Safe Harbor Statement

[LOGO OF CHINA BAK BATTERY INC.]

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This presentation includes or incorporates by reference statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements include, but are not limited to, information or assumptions about revenues, gross profit, expenses, income, capital and other expenditures, financing plans, capital structure, cash flow, liquidity, management’s plans, goals and objectives for future operations and growth. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, levels of activity, performance or achievements.

2

Investment Considerations

[LOGO OF CHINA BAK BATTERY INC.]

• | One of the world’s fastest growing Li-Ion battery cell manufacturers; founded in 2001; US public company with operations in China |

| |

• | Why are Li-Ion batteries the “defacto standard” in most applications? |

| – | Higher power and longer duraion |

| | |

• | Large & growing market: Current market in excess of $2.5 billion |

| – | Growing at an estimated 20% CAGR per year |

| – | 30% CAGR per year in China |

| | |

• | Expanding Li-Ion product opportunities |

| – | Laptop computers |

| – | Lithium Polymer |

| – | High Power |

| | • | Li-Ph (e.g. Power Tools) |

| | • | Hybrid Electric Vehicle (HEV’s) |

3

Investment Considerations

[LOGO OF CHINA BAK BATTERY INC.]

• | Company’s growth plans focus on three key initiatives: |

| – | Grow organically in Company’s original market (mobile phone battery cells to 3rd party replacement battery manufacturers) |

| – | Develop new Li power products serving new applications |

| – | Develop a greater presence in the OEM channel |

| | |

• | Consumable products |

| – | Recurring revenue stream creates predictable business |

| – | “Razor and razorblade” operation |

| | |

• | Established competitive advantages: |

| – | State-of-the-art technical capability with a bias towards development partnerships |

| – | Uniquely structured as low cost producer of high quality products |

4

Facilities

[LOGO OF CHINA BAK BATTERY INC.]

[GRAPHICS APPEAR HERE]

• | New, 90-Acre industrial campus |

| |

• | 1.9 million sq. ft. of manufacturing space |

| |

• | 8250 employees |

| |

• | World-class R&D center |

| |

• | Low cost expansion |

[GRAPHICS APPEAR HERE]

5

Applications for Li-ion Cells

[LOGO OF CHINA BAK BATTERY INC.]

Li-ion is the battery technology of choice, and demand is significantly Increasing.

• | Utilized in: |

| – | Mobile phones |

| – | Digital cameras and camcorders |

| – | MP3 players |

| – | Laptops |

| – | Bluetooth headsets |

| – | Power tools |

| – | General industrial applications |

[GRAPHICS APPEAR HERE]

6

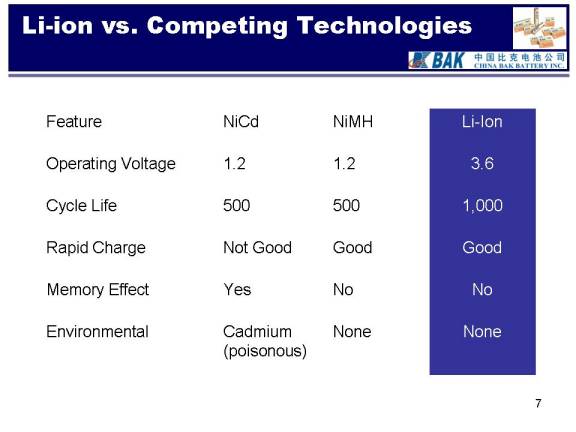

Li-ion vs. Competing Technologies

[LOGO OF CHINA BAK BATTERY INC.]

Feature | | NiCd | | NiMH | | Li-Ion |

| |

| |

| |

|

Operating Voltage | | 1.2 | | 1.2 | | 3.6 |

Cycle Life | | 500 | | 500 | | 1,000 |

Rapid Charge | | Not Good | | Good | | Good |

Memory Effect | | Yes | | No | | No |

Environmental | | Cadmium (poisonous) | | None | | None |

7

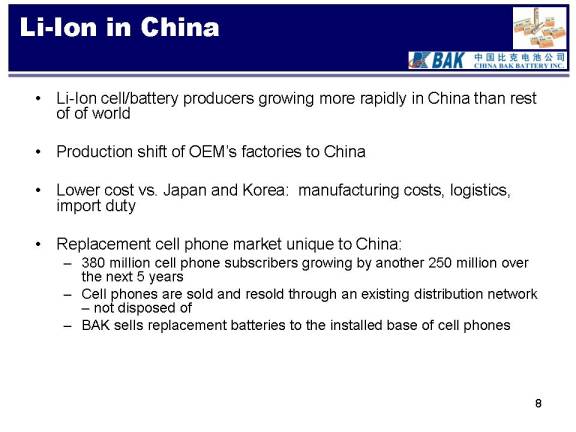

Li-Ion in China

[LOGO OF CHINA BAK BATTERY INC.]

• | Li-Ion cell/battery producers growing more rapidly in China than rest of world |

| |

• | Production shift of OEM’s factories to China |

| |

• | Lower cost vs. Japan and Korea: manufacturing costs, logistics, import duty |

| |

• | Replacement cell phone market unique to china: |

| – 380 million cell phone subscribers growing by another 250 million over the next 5 years |

| – Cell phones are sold and resold through an existing distribution network |

| – not disposed of |

| – BAK sells replacement batteries to the installed base of cell phones |

8

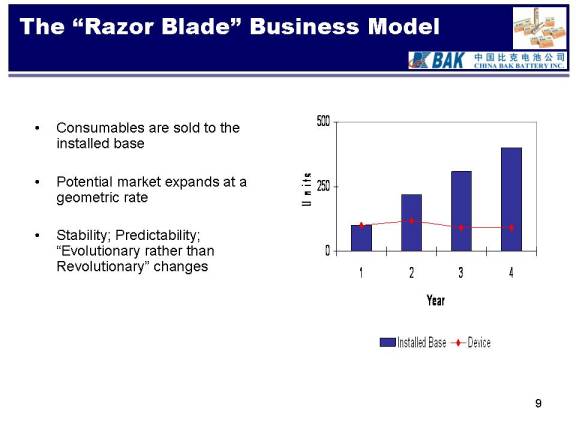

The “Razor Blade” Business Model

[LOGO OF CHINA BAK BATTERY INC.]

• | Consumables are sold to the installed base |

| |

• | Potential market expands at a geometric rate |

| |

• | Stability; Predictability; “Evolutionary rather than Revolutionary” changes |

[CHART APPEARS HERE]

9

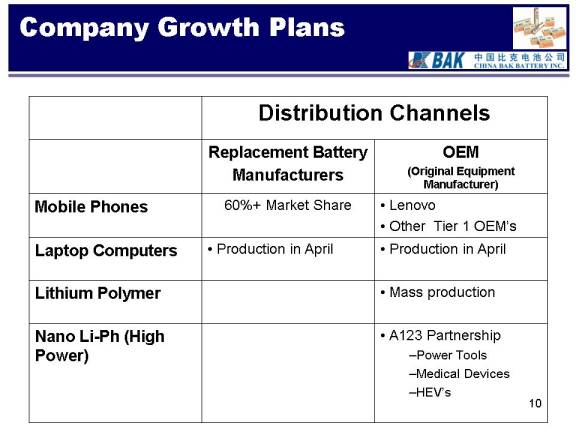

Company Growth Plans

[LOGO OF CHINA BAK BATTERY INC.]

| | Distribution Channels |

| |

|

| | Replacement Battery

Manufacturers | | OEM

(Original Equipment Manufacturer) |

| |

| |

|

Mobile Phones | | 60%+ Market Share | | • Lenovo |

| | | | • Other Tier 1 OEM’s |

| | | | |

Laptop Computers | | • Production in April | | • Production in April |

| | | | |

Lithium Polymer | | | | • Mass production |

| | | | |

Nano Li-Ph (High Power) | | | | • A123 Partnership |

| | | | – Power Tools |

| | | | – Medical Devices |

| | | | – HEV’s |

10

Product Applications for Li Power

[LOGO OF CHINA BAK BATTERY INC.]

[GRAPHIC APPEARS HERE]

Cordless power tools

[GRAPHIC APPEARS HERE]

Laptops

[GRAPHIC APPEARS HERE]

Hybrid-electric vehicles

[GRAPHIC APPEARS HERE]

MP3/Portable Entertainment

[GRAPHIC APPEARS HERE]

Bluetooth Headsets

[GRAPHIC APPEARS HERE]

Cell Phones

11

Mobile phone OEM Channel Sales

[LOGO OF CHINA BAK BATTERY INC.]

• | Lenovo |

| – | Lenovo purchased the IBM PC business |

| – | Plan to make cell phones the second “product pillar” of the company |

| – | Announced goal is to become the largest manufacturer in China |

| – | Sells a unique perfume emitting cell phone which has achieved high volume sales |

| – | CBBT has been producing Lithium-ion cells for Lenovo since August 2005 |

| | |

• | New BAK/Lenovo strategic cooperation agreement |

| – | Enables both companies to jointly contribute and share resources to further product development efforts |

| – | Expands current relationship |

| – | Facilitates the development of new battery solutions for Lenovo |

| | |

• | Qualification underway with other Tier 1 OEM’s |

12

Laptop Power Products

[LOGO OF CHINA BAK BATTERY INC.]

• | Utilizing capital raised in 2005 to build capacity for laptop battery cell manufacturing |

| |

• | 2006 progress to date : |

| – | All production equipment for this product line ordered |

| – | Production line is currently under construction |

| – | Qualifications with OEMs underway |

| – | Estimate that facilities will be ready for production by April |

[GRAPHIC APPEARS HERE]

13

Lithium Polymer Product Line

[LOGO OF CHINA BAK BATTERY INC.]

• | Utilized for small-format batteries customized in size and shape for specific applications |

| |

• | Current Capacity = 1 million pieces per month. |

| |

• | Current applications include: |

| – | MP3 players |

| – | Bluetooth headsets |

| – | Ultra light cell phones |

14

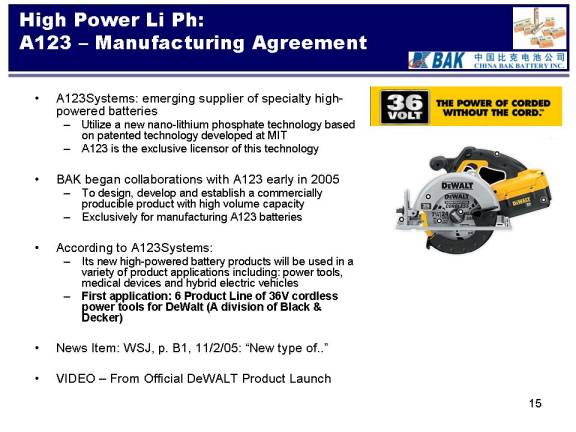

High Power Li Ph:

A123 – Manufacturing Agreement

[LOGO OF CHINA BAK BATTERY INC.]

• | A123Systems: emerging supplier of specialty high-powered batteries |

| – | Utilize a new nano-lithium phosphate technology based on patented technology developed at MIT |

| – | A123 is the exclusive licensor of this technology |

| | |

• | BAK began collaborations with A123 early in 2005 |

| – | To design, develop and establish a commercially producible product with high volume capacity |

| – | Exclusively for manufacturing A123 batteries |

| | |

• | According to A123Systems: |

| – | Its new high-powered battery products will be used in a variety of product applications including: power tools, medical devices and hybrid electric vehicles |

| – | First application: 6 Product Line of 36V cordless power tools for DeWalt (A division of Black & Decker) |

| | |

• | News Item: WSJ, p. B1, 11/2/05: “New type of..” |

| |

• | VIDEO – From Official DeWALT Product Launch |

[GRAPHICS APPEAR HERE]

15

Competitive Advantage:

World Class Technical Capability

[LOGO OF CHINA BAK BATTERY INC.]

• | Bak facilities meet or exceed international standards |

| – | EU and CE attestation, UL Authentication, ISO9001: 2000 quality management system certification of the ZJQC; ISO4001: 1996 environmental management system certification of the ZJQC |

| | |

• | Most advanced Li-ion research lab in China |

| – | State-of-the-art analytical equipment |

| – | Advanced automated model plant |

| | |

• | World class scientists BAK R&D Center |

| – | Expertise from Japan, Canada and China |

| | |

• | R&D organization focus: |

| – | Ability to jointly program manage development with customers and partners |

| – | Unique ability to transition laboratory technology to manufacturing practice |

| – | Partnering leverages the company’s capabilities |

16

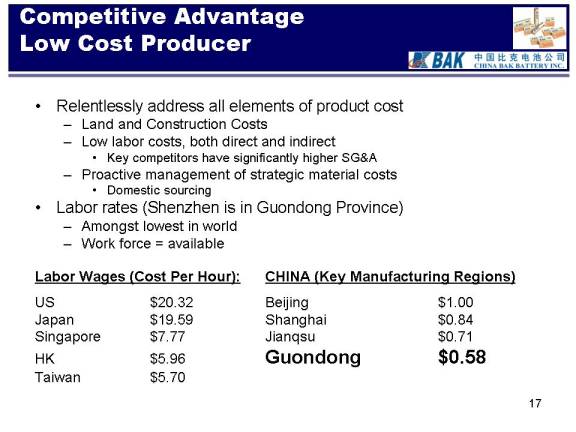

Competitive Advantage:

Low Cost Producer

[LOGO OF CHINA BAK BATTERY INC.]

• | Relentlessly address all elements of product cost |

| – | Land and Construction Costs |

| – | Low labor costs, both direct and indirect |

| | • | key competitors have significantly higher SG&A |

| – | Proactive management of strategic material costs |

| | • | Domestic sourcing |

• | Labor rates (Shenzhen is in Guondong Province) |

| – | Amongst lowest in world |

| – | Work force = available |

Labor Wages (Cost Per Hour): | | CHINA (Key Manufacturing Regions) |

| |

|

US | $20.32 | | Beijing | $1.00 |

Japan | $19.59 | | Shanghai | $0.84 |

Singapore | $ 7.77 | | Jianqsu | $0.71 |

HK | $ 5.96 | | Guondong | $0.58 |

Taiwan | $ 5.70 | | | |

17

Competitive Advantage:

Low cost producer

[LOGO OF CHINA BAK BATTERY INC.]

• | Factory structure is a combination of automated manufacturing processes and manual processes that utilize low cost Chinese cost labor |

| – | Objective is cost optimization by employing automation where it imparts improved yield, throughput or process repeatability that creates value |

| – | Automated equipment sourced in PRC and Taiwan |

• | High market share: |

| – | Economies of scale re: manufacturing overhead and absorption of fixed manufacturing costs |

| – | Purchasing power of key raw materials |

• | Gross margin improvements |

| – | Yield improvements |

| – | Throughput improvements |

| – | Improved purchase costs on raw materials |

| – | Favorable product mix |

| – | Fixed cost absorption |

18

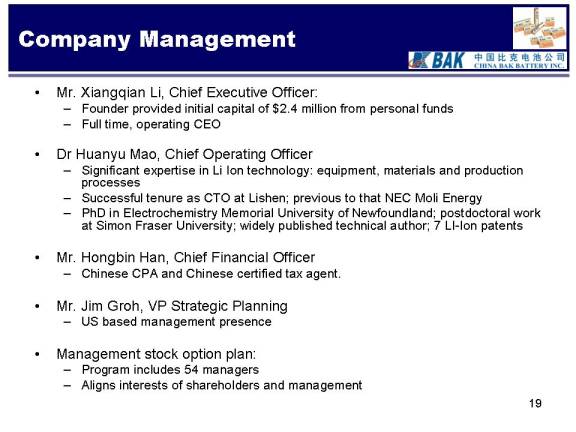

Company Management

[LOGO OF CHINA BAK BATTERY INC.]

• | Mr. Xiangqian Li, Chief Executive Officer: |

| – | Founder provided initial capital of $2.4 million from personal funds |

| – | Full time, operating CEO |

| | |

• | Dr Huanyu Mao, Chief Operating Officer |

| – | Significant expertise in Li Ion technology: equipment, materials and production processes |

| – | Successful tenure as CTO at Lishen; previous to that NEC Moli Energy |

| – | PhD in Electrochemistry Memorial University of Newfoundland; postdoctoral work at Simon Fraser University; widely published technical author; 7 LI-Ion patents |

| | |

• | Mr. Hongbin Han, Chief Financial Officer |

| – | Chinese CPA and Chinese certified tax agent. |

| | |

• | Mr. Jim Groh, VP Strategic Planning |

| – | US based management presence |

| | |

• | Management stock option plan: |

| – | Program includes 54 managers |

| – | Aligns interests of shareholders and management |

19

[LOGO OF CHINA BAK BATTERY INC.]

Financial Overview

[GRAPHICS APPEAR HERE]

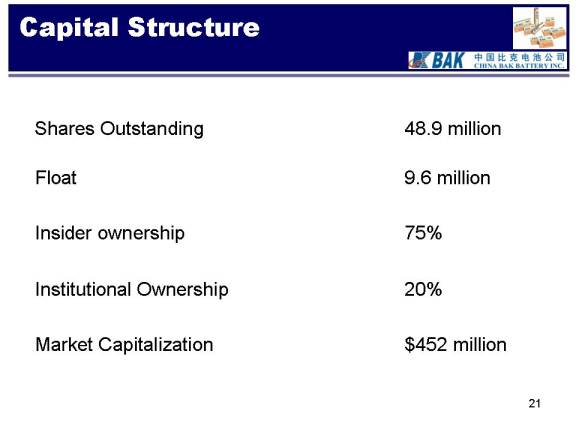

Capital Structure

[LOGO OF CHINA BAK BATTERY INC.]

Shares Outstanding | 48.9 million |

| |

Float | 9.6 million |

| |

Insider Ownership | 75% |

| |

Institutional Ownership | 20% |

| |

Market Capitalization | $452 million |

21

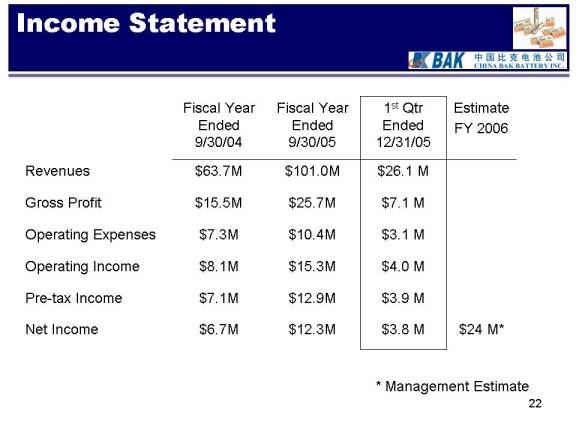

Income Statement

[LOGO OF CHINA BAK BATTERY INC.]

| | | | | | | | | | | | | |

| | Fiscal Year

Ended

9/30/04 | | Fiscal Year

Ended

9/30/05 | | 1st Qtr

Ended

12/31/05 | | Estimate

FY 2006 | |

| |

| |

| |

| |

| |

Revenues | | $ | 63.7M | | $ | 101.0M | | $ | 26.1M | | | | |

Gross Profit | | $ | 15.5M | | $ | 25.7M | | $ | 7.1M | | | | |

Operating Expenses | | $ | 7.3M | | $ | 10.4M | | $ | 3.1M | | | | |

Operating Income | | $ | 8.1M | | $ | 15.3M | | $ | 4.0M | | | | |

Pre-tax Income | | $ | 7.1M | | $ | 12.9M | | $ | 3.9M | | | | |

Net Income | | $ | 6.7M | | $ | 12.3M | | $ | 3.8M | | $ | 24M | * |

22

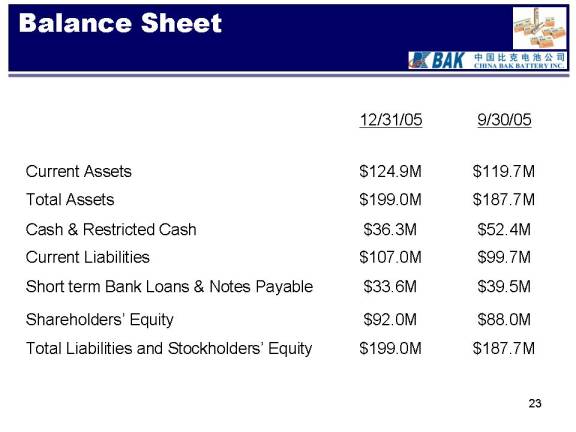

Balance Sheet

[LOGO OF CHINA BAK BATTERY INC.]

| | | | | | | |

| | 12/31/05 | | 9/30/05 | |

| |

|

| |

|

| |

Current Assets | | $ | 124.9M | | $ | 119.7M | |

Total Assets | | $ | 199.0M | | $ | 187.7M | |

Cash & Restricted Cash | | $ | 36.3M | | $ | 52.4M | |

Current Liabilities | | $ | 107.0M | | $ | 99.7M | |

Short term Bank Loans & Notes Payable | | $ | 33.6M | | $ | 39.5M | |

Shareholders’ Equity | | $ | 92.0M | | $ | 88.0M | |

Total Liabilities and Stockholders’ Equity | | $ | 199.0M | | $ | 187.7M | |

23

Summary

[LOGO OF CHINA BAK BATTERY INC.]

• | One of the fastest growing Li-ion battery manufacturers in the world focused on rapidly expanding opportunities in terms of products, applications, and channels |

| |

• | Recurring revenue “razor blade” business model provides business visibility |

| |

• | The Company has crafted significant competitive advantage by combining world class technical capabilities in a low cost manufacturing structure |

| |

• | The partnership with A123 systems with their breakthrough Nano Li-Ph technology for high power applications places BAK at the technological forefront of the industry. |

| |

• | Growth will come from existing channel/market growth, entry into the OEM channel, and new products serving new applications. |

24