Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

RBC Capital Markets

North American Technology Conference 2004

[LOGO] | | Safe Harbor Provision |

During the course of this presentation, we will make projections or other forward-looking statements regarding future events or the future financial performance of the Company. We wish to caution you that such statements reflect only our current expectations, and that actual events or results may differ materially.

We refer you to the risk factors and cautionary language contained in the documents that the Company files from time to time with the Securities and Exchange Commission, specifically the Company’s most recent S-3 Registration Statement and Form 10-K. Such documents contain and identify important factors that could cause the actual results to differ materially from those contained in our projections or forward-looking statements. We undertake no obligation to update such projections or such forward-looking statements in the future.

2

Kent Alder

President

and

Chief Executive Officer

3

Company Overview

TTM is a leading provider of time-critical and technologically complex printed circuit boards to the world’s leading electronic equipment designers and manufacturers

[GRAPHIC]

• “Pure Play” printed circuit board (PCB) manufacturer

• Focused on time (24 hrs to 10 days) & technology service segments

• Three integrated, mission-focused production facilities:

• Santa Ana, CA

• Redmond, WA

• Chippewa Falls, WI

• $119.3 million in first half 2004 sales

• 1,613 employees

4

Investment Highlights

Focused Strategy &

Leading Market Position | | • Leader in most attractive PCB segments – time & technology • Mission-focused facilities – speed, flexibility and technology |

| | |

Demonstrated

Execution Excellence | | • Strong relationships with leading OEM and EMS customers • Proven ability to integrate acquisitions • Cross-selling efforts leading to success |

| | |

Industry Leading

Financial Performance | | • Profitable business model across cycle • Strong balance sheet |

Market Leadership. . .Focus. . . Execution. .. . Performance

5

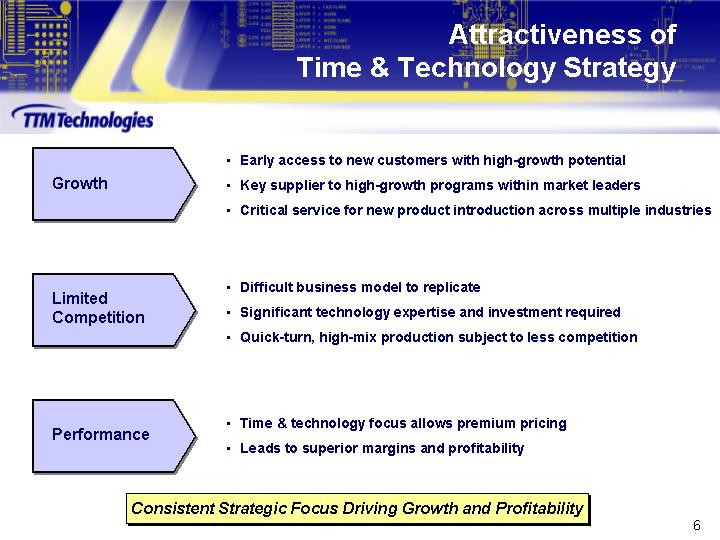

Attractiveness of Time & Technology Strategy

Growth | | • Early access to new customers with high-growth potential • Key supplier to high-growth programs within market leaders • Critical service for new product introduction across multiple industries |

| | |

Limited

Competition | | • Difficult business model to replicate • Significant technology expertise and investment required • Quick-turn, high-mix production subject to less competition |

| | |

Performance | | • Time & technology focus allows premium pricing • Leads to superior margins and profitability |

Consistent Strategic Focus Driving Growth and Profitability

6

Industry Overview

7

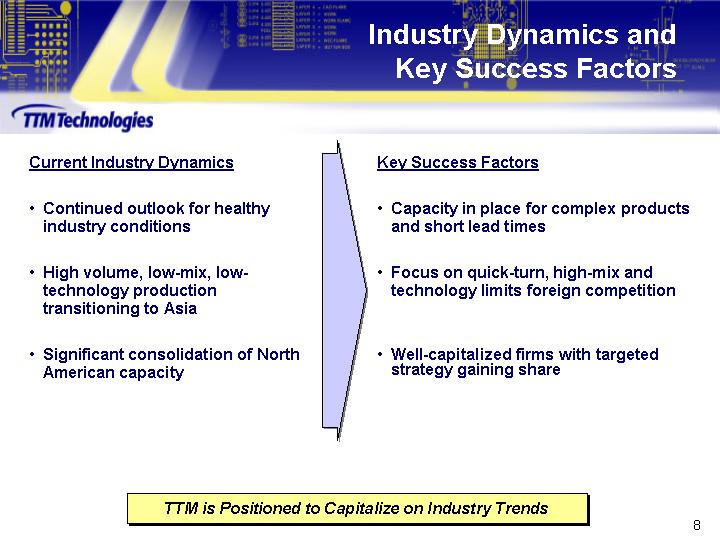

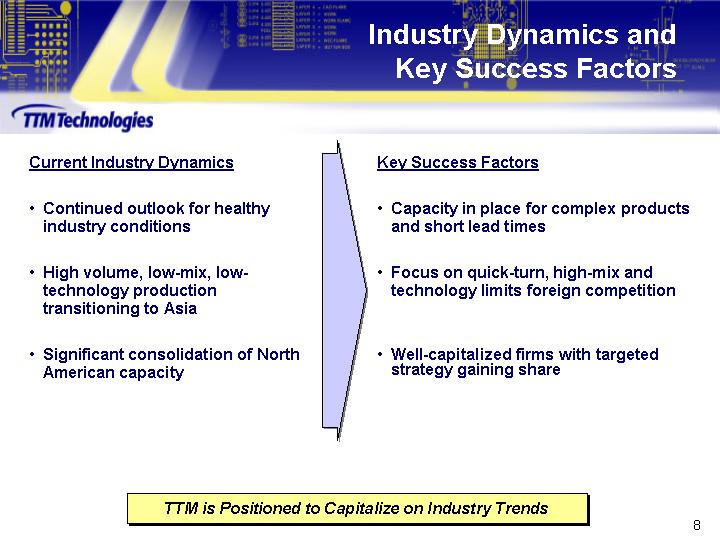

Industry Dynamics and Key Success Factors

Current Industry Dynamics

• Continued outlook for healthy industry conditions

• High volume, low-mix, low-technology production transitioning to Asia

• Significant consolidation of North American capacity

Key Success Factors

• Capacity in place for complex products and short lead times

• Focus on quick-turn, high-mix and technology limits foreign competition

• Well-capitalized firms with targeted strategy gaining share

TTM is Positioned to Capitalize on Industry Trends

8

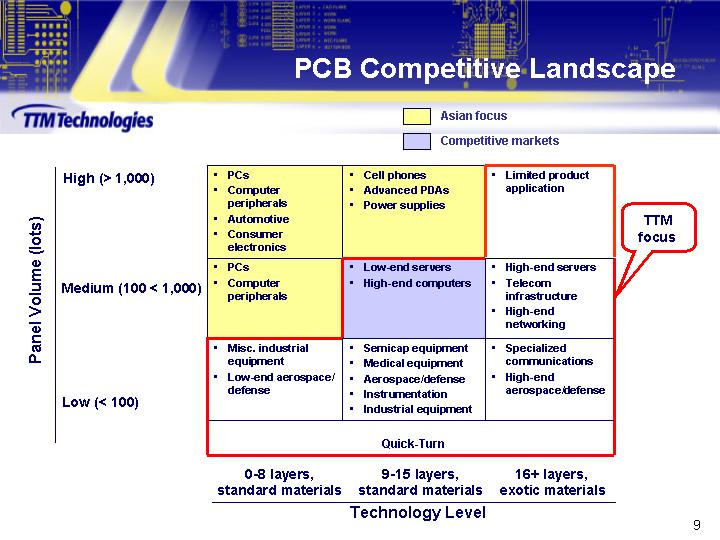

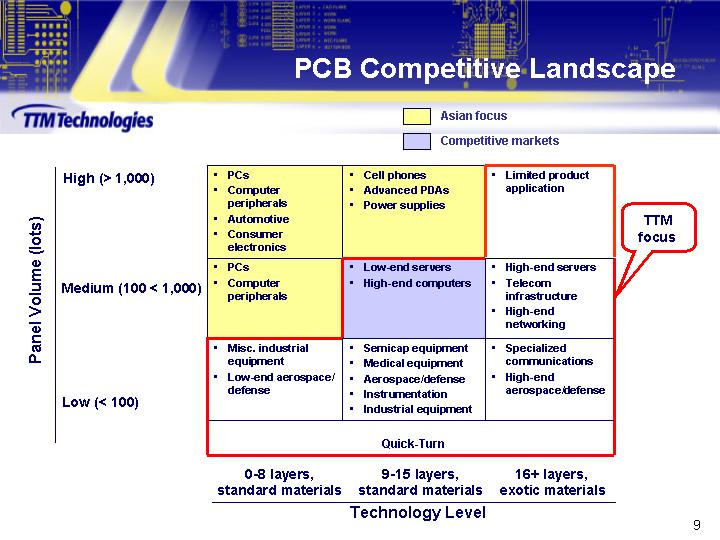

PCB Competitive Landscape

Panel Volume (lots)

| | Technology Level | |

| | 0-8 layers,

standard materials | | 9-15 layers,

standard materials | | 16+ layers,

exotic materials | |

High (> 1,000) | | • PCs • Computer peripherals • Automotive • Consumer electronics | | • Cell phones • Advanced PDAs • Power supplies | | • Limited product application | |

| | | | | | | |

Medium (100 < 1,000) | | • PCs • Computer peripherals | | • Low-end servers • High-end computers | | • High-end servers • Telecom infrastructure • High-end networking | TTM

focus |

| | | | | | | |

Low (< 100) | | • Misc. industrial equipment • Low-end aerospace/defense | | • Semicap equipment • Medical equipment • Aerospace/defense • Instrumentation • Industrial equipment | | • Specialized communications • High-end aerospace/defense | |

Quick-Turn

9

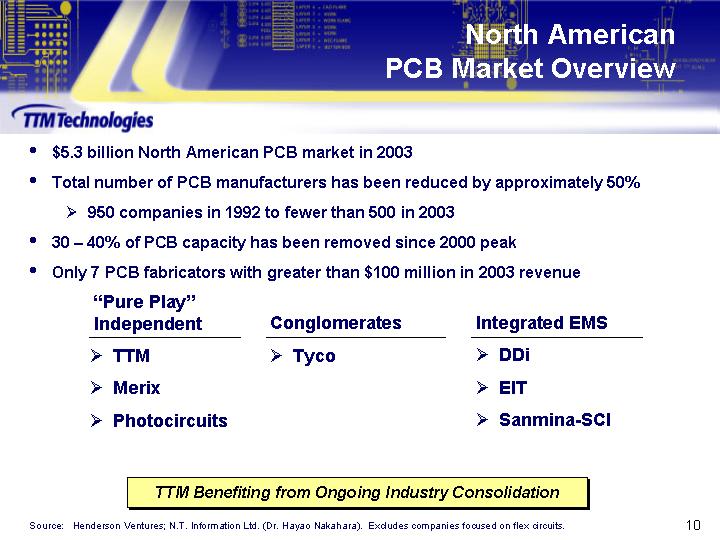

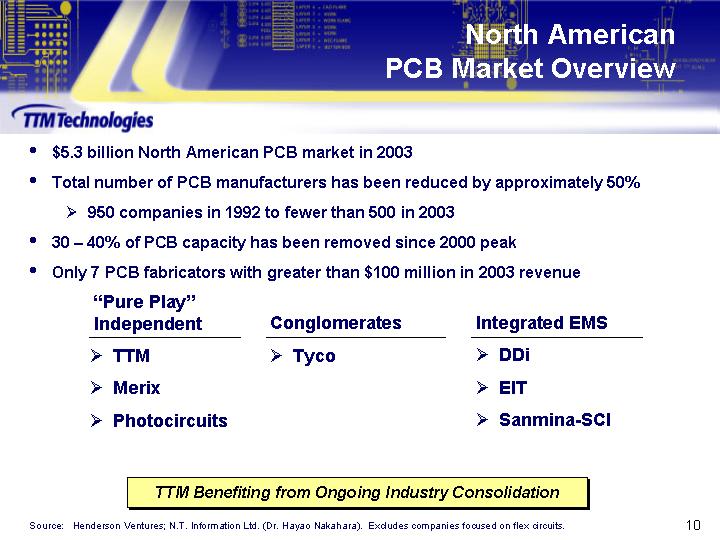

North American PCB Market Overview

• $5.3 billion North American PCB market in 2003

• Total number of PCB manufacturers has been reduced by approximately 50%

• 950 companies in 1992 to fewer than 500 in 2003

• 30 – 40% of PCB capacity has been removed since 2000 peak

• Only 7 PCB fabricators with greater than $100 million in 2003 revenue

“Pure Play”

Independent | | Conglomerates | | Integrated EMS | |

• TTM | | • Tyco | | • DDi | |

• Merix | | | | • EIT | |

• Photocircuits | | | | • Sanmina-SCI | |

TTM Benefiting from Ongoing Industry Consolidation

Source: Henderson Ventures; N.T. Information Ltd. (Dr. Hayao Nakahara). Excludes companies focused on flex circuits.

10

TTM’s Strategy

11

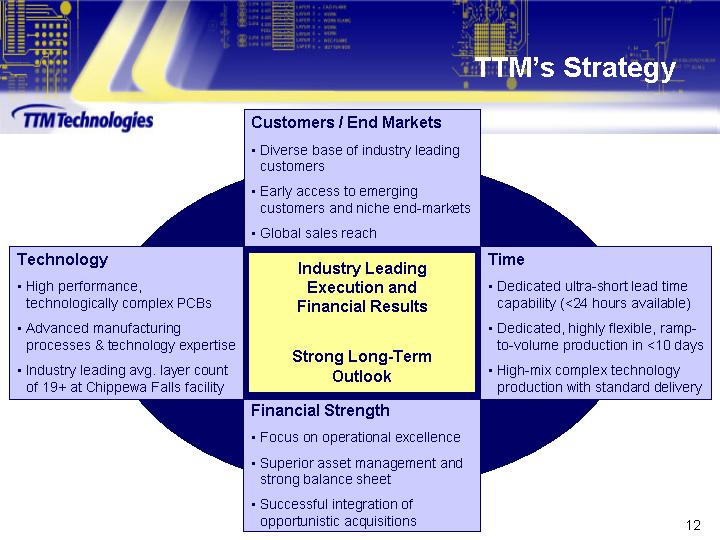

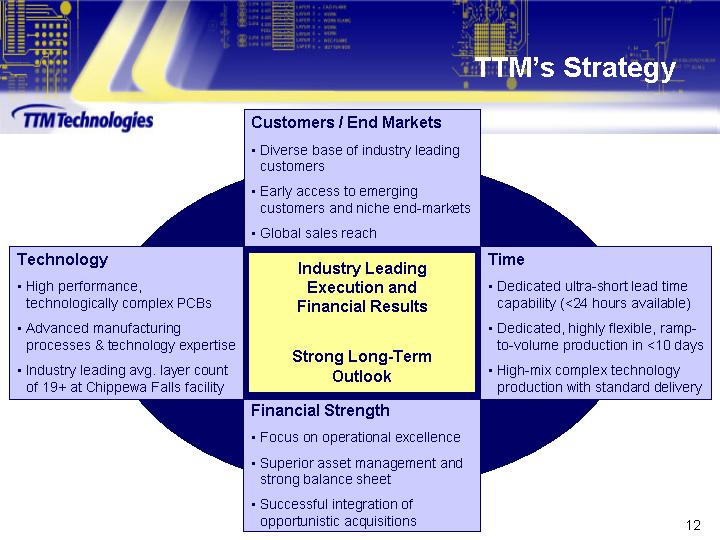

TTM’s Strategy

Industry Leading Execution and Financial Results

Strong Long-Term Outlook

Customers / End Markets

• Diverse base of industry leading customers

• Early access to emerging customers and niche end-markets

• Global sales reach

Time

• Dedicated ultra-short lead time capability (<24 hours available)

• Dedicated, highly flexible, ramp-to-volume production in <10 days

• High-mix complex technology production with standard delivery

Financial Strength

• Focus on operational excellence

• Superior asset management and strong balance sheet

• Successful integration of opportunistic acquisitions

Technology

• High performance, technologically complex PCBs

• Advanced manufacturing processes & technology expertise

• Industry leading avg. layer count of 19+ at Chippewa Falls facility

12

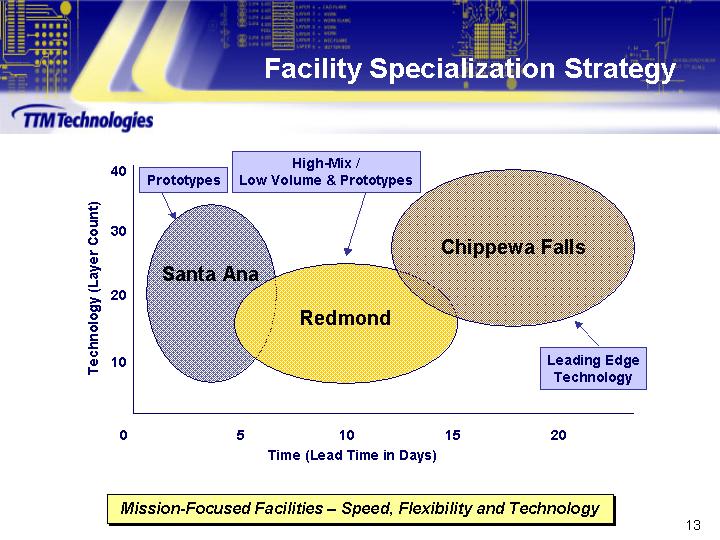

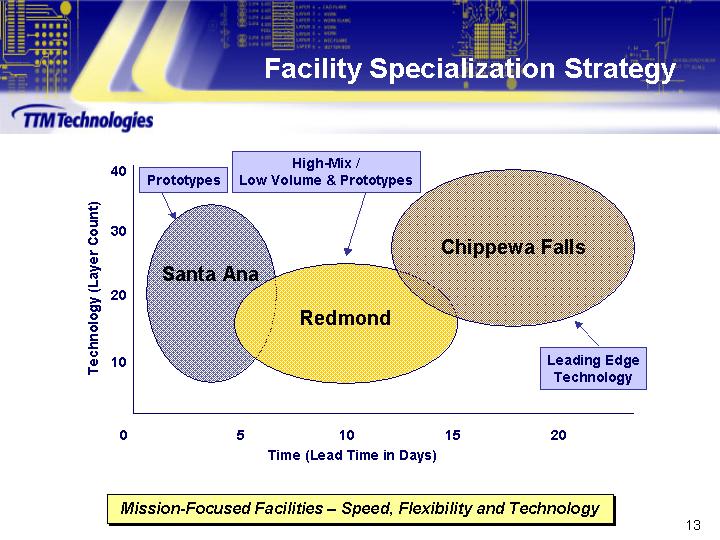

Facility Specialization Strategy

[CHART]

Mission-Focused Facilities – Speed, Flexibility and Technology

13

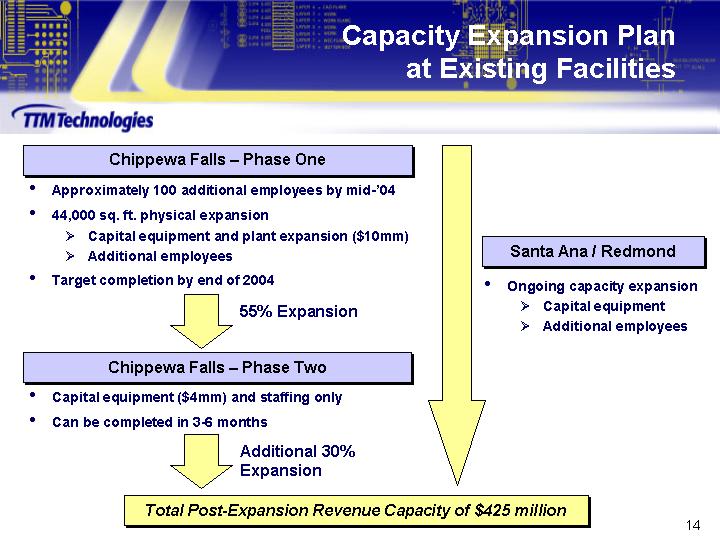

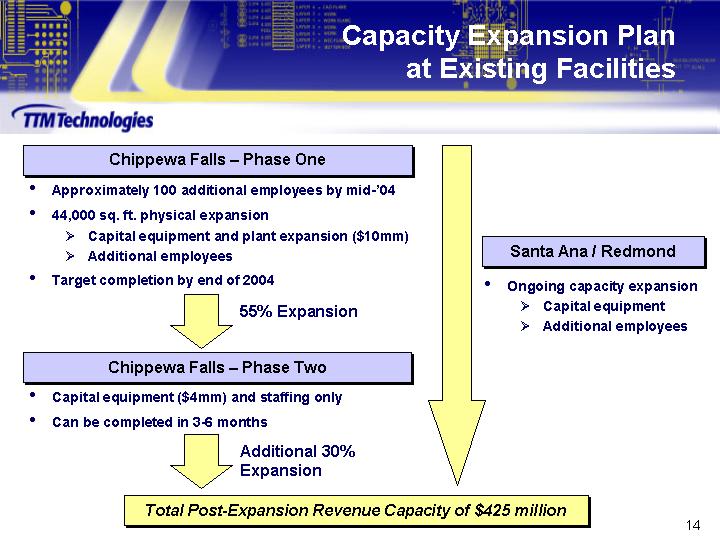

Capacity Expansion Plan at Existing Facilities

Chippewa Falls – Phase One

• Approximately 100 additional employees by mid-’04

• 44,000 sq. ft. physical expansion

• Capital equipment and plant expansion ($10mm)

• Additional employees

• Target completion by end of 2004

55% Expansion

Chippewa Falls – Phase Two

• Capital equipment ($4mm) and staffing only

• Can be completed in 3-6 months

Additional 30% Expansion

Santa Ana / Redmond

• Ongoing capacity expansion

• Capital equipment

• Additional employees

Total Post-Expansion Revenue Capacity of $425 million

14

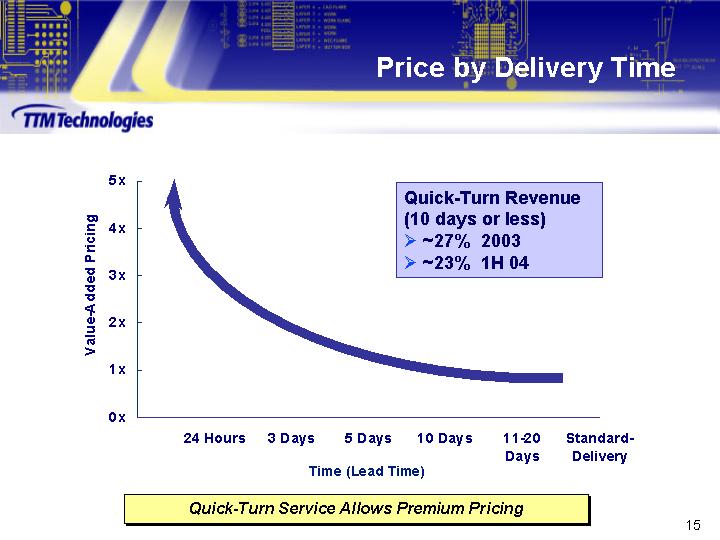

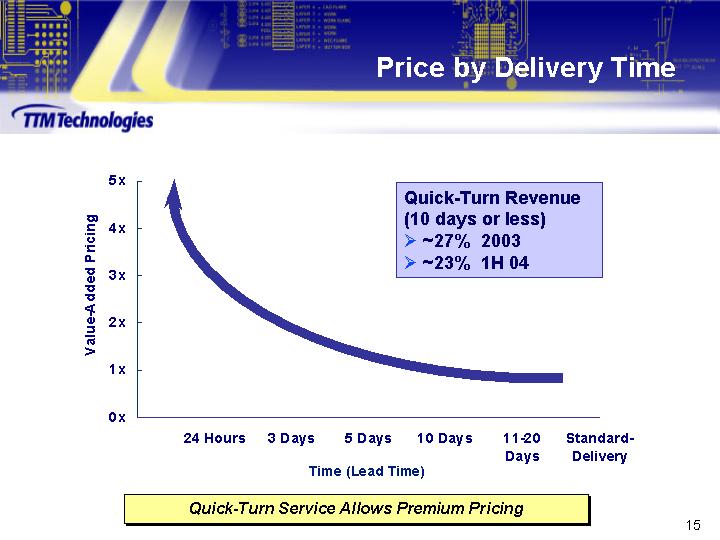

Price by Delivery Time

[CHART]

Quick-Turn Revenue

(10 days or less)

• ~27% 2003

• ~23% 1H 04

Quick-Turn Service Allows Premium Pricing

15

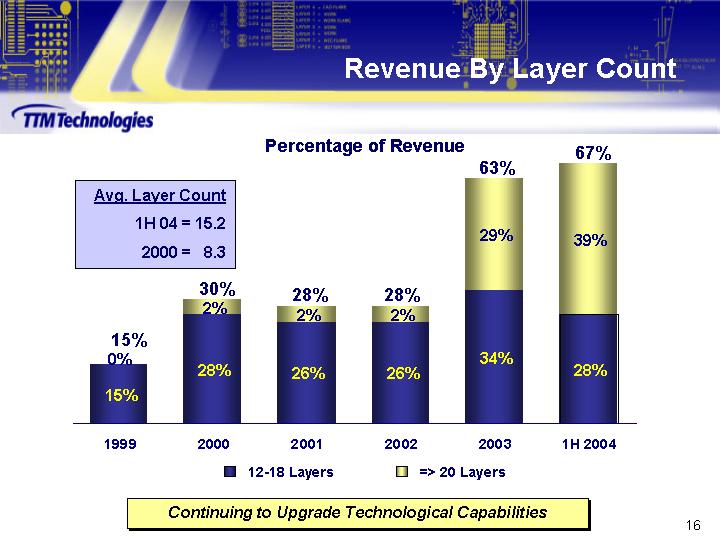

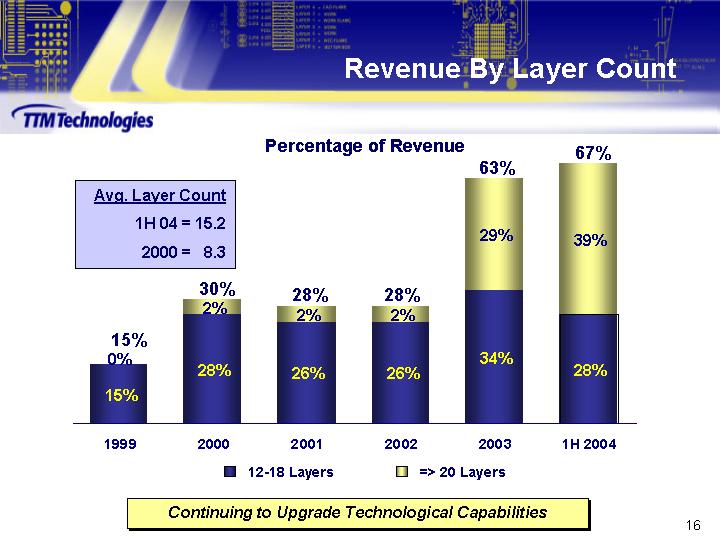

Revenue By Layer Count

Percentage of Revenue

[CHART]

Avg. Layer Count | | |

1H 04 | = | 15.2 | | |

2000 | = | 8.3 | | |

Continuing to Upgrade Technological Capabilities

16

Global Sales Reach

| | TTM Shipments

by Geography

1H 2004 | | Sales | | Technical

Support | | Inventory

Hub | |

| | | | | | | | | |

Europe | | 9 | % | 3 | | 1 | | 2 | |

| | | | | | | | | |

Asia & ROW | | 12 | % | 5 | | 1 | | 1 | |

| | | | | | | | | |

North America | | 79 | % | 86 | | 8 | | 4 | |

| | | | | | | | | |

Total | | | | 94 | | 10 | | 7 | |

Integrated Direct and Rep Network Driving Incremental Sales

17

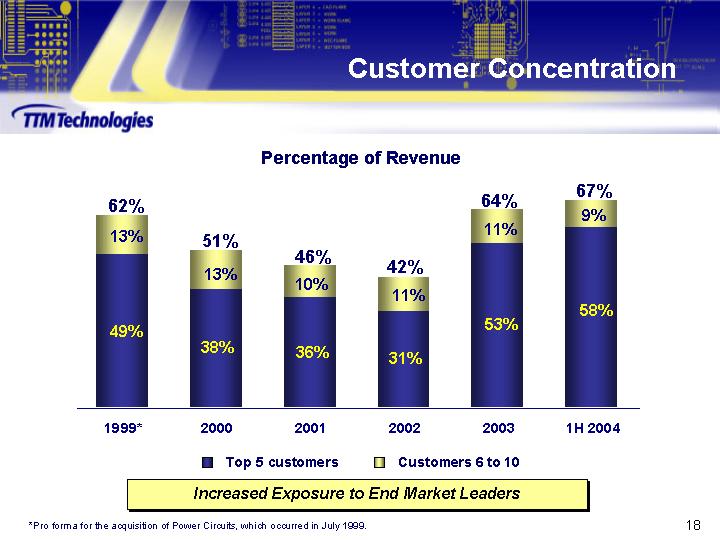

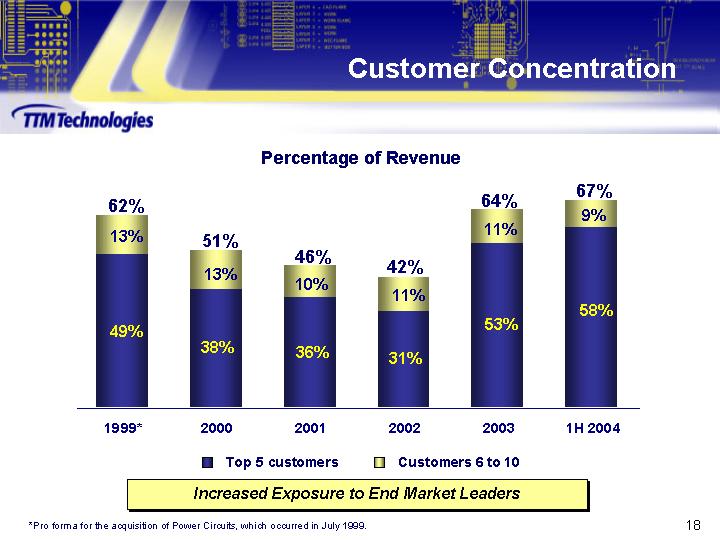

Customer Concentration

Percentage of Revenue

[CHART]

Increased Exposure to End Market Leaders

*Pro forma for the acquisition of Power Circuits, which occurred in July 1999.

18

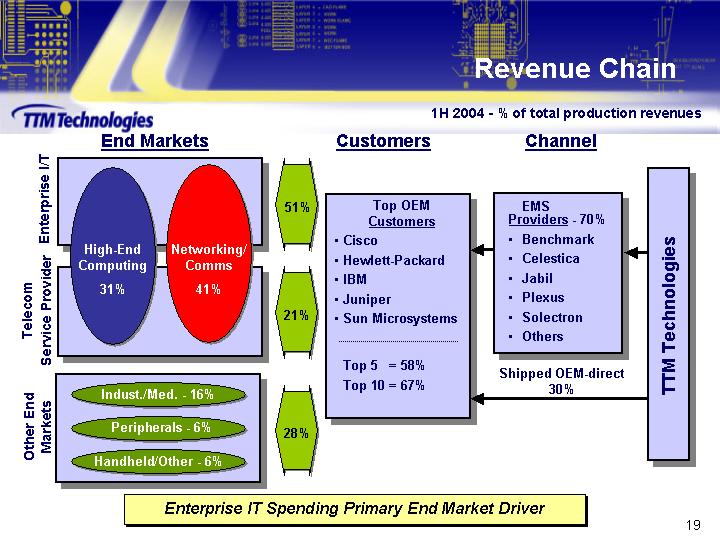

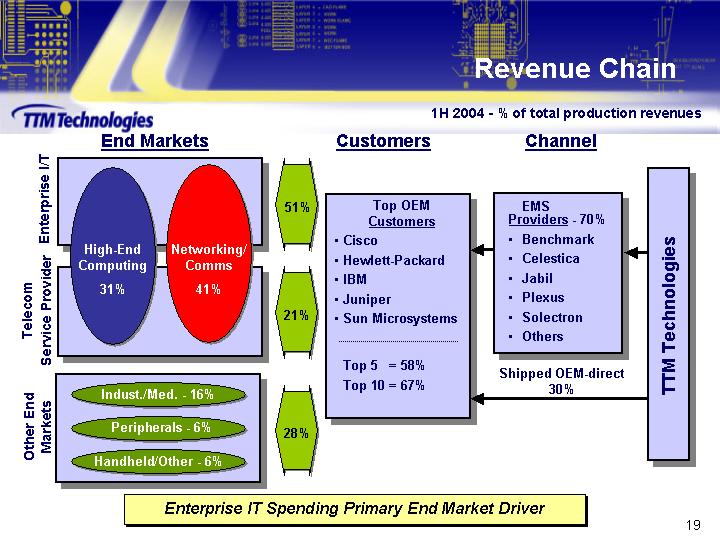

Revenue Chain

1H 2004 - % of total production revenues

End Markets

Enterprise I/T

51%

Telecom Service Provider

21%

High-End Computing

31%

Networking/Comms

41%

Other End Markets

28%

Indust./Med. - 16%

Peripherals - 6%

Handheld/Other - 6%

TTM Technologies

Customers

Top OEM Customers

• Cisco

• Hewlett-Packard

• IBM

• Juniper

• Sun Microsystems

Top 5 = 58%

Top 10 = 67%

Shipped OEM-direct

30%

Channel

EMS Providers - - 70%

• Benchmark

• Celestica

• Jabil

• Plexus

• Solectron

• Others

Enterprise IT Spending Primary End Market Driver

19

Key Customers by End Market

Percentage of Revenue by End Market – 1H 2004

Networking &

Communications | | 41 | % | | [LOGO] |

| | | | | |

High-End

Computing | | 31 | % | | [LOGO] |

| | | | | |

Industrial &

Medical | | 16 | % | | [LOGO] |

| | | | | |

Computer

Peripherals | | 6 | % | | [LOGO] |

| | | | | |

Handheld &

Other | | 6 | % | | [LOGO] |

Leading Positions with Industry Leaders. . .

Approximately 600 Active Customers

20

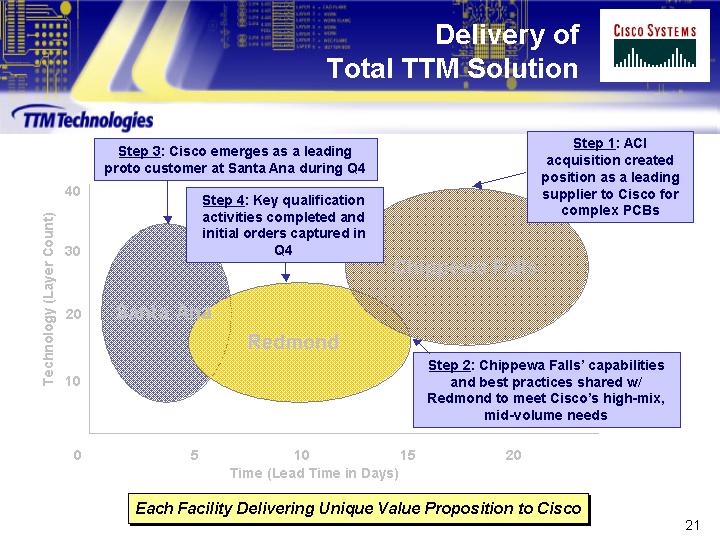

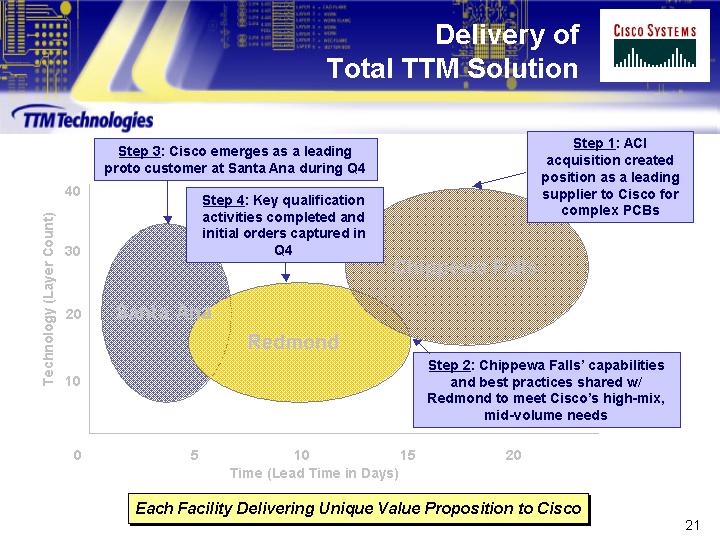

Delivery of Total TTM Solution

[LOGO]

[CHART]

Each Facility Delivering Unique Value Proposition to Cisco

21

Compelling Growth Opportunities

• One-stop manufacturing solution with numerous cross-selling opportunities

• Quick-turn capabilities for attracting emerging high-growth customers

• Leadership in technology and advanced manufacturing processes

• Capacity available through low risk, low cost expansion plan

• Successful track record of completing and integrating acquisitions

22

Stacey Peterson

Chief Financial Officer

23

Annual Sales

Sales ($mm)

[CHART]

24

Quarterly Sales

Sales ($mm)

[CHART]

25

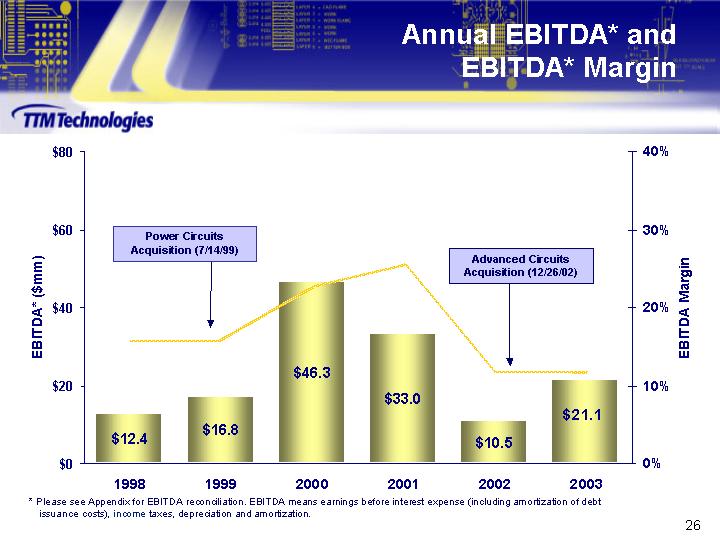

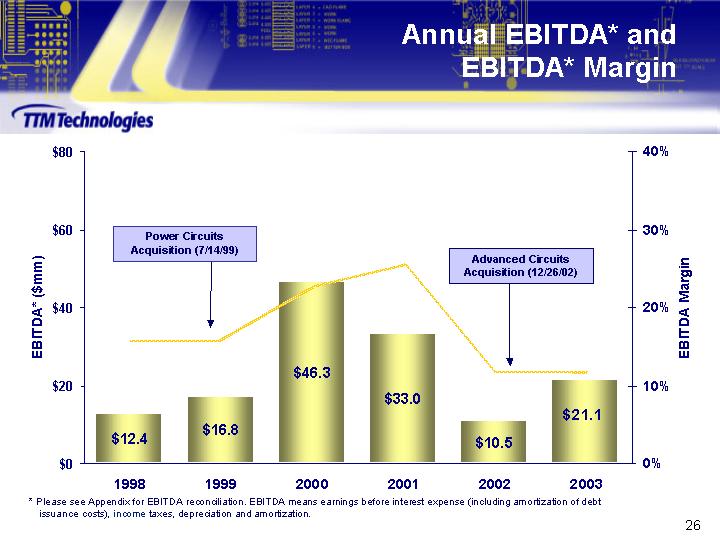

Annual EBITDA* and EBITDA* Margin

[CHART]

* Please see Appendix for EBITDA reconciliation. EBITDA means earnings before interest expense (including amortization of debt issuance costs), income taxes, depreciation and amortization.

26

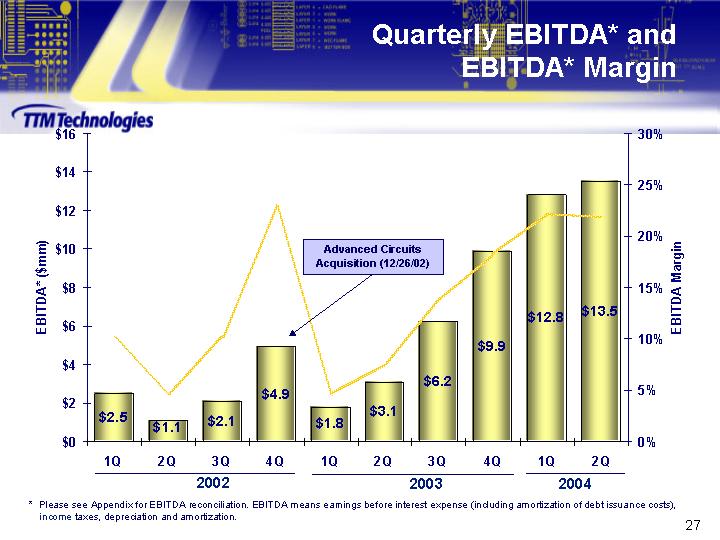

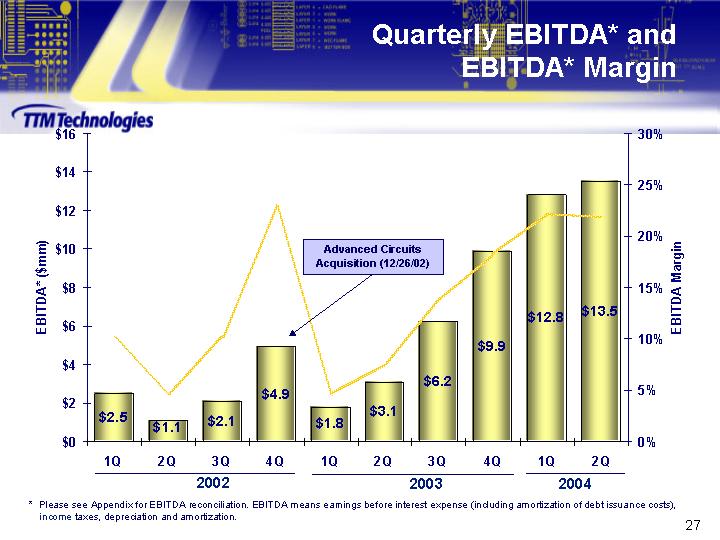

Quarterly EBITDA* and EBITDA* Margin

[CHART]

* Please see Appendix for EBITDA reconciliation. EBITDA means earnings before interest expense (including amortization of debt issuance costs), income taxes, depreciation and amortization.

27

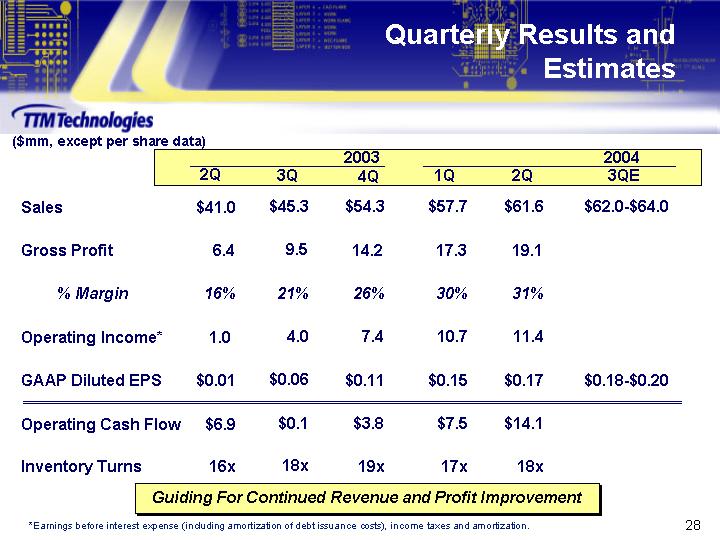

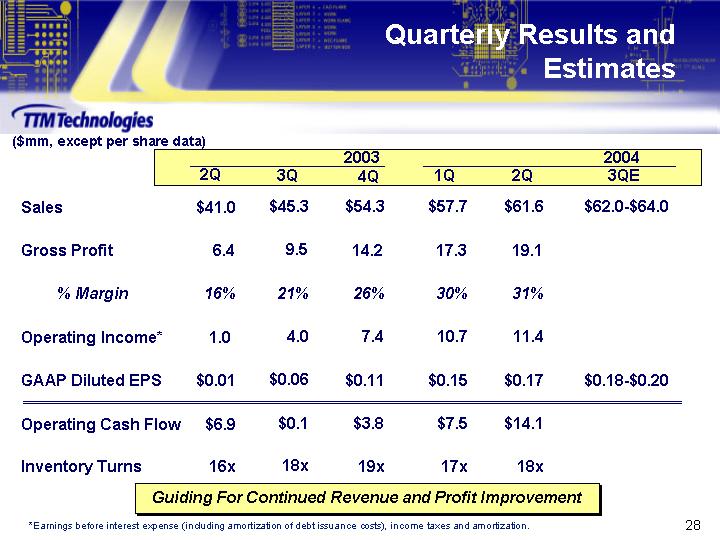

Quarterly Results and Estimates

($mm, except per share data)

| | 2003 | | 2004 | |

| | 2Q | | 3Q | | 4Q | | 1Q | | 2Q | | 3QE | |

Sales | | $ | 41.0 | | $ | 45.3 | | $ | 54.3 | | $ | 57.7 | | $ | 61.6 | | $62.0-$64.0 | |

| | | | | | | | | | | | | |

Gross Profit | | 6.4 | | 9.5 | | 14.2 | | 17.3 | | 19.1 | | | |

| | | | | | | | | | | | | |

% Margin | | 16 | % | 21 | % | 26 | % | 30 | % | 31 | % | | |

| | | | | | | | | | | | | |

Operating Income* | | 1.0 | | 4.0 | | 7.4 | | 10.7 | | 11.4 | | | |

| | | | | | | | | | | | | |

GAAP Diluted EPS | | $ | 0.01 | | $ | 0.06 | | $ | 0.11 | | $ | 0.15 | | $ | 0.17 | | $0.18-$0.20 | |

| | | | | | | | | | | | | |

Operating Cash Flow | | $ | 6.9 | | $ | 0.1 | | $ | 3.8 | | $ | 7.5 | | $ | 14.1 | | | |

| | | | | | | | | | | | | |

Inventory Turns | | 16 | x | 18 | x | 19 | x | 17 | x | 18 | x | | |

Guiding For Continued Revenue and Profit Improvement

*Earnings before interest expense (including amortization of debt issuance costs), income taxes and amortization.

28

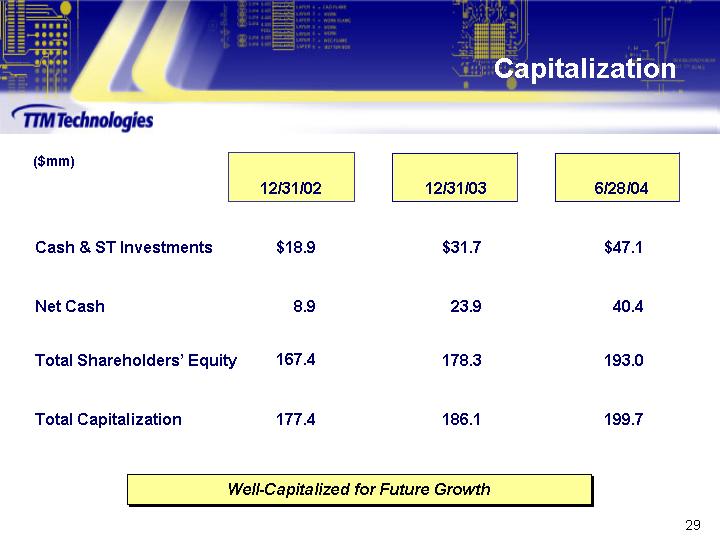

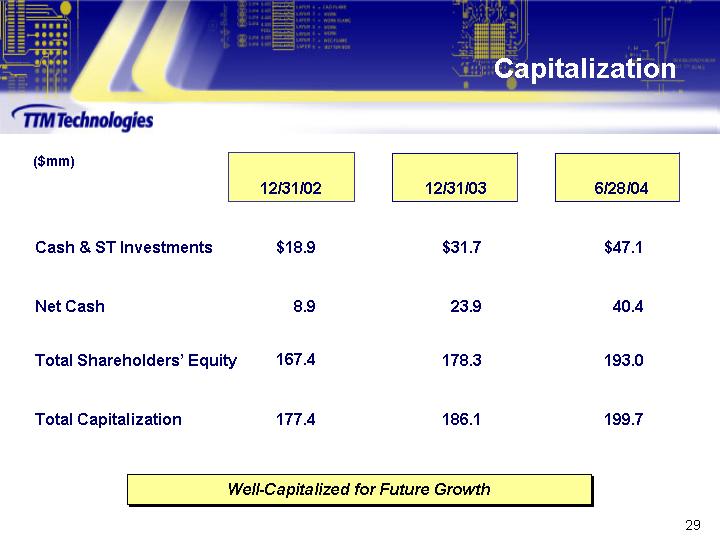

Capitalization

($mm)

| | 12/31/02 | | 12/31/03 | | 6/28/04 | |

| | | | | | | |

Cash & ST Investments | | $ | 18.9 | | $ | 31.7 | | $ | 47.1 | |

| | | | | | | |

Net Cash | | 8.9 | | 23.9 | | 40.4 | |

| | | | | | | |

Total Shareholders’ Equity | | 167.4 | | 178.3 | | 193.0 | |

| | | | | | | |

Total Capitalization | | 177.4 | | 186.1 | | 199.7 | |

| | | | | | | | | | |

Well-Capitalized for Future Growth

29

Conclusion

• Solid industry fundamentals

• Focused strategy and strong market position

• Demonstrated execution excellence

• Industry leading financial performance

30

[LOGO]

31

Appendix

Appendix

32

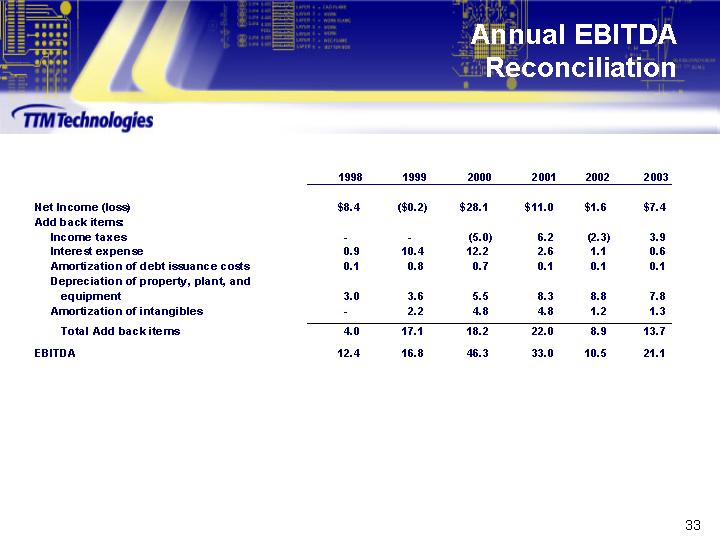

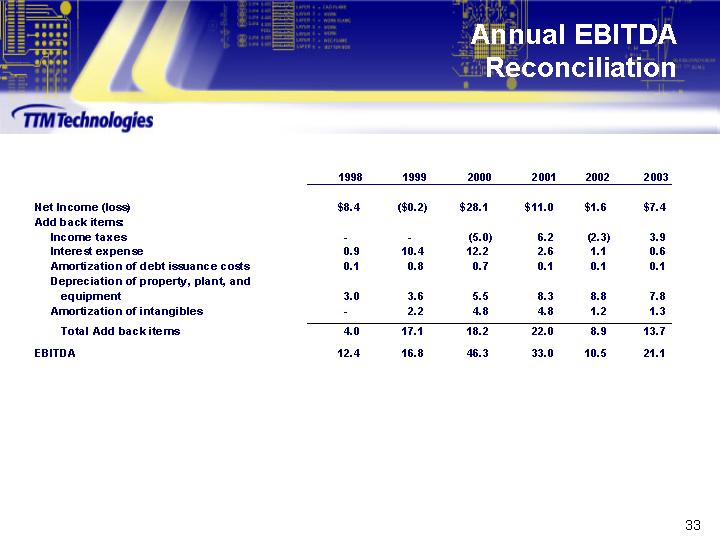

Annual EBITDA Reconciliation

| | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | |

| | | | | | | | | | | | | |

Net Income (loss) | | $ | 8.4 | | $ | (0.2 | ) | $ | 28.1 | | $ | 11.0 | | $ | 1.6 | | $ | 7.4 | |

Add back items: | | | | | | | | | | | | | |

Income taxes | | — | | — | | (5.0 | ) | 6.2 | | (2.3 | ) | 3.9 | |

Interest expense | | 0.9 | | 10.4 | | 12.2 | | 2.6 | | 1.1 | | 0.6 | |

Amortization of debt issuance costs | | 0.1 | | 0.8 | | 0.7 | | 0.1 | | 0.1 | | 0.1 | |

Depreciation of property, plant, and equipment | | 3.0 | | 3.6 | | 5.5 | | 8.3 | | 8.8 | | 7.8 | |

Amortization of intangibles | | — | | 2.2 | | 4.8 | | 4.8 | | 1.2 | | 1.3 | |

Total Add back items | | 4.0 | | 17.1 | | 18.2 | | 22.0 | | 8.9 | | 13.7 | |

| | | | | | | | | | | | | |

EBITDA | | 12.4 | | 16.8 | | 46.3 | | 33.0 | | 10.5 | | 21.1 | |

| | | | | | | | | | | | | | | | | | | |

33

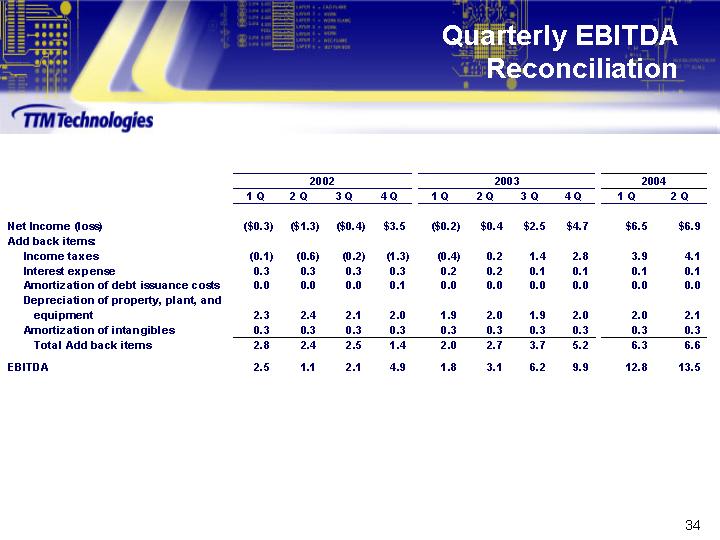

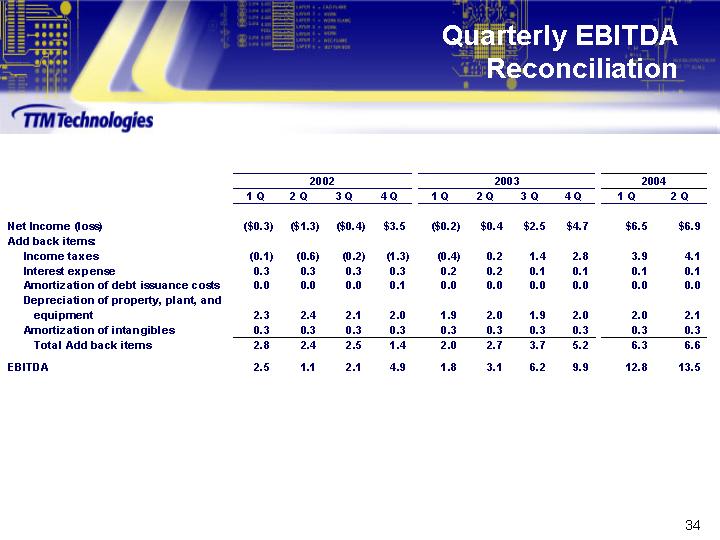

Quarterly EBITDA Reconciliation

| | 2002 | | 2003 | | 2004 | |

| | 1 Q | | 2 Q | | 3 Q | | 4 Q | | 1 Q | | 2 Q | | 3 Q | | 4 Q | | 1 Q | | 2 Q | |

| | | | | | | | | | | | | | | | | | | | | |

Net Income (loss) | | $ | (0.3 | ) | $ | (1.3 | ) | $ | (0.4 | ) | $ | 3.5 | | $ | (0.2 | ) | $ | 0.4 | | $ | 2.5 | | $ | 4.7 | | $ | 6.5 | | $ | 6.9 | |

Add back items: | | | | | | | | | | | | | | | | | | | | | |

Income taxes | | (0.1 | ) | (0.6 | ) | (0.2 | ) | (1.3 | ) | (0.4 | ) | 0.2 | | 1.4 | | 2.8 | | 3.9 | | 4.1 | |

Interest expense | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.2 | | 0.2 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | |

Amortization of debt issuance costs | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Depreciation of property, plant, and equipment | | 2.3 | | 2.4 | | 2.1 | | 2.0 | | 1.9 | | 2.0 | | 1.9 | | 2.0 | | 2.0 | | 2.1 | |

Amortization of intangibles | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | |

Total Add back items | | 2.8 | | 2.4 | | 2.5 | | 1.4 | | 2.0 | | 2.7 | | 3.7 | | 5.2 | | 6.3 | | 6.6 | |

| | | | | | | | | | | | | | | | | | | | | |

EBITDA | | 2.5 | | 1.1 | | 2.1 | | 4.9 | | 1.8 | | 3.1 | | 6.2 | | 9.9 | | 12.8 | | 13.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

34