Pillsbury Winthrop Shaw Pittman LLP

2475 Hanover Street | Palo Alto, CA 94304-1114 | tel 650.233.4500 | fax 650.233.4545

Davina K. Kaile

tel 650.233.4564

dkaile@pillsburylaw.com

March 14, 2012

VIA ELECTRONIC TRANSMISSION AND OVERNIGHT MAIL

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Attn: | Mara L. Ransom, Esq. |

Chris Chase, Esq.

Registration Statement on Form S-1

File No. 333-174829

Ladies and Gentleman:

On behalf of CafePress Inc. (the “Registrant” or the “Company”) and pursuant to verbal discussions with the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), we previously submitted to the Staff Amendment No. 9 to the above referenced Registration Statement on Form S-1 (the “Registration Statement”), which reflected, among other things, information regarding the number of shares proposed to be sold in the offering, the preliminary offering price range, as well as clarification revisions to the Compensation Discussion and Analysis section of the Registration Statement.

In connection with the filing of the Registration Statement, we are supplementally providing the Staff with information with respect to the proposed limited directed share program (“DSP”), which will be administered by J.P. Morgan Securities LLC (“JPM”), including the DSP invitation email, which is attached as Appendix A, and the revised Letter of Notice Template for the DSP, which is attached as Appendix B. The Company wishes to confirm that that the DSP and all DSP-related materials shall comply with applicable federal securities laws and the Commission’s guidelines.

March 14, 2012

Page 2

Questions or comments concerning any matter with respect to the Registration Statement may be directed to the undersigned at (650) 233-4564. Comments can also be sent via facsimile at (650) 233-4545 or via email to dkaile@pillsburylaw.com.

Very truly yours,

/s/ Davina K. Kaile

Davina K. Kaile

Monica Johnson

Kirsten Mellor, Esq.

Martin A. Wellington, Esq.

C.F. Pearson

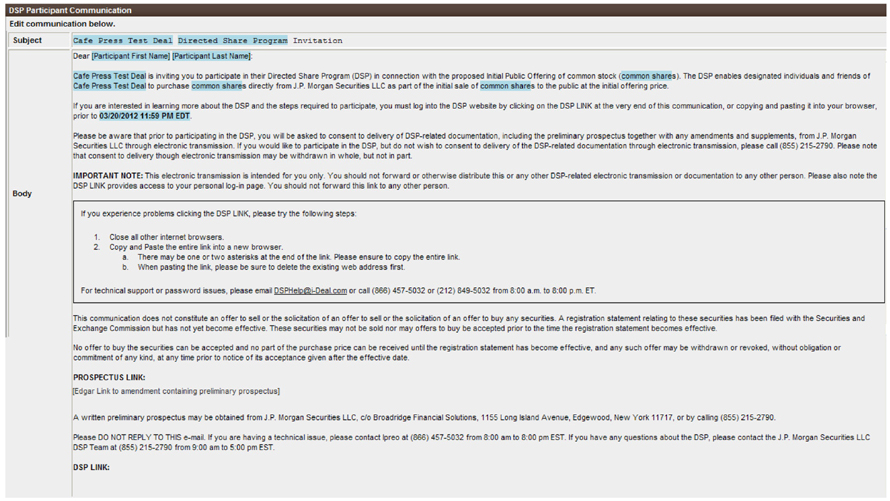

Appendix A

DSP Participant Communication Edit communication below. Subject Cafe Press Test Deal Directed Share Program Invitation Dear [Participant First Name] [Participant Last Name]: Cafe Press Test Deal is inviting you to participate in their Directed Share Program (DSP) in connection with the proposed Initial Public Offering of common stock (common shares). The DSP enables designated individuals and friends of Cafe Press Test Deal to purchase common shares directly from J.P. Morgan Securities LLC as part of the initial sale of common shares to the public at the initial offering price. If you are interested in learning more about the DSP and the steps required to participate, you must log into the DSP website by clicking on the DSP LINK at the very end of this communication, or copying and pasting it into your browser, prior to 03/20/2012 11:59 PM EDT. Please be aware that prior to participating in the DSP, you will be asked to consent to delivery of DSP-related documentation, including the preliminary prospectus together with any amendments and supplements, from J.P. Morgan Securities LLC through electronic transmission. If you would like to participate in the DSP, but do not wish to consent to delivery of the DSP-related documentation through electronic transmission, please call (855) 215-2790. Please note that consent to delivery though electronic transmission may be withdrawn in whole, but not in part. IMPORTANT NOTE: This electronic transmission is intended for you only. You should not forward or otherwise distribute this or any other DSP-related electronic transmission or documentation to any other person. Please also note the DSP LINK provides access to your personal log-in page. You should not forward this link to any other person. Body If you experience problems clicking the DSP LINK, please try the following steps: 1. Close all other internet browsers. 2. Copy and Paste the entire link into a new browser. a. There may be one or two asterisks at the end of the link. Please ensure to copy the entire link. b. When pasting the link, please be sure to delete the existing web address first. For technical support or password issues, please email DSPHelp@i-Deal.com or call (866) 457-5032 or (212) 849-5032 from 8:00 a.m. to 8:00 p.m. ET. This communication does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. A registration statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. No offer to buy the securities can be accepted and no part of the purchase price can be received until the registration statement has become effective, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to notice of its acceptance given after the effective date. PROSPECTUS LINK: [Edgar Link to amendment containing preliminary prospectus] A written preliminary prospectus may be obtained from J.P. Morgan Securities LLC, c/o Broadridge Financial Solution, 1155 Long Island Avenue, Edgewood, New York 11717, or by calling (855) 215-2790. Please DO NOT REPLY TO THIS e-mail. If you are having a technical issue, please contact Ipreo at (866) 457-5032 from 8:00 am to 8:00 pm EST. If you have any questions about the DSP, please contact the J.P. Morgan Securities LLC DSP Team at (855) 215-2790 from 9:00 am to 5:00 pm EST. DSP LINK:

Appendix B

Letter of Notice Template – Online Process

Dear Prospective Investor:

As you may know, CafePress Inc. (“CafePress”) has announced an initial public offering of common shares representing CafePress’s common stock, par value $0.0001 per share. The offering will be made through a group of underwriters with J.P. Morgan Securities LLC acting as a book-running manager. We have set aside a limited number of common shares for certain directors and officers of CafePress to purchase through a program we call the Directed Share Program and arrangements have been made with J.P. Morgan Securities LLC to handle the sale of these common shares for the benefit of the participants in the Directed Share Program. The purchase price if you buy common shares through the Directed Share Program is the same as the offering price to the public, which is expected to be between X and X. Please note that you are not obligated to purchase any shares, and we are not recommending, encouraging or discouraging your participation in our proposed offering. This notice is simply intended to inform you of the proposed offering in case you might be interested in participating.

Purchases of common shares through the Directed Share Program may be made only through a brokerage account at J.P. Morgan Securities LLC. Please be certain to complete the packet in all respects, including the information requested on the new account form. It is the policy and practice of J.P. Morgan Securities LLC to afford confidentiality to any information it receives about a client’s financial affairs. J.P. Morgan Securities LLC may, however, share certain information with us in order to determine how best to allocate common shares under the Directed Share Program. J.P. Morgan reserves the right to deny participation in the DSP based on incomplete information and/or based on the participant’s financial suitability in relation to indication of interest.

You are permitted to express an interest in common shares only for your own personal account and not on behalf of any other person. The common shares may not be purchased on margin. Your indication of interest is not a binding commitment and may be withdrawn when you are asked by J.P. Morgan Securities LLC to confirm your indication of interest or at any earlier time.

In the event that the aggregate indications of interest exceed the maximum number of common shares reserved for the Directed Share Program, common shares will be allocated among the participants in the Directed Share Program in a manner determined by the CafePress.

If you have an interest in purchasing common shares in the public offering, please proceed by selecting the “I am interested in continuing with the Directed Share Program and consent to receiving electronic information documents” button at the bottom of the page and pressing the “Next” button to proceed with completing the following:

| | - | Account Information Form |

You will also have the opportunity to review the preliminary prospectus and acknowledge that you have reviewed it. If you have any other questions, please call J.P. Morgan Securities LLC Directed Share Plan Team at (855) 215-2790 between the hours of 9 a.m. – 5 p.m. Eastern Time, Monday through Friday.

After the offering price of the common shares has been determined, you will be notified that the offering price and allocation information is available by email so that you may review this information online. At this time, you will be able to review the number of common shares allocated to you and the purchase price. You must then confirm the number of shares you wish to purchase online. Upon confirmation of the purchase, you will have entered into a binding legal contract to purchase the common shares and you must pay for them. Following such confirmation, a written confirmation of the sale will be mailed to you. Full payment is required by settlement date, which is three (3) business days after the trade date. Payment information will be provided to you when you confirm your allocation. Prefunding of your account is not required, but isstrongly encouraged. Please contact The Directed Share Plan Team, J.P. Morgan Securities LLC at (855) 215-2790 with any related questions. Failure to pay in full by settlement date will result in theimmediate cancellation of your share purchase.

We are delighted to invite you to participate in the Directed Share Program. However, we do not wish to influence in any way your decision in this matter. The purchase of common shares of CafePress involves certain risks which are described in the preliminary prospectus.

This communication does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. A registration statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.

No offer to buy the securities can be accepted and no part of the purchase price can be received until the registration statement has become effective, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to notice of its acceptance given after the effective date.

A written preliminary prospectus may be obtained from J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, or by calling (855) 215-2790.

This J.P. Morgan Securities LLC Directed Share Plan E-Sign Disclosure (“Disclosure”) applies to all Communications related to your online participation in the Directed Share Plan (your “Participation”).

The words “we,” “us,” and “our” refer to J.P. Morgan Securities LLC and the words “you” and ���your” mean you, the individual(s) or entity identified. As used in this Disclosure, “Communication” means any disclosures, documents, notices, and all other information related to your Participation, including but not limited to information that we are required by law to provide to you in writing.

1.Scope of Communications to Be Provided in Electronic Form.You agree that we may provide you with any Communications in electronic format, and that we may discontinue sending paper Communications to you, unless and until you withdraw your consent as described below. Your consent to receive electronic Communications and transactions includes, but is not limited to:

| | • | | Disclosures required by federal and/or state law |

| | • | | Offering documents, marketing and sales documents, and communication relating to your securities activity for all investment products including both registered and unregistered offerings |

| | • | | Account Information Form |

2

| | • | | Confirmation of Allocation |

2.Method of Providing Communications to You in Electronic Form.All Communications that we provide to you in electronic form will be provided either (1) via e-mail, (2) by access to a web site that we will designate in an e-mail notice we send to you at the time the information is available, (3) to the extent permissible by law, by access to a web site that we will generally designate in advance for such purpose, or (4) by requesting you download a PDF file containing the Communication.

3.How to Withdraw Consent. You may withdraw your consent to receive Communications in electronic form by contacting us ata JPMorgan Representative.At our option, we may treat your provision of an invalid email address, or the subsequent malfunction of a previously valid email address, as a withdrawal of your consent to receive electronic Communications. Any withdrawal of your consent to receive electronic Communications will be effective only after we have a reasonable period of time to process your withdrawal.

4.How to Update Your Records. It is your responsibility to provide us with true, accurate and complete e-mail address, contact, and other information related to this Disclosure and your Participation, and to maintain and update promptly any changes in this information. Please contact the Directed Share Plan Team at J.P. Morgan Securities LLC at (855) 215-2790 to update any information.

5.Hardware and Software Requirements. In order to access, view, and retain electronic Communications that we make available to you, you must have:

| | • | | Windows 2000 (Service Pack 2), Windows 2003, Windows XP, Windows Vista, Windows 7 |

| | • | | Internet Explorer 6.0, Internet Explorer 7.0 or Internet Explorer 8.0 (compatibility mode) |

| | • | | Monitor capable of displaying 1280x1024 resolution |

| | • | | Adobe Acrobat Reader 5.0 or higher |

| | • | | Microsoft Office 2000 or later (Excel, Word, Outlook) |

6.Requesting Paper Copies. We will not send you a paper copy of any Communication, unless you request it or we otherwise deem it appropriate to do so. You can obtain a paper copy of an electronic Communication by printing it yourself or by requesting that we mail you a paper copy. To request a paper copy, contact us by telephone. We may charge you a reasonable service charge, of which we’ve provided you prior notice, for the delivery of paper copies of any Communication provided to you electronically pursuant to this authorization. We reserve the right, but assume no obligation, to provide a paper (instead of electronic) copy of any Communication that you have authorized us to provide electronically.

7.Communications in Writing. All Communications in either electronic or paper format from us to you will be considered “in writing.” You should print or download for your records a copy of this Disclosure and any other Communication that is important to you.

8.Federal Law.You acknowledge and agree that your consent to electronic Communications is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

By clicking the “I am interested in continuing with the Directed Share Program and consent to receiving electronic information and documents” button below you confirm that you have read and agree to the

3

terms and conditions set forth in this e-Sign Disclosure and wish to learn more about the Directed Share Program. You also agree that your computer satisfies the hardware and software requirements the disclosure specifies. Therefore, you give us your affirmative consent to provide electronic Communications to you as described herein.

I understand that the account being opened with J.P. Morgan Securities LLC is solely meant to facilitate this Directed Share Program and will coordinate with a J.P. Morgan Securities LLC account representative to discuss further investment opportunities and requirements.

4