| | EMBRAER RELEASES THIRD QUARTER 2008 RESULTS IN U.S. GAAP The Company's operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) and in accordance with US GAAP. The financial data presented in this document for the quarters ended September 30, 2007, June 30, 2008 and September 30, 2008, are derived from the unaudited financial statements. In order to better understand the Company’s operating performance, additional information is also presented at the end of this release, in accordance with accounting practices adopted in Brazil (“Brazilian GAAP”) São José dos Campos, November 3, 2008 – Embraer (BOVESPA: EMBR3; NYSE: ERJ), the world’s leading manufacturer of commercial jets with up to 120 seats, recorded third quarter 2008 (3Q08) net sales of US$ 1,546.0 million and net income of US$ 57.7 million, equivalent to diluted earnings per ADS of US$ 0.3190. By the end of September 2008, the volatility of the Brazilian currency directly impacted Embraer’s net results. The Company’s policy to mitigate its exposure to currency variations is based on the balance between assets and liabilities indexed in foreign currency and on the daily management of its currency trading, since most of its revenues are denominated in dollars and possibly could act as a natural hedge for the Company. The trend of appreciation of the U.S.dollar against the real might cause losses in the Company’s derivative instruments, but those losses tend to be compensated with an increase in operating revenues, since part of Embraer’s costs are denominated in reais. Embraer holds derivative positions, mostly Non-Deliverable Forward (“NDF”), to hedge its exposure to the Brazilian currency. Those instruments do not have any speculative component and serve exclusively to protect the Company’s operations against a potential loss arising from adverse changes in currency exchange rates. At September 30, 2008, Embraer’s “NDF” positions totaled R$ 1,675.0 million (approximately US$ 875 million), with different maturity dates, as shown below: |

| | | Derivative Instrument | | Original Currency | | Current Currency | | Notional (in R$ thousand) | | Average Maturity Rate | | Accounting Provision at 09.30.2008 | | Accounting Provision at 09.30.2008 | |

Maturity up to 12/30/2008 | | | | | | | | | | | | 574,290 | | | 1.7572 | | | (53,268 | ) | | (53,268 | ) |

Maturity up to 03/31/2009 | | | “NDF” | | | US$ | | | R$ | | | 1,005,008 | | | 1.7254 | | | (122,504 | ) | | (122,504 | ) |

Maturity up to 06/30/2009 | | | | | | | | | | | | 97,715 | | | 1.9000 | | | (5,011 | ) | | (5,011 | ) |

TOTAL | | | | | | | | | | | | 1,675,013 | | | - | | | (180,783 | ) | | (180,783 | ) |

Gain (loss)

| | | The exchange rate used to mark the Company’s “NDF” positions was R$ 1.9143 per U.S. 1.00 and the table below shows Embraer’s foreign exchange gains and losses in each period and also its gains and losses in derivative positions: |

US$ million | |

| | | 1Q08 | | 2Q08 | | 3Q08 | | 9M08 | |

| Gain (loss) on derivatives(*) | | | 9.6 | | | 55.6 | | | (92.9 | ) | | (27.7 | ) |

| Foreign exchange gains (losses), net | | | (4.1 | ) | | (32.3 | ) | | 58.7 | | | 22.2 | |

TOTAL | | | 5.5 | | | 23.3 | | | (34.2 | ) | | (5.5 | ) |

| | | (*) Included in net financial income (expenses) line of the Statement of Income |

| | | |

| | | The balance between assets and liabilities is constantly monitored by the Company, as well as our investments in other currencies, but due to the strong volatility, when we analyze those numbers in the short term, big variations can be noted, and when we analyze the accumulated amount for the year, the numbers are in accordance with the operations of the Company. |

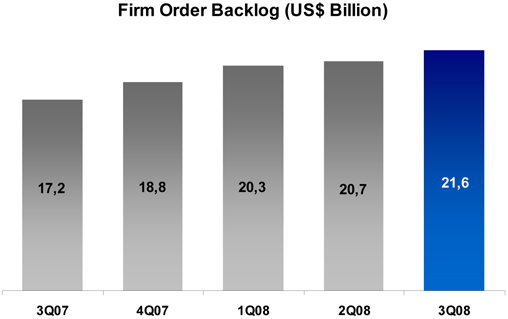

| | | Embraer delivered 48 aircraft during 3Q08, compared to 47 in the third quarter of 2007 (3Q07) and 52 aircraft in 2Q08, totaling 145 jets delivered in by September 30, 2008. Embraer reaffirms its estimate of delivering 195 to 200 jets in 2008, tending toward the higher figure, as well as ten to 15 Phenom 100 jets. Embraer’s firm order backlog on September 30, 2008, reached a record high of US$ 21.6 billion, including sales to the Executive Aviation market, which backlog is approximately US$ 7.0 billion. The EMBRAER 170/190 jet family backlog accumulated a total of 865 firm orders and 813 options. |

| | | |

| | | Net revenues for 3Q08 totaled US$ 1,546.0 million, an 8.2% increase over the US$ 1,428.5 million in net revenues for 3Q07, basically due to the higher number of aircraft deliveries and a more favorable product mix. |

| | | |

| | | The gross margin for 3Q08 totaled 21.7%, representing an increase over the 21.2% in 3Q07 gross margin in despite the impact of the 13.0% decrease in the average exchange rate (R$/US$) on the portion of the Company’s cost stated in reais, and the average increase of 10.13% in the payroll. The higher gross margin is due to productivity gains achieved since the improvement of the Company’s industrial processes that started in mid-2007. The gross margin for 3Q08 is in line with the 21.9% for 2Q08. |

| | | |

| | | Income from operations reached US$ 100.5 million in 3Q08, representing a decrease from the US$ 162.2 million recorded for the same period in 2007. The operating margin was 6.5% in 3Q08, representing a decrease from the 11.4% for 3Q07 and also a decrease from the operating margin of 6.9% for 2Q08. |

| | | |

| | | Net income totaled US$ 57.7 million in 3Q08, compared to US$ 194.9 million in 3Q07 and US$ 134.4 million in 2Q08. The net margin decreased to 3.7% in 3Q08, compared to 13.6% in 3Q07 and 8.2% in 2Q08. |

| | | |

| | | The Company maintained its high level of liquidity, and its net cash position was US$ 491.9 million for the quarter ended September 30, 2008. |

THIRD QUARTER 2008 IN PERSPECTIVE

INDIAN GOVERNMENT ACQUIRES THREE EMBRAER EMB 145 AEW&C JETS

Embraer and the Indian Government signed an agreement for three EMB 145 AEW&C (Airborne Early Warning & Control) jets. The contract includes a comprehensive logistics package comprised of training, technical support, spare parts, and ground support equipment.

EMBRAER SELLS FIVE EMBRAER 190 JETS TO CHINA’S KUN PENG AIRLINES

Embraer and Kun Peng Airlines Co., Ltd., one of the main operators in the Chinese regional aviation market, signed a contract for five firm orders for the EMBRAER 190 jet, marking an important expansion of Embraer’s presence in mainland China.

EMBRAER AND AEROMEXICO SIGN A CONTRACT FOR 12 EMBRAER 190 JETS

Embraer signed a contract with Aeromexico for 12 EMBRAER 190 jets, as part of the airline’s modernization plan. The new aircraft will be flown by its Aeromexico Connect subsidiary, which already operates 28 ERJ 145 jets, and has taken operating leases on an additional four EMBRAER 190 jets from GE Commercial Aviation Services (GECAS), since November 2007.

EMBRAER AND NAS AVIATION CONFIRM FIVE ADDITIONAL EMBRAER 190 JETS

Embraer and Saudi Arabia’s National Air Services (NAS) Aviation confirmed options on five additional EMBRAER 190 jets. The original contract, covering five firm orders and five options, was announced in November 2007, during the Dubai Airshow. The airline also retains purchase rights for 12 additional aircraft of the same model.

EMBRAER SELLS FIVE EMBRAER 190 JETS TO NIKI AIRLINE

Embraer and Austria’s NIKI Luftfarht GmbH signed a contract for five EMBRAER 190 jets. The agreement includes purchase rights for another five aircraft, which could be either the EMBRAER 190 or the EMBRAER 195.

EMBRAER TO CREATE TWO CENTERS OF EXCELLENCE IN PORTUGAL

In a ceremony held in Lisbon, Embraer announced plans for implementing two new industrial units dedicated to manufacturing complex airframe structures, being one focused on metallic assemblies and the other on composites, both of which to be located in the city of Évora, Portugal.

EMBRAER WILL SUPPLY THE SUPER TUCANO TO THE CHILEAN AIR FORCE

Embraer and the Chilean Air Force (FACH) signed a contract for 12 Super Tucano aircraft. This is a result of a public bid held by the FACH, which chose the airplane manufactured by Embraer as the best solution for the tactical training of its pilots. The first Super Tucano is expected to be delivered in the second half of 2009.

EMBRAER MADE FIRST E-JETS SALE TO MONTENEGRO AIRLINES

Embraer announced the sale of the first EMBRAER 195 jet to Montenegro Airlines. The agreement with the airline from the Republic of Montenegro also includes purchase rights for two more aircraft of the same model.

EMBRAER OPENED TWO NEW EXECUTIVE JETS SERVICE CENTERS IN THE U.S.

Embraer celebrated the opening of its facilities at Phoenix-Mesa Gateway Airport, in Mesa, Arizona, and another hangar at Bradley International Airport, in Windsor Locks, Connecticut. The new facilities are dedicated to full-service care for the Company’s Phenom 100, Phenom 300, Legacy 450, Legacy 500 and Legacy 600 executive jets.

INCOME STATEMENT HIGHLIGHTS

The following table presents certain items from Embraer’s unaudited consolidated statement of income for the three months ended June 30, 2008 (2Q08), and for the three months ended September 30, 2007 and 2008 (3Q07 and 3Q08).

Statement of Income In US$ million, except % and earnings | | 2Q08 | | 3Q07 | | 3Q08 | |

per ADS | | (1) | | (1) | | (1) | |

| Net Sales | | | 1,635.0 | | | 1,428.5 | | | 1,546.0 | |

| Gross Profit | | | 358.1 | | | 302.3 | | | 336.1 | |

Gross Margin | | | 21.9 | % | | 21.2 | % | | 21.7 | % |

| Selling, general administrative, other expenses | | | (155.0 | ) | | (79.6 | ) | | (158.0 | ) |

| Research and development | | | (89.8 | ) | | (60.5 | ) | | (77.5 | ) |

| Income from operations | | | 113.2 | | | 162.2 | | | 100.5 | |

| Operating margin | | | 6.9 | % | | 11.4 | % | | 6.5 | % |

| Net financial income (expenses) | | | 64.5 | | | 72.9 | | | (102.0 | ) |

| Foreign exchange (loss), net | | | (32.3 | ) | | (11.1 | ) | | 58.7 | |

| Income before income taxes | | | 145.3 | | | 224.0 | | | 57.2 | |

| Income tax benefit (expense) | | | (9.0 | ) | | (28.3 | ) | | 2.0 | |

| Minority interest and equity in earnings (losses) of affiliates | | | (1.9 | ) | | (0.8 | ) | | (1.6 | ) |

| Net income | | | 134.4 | | | 194.9 | | | 57.7 | |

Net margin | | | 8.2 | % | | 13.6 | % | | 3.7 | % |

| Earnings per ADS - basic | | | 0.7427 | | | 1.0533 | | | 0.3190 | |

| Earnings per ADS - diluted | | | 0.7427 | | | 1.0507 | | | 0.3190 | |

(1) Derived from unaudited quarterly financial information.

DELIVERIES, NET REVENUES, and GROSS MARGIN

A total of 48 jets were delivered during 3Q08, including 37 jets to the commercial aviation market, nine executive jets, and two aircraft to the defense and government segment. As a result of a higher number of aircraft deliveries, net revenues reached US$ 1,546.0 million during 3Q08, representing an 8.2% increase over the same period in 2007.

The following table sets forth the Company’s deliveries per segment for the indicated periods.

Deliveries by Segment | | 2Q08 | | 3Q07 | | 3Q08 | |

Commercial Aviation | | | 43 | | | 38 | | | 37 | |

| ERJ 145 | | | 2 | | | 2 | | | 1 | |

| EMBRAER 170 | | | 1 | | | 4 | | | 3 | |

| EMBRAER 175 | | | 14 | | | 9 | | | 12 | |

| EMBRAER 190 | | | 21 | | | 20 | | | 20 | |

| EMBRAER 195 | | | 5 | | | 3 | | | 1 | |

Defense and Government | | | - | | | - | | | 2 | |

| EMB 145 | | | - | | | - | | | 1 | |

| Legacy 600 | | | | | | - | | | 1 | |

Executive Aviation | | | 9 | | | 9 | | | 9 | |

Legacy 600 | | | 9 | | | 9 | | | 9 | |

Total | | | 52 | | | 47 | | | 48 | |

In 3Q08, net revenues for the Commercial Aviation segment totaled US$ 988.0 million, representing 63.9% of total revenues for the period, compared to US$ 982.0 million and 68.7% in 3Q07.

Even though nine Legacy 600 jets were delivered in each of 3Q08 and 3Q07, net revenues for the Executive Aviation segment reached US$ 223.1 million in 3Q08, representing a 5.5% increase over the US$ 211.4 million in 3Q07, as a result of price adjustments for those jets.

Net revenues for the Defense and Government segment increased from US$ 58.8 million in 3Q07 to US$ 135.3 million in 3Q08, mainly due to the deliveries of one Legacy 600 and one EMB 145 for that segment during 3Q08.

Net revenues for Aviation Services remained stable, at US$ 151.0 million in 3Q08 and US$ 153.6 million in 3Q07.

Net sales | | 2Q08 | | 3Q07 | | 3Q08 | |

by segment | | (1) | | (1) | | (1) | |

| | | US$M | | % | | US$M | | % | | US$M | | % | |

| Commercial Aviation | | | 1,131.6 | | | 69.2 | | | 982.0 | | | 68.7 | | | 988.0 | | | 63.9 | |

| Defense and Government | | | 104.1 | | | 6.4 | | | 58.8 | | | 4.1 | | | 135.3 | | | 8.8 | |

| Executive Aviation | | | 227.6 | | | 13.9 | | | 211.4 | | | 14.8 | | | 223.1 | | | 14.4 | |

| Aviation Services | | | 153.8 | | | 9.4 | | | 153.6 | | | 10.8 | | | 151.0 | | | 9.8 | |

| Others | | | 17.9 | | | 1.1 | | | 22.7 | | | 1.6 | | | 48.6 | | | 3.1 | |

Total | | | 1,635.0 | | | 100.0 | | | 1,428.5 | | | 100.0 | | | 1,546.0 | | | 100.0 | |

The gross margin remained at 21.7% in 3Q08, in line with the 21.9% gross margin of 2Q08 and representing an increase when compared to the 21.2% gross margin in 3Q07, despite a 13.0% decrease in the exchange rate (R$/US$) that impacted the portion of the Company’s sales and services costs stated in reais, and also despite the average 10.13% annual adjustment in the payroll. The stability in gross margin was due to the productivity gains achieved because of the implementation of the Lean manufacturing system in the production processes and also the planned reduction of overtime.

OPERATING EXPENSES & INCOME FROM OPERATIONS

During 3Q08, operating expenses totaled US$ 235.5 million, compared to US$ 140.1 million in 3Q07, mainly due to an extraordinary event related to a favorable decision for the Company regarding a tax dispute over the calculation basis of the Brazilian COFINS tax, resulting in the reversal of a provision in the amount of US$ 83.5 million in 3Q07. The operating expenses during 3Q08 represent a decrease if compared to the US$ 244.8 million in 2Q08.

Sales expenses totaled US$ 101.8 million in 3Q08, compared to US$ 90.9 million in 3Q07, due to the increase in expenses with marketing campaigns related to our executive aviation products.

R&D expenses totaled US$ 77.5 million in 3Q08, compared to US$ 60.5 million in 3Q07. This increase is due to the development and certification process of the Phenom jets family, the certification of the Lineage 1000 jet, the start-up in the development of the Legacy 450 and the Legacy 500 jets and the 13.0% exchange rate decrease (R$/US$).

General and administrative expenses decreased 7.2% from US$ 62.1 million in 3Q07 to US$ 57.6 million in 3Q08. The 13.0% exchange rate decrease was partially offset by the P3E (Embraer Entrepreneurial Excellence) plan that focuses on optimizing resources and bringing cost savings. During 3Q08, the Company informed that it had consolidated its organizational structure by reducing managerial positions and administrative functions, cutting approximately 250 jobs.

Other operating expenses totaled an income of US$ 1.4 million in 3Q08, compared to an income of US$ 73.4 million in 3Q07, mainly due to the reversion of the provision mentioned above.

As a result of the foregoing, the Company’s operating income reached US$ 100.5 million in 3Q08 with an operating margin of 6.5%, compared to US$ 162.2 million and 11.4% in 3Q07, respectively.

NET INCOME

Embraer recorded a total net financial expense of US$ 43.3 million in 3Q08, compared to a total net financial income of US$ 61.8 million in 3Q07. Interest expense net totaled US$ 102.0 million in 3Q08, compared to an interest income, net of US$ 72.9 million in 3Q07. The 3Q08 US$ 102.0 million financial expenses includes the provision of US$ 92.9 million arising from the marked to market (MTM) of financial instruments maintained by the Company to mitigate the effects of foreign currency and interest rate volatility. The derivative instruments held by the Company include NDFs (Non Deliverable Forwards) and plain vanilla interest rate swaps, without any leverage component, and are used for protection of its balance sheet and operations exposures without any speculative component.

Foreign exchange gain/loss reflects exchange variations in monetary assets and liabilities stated in other currencies and is translated into U.S. dollars at the end of each period. The Company recorded a foreign exchange gain of US$ 58.7 million in 3Q08, compared to an expense of US$ 11.1 million in 3Q07.

Net income in 3Q08 was US$ 57.7 million, representing a 3.7% net margin, compared to net income of US$ 194.9 million and a 13.6% net margin in 3Q07.

BALANCE SHEET HIGHLIGHTS

At September 30, 2008, Embraer’s cash and cash equivalents and temporary cash investments totaled US$ 1,922.0 million. On the same date, short- and long-term loans (excluding non-recourse and recourse debt) totaled US$ 1,430.1 million. As a result, the Company had a net cash position (total loans minus cash and cash equivalents and temporary cash investments) of US$ 491.9 million at the end of 3Q08.

Balance Sheet Data | | 3Q07 | | 2Q08 | | 3Q08 | |

(in US$ million) | | (1) | | (1) | | (1) | |

| | | | | | | | |

| Cash and cash equivalents | | | 1,203.0 | | | 1,241.8 | | | 1,063.3 | |

| Temporary cash investments | | | 1,050.3 | | | 921.1 | | | 858.7 | |

| Trade accounts receivable | | | 346.4 | | | 401.1 | | | 406.1 | |

| Customer and commercial financing | | | 564.8 | | | 416.5 | | | 444.1 | |

| Inventories | | | 2,681.3 | | | 2,837.7 | | | 2,924.7 | |

| Property, Plant and Equipment | | | 537.5 | | | 627.7 | | | 674.0 | |

| Trade accounts payable | | | 1,040.3 | | | 1,145.7 | | | 1,146.9 | |

| Loans | | | 1,803.2 | | | 1,638.7 | | | 1,430.1 | |

| Shareholders' equity | | | 2,041.3 | | | 2,139.7 | | | 2,146.7 | |

| Net cash (debt) * | | | 450.1 | | | 524.2 | | | 491.9 | |

* Net cash = Cash and cash equivalents + Temporary cash investments - Loans

(1) Derived from unaudited quarterly financial information.

Cash and cash equivalents and temporary cash investments

Embraer’s cash and cash equivalents and temporary cash investments on September 30, 2008 totaled US$ 1,922.0 million, compared to US$ 2,162.9 million on June 30, 2008. This reduction was due to the reduction on loans outstanding. From the total balance in cash and cash equivalents and temporary cash investments on September 30, 2008, 65.3% is stated in foreign currency, primarily in U.S. dollars, and the remaining 34.7% is comprised of investments stated in reais. The investment strategy adopted by the Company is to maintain sufficient cash to minimize the currency and interest rate risks of its assets and liabilities. This strategy also takes into account expected future R&D and capital expenditures, most of which are stated in reais.

Trade accounts receivable and customer and commercial financing

Trade accounts receivable and customer commercial financing totaled US$ 850.2 million in 3Q08, representing a 4.0% increase compared to US$ 817.6 million in 2Q08, due to the normal course of the Company’s business.

Inventories

During 3Q08, inventories increased to US$ 2,924.7 million, compared to US$ 2,837.7 million in 2Q08. Higher inventory levels are part of Embraer’s plan to achieve committed deliveries of 195 to 200 aircraft in 2008.

Short-Term and Long-Term Loans

On September 30, 2008, Embraer’s total debt was US$ 1,430.1 million, compared to US$ 1,638.7 million on June 30, 2008. The average maturity of Embraer’s total debt was 3.5 years on September 30, 2008, below the average of 3.6 years on June 30, 2008.

Of the total debt on September 30, 2008, 26.2% was stated in reais and indexed to the TJLP, at a weighted average interest rate of 7.71% per annum. The remaining US$ 1,054.7 million were stated in other currencies, primarily U.S. dollars, with a weighted average interest rate of Libor + 1.16% per annuum.

Embraer’s total debt/LTM Adjusted EBITDA ratio decreased from 2.94x on June 30, 2008, to 2.89x on September 30, 2008. Embraer’s total debt/capitalization ratio decreased from 0.43x on June 30, 2008, to 0.40x on September 30, 2008. LTM Adjusted EBITDA was US$ 494.6 million in 3Q08.

Interest coverage as measured by LTM Adjusted EBITDA/Interest paid (gross), decreased from 4.57x on June 30, 2008, to 4.33x on September 30, 2008.

Certain Financial Ratios | | 2Q08 | | 3Q07 | | 3Q08 | |

| | | | | | | | |

| Total debt to Adjusted EBITDA (1) | | | 2.94 | | | 5.26 | | | 2.89 | |

| Net debt to Adjusted EBITDA (2) | | | (0.94 | ) | | (1.31 | ) | | (0.99 | ) |

| Total debt to capitalization (3) | | | 0.43 | | | 0.47 | | | 0.40 | |

| Adjusted EBITDA to interest expense (gross) (4) | | | 4.57 | | | 3.13 | | | 4.33 | |

| Adjusted EBITDA (5) | | | 557.0 | | | 343.0 | | | 494.6 | |

(1) Total debt represents short- and long-term loans and financing.

(2) Net debt represents cash and cash equivalents, plus temporary cash investments, minus short- and long-term loans and financing.

(3) Total capitalization represents short- and long-term loans and financing, plus shareholders’ equity.

(4) Interest expense (gross) includes only interest and commission on loans.

(5) The table at the end of this release sets forth the reconciliation of net income to Adjusted EBITDA, calculated on the basis of financial information prepared with U.S. GAAP data, for the periods indicated.

CAPITAL EXPENDITURES

During 3Q08, Embraer invested US$ 61.3 million to improve and modernize its industrial and engineering processes, as well as its property, plant, and equipment, compared to US$ 44.7 million in 3Q07. Capex for 3Q08 included investments in the production line of the new family of business jets and investments on its after-sale support network for executive aviation, with the opening of its new service centers.

ADDITIONAL INFORMATION UNDER BRAZILIAN GAAP

Embraer also reported its 3Q08 financial statements in accordance with accounting practices adopted in Brazil (Brazilian GAAP), which, under Brazilian law, is the basis for calculating the distribution of dividends and interest on shareholders’ equity and taxes. The following selected financial information is derived from the consolidated income statement prepared in accordance with Brazilian GAAP and in reais (R$).

- Net sales during 3Q08 totaled R$ 2,638.5 million.

- Gross profit totaled R$ 552.2 million, with a gross margin of 20.9% in 3Q08.

- Income from operations for 3Q08 was R$ 241.7 million, with an operating margin of 9.2%.

- During 3Q08, income before taxes represented a loss of R$ 127.9 million.

- Net income for 3Q08 represented a loss of R$ 48.4 million, with a negative margin of 1.8%.

BACKLOG & DELIVERY FORECAST

Embraer delivered 48 jets during 3Q08, representing an increase of one aircraft over the 47 deliveries in 3Q07. Embraer reaffirms its forecast of delivering between 195 and 200 jets in 2008, tending toward the higher figure, for the Commercial Aviation, Executive Aviation and Defense and Government segments, plus 10 to 15 Phenom 100 jets.

On September 30, 2008, Embraer presented the following firm order backlog:

Aircraft Type | | Firm Orders | | Options | | Deliveries | | Firm Order Backlog |

| ERJ 135 | | 108 | | - | | 108 | | - |

| ERJ 140 | | 74 | | - | | 74 | | - |

| ERJ 145 | | 733 | | 50 | | 693 | | 40 |

| EMBRAER 170 | | 187 | | 100 | | 143 | | 44 |

| EMBRAER 175 | | 134 | | 173 | | 100 | | 34 |

| EMBRAER 190 | | 434 | | 460 | | 181 | | 253 |

| EMBRAER 195 | | 110 | | 80 | | 22 | | 88 |

TOTAL | | 1,780 | | 863 | | 1,321 | | 459 |

On September 30, 2008, Embraer’s firm order backlog, including the Commercial Aviation, the Executive Aviation and the Defense and Government segments, totaled a new record of US$ 21.6 billion. The following chart illustrates Embraer’s firm order backlog evolution.

INVESTOR RELATIONS

Embraer’s American Depositary Shares (ADS) traded on the New York Stock Exchange (NYSE) closed at US$ 27.01, on September 30, 2008, representing an increase of 1.9% during the third quarter of 2008.

The Company’s common shares traded on the São Paulo Stock Exchange (Bolsa de Valores de São Paulo - BOVESPA) closed at R$ 13.10, on September 30, 2008, representing a 22.8% increase during the third quarter of 2008.

The average daily ADS trading volume during 3Q08 was US$ 35.1 million or 1,169,230 shares.

CONFERENCE CALL INFORMATION

Embraer will host a conference call to present its 3Q08 Results in US GAAP on November 4, 2008, as described below:

(US GAAP) |

8:00 AM (NY) 11:00 AM (SP) |

Telephones: |

| +1 800 860 2442 (North America) |

| +1 412 858 4600 (International) |

| +55 11 4688 6301(Brazil) |

Code: Embraer |

Replay Number: |

| +55 11 4688 6312 |

Code: 708 |

The conference call will also be broadcasted live over the web at www.embraer.com

For additional information please contact:

Investor Relations

+55 12 3927-4404

investor.relations@embraer.com.br

ABOUT EMBRAER

Embraer (Empresa Brasileira de Aeronáutica S.A. - NYSE: ERJ; Bovespa: EMBR3) is the world’s largest manufacturer of commercial jets up to 120 seats, and one of Brazil's leading exporters. Embraer's headquarters are located in São José dos Campos, São Paulo, and it has offices, industrial operations and customer service facilities in Brazil, the United States, France, Portugal, China and Singapore. Founded in 1969, the Company designs, develops, manufactures and sells aircraft for the Commercial Aviation, Executive Aviation, and Defense and Government segments. The Company also provides after sales support and services to customers worldwide. On September 30, 2008, Embraer had a workforce of 23,745 employees and a firm order backlog of US$ 21.6 billion.

This document may contain forward-looking statements regarding circumstances or events yet to take place. Such statements are based largely on current expectations, forecasts of future events, assumptions and on financial tendencies that affect the Company’s businesses, and may prove not to be accurate and are not guarantees of performance. They are subject to risks, uncertainties and assumptions that are difficult to predict and that may include, among others: general economic, political and trade conditions in Brazil and in those markets where the Company does business; expectations on industry trends; the Company’s investment plans; its capacity to develop and deliver products on the dates previously agreed upon; and existing and future governmental regulations. The actual results can, therefore, differ substantially from those previously published as Company expectations. Further, in view of the inherent risks and uncertainties, the estimates, events and circumstances in such statements may not occur. The words “believe”, “may”, “is able”, “will be able”, “estimate”, “intend”, “continue”, “project”, “anticipate”, “expect” and other similar terms are supposed to identify such forward-looking statements. The Company is not obligated to publish updates nor to revise any such statements due to new information, future events or otherwise.

EMBRAER - EMPRESA BRASILEIRA DE AERONÁUTICA S.A.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands of U.S. dollars)

ASSETS

| | | As of June 30, 2008 | | As of September 30, 2008 | |

| | | (1) | | (1) | |

CURRENT ASSETS | | | | | |

| Cash and cash equivalents | | | 1,241,813 | | | 1,063,318 | |

| Temporary cash investments | | | 921,087 | | | 858,741 | |

| Trade accounts receivable,net | | | 381,669 | | | 371,557 | |

| Collateralized accounts receivable | | | 11,241 | | | 11,577 | |

| Customer and commercial financing | | | 3,176 | | | 3,282 | |

| Inventories | | | 2,828,108 | | | 2,916,483 | |

| Deferred income taxes | | | 124,921 | | | 150,924 | |

| Other current assets | | | 312,882 | | | 307,811 | |

| | | | | | | | |

Total current assets | | | 5,824,897 | | | 5,683,693 | |

| | | | | | | | |

NONCURRENT ASSETS | | | | | | | |

| Trade accounts receivable,net | | | 19,471 | | | 34,515 | |

| Collateralized accounts receivable | | | 465,606 | | | 467,385 | |

| Customer and commercial financing | | | 413,370 | | | 440,832 | |

| Inventories | | | 9,544 | | | 8,241 | |

| Property, plant and equipment, net | | | 627,692 | | | 674,009 | |

| Intangible Assets | | | 24,239 | | | 22,509 | |

| Investments | | | 65,825 | | | 82,878 | |

| Deferred income taxes | | | 178,172 | | | 242,776 | |

| Other noncurrent assets | | | 757,853 | | | 746,175 | |

| | | | | | | | |

Total noncurrent assets | | | 2,561,772 | | | 2,719,320 | |

| | | | | | | | |

TOTAL ASSETS | | | 8,386,669 | | | 8,403,013 | |

(1) Derived from unaudited quarterly financial information.

LIABILITIES AND SHAREHOLDERS' EQUITY

| | | As of June 30, 2008 | | As of September 30, 2008 | |

| | | (1) | | (1) | |

CURRENT LIABILITIES | | | | | |

| Loans and financing | | | 825,723 | | | 639,685 | |

| Capital lease obligation | | | 5,295 | | | 5,517 | |

| Non recourse and recourse debt | | | 115,199 | | | 137,265 | |

| Trade accounts payable | | | 1,145,656 | | | 1,146,897 | |

| Advances from customers | | | 913,611 | | | 1,043,258 | |

| Other payables and accrued liabilities | | | 360,455 | | | 434,528 | |

| Taxes and payroll charges payable | | | 92,922 | | | 53,791 | |

| Accrued taxes on income | | | 23,673 | | | 8,459 | |

| Deferred income taxes | | | 818 | | | 2,841 | |

| Contingencies | | | 13,714 | | | 11,037 | |

| Accrued dividends | | | 1,649 | | | 1,038 | |

| Unearned Income | | | 110,813 | | | 110,759 | |

| | | | | | | | |

Total current liabilities | | | 3,609,528 | | | 3,595,075 | |

| | | | | | | | |

LONG-TERM LIABILITIES | | | | | | | |

| Loans and financing | | | 812,950 | | | 790,388 | |

| Capital lease obligation | | | 15,435 | | | 14,166 | |

| Non recourse and recourse debt | | | 363,265 | | | 369,141 | |

| Advances from customers | | | 469,977 | | | 537,448 | |

| Contribution from suppliers | | | 123,005 | | | 113,941 | |

| Taxes and payroll charges payable | | | 523,066 | | | 441,260 | |

| Other payables and accrued liabilities | | | 192,051 | | | 167,287 | |

| Deferred income taxes | | | 8,214 | | | 109,403 | |

| Contingencies | | | 54,741 | | | 47,407 | |

| Unearned Income | | | 3,304 | | | 3,218 | |

| | | | | | | | |

Total long-term liabilities | | | 2,566,008 | | | 2,593,659 | |

| | | | | | | | |

MINORITY INTEREST | | | 71,457 | | | 67,565 | |

| | | | | | | | |

SHAREHOLDERS' EQUITY | | | 2,139,676 | | | 2,146,714 | |

| | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | | 8,386,669 | | | 8,403,013 | |

(1) Derived from unaudited quarterly financial information.

EMBRAER - EMPRESA BRASILEIRA DE AERONÁUTICA S.A.

CONSOLIDATED STATEMENTS OF INCOME

In thousands of U.S.dollars except per share data

| | | Three Months Ended (1) | | Nine Months Ended (1) | |

| | | September 30, 2007 | | September 30, 2008 | | September 30, 2007 | | September 30, 2008 | |

| | | | | | | | | | |

Gross sales | | | | | | | | | |

| Domestic market | | | 58,904 | | | 101,376 | | | 115,205 | | | 200,884 | |

| Foreign market | | | 1,404,460 | | | 1,439,712 | | | 3,343,048 | | | 4,385,764 | |

| Sales deductions | | | (34,909 | ) | | 4,914 | | | (88,090 | ) | | (69,760 | ) |

Net sales | | | 1,428,455 | | | 1,546,002 | | | 3,370,163 | | | 4,516,888 | |

| | | | | | | | | | | | | | |

| Cost of sales and services | | | (1,126,185 | ) | | (1,209,921 | ) | | (2,642,200 | ) | | (3,550,728 | ) |

| | | | | | | | | | | | | | |

Gross profit | | | 302,270 | | | 336,081 | | | 727,963 | | | 966,160 | |

| | | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | |

| Selling expenses | | | (90,890 | ) | | (101,834 | ) | | (253,122 | ) | | (301,325 | ) |

| Research and development | | | (60,507 | ) | | (77,543 | ) | | (164,796 | ) | | (243,527 | ) |

| General and administrative | | | (62,099 | ) | | (57,587 | ) | | (165,642 | ) | | (169,528 | ) |

| Other operating expense, net | | | 73,423 | | | 1,427 | | | 64,465 | | | 10,663 | |

| | | | | | | | | | | | | | |

Income from operations | | | 162,197 | | | 100,544 | | | 208,868 | | | 262,443 | |

| | | | | | | | | | | | | | |

| Interest(expense) income, net | | | 72,864 | | | (101,971 | ) | | 128,617 | | | (17,374 | ) |

| Foreign exchange gain (loss) ,net | | | (11,108 | ) | | 58,663 | | | (27,511 | ) | | 22,194 | |

| | | | | | | | | | | | | | |

Income before income taxes | | | 223,953 | | | 57,236 | | | 309,974 | | | 267,263 | |

| | | | | | | | | | | | | | |

| Income tax benefits(expense) | | | (28,266 | ) | | 2,027 | | | (23,580 | ) | | 14,238 | |

| | | | | | | | | | | | | | |

Income before minority interest and results of affiliates | | | 195,687 | | | 59,263 | | | 286,394 | | | 281,501 | |

| | | | | | | | | | | | | | |

| Minority interest | | | (897 | ) | | (1,638 | ) | | 1,735 | | | (4,735 | ) |

| Equity in earnings of affiliates | | | 120 | | | 87 | | | 297 | | | 273 | |

| | | | | | | | | | | | | | |

Net income | | | 194,910 | | | 57,712 | | | 288,426 | | | 277,039 | |

| | | | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | |

| Common | | | 0.2633 | | | 0.0797 | | | 0.3897 | | | 0.3811 | |

| | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | |

| Common | | | 0.2627 | | | 0.0797 | | | 0.3887 | | | 0.3811 | |

| | | | | | | | | | | | | | |

Weighted average shares (thousands of shares) | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | |

| Common | | | 740,204 | | | 723,665 | | | 740,204 | | | 726,908 | |

| | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | |

| Common | | | 742,045 | | | 723,665 | | | 742,045 | | | 726,908 | |

| | | | | | | | | | | | | | |

Earnings per share - ADS basic (US$) | | | 1.0533 | | | 0.3190 | | | 1.5586 | | | 1.5245 | |

Earnings per share - ADS diluted (US$) | | | 1.0507 | | | 0.3190 | | | 1.5548 | | | 1.5245 | |

(1) Derived from unaudited quarterly financial information.

EMBRAER - EMPRESA BRASILEIRA DE AERONÁUTICA S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

In thousands of U.S.dollars

| | | Three months ended on | | Nine months ended on | |

| | | September 30, 2007 | | September 30, 2008 | | September 30, 2007 | | September 30, 2008 | |

| | | (1) | | (1) | | (1) | | (1) | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net income | | | 194,910 | | | 57,712 | | | 288,426 | | | 277,039 | |

| Adjustments to reconcile net income to net cash provided by(used in) operating activities: | | | | | | | | | | | | | |

| Depreciation | | | 19,057 | | | 18,313 | | | 42,269 | | | 50,327 | |

| Allowance for doubtful accounts | | | (3,600 | ) | | 408 | | | (416 | ) | | 439 | |

| Allowance (reversal) for inventory obsolescence | | | (867 | ) | | 7,928 | | | (9,037 | ) | | 6,500 | |

| Loss on property, plant and equipment disposals | | | (205 | ) | | 752 | | | (2 | ) | | 1,123 | |

| Accrued interest | | | (2,662 | ) | | (15,793 | ) | | 2,685 | | | (14,567 | ) |

| Minority interest | | | 897 | | | 1,638 | | | (1,735 | ) | | 4,735 | |

| Foreign exchange loss, net | | | 11,108 | | | (58,663 | ) | | 27,511 | | | (22,194 | ) |

| Deferred income taxes | | | 17,575 | | | 12,608 | | | 1,826 | | | (24,028 | ) |

| Equity in earnings (losses) from affiliates | | | (120 | ) | | (87 | ) | | (297 | ) | | (273 | ) |

| Other | | | (1,321 | ) | | (136 | ) | | (8,437 | ) | | (2,136 | ) |

| Provision for losses,property plant and equipment | | | - | | | (205 | ) | | - | | | (936 | ) |

| | | | | | | | | | | | | | |

Changes in assets and liabilities: | | | 118,889 | | | 162,235 | | | (571,768 | ) | | 416,274 | |

| | | | | | | | | | | | | | |

Net cash provided by(used in) operating activities | | | 353,661 | | | 186,710 | | | (228,975 | ) | | 692,303 | |

| | | | | | | | | | | | | | |

CASH FLOW FROM INVESTING ACTIVITIES | | | | | | | | | | | | | |

| Proceeds from sale of property, plant and equipment | | | 208 | | | 189 | | | 1,566 | | | 1,806 | |

| Court-mandated escrow deposits, net of withdrawals | | | (9,104 | ) | | (23,255 | ) | | (29,457 | ) | | (45,800 | ) |

| Additions to property, plant and equipment | | | (44,754 | ) | | (61,284 | ) | | (163,312 | ) | | (176,885 | ) |

| Others | | | 241 | | | (15,910 | ) | | 399 | | | (15,230 | ) |

| | | | | | | | | | | | | | |

Net cash (used in) investing activities | | | (53,409 | ) | | (100,260 | ) | | (190,804 | ) | | (236,109 | ) |

| | | | | | | | | | | | | | |

CASH FLOW FROM FINANCING ACTIVITIES | | | | | | | | | | | | | |

| Proceeds from borrowings | | | 396,489 | | | 311,882 | | | 1,354,208 | | | 888,736 | |

| Repayment of borrowings | | | (383,131 | ) | | (424,010 | ) | | (969,336 | ) | | (1,193,655 | ) |

| Payments of capital lease obligations | | | (1,210 | ) | | (875 | ) | | (1,808 | ) | | (3,754 | ) |

| Proceeds from issuance of shares | | | - | | | - | | | 1,343 | | | - | |

| Dividends and/or Interest on capital paid | | | (32,588 | ) | | (41,275 | ) | | (91,955 | ) | | (193,951 | ) |

| Acquisition of own shares for treasury | | | - | | | - | | | - | | | (182,958 | ) |

Net cash provided by (used in) financing activities | | | (20,440 | ) | | (154,278 | ) | | 292,452 | | | (685,582 | ) |

| | | | | | | | | | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | | 47,287 | | | (110,667 | ) | | 120,957 | | | (14,660 | ) |

| | | | | | | | | | | | | | |

Increase (decrease) in cash and cash equivalents | | | 327,099 | | | (178,495 | ) | | (6,370 | ) | | (244,048 | ) |

| | | | | | | | | | | | | | |

Cash and cash equivalents, at beginning of period | | | 875,927 | | | 1,241,813 | | | 1,209,396 | | | 1,307,366 | |

| | | | | | | | | | | | | | |

Cash and cash equivalents, at end of period | | | 1,203,026 | | | 1,063,318 | | | 1,203,026 | | | 1,063,318 | |

(1) Derived from unaudited quarterly financial information.

RECONCILIATION OF US GAAP AND “NON GAAP” INFORMATION

Adjusted EBITDA represents Earnings Before Interest, Taxation, Depreciation and Amortization. Adjusted EBITDA is not a financial measurement of the Company’s financial performance under U.S. GAAP. Adjusted EBITDA is presented because it is used internally as a measure to evaluate certain aspects of the business, including financial operations. We also believe that some investors find it to be a useful tool for measuring a company’s financial performance. Adjusted EBITDA should not be considered as an alternative to, in isolation from, or a substitution for analysis of the Company’s financial condition or results of operations, as reported under US GAAP. Other companies in the industry may calculate Adjusted EBITDA differently than Embraer has for the purposes of its earnings releases, limiting Adjusted EBITDA’s usefulness as a comparative measure.

Adjusted EBITDA Reconciliation LTM | | 2Q08 (1) | | 3Q07 (1) | | 3Q08 (1) | |

| Net income | | | 615.1 | | | 412.8 | | | 477.9 | |

| Minority interest | | | 13.6 | | | 2.8 | | | 14.4 | |

| Income tax benefit (expense) | | | (4.8 | ) | | 8.5 | | | (35.1 | ) |

| Interest income (expense), net | | | (192.2 | ) | | (162.2 | ) | | (17.4 | ) |

| Foreign Exchange gain (loss), net | | | 57.7 | | | 30.6 | | | (12.0 | ) |

| Depreciation and amortization | | | 67.6 | | | 50.4 | | | 66.9 | |

Adjusted EBITDA | | | 557.0 | | | 343.0 | | | 494.6 | |

(1) Derived from unaudited quarterly financial information.

LTM : Last Twelve Months