the"Clearing Systems"). |

Further Information: | Additional copies of this Statement may be obtained by contacting the Dealer Manager at its address and telephone number set forth on the back cover of this Statement. Questions about the Offer should be directed to the Dealer Manager at its address and telephone number set forth on the back cover of this Statement. Copies of certain documents relating to the Company may be obtained as described below under"Available Information". |

Notices: | Without limiting the manner in which the Company may choose to make any public announcement, the Company shall have no obligation to publish, advertise or otherwise communicate any such public announcement other than by issuing a release tod'Wort (formerly theLuxemburger Wort). |

TERMS OF THE OFFER AND SOLICITATION

Upon the terms and subject to the conditions of the Offer, the Company is offering to purchase for cash all of the outstanding Notes (as defined in the Indenture and as described below) at a price, for each £1,000 principal amount of Notes validly tendered pursuant to the Offer, equal to the Tender Offer Consideration, plus any Accrued Interest.

In addition, upon the terms and subject to the conditions of the Solicitation (including, if the Solicitation is extended or amended, the terms of any such extension or amendments), the Company is soliciting Consents to the Proposed Amendments from Holders, and is offering to pay to each Holder who consents to the Proposed Amendments at or prior to 4:00 p.m., London time, on the Consent Date, the Consent Payment of £30 for each £1,000 principal amount of the Notes for which Consents have been validly delivered and not validly revoked at or prior to such time on the Consent Date, with such payment to be made on the Payment Date if, but only if, the Notes are accepted for payment pursuant to the terms of the Offer.

The"Total Consideration" is equal to the present value on the Payment Date (as defined below) of all future cash flows on the Notes to April 15, 2007 (the first date on which the Notes may be redeemed at the option of the Company (the"Earliest Redemption Date")), calculated in accordance with standard market practice as described in Schedule I to this Statement, based on the assumption that (i) the Notes will be redeemed in full at £1,051.88 per £1,000 principal amount (the"Redemption Price") on the Earliest Redemption Date and (ii) that the yield (the"Tender Offer Yield") to the Earliest Redemption Date is equal to the sum of (a) the yield to maturity (the"Reference Yield") of the U.K. Treasury 4.50% Gilt due March 7, 2007 (the"Reference Security"), as calculated by the Dealer Manager in accordance with standard market practice, based on the bid and offer price for the Reference Security, as of 2:00 p.m., London time, on the second business day immediately preceding the Expiration Date (the"Price Determination Date"), as displayed on the Bloomberg "PXUK" page (the"Bloomberg Page") (or any recognized quotation source selected by the Dealer Manager in its sole discretion if the Bloomberg Page is not available or is manifestly erroneous), plus (b) 0.50% basis points (the"Fixed Spread") (such price being rounded to the nearest £0.01 per £1,000 principal amount of Notes), minus accrued and unpaid interest to, but not including, the Payment Date. If the Offer is extended from the previously scheduled Expiration Date, a new Price Determination Date may be (but is not required to be) established.

The"Consent Payment" is equal to £30 per £1,000 principal amount of Notes.

The"Tender Offer Consideration" is equal to the Total Consideration less the Consent Payment.

In addition to receiving the Total Consideration or the Tender Offer Consideration, as the case may be, tendering Holders will receive accrued and unpaid interest to, but not including, the Payment Date.

Calculation of the Tender Offer Consideration and the Total Consideration. On the Price Determination Date, the Dealer Manager will calculate the Reference Yield, Tender Offer Yield, Tender Offer Consideration and any Accrued Interest for each Note sold pursuant to the Offer and its calculation shall be conclusive and binding, absent manifest error. Holders of Notes may, prior to the Price Determination Date, obtain hypothetical quotes of the Reference Yield, Tender Offer Yield and Tender Offer Consideration for any Note by contacting the Dealer Manager.

After the Price Determination Date, when the Tender Offer Consideration is no longer linked to the yield on a Reference Security, the actual amount of cash that will be received by a tendering Holder pursuant to the Offer will be known and Holders will be able to ascertain the Total Consideration and the Tender Offer Consideration in the manner described above unless the Expiration Date of the Offer is extended and a new Price Determination Date is established. If the Offer is extended from the previously scheduled Expiration Date, a new Price Determination Date may be (but is not required to be) established, in which case the Total Consideration and the Tender Offer Consideration shall be calculated based on the Tender Offer Yield on such new Price Determination Date.

Although the Reference Yield on the Price Determination Date will be determined only from the Bloomberg Page, information regarding the closing Reference Yield may also be found in the London Stock Exchange Daily Official List. The Reference Yield as of 2:00 p.m., London time, on May 13, 2005 was 4.299%.

The following table sets forth for the Notes the outstanding aggregate principal amount, Earliest Redemption Date, Redemption Price, Reference Security, Fixed Spread and Consent Payment. Also included in the table below are columns showing the hypothetical Tender Offer Consideration and Total Consideration for the Notes, based on the yield to maturity of the Reference Security at 2:00 p.m., London time, on May 13, 2005, and a Payment Date of June 21, 2005. The hypothetical Tender Offer Consideration and Total Consideration do not include Accrued Interest that would be payable. There can be no assurance that the actual Tender Offer Consideration or Total Consideration for any Note will be equal to the hypothetical Tender Offer Consideration or Total Consideration shown below.

Outstanding Aggregate Principal Amount | Earliest Redemption Date | Redemption Price | Reference Security | Fixed Spread | Hypothetical Tender Offer Consideration | Consent Payment | Hypothetical Total Consideration |

£100,000,000 | April 15, 2007 | £1,051.88 | U.K. Treasury 4.50% Gilt due March 7, 2007 | 0.50% | £1,113.36 | £30 | £1,143.36 |

| | | | | | | | |

Promptly after the Price Determination Date, but in any event before 9:00 a.m., New York City time, on the following business day, the Company will publicly announce the pricing information referred to above by press release.

If Notes are accepted for payment pursuant to the Offer, Holders who validly tender their Notes pursuant to the Offer at or prior to 4:00 p.m., London time, on the Consent Date will receive the Total Consideration (equal to the Tender Offer Consideration plus the Consent Payment), plus Accrued Interest to, but not including, the Payment Date. Because the Total Consideration is based on a fixed spread pricing formula linked to a Reference Yield, the Tender Offer Consideration, which is the portion of the Total Consideration that would be received by all tendering Holders pursuant to this Offer (whether or not such tenders are made on or prior to the Consent Date), will be affected by changes in such yield during the term of the Offer prior to the Price Determination Date, but on and after the Price Determination Date will be a fixed amount known subject to the terms of the Offer.

Consent Payment. The Consent Date is 4:00 p.m., London time, on June 1, 2005, unless extended. Holders who desire to tender Notes and deliver related Consents and receive the Total Consideration (which includes the Consent Payment) must instruct the relevant Clearing System in accordance with its requirements and indicate their Consents to the Proposed Amendments on or prior to the Consent Date in accordance with the procedures described in this Statement and as established by the relevant Clearing System.

The Consent Payment of £30 per £1,000 principal amount of Notes, which is included in the calculation of the Total Consideration, will be paid to Holders who validly tender Notes and deliver related Consents on or prior to the Consent Date if (i) the Supplemental Indenture Condition is satisfied and (ii) the Notes to which such Consents relate are accepted for payment by the Company. Accordingly, no Consent Payment will be made for Notes tendered and related Consents delivered after the Consent Date, whether or not purchased pursuant to the Offer or for Notes tendered and related Consents delivered prior to the Consent Date and validly withdrawn. Any Holder who becomes eligible to receive the Consent Payment may no longer validly withdraw Notes and revoke related Consents after the Consent Date as set out under"Withdrawal of Tenders and Revocation of Consents".

Tender of Notes. The Expiration Date is 4:00 p.m., London time, on June 15, 2005, unless extended. Holders must tender their Notes on or prior to the Expiration Date in order to receive the Tender Offer Consideration. If Notes are accepted for payment pursuant to the Offer, Holders who validly tender their Notes pursuant to the Offer prior to the Consent Date will receive the Total Consideration (equal to the Tender Offer Consideration plus the Consent Payment), plus Accrued Interest, whereas Holders who validly tender their Notes after such time, but before the Expiration Date will receive only the Tender Offer Consideration plus Accrued Interest.

Holders who tender Notes in the Offer are obligated to consent to the Proposed Amendments. The valid delivery of Notes by a Holder in connection with the tender of Notes will be deemed to constitute the Consent of such tendering Holder to the Proposed Amendments. Holders may not deliver Consents without tendering their Notes in the Offer and may not revoke Consents without withdrawing previously tendered Notes to which such Consents relate from the Offer. See"Procedures for Tendering Notes and Delivering Consents".

Acceptance of Notes and Conditions. All Notes validly tendered in accordance with the procedures set forth under"Procedures for Tendering Notes and Delivering Consents" and not withdrawn in accordance with the procedures set forth under"Withdrawal of Tenders and Revocation of Consents" at or prior to 4:00 p.m., London time, on the Expiration Date will, upon the terms and subject to the conditions as set forth herein, be accepted for payment by the Company and payments will be made therefor promptly after the Expiration Date. The Supplemental Indenture will enter into effect upon satisfaction of the Supplemental Indenture Condition although the Proposed Amendments will not become operative until the Company accepts for payment all the Notes validly tendered (and not withdrawn). In the event the Company does not accept and pay promptly for all of the validly tendered Notes after the expiration of the Offer on the Expiration Date, the Supplemental Indenture will at such time cease to be in effect.

The Company's obligation to accept and pay for Notes validly tendered pursuant to the Offer is conditioned upon satisfaction of (i) the Supplemental Indenture Condition, (ii) the Minimum Tender Condition and (iii) the Financing Condition. Consent Payments to Holders who have validly consented to the Proposed Amendments at or prior to 4:00 p.m., London time, on the Consent Date are conditioned upon (a) the satisfaction of the Supplemental Indenture Condition and (b) the Company's acceptance of the Notes for purchase pursuant to the Offer.

The foregoing conditions are for the sole benefit of the Company and may be asserted by it regardless of the circumstances (including any action or inaction on its part) giving rise to such condition or may be waived by the Company in whole or in part at any time and from time to time. Subject to applicable securities laws and the terms set forth in this Statement, the Company expressly reserves the right in its sole and absolute discretion (but shall not be obligated), prior to the expiration of the Offer on the Expiration Date, (1) to waive any and all conditions to the Offer, (2) to extend or to terminate the Offer or (3) otherwise to amend the Offer in any respect. See"Conditions to the Offer". Any determination by the Company concerning any of the foregoing events shall be final and binding upon all Holders.

If the Company extends the Offer, or if, for any reason, the acceptance for payment of, or the payment for, Notes is delayed or, if the Company is unable to accept for payment Notes pursuant to the Offer, then the Tender Agents may on behalf of the Company cause any tendered Notes which have not been previously withdrawn to remain blocked on behalf of the Company, and such Notes may not be withdrawn except to the extent tendering Holders are entitled to withdrawal rights as described under"Withdrawal of Tenders and Revocation of Consents", subject to Rule l4e-1(c) under the Exchange Act (which requires that a bidder pay the consideration offered or return the securities deposited by or on behalf of holders of securities promptly after the termination or withdrawal of a tender offer). The rights reserved by the Company in this paragraph are in addition to the Company's rights to terminate the Offer described under"Conditions to the Offer".

All conditions to the Offer will, if Notes are to be accepted for payment promptly after the Expiration Date, be either satisfied or waived by the Company prior to the expiration of the Offer on the Expiration Date. If the tendered Notes have been accepted for payment by the Company, Notes purchased pursuant to the Offer will be paid for on the Payment Date in immediately available funds delivered to the Tender Agents. The Company currently expects the Payment Date to be June 21, 2005.

Withdrawal of Notes. Tenders of Notes may be validly withdrawn and Consents may be validly revoked at any time prior to 4:00 p.m., London time, on the Consent Date, but not thereafter. Withdrawal rights will not be reinstated if the Offer is extended at any time after the Consent Date (except as specified below). A valid withdrawal of tendered Notes prior to 4:00 p.m., London time, on the Consent Date will constitute the concurrent valid revocation of such Holder's related Consent. In order for a Holder to revoke a Consent, such Holder must withdraw the related tendered Notes. If, after the Consent Date, the Company increases or decreases either (i) the principal amount of Notes subject to the Offer or (ii) the Tender Offer Consideration, then previously tendered Notes may be validly withdrawn until the expiration of ten business days after the date that notice of any such reduction is first published, given or sent to Holders by the Company. In the event of a termination of the Offer, the Notes tendered pursuant to the Offer will be promptly unblocked in the relevant account maintained at the Clearing Systems. See"Withdrawal of Tenders and Revocation of Consents".

Extension of the Offer. Any extension, amendment or termination will be followed as promptly as practicable by public announcement thereof, including publication ind'Wort (formerly theLuxemburger Wort), the announcement in the case of an extension of the Offer to be issued no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date. Without limiting the manner in which any public announcement may be made, the Company shall have no obligation to publish, advertise, or otherwise communicate any such public announcement other than by issuing a press release.

The terms of any extension or amendment of the Offer may vary from the original Offer depending on such factors as prevailing interest rates and the principal amount of Notes previously tendered or otherwise purchased. There can be no assurance that the Company will exercise its right to extend, terminate or amend the Offer. If, prior to the Expiration Date, the Company amends the terms of the Offer, such amendment will apply to all Notes tendered pursuant to the Offer, whether prior or subsequent to such amendment. The Company does not presently intend to change the consideration offered.

Additional Terms of the Offer

| 1. | | All communications, payments, notices, certificates, or other documents to be delivered to or by a Holder will be delivered by or sent to or by it at the Holder's own risk. |

| | | |

| 2. | | By submitting an electronic acceptance instruction, a Holder will be deemed to have given the representations, warranties and undertakings of the Holder set forth below in"Procedures for Tendering Notes and Delivering Consents—Representations, Warranties and Undertakings". |

| | | |

| 3. | | All acceptances of tendered Notes and delivered Consents shall be deemed to be made on the terms set out in this Statement (and shall be deemed to be given in writing even though submitted electronically) and shall oblige the Holder of tendered Notes to have such Notes blocked in the securities account in the relevant Clearing System to which they are credited with effect from and including the date on which the blocking instruction is transmitted. |

| | | |

| 4. | | The Company may in its sole discretion elect to treat as valid an electronic acceptance instruction not complying in all respects with the requirements of the relevant Clearing System, or in respect of which the relevant Holder does not fully comply with all the requirements of these terms. |

| | | |

| 5. | | Unless waived by the Company, any irregularities in connection with tenders of such Notes and delivery of related Consents must be cured within such time as the Company shall determine. None of the Company, the Dealer Manager, the Clearing Systems, the Tender Agents or any other person shall be under any duty to give notification of any defects or irregularities in such tenders of such Notes and delivery of related Consents, nor will any of such entities incur any liability for failure to give such notifications. Tenders of such Notes and delivery of related Consents may be deemed not to have been made until such irregularities have been cured or waived. |

| | | |

| 6. | | None of the Company, the Dealer Manager, the Clearing Systems or the Tender Agents shall accept any responsibility for failure of delivery of any notice, communication or electronic acceptance instruction. |

| | | |

| 7. | | Any rights or claims which a Holder may have against the Company in respect of any tendered Notes or the Offer shall be extinguished or otherwise released upon the payment to such Holder of the Total Consideration or Tender Offer Consideration, as the case may be, and any Accrued Interest for such Notes. |

| | | |

| 8. | | Without limiting the manner in which the Company may choose to make any public announcement, the Company shall have no obligation to publish, advertise or otherwise communicate any such public announcement other than by issuing a press release or notice, in addition to any press release or notice required pursuant to the terms of the Indenture or the rules of the Luxembourg Stock Exchange, to the Tender Agents (who will convey such notice to the Clearing Systems) and to the Dealer Manager. |

| | | |

| 9. | | The Notes are debt obligations of the Company and are governed by the Indenture. There are no appraisal or other similar statutory rights available to the Holders in connection with the Offer. |

| | | |

| 10. | | The contract constituted by the Company's acceptance for payment in accordance with the terms of this Statement of all Notes validly tendered (or defectively tendered, if such defect has been waived by the Company) shall be governed by, and construed in accordance with, New York law. |

| | | |

| 11. | | The Offer will commence on May 17, 2005. |

CERTAIN SIGNIFICANT CONSIDERATIONS

Each Holder should carefully consider the following considerations, in addition to the other information described elsewhere herein before deciding whether to participate in the Offer.

Effects of the Proposed Amendments. The Supplemental Indenture will become effective upon satisfaction of the Supplemental Indenture Condition although the Proposed Amendments will not become operative until the Company accepts for payment all the Notes validly tendered (and not withdrawn). In the event the Company does not accept and pay promptly for all of the validly tendered Notes after the expiration of the Offer on the Expiration Date, the Supplemental Indenture will at such time cease to be in effect. If such conditions are satisfied, Notes that are not tendered pursuant to the Offer will remain outstanding and will be subject to the terms of the Indenture as modified by the Supplemental Indenture. As a result of the adoption of the Proposed Amendments, Holders of Notes not tendered pursuant to the Offer will no longer be entitled to the benefits of substantially all of the covenants applicable to the Company and its subsidiaries that are currently contained in the Indenture. In addition, certain events which would have constituted a violation of such covenants will no longer constitute Events of Default (as defined in the Indenture) and, upon the occurrence of such events, Holders of Notes not tendered will no longer be entitled to exercise certain rights currently exercisable upon the occurrence of an Event of Default, including the right to accelerate payment of the Notes. The modification or deletion of the restrictive covenants will permit the Company to take actions previously prohibited by the Indenture (such as incurring indebtedness, paying dividends or making other restricted payments, and engaging in transactions with affiliates) that could increase the credit risk with respect to the Company and its subsidiaries, adversely affect the market price and credit rating of the Remaining Notes or otherwise be adverse to the interests of the Holders. The Proposed Amendments also will allow the Company to legally defease the Remaining Notes without being required to obtain certain legal opinions (including legal opinions that the Holders of the Remaining Notes will not recognize a taxable gain or loss as a consequence of legal defeasance) and an auditor's certificate. See" - - Legal Defeasance".

Legal Defeasance.Following consummation of the Offer, the Company will assess whether to effect a legal defeasance of the Notes. Whether the Company effects a legal defeasance will depend on facts and circumstances existing at the time. If the Company elects to legally defease the Remaining Notes in accordance with the Indenture, such defeasance will constitute a taxable event for certain Holders under U.S. and U.K. tax laws and therefore Holders of the Remaining Notes will be required to recognize a gain or loss on the Notes for U.S. federal and U.K. tax purposes. The tax laws of other jurisdictions may provide for a similar tax treatment of a legal defeasance of the Notes. Holders should consult their own legal advisors regarding the tax consequences of a legal defeasance. Non-tendering Holders are cautioned that they may risk the tax consequences of a legal defeasance following consummation of the Offer. See"Certain Tax Consequences".

Notes will be Subordinate to Substantial Additional Indebtedness.The Remaining Notes will effectively be subordinate in right of payment to the lenders under the Restated Senior Credit Agreement because a number of the Company's principal subsidiaries are borrowers and guarantors thereunder. In addition, if the Proposed Amendments become effective, the Company and its subsidiaries will each be permitted (without limitation) to incur debt or to guarantee future indebtedness of the others by the terms of the Indenture as amended by the Supplemental Indenture. Subject to the payment of the balance of an arrangement fee and certain other conditions, an additional $175 million (the"Additional Commitment") will be available to the Group under the Restated Senior Credit Agreement. When the proposed Amendments become effective, the Company will accede to the Restated Senior Credit Agreement as a borrower and a guarantor.

Possible Additional Indebtedness; Impact on Company's Credit Rating. Following the Offer, the Company and/or its direct and indirect subsidiaries may incur significant additional indebtedness as this would be permitted by the amended Indenture. Any such indebtedness may adversely impact the Company's overall credit rating or ability to make payments in respect of interest or principal on the Remaining Notes and, due to structural subordination, may effectively rank senior to the Remaining Notes.

Effects on the Trading Market for the Notes. The Notes are listed on the Luxembourg Stock Exchange. After the consummation of the Offer, it is likely that the outstanding principal amount of Notes available for trading will be significantly reduced. A debt security with a smaller outstanding principal amount available for trading (a smaller"float") may command a lower price than would a comparable issue of debt securities with a larger float. The reduction in the size of the float that is likely to result from the consummation of the Offer may adversely affect both the liquidity and market price of the remaining Notes. The reduction in the float also may tend to make the trading price of Notes more volatile. The absence of financial and other covenant protections as a result of the Proposed Amendments, and the lack of publicly available information about the Company as described below, also may adversely affect the future trading price of the Remaining Notes. The extent of the market for the Notes and the availability of over-the-counter price quotations would depend on the number of owners of Notes remaining, the interest in maintaining a market in the Notes on the part of securities firms and other factors.

No Furnishing of Reports. Pursuant to the Indenture, the Company is obligated to file with or furnish to the U.S. Securities and Exchange Commission (the"SEC") and provide to the Trustee for the benefit of Holders of the Notes (i) within 120 days after the end of each fiscal year, annual reports on Form 20-F (or any successor form) containing the information required to be contained therein (or required in such successor form), including audited financial statements prepared in accordance with generally accepted accounting principles in the United Kingdom ("U.K. GAAP") and reconciled to generally accepted accounting principles in the United States ("U.S. GAAP"); (ii) within 45 days after the end of each of the first three fiscal quarters of each fiscal year, reports on Form 6-K (or any successor form) including a "Management's Discussion and Analysis of Financial Condition and Results of Operations" and unaudited quarterly financial statements, in each case in form and substance substantially similar to the corresponding information required to be contained in a Form 10-Q (or required in any successor form), including audited financial statements prepared in accordance with U.K. GAAP and reconciled to U.S. GAAP; and (iii) promptly from time to time after the occurrence of an event that would be required to be the subject of a public announcement by the Company in accordance with the listing rules of the U.K. Listing Authority, other reports on Form 6-K (or any successor form), which Form 6-K shall contain substantially the same information required to be contained in such public announcement. If the Proposed Amendments become operative, the Company's obligations described in this paragraph will be eliminated. The likely consequences of this change are discussed below under"No Registration under the Exchange Act".

No Registration under the Exchange Act. The Company intends to apply to terminate its reporting obligations under the Exchange Act in respect of the Notes promptly after the Expiration Date. In addition, American depositary shares ("ADSs") representing the Company's ordinary shares are listed on the New York Stock Exchange ("NYSE") and the Company's ordinary shares are registered under the Exchange Act. De-registration of the Company's securities under the Exchange Act is a prime objective of the Company and the Company is examining ways of terminating its SEC registration as soon as practicable. From the date on which the Company no longer has its Notes or ordinary shares registered under the Exchange Act, subject to there not being more than 300 U.S. resident holders of the Notes or ordinary shares at the end of any of the Company's financial years, it will no longer be required to file periodic reports on Form 20-F and Form 6-K with the SEC. The Company intends to apply to the NYSE to de-list the ADSs from the NYSE. The Company intends to terminate the deposit agreement in respect of its ADSs and is proposing changes to its Articles of Association to give it the power to require that ordinary shares held by certain U.S. resident holders be sold to non-U.S. persons.

Conditions to the Consummation of the Offer and Related Risks. The consummation of the Offer is subject to the satisfaction of several conditions. See"Conditions to the Offer". There can be no assurance that such conditions will be met or that, in the event the Offer is not consummated, the market value and liquidity of the Notes will not be materially adversely affected.

Possible Future Purchases of Notes Not Tendered in the Offer. From time to time in the future, the Company may acquire Notes, if any, which are not tendered in response to the Offer through open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise, upon such terms and at such prices as it may determine, which may be more than, less than or equal to the price to be paid pursuant to the Offer and could be for cash or other consideration. There can be no assurance that the Company will pursue any of these alternatives (or combinations thereof) in the future.

PURPOSE AND BACKGROUND OF THE OFFER

The purpose of the Offer is to acquire all of the outstanding Notes and to obtain the related Consents to effect the Proposed Amendments.

The Offer is being made in connection with a capital restructuring program by the Company designed to allow the reinstatement of dividends and the termination of its SEC reporting obligations. The capital restructuring program is also designed to simplify the Company's debt financing and reduce its interest and compliance costs. The capital restructuring program will increase the Company's net debt by approximately £17 million. The costs of the capital restructuring program are expected to total approximately £21 million, including approximately £14.5 million of interest pre-payment on the Notes, £3.6 million of non-cash write-off of deferred finance costs and £2.6 million of fees. These costs will be treated as exceptional items.

Dividend Reinstatement and Reduction of Capital

The Company currently has a deficit on distributable reserves that arose principally as a result of an internal restructuring during the year ended September 28, 2002 and which prevents the Company from paying dividends.

To reinstate dividends, the Company has proposed a capital reduction to create distributable reserves which should allow dividends to be paid to its shareholders.

The capital reduction will require shareholder approval at an extraordinary general meeting of the Company to be held on or about June 13, 2005 (the"EGM") and High Court approval. Before giving its approval, the High Court will require all creditors of the Company to have been protected. In order to satisfy the High Court, as well as to enable the Company to terminate SEC reporting obligations, the Company is making the Offer. The Company will provide such form of protection in respect of the Company's non-consenting creditors, including any holders of Remaining Notes, as it is advised is appropriate and in accordance with the High Court's determination.

Termination of SEC Reporting Obligations, NYSE Listing and ADR Program

Under the Indenture, the Company is required to file annual and quarterly reports, and other disclosure documents, with the SEC. The Proposed Amendments would eliminate this requirement. If the Offer is successful and the Proposed Amendments become effective, the Company intends to cease its regular quarterly reporting and to recommence semi-annual reporting in November and May, with full trading updates at the end of March and September.

Only a very small portion of the Company's total shares and related trading volume is represented by American Depository Receipts ("ADRs"). The Company has therefore decided to de-list from the New York Stock Exchange (the"NYSE") and to terminate its ADR program.

De-listing from the NYSE and effectiveness of the Proposed Amendments would not automatically terminate the Company's obligation to file reports with the SEC. Instead, the Company must continue to comply with the SEC’s reporting requirements, including the requirement to file annual reports on Form 20-F, until its obligation to file periodic reports in respect of each class of its securities is suspended.

The Company cannot effect a de-registration of a class of its securities under the Exchange Act unless the number of U.S. resident holders, whether holding directly or through nominees, of its ordinary shares (including those held in the form of ADRs) or Notes, as the case may be, is below 300. The Company's Board has been advised that the capital restructuring program should enable de-registration to be implemented.

Under current SEC rules, even if the Company is able to de-register its securities under the Exchange Act, it must ensure that the number of U.S. resident holders of its ordinary shares remains below 300 to avoid recommencement of SEC reporting requirements. Accordingly, the Company is seeking approval at the EGM for amendments to its Articles of Association conferring on the Company's board of directors the power to require that any new U.S. shareholder sell its shares to non-U.S. persons.

Restated Senior Credit Agreement

The Offer is to be financed by the increase from $225 million to $400 million in the facility available under the Restated Senior Credit Agreement, on similar terms. The Restated Senior Credit Agreement is a multi-currency revolving credit facility which can be used for general corporate purposes and the issuance of letters of credit and for the purpose of purchasing, prepaying, redeeming, discharging or defeasing the Notes.

The availability of the Restated Senior Credit Agreement is subject to payment of the balance of an arrangement fee, a portion of which was paid on May 6, 2005 and a portion of which is payable only when all or a portion of the Additional Commitment is drawn and certain other conditions. Availability of borrowings are also subject to certain customary conditions. If the Proposed Amendments become effective, the Company will accede to the Restated Senior Credit Agreement as a borrower and a guarantor. When the Company accedes to the Restated Senior Credit Agreement, the definition of the "Group" will be expanded to include the Company in respect of various covenants and undertakings given to the lenders. The Restated Senior Credit Agreement contains customary financial and operating covenants.

SOURCE AND AMOUNT OF FUNDS

Assuming 100% of the Holders consent before the Consent Date, the Total Consideration and estimated expenses in connection with the Offer are estimated to be approximately £115.4 million (subject to variation in the Tender Offer Yield), plus approximately £1.9 million for Accrued Interest to the Payment Date. The Company intends to finance the purchase of the Notes tendered pursuant to the Offer through drawings under the Restated Senior Credit Agreement, subject to customary conditions to drawing.

CERTAIN INFORMATION CONCERNING THE COMPANY

The Company is a public limited company organized under the laws of England and Wales. The Company's principal executive offices are located at Washington House, 40-41 Conduit Street, London W1S 2YQ, England, and its telephone number is +44 (0)20 7304 6000. The Company focuses on the design, manufacture and supply of food equipment. Through its two operating groups, Global Food Service Equipment and Food Retail Equipment, the Company has 27 factories in eight countries and a large portfolio of premium brands, including Scotsman, Garland, Frymaster, Cleveland, Delfield, Jackson, Lincoln, Convotherm, and Merrychef in food service equipment, and Kysor/Warren and Kysor Panel Systems in food retail equipment. For a more detailed description of the business of the Company, see the descriptions thereof set forth in the Company's Annual Report on Form 20-F for the Company's financial year ended October 2, 2004, which is available as described below.

AVAILABLE INFORMATION

The Company is currently subject to the reporting requirements of the U.S. Securities Exchange Act and, in accordance therewith, is required to file an annual report and to furnish certain other information to the SEC relating to its business, financial condition and other matters. These reporting requirements will cease upon the consummation of the Offer and the deregistration of the Notes and the Company's ordinary shares. The reports and other information that the Company has filed with or furnished to the SEC in the past can be inspected and copied at the public reference facilities maintained by the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C: 20549, as well as the regional affairs of the SEC located at 233 Broadway, New York, New York 10279 and Citicorp Center, 500 West Madison Street, Suite 1300, Chicago, Illinois 60661. Information regarding the public reference facilities may be obtained from the SEC by telephoning 1-800-SEC-0330. Copies of such materials may also be obtained by mail from the Public Reference Section of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549 at prescribed rates. The Company files materials with, and furnishes materials to, the SEC electronically. The SEC maintains an Internet site that contains these materials. The address of the SEC's website is http://www.sec.gov. The financial information described above is also available at the offices of the Luxembourg Tender Agent at Aerogolf Centre, 1A Hoehonhof, L-17361 Senningerberg, Grand Duchy of Luxembourg. In addition, the Company's half year results for the 26 weeks ended April 2, 2005 are available through the London Stock Exchange website at http://www.londonstockexchange.com. These publicly available reports are not incorporated by reference.

The Company will make available to any Holder upon request copies of the Notes, the Indenture and the latest drafts of the Supplemental Indenture. Any requests for such information should be directed to the Tender Agents at their addresses and telephone numbers set forth on the back cover page of this Statement.

PROPOSED AMENDMENTS TO THE INDENTURE

This section sets forth a brief description of the Proposed Amendments to the Indenture for which Consents are being sought pursuant to the Solicitation. The summary of provisions of the Indenture set forth below is qualified in its entirety by reference to the full and complete terms contained in the Indenture. Capitalized terms appearing below but not defined in this Statement have the meanings ascribed to such terms in the Indenture.

Upon receipt of valid electronic acceptance instructions (which have not been withdrawn prior to the Consent Date) in respect of Notes and related Consents representing at least a majority of the outstanding aggregate principal amount of the Notes, a Supplemental Indenture will be executed for the Notes by the Company and the Trustee, amending the Notes and the Indenture to eliminate or amend the provisions set out below (the "Proposed Amendments"). Such Proposed Amendments will be effective from the date on which the Supplemental Indenture is executed, provided that such Proposed Amendments will cease to be in effect if the Company does not accept and promptly pay for the tendered Notes upon expiration of the Offer.

The Proposed Amendments to the Indenture are as follows (capitalised terms used below and not otherwise defined herein are used as defined in the Indenture):

Deletion of Restrictive Covenants. The Proposed Amendments would delete the following restrictive covenants and references thereto in their entirety from the Indenture, as well as the events of default related to such restrictive covenants:

Section 4.02 | SEC Reports.Section 4.02 of the Indenture requires the Company to furnish certain information to the Holders of the Notes (regardless of whether or not required by the rules and regulations of the SEC). The Proposed Amendments would delete Section 4.02 in its entirety. |

Section 4.03 | Limitation on Indebtedness.Section 4.03 of the Indenture prohibits the Company and any Restricted Subsidiary from incurring directly or indirectly any Indebtedness unless certain financial tests are satisfied. The Proposed Amendments would delete Section 4.03 in its entirety. |

Section 4.04 | Limitation on Restricted Payments.Section 4.04 of the Indenture prohibits the Company and any Restricted Subsidiary from making any Restricted Payments unless certain conditions are met. The Proposed Amendments would delete Section 4.04 in its entirety. |

Section 4.05 | Limitation on Restrictions on Distributions from Restricted Subsidiaries.Section 4.05 of the Indenture prohibits the Company or any Restricted Subsidiary from restricting the ability of any Restricted Subsidiary, with certain exceptions, to make any advances or loans, transfer property or assets, or pay dividends or other distributions to the Company. The Proposed Amendments would delete Section 4.05 in its entirety. |

Section 4.06 | Limitation on Sales of Assets and Subsidiary Stock.Section 4.06 of the Indenture prohibits the Company and any Restricted Subsidiaries from consummating any Asset Disposition unless certain conditions are met, including the application of the proceeds of such asset sales to the redemption of Notes. The Proposed Amendments would delete Section 4.06 in its entirety. |

Section 4.07 | Limitations on Affiliate Transactions.Section 4.07 of the Indenture prohibits the Company and any Restricted Subsidiaries from entering into any transaction with, or for the benefit of, any Affiliate of the Company unless certain conditions are met. The Proposed Amendments would delete Section 4.07 in its entirety. |

Section 4.08 | Limitation of the Sale or Issuance of Capital Stock of Restricted Subsidiaries.Section 4.08 of the Indenture prohibits the Company and its Restricted Subsidiaries from selling, leasing, transferring or otherwise disposing of any Capital Stock of Enodis Holding Limited or Enodis Group Limited (other than pursuant to certain permitted Liens) or any or Capital Stock of any Restricted Subsidiary to any Person (other than to the Company or a Wholly Owned Subsidiary) or permitting the issuance or sale to any Person of Capital Stock of any Restricted Subsidiary. The proposed amendments would delete Section 4.08 in its entirety. |

Section 4.09 | Change of Control.Section 4.09 of the Indenture gives each Holder the right to require the Company to purchase such Holder's Notes at a purchase price equal to 101% of the aggregate principal amount thereof plus accrued and unpaid interest upon the occurrence of a Change of Control. The Proposed Amendments would delete Section 4.09 in its entirety. |

Section 4.10 | Limitations on Liens.Section 4.10 of the Indenture prohibits the Company and any Restricted Subsidiaries from Incurring or permitting to exist any Lien (other than Permitted Liens) on any of its properties unless certain conditions are met. The Proposed Amendments would delete Section 4.10 in its entirety. |

Section 4.11 | Limitations on Sale/Leaseback Transactions.Section 4.11 of the Indenture prohibits the Company and any Restricted Subsidiaries from entering into any Sale/Leaseback Transaction unless certain conditions are met. The Proposed Amendments would delete Section 4.11 in its entirety. |

Section 4.15 | Limitation of Guarantees of Company indebtedness.Section 4.15 of the Indenture prohibits any Restricted Subsidiary from Guaranteeing any Indebtedness of the Company or securing any Indebtedness of the Company with a Lien on the assets of such Restricted Subsidiary unless certain conditions are met. The Proposed Amendments would delete section 4.15 in its entirety. |

Section 4.16 | Limitation on Business Activities.Section 4.16 of the Indenture prohibits the Company and any Restricted Subsidiary from engaging in any business other than a Related Business, except to such extent as is not material to the Company and its Restricted Subsidiaries as a whole. The Proposed Amendments would delete Section 4.16 in its entirety. |

Amendment of Section 5.01 — When Company May Merge or Transfer Assets.