Registration No. 333-116303

As filed with the Securities and Exchange Commission on June 10, 2004

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

Form F-1

Registration Statement

Under the Securities Act of 1933

GPC BIOTECH AG

(Exact Name of Registrant as Specified in its Charter)

| | | | |

| Germany | | 2834 | | 04-3158193 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

| | |

Fraunhoferstrasse 20 D-82152 Martinsried/Munich, Germany Tel: 011 49 89 8565 2600 | | Brent Hatzis-Schoch Vice President – Legal Affairs GPC Biotech Inc. 101 College Road East Princeton, New Jersey 08540 Tel: (609) 524-1000 |

(Address and telephone number of Registrant’s principal executive offices) | | (Name, address and telephone number of agent for service) |

Copies to:

| | | | |

Danielle Carbone Shearman & Sterling LLP 599 Lexington Avenue New York, NY 10022 Tel: (212) 848-4000 Fax: (212) 848-7179 | | Michael Leppert Shearman & Sterling LLP Gervinusstrasse 17 D-60322 Frankfurt am Main, Germany Tel: 011 49 69 9711 1000 Fax: 011 49 69 9711 1100 | | Wolfgang Feuring David B. Rockwell Sullivan & Cromwell LLP Neue Mainzer Strasse 52 Frankfurt, Germany 60311 Tel: 011 49 69 4272 520 Fax: 011 49 69 4272 5210 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box.¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering.¨

If delivery of the registration statement is expected to be made pursuant to Rule 434, please check the following box.¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | |

|

Title of each class of securities to be registered(1) | | Amount to be

registered(2) | | Proposed maximum

offering price per

security(3) | | Proposed maximum aggregate

offering price(3) | | Amount of

registration fee(4) |

Ordinary Bearer Shares with no par value | | 8,579,000 | | $ | 16.40 | | $ | 140,695,600 | | $ | 17,826 |

|

| (1) | American depositary receipts evidencing American Depositary Shares issuable on deposit of the shares registered hereby are being registered pursuant to a separate Registration Statement on Form F-6 (Registration No. 333-116306). |

| (2) | Includes (a) shares that may be purchased pursuant to the underwriters’ over-allotment option and (b) shares initially offered and sold outside the United States that may be resold from time to time in the United States. The shares are not being registered for the purpose of sales outside the United States. See “Plan of Distribution.” |

| (3) | Estimated pursuant to Rule 457(c) solely for the purposes of calculating the registration fee based on the average of the high and low price per ordinary bearer share as reported by the Frankfurt Stock Exchange on June 2, 2004 translated into U.S. dollars based on the noon buying rate on June 4, 2004 of $1.23 per euro. |

| (4) | This amount was previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated June 10, 2004.

7,460,000 Shares

GPC BIOTECH AG

Ordinary Bearer Shares, with no par value,

in the form of shares or American Depositary Shares

This is an initial public offering of ordinary bearer shares of GPC Biotech AG, a German stock corporation, in the form of shares or American Depositary Shares, or ADSs. Each ADS represents one ordinary share. GPC Biotech AG is offering 7,160,000 of the shares or ADSs to be sold in the offering. The selling shareholders identified in this prospectus are offering an additional 300,000 shares. GPC Biotech AG will not receive any of the proceeds from the sale of the shares being sold by the selling shareholders.

Prior to this offering, there has been no public market in the United States for our shares or ADSs. Our shares are listed on the Frankfurt Stock Exchange under the symbol “GPC”, and application has been made for the quotation of the ADSs on the Nasdaq National Market under the symbol “GPCB”. On June 8, 2004, the closing price of our shares on the Frankfurt Stock Exchange was€ 13.40 per share.

See “Risk Factors” beginning on page 10 to read about factors you should consider before buying our shares or ADSs.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Share

| | Per ADS

| | Total

|

Initial public offering price | | € | | $ | | | $ | |

Underwriting discount and commissions | | € | | $ | | | $ | |

Proceeds, before expenses, to GPC Biotech | | € | | $ | | | $ | |

Proceeds, before expenses, to selling shareholders | | € | | $ | | | $ | |

To the extent that the underwriters sell more than 7,460,000 shares or ADSs, the underwriters have the option to purchase up to an additional 1,119,000 shares or ADSs from GPC Biotech at the offering price less the underwriting discount and commissions.

The underwriters expect to deliver the shares or ADSs against payment in New York, New York on or as soon as practicable after July 2, 2004.

Goldman, Sachs & Co. oHG

Global Coordinator

Goldman, Sachs & Co.

Lehman Brothers

Pacific Growth Equities, LLC | WestLB AG |

Prospectus dated June , 2004.

PROSPECTUS SUMMARY

This summary does not contain all of the information that you should consider before buying shares or ADSs in this offering and highlights information contained elsewhere in this prospectus that we believe is most important to understanding our business. You should read the entire prospectus carefully, including the Risk Factors section and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

GPC Biotech AG

GPC Biotech is a biopharmaceutical company discovering and developing new drugs to treat cancer. Our lead product candidate is satraplatin, an oral platinum-based compound intended for use as a chemotherapy drug. Satraplatin is being evaluated in a Phase 3 registrational trial for second-line treatment of hormone refractory prostate cancer, or HRPC. Patients suffering from HRPC are those who have suffered relapse after having been treated with hormone ablation therapy. See “Business—Our Product Pipeline—Prostate Cancer and Existing Treatment Regimens.” Second-line treatments are those implemented when primary, or first-line, treatment fails. In Phase 3 registrational trials, the drug is tested on patients in a controlled randomized trial comparing the investigational new drug to a placebo or an approved form of therapy, if there is one. Phase 3 registrational trials are usually the final clinical evaluation to support a new drug application, or NDA. “Randomized” means that patients are randomly assigned to receive the drug candidate or a placebo. Our goal is to file an NDA, with the U.S. Food and Drug Administration, or FDA, in this disease setting in 2006.

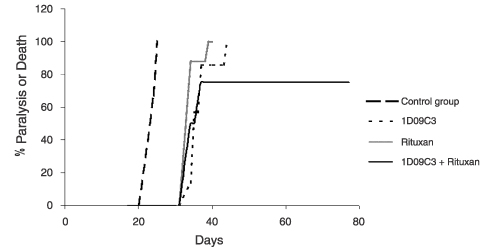

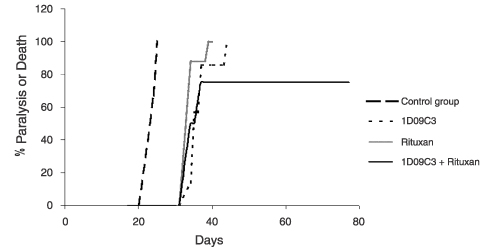

Our second most advanced product candidate is 1D09C3, a monoclonal antibody. Assuming successful and timely completion of preclinical activities and timely approval by the relevant regulatory authorities and ethics committees, we anticipate initiating clinical trials for 1D09C3 in 2004. A monoclonal antibody is an immune system related protein that binds preferentially to one type of foreign substance and may thereby stimulate a biological response. Our third development program involves inhibitors of the cell division cycle, or cell cycle. The cell cycle is the process by which a cell grows, duplicates its DNA and divides into two cells. RGB-286199, our lead compound in this program, is currently in preclinical development. Preclinical development includes work to demonstrate a drug candidate’s efficacy and safety in cell culture and animal models prior to testing in humans. Our goal is to complete preclinical development work on RGB-286199 in the first half of 2005. We also have a number of research programs focused on the discovery of new anticancer drugs.

Cancer is the second leading cause of death in the United States after cardiovascular disease. Prostate cancer is the most common cancer among men and the second leading cause of cancer deaths in men in the United States. Despite progress in understanding cancer and the resulting development of new therapies, there is still a lack of effective treatments, resulting in a substantial unmet medical need.

Our Product Candidates

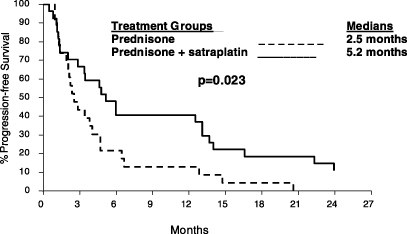

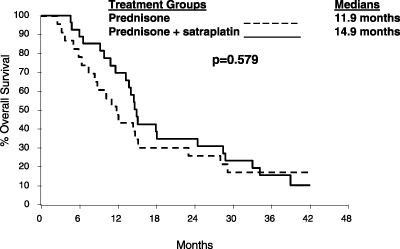

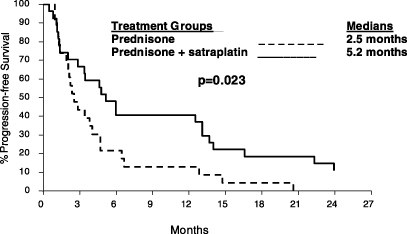

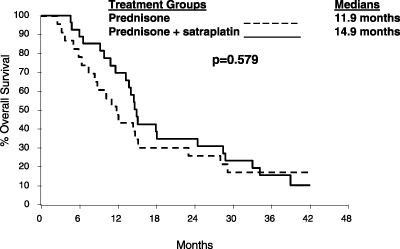

Satraplatin. Satraplatin is in a Phase 3 registrational trial as second-line treatment of HRPC. Satraplatin is an oral platinum-based compound intended for use as a chemotherapy drug. Platinum-based drugs have been clinically proven to be one of the most effective classes of anticancer therapies and are used to treat a wide range of cancers. Unlike the currently marketed platinum-based drugs, satraplatin is administered orally. We licensed satraplatin in September 2002 and, in September 2003, initiated a Phase 3 registrational trial of satraplatin as a second-line chemotherapy treatment for HRPC, with sites in the United States, Europe and South America. We modelled our registrational trial, in which we expect over 900 patients to be enrolled, on a successful 50-patient study of satraplatin in

1

the first-line chemotherapy treatment of HRPC, conducted by others. There is currently no approved second-line chemotherapy treatment regimen for patients who fail first-line chemotherapy treatment for HRPC. We were therefore able to obtain fast-track designation from the FDA for satraplatin in this disease setting. The FDA’s fast track program is intended to facilitate the development and to expedite the review of drugs that are intended for the treatment of a serious or life-threatening condition for which there is no approved treatment. Our goal is to complete the filing of an NDA with the FDA for satraplatin as a treatment of HRPC in 2006. Based on existing clinical data, we believe that satraplatin may have application in a number of cancers, both as a single agent and in combination with other therapies.

1D09C3. 1D09C3 is a monoclonal antibody intended for the treatment of selected leukemias and lymphomas, including non-Hodgkin’s lymphoma. Preclinical activities that need to be completed prior to initiating clinical trials include a toxicological evaluation and the development of certain tests for monitoring drug levels and drug responses in the blood of treated patients. We expect to complete these preclinical activities during 2004. Assuming successful and timely completion of these preclinical activities and timely approval by the relevant regulatory authorities and ethics committees, we anticipate initiating clinical trials for this product candidate in 2004.

RGB-286199. RGB-286199 is our lead compound in a family of small molecule compounds that inhibit the cell cycle, which is essential for tumor growth. RGB-286199 is currently in preclinical development. Our goal is to complete preclinical development work on RGB-286199 in the first half of 2005 and, if successful, to advance this product candidate into clinical trials thereafter.

Our Research Programs

Our research is focused on new anticancer drug discovery opportunities. To date, our research activities have led us to the discovery of 1D09C3 and RGB-286199, our two product candidates in preclinical development. Our current approach to new drug discovery programs is to start with existing small molecules or small molecule classes that are either known to have anticancer activity or known to act on selected targets relevant for cancer drug research. We design our research programs to discover product candidates that have potentially broad application in the treatment of various cancers. Most of our research programs are directed toward discovering cytotoxic drugs, which are drugs that kill cancer cells rather than prevent their growth. Our current research programs can be classified in two areas, inducers of programmed cell death and inhibitors of protein kinases, which play a role in signalling between and within cells.

Our Drug Discovery Technologies

We also have a portfolio of technologies in the fields of proteomics (the systematic study of proteins and their functions) and genomics (the systematic study of genes) that we use in our internal drug discovery efforts and that we have licensed to, or used in collaborations with, various pharmaceutical companies. In early 2003, we expanded our technology portfolio through the introduction of LeadCodeTM, our proprietary cell-based drug-protein interaction screening technology. LeadCode enables us to improve our understanding of the potential efficacy and side effects of drugs and drug candidates. We believe that these technologies allow us to prioritize and optimize drug candidates in our pipeline, identify new drug uses and potentially reduce the risk of failure in drug development.

In 2001, we entered into an agreement with ALTANA Pharma AG, which is our most significant technology collaboration to date. Under this contract, we are assisting ALTANA Pharma through 2007 with its establishment of a research institute in the United States. This agreement includes a research

2

collaboration as well as a transfer of technologies. Effective January 2003, we have also licensed LeadCode to ALTANA Pharma under a separate agreement. We are entitled to receive a total of $60 million in payments from ALTANA Pharma, including upfront payments, license and technology transfer fees, and research funding over the term of the agreements. As of December 31, 2003, we had received an aggregate of€37.4 million from ALTANA Pharma under these agreements, of which€27.4 million have been recognized as revenue.

Our Strategy

Our goals are to discover, develop and commercialize new anticancer drugs. We are pursuing these goals through the following strategies:

| | • | | Enhance the commercial value of satraplatin to us; |

| | • | | Broaden the potential range of applications of satraplatin; |

| | • | | Build and maintain a balanced portfolio of oncology drugs; |

| | • | | Use our research expertise, technologies and external network to build our product candidate pipeline; |

| | • | | Use our internal expertise to find the fastest path to market approval for our product candidates; and |

| | • | | Generate revenue through technology and research collaborations. |

Our Management and Scientific Team

We have assembled a management and scientific team, which we believe has the expertise and experience required to discover, develop and commercialize oncology product candidates. Our clinical development team is highly experienced in designing and conducting successful clinical trial programs for oncology drugs. Members of this group have a combined career track record of obtaining more than 20 marketing approvals with the FDA, including those for TAXOL® (paclitaxel), a widely used chemotherapy drug, and PARAPLATIN® (carboplatin), one of the most well-established platinum-based chemotherapy drugs. Furthermore, we have an extensive external network of scientists and experts in the oncology field, which helps us to identify and evaluate opportunities to license drug candidates from third parties.

Risks of Drug Development

All of our product candidates are undergoing clinical trials or are in earlier stages of development, and failure is common and can occur at any stage of development. To date, we have not obtained regulatory approval for the commercial sale of any drug product, and we have not received any revenues from the commercial sale of drug products. For the year ended December 31, 2003, our total revenues were€21.6 million, our net loss was€26.8 million and, as of that date, we had an accumulated deficit of€127.3 million.

Company Information

GPC Biotech AG was originally formed as a limited liability company (Gesellschaft mit beschränkter Haftungor GmbH) under German law in January 1997, and was named RM 102 Vermôgensverwaltungs GmbH. In August 1997, all of the company’s shares were sold and transferred to members of the company’s management team and scientific advisory board, and its name was

3

changed to Genome Pharmaceuticals Corporation GmbH. In February 1998, Genome Pharmaceuticals Corporation GmbH was transformed into a stock corporation (Aktiengesellschaft orAG) under German law and its name was changed to GPC Aktiengesellschaft Genome Pharmaceuticals Corporation. On March 3, 2000, the company changed its name to GPC Biotech AG.

In March 2000, we acquired Mitotix, Inc., a U.S. drug discovery and development company focused on treatments for cancer and fungal infections. The total purchase price for the acquisition was approximately€31.2 million, which we paid for with our ordinary shares. After the acquisition, Mitotix, Inc. changed its name to GPC Biotech Inc.

Historically, we have been focused on applying genomic, proteomic and drug-discovery technologies to accelerate the identification and validation of novel drug targets for the development of mechanism-based drugs in oncology, infectious diseases and immunology.

In September 2002, we licensed satraplatin, our late stage chemotherapy product candidate for the treatment of HRPC, from Spectrum Pharmaceuticals, Inc. We are now focusing our efforts on our oncology drug discovery and development.

Trademarks

We own rights in the following trademarks: GPC Biotech, the GPC Biotech design, the globe design, LeadCode, ExpressCode, PathCode, UbiCode and KeyCode. All other trademarks or tradenames referred to in this prospectus are the property of their respective owners.

Executive Offices

Our principal executive offices are located at Fraunhoferstrasse 20, D-82152 Martinsried/Munich, Germany and our telephone number is 011 49 89 8565 2600.

Presentation of Financial Information

In this prospectus, references to “€” are to euro and references to “USD”, “U.S.$”, “$” and “U.S. dollars” are to United States dollars. We publish our financial statements in euro.

In this prospectus, unless otherwise provided, references to “GPC Biotech”, “the company”, “we”, “us” and “our” refer to GPC Biotech AG and its wholly owned subsidiary, GPC Biotech Inc.

4

The Combined Offering

The shares being offered by this prospectus are part of a combined offering of up to 8,279,000 newly issued shares offered by the Company (including an over-allotment option of up to 1,119,000 new shares) and 300,000 existing shares offered by selling shareholders. The combined offering consists of a rights offering to existing holders of our shares and a global offering consisting of public offerings in Germany and the United States and private placements with institutional investors in certain other jurisdictions. We are offering up to 7,152,047 newly issued shares in the rights offering. To avoid a fractional subscription ratio, we have excluded shareholders’ subscription rights for a residual amount of 7,953 newly issued shares in accordance with German law and our Articles of Association. Those new shares as to which subscription rights have been excluded or not exercised during the subscription period will be offered in the global offering. In addition, the global offering will include 300,000 existing shares to be sold by certain management shareholders. See “Principal and Selling Shareholders”. All the shares offered in the rights offering and the global offering will be offered through the underwriters. The combined offering can be terminated under some circumstances, even with respect to rights that have been effectively exercised. See “The Combined Offering”, “Plan of Distribution” and “The Rights Offering” below.

The Rights Offering | Existing holders of our shares will have the right to subscribe for one new share for every three shares held at the subscription price. As of the evening of June 14, 2004, Clearstream Banking AG will automatically credit the subscription rights for shares held in collective custody to the depositary banks. |

Subscription Price | We will determine the subscription price at the latest by 12:00 p.m. (noon) Frankfurt time on June 25, 2004. The subscription price will be between or at (x) the volume-weighted average price of the shares from the beginning of the subscription period until the determination of the subscription price and (y) the current market price of our shares at the time of the determination of the subscription price. In determining the subscription price, we will, among other things, consider the current market conditions and the preliminary results of the bookbuilding process for the shares to be offered in the global offering. |

| | We will only determine the subscription price during the subscription period. Therefore, we advise you to inform yourself about the subscription price via the various media set forth below before exercising your subscription rights. See also “The Rights Offering—Important Notices”. |

The subscription price will be published through electronic media (Reuters) immediately after being determined and in the electronic version of the German Federal Gazette (elektronischer Bundesanzeiger) on the first practicable date after determination, at the latest on June 25, 2004. As soon as practicable after determination, the subscription price will also be published in the Frankfurter Allgemeine Zeitung and made available on GPC Biotech’s website at http://www.gpc-biotech.com.

5

| | Existing holders and investors should note that the subscription price in the rights offering may be higher than the initial offer price of the shares to be sold in the global offering. See “The Combined Offering—Important Notices” and “The Right Offering—Important Notices”. |

The subscription rights expire at 11:59 p.m. (Frankfurt time) on June 28, 2004. If you subscribe for new shares in the rights offering, you will receive them as soon as practicable on or after July 2, 2004.

The Global Offering | Those new shares as to which shareholders’ subscription rights have been excluded and any new shares not subscribed for in the rights offering, will be offered by GPC Biotech, together with the shares offered by certain management shareholders, through the underwriters in the global offering. We plan to offer these shares through the underwriters to the public in Germany and the United States, and to institutional investors in certain other jurisdictions. |

Offer Price | The initial offer price of those new shares as to which shareholders’ subscription rights have been excluded, any new shares not subscribed for in the rights offering and the shares offered by certain management shareholders will be determined by GPC Biotech and Goldman, Sachs & Co. oHG at the end of a bookbuilding period. The bookbuilding period will begin on June 15 and is expected to end on or about June 29, 2004. |

The initial offer price of the shares to be sold in the global offering to the public will be published through electronic media (Reuters) immediately after being determined on or about June 29, 2004. The initial offer price to the public will be published in the Frankfurter Allgemeine Zeitung and The Wall Street Journal on or about July 1, 2004.

Over-Allotment Option | As part of the global offering, the underwriters have an option to purchase up to 1,119,000 additional new shares from GPC Biotech to cover over-allotments; shareholders’ subscription rights with respect to these shares will be excluded. |

Shares Outstanding | 29,735,140 (assuming that all the new shares are sold in the combined offering and that the underwriters exercise their over-allotment option in full). |

American Depositary Shares | Investors in the United States may also purchase shares in the form of ADSs. Each ADS, evidenced by an American Depositary Receipt, represents an ownership interest in one share. We are offering ADSs in addition to shares so that our company can be quoted on the Nasdaq National Market and investors will be able to trade our securities and receive dividends on them in U.S. dollars if they wish. |

6

Voting Rights | Each share entitles the holder to cast one vote on all matters submitted to a vote of our shareholders. Holders of ADSs must follow specific procedures to exercise the voting rights of the shares underlying the ADSs and will not be able to exercise those rights unless we request The Bank of New York, as ADS depositary, to solicit voting instructions from ADS holders. We discuss these voting rights and procedures further in the sections of this prospectus entitled “Description of Share Capital—Shareholders’ Meeting and Voting Rights” and “Description of American Depositary Receipts—Voting Rights”. |

Dividends | All shares offered in the combined offering are or will be entitled to full dividend rights for all periods commencing January 1, 2003. We have, however, not paid any dividends on our shares in the past and do not intend to pay dividends on our shares for the foreseeable future. |

Lock-Up | We will agree with the underwriters that, on or before December 27, 2004 we will, subject to certain exceptions, (a) not directly or indirectly, offer, sell or otherwise dispose of any shares of our capital stock or any other securities which are convertible into or exchangeable for shares of our capital stock, (b) not exercise any authorization pursuant to our articles of association to increase our capital other than for the purpose of issuing ordinary shares to the beneficiaries of our existing stock option plans and convertible bond programs upon the exercise of option or conversion rights, and (c) not propose a capital increase to our shareholders other than a proposal for authorized capital (genehmigtes Kapital) or for conditional capital (bedingtes Kapital), in each case except with the prior written consent of Goldman, Sachs & Co. oHG. Certain exceptions apply for share issuances directly to strategic partners in the pharmaceutical or biotech sector in connection with partnering or licensing transactions or in connection with an acquisition or joint venture. See “Plan of Distribution”. |

All Management Board members will individually agree with the underwriters that, except with the prior written consent of Goldman, Sachs & Co. oHG, on or before December 27, 2004 they will not sell their shares or enter into similar transactions to this effect or propose, or vote in favor of, any increase in our share capital unless GPC Biotech is or would be permitted to propose such resolution. These lock-up restrictions do not apply to up to 150,000 cash settled stock options, which two of the Company’s Management Board members intend to exercise before the end of the combined offering but after the publication of the initial offer price (see “Principal and Selling Shareholders and Exercise of Cash Settled Stock Options—Exercise of Cash Settled Stock Options”).

Listing and Quotation | Our shares are listed on the Frankfurt Stock Exchange under the symbol GPC (International Securities Identification Number (ISIN) DE0005851505; German securities code (WKN) 585 |

7

| | 150). Application has been made for quotation of the ADSs on the Nasdaq National Market under the symbol “GPCB.” |

| | Application has been made for admission of the new shares offered in the combined offering to the Frankfurt Stock Exchange, which is expected to be granted on June 28, 2004. Trading of the new shares on the Frankfurt Stock Exchange is expected to commence on June 30, 2004. |

The subscription rights (ISIN DE000A0AYYP6) will be admitted for trading on the Frankfurt Stock Exchange. The subscription rights will not be listed on a U.S. exchange or quoted on the Nasdaq National Market. Since we will only determine the subscription price during the subscription period, a price for the traded subscription rights may not be determinable or, to the extent that a price for the traded subscription rights can be determined, any such price may not constitute the arithmetic value of the subscription rights. See “The Rights Offering—Important Notices.”

Stabilization | Goldman, Sachs & Co. oHG is authorized for a period beginning on the date of publication of the initial offer price and ending 30 days after allocation of the shares in the global offering to perform either by itself or through any of its affiliates certain stabilization measures for the purpose of keeping the market price of the shares or ADSs at a level that may not otherwise prevail. Any stabilization may be discontinued at any time. Stabilization measures will be performed in Germany and elsewhere in accordance with applicable laws. |

Use of Proceeds | We intend to use the net proceeds from this offering to continue to fund clinical trials of satraplatin, to make regulatory filings for marketing approval of satraplatin, and to fund our other clinical, preclinical and research programs, including our monoclonal antibody program (1D09C3) and cell cycle inhibitor program (RGB-286199). We currently estimate that from the net proceeds of this offering we will spend between 50% and 60% to continue to fund clinical trials of satraplatin, to broaden the potential anticancer applications of this drug candidate, and to make regulatory filings for marketing approval of satraplatin; between 20% and 30% to fund our other clinical, preclinical and research programs, including our monoclonal antibody program (1D09C3) and cell cycle inhibitor program (RGB-286199), and to invest in new capabilities relating to our research and development activities; and between 15% and 25% for general corporate purposes, which may include the licensing of other product candidates, technologies or intellectual property. We will not receive any proceeds from the sale of the shares by the selling shareholders. See “Use of Proceeds”. |

8

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following table presents summary of consolidated financial information of GPC Biotech. We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. You should read the following summary of consolidated financial information in conjunction with the section of this prospectus entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes contained elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended

March 31,

| | | Year ended December 31,

| |

| | | 2004

| | | 2003

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

| | | € | | | € | | | € | | | € | | | € | | | € | | | € | |

| | | (amounts in thousands, except share and per share data) | |

Statement of operations data: | | | | | | | | | | | | | | | | | | | | | |

Revenues | | 3,959 | | | 6,112 | | | 21,594 | | | 21,511 | | | 13,889 | | | 5,936 | | | 4,264 | |

Research and development expenses | | 8,682 | | | 8,323 | | | 37,741 | | | 38,053 | | | 30,644 | | | 20,404 | | | 5,280 | |

Impairment of goodwill | | — | | | — | | | — | | | 7,314 | | | — | | | — | | | — | |

Acquired in-process research and development | | — | | | — | | | — | | | — | | | — | | | 15,974 | | | — | |

Total operating expenses | | 11,569 | | | 11,112 | | | 51,068 | | | 57,907 | | | 45,239 | | | 46,013 | | | 6,802 | |

Operating loss | | (7,610 | ) | | (5,000 | ) | | (29,474 | ) | | (36,396 | ) | | (31,350 | ) | | (40,077 | ) | | (2,538 | ) |

Net loss | | (6,925 | ) | | (4,162 | ) | | (26,831 | ) | | (32,934 | ) | | (26,217 | ) | | (34,783 | ) | | (3,305 | ) |

Per share data: | | | | | | | | | | | | | | | | | | | | | |

Basic and diluted loss per share | | (0.33 | ) | | (0.20 | ) | | (1.29 | ) | | (1.59 | ) | | (1.42 | ) | | (2.39 | ) | | (0.54 | ) |

Shares used in computing basic and diluted loss per share | | 21,085,710 | | | 20,724,174 | | | 20,731,535 | | | 20,688,515 | | | 18,509,398 | | | 14,572,917 | | | 6,118,750 | |

| | | | | | | | | | | | |

| | |

| | | At March 31,

| | At December 31,

|

| | | 2004

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

| | | € | | € | | € | | € | | € | | € |

| | | (amounts in thousands) |

Balance sheet data: | | | | | | | | | | | | |

Cash and cash equivalents(1) | | 18,201 | | 34,947 | | 39,947 | | 91,245 | | 55,108 | | 4,787 |

Marketable securities and short-term investments | | 63,783 | | 54,221 | | 74,935 | | 48,885 | | 53,573 | | 14,928 |

Total assets | | 97,117 | | 101,564 | | 132,333 | | 167,860 | | 132,739 | | 22,341 |

Long-term debt, including capital lease obligations | | 835 | | 959 | | 1,528 | | 1,680 | | 1,952 | | 9,253 |

Total shareholders’ equity | | 77,168 | | 81,879 | | 107,270 | | 139,093 | | 124,516 | | 10,341 |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Three months ended

March 31,

| | | Year ended December 31,

| |

| | | 2004

| | | 2003

| | | 2003

| | | 2002

| | | 2001

| | 2000

| | | 1999

| |

| | | € | | | € | | | € | | | € | | | € | | € | | | € | |

| | | (amounts in thousands) | |

Other financial data: | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | (8,268 | ) | | (5,390 | ) | | (22,974 | ) | | (23,537 | ) | | 2,372 | | (17,581 | ) | | (150 | ) |

Net cash provided by (used in) investing activities | | (9,783 | ) | | (14,084 | ) | | 18,723 | | | (26,771 | ) | | 1,477 | | (39,878 | ) | | (14,797 | ) |

Net cash provided by (used in) financing activities | | 1,176 | | | (102 | ) | | 42 | | | (255 | ) | | 35,019 | | 107,709 | | | 19,381 | |

Depreciation, amortization and impairment of tangible, intangible assets and goodwill | | 560 | | | 678 | | | 3,827 | | | 10,840 | | | 6,616 | | 4,923 | | | 570 | |

| (1) | Does not include restricted cash of€2.5 million,€3.0 million and€3.5 million at December 31, 2003, 2002 and 2001, respectively and€2.6 million at March 31, 2004. |

9

RISK FACTORS

An investment in our shares or ADSs involves a high degree of risk. In addition to the other information contained in this prospectus, you should consider carefully the specific risk factors described below, together with all of the other information in this prospectus, before making a decision to invest in our shares or ADSs. The trading price of our shares and ADSs could decline as a result of any of these risks, and you may lose part or all of your investment.

Risks Related to Our Business

We are substantially dependent on the success of our lead product candidate, satraplatin. If we do not successfully complete our current Phase 3 registrational trial, receive regulatory approval or achieve market acceptance for satraplatin, we may be unable to commercialize satraplatin within the timeframe we planned, or at all.

Satraplatin is our only product candidate currently in clinical trials. We have expended significant time, money and effort developing satraplatin, which entered a Phase 3 registrational trial for the second-line chemotherapy treatment of HRPC in late 2003. Before we can market and sell satraplatin, we will need to demonstrate in adequate and well controlled clinical trials that the drug is safe and effective. We will need to obtain necessary approvals from the FDA and similar regulatory agencies in Europe and elsewhere.

Although our current Phase 3 registrational trial as a second-line chemotherapy for HRPC is modelled on a successful earlier 50-patient study as a first-line chemotherapy for HRPC conducted by others, the results from the earlier study may not accurately predict the results of our Phase 3 trial. If our satraplatin Phase 3 registrational trial is significantly delayed or fails to demonstrate that satraplatin is safe or effective, regulatory approval of satraplatin would be significantly delayed or may not be obtainable. In this event, the overall costs of the program will increase and the time at which we can introduce the drug into the marketplace and begin to generate product revenues will also be delayed. We expect that our Phase 3 trial will be completed in 2006 and the FDA’s review and approval of the application for marketing approval of satraplatin could then occur in 2007. If regulatory approval is significantly delayed, competing therapies could be developed, which could decrease the market potential for satraplatin.

Even if we ultimately receive regulatory approval for satraplatin, satraplatin may not gain market acceptance. Furthermore, the availability of less expensive or more effective alternative treatments may affect our ability to successfully commercialize satraplatin.

Our two other product candidates are both in preclinical development. We may not successfully develop these product candidates. Even if their further development is successful, it will take several more years before we can file for regulatory approval of these product candidates. Therefore, if we fail to commercialize satraplatin, our ability to achieve profitability will be significantly delayed and our business prospects will be seriously limited.

We have a history of losses and our future profitability is uncertain.

We have incurred losses in each year since our inception in 1997 because our research and development and general and administrative expenses exceeded our revenues. Our net loss for the years ended December 31, 2003, 2002 and 2001 was€26.8 million,€32.9 million and€26.2 million, respectively. As of December 31, 2003, we had an accumulated deficit of€127.3 million.

10

To attain profitability, we will need to develop and bring products to market. We have never generated revenue from the commercialization of our product candidates, and there is no guarantee that we will be able to do so in the future. If satraplatin fails to show positive results in our ongoing Phase 3 registrational trial and we do not receive regulatory approval for satraplatin, or if satraplatin does not achieve market acceptance even if approved, we will not become profitable in the foreseeable future. Furthermore, if our other product candidates do not advance to clinical trials or fail in clinical trials, we may not be able to achieve or maintain profitability. If we fail to become or remain profitable, or if we are unable to fund our continuing losses, we may be unable to continue our research and development programs, and you could lose all or part of your investment.

We expect to make substantial additional expenditures and incur substantial losses in the future as we continue our clinical trials of satraplatin, file for regulatory approvals and commercialize satraplatin, if and when we receive regulatory approvals. We also expect to make substantial expenditures to advance 1D09C3, our monoclonal antibody, and RGB-286199, our cell cycle inhibitor, into clinical trials and to continue our other research activities. As our product candidates advance, we will continue to need resources for research and development activities, for regulatory approval filings and for commercialization of any approved drugs.

We currently depend on our agreements with ALTANA Pharma for substantially all of our revenues.

We derive a significant portion of our revenues from our agreements with ALTANA Pharma. Our revenues from these agreements accounted for approximately 94% of our total revenue in 2003 and 81% of our total revenue in 2002. ALTANA Pharma accounted for 100% of our revenues in the three months ended March 31, 2004. In 2001, we entered into an agreement with ALTANA Pharma AG, which is our most significant technology collaboration to date. Under this contract, we are assisting ALTANA Pharma through 2007 with its establishment of a research institute in the United States. This agreement includes a research collaboration as well as a transfer of technologies. Effective January 2003, we have also licensed LeadCode™ to ALTANA Pharma under a separate agreement. We are entitled to receive a total of $60 million in payments from ALTANA Pharma, including upfront payments, license and technology transfer fees, and research funding over the term of the agreements. As of December 31, 2003, we had received an aggregate of€37.4 million from ALTANA Pharma under these agreements, of which€27.4 million have been recognized as revenue. Revenues from ALTANA Pharma are expected to constitute a substantial portion of our revenues in future periods through 2007. Our operating results would be adversely affected if this collaboration were to terminate early. After expiration of our agreements with ALTANA Pharma, if we have not commercialized satraplatin or developed alternative sources of revenues, our revenues could be significantly lower than in prior periods.

If our competitors develop and market products that are more effective, safer or more affordable than ours, or obtain marketing approval before we do, our commercial opportunities will be more limited.

Competition in the biotechnology and pharmaceutical industries is intense and continues to increase, particularly in the area of cancer treatment. Our competitors include other biotechnology companies, pharmaceutical companies, as well as academic institutions and other research institutions engaged in the discovery and development of anticancer drugs and therapies. Many of our competitors have significantly greater research and development capabilities, greater experience in obtaining regulatory approvals, manufacturing and marketing, or greater financial and management resources than we have. Our competitors may succeed in developing products that are more effective, safer or more affordable than the ones we have under development or that render our product candidates or technologies noncompetitive or obsolete. Moreover, competitors that are able to achieve patent protection, obtain regulatory approvals and commence commercial sales of their products before we do, and competitors that have already done so, may enjoy a significant competitive advantage.

11

Satraplatin, our lead product candidate, will face significant competition from other drugs that are either marketed or that may be developed for treating prostate cancer, as well as from other platinum-based compounds and other chemotherapy drugs.

In the prostate cancer market, currently approved drugs include EMCYT® (Pfizer, Inc.), NOVANTRONE® (OSI Pharmaceuticals Inc./Serono S.A.), QUADRAMET® (Schering AG/CYTOGEN Corporation), METASTRON® (Amersham Health/Medi-Physics, Inc.) and TAXOTERE® (Aventis S.A.). Two of these drugs (NOVANTRONE and QUADRAMET) are injectable pharmaceuticals approved for use in treating bone pain in cancer patients, and EMCYT is an oral drug used to relieve symptoms of advanced prostate cancer. The most recent approved of these prostate cancer drugs, TAXOTERE, is approved in the United States, in combination with prednisone (a commonly used synthetic steroid), for the treatment of patients with advanced prostate cancer. TAXOTERE has been shown to prolong survival of patients with HRPC.

In addition to the drugs mentioned above, there are other drugs in development for both advanced HRPC and earlier stages of prostate cancer, which may compete with satraplatin. The other agents of which we are aware include the drugs which are listed in the following table.

| | | | |

Drug

| | Company

| | Stage of development for

prostate cancer

|

| | |

| Atrasentan | | Abbott | | · Not a marketed drug · Phase 3 trials have been completed for various stages of prostate cancer |

| | |

| Calcitriol | | Novacea | | · Not a marketed drug · Phase 2/3 trial in combination with TAXOTERE for first line HRPC is on-going |

| | |

| Provenge | | Dendreon | | · Not a marketed drug · Phase 3 trials for first line HRPC on-going |

| | |

| Ixabepilone | | Bristol-Myers Squibb | | · Not a marketed drug · Phase 2 data have been reported for first line HRPC |

There are currently three marketed platinum-based drugs in the United States and in Europe. These are cisplatin, carboplatin and oxaliplatin. All three agents are administered intravenously and are not approved for the treatment of prostate cancer. In addition to these, there are other platinum-based compounds approved and/or marketed in the Asian markets such as lobaplatin (China), nedaplatin (Japan) and eptaplatin (South Korea). These drugs are not approved, however, for the treatment of prostate cancer. All three of these are also administered intravenously. Another platinum-based drug, which is not currently on the market, is AMD-473. AMD-473, which is administered intravenously, has shown activity for HRPC in a Phase 2 clinical trial. There are no reported clinical trials for an oral formulation of AMD-473. We are aware that other companies may be developing orally bioavailable platinum-based compounds. We are not aware, however, of any other orally bioavailable platinum-based compounds that are approved or are in Phase 3 clinical trials.

If 1D09C3 is approved and commercialized, it will face significant competition. Currently marketed antibodies for the treatment of non-Hodgkin’s lymphoma are RITUXAN® (Biogen Idec, Inc./Genentech, Inc./Roche Holdings AG), ZEVALIN® (Biogen Idec, Inc/Schering AG), and BEXXAR® (Corixa/

12

GlaxoSmithKline). CAMPATH® (Berlex Laboratories) is approved for chronic lymphatic leukemia. In addition, there are a number of other antibodies and other drugs in development for the treatment of lymphoma and leukemia.

1D09C3 could also be developed for the treatment of leukemias and melanoma. There is, and will continue to be, significant competition in these markets from both large molecule drugs (antibodies) and small molecule drugs.

If RGB-286199 is approved and commercialized, it will face significant competition. There are no currently marketed cell cycle inhibitors. Competitors with development programs for cell cycle inhibitors include Aventis S.A. (flavopiridol), Cyclacel Limited (CYC 202) and Bristol-Myers Squibb (BMS-387032). Aventis and Cyclacel have advanced their cell cycle inhibitors to Phase 2 clinical trials, however, Aventis announced in February 2004 that development of flavopiridol had been terminated. Bristol-Myers Squibb has advanced its cell cycle inhibitor to Phase 1 clinical trials.

Even if our product candidates are approved for marketing, they may not be competitive with established drugs and therapies or may not be able to supplant established products and therapies in the disease settings that we target, thereby reducing the commercial value of our products.

Our operating results may fluctuate considerably on a quarterly basis. These fluctuations could have an adverse effect on the price of our shares and ADSs.

Our results of operations may fluctuate significantly in the future on a quarterly basis as a result of a number of factors, many of which are beyond our control. Although many companies may encounter this problem, it is particularly relevant to us because of our relatively small size, the fact that we do not have any marketed products and the dynamics of the biotechnology industry in which we operate. Factors that could cause our results of operations to fluctuate include, among others:

| | • | | timing of clinical trial expenses; |

| | • | | failure to achieve milestones under collaborative arrangements; |

| | • | | new product introductions by us or our competitors; |

| | • | | variations in the demand for products we may introduce; |

| | • | | litigation involving patents, licenses or other intellectual property; and |

| | • | | product failures or product liability lawsuits. |

Any of the foregoing factors could cause us to fail to meet the expectations of securities analysts or investors, which could cause the trading price of our shares and ADSs to decline.

Currency fluctuations may expose us to increased costs and revenue decreases.

Our business is affected by fluctuations in foreign exchange rates between the U.S. dollar and the euro. A significant portion of our revenues are denominated in U.S. dollars but are reported in euros. Therefore currency fluctuations could cause our revenues to decline. Historically, the majority of our expenses were denominated in euros, but, on a going forward basis we expect that the majority of our expenses will be denominated in U.S. dollars. The majority of our cash and cash equivalents are denominated in euros. In addition, we conduct clinical trials in many different countries, which exposes us to cost increases if the euro declines in value compared to the currencies of those countries.

13

We will need substantial additional funding and may be unable to raise capital when needed, which could force us to delay, reduce or eliminate our drug discovery, development and commercialization activities.

We may need to raise additional capital to fund our operations and clinical trials, to continue our research and development activities and to commercialize future product candidates.

We believe the net proceeds from this offering, together with our cash on hand, as well as future payments we expect to receive from our collaboration with ALTANA Pharma and interest earned on our investments are sufficient to fund our anticipated operating requirements for at least the next two years. However, we may to need to raise additional funds in the future. Our ability to raise additional funds will depend on financial, economic, market conditions and other factors, many of which are beyond our control. If necessary funds are not available to us on satisfactory terms, we may have to reduce expenditures for research and development and clinical trials, which could delay, reduce or eliminate our drug discovery, development and commercialization activities. Any delay in our development activities could delay our ability to commercialize a product.

Our success depends on recruiting and retaining key personnel and if we fail to do so, it may be more difficult for us to execute our business strategy.

We depend on key members of our management team and scientific personnel. The loss of key managers or scientists could delay the advancement of our research and development activities. We do not maintain any key man insurance. The implementation of our business strategy and our future success will also depend in large part on our continued ability to attract and retain other highly qualified scientific, technical and management personnel, as well as personnel with expertise in clinical testing and regulatory approval.

We face competition for personnel from other companies, universities, public and private research institutions and other organizations. The process of hiring suitably qualified personnel is often lengthy. If our recruitment and retention efforts are unsuccessful in the future, it may be more difficult for us to execute our business strategy.

The members of the Management Board and of the management team identified in the Section “Directors, Senior Management and Employees” comprise our key employees. The members of our Management Board have service agreements for a term of four years each, except for Dr. Seizinger who has a service agreement for a term of five years. The Germany-based members of the management team, Drs. Bancroft, Hombeck, and Nagy all have standard German employment contracts of indefinite duration subject to termination in accordance with applicable law and upon reaching the age of 65. In the United States, only Mr. Gregory Hamm (our Vice President, Corporate Integration and Princeton Site Head) has an employment contract as a result of his having been our first US-based employee. Pursuant to Mr. Hamm’s agreement, we must provide Mr. Hamm 60 days’ written notice of any termination without cause and must continue paying Mr. Hamm’s base salary and other benefits for six months after such termination, unless Mr. Hamm sooner commences new employment, in which case these severance benefits will terminate on that earlier date. No other US-based member of the management team has an employment contract, and their employment relationship with us is terminable at will.

We expect to expand our research and clinical development capabilities and, as a result, may encounter difficulties in managing our growth, which could disrupt our operations.

As our research and development programs continue to advance, we expect that the number of our employees and the scope of our operations will grow. To manage our anticipated future growth, we

14

must continue to improve our managerial, operational and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. Because we are a relatively small company, we may not be able to effectively manage the expansion of our operations or recruit and train additional qualified personnel. The physical expansion of our operations could increase our costs significantly and may divert our management and business development resources. Our future financial performance and our ability to commercialize our product candidates and to compete effectively will depend, in part, on our ability to manage future growth effectively.

We depend on intellectual property licensed from third parties, and termination of any of these licenses could result in the loss of significant rights, which would harm our business.

We hold licenses granted by Spectrum Pharmaceuticals for satraplatin, by MorphoSys for our antibody product candidate, 1D09C3, and by Bristol-Myers Squibb related to our cell cycle inhibitor, RGB-286199. In addition, because the field of antibody therapeutics is characterized by a large amount of intellectual property, we also have a number of other licenses in addition to our license from MorphoSys related to the discovery or the production and commercialization of 1D09C3. We also hold licenses to third party patents important for our research technologies. Any termination of these licenses could result in the loss of significant rights and could harm our ability to commercialize our drug candidates or technologies. Our ownership of patents relating to some or all of our products will not reduce our reliance on these and other third party patents.

Our agreement with Spectrum Pharmaceuticals is a sublicense under a license agreement between Spectrum Pharmaceuticals and Johnson Matthey. We must therefore rely on Spectrum Pharmaceuticals to enforce its rights and Johnson Matthey’s obligations under their license agreement. If Spectrum Pharmaceuticals were to become insolvent or go into receivership, we would have limited access to assets related to satraplatin and limited ability to enforce directly any of Spectrum Pharmaceuticals’ rights or Johnson Matthey’s obligations under such agreement. As a result, our development of satraplatin could be significantly delayed or prevented.

When we license intellectual property from third parties, those parties generally retain most or all of the obligations to maintain, as well as the rights to assert, that intellectual property. We generally have no rights to require our licensors to apply for new patents, except to the extent that we actually assist in the creation or development of patentable intellectual property. With respect to intellectual property that we license, we are generally also subject to all of the same risks with respect to its protection as we are for intellectual property that we own, which are described below.

We rely on third parties to supply the active pharmaceutical ingredients in our product candidates. If they do not supply materials of satisfactory quality, in a timely manner, in sufficient quantities or at an acceptable cost, clinical development and commercialization of our product candidates could be delayed.

We will depend on supply agreements for compounds that are essential for the development and commercialization of our product candidates, including satraplatin. We believe that we have obtained sufficient amounts of satraplatin from Johnson Matthey to conduct our current Phase 3 registrational trial of satraplatin. If we are unable, however, to secure a supply of satraplatin in sufficient quantity and of satisfactory quality in a timely manner for any future clinical trials or commercial sale of satraplatin, after regulatory approval, our ability to further develop and commercialize satraplatin will suffer. Johnson Matthey has been our sole supplier of satraplatin to date. We are currently discussing the manufacture of satraplatin with selected manufacturers who have experience in producing platinum-based drugs. We estimate that identifying and contracting with an alternative supplier for satraplatin will cost approximately $1 million.

15

Our sole supplier of 1D09C3, our monoclonal antibody product candidate, has been Icos Corporation. We estimate that, under current regulations, if we had to replace a manufacturer of 1D09C3, the costs of verifying both quality and equivalence as compared to the previously produced material could be in excess of $5 million.

Our supply of the active ingredient for satraplatin and other product candidates may become limited, be interrupted or become restricted in certain geographic regions, and our suppliers may not perform their contractual obligations, for reasons including a shortage of raw materials or adverse regulatory actions. In this event, because we have not yet completed negotiations with alternate suppliers, we may not be able to obtain materials of acceptable quality from other manufacturers, or at prices, on terms or in quantities acceptable to us. Any inability to obtain alternate suppliers, including an inability to obtain approval of an alternate supplier from the FDA and other regulatory agencies, would delay or prevent the clinical development and commercialization of satraplatin and our other product candidates.

Although we believe we have sufficient amounts of 1D09C3 for our preclinical studies and initial planned clinical trials from a third party, we will need to procure additional supplies of 1D09C3 to continue its development should early clinical trials be successful or should our current supplies be damaged or lost.

We rely on third parties to manufacture our product candidates. If they do not manufacture our product candidates of satisfactory quality, in a timely manner, in sufficient quantities or at an acceptable cost, clinical development and commercialization of our product candidates could be delayed.

We do not currently own or operate manufacturing facilities and rely and expect to continue to rely on third parties for the production of clinical and commercial quantities of our product candidates. Our current and anticipated future dependence upon others for the manufacture of our product candidates may adversely affect our ability to develop and commercialize any product candidates on a timely and competitive basis. We may not be able to maintain or renew our existing manufacturing arrangements on acceptable terms, if at all.

To date, our product candidates have been manufactured in small quantities for preclinical studies or clinical trials. If any of our product candidates is approved by the FDA or other regulatory agencies for commercial sale, we will need to have it manufactured in commercial quantities. We may not be able to successfully increase the manufacturing capacity for any of our product candidates in a timely or economic manner or at all. Significant scale-up of manufacturing may require additional validation studies, which the FDA and other regulatory agencies must review and approve. If we are unable to successfully increase the manufacturing capacity for a product candidate, the regulatory approval or commercial launch of that product candidate may be delayed, or there may be a shortage of supply, which could negatively affect our product sales.

We rely on third parties to conduct clinical trials and assist with preclinical activities. If they do not perform as contractually required or expected, we may not be able to obtain regulatory approval for or commercialize our product candidates.

We do not have the ability to independently conduct clinical trials for our product candidates, and we rely on third parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories to conduct our clinical trials. In particular, with regard to our Phase 3 registrational trial for satraplatin, we have contracts with two contract research organizations, PharmaNet LLC and Cvitkovic Associes Consultants S.A. In the event that one of these clinical research organizations were to terminate its agreement with us, we would shift the full responsibility for

16

conducting the trial to the remaining clinical research organization. In the event that both of our clinical research organizations were to terminate their agreements with us and, as a result, we needed to transfer responsibilities to a new contract research organization, we believe we could engage one or more new clinical research organizations with sufficient qualifications and international capabilities. Any of the foregoing events could, however, cause significant delays, disruptions and cost increases in our satraplatin trials.

In addition, we rely on third parties to assist us with our preclinical development of product candidates. Our preclinical development activities or clinical trials may be extended, delayed, suspended or terminated, if:

| | • | | these third parties do not successfully carry out their contractual duties or regulatory obligations or meet expected deadlines; |

| | • | | these third parties need to be replaced; |

| | • | | or the quality or accuracy of the data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements or for other reasons. |

If any of these events occur, we may not be able to obtain regulatory approval for, or successfully commercialize our product candidates.

We depend in part on the continued availability of outside scientific collaborators, including researchers at clinical research organizations and universities, in areas relevant to our research and product development. The competition for these relationships is intense, and we cannot assure you that we will be able to maintain such relationships on acceptable terms, if at all. In addition, these outside relationships may be terminated by the collaborator at any time. Our scientific collaborators are not employees of GPC Biotech. As a result, we have limited control, if any, over their activities and can expect that only limited amounts of their time will be dedicated to GPC Biotech activities. In addition, we may not control any intellectual property resulting from their activities.

We are, and expect to continue to be, dependent upon collaborative arrangements to complete the development and commercialization of some of our product candidates. These collaborative arrangements may place the development and commercialization of our product candidates outside of our control, may require us to relinquish important rights or may otherwise be on terms unfavorable to us.

We have limited experience in selling, marketing or distributing products and have no internal sales force to do so. If we receive regulatory approval to commence commercial sales of any of our product candidates, we will either have to establish a sales and marketing organization with appropriate technical expertise and supporting distribution capability, or engage one or more collaboration partners, such as a pharmaceutical or other healthcare company with an existing distribution network and direct sales and marketing organization.

We may not be successful in entering into collaborative arrangements with third parties. Any failure to enter into additional collaborative arrangements on favorable terms could delay or hinder our ability to develop and commercialize our product candidates and could increase our costs of development and commercialization. Dependence on collaborative arrangements will subject us to a number of risks, including:

| | • | | we may not be able to control the amount or timing of resources that our collaborators may devote to the product candidates; |

| | • | | we may be required to relinquish important rights, including intellectual property, marketing and distribution rights; |

17

| | • | | should a collaborator fail to develop or commercialize one of our compounds or product candidates, we may not receive any future milestone payments or royalties; |

| | • | | a collaborator could separately move forward with a competing product candidate developed either independently or in collaboration with others, including our competitors; |

| | • | | our collaborators may experience financial difficulties; |

| | • | | business combinations or significant changes in a collaborator’s business strategy may also adversely affect a collaborator’s willingness or ability to complete its obligations under any arrangement; and |

| | • | | collaborative research and development arrangements are often terminated or allowed to expire, which would delay the development and may increase the cost of developing our product candidates. |

The primary patents covering satraplatin in the United States will expire in 2008 and 2010, and in 2009 in most other countries. If we are unable to extend these patents, we may be subject to competition from third parties with products with the same active pharmaceutical ingredients as satraplatin.

Even if our product candidates and technologies are covered by valid and enforceable patents, the patents will provide protection only for a limited amount of time. For example, the primary patents covering the active pharmaceutical ingredient and anticancer use of satraplatin will expire in 2008 and 2010 in the United States, respectively, and in 2009 in most other countries. Thereafter, we will have no direct means to prevent third parties from making, selling, using or importing satraplatin in the United States, Europe or Japan. Instead, we expect to rely upon the U.S. Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, and comparable foreign legislation, to seek product exclusivity for satraplatin. While we believe that satraplatin will meet the Hatch-Waxman criteria for patent extension, delays in the completion of our Phase 3 registrational trial or in obtaining regulatory approval may jeopardize our ability to obtain a timely patent extension or a patent extension may ultimately not be granted. The terms of the Hatch-Waxman Act, or similar foreign statutes, could be amended to our disadvantage. If we do not qualify for marketing exclusivity for satraplatin, the competition we will face would increase significantly, reducing our potential revenues and harming our ability to achieve profitability.

Under the provisions of the Hatch-Waxman Act, we may also have to defend one or more of our patents, if challenged. Although we are currently not involved in any litigation concerning our intellectual property related to satraplatin and we are not currently aware of any threats or challenges with respect to our product candidates, the risk of a challenge increases as our product candidates progress toward commercialization. Information about the patents covering drug products in the United States is published by the FDA in a publicly available database, Approved Drug Products with Therapeutic Equivalance Evaluations, also known as the Orange Book. A competitor (usually a generic drug company) seeking to market a competing or generic version of our drug products in the United States may notify us that its competing drug product does not infringe one or more patents listed in the Orange Book covering our product, or may challenge the validity or enforceability of one or more of our listed patents covering our product. Once we are so notified we would have 45 days in which to file a lawsuit claiming patent infringement based on the competitor’s assertion about the characteristics of its proposed product. If we file such a lawsuit within 45 days, the FDA is required to delay, or stay, final approval of the competing product for up to 30 months. If a court determines that the patent would be infringed by the product proposed in the competitor’s drug application, the FDA will not approve the application until the patent expires. If, however, the court decides that the patent would not be infringed, or is invalid, the FDA may approve the competitor’s drug application when that decision occurs. The FDA may approve the application at the thirty-month date, even if the litigation is ongoing. If litigation is pending and the FDA

18

approves the application at the end of the thirty-month period, the competitor may launch a competing product. Under the provisions of the recently enacted Medicare Prescription Drug Improvement and Modernization Act of 2003, we are limited to only a single 30-month stay per competing or generic drug application.

Risks Related to Our Industry

Early-stage drug discovery is subject to a high degree of failure.

Although we devote significant resources to the discovery of new anticancer drugs and employ advanced technologies in our efforts to identify promising drug candidates to advance into preclinical studies, the risk that all or any one of our early-stage product candidates will fail is high. According to pharmaceutical industry statistics published in 2001 by the Pharmaceutical Research and Manufacturers of America, only 1 in 1000 early stage drug discovery compounds is tested in clinical trials, and only 1 in 5 compounds that enters clinical trials receives FDA approval for marketing as a prescription drug. Moreover, the results from preclinical studies and early clinical trials may not accurately predict the results obtained in later-stage clinical trials required for regulatory approval. Because there is no prior experience in treating humans with early stage product candidates, we cannot assure you that early-stage product candidates will prove in clinical testing to be effective and safe for use in humans. If our early-stage product candidates do not prove to be effective in such tests, regulatory approval for such products would be delayed or may not be obtainable.

Our product candidates must undergo rigorous clinical testing, the results of which are uncertain and could substantially delay or prevent us from bringing these products to market.

Before we can obtain regulatory approval for a product candidate, we must undertake extensive clinical testing in humans to demonstrate the product’s safety and effectiveness. These clinical trials are expensive, time-consuming and often take years to complete. According to pharmaceutical industry statistics published in 2001 by the Pharmaceutical Research and Manufacturers of America, an average drug candidate receiving approval for marketing as a prescription drug required 6.5 years of clinical testing prior to submission of a request to the FDA for marketing approval.

In connection with clinical trials, we face risks that:

| | • | | the product candidate may not be efficacious; |

| | • | | the product candidate may cause harmful side effects or patients may die; |

| | • | | the results may not confirm the results of earlier trials; or |

| | • | | the results may not meet the level of statistical significance required by the FDA or other regulatory agencies. |

Any of these events could cause a trial to fail and may significantly delay or prevent us from obtaining regulatory approval for a product candidate.

Difficulties in enrolling patients in our clinical trials may increase costs and negatively affect the timing and outcome of our trials.

Completion of clinical trials depends, among other things, on our ability to enroll a sufficient number of patients, which is a function of many factors, including:

| | • | | the nature of the clinical protocol; |

| | • | | the therapeutic endpoints chosen for evaluation; |

| | • | | the eligibility criteria for the trial that is related to the protocol; |

| | • | | the size of the patient population required for analysis of the trial’s therapeutic endpoints; |

19

| | • | | our ability to recruit clinical trial investigators with the appropriate competencies and experience; |

| | • | | competition for patients by clinical trial programs for other treatments; |

| | • | | the proportion of patients leaving the study before reaching an endpoint; and |

| | • | | the availability of adequate insurance. |

We may experience difficulties in enrolling patients in our clinical trials, which could increase the costs or affect the timing or outcome of these trials. This is particularly true with respect to diseases with relatively small patient populations, such as HRPC, which is the indication for which our product candidate satraplatin is currently being evaluated in a Phase 3 registrational trial.

We are subject to significant regulatory approval requirements, which could delay, prevent or limit our ability to market our product candidates.

Our research and development activities, preclinical studies, clinical trials and the anticipated manufacturing and marketing of our product candidates are subject to extensive regulation by the FDA and other regulatory agencies in the United States and by comparable authorities in Europe and elsewhere. We require the approval of the relevant regulatory authorities before we may commence commercial sales of our product candidates in a given market. The regulatory approval process is expensive and time-consuming, and the timing of receipt of regulatory approval is difficult to predict.

Our product candidates could require a significantly longer time to gain regulatory approval than expected, or may never gain approval. A delay or denial of regulatory approval could delay our ability to generate product revenues and to achieve profitability.

We have had an “End-of-Phase 2 Meeting” with the FDA and completed a Special Protocol Assessment under which the FDA has evaluated our registrational approach for satraplatin to assess whether it is adequate to meet scientific and regulatory requirements in the United States. We have also received a Scientific Advice Letter from the European Agency for the Evaluation of Medicinal Products, or EMEA, relating to our registrational approach for satraplatin in the European Union. A successful “End-of-Phase 2 Meeting”, Special Protocol Assessment and a Scientific Advice Letter, however, do not guarantee that satraplatin will receive regulatory approval and, in any event, are subject to further developments in the medical and regulatory field. The Scientific Advice Letter from the EMEA also identifies specific issues to be addressed in the clinical trial program and indicates that if the clinical data are not sufficiently convincing, then one Phase 3 trial will be insufficient to obtain approval.

Changes in the regulatory approval policy during the development period of any of our product candidates, changes in, or the enactment of, additional regulations or statutes, or changes in regulatory review practices for a submitted product application may cause a delay in obtaining approval or result in the rejection of an application for regulatory approval.

Regulatory approval, if obtained, may be made subject to limitations on the indicated uses for which we may market a product. These limitations could adversely affect our potential product revenues and our ability to achieve profitability. Regulatory approval may also require costly post-marketing follow-up studies. In addition, the labeling, packaging, adverse event reporting, storage, advertising, promotion and record-keeping related to the product will be subject to extensive ongoing regulatory requirements. Furthermore, for any marketed product, its manufacturer and its manufacturing facilities will be subject to continual review and periodic inspections by the FDA and other regulatory authorities. Failure to comply with applicable regulatory requirements may, among

20