Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule13a-16 or15d-16 of

the Securities Exchange Act of 1934

For the month ofMay,2019

PRUDENTIAL PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

1 ANGEL COURT,

LONDON, EC2R 7AG, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form20-F or Form40-F.

Form20-F X Form40-F

Indicate by check mark whether the registrant is submitting theForm6-K in paper as permitted by RegulationS-T Rule 101(b)(1): ☐

Indicate by check mark whether the registrant is submitting theForm6-K in paper as permitted by RegulationS-T Rule 101(b)(7): ☐

Table of Contents

Table of Contents

Prudential plc

Solvency and Financial Condition Report

31 December 2018

This report has been prepared in compliance with the Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009|138|EC of the European Parliament and of the Council on thetaking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (‘Delegated Regulation’). The structure of this report follows the structure set out in Annex XX and discloses the information referred to in Articles 292 to 298 and Article 359 of the Delegated Regulation. The report also contains narrative information in quantitative and qualitative form supplemented, where appropriate, with quantitative templates.

Table of Contents

| Summary |

Summary

Prudential is an international financial services group serving over 26 million customers and with £657 billion of assets under management (as at 31 December 2018). Prudential plc is incorporated in England and Wales and its ordinary shares are listed on the stock exchanges in London, Hong Kong and Singapore, and its American Depository Receipts (ADRs) are listed on the New York Stock Exchange. Prudential plc is the parent company of the Prudential group (the ‘Prudential Group’, ‘Prudential’ or the ‘Group’). Prudential is not affiliated in any manner with Prudential Financial, Inc. or its subsidiary, The Prudential Insurance Company of America, whose principal place of business is in the US.

Business and Performance

Prudential meets the long-term savings and protection needs of a growing middle-class and ageing population. The Group focuses on markets where the need for its products is strong and growing and the Group uses its capabilities, footprint and scale to meet that need. In 2018, the Group announced its intention to demerge its UK and Europe business, M&GPrudential, from Prudential plc, which will result in two separately listed companies, with different investment characteristics and opportunities. Prudential has always been clear about the importance of creating optionality in its corporate structure, and decided to exercise one of those options in the interest of both the businesses and all of our stakeholders.

Further details on the demerger are set out in Section A.1.3, ‘Significant business or other events that have material impact on the group’.

Prudential helps peoplede-risk their lives and deal with their biggest financial concerns. The Group’s strategy is to capture the long-term structural opportunities within its markets, operating with discipline and enhancing capabilities through innovation to deliver high-quality resilient outcomes for its customers. Prudential aims to do this by:

| — | Serving the protection and investment needs of the growing middle class in Asia; |

| — | Providing asset accumulation and retirement income products to US retirees; |

| — | Offering products to new customers in Africa, one of the fastest-growing regions in the world; and |

| — | Meeting the savings and retirement needs of an ageing UK and continental European population. |

The Group’s financial performance in 2018 reflects its focus on high quality execution of its strategy, and is again led by its business in Asia. As in previous years, comment on performance is in local currency terms (expressed on a constant exchange rate basis) to show the underlying business trends in periods of currency movement.

Group adjusted IFRS operating profit based on longer-term investment returns1 (‘operating profit’) was 6 per cent higher at £4,827 million (up 3 per cent on an actual exchange rate basis). Operating profit from our Asia life insurance and asset management businesses grew by 14 per cent, reflecting continued broad-based business momentum across the region and high-quality sales, with over 85 per cent of operating income from our preferred sources of insurance income, fee income and with-profits. In the US, Jackson’s total operating profit was 11 per cent lower, with higher fee income outweighed by an increase in market-related deferred acquisition costs (DAC) amortisation expense and the anticipated reduction in spread earnings. In the UK and Europe, M&GPrudential’s total operating profit was 19 per cent higher than the prior year, which principally reflects the benefit from updated longevity assumptions and an 11 per cent increase in the shareholder transfer from the with-profits business, which includes a 30 per cent increase from PruFund.

The Group’s capital generation is underpinned by our large and growingin-force business portfolio, and focus on profitable business with fast payback of capital invested. Overall, cash remittances to the Group from business units were £1,732 million (2017: £1,788 million). The Group’s overall performance supported a 5 per cent increase in the 2018 full year ordinary dividend to 49.35 pence per share.

The Group remains robustly capitalised, with a 2018year-end shareholder Solvency II cover ratio of 232 per cent. Over the period, IFRS shareholders’ funds increased by 7 per cent to £17.2 billion, reflecting profit after tax of £3,013 million (2017: £2,390 million on an actual exchange rate basis) and other movements that included dividend payments to shareholders of £1,244 million and favourable foreign exchange movements of £348 million.

The performance of the Prudential Group for the year ended 31��December 2018 set out in Section A is described using the Group’s results as presented in the Group IFRS financial statements.

| 1 | Adjusted IFRS operating profit based on longer-term investment returns is management’s primary measure of profitability and provides an underlying operating result based on longer-term investment returns and excludesnon-operating items. Please refer to section A.2 for further details. |

Solvency and Financial Condition Report 2018 Prudential plc 1

Table of Contents

| Summary |

System of Governance

The Group has established a governance framework for the business which is designed to promote appropriate behaviours across the Group. The governance framework includes the key mechanisms through which the Group sets strategy, plans its objectives, monitors performance, considers risk management, holds business units to account for delivering on business plans and arranges governance.

The Group Governance Manual (the Manual) sets out the policies and procedures under which the Group operates, taking into account statutory, regulatory and other relevant matters. Business units manage and report compliance with the Group-wide mandatory requirements and standards set out in the Manual through annual attestations, including compliance with the Group’s risk management framework.

Following the announcement in 2017 of the combination of our asset manager, M&G, and Prudential UK and Europe to form M&GPrudential, early in 2018 the Board announced the intention to demerge M&GPrudential from the remainder of the Prudential Group. During the year the Board has therefore been focused on the execution of that decision.

In preparation for this major transaction, the Board looked at its ways of working at the end of 2017 through its annual effectiveness review. The feedback from that review was used to ensure that the right environment for critical decision-making continued to be in place, and this has proved very helpful and effective groundwork as the Board was asked to consider a number of demerger-related items through the year.

In relation to the governance of both the Prudential and the M&GPrudential Groups, work has been undertaken to help ensure a smooth transition and ensure that both Groups have boards properly composed to meet their future strategic needs. Most importantly this has included establishing a separate M&GPrudential board and the appointment of the first independentnon-executive director, Mike Evans, as chairman of that board. Since 31 December 2018, Prudential has announced the appointment of four furthernon-executive directors to the M&GPrudential board.

Until the demerger is completed, the Prudential Regulation Authority (PRA) will continue to be the Group-wide supervisor of Prudential. The PRA will be the Group-wide supervisor of M&GPrudential following the demerger. After the demerger, Prudential’s individual insurance and asset management businesses will continue to be supervised at a local entity level and local statutory capital requirements will continue to apply. The Supervisory College, made up of the authorities overseeing the principal regulated activities in jurisdictions where the future Prudential Group will operate, has made a collective decision that Hong Kong’s Insurance Authority (IA) should become the new Group-wide supervisor for Prudential plc.

Further information on Prudential’s system of governance including information on the composition of its Board, key functions, risk management and internal control system is provided in Section B.

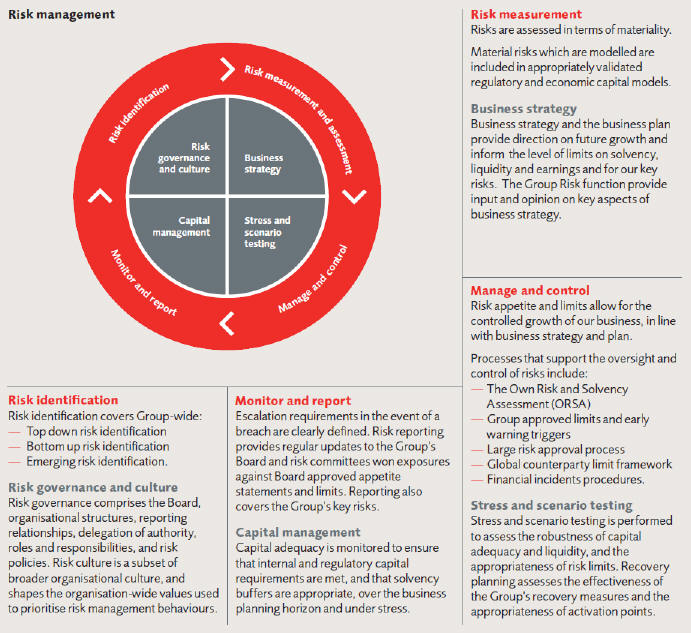

Risk Profile

Prudential’s Group Risk Framework and risk appetite have allowed it to control its risk exposure successfully throughout the year. The governance, processes and controls enable the Group to deal with uncertainty effectively, which is critical to the achievement of its strategy of helping its customers achieve their long-term financial goals.

The merger activity ongoing at M&GPrudential and its planned separation from the rest of the Group (as set out above) requires significant and complex changes and these have been progressing apace throughout 2018. The Group Risk function is embedded within key work streams and a clear view exists of the objectives, risks and dependencies involved in order to execute this change agenda. A mature and well-embedded risk framework is in place and, during this period of transition, the Group Risk function has a defined role in providing oversight, support and risk management, as well as providing objective challenge to ensure the Group remains within its risk appetite. During 2018 these activities have been in the form of risk opinions, guidance and assurance on critical transformation and demerger activity, as well as assessments of the financial risks to the execution of the demerger under various stress scenarios. A key objective is that post demerger there are two strong, standalone risk functions in M&GPrudential and Prudential plc, with operational separation planning for the risk functions remaining on track.

The risks inherent in our business are influenced by the current global environment. The key factors and developments in 2018 are set out below.

Focus in western economies continues to shift from the goods and services which businesses deliver to customers towards the way in which such business is conducted and how this impacts on the wider society. Stakeholder and regulatory expectations of the Group’s environmental, social and governance (ESG) activities are also increasing. In undertaking its business, the Group actively considers the ESG implications of its activities.

The beginning of 2018 saw strong and broad economic growth following the significant US tax reforms enacted toward the end of 2017. As the year progressed the global economic backdrop evolved and a divergence in growth between the US and the rest of the world was observed. Financial markets faced a number of headwinds in 2018 and asset valuations suffered broadly amid there-emergence of market volatility. Global markets, and emerging markets in particular, faced broad pressure throughout the year.

Solvency and Financial Condition Report 2018 Prudential plc 2

Table of Contents

| Summary |

Events in the past year continue to indicate that the world is in a period of global geopolitical transition and increasing uncertainty. Across the Group’s key geographies we have increasingly seen national protectionism in trade and economic policies. The UK’s exit from the EU and the nature of the future relationship remains a key political uncertainty. As a global organisation, we develop plans to mitigate business risks arising from this shift and engage with national bodies where we can in order to ensure our policyholders are not adversely impacted. It is clear, however, that the full long-term impacts of these changes remain to be seen.

Prudential operates in highly regulated markets across the globe, and the nature and focus of regulation and laws remains fluid. A number of national and international regulatory developments are in progress, with a continuing focus on solvency and capital standards, conduct of business, systemic risks and macro-prudential policy. Such developments will continue to be monitored at a national and global level and form part of Prudential’s engagement with government policy teams and regulators. The Group announced in August 2018 that the Hong Kong Insurance Authority would be the Group-wide supervisor after the demerger of M&GPrudential, and constructive engagement on the future Group-wide regulatory framework, led by the Group Chief Risk Officer, will continue in 2019.

Further information on the main risks inherent in Prudential’s business (underwriting risk, market risk, credit risk, liquidity risk, operational risk and other material risks) and how Prudential manages its risks and maintains an appropriate risk profile is provided in Section C.

Valuation for Solvency Purposes

For the purposes of Solvency II reporting, Prudential applies the Solvency II valuation rules to value the majority of the assets and liabilities of the Group. As a general principle, technical provisions under Solvency II are valued at the amount for which they could theoretically be transferred immediately to a third party in an arm’s length transaction. The technical provisions consist of the best estimate liability and a risk margin plus a transitional deduction, which was recalculated at 31 December 2018.

The assets and other liabilities are valued under Solvency II at the amount for which they could be exchanged between knowledgeable and willing parties in an arm’s length transaction. The assets and other liabilities are valued separately using methods that are consistent with this principle in accordance with the valuation approaches set out in the Solvency directives.

In accordance with the Solvency II framework, and as agreed with the PRA, the US insurance companies (Brooke Life Insurance Company, Jackson National Life Insurance Company, Jackson National Life Insurance Company of New York and Squire Reassurance Company II) are aggregated into the Group’s Solvency II results using the ‘Deduction and Aggregation’ methodology on an ‘equivalent’ basis. The Group’s Solvency II results therefore incorporate US insurance companies as follows:

| — | Own funds: represent Jackson’s local US Risk Based available capital less 100 per cent of the US Risk Based Capital requirement (Company Action Level); |

| — | Solvency Capital Requirement: represents 150 per cent of Jackson’s local US Risk Based Capital requirement (Company Action Level); and |

| — | No diversification benefits are taken into account between Jackson and the rest of the Group. |

The own funds and capital for asset managers andnon-regulated entities carrying out financial activities are included using sectoral rules and notional sectoral rules, respectively.

Further information on the valuation of assets, technical provisions and other liabilities of the Group for solvency purposes is provided in Section D, including a discussion of the differences between Solvency II and IFRS valuation bases.

Capital Management

The Group has been granted approval by the PRA to calculate its Solvency Capital Requirement (SCR) for all companies in the Group, except the US insurance entities discussed above, based on its internal model. The Group solvency capital requirement has been met during 2018.

The Group’s shareholder Solvency II position was published in the Group’s 2018 Annual Report. A reconciliation from the amounts shown in the Annual Report to the Solvency II position included in the quantitative reporting templates (QRTs) attached to this document, which incorporates the Group’s ring-fenced funds, is provided in Section E.1.2.

At 31 December 2018, the Group’s consolidated own funds as shown in the QRTs (including those of the Group’s ring-fenced funds) were £35,762 million (of which 81 per cent were classified as Tier 1) to cover an SCR of £18,598 million, leading to a surplus of £17,164 million. As at 31 December 2018, the minimum Group SCR was £8,445 million.

Additional information on the components of the Group’s own funds and solvency capital requirement is also provided in Section E.

Solvency and Financial Condition Report 2018 Prudential plc 3

Table of Contents

| A. | Business and Performance |

| A. | Business and Performance |

(Unaudited)

| A.1 | Business |

A.1.1 Overview

Name and legal form

Prudential plc is a public limited company incorporated on 1 November 1978 and registered in England and Wales. Its ordinary shares are listed on the stock exchanges in London, Hong Kong and Singapore, and its American Depository Receipts (ADRs) are listed on the New York Stock Exchange. Prudential plc is the parent company of the Prudential group (the ‘Prudential Group’, ‘Prudential’ or the ‘Group’).

During 2018, Prudential’s registered office was Laurence Pountney Hill, London EC4R 0HH. The Company’s registered office changed to 1 Angel Court, London, EC2R 7AG on 12 April 2019.

Supervisory authority

The Group is supervised by the Prudential Regulation Authority (PRA). The contact details are:

Prudential Regulation Authority

Bank of England

Threadneedle Street

London

EC2R 8AH

United Kingdom

The Group announced in August 2018 that the Hong Kong IA would be the Group-wide supervisor after the demerger of M&GPrudential, and constructive engagement on the future Group-wide regulatory framework, led by the Group Chief Risk Officer, will continue in 2019.

External auditor

The Group is audited by KPMG LLP. The contact details are:

KPMG LLP

15 Canada Square

London

E14 5GL

United Kingdom

Holders of qualifying holdings

As at 31 December 2018, there were no holders of qualifying holdings in Prudential plc (being a holder of 10 per cent or more of the capital or voting rights).

The following notifications as at 31 December 2018 have been disclosed under the Financial Conduct Authority’s (FCA’s) Disclosure Guidance and Transparency Rules in respect of notifiable interests exceeding 3 per cent in the voting rights of the issued share capital.

| As at 31 December 2018 | % of total voting rights | |||

Capital Group Companies, Inc. | 9.87% | |||

BlackRock, Inc | 5.08% | |||

Norges Bank | 3.99% | |||

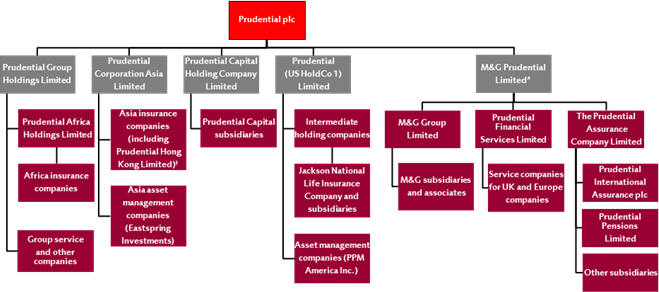

A.1.2 Group structure

Material subsidiaries

Prudential plc is the ultimate parent holding company of the Group. The table below lists Prudential’s material subsidiaries as at 31 December 2018:

| Name of entity | Main activity | Jurisdiction of incorporation | ||

| The Prudential Assurance Company Limited* | Insurance | England and Wales | ||

| M&G Group Limited* | Asset management | England and Wales | ||

| Jackson National Life Insurance Company* | Insurance | Michigan, US | ||

| Prudential Corporation Asia Limited | Insurance | Hong Kong |

| * | Owned by another subsidiary undertaking of the Company. |

The material subsidiaries listed above are all wholly owned group companies both as to equity and voting rights.

Solvency and Financial Condition Report 2018 Prudential plc 4

Table of Contents

| A. | Business and Performance |

Prudential has appointed independentnon-executive directors to the boards of its four Material Subsidiary entities within the Group. Each Material Subsidiary has a board of directors led by an independent chair and an audit committee and risk committee, composed entirely of independentnon-executives. The focus of these boards is on oversight of the relevant material subsidiary, rather than theday-to-day management.

Dialogue between the Group Chair, Group Risk Committee Chair and Group Audit Committee Chair and their counterparts in the Material Subsidiaries provides an effective information flow. Over the course of 2018 and early 2019, the Board of M&GPrudential has been developed by its independent Chairman, Mr Mike Evans. Mr Evans and the Group Chair have maintained dialogue throughout. Since 31 December 2018, Prudential has announced the appointment of four furthernon-executive directors to the M&GPrudential board.

Information on the scope of the Group

A complete list of the Group’s related undertakings is provided in the attached template S.32.01.22 ‘Undertakings in the scope of the group’. As required, this includes subsidiaries, joint ventures and associates and participations (being holdings in excess of 20 per cent where the Group exercises no significant influence or control).

The scope of the Group for Solvency II purposes is the same in all material respects as for the Group IFRS financial statements.

Simplified group structure

The Prudential Group is structured around three main business units: Prudential Corporation Asia, the North American Business Unit and M&GPrudential in UK and Europe. In addition, in recent years, the Group has expanded into Africa. These business units derive revenue from both long-term insurance and asset management activities. These are supported by central functions which are responsible for Prudential strategy, cash and capital management, leadership development and succession, reputation management and other core group functions.

In 2018, the Group announced its intention to demerge its UK and Europe businesses from Prudential plc, to form two separately listed companies.

The following chart shows, in a simplified form, the legal structure of the Prudential Group as at 31 December 2018.

| * | In 2018, the Group announced its intention to demerge its UK and Europe businesses, M&GPrudential, from Prudential plc, which will result in two separately-listed companies. See Section A.1.3, ‘Significant business or other events that have material impact on the group’, for further details. |

| † | The Group completed the transfer of the legal ownership of its Hong Kong insurance subsidiaries from The Prudential Assurance Company Limited to Prudential Corporation Asia Limited in December 2018. |

Solvency and Financial Condition Report 2018 Prudential plc 5

Table of Contents

| A. | Business and Performance |

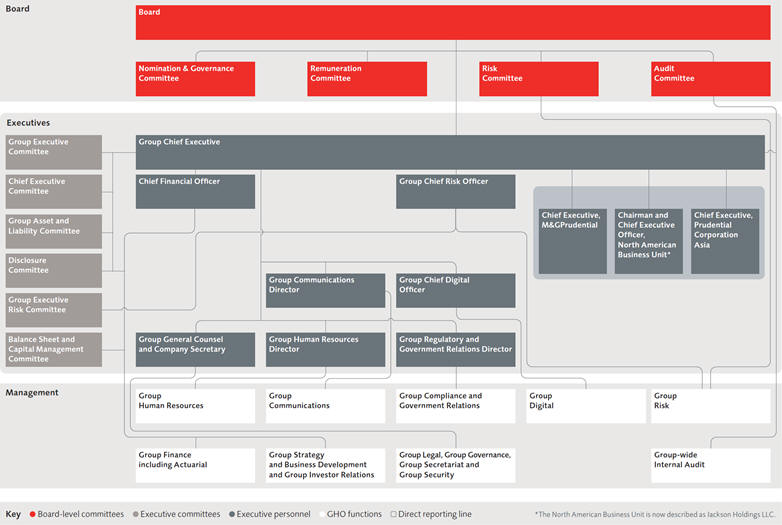

Governance and organisational structure of the Group

The following chart shows, in a simplified form, the governance and organisational structure of the Prudential Group as at 31 December 2018.

This report reflects the governance and risk framework currently in place and in operation over 2018.

A.1.3 Business and performance

Material lines of business and material geographical areas

Prudential meets the long-term savings and protection needs of a growing middle-class and ageing population. The Group focuses on markets where the need for its products is strong and growing and the Group uses its capabilities, footprint and scale to meet that need. In 2018, the Group announced its intention to demerge its UK and Europe business, M&GPrudential, from Prudential plc, which will result in two separately listed companies, with different investment characteristics and opportunities. Prudential has always been clear about the importance of creating optionality in our corporate structure, and decided to exercise one of those options in the interest of both the businesses and all of our stakeholders.

Asia

Prudential Corporation Asia’s (PCA’s) core business is health and protection, either attached to a life policy or on a standalone basis, other life insurance (including participating business) and mutual funds. It also provides selected personal lines property and casualty insurance, group insurance and institutional fund management.

PCA offers its customers a broad range of health, protection and savings solutions that are tailored to local market requirements and individual needs. For example, in Hong Kong, PCA launched a new critical illness product with extended protection for cancer, heart attacks and strokes, and three common causes of death. Similarly, PCA enhanced its protection product for mothers and unborn children in Malaysia, PRUmy child, by expanding the range of pregnancy complications included and extending the coverage period for congenital illnesses. PCA is also actively developing products to meet the upcoming needs of Asia’s ageing populations and were amongst the first group of insurers to be granted approval to offer atax-deferred pension product in China.

PCA develops products with specialist characteristics that broaden its offering and appeal. It has been proponents of products that comply with the requirements of Islamic law for many years. Sales of Syariah products in Indonesia grew by 17 per cent in 2018 to over £50 million. This positions PCA as market leaders in Indonesia’s Syariah market, in addition to Malaysia’s Takaful market, with market shares of approximately 30 per cent in both cases. PCA has also launched PRUvital cover in Singapore, afirst-in-the-market protection plan for customers with four types of commonpre-existing chronic medical condition that previously could act as barriers in obtaining insurance coverage.

Solvency and Financial Condition Report 2018 Prudential plc 6

Table of Contents

| A. | Business and Performance |

Eastspring Investments, Prudential’s asset management business in Asia, manages investments for Prudential’s Asia and UK life companies and also has a broad base of third-party retail and institutional clients. Eastspring has a number of advantages and is well placed for the anticipated growth in Asia’s retail mutual fund market. It has one of the largest footprints in Asia, being operational in 11 major markets and distribution offices in US and Europe. It has a well-diversified customer base, comprising Prudential’s internal life funds, and a number of institutional clients, including sovereign wealth funds and retail customers. Assets managed are well diversified between fixed income and equities and also include infrastructure funds.

Africa

Prudential entered Africa in 2014, to offer products to new customers in one of the fastest-growing regions in the world. Prudential aims to provide products that help its customers to live longer and healthier lives, and save to improve future choices for them and their families.

US

Through its distribution partners, Jackson provides products that offer Americans the retirement strategies they need, including variable, fixed, and fixed index annuities. Each of these products offer a unique range of features tailored to meet the individual needs of the retiree:

| — | Variable annuity:A Jackson variable annuity, with investment freedom, represents an attractive option for retirees, providing both access to equity market appreciation and guaranteed lifetime income as an add on benefit. |

| — | Fixed index annuity: A Jackson fixed index annuity is a guaranteed product with limited market exposure but no direct equity ownership. It is designed to build wealth through a combination of a base crediting rate that is generally lower than a traditional fixed annuity crediting rate, but with the potential for additional upside, based upon the performance of the linked index. |

| — | Fixed annuity:A Jackson fixed annuity is a guaranteed product designed to build wealth without market exposure, through a crediting rate that is likely to be superior to interest rates offered from banks or money market funds. |

| — | Grouppay-out annuity: consist of a closed block of defined benefit annuity plans assumed from John Hancock Life Insurance Company (John Hancock USA) in 2018 through a reinsurance agreement. The contracts provide annuity payments that meet the requirements of the specific pension plan being covered. |

These products also offer tax deferral, allowing interest and earnings to growtax-free until withdrawals are made.

In March 2018, Jackson launched MarketProtector and MarketProtector Advisory, two new fixed annuities with index-linked interest. These products provide consumers with the sought-after combination oftax-deferred investment growth, protection from market risk and the flexibility to adapt to changing needs in retirement. Both products offer anadd-on living benefit that allows customers to safeguard their financial futures with income for life.

In 2018, Jackson took a lead role in bringing together 24 of America’s financial services organisations to launch the Alliance for Lifetime Income (Alliance). The Alliance was launched to educate Americans on the risk of outliving their income, so they can enjoy their years in retirement. The Alliance’s nationwide, multi-year, integrated educational campaign is designed to raise awareness and motivate consumers and financial advisers to discuss the need for protected lifetime income in retirement, which can be achieved with the use of annuity products such as those provided by Jackson.

The US operations also include PPM Holdings, Inc. (PPM), Prudential’s US internal and institutional investment management operation. As at 31 December 2018, Prudential’s US operations had more than 4 million policies and contracts in force and PPM managed approximately £92.2 billion of assets.

UK and Europe

M&GPrudential is the UK and Europe savings and investments business of Prudential plc. It was formed in 2017 through the merger of Prudential’s UK and Europe insurance operations with M&G Investments, Prudential’s international asset manager.

In March 2018, the Board of Prudential plc announced its intention to demerge M&GPrudential. The Prudential Board believes the demerger will further strengthen two already strong businesses. For M&GPrudential, the demerger will enable its leadership team to focus solely on what is important to its customers, giving M&GPrudential direct control over its own capital and enable it to pursue growth opportunities without competing for resources with other Prudential plc businesses. M&GPrudential is expected to have a premium listing on the London Stock Exchange.

Solvency and Financial Condition Report 2018 Prudential plc 7

Table of Contents

| A. | Business and Performance |

M&GPrudential’s long-term products in the UK consist of life insurance, pension products and pensions annuities. M&GPrudential also distributes life insurance products, primarily investment bonds, in other European countries and has a business in Poland which primarily sells with-profits savings and protection products.

Following the decision taken in 2016 to curtail retail sales of annuity business, during 2017, M&GPrudential introduced an annuity service which gives retiring customers access to a panel of annuity providers rather than access to a M&GPrudential’s annuity. This has been rolled out to approximately 50 per cent of the pension books.

M&GPrudential offers customers a range of investment funds to meet different risk and reward objectives. M&GPrudential’s main onshore bond product wrapper is the Prudential Investment Plan (PIP). Through this plan, based on a single premium with no fixed term, customers have the option to invest in the with-profits fund through PruFund or in a range of unit-linked investment funds. M&GPrudential’s offshore bond products are the Prudential International Investment Bond and the Prudential International Investment Portfolio offering clients access to a wide range of quoted UK investments.

M&GPrudential provides both corporate, individual pension and income drawdown products. Pension products are tax advantaged long-term savings products that comply with rules established by the HM Revenue & Customs (HMRC) and are designed to supplement state provided pensions. These products provide policyholders with a number of options at retirement. From age 55 onwards, policyholders may elect to use part or all of their maturity benefits to purchase a pension annuity, they may choose to draw-down funds without purchasing an annuity, they may delay taking any benefits, take cash or take a combination of these options. They are also permitted to take a portion as atax-free lump sum.

Significant business or other events that have material impact on the Group

As discussed above, in March 2018, the Group announced its intention to demerge M&GPrudential from the Group, in order to create two separately listed companies with distinct investment characteristics and opportunities. After the demerger, shareholders will have shares in Prudential plc, which will be even better positioned to capture the structural opportunities ahead of the Group, and M&GPrudential, with greater freedom to deploy its capital where and how it likes to meet the changing needs of customers.

The Group is making good progress towards the demerger. On the structural side, the holding company for M&GPrudential has been established, and the first stages at the High Court of England and Wales for the transfer of part of the M&GPrudential annuity book to Rothesay have been completed. On the operational side, the Group is moving forward with separating the functions of the two businesses and building new ones to prepare M&GPrudential for its post-demerger future. The Group also raised £1.6 billion of subordinated debt, with substitution clauses to be activated on demerger, supporting the capital rebalancing of the two businesses, and it continues to work with its regulators.

In addition the Group undertook the following corporate transactions in the year:

Transfer of subsidiaries and reinsurance of £12.0 billion UK annuity portfolio

In preparation for the demerger of M&GPrudential from Prudential plc, the Group transferred legal ownership of The Prudential Assurance Company Limited (PAC) and M&G Group Limited to the new holding company for M&GPrudential, and completed the transfer of the legal ownership of its Hong Kong insurance subsidiaries from PAC to Prudential Corporation Asia Limited in December 2018.

In March 2018, M&GPrudential reinsured £12.0 billion (as at 31 December 2017) of its shareholder-backed annuity portfolio to Rothesay Life. Under the terms of the agreement, this is expected to be followed by a Part VII transfer of most of the portfolio by 30 June 2019. The reinsurance agreement became effective on 14 March 2018 and resulted in an IFRS basispre-tax loss of £508 million.

The above transactions increased the Group’s shareholder Solvency II capital position by £0.4 billion.

Entrance into Thailand mutual fund market

In July 2018, Eastspring reached an agreement to acquire initially 65 per cent of TMB Asset Management Co., Ltd. (TMBAM), a leading asset management company in Thailand, from the TMB Bank Public Company Limited (TMB). Thailand is the largest fund management market within the Association of Southeast Asian Nations (ASEAN) with total assets under management of £115 billion at 31 December 2018. Eastspring has an option to increase its ownership to 100 per cent in the future. As part of this acquisition, Eastspring has also entered into a distribution agreement with TMB to providebest-in-class investment solutions to their customers. The acquisition of TMBAM, with £9 billion of assets under management as at 31 December 2018, reinforces Prudential’s commitment to the Thai market.

Solvency and Financial Condition Report 2018 Prudential plc 8

Table of Contents

| A. | Business and Performance |

Acquisition of John Hancock’s grouppay-out annuity business

In November 2018, Jackson announced an agreement with John Hancock Life Insurance Company to reinsure 100 per cent of John Hancock’s grouppay-out annuity business, effective from 1 October 2018.

In total, the transaction involves Jackson indemnity reinsuring approximately US$5.5 billion of reserves, representing an increase in Jackson’s general account liabilities of approximately 10 per cent. John Hancock will continue to be responsible for the administration of the business.

Renewal and expansion of regional strategic bancassurance alliance with UOB

In January 2019, Prudential and UOB renewed their regional bancassurance alliance until 2034, extending the scope to include a fifth market, Vietnam, alongside our existing footprint across Singapore, Malaysia, Thailand and Indonesia.

Under the terms of the renewal, Prudential’s life insurance products will be distributed through UOB’s extensive network of more than 400 branches in five markets, providing access to over four million UOB customers. In addition, Prudential will use its digital capabilities to deliver protection-focused propositions to aid UOB’s digital bank expansion and customer acquisition aspirations. An initial fee of £662 million will be paid under the agreement which will be funded through internal resources. This amount will be paid in three instalments. £230 million was paid in February 2019 with £331 million to be paid in January 2020 and £101 million to be paid in January 2021.

Acquisition of majority stake in Group Beneficial

In March 2019, Prudential plc announced it is acquiring a majority stake in Group Beneficial (Beneficial), one of the leading life insurers in Cameroon, Côte d’Ivoire and Togo. Beneficial provides savings and protection products to over 300,000 customers through 41 branches and more than 2,000 agents. The acquisition will significantly add to Prudential’s growing scale in Africa, and is subject to various conditions and regulatory approvals.

| A.2 | Underwriting Performance |

All discussions of the Group’s underwriting, investment and other activities in this section and the subsequent Sections A.3, A.4 and A.5 are based on the Group’s IFRS basis results.

Adjusted IFRS operating profit based on longer-term investment returns (operating profit) is management’s primary measure of profitability and provides an underlying operating result based on longer-term investment returns and excludesnon-operating items.

This measurement basis distinguishes operating profit from other constituents of the total profit as follows:

| — | Short-term fluctuations in investment returns on shareholder-backed business, which include the impact of short-term market effects on the carrying value of Jackson’s guarantee liabilities and related derivatives as explained below; |

| — | Amortisation of acquisition accounting adjustments arising on the purchase of business, which comprises principally the charge for the adjustments arising on the purchase of REALIC in 2012; and |

| — | Gain or loss on corporate transactions, such as disposals undertaken in the year. |

Given the linkage between the movement of technical provisions and the movement in the investments backing those liabilities (eg for unit-linked funds, investment returns, both positive and negative, result in a corresponding change in unit-linked technical provisions), the Group has defined operating profit, which by definition excludes short-term fluctuations in investment returns, for its insurance businesses as its underwriting performance discussed in this section. Accordingly, the core discussion of the investment performance of the Group in Section A.3 is by reference to short-term fluctuations in investment returns. The discussion of the performance of the Group’s asset management business is also provided in this section and Section A.3, together with the performance discussion of the insurance businesses. Further discussion on the contribution to operating profit by the Group’s other operations, including central operations (amounts for corporate expenditure for Group Head Office as well as Asia Regional Head Office), Africa operations and Prudential Capital, is provided in Section A.4, ‘Performance of other activities’.

An analysis of premiums, claims and expenses is given in Section A.5.

Solvency and Financial Condition Report 2018 Prudential plc 9

Table of Contents

| A. | Business and Performance |

A.2.1 Group operating profit analysed by geographical region

| Actual Exchange Rates (AER) | Constant Exchange Rates (CER)* | |||||||||||||||||||||

| Section | 2018 £m | 2017 £m | Change % | 2017 £m | Change % | |||||||||||||||||

| Operating profit before tax | �� | |||||||||||||||||||||

| Asia | ||||||||||||||||||||||

Long-term business | A2.2 | 1,982 | 1,799 | 10% | 1,727 | 15% | ||||||||||||||||

Asset management | 182 | 176 | 3% | 171 | 6% | |||||||||||||||||

Total | 2,164 | 1,975 | 10% | 1,898 | 14% | |||||||||||||||||

| US | ||||||||||||||||||||||

Long-term business | A2.2 | 1,911 | 2,214 | (14)% | 2,137 | (11)% | ||||||||||||||||

Asset management | 8 | 10 | (20)% | 9 | (11)% | |||||||||||||||||

Total | 1,919 | 2,224 | (14)% | 2,146 | (11)% | |||||||||||||||||

| UK and Europe | ||||||||||||||||||||||

Long-term business | A2.2 | 1,138 | 861 | 32% | 861 | 32% | ||||||||||||||||

General insurance commission | 19 | 17 | 12% | 17 | 12% | |||||||||||||||||

Total insurance operations | 1,157 | 878 | 32% | 878 | 32% | |||||||||||||||||

Asset management | 477 | 500 | (5)% | 500 | (5)% | |||||||||||||||||

Total | 1,634 | 1,378 | 19% | 1,378 | 19% | |||||||||||||||||

Other income and expenditure | A4.1 | (725) | (775) | 6% | (769) | 6% | ||||||||||||||||

Total operating profit based on longer-term investment returns before tax and restructuring costs | 4,992 | 4,802 | 4% | 4,653 | 7% | |||||||||||||||||

Restructuring costs | A4.1 | (165) | (103) | (60)% | (103) | (60)% | ||||||||||||||||

Total operating profit | 4,827 | 4,699 | 3% | 4,550 | 6% | |||||||||||||||||

Non-operating items: | ||||||||||||||||||||||

Short-term fluctuations in investment returns on shareholder-backed business: | ||||||||||||||||||||||

Insurance operations | A3.1 | (563) | (1,589) | 65% | (1,540) | 63% | ||||||||||||||||

Other operations | A4.1 | 5 | 26 | (81)% | 26 | (81)% | ||||||||||||||||

| (558) | (1,563) | 64% | (1,514) | 63% | ||||||||||||||||||

Amortisation of acquisition accounting adjustments | A4.1 | (46) | (63) | 27% | (61) | 25% | ||||||||||||||||

Loss (profit) attaching to corporate transactions | A4.1 | (588) | 223 | n/a | 218 | n/a | ||||||||||||||||

Profit before tax | 3,635 | 3,296 | 10% | 3,193 | 14% | |||||||||||||||||

Tax charge attributable to shareholders’ returns | (622) | (906) | 31% | (876) | 29% | |||||||||||||||||

Profit for the year | 3,013 | 2,390 | 26% | 2,317 | 30% | |||||||||||||||||

| * | Sterling weakened over the course of 2018, compared with most of the currencies in Prudential’s major international markets. However, average exchange rates remained above those in 2017, leading to a negative effect on the translation of results fromnon-sterling operations. To aid comparison of underlying progress, Prudential expresses and comments on the performance trends of its Asia and US operations on a constant exchange rate basis. The 2017 CER comparative results have been translated at 2018 average exchange rates. |

2018 total operating profit increased by 6 per cent (3 per cent on an actual exchange rate basis) to £4,827 million.

Asia total operating profitof £2,164 million was 14 per cent higher than the previous year (10 per cent on an actual exchange rate basis). Operating profit from life insurance operations increased 15 per cent to £1,982 million (10 per cent on an actual exchange rate basis), reflecting the continued growth of ourin-force book of recurring premium business, with renewal insurance premiums2 reaching £12,856 million (2017: £11,087 million). Insurance margin was up 15 per cent, driven by our continued focus on health and protection business, now contributing to 70 per cent of Asia life insurance revenues (2017: 68 per cent). At a market level, growth was led by Hong Kong up 33 per cent, Singapore 22 per cent and China 20 per cent respectively. Eastspring’s operating profit increased by 6 per cent (up 3 per cent on an actual exchange rate basis) to £182 million reflecting 4 per cent revenue growth which, combined with positive operating leverage, resulted in an improvement in the cost-income ratio3 to 55 per cent (2017: 56 per cent on an actual exchange rate basis).

US total operating profitat £1,919 million decreased by 11 per cent (14 per cent on an actual exchange rate basis). Higher fee income was more than offset by higher market-related DAC amortisation and lower spread-based income. Although equity markets declined in the fourth quarter, average separate account balances were above the prior year, given positive net inflows which supported higher levels of fee income. The higher market-related DAC amortisation arises mainly from £194 million acceleration of amortisation compared with £83 million favourable deceleration in 2017 (on a constant exchange rate basis), leading to an adverseyear-on-year movement of £277 million. Excluding the acceleration and deceleration in 2018 and 2017, operating profit in 2018 would have been 2 per cent higher than 2017 on a constant exchange rate basis.

| 2 | Asia renewal insurance premium is calculated as IFRS gross earned premiums less new business premiums and adjusted for the contribution from joint ventures. |

| 3 | Margin represents operating income before performance related fees as a proportion of the related funds under management. |

Solvency and Financial Condition Report 2018 Prudential plc 10

Table of Contents

| A. | Business and Performance |

The variability in DAC fromyear-to-year is dependent on separate account return and its interaction with the mean reversion formula applied by Jackson when determining the amortisation charge for the year. In the current year the dominant factor driving this calculation has been the equity market falls in 2018 (whereas 2017 saw equity market rises). Spread-based income decreased 20 per cent (22 per cent on an actual exchange rate basis), as anticipated, reflecting the impact of lower yields on our fixed annuity portfolio and a reduced contribution from asset duration swaps. While Jackson expects these effects to continue to compress spread margins, the continued upwards movements in US reinvestment yields may help to reduce the speed of the decline.

UK and Europe total operating profitwas 19 per cent higher at £1,634 million. Life insurance operating profit increased by 32 per cent to £1,138 million (2017: £861 million). Within this total, the contribution from our core2 with-profits andin-force annuity business was £519 million (2017: £597 million), including an increased transfer to shareholders from the with-profits funds of £320 million (2017: £288 million) and within this, a 30 per cent increase in the contribution from PruFund business of £55 million. Earnings from our core annuities business were lower, reflecting the reinsurance of £12 billion of annuity liabilities to Rothesay Life in March 2018. The balance of the life insurance result reflects the contribution from other elements which are not expected to recur at the same level. This includes the favourable impact of longevity assumption changes, contributing £441 million (2017: £204 million) relating to changes to annuitant mortality assumptions reflecting recent mortality trends, which have shown a slowdown in life expectancy improvements in recent periods, and the adoption of the Continuous Mortality Investigation (CMI) 2016 model (2017: adoption of 2015 model). The result also includes a £166 million insurance recovery, related to the costs of reviewing internally vesting annuities sold without advice after July 2008. Profits from management actions of £58 million were broadly offset by a provision of £55 million for the cost of equalising guaranteed minimum pension benefits on products sold by the UK insurance business, following a High Court ruling in October which applied across the UK life insurance industry.

Asset management operating profitdecreased 5 per cent to £477 million, largely reflecting a normalisation of performance fees to £15 million, compared with a particularly high contribution of £53 million in the prior year. Excluding the contribution of performance fees, operating profit was 3 per cent higher. This reflects both the higher average level of funds managed by M&G (up from £275.9 billion in 2017 to £276.6 billion in 2018) and a higher revenue margin3 of 40 basis points (2017: 37 basis points). Operating profit is after charges of £27 million incurred in preparing the business for the UK’s proposed exit from the European Union, including the migration of fund assets to our Luxembourg-domiciled SICAV platform. The cost-income ratio4 of 59 per cent remains broadly in line with the prior year (2017: 58 per cent).

| 4 | The asset management cost/income ratio is calculated as asset management operating expenses, adjusted for commission and joint venture contribution, divided by asset management total IFRS revenue adjusted for commission, joint venture contribution, performance-related fees andnon-operating items. |

Solvency and Financial Condition Report 2018 Prudential plc 11

Table of Contents

| A. | Business and Performance |

A.2.2 Operating profit analysed by Solvency II lines of business

The following tables analyse operating profit by material Solvency II lines of business split by geographical segment:

Asia insurance operations

| Operating profit | 2018 £m | AER 2017 £m | CER 2017 £m | 2018 vs 2017 AER | 2018 vs 2017 CER | Relevant material Solvency II lines of business | ||||||||||||||||||||||

| Hong Kong | 443 | 346 | 332 | 28% | 33% | • Insurance with-profit participation* • Health insurance • Other life insurance (including protection)

| ||||||||||||||||||||||

| Indonesia | 416 | 457 | 415 | (9)% | 0% | • Unit-linked insurance combined with health and protection riders

| ||||||||||||||||||||||

| Malaysia | 194 | 173 | 178 | 12% | 9% | • Insurance with-profit participation* • Unit-linked insurance combined with health and protection riders

| ||||||||||||||||||||||

| Philippines | 43 | 41 | 38 | 5% | 13% | • Unit-linked products combined with health and protection riders

| ||||||||||||||||||||||

| Singapore | 329 | 272 | 269 | 21% | 22% | • Insurance with-profit participation* • Unit-linked products combined with health and protection riders • Health insurance • Other life insurance

| ||||||||||||||||||||||

| Thailand | 113 | 107 | 108 | 6% | 5% | • Other life insurance (including health and protection) • Unit-linked insurance

| ||||||||||||||||||||||

| Vietnam | 149 | 135 | 129 | 10% | 16% | • Insurance with-profit participation* • Other life insurance

| ||||||||||||||||||||||

| China | 143 | 121 | 119 | 18% | 20% | • Insurance with-profit participation* • Health insurance • Unit-linked insurance • Other life insurance (including protection)

| ||||||||||||||||||||||

| Taiwan | 51 | 43 | 41 | 19% | 24% | • Insurance with-profit participation* • Health insurance • Unit-linked insurance • Other life insurance

| ||||||||||||||||||||||

Other (includingnon-recurrent items) | 145 | 146 | 140 | (1)% | 4% | |||||||||||||||||||||||

Total before share of related tax charges from joint ventures and associate and development expenses | 2,026 | 1,841 | 1,769 | 10% | 15% | |||||||||||||||||||||||

Share of related tax charges from joint ventures and associate | (40) | (39) | (39) | (3)% | (3)% | |||||||||||||||||||||||

Development expenses | (4) | (3) | (3) | (33)% | (33)% | |||||||||||||||||||||||

| Total | 1,982 | 1,799 | 1,727 | 10% | 15% | |||||||||||||||||||||||

| * | Insurance with-profit participation products relate to those sold from a ring-fenced fund as defined by the Solvency II legislation. |

Solvency and Financial Condition Report 2018 Prudential plc 12

Table of Contents

| A. | Business and Performance |

US insurance operations

| AER | CER | |||||||||||||||||||||

| Operating profit | 2018 £m | 2017 £m | Change % | 2017 £m | Change % | |||||||||||||||||

| Index-linked and unit-linked insurancenote (a) | 1,532 | 1,788 | (14)% | 1,726 | (11)% | |||||||||||||||||

| Other life insurancenote (b) | 379 | 426 | (11)% | 411 | (8)% | |||||||||||||||||

Total | 1,911 | 2,214 | (14)% | 2,137 | (11)% | |||||||||||||||||

Notes

| (a) | Index-linked and unit-linked insurance represents profits from Jackson’s variable annuity products. |

| (b) | Other life insurance includes profits from fixed annuity, fixed index annuity, guaranteed investment contracts, life and other business. |

UK and Europe insurance operations

| Operating profit | 2018 £m | 2017 £m | Change % | |||||||||

| Insurance with-profit participationnote (a) | 320 | 288 | 11% | |||||||||

Other (comprising index-linked and unit-linked insurance, other life insurance and life reinsurance)note (b) | 818 | 573 | 43% | |||||||||

Total | 1,138 | 861 | 32% | |||||||||

Notes

| (a) | Insurance with-profit participation comprises thepre-tax shareholders’ transfer from the with-profits fund for the year. |

| (b) | ‘Other’ substantially comprises profits arising from shareholder annuity business. |

| A.3 | Investment Performance |

A.3.1 Short-term fluctuations in investment returns

As explained in Section A.2.1, the Group describes its performance by reference to operating profit (see Section A.2 Underwriting Performance) andnon-operating profit, the key component of which is IFRS short-term fluctuations in investment returns (as described below). Additional analysis on investment returns is provided in Section A.5.4.

Operating profit is based on longer-term investment return assumptions. The difference between actual investment returns recorded in the income statement and the assumed longer-term returns is reported within short-term fluctuations in investment returns.

In 2018, the total short-term fluctuations in investment returns on shareholder-backed business were negative £558 million (2017: negative £1,563 million on an actual exchange rate basis) and comprised negative £512 million (2017: negative £1 million on an actual exchange rate basis) for Asia, negative £100 million (2017: negative £1,568 million on an actual exchange rate basis) in the US, positive £34 million (2017: negative £14 million on an actual exchange rate basis) in the UK and Europe and positive £20 million (2017: positive £20 million on an actual exchange rate basis) in other operations.

Rising interest rates in many markets in Asia led to unrealised bond losses in the period. In the US, lower equity market levels, alongside higher interest rate levels, as expected, resulted in gains on equity hedge instruments which are designed to protect Jackson’s capital position, balanced by higher technical reserve requirements.

A.3.2 Investment management expenses

The total investment management expenses incurred by the Group’s insurance operations, including those that were paid to the Group’s asset management operations, totalled £803 million (2017: £890 million). These amounts comprise investment management expenses incurred by both the Group’s shareholder-backed business and with-profits business.

| A.3.3 | Movement in unrealised gains and losses onavailable-for-sale securities of Jackson recognised as other comprehensive income |

The majority of the US insurance operation’s debt securities portfolio is accounted for on anavailable-for-sale basis. Movements in unrealised appreciation/depreciation of Jackson’s debt securities designated asavailable-for-sale are recorded in other comprehensive income. The amounts recognised in other comprehensive income are as follows:

| 2018 £m | 2017 £m | |||||||

Net unrealised holding (losses) gains arising in the year | (1,606) | 591 | ||||||

(Deduct net gains) add back net losses included in the income statement on disposal and impairment | (11) | 26 | ||||||

Total | (1,617) | 617 | ||||||

Solvency and Financial Condition Report 2018 Prudential plc 13

Table of Contents

| A. | Business and Performance |

| A.3.4 | Investments in securitisation |

Certain of the securities classified as asset-backed securities in the Group IFRS financial statements meet the definition of securitisation for the purpose of the Solvency II capital requirements calculation.

Investments in securitisation are subject to specific spread stresses in the calculation of the Solvency II capital requirements in order to ensure that risks arising from securitisation positions are reflected appropriately.

For the Group’s UK and Europe insurance operations, of the £6,676 million (31 December 2017: £6,728 million) of asset-backed securities disclosed in the Group IFRS financial statements at 31 December 2018, £4,971 million (31 December 2017: £4,654 million) meet the definition of investments in securitisation.

The securitisation investment holdings of the Group’s US insurance operations are not included as these operations are included on a Deduction and Aggregation basis based on the local US Risk Based Capital approach and do not form a part of the internal model for Solvency II Pillar 1. The securitisation investment holdings of the Group’s Asia insurance operations were not material.

| A.4 | Performance of other activities |

| A.4.1 | Contribution to operating profit and short-term fluctuations in investment returns from other operating income and expenditure |

Other operating income and expenditure

Other operating income and expenditure for 2018 of £(890) million (2017: £(878) million) comprise the following items:

| 2018 £m | 2017 £m | |||||||

Investment return and other income Interest payable on core structural borrowings Corporate expenditure | 52 | 11 | ||||||

| (410) | (425) | |||||||

| (367) | (361) | |||||||

| Other income and expenditures | (725) | (775) | ||||||

| Restructuring costs | (165) | (103) | ||||||

| Total | (890) | (878) | ||||||

Othernon-operating items

Short-term fluctuations in investment returns on other operations

The positive short-term fluctuations in investment returns for other operations of £5 million (2017: £26 million) include unrealised value movements on financial instruments held outside of the main life operations.

Other items

Other items include the results attaching to disposal of businesses of negative £(588) million (2017: positive £218 million) and the amortisation of acquisition accounting adjustments of negative £46 million (2017: negative £61 million) arising mainly from the REALIC business acquired by Jackson in 2012. The loss related to the disposal of businesses relates primarily to the £(508) millionpre-tax loss following the reinsurance of £12 billion UK annuities to Rothesay Life in March 2018.

| A.4.2 | Leasing |

The Group does not hold any individually material leasing arrangement. The Group’s operating and finance lease arrangements relate principally to properties as described further below, and are differentiated between operating and finance leases.

Operating leases

Prudential as a lessee

As at 31 December 2018, Prudential’s UK headquartered businesses occupied 115 operating leases in the United Kingdom, Europe, Asia and Africa. These properties are primarily offices with some ancillary storage facilities. Prudential’s global headquarters is located in London. Of the remainder, the most significant holdings are offices in London and Reading in England, Stirling in Scotland and Mumbai in India. Of the 115 operating leases, 100 are held leasehold and the rest 15 are short-term serviced offices.

The 2018 Group IFRS consolidated income statement includes minimum operating lease rental payments made by the Group of £139 million (2017: £123 million).

Prudential as a lessor

Investment properties principally relate to the UK with-profits fund (including its property fund subsidiaries) and are carried at fair value. The Group’s policy is to let investment properties to tenants through operating leases.

Solvency and Financial Condition Report 2018 Prudential plc 14

Table of Contents

A. Business and Performance

The 2018 income statement includes rental income from investment properties of £927 million (2017: £876 million), including income from property funds consolidated by the Group, and direct operating expenses including repairs and maintenance arising from these properties of £56 million (2017: £82 million).

Finance leases

Prudential as a lessee

The Group’s portfolio of investment properties comprises both freehold and leasehold properties. Investment properties of £5,825 million (31 December 2017: £5,689 million) are held under finance leases. These finance leases are arrangements which grant very long leases with a large payment made upfront with minimal ground rent payable on an annual basis.

Prudential as a lessor

Prudential does not have any material finance leasing arrangements where Prudential acts as a lessor.

| A.5 | Any other information |

An additional analysis of the premiums, benefits and claims, acquisition costs and other expenditure of the Group’s insurance operations by geographical region on an IFRS basis is provided below.

The following table shows Prudential’s consolidated total revenue and consolidated total charges for the years presented:

| Section | 2018 £m | 2017 £m | ||||||||||

| Gross premiums earned | A.5.1 | 47,224 | 44,005 | |||||||||

| Outward reinsurance premiums | (14,023) | (2,062) | ||||||||||

| Earned premiums, net of reinsurance | 33,201 | 41,943 | ||||||||||

| Investment return | A.5.4 | (10,263) | 42,189 | |||||||||

| Other income | 1,993 | 2,258 | ||||||||||

| Total revenue, net of reinsurance | 24,931 | 86,390 | ||||||||||

| Benefits and claims | (27,411) | (71,854) | ||||||||||

| Outward reinsurers’ share of benefit and claims | 13,554 | 2,193 | ||||||||||

| Movement in unallocated surplus of with-profits funds | 1,289 | (2,871) | ||||||||||

Benefits and claims and movement in unallocated surplus of with-profits funds, net of reinsurance | A.5.2 | (12,568) | (72,532) | |||||||||

| Acquisition costs and other expenditure | A.5.3 | (8,855) | (9,993) | |||||||||

| Finance costs: interest on core structural borrowings of shareholder-financed operations | (410) | (425) | ||||||||||

| (Loss) gain on disposal of businesses and corporate transactions | (80) | 223 | ||||||||||

| Remeasurement of the sold Korea life business | - | 5 | ||||||||||

| Total charges, net of reinsurance and gain (loss) on disposal of businesses | (21,913) | (82,722) | ||||||||||

| Share of profits from joint ventures and associates, net of related tax | 291 | 302 | ||||||||||

| Profit before tax(being tax attributable to shareholders’ and policyholders’ returns) | 3,309 | 3,970 | ||||||||||

| Less tax charge attributable to policyholders’ returns | 326 | (674) | ||||||||||

| Profit before tax attributable to shareholders | 3,635 | 3,296 | ||||||||||

Solvency and Financial Condition Report 2018 Prudential plc 15

Table of Contents

A. Business and Performance

A.5.1 Comparison of gross premiums earned with the prior period

| 2018 £m | 2017 £m | |||||||

| Asia | 16,469 | 15,688 | ||||||

| US | 17,656 | 15,164 | ||||||

| UK and Europe | 13,061 | 13,126 | ||||||

| Unallocated to a segment (Africa) | 38 | 27 | ||||||

| Total | 47,224 | 44,005 | ||||||

The gross premiums earned of £47,224 million under IFRS in 2018 excludes £1,446 million (2017: £2,164 million) of premiums for policies which are classified as investment contracts without discretionary participation features under IFRS 4 ‘Investment Contracts’ and recorded as deposits. These amounts are included in gross premiums earned within the Solvency II template S.05.01.02. The increase in gross premiums earned from 2017 to 2018 was primarily due to an addition of £3.7 billion from the agreement entered into by Jackson with John Hancock Life in October 2018 to assume 100 per cent of their grouppay-out annuity business. The gross premiums earned of £48,670 million under Solvency II, including investment contracts, is analysed by line of business as follows:

| Gross premiums earned £m | ||||||||||||||

Health insurance | Insurance with-profit participation | Index- linked and unit-linked insurance | Other life insurance | Accepted life reinsurance | Non- life | Total | ||||||||

| 2018 | 863 | 21,132 | 16,362 | 10,198 | 24 | 91 | 48,670 | |||||||

| 2017 | 836 | 20,514 | 18,147 | 6,559 | 24 | 89 | 46,169 | |||||||

The analysis of the premiums of the Group’s insurance operations provided below is on an IFRS basis and therefore excludes premiums from investment contracts without discretionary participation features.

Gross premiums earned for insurance operations total £47,224 million in 2018, up 7 per cent from £44,005 million in 2017. The increase of £3,219 million is primarily driven by growth of £2,492 million in the US operations and £781 million in the Asia operations, marginally offset by a decline of £65 million in the UK and Europe operations.

Asia

Gross premiums earned reflect the aggregate of single and regular premiums of new business sold in the year and premiums on annual business sold in previous years.

Gross premiums for Asia have increased by £781 million or 5 per cent from £15,688 million in 2017 to £16,469 million in 2018 on an actual exchange rate basis. Excluding the impact of exchange translation, gross earned premiums in Asia have increased by 9 per cent from 2017 to 2018, from £15,168 million on a constant exchange rate in 2017 to £16,469 million in 2018.

The Group’s focus on quality is undiminished with regular premium contracts accounting for majority of sales as well as the mix of health and protection products. This favourable mix provides a high level of recurring income and an earnings profile that is significantly less correlated to investment markets.

In 2018, Hong Kong sales have increased during the year, with higher sales levels from Mainland China visitors to Hong Kong driving positive momentum over the course of the year. In China, sales grew in the fourth quarter. In Singapore, sales were higher driven by agency and bancassurance channels, pricing actions and favourable product mix shifts. Indonesia continues to experience a challenging market environment, which was compounded by the adverse impact of higher yields and hence sales were lower. Despite these headwinds, the Group is investing in business to strengthen its distribution capabilities, upgrading its systems and refreshing its product propositions to meet customer needs.

United States

Gross premiums have increased by 16 per cent from £15,164 million in 2017 to £17,656 million in 2018 on an actual exchange rate basis. Excluding the impact of exchange translation, gross premiums in the US have increased by 21 per cent from £14,638 million in 2017 to £17,656 million in 2018. In October 2018, Jackson entered into an agreement with John Hancock Life to assume the risk on 100 per cent of their grouppay-out annuity business, increasing gross premiums earned by £3.7 billion. Excluding the premiums from this transaction, gross premiums decreased slightly from the prior year on a constant exchange rate basis.

United Kingdom and Europe

Gross premiums for UK and Europe life business of £13,061 million are in line with 2017. New sales continue to be driven by the popular PruFund ISA proposition. Reflecting this performance, total PruFund assets under management of £43 billion as at 31 December 2018 were 20 per cent higher than at the start of the year, driven by positive net flows of £8.5 billion.

Solvency and Financial Condition Report 2018 Prudential plc 16

Table of Contents

A. Business and Performance

A.5.2 Comparison of benefits and claims (including the movement in unallocated surplus of with-profits funds) with the prior period

| 2018 £m | 2017 £m | |||||||

Asia* | (8,775) | (18,269) | ||||||

US | (8,790) | (31,205) | ||||||

UK and Europe* | 5,016 | (23,047) | ||||||

Unallocated to a segment (Africa) | (19) | (11) | ||||||

Total | (12,568) | (72,532) | ||||||

| * | The Asia and UK benefits and claims exclude intra-group reinsurance transactions. |

The analysis of the benefits and claims of the Group’s insurance operations provided above is on an IFRS basis and therefore excludes benefits and claims from investment contracts without discretionary participation features.

The underlying reasons for theyear-on-year changes in benefits and claims and movement in unallocated surplus in each of Prudential’s regional operations are changes in the incidence of claims incurred, increases or decreases in policyholders’ liabilities, and movements in unallocated surplus of with-profits funds. Movement for each Group operation is described below.

Claims incurred and increase in policyholder liabilities totalling £(12,568) million in 2018 include £(34) million of claims handling expenses but exclude £(1,443) million of charges in respect of policies which are classified as investment contracts without discretionary participation features under IFRS 4 ‘Investment Contracts’. A reconciliation of the amounts shown in the Group IFRS financial statements to that shown in Solvency II template S.05.01.02 is shown below:

| 2018 £m | 2017 £m | |||||||

| Benefits and claims and movement in unallocated surplus, net of reinsurance as disclosed in the Group IFRS financial statements | (12,568) | (72,532) | ||||||

Remove movement in unallocated surplus of with-profits funds | (1,289) | 2,871 | ||||||

Remove Claims handling expenses | 34 | 33 | ||||||

Add Charges for investment contracts without discretionary participation features | (1,443) | (1,950) | ||||||

Benefits and claims, net of reinsurance within the Solvency II template S.05.01.02 | (15,266) | (71,578) | ||||||

The amount of £(15,266) million within the Solvency II template S.05.01.02, excluding claims handling expenses but including the charges for investment contracts, is analysed by line of business as follows:

| Claims incurred and changes in other technical provisions - net of reinsurance £m | ||||||||||||||||||||||||||||

Health insurance | Insurance with-profit participation | Index- linked and unit-linked insurance | Other life insurance | Accepted life reinsurance | Non- life | Total | ||||||||||||||||||||||

| 2018 | (326 | ) | (12,311 | ) | (4,887 | ) | 2,436 | (135 | ) | (43 | ) | (15,266 | ) | |||||||||||||||

2017 | (487 | ) | (26,755 | ) | (37,708 | ) | (6,412 | ) | (178 | ) | (38 | ) | (71,578 | ) | ||||||||||||||

The principal variations in the movements in policyholder liabilities and movements in unallocated surplus of with-profits funds for each regional operation are discussed below.

Asia

In 2018, the charge for benefits and claims and movement in unallocated surplus of with-profits funds totalled £(8,775) million, representing a decrease of £9,494 million compared with the charge of £(18,269) million in 2017. The amounts of theyear-on-year change attributable to each of the underlying reasons are shown below:

| 2018 £m | 2017 £m | |||||||

| Claims incurred, net of reinsurance | (4,925) | (5,118) | ||||||

(Increase) in policyholder liabilities, net of reinsurance | (4,969) | (12,049) | ||||||

Movement in unallocated surplus of with-profits funds | 1,119 | (1,102) | ||||||

Benefits and claims and movement in unallocated surplus, net of reinsurance | (8,775) | (18,269) | ||||||

In general, the growth in policyholder liabilities in Asia over the years shown above reflects the combined growth of new business and thein-force books in the region.

The variations in the increases or decreases in policyholder liabilities in individual years were, however, primarily due to movement in investment returns. This was as a result of asset value movements that are reflected in the unit value of the unit-linked policies and the fluctuation of the policyholder liabilities of the Asia operations’ with-profits policies with the funds’ investment performance.

The decrease in investment return in 2018, mainly driven by unfavourable equity market performances across the region as compared with strong growth in 2017 and unrealised bond losses as a result of higher interest rates, resulted in a related decrease in the charge for benefits and claims in the year.

Solvency and Financial Condition Report 2018 Prudential plc 17

Table of Contents

A. Business and Performance

United States

In 2018, the charge for benefits and claims has decreased by £22,415 million to £(8,790) million compared with £(31,205) million in 2017. The amounts of theyear-on-year change attributable to each of the underlying reasons are shown below:

| 2018 £m | 2017* £m | |||||||

| Claims incurred, net of reinsurance | (14,667) | (11,583) | ||||||

Decrease/(Increase) in policyholder liabilities, net of reinsurance | 5,877 | (19,622) | ||||||

Benefits and claims, net of reinsurance | (8,790) | (31,205) | ||||||

| * | The comparative results have beenre-presented from previously published for a reclassification between Claims incurred, net of reinsurance and Increase in policyholder liabilities, net of reinsurance. |

Theyear-on-year movement in claims incurred for US operations as shown in the table above also includes the effect of translating the US dollar results into pound sterling at the average exchange rates for the year.

The charges in each year comprise amounts in respect of variable annuity and other business. Theyear-on-year movement is principally driven by the movement in the investment return on the assets backing the variable annuity separate account liabilities. This has decreased in 2018 compared to 2017 due to relatively less favourable US equity markets in the current year. The decrease in policyholder liabilities in 2018 as a result of equity market movements is partially offset by an increase in the liability for variable guarantees in the year and an increase from the reinsurance agreement entered into by Jackson in November 2018 to acquire a closed block of grouppay-out annuity business from John Hancock Life Insurance Company. The transaction resulted in an increase to policyholder liabilities of £4.1 billion at the inception of the contract.

United Kingdom and Europe

The overall result for benefits, claims and the transfer to unallocated surplus has decreased to a credit of £5,016 million in 2018 compared with a £(23,047) million charge in 2017. Theyear-on-year changes attributable to each of the underlying reasons are shown below, together with a further analysis of the change in policyholder liabilities by type of business:

| 2018 £m | 2017 £m | |||||||

Claims incurred, net of reinsurance | (10,903) | (11,101) | ||||||

Decrease (increase) in policyholder liabilities, net of reinsurance: | ||||||||

SAIF | 852 | 349 | ||||||

Shareholder-backed annuity business | 13,938 | 897 | ||||||

Unit-linked and othernon-participating business | 1,388 | (1,479) | ||||||

With-profits (excluding SAIF) | (429) | (9,944) | ||||||

| 15,749 | (10,177) | |||||||

Movement in unallocated surplus of with-profits funds | 170 | (1,769) | ||||||

Benefits and claims and movement in unallocated surplus, net of reinsurance | 5,016 | (23,047) | ||||||

Claims incurred in the UK and Europe operations of £(10,903) million in 2018 are in line with £(11,101) million incurred in 2017.

As has been explained above, the principal driver for variations in amounts allocated to the policyholders is changes to investment return. In 2018, the result for benefits and claims is also significantly impacted by the reinsurance of £12.0 billion of the shareholder annuity liabilities to Rothesay Life.

In aggregate, as a result of lower market returns in 2018 compared with 2017 and the aforementioned reinsurance transaction, there has been a corresponding impact on benefits and claims and movements in unallocated surplus of with-profits funds in the year, moving from a net charge of £(23,047) million in 2017 to a net credit of £5,016 million in 2018.

SAIF is a ring-fenced fund with no new business written. Policyholder liabilities in SAIF reflect the underlying decreasing policyholder liabilities as the liabilities run off. The variations from year to year are, however, affected by the market valuation movement of the investments held by SAIF, which are wholly attributable to policyholders.