UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Sajan, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| Sajan, Inc. |

| 625 Whitetail Boulevard |

| River Falls, WI 54022 |

| |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 6, 2012 |

TO THE STOCKHOLDERS OF SAJAN, INC.:

Please Take Notice that Sajan, Inc. will hold its Annual Meeting of Stockholders at the offices of Sajan, Inc., 625 Whitetail Boulevard, River Falls, Wisconsin (at the intersection of South U.S. 35 and Whitetail Boulevard), on June 6, 2012 at 1:00 p.m. local time, or at any adjournment or adjournments thereof. We are holding the meeting for the purpose of considering and taking appropriate action with respect to the following:

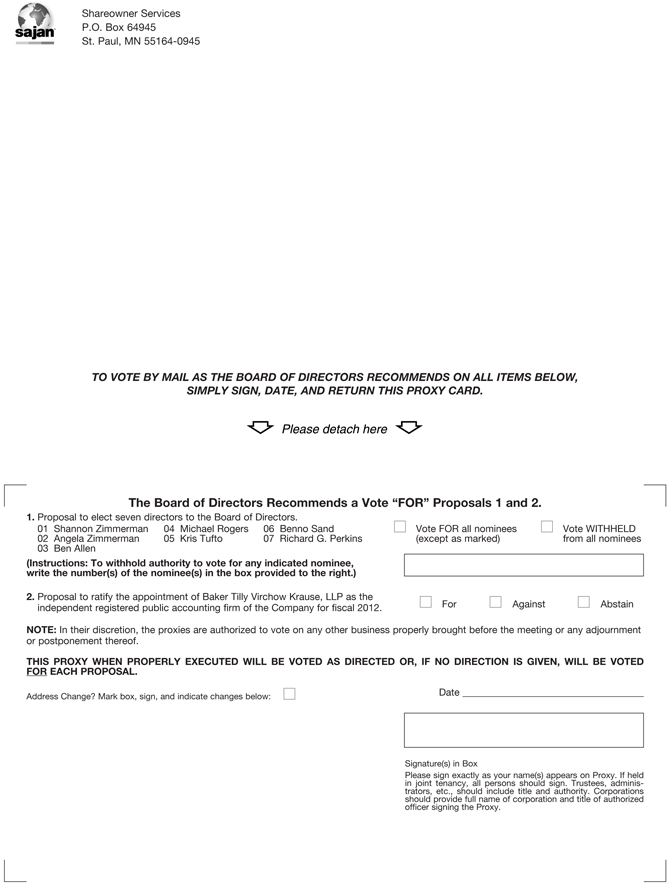

| 1. | To elect the seven director nominees named in this Proxy Statement to the Sajan Board of Directors, to serve until the earlier of the next annual meeting of stockholders, such director’s successor has been duly elected and qualified, or such director’s death, resignation or removal; |

| 2. | To ratify the appointment by the Audit Committee of Sajan’s Board of Directors of Baker Tilly Virchow Krause, LLP as Sajan’s independent registered public accounting firm for the year ending December 31, 2012; and |

| 3. | To transact any other business as may properly come before the meeting or any adjournments thereof, including matters incident to the conduct of the meeting. |

Holders of record of our common stock at the close of business on April 13, 2012 will be entitled to vote at the meeting or any adjournments thereof. Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of the matters to be considered at the meeting. A copy of the Annual Report on Form 10-K for the year ended December 31, 2011 also accompanies this Notice.

You can vote your shares by completing and returning the enclosed proxy card.

By Order of the Board of Directors,

Timothy Clayton

Secretary

May 2, 2012

Your vote is important. To vote your shares, please complete, sign, date and mail the enclosed proxy card promptly in the enclosed return envelope. The prompt return of proxies will save us the expense of further requests for proxies.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders To Be Held on June 6, 2012: The notice, proxy statement, form of proxy, and Annual Report on Form 10-K are available on the Investor Relations section of the Sajan, Inc. website athttp://www.sajan.com/company/investors.html.

SAJAN, INC.

625 Whitetail Boulevard

River Falls, WI 54022

PROXY STATEMENT

2012 ANNUAL MEETING OF STOCKHOLDERS

to be held on June 6, 2012

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Sajan, Inc., a Delaware corporation, (“Sajan,” the “Company,” “we,” “our” or “us”) for use at the 2012 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Sajan corporate offices, 625 Whitetail Boulevard, River Falls, Wisconsin (at the intersection of South U.S. 35 and Whitetail Boulevard), at 1:00 p.m. local time on June 6, 2012.

Purposes of the Annual Meeting

The purposes of the Annual Meeting are:

| 1. | To elect the seven director nominees named in this Proxy Statement to the Sajan Board of Directors, to serve until the earlier of the next annual meeting of stockholders, such director’s successor has been duly elected and qualified, or such director’s death, resignation or removal; |

| 2. | To ratify the appointment by the Audit Committee of Sajan’s Board of Directors of Baker Tilly Virchow Krause, LLP as Sajan’s independent registered public accounting firm for the year ending December 31, 2012; and |

| 3. | To transact any other business as may properly come before the meeting or any adjournments thereof, including matters incident to the conduct of the meeting. |

Any action may be taken on any one of the foregoing proposals on the date specified above for the Annual Meeting, or on any date or dates to which the Annual Meeting may be adjourned.

This Proxy Statement and the enclosed proxy card are first being mailed or given to stockholders on or about May 2, 2012.

An Important Note on Language

Throughout this Proxy Statement, unless specifically noted or the context otherwise requires, references to the “Company,” “we,” “our” and “Sajan” are references to Sajan, Inc., a Delaware corporation, and its direct and indirect subsidiaries. References to “Merger” refer to the merger of the former Sajan, Inc., a Minnesota corporation, with the Company, a transaction that is described in our Annual Report on Form 10-K for the year ended December 31, 2011. The former Sajan, Inc. is referred to herein as “pre-Merger Sajan.”

Solicitation

Sajan will pay the cost of soliciting proxies for the Annual Meeting. In addition to soliciting proxies by mail, we may solicit proxies personally or by telephone, facsimile or other means of communication by our directors, officers and employees. These persons will not specifically be compensated for these activities, but they may be reimbursed for reasonable out-of-pocket expenses in connection with this solicitation. We will also arrange with brokerage firms and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of shares held of record by these persons. We will reimburse these brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection with this solicitation.

Record Date and Shares Outstanding

Only holders of record of our common stock at the close of business on April 13, 2012 will be entitled to vote at the Annual Meeting or any adjournments thereof. There were 16,185,804 shares of our common stock and no shares of our preferred stock outstanding on the record date. Each share of common stock entitles the holder thereof to one vote upon each matter to be presented at the Annual Meeting. Ballots will be passed out during the Annual Meeting to all holders of record who wish to vote in person at the Annual Meeting.

If you hold your shares in street name, meaning that your shares are held in the name of a broker, bank, trust or other nominee as custodian, you may vote by completing the voting instruction form provided to you by your broker or nominee. You may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker or nominee.

Quorum

A quorum, consisting of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting, must be present in person or by proxy before any action can be taken by the stockholders at the Annual Meeting. The ratification of the appointment of our independent registered public accounting firm is considered a “routine” matter under New York Stock Exchange rules that apply to all brokers. These rules allow brokerage firms to vote their clients’ shares held in street name on routine matters if the clients do not provide voting instructions. If you hold your shares in street name and your brokerage firm votes your shares on a routine matter because you do not provide voting instructions, your shares will be counted for purposes of establishing a quorum to conduct business at the Annual Meeting. Abstentions and withheld votes are counted as present and entitled to vote for purposes of determining a quorum.

The stockholders present at the Annual Meeting may continue to transact business until adjournment, even though enough stockholders have left the meeting to leave less than a quorum or the refusal of any stockholder present in person or by proxy to vote or participate in the Annual Meeting. If the Annual Meeting is adjourned for any reason, the approval of the proposals may be considered and voted upon by stockholders at the subsequent reconvened meeting. All proxies will be voted in the same manner as they would have been voted at the original Annual Meeting except for any proxies that have been properly withdrawn or revoked.

Board Recommendation and Voting of Proxies

The Board recommends a vote:

| · | For the election of each of the nominated directors (Proposal 1). |

| · | For the ratification of the appointment of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the current fiscal year (Proposal 2). |

With respect to any other matter that properly comes before the Annual Meeting, Shannon Zimmerman and Timothy Clayton (the “Proxy Agents”) will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

Each proxy returned to us by a record holder will be voted according to the instructions on the proxy. If no instructions are indicated, the Proxy Agents will vote in accordance with the recommendations of the Board. Although the Board of Directors knows of no other matters to be presented at the Annual Meeting or any adjournment or postponement of the Annual Meeting, all proxies returned to Sajan will be voted on any such matter according to the judgment of the Proxy Agents. If you hold your shares in street name and do not provide instructions to your brokerage firm, your broker will have discretionary voting power only on the proposal to ratify the independent registered public accounting firm. Your shares will be voted in accordance with the recommendation of the Board for that proposal and will not be cast for the proposal to elect directors.

Vote Required

A plurality of the votes cast is required for the election of directors. This means that the seven director nominees with the most votes are elected. If you withhold authority to vote on any or all nominees, your vote will have no effect on the outcome of the election. If you hold your shares in street name and do not provide instructions to your brokerage firm, your broker will not have discretionary voting power with respect to the proposal to elect directors and will therefore provide a “broker non-vote.” Since broker non-votes are not deemed votes cast, they will have no effect on the outcome of the election.

The affirmative vote of a majority of the shares of common stock of Sajan represented at the Annual Meeting, either in person or by proxy, assuming a quorum is present, is required to approve the ratification of the appointment of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm. If you mark “Abstain” on your proxy card with respect to this proposal, your shares will be counted as present and entitled to vote and will have the same effect as a vote against a proposal. If you hold your shares in street name and do not provide instructions to your brokerage firm, your broker will have discretionary authority with respect to the proposal to ratify the selection of our independent registered public accounting firm, and will vote your shares in accordance with the recommendation of the Board.

Revocability of Proxies

Any person giving a proxy for the Annual Meeting has the power to revoke it at any time before it is voted by:

| · | sending a written notice of revocation dated after the date of the proxy to our Corporate Secretary, Timothy Clayton, in care of Sajan, Inc. at 625 Whitetail Boulevard, River Falls, Wisconsin 54022; |

| · | submitting a properly signed proxy with a later date to our Corporate Secretary; or |

| · | attending the Annual Meeting and voting in person. |

If a broker, bank or other nominee holds your shares, you must contact it in order to find out how to revoke your proxy. Attendance at the Annual Meeting will not, in and of itself, constitute a revocation of a proxy.

Other Business

Although the notice of Annual Meeting provides for the transaction of such other business as may properly come before the Annual Meeting, our Board of Directors currently has no knowledge of any matters to be presented at the Annual Meeting other than those referred to in this proxy statement and on the enclosed form of proxy. The enclosed form of proxy gives discretionary authority to the Proxy Agents to vote in accordance with the recommendation of management if any other matters are presented.

FINANCIAL INFORMATION

Our 2011 Annual Report on Form 10-K filed with the Securities and Exchange Commission including, but not limited to, the balance sheets and the related statements of operations, stockholders’ equity and cash flows for Sajan for the years ended December 31, 2011 and 2010 accompanies these materials. A copy of the 2011 Annual Report on Form 10-K may be obtained without charge upon request to our Chief Financial Officer. Requests should be directed to Mr. Timothy Clayton, Sajan, Inc. 625 Whitetail Boulevard, River Falls, Wisconsin 54022. Our 2011 Annual Report on Form 10-K is also available on our website athttp://www.sajan.com/company/investors.html.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Sajan’s business and affairs are managed under the direction of its Board of Directors. All of our directors are elected at each Annual Meeting to serve until their successors are duly elected and qualified or until their earlier death, resignation or removal. If any of the nominees for director at the Annual Meeting becomes unavailable for election for any reason (none being presently known), the Proxy Agents named in the proxy will have discretionary authority to vote, pursuant to the proxy, for a suitable substitute or substitutes selected in accordance with the best judgment of the Proxy Agents.

The affirmative vote of a plurality of the shares of common stock of Sajan represented at the Annual Meeting either in person or by proxy, assuming a quorum is present, is required for the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTEFORTHE

SLATE OF NOMINEES NAMED IN THE TABLE BELOW.

The Board, upon the recommendation of the Nominating and Governance Committee, has nominated the seven persons named in the table below for election as directors:

| Name | | Age | | Positions | | Director Since |

| Shannon Zimmerman | | 40 | | Chairman of the Board, President and Chief Executive Officer | | February 2010 |

| Angela (Angel) Zimmerman | | 39 | | Director, Chief Operating Officer | | February 2010 |

| Benjamin F. Allen | | 47 | | Director, Chairman of the Compensation Committee | | April 2011 |

| Richard C. Perkins | | 58 | | Director, member of the Audit Committee | | February 2009 |

| Michael W. Rogers | | 56 | | Lead Independent Director, Chairman of the Governance and Nominating Committee; member of the Audit and Compensation Committees | | February 2010 |

| Benno G. Sand | | 57 | | Director, Chairman of the Audit Committee, member of the Compensation and Governance and Nominating Committees | | August 2001 |

| Kris Tufto | | 53 | | Director, member of the Audit, Compensation and Governance and Nominating Committees | | February 2010 |

Each of these nominees is presently serving on our Board of Directors and has served continuously as a member of our Board since the month and year indicated. The Board of Directors has determined that each of Benjamin Allen, Richard C. Perkins, Michael W. Rogers, Benno G. Sand and Kris Tufto qualifies as an independent director under the Marketplace Rules of The NASDAQ Stock Market (“NASDAQ”). Accordingly, the Board is composed of a majority of independent directors.

Biographical information about our Board members follows:

Shannon Zimmerman.Mr. Zimmerman became the Company’s President, Chief Executive Officer and Chairman on the effective date of the Merger, and continues to hold these positions. He co-founded pre-Merger Sajan, Inc. in 1998 along with Angela Zimmerman, and served as its Chairman and Chief Executive Officer from its inception until the date of the Merger. Mr. Zimmerman is the spouse of Angela Zimmerman. Mr. Zimmerman has served in technology focused and strategic business leadership roles in the telecommunications, healthcare, manufacturing and service industries.

Mr. Zimmerman’s experience as Chief Executive and co-founder of pre-Merger Sajan, Inc., as well as his prior technology-focused and leadership experience in the telecommunication, healthcare, manufacturing and service industries, gives him unique insights into the Company’s challenges, opportunities and operations.

Angela (Angel) Zimmerman.Ms. Zimmerman became the Company’s Chief Operating Officer and a director on the date of the Merger. She co-founded pre-Merger Sajan, Inc. in 1998, and served as its President, Chief Operating Officer, Treasurer and a director from inception until the date of the Merger. While in that position, Ms. Zimmerman analyzed and developed the Company’s global language business model. She also introduced the ISO quality certification process and oversaw the initial ISO 9000 certification. In her position as COO, Ms. Zimmerman is responsible for continual analysis of the global language business model and adapting the model to meet the growing needs and demands of a global economic environment. She also develops strategies related to international and domestic expansion and integrates those new locations into the Company’s global language service model. She is also responsible to establish quality and customer satisfaction levels and to continuously monitor the Company’s level of service excellence. Additionally, Ms. Zimmerman manages and oversees the qualifications of over 2,000 independent translators used by Sajan. Ms. Zimmerman is the spouse of Shannon Zimmerman.

Ms. Zimmerman’s experience as Chief Operating Officer and co-founder of pre-Merger Sajan, Inc. and her expertise in service level quality gives her unique insights into the Company’s challenges, opportunities and operations.

Benjamin F. Allen.Mr. Allen has been a Director of the Company since April 4, 2011. Mr. Allen was formerly president and chief executive officer of Kroll, Inc., an operating unit of Marsh & McLennan Companies, Inc., the global professional services firm, until it was sold by Marsh & McLennan in August 2010. Mr. Allen was responsible for the strategic direction and day-to-day operations of Kroll’s global business. Prior to his appointment as CEO of Kroll, Inc. in March 2008, Mr. Allen served as chief operating officer of Kroll. From 2002 until being named COO in 2007, he was president of Kroll Ontrack, Kroll’s legal technologies and data recovery subsidiary. Prior to Kroll’s acquisition of Ontrack, Mr. Allen served as president and CEO of Ontrack Data International, Inc. Preceding his appointment as president and CEO, he served in several other international roles for Ontrack, including chief operating officer and general manager of the U.K. and France offices.

Mr. Allen provides the Board with extensive global operations and expansion expertise, as well as substantial experience with technology oriented sales and marketing operations, capital markets and mergers and acquisitions.

Richard C. Perkins, CFA.Mr. Perkins has been a Director of the Company since February 26, 2009. He is a Chartered Financial Analyst (“CFA”), has been Executive Vice President and Portfolio Manager of Perkins Capital Management, Inc. since 1990, and has over 30 years of experience in the investment business. From 1978 until 1990, Mr. Perkins was an Investment Executive with Piper, Jaffray & Hopwood, Incorporated, an investment banking firm. From 1975 through 1977, he was a Grain Merchandiser with General Mills, Inc. Mr. Perkins served as President of the Board of Directors, YMCA Camp Olson in Rochester, Minnesota from 1983 through 1986 and again from 2004 through 2006. He has also served on the boards of several privately-held companies.

Mr. Perkins’ extensive knowledge of the capital markets and accounting issues from his experience as Executive Vice President and Portfolio Manager of Perkins Capital Management and Investment Executive with Piper, Jaffray & Hopwood, Inc., and his extensive experience evaluating the business plans of growth companies are valuable to our Board’s discussions of the Company’s capital and liquidity needs.

Michael W. Rogers.Mr. Rogers became a Director of the Company on the date of the Merger. He served as a member of the Board of Directors of pre-Merger Sajan, Inc. from April 2006 until the date of the Merger. He is currently a Senior Management Consultant to entrepreneurs of emerging companies in the computer software industry and has worked in this capacity since 2002. From March 2002 until 2006, he served as a consultant to several early-stage technology companies. In 1985, Mr. Rogers founded Ontrack Data International, Inc., a once publicly-held provider of computer data recovery services and electronic discovery services located in Eden Prairie, Minnesota, which was acquired by Kroll, Inc. in May 2002. He served as Chief Executive Officer of Ontrack Data International, Inc. from 1986 to 2001, and as Chairman from 1989 to 2002. During his tenure with Ontrack Data International, Inc., he identified opportunities for and successfully led the Company’s expansion into England, Japan, Germany, France and elsewhere internationally as well as within the United States. During the same period, Ontrack grew from 6 employees to over 400 employees. At the time of the merger with Kroll, Ontrack’s annual revenues exceeded $55 million.

Mr. Rogers brings to the Board entrepreneurial experience with early-stage technology companies and expertise in transitioning companies from single location entities to global enterprises.

Benno G. Sand.Mr. Sand has been a Director of the Company since August 2001. He is Executive Vice President, Business Development, Investor Relations and Secretary at FSI International, Inc. (NASDAQ: FSII), a global supplier of wafer-cleaning and resist-processing equipment and technology, and he has served in such positions since January 2000.During his tenure at FSI, Mr. Sand has served in several executive and financial management roles, including Executive Vice President, Chief Administrative Officer, and Chief Financial Officer.He also serves on the boards of several United States, Asian and European based subsidiaries of FSI International, Inc.,Apprecia Technology, Inc., the Company's Japanese distributor, and other privately-held companies. Throughout his career, he has served as a director of various public and private companies and several community organizations.

Mr. Sand’s extensive knowledge of the capital markets, corporate governance, mergers and acquisitions and accounting issues from his 30 year career at FSI and experience as a board member of other public and private companies brings to our board the perspective of a leader facing a similar set of current external economic, social and governance issues.

Kris Tufto.Mr. Tufto joined the Company’s Board of Directors on the date of the Merger. He served as a member of pre-Merger Sajan, Inc.’s Board of Directors from February 2006 until the date of the Merger. He is currently Vice President of Global Sales for Code42 Software, Inc., a software development company specializing in backup software for homes and businesses. From May 2008 to January 2010, he was President and Chief Executive Officer of MarketingBridge, LLC, a company providing internet connectivity. From April 2005 until April 2008, he served as an executive with or consultant to several early-stage technology companies. Mr. Tufto was President and Chief Executive Officer of Jasc Software, Inc., a provider of digital imaging software based in Eden Prairie, Minnesota, from March 1998 through March 2005. Jasc Software, Inc. was acquired by Corel Corporation in 2004.

Among other skills and attributes, Mr. Tufto brings to the Board valuable entrepreneurial experience and expertise in early-stage technology companies.

CORPORATE GOVERNANCE

Board of Directors

Our Board of Directors consists of seven members and has determined that Benjamin F. Allen, Richard C. Perkins, Michael W. Rogers, Benno G. Sand and Kris Tufto are independent directors under the NASDAQ Marketplace Rules. Presently, we are not required to comply with the director independence requirements of any securities exchange. Under our corporate bylaws, a director elected for an indefinite term serves until the next regular meeting of the stockholders and until the director’s successor is elected, or until the earlier death, resignation or removal of the director.

Board Leadership Structure

Mr. Zimmerman serves as the Chairman of the Board. Mr. Zimmerman is also the Company’s President and Chief Executive Officer. The Board of Directors believes this leadership structure is appropriate for Sajan given Mr. Zimmerman’s extensive knowledge of Sajan and the language translation industry, and because this combination has served, and is serving, Sajan well by providing unified leadership and direction. In order to ensure independent oversight and a strong corporate governance structure, the Board of Directors has also appointed Michael Rogers as Lead Independent Director. The responsibilities of the Lead Independent Director include presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors, and serving as principal liaison of Board-wide issues between the independent directors and the Company’s management, including the Chairman. The Board of Directors periodically reviews its leadership structure in order to ensure the most appropriate governance in light of the Company’s then-current circumstances.

Family Relationships

Shannon Zimmerman, the Company’s Chief Executive Officer and Angel Zimmerman, the Company’s Chief Operating Officer are spouses. Mr. Zimmerman’s sister-in-law, who is also Ms. Zimmerman’s sister, is the Company’s Controller. The Controller’s husband is the Company’s Vice President of North American Client Services and he reports directly to the Chief Operating Officer. The Chief Operating Officer reports directly to the Chief Executive Officer.

Involvement in Certain Legal Proceedings

During the past ten years, no officer, director, control person or promoter of the Company has been involved in any legal proceedings respecting: (i) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (ii) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (iii) being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (iv) being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; (v) being subject to any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any federal or state securities or commodities laws or regulations, any laws or regulations relating to financial institutions or insurance companies, or any law or regulation relating to fraud in connection with a business entity; or (vi) being subject to any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization or any equivalent organization that has disciplinary authority over its members.

Risk Oversight

The Audit Committee is responsible for overseeing the Company’s risk management structure on behalf of the full Board. The Audit Committee and the full Board assess the primary risks facing the Company, the Company’s risk management strategy and management’s plan for addressing these risks.

In connection with its oversight of compensation-related risks, the Compensation Committee annually evaluates whether Sajan’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on Sajan. For fiscal 2011, the Compensation Committee evaluated the current risk profile of Sajan’s compensation policies and programs for all of its employees, with particular emphasis on annual and long-term incentive compensation. In its evaluation, the Compensation Committee reviewed the executive compensation structure, identified important business risks that could materially affect Sajan, and assessed how Sajan managed or mitigated these risks in the design of its compensation structure. The Compensation Committee also considered the ability of Sajan’s officers and other employees to affect changes in their incentive compensation that could create risk for Sajan. Based on this evaluation, Sajan determined that its compensation programs do not encourage risk-taking that is reasonably likely to have a material adverse effect on Sajan.

Code of Ethics

We adopted a Code of Ethics on March 30, 2010 which governs the conduct of our officers, directors and employees in order to promote honesty, integrity, loyalty and the accuracy of our financial statements. You may obtain a copy of the Code of Ethics without charge by writing us and requesting a copy, attention: Timothy Clayton, 625 Whitetail Drive, River Falls, Wisconsin 54022 or by calling us at (715) 426-9505. Our Code of Ethics is also available on our website atwww.sajan.com/company/investors.html. Any amendment to, or waiver from, the provisions of the Code of Ethics for the CEO and other executive officers that applies to any of those officers will be posted to the same location on our website.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

During 2011, our Board of Directors met six times and acted once by written action. During 2011, all directors attended at least 75% of the meetings that occurred during each director’s service on the Board of Directors.

The standing committees of our Board of Directors are the Audit Committee, the Compensation Committee and the Governance and Nominating Committee. During 2011, the Audit Committee met five times, the Compensation Committee met four times and the Governance and Nominating Committees met once and all directors attended at least 75% of meetings of each committee on which they served.

Executive Sessions; Attendance at Annual Meeting of Stockholders

The independent members of the Board of Directors periodically meet outside the presence of management. The Audit Committee has adopted a policy of meeting in executive session, without management being present, on a regular basis. During 2011, the members of the Audit Committee met in executive session twice.

It is the policy of the Board that each member of the Board should attend Sajan’s annual meeting of stockholders whenever practical and that at least one member of the Board must attend each annual meeting. All directors attended the 2011 annual meeting.

Audit Committee

The Audit Committee is responsible, among its other duties and responsibilities, for overseeing our accounting and financial reporting processes, the audits of our consolidated financial statements, the qualifications of our independent registered public accounting firm, and the performance of our internal audit function and independent registered public accounting firm. The Audit Committee reviews and assesses the qualitative aspects of our financial reporting, our processes to manage business and financial risk, and our compliance with significant applicable legal, ethical, and regulatory requirements. The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of our independent registered public accounting firm. The Audit Committee also oversees our policies regarding related party transactions.

The members of our Audit Committee are Benno G. Sand, who serves as chair of the committee, Richard C. Perkins, Michael W. Rogers and Kris Tufto. Our Board of Directors has determined that each of Mr. Benno Sand and Mr. Richard C. Perkins is an “audit committee financial expert,” as that term is defined under the Securities and Exchange Commission rules implementing Section 407 of the Sarbanes-Oxley Act of 2002. Our Board of Directors has determined that each member of our Audit Committee is independent under the NASDAQ Marketplace Rules and each member of our Audit Committee is independent pursuant to Rule 10A-3 of the Securities and Exchange Act of 1934.

The Board of Directors has determined that each of the Audit Committee members is able to read and understand fundamental consolidated financial statements and that at least one member of the Audit Committee has past employment experience in finance or accounting.

The Board adopted the Audit Committee Charter on March 30, 2010. A copy of the Audit Committee Charter is available on our website, free of charge, atwww.sajan.com/company/investors/corporate-governance.html. References to our website are not intended to and do not incorporate information found on the website into this Proxy Statement. You may also obtain a copy of the charter, free of charge, by writing to us at Sajan, Inc., Attention: Timothy Clayton, 625 Whitetail Boulevard, River Falls, Wisconsin 54022.

Compensation Committee

The Compensation Committee is responsible, among its other duties and responsibilities, for establishing the compensation and benefits of our Chief Executive Officer and other executive officers, monitoring compensation arrangements applicable to our Chief Executive Officer and other executive officers in light of their performance, effectiveness, and other relevant considerations, and administering our equity incentive plans. The Chief Executive Officer does not participate in Compensation Committee discussions regarding his own compensation or performance, but may participate in discussions and make recommendations regarding the compensation of other executive officers. The members of our Compensation Committee are Benjamin Allen, who serves as chair of the committee, Michael Rogers, Benno Sand and Kris Tufto. Our Board of Directors has determined that the composition of our Compensation Committee meets the NASDAQ independence requirements for approval of the compensation of our Chief Executive Officer and other executive officers. The Compensation Committee may, in its discretion, delegate some of its duties and responsibilities to a subcommittee, which shall consist of a member or members of the Compensation Committee and shall be delegated by unanimous vote by the members of the Compensation Committee.

The Board adopted the Compensation Committee Charter on March 30, 2010. A copy of the Compensation Committee Charter is available on our website, free of charge, atwww.sajan.com/company/investors/corporate-governance.html. You may also obtain a copy of the charter, free of charge, by writing to us at Sajan, Inc., Attention: Timothy Clayton, 625 Whitetail Boulevard, River Falls, Wisconsin 54022.

Governance and Nominating Committee

The Governance and Nominating Committee (“Governance Committee”) is responsible for recommending candidates for election to the Board of Directors. The Governance Committee is also responsible, among its other duties and responsibilities, for making recommendations to the Board of Directors or otherwise acting with respect to corporate governance policies and practices, including board size and membership qualifications, new director orientation, committee structure and membership, succession planning of our Chief Executive Officer and other executive officers, and communications with stockholders. The members of our Governance Committee are Michael Rogers, who serves as the chair of the committee, Benno Sand and Kris Tufto. Our Board of Directors has determined that the composition of our Governance Committee meets the NASDAQ independence requirements for director nominations.

The Board adopted the Governance Committee Charter on March 30, 2010. A copy of the Governance Committee Charter is available on our website, free of charge, atwww.sajan.com/company/investors/corporate-governance.html. You may also obtain a copy of the charter, free of charge, by writing to us at Sajan, Inc., Attention: Timothy Clayton, 625 Whitetail Boulevard, River Falls, Wisconsin 54022.

QUALIFICATIONS OF CANDIDATES FOR ELECTION TO THE BOARD

The Governance Committee identifies and recommends candidates it believes are qualified to stand for election as directors of Sajan or to fill any vacancies on the Board. In identifying director candidates, the Governance Committee may retain third party search firms.

In order to evaluate and identify director candidates, the Governance Committee considers the suitability of each director candidate, including the current members of the Board, in light of the current size, composition and current perceived needs of the Board. The Governance Committee seeks highly qualified and experienced director candidates and considers many factors in evaluating such candidates, including issues of character, judgment, independence, background, age, expertise, diversity of experience, length of service and other commitments. Additionally, while the Governance Committee does not have a formal policy with respect to diversity, it seeks to have a Board that is diverse in these factors and gives due consideration to contributions to diversity on the Board when evaluating the qualifications of any potential director candidate. The Governance Committee does not assign any particular weight or priority to any of these factors. The Board's Governance Committee has established the following minimum requirements for director candidates: being able to read and understand fundamental consolidated financial statements; having at least 10 years of relevant business experience; having no identified conflicts of interest as a director of Sajan; having not been convicted in a criminal proceeding other than traffic violations during the ten years before the date of selection; and being willing to comply with the Sajan Code of Ethics. The Governance Committee retains the right to modify these minimum qualifications from time to time. Exceptional candidates who do not meet all of these criteria may still be considered.

The Governance Committee may review director candidates by reviewing information provided to it, through discussions with persons familiar with the candidate, or other actions that the Governance Committee deems proper. After such review and consideration, the Governance Committee designates any candidates who are to be interviewed and by whom they are to be interviewed. After interviews, the Governance Committee recommends for Board approval any new directors to be nominated.

STOCKHOLDER RECOMMENDATIONS FOR DIRECTORS

Stockholders who have owned at least 10,000 shares of our common stock for at least a 12-month period may make recommendations to the Governance Committee for potential Board members as follows:

| · | The recommendation must be made in writing to Sajan, Inc., Attention: Corporate Secretary, 625 Whitetail Boulevard, River Falls, Wisconsin 54022, and it must be received by Sajan at least 120 days before the next annual meeting of stockholders. |

| · | The recommendation must include the director candidate's name; home and business contact information; detailed biographical data and qualifications (including at least ten years of employment history); whether the candidate can read and understand consolidated financial statements; information regarding any relationships between the candidate and Sajan within the last three years; and evidence of the recommending person's ownership of Sajan common stock. |

| · | The recommendation must contain a statement from the recommending stockholder in support of the candidate; a list of the candidate's professional references; and a description of the candidate's qualifications, particularly those that pertain to Board membership, including qualifications related to character, judgment, diversity, age, independence, expertise, corporate experience, length of service and other commitments. |

| · | The recommendation must include other information sufficient to enable the Governance Committee to evaluate the minimum qualifications stated above under the section of this Proxy Statement entitled "Qualifications of Candidates for Election to the Board." |

| · | It must also include a statement from the director candidate indicating that he or she consents to serve on the Board and could be considered "independent" under the NASDAQ Marketplace Rules and the applicable rules and requirements of the Securities and Exchange Commission in effect at that time. |

| · | If a director candidate is eligible to serve on the Board of Directors, and if the recommendation is proper, the Governance Committee then will deliberate and make its recommendation to the Board regarding the Board candidate. |

| · | The Governance Committee will not change the manner in which it evaluates candidates, including the applicable minimum criteria set forth above, based on whether the candidate was recommended by a stockholder. |

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Our stockholders may contact our Board of Directors, or any Committee of our Board, by regular mail at Sajan, Inc., Attention: Chief Executive Officer, 625 Whitetail Boulevard, River Falls, Wisconsin 54022. All communications will be reviewed by management and then forwarded to the appropriate director or directors or to the full Board, as appropriate.

DIRECTOR COMPENSATION

Sajan’s non-employee directors receive a cash retainer of $2,000 per quarter. Each of the chairpersons of the Audit Committee, Compensation Committee and Governance Committee also receive an additional $1,500 annually.

Under the 2004 Incentive Plan, non-employee directors automatically receive an option to purchase 5,000 shares of the Company’s common stock when they are initially elected or appointed to our Board of Directors, which vests as to one-third of the shares subject to the option on the first, second and third anniversary dates of the date of grant so long as they are directors of the Company. Non-employee directors also automatically receive an option to purchase 5,000 shares at each Annual Meeting of Shareholders which vests as to all of the shares subject to the option ratably over 11 months following the date of grant of the option. The exercise price of these options is equal to the closing price of the Company’s common stock on the grant date of the option, and all options expire 10 years after the date of grant. Under the automatic grant provisions of the 2004 Incentive Plan, on April 4, 2011, Mr. Allen received a 10-year option to purchase 5,000 shares at an exercise price of $1.30 per share, and on June 8, 2011, Mr. Sand, Mr. Rogers, Mr. Perkins, Mr. Allen and Mr. Tufto each received a 10-year option to purchase 5,000 shares at an exercise price of $1.30 per share.

The table below delineates director compensation for the Company Board of Directors for the year ended December 31, 2011. Compensation received by the Chief Executive Officer, Mr. Zimmerman, and the Chief Operating Officer, Ms. Zimmerman, is included in the respective executive compensation tables below. Neither Mr. nor Ms. Zimmerman was compensated for their services as a director.

| Name | | Fees Earned

or

Paid in Cash | | | Option Awards(1)(2) | | | Total | |

| Benno G. Sand | | $ | 9,500 | | | $ | 3,970 | | | $ | 13,470 | |

| | | | | | | | | | | | | |

| Michael Rogers | | $ | 9,500 | | | $ | 3,970 | | | $ | 13,470 | |

| | | | | | | | | | | | | |

| Richard C. Perkins | | $ | 8,000 | | | $ | 3,970 | | | $ | 11,970 | |

| | | | | | | | | | | | | |

| Kris Tufto | | $ | 9,500 | | | $ | 3,970 | | | $ | 13,470 | |

| | | | | | | | | | | | | |

| Benjamin F. Allen | | $ | 6,000 | | | $ | 7,940 | (3) | | $ | 13,940 | |

| (1) | The amounts shown for option awards reflect the aggregate full grant date value as determined under ASC Topic 718 –Compensation – Stock Compensation. Refer to “Note 5 – Stock -Based Compensation” in the audited financial statements included in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2011 for a discussion of the assumptions used in calculating the award amount. On June 8, 2011, all non-employee directors were automatically granted a 10-year option under the 2004 Incentive Plan to purchase 5,000 shares of common stock at an exercise price of $1.30 per share with a grant date fair value of $3,970. These options vest ratably over eleven months, but only if the director is then a director of the Company. |

| | |

| (2) | As of December 31, 2011, Mr. Sand had outstanding options to purchase 25,667 shares, which were vested as to 23,394 shares and not vested as to 2,273 shares; Mr. Rogers had outstanding options to purchase 15,000 shares, which were vested as to 9,394 shares and not vested as to 5,606 shares; Mr. Perkins had outstanding options to purchase 16,000 shares, which were vested as to 12,061 and not vested as to 3,939 shares; Mr. Tufto had outstanding options to purchase 15,000 shares, which were vested as to 11,061 shares and not vested as to 3,939 shares; and Mr. Allen had outstanding options to purchase 10,000 shares, which were vested as to 2,727 shares and not vested as to 7,273 shares. |

| | |

| (3) | Includes the dollar value of a 10-year option under the 2004 Incentive Plan to purchase 5,000 shares of Company common stock at an exercise price of $1.30 per share, granted on April 4, 2011 with a grant date fair value of $3,970. This option vests ratably on each of April 4, 2012, 2013 and 2014. |

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table contains information regarding the beneficial ownership of Sajan’s common stock as of April 13, 2012 (except as otherwise indicated) by (i) each person who is known by Sajan to own beneficially more than 5% of the outstanding shares of our common stock; (ii) each director of Sajan; (iii) each named executive officer of Sajan; and (iv) all executive officers and directors as a group. Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares.

Name and Address | | Common Shares Beneficially Owned (2) | | | Percentage of Common Shares (2) | |

| Officers and Directors | | | | | | | | |

| | | | | | | | | |

| Shannon Zimmerman(1) | | | 2,630,937 | | | | 16.25 | % |

| | | | | | | | | |

| Angel Zimmerman(1) | | | 2,605,937 | | | | 16.10 | % |

| | | | | | | | | |

| Timothy Clayton | | | 125,000 | (3) | | | * | % |

| | | | | | | | | |

| Harold Fagley | | | - | (4) | | | * | % |

| | | | | | | | | |

| Benjamin F. Allen | | | 72,917 | (5) | | | * | % |

| | | | | | | | | |

| Kris Tufto | | | 26,391 | (6) | | | * | % |

| | | | | | | | | |

| Michael W. Rogers | | | 40,537 | (7) | | | * | % |

| | | | | | | | | |

| Benno G. Sand | | | 28,334 | (8) | | | * | % |

| | | | | | | | | |

| Richard C. Perkins | | | 16,000 | (9) | | | * | % |

| | | | | | | | | |

| All directors and executive officers as a group (9 individuals) | | | 5,546,053 | (10) | | | 33.84 | % |

* less than 1%

| (1) | The business address for this individual is c/o Sajan, 625 Whitetail Blvd., River Falls, Wisconsin 54022. |

| (2) | Based on 16,185,804 shares of common stock outstanding as of April 13, 2012. Shares of Sajan common stock not outstanding but deemed beneficially owned by virtue of a person’s right to acquire them as of April 13, 2012, or within 60 days of such date, pursuant to the exercise of outstanding stock options and warrants, are treated as outstanding only when determining the number and percentage of shares owned by such individual and when determining the number and percentage of shares owned by all directors and executive officers as a group. |

| (3) | Includes options to purchase 125,000 shares of common stock that are currently exercisable or will become exercisable within 60 days of April 13, 2012 |

| (4) | As of April 6, 2012, Mr. Fagley is no longer employed with the Company and all outstanding options previously held by Mr. Fagley have expired per their terms. |

| | |

| (5) | Includes options to purchase 6,667 shares of common stock that are currently exercisable or will become exercisable within 60 days of April 13, 2012. |

| | |

| (6) | Includes options to purchase 15,000 shares of common stock that are currently exercisable or will become exercisable within 60 days of April 13, 2012. |

| (7) | Includes 7,656 shares held indirectly by Rogers Family Limited Partnership and 7,656 shares held indirectly as co-trustee of the Michael W. Rogers Revocable Trust U/A/D 2/7/2002, and includes options to purchase 13,334 shares of common stock that are currently exercisable or will become exercisable within 60 days of April 13, 2012. |

| (8) | Includes options to purchase 25,667 shares of common stock that are currently exercisable or will become exercisable within 60 days of April 13, 2012. |

| (9) | Consists of options to purchase 16,000 shares of common stock that are currently exercisable or will become exercisable within 60 days of April 13, 2012. |

| (10) | Includes options to purchase a total of 201,668 shares of common stock. See Footnotes 3, 5, 6, 7, 8 and 9 above. |

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons considered to be beneficial owners of more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission and NASDAQ. Officers, directors and greater-than-ten-percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to the Company, or written representations that no applicable filings were required, the Company believes that all such filings were filed on a timely basis for the fiscal year 2011, except that Mr. Fagley filed a Form 4 on March 10, 2012 to report options granted on March 1, 2011 and May 20, 2011.

EXECUTIVE OFFICERS

The following table identifies our current executive officers, the positions they hold, and their current age. Our executive officers have been appointed by our Board of Directors to hold office until their successors are elected or their earlier death, resignation or removal.

| Name | | Age | | Positions |

| Shannon Zimmerman | | 40 | | Chairman of the Board, President and Chief Executive Officer |

| Angela (Angel) Zimmerman | | 39 | | Chief Operating Officer |

| Timothy Clayton | | 57 | | Chief Financial Officer |

| Harold Fagley | | 51 | | Vice President, Software Engineering |

Timothy Clayton. Mr. Clayton was appointed Chief Financial Officer on August 4, 2010. Prior to joining Sajan, Mr. Clayton was the founding principal of Emerging Capital, LLC, a specialized management consulting firm providing advisory services in the areas of strategic planning, mergers and acquisitions, capital formation, corporate governance and CFO-related activities. Prior to establishing Emerging Capital, Mr. Clayton served as Executive Vice President, Chief Financial Officer and Treasurer of Building One Services Corporation, a publicly traded national provider of facility services. Prior to that, Mr. Clayton worked for 21 years at Price Waterhouse, LLP, serving as an audit partner for nine years. In this role, he was responsible for audit, acquisition support and business advisory services for a variety of clients. Mr. Clayton has a B.A. in Accounting from Michigan State University and is a Certified Public Accountant.

Harold Fagley.Mr. Fagley was appointed as Vice President Software Engineering on January 15, 2011. As of April 6, 2012, Mr. Fagley is no longer employed with the Company. Prior to joining Sajan, Mr. Fagley was Vice President Operations at Business Incentives, Inc. in the e-learning division of a business incentives corporation. Prior to Business Incentives, Inc., Mr. Fagley was Vice President Software Engineering at Corel Corporation, a manufacturer of software applications which acquired JASC Inc., where Mr. Fagley was the Executive Director of Software Engineering publishing various consumer imaging applications. Prior to Jasc, Mr. Fagley was at Macromedia Inc. (now Adobe), a producer of web development and imaging software. Mr. Fagley has a B.A. in Mathematics from St. Olaf College.

For biographical information on our other executive officers, see “Election of Directors” above.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes the compensation for fiscal 2011 and 2010 of Sajan, Inc.’s chief executive officer and the next two most highly compensated executive officers serving as executive officers as of December 31, 2011. Ms. Zimmerman’s compensation is included in this table due to her position as a director of the Company and as a related person to Mr. Zimmerman.

| Name and Principal Position | | Year | | | Salary | | | Option Awards (1) | | | All Other

Compensation | | | Total | |

| Shannon Zimmerman | | | 2011 | | | $ | 185,000 | | | $ | - | | $ | 14,356 | (2) | | | 195,356 | |

| President, Chief Executive Officer, Chief Financial Officer through August 2010 | | | 2010 | | | $ | 185,000 | | | $ | - | | $ | 50,208 | (3) | | $ | 235,208 | |

| Timothy Clayton(4) | | | 2011 | | | $ | 175,000 | | | $ | - | | $ | 9,233 | (5) | | $ | 184,233 | |

| Chief Financial Officer since August 2010 | | | 2010 | | | $ | 71,337 | | | $ | 173,800 | | $ | 2,036 | (6) | | $ | 247,173 | |

| Harold Fagley(7) | | | 2011 | | | $ | 163,570 | | | $ | 52,975 | | $ | 8,986 | (8) | | $ | 225,531 | |

| Vice President, Software Engineering since January 2011 | | | | | | | | | | | | | | | | | | | |

| Angela Zimmerman | | | 2011 | | | $ | 150,000 | | | $ | - | | $ | 9,983 | (9) | | $ | 158,822 | |

| Chief Operating Officer | | | 2010 | | | $ | 153,000 | | | $ | - | | $ | 5,822 | (10) | | $ | 158,822 | |

| (1) | Reflects the aggregate full grant date value as determined under ASC Topic 718 – Compensation – Stock Compensation. Refer to “Note 5 – Stock -Based Compensation” in the audited financial statements included in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2011 for a discussion of the assumptions used in calculating the award amount. |

| (2) | Figure includes commissions of $263 earned prior to the Merger, $7,410 in employer-paid retirement contributions and $6,683 for family health insurance premiums, which includes coverage for Ms. Zimmerman. |

| (3) | Figure includes commissions of $37,880, $8,470 in employer-paid retirement contributions and $3,858 for health and life insurance premiums. |

| | |

| (4) | Mr. Clayton became the Company’s Chief Financial Officer effective August 1, 2010. |

| | |

| (5) | Figure includes $5,250 in employer-paid retirement contributions and $3,983 in health insurance premiums. |

| (6) | Figure includes $1,750 in employer-paid retirement contributions and $286 in health insurance premiums. |

| (7) | Mr. Fagley became the Company’s Vice President, Software Engineering effective January 15, 2011. As of April 6, 2012, Mr. Fagley is no longer employed with the Company. |

| | |

| (8) | Figure includes $5,667 in employer-paid retirement contributions and $3,319 in health insurance premiums. |

| | |

| (9) | Figure includes $6,000 in employer-paid retirement contributions and $3,983 in health insurance premiums. |

| | |

| (10) | Figure includes $5,750 in employer paid retirement contributions and $72 in disability insurance premiums. |

Outstanding Equity Awards at Fiscal Year End - 2011

The following table sets forth information about unexercised options that were held at December 31, 2011 by the named executive officers of Sajan, Inc. (neither Mr. nor Ms. Zimmerman hold any options):

| | Option Awards | | | | |

| Name | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | | Equity Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#) | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | |

| Timothy Clayton | | | 62,500 | | | 187,500 | (1) | | | - | | | $ | 1.45 | | | | 8/4/20 | |

| | | | | | | | | | | | | | | | | | | | |

| Harold Fagley | | | - | | | 35,000 | (2) | | | - | | | $ | 1.14 | | | | 3/1/21 | |

| | | | - | | | 30,000 | (3) | | | - | | | $ | 1.60 | | | | 5/20/21 | |

| (1) | These options vest in equal installments on June 1, 2011, 2012, 2013 and 2014 and expire 10 years from the date of grant. |

| (2) | These options would have vested in equal installments on March 1, 2012, 2013, 2014, 2015 and expired 10 years from the date of grant. As of April 6, 2012, Mr. Fagley is no longer employed by the Company and these options expired per their terms. |

| (3) | These options would have vested in equal installments on May 20, 2012, 2013, 2014, 2015 and expired 10 years from the date of grant. As of April 6, 2012, Mr. Fagley is no longer employed by the Company and these options expired per their terms. |

Employee Benefit Plans

2004 Amended and Restated Long-Term Incentive Plan.Our 2004 Incentive Plan allows our Board of Directors

or a committee of the Board to grant awards to our employees (including our named executive officers), independent contractors, and other service providers or any parent or subsidiary of Sajan. The awards may take the form of qualified or non-qualified options, stock appreciation rights, shares of restricted stock, other stock-based awards or cash-based awards. For additional information regarding the 2004 Incentive Plan, please refer to the information in our Form 8-K filed February 24, 2010, under the section entitled “General Description of the 2004 Incentive Plan,” which description is incorporated herein by reference.

Retirement Savings Plans.Sajan maintains an employee benefit plan qualified under Section 401(k) of the Internal Revenue Code of 1986, as amended. At the discretion of the Board of Directors, the Company may make discretionary profit-sharing contributions into the 401(k) plan for all eligible employees, including our named executive officers. The Company will make matching contributions equal to each participant’s contribution, up to a maximum matching contribution of 4% of each participant’s compensation. For the year ended December 31, 2011, the Company’s matching contributions totaled $157,247.

Employment and Change-in-Control Agreements

On May 19, 2006, pre-Merger Sajan entered into an employment agreement with Shannon Zimmerman, which was amended effective as of February 1, 2010 and assumed by the Company in the Merger. Under the employment agreement, Mr. Zimmerman receives an annual base salary of $185,000. The employment agreement requires us to pay severance in an amount equal to the then-current annual salary upon termination of employment by the Company other than for cause or upon termination of employment by the employee for the Company’s breach. The employment agreement contains confidentiality, invention assignment, non-solicitation and non-competition provisions.

Timothy Clayton receives an annual base salary of $182,000. Pursuant to an employment agreement effective August 4, 2010, Sajan granted to Mr. Clayton an option to purchase 250,000 shares of common stock of Sajan. The stock options will be exercisable at the fair market value of Sajan’s common stock on the date of grant, will vest in equal installments on June 1, 2011, 2012, 2013, and 2014 and will expire 10 years from the date of the grant. The employment agreement requires that in the event Sajan terminates Mr. Clayton’s employment for any reason not constituting Cause, Sajan will pay his base salary through the date of termination and will provide the following benefits: (i) severance pay equal to six months of his ending base salary and (ii) immediate vesting of all stock options that are due to be vested within six months from the date of termination. Mr. Clayton is subject to non-competition and employee non-solicitation restrictions during the term of his employment with Sajan and for one year following his termination of employment with Sajan for any reason.

Harold Fagley received an annual base salary of $170,000. Following commencement of his employment, Sajan granted to Mr. Fagley an option to purchase 35,000 shares of common stock of Sajan. The stock options were exercisable at the fair market value of Sajan’s common stock on the date of grant, were to vest in equal installments on March 1, 2012, 2013, 2014, and 2015, and were to expire 10 years from the date of the grant. On May 20, 2011, Sajan granted to Mr. Fagley an option to purchase 30,000 shares of common stock of Sajan. The stock options were exercisable at the fair market value of Sajan’s common stock on the date of grant, were to vest in equal installments on May 20, 2012, 2013, 2014, and 2015, and were to expire 10 years from the date of the grant. As of April 6, 2012, Mr. Fagley is no longer employed with the Company and all options have expired by their terms. Mr. Fagley is subject to non-competition and employee non-solicitation restrictions for one year following his termination of employment with Sajan.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table summarizes equity securities authorized for issuance under our equity compensation plan as of December 31, 2011:

| Plan Category | | Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights | | | Weighted

average exercise

price of

outstanding

options, warrants

and rights | | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

First column) | |

| Equity compensation plans approved by stockholders (1) | | | 1,436,467 | | | $ | 1.74 | | | | 742,860 | |

| Equity compensation plans not approved by stockholders | | | | | | | | | | | | |

| Total | | | 1,436,467 | | | $ | 1.74 | | | | 742,860 | |

(1) Consists of the 2004 Incentive Plan

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Sajan is a party to three office lease agreements with River Valley Business Center, LLC (“RVBC”). RVBC owns a two-story commercial office building located near River Falls, Wisconsin. RVBC is owned and operated by Shannon Zimmerman and Angel Zimmerman, both of whom are executive officers, directors and significant stockholders of Sajan. Under the terms of a lease agreement dated February 1, 2010, Sajan leases 12,000 square feet of space which comprises the entire second floor of the building, and pays monthly rent of approximately $19,000. Under the terms of a lease agreement dated February 1, 2010, Sajan leases an additional 4,100 square feet of space which comprises a portion of the first floor of the building and pays monthly rent of approximately $6,500. Under the terms of a lease agreement effective February 28, 2012, Sajan leases an additional 3,850 square feet of space which comprises a portion of the first floor of the building and pays monthly rent of approximately $5,000. All three of these leases will expire on January 31, 2017. Sajan may not assign any of the lease agreements without the prior written consent of RVBC. In the lease agreements, Sajan granted RVBC a security interest in all goods, chattels, fixtures and personal property of Sajan located in the premises to secure rents and other amounts that may be due under the lease agreements. Management of Sajan believes, based on an informal assessment conducted by a commercial real estate agent familiar with commercial properties in the River Falls, Wisconsin area, that the rent paid for the leased premises is competitive with rents paid for similar commercial office space in the River Falls, Wisconsin market. The foregoing lease agreements were authorized by the disinterested members of the pre-Merger Sajan, Inc. Board of Directors before the date of the Merger.

In connection with the Merger, Shannon Zimmerman and Angela Zimmerman received a promissory note in the aggregate principal amount of $1.0 million in lieu of $1.0 million of cash consideration. The interest rate on this note is 8%. This note was amended on February 22, 2011 to provide for the payment of $250,000 plus accrued interest immediately but to extend the payment date for the remaining $750,000 until August 23, 2012. On March 26, 2012, this note was amended to extend the payment date for the $750,000 until August 23, 2013. All other terms remain unchanged.

Lori Bechtel is the sister of Angela Zimmerman and the sister-in-law of Shannon Zimmerman, and is currently employed as the Company’s Comptroller. During fiscal year 2011, Ms. Bechtel earned $105,500 as base salary and $8,803 in employer-paid retirement contributions and family health and life insurance premiums. Ms. Bechtel was also granted options to purchase 25,500 shares of common stock, with a grant date fair value of $17,340.

Joe Bechtel is the husband of Lori Bechtel and the brother-in-law of Angela Zimmerman, and is currently employed as the Company’s Vice President of North American Client Services. During fiscal year 2011, Mr. Bechtel earned $127,301 as base salary and $9,063 in employer-paid retirement contributions and family health and life insurance premiums. Mr. Bechtel was also granted options to purchase 60,000 shares of common stock, with a grant date fair value of $49,575.

All ongoing and future transactions between us and any of our officers and directors or their respective affiliates, including loans made to the Company by our officers and directors, will be on terms believed by us to be no less favorable than are available from unaffiliated third parties and such transactions or loans, including any forgiveness of loans, will require prior approval in each instance by a majority of our uninterested “independent” directors or the members of our board who do not have an interest in the transaction, in either case who had access, at our expense, to our attorneys or independent legal counsel.

PROPOSAL NO. 2

RATIFY APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Board of Directors and management are committed to the quality, integrity and transparency of the financial reports. Independent auditors play an important part in our system of financial control. Our Board of Directors has appointed Baker Tilly Virchow Krause, LLP (“Baker Tilly Virchow Krause”) as our independent registered public accounting firm for the fiscal year ending December 31, 2012. A representative of Baker Tilly Virchow Krause is expected to attend the Annual Meeting and will be available to make statements and respond to questions from stockholders.

If the stockholders do not ratify the appointment of Baker Tilly Virchow Krause, the Board of Directors may reconsider its selection, but is not required to do so. Notwithstanding the proposed ratification of the appointment of Baker Tilly Virchow Krause by the stockholders, the Board of Directors may, in its discretion, direct the appointment of a new independent registered public accounting firm at any time during the year without notice to, or the consent of, the stockholders, if the Board of Directors determines that such a change would be in the best interests of the Company.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTEFORRATIFICATION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

Audit and Non-Audit Services and Fees Billed to Company by Independent Registered Public Accounting Firm

The following table summarizes the fees we were billed for audit and non-audit services rendered for fiscal years 2011 and 2010. Baker Tilly Virchow Krause audited the Company’s consolidated financial statements for fiscal years 2011 and 2010.

| | | 2011 | | | 2010 | |

| Audit Fees | | $ | 67,000 | | | $ | 88,241 | |

| Audit-Related Fees | | | - | | | | - | |

| Tax Fees | | | - | | | | - | |

| All Other Fees | | | 685 | | | | 5,857 | |

| | | | | | | | | |

| Total | | $ | 67,685 | | | $ | 94,098 | |

Audit Fees. The fees identified under this caption were for professional services rendered for years ended 2011 and 2010 in connection with the audit of our annual financial statements and review of the financial statements included in our quarterly reports on Form 10-Q. The amounts also include fees for services that are normally provided by the independent public registered accounting firm in connection with statutory and regulatory filings and engagements for the years identified.

Audit-Related Fees. The fees identified under this caption were for assurance and related services that were related to the performance of the audit or review of our financial statements and were not reported under the caption “Audit Fees.” This category may include fees related to the performance of audits and attestation services not required by statute or regulations, and accounting consultations about the application of generally accepted accounting principles to proposed transactions.

Tax Fees. The fees identified under this caption were for tax compliance, tax planning, tax advice and corporate tax services. Corporate tax services encompass a variety of permissible services, including technical tax advice related to tax matters; assistance with withholding-tax matters; assistance with state and local taxes; preparation of reports to comply with local tax authority transfer pricing documentation requirements; and assistance with tax audits.

All Other Fees. The fees identified under this caption were for services related to potential acquisitions, due diligence and review of merger-related documents and filings.

Approval Policy. Our Audit Committee approves in advance all services provided by our independent registered public accounting firm. All engagements of our independent registered public accounting firm in years ended 2011 and 2010 were pre-approved by the Audit Committee.

Audit Committee Report

This section shall not be deemed to be "soliciting material," or to be "filed" with the Securities and Exchange Commission, is not subject to the liabilities of Section 18 of the Securities Exchange Act of 1934 and is not to be incorporated by reference into any filing of Sajan under the Securities Act of 1933 or the Securities Exchange Act of 1934, regardless of date or any other general incorporation language in such filing.

Management is responsible for Sajan's financial reporting process, including the system of internal controls, and for preparing Sajan's consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent registered public accounting firm is responsible for auditing those consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America. The Audit Committee's responsibility is to monitor and review these processes. The members of the Audit Committee rely, without independent verification, on the information provided to them and on the representations made by Sajan's management and the independent registered public accounting firm.

During 2011, the Audit Committee, consisting of Benno G. Sand (chairman), Michael Rogers, Kris Tufto and Richard C. Perkins, held five meetings. The meetings were designed to, among other things, facilitate and encourage communication among the Audit Committee, management and Sajan's independent registered public accounting firm, Baker Tilly Virchow Krause, LLP. The Audit Committee discussed with Baker Tilly Virchow Krause, LLP the overall scope and plans for its 2011 audit. The Audit Committee met with Baker Tilly Virchow Krause, LLP, with and without management present, to discuss the results of its examinations and its evaluations of Sajan's system of internal controls.

During the meetings held in 2011, the Audit Committee reviewed and discussed, among other things:

| · | Financial statements, Quarterly Reports on Form 10-Q and Annual Report on Form 10-K and reports from the independent registered public accounting firm; |

| · | Recent accounting pronouncements and the Company’s significant accounting policies; |

| · | Disclosure controls and internal controls over financial reporting; |

| · | Engagement of its independent registered public accounting firm. |

In February and March 2012, the Audit Committee reviewed and discussed the 2011 audited consolidated financial statements and notes to the consolidated financial statements for inclusion in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2011 with management and Baker Tilly Virchow Krause, LLP, including a discussion of the application of accounting principles generally accepted in the United States, the reasonableness of significant judgments, and the clarity of disclosures in the consolidated financial statements. The Audit Committee also has discussed with our independent registered public accounting firm the firm's independence from management, including whether the provision of non-audit services is compatible with maintaining the firm's independence, and matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (Communications with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent account's independence.

Based on this review and prior discussions with management and the independent registered public accounting firm, the Audit Committee recommended to the Board that Sajan’s audited consolidated financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2011 for filing with the Securities and Exchange Commission.

Audit Committee

Benno G. Sand, Chairman Michael Rogers

Kris Tufto

Richard C. Perkins

STOCKHOLDER PROPOSALS AND

DISCRETIONARY PROXY VOTING AUTHORITY

Any stockholder desiring to submit a proposal for action by the stockholders at the next annual stockholders’ meeting, which will be the 2013 annual meeting, must submit that proposal in writing to the Secretary of the Company at the Company’s corporate headquarters no later than January 3, 2013, approximately 120 days prior to the one-year anniversary of the mailing of this Proxy Statement, to have the proposal included in the Company’s proxy statement for that meeting. Due to the complexity of the respective rights of the stockholders and the Company in this area, any stockholder desiring to propose such an action is advised to consult with his or her legal counsel with respect to such rights. The Company suggests that any such proposal be submitted by certified mail, return-receipt requested.

Rule 14a-4 promulgated under the Securities Exchange Act of 1934 governs the Company’s use of its discretionary proxy voting authority with respect to a stockholder proposal that the stockholder has not sought to include in the Company’s proxy statement. Rule 14a-4 provides that if a proponent of a proposal fails to notify the Company at least 45 days prior to the month and day of mailing of the prior year’s proxy statement, management proxies will be allowed to use their discretionary voting authority when the proposal is raised at the meeting, without any discussion of the matter.