Investor Presentation

February 2007

[LOGO OF CHINA BAK BATTERY, INC.]

Safe Harbor Statement

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This presentation includes or incorporates by reference statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements include, but are not limited to, information or assumptions about revenues, gross profit, expenses, income, capital and other expenditures, financing plans, capital structure, cash flow, liquidity, management’s plans, goals and objectives for future operations and growth. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, levels of activity, performance or achievements.

2 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Investment Considerations

| • | One of the world’s biggest & fastest growing Li-ion battery cell manufacturers |

| | |

| • | Large & growing $2.5 billion Li-ion battery market |

| | |

| • | Expanding Li-ion product opportunities |

| | |

| • | Recurring revenue stream |

| | |

| • | Low cost manufacturing |

| | |

| • | State-of-the-art technical capability |

| | |

| • | Multiple growth opportunities |

[GRAPHIC APPEARS HERE]

3 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Li-Ion Cell Market in China

| • | Li-Ion cell/battery producers growing more rapidly in China than rest of of world |

| | |

| • | Production shift of OEM’s factories to Asia in general and China in particular |

| | |

| • | Lower cost vs. Japan and Korea: manufacturing costs, logistics, import duty |

| | |

| • | Replacement cell phone market unique to China: |

| | | |

| | – | 416 million cell phone subscribers growing by another 250 million over the next 5 years |

| | | |

| | – | Cell phones are sold and resold through an existing distribution network – not disposed of like in the US |

| | | |

| | – | BAK sells replacement batteries to the installed base of cell phones |

4 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

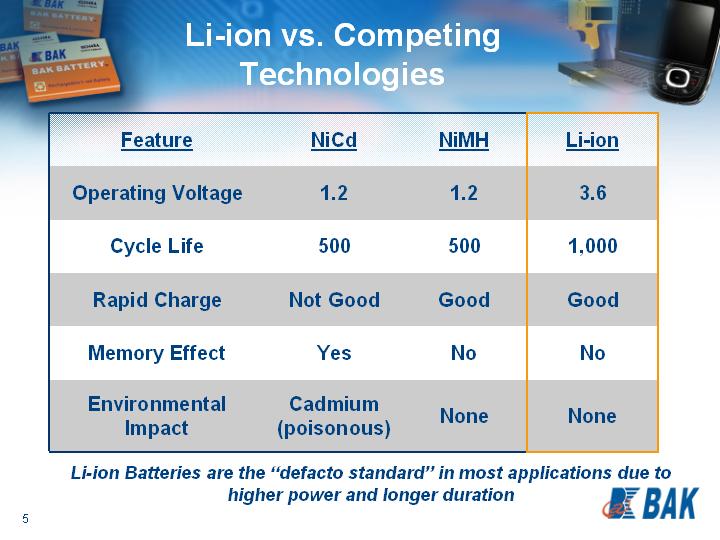

Li-ion vs. Competing Technologies

Feature | | NiCd | | NiMH | | Li-ion |

| |

| |

| |

|

Operating Voltage | | 1.2 | | 1.2 | | 3.6 |

Cycle Life | | 500 | | 500 | | 1,000 |

Rapid Charge | | Not Good | | Good | | Good |

Memory Effect | | Yes | | No | | No |

Environmental Impact | | Cadmium (poisonous) | | None | | None |

Li-ion Batteries are the “defacto standard” in most applications due to higher power and longer duration

5 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Key Rechargeable Battery Applications

[GRAPHIC APPEARS HERE] | [GRAPHIC APPEARS HERE] | [GRAPHIC APPEARS HERE] |

Notebook Computers | PDAs | Digital Cameras |

| | |

[GRAPHIC APPEARS HERE] | [GRAPHIC APPEARS HERE]

Li-ion Rechargeable Batteries | [GRAPHIC APPEARS HERE] |

Cell phones | Bluetooth Headsets |

| |

[GRAPHIC APPEARS HERE] | [GRAPHIC APPEARS HERE] |

Cordless power tools | | Hybrid-electric vehicles |

| | |

[GRAPHIC APPEARS HERE] | [GRAPHIC APPEARS HERE] | [GRAPHIC APPEARS HERE] |

MP3/Portable Entertainment | Uninterruptible Power Supply | Light-electric vehicles |

6 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Replacement Battery Market

| • | BAK has 60% share of this market |

| | | |

| • | Provides recurring revenue stream |

| | | |

| • | BAK’s historical core business |

| | | |

| | – | Sales of steel and aluminum case battery cells to replacement battery manufacturers |

| | | |

| | – | These manufacturers, who sell under their own brand name or private-label brands, are predominantly Chinese manufactures |

| | | |

| • | Relationships with key battery pack customers, including: |

| | | |

| | – | SCUD (Fujian) Electronics Co., Ltd. |

| | | |

| | – | Desay Power Tech. Co., Ltd. |

| | | |

| | – | Shenzhen Ya Litong Electronic Co., Ltd. |

7 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

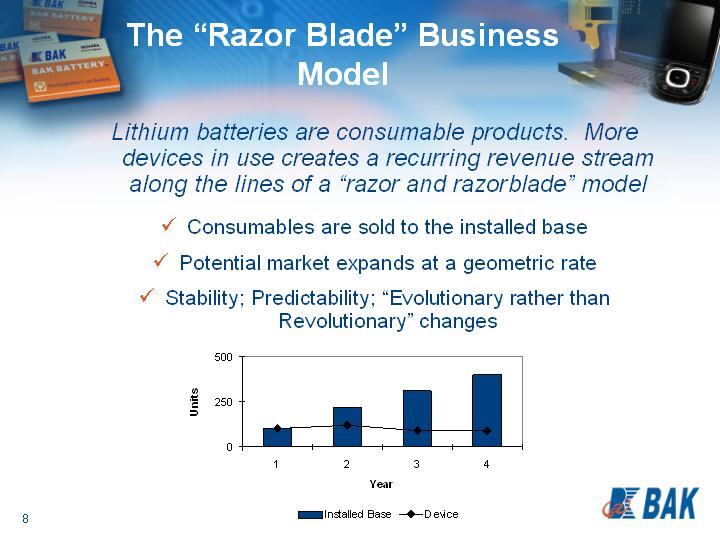

The “Razor Blade” Business Model

Lithium batteries are consumable products. More devices in use creates a recurring revenue stream along the lines of a “razor and razorblade” model

| • | Consumables are sold to the installed base |

| | |

| • | Potential market expands at a geometric rate |

| | |

| • | Stability; Predictability; “Evolutionary rather than Revolutionary” changes |

[CHART APPEARS HERE]

8 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Sales to Mobile Phone OEMs

| • | The competitive environment |

| | |

| | – | Product safety is the OEM’s primary concern. |

| | | |

| | – | Most OEM cells manufactured in Japan or Korea |

| | | |

| | – | BAK believes it has a significant cost manufacturing advantage over Japanese and Korean suppliers |

| | | |

| • | New Customers |

| | |

| | – | BAK has announced a number of new customers: Lenovo, Ben Q Siemens, China Tech Faith Wireless, UTStarcom, SIM Technology Group, Longcheer Technology, Hisense |

| | | |

| • | Qualification underway with international Tier 1 OEM’s |

9 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

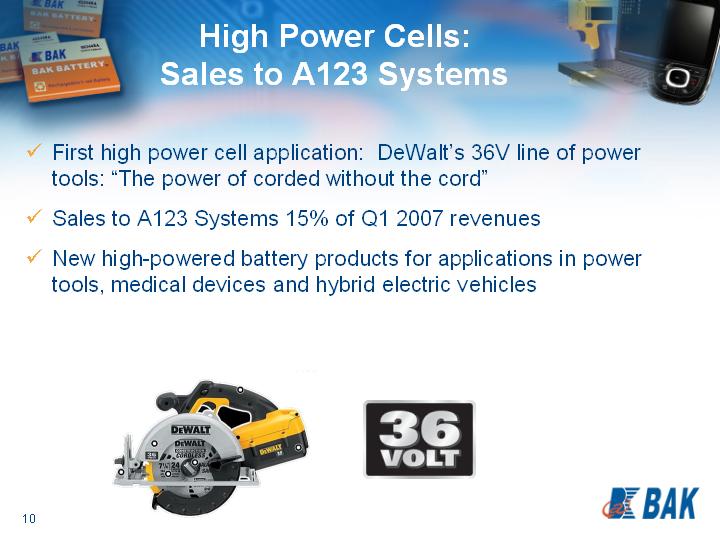

High Power Cells:

Sales to A123 Systems

| • | First high power cell application: DeWalt’s 36V line of power tools: “The power of corded without the cord” |

| | |

| • | Sales to A123 Systems 15% of Q1 2007 revenues |

| | |

| • | New high-powered battery products for applications in power tools, medical devices and hybrid electric vehicles |

[GRAPHIC APPEARS HERE]

10 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Laptop Power Products

| • | Began commercial production in July 2006 |

| | |

| • | Significant increase in manufacturing sophistication as compared to mobile phone cells |

| | |

| • | Customers |

| | |

| | – | Shenzhen Fonleate Electronics |

| | | |

| | – | In negotiations with several Tier 1 OEMs |

| | | |

| • | Production is currently 40,000 pieces per day |

[GRAPHIC APPEARS HERE]

11 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Lithium Polymer Product Line

| • | Utilized for small-format batteries customized in size and shape for specific applications |

| | |

| • | Current Capacity > 1 million pieces per month |

| | |

| • | Current applications include: |

| | |

| | – | MP3 players |

| | | |

| | – | Bluetooth headsets |

| | | |

| | – | Ultra light cell phones |

[GRAPHIC APPEARS HERE]

12 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

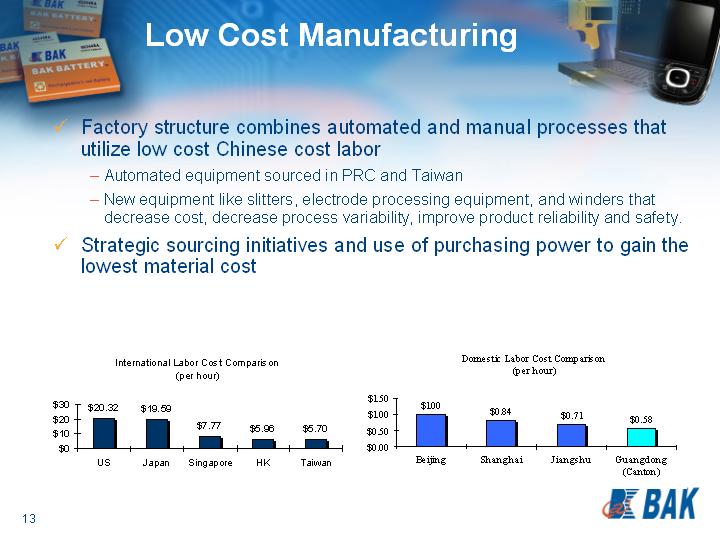

Low Cost Manufacturing

| • | Factory structure combines automated and manual processes that utilize low cost Chinese cost labor |

| | |

| | – | Automated equipment sourced in PRC and Taiwan |

| | | |

| | – | New equipment like slitters, electrode processing equipment, and winders that decrease cost, decrease process variability, improve product reliability and safety. |

| | | |

| • | Strategic sourcing initiatives and use of purchasing power to gain the lowest material cost |

International Labor Cost Comparison

(per hour) | Domestic Labor Cost Comparison

(per hour) |

| |

[CHART APPEARS HERE] | [CHART APPEARS HERE] |

| |

13 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

World Class Technical Capability

| • | BAK facilities meet or exceed international standards |

| | | |

| | – | EU and CE attestation, UL Authentication, ISO9001: 2000, ISO4001:1996 certified |

| | | |

| | – | Most advanced Li-ion research lab in China |

| | | |

| | – | State-of-the-art analytical equipment |

| | | |

| | – | Advanced automated model plant |

| | | |

| • | World class scientists BAK R&D Center |

| | | |

| • | R&D organization focus: |

| | | |

| | – | Joint program development with customers and partners |

| | | |

| | – | Unique ability to transition laboratory technology to manufacturing practice |

14 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

State of the Art Facilities

| • | 90-Acre industrial campus in Shenzhen including R&D center |

| | |

| • | 1.9 million sq. ft. of manufacturing space |

| | |

| • | 10,500+ employees |

| | |

| • | New planned facility in Tianjin |

| | |

| • | New R&D offices planned in central Shenzhen |

[GRAPHICS APPEAR HERE]

15 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Company Growth Plans

Distribution Channels |

|

| | Replacement Battery

Manufacturers | | OEM

(Original Equipment Manufacturer) |

|

|

|

|

|

Mobile Phones | • | 60%+ Market Share | • | Automated, process controlled production capability established |

| • | Strong relationships with key battery pack manufacturers | • | Growth catalyst: New OEM customers |

| • | Growth catalyst: Organic growth with market | • | Early success with China “Tier 1” OEM’s |

| | | • | Targeting international “Tier 1” OEM’s |

|

|

|

|

|

Laptop Computers | • | Growth catalyst: New battery pack manufacturer customers | • | Automated process controlled production capability established April 2006 |

| | | • | Growth catalyst: New OEM customers |

16 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Company Growth Plans

OEM |

(Original Equipment Manufacturer) |

|

Lithium Polymer | • | Production capability established 2006 |

| • | Growth catalyst: New customer development; continue to add manufacturing capacity |

|

|

|

Lithium Phosphate | • | Production established 2006 to supply A123 with nano lithium phosphate based cells for high power applications. |

High Power | • | Initial application: Power tools manufactured by Black and Decker’s DeWalt division. |

| • | Growth catalyst: supply to A123 |

|

|

|

High power | • | Planned facility announced in Tianjin. |

| • | Target applications: UPS, LEV. |

| • | Potential applications: HEV |

17 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Company Management

| • | Mr. Xiangqian Li, Chief Executive Officer |

| | |

| | – | Founder provided initial capital of $2.4 million from personal funds |

| | | |

| | – | Full time, operating CEO |

| | | |

| • | Dr Huanyu Mao, Chief Operating Officer |

| | |

| | – | Significant expertise in Li Ion technology: equipment, materials and production processes |

| | | |

| | – | Successful tenure as CTO at Lishen; previous to that NEC Moli Energy |

| | | |

| | – | PhD in Electrochemistry Memorial University of Newfoundland; postdoctoral work at Simon Fraser University; widely published technical author; 7 LI-Ion patents |

| | | |

| • | Mr. Hongbin Han, Chief Financial Officer |

| | |

| | – | Chinese CPA and Chinese certified tax agent. |

| | | |

| • | Mr. Jim Groh, US Representative |

| | |

| | – | US based management presence |

18 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Financial Overview

19 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

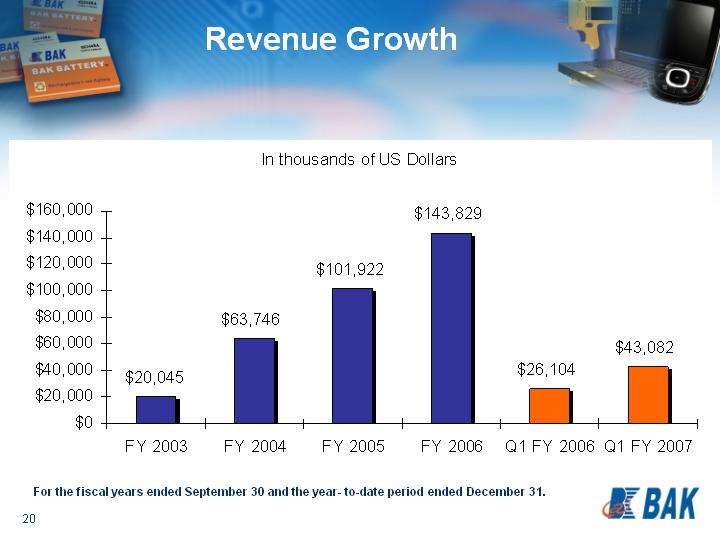

Revenue Growth

[CHART APPEARS HERE]

For the fiscal years ended September 30 and the year- to-date period ended December 31.

20 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Gross Profit Growth

[CHART APPEARS HERE]

For the fiscal years ended September 30 and the year- to-date period ended December 31.

21 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

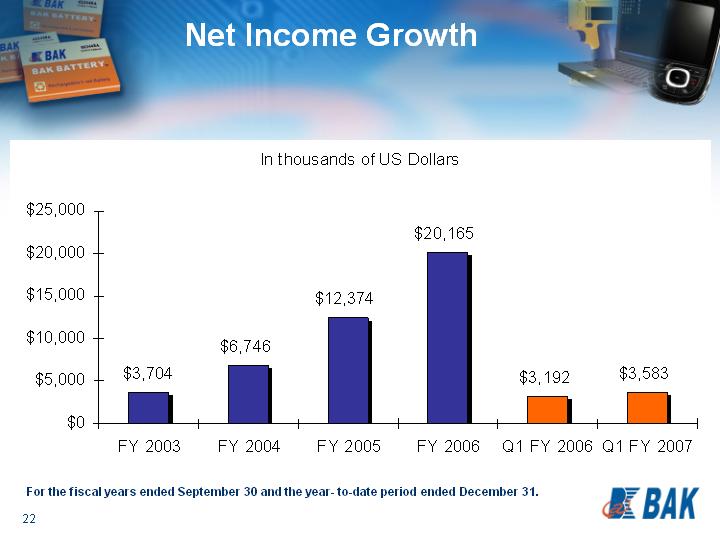

Net Income Growth

[CHART APPEARS HERE]

For the fiscal years ended September 30 and the year- to-date period ended December 31.

22 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Capital Structure

Shares Outstanding | | 48.9 million |

Float | |  21 million 21 million

|

Insider ownership | | 46% |

Institutional Ownership | | 69% |

23 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

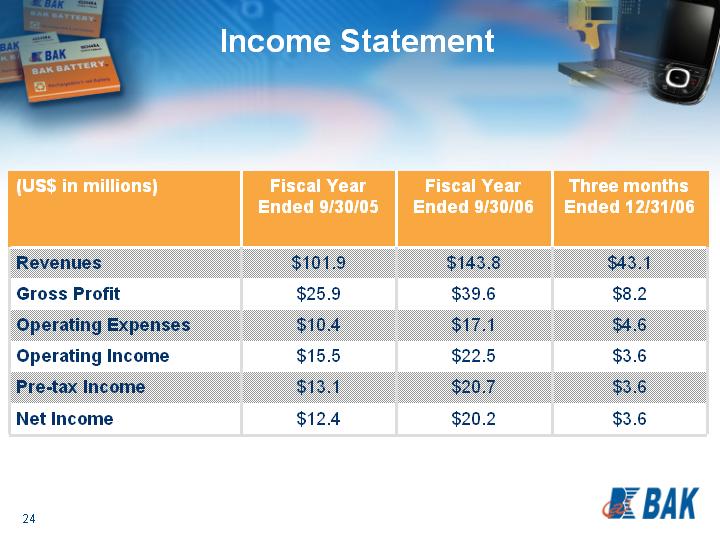

Income Statement

(US$ in millions) | | Fiscal Year

Ended 9/30/05 | | Fiscal Year

Ended 9/30/06 | | Three months

Ended 12/31/06 | |

| |

|

| |

|

| |

|

| |

Revenues | | $ | 101.9 | | $ | 143.8 | | $ | 43.1 | |

Gross Profit | | $ | 25.9 | | $ | 39.6 | | $ | 8.2 | |

Operating Expenses | | $ | 10.4 | | $ | 17.1 | | $ | 4.6 | |

Operating Income | | $ | 15.5 | | $ | 22.5 | | $ | 3.6 | |

Pre-tax Income | | $ | 13.1 | | $ | 20.7 | | $ | 3.6 | |

Net Income | | $ | 12.4 | | $ | 20.2 | | $ | 3.6 | |

24 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

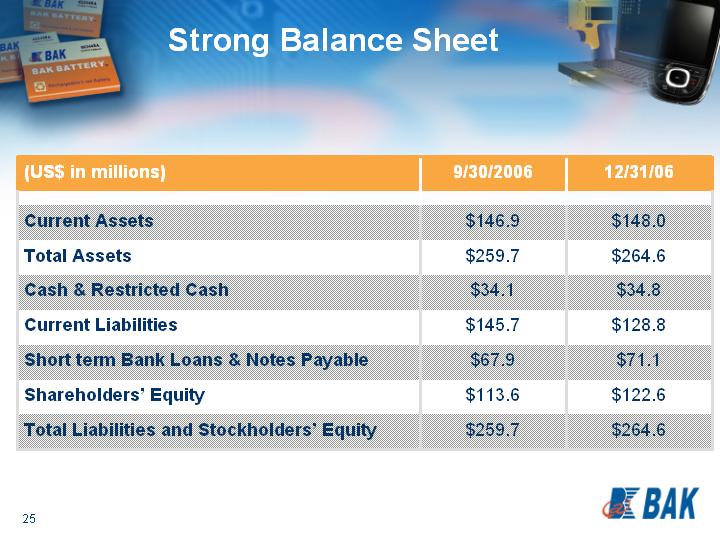

Strong Balance Sheet

(US$ in millions) | | 9/30/2006 | | 12/31/06 | |

| |

|

| |

|

| |

Current Assets | | $ | 146.9 | | $ | 148.0 | |

Total Assets | | $ | 259.7 | | $ | 264.6 | |

Cash & Restricted Cash | | $ | 34.1 | | $ | 34.8 | |

Current Liabilities | | $ | 145.7 | | $ | 128.8 | |

Short term Bank Loans & Notes Payable | | $ | 67.9 | | $ | 71.1 | |

Shareholders’ Equity | | $ | 113.6 | | $ | 122.6 | |

Total Liabilities and Stockholders’ Equity | | $ | 259.7 | | $ | 264.6 | |

25 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Investment Considerations

| • | One of the world’s biggest & fastest growing Li-ion battery cell manufacturers |

| | |

| • | Large & growing $2.5 billion Li-ion battery market |

| | |

| • | Expanding Li-ion product opportunities |

| | |

| • | Recurring revenue stream |

| | |

| • | Low cost manufacturing |

| | |

| • | State-of-the-art technical capability |

| | |

| • | Multiple growth opportunities |

[GRAPHIC APPEARS HERE]

26 | [LOGO OF CHINA BAK BATTERY, INC.] |

[GRAPHIC APPEARS HERE]

Questions and Answers

| [LOGO OF CHINA BAK BATTERY, INC.] |