Exhibit 10.1

THIRD AMENDMENT AND MODIFICATION OF LEASE

THIS THIRD AMENDMENT AND MODIFICATION TO LEASE (“Third Amendment”), made this 17th day of July, 2014, by and among6901, LLC, a Florida limited liability corporation, whose address is 1625 S.E. 17th Street, Fort Lauderdale, FL 33316 (the “Landlord”), andCafepress Inc., a Delaware corporation, (“Tenant”), with headquarters at 6901 Riverport Drive, Louisville, Kentucky 40258-2852 and corporate offices at 1850 Gateway Drive, Suite 300, San Mateo, California 94404.

WHEREAS, Riverport Group, LLC (“Riverport”) and Tenant entered into that certain lease dated May 3, 2005 (the “Lease”) for that certain portion of interior space in a Building at 6901 Riverport Drive, Louisville, Kentucky 40258-2852 consisting of approximately 126,352 square feet of rentable area more completely described inExhibit A to the Lease, (“Premises”);

WHEREAS, Riverport and Tenant executed and delivered that certain Amendment and Modification of Lease dated June 18, 2007 (“First Amendment”), which, among other things, increased the Premises by 20,000 rentable square feet, as described onExhibit A to the First Amendment (the “First Expansion Space”);

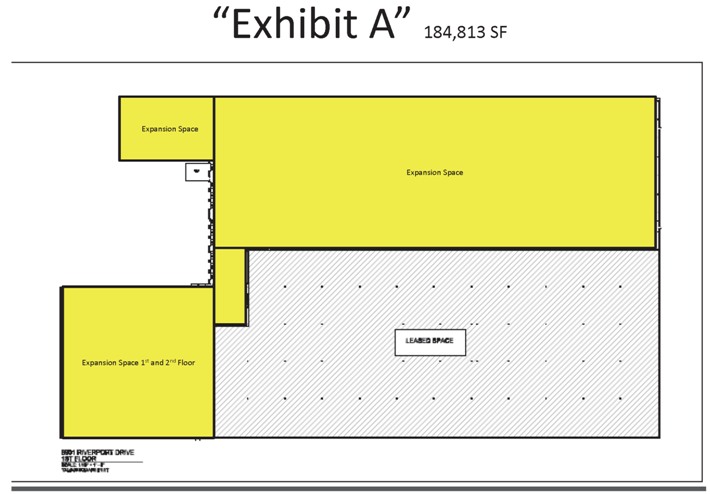

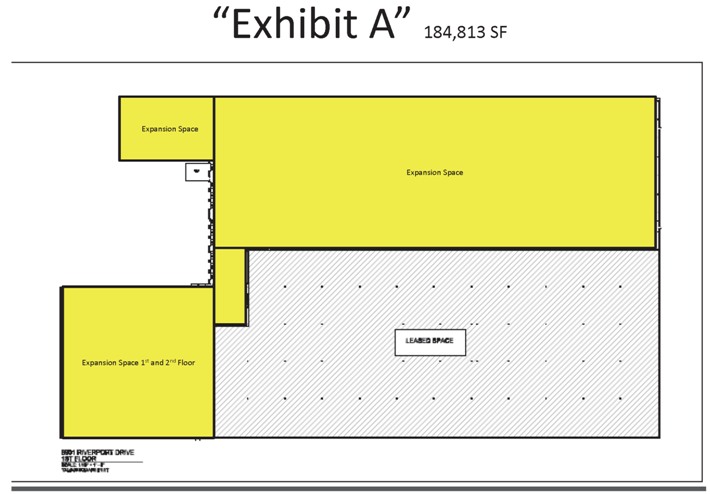

WHEREAS, Riverport and Tenant executed and delivered that certain Second Amendment and Modification of Lease dated August 1, 2012 (“Second Amendment”) which, among other things, increased the Premises by 184,813 rentable square feet as described onExhibit A to the Second Amendment (the “Second Expansion Space”).

WHEREAS, Landlord acquired the real estate which contains the Premises via a Warranty Deed executed by Riverport dated January 31, 2006 and recorded on February 10, 2006 in the Office of the Recorder of Deeds of Jefferson County, Kentucky as document number DN2006021991.

WHEREAS, Riverport assigned the Lease to Landlord by assignment dated April 15, 2014, but effective as of February 10, 2006, in connection with the transfer from Riverport to Landlord of ownership of the real property of which the Premises are a part and Tenant hereby acknowledges the effectiveness of such assignment and transfer.

WHEREAS, the term of the Lease for the Second Expansion Space is scheduled to end on July 31, 2014 and Tenant has elected not to exercise the Option to Extend such term as contained in the Second Amendment; and

WHEREAS, the parties have agreed to further amend certain provisions of the Lease as set forth below.

NOW THEREFORE, in consideration of the mutual covenants and conditions contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties, intending to be legally bound, hereby agree as follows:

1.Recitals. The recitals set forth above are true, correct and incorporated herein by reference and are made part of this Amendment.

-1-

2.Capitalized Terms. All initially capitalized terms used herein shall have the meanings ascribed to them in the Lease, unless otherwise defined herein or required by context to have a modified meaning.

3.Controlling Language. The provisions of this Amendment shall control over any conflicting provisions in the Lease (including, without limitation, the First Amendment and all Exhibits thereto).

4.Terms. Any terms utilized in this Amendment, which are defined in the Lease, shall have the same meaning herein as set forth in the Lease.

5.Second Expansion Space. Effective on August 1, 2014 (the “Effective Date”), Tenant leases from Landlord and Landlord leases to Tenant certain space, as further depicted onExhibit A attached hereto and asExhibit A to the Second Amendment, consisting of 184,813 rentable square feet (the “Second Expansion Space”), on the terms and conditions set forth in the Lease, except as modified hereby. The term of the Lease, as it relates to the Second Expansion Space only, is for a period of seven (7) years, ending on July 31, 2021 (“Second Expansion Space Term”), subject to the Right of Termination set forth in Paragraph 8 below. From and after the Effective Date, the “Premises” shall consist of the original leased Premises of 126,352 square feet; the First Expansion Space of 20,000 square feet and the Second Expansion Space of 184,813 square feet; for a total of 331,165 square feet.

6.Rent for Second Expansion Space. The rent for the Second Expansion Space during the Second Expansion Space Term shall be as attached hereto onExhibit B.

7.Additional Rent. Tenant’s Proportionate Share, as defined in Paragraph 5 of the Lease, as it relates to the Second Expansion Space, is deemed to be 55.81%. Tenant’s obligation to pay its Proportionate Share of Operating Expenses in respect to the Second Expansion Space shall commence as of the Effective Date.

8.Right of Termination. Effective upon the expiration of the fourth (4th) year of the Second Expansion Term (i.e. July 31, 2018), and in strict compliance with the provisions below, Tenant shall have the right to terminate the Lease as it pertains to the Second Expansion Space.

Tenant may exercise such right of termination:

| (i) | for the final three (3) years of the Second Expansion Lease Term by giving written notice (the “Termination Notice”) to Landlord prior to the end of the third (3rd) year of the Second Expansion Lease Term (i.e. July 31, 2017); |

| (ii) | for the final two (2) years of the Second Expansion Lease Term by giving the Termination Notice to Landlord prior to the end of the fourth (4th) year of the Second Expansion Lease Term (i.e. July 31, 2018); and |

-2-

| (iii) | for the final year of the Second Expansion Lease Term by giving the Termination Notice to Landlord prior to the end of the fifth (5th) year of the Second Expansion Lease Term (i.e. July 31, 2019). |

The right of termination described above shall be subject to the following terms and conditions:

(a) Tenant may not exercise its right of termination if at the time of the purported exercise there is an uncured Event of Default under the Lease, as defined in Paragraph 18 of the Lease; and

(b) In order for the Termination Notice to be effective, Tenant shall include with the Termination Notice a termination fee (the “Termination Fee”) payable to Landlord in accordance with the following schedule:

| | (i) | For a termination effective as of July 31, 2018: $1,512,679.00 |

| | (ii) | For a termination effective as of July 31, 2019: $934,814.00 |

| | (iii) | For a termination effective as of July 31, 2020: $429,736.00 |

9.Remaining Option. The Option to Extend the Lease for an additional period of five (5) years (i.e. through July 31, 2029), as described in Paragraph 41 of the Lease, shall remain effective. The terms of such option and the method of exercise shall be as set forth in Paragraph 41 of the Lease. The Option to Extend the Lease shall pertain to the original leased Premises only, as expanded by the First Expansion Space, and shall not pertain to the Second Expansion Space.

10.Letter of Credit. In order to secure the payment of the Termination Fee described above in Paragraph 8, Tenant shall furnish to Landlord, contemporaneously with the execution of this Amendment, an irrevocable letter of credit, drawable upon sight, on a form and in substance acceptable to Landlord in the exercise of its reasonable discretion, naming Landlord as the beneficiary, in the amount of the maximum amount of the Termination Fee for which Tenant may at any time be liable pursuant to the terms of this Amendment. At such time as the maximum exposure of the Tenant with respect to the Termination Fee is reduced by the passage of time, the face amount of the aforesaid letter of credit may be correspondingly reduced.

11.AS-IS. Tenant accepts the Second Expansion Space “AS-IS” “Where-Is” and “With All Faults” and agrees that any and all improvements to the Second Expansion Space shall be at the sole cost and expense of Tenant.

12.Security Deposit. No additional Security Deposit will be required upon the execution of this Second Amendment.

-3-

13.Certification. The following certification shall be binding upon, and shall inure to the benefit of the Landlord, the respective successors and assigns of the Landlord and all parties claiming through or under such persons or any such successor or assign:

(a) There are not, to Tenant’s knowledge, any uncured defaults on the part of Landlord under the Lease as of the date hereof;

(b) The Lease is in full force and effect and (except for the First Amendment and the Second Amendment) has not been amended, modified, extended or renewed, whether verbally or in writing and no default on the part of Landlord or Tenant exists, and, as of the date hereof, no circumstances or state of facts exist which for any reason would give Tenant the right to rent credits (other than the credit described herein) or other offsets or to terminate this Lease or pursue any other recourse or remedy against Landlord provided under the Lease; and

(c) As of the date hereof, Landlord has performed all of its obligations to Tenant presently due from Landlord. There are no written or oral agreements between Tenant and Landlord related to rent concessions, additional improvements, or allowances for tenant improvements, other than as set forth in the Lease, as modified by the First Amendment and the Second Amendment.

14.Acknowledgement. Tenant hereby confirms and acknowledges that, as of the date hereof, the Lease is in full force and effect, Tenant is occupying the Premises in accordance with the Lease, and to the best of Tenant’s knowledge, Landlord has fully performed all obligations of Landlord under the Lease, as amended. Tenant further confirms and acknowledges, to the best of Tenant’s knowledge, that Landlord is not, and would not be but for the giving of notice or the passage of time, or both, in default of any of Landlord’s obligations under the Lease.

15.Remaining Terms of Lease. Except as specifically modified or amended by the terms of this Third Amendment, the parties hereby agree that all of the terms and provisions of the Lease and the First Amendment shall remain in full force and effect.

THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK

-4-

IN WITNESS WHEREOF, Landlord and Tenant have caused this Third Amendment and Modification of Lease to be duly executed as of the date affixed next to their respective names.

| | | | | | |

| | | | LANDLORD: |

| | |

| | | | 6901, LLC |

| | | |

| Date: 7/17/14 | | | | By: | | /s/ Daniel L. Smith |

| | |

| | | | Daniel L. Smith PA, Managing Partner |

| | | | Printed Name and Title |

| | |

| | | | TENANT: |

| | |

| | | | Cafepress Inc. |

| | | |

| Date: 7/17/14 | | | | By: | | /s/ Garett Jackson |

| | |

| | | | Garett Jackson, CFO |

| | | | Printed Name and Title |

-5-

-6-

6901 Riverport Drive

Lease Exhibit B

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unit B | | Tenant | | Lease

Term | | | | Square

Footage | | | Yearly Base Rent | | | Base

Rent Per

Sq Foot | | | Yearly CAM

Reimb* | | | C.A.M Per

Square Foot | | | Total Yearly

Payment | |

| | CafePress | | 08/01/14 | | 07/31/15 | | | 184,813 | | | | 659,475.48 | | | | 3.57 | | | | 103,495.32 | | | | 0.56 | | | | 762,970.80 | |

| | | | 08/01/15 | | 07/31/16 | | | | | | | 676,108.68 | | | | 3.66 | | | | 103,495.32 | | | | 0.56 | | | | 779,604.00 | |

| | | | 08/01/16 | | 07/31/17 | | | | | | | 693,240.84 | | | | 3.75 | | | | 103,495.32 | | | | 0.56 | | | | 796,736.16 | |

| | | | 08/01/17 | | 07/31/18 | | | | | | | 710,886.96 | | | | 3.85 | | | | 103,495.32 | | | | 0.56 | | | | 814,382.28 | |

| | | | 08/01/18 | | 07/31/19 | | | | | | | 729,062.52 | | | | 3.94 | | | | 103,495.32 | | | | 0.56 | | | | 832,557.84 | |

| | | | 08/01/19 | | 07/31/20 | | | | | | | 747,783.24 | | | | 4.05 | | | | 103,495.32 | | | | 0.56 | | | | 851,278.56 | |

| | | | 08/01/20 | | 07/31/21 | | | | | | | 767,065.68 | | | | 4.15 | | | | 103,495.32 | | | | 0.56 | | | | 870,561.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 4,983,623.40 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | Monthly Base

Rent | | | Base

Rent Per

Sq Foot | | | Monthly

CAM Reimb* | | | C.A.M Per

Square Foot | | | Total Monthly

Payment | |

| | CafePress | | 08/01/14 | | 07/31/15 | | | 184,813 | | | | 54,956.29 | | | | 3.57 | | | | 8,624.61 | | | | 0.56 | | | | 63,580.90 | |

| | | | 08/01/15 | | 07/31/16 | | | | | | | 56,342.39 | | | | 3.66 | | | | 8,624.61 | | | | 0.56 | | | | 64,967.00 | |

| | | | 08/01/16 | | 07/31/17 | | | | | | | 57,770.07 | | | | 3.75 | | | | 8,624.61 | | | | 0.56 | | | | 66,394.68 | |

| | | | 08/01/17 | | 07/31/18 | | | | | | | 59,240.58 | | | | 3.85 | | | | 8,624.61 | | | | 0.56 | | | | 67,865.19 | |

| | | | 08/01/18 | | 07/31/19 | | | | | | | 60,755.21 | | | | 3.94 | | | | 8,624.61 | | | | 0.56 | | | | 69,379.82 | |

| | | | 08/01/19 | | 07/31/20 | | | | | | | 62,315.27 | | | | 4.05 | | | | 8,624.61 | | | | 0.56 | | | | 70,939.88 | |

| | | | 08/01/20 | | 07/31/21 | | | | | | | 63,922.14 | | | | 4.15 | | | | 8,624.61 | | | | 0.56 | | | | 72,546.75 | |

| * | CAM is estimated and will be reconciled at the end of each year. |

-7-