Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

TTM Technologies

JP Morgan Technology & Telecom Conference

May 8, 2003

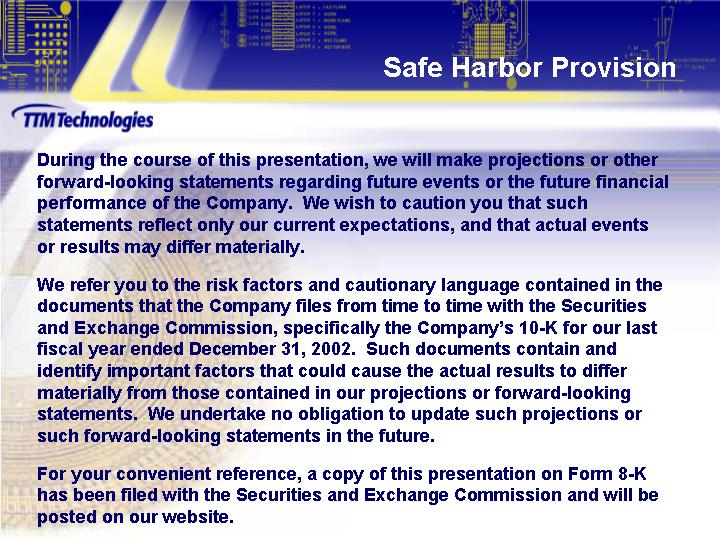

Safe Harbor Provision

[LOGO]

During the course of this presentation, we will make projections or other forward-looking statements regarding future events or the future financial performance of the Company. We wish to caution you that such statements reflect only our current expectations, and that actual events or results may differ materially.

We refer you to the risk factors and cautionary language contained in the documents that the Company files from time to time with the Securities and Exchange Commission, specifically the Company’s 10-K for our last fiscal year ended December 31, 2002. Such documents contain and identify important factors that could cause the actual results to differ materially from those contained in our projections or forward-looking statements. We undertake no obligation to update such projections or such forward-looking statements in the future.

For your convenient reference, a copy of this presentation on Form 8-K has been filed with the Securities and Exchange Commission and will be posted on our website.

Kent Alder

President

and

Chief Executive Officer

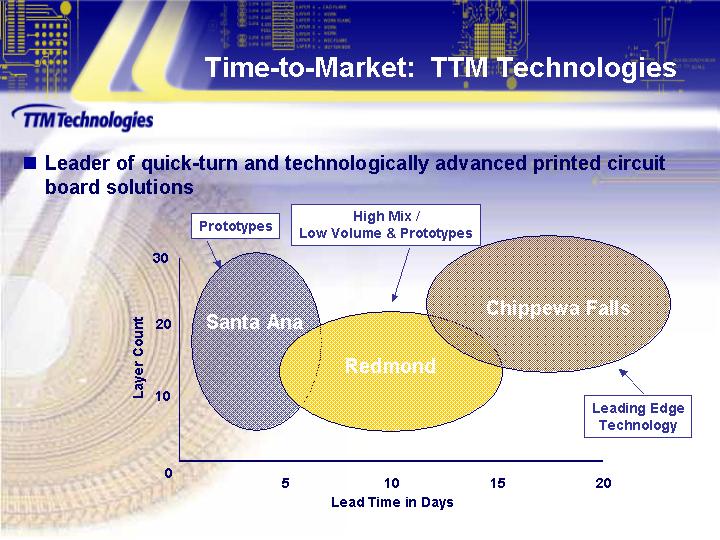

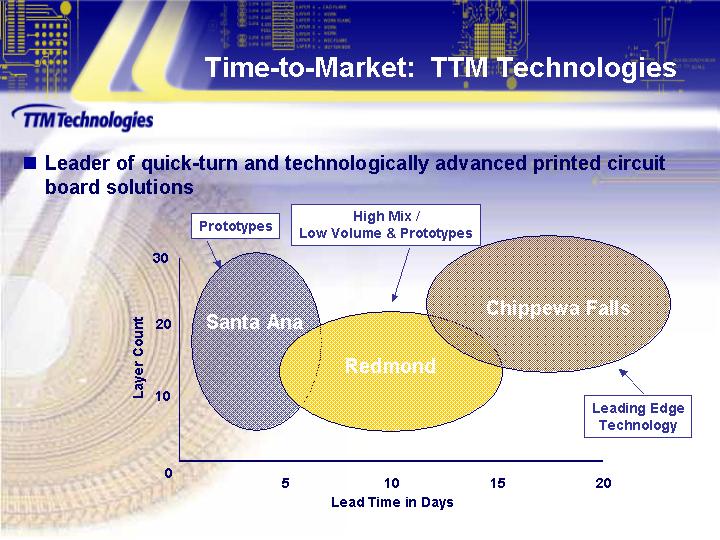

Time-to-Market: TTM Technologies

• Leader of quick-turn and technologically advanced printed circuit board solutions

[CHART]

Advantages of

Time and Technology

• Faster Growth

• Access to more diversified customer base

• Critical to NPI across industries

• Superior margins and profitability

• Significant barriers to entry

• Unique capabilities and culture for time

• Significant investment and expertise for technology

• Few competitors in either target market segment

Investment Opportunity

• Industry leading financial performance

• Most profitable business model through the cycle

• Strong balance sheet

• Lowest domestic cost structure

• Focus on most attractive PCB industry niches

• Time and technology

• Recent ACI acquisition surpasses high-technology positioning in the market

• Well positioned for industry upturn

• Diversified customers and end-markets

• Ability to double revenues without additional capital investment

• Proven ability to integrate acquisitions

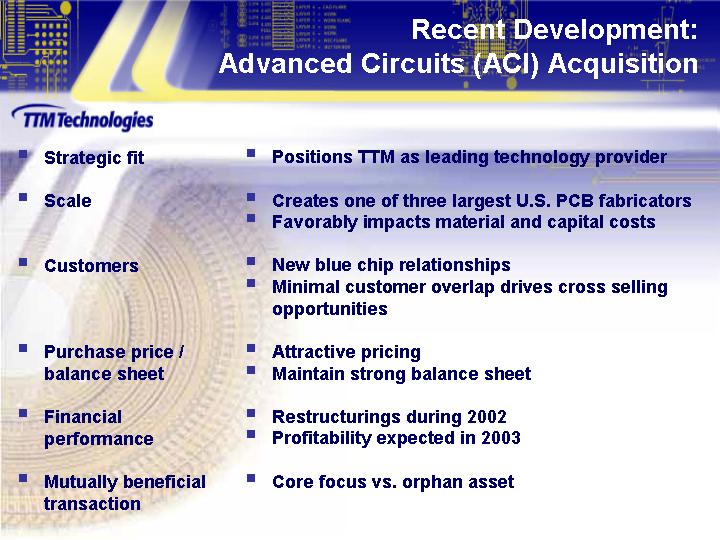

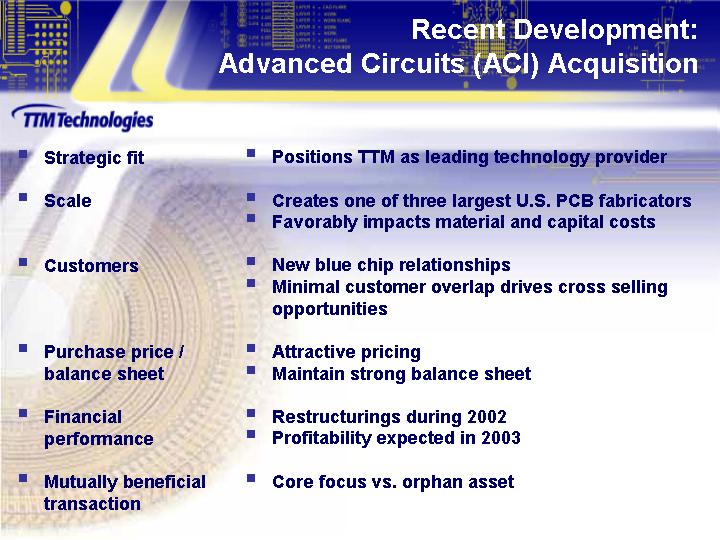

Recent Development:

Advanced Circuits (ACI) Acquisition

• Strategic fit | | • Positions TTM as leading technology provider |

| | |

• Scale | | • Creates one of three largest U.S. PCB fabricators

• Favorably impacts material and capital costs |

| | |

• Customers | | • New blue chip relationships

• Minimal customer overlap drives cross selling opportunities |

| | |

• Purchase price / balance sheet | | • Attractive pricing

• Maintain strong balance sheet |

| | |

• Financial performance | | • Restructurings during 2002

• Profitability expected in 2003 |

| | |

• Mutually beneficial transaction | | • Core focus vs. orphan asset |

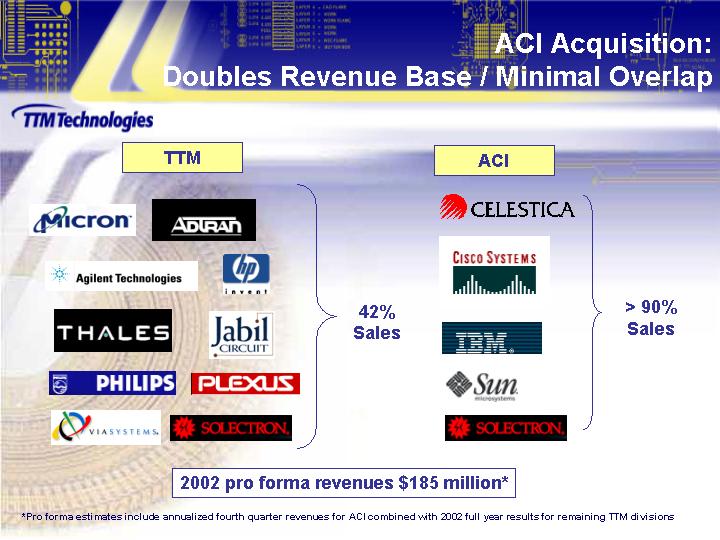

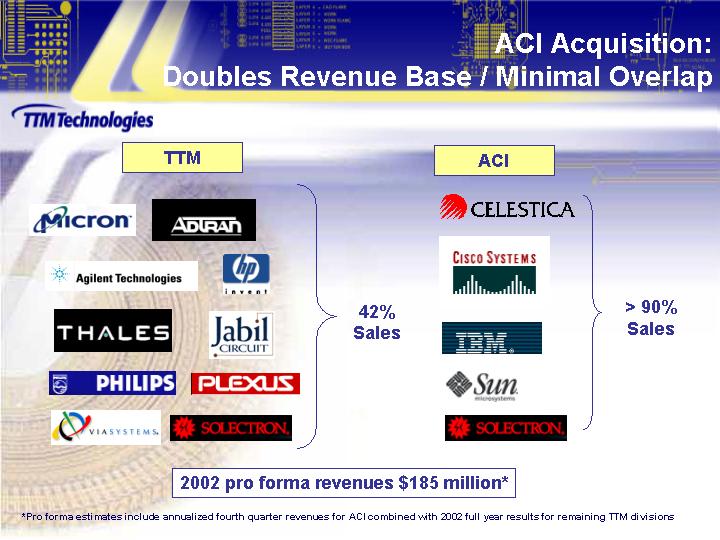

ACI Acquisition:

Doubles Revenue Base / Minimal Overlap

TTM | | | | ACI | | | |

[LOGOS] | | 42%

Sales | | [LOGOS] | | > 90%

Sales | |

2002 pro forma revenues $185 million* |

* Pro forma estimates include annualized fourth quarter revenues for ACI combined with 2002 full year results for remaining TTM divisions

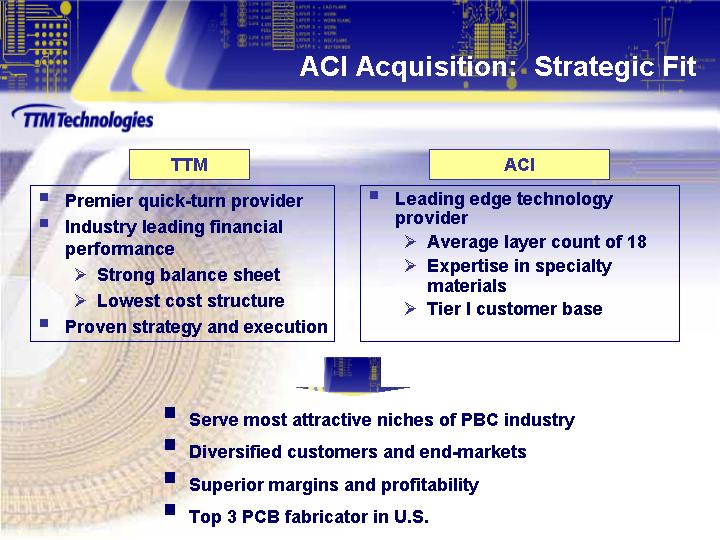

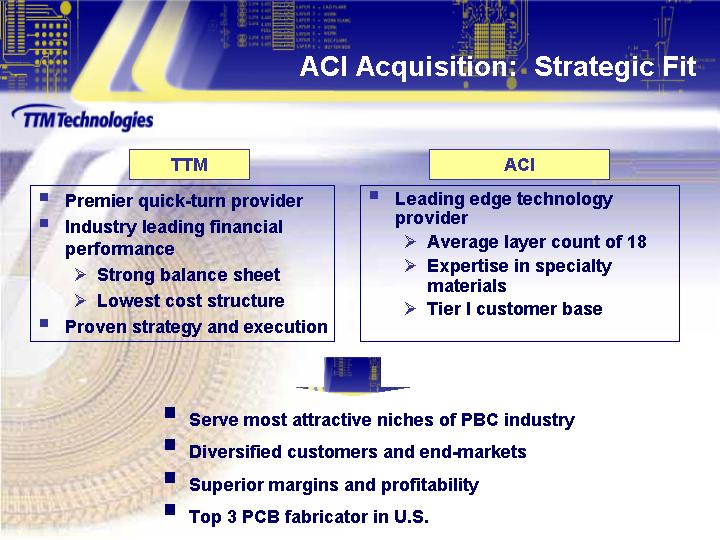

ACI Acquisition: Strategic Fit

TTM | | ACI | |

• Premier quick-turn provider | | • Leading edge technology provider | |

• Industry leading financial performance | | • Average layer count of 18 | |

• Strong balance sheet | | • Expertise in specialty materials | |

• Lowest cost structure | | • Tier I customer base | |

• Proven strategy and execution | | | |

[GRAPHIC]

• | | Serve most attractive niches of PBC industry |

• | | Diversified customers and end-markets |

• | | Superior margins and profitability |

• | | Top 3 PCB fabricator in U.S. |

Industry Overview

TTM Capitalizing on

Challenging Industry Trends

• Prolonged downturn in electronics industry | | • Diversified customer base—well positioned for recovery |

| | |

• Increased competition | | • Focus on cost management and operational efficiency |

| | |

• Capacity reduction / consolidation [GRAPHIC] | | • Remaining competitors including TTM gaining customers / share |

| | |

• North American PCB market transitioning to high mix, high complexity | | • Differentiation through technology and service |

| | |

• Several companies experiencing liquidity constraints / solvency issues | | • Well capitalized players like TTM capturing share |

Consolidation Trends—

U.S. PCB Market

Estimate of U.S. PCB fabricators with

>$100 million in 2002 revenues* |

Independent | | | |

Public | | Captive | | Integrated EMS | |

• TTM | | • Tyco | | • Sanmina | |

| | | | | |

• DDI | | • IBM – Endicott | | • Flextronics | |

| | | | | |

• Merix | | • Photocircuits | | • Viasystems | |

| | | | | |

| | • 3M | | | |

TTM continues to benefit from rapid

consolidation in the U.S. PCB market |

* PCB Fab magazine, September 2002

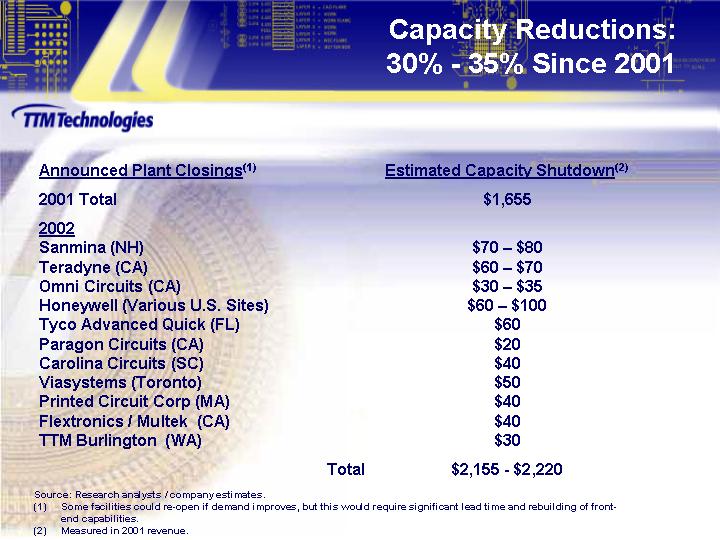

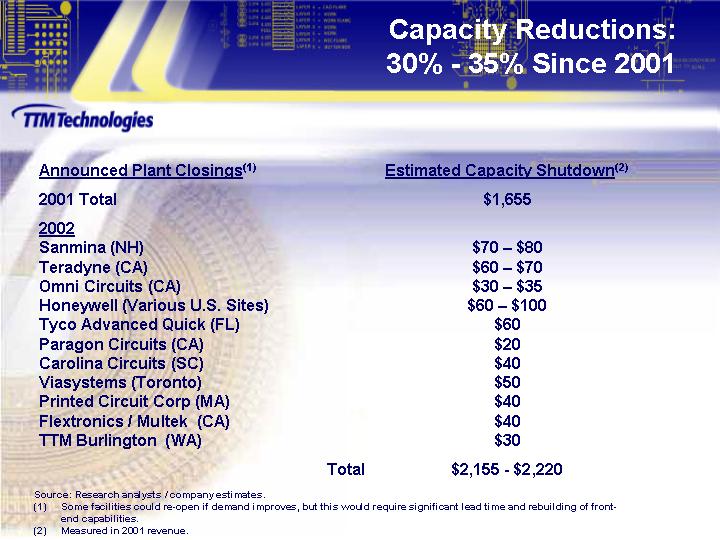

Capacity Reductions:

30% - 35% Since 2001

Announced Plant Closings(1) | | Estimated Capacity Shutdown(2) | |

2001 Total | | $1,655 | |

| | | |

2002 | | | |

Sanmina (NH) | | $70 – $80 | |

Teradyne (CA) | | $60 – $70 | |

Omni Circuits (CA) | | $30 – $35 | |

Honeywell (Various U.S. Sites) | | $60 – $100 | |

Tyco Advanced Quick (FL) | | $60 | |

Paragon Circuits (CA) | | $20 | |

Carolina Circuits (SC) | | $40 | |

Viasystems (Toronto) | | $50 | |

Printed Circuit Corp (MA) | | $40 | |

Flextronics / Multek (CA) | | $40 | |

TTM Burlington (WA) | | $30 | |

| | | |

Total | | $2,155 - $2,220 | |

Source: Research analysts / company estimates.

(1) Some facilities could re-open if demand improves, but this would require significant lead time and rebuilding of front-end capabilities.

(2) Measured in 2001 revenue.

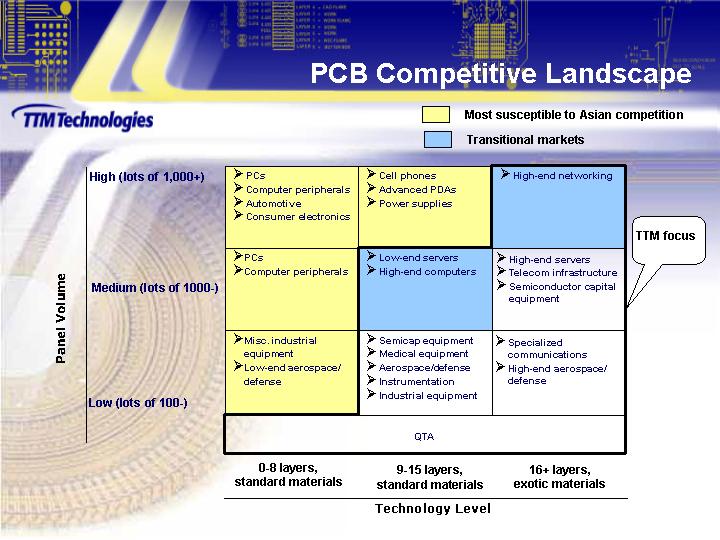

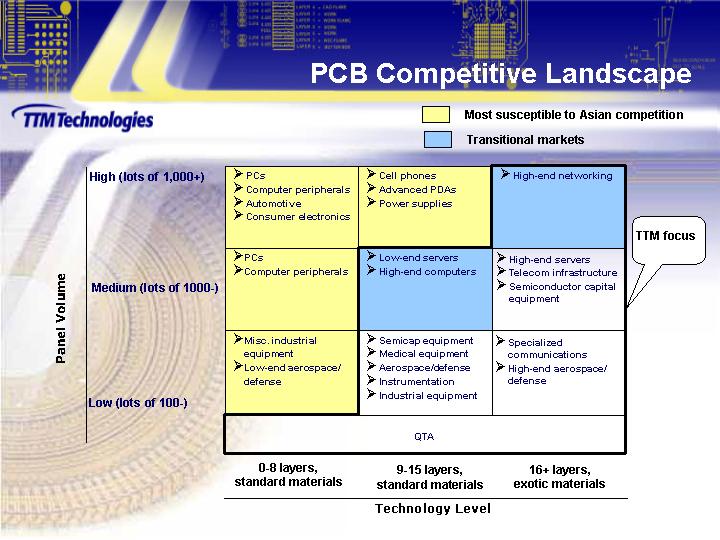

PCB Competitive Landscape

| | | | | | TTM focus |

Panel volume | | Most susceptible

to Asian competition | | Most susceptible to Asian competition | | Transitional

markets | | | | Transitional

markets | | |

| | | | | | | | | | | | |

High (lots of 1,000+) | | • PCs | | • Cell phones | | | | | | • High-end networking | | |

| | • Computer peripherals | | • Advanced PDAs | | | | | | | | |

| | • Automotive | | • Power supplies | | | | | | | | |

| | • Consumer electronics | | | | | | | | | | |

| | | | | | | | | | | | |

Medium (lots of 1000-) | | • PCs | | | | • Low-end servers | | | | • High-end servers | | |

| | • Computer peripherals | | | | • High-end computers | | | | • Telecom infrastructure | | |

| | | | | | | | | | • Semiconductor capital equipment | | |

| | | | | | | | | | | | |

Low (lots of 100-) | | • Misc. industrial equipment | | | | • Semicap equipment | | | | • Specialized communications | | |

| | • Low-end aerospace/defense | | | | • Medical equipment | | | | • High-end aerospace/ defense | | |

| | | | | | • Aerospace/ defense | | | | | | |

| | | | | | • Instrumentation | | | | | | |

| | | | | | • Industrial equipment | | | | | | |

| | QTA |

| | 0-8 layers, standard materials | | 9-15 layers, standard materials | | 16+ layers, exotic materials |

| | Technology Level |

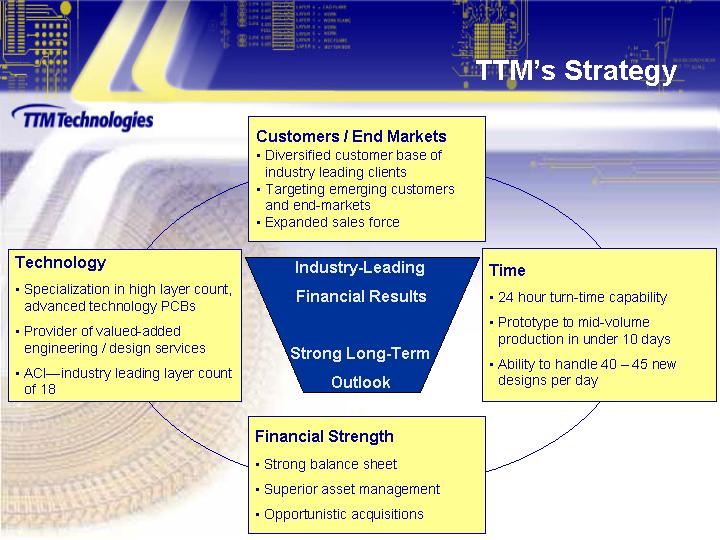

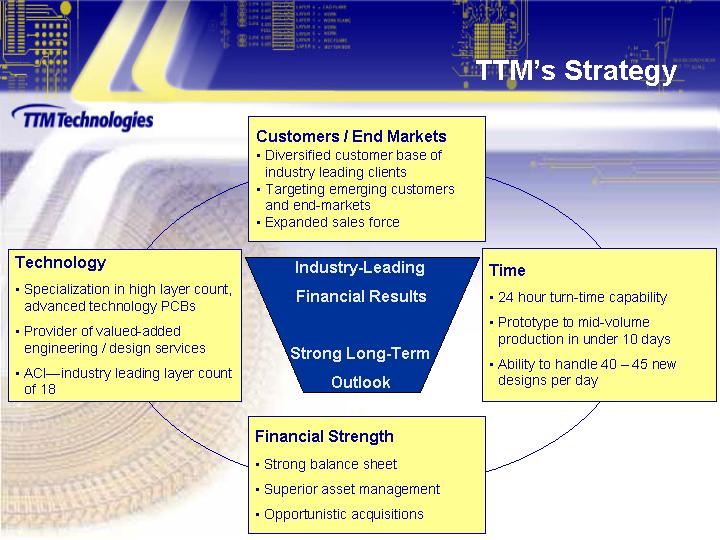

TTM’s Strategy

TTM’s Strategy

Industry-Leading Financial Results

Strong Long-Term Outlook

Customers / End Markets

• Diversified customer base of industry leading clients

• Targeting emerging customers and end-markets

• Expanded sales force

Time

• 24 hour turn-time capability

• Prototype to mid-volume production in under 10 days

• Ability to handle 40 – 45 new designs per day

Financial Strength

• Strong balance sheet

• Superior asset management

• Opportunistic acquisitions

Technology

• Specialization in high layer count, advanced technology PCBs

• Provider of valued-added engineering / design services

• ACI—industry leading layer count of 18

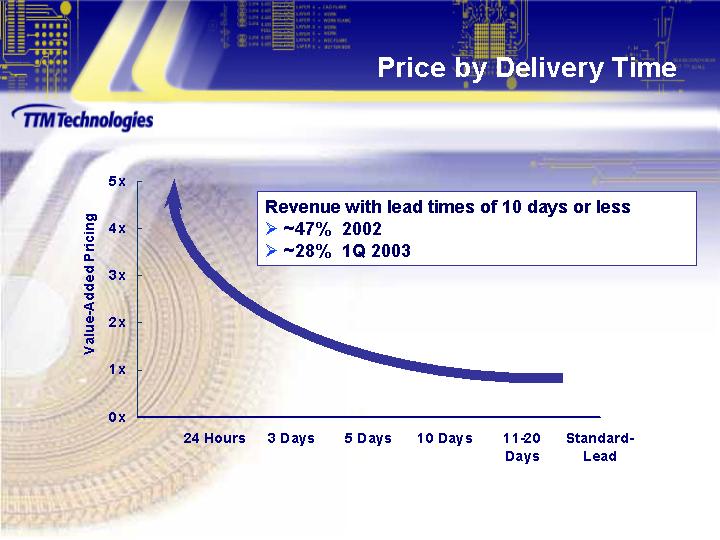

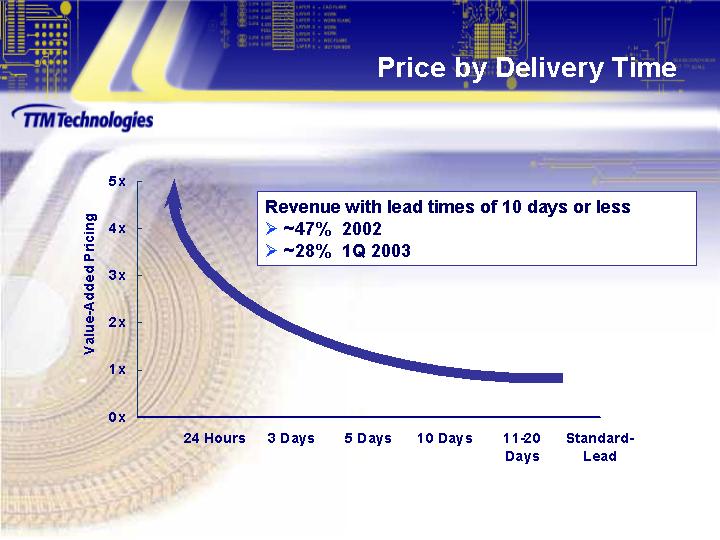

Price by Delivery Time

[CHART]

Revenue with lead times of 10 days or less

• ~47% 2002

• ~28% 1Q 2003

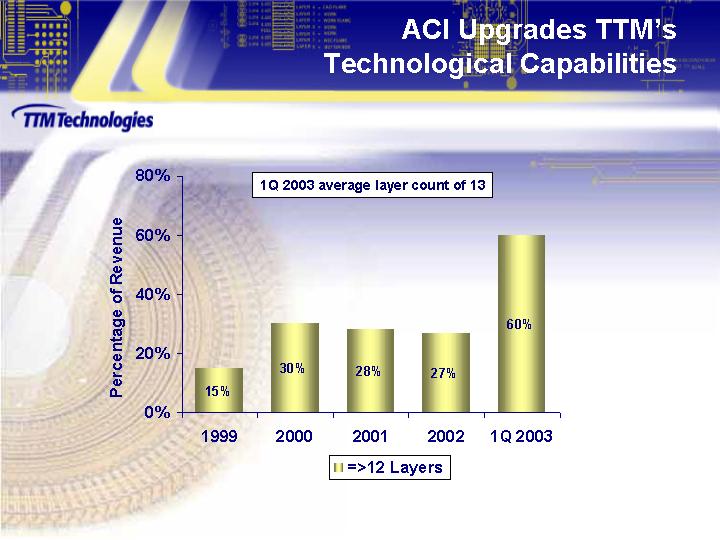

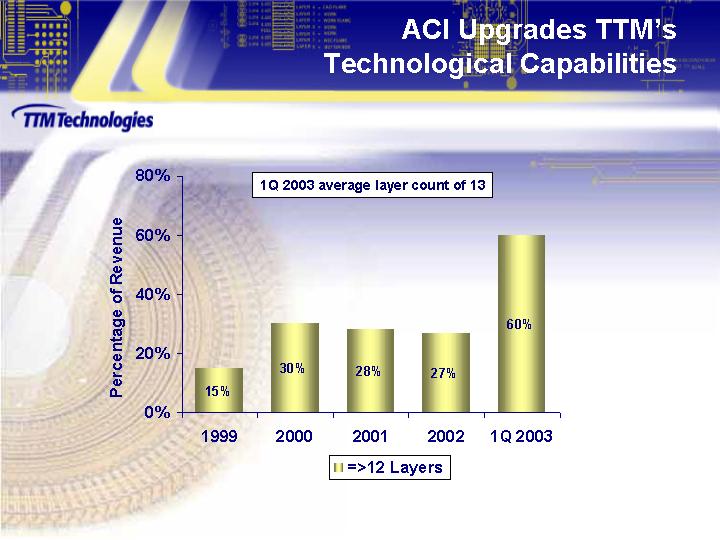

ACI Upgrades TTM’s

Technological Capabilities

[CHART]

1Q 2003 average layer count of 13

Recognized by

Industry Leaders

OEMs | | EMS Providers | |

[LOGOS] | | [LOGOS] | |

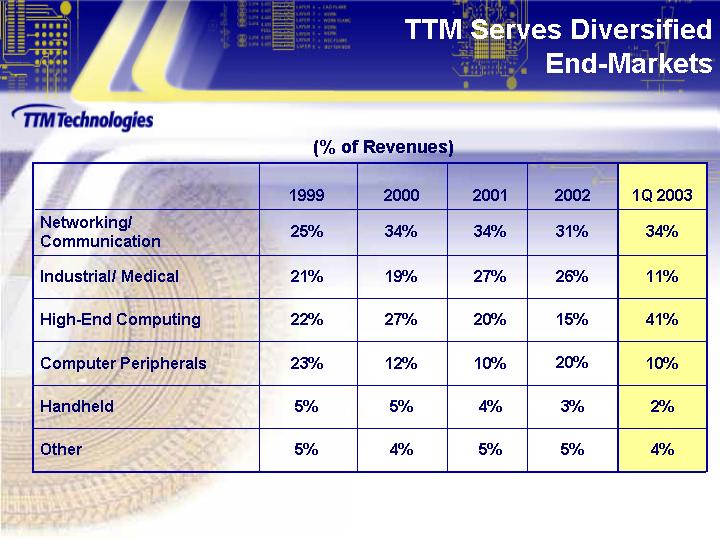

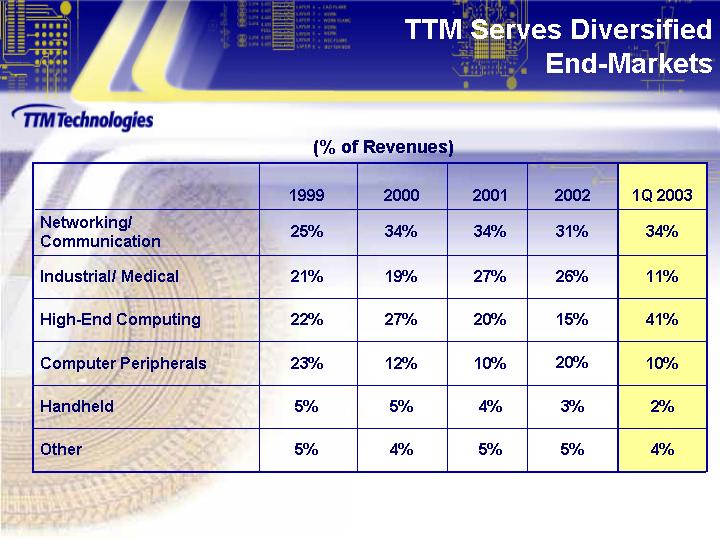

TTM Serves Diversified

End-Markets

(% of Revenues)

| | 1999 | | 2000 | | 2001 | | 2002 | | 1Q 2003 | |

Networking/ Communication | | 25% | | 34% | | 34% | | 31% | | 34% | |

| | | | | | | | | | | |

Industrial/ Medical | | 21% | | 19% | | 27% | | 26% | | 11% | |

| | | | | | | | | | | |

High-End Computing | | 22% | | 27% | | 20% | | 15% | | 41% | |

| | | | | | | | | | | |

Computer Peripherals | | 23% | | 12% | | 10% | | 20% | | 10% | |

| | | | | | | | | | | |

Handheld | | 5% | | 5% | | 4% | | 3% | | 2% | |

| | | | | | | | | | | |

Other | | 5% | | 4% | | 5% | | 5% | | 4% | |

Future Acquisition Strategy

• Niche-oriented

• Expand quick-turn market share

• Expand specialty materials opportunities with military / aerospace end-market exposure

• Develop profitable Asian relationship

• Focus on PCB manufacturing

Stacey Peterson

Chief Financial Officer

Historical Sales Growth

[CHART]

* Pro forma estimates include annualized fourth quarter revenues for ACI combined with 2002 full year results for remaining TTM divisions

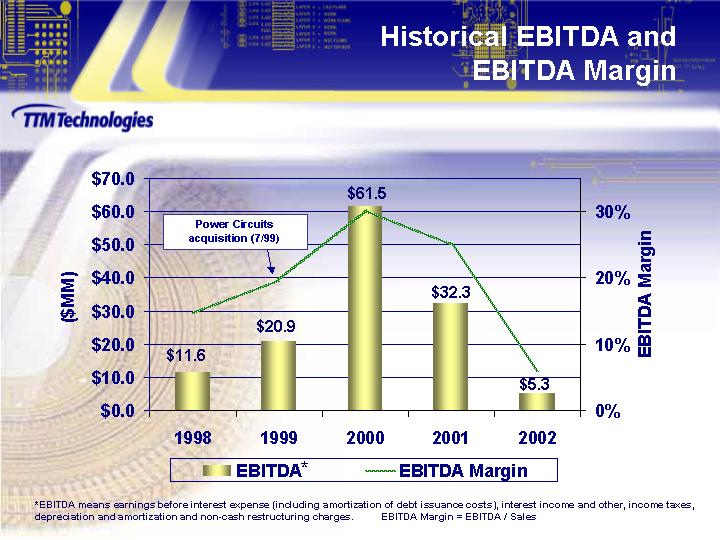

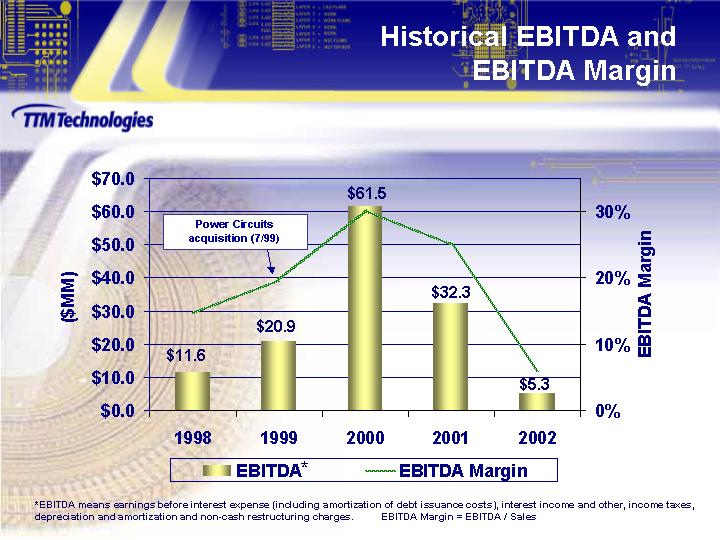

Historical EBITDA and

EBITDA Margin

[CHART]

* EBITDA means earnings before interest expense (including amortization of debt issuance costs), interest income and other, income taxes, depreciation and amortization and non-cash restructuring charges. EBITDA Margin = EBITDA / Sales

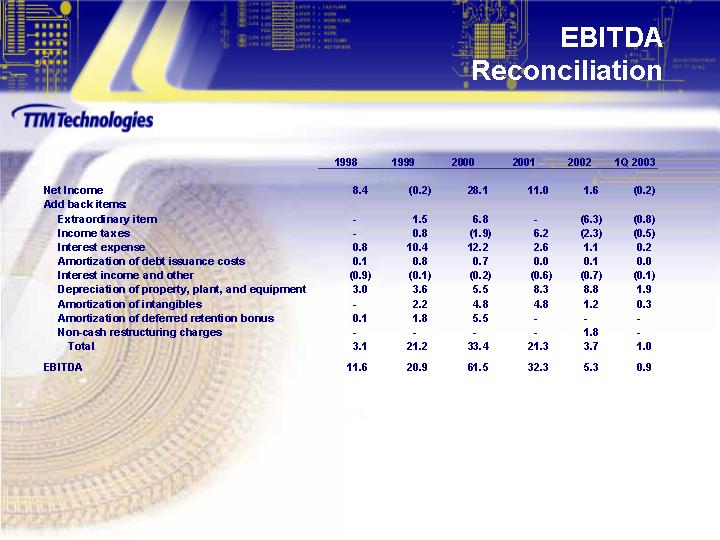

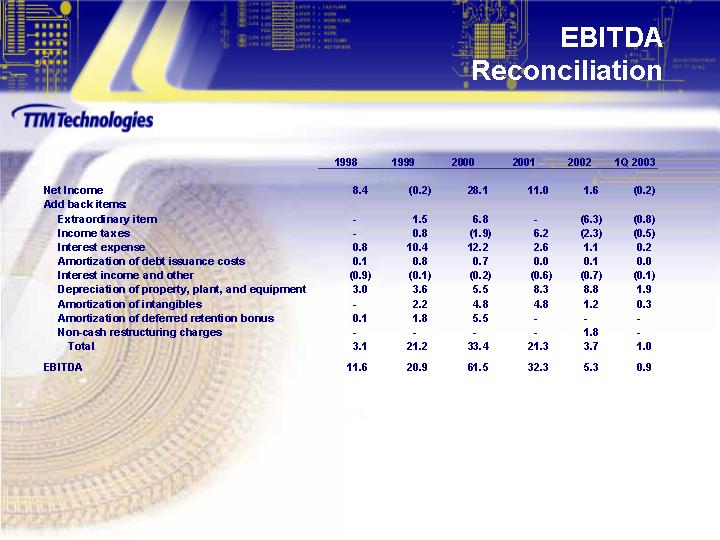

EBITDA

Reconciliation

| | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 1Q 2003 | |

Net Income | | 8.4 | | (0.2) | | 28.1 | | 11.0 | | 1.6 | | (0.2) | |

Add back items: | | | | | | | | | | | | | |

Extraordinary item | | — | | 1.5 | | 6.8 | | — | | (6.3) | | (0.8) | |

Income taxes | | — | | 0.8 | | (1.9) | | 6.2 | | (2.3) | | (0.5) | |

Interest expense | | 0.8 | | 10.4 | | 12.2 | | 2.6 | | 1.1 | | 0.2 | |

Amortization of debt issuance costs | | 0.1 | | 0.8 | | 0.7 | | 0.0 | | 0.1 | | 0.0 | |

Interest income and other | | (0.9) | | (0.1) | | (0.2) | | (0.6) | | (0.7) | | (0.1) | |

Depreciation of property, plant, and equipment | | 3.0 | | 3.6 | | 5.5 | | 8.3 | | 8.8 | | 1.9 | |

Amortization of intangibles | | — | | 2.2 | | 4.8 | | 4.8 | | 1.2 | | 0.3 | |

Amortization of deferred retention bonus | | 0.1 | | 1.8 | | 5.5 | | — | | — | | — | |

Non-cash restructuring charges | | — | | — | | — | | — | | 1.8 | | — | |

Total | | 3.1 | | 21.2 | | 33.4 | | 21.3 | | 3.7 | | 1.0 | |

EBITDA | | 11.6 | | 20.9 | | 61.5 | | 32.3 | | 5.3 | | 0.9 | |

First Quarter 2003 Results

| | FIRST QUARTER | |

Dollars in millions, except per share data | | 2002 | | 2003 | |

Sales | | $ 23.7 | | $ 39.6 | |

| | | | | |

Gross Profit | | 2.6 | | 4.5 | |

| | | | | |

Operating Profit | | (0.2) | | (1.3) | |

| | | | | |

Net Income Before Extraordinary* | | (0.3) | | (0.8) | |

| | | | | |

EPS Before Extraordinary* | | $ (0.01) | | $ (0.02) | |

| | | | | |

Operating Cash Flow | | $ 3.9 | | $ 7.8 | |

| | | | | |

Inventory Turns | | 26x | | 14x | |

* 1Q 2003 results includes $203,000 restructuring charge and are before extraordinary gain of $824,000, related to acquisition of ACI

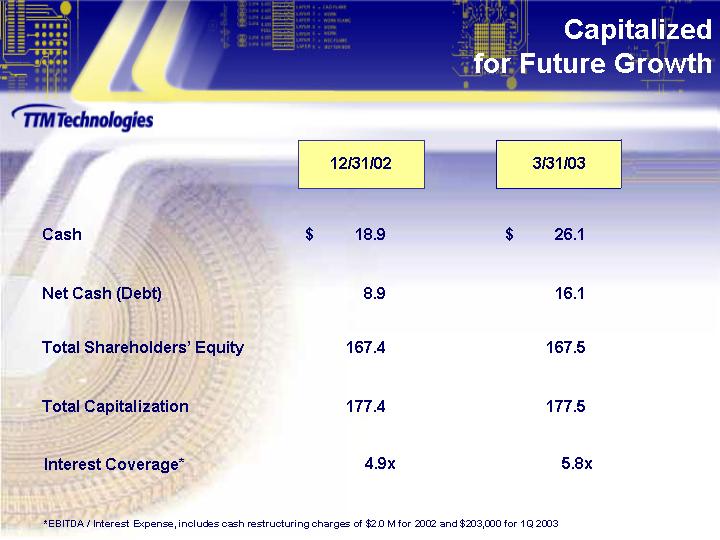

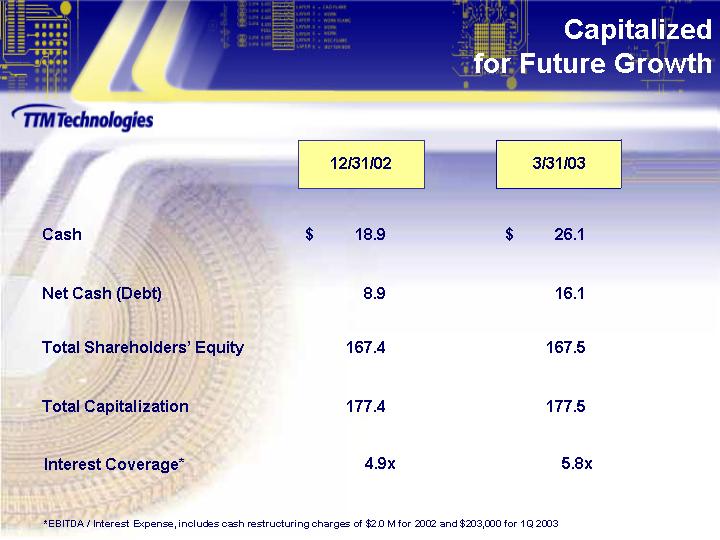

Capitalized

for Future Growth

| | 12/31/02 | | 3/31/03 | |

Cash | | $ 18.9 | | $ 26.1 | |

| | | | | |

Net Cash (Debt) | | 8.9 | | 16.1 | |

| | | | | |

Total Shareholders’ Equity | | 167.4 | | 167.5 | |

| | | | | |

Total Capitalization | | 177.4 | | 177.5 | |

| | | | | |

Interest Coverage* | | 4.9x | | 5.8x | |

* EBITDA / Interest Expense, includes cash restructuring charges of $2.0 M for 2002 and $203,000 for 1Q 2003

Conclusion

• Proven, industry-leading execution

• ACI acquisition establishes TTM as leading technology provider

• Well-positioned for industry recovery as one of the largest U.S. PCB fabricators

• Investing in “time” and “technology”

• Positioned to gain market share as industry “winner”

• Strong balance sheet

[LOGO]