August 23, 2013

Jeanne Bennett

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

Re: China BAK Battery, Inc.

Form 10-K for the Fiscal Year Ended September 30, 2012

Filed December 31, 2012

Form 10-Q for the Quarterly Period Ended March 31, 2013

Filed May 20, 2013

Amendment No. 1 to Form 10-Q for Quarterly Period Ended March 31, 2013

Filed July 15, 2013

File No. 001-32898

Dear Ms. Bennett:

On behalf of China BAK Battery, Inc. (the “Company”), we hereby submit the Company’s responses to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated July 26, 2013, with respect to the above-referenced Form 10-K for the fiscal year ended September 30, 2012 (the “Form 10-K”) and the Form 10-Q for the quarterly period ended March 31, 2013 (the “Form 10-Q”) and the Amendment No. 1 to the Form 10-Q (the “Amendment No. 1”).

For the convenience of the Staff, a summary of the Staff’s comments is included and is followed by the corresponding response of the Company. References in this letter to “we,” “us” and “our” refer to the Company, and “you” and “your” refer to the Staff, unless the context indicates otherwise.

Form 10-Q for the Quarterly Period Ended March 31, 2013

Item 1. Financial Statements

Note 4. Inventories, page F-12

| 1. | We note your response to prior comment 4. From your statements of cash flows and the tables presenting your analysis of the provision for obsolete inventories included in your filings, we note that you recorded reversals of the provision for obsolete inventories in each period. |

- Please describe to us in detail the transactions that resulted in your reversingprevious inventory obsolescence charges.

Jeanne Bennett

August 23, 2013

Page 2 of 9

- To the extent such charges relate to the sale of previously written downinventory, provide a quantified example using journal entries, showing howsuch sales result in the reversal.

- Tell us how your accounting is consistent with SAB Topic 5BB.

- Tell us thegross amountsof such reversals of provision for obsoleteinventories recorded in fiscal 2011, 2012 and in each of the quarters in theperiod ended June 30, 2013.

COMPANY RESPONSE: In response to the Staff’s comment:

- We would like to advise the Staff that we did not reverse previous inventory obsolescencecharges(see explanation below).

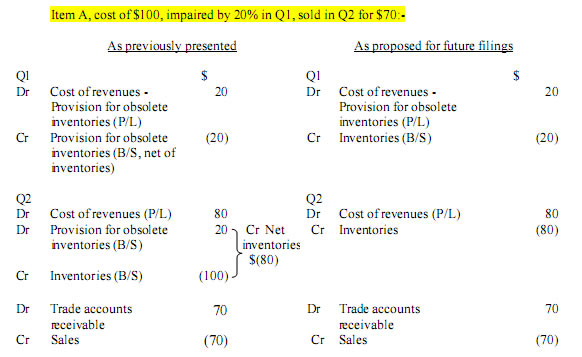

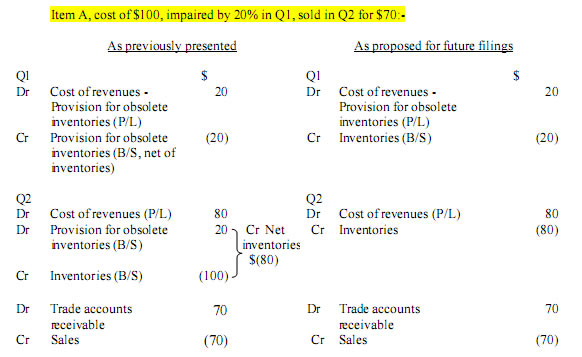

- We would like to provide the following example of our journal entries to record to the sale of previously written down inventory:

- We would like to advise the Staff that our treatment is consistent with SAB Topic 5BB as shown above.

Jeanne Bennett

August 23, 2013

Page 3 of 9

- We would also like to advise the Staff that the gross amounts of the reversals of the balance sheet provision for obsolete inventories recorded, as follows:

Jeanne Bennett

August 23, 2013

Page 4 of 9

Jeanne Bennett

August 23, 2013

Page 5 of 9

Jeanne Bennett

August 23, 2013

Page 6 of 9

| 2. | We note from the proposed revised disclosure submitted in response to comment 6 in your letter dated June 13, 2013 that the amounts for the statement of cash flow captions “provisions for obsolete inventories” and “inventories” changed from the amounts previously presented for the years ended September 30, 2012 and 2011, respectively. Please explain to us the reasons for the change. |

COMPANY RESPONSE: In accordance with the Staff’s request, we would like to advise that we determined it more appropriate to show the impairment charge on inventories on the statement of cash flows, instead of the “movement” in the balance sheet provision for obsolete inventories. See below for our proposed changes regarding fiscal years 2012 and 2011, and the quarter ended 12/31/2012:

| | | As previously presented | | | As proposed for future | |

| | | in the statements of | | | statements of | |

| | | cash flows | | | cash flows | |

| | | $ | | | $ | |

| Fiscal 2011 | | | | | | |

| Provision for obsolete inventories (representing “movement” in the balance sheet provision) | | (1,807,330 | ) | | | |

| Provision for obsolete inventories (representing P/L impairment charge) | | | | | 4,517,357 | |

| Inventories | | 2,088,744 | | | (4,235,943 | ) |

| | | 281,414 | | | 281,414 | |

| | | | | | | |

| Fiscal 2012 | | | | | | |

| Provision for obsolete inventories (representing “movement” in the balance sheet provision) | | 5,139,589 | | | | |

| Provision for obsolete inventories (representing P/L impairment charge) | | | | | 9,702,373 | |

| Inventories | | (2,390,817 | ) | | (6,953,601 | ) |

| | | 2,748,772 | | | 2,748,772 | |

| | | | | | | |

| Three months ended 12/31/2012:- | | | | | | |

| Provision for obsolete inventories (representing “movement” in the balance sheet provision) | | (710,827 | ) | | | |

| Provision for obsolete inventories (representing P/L impairment charge) | | | | | 19,275,145 | |

| Inventories | | 6,062,969 | | | (13,923,003 | ) |

| | | 5,352,142 | | | 5,352,142 | |

| 3. | Please reconcile for us the write-downs of obsolete inventories of $9,702,373 and $4,517,357 in the years ended September 30, 2012 and 2011, respectively, noted in the revised disclosure included in your response to comment 6 in your letter dated June 13, 2013, to the amounts previously reported in your Form 10-K. |

COMPANY RESPONSE: Please refer to our responses to comments 1 and 2 above.

Jeanne Bennett

August 23, 2013

Page 7 of 9

| 4. | Your statement of cash flows for the six months ended March 31, 2013 in your Form 10-Q for the period then ended reflects a provision for obsolete inventories of $25,795,764. After deducting the provision you recorded in the 2013 second quarter of $5.8 million, it would appear that your statement of cash flows now reflects a provision of $19.9 million for the three months ended December 31, 2013, which is different from the recovery of $710,827 previously reported for the period. Please explain your reasons for the change. |

COMPANY RESPONSE: In accordance with the Staff’s request, we would like to provide the following reconciliations:

| | | $ | |

Provision for obsolete inventories (P/L) charge for the 6 months ended

March 31, 2013, which has already been disclosed in the statement of

cash flows | | 25,795,764 | |

Less: Provision for obsolete inventories (P/L) charge for the 3 months

ended March 31, 2013 (erroneously disclosed as $5.8 million on the

Form 10-Q) | | (6,520,619 | ) |

Provision for obsolete inventories (P/L) charge for the 3 months ended

December 31, 2012 - to be disclosed in the proposed revised statement

of cash flows | | 19,275,145 | |

The amount of $710,827 is the net “movement” in the provision for obsolete inventory (B/S) – Note 4 to the financial statements in the Form 10-Q, as explained in our responses to Comment 1 above.

| 5. | Otherwise, explain to us how the write-down of obsolete inventories of $19,985,972 indicated in your response to comment 15 in your letter dated June 13, 2013 was reflected in your statement of cash flow, and in the table showing the analysis of the provision for obsolete inventories of page F-13 of your Form 10-Q for the period ended December 31, 2012. |

COMPANY RESPONSE: In response to the Staff’s request, we would like to advise that $19,275,145 (instead of $19,985,972 as indicated in our response to comment 15 in our letter dated June 13, 2013) was the write down of obsolete inventories (also termed as provision for obsolete inventories (P/L) charge elsewhere in this letter), which is also the amount to be disclosed in the proposed revised statement of cash flows (as explained in responses to comments 2 and 4 above), whereas the amount of $710,827 as shown in the table on page F-13 of our Form 10-Q for the period ended December 31, 2012 is the net “movement” in provision for obsolete inventory (B/S), as explained in our responses to comments 1 and 4 above.

| 6. | Specifically address whether these changes result from a correction of your previous accounting for obsolete inventory write-downs. Discuss your conclusion that the changes should not be labeled and reported as a restatement, along with the disclosures required by ASC 250-10-50 (formerly SFAS 154) in amendments to the respective documents. |

Jeanne Bennett

August 23, 2013

Page 8 of 9

COMPANY RESPONSE: In response to the Staff’s comment, we would like to advise that the above proposed revised disclosures in respect of write-down of obsolete inventories do not have any impact on the statement on comprehensive income and statement of financial position. Therefore, the changes would not normally require a restatement in accordance with ASC 250-10-50. However, as a result of restatements of the quarterly reports on Forms 10Q/A for the periods ended December 31, 2012 and March 31, 2013 that are being filed concurrently with this response to correct other errors we have also labeled and reported these changes as restatements in those filings.

Exhibit 31.1 and Exhibit 32.1

| 7. | We note that the amendment filed in response to prior comment 7 did not include the entire filing as requested in our prior comment. Please file another amendment to include the entire filing and the signed and dated certifications. Refer to Item 601(B)(31) and (32) of Regulation S-K and Rule 13a-14(a) and (b) or Rule 15d-14(a) and (b). |

COMPANY RESPONSE: Pursuant to the Staff’s request, on August 23, 2013, we filed the Amendment No. 2 to the Form 10-Q as well as the Amendment No. 1 to Form 10-Q for the period ended December 31, 2012, each including the entire filing and the signed and dated certifications.

****

Jeanne Bennett

August 23, 2013

Page 9 of 9

In connection with the Company’s response to the foregoing comments, the Company hereby acknowledges that

- the Company is responsible for the adequacy and accuracy of the disclosure in the filing;

- Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and

- the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you would like to discuss any of our responses to the Staff’s comments or if you would like to discuss any other matters, please contact Thomas M. Shoesmith at (650)-233-4553, of Pillsbury Winthrop Shaw Pittman LLP, our outside counsel.

| | Sincerely, |

| | |

| | CHINA BAK BATTERY, INC. |

| | |

| | By:/s/ Xiangqian Li |

| | Xiangqian Li |

| | Chief Executive Officer |