UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33870

NetSuite Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 94-3310471 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

2955 Campus Drive, Suite 100

San Mateo, CA

94403-2511

(Address of principal executive offices, including zip code)

(650) 627-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Common Stock, $0.01 par value | | New York Stock Exchange, Inc. |

| (Title of class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

¨ Large accelerated filer ¨ Accelerated filer x Non-accelerated filer (Do not check if a smaller reporting company)¨ Smaller reporting company

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

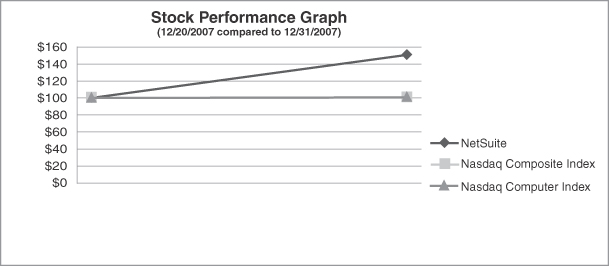

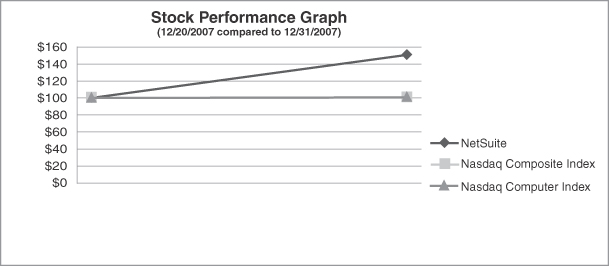

As of June 30, 2007, the last business day of our most recently completed second fiscal quarter; our common stock was not listed on any exchange or over-the-counter market. Our common stock began trading on the New York Stock Exchange on December 20, 2007. As of December 31, 2007, the aggregate market value of the voting stock held by non-affiliates was $309,731,260, based on the number of shares held by non-affiliates of the registrant as of December 31, 2007, and based on the reported last sale price of common stock on December 31, 2007. This calculation does not reflect a determination that persons are affiliates for any other purposes.

Number of shares of common stock outstanding as of February 29, 2008: 60,211,259.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its fiscal 2008 Annual Meeting of Stockholders to be filed within 120 days of the Registrant’s fiscal year ended December 31, 2007 are incorporated by reference into Part III.

TABLE OF CONTENTS

FORM 10-K

INDEX

2

PART I

Overview

We are a leading vendor of on-demand, integrated business management application suites that include Accounting / Enterprise Resource Planning, or ERP, Customer Relationship Management, or CRM, and Ecommerce software for small and medium-sized businesses and divisions of large companies. We enable customers to manage their critical back-office, front-office and web operations in a single application. Our suite serves as a single system for running business operations and is targeted at small and medium-sized businesses, or SMBs, as well as divisions of large companies. Our suite is designed to be affordable and easy to use, while delivering functionality and levels of reliability, scalability and security that have typically only been available to large enterprises with substantial information technology resources. We deliver our suite over the Internet as a subscription service using the software-as-a-service or on-demand model.

Our revenue has grown from $17.7 million during the year ended December 31, 2004 to $108.5 million during the year ended December 31, 2007. As of December 31, 2007, we had over 5,600 active customers. For the years ended December 31, 2005, 2006 and 2007, the percentage of our revenue generated outside of North America was 11%, 14% and 18%, respectively.

Industry Background

The 1990s saw the widespread adoption among large enterprises of packaged business management software applications that automated a variety of departmental functions, such as accounting, finance, order and inventory management, human resources, sales and customer support. These sophisticated applications required significant cash outlays for the initial purchase and for ongoing maintenance and support. In addition, these applications were internally managed and maintained by enterprise customers, requiring large staffs to support complex information technology infrastructures. Most importantly, the applications generally were provided by multiple vendors, with each application providing only a departmental view of the enterprise. To gain an enterprise-wide view, organizations attempted to tie together their various incompatible packaged applications through long, complex and costly integration efforts. Many of these attempts failed, in whole or in part, often after significant delay and expense. As a consequence, many large enterprises have transitioned from multiple point products to comprehensive, integrated business management suites, such as those offered by Oracle and SAP, as their core business management platforms.

SMBs, which we define as businesses with up to 1,000 employees, have application software requirements that are similar, in many respects, to large enterprises because their core business processes are substantially similar to those of large enterprises. These requirements include the integration of back-office activities, such as managing payroll and tracking inventory; front-office activities, including order management and customer support; and, increasingly, sophisticated e-commerce capabilities.

SMBs are generally less capable than large enterprises of performing the costly, complex and time-consuming integration of multiple point products from one or more vendors. As a result, SMBs can frequently derive greater benefits from a comprehensive business suite. Suites designed for, and broadly adopted by, large enterprises to provide a comprehensive, integrated platform for managing these core business processes, however, generally are not well suited to SMBs due to the complexity and cost of such applications.

Recently, SMBs have begun to benefit from the development of the on-demand software-as-a-service, or SaaS, model. SaaS uses the Internet to deliver software applications from a centrally hosted computing facility to end users through a web browser. SaaS eliminates the costs associated with installing and maintaining applications within the customer’s information technology infrastructure. On-demand applications are generally licensed for a monthly, quarterly or annual subscription fee, as opposed to on-premise enterprise applications that

3

typically require the payment of a much larger, upfront license fee. As a result, on-demand applications require substantially less initial and ongoing investment in software, hardware and implementation services and lower ongoing support and maintenance, making them more affordable for SMBs.

To date, the on-demand software model has been applied to a variety of types of business software applications, including CRM, security, accounting, human resources management, messaging and others, and it has been adopted by a wide variety of businesses.

While SaaS applications have enabled SMBs to benefit from enterprise-class capabilities, most are still point products that require extensive, costly and time-consuming integration to work with other applications. SMBs generally have been unable to purchase a comprehensive business management application suite at an affordable cost that enables them to run their businesses using a single system of record, provides real-time views of their operations and can be readily customized and rapidly implemented. Until NetSuite, we believe there was no provider of an on-demand, integrated suite of business management applications that addresses the needs of SMBs in the comprehensive manner that Oracle and SAP address the similar needs of large enterprises.

Our Solution

Our comprehensive business management application suite is designed to serve as a single system for running a business. All elements of our application suite share the same customer and transaction data, enabling seamless, cross-departmental business process automation and real-time monitoring of core business metrics. In addition, our integrated ERP, CRM and e-commerce capabilities provide users with real-time visibility and appropriate application functionality through dashboards tailored to their particular job function and access rights. Because our offering is delivered via the Internet, it is available wherever a user has Internet access, whether on a personal computer or a mobile device. The key advantages of our application suite to our customers are:

One Integrated System for Running a Business. Our integrated business application suite provides the functionality required to automate the core operations of an SMB, as well as divisions of large companies. This unified approach to managing a business enables companies to create cross-functional business processes; extend access to appropriate customers, partners, suppliers or other relevant constituencies; and efficiently share and disseminate information in real time. Our suite is designed to be easy to use, while also providing in depth functionality to meet the needs of our most sophisticated customers. Our customers can use our application suite to manage mission-critical business processes, including complex ERP (finance, accounting, inventory and payroll), CRM (sales, order management, marketing and customer support) and e-commerce (hosting, online stores and website analytics) functions. We also have tailored our offering to the specific needs of customers in the wholesale/distribution, services and software industries, to better serve those customers’ distinct business requirements and accelerate the implementation of our offerings for customers in those industries.

Role-Based Application Functionality and Real-Time Business Intelligence. Users access our suite through a role-based user interface, or dashboard that delivers specific application functionality and information appropriate for each user’s job responsibilities in a format familiar to them. For example, the dashboard for a salesperson would deliver functionality for managing contacts, leads and forecasts, while the dashboard for a warehouse manager would deliver capabilities appropriate for managing shipping, receiving and returns. These dashboards also incorporate sophisticated business intelligence tools that enable users to track key performance indicators, analyze operational data to identify trends, issues and opportunities and make decisions that can improve the performance of their business, all in real time.

On-Demand Delivery Model. We deliver our suite over the Internet as a subscription service using the SaaS model, eliminating the need for customers to buy and maintain on-premise hardware and software. Our suite is designed to achieve levels of reliability, scalability and security for our customers that have typically only been available to large enterprises with substantial information technology resources. Our architecture enables us to maintain very high levels of availability, scale easily as our customers grow and provide a safe and secure environment for their business-critical data and applications.

4

Low Total Cost of Ownership. Our suite incorporates the functionality of multiple applications, thereby eliminating the costs associated with attempting to integrate disparate applications, whether managed on-premise or delivered on-demand. Our on-demand delivery model and our application’s ease of use and configurability significantly reduce implementation costs for hardware, software and services and the need for dedicated information technology personnel. Customers typically subscribe to our application suite for a quarterly or annual fee based on the number of users and the solutions they elect to deploy. Our subscription fees are significantly less than typical upfront costs to purchase perpetual licenses and our on-demand delivery system eliminates ongoing maintenance and upgrade charges.

Rapid Implementation. Because we offer a relatively comprehensive application suite that incorporates the functionality of multiple applications, we significantly reduce the time and risk associated with implementing and integrating multiple point products. Our on-demand delivery model enables remote implementations and eliminates many of the steps associated with on-premise installations, such as purchasing and setting up hardware. In addition to our industry-specific offerings, our professional services organization is organized along customers’ industries; therefore, knowledge gained through an implementation with one customer may be applied to other customers within that industry, speeding implementations. Customers can implement our offerings themselves, engage our professional services organization or utilize the services of our partners.

Ease of Customization and Configuration. We enable users to customize our application suite to the particular needs of their businesses. Our application suite can be configured by end users without software programming expertise. In contrast to traditional on-premise applications, as new versions of our application suite become available, each customer’s customizations and configurations are maintained with little or no additional effort or expense required.

Our Business Strategy

Our goal is to enhance our position as a leading vendor of on-demand, integrated business management application suites for SMBs. The key elements of our strategy include:

Expanding Our Leadership in On-Demand, Integrated Business Suites. We believe we were the first software vendor to integrate front-office, back-office and e-commerce management capabilities into a single on-demand software suite. We intend to improve our position in the on-demand applications market by continuing to provide high quality offerings that encompass the enterprise-class functionality and ease-of-use our customers require. We also intend to leverage our position as our customers’ primary business management platform to add new and enhanced functionality that will help them run their businesses more efficiently and expand our presence within their organizations.

Tailoring Our Offering to Customers’ Specific Industries. While we provide a general purpose suite applicable to all businesses, we believe that tailoring our application to customers’ specific industries has been and will continue to be important to our growth. We currently offer industry-specific editions of our service for wholesale/distribution, services and software companies. We will continue to enhance the capabilities of our application by further tailoring the functionality for these and other industries.

Growing Our Customer Base and Expanding Use of Our Service Within Existing Accounts. We intend to broaden our offerings and expand our direct and indirect sales efforts to grow our customer base. In addition, we seek to increase ongoing subscription revenue from our existing customers by broadening their use of our suite, thereby increasing the number of users and modules deployed.

Fostering the Continued Development of the NetSuite Partner Network. We provide tools and programs to foster the development of a network of value-added resellers, or VARs, systems integrators and independent software vendors. In addition to programs that enable our partners to resell our suite, our NetSuite Business Operating System (NS-BOS) allows these partners to extend our platform by developing products of their own, including industry-specific versions of our application suite. We intend to continue to enhance the NS-BOS platform and establish distribution models to bring these new solutions to market.

5

Addressing the Multinational Business Requirements of SMBs. SMBs are increasingly seeking global business opportunities, in large part by leveraging the Internet. We believe that there is significant opportunity to address the needs of SMBs with multinational business operations, and we currently offer a localized version of our suite in a number of countries and languages. We will continue to extend our application offerings to support the requirements of multinational SMBs.

Our Offerings

Our main offering is NetSuite, which is designed to provide the core business management capabilities that most of our customers require. NetSuite, NetSuite CRM+ and NetSuite Small Business are designed for use by most types of businesses. In addition, we offer industry-specific configurations for use by wholesale/distribution, services and software companies. Finally, we sell additional on-demand application modules that customers can purchase to obtain additional functionality required for their specific business needs.

NetSuite. NetSuite is targeted at SMBs and divisions of large companies, and provides a single platform for ERP, CRM and e-commerce capabilities. It contains a broad array of features that enable users to do their individual jobs more effectively. In addition, because all users are transacting business on the same database system, NetSuite can easily automate processes across departments. For example, when a sales representative enters an order, upon approval it automatically appears on the warehouse manager’s dashboard as an item to be shipped and, once the item has been shipped, it automatically appears on the finance manager’s dashboard as an item to be billed. Each customer can automate their key business functions across all departments, including sales, marketing, service, finance, inventory, order fulfillment, purchasing and employee management. As with all of our offerings, users access the application and data through a role-based user interface, or dashboard, tailored to deliver specific functionality and information appropriate for their position.

NetSuite CRM+. NetSuite CRM+ is targeted at a wide range of companies, including companies larger than our traditional SMB customers. SMB customers may use NetSuite CRM+ as an entry point into the entire suite, while larger enterprises often implement it as an alternative to more limited CRM offerings. This application provides traditional sales force automation, marketing automation, customer support and service management functionality. NetSuite CRM+ contrasts with competitive CRM products by also incorporating, without requiring additional integration, order management and many other ERP and e-commerce capabilities. This provides users with a more comprehensive, real-time view of customer interactions than can be provided by traditional, stand-alone CRM products, whether on-premise or on-demand. NetSuite CRM+ also offers incentive management, project tracking, website hosting and analytics and partner relationship management.

NetSuite Small Business. NetSuite Small Business is targeted primarily at small businesses that require fewer features than our NetSuite application. It includes basic ERP, CRM and e-commerce functionality, as well as customizable, real-time dashboards.

Add-On Modules. We also offer advanced capabilities that are part of our integrated suite, but are typically sold separately. These modules allow our customers to specifically augment aspects of our suite to enhance its relevance to their businesses.

NetSuite Industry Editions. We have configured NetSuite to meet the requirements of selected industries. Our current editions serve companies in the wholesale/distribution, services and software industries. Within each edition, we offer advanced functionality to complement our core NetSuite offering, templates of best practices and dedicated sales and professional services teams with industry-specific expertise.

Wholesale/Distribution Company Edition. NetSuite Wholesale/Distribution Edition allows product-based companies to manage their entire customer lifecycle, from lead through fulfillment, invoicing and payment. It includes customer-facing sales force automation, marketing and customer service processes integrated with back-office inventory management, fulfillment and accounting processes, all within a single, flexible business application. In this edition, we have extended the core NetSuite application to include industry-specific business

6

functionality, such as demand-based inventory replenishment, to meet the unique requirements of wholesale/distribution companies. In addition, we have taken advantage of the expertise gathered from working with over 800 wholesale/distribution customers to create best practices implementation methodologies.

Services Company Edition. NetSuite Services Company Edition allows customers to manage their entire client service and business management processes with a flexible, powerful business application, integrating professional services automation, CRM, client service delivery, financials and many more capabilities of particular importance to services companies. This edition manages the end-to-end project lifecycle business processes in one system, from prospecting through proposal generation, contract management, project/time tracking, service delivery and billing. NetSuite Services Company Edition incorporates deeper project and resource management capabilities than the core NetSuite offering. Other important features include milestone and percentage-of-completion billing; resource scheduling, tracking and utilization; and project document management.

Software Company Edition. In addition to the comprehensive, integrated front-office, back-office and e-commerce capabilities of our NetSuite offering, NetSuite Software Company Edition adds functionality to address the complex accounting, billing and order management requirements of software companies. This edition is designed to enable our software customers to conform to the various revenue recognition and other compliance requirements relevant to software companies. This edition can be supplemented with modules designed to streamline business processes unique to software companies, such as bug tracking and electronic software distribution.

NetSuite Business Operating System. NetSuite Business Operating System (NS-BOS) is our technology platform that allows customers, partners and developers to tailor and extend our suite to meet specific company, vertical and industry requirements for personalization, business processes and best practices. NS-BOS allows partners to develop products of their own, including industry-specific versions of our application suite. NS-BOS and our SuiteFlex customization environment are designed to continue to operate across version upgrades without modification and include the following tools: SuiteBuilder, SuiteScript, SuiteTalk, SuiteScript D-Bug and SuiteBundler.

| | • | | SuiteBuilder. SuiteBuilder is an integrated set of easy-to-use, point-and-click tools that enables customers to tailor NetSuite to fit their company and industry requirements. SuiteBuilder enables users to easily customize fields and forms and add database tables, without the need for additional programming. The flexibility of SuiteBuilder also allows the look, feel and content of individual users’ dashboards to be easily personalized. |

| | • | | SuiteScript. Customers, partners and developers use SuiteScript to extend the suite with everything from simple functions to new business process flows and even entirely new applications. SuiteScript provides the benefits of a robust architecture and on-demand hosting efficiencies for interaction between our standard and custom processes. SuiteScript introduces customization and tailoring capabilities that allow complex processes with branching logic and time-based decision trees to be automated. SuiteScript gives developers access to the same software objects used to build our core application, allowing seamless extensions of the suite’s core functionality. |

| | • | | SuiteTalk. SuiteTalk is an integration tool that utilizes simple object access protocol and standards-based web service application programming interfaces to integrate our suite with other applications, such as third-party vertical applications and legacy systems. Our suite’s single data repository, combined with SuiteTalk’s advanced integration technologies, enables our application suite to incorporate and leverage a wide range of data generated by our customers’ legacy applications. Developers can also use SuiteTalk to build add-on capabilities, such as wireless interfaces. |

| | • | | SuiteScript D-Bug.SuiteScript D-Bug, the real-time, interactive debugger enables code validation and testing as third-party applications run on the application server. Most if not all SaaS development environments support testing of third-party applications on client machines. SuiteScript D-Bug enables |

7

| | third-party applications to be tested in an actual server environment against live data, allowing developers to see and correct the behavior exhibited by the application in real-world conditions. |

| | • | | SuiteBundler. SuiteBundler enables the reuse of customizations and applications built with SuiteFlex. Our value-added reseller, systems integration and independent software vendor partners will use SuiteBundler to package and distribute industry-specific extensions and customizations of NetSuite they have developed. SuiteBundler allows our partners to embed their applications, knowledge and industry best practices into our suite, converting professional services traditionally applicable only to an individual customer into a product offering that can be sold to all customers in the same industry. In addition, our customers can use SuiteBundler to share their SuiteFlex customizations with others. |

Sales and Marketing

Sales. We generate sales through both direct and indirect approaches, with most selling done over the phone. Our direct sales team consists of professionals in various locations across the United States, Europe and the Asia-Pacific region. Within these regions, our direct sales organization focuses on selling to SMBs and divisions of large companies.

Indirect sales are produced through our relationships with channel partners in North America, Latin America, Europe and the Asia-Pacific region. In 2006, we expanded into Japan with the formation of our Japanese subsidiary and strategic partnerships with Transcosmos, Inc., or TCI, Miroku Jyoho Service Ltd., or MJS and Inspire Corporation, each of which is a Japanese corporation. In the future, we plan to continue to invest to expand our direct sales force within North America, Europe and the Asia-Pacific region and pursue additional indirect channel partnerships.

Our sales process typically begins with the generation of a sales lead from a marketing program or customer referral. After the lead is qualified, our sales personnel conduct focused web-based demonstrations along with initial price discussions. Members of our professional services team are engaged as needed to offer insight around aspects of the implementation. Our sales cycle typically ranges from one to six months, but can vary based on the specific application, the size and complexity of the potential customer’s information technology environment and other factors.

Marketing. We tailor our marketing efforts around relevant application categories, customer sizes and customer industries. As part of our marketing strategy, we have established a number of key programs and initiatives including online and search engine advertising, email campaigns and web seminars, product launch events, trade show and industry event sponsorship and participation, marketing support for channel partners, and referral programs.

Japanese Majority-Owned Subsidiary. In March 2006, we established a majority-owned subsidiary in Japan, NetSuite Kabushiki Kaisha, or NetSuite KK. We own this subsidiary with TCI, MJS and Inspire Corporation. TCI and MJS have exclusive distribution rights to distribute our on-demand application suite in Japan. As of December 31, 2007, we owned approximately 72% of the subsidiary. Because of this majority interest, we consolidate NetSuite KK’s financial results, which are reflected in each revenue, cost of revenue and expense category in our consolidated statement of operations. We then record minority interest, which reflects the minority investors’ interest in NetSuite KK’s results. Through December 31, 2007, the operating performance and liquidity requirements of NetSuite KK had not been material to our results of operations or financial condition. Although we plan to expand our selling and marketing activities in Japan to add new customers, we believe the future liquidity requirements of NetSuite KK will not be significant in the near future.

Service and Support

Professional Services. We have developed repeatable, cost-effective consulting and implementation services to assist our customers with integrating and importing data from other systems, changing their business processes

8

to take advantage of the enhanced capabilities enabled by our integrated suite, implementing those new business processes within their organization and configuring and customizing our application suite for their business processes and requirements.

Our consulting and implementation methodology leverages the nature of our on-demand software architecture, the industry-specific expertise of our professional services employees and the design of our platform to simplify, streamline and expedite the implementation process. We generally employ a joint staffing model for implementation projects whereby we involve the customer more actively in the implementation process than traditional software companies. We believe this better prepares our customers to support the application throughout their use of our service. In addition, because our service is on-demand, our professional services employees can remotely configure our application for most customers based on telephonic consultations. Our consulting and implementation services are generally offered on a fixed price basis. Our network of partners also provides professional services to our customers.

Client Support. Our technical support organization, with personnel in Canada and Asia, offers support 24 hours a day, seven days a week. Our system allows for skills-based and time zone-based routing to address general and technical inquiries across all aspects of our services. For our direct customers, we offer tiered customer support programs depending upon the service needs of our customers’ deployments. Support contracts typically have a one-year term. For customers purchasing through resellers, primary product support is provided by our resellers, with escalation support provided by us.

Training. We offer a variety of training services through our training resource, NetSuite University, to facilitate the successful adoption of our suite throughout the customer’s organization.

Operations, Technology and Development

Our customers rely on our application suite to run their businesses, and, as a result, we need to ensure the availability of our service. We have developed our infrastructure with the goal of maximizing the availability of our application, which is hosted on a highly-scalable network located in a single, secure third-party facility. On March 17, 2006, we entered into a revised Master Service Agreement with Level 3 Communications, LLC in connection with our data center facility. Pursuant to this agreement, and associated work orders, we have leased facility space, power, and internet connectivity for multiple one-year terms. On December 4, 2007, we entered into an agreement with SAVVIS Communications Corporation, or SAVVIS, a secondary data center facility provider, to provide additional capacity beginning in 2008. Our hosting operations incorporate industry-standard hardware, the Linux open-source operating system and Oracle databases and application servers into a flexible, scalable architecture. Elements of our application suite’s infrastructure can be replaced or added with no interruption in service, helping to ensure that the failure of any single device will not cause a broad service outage.

Our single-instance, multi-tenant architecture allows us to provide our customers with enterprise-class capabilities, high quality of service, scalability and security, all at an affordable price. Our architecture enables us to host multiple smaller customers on a single x86 server while preserving the ability to migrate any customer to its own server without interruption or alteration when the customers’ growth and business needs require it. In addition to the enhanced flexibility and scalability our architecture provides, it also is designed to work on inexpensive, industry-standard hardware, thereby providing us a significant cost advantage that is reflected in the pricing we are able to offer our customers.

Unlike other SaaS companies that deploy major new releases to all customers at once, we roll out all major releases and many upgrades of our application suite to only a portion of our customer base at any one time. This “phased release process” is designed to allow us to mitigate the impact of major changes and new releases, ensuring that any potential issues affect only a portion of our customers before they are addressed.

9

The combination of our hosting infrastructure, flexible architecture and phased release process enables us to offer a service level commitment to our customers of 99.5% uptime per period, excluding designated periods of maintenance. Under the terms of this commitment, we offer to credit a full month’s service fees for any period in which we do not meet this service level.

In developing our service offerings, we rely on customer feedback and spend significant time with our customers in formal user testing sessions as well as less formal “ride-alongs” and customer roundtables. We use the NetSuite service to track customer interest in service enhancements and actual work done on these enhancements. We develop our offerings using Java and the Oracle database on the server and AJAX on the client with a goal of making our service scalable, high performance, robust and easy to use. Finally, we expose many of our internal development tools to third party developers via SuiteFlex to allow extensions to the service that mirror the built-in capabilities we develop internally.

In April 2005, we entered into a software license agreement with Oracle USA, Inc., an affiliate of Oracle Corporation. Lawrence J. Ellison, who beneficially owns our majority stockholder, is the Chief Executive Officer, a principal stockholder and a director of Oracle Corporation. This perpetual license is for the use of Oracle database and application server software on a certain number of individual computers, along with technical support. Under the April 2005 agreement, we paid $2.5 million over nine installments, including the final buyout payment of $227,000, which occurred on June 19, 2007. In May 23, 2007, we entered into another software license agreement with Oracle USA, Inc. to license Oracle software for an additional number of computers, along with technical support. The May 2007 agreement calls for payments in total of $0.9 million payable over 12 equal quarterly installments through 2010. On October 31, 2007 we entered into another perpetual software license agreement with Oracle USA, Inc. to license Oracle database and application server software, along with technical support. This license has a forty-two month term that allows us to download an unlimited number of licenses which are perpetual in nature. We also purchased the initial 12 months of technical support services under the agreement, which are renewable annually. The October 2007 agreement requires us to pay a total of $4.7 million for the net license fees to be paid over 12 equal quarterly installments through 2010 and annual payments of $1.4 million for the technical support fees. The October 2007 agreement replaces the support portion of the product orders made under the April 2005 and May 2007 agreements.

Our product development expenses were $24.8 million in 2005, $20.7 million in 2006 and $23.7 million in 2007.

Customers

As of December 31, 2007, we served over 5,600 active customers, which we define as companies under contract at that date who have used our service within the past quarter. Our customers are diverse in size and type across a wide variety of industries, with a focus on SMBs, which we define as businesses with up to 1,000 employees, and divisions of large companies. In 2007, the top 10 industries in which our customers operated, as measured by our recognized revenue, were as follows: Distribution & Wholesale; Professional, Consulting and Other Services; Computer Software; e-Commerce & Retail; Manufacturing; Computer & IT Services; Telecommunications Services; Financial Services; Healthcare Services; and Education. We had customers in over 60 countries in 2007. No single customer accounted for more than 3% of our revenue in 2005, 2006 or 2007.

Competition

We compete with a broad array of ERP, CRM and e-commerce companies. Our markets are highly competitive, fragmented and subject to rapid changes in technology. Many of our potential customers are seeking their first packaged ERP, CRM or e-commerce application and, as such, evaluate a wide range of alternatives during their purchase process. Although we believe that none of our larger competitors currently offer an on-demand comprehensive business management suite, we face significant competition within each of our markets from companies with broad product suites and greater name recognition and resources than we have, as

10

well as smaller companies focused on specialized solutions. In addition, some of our larger competitors have announced plans to launch new products that could compete more closely with our on-demand application suite. Internationally, we face competition from local companies as well as larger competitors, each of which has products tailored for those local markets. To a lesser extent, we compete with internally developed and maintained solutions. Our current principal competitors include Epicor Software Corporation, Intuit Inc., Microsoft Corporation, SAP, The Sage Group plc and salesforce.com, inc.

We believe the principal competitive factors in our markets include:

| | • | | service breadth and functionality; |

| | • | | service performance, security and reliability; |

| | • | | ability to tailor and customize services for a specific company, vertical or industry; |

| | • | | speed and ease of deployment, integration and configuration; |

| | • | | total cost of ownership, including price and implementation and support costs; |

| | • | | sales and marketing approach; and |

| | • | | financial resources and reputation of the vendor. |

We believe that we compete favorably with most of our competitors on the basis of each of the factors listed above, except that certain of our competitors have greater sales, marketing and financial resources, more extensive geographic presence and greater name recognition than we do. In addition, although we have extended the number of applications we have introduced for specific vertical markets, we may be at a disadvantage in certain vertical markets compared to certain of our competitors. We may face future competition in our markets from other large, established companies, as well as from emerging companies. In addition, we expect that there is likely to be continued consolidation in our industry that could lead to increased price competition and other forms of competition.

Intellectual Property

Our success depends upon our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including trade secrets, patents, copyrights and trademarks, as well as customary contractual protections. We view our trade secrets and know-how as a significant component of our intellectual property assets, as we have spent years designing and developing our on-demand, integrated application suite, which we believe differentiates us from our competitors.

As of December 31, 2007, we had eight U.S. and no foreign pending patent applications. We do not know whether any of our pending patent applications will result in the issuance of patents or whether the examination process will require us to narrow our claims. Even if granted, there can be no assurance that these pending patent applications will provide us with protection.

We have a number of registered and unregistered trademarks. We maintain a policy requiring our employees, consultants and other third parties to enter into confidentiality and proprietary rights agreements and to control access to software, documentation and other proprietary information.

In addition, we license third-party technologies that are incorporated into some elements of our services. Licenses of third-party technologies may not continue to be available to us at a reasonable cost, or at all. The steps we have taken to protect our intellectual property rights may not be adequate. Third parties may infringe or misappropriate our proprietary rights. Competitors may also independently develop technologies that are substantially equivalent or superior to the technologies we employ in our services. Failure to protect our proprietary rights adequately could significantly harm our competitive position and operating results.

11

The software and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims against us grows. Many of our service agreements require us to indemnify our customers for certain third-party intellectual property infringement claims, which would increase our costs as a result of defending those claims and might require that we pay damages if there were an adverse ruling in any such claims. We, and certain of our customers, have in the past received correspondence from third parties alleging that certain of our services, or customers’ use of our services, violate these third parties’ patent rights. These types of correspondence and future claims could harm our relationships with our customers and might deter future customers from subscribing to our services.

With respect to any intellectual property rights claim against us or our customers, we may have to pay damages or stop using technology found to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms, significantly increase our operating expenses or require us to restrict our business activities in one or more respects. The technology also may not be available for license to us at all. As a result, we may be required to develop alternative non-infringing technology, which could require significant effort and expense.

Employees

As of December 31, 2007, we had approximately 675 employees. We also engage a number of independent contractors and consultants.

None of our employees is represented by a labor union with respect to his or her employment with us. We have not experienced any work stoppages, and we consider our relations with our employees to be good. Our future success will depend upon our ability to attract and retain qualified personnel. Competition for qualified personnel remains intense and we may not be successful in retaining our key employees or attracting skilled personnel.

Available Information

You can obtain copies of our Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission (“SEC”), and all amendments to these filings, free of charge from our Web site athttp://www.netsuite.com/investors as soon as reasonably practicable following our filing of any of these reports with the SEC. You can also obtain copies free of charge by contacting our Investor Relations department at our corporate headquarters.

You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

12

Executive Officers of the Registrant

Our current executive officers, and their ages and positions as of December 31, 2007, are set forth below:

| | | | |

Name | | Age | | Position(s) |

Zachary Nelson | | 46 | | President, Chief Executive Officer and Director |

Evan M. Goldberg | | 41 | | Chief Technology Officer and Chairman of the Board |

James McGeever | | 40 | | Chief Financial Officer |

Timothy Dilley | | 48 | | Executive Vice President, Services |

Dean Mansfield | | 45 | | President, Worldwide Sales and Distribution |

Douglas P. Solomon | | 41 | | Vice President, Legal and Corporate Affairs and Secretary |

Zachary Nelsonhas served as a director since July 2002 and as our President and Chief Executive Officer since January 2003. Prior to that, Mr. Nelson served as our President and Chief Operating Officer from July 2002 to January 2003. From March 1996 to October 2001, Mr. Nelson was employed by Network Associates, Inc. (now McAfee, Inc.), an enterprise security software company. While at Network Associates, Mr. Nelson held positions including Chief Strategy Officer of Network Associates and President and Chief Executive Officer of MyCIO.com, a subsidiary that provided on-demand software security services. From 1992 to 1996, he held various positions, including Vice President of Worldwide Marketing at Oracle Corporation, an enterprise software company. He holds B.S. and M.A. degrees from Stanford University.

Evan M. Goldberg co-founded our company in 1998 and has served as Chairman of our board of directors and as our Chief Technology Officer since January 2003. From October 1998 through January 2003, Mr. Goldberg held various positions with us, including President and Chief Executive Officer and Chief Technology Officer. Prior to joining us, Mr. Goldberg founded mBed Software, Inc., a software company focused on multimedia tools for website developers, where he served as Chief Executive Officer from November 1995 to September 1998. From August 1987 to November 1995, Mr. Goldberg held various positions in product development at Oracle Corporation, including Vice President of Development in the New Media Division. Mr. Goldberg holds a B.A. from Harvard College.

James McGeever has served as our Chief Financial Officer since June 2000. Mr. McGeever served as our Director of Finance from January 2000 to June 2000. Prior to joining us, Mr. McGeever was the controller of Clontech Laboratories, Inc., a privately held biotechnology company from 1998 to 2000 and the corporate controller at Photon Dynamics, Inc., a capital equipment maker from 1994 to 1998. Mr. McGeever holds a B.Sc. from the London School of Economics. Mr. McGeever has qualified as a chartered accountant in the United Kingdom.

Timothy Dilley has served as our Executive Vice President, Services since December 2006. Prior to joining us, Mr. Dilley served as Senior Vice President of Global Customer Services at Informatica Corporation, an enterprise software company, from December 1998 until December 2006. He holds a B.S. from California State University at Fresno.

Dean Mansfield has served as our President, Worldwide Sales and Distribution since January 2007. Mr. Mansfield served as our Senior Vice President, Worldwide Sales from May 2005 until January 2007 and served as our Vice President of Europe, Middle East and Africa Sales from January 2004 until May 2005. Prior to joining us, Mr. Mansfield held a senior management position with Brocade Communications, a data storage company, from January 2002 until December 2002. He holds a LL.B. from the University of London, TVU.

Douglas P. Solomon has served as our Vice President, Legal & Corporate Affairs since November 2006 and has been our Secretary since January 2007. Prior to joining us, Mr. Solomon served in senior legal and management roles at Openwave Systems Inc., a software company, from April 2000 through March 2006, including Vice President, Legal & Corporate Affairs. He holds a B.A. from the University of Michigan and a J.D. from Harvard Law School.

13

Set forth below and elsewhere in this Annual Report, and in other documents we file with the SEC, are risks and uncertainties that could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this Annual Report. Because of the following factors, as well as other variables affecting our operating results, past financial performance should not be considered as a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to Our Business

We have a history of losses and we may not achieve profitability in the future.

We have not been profitable on a quarterly or annual basis since our formation. We experienced a net loss of $23.9 million during the year ended December 31, 2007. As of December 31, 2007, our accumulated deficit was $244.9 million. We expect to make significant future expenditures related to the development and expansion of our business. In addition, as a public company, we are incurring significant legal, accounting and other expenses that we did not incur as a private company. As a result of these increased expenditures, we will have to generate and sustain increased revenue to achieve and maintain future profitability. While our revenue has grown in recent periods, this growth may not be sustainable and we may not achieve sufficient revenue to achieve or maintain profitability. We may incur significant losses in the future for a number of reasons, including due to the other risks described in this Annual Report, and we may encounter unforeseen expenses, difficulties, complications and delays and other unknown factors. Accordingly, we may not be able to achieve or maintain profitability and we may continue to incur significant losses for the foreseeable future.

The market for on-demand applications may develop more slowly than we expect.

Our success will depend, to a large extent, on the willingness of SMBs to accept on-demand services for applications that they view as critical to the success of their business. Many companies have invested substantial effort and financial resources to integrate traditional enterprise software into their businesses and may be reluctant or unwilling to switch to a different application or to migrate these applications to on-demand services. Other factors that may affect market acceptance of our application include:

| | • | | the security capabilities, reliability and availability of on-demand services; |

| | • | | customer concerns with entrusting a third party to store and manage their data, especially confidential or sensitive data; |

| | • | | our ability to minimize the time and resources required to implement our suite; |

| | • | | our ability to maintain high levels of customer satisfaction; |

| | • | | our ability to implement upgrades and other changes to our software without disrupting our service; |

| | • | | the level of customization or configuration we offer; |

| | • | | our ability to provide rapid response time during periods of intense activity on customer websites; and |

| | • | | the price, performance and availability of competing products and services. |

The market for these services may not develop further, or may develop more slowly than we expect , either of which would harm our business.

14

Our customers are small and medium-sized businesses and divisions of large companies, which may result in increased costs as we attempt to reach, acquire and retain customers.

We market and sell our application suite to SMBs and divisions of large companies. To grow our revenue quickly, we must add new customers, sell additional services to existing customers and encourage existing customers to renew their subscriptions. However, selling to and retaining SMBs can be more difficult than selling to and retaining large enterprises because SMB customers:

| | • | | are more price sensitive; |

| | • | | are more difficult to reach with broad marketing campaigns; |

| | • | | have high churn rates in part because of the nature of their businesses; |

| | • | | often lack the staffing to benefit fully from our application suite’s rich feature set; and |

| | • | | often require higher sales, marketing and support expenditures by vendors that sell to them per revenue dollar generated for those vendors. |

If we are unable to cost-effectively market and sell our service to our target customers, our ability to grow our revenue quickly and become profitable will be harmed.

Our quarterly operating results may fluctuate in the future. As a result, we may fail to meet or exceed the expectations of research analysts or investors, which could cause our stock price to decline.

Our quarterly operating results may fluctuate as a result of a variety of factors, many of which are outside of our control. A decline in general macroeconomic conditions could adversely affect our customers’ ability or willingness to purchase our application suite, which could adversely affect our operating results or financial outlook. Fluctuations in our quarterly operating results or financial outlook may also be due to a number of additional factors, including the risks and uncertainties discussed elsewhere in this Annual Report.

Fluctuations in our quarterly operating results could cause our stock price to decline rapidly, may lead analysts to change their long-term model for valuing our common stock, could cause us to face short-term liquidity issues, may impact our ability to retain or attract key personnel, or cause other unanticipated issues. If our quarterly operating results or financial outlook fall below the expectations of research analysts or investors, the price of our common stock could decline substantially.

We believe that our quarterly revenue and operating results may vary significantly in the future and that period-to-period comparisons of our operating results may not be meaningful. You should not rely on the results of one quarter as an indication of future performance.

Our limited operating history makes it difficult to evaluate our current business and future prospects, and may increase the risk of your investment.

Our company has been in existence since 1998, and much of our growth has occurred since 2004, with our revenue increasing from $17.7 million during the year ended December 31, 2004 to $108.5 million during the year ended December 31, 2007. Our limited operating history may make it difficult to evaluate our current business and our future prospects. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries. If we do not address these risks successfully, our business may be harmed.

We use a single data center to deliver our services. Any disruption of service at this facility could interrupt or delay our ability to deliver our service to our customers.

We host our services and serve all of our customers from a single third-party data center facility with Level 3 Communications located in California. We do not control the operation of this facility. This facility is

15

vulnerable to damage or interruption from earthquakes, hurricanes, floods, fires, terrorist attacks, power losses, telecommunications failures and similar events. Our data facility is located in an area known for seismic activity, increasing our susceptibility to the risk that an earthquake could significantly harm the operations of this facility. It also could be subject to break-ins, computer viruses, sabotage, intentional acts of vandalism and other misconduct. The occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice or other unanticipated problems could result in lengthy interruptions in our services. We currently operate and maintain an offsite facility for customers who specifically pay for accelerated disaster recovery services. For customers who do not pay for such services, although we maintain tape backups of their data, we do not operate or maintain a separate disaster recovery facility, which may increase delays in the restoration of our service for those customers.

On December 4, 2007, we entered into an agreement with SAVVIS, a secondary data center facility provider, to provide additional capacity beginning in 2008. We will be transferring our existing data center facility to SAVVIS in 2008. This additional facility may not be operational in a timely manner.

Our data center facility provider has no obligation to renew its agreement with us on commercially reasonable terms, or at all. If we are unable to renew our agreement with the facility provider on commercially reasonable terms, or when we elect to make changes to data center facility providers in order to increase capacity we may experience costs or downtime in connection with the transfer to a new data center facility. There can be no assurance that the transfer of our data services to any such alternative provider will not result in errors, defects, disruptions or other performance problems with our services.

Any errors, defects, disruptions or other performance problems with our services could harm our reputation and may damage our customers’ businesses. Interruptions in our services might reduce our revenue, cause us to issue credits to customers, subject us to potential liability, cause customers to terminate their subscriptions and harm our renewal rates.

We may become liable to our customers and lose customers if we have defects or disruptions in our service or if we provide poor service.

Because we deliver our application suite as a service, errors or defects in the software applications underlying our service, or a failure of our hosting infrastructure, may make our service unavailable to our customers. Since our customers use our suite to manage critical aspects of their business, any errors, defects, disruptions in service or other performance problems with our suite, whether in connection with the day-to-day operation of our suite, upgrades or otherwise, could damage our customers’ businesses. If we have any errors, defects, disruptions in service or other performance problems with our suite, customers could elect not to renew, or delay or withhold payment to us, we could lose future sales or customers may make warranty claims against us, which could result in an increase in our provision for doubtful accounts, an increase in collection cycles for accounts receivable or costly litigation.

Our business depends substantially on customers renewing, upgrading and expanding their subscriptions for our services. Any decline in our customer renewals, upgrades and expansions would harm our future operating results.

We sell our application suite pursuant to service agreements that are generally one year in length. Our customers have no obligation to renew their subscriptions after their subscription period expires, and these subscriptions may not be renewed at the same or higher levels. Moreover, under specific circumstances, our customers have the right to cancel their service agreements before they expire. In addition, in the first year of a subscription, customers often purchase a higher level of professional services than they do in renewal years. As a result, our ability to grow is dependent in part on customers purchasing additional subscriptions and modules after the first year of their subscriptions. We have limited historical data with respect to rates of customer subscription renewals, upgrades and expansions so we may not accurately predict future trends in customer

16

renewals. Our customers’ renewal rates may decline or fluctuate because of several factors, including their satisfaction or dissatisfaction with our services, the prices of our services, the prices of services offered by our competitors or reductions in our customers’ spending levels. If our customers do not renew their subscriptions for our services, renew on less favorable terms, or do not purchase additional functionality or subscriptions, our revenue may grow more slowly than expected or decline and our profitability and gross margins may be harmed.

If our security measures are breached and unauthorized access is obtained to a customer’s data, we may incur significant liabilities, our service may be perceived as not being secure and customers may curtail or stop using our suite.

The services we offer involve the storage of large amounts of our customers’ sensitive and proprietary information. If our security measures are breached as a result of third-party action, employee error, malfeasance or otherwise, and someone obtains unauthorized access to our customers’ data, we could incur significant liability to our customers and to individuals or businesses whose information was being stored by our customers, our business may suffer and our reputation will be damaged. Because techniques used to obtain unauthorized access to, or to sabotage, systems change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventive measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed and we could lose sales and customers. Such an actual or perceived breach could also cause a significant and rapid decline in our stock price.

We provide service level commitments to our customers, which could cause us to issue credits for future services if the stated service levels are not met for a given period and could significantly harm our revenue.

Our customer agreements provide service level commitments on a monthly basis. If we are unable to meet the stated service level commitments or suffer extended periods of unavailability for our service, we may be contractually obligated to provide these customers with credits for future services. Our revenue could be significantly impacted if we suffer unscheduled downtime that exceeds the allowed downtimes under our agreements with our customers. In light of our historical experience with meeting our service level commitments, we do not currently have any reserves on our balance sheet for these commitments. Our service level commitment to all customers is 99.5% uptime per period, excluding scheduled maintenance. The failure to meet this level of service availability may require us to credit qualifying customers for the value of an entire month of their subscription fees, not just the value of the subscription fee for the period of the downtime. As a result, a failure to deliver services for a relatively short duration could cause us to issue these credits to all qualifying customers. Any extended service outages could harm our reputation, revenue and operating results.

We have experienced rapid growth in recent periods. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or address competitive challenges adequately.

We have increased our number of full-time employees from approximately 296 at December 31, 2004 to approximately 675 at December 31, 2007 and have increased our revenue from $17.7 million during the year ended December 31, 2004 to $108.5 million during the year ended December 31, 2007. Our expansion has placed, and our anticipated growth may continue to place, a significant strain on our managerial, administrative, operational, financial and other resources. We intend to further expand our overall business, customer base, headcount and operations. We also intend to continue expanding our operations internationally. Creating a global organization and managing a geographically dispersed workforce will require substantial management effort and significant additional investment in our infrastructure. We will be required to continue to improve our operational, financial and management controls and our reporting procedures and we may not be able to do so effectively. As such, we may be unable to manage our expenses effectively in the future, which may negatively impact our gross margins or operating expenses in any particular quarter.

17

The market in which we participate is intensely competitive, and if we do not compete effectively, our operating results may be harmed.

The markets for ERP, CRM and e-commerce applications are intensely competitive and rapidly changing with relatively low barriers to entry. With the introduction of new technologies and market entrants, we expect competition to intensify in the future. In addition, pricing pressures and increased competition generally could result in reduced sales, reduced margins or the failure of our service to achieve or maintain more widespread market acceptance. Often we compete to sell our application suite against existing systems that our potential customers have already made significant expenditures to install. Competition in our market is based principally upon service breadth and functionality; service performance, security and reliability; ability to tailor and customize services for a specific company, vertical or industry; ease of use of the service; speed and ease of deployment, integration and configuration; total cost of ownership, including price and implementation and support costs; professional services implementation; and financial resources of the vendor.

We face competition from both traditional software vendors and SaaS providers. Our principal competitors include Epicor Software Corporation, Intuit Inc., Microsoft Corporation, SAP, The Sage Group plc and salesforce.com, inc. Many of our actual and potential competitors enjoy substantial competitive advantages over us, such as greater name recognition, longer operating histories, more varied products and services and larger marketing budgets, as well as substantially greater financial, technical and other resources. In addition, many of our competitors have established marketing relationships and access to larger customer bases, and have major distribution agreements with consultants, system integrators and resellers. If we are not able to compete effectively, our operating results will be harmed.

Our brand name and our business may be harmed by aggressive marketing strategies of our competitors.

Because of the early stage of development of our markets, we believe that building and maintaining brand recognition and customer goodwill is critical to our success. Our efforts in this area have, on occasion, been complicated by the marketing efforts of our competitors, which may include incomplete, inaccurate and false statements about our company and our services that could harm our business. Our ability to respond to our competitors’ misleading marketing efforts may be limited under certain circumstances by legal prohibitions on permissible public communications by us as a public company.

Many of our customers are price sensitive, and if the prices we charge for our services are unacceptable to our customers, our operating results will be harmed.

Many of our customers are price sensitive, and we have limited experience with respect to determining the appropriate prices for our services. As the market for our services matures, or as new competitors introduce new products or services that compete with ours, we may be unable to renew our agreements with existing customers or attract new customers at the same price or based on the same pricing model as previously used. As a result, it is possible that competitive dynamics in our market may require us to change our pricing model or reduce our prices, which could harm our revenue, gross margin and operating results.

If we do not effectively expand and train our direct sales force and our services and support teams, we may be unable to add new customers and retain existing customers.

We plan to continue to expand our direct sales force and our services and support teams both domestically and internationally to increase our customer base and revenue. We believe that there is significant competition for direct sales, service and support personnel with the skills and technical knowledge that we require. Our ability to achieve significant revenue growth will depend, in large part, on our success in recruiting, training and retaining sufficient numbers of personnel to support our growth. New hires require significant training and, in most cases, take significant time before they achieve full productivity. Our recent hires and planned hires may not become as productive as we expect, and we may be unable to hire or retain sufficient numbers of qualified individuals in the markets where we do business. If these expansion efforts are not successful or do not generate a corresponding increase in revenue, our business will be harmed.

18

If we are unable to develop new services or sell our services into new markets, our revenue growth will be harmed and we may not be able to achieve profitability.

Our ability to attract new customers and increase revenue from existing customers will depend in large part on our ability to enhance and improve our existing application suite and to introduce new services and sell into new markets. The success of any enhancement or new service depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or service. Any new service we develop or acquire may not be introduced in a timely or cost-effective manner and may not achieve the broad market acceptance necessary to generate significant revenue. Any new markets into which we attempt to sell our application, including new vertical markets and new countries or regions, may not be receptive. If we are unable to successfully develop or acquire new services, enhance our existing services to meet customer requirements or sell our services into new markets, our revenue will not grow as expected and we may not be able to achieve profitability.

Because we are a global organization and our long-term success depends, in part, on our ability to expand the sales of our services to customers located outside of the United States, our business is susceptible to risks associated with international sales and operations.

We currently maintain offices outside of the United States and have sales personnel or independent consultants in several countries. We have limited experience operating in foreign jurisdictions and are rapidly building our international operations. Managing a global organization is difficult, time consuming and expensive. Our inexperience in operating our business outside of the United States increases the risk that any international expansion efforts that we may undertake will not be successful. In addition, conducting international operations subjects us to new risks that we have not generally faced in the United States. These risks include:

| | • | | localization of our services, including translation into foreign languages and adaptation for local practices and regulatory requirements; |

| | • | | lack of familiarity with and unexpected changes in foreign regulatory requirements; |

| | • | | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| | • | | difficulties in managing and staffing international operations; |

| | • | | fluctuations in currency exchange rates; |

| | • | | potentially adverse tax consequences, including the complexities of foreign value added tax systems and restrictions on the repatriation of earnings; |

| | • | | dependence on certain third parties, including channel partners with whom we do not have extensive experience; |

| | • | | the burdens of complying with a wide variety of foreign laws and legal standards; |

| | • | | increased financial accounting and reporting burdens and complexities; |

| | • | | political, social and economic instability abroad, terrorist attacks and security concerns in general; and |

| | • | | reduced or varied protection for intellectual property rights in some countries. |

Operating in international markets also requires significant management attention and financial resources. The investment and additional resources required to establish operations and manage growth in other countries may not produce desired levels of revenue or profitability.

We rely on third-party software, including Oracle database software, that may be difficult to replace or which could cause errors or failures of our service that could lead to lost customers or harm to our reputation.

We rely on software licensed from third parties to offer our service, including database software from Oracle. This software may not continue to be available to us on commercially reasonable terms, or at all. Any

19

loss of the right to use any of this software could result in delays in the provisioning of our service until equivalent technology is either developed by us, or, if available, is identified, obtained and integrated, which could harm our business. Any errors or defects in third-party software could result in errors or a failure of our service which could harm our business.

Assertions by a third party that we infringe its intellectual property, whether successful or not, could subject us to costly and time-consuming litigation or expensive licenses.

The software and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims against us may grow. Our technologies may not be able to withstand any third-party claims or rights against their use. Additionally, although we have licensed from other parties proprietary technology covered by patents, we cannot be certain that any such patents will not be challenged, invalidated or circumvented. Furthermore, many of our service agreements require us to indemnify our customers for certain third-party intellectual property infringement claims, which could increase our costs as a result of defending such claims and may require that we pay damages if there were an adverse ruling related to any such claims. These types of claims could harm our relationships with our customers, may deter future customers from subscribing to our services or could expose us to litigation for these claims. Even if we are not a party to any litigation between a customer and a third party, an adverse outcome in any such litigation could make it more difficult for us to defend our intellectual property in any subsequent litigation in which we are a named party.

Any intellectual property rights claim against us or our customers, with or without merit, could be time-consuming, expensive to litigate or settle and could divert management attention and financial resources. An adverse determination also could prevent us from offering our suite to our customers and may require that we procure or develop substitute services that do not infringe.

For any intellectual property rights claim against us or our customers, we may have to pay damages or stop using technology found to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms, if at all, may significantly increase our operating expenses or may require us to restrict our business activities in one or more respects. As a result, we may also be required to develop alternative non-infringing technology, which could require significant effort and expense.

Our success depends in large part on our ability to protect and enforce our intellectual property rights.