SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Month of September 2020

Commission File Number: 1-14696

China Mobile Limited

(Translation of registrant’s name into English)

60/F, The Center

99 Queen’s Road Central

Hong Kong, China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.:

Form 20-F X Form 40-F ____

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ____No X_

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBITS

Exhibit Number | |

1.1 | 2020 Interim Report, dated August 31, 2020 |

FORWARD-LOOKING STATEMENTS

This announcement contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are, by their nature, subject to significant risks and uncertainties. These forward-looking statements include, without limitation, statements relating to:

| • | our business objectives and strategies, including those relating to the development of our terminal procurement and distribution business; |

| • | our operations and prospects; |

| • | our network expansion and capital expenditure plans; |

| • | the expected impact of any acquisitions or other strategic transactions; |

| • | our provision of services, including fifth generation, or 5G, services, wireline broadband services and services based on technological evolution, and the ability to attract customers to these services; |

| • | the planned development of future generations of mobile technologies, including 5G technologies, and other technologies and related applications; |

| • | the anticipated evolution of the industry chain of 5G and future generations of mobile technologies, including future development in, and availability of, terminals that support our provision of services based on 5G and future generations of mobile technologies, and testing and commercialization of future generations of mobile technologies; |

| • | the expected benefit from our investment in and any arrangements with China Tower Corporation Limited; |

| • | the expected impact of the implementation in Mainland China of the policy of “speed upgrade and tariff reduction” and the cancellation of roaming tariffs on our business, financial condition and results of operations; |

| • | the expected impact of tariff changes on our business, financial condition and results of operations; |

| • | the potential impact of restrictions, sanctions or other legal or regulatory actions under relevant laws and regulations in various jurisdictions on our telecommunications equipment suppliers and other business partners; |

| • | the potential impact of the outcome of the State Administration for Market Regulation’s investigation on us; |

| • | the impact of the outbreak of the coronavirus disease, or COVID-19, a disease caused by a novel strain of coronavirus, on the PRC economy and our operations and financial performance; |

| • | the expected impact of new service offerings on our business, financial condition and results of operations; and |

2

| • | future developments in the telecommunications industry in Mainland China, including changes in the regulatory and competitive landscape. |

The words “aim”, “anticipate”, “believe”, “could”, “endeavor”, “estimate”, “expect”, “intend”, “may”, “plan”, “seek”, “should”, “strive”, “target”, “will” and similar expressions, as they relate to us, are intended to identify certain of these forward-looking statements. We do not intend to update these forward-looking statements and are under no obligation to do so.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including the risk factors set forth in the “Risk Factor” section of our latest Annual Report on Form 20-F, as filed with the U.S. Securities and Exchange Commission.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| | | CHINA MOBILE LIMITED |

| | | | | |

Date: | September 1, 2020 | | By: | /s/ Dong Xin |

| | | | Name: | Dong Xin |

| | | | Title: | Executive Director and Chief Executive Officer |

| | | 4 | | |

Exhibit 1.1

Chlna moblle 5G lot cloud big data edge ai infinite future china mobile limited stock code 941 interim report 2020

Contents 1 Financial Highlights 2 Chairman’s Statement 11 Financial Review 13 Interim Financial Information 13 Unaudited Condensed Consolidated Statement of Comprehensive Income 15 Unaudited Condensed Consolidated Balance Sheet 17 Unaudited Condensed Consolidated Statement of Changes in Equity 18 Unaudited Condensed Consolidated Statement of Cash Flows 19 Notes to Unaudited Condensed Consolidated Interim Financial Information 35 Report on Review of Interim Financial Information 36 Other Information 40 Forward-Looking Statements

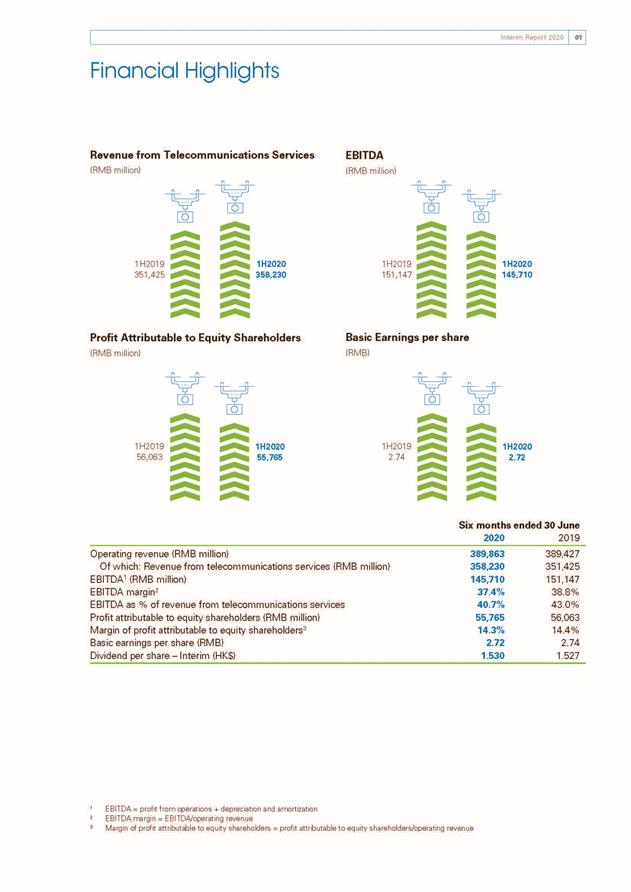

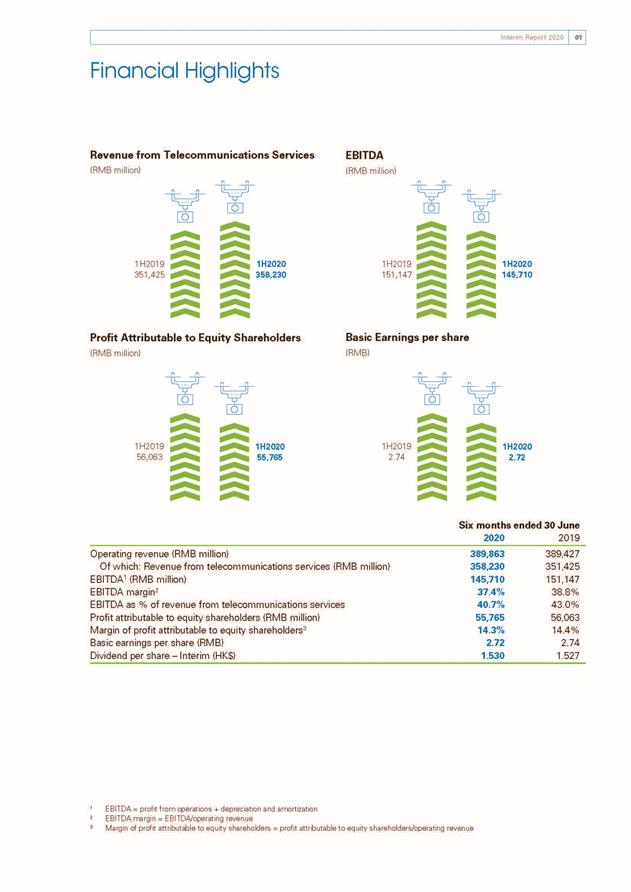

Interim Report 2020 01 Financial Highlights Revenue from Telecommunications Services (RMB million) EBITDA (RMB million) 1H2019 351,425 1H2020 358,230 1H2019 151,147 1H2020 145,710 Profit Attributable to Equity Shareholders (RMB million) Basic Earnings per share (RMB) 1H2019 56,063 1H2020 55,765 1H2019 2.74 1H2020 2.72 Six months ended 30 June 202 0 201 9 Operating revenue (RMB million) 389,863 389,427 Of which: Revenue from telecommunications services (RMB million) 358,230 351,425 EBITDA1 (RMB million) 145,710 151,147 EBITDA margin2 37.4% 38.8% EBITDA as % of revenue from telecommunications services 40.7% 43.0% Profit attributable to equity shareholders (RMB million) 55,765 56,063 Margin of profit attributable to equity shareholders3 14.3% 14.4% Basic earnings per share (RMB) 2.72 2.74 Dividend per share – Interim (HK$) 1.53 0 1.5271 EBITDA = profit from operations + depreciation and amortization 2 EBITDA margin = EBITDA/operating revenue 3 Margin of profit attributable to equity shareholders = profit attributable to equity shareholders/operating revenue

02 China Mobile Limited Chairman’s Statement DEAR SHAREHOLDERS, At present, the world is experiencing a global health crisis. Although COVID-19 has come under control in China, it has created serious repercussions for economic and social development. Yet, we believe that crisis and opportunity always appear at the same time. The actions taken as a response to COVID-19 will catalyze and accelerate a new round of technological revolution and industrial transformation, that will further the digitalization of both the economy and society. As a responsible corporate citizen, we have been actively participating in COVID-19 prevention and control in all sectors of society, as well as taking practical actions to facilitate the resumption of work and production to support the government, customers, up- and down-stream supply chain partners and our employees. Making full use of our information technology advantages in areas including 5G, cloud computing and big data, we are committed to providing reliable communications, maintaining service continuity and taking comprehensive prevention and control measures in the fight against COVID-19. As we navigate this challenge, our confidence in the ability to build a better digital future is further cemented. So far in 2020, we have adhered to our development strategy of becoming a world-class enterprise by building a dynamic “Powerhouse”, working hard to expand our business from communication services to information services and to shift our business focus from mobile market to the more encompassing CHBN “four growth engines”: the “customer” (C), “home” (H), “business” (B) and “new” (N) markets. We have also adopted a new development approach focusing on innovation-driven business transformation and upgrade instead of traditional growth drivers that rely on factors of resources. We attach great importance to customer interaction and trust, deepening our collaboration with all parties to achieve win-win situations within the industry and promoting long-term sustainable development of the Company. Our growth has only been made possible by the support of all shareholders, customers and members of the general public, as well as the dedication and relentless efforts of China Mobile employees at all levels. INTERIM RESULTS 2020 The unexpected occurrence of COVID-19 in the first half of 2020 not only created an enormous impact on the economy and society but also cast a pall over our operations. It has nevertheless given rise to a surge in demand for informatization in every industry sector and created new growth opportunities for the Company. China is actively promoting the construction of new infrastructure and is undergoing further integration of information communication technologies into every aspect of the economy, society and people’s livelihood. These developments have led to the acceleration of digitalization of the economy and society. Meanwhile, competition and cooperation from both inside and outside of the industry, alongside the progressively clearer trend of industry convergence, have conspired to create an increasingly complex and volatile business development landscape which requires us to take our operations to the next level. Whilst this has been a time to face up to difficulties and challenges, we have spared no effort in seeking opportunities from the crisis and turning negatives into positives. In fact, our overall operating results have remained stable. In the first half of 2020, we recorded operating revenue of RMB389.9 billion, an increase of 0.1% year-on-year. Of this, telecommunications services revenue reached RMB358.2 billion, up by 1.9% compared with the same period last year. We posted EBITDA of RMB145.7 billion, down by 3.6% compared with the first half of 2019. This represents an EBITDA margin of 37.4%, or a decrease of 1.4 percentage points year-on-year. Profit attributable to equity shareholders reached RMB55.8 billion, or RMB2.72 per share, marking a 0.5% year-on-year decline. These results reflect our leading position in profitability among top-tier global telecommunications operators. We are steadfast in our goal of consistently creating value for shareholders. In order to create higher returns for our shareholders who should benefit from our operating gains, the Company has decided to pay HK$1.53 per share for the 2020 interim dividend.

Chairman’s statement interim report 2020 03

04 China Mobile Limited Chairman’s Statement ADVANCING THE COORDINATED DEVELOPMENT OF CHBN MARKETS In response to the changes brought by the accelerating digital transformation of the economy and society, we have spearheaded and expedited the coordinated development of the CHBN “four growth engines”. Our intention was to seize opportunities arising from the penetration of new-generation information technology into various fields of the economy and society. Fully leveraging 5G, clouds, AI (artificial intelligence) and data centers, we aimed to better satisfy demands for the transformation of the economy and society, as well as meet people’s needs for a more fulfilling digital life. Our next step is to focus on strengthening and upgrading our existing businesses, exploring new areas for growth, optimizing revenue structure and achieving high-quality growth. With regard to the “customer” market, as the leading operator in terms of the number of mobile customers, we actively promoted rational industry competition with a returning focus on value. We stepped up efforts to improve our own network services and brand operations, striving to build competitive advantages that truly differentiate us. By revamping our customer value operating system, we have strengthened customer development using cases, promoted value uplift based on business scale and fostered innovative practices on brands and customer interest management, which further increased the value that could be driven from existing customers. Fully leveraging our leading role in 5G, we have placed a focus on tariff plans and devices, taken steps to encourage customers to subscribe to our 5G packages using 5G devices, accelerated 5G migration and promoted the development of 5G with an emphasis on both quantity and quality. As of the end of June 2020, we recorded a total of 947 million mobile customers. Of this, the numbers of 4G customers and 5G package customers reached 760 million and 70.20 million respectively. In the first half of the year, although our mobile ARPU (average revenue per user per month) went down by 3.7% year-on-year to RMB50.3, the decline rate was further flattened. Our DOU (average handset data traffic per user per month) rose by 39.7% to 8.6 GB. Within the “home” market, we are shifting from leading in scale to leading in smart home operations. We firmly believe network quality and customer service is fundamental to this area and will spare no effort to improve them. Firstly, we adhered to leading in gigabit broadband and building a broadband network to enhance the quality of our household network. Secondly, we carried out end-to-end quality optimization initiatives to raise the level of our one-stop service offerings including installation, maintenance, operation and customer service. Thirdly, we placed great emphasis on capitalizing value, striving to optimize smart home operations in order to generate more value for our customers. Centering on our goals of building smart connection over the entire network and realizing home intelligence and family sharing, we worked to strengthen the value we provide through connection and promote the growth of different smart home businesses, such as “Mobaihe”(a set-top box that provides high-definition video-ondemand service), smart home network deployment, home security and smart voice remote controls. In the first half of 2020, our household broadband customers drew a net increase of 8.95 million and reached 181 million. Among them, “Mobaihe” registered a total of 130 million customers, representing a penetration rate of 72.1%. Meanwhile, household broadband blended ARPU continued to increase and reached RMB35.4, representing a year-on-year increase of 1.0%.

Chairman’s Statement Interim Report 2020 05 We view the “business” market as a “blue ocean”– the main driver of our revenue growth. We persistently promoted the development of “Network + Cloud + DICT” information services especially for key business areas including smart cities, smart transportation and industrial Internet. Our “Leading in 5G” thematic campaign formed part of our efforts to promote 5G demo industry applications and build up our 5G capabilities. Specifically, we have created more than 100 industry-leading group-level demo projects and more than 1,400 province-level feature projects, and these projects have gradually gained traction following our promotion efforts in 15 industry segments. Our implementation of “Cloud business: going all out to win” thematic campaign was another example reflecting our determination to expedite deployment of cloud resources. To enrich our product portfolio, we have adopted a dual approach that utilizes internal product research and development capability and introduces products from external parties. In the first half of 2020, mobile cloud revenue reached RMB4.46 billion, leapt by 556.4% year-on-year. At the same time, we have extended reforms of corporate market operations, putting an emphasis on customer demands while bettering our product R&D system and service support system. In the first half of the year, our number of corporate clients reached 11.29 million, a net increase of 1.01 million from the end of 2019; revenue from DICT including IDC, ICT, mobile cloud and other corporate applications and information services reached RMB20.9 billion, up by 55.3% year-on-year. The four major areas of our “new” market including international business, equity investment, digital content and financial technology are important vehicles supporting the transformation and upgrade of the Company. Our approach is to drive the development of international business and further expand our operations across the globe with the dual engines of “investment + business”. In the first half of this year, international business revenue reached RMB5.65 billion, an increase of 26.1% year-on-year. Equity investment is an important means for us to increase capital efficiency and our principle is to increase value contribution, construct ecology and unleash synergy with our operations through making investments. We endeavored to improve the investment platform for mergers and acquisitions, equity participation and venture capital. We further improved the “direct investment + fund” collaboration model and expected to play a more important role in areas such as 5G, cloud computing, digital content, ICT, security services and business internationalization. We continued to explore content services and Internet finance so as to cultivate high-quality Internet products and continuously increase market influence. In the first half of the year, the monthly active users of the MIGU video platform increased by 114.8% year-on-year, the users of video connecting tones exceeded 100 million, and the number of monthly active users of “and-Wallet” increased by 92.2% year-on-year. ACCELERATING 5G DEVELOPMENT THROUGH THE FULL IMPLEMENTATION OF THE “5G+” PLANS The construction of new infrastructure driven by the move to 5G is leading the digitalization, intelligent upgrade and integrated innovation of China’s economy and society. As of the end of June 2020, China Mobile has accumulatively deployed and put in use 188,000 5G base stations in over 50 cities in China to provide commercialized 5G services. We have successfully connected 5G on Mount Everest and in deep mines, offering reliable communications services for elevation measurement at Mount Everest and smart management in coal mines. In the area of 5G standardization, we actively played a role in the timely announcement of R16, an international standard that fully supports 5G application scenarios, in order to accelerate the maturity of SA (Standalone) standard. We also worked to speed up the construction of the 5G SA core network to lay a foundation for achieving the scale commercialization of SA within this year. In the first half of 2020, CMCC, our Parent Company, signed a collaborative framework agreement in relation to 5G co-construction and sharing with China Broadcasting Network Corporation Limited. We are hopeful that both parties will further detail their arrangements in areas such as joint construction, opening up and sharing, as well as content channels in order to achieve mutually beneficial results.

06 China Mobile Limited Chairman’s Statement While endorsing 5G network construction, we also put an increased focus on accelerating the promotion of 5G applications. In order to meet the needs of the mass market, we launched feature services such as ultra-high definition live broadcasts, cloud-based games and cloud VR solutions which are intended to be exciting and engaging, as well as providing the highest-quality information and telecommunications services for our customers. We have also released a 5G messaging white paper which explores a new business model, messaging ecosystem and traffic entry for 5G applications. On-site pilot tests on 5G messaging services are currently underway in certain areas. In the vertical market, we have launched various 5G demo applications for 15 core segments, including smart factory, smart power grid, smart steel, smart port and smart mine. Meanwhile, we have nurtured 5G generic competencies applicable to various industry sectors and expedited the construction of 5G platforms especially for nine major vertical sectors including OneCity smart city and industrial Internet. We have initially completed the design of dedicated 5G network products and launched a thematic campaign which sets sail for the development of 5G modules. In this exceptional period of COVID-19 prevention and control, the norms of working and living have been significantly disrupted. The use of information technology has become crucial as people turn to quality alternative solutions with 5G at the forefront of this trend. 5G remote medical services have made “face-to-face” treatment possible despite being miles apart. 5G online education has enabled classes to resume and students to continue learning during school closures, 5G smart factory has enabled unmanned production or helped minimize the number of operating personnel required. Other applications, such as the 5G thermal imagery temperature measurement system, 5G self-driving logistics vehicles and 5G remote operation and control, have all played an important role in enabling the resumption of work and production. We also witnessed rapid adoption in areas including cloud office, cloud videos and cloud commerce. As the major builder, advocator and provider of 5G applications, we recognize the enormous potential and infinite possibilities presented by 5G in spurring a new smart era of the digital economy. We will continue to serve the public and strengthen our leading position by further implementing our “5G+” plans, integrating 5G into every industry and every walk of life. PROMOTING CONVERGENCE, INTEGRATION AND DIGITIZATION TO REFRESH BUSINESS TRANSFORMATION AND UPGRADE In light of rapid economic and social transformation and a fast-changing competitive landscape, the inevitable process of change and adjustment may be painful in the short-term but is conducive to the long-term sustainable development of the Company. With the focus on the three elements of “convergence, integration and digitization”, we made a timely adjustment to our business model and moved the focus to establishing a scale-based and valueoriented operating system that would support our on-going transformation and maintain our sustainable growth. We extended our scale by fully embracing convergence. The Company stepped up efforts to converge data access, applications and customer interests in our operations while unleashing the potential of synergies between household and consumer, as well as the corporate and consumer markets. By expanding the scope of our partnerships with leading Internet companies in terms of content, customer interests, brands and channels, we have managed to focus more on the integrated marketing of our fundamental businesses. Together with our efforts to enhance our “Mobile Number Portability” service, our customer base was strengthened. At the same time, we have accurately captured the opportunities arising from the development of cloud native technologies and pushed ahead with the convergence of cloud and network, cloud and intelligence, cloud and edge, and cloud and big data to build out our distinctive competitive advantage in providing mobile cloud services.

Chairman’s Statement Interim Report 2020 07 We managed to achieve significant advantages through integration. We have accelerated channel integration and strengthened online and offline collaboration, enhancing the operating functions and coordination of our own digital channels. By establishing an integrated, intelligent and efficient operations system and building out scenario-based mid-end customer platforms, we have effectively unleashed cross-channel synergy. These efforts have also enabled us to offer full communications services, deliver comprehensive customer care and achieve full channel integration, thus raising market operations efficiency. In the first half of 2020, the proportion of transactions conducted by online channels has reached 61.7%, an increase of 2.9 percentage points from 2019. Focusing on 5G development, household deployment, corporate business retention and expansion as well as product operations, we extended the applications of data integration and offered our big data capabilities to build up more detailed profiling and understanding of the life cycles of our “customer”, “home” and “business” markets. We enhanced our efficiency through digitization. We continued to construct our smart mid-end AaaS (Analytics as a Service) platform, standardize our business processes while developing three major mid-end platforms covering “business+ data+ technology”. By doing so, we hope to comprehensively build up our capabilities, support business operations and empower smart development. Further, we have built a proprietary “Jiutian” AI Platform and through “self-developed R&D and industry collaboration”, we managed to consolidate more than 60 core AI technologies by leveraging the advantages from the use of divergent case scenarios. We also moved “Jiutian” up the value scale through more applications in areas such as network, service, marketing, management and security. BOOSTING CAPABILITY, COLLABORATION AND ORGANIZATIONAL VITALITY TOGENERATE NEW MOMENTUM TOWARD REFORM AND INNOVATION To maximize the benefits of our value-driven operating system, built on the principles of convergence, integration and digitization, we are committed to promoting the effective coordination of our organizational structure, operating mechanisms and strategies to realize long-term dynamic matching. To this end, we continued to optimize our effective and synergetic operating system and promote our capability, collaboration and organizational vitality to further unleash potential.

08 China Mobile Limited Chairman’s Statement Our core capability continued to grow. We remained steadfast in strengthening our five major capabilities of network support, sales services, product innovation, operations management and strategy execution. Regarding network construction, we have constructed and operated 4.72 million base stations as of the end of June 2020. We have taken measures tailored to support our gigabit broadband network, and 97% of the OLT (Optical Line Terminal) facilities in the urban areas of cities at prefectural-level and above were equipped with the capabilities needed for the rapid expansion of our gigabit broadband business. We also accelerated the construction of mobile cloud infrastructure and further optimized our IT cloud resources. With our “3+3+X” data center layout (3 hotspot regional centers, 3 cross-province centers and various province-level centers and business nodes) taking shape, the capacity of our data centers has continued to increase. We also made progress in the development of network cloudification and virtualization, further promoting the gradual scale commercialization of NFV (Network Function Virtualization). Considering customer service, we continued to improve our “all-dimension”, “all-process” and “all-member” service system and by enhancing and upgrading our three flagship brands, “Go Tone”, “M-Zone” and “Easy own”, we were able to better satisfy the needs of different customer segments. We also launched an intelligent upgrade to our “10086” customer service platform and improved our network and information security mechanisms. These efforts all contributed to a continuous increase in our customer satisfaction. In terms of product innovation, we have established a work mechanism driven by a product management committee and devised a comprehensive product management system covering CHBN products. We promoted product research and development and advance product development with a dual focus on self-developed R&D and industry collaboration, while enhancing product full-life cycle management and speeding up the development of the flagship products related to information consumption. In respect of strategy execution and operations management, to address the strategic needs of the Company and further increase execution ability and efficiency, we have adhered to our strategy of becoming a world class enterprise by building a dynamic “Powerhouse”, comprehensively launched reforms to market and network operations systems and accelerated the establishment of a three-tier corporate business support system. We continued to enhance development driven by collaboration. Focusing on multiple business areas, including 5G, cloud computing, AI, smart home and vertical markets, we built strategic collaborations with large-scale enterprises and groups to proactively complement our partners’ advantages and resources. Moreover, we continued to nurture our strategic partnerships with local governments to expedite the construction and deployment of new infrastructure. By promoting the in-depth integration of new-generation information technology with the real economy, we are committed to promoting the construction of smart cities. In addition, we advanced the expansion of our 5G “Circle of Friends” and launched the “Joint Innovation Plus” initiative to promote collaborative research and development. Through our 5G Innovation Centre and 5G Industry Digital Alliance, we attracted more than 2,100 partners. We also launched an initiative aiming at introducing a RMB10 billion ecosystem and put forward a plan sharing the incremental revenue from selected businesses with a scale of RMB10 billion, as a way of encouraging the transformation of the industry chain by fully unleashing the power of capital and funds. Internally, following our reform direction of setting up a structure that fully equips headquarters to command, the regions to compete and the specialized businesses to provide supporting services, we have further refined our operations mechanism and implemented a differentiating system of appraisal and resource allocation. These efforts ensured strong centralised management from the headquarters and created strong synergetic dynamics between the regions and specialized businesses.

Chairman’s Statement Interim Report 2020 09 We boosted organizational vitality effectively. To deepen the reform of our mechanisms, we offered 306 million share options to 9,914 backbone management members and core talents. This offering is a reflection of our commitment to building a refined mid- to long-term incentive scheme that will nurture a culture of shared interests and risks. We offered project-based incentives for the corporate business and initiated incentive projects and contracts targeting business areas such as 5G and AICDE (AI, IoT, cloud computing, big data and edge computing). In addition, we established a T-H-T (“Ten-Hundred-Thousand”) technical expert system, recruiting 10 group-level “chief experts” during the first phase. We also implemented all-round grid reforms, where each grid fulfills overall responsibilities of CHBN market development, customer relationship maintenance and general services. We optimized our inverted pyramid support structure and mechanism where back offices render support to the frontline. By further defining the authority, responsibilities and benefits relating to each grid, we will empower and vitalize frontline staff members, leading to an increase in their efficiency. CORPORATE GOVERNANCE AND SUSTAINABLE DEVELOPMENT The Company is committed to upholding the principles of integrity, transparency, openness and efficiency, and strives to remain in full compliance with all applicable listing rules to ensure sound corporate governance. We remained committed to the diversity of our Board membership and introduced further improvements to our governance structure and decision-making mechanisms. Adhering to the Company’s compliance philosophy – “abide by the law, follow the rules, observe commitments and uphold integrity” – we further improved our compliance management structure and enhanced our compliance management capabilities. By optimizing our risk management and internal control system, we sought to increase our risk prediction capability and achieve a more effective risk oversight. At the same time, we placed great emphasis on the sustainable development of the Company. Fulfilling social responsibilities is an integral part of our strategy of becoming a world-class enterprise by building a dynamic “Powerhouse” and by upholding our corporate responsibility philosophy – “with perfect sincerity and integrity, we will strive to fulfill our responsibilities of economy, society and environment” – we remained committed to fulfilling our product-related and operational responsibilities with honesty and integrity. Based on our competitive advantages and expertise, we made all efforts to empower stakeholders to jointly create social value. Meanwhile, we worked to help more people obtain fair development opportunities and promoted the harmonious co-existence between humankind and nature. Reflecting our commitment to meet peoples’ demands for a better digital life, we have and will continue to implement regular COVID-19 prevention and control measures and continue to actively work on poverty alleviation and ecological protection initiatives, among other areas.

10 China Mobile Limited Chairman’s Statement FUTURE OUTLOOK China is currently accelerating the construction of new infrastructure such as 5G network and data centers, and promoting in-depth integration of information communication technologies into the economy, society and people’s livelihood. These developments have turned out to be a catalyst in accelerating economic and social transformation, shaping a new landscape of “five verticals and three horizontals”. The verticals represent the emergence of five key application scenarios, which are a result of the rapid penetration of information technology in the economy and society. This specifically refers to the digitalization of infrastructure, social governance, production, ways of working and lifestyle. The horizontals refer to the three common demands that arise from the digital transformation of the economy and society, namely online operations, intelligentization and cloudification. “Five verticals and three horizontals” represents how the scope and application of innovation within information technology is expanding from specific areas to the whole network end-to-end. This is reaching both up- and- down stream of the industry value chain, extending from partial domains to all fields of the economy and society. This positive trend will result in a significant enhancement of the overall level of economic and social innovation while productivity will experience a forward leap in terms of growth. As a result, new momentum will be generated for the digital economy and we will enter a development phase for the information and telecommunications industry. According to estimates by relevant institutions (MIIT and CAICT), the growth of China’s digital economy will reach RMB60 trillion while the revenue of software and information service industry will reach RMB13.1 trillion by 2025, demonstrating vast market potential. 5G, as the key pillar supporting information flow within society, the accelerator for industrial transformation and upgrade, as well as the cornerstone for the development of the digital society, will contribute to the new landscape of “five verticals and three horizontals”. As we look to the period ahead of us, this promises a much broader space for growth and huge opportunities for the Company. Looking forward with certainty on the inevitable prosperous future of digitalization, China Mobile will continue to strive for stable growth, and implement our strategy of becoming a world-class enterprise by building a dynamic “Powerhouse”. Centering on the key strategy of high-quality development, we will focus on transforming and upgrading the business while devoting an ongoing effort to reform and innovate. Our emphasis will remain on implementing our “5G+” plans, forging convergence, integration and digitization across all of our operations and building capabilities, establishing collaborative relationships and infusing vitality into the organization. As we stimulate digital innovation in networks, products, technology and ecosystem in this 5G era, we are demonstrating our dedication to contributing our strength to economic and societal development, and continuously creating greater value for our shareholders. Yang Jie Chairman Hong Kong, 13 August 2020

Interim Report 2020 11 Financial Review OPERATING REVENUE In the first half of 2020, the unexpected occurrence of COVID-19 created an impact on the economy and society as a whole, and the Group’s business development was no exception. The Group coordinated and promoted epidemic prevention and business operations, and spared no effort in turning negatives into positives and seeking opportunities from the crisis. The operating revenue of the Group was RMB389.9 billion, up by 0.1% year-on-year, of which the revenue from telecommunications services reached RMB358.2 billion, up by 1.9% year-on-year. The revenue from wireless data traffic reached RMB208.1 billion, up by 3.2% year-on-year. The decline rate of data tariff has relatively flattened. The revenue from wireline broadband services was RMB36.4 billion, up by 10.6% year-on year, and its contribution to the revenue from telecommunications services increased year-on-year. The revenue from applications and information services was RMB47.7 billion, up by 16.1% year-on-year, achieving momentum for favorable growth, and the Group’s overall revenue structure was further optimized. OPERATING EXPENSES In the face of various challenges including the Group’s transformation and upgrade, together with the rapid growth of the demand for resources in the commercial use of 5G and the increase in the costs relating to the control and prevention of COVID-19, the Group continued to adhere to the principles of “forward-looking planning, effective resource allocation, rational investment and refined management” to increase revenue, reduce expenditure and maintain favorable profitability. In the first half of 2020, the Group’s operating expenses were RMB330.7 billion, up by 0.3% year-on-year, representing 84.8% of operating revenue. With respect to the asset-related costs, due to the effects brought by the adjustment to the depreciable life of 4G assets, the depreciation and amortization expenses for the first half of 2020 were RMB86.6 billion, down by 5.3% year-on-year. As a result of the rapid construction and commencement of operation of 5G networks and data centers, the asset scale continued to expand, and the tower leasing fee on a comparable basis was RMB21.8 billion, up by 7.3% year-on-year. The power and utilities expenses were RMB23.7 billion, up by 13.2% year-on-year. With respect to the selling expenses, the Group strengthened its integrated and online marketing, and enhanced its efficiency in the utilization of resources. In the meantime, the offline marketing activities were under the impact of COVID-19. The selling expenses were RMB31.4 billion, down by 8.7% year-on-year. With respect to the personnel expenses, the Group continued to adjust and optimize its personnel structure and enhanced the incentive scheme for attracting talents in the fields of 5G and AICDE research and development as well as “business” and “new” markets. Moreover, the average labor cost has continuously increased society-wide. The employee benefit and related expenses for the first half of 2020 were RMB49.1 billion, up by 8.8% year-on-year. As of 30 June 2020, the Group had a total of 451,000 employees. PROFITABILITY The Group continued to promote quality improvement and efficiency enhancement and improve its operating efficiency, thereby continuously maintaining favorable profitability. In the first half of 2020, the profit attributable to equity shareholders was RMB55.8 billion, slightly down by 0.5% year-on-year, and the margin of profit attributable to equity shareholders was 14.3%. The EBITDA was RMB145.7 billion, down by 3.6% year-on-year, and the EBITDA margin was 37.4%. The EBITDA represented 40.7% of revenue from telecommunications services.

12 China Mobile Limited Financial Review CAPITAL EXPENDITURE In order to satisfy customer demands and the need for network evolution and upgrade in the future, the Group speeded up its construction of new infrastructure such as 5G, and continued to build high-quality networks by making investments precisely. In the first half of 2020, the Group’s capital expenditure was RMB101.0 billion, representing 28.2% of revenue from telecommunications services, of which RMB55.2 billion were capital expenditure relating to 5G, funded primarily by cash generated from operating activities. CAPITAL STRUCTURE The financial position of the Group continued to remain steady. As of 30 June 2020, the total assets and total liabilities of the Group amounted to RMB1,724.5 billion and RMB594.5 billion respectively, and the liabilities to assets ratio was 34.5%. The Group consistently and firmly adhered to its prudent financial risk management policies and maintained sound repayment capabilities. FINANCIAL POLICIES AND CASH FLOW Amidst the complex operating environment and investment pressure, the Group continued to maintain a healthy cash flow as a result of the stable growth in its business operations and revenue, refined cost control and the further manifestation of economies of scale. The Group’s free cash flow was RMB59.0 billion in the first half of 2020, up by 44.1% year-on-year. As of 30 June 2020, the Group’s total cash and bank balances were RMB410.3 billion, of which 97.6%, 0.7% and 1.7% were denominated in Renminbi, U.S. dollars and Hong Kong dollars, respectively. The Group will continue to uphold prudent financial policies and strictly monitor and control financial risks in order to continuously maintain healthy cash flow generation capabilities as well as value preservation and enhancement capabilities. In addition, the Group will focus on scientific resource allocation, maintain a healthy capital structure and level, and reinforce and develop favorable economic benefits in order to continuously create value for its shareholders.

Interim Report 2020 13 Unaudited Condensed Consolidated Statement of Comprehensive Income for the six months ended 30 June 2020 (Expressed in Renminbi (“RMB”)) Six months ended 30 June 2020 2019 Note Million Million Operating revenue 5 Revenue from telecommunications services 358,230 351,425 Revenue from sales of products and others 31,633 38,002 389,863 389,427 Operating expenses Network operation and support expenses 6 108,773 98,087 Depreciation and amortization 86,592 91,392 Employee benefit and related expenses 49,056 45,075 Selling expenses 31,350 34,330 Cost of products sold 31,442 39,618 Other operating expenses 7 23,532 21,170 330,745 329,672 Profit from operations 59,118 59,755 Other gains 2,355 1,213 Interest and other income 8 6,886 7,350 Finance costs (1,470) (1,627) Income from investments accounted for using the equity method 5,998 6,579 Profit before taxation 72,887 73,270 Taxation 9 (17,023) (17,151) PROFIT FOR THE PERIOD 55,864 56,119 Other comprehensive income for the period, net of tax: Items that will not be subsequently reclassified to profit or loss Changes in the fair value of financial assets at fair value through other comprehensive income 148 (115) Share of other comprehensive (loss)/income of investments accounted for using the equity method (37) 36 Items that may be subsequently reclassified to profit or loss Currency translation differences 412 131 Share of other comprehensive income/(loss) of investments accounted for using the equity method 102 (237) TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 56,489 55,934

14 China Mobile Limited Unaudited Condensed Consolidated Statement of Comprehensive Income (Continued) for the six months ended 30 June 2020 (Expressed in RMB) Unaudited Condensed Consolidated Statement of Comprehensive Income (Continued) Six months ended 30 June 2020 2019 Note Million Million Profit attributable to: Equity shareholders of the Company 55,765 56,063 Non-controlling interests 99 56 PROFIT FOR THE PERIOD 55,864 56,119 Total comprehensive income attributable to: Equity shareholders of the Company 56,390 55,878 Non-controlling interests 99 56 TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 56,489 55,934 Earnings per share – Basic 11(a) RMB2.72 RMB2.74 Earnings per share – Diluted 11(b) RMB2.72 RMB2.74 The notes on pages 19 to 34 are an integral part of this interim financial information.

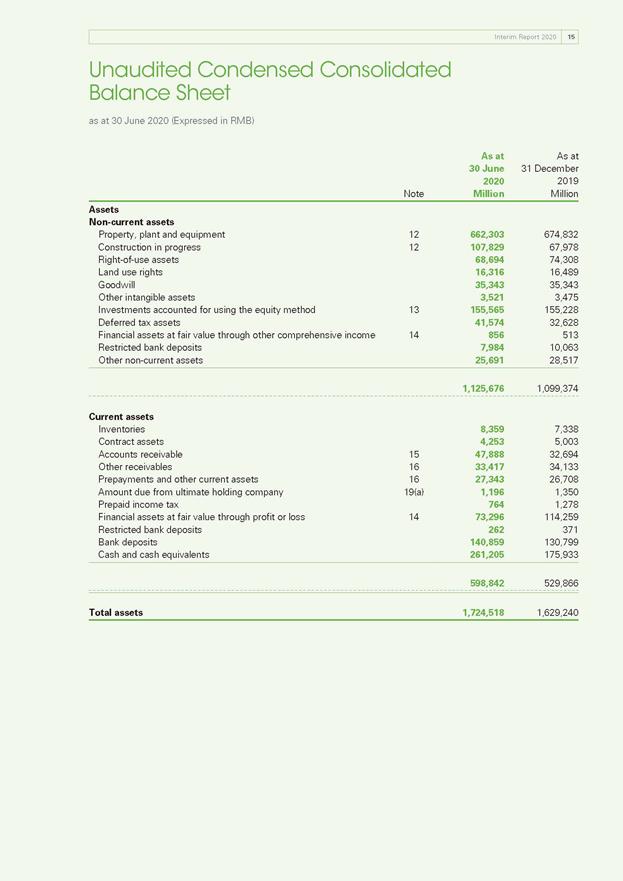

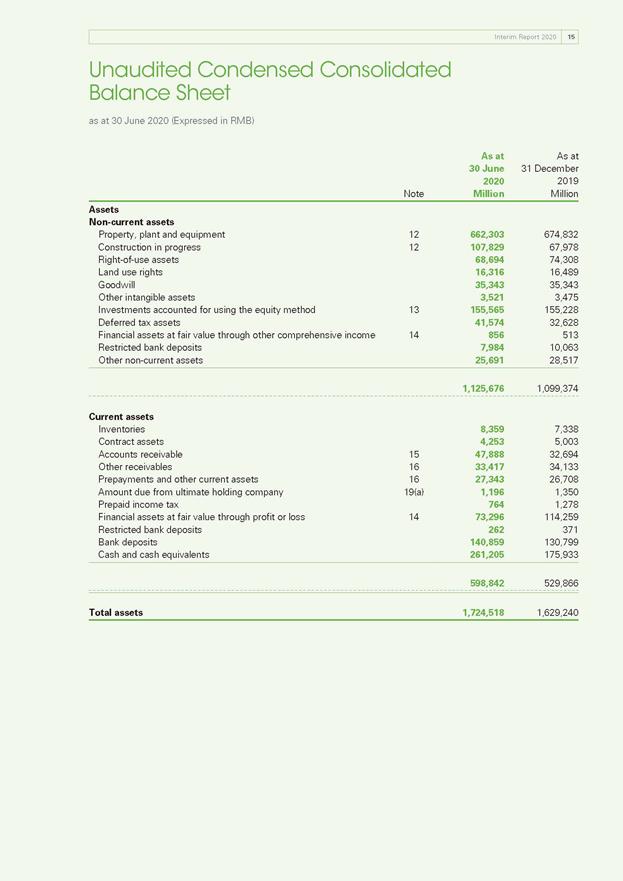

Interim Report 2020 15 Unaudited Condensed Consolidated Balance Sheet as at 30 June 2020 (Expressed in RMB) As at 30 June 2020 As at 31 December 2019 Note Million Million Assets Non-current assets Property, plant and equipment 12 662,303 674,832 Construction in progress 12 107,829 67,978 Right-of-use assets 68,694 74,308 Land use rights 16,316 16,489 Goodwill 35,343 35,343 Other intangible assets 3,521 3,475 Investments accounted for using the equity method 13 155,565 155,228 Deferred tax assets 41,574 32,628 Financial assets at fair value through other comprehensive income 14 856 513 Restricted bank deposits 7,984 10,063 Other non-current assets 25,691 28,517 1,125,676 1,099,374 Current assets Inventories 8,359 7,338 Contract assets 4,253 5,003 Accounts receivable 15 47,888 32,694 Other receivables 16 33,417 34,133 Prepayments and other current assets 16 27,343 26,708 Amount due from ultimate holding company 19(a) 1,196 1,350 Prepaid income tax 764 1,278 Financial assets at fair value through profit or loss 14 73,296 114,259 Restricted bank deposits 262 371 Bank deposits 140,859 130,799 Cash and cash equivalents 261,205 175,933 598,842 529,866 Total assets 1,724,518 1,629,240

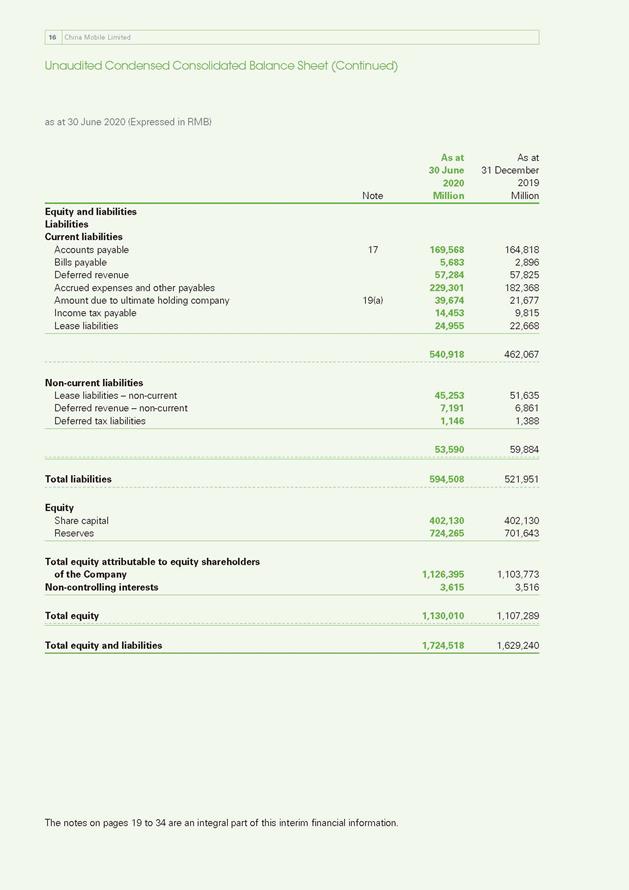

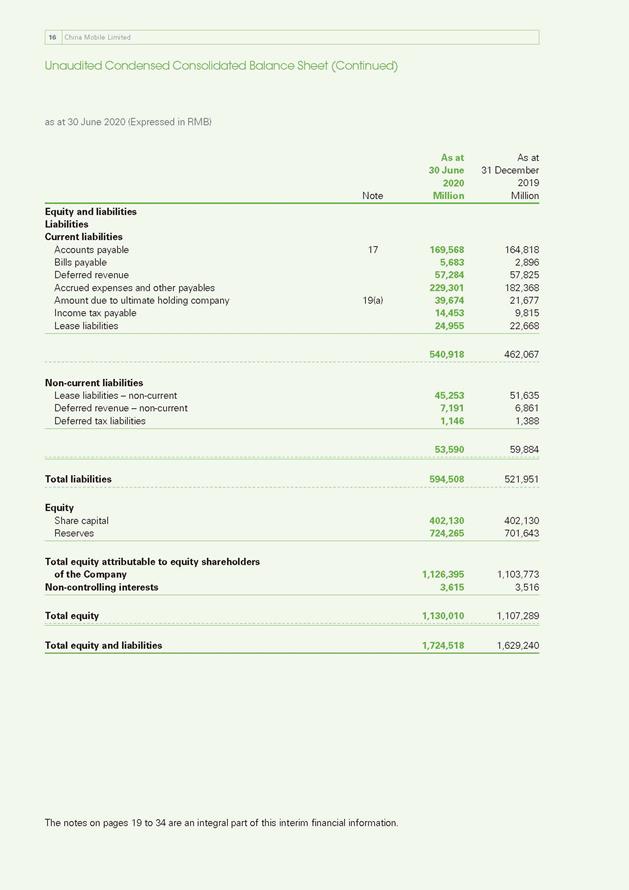

16 China Mobile Limited Unaudited Condensed Consolidated Balance Sheet (Continued) as at 30 June 2020 (Expressed in RMB) As at 30 June 2020 As at 31 December 2019 Note Million Million Equity and liabilities Liabilities Current liabilities Accounts payable 17 169,568 164,818 Bills payable 5,683 2,896 Deferred revenue 57,284 57,825 Accrued expenses and other payables 229,301 182,368 Amount due to ultimate holding company 19(a) 39,674 21,677 Income tax payable 14,453 9,815 Lease liabilities 24,955 22,668 540,918 462,067 Non-current liabilities Lease liabilities – non-current 45,253 51,635 Deferred revenue – non-current 7,191 6,861 Deferred tax liabilities 1,146 1,388 53,590 59,884 Total liabilities 594,508 521,951 Equity Share capital 402,130 402,130 Reserves 724,265 701,643 Total equity attributable to equity shareholders of the Company 1,126,395 1,103,773 Non-controlling interests 3,615 3,516 Total equity 1,130,010 1,107,289 Total equity and liabilities 1,724,518 1,629,240

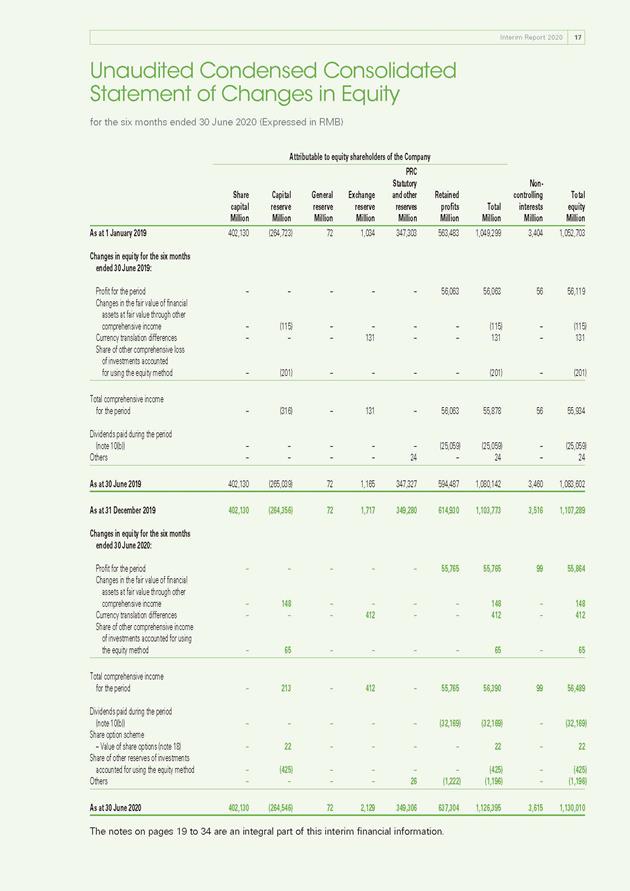

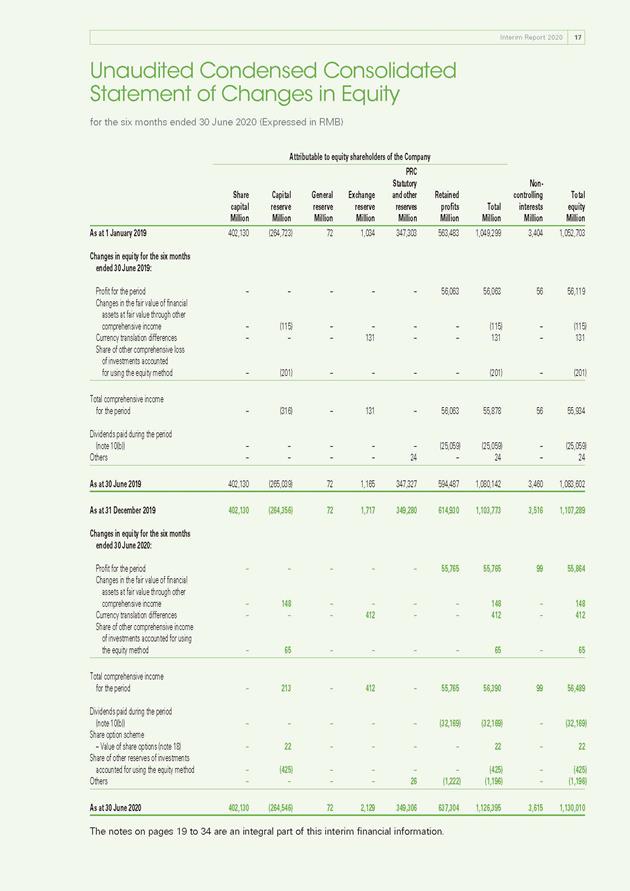

Interim Report 2020 17 Unaudited Condensed Consolidated Statement of Changes in Equity for the six months ended 30 June 2020 (Expressed in RMB) Attributable to equity shareholders of the Company Noncontrolling interests Million Total equity Million Share capital Million Capital reserve Million General reserve Million Exchange reserve Million PRC Statutory and other reserves Million Retained profits Million Total Million As at 1 January 2019 402,130 (264,723) 72 1,034 347,303 563,483 1,049,299 3,404 1,052,703 Changes in equity for the six months ended 30 June 2019: Profit for the period – – – – – 56,063 56,063 56 56,119 Changes in the fair value of financial assets at fair value through other comprehensive income – (115) – – – – (115) – (115) Currency translation differences – – – 131 – – 131 – 131 Share of other comprehensive loss of investments accounted for using the equity method – (201) – – – – (201) – (201) Total comprehensive income for the period – (316) – 131 – 56,063 55,878 56 55,934 Dividends paid during the period (note 10(b)) – – – – – (25,059) (25,059) – (25,059) O thers – – – – 24 – 24 – 24 A s at 30 June 2019 402,130 (265,039) 72 1,165 347,327 594,487 1,080,142 3,460 1,083,602 As at 31 December 2019 402,130 (264,356) 72 1,717 349,280 614,930 1,103,773 3,516 1,107,289 Changes in equity for the six months ended 30 June 2020: Profit for the period – – – – – 55,765 55,765 99 55,864 Changes in the fair value of financial assets at fair value through other comprehensive income – 148 – – – – 148 – 148 Currency translation differences – – – 412 – – 412 – 412 Share of other comprehensive income of investments accounted for using the equity method – 65 – – – – 65 – 65 Total comprehensive income for the period – 213 – 412 – 55,765 56,390 99 56,489 Dividends paid during the period (note 10(b)) – – – – – (32,169) (32,169) – (32,169) Share option scheme – Value of share options (note 18) – 22 – – – – 22 – 22 Share of other reserves of investments accounted for using the equity method – (425) – – – – (425) – (425) O thers – – – – 26 (1,222) (1,196) – (1,196) A s at 30 June 2020 402,130 (264,546) 72 2,129 349,306 637,304 1,126,395 3,615 1,130,010 The notes on pages 19 to 34 are an integral part of this interim financial information.

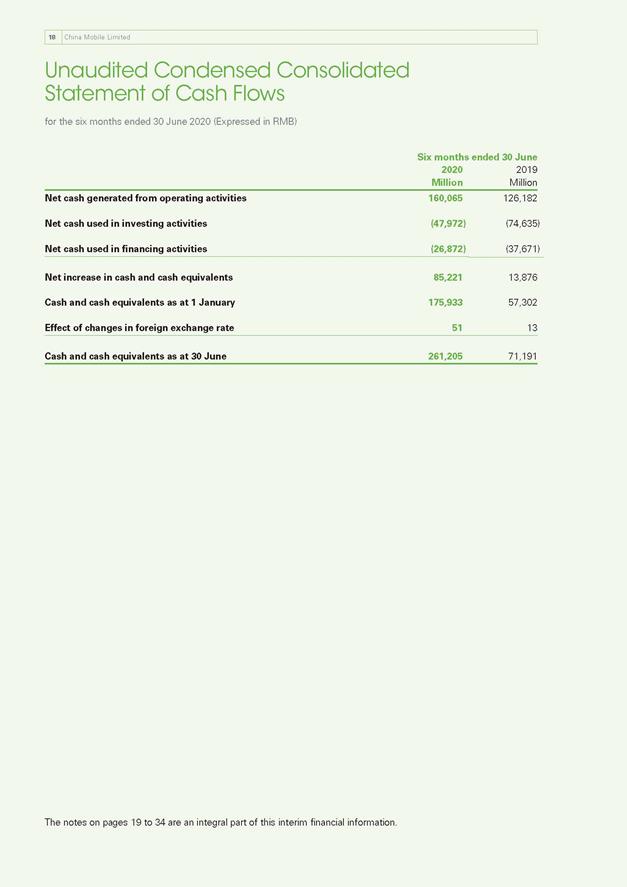

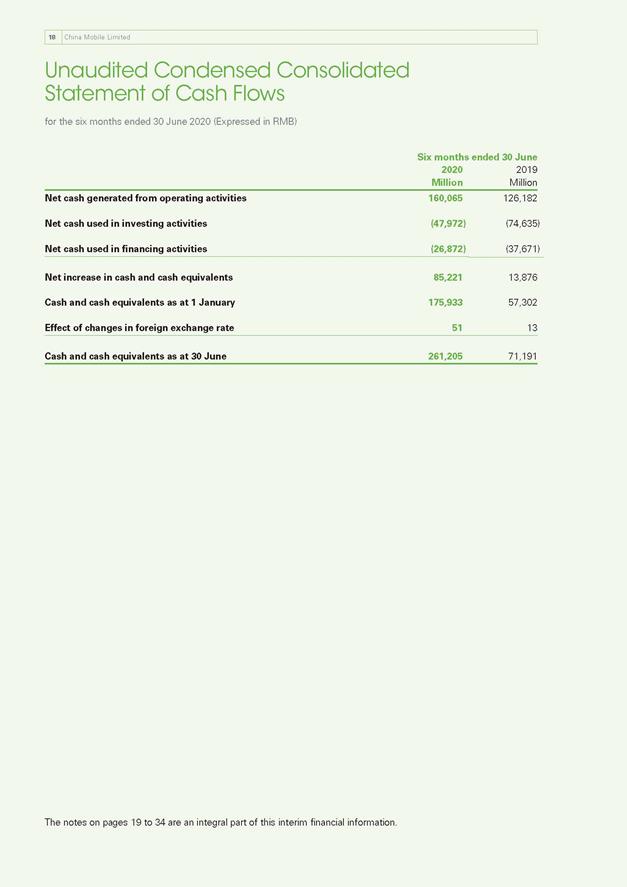

18 China Mobile Limited Unaudited Condensed Consolidated Statement of Cash Flows for the six months ended 30 June 2020 (Expressed in RMB) Six months ended 30 June 2020 2019 Million Million Net cash generated from operating activities 160,065 126,182 Net cash used in investing activities (47,972) (74,635) Net cash used in financing activities (26,872) (37,671) Net increase in cash and cash equivalents 85,221 13,876 Cash and cash equivalents as at 1 January 175,933 57,302 Effect of changes in foreign exchange rate 51 13 Cash and cash equivalents as at 30 June 261,205 71,191 The notes on pages 19 to 34 are an integral part of this interim financial information.

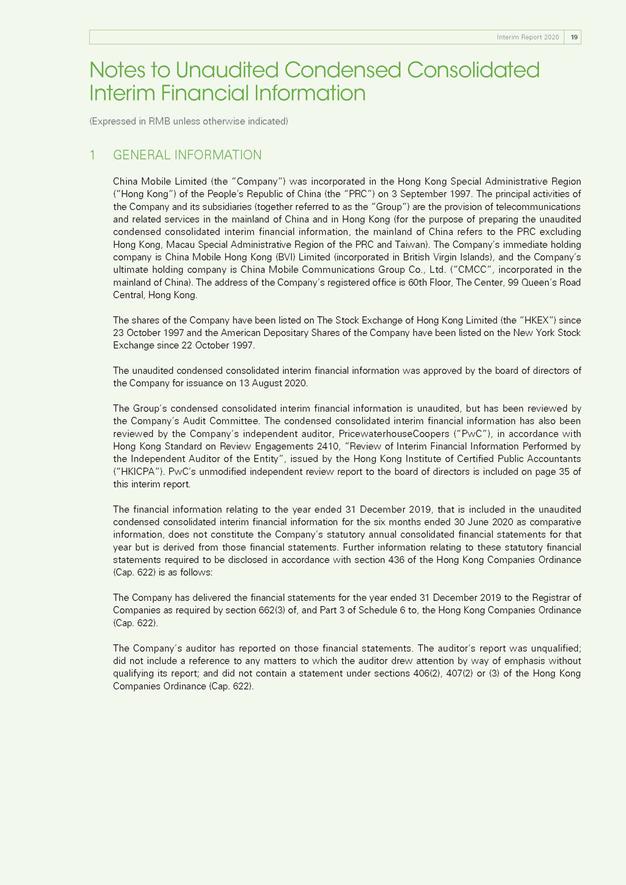

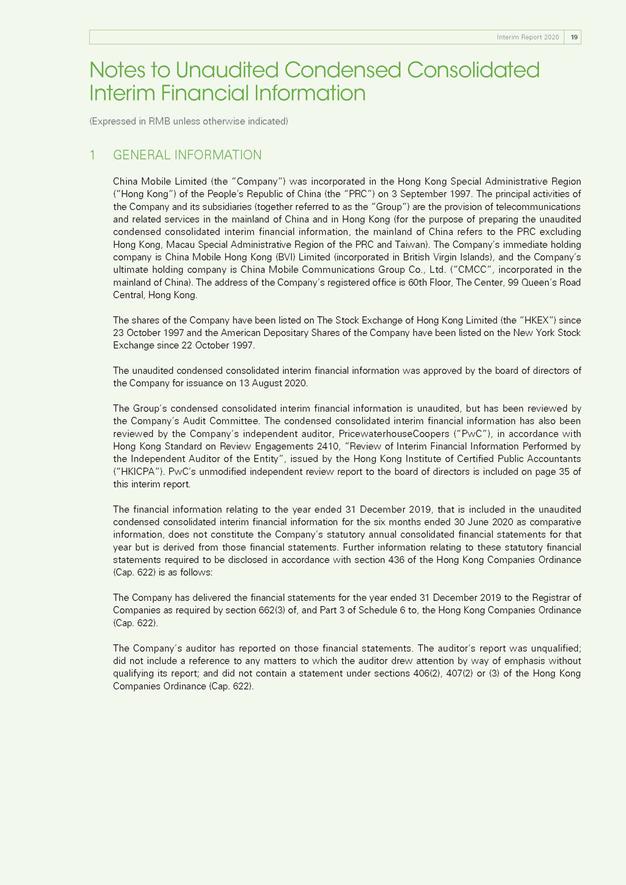

Interim Report 2020 19 Notes to Unaudited Condensed Consolidated Interim Financial Information (Expressed in RMB unless otherwise indicated) 1 GENERAL INFORMATION China Mobile Limited (the “Company”) was incorporated in the Hong Kong Special Administrative Region (“Hong Kong”) of the People’s Republic of China (the “PRC”) on 3 September 1997. The principal activities of the Company and its subsidiaries (together referred to as the “Group”) are the provision of telecommunications and related services in the mainland of China and in Hong Kong (for the purpose of preparing the unaudited condensed consolidated interim financial information, the mainland of China refers to the PRC excluding Hong Kong, Macau Special Administrative Region of the PRC and Taiwan). The Company’s immediate holding company is China Mobile Hong Kong (BVI) Limited (incorporated in British Virgin Islands), and the Company’s ultimate holding company is China Mobile Communications Group Co., Ltd. (“CMCC”, incorporated in the mainland of China). The address of the Company’s registered office is 60th Floor, The Center, 99 Queen’s Road Central, Hong Kong. The shares of the Company have been listed on The Stock Exchange of Hong Kong Limited (the “HKEX”) since 23 October 1997 and the American Depositary Shares of the Company have been listed on the New York Stock Exchange since 22 October 1997. The unaudited condensed consolidated interim financial information was approved by the board of directors of the Company for issuance on 13 August 2020. The Group’s condensed consolidated interim financial information is unaudited, but has been reviewed by the Company’s Audit Committee. The condensed consolidated interim financial information has also been reviewed by the Company’s independent auditor, PricewaterhouseCoopers (“PwC”), in accordance with Hong Kong Standard on Review Engagements 2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”, issued by the Hong Kong Institute of Certified Public Accountants (“HKICPA”). PwC’s unmodified independent review report to the board of directors is included on page 35 of this interim report. The financial information relating to the year ended 31 December 2019, that is included in the unaudited condensed consolidated interim financial information for the six months ended 30 June 2020 as comparative information, does not constitute the Company’s statutory annual consolidated financial statements for that year but is derived from those financial statements. Further information relating to these statutory financial statements required to be disclosed in accordance with section 436 of the Hong Kong Companies Ordinance (Cap. 622) is as follows: The Company has delivered the financial statements for the year ended 31 December 2019 to the Registrar of Companies as required by section 662(3) of, and Part 3 of Schedule 6 to, the Hong Kong Companies Ordinance (Cap. 622). The Company’s auditor has reported on those financial statements. The auditor’s report was unqualified; did not include a reference to any matters to which the auditor drew attention by way of emphasis without qualifying its report; and did not contain a statement under sections 406(2), 407(2) or (3) of the Hong Kong Companies Ordinance (Cap. 622).

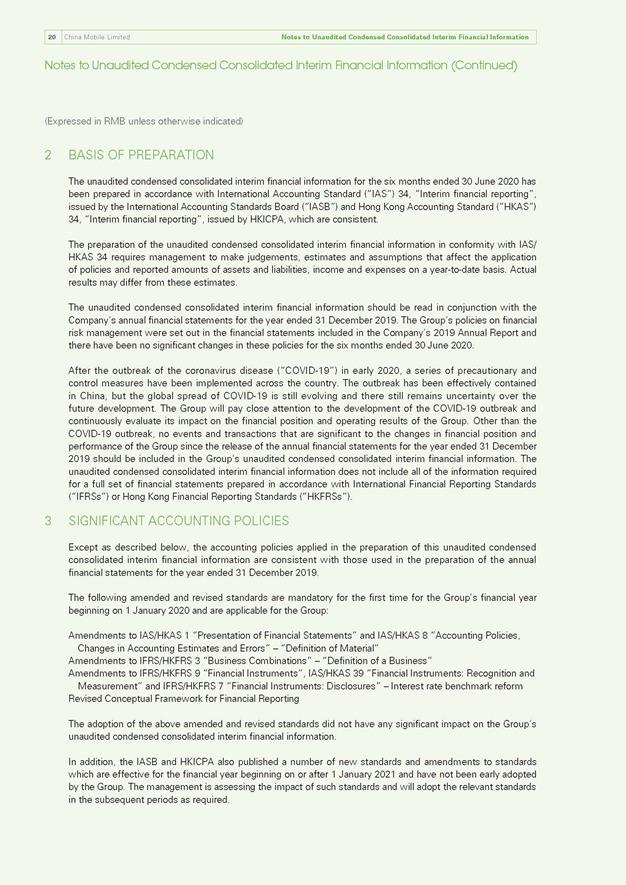

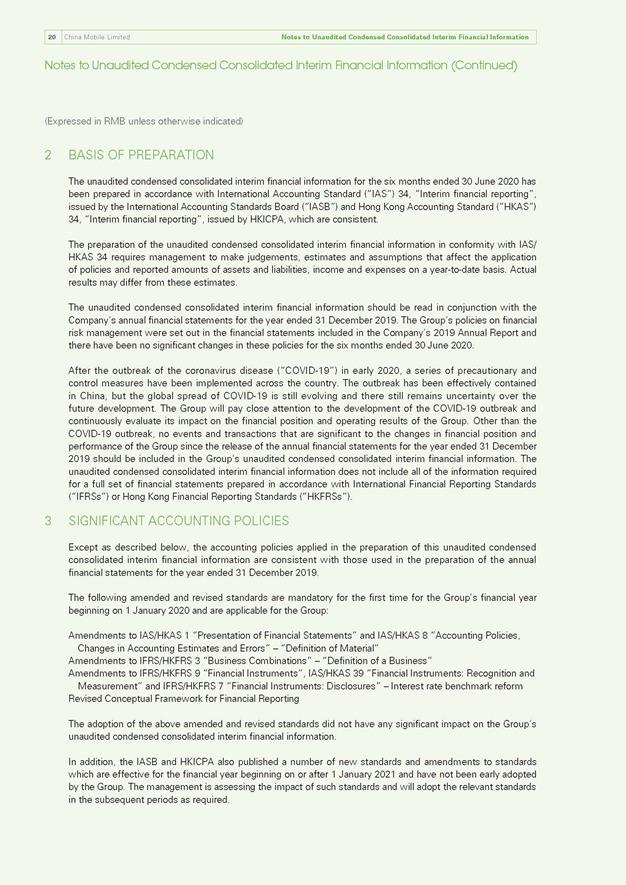

20 China Mobile Limited Notes to Unaudited Condensed Consolidated Interim Financial Information Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 2 BASIS OF PREPARATION The unaudited condensed consolidated interim financial information for the six months ended 30 June 2020 has been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim financial reporting”, issued by the International Accounting Standards Board (“IASB”) and Hong Kong Accounting Standard (“HKAS”) 34, “Interim financial reporting”, issued by HKICPA, which are consistent. The preparation of the unaudited condensed consolidated interim financial information in conformity with IAS/ HKAS 34 requires management to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses on a year-to-date basis. Actual results may differ from these estimates. The unaudited condensed consolidated interim financial information should be read in conjunction with the Company’s annual financial statements for the year ended 31 December 2019. The Group’s policies on financial risk management were set out in the financial statements included in the Company’s 2019 Annual Report and there have been no significant changes in these policies for the six months ended 30 June 2020. After the outbreak of the coronavirus disease (“COVID-19”) in early 2020, a series of precautionary and control measures have been implemented across the country. The outbreak has been effectively contained in China, but the global spread of COVID-19 is still evolving and there still remains uncertainty over the future development. The Group will pay close attention to the development of the COVID-19 outbreak and continuously evaluate its impact on the financial position and operating results of the Group. Other than the COVID-19 outbreak, no events and transactions that are significant to the changes in financial position and performance of the Group since the release of the annual financial statements for the year ended 31 December 2019 should be included in the Group’s unaudited condensed consolidated interim financial information. The unaudited condensed consolidated interim financial information does not include all of the information required for a full set of financial statements prepared in accordance with International Financial Reporting Standards (“IFRSs”) or Hong Kong Financial Reporting Standards (“HKFRSs”). 3 SIGNIFICANT ACCOUNTING POLICIES Except as described below, the accounting policies applied in the preparation of this unaudited condensed consolidated interim financial information are consistent with those used in the preparation of the annual financial statements for the year ended 31 December 2019. The following amended and revised standards are mandatory for the first time for the Group’s financial year beginning on 1 January 2020 and are applicable for the Group: Amendments to IAS/HKAS 1 “Presentation of Financial Statements” and IAS/HKAS 8 “Accounting Policies, Changes in Accounting Estimates and Errors” – “Definition of Material” Amendments to IFRS/HKFRS 3 “Business Combinations” – “Definition of a Business” Amendments to IFRS/HKFRS 9 “Financial Instruments”, IAS/HKAS 39 “Financial Instruments: Recognition and Measurement” and IFRS/HKFRS 7 “Financial Instruments: Disclosures” – Interest rate benchmark reform Revised Conceptual Framework for Financial Reporting The adoption of the above amended and revised standards did not have any significant impact on the Group’s unaudited condensed consolidated interim financial information. In addition, the IASB and HKICPA also published a number of new standards and amendments to standards which are effective for the financial year beginning on or after 1 January 2021 and have not been early adopted by the Group. The management is assessing the impact of such standards and will adopt the relevant standards in the subsequent periods as required.

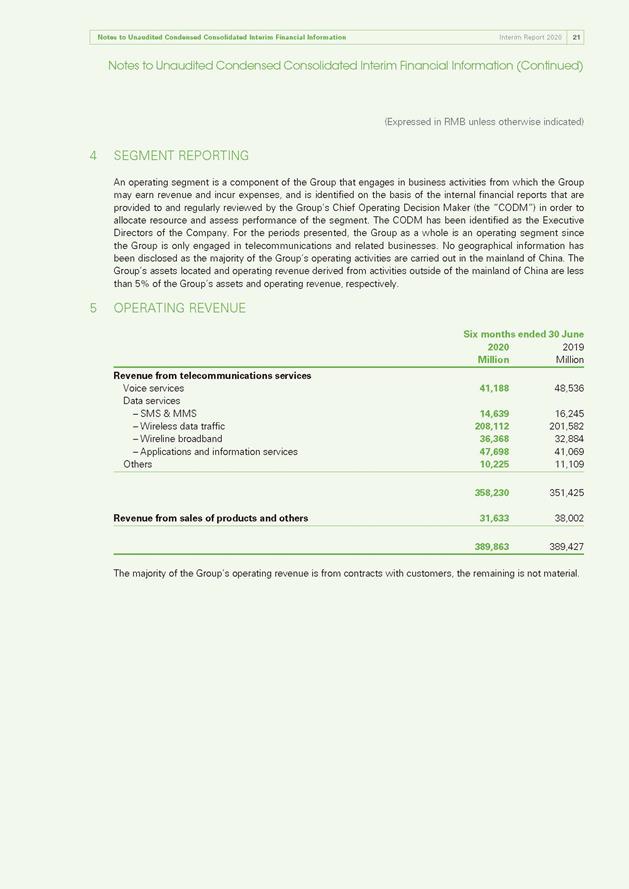

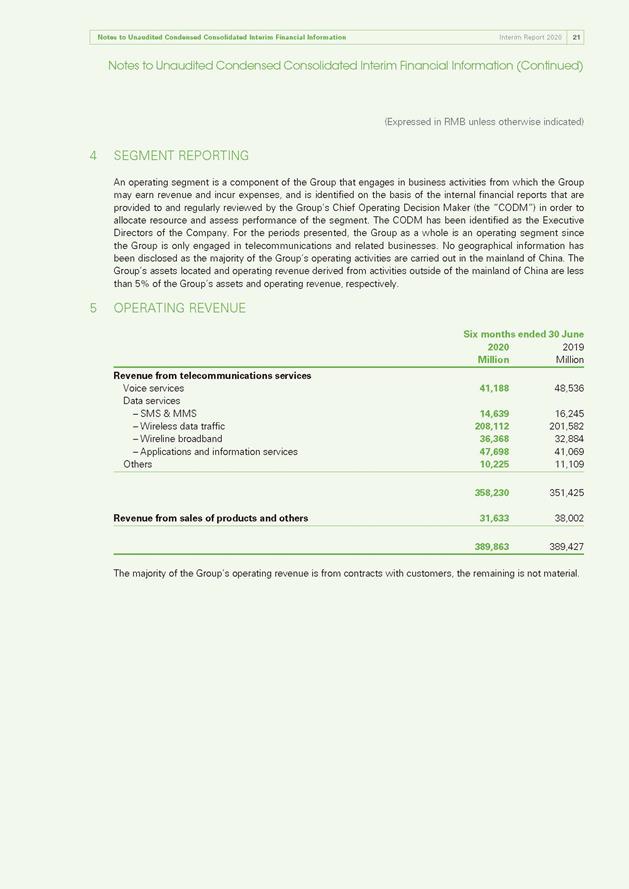

Notes to Unaudited Condensed Consolidated Interim Financial Information Interim Report 2020 21 Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 4 SEGMENT REPORTING An operating segment is a component of the Group that engages in business activities from which the Group may earn revenue and incur expenses, and is identified on the basis of the internal financial reports that are provided to and regularly reviewed by the Group’s Chief Operating Decision Maker (the “CODM”) in order to allocate resource and assess performance of the segment. The CODM has been identified as the Executive Directors of the Company. For the periods presented, the Group as a whole is an operating segment since the Group is only engaged in telecommunications and related businesses. No geographical information has been disclosed as the majority of the Group’s operating activities are carried out in the mainland of China. The Group’s assets located and operating revenue derived from activities outside of the mainland of China are less than 5% of the Group’s assets and operating revenue, respectively. 5 OPERATING REVENUE Six months ended 30 June 2020 2019 Million Million Revenue from telecommunications services Voice services 41,188 48,536 Data services – SMS & MMS 14,639 16,245 – Wireless data traffic 208,112 201,582 – Wireline broadband 36,368 32,884 – Applications and information services 47,698 41,069 Others 10,225 11,109 358,230 351,425 R evenue from sales of products and others 31,633 38,002 389,863 389,427 The majority of the Group’s operating revenue is from contracts with customers, the remaining is not material.

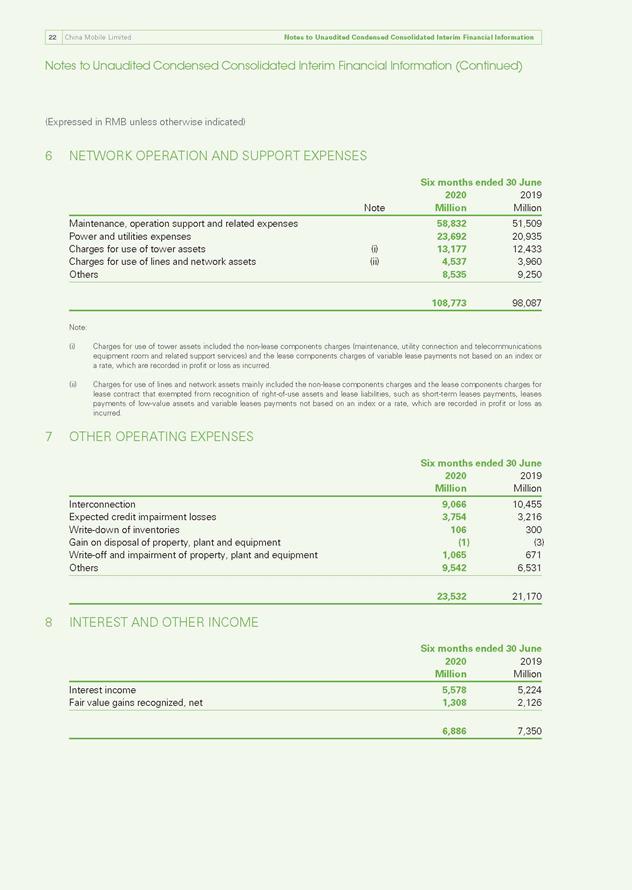

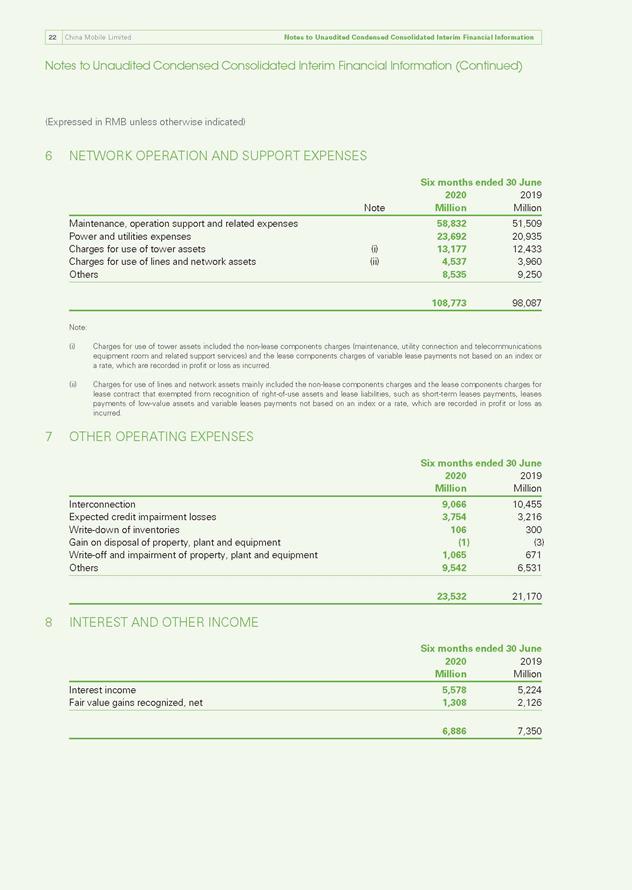

22 China Mobile Limited Notes to Unaudited Condensed Consolidated Interim Financial Information Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 6 NETWORK OPERATION AND SUPPORT EXPENSES Six months ended 30 June 2020 2019 No te Million Million Maintenance, operation support and related expenses 58,832 51,509 Power and utilities expenses 23,692 20,935 Charges for use of tower assets (i) 13,177 12,433 Charges for use of lines and network assets (ii) 4,537 3,960 O thers 8,535 9,250 108,773 98,087 Note: (i) Charges for use of tower assets included the non-lease components charges (maintenance, utility connection and telecommunications equipment room and related support services) and the lease components charges of variable lease payments not based on an index or a rate, which are recorded in profit or loss as incurred. (ii) Charges for use of lines and network assets mainly included the non-lease components charges and the lease components charges for lease contract that exempted from recognition of right-of-use assets and lease liabilities, such as short-term leases payments, leases payments of low-value assets and variable leases payments not based on an index or a rate, which are recorded in profit or loss as incurred. 7 OTHER OPERATING EXPENSES Six months ended 30 June 2020 2019 Million Million Interconnection 9,066 10,455 Expected credit impairment losses 3,754 3,216 Write-down of inventories 106 300 Gain on disposal of property, plant and equipment (1) (3) Write-off and impairment of property, plant and equipment 1,065 671 O thers 9,542 6,531 23,532 21,170 8 INTEREST AND OTHER INCOME Six months ended 30 June 2020 2019 Million Million Interest income 5,578 5,224 F air value gains recognized, net 1,308 2,126 6,886 7,350.

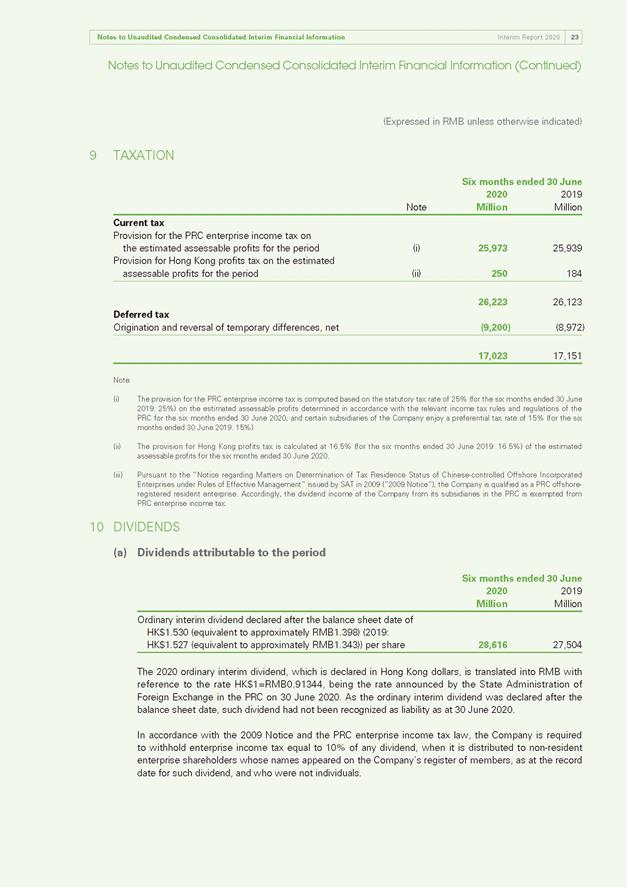

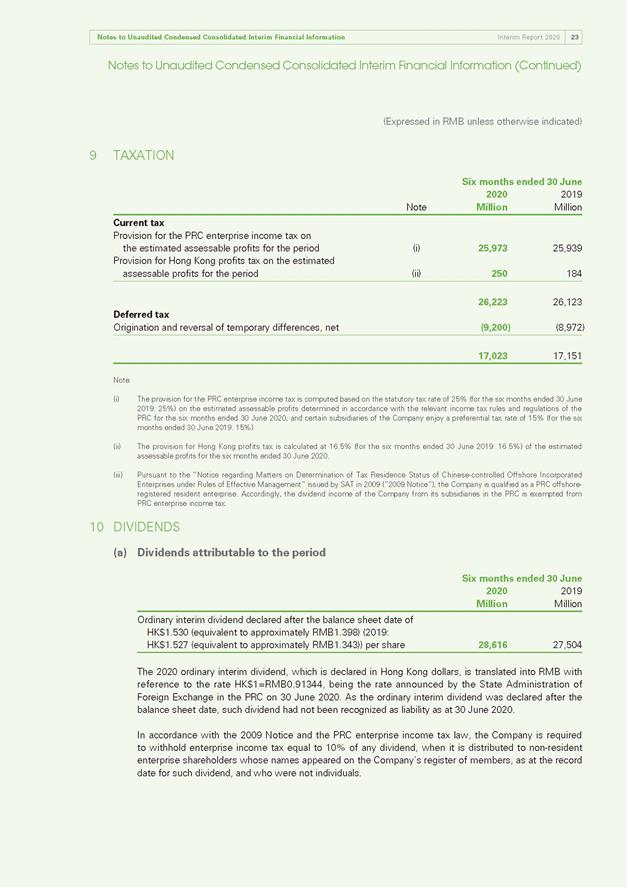

Notes to Unaudited Condensed Consolidated Interim Financial Information Interim Report 2020 23 Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 9 TAXATION Six months ended 30 June 2020 2019 No te Million Million Current tax Provision for the PRC enterprise income tax on the estimated assessable profits for the period (i) 25,973 25,939 Provision for Hong Kong profits tax on the estimated assessable profits for the period (ii) 250 184 26,223 26,123 Deferred tax O rigination and reversal of temporary differences, net (9,200) (8,972) 17,023 17,151 Note: (i) The provision for the PRC enterprise income tax is computed based on the statutory tax rate of 25% (for the six months ended 30 June 2019: 25%) on the estimated assessable profits determined in accordance with the relevant income tax rules and regulations of the PRC for the six months ended 30 June 2020, and certain subsidiaries of the Company enjoy a preferential tax rate of 15% (for the six months ended 30 June 2019: 15%). (ii) The provision for Hong Kong profits tax is calculated at 16.5% (for the six months ended 30 June 2019: 16.5%) of the estimated assessable profits for the six months ended 30 June 2020. (iii) Pursuant to the “Notice regarding Matters on Determination of Tax Residence Status of Chinese-controlled Offshore Incorporated Enterprises under Rules of Effective Management” issued by SAT in 2009 (“2009 Notice”), the Company is qualified as a PRC offshoreregistered resident enterprise. Accordingly, the dividend income of the Company from its subsidiaries in the PRC is exempted from PRC enterprise income tax. 10 DIVIDENDS (a) Dividends attributable to the period Six months ended 30 June 2020 2019 Million Million Ordinary interim dividend declared after the balance sheet date of HK$1.530 (equivalent to approximately RMB1.398) (2019: HK$1.527 (equivalent to approximately RMB1.343)) per share 28,616 27,504 The 2020 ordinary interim dividend, which is declared in Hong Kong dollars, is translated into RMB with reference to the rate HK$1=RMB0.91344, being the rate announced by the State Administration of Foreign Exchange in the PRC on 30 June 2020. As the ordinary interim dividend was declared after the balance sheet date, such dividend had not been recognized as liability as at 30 June 2020. In accordance with the 2009 Notice and the PRC enterprise income tax law, the Company is required to withhold enterprise income tax equal to 10% of any dividend, when it is distributed to non-resident enterprise shareholders whose names appeared on the Company’s register of members, as at the record date for such dividend, and who were not individuals.

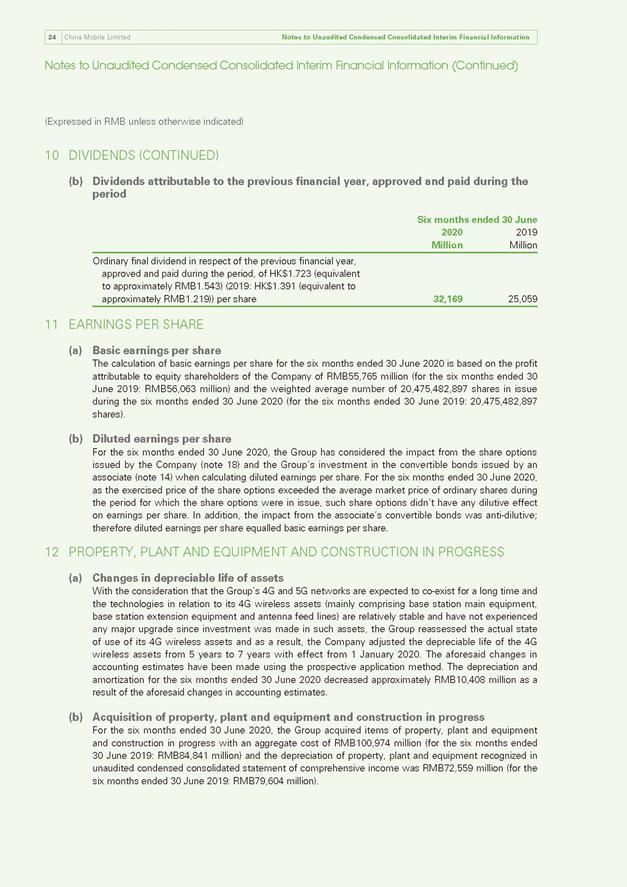

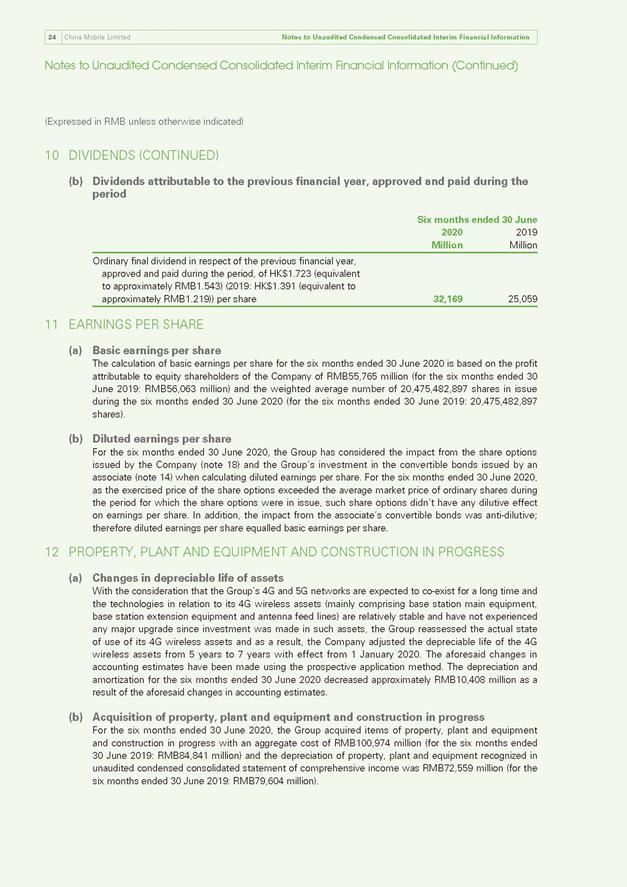

24 China Mobile Limited Notes to Unaudited Condensed Consolidated Interim Financial Information Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 10 DIVIDENDS (CONTINUED) (b) Dividends attributable to the previous financial year, approved and paid during the period Six months ended 30 June 2020 2019 Million Million Ordinary final dividend in respect of the previous financial year, approved and paid during the period, of HK$1.723 (equivalent to approximately RMB1.543) (2019: HK$1.391 (equivalent to approximately RMB1.219)) per share 32,169 25,059 11 EARNINGS PER SHARE (a) Basic earnings per share The calculation of basic earnings per share for the six months ended 30 June 2020 is based on the profit attributable to equity shareholders of the Company of RMB55,765 million (for the six months ended 30 June 2019: RMB56,063 million) and the weighted average number of 20,475,482,897 shares in issue during the six months ended 30 June 2020 (for the six months ended 30 June 2019: 20,475,482,897 shares). (b) Diluted earnings per share For the six months ended 30 June 2020, the Group has considered the impact from the share options issued by the Company (note 18) and the Group’s investment in the convertible bonds issued by an associate (note 14) when calculating diluted earnings per share. For the six months ended 30 June 2020, as the exercised price of the share options exceeded the average market price of ordinary shares during the period for which the share options were in issue, such share options didn’t have any dilutive effect on earnings per share. In addition, the impact from the associate’s convertible bonds was anti-dilutive; therefore diluted earnings per share equalled basic earnings per share. 12 PROPERTY, PLANT AND EQUIPMENT AND CONSTRUCTION IN PROGRESS (a) Changes in depreciable life of assets With the consideration that the Group’s 4G and 5G networks are expected to co-exist for a long time and the technologies in relation to its 4G wireless assets (mainly comprising base station main equipment, base station extension equipment and antenna feed lines) are relatively stable and have not experienced any major upgrade since investment was made in such assets, the Group reassessed the actual state of use of its 4G wireless assets and as a result, the Company adjusted the depreciable life of the 4G wireless assets from 5 years to 7 years with effect from 1 January 2020. The aforesaid changes in accounting estimates have been made using the prospective application method. The depreciation and amortization for the six months ended 30 June 2020 decreased approximately RMB10,408 million as a result of the aforesaid changes in accounting estimates. (b) Acquisition of property, plant and equipment and construction in progress For the six months ended 30 June 2020, the Group acquired items of property, plant and equipment and construction in progress with an aggregate cost of RMB100,974 million (for the six months ended 30 June 2019: RMB84,841 million) and the depreciation of property, plant and equipment recognized in unaudited condensed consolidated statement of comprehensive income was RMB72,559 million (for the six months ended 30 June 2019: RMB79,604 million).

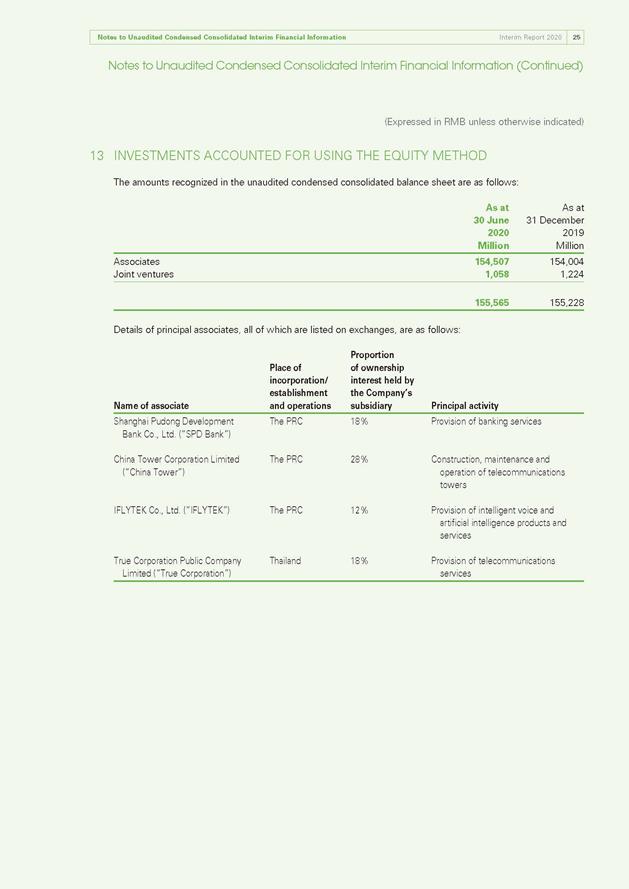

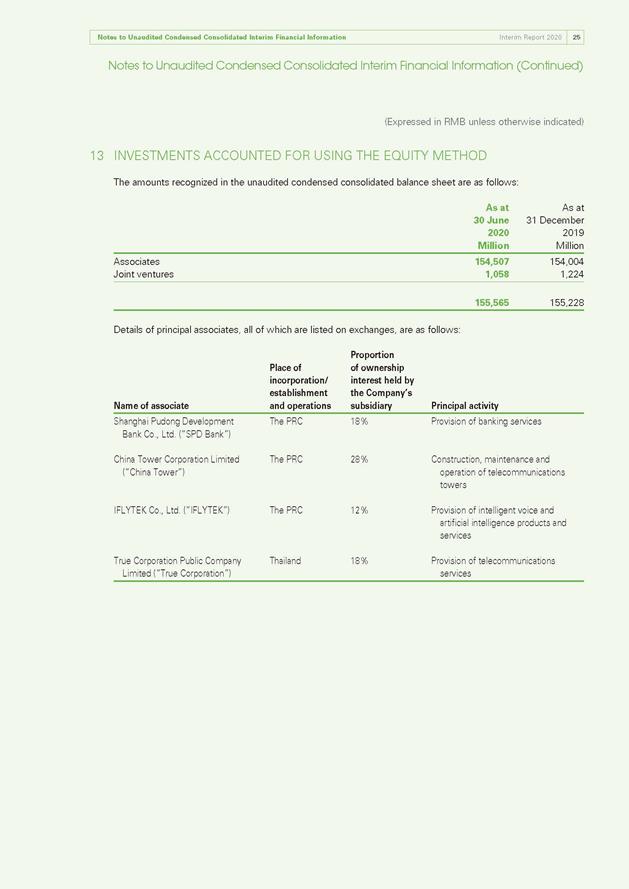

Notes to Unaudited Condensed Consolidated Interim Financial Information Interim Report 2020 25 Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 13 INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD The amounts recognized in the unaudited condensed consolidated balance sheet are as follows: As at 30 June 2020 As at 31 December 2019 Million Million Associates 154,507 154,004 J oint ventures 1,058 1,224 155,565 155,228 Details of principal associates, all of which are listed on exchanges, are as follows: Name of associate Place of incorporation/ establishment and operations Proportion of ownership interest held by the Company’s subsidiary Principal activity Shanghai Pudong Development Bank Co., Ltd. (“SPD Bank”) The PRC 18% Provision of banking services China Tower Corporation Limited (“China Tower”) The PRC 28% Construction, maintenance and operation of telecommunications towers IFLYTEK Co., Ltd. (“IFLYTEK”) The PRC 12% Provision of intelligent voice and artificial intelligence products and services True Corporation Public Company Limited (“True Corporation”) Thailand 18% Provision of telecommunications services

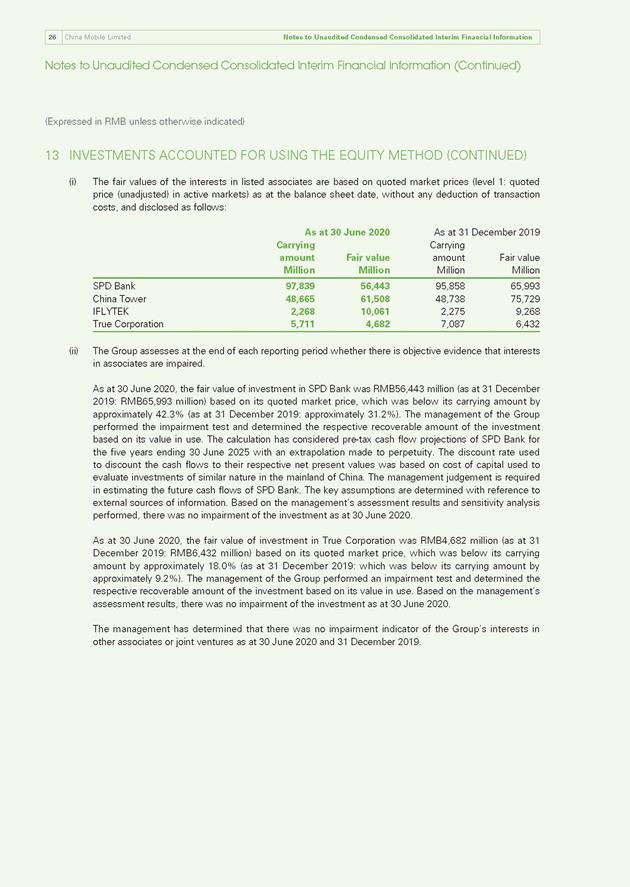

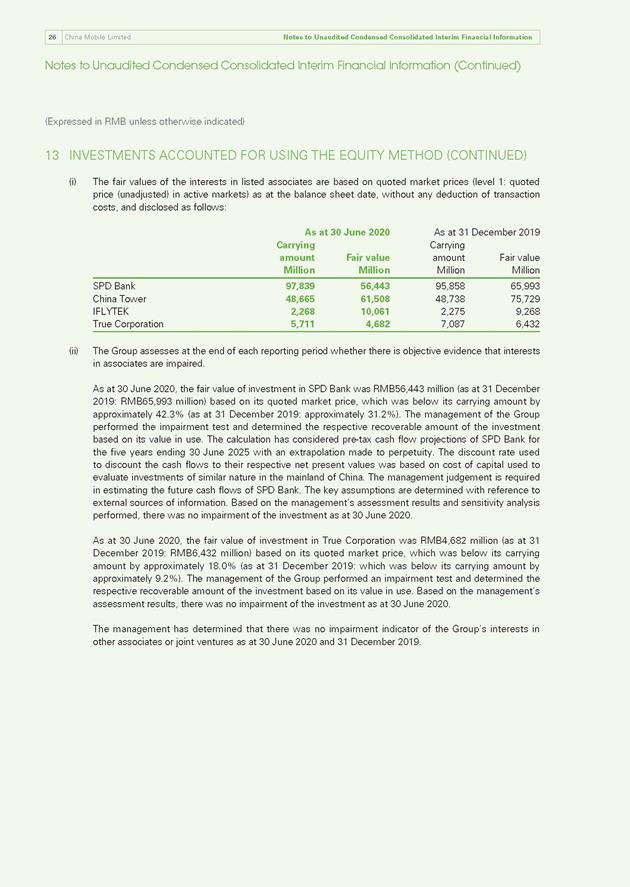

26 China Mobile Limited Notes to Unaudited Condensed Consolidated Interim Financial Information Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 13 INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD (CONTINUED) (i) The fair values of the interests in listed associates are based on quoted market prices (level 1: quoted price (unadjusted) in active markets) as at the balance sheet date, without any deduction of transaction costs, and disclosed as follows: As at 30 June 2020 As at 31 December 2019 Carrying amount Fair value Carrying amount Fair value Million Million Million Million SPD Bank 97,839 56,443 95,858 65,993 China Tower 48,665 61,508 48,738 75,729 IFLYTEK 2,268 10,061 2,275 9,268 True Corporation 5,711 4,682 7,087 6,432 (ii) The Group assesses at the end of each reporting period whether there is objective evidence that interests in associates are impaired. As at 30 June 2020, the fair value of investment in SPD Bank was RMB56,443 million (as at 31 December 2019: RMB65,993 million) based on its quoted market price, which was below its carrying amount by approximately 42.3% (as at 31 December 2019: approximately 31.2%). The management of the Group performed the impairment test and determined the respective recoverable amount of the investment based on its value in use. The calculation has considered pre-tax cash flow projections of SPD Bank for the five years ending 30 June 2025 with an extrapolation made to perpetuity. The discount rate used to discount the cash flows to their respective net present values was based on cost of capital used to evaluate investments of similar nature in the mainland of China. The management judgement is required in estimating the future cash flows of SPD Bank. The key assumptions are determined with reference to external sources of information. Based on the management’s assessment results and sensitivity analysis performed, there was no impairment of the investment as at 30 June 2020. As at 30 June 2020, the fair value of investment in True Corporation was RMB4,682 million (as at 31 December 2019: RMB6,432 million) based on its quoted market price, which was below its carrying amount by approximately 18.0% (as at 31 December 2019: which was below its carrying amount by approximately 9.2%). The management of the Group performed an impairment test and determined the respective recoverable amount of the investment based on its value in use. Based on the management’s assessment results, there was no impairment of the investment as at 30 June 2020. The management has determined that there was no impairment indicator of the Group’s interests in other associates or joint ventures as at 30 June 2020 and 31 December 2019.

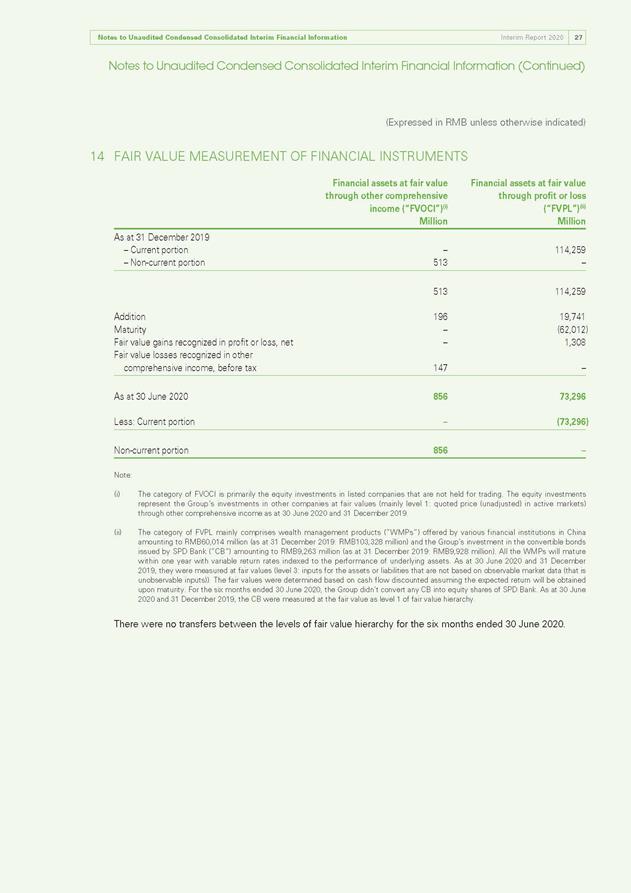

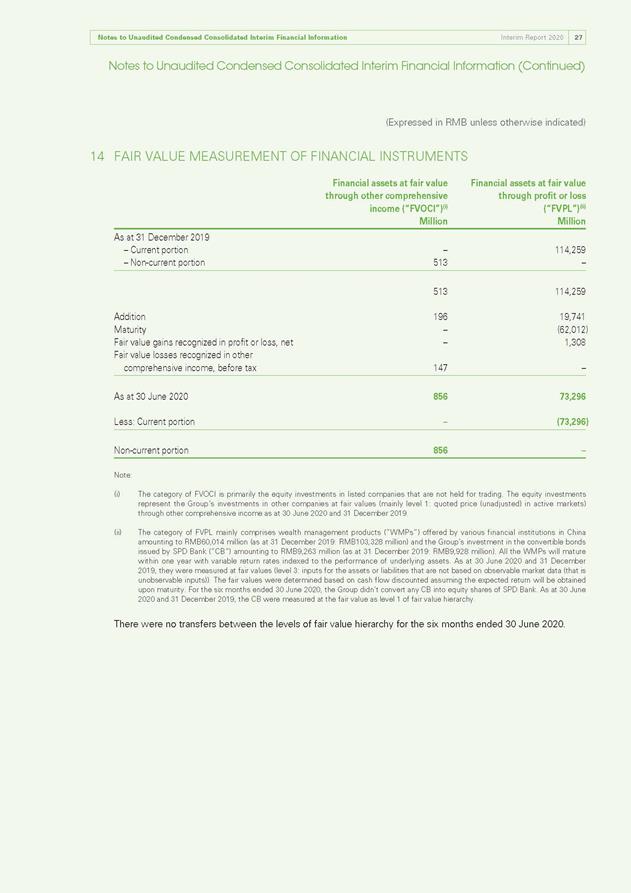

Notes to Unaudited Condensed Consolidated Interim Financial Information Interim Report 2020 27 Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 14 FAIR VALUE MEASUREMENT OF FINANCIAL INSTRUMENTS Financial assets at fair value through other comprehensive income (“FVOCI”)(i) Financial assets at fair value through profit or loss (“FVPL”)(ii) Million Million As at 31 December 2019 – Current portion – 114,259 – Non-current portion 513 – 513 114,259 Addition 196 19,741 Maturity – (62,012) Fair value gains recognized in profit or loss, net – 1,308 Fair value losses recognized in other comprehensive income, before tax 147 – As at 30 June 2020 856 73,296 Less: Current portion – (73,296) Non-current portion 856 – Note: (i) The category of FVOCI is primarily the equity investments in listed companies that are not held for trading. The equity investments represent the Group’s investments in other companies at fair values (mainly level 1: quoted price (unadjusted) in active markets) through other comprehensive income as at 30 June 2020 and 31 December 2019. (ii) The category of FVPL mainly comprises wealth management products (“WMPs”) offered by various financial institutions in China amounting to RMB60,014 million (as at 31 December 2019: RMB103,328 million) and the Group’s investment in the convertible bonds issued by SPD Bank (“CB”) amounting to RMB9,263 million (as at 31 December 2019: RMB9,928 million). All the WMPs will mature within one year with variable return rates indexed to the performance of underlying assets. As at 30 June 2020 and 31 December 2019, they were measured at fair values (level 3: inputs for the assets or liabilities that are not based on observable market data (that is unobservable inputs)). The fair values were determined based on cash flow discounted assuming the expected return will be obtained upon maturity. For the six months ended 30 June 2020, the Group didn’t convert any CB into equity shares of SPD Bank. As at 30 June 2020 and 31 December 2019, the CB were measured at the fair value as level 1 of fair value hierarchy. There were no transfers between the levels of fair value hierarchy for the six months ended 30 June 2020.

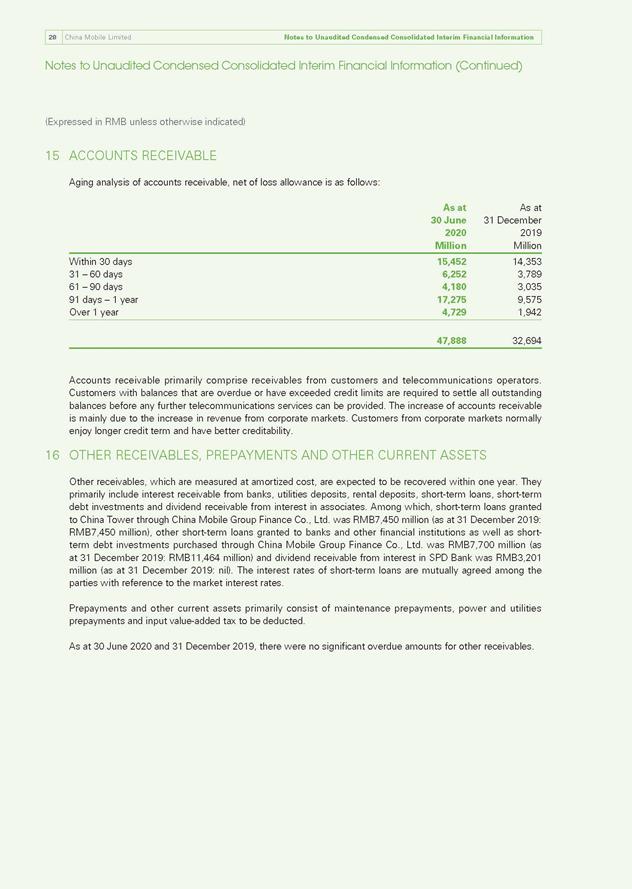

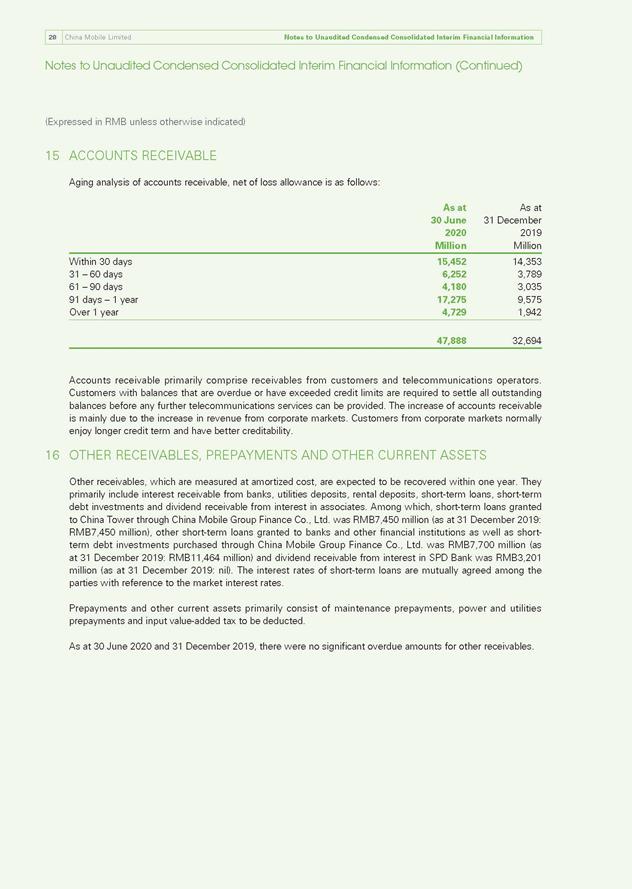

28 China Mobile Limited Notes to Unaudited Condensed Consolidated Interim Financial Information Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 15 ACCOUNTS RECEIVABLE Aging analysis of accounts receivable, net of loss allowance is as follows: As at 30 June 2020 As at 31 December 2019 Million Million Within 30 days 15,452 14,353 31 – 60 days 6,252 3,789 61 – 90 days 4,180 3,035 91 days – 1 year 17,275 9,575 O ver 1 year 4,729 1,942 47,888 32,694 Accounts receivable primarily comprise receivables from customers and telecommunications operators. Customers with balances that are overdue or have exceeded credit limits are required to settle all outstanding balances before any further telecommunications services can be provided. The increase of accounts receivable is mainly due to the increase in revenue from corporate markets. Customers from corporate markets normally enjoy longer credit term and have better creditability. 16 OTHER RECEIVABLES, PREPAYMENTS AND OTHER CURRENT ASSETS Other receivables, which are measured at amortized cost, are expected to be recovered within one year. They primarily include interest receivable from banks, utilities deposits, rental deposits, short-term loans, short-term debt investments and dividend receivable from interest in associates. Among which, short-term loans granted to China Tower through China Mobile Group Finance Co., Ltd. was RMB7,450 million (as at 31 December 2019: RMB7,450 million), other short-term loans granted to banks and other financial institutions as well as shortterm debt investments purchased through China Mobile Group Finance Co., Ltd. was RMB7,700 million (as at 31 December 2019: RMB11,464 million) and dividend receivable from interest in SPD Bank was RMB3,201 million (as at 31 December 2019: nil). The interest rates of short-term loans are mutually agreed among the parties with reference to the market interest rates. Prepayments and other current assets primarily consist of maintenance prepayments, power and utilities prepayments and input value-added tax to be deducted. As at 30 June 2020 and 31 December 2019, there were no significant overdue amounts for other receivables.

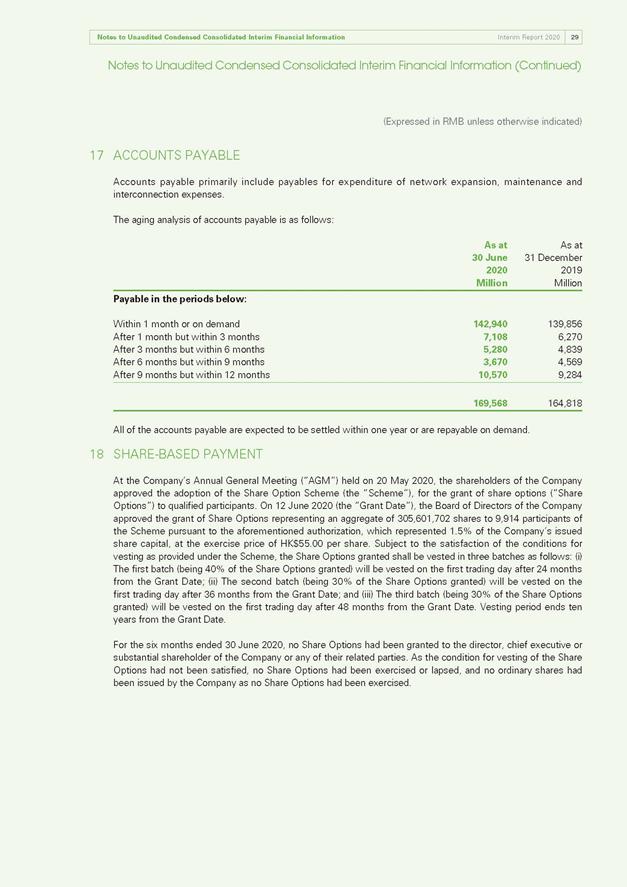

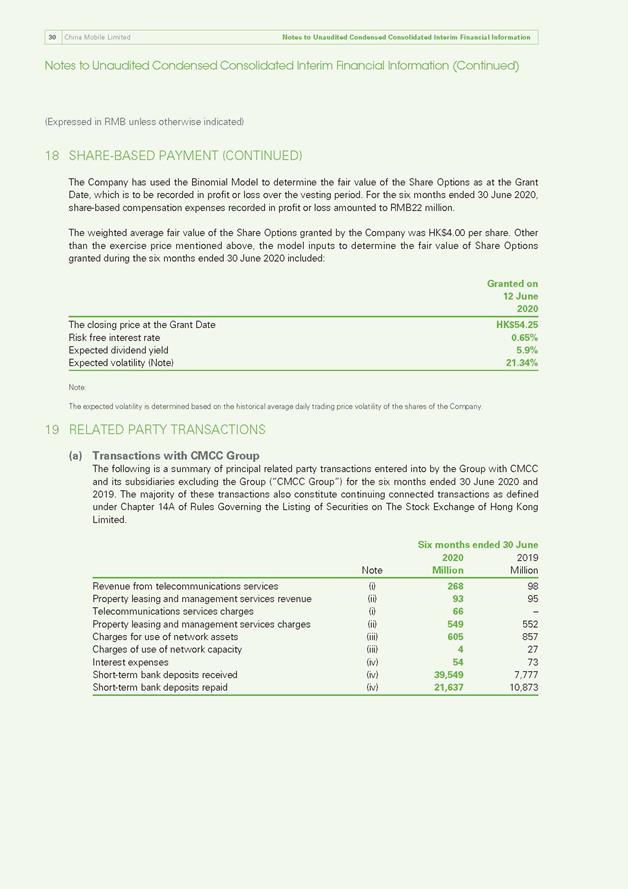

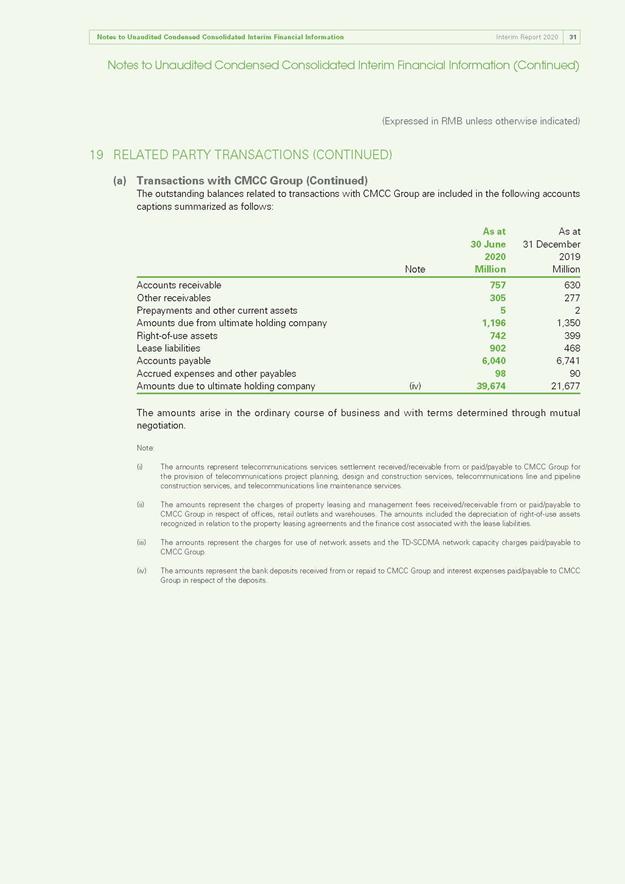

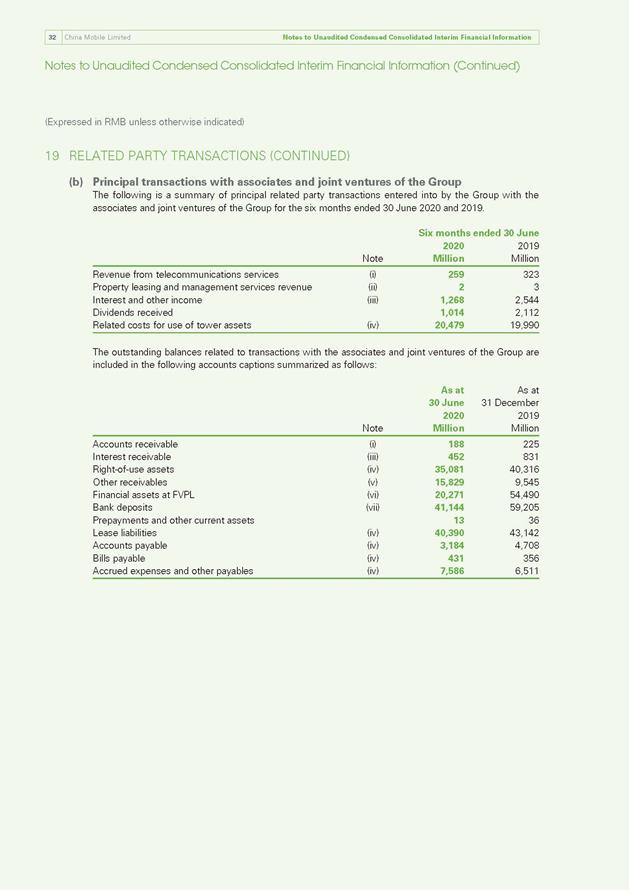

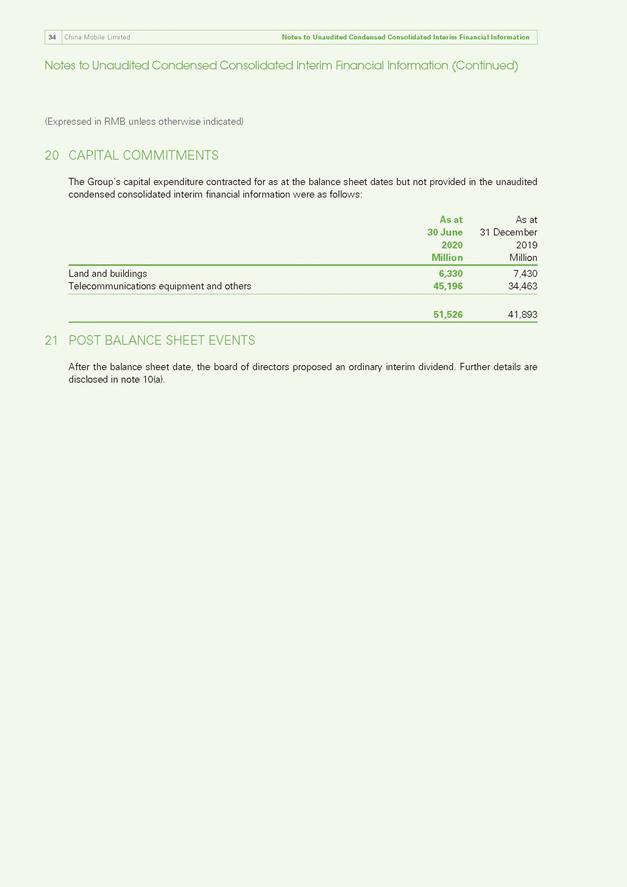

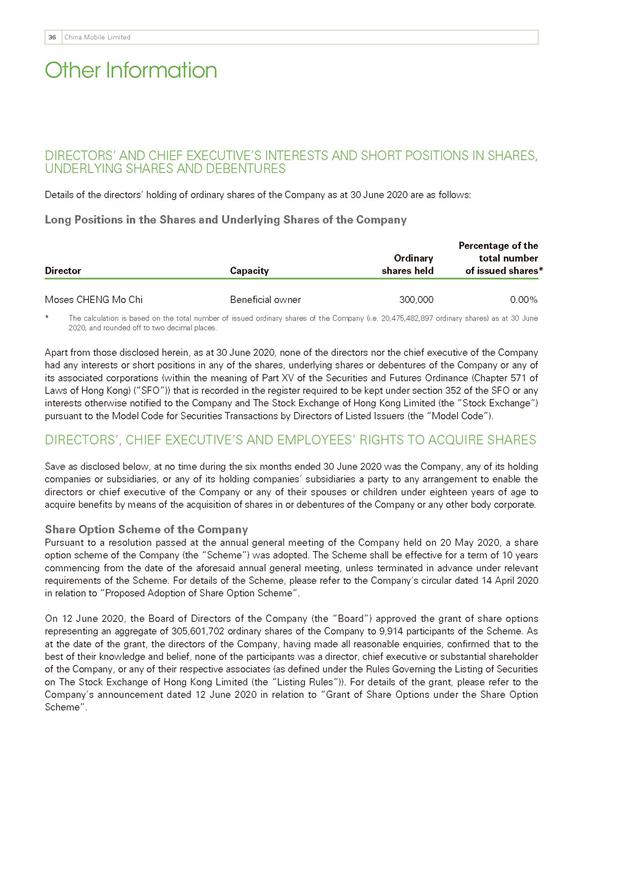

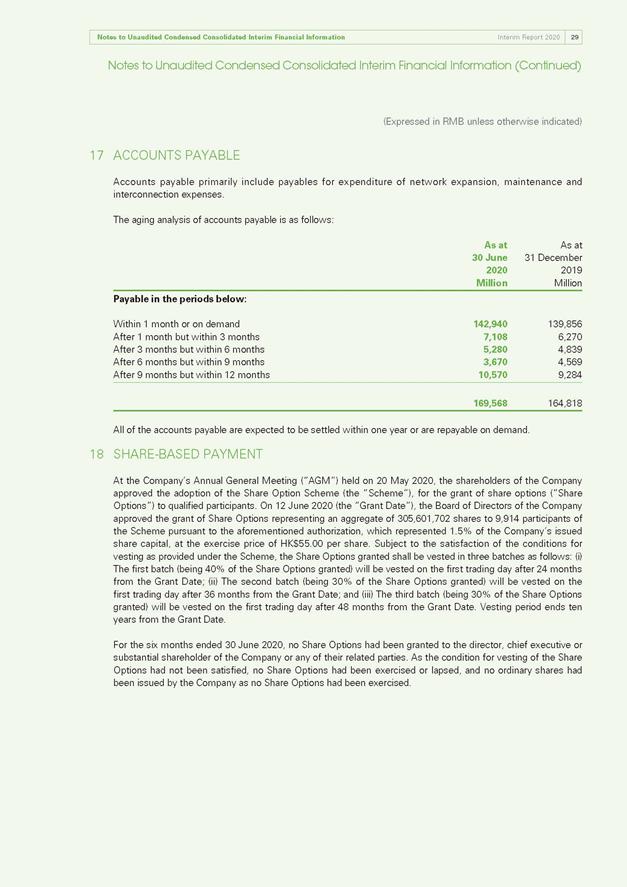

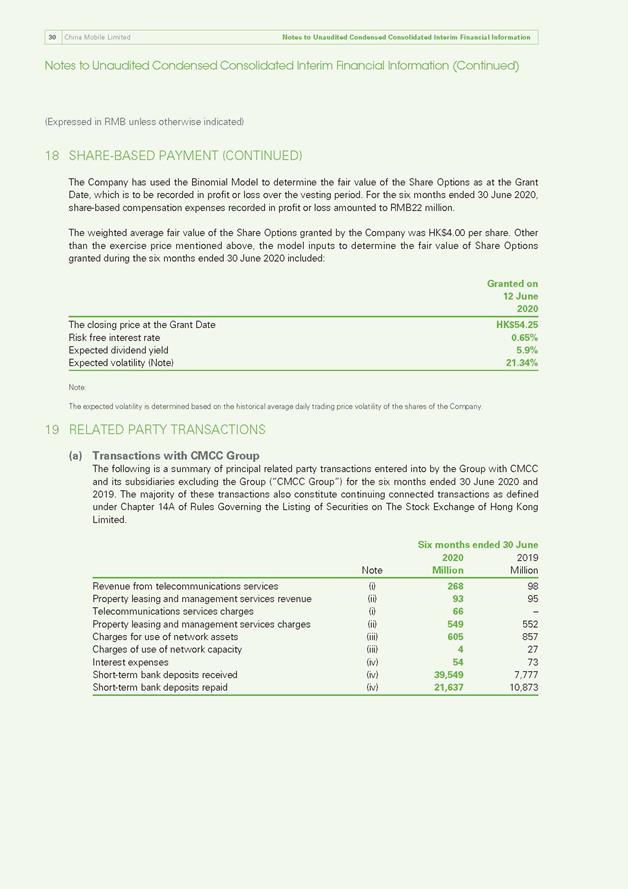

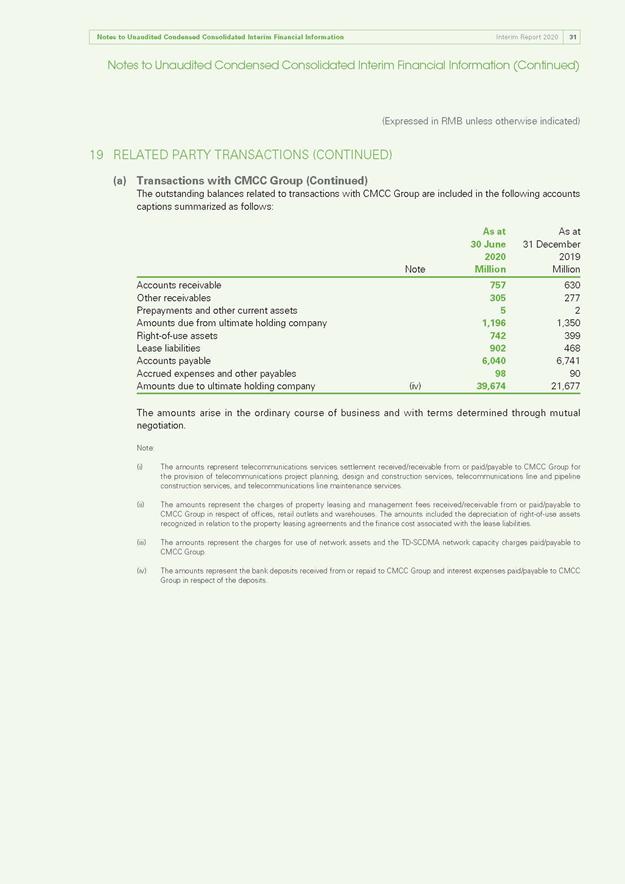

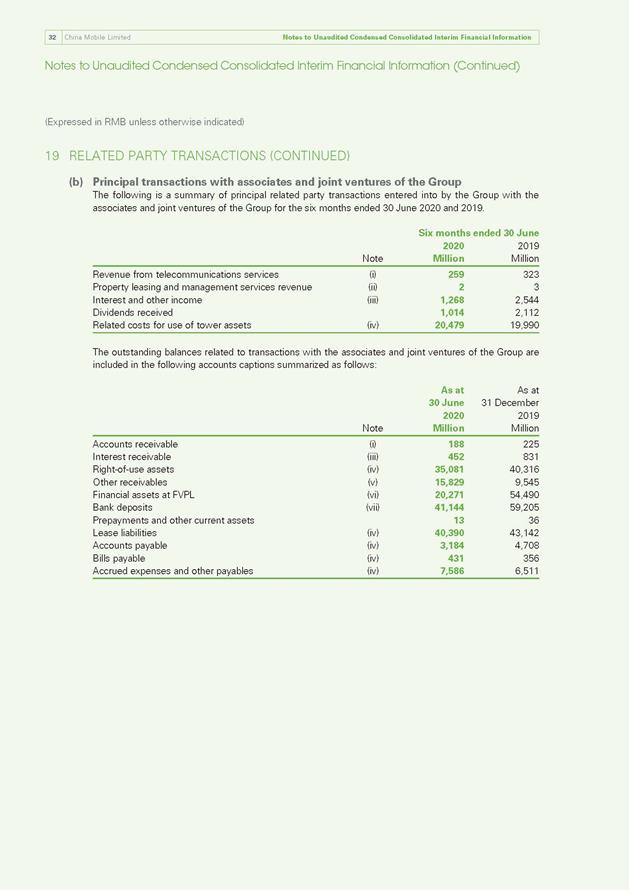

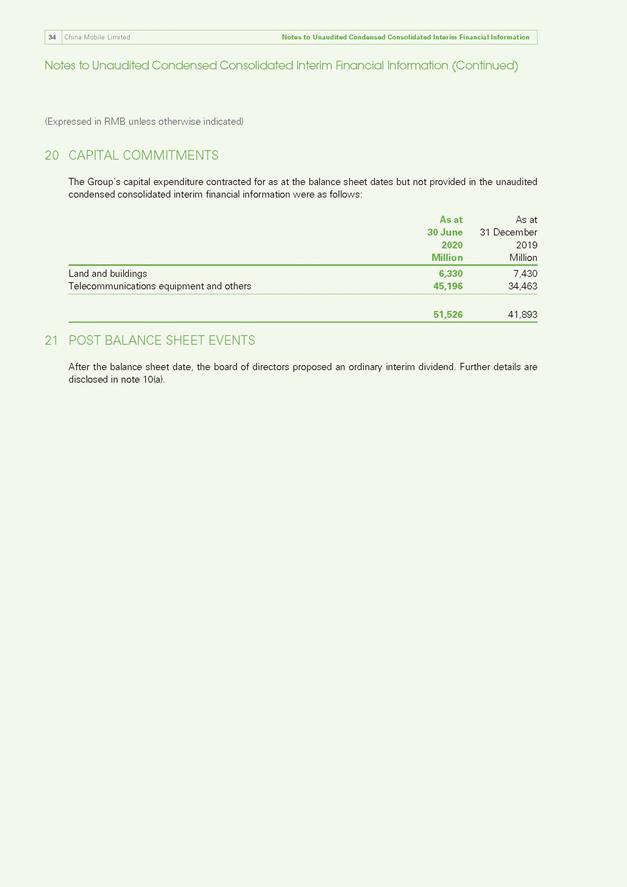

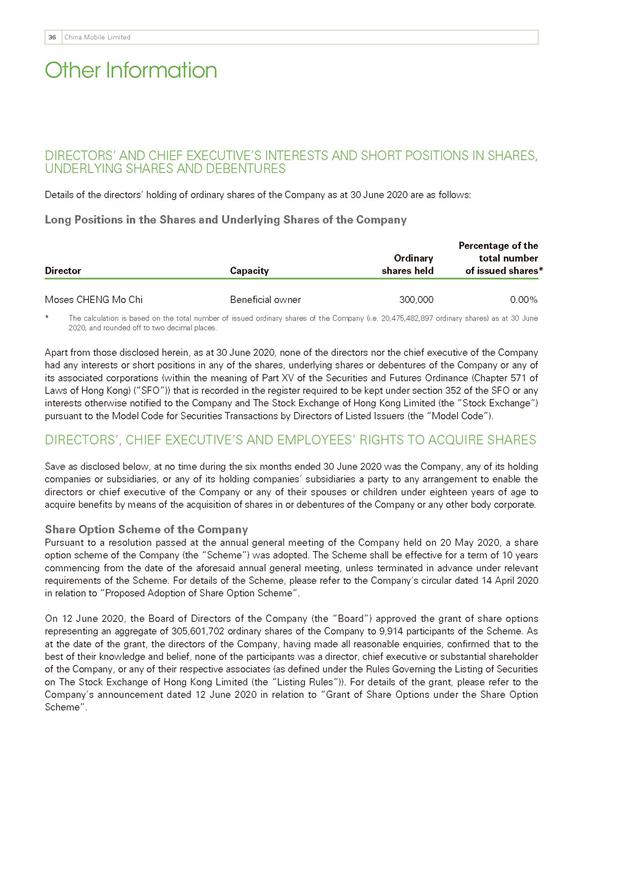

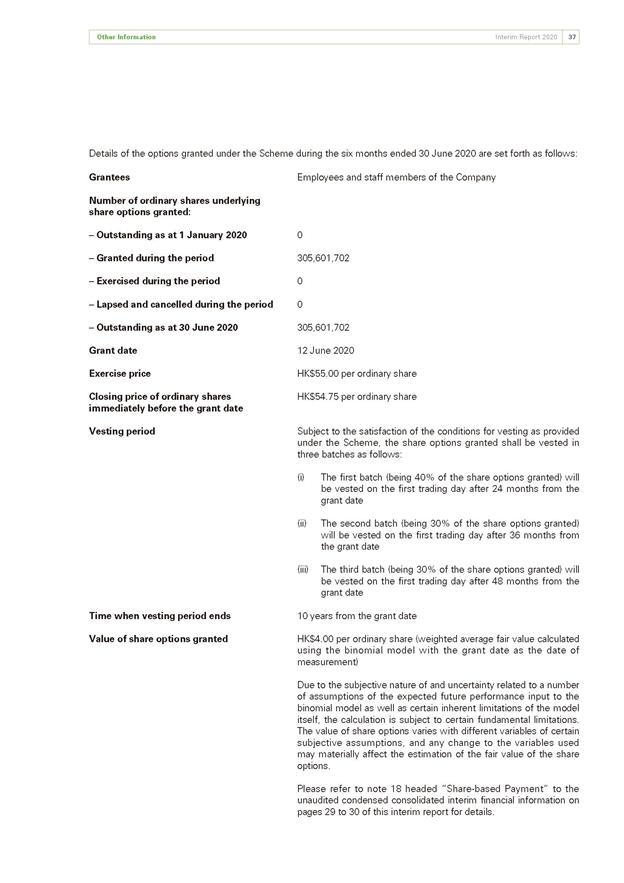

Notes to Unaudited Condensed Consolidated Interim Financial Information Interim Report 2020 29 Notes to Unaudited Condensed Consolidated Interim Financial Information (Continued) (Expressed in RMB unless otherwise indicated) 17 ACCOUNTS PAYABLE Accounts payable primarily include payables for expenditure of network expansion, maintenance and interconnection expenses. The aging analysis of accounts payable is as follows: As at 30 June 2020 As at 31 December 2019 Million Million Payable in the periods below: Within 1 month or on demand 142,940 139,856 After 1 month but within 3 months 7,108 6,270 After 3 months but within 6 months 5,280 4,839 After 6 months but within 9 months 3,670 4,569 A fter 9 months but within 12 months 10,570 9,284 169,568 164,818 All of the accounts payable are expected to be settled within one year or are repayable on demand. 18 SHARE-BASED PAYMENT At the Company’s Annual General Meeting (“AGM”) held on 20 May 2020, the shareholders of the Company approved the adoption of the Share Option Scheme (the “Scheme”), for the grant of share options (“Share Options”) to qualified participants. On 12 June 2020 (the “Grant Date”), the Board of Directors of the Company approved the grant of Share Options representing an aggregate of 305,601,702 shares to 9,914 participants of the Scheme pursuant to the aforementioned authorization, which represented 1.5% of the Company’s issued share capital, at the exercise price of HK$55.00 per share. Subject to the satisfaction of the conditions for vesting as provided under the Scheme, the Share Options granted shall be vested in three batches as follows: (i) The first batch (being 40% of the Share Options granted) will be vested on the first trading day after 24 months from the Grant Date; (ii) The second batch (being 30% of the Share Options granted) will be vested on the first trading day after 36 months from the Grant Date; and (iii) The third batch (being 30% of the Share Options granted) will be vested on the first trading day after 48 months from the Grant Date. Vesting period ends ten years from the Grant Date. For the six months ended 30 June 2020, no Share Options had been granted to the director, chief executive or substantial shareholder of the Company or any of their related parties. As the condition for vesting of the Share Options had not been satisfied, no Share Options had been exercised or lapsed, and no ordinary shares had been issued by the Company as no Share Options had been exercised.