SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2011 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| OR |

| o | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Date of event requiring this shell company report: |

For the transition period from ____ to ______

| Commission file number: 000-30780 |

(Exact name of Registrant as specified in its charter)

Province of Alberta, Canada

(Jurisdiction of incorporation or organization)

2300 – 1066 West Hastings Street, Vancouver, British Columbia V6E 3X2 Canada

(Address of principal executive offices)

Stuart Rogers, President and CEO

Max Resource Corp.

2300 – 1066 West Hastings Street

Vancouver, British Columbia V6E 3X2 Canada

Tel: (604) 689-1749

Facsimile: (604) 648-8665

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act: None

(Title of Class)

Securities registered pursuant to Section 12(g) of the Act: Common Shares, no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

(Title of Class)

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or common stock as of the close of the period covered by the annual report: 24,505,985 common shares as at December 31, 2011

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o International Reporting Standards as issued x Other o

by the International Accounting Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

MAX Resource Corp.

Form 20-F Annual Report

Table of Contents

CONTENTS

| Table of Contents | 3 |

| SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS | 5 |

| PART I | | 7 |

| ITEM 1. | Identity of Directors, Senior Management and Advisers | 7 |

| ITEM 2. | Offer Statistics and Expected Timetable | 7 |

| ITEM 3. | Key Information | 7 |

| 3.A | Selected Financial Data | 8 |

| 3.B | Capitalization and Indebtedness | 11 |

| 3.C | Reasons for the Offer and Use of Proceeds | 11 |

| 3.D | Risk Factors | 12 |

| Item 4. | Information on the Company | 16 |

| 4.A | History and Development of the Company | 16 |

| 4.B | Business Overview | 21 |

| 4.C | Organizational Structure | 22 |

| 4.D | Property, Plants and Equipment | 22 |

| Item 4.A | Unresolved Staff Comments | 49 |

| Item 5. | Operating and Financial Review and Prospects | 49 |

| 5.A | Operating Results | 51 |

| 5.B | Liquidity and Capital Resources | 52 |

| 5.C | Research and Development, Patents and Licenses, etc. | 53 |

| 5.D | Trend Information | 53 |

| 5.E | Off-balance Sheet Arrangements | 53 |

| 5.F | Tabular Disclosure of Contractual Obligations | 54 |

| Item 6. | Directors, Senior Management and Employees | 54 |

| 6.A | Directors and Senior Management | 54 |

| 6.B. | Compensation | 56 |

| 6.C | Board Practices | 57 |

| 6.D | Employees | 58 |

| 6.E | Share Ownership | 58 |

| Item 7. | Major Shareholders and Related Party Transactions | 59 |

| 7.A | Major Shareholders | 59 |

| 7.B | Related Party Transactions | 60 |

| 7.C | Interests of Experts and Counsel | 61 |

| Item 8. | Financial Information | 61 |

| 8.A | Consolidated Statements and other Financial Information | 61 |

| 8.B | Significant Changes | 62 |

| Item 9. | The Offer and Listing | 62 |

| 9.A | Offer and Listing Details | 62 |

| 9.B | Plan of Distribution | 63 |

| 9.C | Markets | 63 |

| 9.D | Selling Shareholders | 63 |

| 9.E | Dilution | 63 |

| 9.F | Expenses of the Issue | 63 |

| Item 10. | Additional Information | 63 |

| 10.A | Share Capital | 63 |

| 10.B | Memorandum and Articles of Association | 63 |

| 10.C | Material Contracts | 64 |

| 10.D | Exchange Controls | 64 |

| 10.E | Taxation | 65 |

| 10.F | Dividends and Paying Agents | 73 |

| 10.G | Statement by Experts | 73 |

| 10.H | Documents on Display | 73 |

| 10.I | Subsidiary Information | 73 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 73 |

| Item 12. | Description of Securities Other than Equity Securities | 73 |

| PART II | 74 |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 74 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 74 |

| Item 15. | Controls and Procedures | 74 |

| Item 16. | Reserved | 75 |

| 16A. | Audit Committee Financial Expert | 75 |

| 16.B | Code of Ethics | 75 |

| 16.C | Principal Accountant Fees and Services | 75 |

| 16.D | Exemptions from the Listing Standards for Audit Committees | 76 |

| 16.E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 76 |

| 16.F | Change in Registrant’s Certifying Accountant | 76 |

| 16.G | Corporate Governance | 76 |

| PART III | FINANCIAL STATEMENTS | 78 |

| Item 17. | Financial Statements | 78 |

| Item 18. | Financial Statements | 78 |

| Item 19. | Exhibits | 78 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” (or the negative and grammatical variations of any of these terms and similar expressions) be taken, occur or be achieved,) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| | ● | risks related to our status as a passive foreign investment company for U.S. tax purposes; |

| | ● | risks related to our history of operating losses; |

| | ● | risks related to our lack of production history; |

| | ● | risks related to our limited financial resources; |

| | ● | risks related to our need for additional financing; |

| | ● | risks related to competition in the mining industry; |

| | ● | risks related to increased costs; |

| | ● | risks related to possible shortages in equipment; |

| | ● | risks related to mineral exploration activities; |

| | ● | risks related to our lack of insurance for certain activities; |

| | ● | risks related to all our properties being in the exploration stage; |

| | ● | risks related to uncertainty that our properties will ultimately be developed; |

| | ● | risks related to our management’s limited experience in mineral exploration; |

| | ● | risks related to fluctuations in precious and base metal prices; |

| | ● | risks related to the possible loss of key management personnel; |

| | ● | risks related to possible conflicts of interest; |

| | ● | risks related to our mineral properties being subject to prior unregistered agreements, transfers, or claims and other defects in title; |

| | ● | risks related to governmental and environmental regulations; |

| | ● | risks related to our ability to obtain necessary permits; |

| | ● | risks related our status as a foreign corporation; |

| | ● | risks related to current economic conditions; and |

| | ● | other risks related to our securities. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in the sections entitled “Risk Factors”, “Information on the Company” and “Operating and Financial Review and Prospects” and in the exhibits attached to this Annual Report on Form 20-F. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company’s forward-looking statements are based on beliefs, expectations and opinions of management on the date the statements are made and the Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

All references in this Report on Form 20-F to the terms “we”, “our”, “us”, “the Company” and “MAX” refer to MAX Resource Corp. and its subsidiary.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES

Certain disclosure in this Annual Report on Form 20-F has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in United States Securities and Exchange Commission (“SEC”) Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

“Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report on Form 20-F and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Conversion Table

In this Annual Report a combination of Imperial and metric measures are used. Conversions from Imperial measure to metric and from metric to Imperial are provided below:

| Imperial Measure = | Metric Unit | Metric Measure = | Imperial Unit |

| 2.47 acres | 1 hectare | 0.4047 hectares | 1 acre |

| 3.28 feet | 1 meter | 0.3048 meters | 1 foot |

| 0.62 miles | 1 kilometer | 1.609 kilometers | 1 mile |

| 0.032 ounces (troy) | 1 gram | 31.1 grams | 1 ounce (troy) |

| 1.102 tons (short) | 1 tonne | 0.907 tonnes | 1 ton |

| 0.029 ounces (troy)/ton | 1 gram/tonne | 34.28 grams/tonne | 1 ounce (troy/ton) |

CURRENCY AND EXCHANGE RATES

Canadian Dollars Per U.S. Dollar

Unless otherwise indicated, all references in this annual report are to Canadian dollars.

The following table sets out the exchange rates for one United States dollar (“US$”) expressed in terms of one Canadian dollar (“Cdn$”) in effect at the end of the following periods, and the average exchange rates (based on the average of the exchange rates on the last day of each month in such periods) and the range of high and low exchange rates for such periods.

| Canadian Dollars per U.S. dollar |

| | 2011 | 2010 | 2009 | 2008 | 2007 |

| Average for the period | 0.9927 | 1.0346 | 1.1486 | 1.0716 | 1.0782 |

| Low for the period | 1.0658 | 1.0848 | 1.3066 | 1.3008 | 1.1878 |

| Canadian Dollars per U.S. Dollar for the Month of |

| | April 2012 | March 2012 | February 2012 | January 2012 | December 2011 | November 2011 |

| High for the period | 0.9838 | 0.9870 | 0.9910 | 1.0022 | 1.0134 | 1.0167 |

| Low for the period | 1.0050 | 1.0035 | 1.0040 | 1.0296 | 1.0423 | 1.0522 |

The noon exchange rate on May 18, 2012 as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$1.00 = Cdn $0.9794.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable.

Item 2. Offer Statistics and Expected Timetable

Not Applicable.

Item 3. Key Information

We were incorporated as Proven Capital Corp. on April 25, 1994 under the Business Corporations Act of Alberta (the “BCA”). We changed our name to Cedar Capital Corp. on January 10, 1995 and subsequently to Vancan Capital Corp. on February 12, 2002. On May 14, 2004, we changed our name to Max Resource Corp. On June 27, 2007 we were registered as an extra-provincial company with the Registrar of Companies in British Columbia, pursuant to the Business Corporations Act of British Columbia (“BCABC”).

We are in the business of mineral property exploration and development. The recoverability of amounts recorded for mineral properties and related deferred costs is dependent upon the discovery of economically recoverable reserves, our ability to obtain necessary financing to complete the development, and future production or proceeds from the disposition thereof. We will depend almost exclusively on outside capital to complete the exploration and development of our mineral properties. Such outside capital will include the sale of additional stock. There can be no assurance that capital will be available as necessary to meet these continuing exploration and development costs or, if the capital is available, that it will be on terms acceptable to us. The issuances of additional stock by the Company may result in a significant dilution in the equity interests of our current stockholders. If we are unable to obtain financing in the amounts and on terms deemed acceptable, our business

and future success may be adversely affected. Our ability to continue operations as a going concern is dependent upon our ability to obtain necessary financing. To date, we have not generated any revenues from operations and will require additional funds to meet our obligations and the costs of our operations. As a result, significant losses are anticipated prior to the generation of any profits.

We are a reporting issuer in British Columbia and Alberta and trade in Canada on the TSX Venture Exchange under the symbol MXR. We are quoted in the United States on the OTC Bulletin Board under the symbol MXROF. We were listed on the Frankfurt Stock Exchange on March 2, 2006 under the symbol M1D.

3.A Selected Financial Data

The selected financial data of the Company and the information in the following table for the years ended December 31, 2011 and December 31, 2010, and as at January 1, 2010 was derived from the audited consolidated financial statements of the Company audited by DMCL CA, LLP, independent Registered Public Accountant, as indicated in their report which is included elsewhere in this annual report.

The information in the following tables should be read in conjunction with the information appearing under the heading “Item 5. Operating and Financial Review and Prospects” and the audited consolidated financial statements under the heading "Item 18. Financial Statements" and related notes thereto. Historical results from any prior period are not necessarily indicative of results to be expected for any future period.

The following table of selected financial data has been derived from audited financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”).

International Financial Reporting Standards (Cdn$ in 000, except per share data)

| | | 2011 | | | 2010 | |

| Revenue | | Nil | | | Nil | |

| Net income (Loss) for the year | | $ | (1,197 | ) | | $ | (418 | ) |

| Earnings (Loss) per share | | $ | (0.05 | ) | | $ | (0.02 | ) |

| Dividends per Shares | | Nil | | | Nil | |

| | | | | | | | | |

| Working capital | | $ | 1,101 | | | $ | 2,258 | |

| Mineral Properties | | $ | 3,721 | | | $ | 2,592 | |

| Long Term Debt | | Nil | | | Nil | |

| Total assets | | $ | 5,019 | | | $ | 4,944 | |

| Shareholders’ equity | | $ | 4,892 | | | $ | 4,914 | |

Consolidated Statements of Cash Flows

| | | 2011 | | | 2010 | |

| Operating activities | | | | | | |

| Cash used per IFRS | | $ | 495 | | | $ | 498 | |

| Investing activities | | | | | | | | |

| Cash used per IFRS | | $ | 1,125 | | | $ | 533 | |

| Financing Activities | | | | | | | | |

| Cash provided per IFRS | | $ | 665 | | | Nil | |

The date set forth in the table below for the years ended December 31, 2009, December 31, 2008 and December 31, 2007 is data derived from consolidated financial statements of the Company audited by DMCL CA, LLP, independent Registered Public Accountant, as indicated in their report which is included elsewhere in this annual report.

The selected consolidated financial information set forth in the first table below for each of the three years ended December 31, 2009, 2008 and 2007, which is expressed in Canadian dollars (the Company prepares its financial statements in Canadian dollars), has been derived from the Company's audited consolidated financial statements as at and for the financial years ended December 31, 2009, 2008 and 2007. These consolidated financial statements were prepared in accordance with generally accepted accounting principles in Canada ("Canadian GAAP"), which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with United States GAAP.

Selected Financial Data

| | | (In $000 except per share data) | |

| Canadian GAAP | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| Revenue | | Nil | | | Nil | | | Nil | |

| Net income (Loss) for the year | | $ | (4,660 | ) | | $ | (1,149 | ) | | $ | (1,094 | ) |

| Earnings (Loss) per share | | $ | (0.22 | ) | | $ | (0.05 | ) | | $ | (0.06 | ) |

| Dividends per Shares | | Nil | | | Nil | | | Nil | |

| | | | | | | | | | | | | |

| Working capital | | $ | 3,093 | | | $ | 4,345 | | | $ | 7,852 | |

| Mineral Properties | | $ | 2,142 | | | $ | 5,463 | | | $ | 2,886 | |

| Long Term Debt | | Nil | | | Nil | | | Nil | |

| Total assets | | $ | 5,325 | | | $ | 9,983 | | | $ | 10,801 | |

| Shareholders’ equity | | $ | 5,268 | | | $ | 9,836 | | | $ | 10,767 | |

Consolidated Statements of Cash Flows

| | | 2009 | | | 2008 | | | 2007 |

| Operating activities | | | | | | | | |

| Cash used per Canadian GAAP | | $ | 621 | | | $ | 370 | | | $ | 600 |

| Investing activities | | | | | | | | | | | |

| Cash used per Canadian GAAP | | $ | 638 | | | $ | 2,914 | | | $ | 1,449 |

| Financing Activities | | | | | | | | | | | |

| Cash provided per Canadian GAAP | | Nil | | | Nil | | | $ | 8,830 |

| | | (In $000 except per share data) | |

| United States GAAP | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| Revenue | | Nil | | | Nil | | | Nil | |

| Net income (Loss) for the year | | $ | (4,973 | ) | | $ | (3,490 | ) | | $ | (2,186 | ) |

| Earnings (Loss) per share | | $ | (0.23 | ) | | $ | (0.16 | ) | | $ | (0.13 | ) |

| Dividends per Shares | | | 0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | |

| Working capital | | $ | 3,093 | | | $ | 4,345 | | | $ | 7,852 | |

| Mineral Properties | | $ | 644 | | | $ | 1,424 | | | $ | 1,187 | |

| Long Term Debt | | | 0 | | | | 0 | | | | 0 | |

| Total assets | | $ | 3,826 | | | $ | 5,943 | | | $ | 9,103 | |

| Shareholders’ equity | | $ | 3,762 | | | $ | 5,790 | | | $ | 9,061 | |

Consolidated Statements of Cash Flows

| | | 2009 | | | 2008 | | | 2007 |

| Operating activities | | | | | | | | |

| Cash used per US GAAP | | $ | 1,023 | | | $ | 2,710 | | | $ | 1,692 |

| Investing activities | | | | | | | | | | | |

| Cash used per US GAAP | | $ | 235 | | | $ | 574 | | | $ | 357 |

| Financing Activities | | | | | | | | | | | |

| Cash provided per US GAAP | | Nil | | | Nil | | | $ | 8,830 |

See the heading “Currency and Exchange Rates” above for disclosure of exchange rates between Canadian dollars and United States dollars. Unless indicated otherwise, all references to dollars in this annual report are to Canadian dollars.

Accounting Standards

International Financial Reporting Standards ("IFRS")

In February 2008, the Canadian Accounting Standards Board confirmed that publicly accountable enterprises are required to adopt IFRS for fiscal years beginning on or after January 1, 2011. Accordingly, the Company changed from Canadian

GAAP reporting and commenced reporting under IFRS effective January 1, 2010 with restatement of comparative information presented. The conversion to IFRS from Canadian GAAP affects the Company’s reported financial position and results of operations and comprehensive income (loss) and affects the Company’s accounting policies, internal control over financial reporting and disclosure controls and procedures.

Accounting Standards Issued– not yet in effect

Amendments to IFRS 7 “Financial Instruments: Disclosures”

This amendment increases the disclosure required regarding the transfer of financial assets, especially if there is a disproportionate amount of transfer transactions that take place around the end of a reporting period. This amendment is effective for annual periods beginning on or after July 1, 2011

New standard IFRS 9 “Financial Instruments”

This new standard is a partial replacement of IAS 39 “Financial Instruments: Recognition and Measurement”. IFRS 9 uses a single approach to determine whether a financial asset is measured at amortized cost or fair value, replacing the multiple rules in IAS 39. The approach in IFRS 9 is based on how an entity manages its financial instruments in the context of its business model and the contractual cash flow characteristics of the financial assets.

The new standard also requires a single impairment method to be used, replacing the multiple impairment methods in IAS 39. IFRS 9 is effective for annual periods beginning on or after January 1, 2013.

New standard IFRS 10 “Consolidated Financial Statements”

This new standard will replace IAS 27 “Consolidated and Separate Financial Statements”, and SIC-12 “Consolidation – Special Purpose Entities”. Concurrent with IFRS 10, the IASB issued IFRS 11 “Joint Ventures”; IFRS 12 “Disclosures of Involvement with Other Entities”; IAS 27 “Separate Financial Statements”, which has been amended for the issuance of IFRS 10 but retains the current guidance for separate financial statements; and IAS 28 “Investments in Associates and Joint Ventures”, which has been amended for conforming changes based on the issuance of IFRS 10 and IFRS 11.

IFRS 10 uses control as the single basis for consolidation, irrespective of the nature of the investee, eliminating the risks and rewards approach included in SIC-12, and requires continuous assessment of control over an investee. The above consolidation standards are effective for annual periods beginning on or after January 1, 2013.

New interpretation IFRIC 20 “Stripping Costs in the Production Phase of a Surface Mine”

This new IFRIC clarifies when production stripping should lead to the recognition of an asset and how that asset should be measured, both initially and in subsequent periods. IFRIC 20 is effective for annual periods beginning on or after January 1, 2013.

The Company has not early adopted these revised standards and is currently assessing the impact that these standards will have on its consolidated financial statements.

IFRS 11, Joint Arrangements

IFRS 11 requires a venturer to classify its interest in a joint arrangement as a joint venture or joint operation. Joint ventures will be accounted for using the equity method of accounting whereas for a joint operation the venture will recognize its share of the assets, liabilities, revenue and expenses of the joint operation. Under existing IFRS, entities have the choice to proportionately consolidate or equity account for interests in joint ventures. IFRS 11 supersedes lAS 31, Interests in Joint Ventures, and SIC-13, Jointly Controlled Entities-Non-monetary Contributions by Venturers.

IFRS 12, Disclosure of Interests in Other Entities

IFRS 12 establishes disclosure requirements for interests in other entities, such as joint arrangements, associates, special purpose vehicles and off balance sheet vehicles. The standard carries forward existing disclosures and also introduces significant additional disclosure requirements that address the nature of, and risks associated with, an entity's interests in other entities.

IFRS 13 Fair Value Measurement

IFRS 13 is a comprehensive standard for fair value measurement and disclosure requirements for use across all IFRS standards. The new standard clarifies that fair value is the price that would be received to sell an asset, or paid to transfer a

liability in an orderly transaction between market participants, at the measurement date. It also establishes disclosures about fair value measurement. Under existing IFRS, guidance on measuring and disclosing fair value is dispersed among the specific standards requiring fair value measurements and in many cases does not reflect a clear measurement basis or consistent disclosures.

Other accounting standards or amendments to existing accounting standards that have been issued but have future effective dates are either not applicable or are not expected to have a significant impact on the Company’s financial statements.

TRANSITION TO IFRS

The Company’s first audited consolidated financial statements prepared in accordance with IFRS were prepared for the year ended December 31, 2011 with comparative information for the year ended December 31, 2010 and at January 1, 2010 (the Company’s “Transition Date”).

An explanation of how the transition from previous Canadian GAAP to IFRS has affected the Company’s financial position and comprehensive loss is set out in the Note 16 to the audited consolidated financial statements for the year ended December 31, 2011.

The accounting policies set out in Note 2 to the audited consolidated financial statements for the year ended December 31, 2011 have been applied in preparing those statements and in the comparative information presented in those financial statements for the year ended December 31, 2010 and in the preparation of an opening IFRS statement of financial position at the Transition Date.

FIRST TIME ADOPTION OF IFRS

The Company adopted IFRS effective on the Transition Date. Under IFRS 1 - First Time Adoption of International Financial Reporting Standards (IFRS 1), the IFRS standards are applied retrospectively at the Transition Date with all adjustments to assets and liabilities as stated under Canadian GAAP taken to deficit, with IFRS 1 providing for certain optional and mandatory exemptions to this principle.

The Company has elected to apply the following optional exemptions:

Share-based payment transactions

IFRS 1 allows that full retrospective application may be avoided for certain share-based instruments depending on the grant date, vesting terms and settlement of any real liabilities. A first-time adopter can elect to not apply IFRS 2 to share-based payments granted after November 7, 2002 that vested before the Transition Date. The Company has elected this exemption and will apply IFRS 2 to only unvested share options as at the Transition Date.

Business Combinations

IFRS 1 allows that a first-time adopter may elect not to apply IFRS 3 Business Combinations (IFRS 3) retrospectively to business combinations prior to the Transition Date avoiding the requirement to restate prior business combinations. The Company has elected to apply IFRS 3 only to business combinations that occur on or after January 1, 2010.

Effects of Changes in Foreign Exchange Rates

IAS 21 “The Effects of Changes in Foreign Exchange Rates” has not been applied to cumulative translation differences that existed at the date of transition to IFRS. The Company has eliminated the cumulative translation difference and adjusted retained earnings by the same amount at the date of transition to IFRS. If, subsequent to adoption, a foreign operation is disposed of, the translation differences that arose before the date of transition to IFRS will not affect the gain or loss on disposal.

3.B. Capitalization and Indebtedness

Not Applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not Applicable.

3.D. Risk Factors

Any investment in our common shares involves a high degree of risk. You should consider carefully the following information before you decide to buy our common shares. If any of the events discussed in the following risk factors actually occurs, our business, financial condition or results of operations would likely suffer. In this case, the market price of our common shares could decline, and you could lose all or part of your investment in our shares. In particular, you should consider carefully the following risk factors:

We have a history of losses.

We have historically incurred losses and have no revenue from operations. We incurred losses from operations of $1,112,646 for the fiscal year ended December 31, 2011 and losses of $502,315 and $4,660,805 and for the fiscal years ended December 31, 2010 and 2009, respectively. As of December 31, 2011, we had a cumulative deficit of $11,032,632 (December 31, 2010: $9,919,986). There can be no assurance that either the Company or our subsidiary will achieve profitability in the future or at all.

We have not identified any commercially viable mineral deposits. We have not commenced development or commercial production on any of our properties. We have no history of earnings or cash flow from operations. We do not have a line of credit and our only present source of funds available may be through the sale of our equity shares or assets. Even if the results of exploration are encouraging, we may not have the ability to raise sufficient funds to conduct further explorations to determine whether a commercially mineable deposit exists on any of our properties. While additional working capital may be generated through the issuance of equity or debt, the sale of properties or possible joint venturing of the properties, we cannot assure you that any such funds will be available for operations on acceptable terms, if at all.

Very few mineral properties are ultimately developed into producing mines.

At present, none of our properties have a known body of ore and all our proposed exploration programs are an exploratory search for ore. The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. Most exploration projects do not result in the discovery of commercially mineable deposits of ore.

Substantial expenditures will be required for us to establish ore reserves through drilling, to develop metallurgical processes, to extract the metal from the ore and to develop the mining and processing facilities and infrastructure at any site chosen for mining.

Although substantial benefits may be derived from the discovery of a major mineral deposit, no assurance can be given that we will discover minerals in sufficient quantities to justify commercial operations or that we can obtain the funds required for development on a timely basis. The economics of developing precious and base metal mineral properties is affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection.

Additional financing may be needed for our business operations.

As at December 31, 2011, we had cash and cash equivalents on hand of $1,131,358. We have sufficient working capital to fund our exploration activities on our mineral properties through fiscal 2012. Our business plan calls for significant expenses in connection with the acquisition and exploration of mineral claims. While we believe we have sufficient working capital to fund our activities through our 2012 fiscal year, we will require additional financing to sustain our business operations if we are not successful in earning revenues once we complete exploration on any mineral properties we acquire.

We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. We believe the only realistic source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders.

Mineral exploration involves a high degree of risk against which we are not currently insured.

Unusual or unexpected rock formations, formation pressures, fires, power outages, labour disruptions, flooding, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are risks involved in the operation of mines and the conduct of exploration programs. We have relied on and will continue to rely upon consultants and others for exploration expertise.

It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of our common stock.

We may require permits and licenses that we may not be able to obtain.

Our operations may require licenses and permits from various governmental authorities. There can be no assurance that we will be able to obtain all necessary licenses and permits that may be required to conduct exploration, development and mining operations at any projects we acquire.

Our plan of operation for our properties is subject to unexpected delays.

Our exploration activities will be subject to the risk of unanticipated delays including permitting its contemplated projects. Such delays may be caused by fluctuations in commodity prices, mining risks, difficulty in arranging needed financing, unanticipated permitting requirements or legal obstruction in the permitting process by project opponents. In addition to adding to project capital costs (and possibly operating costs), such delays, if protracted, could result in a write-off of all or a portion of the carrying value of the delayed project.

Our properties may not have been examined in detail by a qualified mining engineer or geologist.

Our properties are in an exploratory stage. As a result, they may not have been examined in detail by a qualified mining engineer or geologist who could quantify exactly what their economic potential or value, if any, is.

Metal prices fluctuate widely.

Our business activities are significantly affected by the prices of precious metals and base metals on international markets. The price of minerals affects our ability to raise financing, the commercial feasibility of our properties, the future profitability of our properties should they be developed and our future business prospects. The prices of precious metals and base metals fluctuate widely and are affected by numerous factors beyond our control, including expectations with respect to the rate of inflation, the strength of the U.S. dollar and of other currencies, interest rates, and global or regional political or economic crisis. The demand for and supply of precious metals and base metals may affect precious metals and base metals prices but not necessarily in the same manner as supply and demand affect the prices of other commodities.

The resource industry is very competitive.

Significant competition exists for the limited number of property acquisition opportunities available. As a result of this competition, some of which is with large established mining companies with substantial capabilities and greater financial and technical resources than our Company, we may be unable to acquire attractive mining properties on terms we consider acceptable.

Competition in the precious and base metals mining industry is primarily for mineral rich properties which can be developed and exploited economically; the technical expertise to find, develop, and produce such properties; the labor to operate the properties; and the capital for the purpose of funding such properties. Many competitors not only explore for and mine precious and base metals and minerals but conduct refining and marketing operations on a worldwide basis. Such competition may result in our being unable to acquire desired properties, to recruit or retain qualified employees or to acquire the capital necessary to fund our operations and develop our properties. Our inability to compete with other mining companies for these resources may have a material adverse effect on our results of operation and business. There can be no assurance that our exploration and acquisition programs will yield any reserves or result in any commercial mining operation.

Our operations may be adversely affected by environmental regulations.

Our operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, release or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would

result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner, which means that standards, enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for us and our directors, officers and consultants. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of our operations. We do not maintain environmental liability insurance.

Differences in U.S. and Canadian reporting of reserves and resources

The Company’s reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as the Company generally reports reserves and resources in accordance with Canadian practices. These practices are different from those used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred resources, which are not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves.

Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations; however, the SEC permits issuers to report "resources" only as in-place tonnage and grade without reference to unit of metal measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in this Annual Report, or in the documents incorporated herein by reference, may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

As a foreign private issuer, our shareholders may have less complete and timely data.

We are a “foreign private issuer” as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). We are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 of the Exchange Act. Therefore, we are not required to file a Schedule 14A proxy statement in relation to the annual meeting of shareholders. The submission of proxy and annual meeting of shareholder information on Form 6-K may result in shareholders having less complete and timely information in connection with shareholder actions. The exemption from Section 16 rules regarding reports of beneficial ownership and purchases and sales of common shares by insiders and restrictions on insider trading in our securities may result in shareholders having less data and there being fewer restrictions on insiders’ activities in our securities.

Recent market events and conditions

Throughout 2009, 2010 and 2011, the U.S. credit markets experienced serious disruption due to a deterioration in residential property values, defaults and delinquencies in the residential mortgage market (particularly, sub-prime and non-prime mortgages) and a decline in the credit quality of mortgage backed securities. These problems led to a slow-down in residential housing market transactions, declining housing prices, delinquencies in non-mortgage consumer credit and a general decline in consumer confidence. These conditions caused a loss of confidence in the broader U.S. and global credit and financial markets and resulting in the collapse of, and government intervention in, major banks, financial institutions and insurers and creating a climate of greater volatility, less liquidity, widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. These unprecedented disruptions in the current credit and financial markets have had a significant material adverse impact on a number of financial institutions and have limited access to capital and credit for many smaller companies. These disruptions could, among other things, make it more difficult for us to obtain, or increase its cost of obtaining, capital and financing for its operations. The Company’s access to additional capital may not be available on terms acceptable to it or at all.

General economic conditions

The recent unprecedented events in global financial markets have had a profound impact on the global economy. Many industries, including the gold mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity.

A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to,

| | ● | lack of available credit, |

| | ● | the state of the financial markets, |

| | ● | and tax rates may adversely affect our growth and profitability. |

Specifically:

The global credit/liquidity crisis could impact the cost and availability of financing and our overall liquidity; the volatility of gold prices may impact our potential revenues, profits and cash flow; volatile energy prices, commodity and consumables prices and currency exchange rates impact potential production costs; and the devaluation and volatility of global stock markets impacts the valuation of our equity securities

These factors could have a material adverse effect on our financial condition and results of operations.

The trading market for our shares is not always liquid.

Although our shares trade on the TSX Venture Exchange, the Frankfurt Stock Exchange and the FINRA OTC Bulletin Board, the volume of shares traded at any one time can be limited, and, as a result, there may not be a liquid trading market for our shares. In addition, trading volumes in our common shares can be volatile and if the trading volume of our common shares experiences significant changes, the price of our common shares could be adversely affected. The price of our common shares could also be significantly affected by factors, many of which are beyond our control.

Our securities may be subject to penny stock regulation.

Our stock is subject to “penny stock” rules as defined in 1934 Securities and Exchange Act Rules. The Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Our common shares are subject to these penny stock rules. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity securities with a price of less than U.S. $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our common shares in the United States and shareholders may find it more difficult to sell their shares.

Our Passive Foreign Investor Company (“PFIC”) Status Has Possible Adverse Tax Consequences for U.S. Investors

Current holders of and potential investors in our common shares who are U.S. taxpayers should be aware that we believe we were a passive foreign investment company (“PFIC”) for the year ended December 31, 2011, and may continue to be a PFIC in future years. If we are a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayers generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized

upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distributions or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to our shares. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of our net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to its shareholders. However, U.S. taxpayers should be aware that there can be no assurance that we will satisfy record keeping requirements that apply to a QEF, or that we will supply U.S. taxpayers with information that such U.S. taxpayers require to report under the QEF rules, in event that we are a PFIC and a U.S. taxpayers wishes to make a QEF election. Thus, U.S. taxpayers may not be able to make a QEF election with respect to their common shares. Each U.S. taxpayer should consult its own financial advisor, legal counsel, or accountant regarding the availability of, and procedure for making, a QEF election. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s basis therein. U.S. taxpayers are advised to seek the counsel of their professional tax advisors. This paragraph is qualified in its entirety by the discussion below under the heading “Taxation—Certain U.S. Federal Income Tax Considerations.” Each U.S. taxpayer should consult his or her own tax advisor regarding the U.S. federal, U.S. state and local, and foreign tax consequences of the PFIC rules and the acquisition, ownership, and disposition of our common shares.

We are a foreign corporation and most of our directors and officers are outside of the United States, which may make enforcement of civil liabilities difficult.

We are incorporated under the laws of the Province of Alberta, Canada and registered extra-provincially in the Province of British Columbia, Canada. All of our directors and officers are residents of Canada, with the exception of Clancy Wendt (who resides in the United States), and part of our assets are located outside of the United States. Consequently, it may be difficult for United States investors to effect service of process within the United States upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the United States Securities Exchange Act of 1934, as amended. A judgment of a US court predicated solely upon such civil liabilities would probably be enforceable in Canada by a Canadian court if the US court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or us predicated solely upon such civil liabilities.

Item 4. Information on the Company

4.A History and Development of the Company

We were incorporated as Proven Capital Corp. on April 25, 1994 under the Business Corporations Act of Alberta. We changed our name and consolidated our share capital as set forth below on the following dates:

| Date | Name | Consolidation (Old:New) |

| April 25, 1994 | Proven Capital Corp. | Not applicable |

| January 10, 1995 | Cedar Capital Corp. | Not applicable |

| February 12, 2002 | Vancan Capital Corp. | 4:1 |

| May 14, 2002 | MAX Resource Corp. | Not applicable |

On June 27, 2007 we were registered as an extra-provincial company with the Registrar of Companies in British Columbia, pursuant to the Business Corporations Act of British Columbia.

We have an authorized capital of an unlimited number of common shares and an unlimited number of preferred shares, none of which preferred shares are issued.

The trading symbol for the Company on the TSX Venture Exchange is “MXR” with the symbol on the OTC Bulletin Board being “MXROF”. The trading symbol on the Frankfurt Exchange is “M1D”.

We are a reporting issuer in the United States and our annual report and 6K filings can be found on the SEC’s EDGAR system at www.sec.gov . We are a reporting issuer in certain Canadian jurisdictions and our required disclosure filings for Canada can be found at www.sedar.com.

Our head office is located at 1066 West Hastings Street, Suite 2300, Vancouver, British Columbia, Canada, V6E 3X2. Our telephone number is (604) 689-1749.

We have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets.

We are engaged in the business of acquiring and exploring resource properties.

Principal Expenditures And Divestitures

Since the beginning of the last three financial years, our principal capital expenditures and divestitures have been comprised principally of the acquisition, exploration and abandonment or disposition of our mineral properties, as described below.

Mineral Properties Now Held

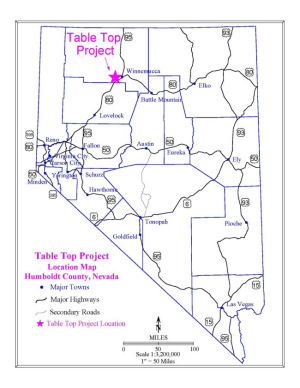

Table Top Gold Project (Nevada)

On September 1, 2009 we entered into an Option Agreement with Energex, LLC, a Nevada corporation wholly-owned by Clancy J. Wendt, our Vice President of Exploration, granting us an option (the “Table Top Option”) to acquire a 100% interest in the Table Top gold project claims (“Table Top Project”) in Humboldt County, Nevada for the sum of US$300,000 (the “Table Top Purchase Price”) and a 3% NSR Royalty, 1% of which can be repurchased for US$1 million. The Table Top Project consists of 58 claims and is located 10 miles west of the town of Winnemucca, Nevada. Under the terms of the agreement we are required to make the following rental payments (the “Table Top Rental Payments”) in order to maintain the Table Top Option in good standing:

| Date | Payment Amount (USD) |

| Upon execution of the Agreement (September 1, 2009) | $5,000 (paid) |

| On the First anniversary of the Agreement (September 1, 2010) | $25,000 (deferred) |

| On the Second anniversary of the Agreement (September 1, 2011) | $35,000 (deferred) |

| Each anniversary thereafter | $50,000 |

During 2011 we spent a total of $150,820 on exploration on the Table Top Project, including drilling. See “Special Notes regarding Forward Looking Statements”. See Item 4.D, “Property, Plant and Equipment – Table Top Project”.

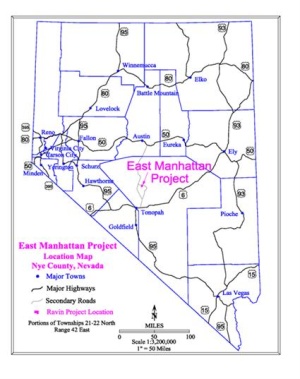

East Manhattan Wash gold project (Nye County, Nevada)

In December, 2007, we entered into an option agreement in conjunction with Max Resource, Inc., our wholly owned Nevada subsidiary, to acquire a 100 % interest in the East Manhattan Wash (“EMW”) claims in the Manhattan Mining District, Nye County, Nevada from MSM LLC, a Nevada corporation. The property is comprised of 78 claims and is located 40 miles north of the town of Tonopah, Nevada. We made a cash payment of US$28,000 to MSM LLC and, in accordance with the terms of the option agreement, are required to make the following option payments:

| Date | Payment Amount |

| Upon execution of the option agreement | $28,000 (US) (Paid) |

| First anniversary of effective date (December 4, 2008) | $20,000 (US) (Paid) |

| Second anniversary of effective date (December 4, 2009) | $25,000 (US) (Paid) |

| Third anniversary of effective date (December 4, 2010) | $40,000 (US) (Paid) |

| Fourth anniversary of effective date (December 4, 2011) | $50,000 (US) (deferred, subject to receipt of drill permit) |

| Fifth anniversary of effective date (December 4, 2012) | $100,000 (US) (subject to receipt of drill permit) |

The payments due on the fourth and fifth anniversary are both subject to securing a drill permit.

In addition we are required to make exploration expenditures totalling US$700,000 on the EMW claims in the second to fifth years (subject to receipt of the necessary drill permits),as follows:

● on or before December 4, 2009, US$50,000;

● on or before December 4, 2010, a further US$150,000

● on or before December 4, 2011, a further US$200,000

● on or before December 4, 2012, a further US$300,000

The EMW Property is subject to a 3% NSR royalty. The option may be exercised by making all of the above option payments and exploration expenditures. Upon full exercise of the option, we will own 100% of the project.

We made the following expenditures on this property during the fiscal years ending December 31, 2011, 2010 and 2009:

| | | 2011 | | | 2010 | | | 2009 |

| Drilling and assays | | $ | - | | | $ | 5,202 | | | $ | 12,763 |

| Geological consulting | | | 6,045 | | | | 29,923 | | | | 35,133 |

| Field expenses | | | 282 | | | | 3,632 | | | | 5,552 |

| | | $ | 6,327 | | | $ | 38,748 | | | $ | 53,448 |

See Item 4.D, “Property, Plant and Equipment – East Manhattan Wash Gold Project”.

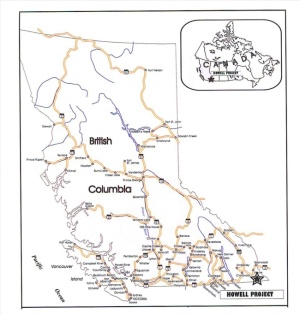

Howell/Crowsnest Gold Project (British Columbia)

Due to a change in policy by the Government of British Columbia resulting in a moratorium on exploration in the area, we ceased exploration on this property in 2010 and received compensation from the Province of British Columbia in March 2012 for our out-of-pocket expenditures totalling $655,306 in return for our relinquishing our interest in the property.

On June 9, 2008, we entered into an option agreement with Eastfield Resources Ltd. (“Eastfield”) whereby we can earn up to a 60% interest in the Howell Gold Project located one hour south of the town of Sparwood (by gravel road) in Southeast B.C. Eastfield has the right to earn a 100% interest in the Howell property through an amended 1999 option agreement with Teck Cominco Metals Limited (“TCML”) and Goldcorp Inc. (“GI”) whereby outstanding commitments include a final exploration expenditure totaling $423,759 and cash payments of $100,000 to each of TCML and GI due by August 31, 2010.

On July 24, 2009, we entered into an amending agreement with Eastfield, amending the June 9, 2008 Howell agreement to allow us to earn a 60% interest in the Howell Gold Project (“Howell Property”) and/or the Crowsnest Mineral Property (“Crowsnest Property”) projects over a four year period. The Crowsnest Property is comprised of 14 claims totaling 3,163 hectares and is located approximately 10 km southeast of the Howell property.

The terms of our option agreement (as amended) with Eastfield were as follows:

| Property | Date | Cash Payment

Amount | Issuance of Shares |

| | | | |

| Combined Howell Property & Crowsnest Property | On signing amending agreement (July 24, 2009) | $10,000 (paid) | |

| | On signing amending agreement (July 24, 2009) | | 50,000 common shares (Issued) |

| | On or before 1st anniversary date (June 30, 2010) | $20,000 | OR 50,000 common shares |

| | On or before June 30, 2011 | $30,000 | |

| Howell Property | On or before August 31, 2010 | $120,000* | |

| Howell Property | On or before June 30, 2012 | $40,000 | 200,000 Common shares |

| Crowsnest Property | On or before June 30, 2012 | $40,000 | 200,000 Common shares |

| Howell Property | On or before June 30, 2013 | $50,000 | 200,000 Common shares |

| Crowsnest Property | On or before June 30, 2013 | $50,000 | 200,000 Common shares |

| | | | |

*our portion of the $200,000 payment due to GI and TCML by August 31, 2010 pursuant to Eastfield’s underlying agreement with them.

In addition we are required under the agreement to make exploration expenditures as follows:

In the first and second years, $400,000 on the combined Howell and Crowsnest properties as follows:

| | ● | on or before June 30, 2010, $150,000; |

| | ● | on or before June 30, 2011, a further $250,000; |

In the third and fourth years, $701,000 on the Howell Property as follows:

| | ● | on or before June 30, 2012, $1.00 |

| | ● | on or before June 30, 2013, a further $700,000 |

In the third and fourth years, $1,050,000 on the Crowsnest Property as follows:

| | ● | on or before June 30, 2012 $350,000 |

| | ● | on or before June 30, 2013, a further $700,000. |

During the year ended December 31, 2009, we spent a total of $3,078 for geological consulting fees on the Howell property, and we claimed a BC Mining Tax recovery in the amount of $20,684. We also spent a total of $248,429 on exploration of the Crowsnest property, comprised of drilling and assays ($112,088), geological consulting ($52,524), and field expenses ($83,817) during 2009.

During the year ended December 31, 2010, we spent a total of $613 for geological consulting fees on the Crowsnest property, and we received a BC Mining Tax recovery in the amount of $77,670. We did not spend any money on the Howell property during 2010.

In February 2010 the Government of British Columbia announced that it intends to halt all ongoing mineral exploration work and prohibit any future mine development in the Flathead Valley in southeastern British Columbia where the Howell and Crowsnest properties are located. The Company was immediately contacted by the Ministry of Energy, Mines and Petroleum Resources and discussions were initiated with respect to compensation, which was subsequently received by the Company in March of 2012. See Item 4.D, “Property, Plant and Equipment – Howell/Crowsnest Gold Project”.

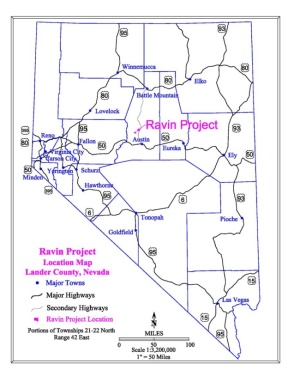

Ravin Molybdenum/ Tungsten Property (Lander County, Nevada):

On September 10, 2007, and as amended on November 9, 2010, we entered into an option agreement (the “Ravin Option”) to acquire a 100 % interest in the Ravin molybdenum/tungsten property in Lander County, Nevada (the “Ravin Property”) from Energex, LLC, a Nevada corporation wholly-owned by Clancy J. Wendt, our Vice President of Exploration for the sum of US$300,000 (the “Ravin Purchase Price”).

The following rental payments (the “Rental Payments”) are required in order to maintain the Ravin Option:

| Date | Payment Amount |

| Upon execution of the option agreement | $5,000 USD (paid) |

| First anniversary of effective date (September 10, 2008) | $25,000 USD (paid) |

| Second anniversary of effective date (September 10, 2009) | $35,000 USD (paid) |

| Each anniversary thereafter (subject to increase to $US50,000 on certain triggering events) | $10,000 USD (paid) |

The Ravin Option may be exercised at any time by payment of the Ravin Purchase Price and grant of a 3% NSR, 1% of which can be repurchased for US$1 million (the “Ravin Royalty”).

During the year ended December 31, 2009 we spent a total of $17,930 on exploration of the Ravin property comprised of drilling and assay costs ($3,939), geological consulting fees ($12,930), and field expenses ($1,071). During the year ended December 31, 2010 we spent $639 on geological consulting for the Ravin property, with no expenditures incurred during the year ended December 31, 2011. See Item 4.D, “Property, Plant and Equipment – Ravin Molybdenum/Tungsten Property”.

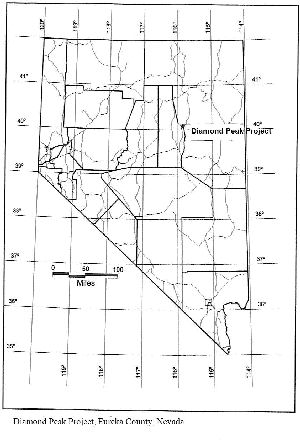

Diamond Peak Property (Nevada)

On May 9, 2006, we entered into an Option Agreement, as amended on June 30, 2010, to acquire an option (the “Diamond Peak Option”) to purchase a 100% interest in the FMC claims in Eureka County, Nevada, (the “Diamond Peak Property”) for the sum of US$300,000 (the “Diamond Peak Purchase Price”) plus a 3% NSR, 1% of which can be repurchased for US$1 million (the “Diamond Peak Royalty”), from The Wendt Family Trust of Reno, Nevada. The Wendt Family Trust is controlled by Clancy J. Wendt, our Vice President of Exploration.

Under the terms of the Diamond Peak Option Agreement, we issued 100,000 shares of the Company to the Wendt Family Trust and must make the following rental payments (the “Diamond Peak Rental Payments”) in order to maintain the Diamond Peak Option:

| Date | Payment Amount (U.S funds) |

| Upon execution of the option agreement (May 9, 2006) | $25,000 (paid) |

| First anniversary of effective date (May 9, 2007) | $35,000 (paid) |

| Second anniversary of effective date (May 9, 2008) | $45,000 (paid) |

| Third anniversary of effective date (May 9, 2009) | $50,000 (paid ) |

| On June 30, 2010 upon execution of the amending agreement | $25,000 (paid) |

| On May 9, 2011 (as amended) | $35,000 (deferred) |

| On May 9, 2012 (as amended) | $45,000 |

| Each anniversary thereafter for 4 years (as amended) | $50,000 |

The Diamond Peak Option may be exercised at any time by payment of the Diamond Peak Purchase Price and grant of the Diamond Peak Royalty. We are required to make minimum annual advance royalty payments of US$50,000 after exercise until commencement of sustained commercial production, with such payments being credited against the Diamond Peak Royalty. The Diamond Peak Rental Payments are not credited against the Royalty or the Purchase Price, but are not payable after the Option is exercised.

We entered into a mineral property option agreement on May 15, 2006, as amended effective September 30, 2009, with Kokanee Placer Ltd. (“Kokanee Placer”), a British Columbia company, whereby we granted to Kokanee the right to acquire up to a 51% interest in the Diamond Peak Property (the “Kokanee Option”) in consideration of a cash payment of US$25,000 (paid) and the issuance of 100,000 common shares of “Kokanee Minerals Inc.” (“Kokanee”) (received subsequent to December 31, 2009), a public company (TSX V : KOK) which exchanged its shares for Kokanee Placer in conjuction with its public listing (completed in January, 2010).

To maintain this agreement in good standing, Kokanee had agreed to make the following annual payments and share issuances to the Company:

| - | By May 15, 2007 pay US$35,000 to the Company (received); |

| - | within five days after listing of Kokanee’s common shares on the TSX Venture Exchange, pay US$95,000 and issue 500,000 Kokanee shares to the Company (received); and |

| - | On or before May 9, 2010 and on each anniversary thereof up to and including May 9, 2016, pay US$50,000 to the Company; and |

| - | On commencement of commercial production, issue 1,000,000 Kokanee shares to the Company; |

The Kokanee Option was also subject to Kokanee completing $1,000,000 in exploration on the Diamond Peak Property over a three year period.

In June 2010 Kokanee advised us that they would not be making the US$50,000 payment then due and would be abandoning their option. We have reviewed all work conducted by Kokanee and conducted soil sampling and constructed roads and drill pads at Diamond Peak in preparation for drilling. During the year ended December 31, 2011, we incurred $1,794 of drilling and assaying fees and $577 of field expenses on the Diamond Peak project. During 2010, we spent $21,248 on geological consulting, $9,220 on assays and $27,624 on field expenses at Diamond Peak. See Item 4.D, “Property, Plant and Equipment – Diamond Peak Property.”

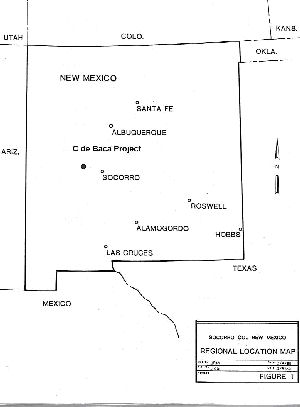

C de Baca Project (New Mexico):

In September 2005, we announced that we had entered into an agreement with Applied Geological Services, Inc. of Denver, Colorado for the acquisition of a total of 108 uranium exploration claims (the “Dat Claims”) in Socorro County, New Mexico. Consideration for the acquisition of the Dat Claims (known also as the “C de Baca Project”) is an immediate US$10,000 cash payment with annual payments of US$10,000 until production. After production, a royalty of 2% of revenues is payable until such time as a total of US$500,000 (including the initial cash payment and annual payments) has been paid. The obligation to make payments to Applied Geologic Services can be terminated at anytime by us by providing notice that we are abandoning the Dat Claims and agreeing to transfer them back to the vendor.

In 2007 we conducted a 14 hole drill program to follow up on historic Occidental Minerals drilling and we were successful in confirming historic uranium grades. In March 2008 we received a Technical Report prepared by Michael G. Bersch, Phd. PG, which recommends further exploration at C de Baca that will include diamond drilling, project and regional scale

geologic mapping. During the year ended December 31, 2008 we spent $16,360 for geological consulting and $2,001 permitting on the C de Baca project. No money was spent on the project during the years ended December 31, 2011, 2010 and 2009. See Item 4.D, “Property, Plant and Equipment – C de Baca Project”.

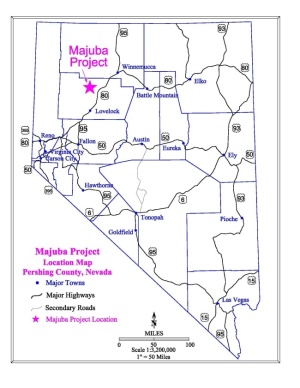

Majuba Hill Copper/Silver Project (Nevada):

On March 4, 2011 we entered into an option agreement to acquire up to a 75% interest in the Majuba Hill Copper/Gold/Silver property in Pershing County, Nevada (the “Majuba Hill Property”) from Claremont Nevada Mines LLC., Nevada. (the “Majuba Hill Option Agreement”). The Majuba Hill Project encompasses 2,568 acres consisting of patented and unpatented lode mining claims and private mineral rights.

The terms of the Majuba Hill Option Agreement with Claremont allow us to earn an initial 60% interest in the property over six years by spending US$6.5 Million on exploration of the property, as follows.

Performance Date | | Annual Amount | | | Cumulative

Amount | |

| By the first anniversary date | | $ | 500,000 | | | $ 500,000 | (completed) |

| By the second anniversary date | | $ | 750,000 | | | $ | 1,250,000 | |

| By the third anniversary date | | $ | 1,000,000 | | | $ | 2,250,000 | |

| By the fourth anniversary date | | $ | 1,250,000 | | | $ | 3,500,000 | |

| By the fifth anniversary date | | $ | 1,500,000 | | | $ | 5,000,000 | |

| By the sixth anniversary date | | $ | 1,500,000 | | | $ | 6,500,000 | |

We can increase our interest in the Majuba Hill Property to 75% by spending a further $3.5 Million on exploration over a subsequent two year period.

In addition, we are also required to make annual advance royalty payments of US$20,000 to a third party, JR Exploration LLC, a Nevada limited liability company, on the effective date of the Option Agreement and each anniversary thereafter. The Majuba Hill Property is also be subject to a 3% NSR payable to the vendor, 1.5% of which may be purchased at any time for US$1.5 Million. See Item 4.D, “Property, Plant and Equipment – Majuba Hill Copper/Silver Property”.

NUSTAR Uranium Project (Colorado Plateau, Arizona):

On April 4, 2007, we entered into an agreement with NUSTAR Exploration LLC, a private Arizona limited liability corporation, for the acquisition of a 100% interest in 427 mineral claims located in the Arizona Strip of the Colorado Plateau in northwest Arizona.

Under the terms of our agreement with NUSTAR, we purchased a 100% interest in the NUSTAR Claims by making a cash payment to NUSTAR of US$128,100 and issuing 200,000 shares of our common stock, subject to a gross royalty of 4% (the “NUSTAR Royalty”) of sales revenue from commercial production of uranium from the NUSTAR Claims. The agreement provided that we would have the right to purchase 3% of the 4% NUSTAR Royalty applicable to each breccia pipe identified on the NUSTAR Claims that went into commercial production, for the sum of $1,000,000.

During the year ended December 31, 2009, we incurred $1,392 of geological consulting expenses on the Nustar project.

In September 2009, we elected to abandon the Nustar project and wrote off $497,948 of acquisition costs and $5,488 of deferred exploration costs to operations during the period.

4.B Business Overview

During the fiscal year ended December 31, 2011, we

| | (i) | completed a 497 meter core drilling program at the Table Top Project; |

| | (ii) | entered into an agreement whereby we can earn up to a 75% interest in the Majuba Hill Property by spending US$10 Million over an eight year period; |

| | (iii) | completed a private placement of 2,016,755 units at $0.28 for gross proceeds of $564,691; |

| | (iv) | conducting extensive soil sampling at Majuba Hill, taking a total of 834 individual samples; and |

| | (v) | completed two core drill programs at Majuba Hill totaling 1,828 meters. |

See “Principal Expenditures and Divestitures”.

Management & Employees

We do not have any employees other than our directors and officers.

Our President and Chief Executive Officer, Stuart Rogers devotes approximately 80% of his business time to our affairs. Effective October 1, 2008, the Company entered into a Consulting Agreement between West Oak Consulting Group, Inc. (“West Oak) and us. Mr. Rogers is the sole shareholder and key employee of West Oak. Pursuant to the Agreement, West Oak, through its key employee who acts as our President and CEO, performs management services on our behalf, will receive $10,000 per month for a period of 24 months. The Agreement calls for an automatic renewal for a second 24 month period in the absence of either West Oak or us providing written notice of termination of the agreement.

Our Vice-President of Exploration, Mr. Clarence J. (Clancy) Wendt, entered into a Consulting Agreement with us effective October 1, 2008, which agreement is in force and effect for a period of 24 months, with a fee of US$10,000 per month being paid to him for his geological consulting services and the performance of duties associated with the position of Vice President, Exploration. The agreement calls for an automatic renewal for a second 24 month period in the absence of either Mr. Wendt or us providing written notice of termination of the agreement.

Office Space

We utilize about 167 square feet of office space in Vancouver, British Columbia. On September 1, 2010, we entered into a two year lease on these premises with a property management firm for $1,789 per month plus telephones.