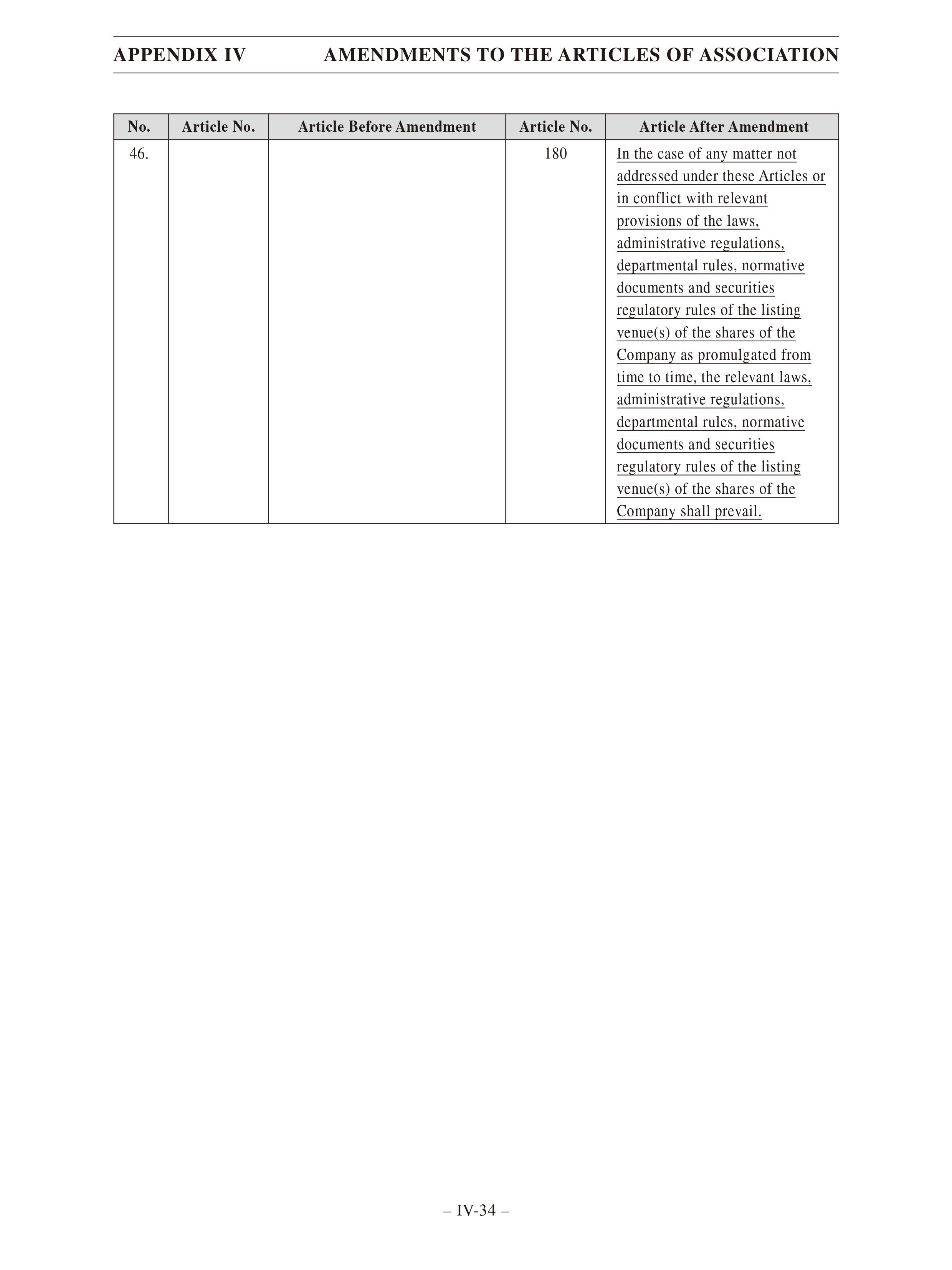

Exhibit 2.1

THIS CIRCULAR IS IMPORTANTAND REQUIRESYOUR IMMEDIATE ATTENTION Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. If you have sold or transferred all your shares in China Mobile Limited, you should at once hand this circular and the accompanying form of proxy to the purchaser or transferee, or to the bank, stockbroker or otheragentthroughwhomthesaleortransferwaseffectedfortransmissiontothepurchaserortransferee. If you are in any doubt as to any aspect of this circular, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. This circular is for information only and is not intended to and does not constitute, or form part of, an invitation or offer to acquire, purchase or subscribe for any securities of the Company. Logo CHINA MOBILE LIMITED 中國移動有限公司 (Incorporated in Hong Kong with limited liability under the Companies Ordinance) (Stock Code: 941) PROPOSED RMB SHARE ISSUE UNDERSPECIFIC MANDATE PROPOSEDAMENDMENT TO ARTICLES OF ASSOCIATION AND NOTICE OF THEEXTRAORDINARY GENERAL MEETING A letter from the Board is set out on pages 3 to 20 of this circular. The EGM will be held on Wednesday, 9 June 2021 at 9:30 a.m. in the Grand Ballroom, Grand Hyatt Hong Kong, 1 Harbour Road, Wanchai, Hong Kong. A notice of the EGM is set out on pages EGM-1 to EGM-5 of this circular. The form of proxy for use at the EGM has been despatched to the Shareholders together with this circular and also published on the websites of the Hong Kong Stock Exchange and the Company. Whether or not you intend to attend the EGM, you are requested to complete and return the form of proxy in accordance with the instructions printed thereon.The form of proxy should be deposited at the Company’s registered office at 60/F, The Center, 99 Queen’s Road Central, Hong Kong as soon as possible and in any event not less than 24 hours before the time appointed for the EGM or any adjournment thereof. Completion and return of the form of proxy will not preclude you from attending and voting in person at the EGM or at any adjournment thereof should you so wish. 24 May 2021

CONTENTS Page DEFINITIONS 1 LETTERFROM THE BOARD 3 I. INTRODUCTION 3 II. MATTERS TO BE RESOLVED AT THE EGM 3 III. OTHER INFORMATION RELATED TO THE RMB SHARE ISSUE 15 IV. EGM 19 V. RECOMMENDATION 20 VI. RESPONSIBILITY STATEMENT 20 VII. FURTHER INFORMATION 20 APPENDIX I — PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE I-1 APPENDIX II — SHAREHOLDERRETURN PLAN WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE II-1 APPENDIX III — REMEDIAL MEASURES FOR THE POTENTIAL DILUTION OF IMMEDIATE RETURNS RESULTING FROM THE RMB SHARE ISSUE III-1 APPENDIX IV — AMENDMENTS TO THE ARTICLES OF ASSOCIATION IV-1 APPENDIX V — POLICY GOVERNING THE PROCEDURESOF GENERAL MEETINGS V-1 APPENDIX VI — POLICY GOVERNING THE PROCEDURESOF BOARD MEETINGS VI-1 NOTICE OF THEEXTRAORDINARY GENERAL MEETING EGM-1 –i–

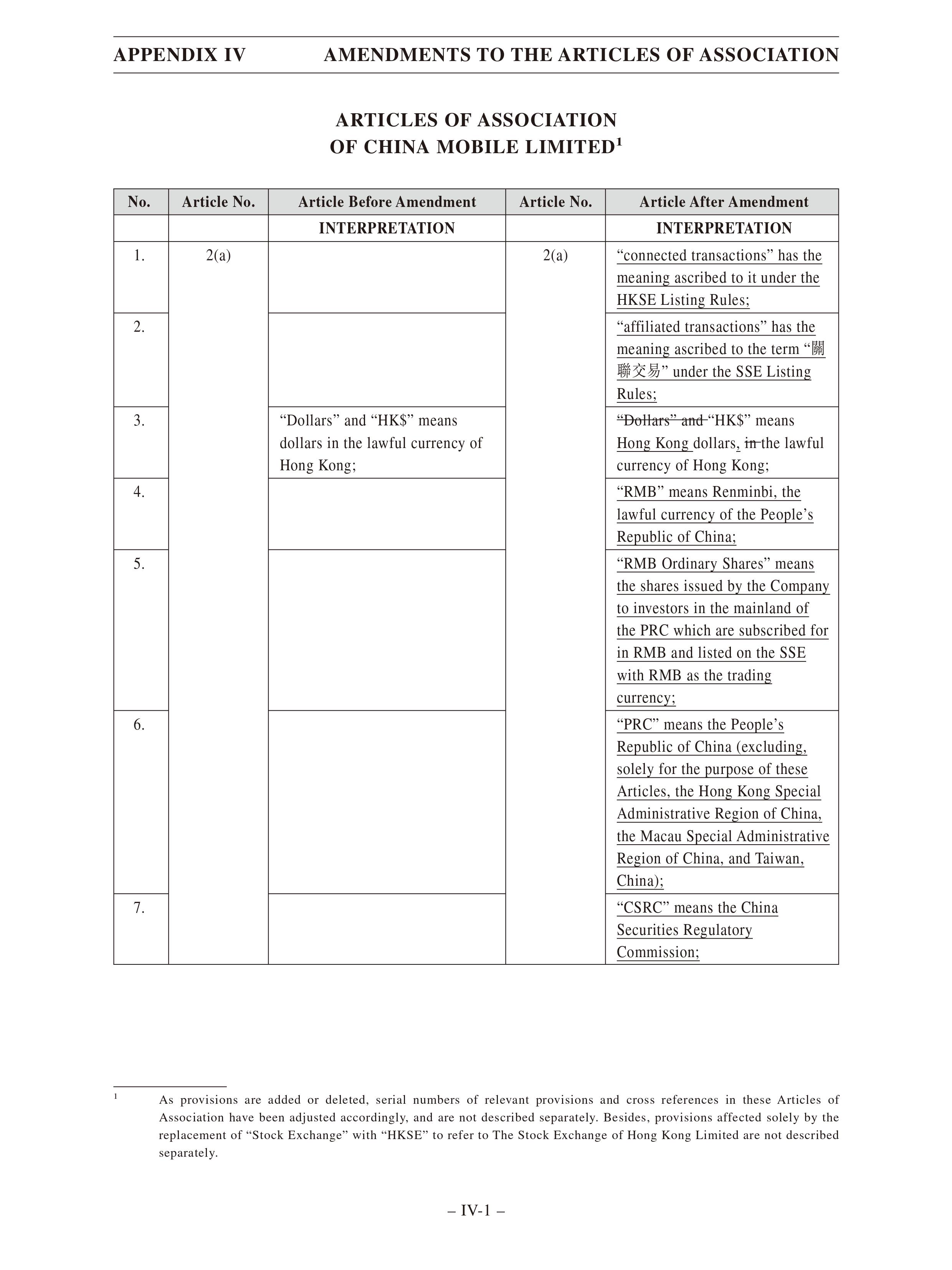

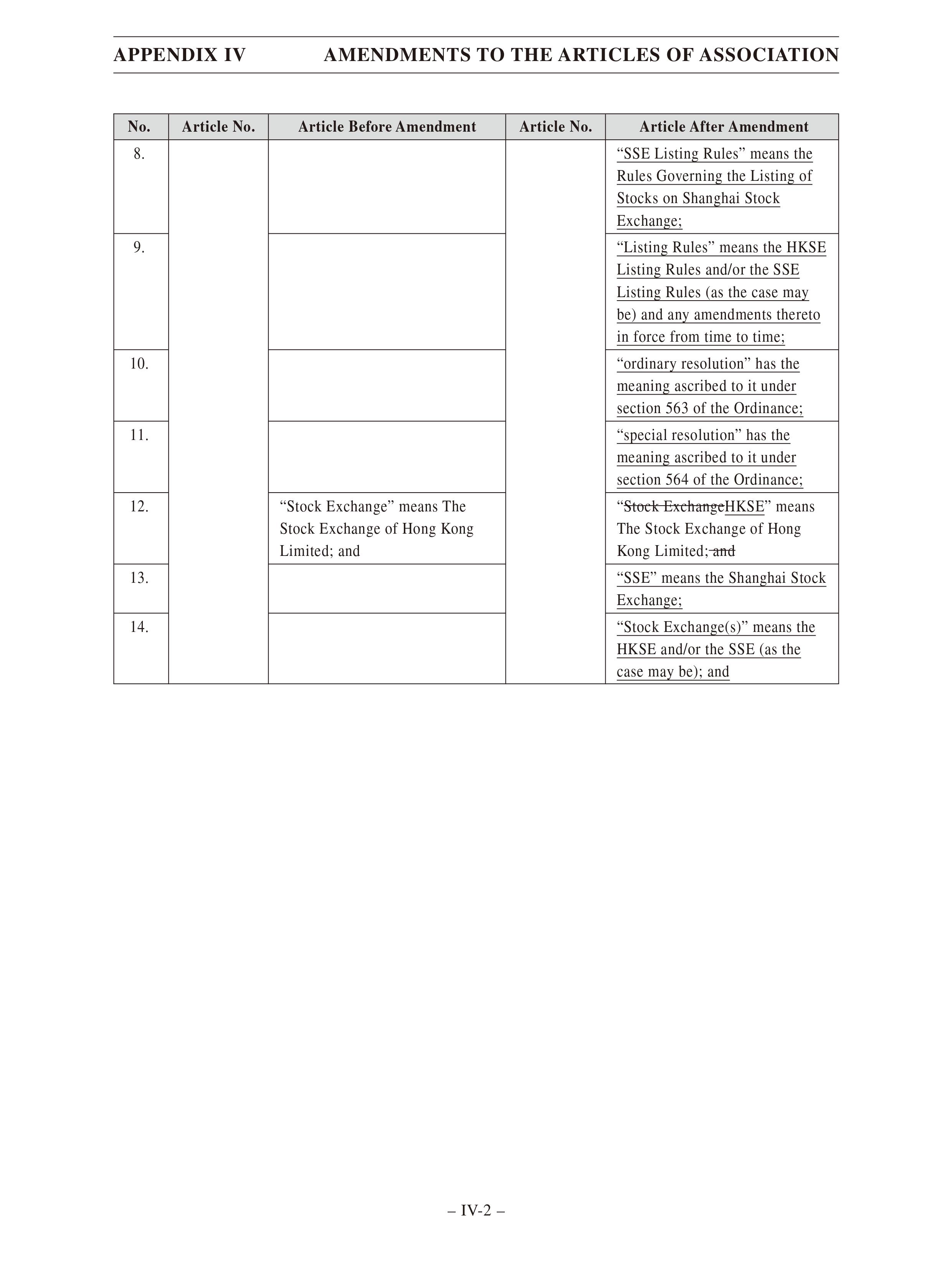

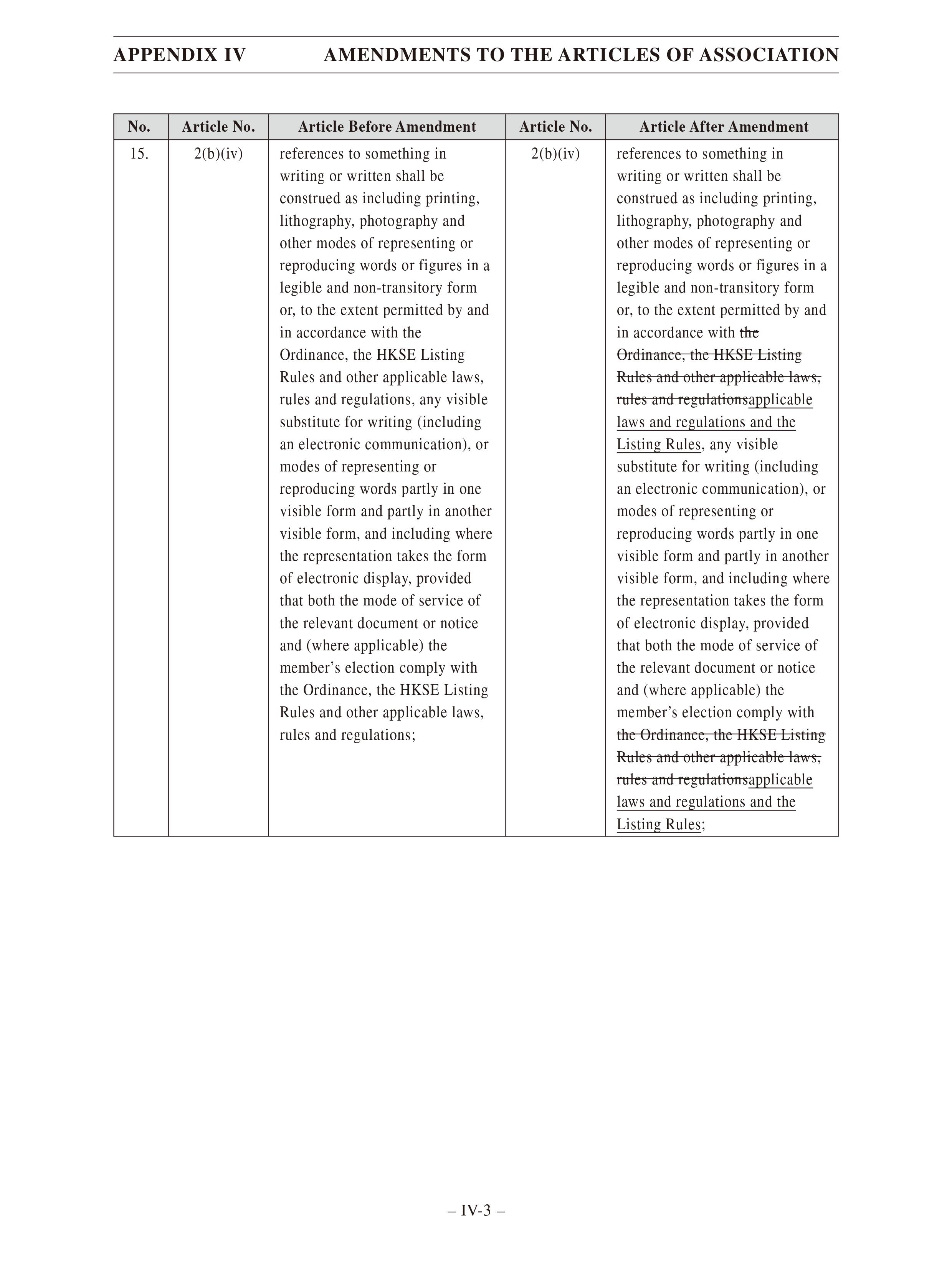

DEFINITIONS In this circular, unless thecontext otherwiserequires,the expressions below shall have the following meanings: “Articles of Association” the articles of association of the Company (as amended from time to time) “Board” the board of Directors of the Company “Companies Ordinance” the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) “Company” China Mobile Limited “CSDC” China Securities Depository and Clearing Corporation Limited “CSRC” China Securities Regulatory Commission “Directors” the directors of the Company “EGM” the extraordinary general meeting of the Company to be held on 9 June 2021, or any adjournment thereof, for consideration by the Shareholders and seeking their approval for the RMB Share Issue, the granting of the Specific Mandate and the other related matters as set out in this circular “Hong Kong” the Hong Kong Special Administrative Region of the PRC “Hong Kong Listing Rules” the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited “Hong Kong Shares” the existing Ordinary Shares which are listed on the Hong Kong Stock Exchange “Hong Kong Stock Exchange” The Stock Exchange of Hong Kong Limited “Latest Practicable Date” 18 May 2021, being the latest practicable date prior to the printing of this circular for ascertaining certain information for inclusion herein “Ordinary Shares” ordinary shares in the issued share capital of the Company and as may be issued by the Company from time to time –1–

DEFINITIONS “PRC” the People’s Republic of China (excluding, solely for the purposes of this circular, the Hong Kong Special Administrative Region of China, the Macau Special Administrative Region of China and Taiwan, China) “RMB” Renminbi, the lawful currency of the PRC “RMB Shares” the Ordinary Shares to be subscribed for in RMB by investors in the PRC, listed on the Shanghai Stock Exchange and traded in RMB “RMB Share Issue” or “RMB Share Issue the Company’s proposed initial public offering of RMB and Listing” Shares, which will be listed on the Shanghai Stock Exchange “Shareholders” holders of Ordinary Shares “Specific Mandate” a specific mandate to be sought from the Shareholders at the EGM to allot and issue RMB Shares pursuant to the RMB Share Issue “%” per cent FORWARD-LOOKING STATEMENTS Certain statements contained in this circular may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. SecuritiesAct of 1933, as amended, and Section 21E of the U.S. Securities ExchangeAct of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from those implied by such forward-looking statements. In addition, the Company does not intend to update these forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s most recent Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. –2–

LETTERFROM THE BOARD Logo CHINA MOBILE LIMITED 中國移動有限公司 (Incorporated in Hong Kong with limited liability under the Companies Ordinance) (Stock Code: 941) Executive Directors: Registered Office: YANG Jie (Chairman) 60th Floor DONG Xin (Chief Executive Officer) The Center WANG Yuhang 99 Queen’s Road Central LI Ronghua (Chief Financial Officer) Hong Kong IndependentNon-executive Directors: Moses CHENG Mo Chi Paul CHOW Man Yiu Stephen YIU Kin Wah YANG Qiang 24 May 2021 To theShareholders Dear Sir or Madam, PROPOSED RMB SHARE ISSUE UNDERSPECIFIC MANDATE PROPOSEDAMENDMENT TO ARTICLES OF ASSOCIATION AND NOTICE OF THEEXTRAORDINARY GENERAL MEETING I. INTRODUCTION Reference is made to the announcement of the Company dated 17 May 2021 in relation to the RMB Share Issue, the Specific Mandate and related matters (including proposed amendments to theArticles of Association). The purpose of this circular is to provide Shareholders with further details of the resolutions proposed to be considered and approved by Shareholders at the EGM and provide relevant information to enable Shareholders to make an informed decision on whether to vote for or against or abstain from voting at these resolutions. Such resolutions and information are set out in this letter from the Board. II. MATTERS TO BE RESOLVEDAT THEEGM 1. Resolution on the RMB Share Issue and the Specific Mandate An ordinary resolution will be proposed at the EGM to approve the RMB Share Issue and the Specific Mandate subject to obtaining approvals from the relevant regulatory authorities. –3–

LETTERFROM THE BOARD In order to grasp the window of opportunity to develop the information services market, promote the implementation of the strategy of becoming a world-class enterprise by building a dynamic “Powerhouse”, advance digitalized and intelligent transformation, cultivate a digitalized and intelligent ecosystem with new vitality and build new momentum toward high-quality development, the Company proposes to apply for the RMB Share Issue. The RMB Share Issue is detailed as follows: (1) Nature of RMB Shares Ordinary Shares to be subscribed for in RMB by the target subscribers (as stated below), and proposed to be listed on the Shanghai Stock Exchange and traded in RMB, forming the same class of shares as the Hong Kong Shares The RMB Shares do not have a par value pursuant to section 135 of the Companies Ordinance (2) Number of RMB Shares to The Company proposes to conduct a public offering of no be issued more than 964,813,000 RMB Shares, representing no more than 4.50% of the Company’s total number of Ordinary Shares in issue upon the RMB Share Issue (prior to the exercise of the over -allotment option); subject to compliance with laws and regulations and regulatory requirements, the Company may authorise the lead underwriter(s) to exercise the over-allotment option, and conduct an over-allotment of no more than 15% of the number of RMB Shares under the RMB Share Issue (prior to the exercise of the over-allotment option) In the event of issue of bonus shares, capitalisation of capital reserve, exercise of share options, repurchase or other events of the Company prior to the RMB Share Issue, the number of RMB Shares to be issued will be adjusted accordingly The RMB Share Issue will be conducted wholly by way of issuing new shares The final number of RMB Shares to be issued and matters in relation to over-allotment will be determined according to market conditions and communications with relevant regulatory authorities –4–

LETTERFROM THE BOARD (3) Target subscribers Qualified natural persons and institutional investors (except for investors prohibited by laws, regulations and applicable regulatory requirements) If any of the aforesaid target subscribers of the RMB Share Issue is a connected person of the Company, the Company will take all reasonable measures to comply with the requirements of the relevant regulatory authorities (4) Method of issuance The RMB Share Issue will adopt a combination of off-line placement to inquiring subscribers and on-line fixed-price issuance to eligible public investors or such other methods of issuance as permitted by the relevant regulatory authorities (including without limitation placement to strategic investors) (5) Method of pricing The offer price will be determined via off-line price enquiries with potential investors and other legally practicable methods pursuant to applicable laws and regulations as well as regulatory rules, based on the prevailing conditions of the domestic and overseas capital markets and the actual circumstances of the Company at the time of the RMB Share Issue, and taking into account the interests of the existing Shareholders as a whole Pursuant to the Administrative Measures on Issue and Underwriting of Securities (CSRC Order No. 144) (《證券 發行與承銷管理辦法》(中國證監會令第144號)) and other relevant requirements, where the price under an initial public offering of RMB shares is determined by way of price enquiries, after off-line investors make offers, the issuer and the lead underwriter(s) shall disregard a portion of the highest offer price(s) among the total number intended to be subscribed for, provided that the portion disregarded shall not be less than 10% of the total number intended to be subscribed for by all off-line investors, upon which the issue price shall be determined after discussions with reference to the remaining offers and the number intended to be subscribed for There is no prescribed restriction on the specific issue price of the RMB Shares under applicable laws and regulations (6) Joint sponsors and lead China International Capital Corporation Limited and underwriters CITIC Securities Company Limited –5–

LETTERFROM THE BOARD Method of underwriting Standby underwriting by the underwriters or other methods as permitted by the relevant regulatory authorities Use of proceeds After deducting issuance expenses, the proceeds from the RMB Share Issue are proposed to be used in the following projects: the development of premium 5G networks, the development of new infrastructure for cloud resources, the development of gigabit broadband and smart home, the development of smart mid-end platform, the research and development of the next-generation information technology and digitalized and intelligent ecosystem Prior to the exercise of the over-allotment option, if the actual funds raised from the RMB Share Issue (after deducting issuance expenses) exceed the amount of the proceeds proposed to be invested into the aforesaid projects, the Company will apply the surplus in the aforesaid specific investment projects or any other uses permitted by applicable laws, regulations and the relevant regulatory authorities upon going through the necessary procedures Any proceeds raised from the issue of RMB Shares as a result of the lead underwriter(s)’ exercise of the over-allotment option will be used in the aforesaid specific investment projects or any other uses permitted by applicable laws, regulations and the relevant regulatory authorities If the actual funds raised from the RMB Share Issue (including the proceeds from the exercise of over-allotment option) are less than the amount of the proceeds proposed to be invested into the aforesaid projects, the Company will make up the shortfall using its own or self-financed funds Prior to receiving the proceeds raised from the RMB Share Issue, the Company may use its own or self-financed funds based on the progress of the aforesaid investment projects. Upon receiving the proceeds, the Company will use such proceeds to reimburse the funds previously invested Distribution of accumulated All Shareholders following the completion of the RMB profits Share Issue will be jointly entitled to the undistributed profits accumulated prior to the RMB Share Issue, pro-rated to their respective shareholding –6–

LETTERFROM THE BOARD (10) Place of listing of RMB The Main Board of the Shanghai Stock Exchange Shares (11) Valid period of the The Specific Mandate for the RMB Share Issue shall be resolutions valid for 12 months from the date of approval at the EGM The RMB Share Issue is conditional upon: the Specific Mandate having been granted by the Shareholders to the Board at the EGM; and approvals having been obtained from the relevant regulatory authorities for the RMB Share Issue. Details about the RMB Shares are as follows, which are based on the laws, rules and regulations in the PRC as at the Latest Practicable Date and subject to any subsequent changes in those laws, rules and regulations and other requirements of PRC regulators in respect of the RMB Share Issue: Same class: The RMB Shares will be ordinary Shares (with no par value) ranking pari passu with the Hong Kong Shares and having the same rights to voting, dividend and return of assets. The RMB Shares and the Hong Kong Shares are of the same class. Registers of members: The RMB Shares will be registered on a separate share register of the Company in the mainland of China (the “Domestic Register”). The RMB Shares will not be registered on the existing share register of the Company in Hong Kong (the “Hong Kong Register”). The Hong Kong Shares will continue to be registered on the Hong Kong Register. The Company will issue share certificate(s) in compliance with the Companies Ordinance in respect of the RMB Shares to CSDC or other person(s) as permitted by PRC laws and regulations. For completeness, Hong Kong Registrars Limited will continue to serve as the share registrar for the Hong Kong Shares. The Hong Kong Register will continue to be kept in Hong Kong and will not include the details of the RMB Shares. Due to the current restrictions under laws, rules and regulations in the PRC, no movement of Ordinary Shares will be allowed between the Hong Kong Register and the Domestic Register. Share depositories: The RMB Shares will be deposited with CSDC. For completeness, the Hong Kong Securities Clearing Company Limited (or its nominee or appointee) will continue to serve as the depository of the Hong Kong Shares. –7–

LETTERFROM THE BOARD (4) RMB Shares cannot be moved outside of the PRC or to the Hong Kong Register: The RMB Shares are subscribed and traded in RMB, issued to investors in the mainland of China solely for trading on the Shanghai Stock Exchange. The RMB Shares will not be able to be moved outside of the PRC for trading in Hong Kong or to the Hong Kong Register. (5) Non-fungibility between the RMB Shares and the Hong Kong Shares: The RMB Shares and the Hong Kong Shares will not be fungible. (6) Dividends: After the RMB Share Issue, the Company’s profits distribution plan will be approved by holders of RMB Shares and Hong Kong Shares voting together on a general meeting of the Company. The Company expects that declared cash dividends to be distributed to the holders of RMB Shares will be paid in RMB. (7) Compliance with relevant regulatory requirements: After the listing of RMB Shares on the Shanghai Stock Exchange, subject to the Articles of Association and exemptions from relevant regulatory authorities, the Company will need to comply with laws, rules and regulations in the PRC including but not limited to the Securities Law of the People’s Republic of China (Order No. 37 of the President of the People’s Republic of China) (《中華人民共和國證券法》(中華人民共和國主席令第37號)), the Notice of the General Office of the State Council on Forwarding the Several Opinions of the CSRC on Launching the Pilot Program of Innovative Enterprises Domestically Issuing Stocks or Depository Receipts (The General Office of the State Council [2018] No.21) (《國務院辦公廳轉發證監 會關於開展創新企業境內發行股票或存託憑證試點若干意見的通知》(國辦發 [2018]21 號)), Measures for the Continuous Supervision of the Innovative Enterprises That Have Domestically Listed and Issued Stocks or Depository Receipts (Trial Implementation) (CSRC Announcement [2018] No.19) (《創新企業境內發行股票或存託憑證上市後持續監 管實施辦法(試行)》(中國證監會公告[2018]19號)) and the Rules Governing the Listing of Stocks on the Shanghai Stock Exchange (Shanghai Stock Exchange [2020] No. 100) (《上海證券交易所股票上市規則》(上證發 [2020]100 號)). The Company’s PRC legal adviser and Hong Kong legal adviser are of the view that the RMB Share Issue does not contravene relevant applicable laws and regulations of the PRC and Hong Kong, respectively. 2. Other Resolutions related to the RMB Share Issue (i) Resolution on the Authorisation to be Granted at the EGM to the Board to Deal with Matters Relating to the RMB Share Issue An ordinary resolution will be proposed at the EGM to approve the authorisation to the Board to deal with matters relating to the RMB Share Issue. –8–

LETTERFROM THE BOARD To facilitate the matters in relation to the RMB Share Issue of the Company, it is proposed that approval will be sought from the Shareholders at the EGM to authorise the Board to, and the Board to delegate powers to the Chairman, the Chief Executive Officer and the Chief Financial Officer and their authorised persons to (individually or collectively) determine and deal with matters relating to the RMB Share Issue, subject to the approval of the RMB Share Issue by the Shareholders having been obtained at the EGM. The specific scope of authorisation includes without limitation: (1) In accordance with the relevant laws and regulations as well as views of the regulatory authorities, and taking into account market conditions, to modify, enhance and execute specific implementation of the plan of the RMB Share Issue, including without limitation: (a) to determine on specific matters including the issue size, method of pricing, the offer price (including the offer price range and the final offer price), time of issuance, method of issuance, method of underwriting, target subscribers, specific implementation plan of the over-allotment option, strategic placing plan (including the proportion and target investors of the placing) and other matters relevant to the implementation of the plan of the RMB Share Issue; (b) to determine and adjust the plan on specific investment and utilisation of proceeds (including proceeds from the exercise of the over-allotment option where the over-allotment option is exercised) within the scope of use of proceeds as approved by the Shareholders at the EGM; (c) to analyse, consider and substantiate the impacts of the RMB Share Issue on matters including the Company’s immediate financial indicators and the Shareholders’ immediate return in accordance with the requirements under relevant laws and regulations and of the relevant regulatory authorities, revise, enhance and implement relevant measures and policies, and exercise full powers in handling other relevant matters; (d) to sign, execute, modify and complete all applications, reports or materials related to the RMB Share Issue to be submitted to the relevant domestic and overseas government agencies, regulatory authorities and other institutions that are involved in the RMB Share Issue; deal with relevant procedures including approvals, registration, filing, ratification and consents; issue statements and undertakings relevant to the RMB Share Issue and take all actions and deal with all matters as necessary, proper or appropriate to the RMB Share Issue; (e) to draft, modify, sign, submit, publish, disclose, execute, suspend and terminate any agreements, contracts, announcements, circulars or other documents related to the RMB Share Issue, including but not limited to letters of intent, the prospectus, sponsorship and underwriting agreements, listing agreements and service contracts with intermediaries; determine on the selection and establishment of the designated accounts for proceeds of the RMB Share Issue and other related matters; engage sponsors, underwriters, law firms, accounting firms, receiving banks and other intermediaries involved in the RMB Share Issue; and determine and pay the fees related to the RMB Share Issue. –9–

LETTERFROM THE BOARD (2) To adjust and modify the Articles of Association, policies governing the procedures of meetings, and other corporate governance documents, relevant measures and undertakings as well as other application documents (including without limitation adjustments and modifications to expressions, sections, provisions and conditions of effect therein) that are amended or formulated for the purpose of the RMB Share Issue and have been considered and approved at the relevant Board meeting and the EGM, in accordance with the changes in the relevant laws, regulations and policies, the requirements and suggestions from the relevant domestic and overseas government agencies and regulatory authorities, and the actual circumstances of the RMB Share Issue. (3) To deal with matters in relation to the listing of RMB Shares issued pursuant to the RMB Share Issue on the Shanghai Stock Exchange. (4) To adjust the specific plan of the RMB Share Issue and other relevant matters (including suspension and termination of the implementation of the listing plan) in cases of changes in the laws and regulations, or changes in regulatory policies related to the RMB Share Issue, or changes in the market conditions, save for such matters that are required to be submitted to and voted by Shareholders at a general meeting pursuant to the laws, regulations and the Articles of Association. (5) To deal with share registration, settlement and other related procedures in accordance with the actual circumstances of the RMB Share Issue. (6) To authorise the Board to delegate powers to the Chairman, the Chief Executive Officer and the Chief Financial Officer and their authorised persons (individually or collectively) to decide on and deal with matters related to the RMB Share Issue, and the authorised persons to further delegate powers to other relevant persons (individually or collectively) to deal with matters related to the RMB Share Issue. (7) To deal with other matters that are considered necessary, proper or appropriate to the RMB Share Issue by the Board, provided that such matters are not in contravention of applicable domestic and overseas laws and regulations. The authorisation shall be valid for 12 months from the date of approval at the EGM. (ii) Resolution on the Plan for Distribution of Profits Accumulated prior to the RMB Share Issue An ordinary resolution will be proposed at the EGM to approve the following plan for distribution of profits accumulated before the RMB Share Issue. Considering the Company’s actual operating conditions and needs for future development, a plan for distribution of profits accumulated prior to the RMB Share Issue is proposed to be approved by the Shareholders. Prior to the completion of the RMB Share Issue, the Company will distribute profits in accordance with the Articles of Association and relevant internal governance rules; following the completion of the RMB Share Issue, all Shareholders will be jointly entitled to the undistributed profits of the Company accumulated prior to the RMB Share Issue, pro-rated to their respective shareholding. –10–

LETTERFROM THE BOARD (iii) Resolution on the Plan for Stabilisation of the Price of RMB Shares within Three Years following the RMB Share Issue An ordinary resolution will be proposed at the EGM to approve the plan for stabilisation of the price of the RMB Shares within the three years after the RMB Share Issue. To better protect the rights and interests of the minority Shareholders, a plan for stabilisation of the price of RMB Shares within three years following the RMB Share Issue and Listing is proposed to be approved by the Shareholders, in accordance with the requirements under the Securities Law of the People’s Republic of China (Order No. 37 of the President of the People’s Republic of China)《中華人 (民共和國證券法》 (中華人民共和國主席令第37號)), the Opinions of the CSRC on Further Promoting theReformofNewShareOfferingScheme(CSRCAnnouncement[2013]No.42)(《中國證監會關於進一步推進新股發行體制改革的意見》 (中國證監會公告[2013]42號)) and other applicable laws and regulations. Such plan for stabilisation will, upon approval by the Shareholders at the EGM, be effective from the date of listing of RMB Shares on the Shanghai Stock Exchange, and remain valid within three years thereafter. The relevant details are set forth in Appendix I to this circular. (iv) Resolution on the Shareholder Return Plan within ThreeYears following the RMB Share Issue An ordinary resolution will be proposed at the EGM to approve the shareholder return plan for the three years after the RMB Share Issue. To fully protect the rights and interests of the Shareholders, to provide a sustainable, stable and reasonable investment return to the Shareholders, to further improve the profits distribution mechanism, and to enable Shareholders to supervise the Company’s profits distribution, a shareholder return plan within three years following the RMB Share Issue and Listing is proposed to be approved by the Shareholders, in accordance with the Notice on Further Implementation of Matters Relevant to the Cash Dividend Distribution of Listed Companies (CSRC Issue [2012] No. 37)《關於進一步落實上市公司現 (金分紅有關事項的通知》 (證監發[2012]37號)), the Guidelines No. 3 on the Supervision and Administration of Listed Companies – Cash Dividend Distribution of Listed Companies (CSRC Announcement [2013] No.43)《上市公司監管指引第 ( 3號 —上市公司現金分紅》 (中國證監會公告 [2013]43號)) and other relevant laws and regulations as well as the provisions under the Articles of Association, after taking into full account the Company’s actual operation conditions and the needs for future development. Such shareholder return plan will, upon approval by the Shareholders at the EGM, be effectivefromthedateoflistingofRMBSharesontheShanghaiStockExchange.Therelevantdetailsare set forth in Appendix II to this circular. (v) Resolution on the Use of Proceeds from the RMB Share Issue An ordinary resolution will be proposed at the EGM to approve the use of the proceeds to be raised from the RMB Share Issue. –11–

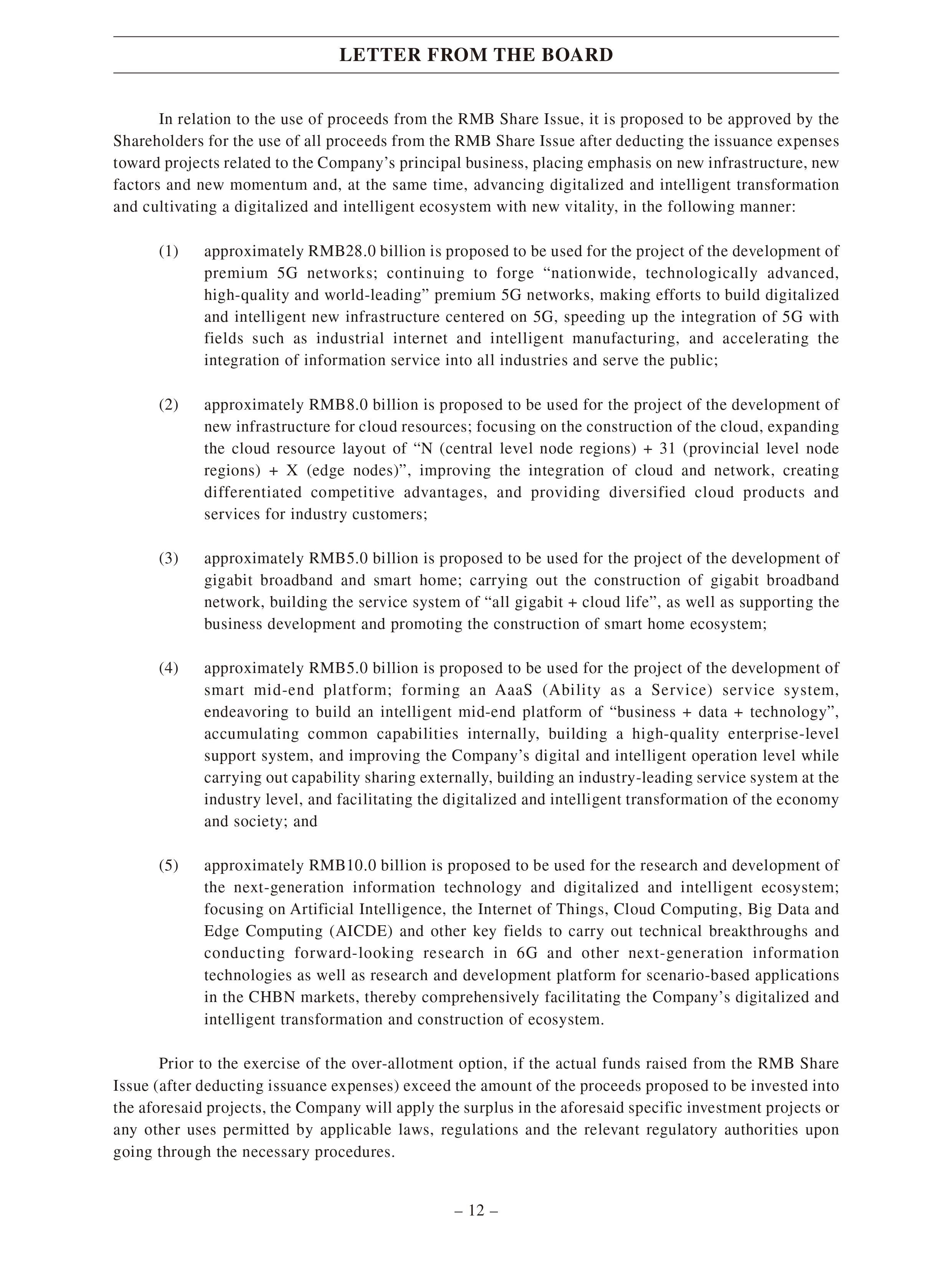

LETTERFROM THE BOARD In relation to the use of proceeds from the RMB Share Issue, it is proposed to be approved by the Shareholders for the use of all proceeds from the RMB Share Issue after deducting the issuance expenses toward projects related to the Company’s principal business, placing emphasis on new infrastructure, new factors and new momentum and, at the same time, advancing digitalized and intelligent transformation and cultivating a digitalized and intelligent ecosystem with new vitality, in the following manner: (1) approximately RMB28.0 billion is proposed to be used for the project of the development of premium 5G networks; continuing to forge “nationwide, technologically advanced, high-quality and world-leading” premium 5G networks, making efforts to build digitalized and intelligent new infrastructure centered on 5G, speeding up the integration of 5G with fields such as industrial internet and intelligent manufacturing, and accelerating the integration of information service into all industries and serve the public; (2) approximately RMB8.0 billion is proposed to be used for the project of the development of new infrastructure for cloud resources; focusing on the construction of the cloud, expanding the cloud resource layout of “N (central level node regions) + 31 (provincial level node regions) + X (edge nodes)”, improving the integration of cloud and network, creating differentiated competitive advantages, and providing diversified cloud products and services for industry customers; (3) approximately RMB5.0 billion is proposed to be used for the project of the development of gigabit broadband and smart home; carrying out the construction of gigabit broadband network, building the service system of “all gigabit + cloud life”, as well as supporting the business development and promoting the construction of smart home ecosystem; (4) approximately RMB5.0 billion is proposed to be used for the project of the development of smart mid-end platform; forming an AaaS (Ability as a Service) service system, endeavoring to build an intelligent mid-end platform of “business + data + technology”, accumulating common capabilities internally, building a high-quality enterprise-level support system, and improving the Company’s digital and intelligent operation level while carrying out capability sharing externally, building an industry-leading service system at the industry level, and facilitating the digitalized and intelligent transformation of the economy and society; and (5) approximately RMB10.0 billion is proposed to be used for the research and development of the next-generation information technology and digitalized and intelligent ecosystem; focusing on Artificial Intelligence, the Internet of Things, Cloud Computing, Big Data and Edge Computing (AICDE) and other key fields to carry out technical breakthroughs and conducting forward-looking research in 6G and other next-generation information technologies as well as research and development platform for scenario-based applications in the CHBN markets, thereby comprehensively facilitating the Company’s digitalized and intelligent transformation and construction of ecosystem. Prior to the exercise of the over-allotment option, if the actual funds raised from the RMB Share Issue (after deducting issuance expenses) exceed the amount of the proceeds proposed to be invested into the aforesaid projects, the Company will apply the surplus in the aforesaid specific investment projects or any other uses permitted by applicable laws, regulations and the relevant regulatory authorities upon going through the necessary procedures. –12–

LETTERFROM THE BOARD Any proceeds raised from the issue of RMB Shares as a result of the underwriter(s)’ exercise of the over-allotment option will be used in the aforesaid specific investment projects or any other uses permitted by applicable laws, regulations and the relevant regulatory authorities. If the actual funds raised from the RMB Share Issue (including the proceeds from the exercise of over-allotment option) are less than the amount of the proceeds proposed to be invested into the aforesaid projects, the Company will make up the shortfall using its own or self-financed funds. Prior to receiving the proceeds raised from the RMB Share Issue, the Company may use its own or self-financed funds based on the progress of the aforesaid investment projects. Upon receiving the proceeds, the Company will use such proceeds to reimburse the funds previously invested. (vi) ResolutionontheRemedialMeasuresforthePotentialDilutionofImmediateReturnsResulting from the RMB Share Issue An ordinary resolution will be proposed at the EGM to approve the remedial measures for the potential dilution of immediate returns resulting from the RMB Share Issue. To safeguard the interests of minority investors, the Company’s formulation of specific remedial measures for the potential dilution of immediate returns resulting from the RMB Share Issue is proposed to be approved by the Shareholders, in accordance with the Opinions of the General Office of the State Council on Further Strengthening the Protection of the Legitimate Rights and Interests of Minority Investors in the Capital Markets (The General Office of the State Council [2013] No.110)《國務院辦公 ( 廳關於進一步加強資本市場中小投資者合法權益保護工作的意見》 (國辦發 [2013]110號)), the Administrative Measures of Initial Public Offering and Listing of Stocks (CSRC Order No. 173)《首次 (公開發行股票並上市管理辦法》 (中國證監會令第173號)), and the Guiding Opinions on Matters concerning the Dilution of Immediate Return in Initial Public Offering, Refinancing and Material Asset Restructuring (CSRC Announcement [2015] No. 31)《關於首發及再融資、重大資產重組攤薄即期回 (報有關事項的指導意見》 (中國證監會公告[2015]31號)) and other relevant laws and regulations. The relevant details are set forth in Appendix III to this circular. (vii) ResolutiononUndertakingsandCorrespondingBindingMeasuresinConnectionwiththeRMB Share Issue An ordinary resolution will be proposed at the EGM to approve the Company’s undertakings and corresponding binding measures in connection with the RMB Share Issue. Pursuant to the requirements under the Opinions of the CSRC on Further Promoting the Reform of New Share Offering Scheme (CSRC Announcement [2013] No. 42)《中國證監會關於進一步推進新股 (發行體制改革的意見》 (中國證監會公告[2013]42號)) and other relevant laws and regulations in relation to the public undertakings that are required to be given by issuers in the public offering and listing documents, taking into account the Company’s actual circumstances, it is proposed to be approved by the Shareholders for the Company to provide certain undertakings with respect to the RMB Share Issue and Listing and take corresponding binding measures. The undertakings include, among others, the undertaking in relation to the truthfulness, accuracy and completeness of the contents contained in the listing application documents, the undertaking in relation to no misrepresentation, misleading statement or material omission in the prospectus, the undertaking in relation to stabilisation of the price of RMB Shares, the arrangement and undertaking in relation to dividend distribution policy, the undertaking in –13–

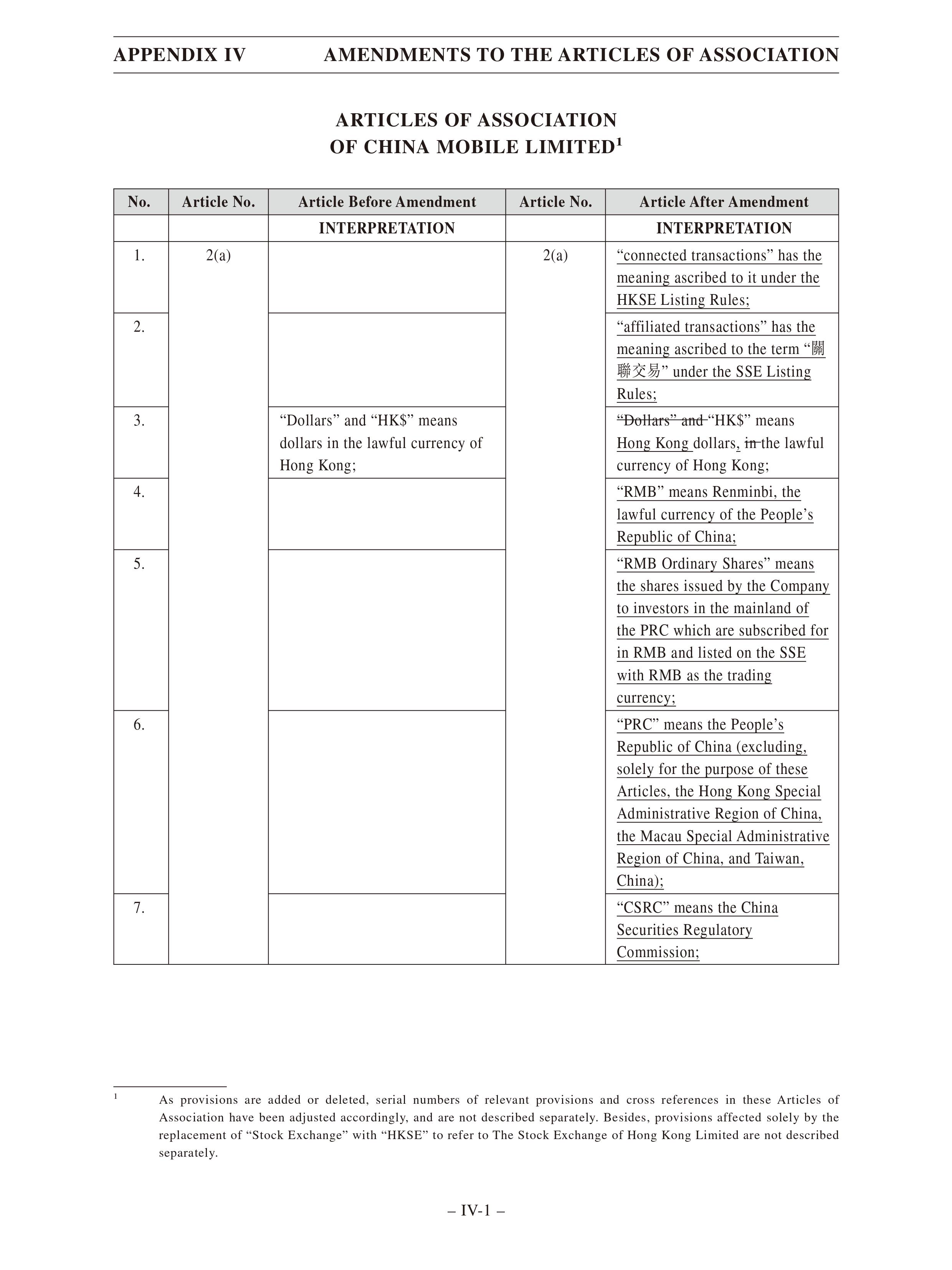

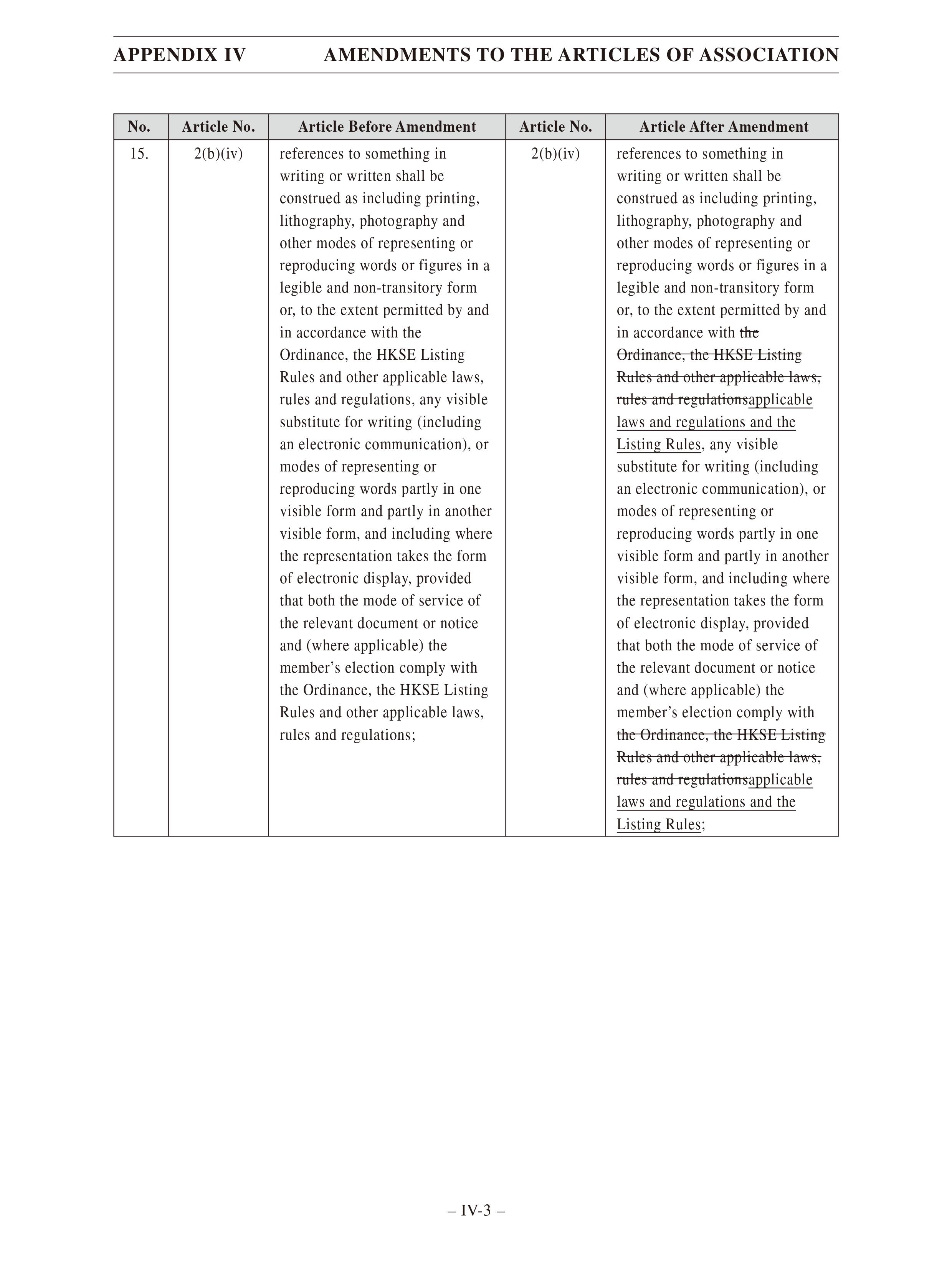

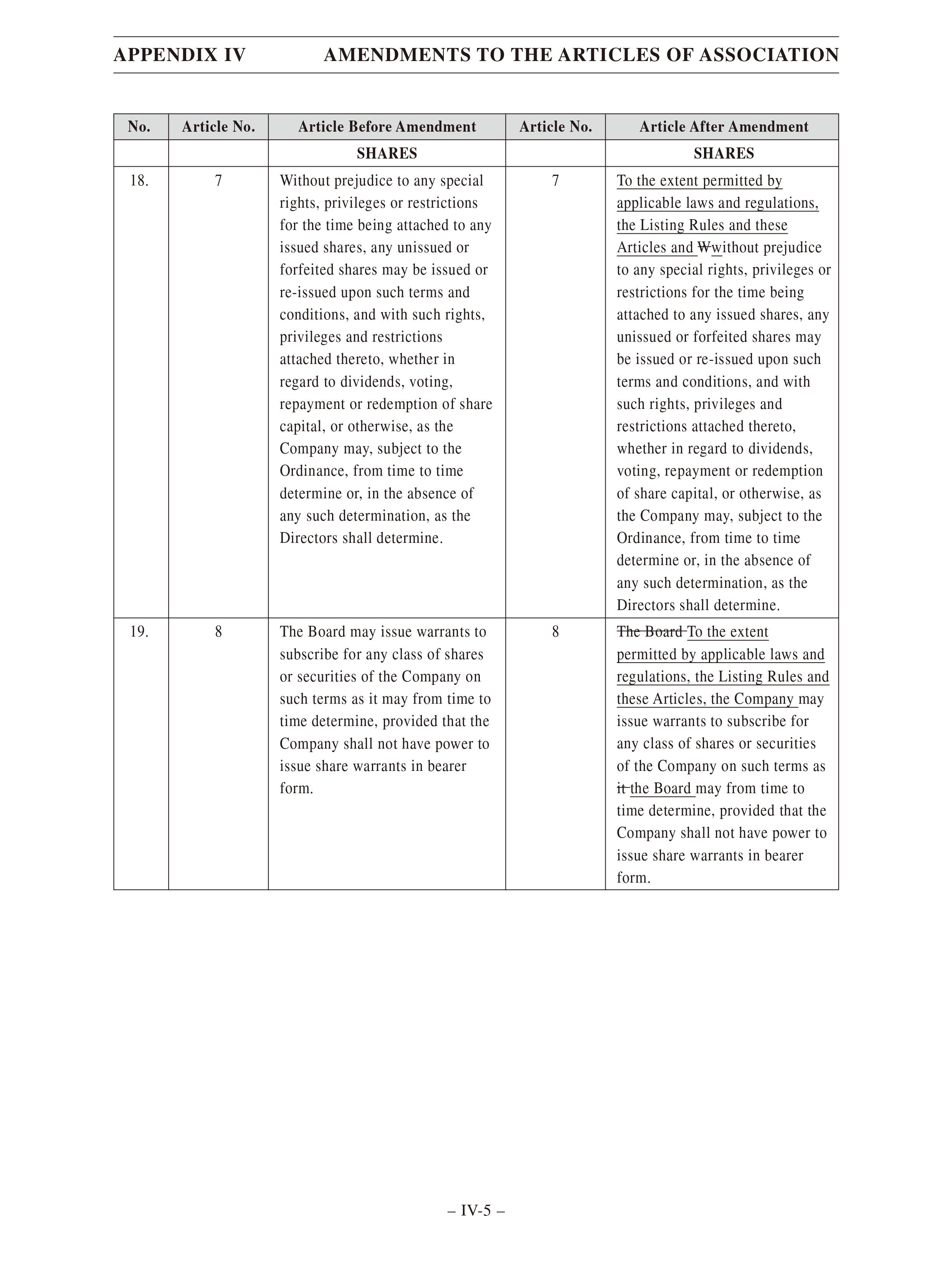

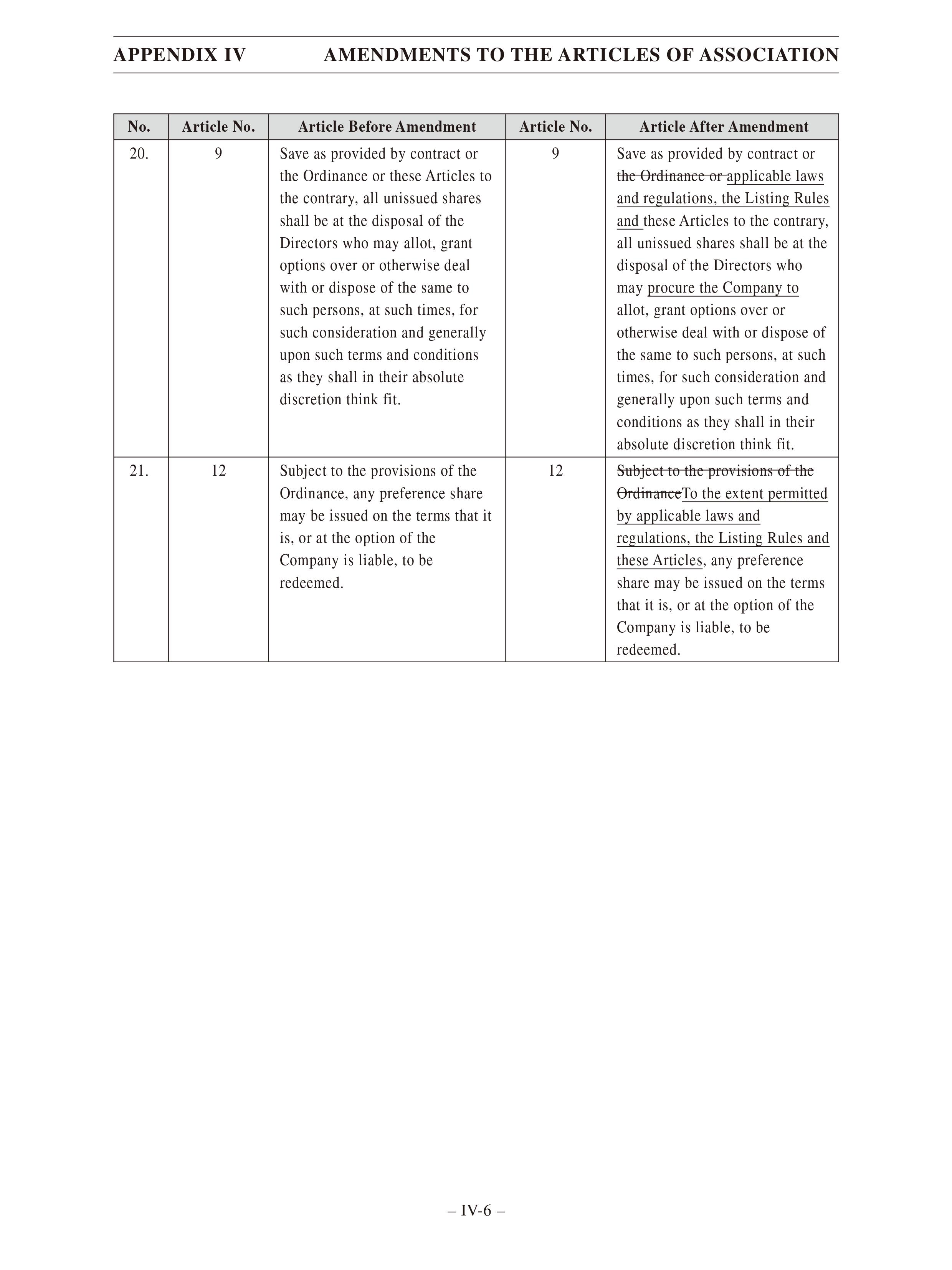

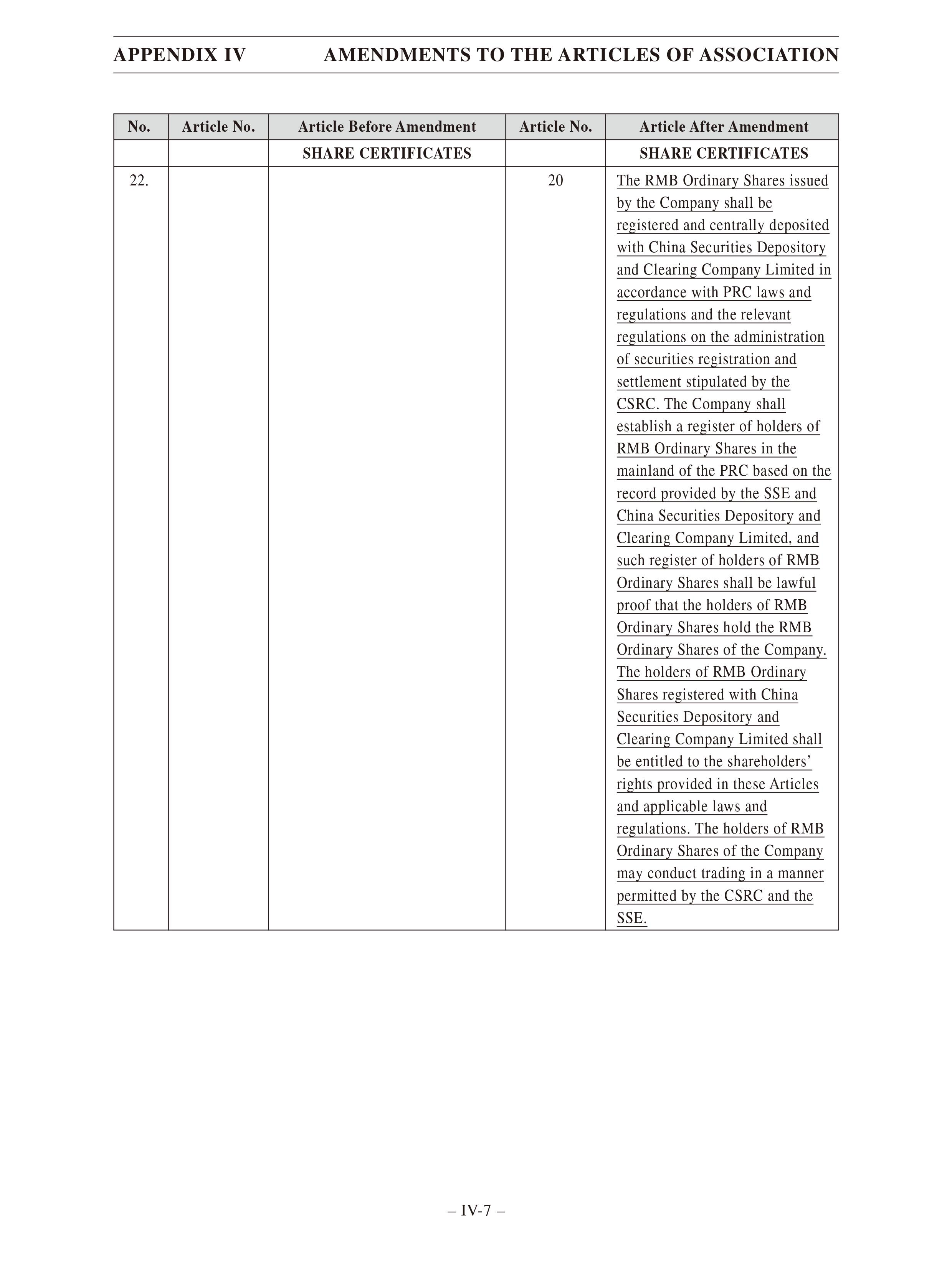

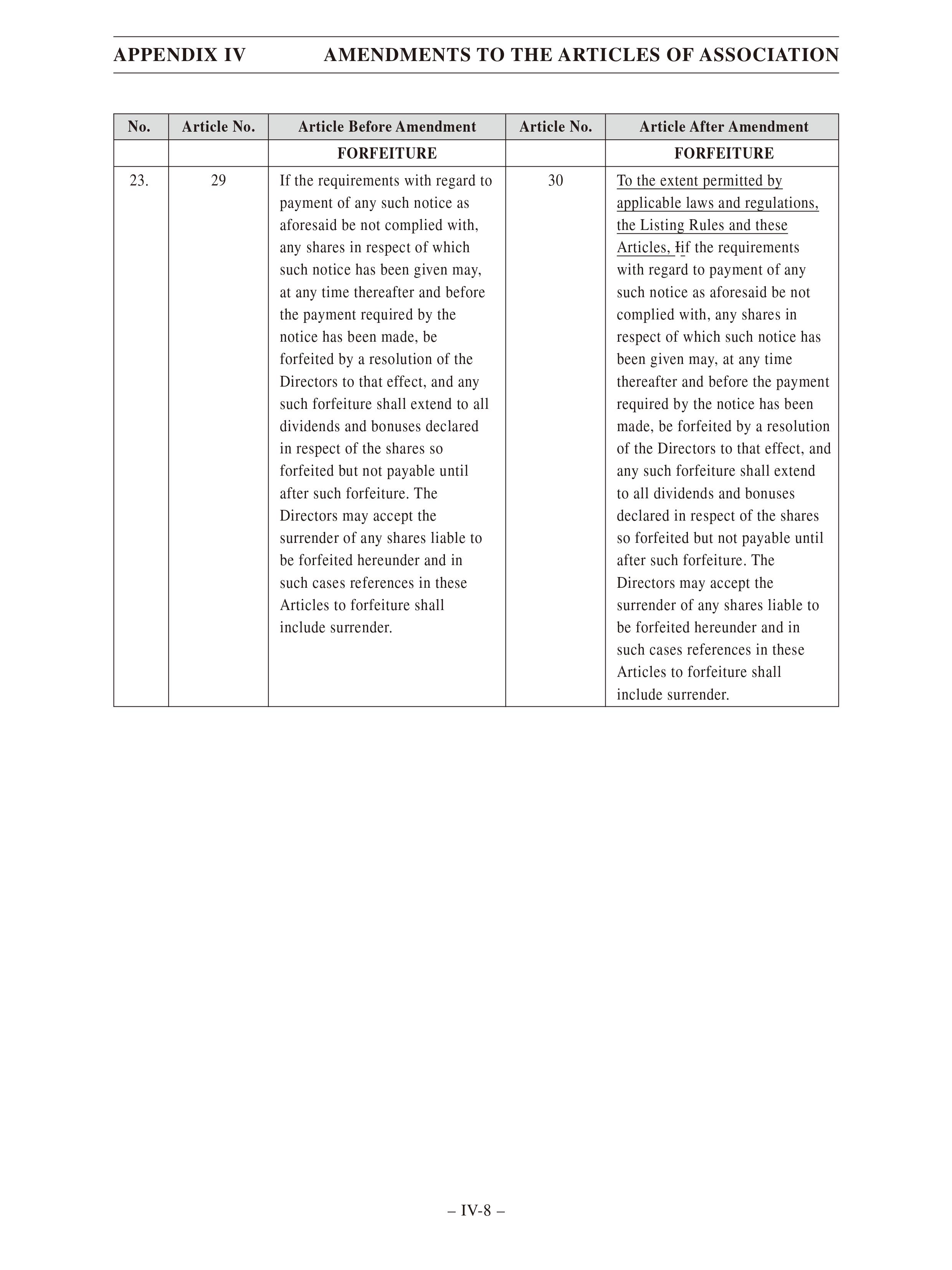

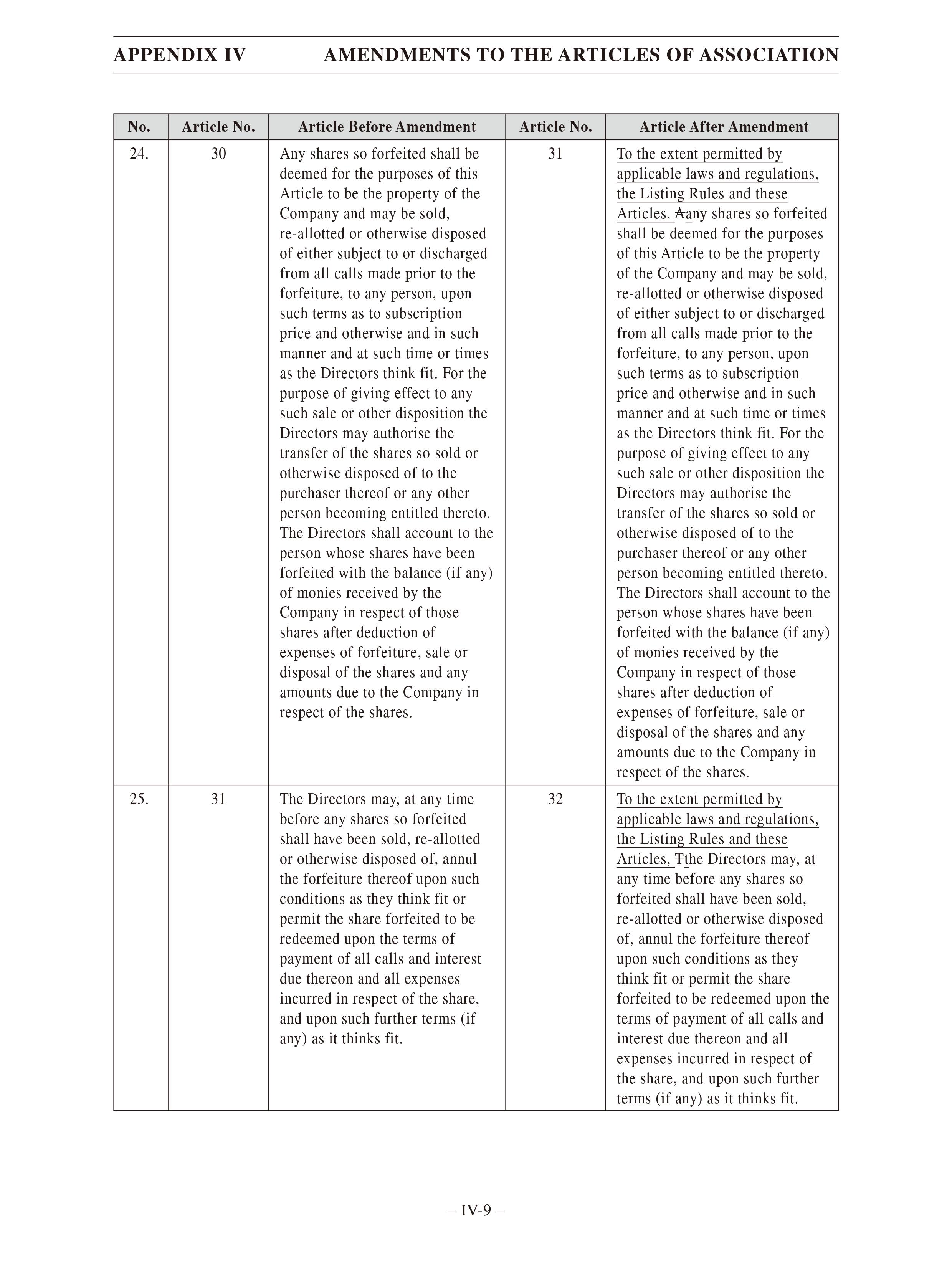

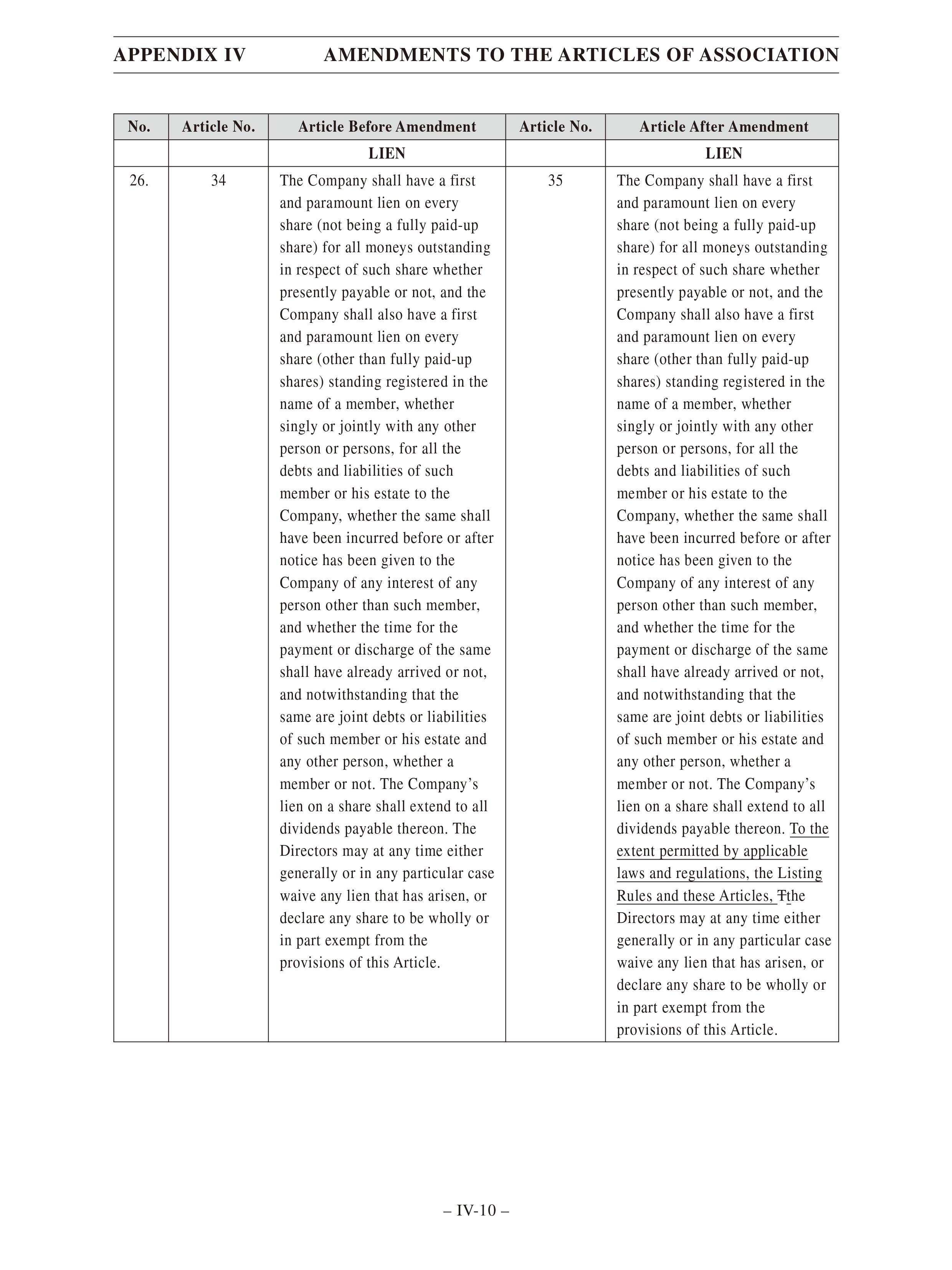

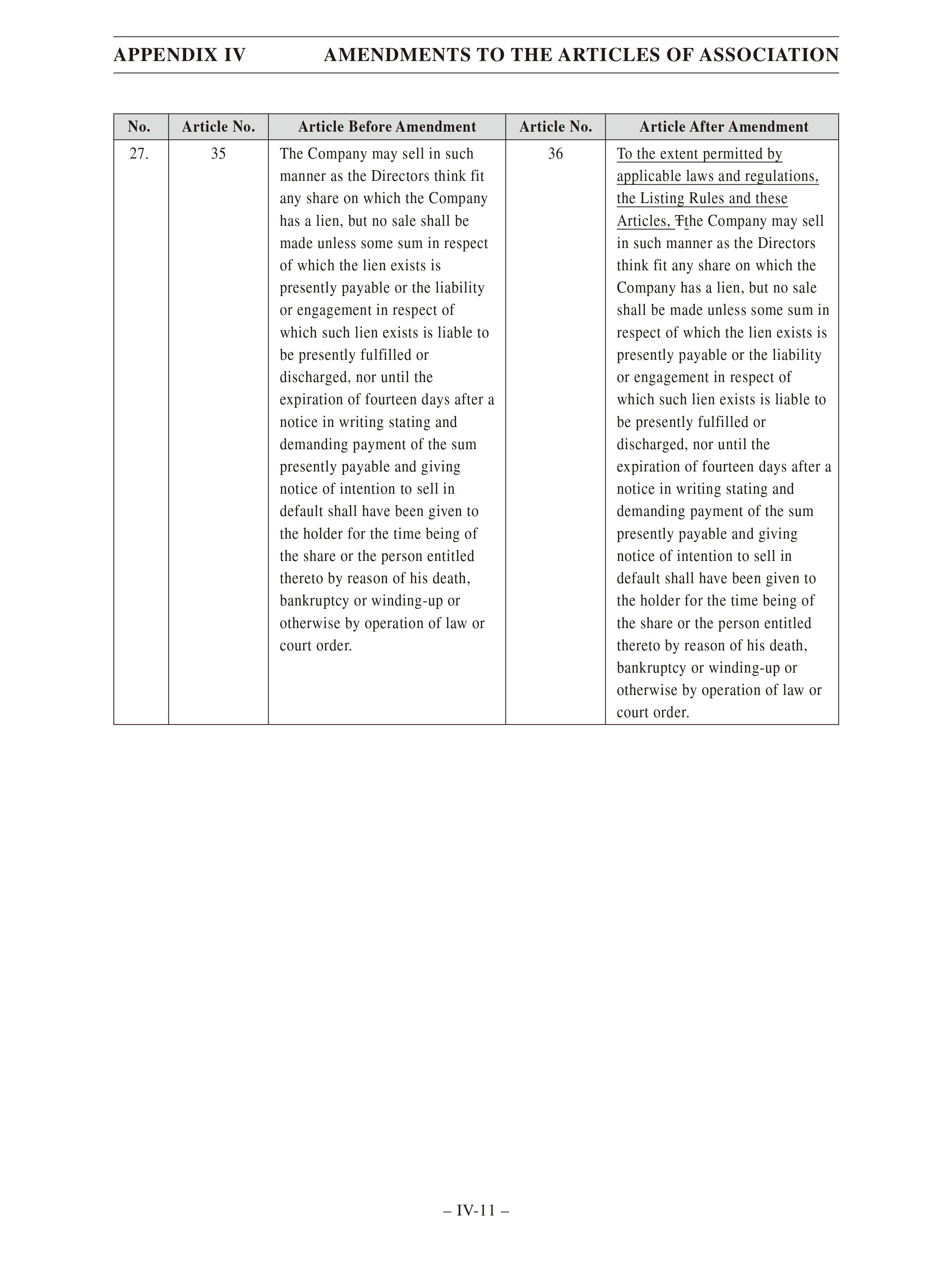

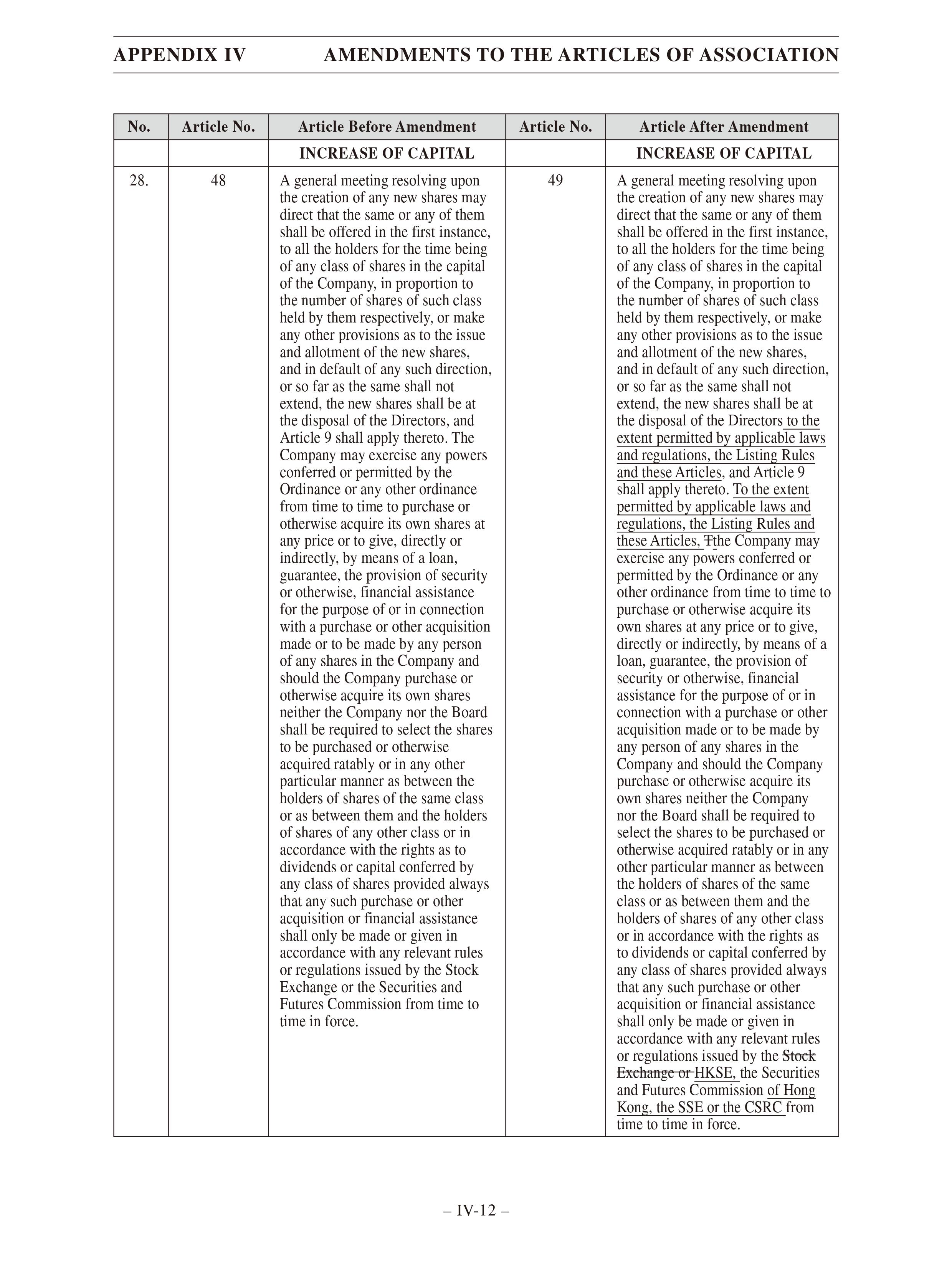

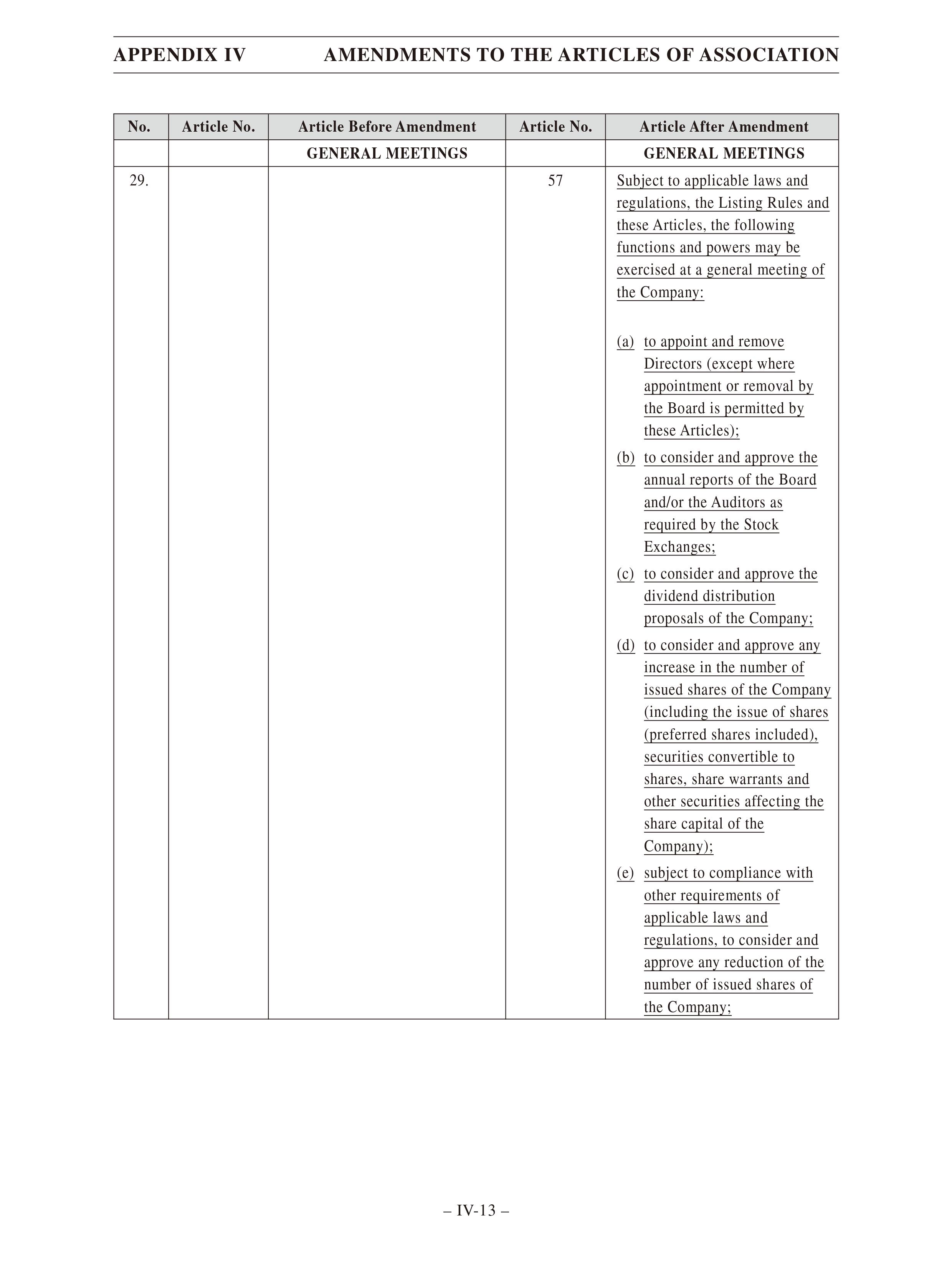

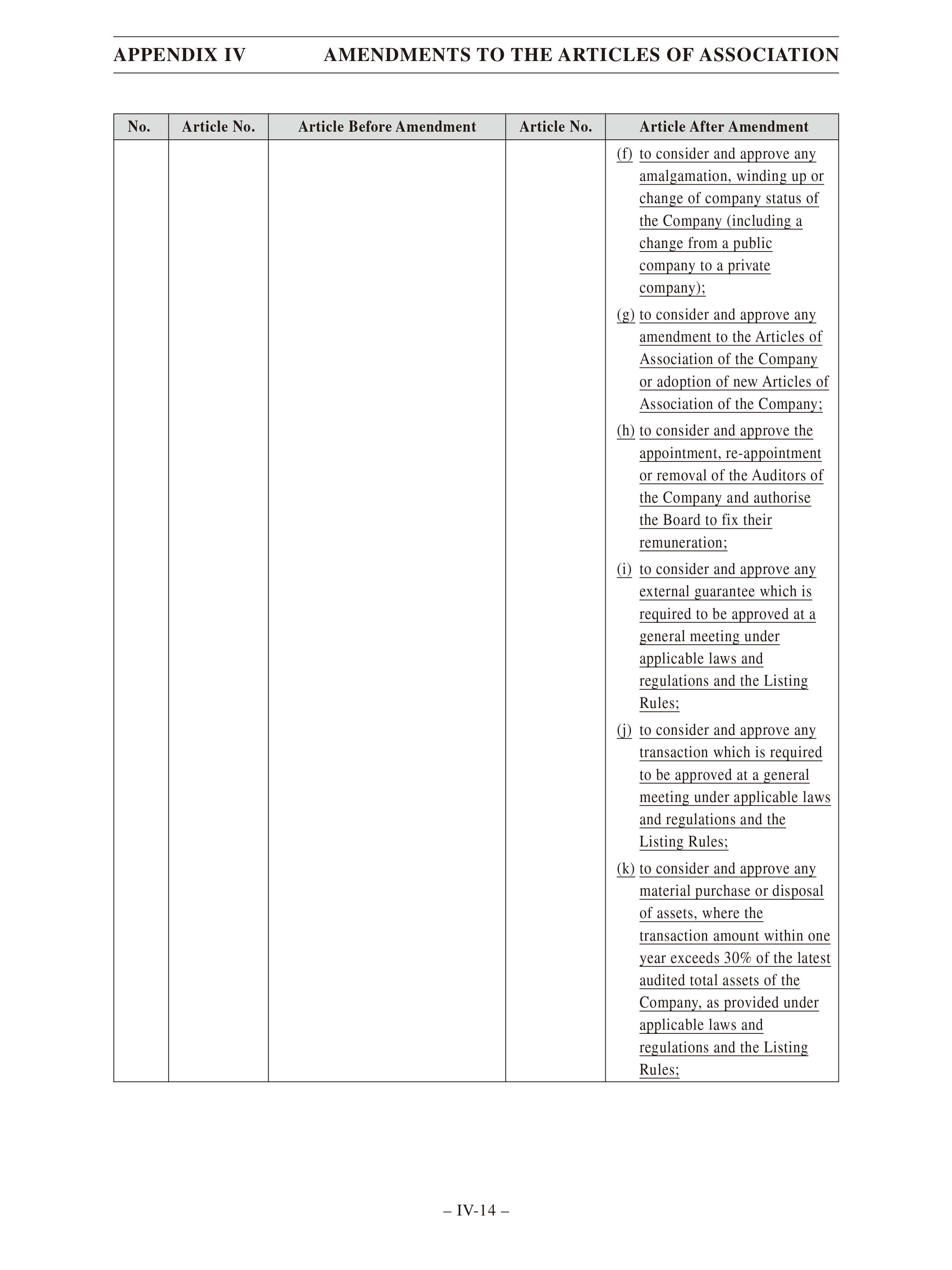

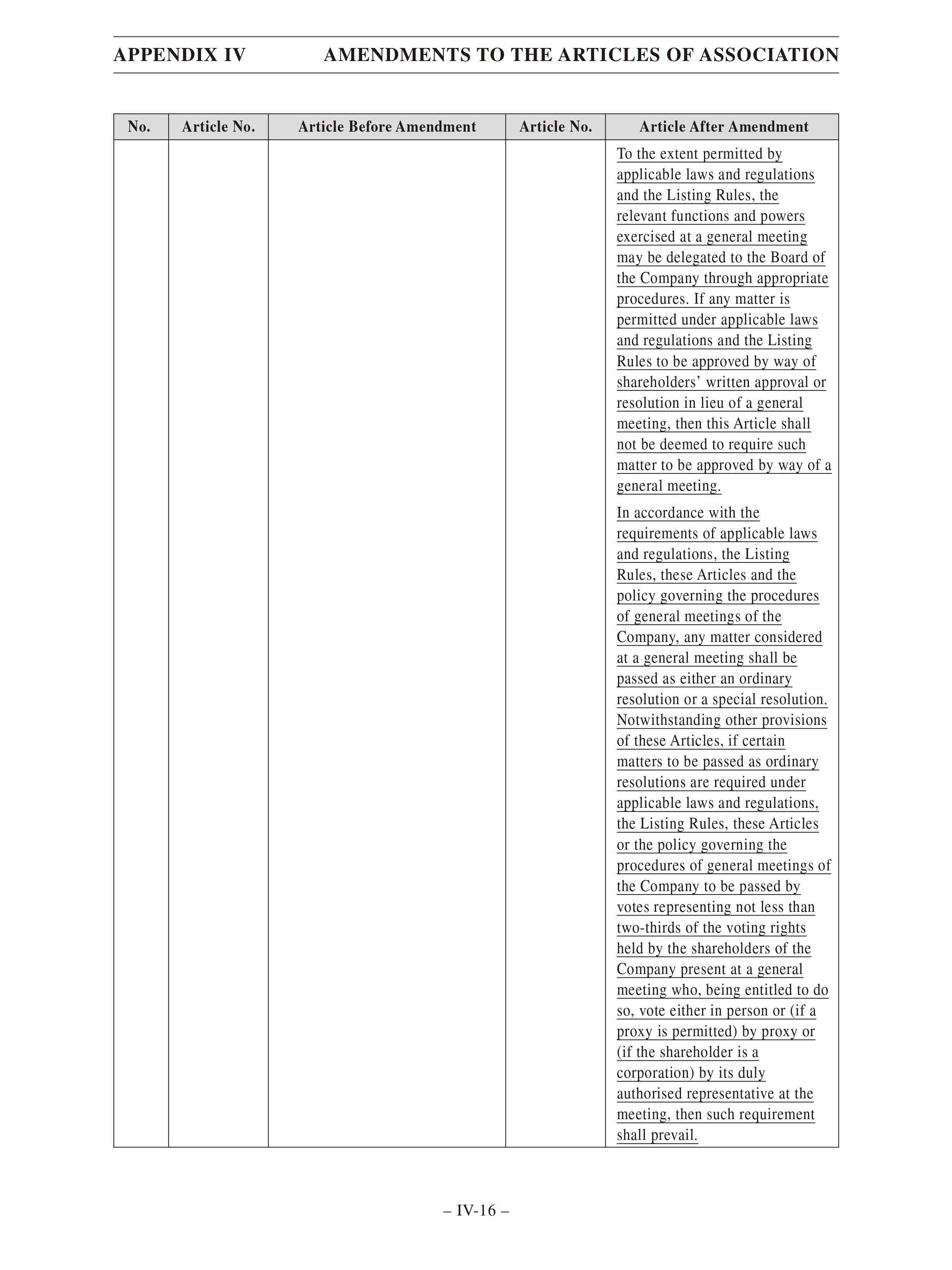

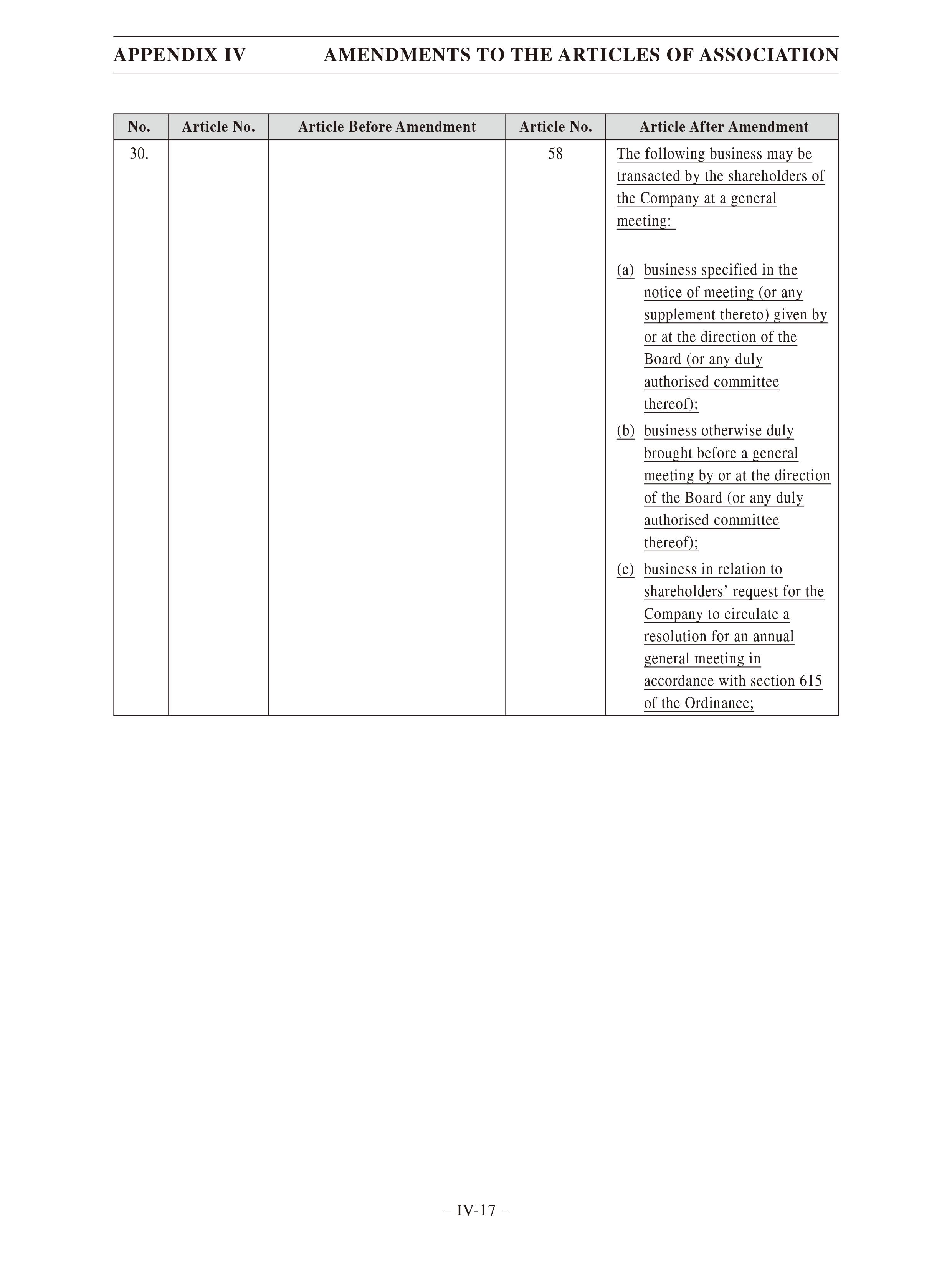

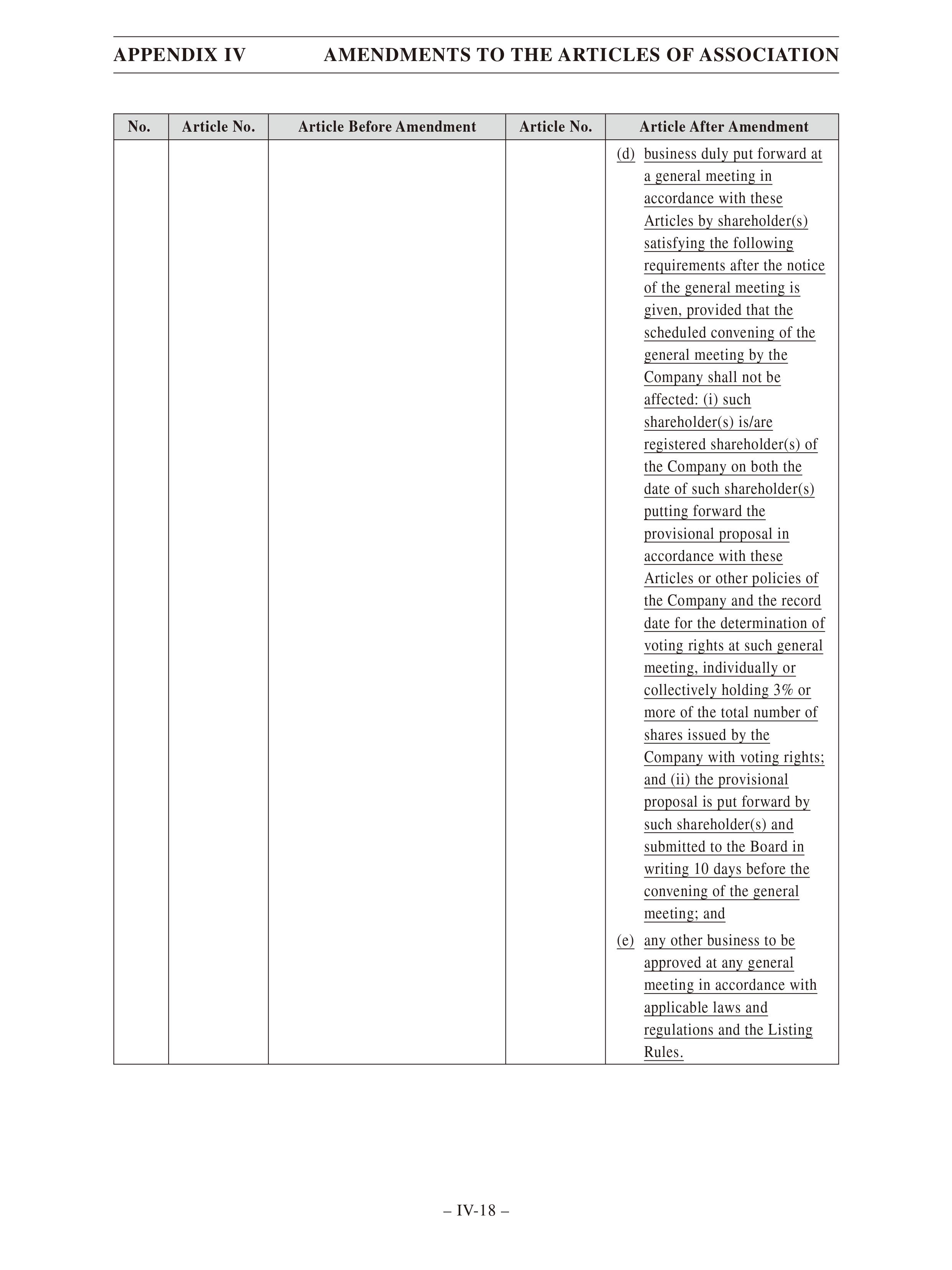

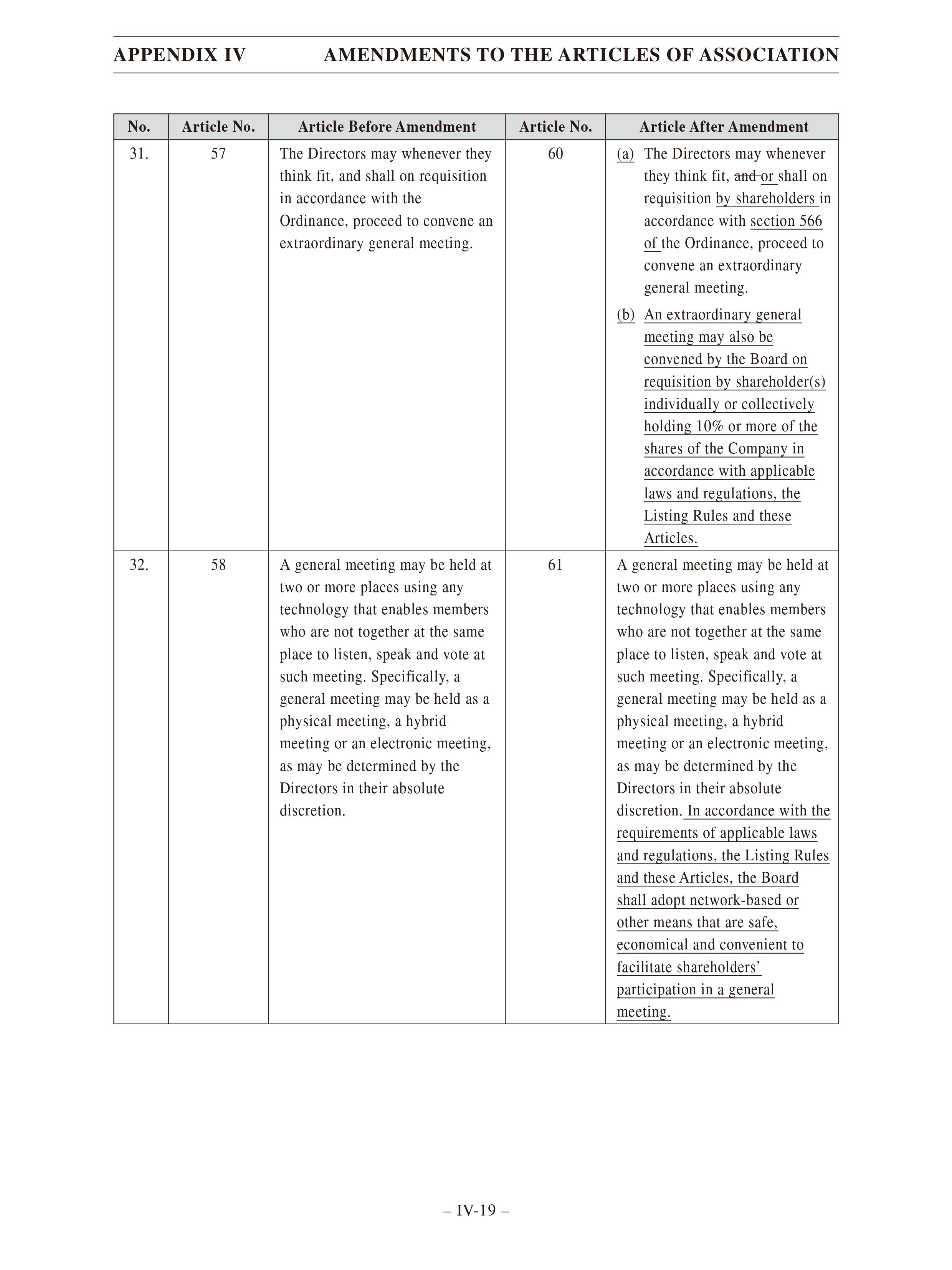

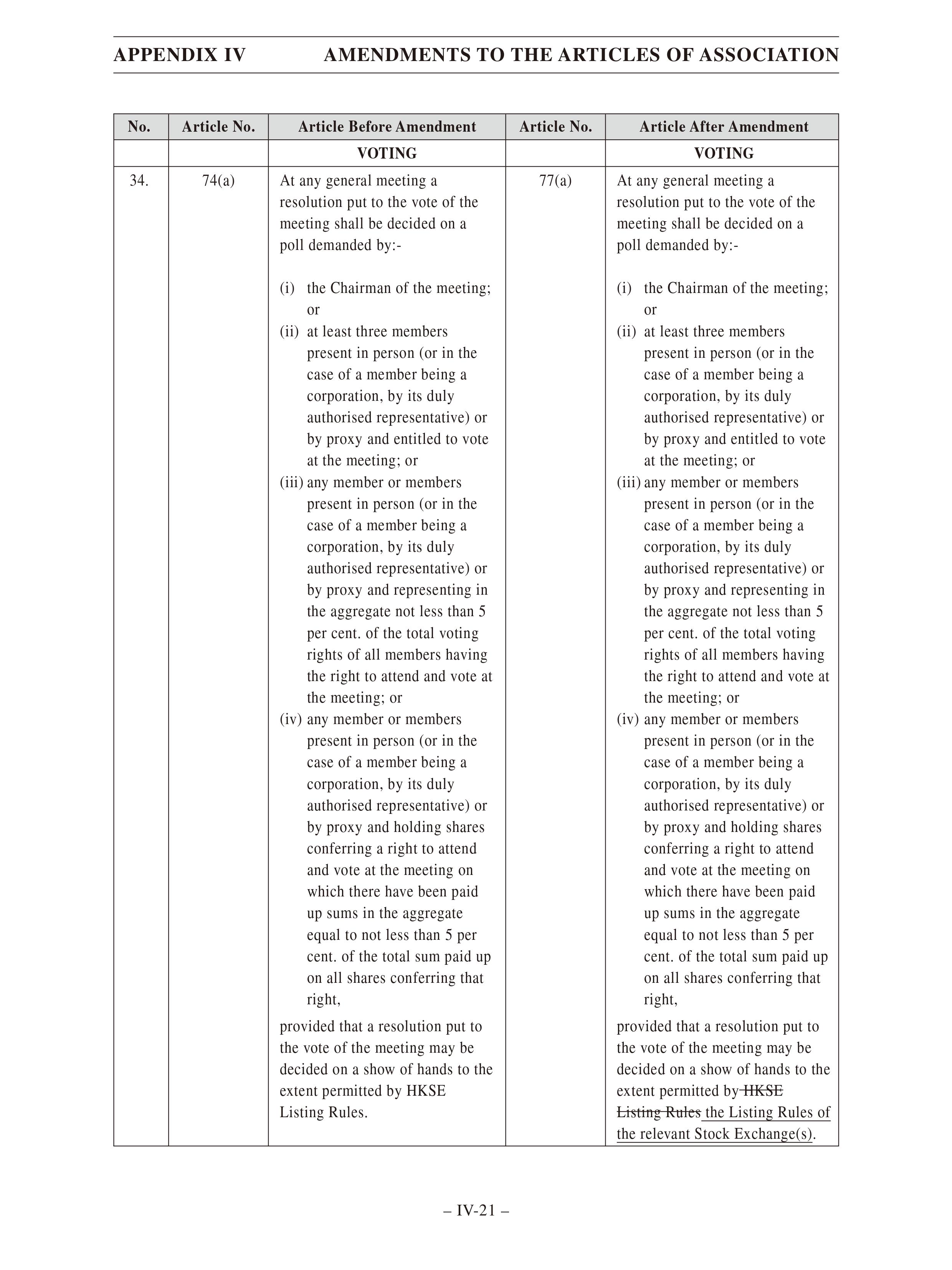

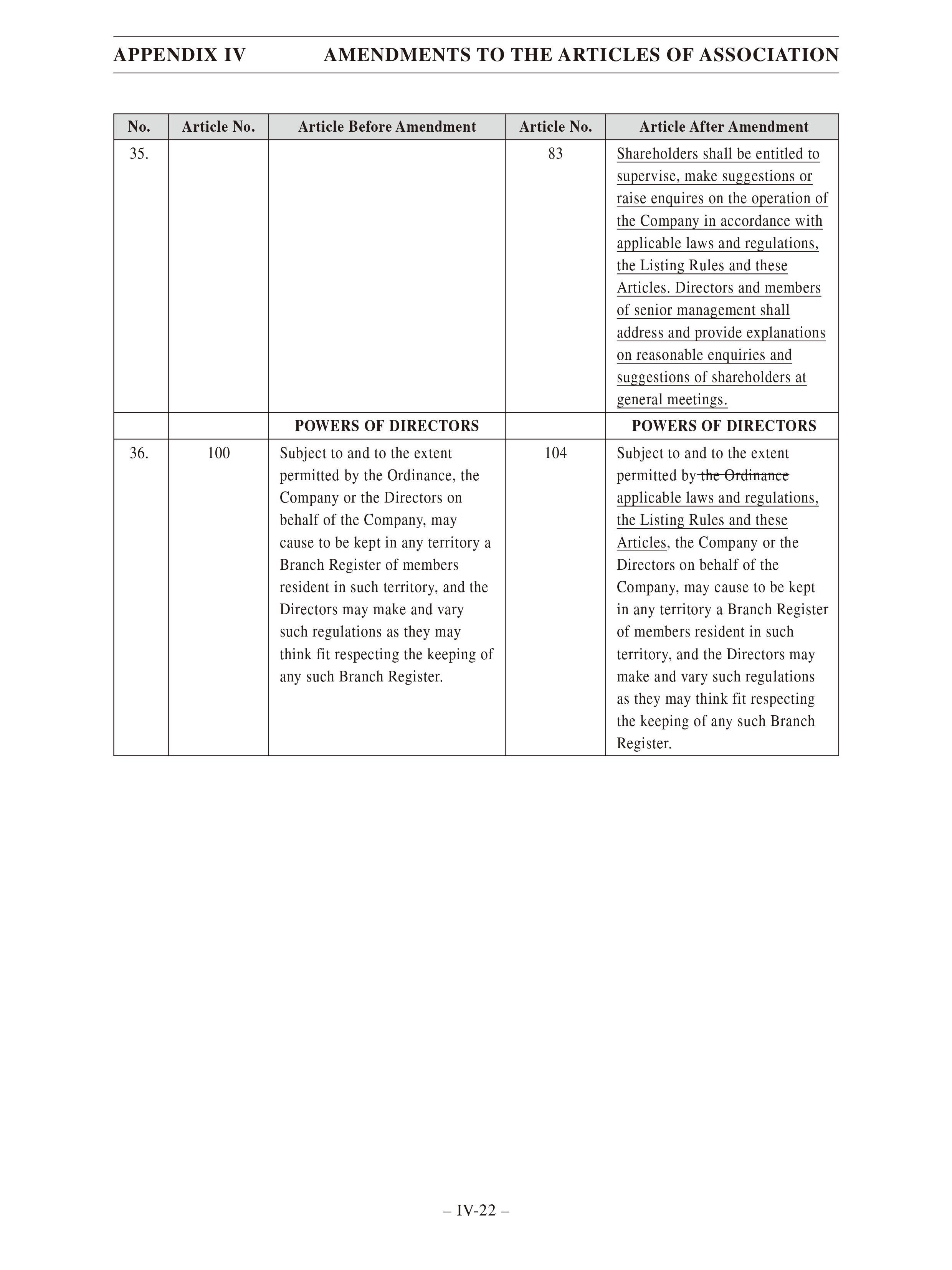

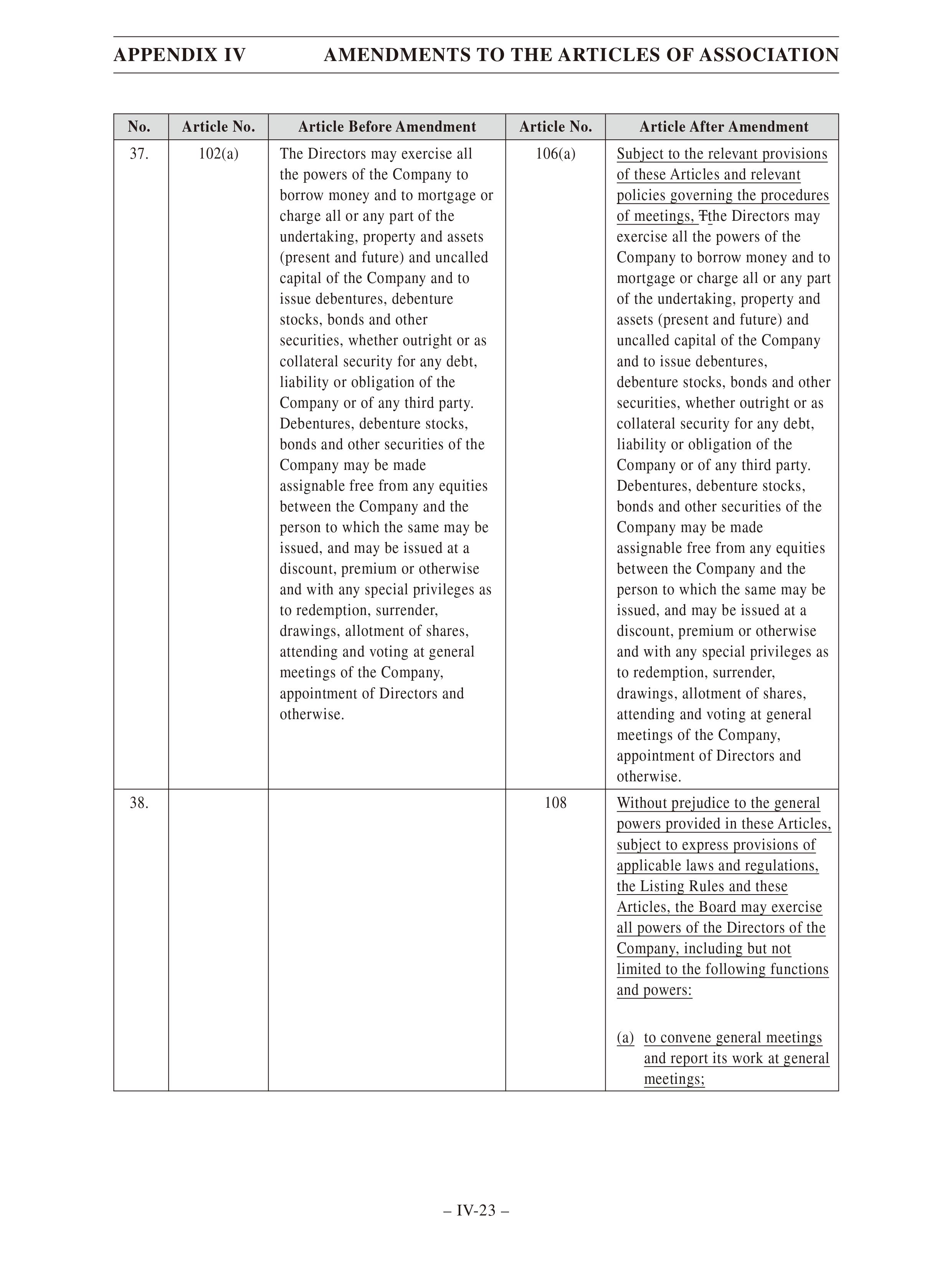

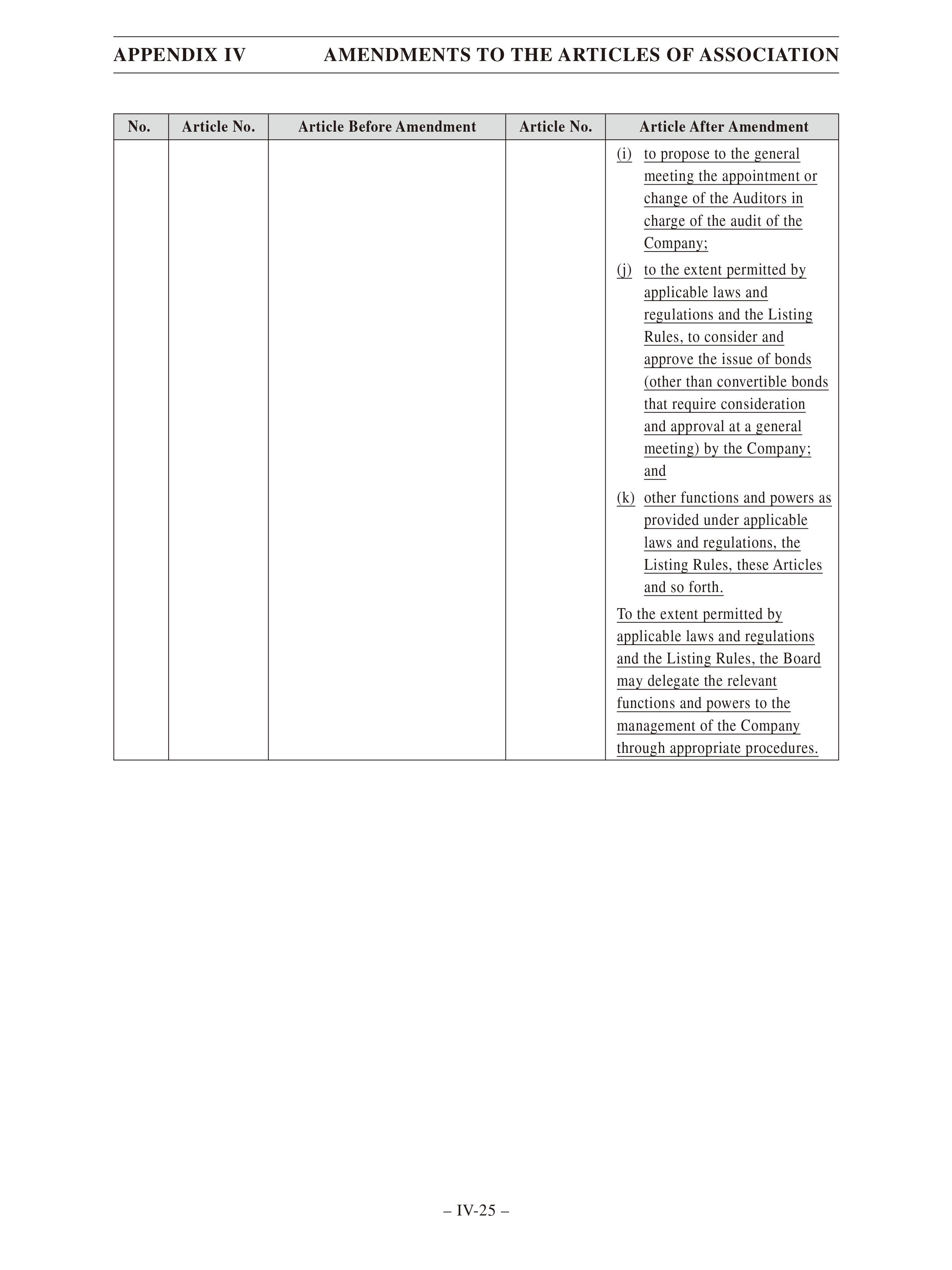

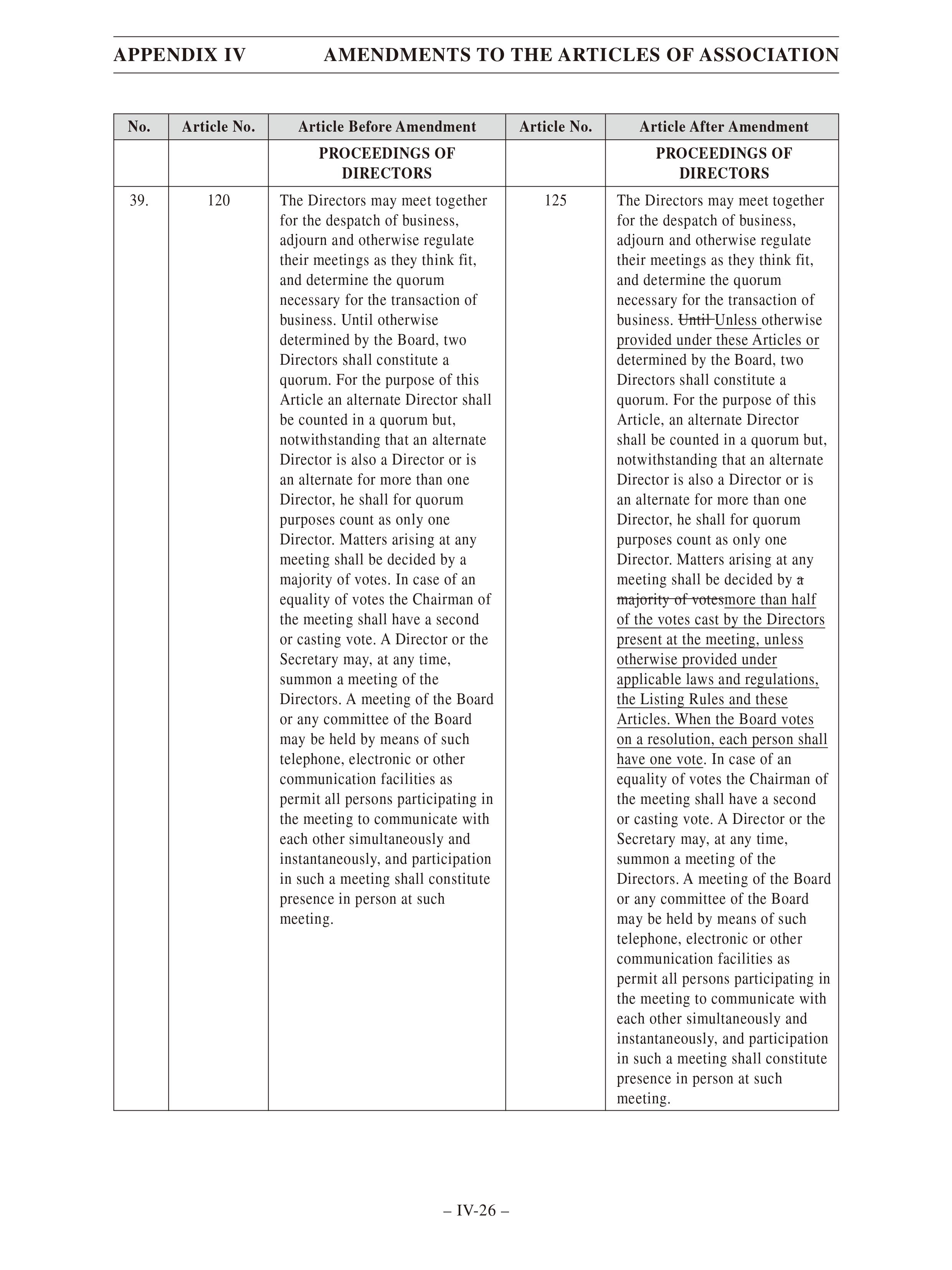

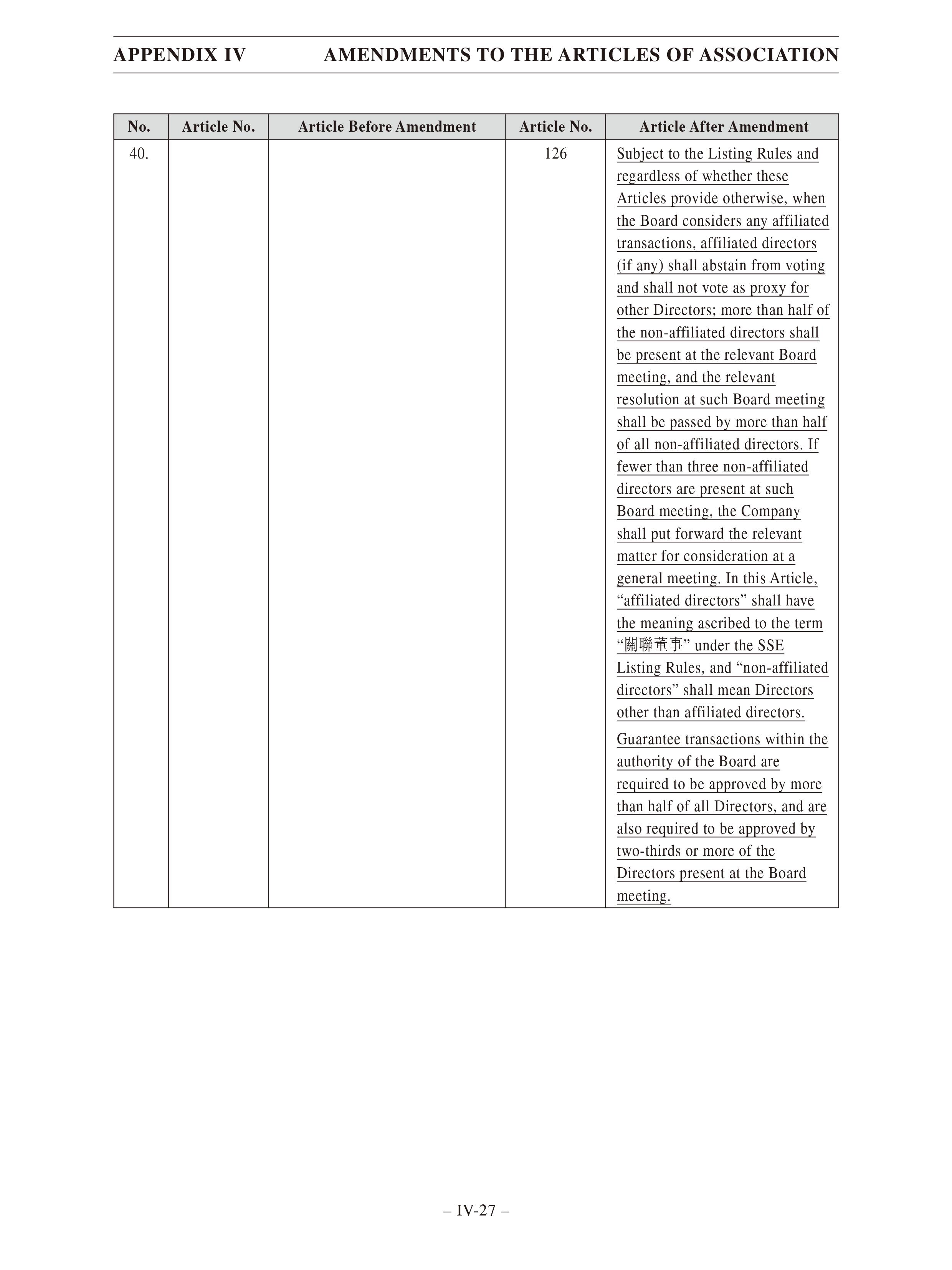

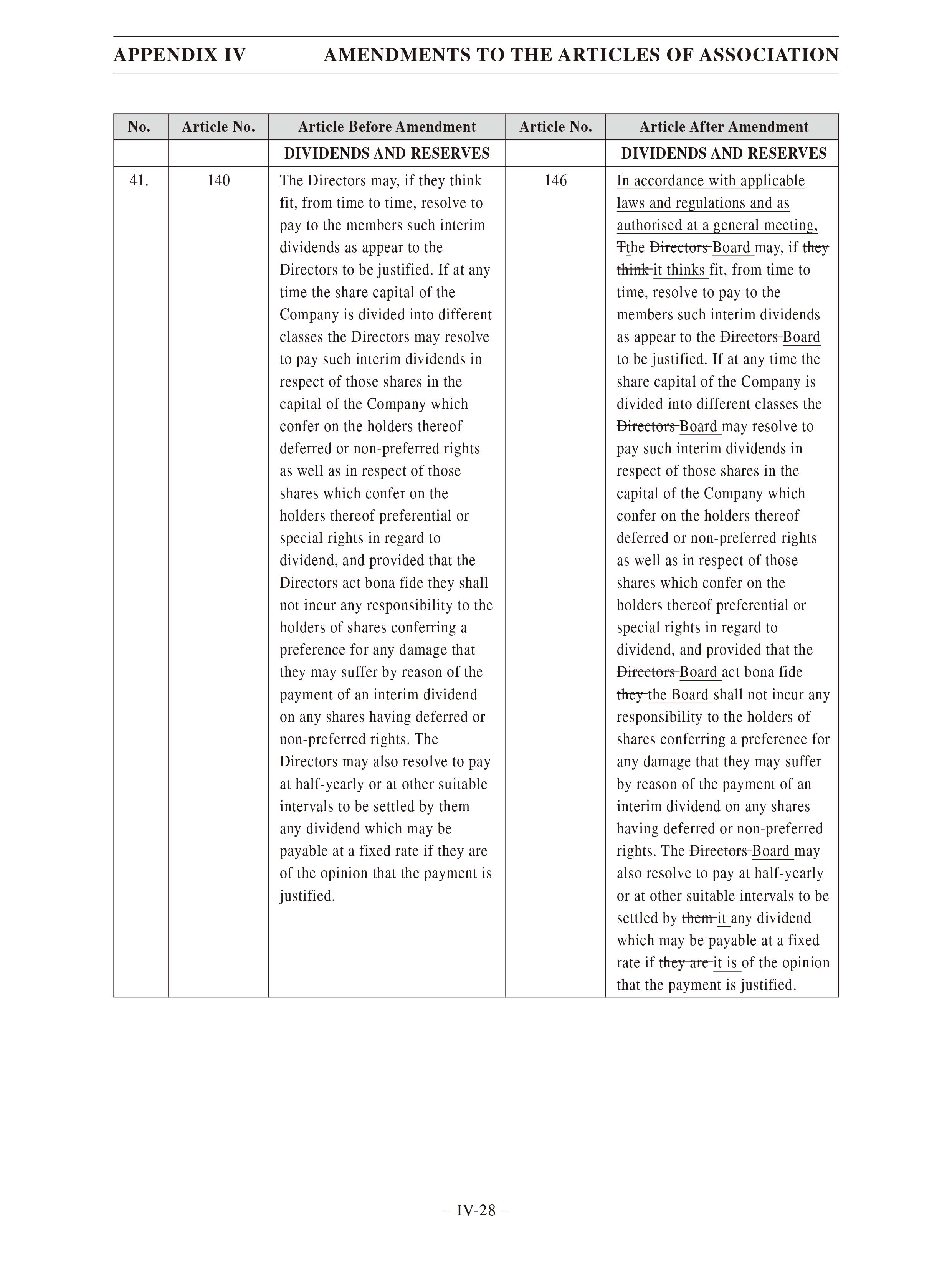

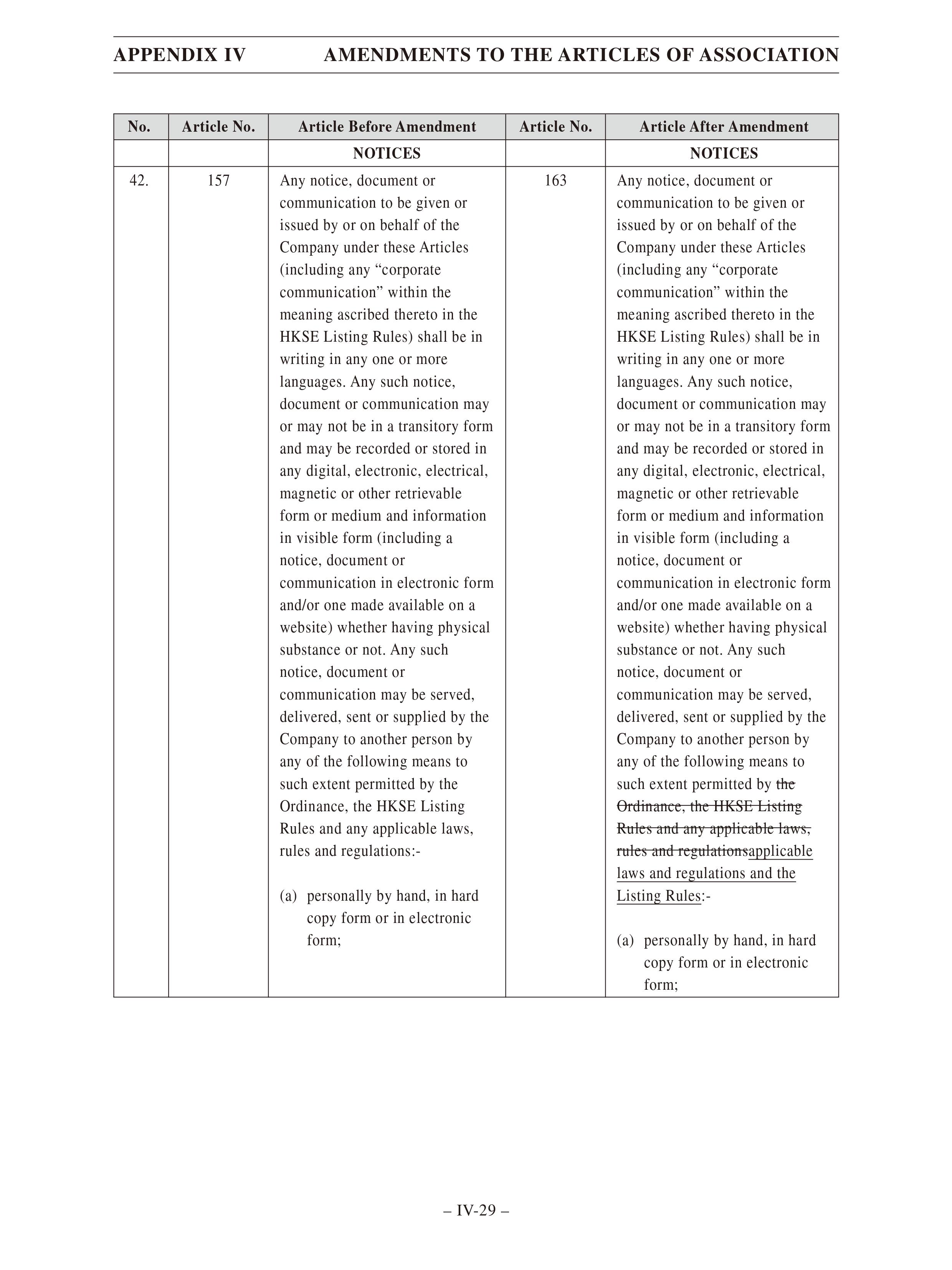

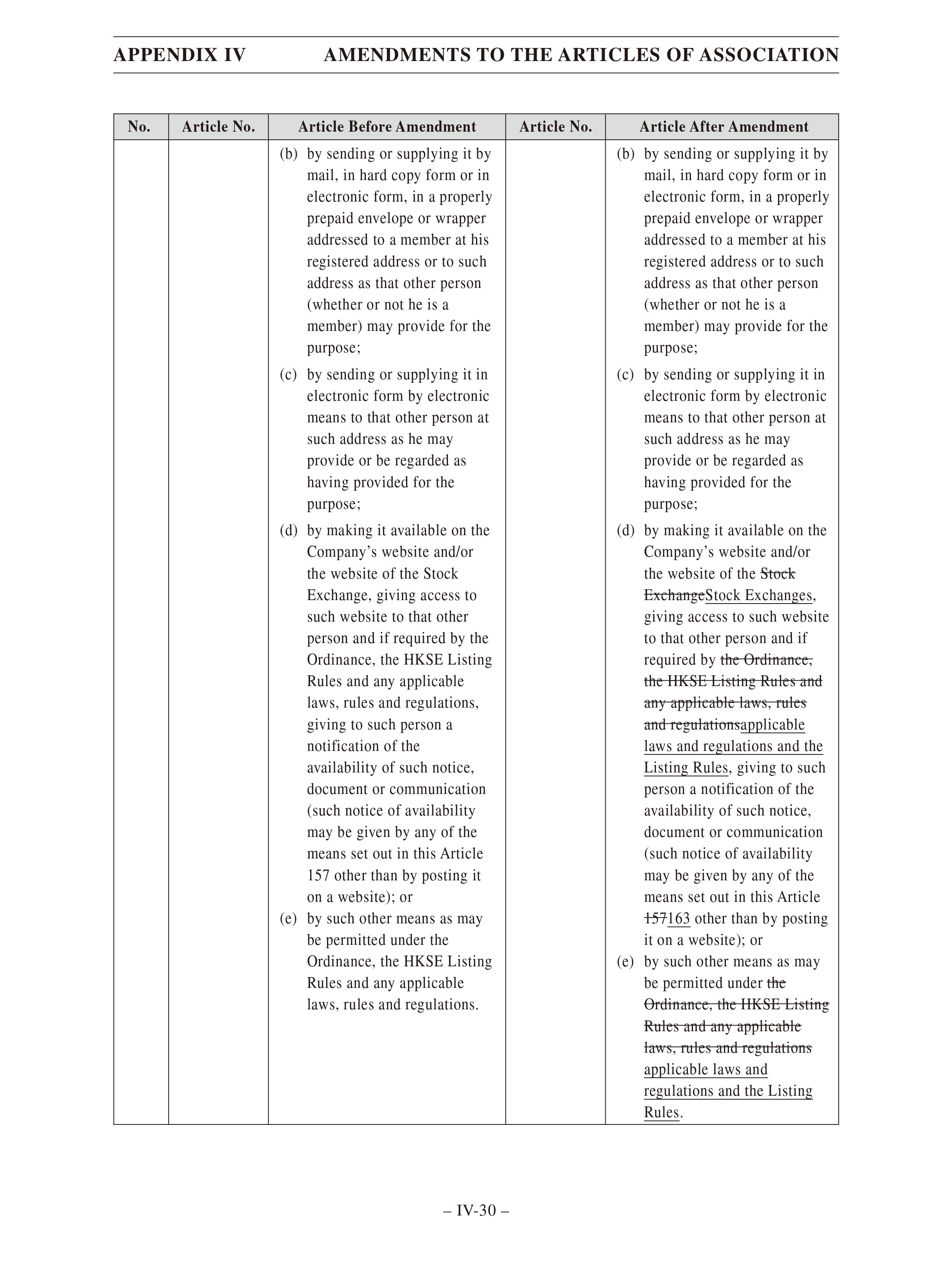

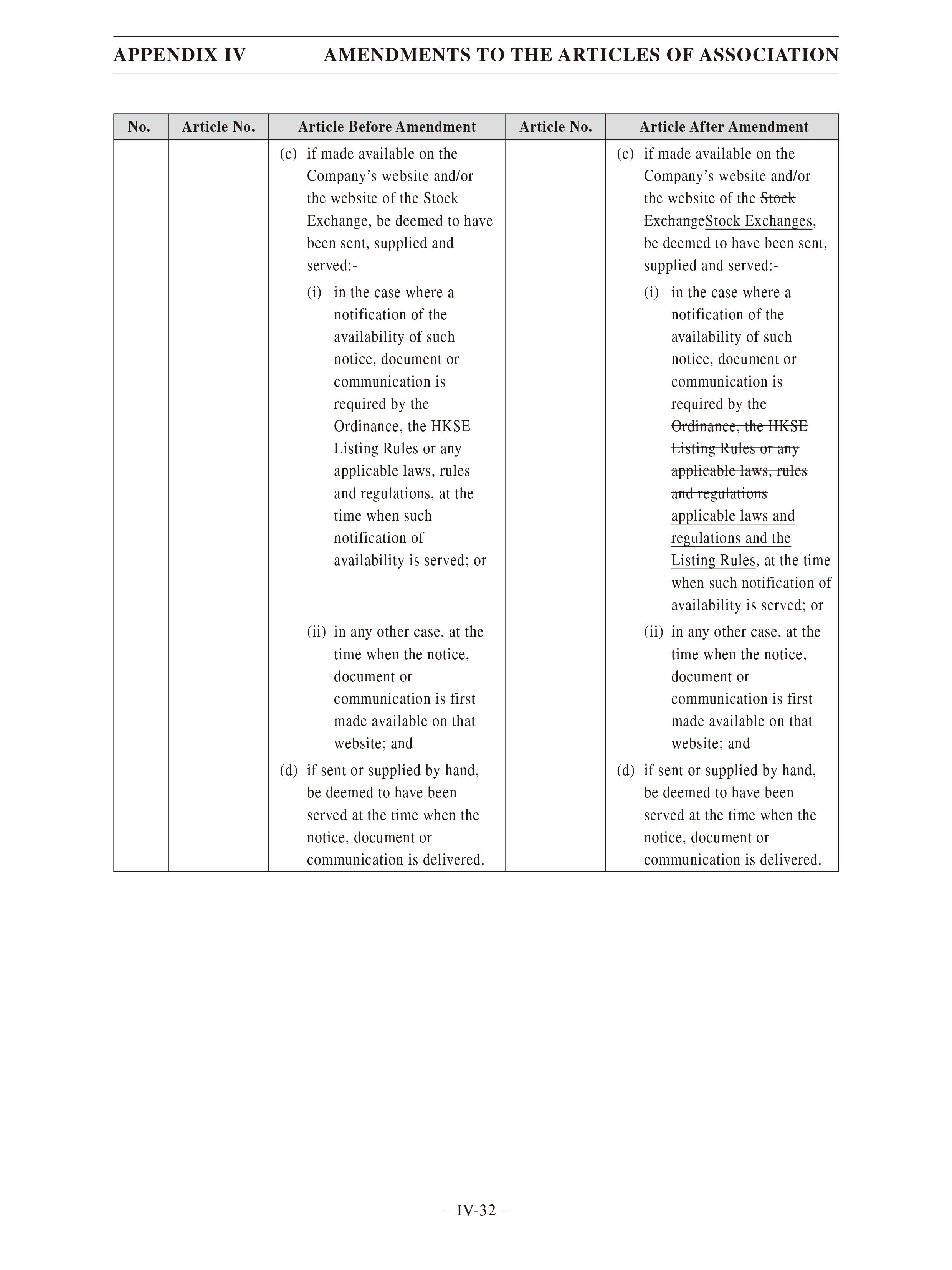

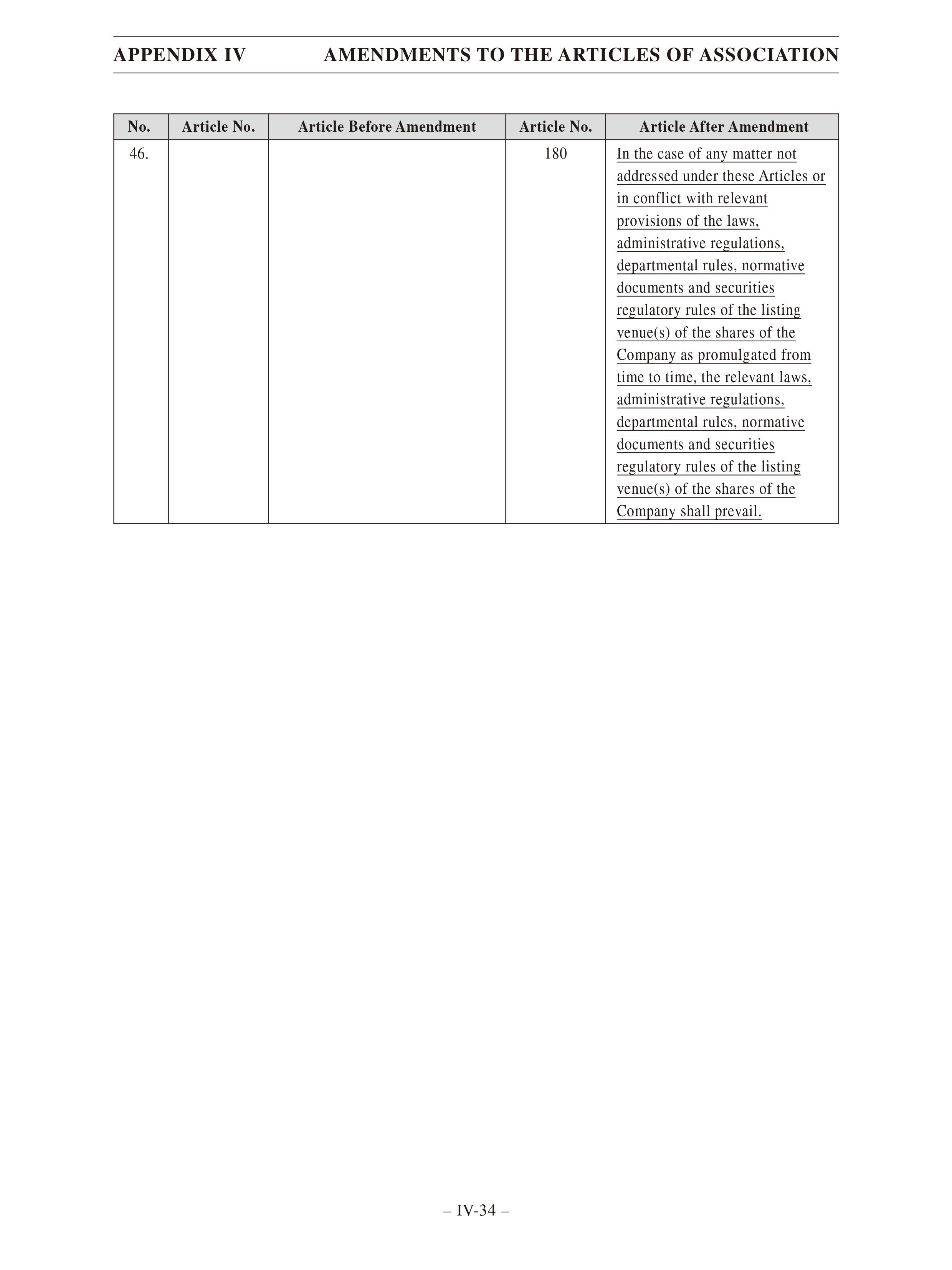

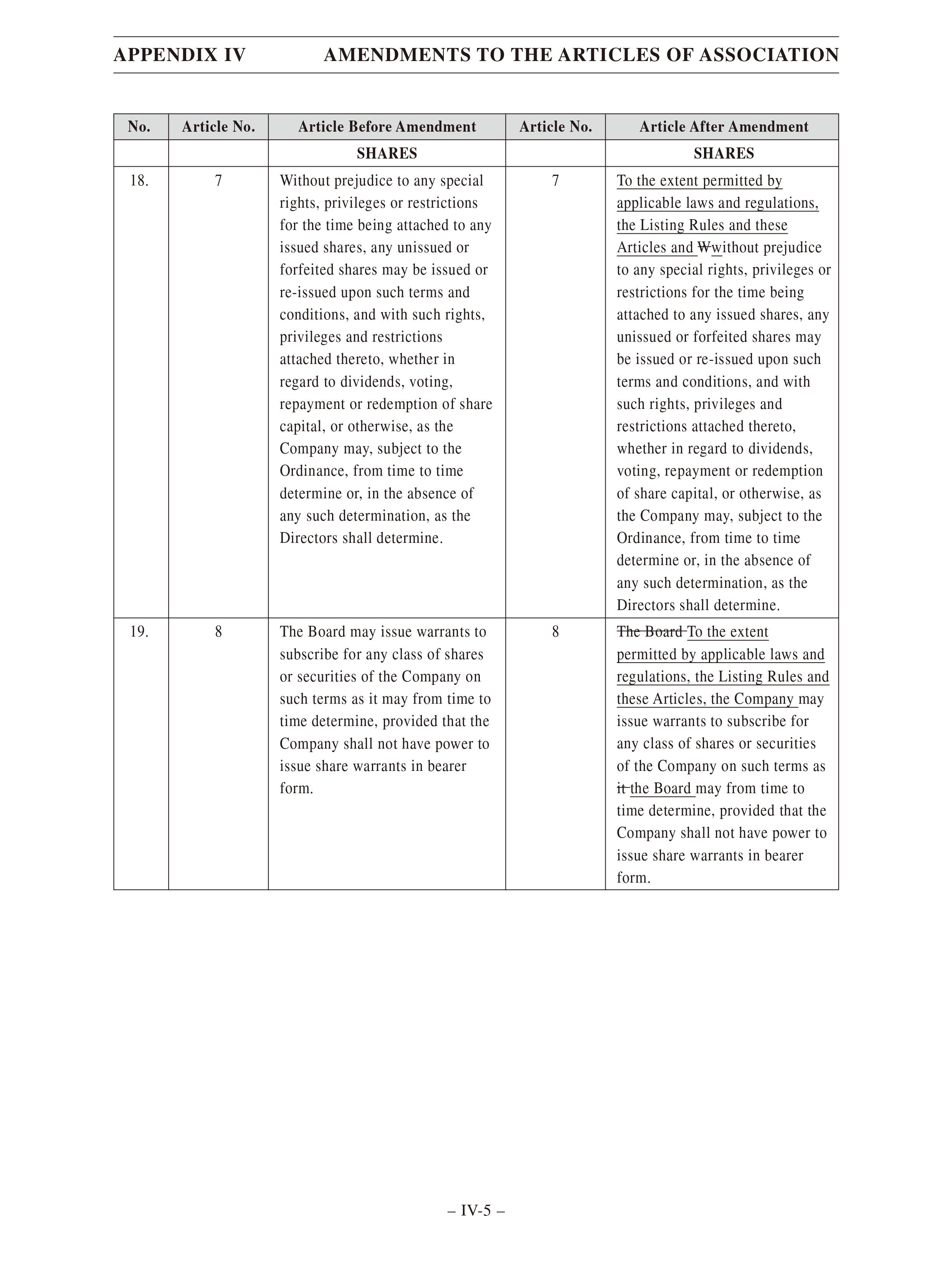

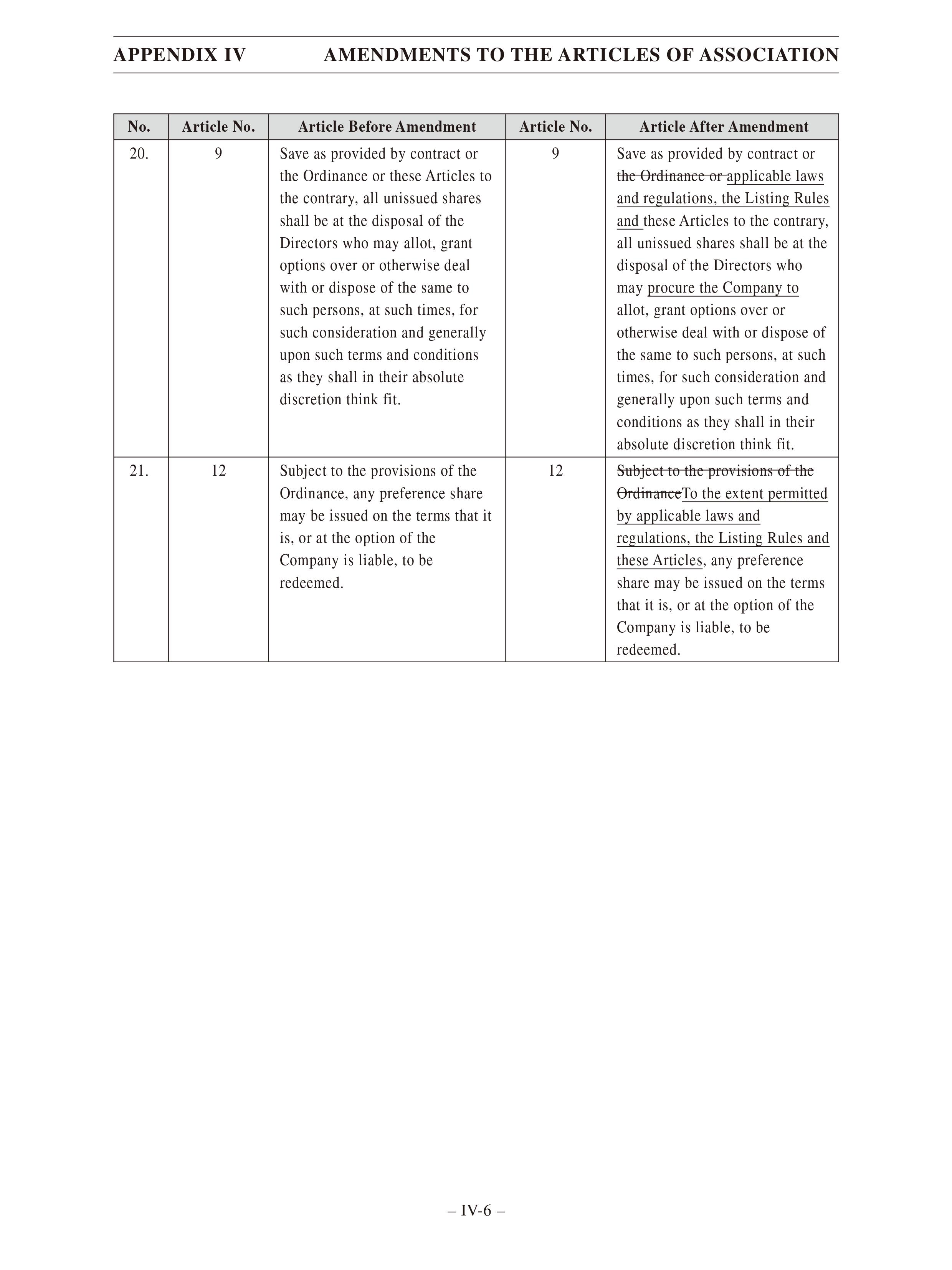

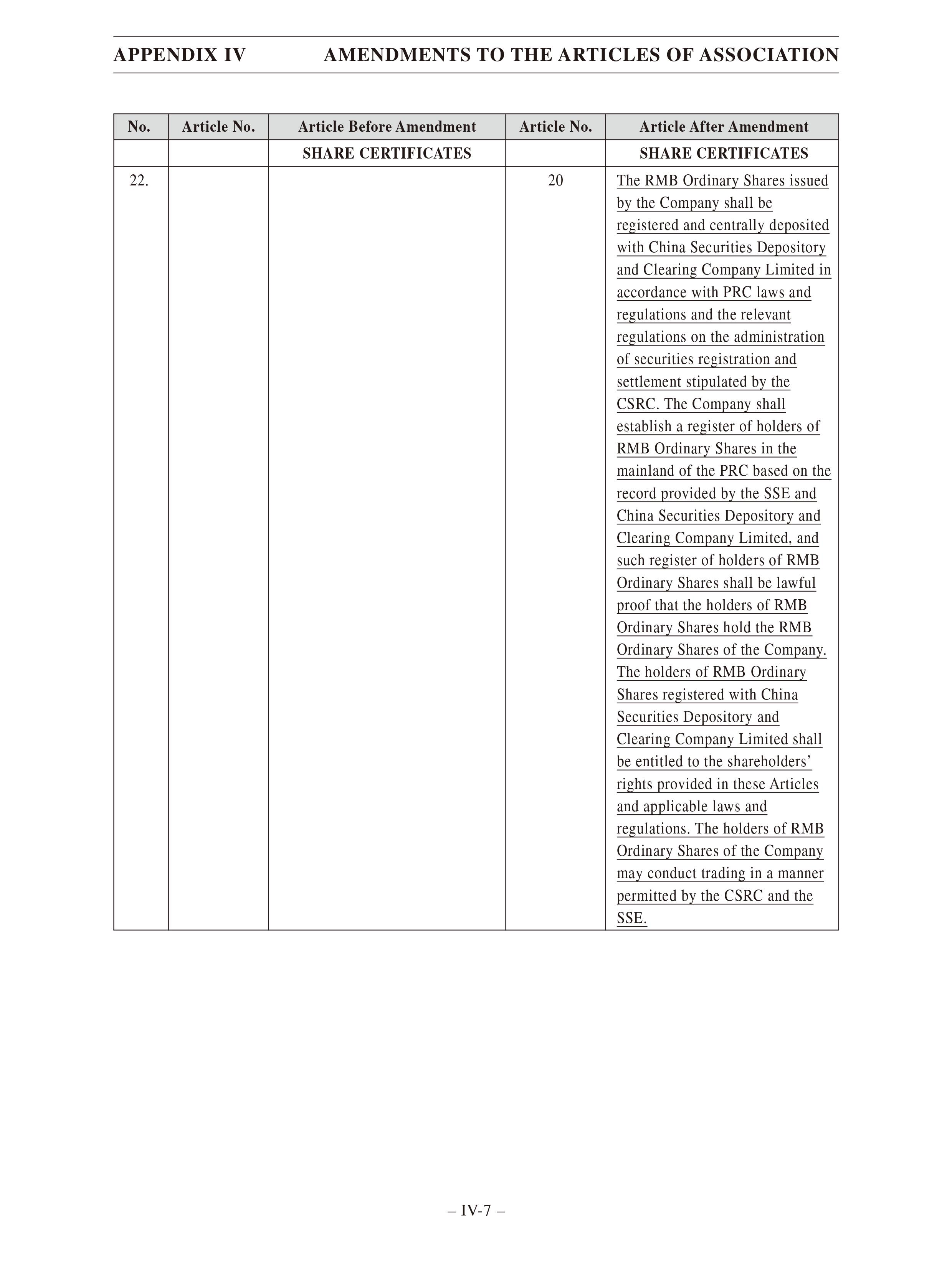

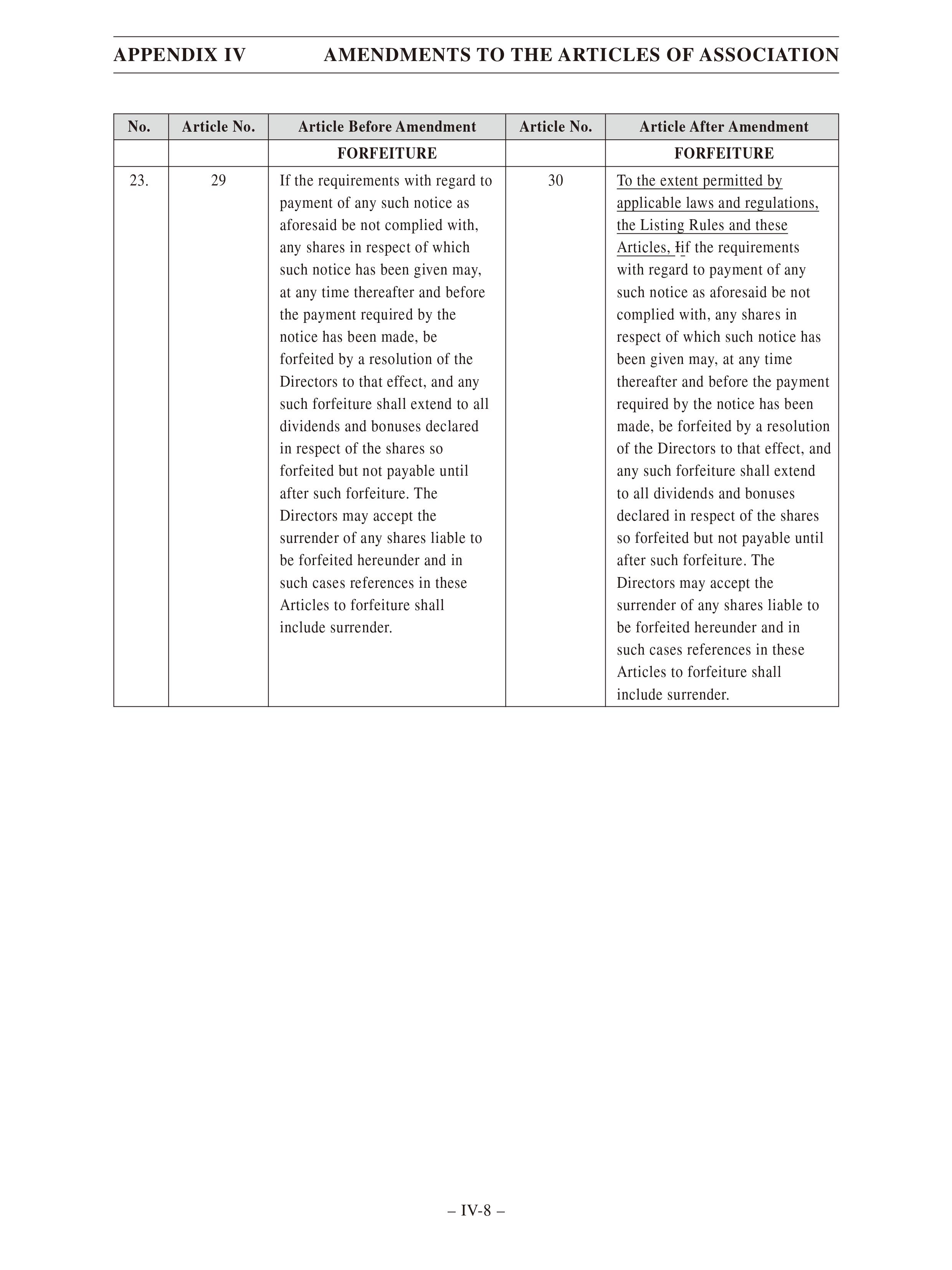

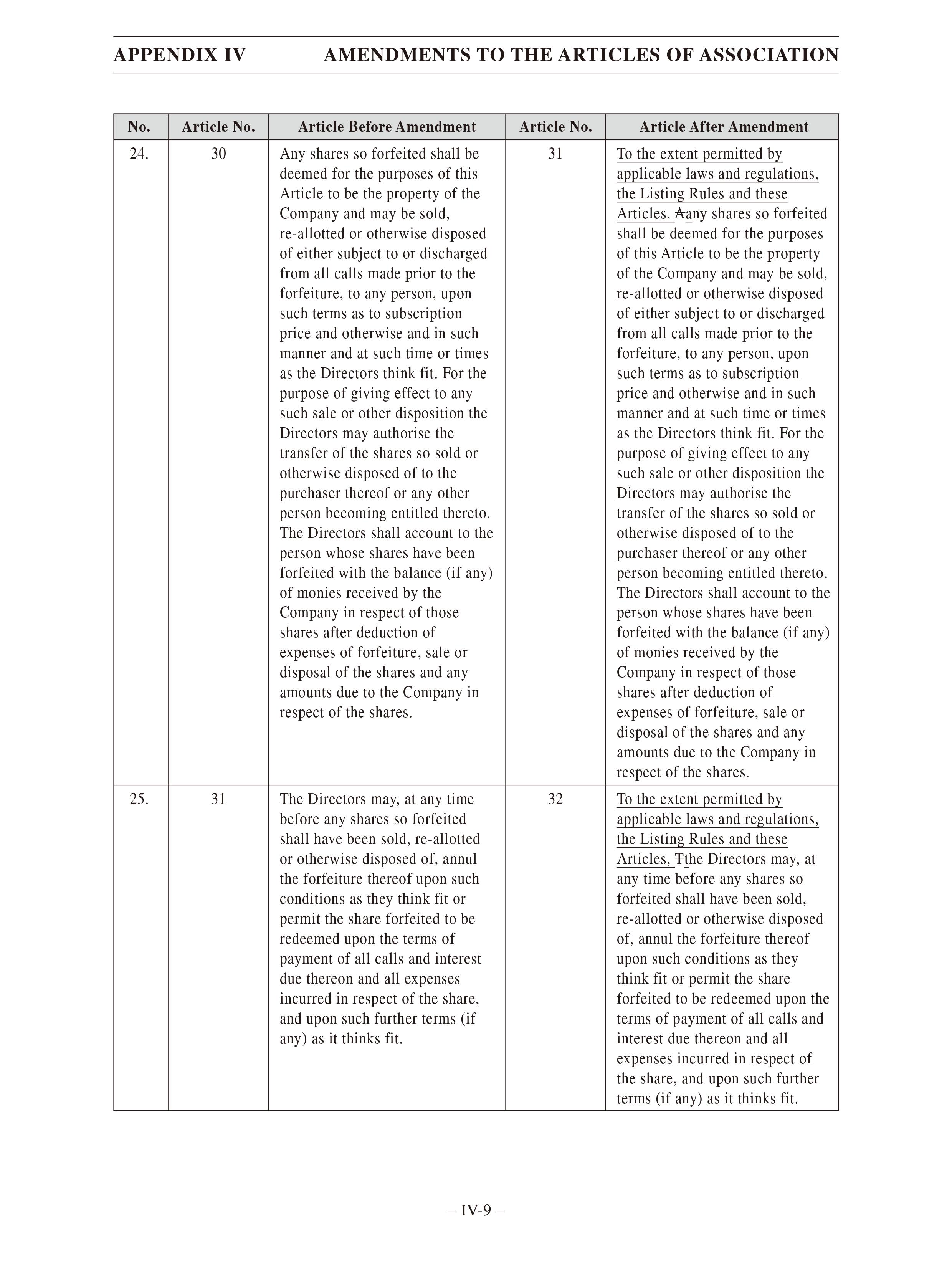

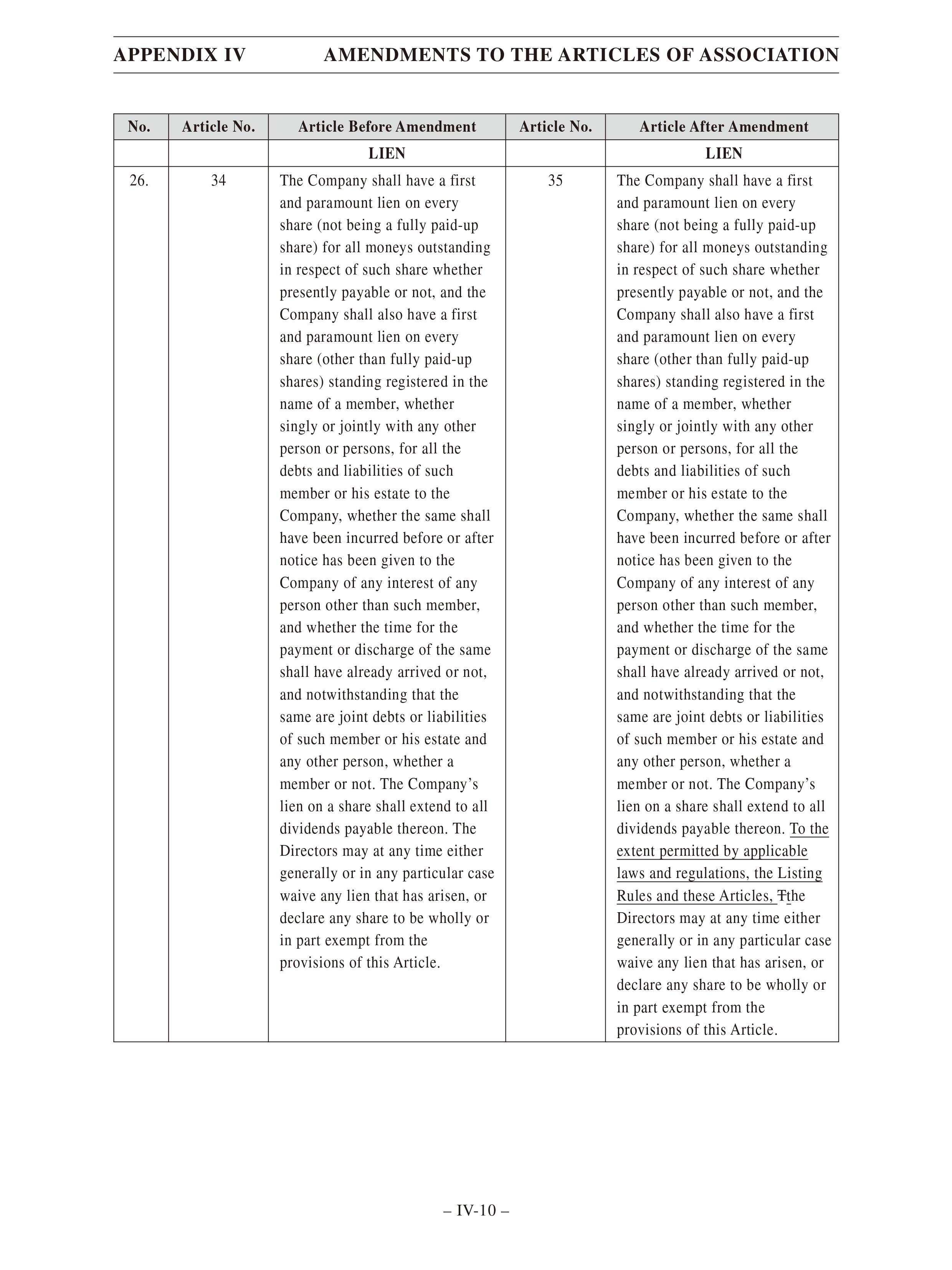

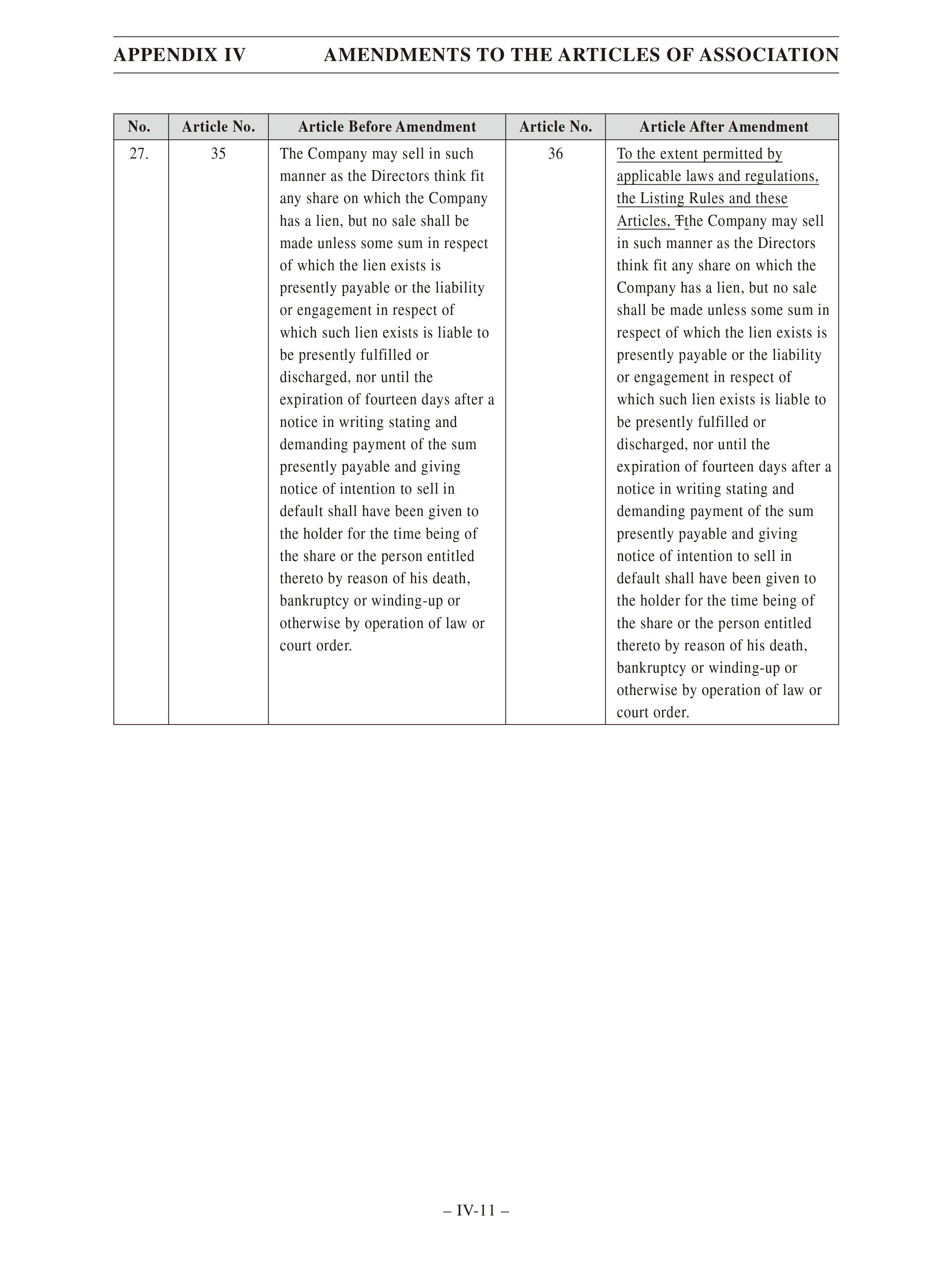

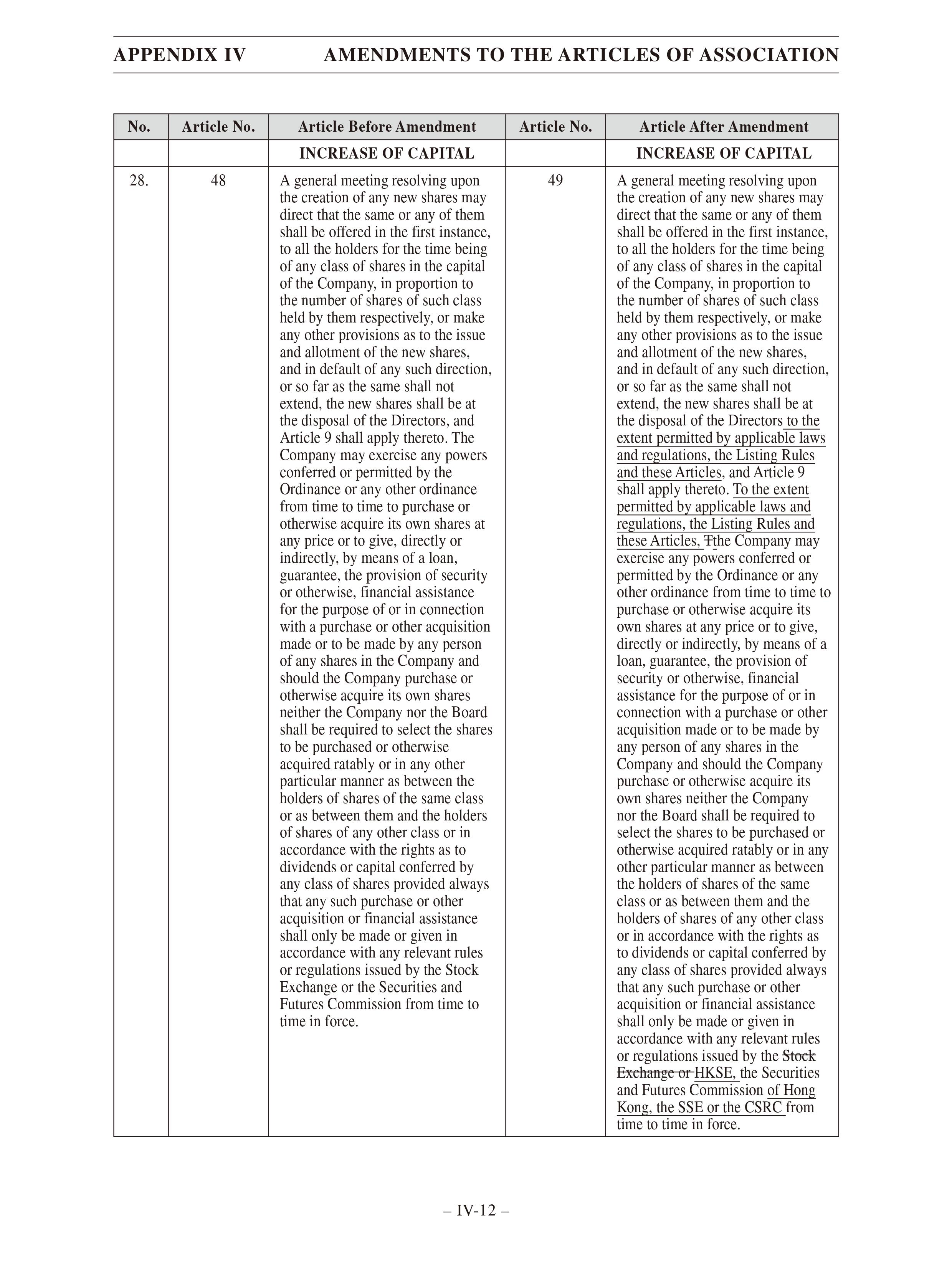

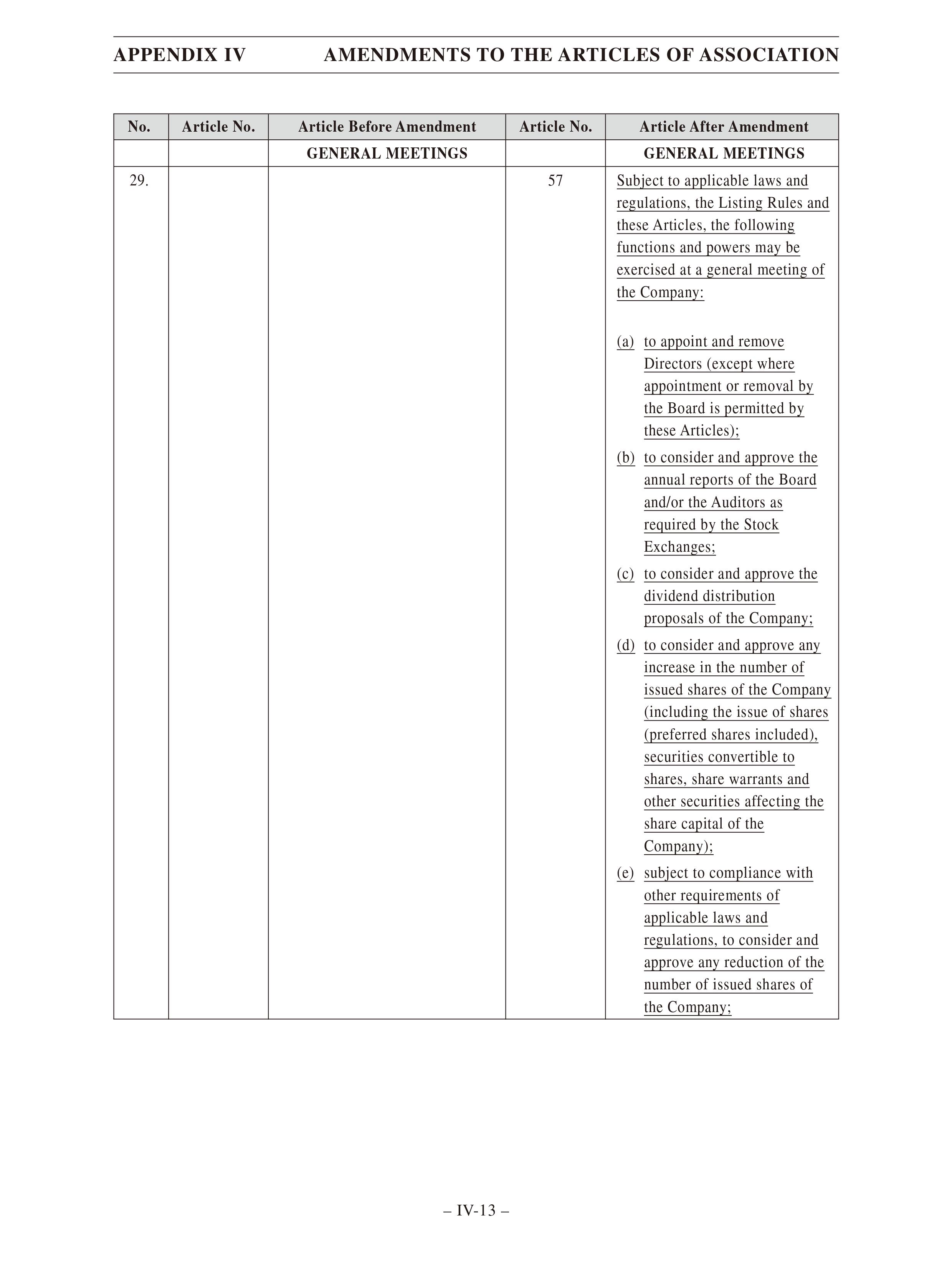

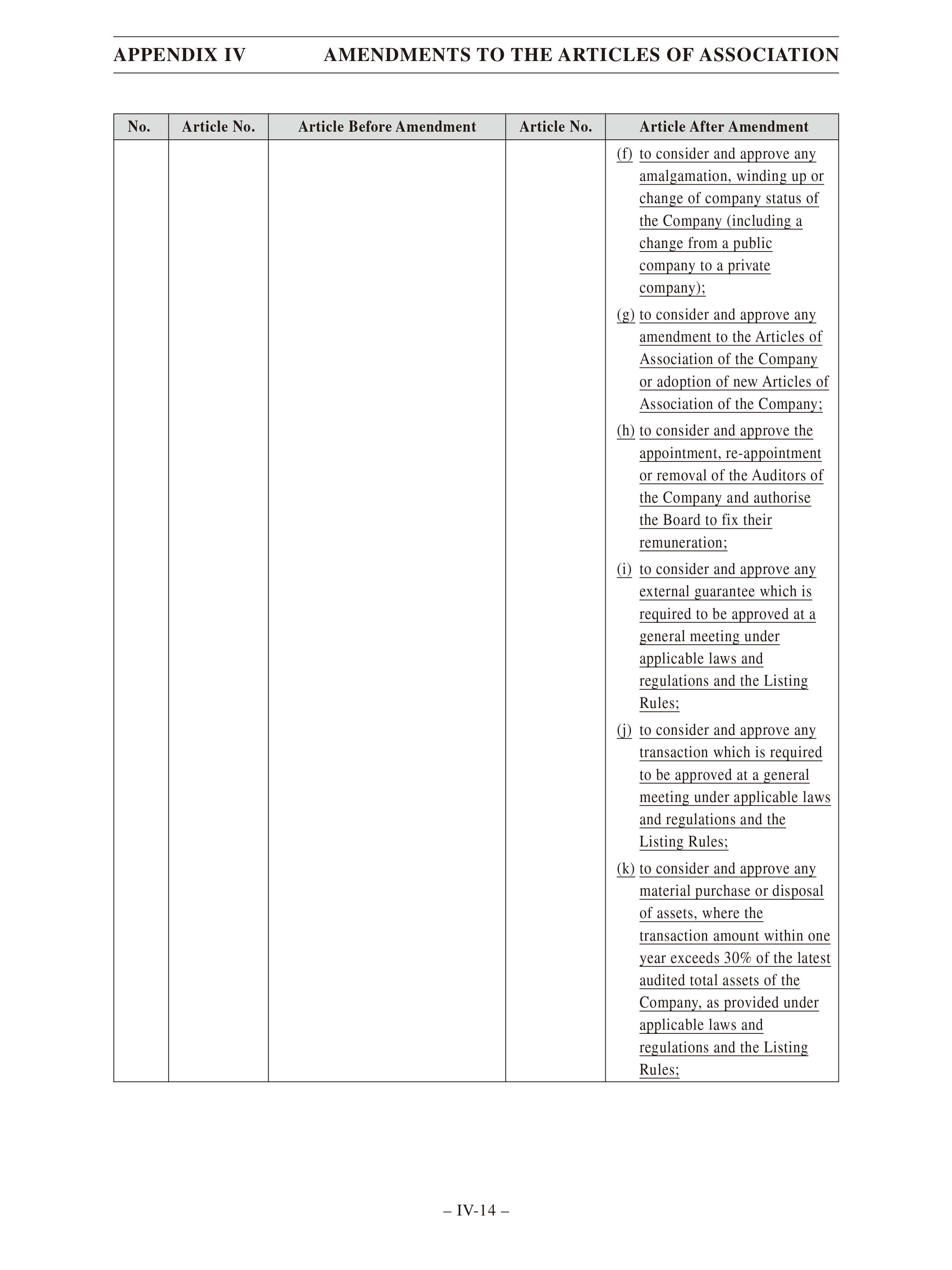

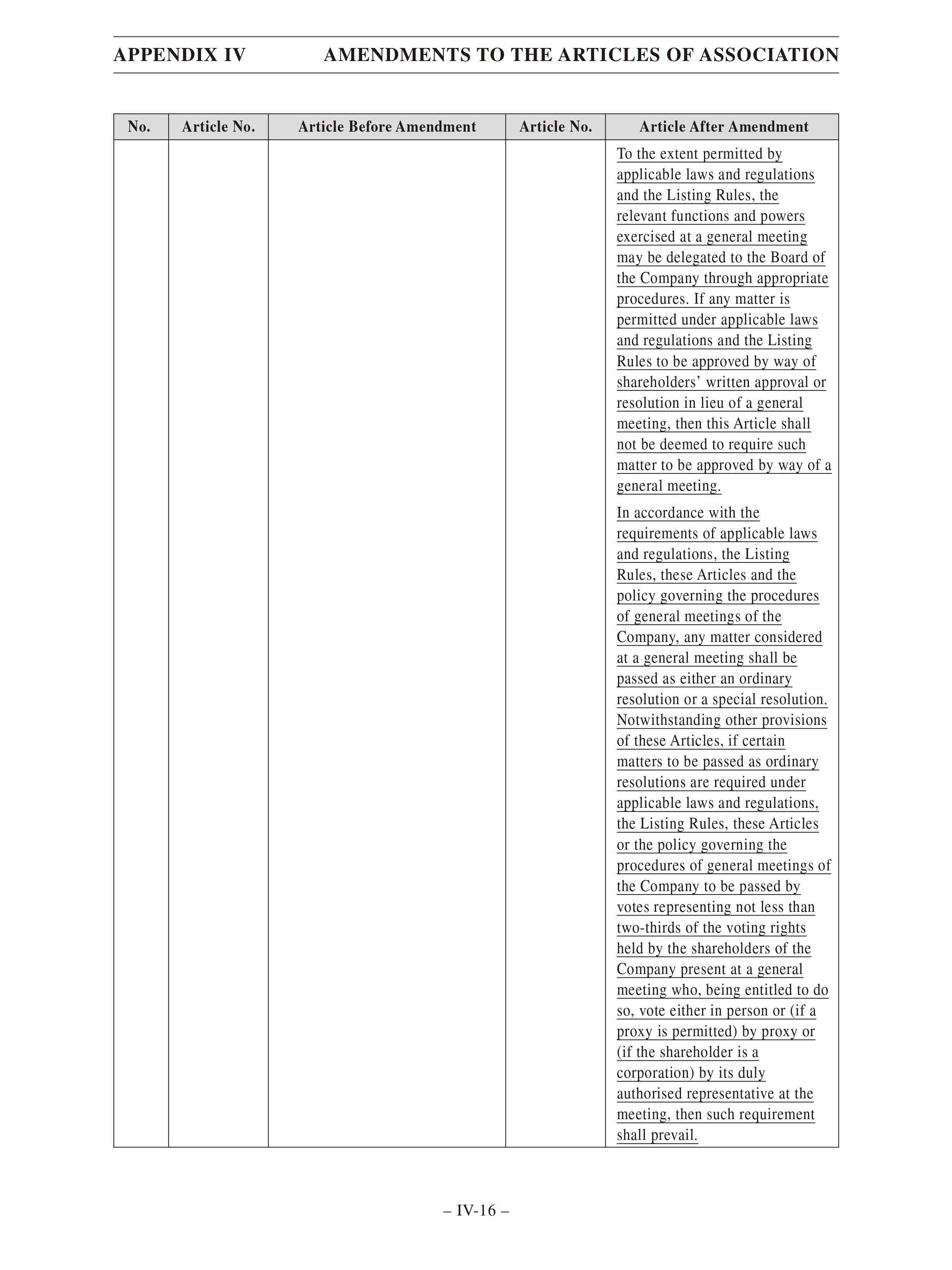

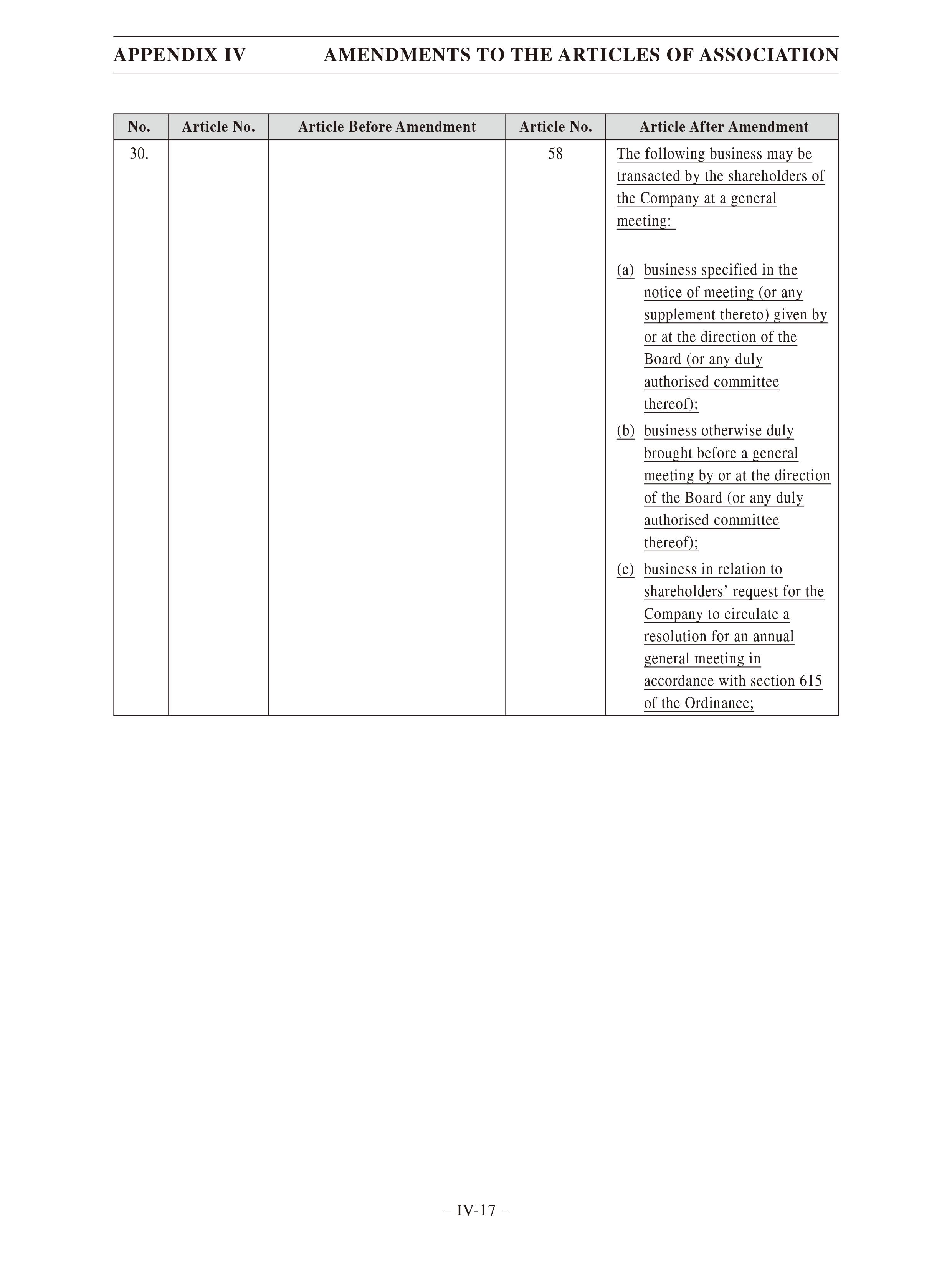

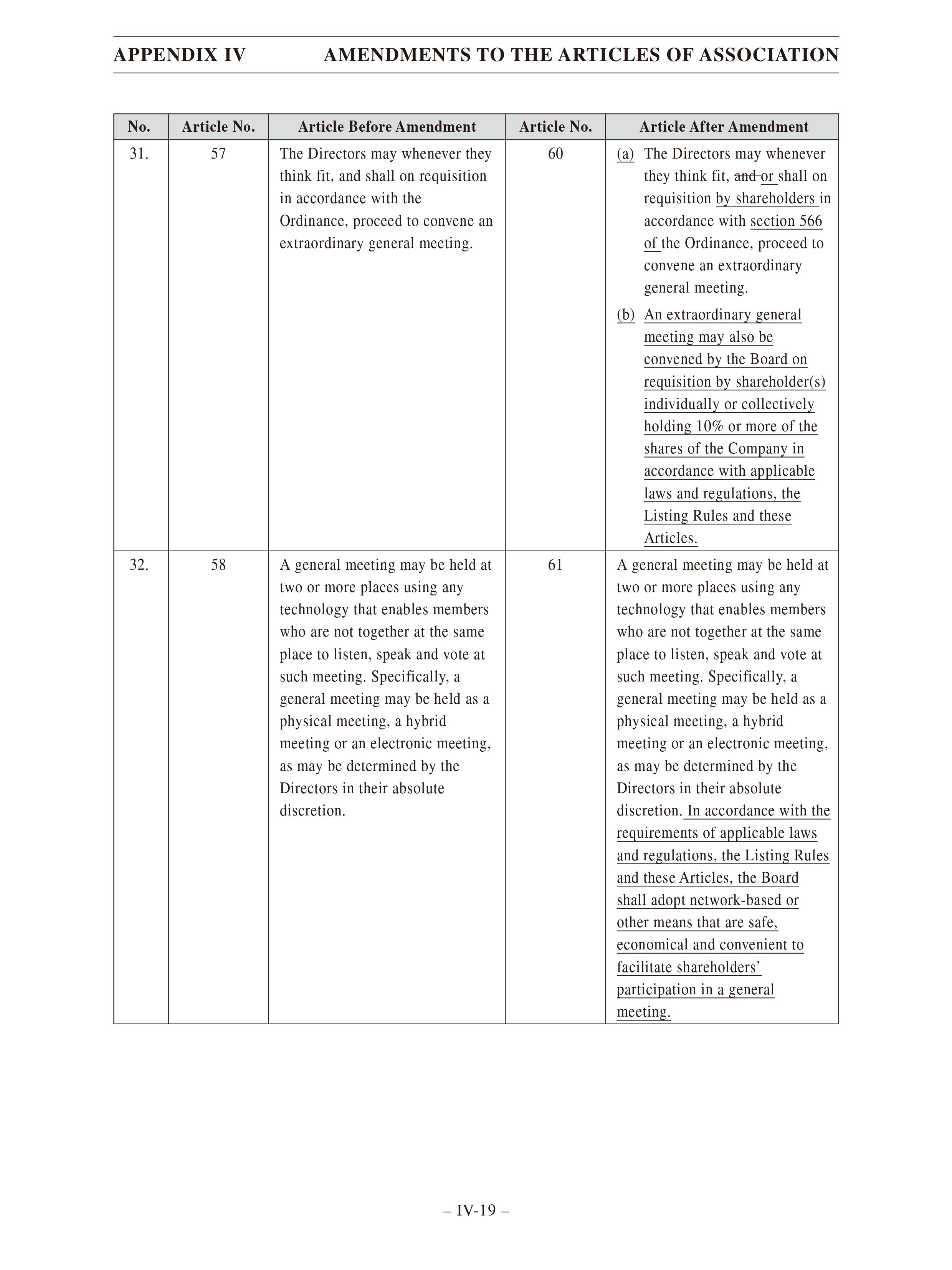

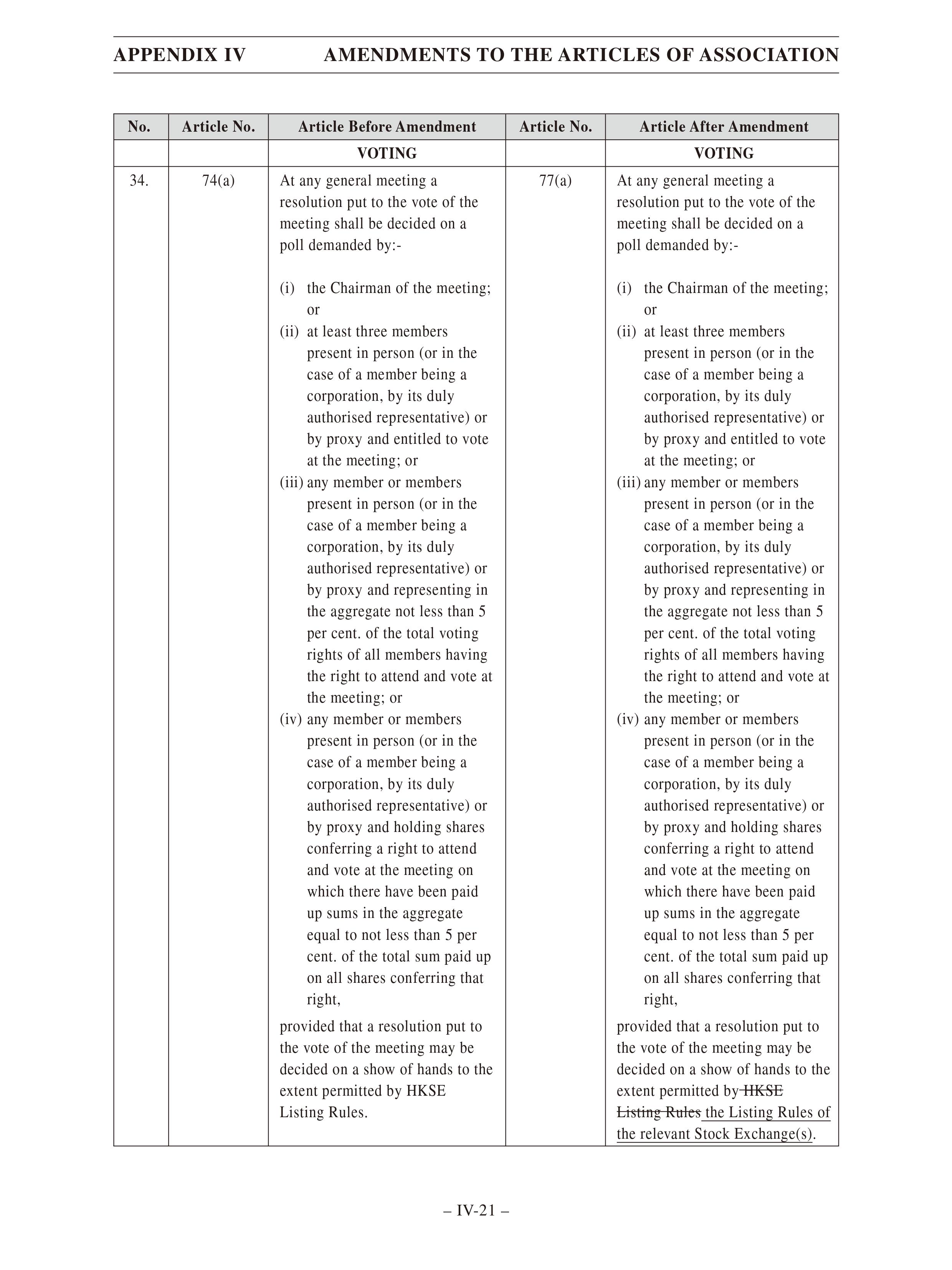

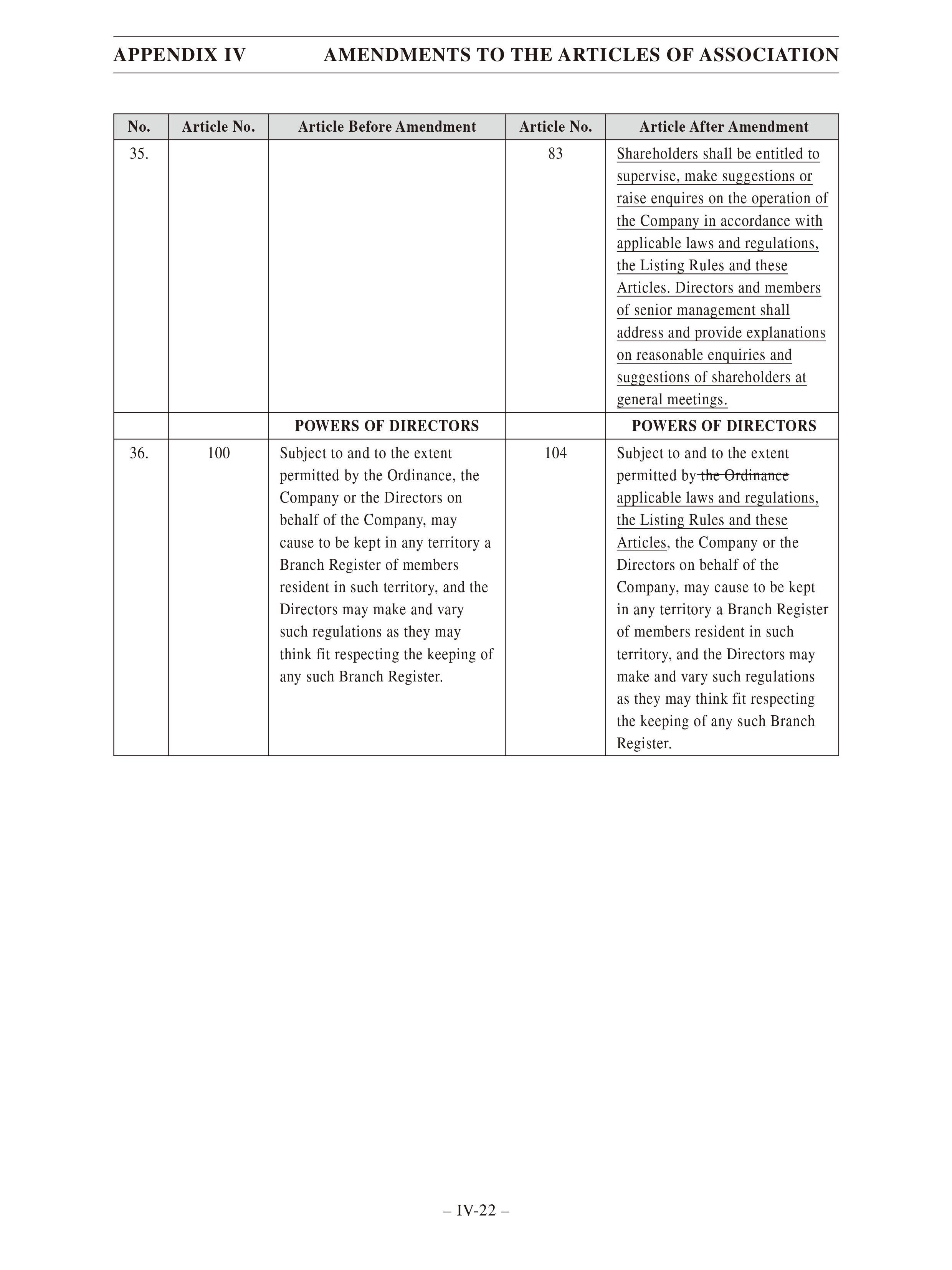

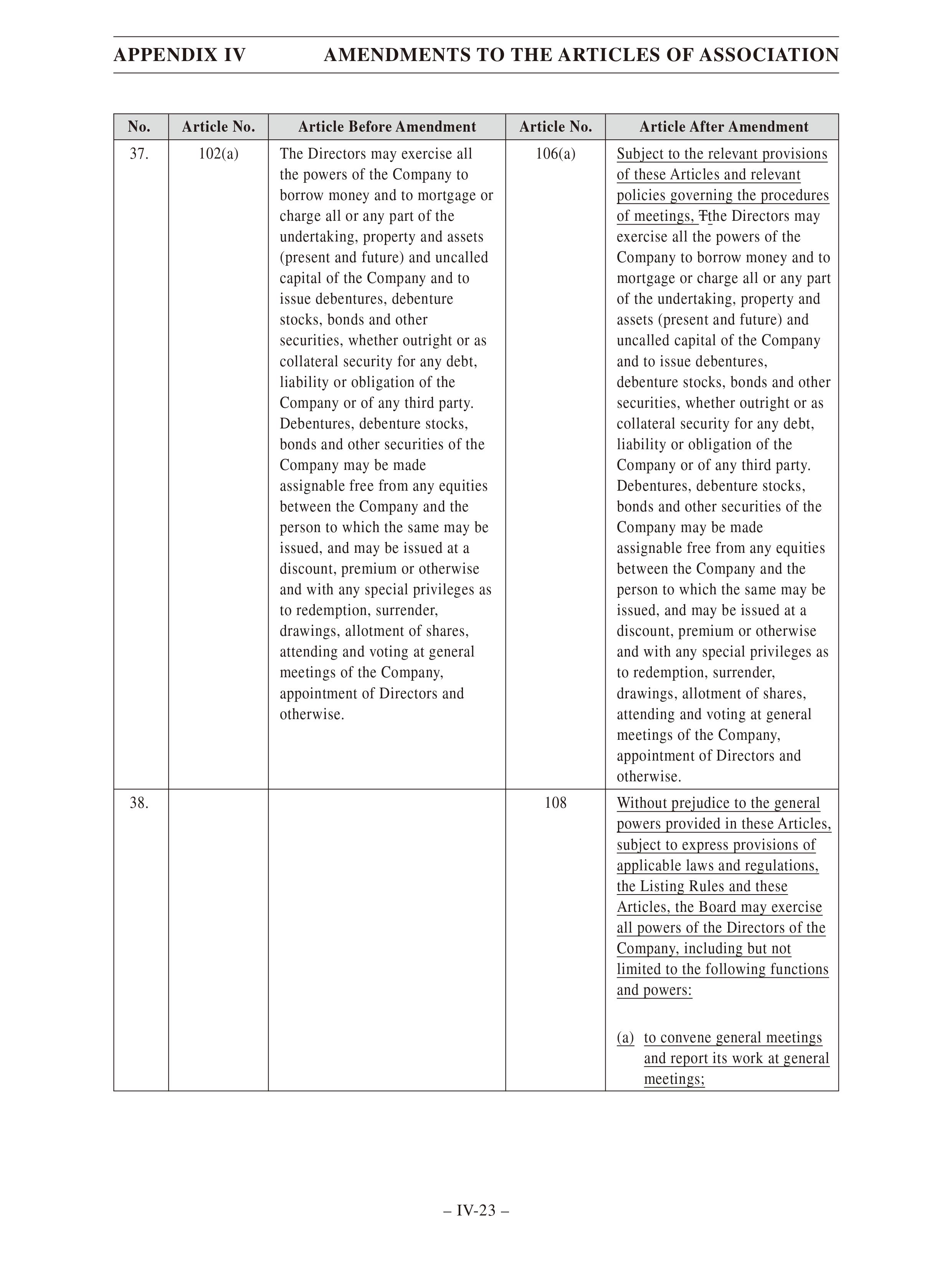

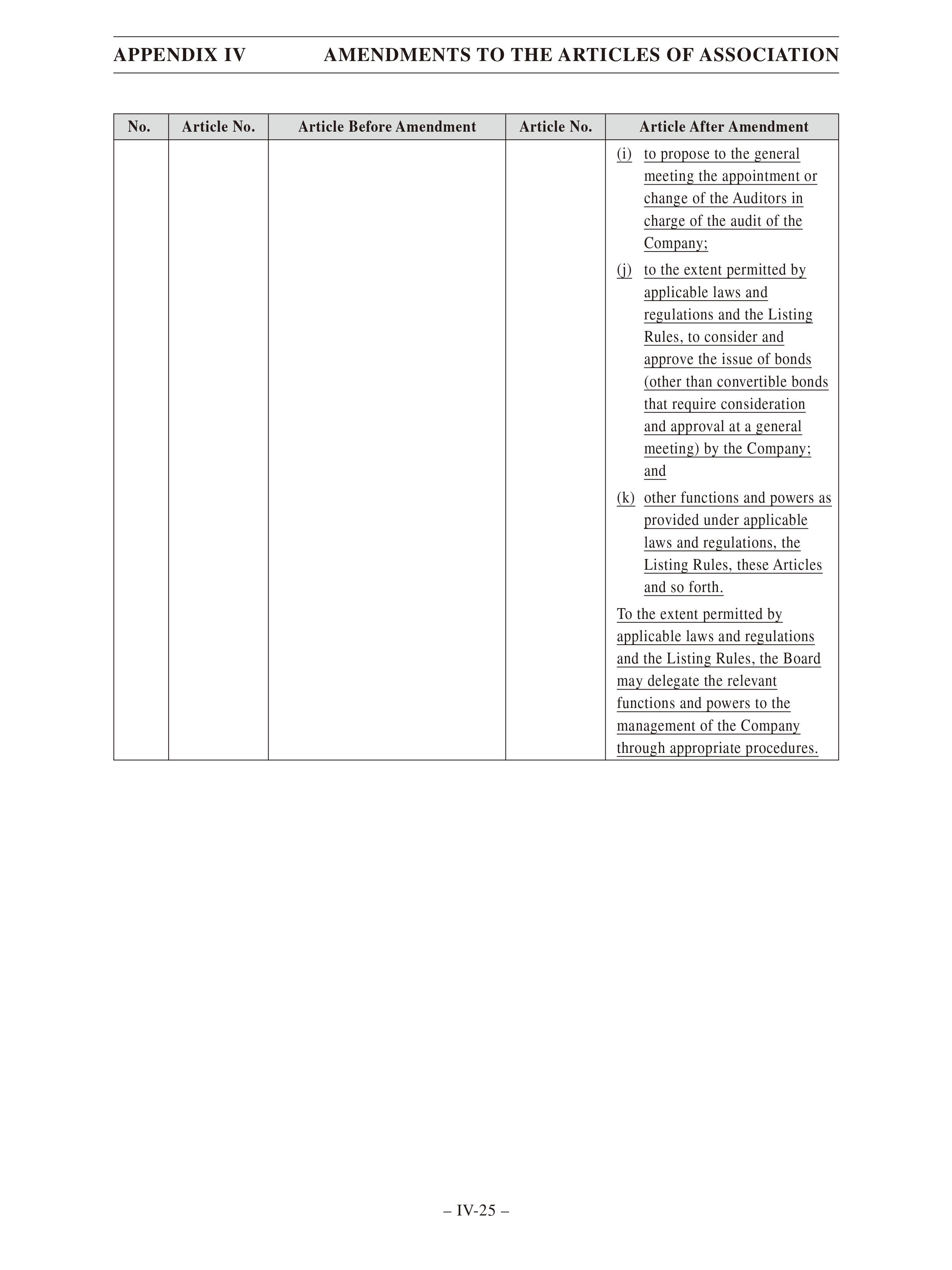

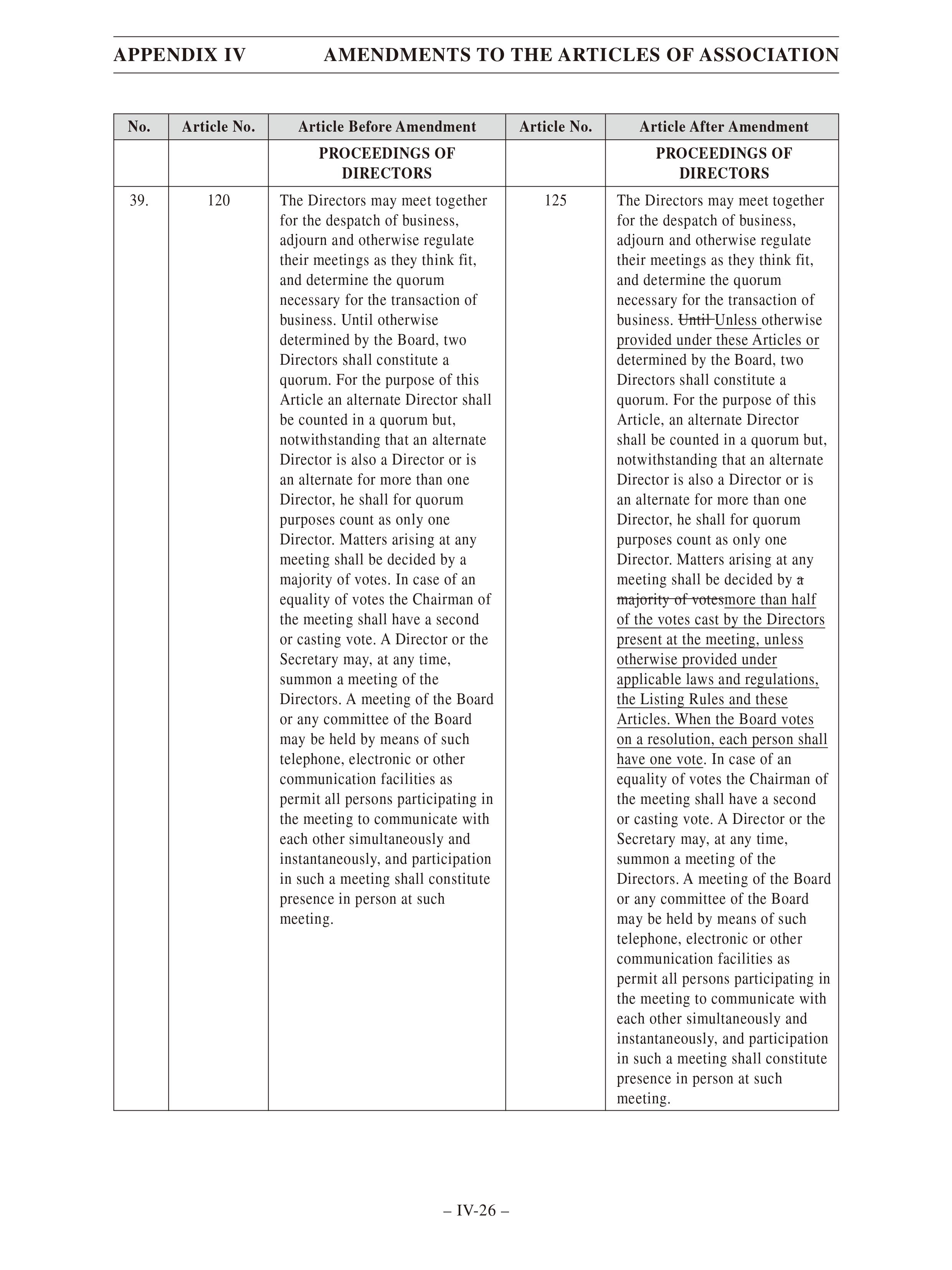

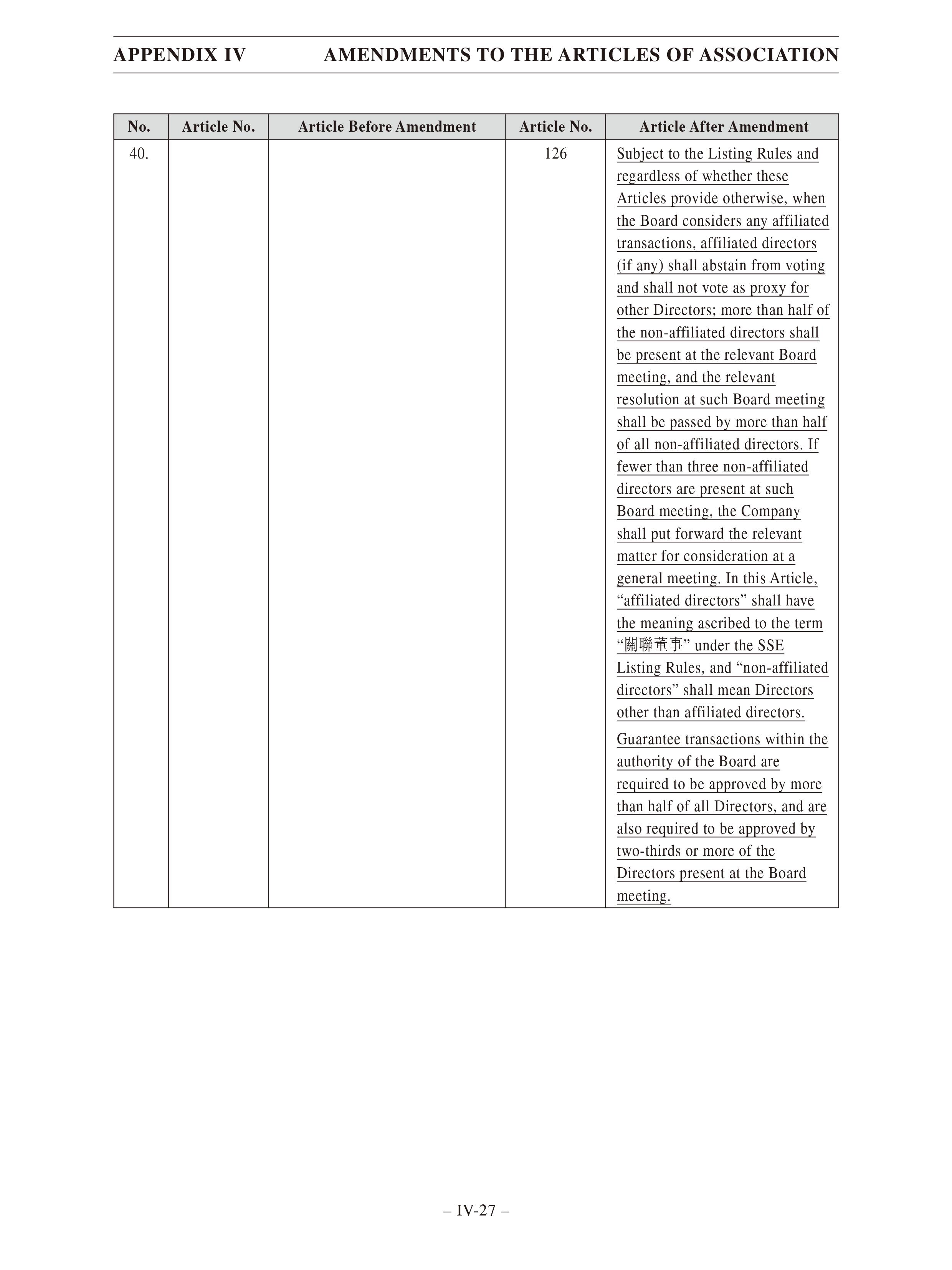

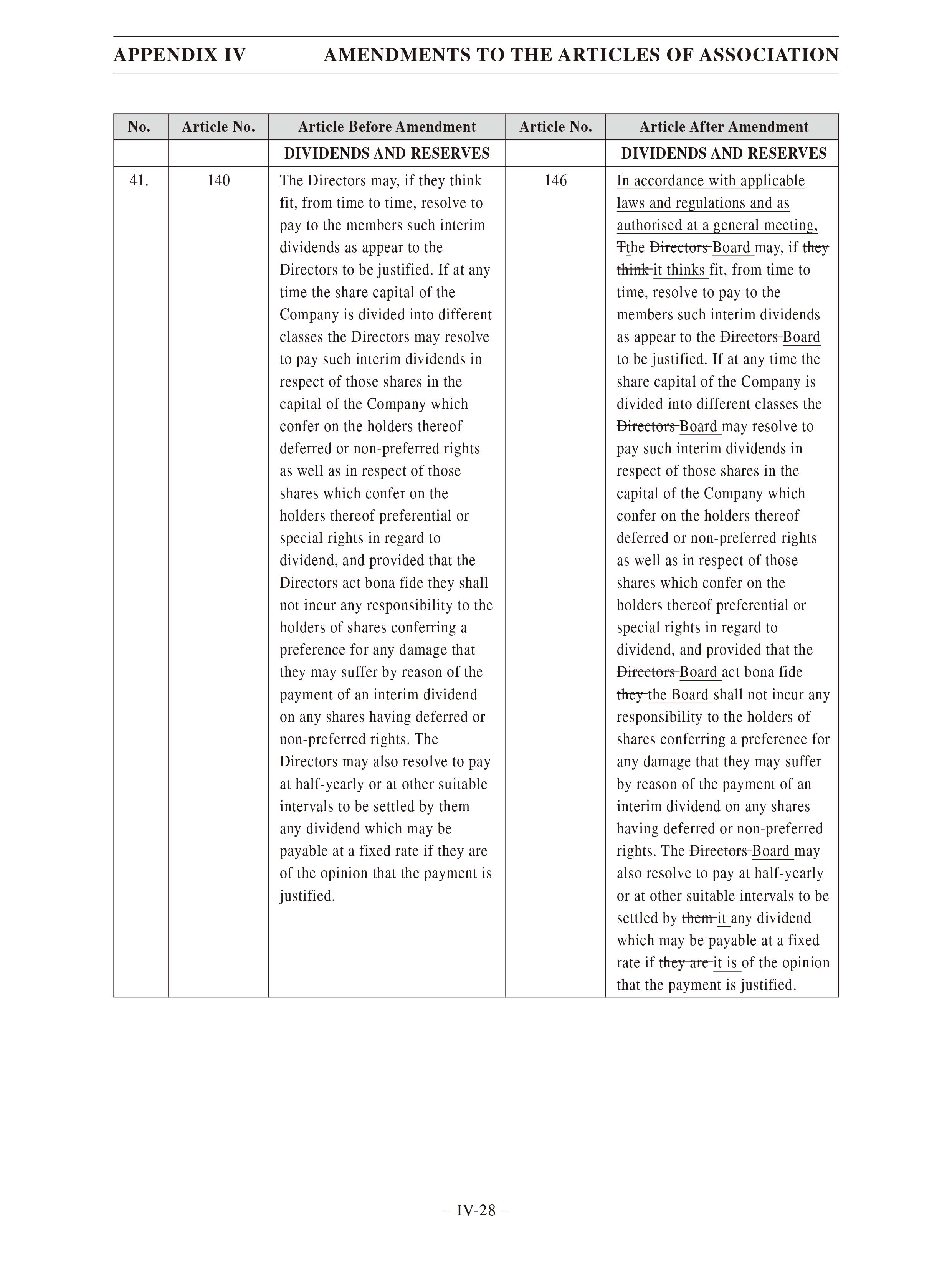

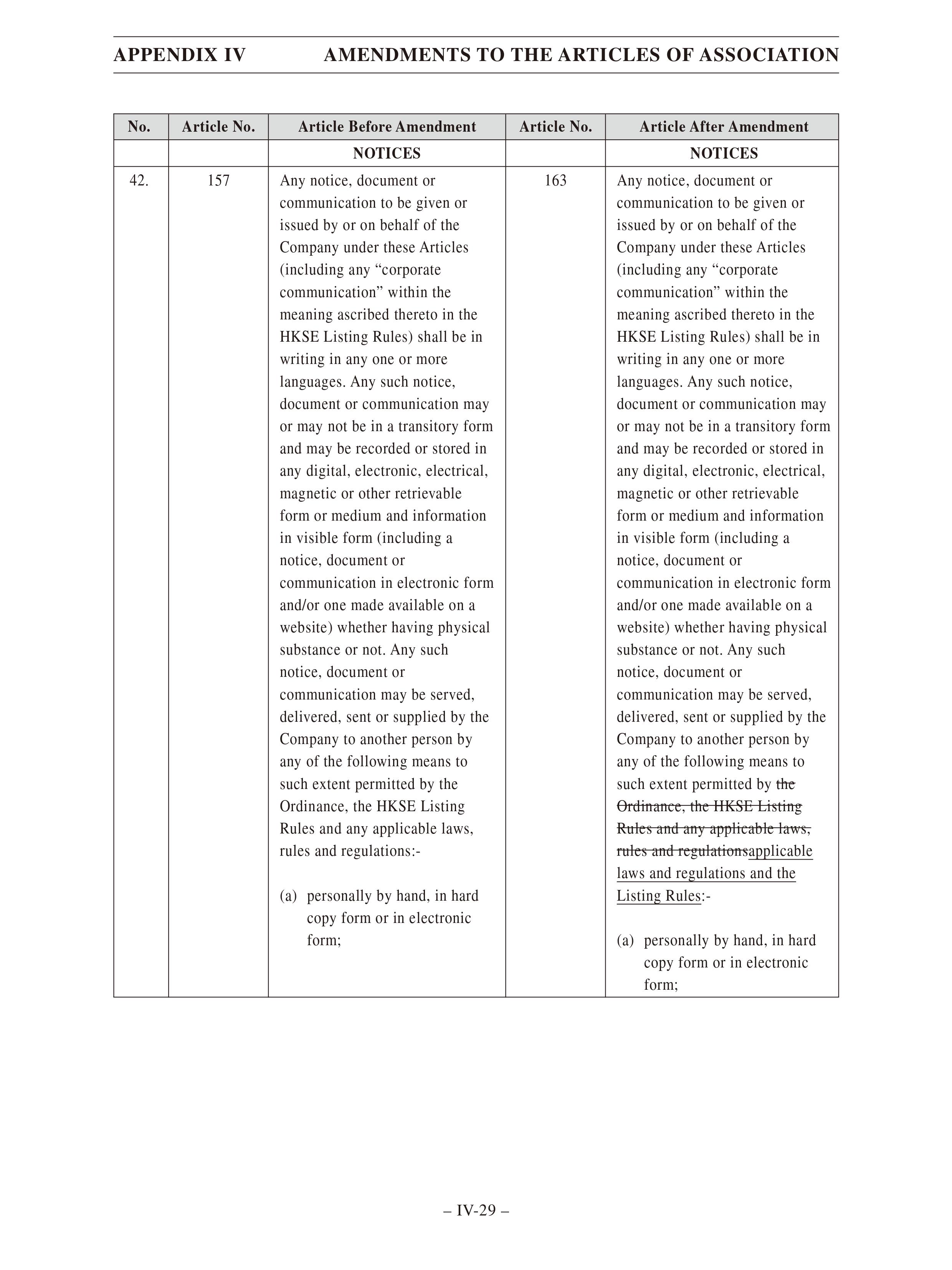

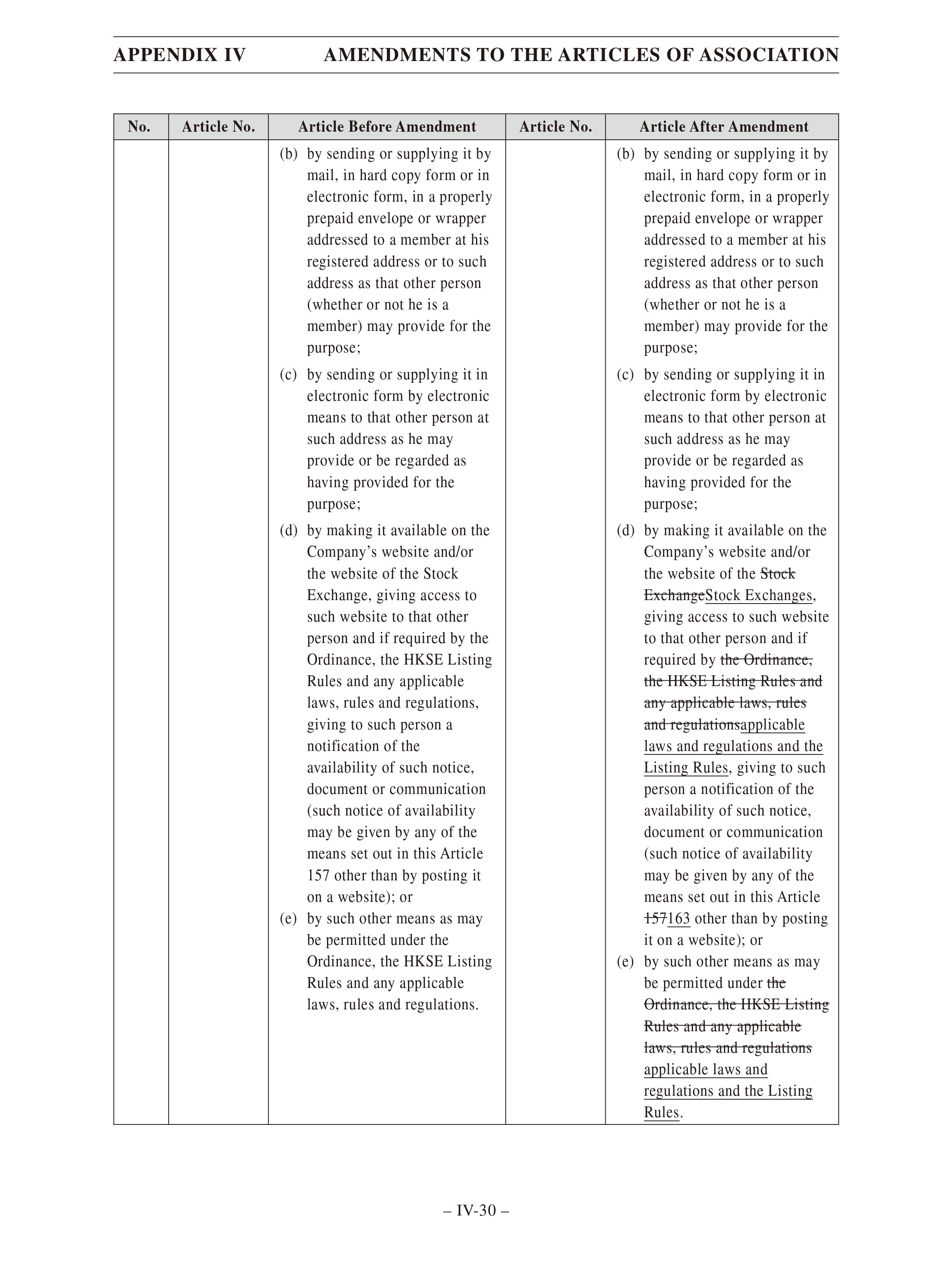

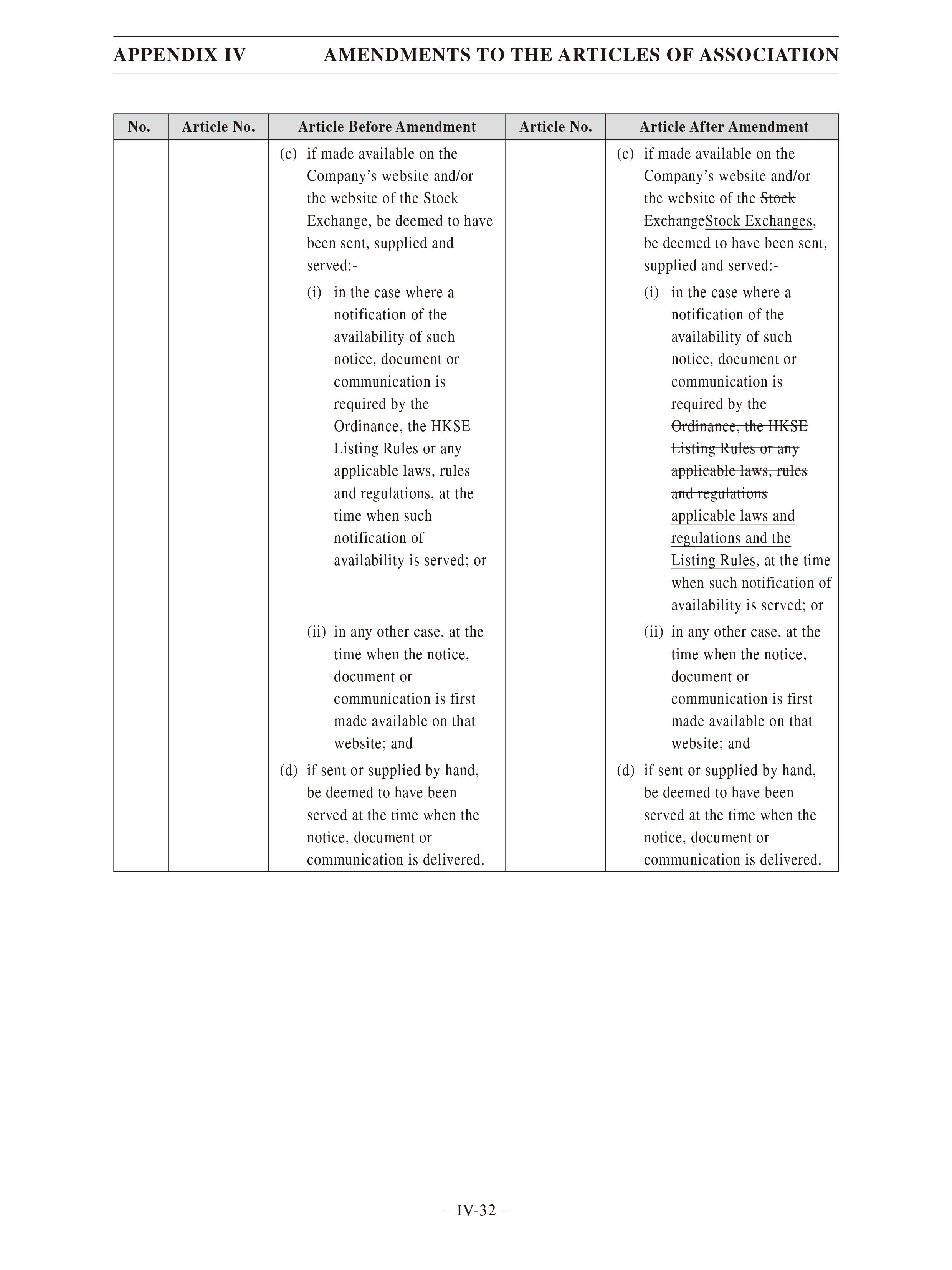

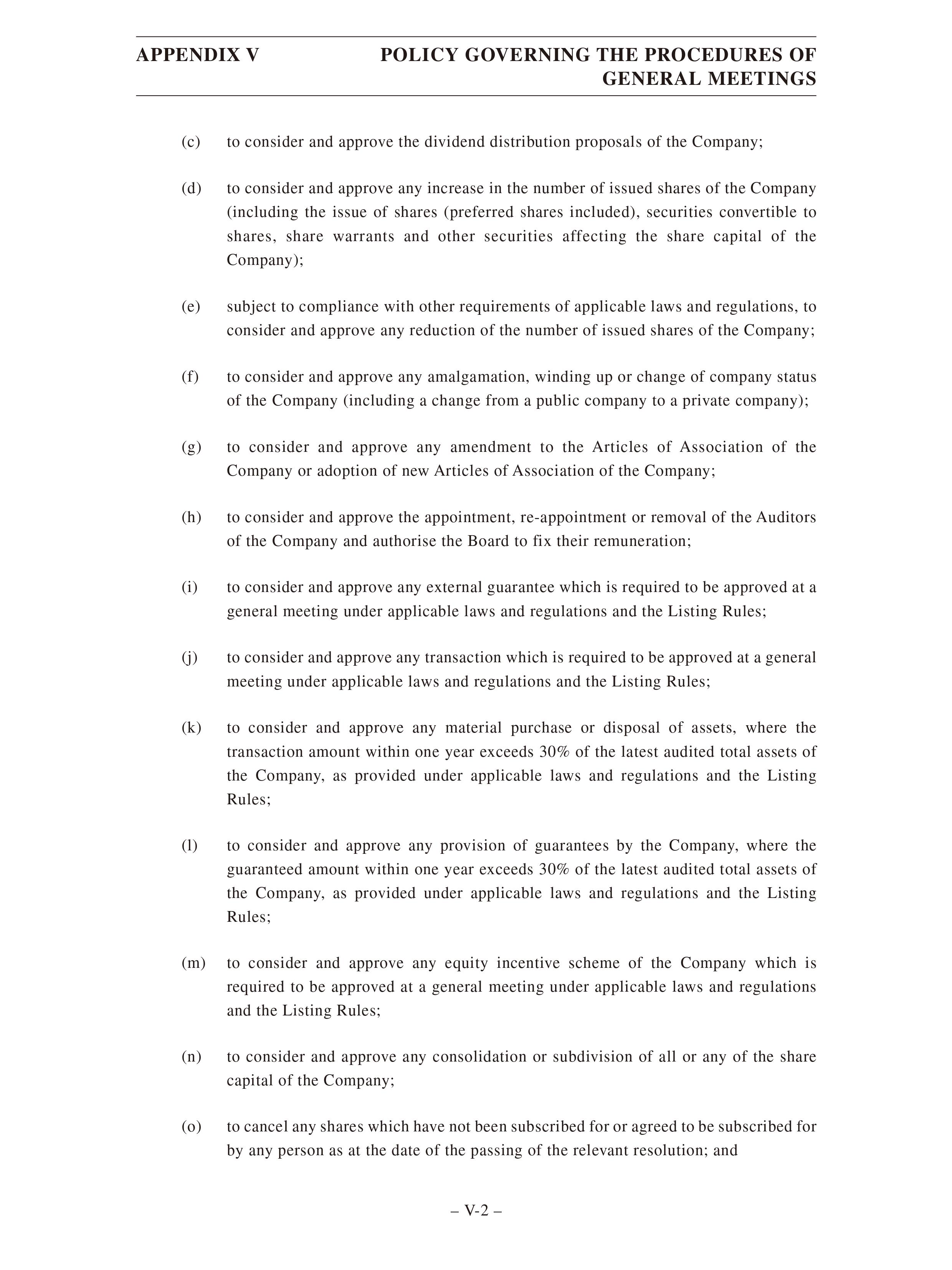

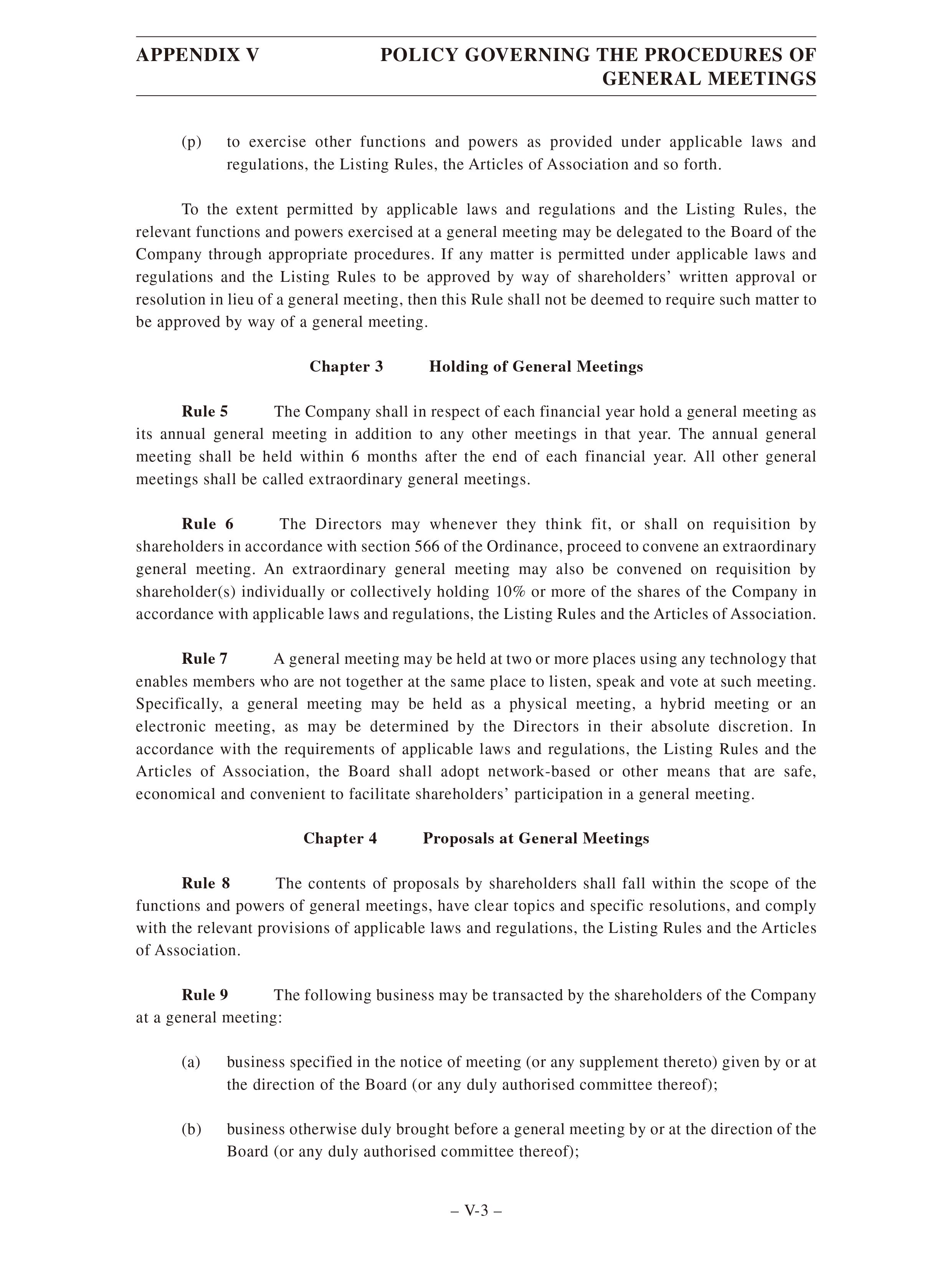

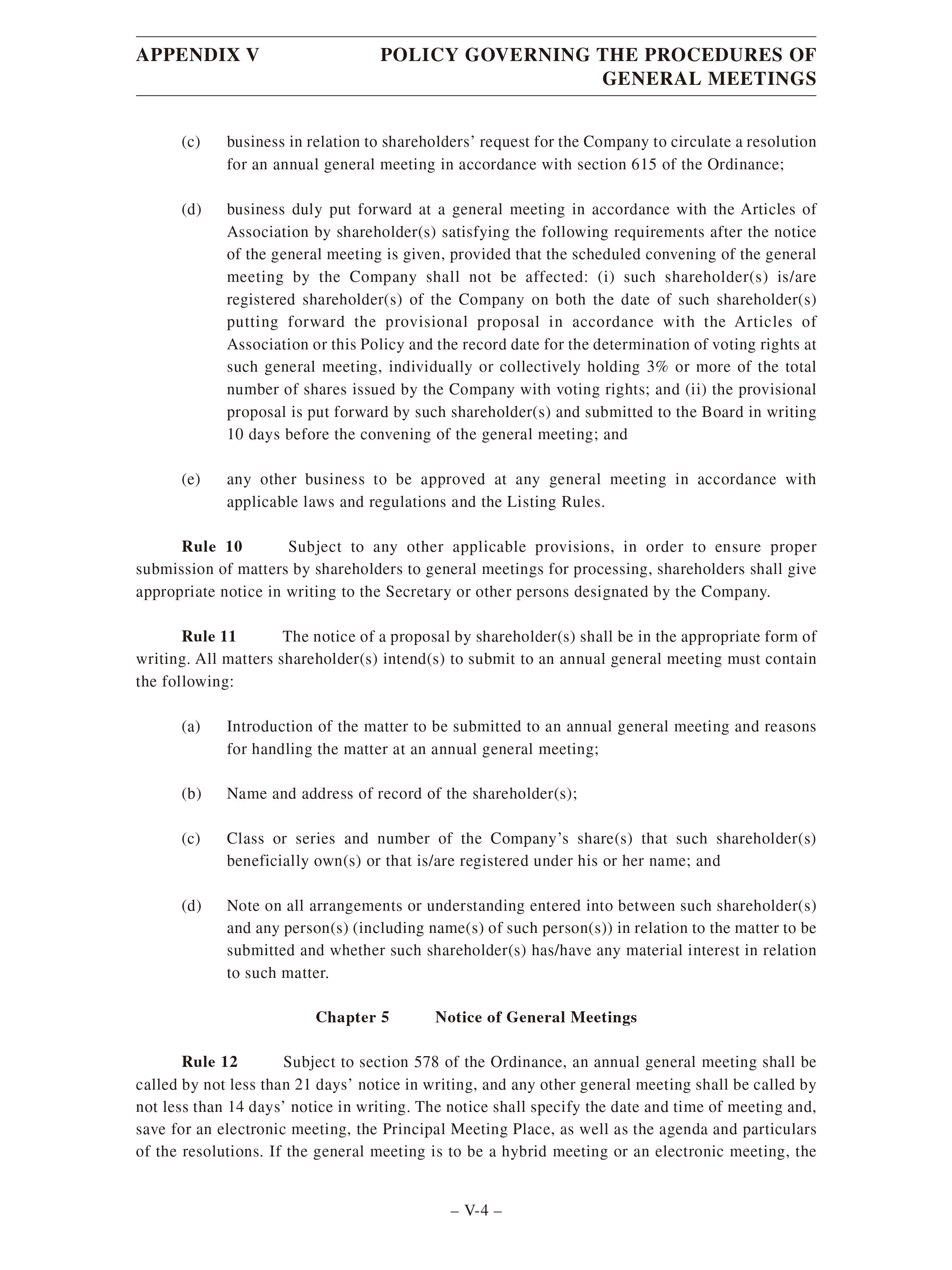

LETTERFROM THE BOARD relation to remedial measures for the potential dilution of immediate returns and the undertaking on binding measures when failing to fulfill relevant undertakings. It is proposed for the Board to be authorised at the general meeting and for the Board to authorise the Chairman, the Chief Executive Officer and the Chief Financial Officer and their authorised persons (individually or collectively) to adjust the content of the undertakings or (where appropriate) to issue new undertakings related to the RMB Share Issue pursuant to the requirements of the relevant laws and regulations, and changes in relevant policies as well as requirements of the regulatory authorities. (viii) Resolution on Dealing with Matters related to Director and Senior Management Liability Insurance and A Share Prospectus Liability Insurance An ordinary resolution will be proposed at the EGM to approve the Company’s proposed dealing in matters related to director and senior management liability insurance and A share prospectus liability insurance. In accordance with the relevant requirements under the Code of Corporate Governance for Listed Companies(CSRCAnnouncement[2018]No.29)(《上市公司治理準則》 (中國證監會公告[2018]29號)),itis proposed to be approved by the Shareholders for the Company to deal with matters related to director and senior management liability insurance and A share prospectus liability insurance, and to authorise the Board and for the Board to authorise the Chairman, the Chief Executive Officer and the Chief Financial Officer and their authorised persons (individually or collectively) to deal with matters related to director and senior management liability insurance and A share prospectus liability insurance (including but not limited to determining the insurance company, amount, premium and other terms; selecting and engaging insurance brokers or other intermediaries; signing relevant legal documents and dealing with other related matters). (ix) Resolution on the Amendments to the Articles of Association A special resolution will be proposed at the EGM to approve, subject to and conditional upon the approval of the RMB Share Issue and the Specific Mandate as described in the above section headed “Resolution on the RMB Share Issue and the Specific Mandate”, the amendments to the Articles of Association as set forth in Appendix IV to this circular and the adoption of the Articles of Association incorporating such proposed amendments. To satisfy the relevant regulatory requirements in relation to the Company’s corporate governance structure after the RMB Share Issue and Listing, the amended Articles of Association is proposed to be approved by the Shareholders. The aforesaid proposal to amend theArticles ofAssociation will take effect at the date of listing of RMB Shares on the Shanghai Stock Exchange after consideration and approval by the Shareholders by way of a special resolution at the EGM. Prior to that, the Articles of Association currently in force shall continue to be effective. The relevant details are set forth in Appendix IV to this circular. (x) Resolution on the Adoption of Policy Governing the Procedures of General Meetings An ordinary resolution will be proposed at the EGM to approve the adoption of the policy governing the procedures of general meetings. –14–

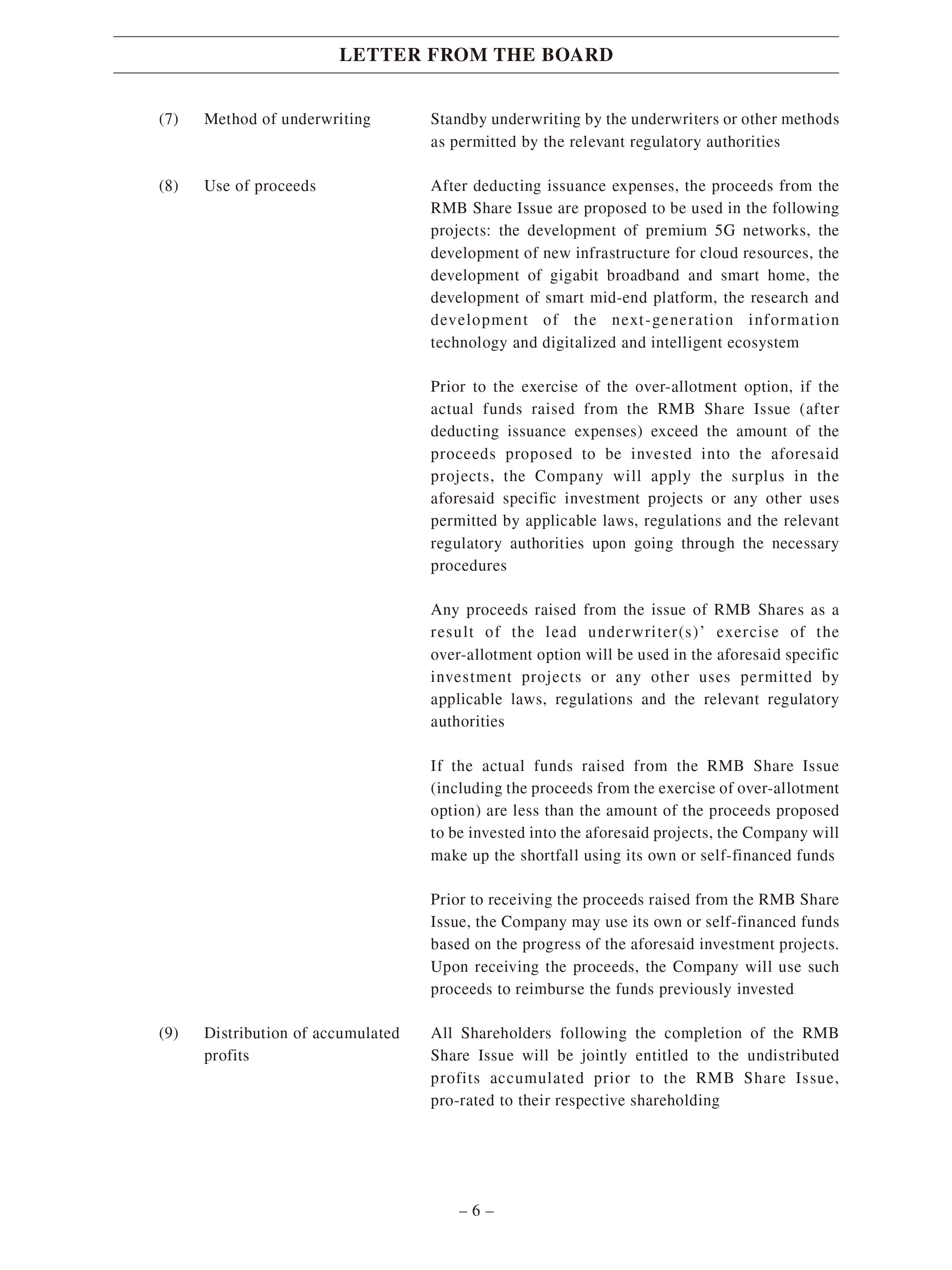

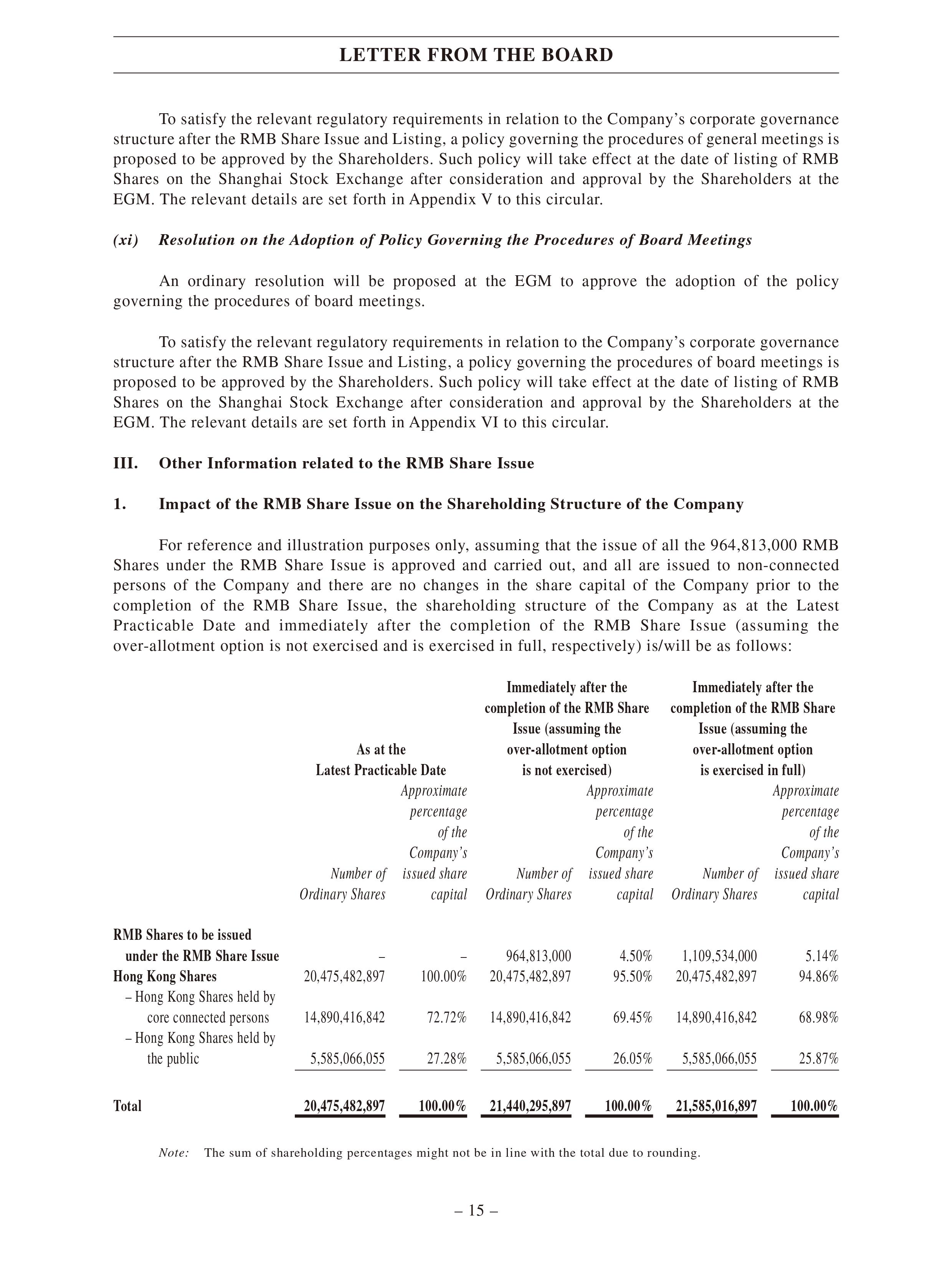

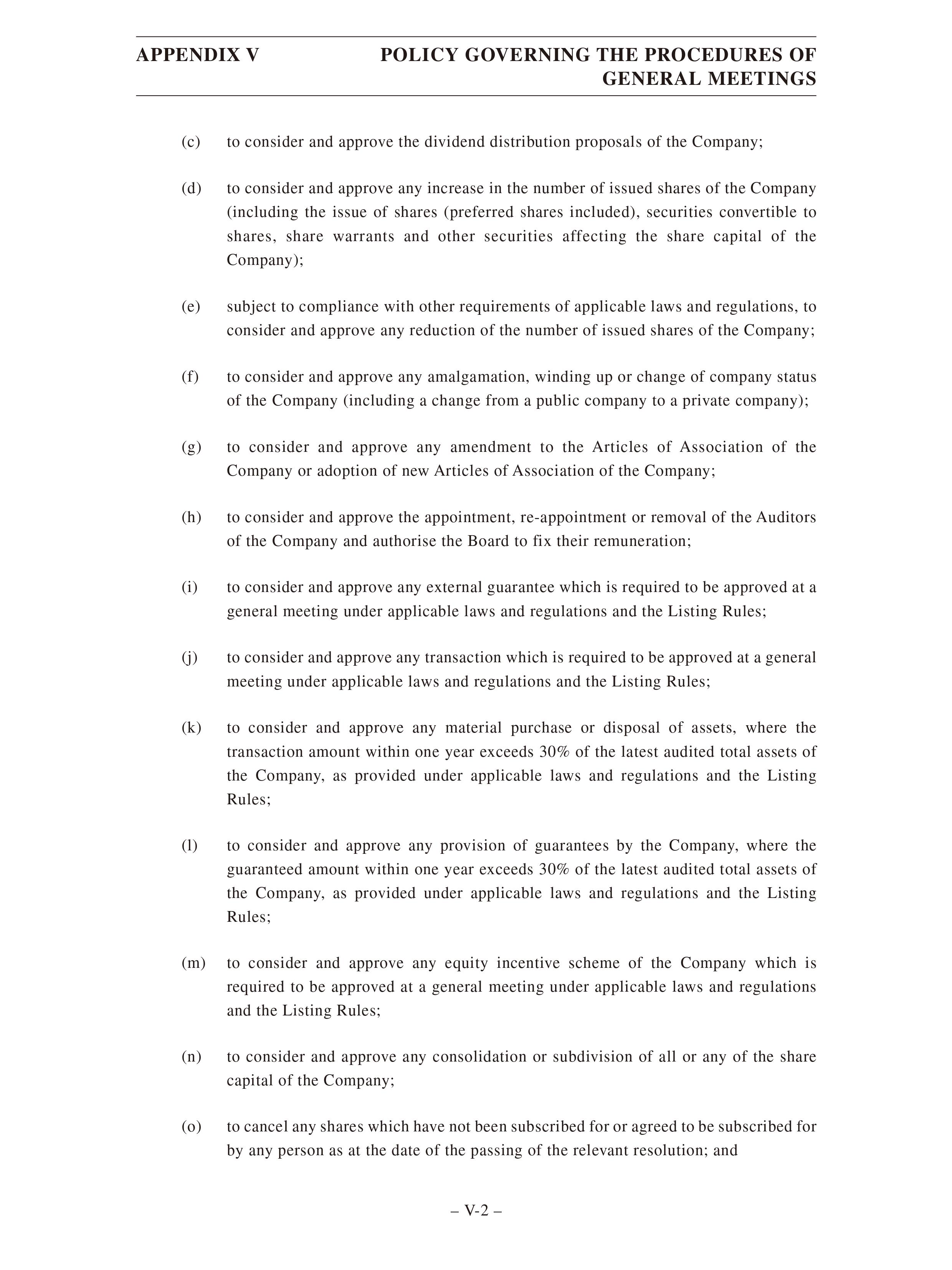

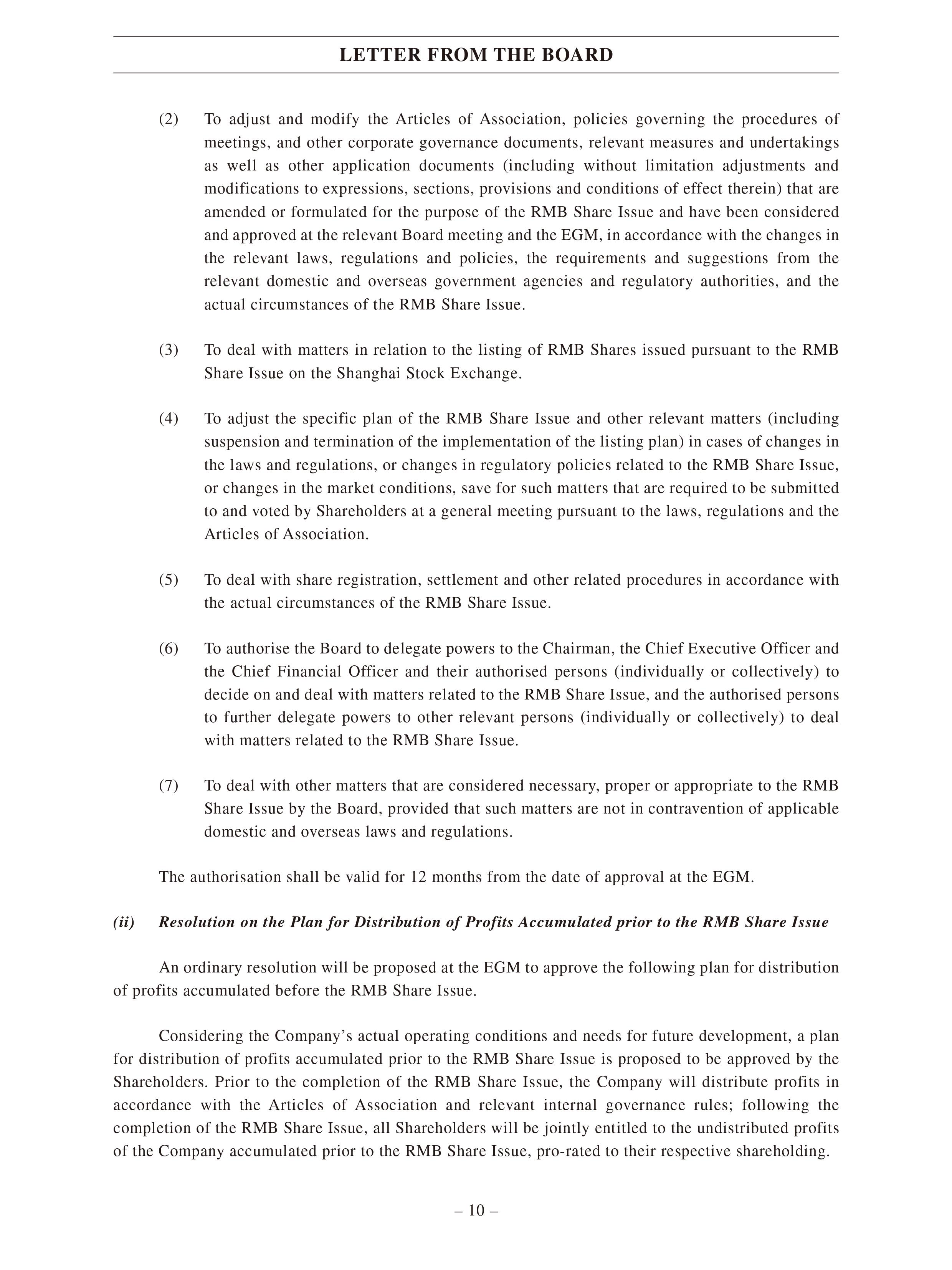

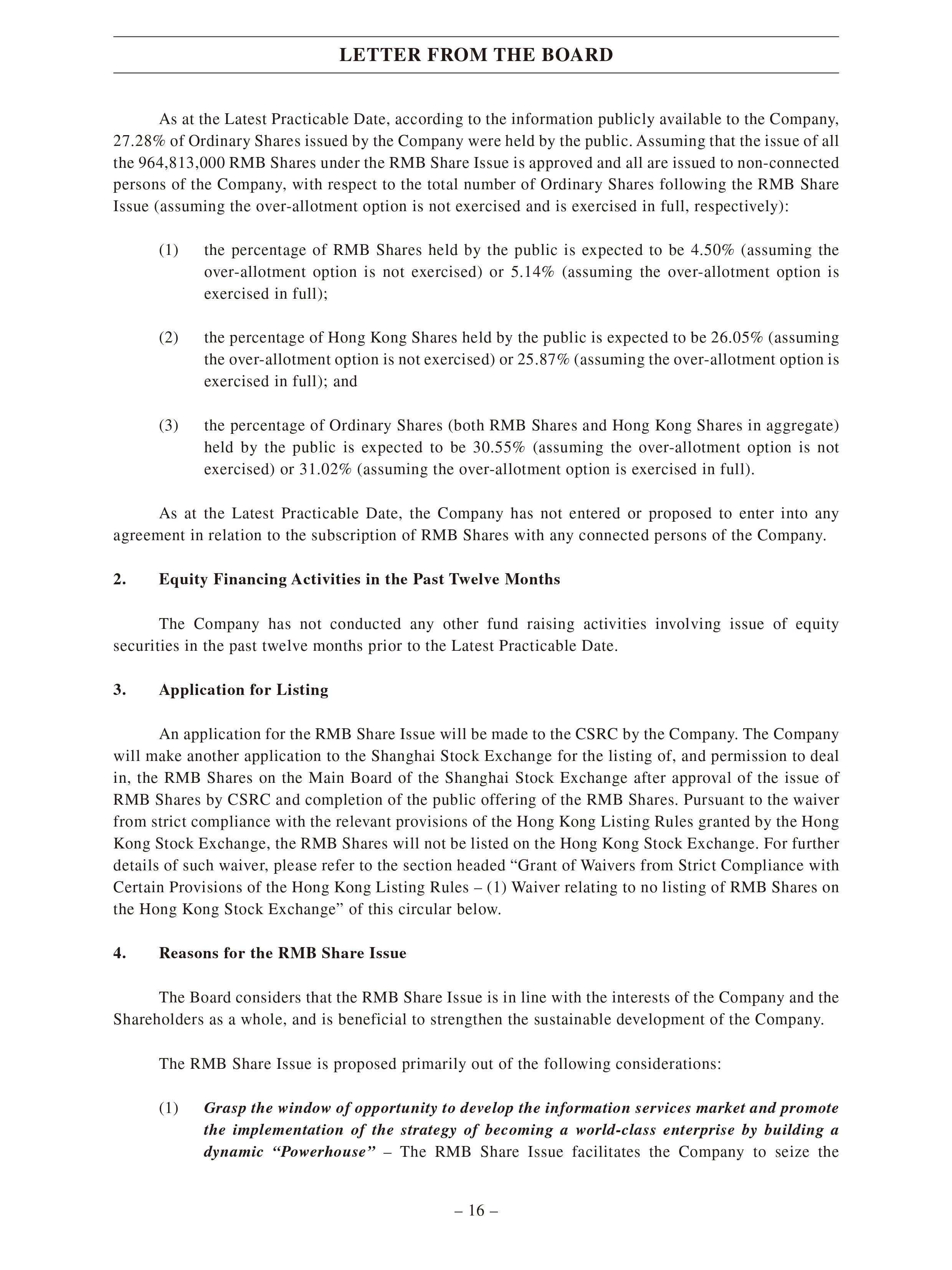

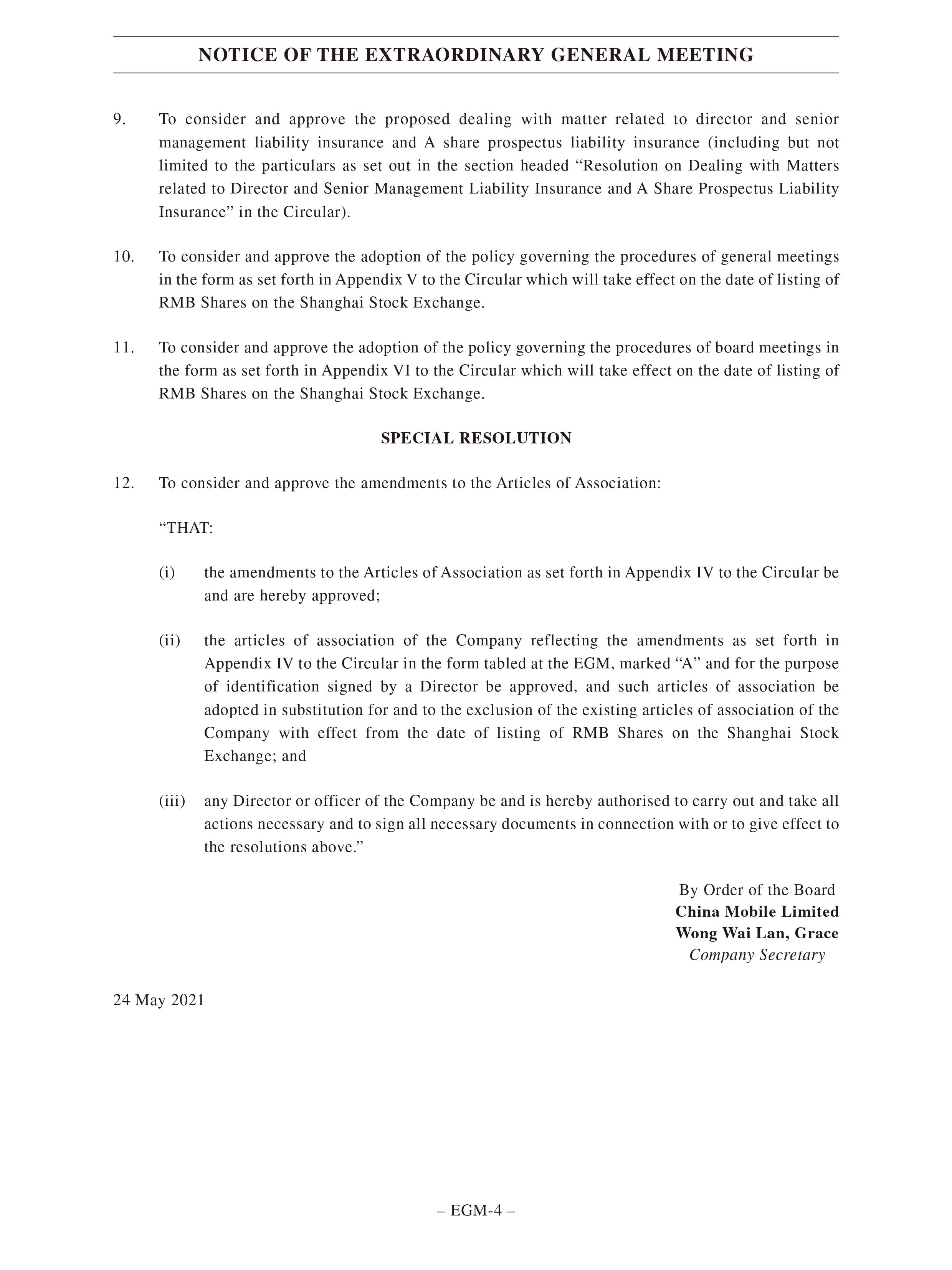

LETTERFROM THE BOARD To satisfy the relevant regulatory requirements in relation to the Company’s corporate governance structure after the RMB Share Issue and Listing, a policy governing the procedures of general meetings is proposed to be approved by the Shareholders. Such policy will take effect at the date of listing of RMB Shares on the Shanghai Stock Exchange after consideration and approval by the Shareholders at the EGM. The relevant details are set forth in Appendix V to this circular. (xi) Resolution on the Adoption of Policy Governing the Procedures of Board Meetings An ordinary resolution will be proposed at the EGM to approve the adoption of the policy governing the procedures of board meetings. To satisfy the relevant regulatory requirements in relation to the Company’s corporate governance structure after the RMB Share Issue and Listing, a policy governing the procedures of board meetings is proposed to be approved by the Shareholders. Such policy will take effect at the date of listing of RMB Shares on the Shanghai Stock Exchange after consideration and approval by the Shareholders at the EGM. The relevant details are set forth in Appendix VI to this circular. III. Other Information related to the RMB Share Issue 1. Impact of the RMB Share Issue on the Shareholding Structure of the Company For reference and illustration purposes only, assuming that the issue of all the 964,813,000 RMB Shares under the RMB Share Issue is approved and carried out, and all are issued to non-connected persons of the Company and there are no changes in the share capital of the Company prior to the completion of the RMB Share Issue, the shareholding structure of the Company as at the Latest Practicable Date and immediately after the completion of the RMB Share Issue (assuming the over-allotment option is not exercised and is exercised in full, respectively) is/will be as follows: Immediately after the Immediately after the completion of the RMB Share completion of the RMB Share Issue (assuming the Issue (assuming the As at the over-allotment option over-allotment option Latest Practicable Date is not exercised) is exercised in full) Approximate Approximate Approximate percentage percentage percentage of the of the of the Company’s Company’s Company’s Number of issued share Number of issued share Number of issued share Ordinary Shares capital Ordinary Shares capital Ordinary Shares capital RMB Shares to be issued under the RMB Share Issue – – 964,813,000 4.50% 1,109,534,000 5.14% Hong Kong Shares 20,475,482,897 100.00% 20,475,482,897 95.50% 20,475,482,897 94.86% – Hong Kong Shares held by core connected persons 14,890,416,842 72.72% 14,890,416,842 69.45% 14,890,416,842 68.98% – Hong Kong Shares held by the public 5,585,066,055 27.28% 5,585,066,055 26.05% 5,585,066,055 25.87% Total 20,475,482,897 100.00% 21,440,295,897 100.00% 21,585,016,897 100.00% Note: The sum of shareholding percentages might not be in line with the total due to rounding. –15–

LETTERFROM THE BOARD As at the Latest Practicable Date, according to the information publicly available to the Company, 27.28% of Ordinary Shares issued by the Company were held by the public.Assuming that the issue of all the 964,813,000 RMB Shares under the RMB Share Issue is approved and all are issued to non-connected persons of the Company, with respect to the total number of Ordinary Shares following the RMB Share Issue (assuming the over-allotment option is not exercised and is exercised in full, respectively): (1) the percentage of RMB Shares held by the public is expected to be 4.50% (assuming the over-allotment option is not exercised) or 5.14% (assuming the over-allotment option is exercised in full); (2) the percentage of Hong Kong Shares held by the public is expected to be 26.05% (assuming the over-allotment option is not exercised) or 25.87% (assuming the over-allotment option is exercised in full); and (3) the percentage of Ordinary Shares (both RMB Shares and Hong Kong Shares in aggregate) held by the public is expected to be 30.55% (assuming the over-allotment option is not exercised) or 31.02% (assuming the over-allotment option is exercised in full). As at the Latest Practicable Date, the Company has not entered or proposed to enter into any agreement in relation to the subscription of RMB Shares with any connected persons of the Company. 2. Equity Financing Activities in the Past Twelve Months The Company has not conducted any other fund raising activities involving issue of equity securities in the past twelve months prior to the Latest Practicable Date. 3. Application for Listing An application for the RMB Share Issue will be made to the CSRC by the Company. The Company will make another application to the Shanghai Stock Exchange for the listing of, and permission to deal in, the RMB Shares on the Main Board of the Shanghai Stock Exchange after approval of the issue of RMB Shares by CSRC and completion of the public offering of the RMB Shares. Pursuant to the waiver from strict compliance with the relevant provisions of the Hong Kong Listing Rules granted by the Hong Kong Stock Exchange, the RMB Shares will not be listed on the Hong Kong Stock Exchange. For further details of such waiver, please refer to the section headed “Grant of Waivers from Strict Compliance with Certain Provisions of the Hong Kong Listing Rules – (1) Waiver relating to no listing of RMB Shares on the Hong Kong Stock Exchange” of this circular below. 4. Reasons for the RMB Share Issue The Board considers that the RMB Share Issue is in line with the interests of the Company and the Shareholders as a whole, and is beneficial to strengthen the sustainable development of the Company. The RMB Share Issue is proposed primarily out of the following considerations: (1) Grasp the window of opportunity to develop the information services market and promote the implementation of the strategy of becoming a world-class enterprise by building a dynamic “Powerhouse” – The RMB Share Issue facilitates the Company to seize the –16–

LETTERFROM THE BOARD historic opportunities in the new era, construct first-class new infrastructure, speed up the implementation of next-generation information technologies, advance the deep integration of information technology and the economy, society and people’s livelihood, capture new markets emerged in the blue-ocean digital economy, comprehensively promote digitalized and intelligent transformation, achieve high-quality development, and take solid steps toward becoming a world-class enterprise by building a dynamic “Powerhouse”. (2) Leverage high-quality resources in the capital market and cultivate an open and collaborative ecosystem with new vitality – The RMB Share Issue will see the introduction of strategic investors, which will help build a new cooperative mechanism with complementary capabilities, positive interaction, resources sharing and synergized development, accelerate the deployment of the Company’s digital intelligence plan in breadth and depth and the flourishment of a digitalized and intelligent collaborative ecosystem, thereby sharing the benefits of digitalization with shareholders, customers and industries. (3) Advance system reforms and build new momentum toward high-quality development – The RMB Share Issue will help further improve the Company’s corporate governance structure and decision-making mechanism, enhance the level of governance, explore and build a more flexible incentive mechanism, establish more mature institutions suited for a modern enterprise, raise the enterprise’s vitality and productivity, and achieve high-quality development. 5. Grant of Waivers from Strict Compliance with Certain Provisions of the Hong Kong Listing Rules For the purpose of the RMB Share Issue, the Company has applied for, and the Hong Kong Stock Exchange has granted, the following waivers from strict compliance with the relevant provisions of the Hong Kong Listing Rules. (i) Waiver relating to no listing of RMB Shares on the Hong Kong Stock Exchange The RMB Shares and the Hong Kong Shares are of the same class. However, the RMB Shares will only be listed on the Shanghai Stock Exchange (subject to the obtaining of the necessary approval by the relevant PRC regulatory authorities), and not on the Hong Kong Stock Exchange. The Company has applied for, and the Hong Kong Stock Exchange has granted, a one-off waiver so that there is no need to seek listing on the Hong Kong Stock Exchange of the RMB Shares to be issued under the RMB Share Issue as required under Rules 8.20 and 13.26 of the Hong Kong Listing Rules, subject to the following conditions: (1) Rule 6.11 of the Hong Kong Listing Rules is modified such that the requirements of obtaining the prior approval of shareholders and holders of any other class of listed securities (where applicable) for voluntary withdrawal of listing on the Hong Kong Stock Exchange shall apply to holders of the Hong Kong Shares only; –17–

LETTERFROM THE BOARD (2) Rule 6.12 of the Hong Kong Listing Rules is modified such that the requirement of obtaining the prior approval of shareholders for voluntary withdrawal of listing on the Hong Kong Stock Exchange that (i) the approval must be given by at least 75% of the votes attaching to any class of listed securities held by holders voting either in person or by proxy at a general meeting; and (ii) the number of votes cast against the resolution is not more than 10% of the votes attaching to any class of listed securities held by holders permitted under Rule 6.12(1) of the Hong Kong Listing Rules to vote in person or by proxy at the meeting, shall apply to holders of the Hong Kong Shares only; (3) Rule 6.15 of the Hong Kong Listing Rules is modified such that the requirement of fulfilling shareholders’ approval requirements under the Code on Takeovers and Mergers for voluntary withdrawal of listing on the Hong Kong Stock Exchange shall apply to holders of the Hong Kong Shares only; (4) Rule 13.36(2)(b) of the Hong Kong Listing Rules is modified such that all the Shareholders can, by ordinary resolution in a general meeting of holders of both the Hong Kong Shares and the RMB Shares voting as a single class, give a general mandate to the Directors under which (i) the aggregate number of Hong Kong Shares allotted or agreed to be allotted must not exceed 20% of the number of the issued Hong Kong Shares as at the date of the resolution granting the general mandate; and (ii) the aggregate number of RMB Shares allotted or agreed to be allotted must not exceed 20% of the number of the issued RMB Shares as at the date of the resolution granting the general mandate; and (5) Rule 13.36(2)(b) of the Hong Kong Listing Rules is further modified such that all the Shareholders can, by ordinary resolution in a general meeting of holders of both the Hong Kong Shares and the RMB Shares voting as a single class, give a repurchase mandate to the Directors under which the maximum number of Hong Kong Shares repurchased by the Company since the granting of the general mandate will be 10% of the number of the issued Hong Kong Shares as at the date of the resolution granting the repurchase mandate and the 10% repurchase mandate will be used for purchasing the Hong Kong Shares only. Given this is a one-off waiver for the RMB Share Issue only, the Company would need to apply for waiver from Rules 8.20 and 13.26 of the Hong Kong Listing Rules for any further issue of new RMB Shares. (ii) Waiver relating to corporate communications In respect of the RMB Shares to be listed on the Shanghai Stock Exchange, the Company is not required by the relevant rules and regulations in the PRC to (i) seek an express and positive written confirmation from each holder of the RMB Shares that corporate communications may be made available using electronic means, or (ii) physically send a circular to the holders of the RMB Shares. Publication of corporate communications on the website of the Shanghai Stock Exchange and the media that meets the requirements prescribed by the CSRC would constitute effective delivery to the holders of the RMB Shares. –18–

LETTERFROM THE BOARD The Company has applied for, and the Hong Kong Stock Exchange has granted, a waiver so that the requirements relating to corporate communications under Rule 2.07A of the Hong Kong Listing Rules will apply only to the holders of the Hong Kong Shares. (iii) Waiver relating to certification of transfers Pursuant to the relevant regulatory requirements, the RMB Shares shall be listed and traded on the Shanghai Stock Exchange, and be registered and deposited with and settled through CSDC. Pursuant to the trading rules of the Shanghai Stock Exchange, trading in securities is conducted via a paperless, book entry based trading system, and there is no requirement under the Rules Governing the Listing of Stocks on the Shanghai Stock Exchange (Shanghai Stock Exchange [2020] No. 100)《上海證券交易所股票上 (市規則》 (上證發[2020]100號)) to issue physical share certificates in respect of the RMB Shares as proof of title. CSDC adopts an electronic securities registration system, conducts registration onto the register of securities holders pursuant to the record of the securities accounts. The record issued by CSDC is the legal proof of security holders’ holding in shares. Further, the RMB Shares can be transferred on the Shanghai Stock Exchange (“On-Exchange Transfers”) in two ways, namely, “on-market trading” and “off-market transfers”. On-market trading refers to transfers pursuant to transactions conducted between two parties holding stock accounts through the paperless trading platform of the Shanghai Stock Exchange, which does not involve any certificate, temporary documents or split renounceable documents. Off-market transfers include (without limitation) share transfers due to assignment by agreement, inheritance, gift and property division, for which relevant applicants must submit materials required by CSDC to complete the transfer, and CSDC will handle the transfer registration with respect to such off-market transfers of the RMB Shares. The Company has applied for, and the Hong Kong Stock Exchange has granted, a waiver so that requirements relating to certification of transfers to be completed within certain time frame under Rule 13.58 of the Hong Kong Listing Rules will apply only to transfers of the Hong Kong Shares and any transfer of RMB Shares other than On-Exchange Transfers. (iv) Waiver relating to securities registration services As CSDC will provide securities registration services to holders of the RMB Shares, and there will be no need for certificate registration services given that the RMB Shares can be traded electronically on the Shanghai Stock Exchange and will not require any share certificate to evidence title. In addition, the RMB Shares and the Hong Kong Shares will not be fungible. The Company has applied for, and the Hong Kong Stock Exchange has granted, a waiver so that the requirements relating to securities registration services under Rules 13.59 and 13.60 of the Hong Kong Listing Rules will apply only to the Hong Kong Shares. IV. EGM The EGM will be held onWednesday, 9 June 2021 at 9:30 a.m. in the Grand Ballroom, Grand Hyatt Hong Kong, 1 Harbour Road, Wanchai, Hong Kong. A notice of the EGM is set out on pages EGM-1 to EGM-5 of this circular. The form of proxy for use at the EGM has been despatched to the Shareholders together with this circular and also published on the websites of the Hong Kong Stock Exchange and the Company. –19–

LETTERFROM THE BOARD Whether or not you intend to attend the EGM, you are requested to complete and return the form of proxy in accordance with the instructions printed thereon. The form of proxy should be deposited at the Company’s registered office at 60/F, The Center, 99 Queen’s Road Central, Hong Kong as soon as possible and in any event not less than 24 hours before the time appointed for the EGM or any adjournment thereof. Completion and return of the form of proxy will not preclude you from attending and voting in person at the EGM or at any adjournment thereof should you so wish, but in such event the instrument appointing a proxy shall be deemed to be revoked. To the best of the Directors’ knowledge, information and belief, having made all reasonable enquiries, no Shareholder has a material interest in the resolutions mentioned above and therefore no Shareholder is required to abstain from voting at the EGM. V. RECOMMENDATION The Directors (including the independent non-executive Directors) consider that the resolutions mentioned above are in the best interests of the Company and the Shareholders as a whole.Accordingly, the Directors (including the independent non-executive Directors) recommend all Shareholders to vote in favour of the resolutions to be proposed at the EGM. VI. RESPONSIBILITY STATEMENT This circular, for which the Directors collectively and individually accept full responsibility, includes particulars given in compliance with the Hong Kong Listing Rules for the purpose of giving information with regard to the Company. The Directors, having made all reasonable enquiries, confirm that to the best of their knowledge and belief the information contained in this circular is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make this circular or any statement herein misleading. VII. FURTHER INFORMATION Your attention is drawn to the additional information set out in this circular and appendices. As the RMB Share Issue and the Specific Mandate are subject to approval by Shareholders at the EGM and approvals from the relevant regulatory authorities, there is uncertainty as to whether it will or will not proceed. Shareholders and investors should exercise caution when dealing in the securities of the Company. Further announcement(s) will be made to disclose any material updates and progress in respect of the RMB Share Issue and the Specific Mandate in accordance with the Hong Kong Listing Rules and other applicable laws and regulations as and when appropriate. This circular is for information only and is not intended to and does not constitute, or form part of, an invitation or offer to acquire, purchase or subscribe for any securities of the Company. Yours faithfully Yang Jie Chairman –20–

APPENDIX I PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE CHINA MOBILE LIMITED PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE INITIAL PUBLIC OFFERING AND LISTING OF RMB ORDINARY SHARE (A SHARES) To protect the rights and interests of the minority Shareholders, this plan is hereby formulated by the Company in accordance with the requirements under the Securities Law of the People’s Republic of China (Order No. 37 of the President of the People’s Republic of China) 《中華人民共和國證券法》 ( (中華人民共和國主席令第37號)), the “Securities Law”), the Opinions of the China Securities Regulatory Commission on Further Promoting the Reform of New Share Offering Scheme (CSRCAnnouncement [2013] No.42)《中國證監會關於進一步推進 (新股發��體制改革的意見》 (中國證監會公告[2013]42號)) and other applicable laws and regulations. I. Specific Condition for Initiating the Plan for Share Price Stabilisation (1) Where the closing price of the A Shares has been lower than the latest audited net asset value per share (as adjusted for changes in the Company’s net assets or number of shares due to dividends distribution, stock distribution, capitalisation of capital reserve, stock splitting, share allotment, placing, stock reduction or other events after the latest auditing benchmark date, similarly hereinafter) for 20 consecutive trading days within three years following the issuing and listing of RMB Shares which is not caused by force majeure events (the “Condition for Share Price Stabilisation”), and subject to requirements for changes in share capital including increase of shareholding and repurchase under the Securities Law and other relevant laws, administrative regulations, departmental rules, regulatory documents and other domestic and overseas regulatory requirements (including the listing rules of the place where the Shares of the Company are listed, collectively, the “Relevant Laws and Regulations”), the Company and the relevant parties will initiate the measures for share price stabilisation. 1. The controlling shareholder or the actual controller (or their designated entity subject to laws and regulations) of the Company shall, within 10 trading days after the fulfillment of the Condition for Share Price Stabilisation, notify the Company in writing as to whether they have any specific plan to increase their holding of A Shares of the Company, and the Company shall make an announcement in accordance with information disclosure requirements applicable to the listed companies. If the controlling shareholder or the actual controller of the Company (or their designated entity subject to laws and regulations) plan to increase its shareholding, it shall disclose the range of quantity and price, completion time and other information of the proposed increase in shareholding, and the total amount of funds to be used for such increase in shareholding shall not be less than RMB200 million. The shareholding structure of the Company after the increase in shareholding shall meet the listing conditions, and the increase in shareholding and information disclosure shall comply with the Relevant Laws and Regulations. – I-1 –

APPENDIX I PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE 2. If the controlling shareholder or the actual controller (or their designated entity subject to laws and regulations) of the Company fails to timely announce the aforementioned specific plan to increase shareholding, or has clearly stated that there is no plan to increase shareholding, the Board will announce its plan for stabilisation of A Share price within 20 trading days after the fulfillment of the Condition for Share Price Stabilisation. The plan for stabilisation of A Share price includes but is not limited to repurchase of A Shares and other measures subject to the Relevant Laws and Regulations. If the Company plans to repurchase A Shares, the share repurchase plan will include but not limited to the number of A Shares to be repurchased, the price range, the source of funds for the repurchase and the completion time, and the total amount of funds to be used for such repurchase under the plan shall not be less than RMB200 million. The Company shall complete the internal approval procedures in accordance with the Relevant Laws and Regulations applicable to the plan for stabilisation of share price and the Articles of Association, and perform other relevant procedures required by the Relevant Laws and Regulations and obtain relevant approvals before implementing the plan for stabilisation of share price. 3. If the Board fails to timely announce the aforementioned plan for stabilisation of A Share price as scheduled, or fails to obtain approvals for the aforementioned plan for stabilisation of share price from the Shareholders’ general meeting or regulatory authorities due to various reasons, the obligations to increase the holding of the Company’s A Shares by the Directors (other than independent non-executive Directors and Directors who do not receive remuneration from the Company) (the “Relevant Directors”) and senior management will be triggered. The Relevant Directors and senior management shall notify the Company in writing as to whether they have any specific plan to increase their holding of A Shares of the Company within 30 trading days after the fulfillment of the Condition for Share Price Stabilisation, and the Company shall make an announcement in accordance with information disclosure requirements applicable to the listed companies. Subject to the requirements of the Relevant Laws and Regulations, the Relevant Directors and senior management shall purchase the A Shares within 10 trading days after the obligation to increase their holding of the Company’s A Shares is triggered (if there are N trading days during the period when the transactions by the Relevant Directors and senior management are restricted, the Relevant Directors and senior management shall purchase A Shares within 10+N trading days after the obligation to increase their shareholding in the Company is triggered), and their cumulative amount of funds to be used for such increase in shareholding shall not be less than 10% of the total amount of post-tax remuneration received from the Company in the previous year. – I-2 –

APPENDIX I PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE (2) Within 120 trading days after the completion of any of the aforementioned three measures for stabilisation of A Share price, the obligation of stabilisation of A Share price by the controlling shareholder or the actual controller (or their designated entity subject to laws and regulations) of the Company, the Company, the Relevant Directors and senior management is automatically released. Starting from the 121st trading day after the completion of any of the above three measures for stabilisation of the A Share price, if the closing price of the Company’s A Shares is lower than the latest audited net asset value per share for 20 consecutive trading days, the Condition for Share Price Stabilisation shall be deemed to be met again. (3) The controlling shareholder or the actual controller (or their designated entity subject to laws and regulations) of the Company, the Company, the Relevant Directors and senior management shall, when adopting the aforementioned measures for stabilisation of A Share price, fulfill the corresponding information disclosure obligations in accordance with the Relevant Laws and Regulations, and comply with the Relevant Laws and Regulations applicable and the Articles of Association of the Company. II. Termination of the Plan for Share Price Stabilisation After the Condition for Share Price Stabilisation is triggered, the plan for stabilisation ofA Share price that has been formulated or announced would be terminated, and the plan that has been implemented is deemed to have been complete with no need for further implementation, if one of the following circumstances occurs: (1) The closing price of the Company’s A Shares is not lower than the Company’s latest audited net asset value per share for 5 consecutive trading days; (2) Further implementation of the stabilisation of A Share price will result in the failure of the Company’s shareholding structure to meet the listing conditions or will violate the relevant prohibition regulations in effect. III. Restrictive Measures (1) If the Company’s controlling shareholder or the actual controller (or their designated entity subject to laws and regulations) fails to increase its holding of A Shares due to subjective reasons after the Company published the relevant announcement, the Company may temporarily withhold the cash dividends (if any) for the year in which the obligation of the controlling shareholder or the actual controller to increase shareholding is triggered and the following year, until the controlling shareholder or the actual controller (or their designated entity subject to laws and regulations) fulfills its obligation to increase its holding of A Shares. – I-3 –

APPENDIX I PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE (2) Where the board of Directors fails to timely announce the measures for stabilisation of A Share price, or the stabilisation measures of A Share price passed by the board of Directors and the general meeting requiring the Company to buy back the A Shares are not implemented, the Company should publicly explain the reasons for non-implementation and apologize to the Shareholders and the public investors in the general meeting and the newspapers and magazines specified by the CSRC. (3) If the Relevant Directors and senior management of the Company fail to increase their holdings of A Shares due to subjective reasons after the Company published the announcement regarding shareholding increase, the Company is entitled to temporarily withhold the equivalent amount of remuneration payable to the Relevant Directors and senior management (i.e. 10% of monthly post-tax remuneration of the relevant party will be deducted from the month when such party fails to fulfill the obligation to increase shareholding, and the cumulative deduction amount shall not exceed 10% of the total post-tax remuneration received from the Company in the year before the obligation for stabilisation of share price is triggered), until the Relevant Directors and senior management perform their obligation to increase their holdings of A Shares. (4) If the Company, the Relevant Directors and senior managers are unable to perform their obligations to repurchase or increase holding in A Shares within a certain period of time due to the public float requirements of securities regulatory laws and regulations (including the listing rules of the place where the Shares of the Company are listed), the relevant responsible entities would be exempted from the above restrictive measures, but they should actively take other measures for stabilisation of A Share price. IV. Others During the validity period of this plan, the Relevant Directors and senior management of the Company newly appointed shall perform the obligations of the Relevant Directors and senior management stipulated in this plan, and perform the other undertakings made by the Relevant Directors and senior management in the initial public offering of RMB ordinary shares (A Shares) with the same standards. If the Relevant Laws and Regulations provide otherwise when this plan is implemented, the Company shall comply with the relevant requirements. During the validity period of this plan, if this plan needs to be revised in accordance with new requirements issued by regulatory authorities including the CSRC and the Shanghai Stock Exchange, the Board and its designated persons shall be authorized by the Shareholders’ general meeting to make such amendment accordingly. – I-4 –

APPENDIX I PLAN FOR STABILISATION OF THE PRICE OF RMB SHARES WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE V. Validity Period of the Policy Subject to the approval by the Shareholders at the general meeting, the plan shall take effect from the date of the issuing and listing of the RMB Shares, and remain valid within three years thereafter. – I-5 –

APPENDIX II SHAREHOLDERRETURN PLAN WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE CHINA MOBILE LIMITED SHAREHOLDERRETURN PLAN WITHIN THREE YEARS FOLLOWING THE INITIAL PUBLIC OFFERING AND LISTING OF RMB ORDINARY SHARE (A SHARES) In order to fully protect the rights and interests of the Shareholders, to provide a sustainable, stable and reasonable investment return to the Shareholders, and to improve the profits distribution mechanism,aswellastoenabletheShareholderstosupervisetheCompany’sprofitdistribution,in accordance with the Notice on Further Implementation of Matters Relevant to the Cash Dividend DistributionofListedCompanies(CSRCIssue[2012]No.37)(《關於進一步落實上市公司現金分紅有關事項的通知》 (證監發[2012]37號)), and the Guidelines No. 3 on the Supervision and Administration of Listed Companies – Cash Dividend Distribution of Listed Companies (CSRC Announcement [2013] No. 43)《上市公司監管指引第 ( 3號 —上市公司現金分紅》 (中國證監會公告[2013]43號)) and other relevant requirements, the Company has formulated this plan as detailed below: I. Principles of the Shareholder Return Plan The shareholder return plan shall be formulated in compliance with requirements under relevant laws and regulations and the Articles of Association of the Company, taking into full account reasonable investment returns to investors as well as the Company’s actual operating conditions and the needs for future development. In formulating its shareholder return plan, the Company shall give due consideration to the opinion of shareholders (especially minority investors) and independent non-executive directors. II. Details of the Shareholder Return Plan (1) The Company may distribute its profits in cash, shares or a combination of both or in any other manner(s) permitted by laws and regulations. The Company shall take into account its profitability, cash flow conditions and other factors, and formulate cash dividend policy that can create greater value for the Shareholders and enable them to obtain reasonable return on investment. (2) The Company adopts cash dividend as its priority profit distribution policy, in other words, the Company shall distribute dividends preferentially in cash in that year, when it has accumulated undistributed profits and it has distributable profits after making up for its losses in accordance with laws. Profits distributed by the Company shall not exceed its distributable profits and without prejudice to the Company’s ability to maintain its ongoing operations. If the Company does not have any major investment plan or major cash expenditure, and the Company’s capital requirements in its ordinary course of business will be satisfied after the distribution of cash dividends, the total profits distributed by the Company by way of cash dividend in any three consecutive years shall not be lower than 30% of the average annual distributable profits realized in such three years. – II-1 –

APPENDIX II SHAREHOLDERRETURN PLAN WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE (3) In principle, the Company shall distribute profits on a yearly basis, but it may make interim profit distribution taking into account the Company’s profitability and liquidity conditions. (4) If the Company is in a good operating condition, and the Board considers that the Company’s share price is not proportional to the scale of its share capital and that distribution of share dividend is beneficial to all Shareholders’ overall interests, then it may, in addition to distributing cash dividends and taking into comprehensive consideration the factors including the Company’s development, dilutive effect on the net asset value per share, make proposals for a distribution of share dividend. (5) The Board of the Company should comprehensively consider the characteristics of the industry, development stage, business model, profitability, arrangements for major capital expenditure and other factors, differentiate between the following scenarios and, in accordance with procedures required under the Articles of Association of the Company, propose the following differentiated cash dividend policies: 1. If the Company is at a mature stage of development and has no arrangement for major capital expenditure, the proportion of cash dividend shall account for at least 80% of the profits distributed in the corresponding period; 2. If the Company is at a mature stage of development but has arrangements for major capital expenditure, the proportion of cash dividend shall account for at least 40% of the profits distributed in the corresponding period; 3. If the Company is at a growing stage of development and has arrangements for major capital expenditure, the proportion of cash dividend shall account for at least 20% of the profits distributed in the corresponding period; 4. If it is difficult to identify the development stage of the Company and the Company has arrangements for major capital expenditure, then the provisions in the foregoing paragraph shall apply. (6) In the event of war, natural disaster or other force majeure, or change in the external business environment which causes material impact to the Company’s business, or if there are significant changes to the Company’s operating and financial circumstances, or where there are changes or adjustments to laws, regulations or regulatory requirements, or where the Board considers necessary, the Company may make changes to its cash dividend policy. Where the Company proposes to amend its cash dividend policy, the Board shall conduct a thorough discussion on the amendment and submit a specific resolution to the general meeting for approval by no less than two-thirds of the voting rights held by the Shareholders who, being entitled to do so, attend such general meeting. – II-2 –

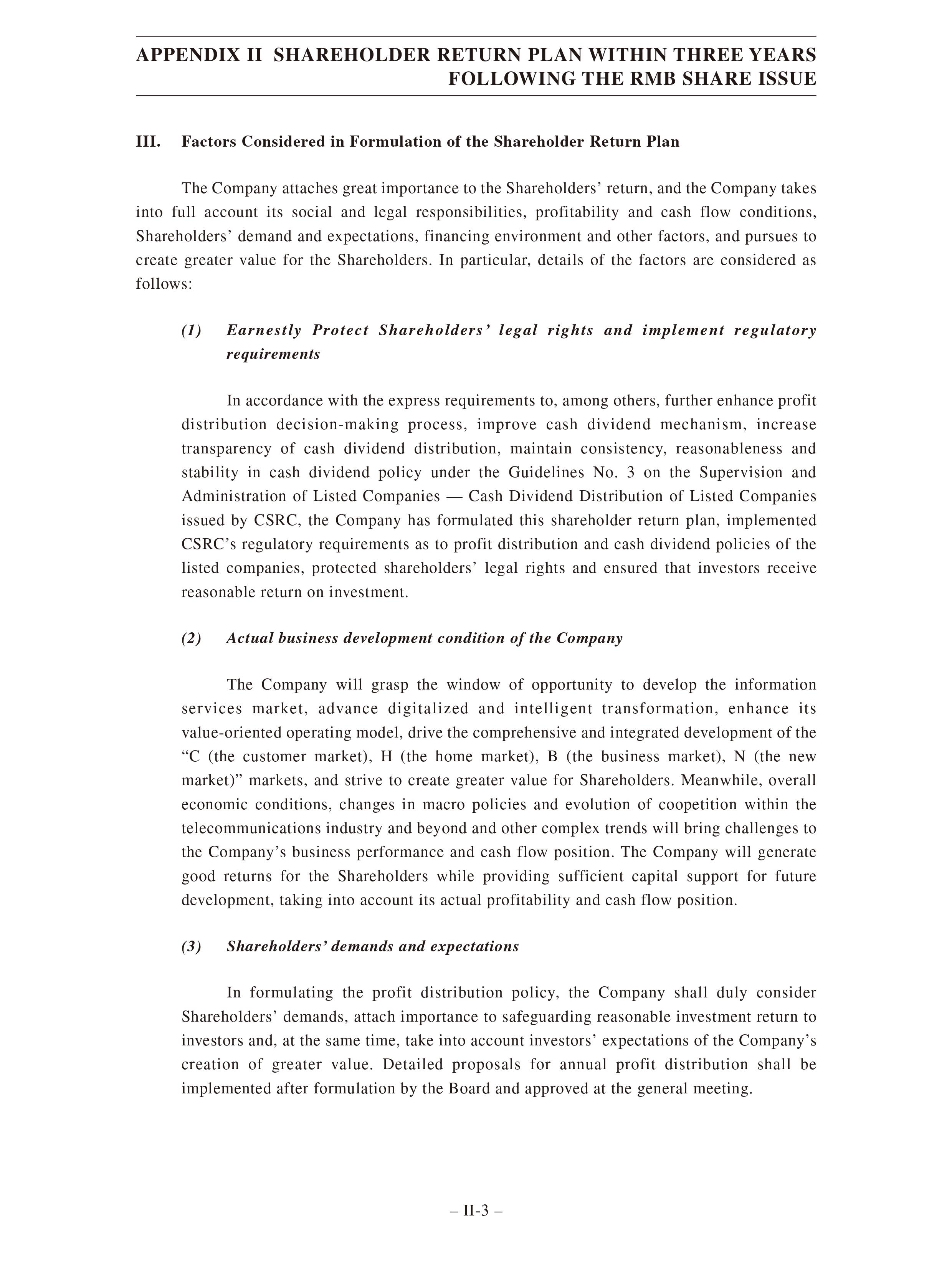

APPENDIX II SHAREHOLDERRETURN PLAN WITHIN THREE YEARS FOLLOWING THE RMB SHARE ISSUE III. Factors Considered in Formulation of the Shareholder Return Plan The Company attaches great importance to the Shareholders’ return, and the Company takes into full account its social and legal responsibilities, profitability and cash flow conditions, Shareholders’ demand and expectations, financing environment and other factors, and pursues to create greater value for the Shareholders. In particular, details of the factors are considered as follows: (1) Earnestly Protect Shareholders’ legal rights and implement regulatory requirements In accordance with the express requirements to, among others, further enhance profit distribution decision-making process, improve cash dividend mechanism, increase transparency of cash dividend distribution, maintain consistency, reasonableness and stability in cash dividend policy under the Guidelines No. 3 on the Supervision and Administration of Listed Companies — Cash Dividend Distribution of Listed Companies issued by CSRC, the Company has formulated this shareholder return plan, implemented CSRC’s regulatory requirements as to profit distribution and cash dividend policies of the listed companies, protected shareholders’ legal rights and ensured that investors receive reasonable return on investment. (2) Actual business development condition of the Company The Company will grasp the window of opportunity to develop the information services market, advance digitalized and intelligent transformation, enhance its value-oriented operating model, drive the comprehensive and integrated development of the “C (the customer market), H (the home market), B (the business market), N (the new market)” markets, and strive to create greater value for Shareholders. Meanwhile, overall economic conditions, changes in macro policies and evolution of coopetition within the telecommunications industry and beyond and other complex trends will bring challenges to the Company’s business performance and cash flow position. The Company will generate good returns for the Shareholders while providing sufficient capital support for future development, taking into account its actual profitability and cash flow position. (3) Shareholders’demands and expectations In formulating the profit distribution policy, the Company shall duly consider Shareholders’ demands, attach importance to safeguarding reasonable investment return to investors and, at the same time, take into account investors’ expectations of the Company’s creation of greater value. Detailed proposals for annual profit distribution shall be implemented after formulation by the Board and approved at the general meeting. – II-3 –