UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________________ to ___________________

Commission File Number:000-51560

Sajan, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 41-1881957 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

| | |

| 625 Whitetail Blvd., River Falls, Wisconsin | 54022 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (715) 426-9505

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Name of Each Exchange on which Registered |

| None | | Not Applicable |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share

Preferred Stock Purchase Rights

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days.x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).¨ Yes x No

The aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant, as of the last day of the registrant’s most recently completed second fiscal quarter was approximately $16,185,804 based on the closing sales price of $0.80 per share as reported on the OTCBB market. As of March 15, 2013, there were 16,268,391 shares of our common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of our definitive proxy statement relating to our 2013 Annual Meeting of Stockholders is incorporated by reference into Part III of this Annual Report on Form 10-K.

2012 Annual Report on Form 10-K

Table of Contents

| | | Page |

| | | |

| PART I | | |

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 12 |

| Item 1B. | Unresolved Staff Comments | 21 |

| Item 2. | Properties | 21 |

| Item 3. | Legal Proceedings | 22 |

| Item 4. | Mine Safety Disclosures | 22 |

| | | |

| PART II | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 23 |

| Item 6. | Selected Financial Data | 24 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 32 |

| Item 8. | Financial Statements and Supplementary Data | 33 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 54 |

| Item 9A. | Controls and Procedures | 54 |

| Item 9B. | Other Information | 55 |

| | | |

| PART III | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 57 |

| Item 11. | Executive Compensation | 57 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 57 |

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 57 |

| Item 14. | Principal Accounting Fees and Services | 57 |

| | | |

| PART IV | | |

| Item 15. | Exhibits, Financial Statement Schedules | 58 |

| | Signatures | 59 |

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (“Securities Exchange Act ”). Forward-looking statements reflect the current view about future events. When used in this Annual Report on Form 10-K the words “anticipate,” “will,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” and similar expressions or the negative of these terms as they relate to Sajan , Inc. (the “Company,” “Sajan,” “we,” “us” or “our”) its subsidiaries or its management identify forward-looking statements. Our forward-looking statements in this report generally relate to: our expectations regarding customer demand, market growth rates and conditions, pricing, our competitive position and strategic opportunities; our beliefs regarding the benefits of our technology and our ability to adapt to changing industry conditions; expectations regarding international sales; our intent with respect to intellectual property protection and research and development activities; our intent to grow organically and through acquisitions; our intent to list our securities for trading on NASDAQ upon satisfaction of the relevant listing standards; our intent to retain earnings to fund development; our expected growth initiatives; and our expectations with respect to cash flows and adequacy of capital resources. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section entitled “Risk Factors” of this Annual Report on Form 10-K) relating to the Company’s industry, its operations and results of operations, and any businesses that may be acquired by it. These factors include:

| · | our rate of growth in the global multilingual content delivery industry; |

| · | our ability to effectively manage our growth; |

| · | lack of acceptance of any existing or new solutions we offer; |

| · | our ability to continue increasing the number of our customers or the revenues we derive from our recurring revenue customers; |

| · | continued economic weakness and constrained globalization spending by businesses operating in international markets; |

| · | our ability to effectively develop new solutions that compete effectively with the solutions that our current and future competitors offer; |

| · | risk of increased regulation of the Internet and business conducted via the Internet; |

| · | our ability to identify attractive acquisition opportunities, successfully negotiate acquisition terms and effectively integrate any acquired companies or businesses; |

| · | availability of capital on acceptable terms to finance our operations and growth; |

| · | risks of conducting international commerce, including foreign currency exchange rate fluctuations, changes in government policies or regulations, longer payment cycles, trade restrictions, economic or political instability in foreign countries where we may increase our business and reduced protection of our intellectual property; |

| · | our ability to add sales and marketing, research and development or other key personnel who are able to successfully sell or develop our solutions; |

| · | our ability to operate as a public company and comply with applicable disclosure and other requirements and to hire additional personnel with public company compliance experience; and |

| · | other risk factors included under “Risk Factors” in this Annual Report on Form 10–K. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Although our management believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Sajan does not intend to update any of the forward-looking statements to conform these statements to actual results.

PART I

ITEM 1. BUSINESS

Sajan provides language translation solutions to customers selling products into global markets. These customers use our solutions to translate product sales and marketing materials, packaging, user manuals, technical support and training documents, product manuals, instructions, warnings, and other product information into numerous languages. We combine our internally developed proprietary technology and high quality translation services to provide language translation solutions that are fast, reliable, and user-friendly. By utilizing an integrated technology and a service-based approach to language translation, we offer comprehensive solutions that allow customers to rely upon a single provider to meet all of their language translation needs. Our cloud-based technology system delivers a secure online solution that can be offered on a modular basis, which makes it attractive in both small business settings and in large enterprise environments. Sajan provides language translation services and technology solutions to companies located throughout the world, particularly in the technology, consumer products, medical and life sciences, financial services, manufacturing, government, and retail industries that are selling products into global markets. The Company is located in River Falls, Wisconsin.

Pursuant to an Agreement and Plan of Merger (the “Merger Agreement”) dated January 8, 2010, by and among MathStar, Inc., a Delaware corporation, incorporated in June 2005, Sajan, Inc. a privately held Minnesota corporation whose business is providing language translation technology and service; Garuda Acquisition, LLC, a wholly-owned subsidiary of MathStar, subsequently known as Sajan, LLC; and Thomas Magne, solely in his capacity as agent for the holders of common stock of Sajan, Inc., Sajan, Inc. was merged with and into Garuda Acquisition, LLC, (the “Merger”). Garuda Acquisition, LLC (“Garuda”) was the surviving entity in the Merger and subsequently changed its name to Sajan, LLC. As a result of the Merger, Sajan became a wholly-owned subsidiary of MathStar. MathStar continued the business of Sajan and began operating as a provider of language translation technology and service under the Sajan name. The Merger was closed and effective on February 23, 2010.

For accounting purposes, Sajan was treated as the continuing reporting entity that acquired MathStar because Sajan obtained effective control of MathStar as a result of the Merger. This determination was based on the following facts: Sajan stockholders have a large minority interest in the combined entity, the governing board consists of a majority of Sajan board members, and the composition of the senior management will be Sajan’s management team. Under this method of accounting, the recognition and measurement provisions of the accounting guidance for business combinations do not apply and, therefore, there is no recognition of goodwill or other intangible assets. Instead, the acquisition has been treated as the equivalent of Sajan issuing stock for the net monetary assets of MathStar, primarily cash, which are stated at their carrying value.

In 2009, we established Sajan Software Ltd (“Sajan Software”), which is based in Dublin, Ireland. The Ireland facility serves as both a Global Language Service Center and is home to Sajan Software, the producer of Sajan’s technology tools. Sajan India Software Private Limited (“Sajan India”), based in Delhi, India, was previously our software development center. This center was closed in January 2012 and these functions were moved to our River Falls headquarters. In 2010, we also established a Global Language Service Center in Spain, Sajan Spain S.L.A. (“Sajan Spain”), to serve the European market. In 2011, we established a Global Language Service Center in Singapore, Sajan Singapore Pte. Ltd. (“Sajan Singapore”), to serve the Asia Pacific market. All of these operations are wholly-owned subsidiaries of Sajan.

In October 2011, we completed the acquisition of the New Global Group (“New Global”) of companies. New Global is a provider of multilingual communication services and technologies and serves clients in the United States, Canada and Europe through offices in Montreal, Canada and Madrid, Spain. This acquisition included the purchase of the outstanding stock of two subsidiaries of New Global, New Global Canada and New Global Europe, and certain assets and liabilities of New Global LLC. The effective date of the acquisition was October 1, 2011. New Global Canada and New Global Europe are now wholly-owned subsidiaries of Sajan.

Effective as of May 7, 2012, Sajan, LLC was merged with and into Sajan, Inc, and Sajan, Inc. was the surviving entity in the merger.

Products and Services

Our robust language translation solution incorporates an innovative technology product that serves as a single platform to meet the needs of the smallest user to the largest enterprise customer. The solution is a cloud-based platform and requires no installed software, which means customers can access all of our translation lifecycle components via an internet browser. We combine both language translation services and our own proprietary technology to give customers a single source solution to meet all of their translation needs. The solution integrates people, processes and data into a service and technology solution that is designed to deliver measurable value in the form of cost reduction, business process automation, improved quality and integrated version control and audit trail.

Sajan launched Transplicity in 2013. This next generation technology solution is designed to replace, over time, the formerGlobal Communication Management System (“GCMS”). By categorical definition, it is a Translation Management System (“TMS”), which means the technology encompasses feature that span the entire language translation lifecycle. Transplicity is a cloud-based technology solution designed specifically to enhance all aspects of the language translation and localization process. The product represents a dynamic shift in how clients can use and experience their technology by meeting the voice of market demands for advanced capability, but offering flexibility for unique user needs. Transplicity draws from the same advanced core multilingual data management system Sajan has historically offered, however it completely changes how users interact. The flexibility of user personalization differs from Sajan’s previous GCMS solution offering.

The Transplicity platform is an integrated solution suite that provides an array of tools for the diverse roles needed in the language translation process. By way of this integrated platform, not only are all roles tied together, but the technology feature set is also rich and robust in one cohesive solution. This is often unlike other technology offerings.

The purpose of the Transplicity platform is to deliver value to all users. It is specifically designed to automate nearly all tasks and functions. This approach reduces human involvement and dependence resulting in lower cost, greater scalability and process optimization. At the heart of Transplicity is Sajan’s patented Translation Data Repository. Data storage in the language translation industry is often referred to as Translation Memory (“TM”). Sajan’s approach enhances substantially what traditional TM can do. By design, TM is intended to reuse previously translated content. An effective technology used by many, Sajan has changed how this is done. By contextually indexing all data, reuse results are improved. In addition, Sajan has taken an enterprise approach to this aspect of the technology solution and it has the scalability to handle millions of source to target segments. This is materially different than a desktop or workgroup TM solution commonly found in the industry.

Sajan also has developed very specific multilingual search algorithms to take advantage of this superior multilingual storage approach. These search technologies capitalize on the intelligent storage and incorporate a rules engine and learning agent to make it one of the most advanced multilingual solutions available.

If the data is at the heart of the solution, it requires active workflow to tie together the multitude of roles that are required in the process. Workflow is meant to automate both human and machine functions throughout the process. This has a positive impact on operational expenses for the company, but also delivers a substantial benefit to Sajan’s customers. The Transplicity workflow enables file disassembly, reassembly, system-to-system integration, event driven workflow, integrated Machine Translation and automated exceptional handling to keep the often time critical translation process moving forward.

Many of the very top translation vendors provide some form of technology. They also do so most commonly by way of offering individual pieces of what should be the whole solution. They may offer an online web project submission tool and call their solution “cloud-based”. Sajan believes that a complete solution must build and improve a central enterprise repository; offer automated workflow; provide advanced analytics and reporting; connect with other business systems such as Content Management Systems (“CMS”); and finally adapt itself to the unique needs of each user or client. It is the final requirement where Transplicity stands out.

Transplicity is, to our knowledge, the first personalized TMS available on the market. This next generation solution includes a widget design, which offers users the ability to change their “Translation Surface” in a way to make it personal, productive and meaningful to them. Widgets can be added or removed to change how the Translation Surface behaves and what it does so as to make our clients more productive and deliver greater value. Transplicity goes so far as to offer the ability to “skin” the application or change the branding for those situations where this may be required.

Not only does Transplicity raise the bar on how translation is done, it opens up a new business model for Sajan. Common historical barriers to technology adoption were derived from client/vendor acceptance and/or a customer’s ability to manage a TMS themselves. A TMS is an enterprise solution, and while many companies want the benefits it can offer, they are not staffed to run it themselves, nor is it their core competency. Finally, even for those clients that want the value of technology but determine it is not in their interest to run it themselves, they do not want to be dependent on one sole language service vendor.

If the market continues a move towards Translation Management System solutions, Transplicity sets the stage for Sajan to provide a solution to meet this market opportunity. The dynamic and personalized capabilities, along with Sajan’s expert Managed Service strengths may meet a need that has not been satisfied to date. Sajan will continue to expand this offering in parallel with its core solution offering as we go forward.

Technological Features. The Sajan solution is not just feature rich in capability, it is also designed to be highly scalable and consistent with the latest cloud architectural models.

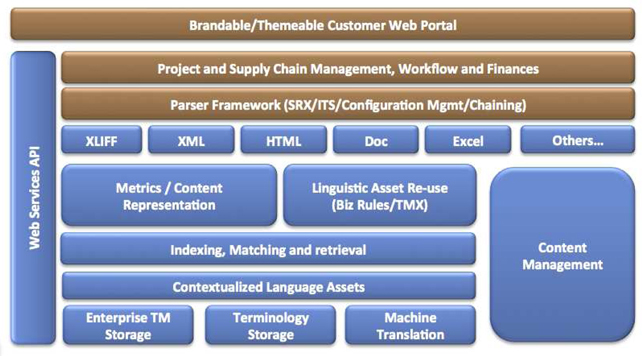

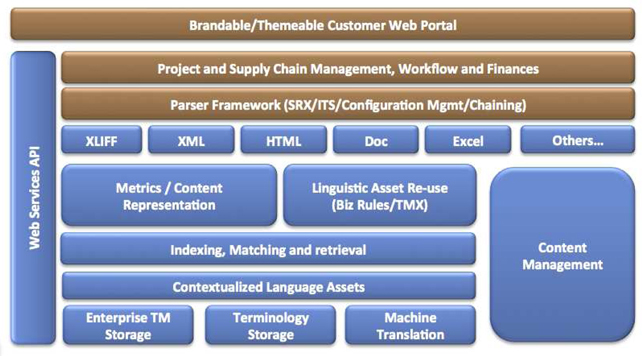

The below image illustrates the architectural composition of Transplicity.

Process. Utilizing the Transplicity platform, human translators who provide translation services to Sajan are first systematically ranked and qualified to ensure that a high-quality language resource is performing translation on a particular project. Incorporating advanced search capabilities using TMate™ (Sajan’s multilingual search algorithm) we believe provides greater price and value differentiation. We believe our technological advances, detailed process methodology, and ISO 9001 & ISO 13485 practices result in reduced costs while delivering a higher quality and value to the customer. This method offers a blend of both service and technology. Customers may sign in online, request translation of new content, view the status of pending projects, and obtain completed projects. All content is stored at a granular level, referred to as a segment, with language context retained, and each translated segment is stored indefinitely. This capability allows us to offer audit trail and version control, which are useful to regulated businesses operating in industries where compliance is important. Sajan Transplicity brings customers, translators and technology together.

The image below shows the Sajan Transplicity branded logo and illustrates the tie between all participants in this cloud solution.

Transplicity Advantages. By utilizing a language management platform such as Transplicity, we believe that customers are able to reduce the time-to-market for their products. The platform also enables enterprises to simultaneously launch products into all markets, which can result in more rapid revenue growth and a competitive advantage. The Transplicity platform has been designed to ensure improved quality of multilingual content. Transplicity uses advanced features, which increase the contextual accuracy of re-used multilingual content. For customers whose content accuracy and contextual sensitivity is vital, the Transplicity platform offers an attractive solution to these problems. These rich features are all available in a personalized customer experience making the system right for them and how they work. This solution also opens up a new selling channel as a Translation Managed Service.

In June 2011, Sajan was granted a patent covering a number of components that make up the Transplicity platform. Specifically, the structure in which both source and target content is stored results in a logical and contextually accurate placement of content. This means that the content becomes more intelligent and can be used in ways that are more meaningful for future language translation services.

ISO Certified. According to leading industry analysts, approximately 10% of suppliers in this market claim ISO certification. The certification requires significant investment of time and money. The benefits to clients are the assurance of quality controls and defined business structure. We received our ISO 9001:2000 certification in 2005, and are currently ISO 9001:2008 and ISO 13485:2003 certified.

Market Description

Language is often a barrier in global commerce. The demand for effective language translation continues to grow. The industry has historically been very service centric, but, as is the case in many service industries, price pressures and other market demands impose the need for innovation and new solution paradigms.

Language translation services, although often treated like a commodity service, have historically been expensive, labor intensive and relatively slow in delivery. Human translators can typically translate 2,500 words per day on average, although this varies based on the complexity of the subject matter. This creates constraints on the available supply of translation services and, when positioned against growing demand, we believe will provide translation technology innovators with an advantage. As a result, based on the rising demand for translation services and the looming shortage of human translators worldwide, we expect a favorable pricing environment for Language Service Providers (LSPs) in the coming years.

Machine Translation (“MT”) is a technology that can help to offset any market supply challenges by systematically producing language translation. MT is just one element to an enterprise language translation solution and Sajan incorporates MT into its overall solution. However, the quality of the translation produced by MT requires editing and correction to perfect it.

Global economic challenges have created opportunities. Although the weak economy and declines in the U.S. Dollar against foreign currency have impacted corporate spending, it has also influenced United States business executives to seek revenue from foreign markets. We believe recent negative worldwide economic conditions have hastened the trend towards globalization. In addition, growth in emerging markets will also help fuel market growth. Language translation is becoming more synonymous with revenue as critical company messages can now reach broader audiences.

We believe the shortage in human translators and a rising demand for content translation will result in increased opportunities for companies that offer technology-based solutions and improve the efficiency of language translation services. In theory, the language translation service market should shrink if technology is offering improved content reuse. To compete effectively, language translation companies need to obtain translation in an accurate, timely, and cost effective manner. With advances in content management and the growth of the Internet, providers will also need to integrate their multilingual content with other enterprise systems to establish a cohesive single repository of all global content. Content is no longer monolingual content; it is multilingual. Industry analysts and general business analysts have indicated that a more integrated solution, often referred to as the Global Content Lifecycle, will be required to be successful in the future for both global enterprises and for the LSPs that support them. As a result, language translation is no longer likely to be treated as an afterthought in the globalization process, but rather as an integral part of an enterprise system. Further, as the annual spending by multinational companies for language translation solutions accelerates over the next several years, we believe a more technology-based solution will be required to keep pace with the rate of growth in the amount of content and increasingly sophisticated content management solutions.

An additional advantage that Sajan provides is flexibility in our solution against a transforming market landscape. Many have speculated as to when the language translation technology industry will realize strong independent growth. Conceptually it makes perfect sense. However, adoption of independent technology solutions, comparable with other markets like Content Management, is occurring at a slower pace. We feel this is in part due to the complexity of the translation lifecycle and internal subject matter expertise required by companies to manage both the process and technology themselves. We believe Sajan is well positioned because it aligns the manner in which it offers technology with customer preferences. If the industry matures to a more independent technology approach, we expect that Sajan will be able to modify how it offers its solution using existing base technology that has been stress tested.

Based on the current globalization and language translation market dependence upon non-technology oriented, small language translation firms, we believe that vendors who provide both language translation capabilities and offer a strong technology platform will enjoy a competitive advantage.

Market Revenues. Research completed by Common Sense Advisory (“CSA”) confirms that language translation is a rapidly growing market. According to CSA’s research, the worldwide global multilingual content delivery market in 2012 was $33 billion and the global language services market is expected to reach $47 billion by 2015. The 2012 growth rate was over 12%. Human translation services account for over 90% of the global translation market and are generally delivered through a network of freelance linguists that freely associate among the LSPs on a per job basis. Nearly 90% of companies outsource some or all of their translation and localization work, and 67% of language buyers say that a vendor’s automation capabilities are important.

The global multilingual content delivery market is very fragmented. The combined revenues of the world’s top 40 translation firms account for less than 16% of the overall market, and most are service-only agencies. No single language translation provider exceeds 2% market share.

The market consists largely of traditional LSPs, meaning that these language service providers are very good at providing language translation service, but do not necessarily offer technological solutions which are becoming more and more vital. It is estimated that over 26,000 LSPs operate in the United States alone. Many of these companies are small language translation service-only companies.

According to CSA’s 2012 market research, the breakdown of language services revenue by geographical region is as follows:

| Region | | Market

Share | | | 2011

US$M | | | 2012

US$M | | | 2013

US$M | | | 2014

US$M | | | 2015

US$M | |

| Africa | | | 0.27 | % | | | 81 | | | | 91 | | | | 102 | | | | 114 | | | | 128 | |

| Asia | | | 12.88 | % | | | 3,849 | | | | 4,318 | | | | 4,843 | | | | 5,433 | | | | 6,094 | |

| Europe | | | 49.38 | % | | | 14,757 | | | | 16,553 | | | | 18,569 | | | | 20,830 | | | | 23,365 | |

| Europe - Eastern | | | 4.39 | % | | | 1,312 | | | | 1,472 | | | | 1,651 | | | | 1,852 | | | | 2,077 | |

| Europe - Northern | | | 18.86 | % | | | 5,636 | | | | 6,322 | | | | 7,092 | | | | 7,956 | | | | 8,924 | |

| Europe - Southern | | | 3.44 | % | | | 1,028 | | | | 1,153 | | | | 1,294 | | | | 1,451 | | | | 1,628 | |

| Europe - Western | | | 22.69 | % | | | 6,781 | | | | 7,606 | | | | 8,532 | | | | 9,571 | | | | 10,736 | |

| Latin America | | | 0.63 | % | | | 188 | | | | 211 | | | | 237 | | | | 266 | | | | 298 | |

| North America | | | 34.85 | % | | | 10,415 | | | | 11,683 | | | | 13,105 | | | | 14,700 | | | | 16,490 | |

| Oceania | | | 2.00 | % | | | 598 | | | | 670 | | | | 752 | | | | 844 | | | | 946 | |

| TOTALS | | | 100.00 | % | | | 29,885 | | | | 33,523 | | | | 37,604 | | | | 42,182 | | | | 47,317 | |

Table 1: Language Services Market Share by Region

Source: Common Sense Advisory, Inc.

Source: Projected Language Services Revenues for 2013-2015 in U.S. Millions of Dollars,Common Sense Advisory, Inc.

The ability of a traditional LSP to compete is growing more challenging. While demand for the service may be rising, which should allow for price increases, the buyers currently are demanding that providers hold or reduce prices. Without technological differentiation, a traditional LSP will continue to operate at a severe disadvantage, not only in its ability to manage the delivered cost, but also to integrate and interoperate with technologies used by its clients such as content management systems and other enterprise class business systems.

Key Market Trends and Influences. Several distinct trends and influences within the global multilingual content delivery market have emerged, and we believe they will provide significant opportunities for market innovation. The underlying motivators for many of these include historic objectives such as cost reduction, quality improvement and schedule predictability. In addition, globalization is causing new factors to emerge, such as revenue growth derived from foreign market penetration, improving global customer experience and brand support worldwide.

Competition

The global multilingual content delivery market is highly competitive and highly-fragmented with numerous existing competitors. We believe the principal competitive factors in providing language translation solutions include the ability to provide a comprehensive solution to customers; infrastructure that supports cost effective and high quality delivery to customers; project management expertise; quality and speed of service delivery; and corporate reputation. We believe that we have competed favorably with respect to these factors and have developed a strong reputation in our industry.

While many potential customers utilize internal resources to address their translation and localization requirements, we believe our primary competition is external and within our industry. Competitors within our industry are categorized into three primary segments: Language Service Providers, Technology Only Providers, and Technology-Enabled Service Providers.

Language Service Providers. The largest segment is comprised of competitors that offer only human language translation services and make limited use of technology on either an internal basis or as part of their solution. These service vendors are abundant due to low barriers to entry and often have only a small number of key, ongoing relationships. These providers make up the largest segment of the translation market and account for approximately 75% of the number of industry participants. The challenge for these providers is that they have little that differentiates them from other providers, with no technology and often unproven processes and quality controls. We believe that such firms offer an opportunity to increase our scale, gain access to critical linguistic skills and also open new geographic markets. We believe providing our technologies and business processes to these organizations will solidify their account base and enhance their margins.

Technology Only Providers. The second segment consists of pure technology providers. This group is a disparate collection of point solution and suite providers to enterprises for handling their own translation requirements. These technology solutions handle a wide range of requirements and leave much to the customers to do on their own to integrate and operate across multiple applications. Examples of competitive technology only companies are SDL Plc, Across Systems GmbH, Kilgray Translation Technologies, LingoTek, Inc., XTM and Smartling.

Within the category of technology only providers, there are two subsets. One subset consists of providers that serve the translator market most often with what is referred to as Translation Memory tools (a data management application). Often these are inexpensive productivity tools used by translators or small language service providers. The second subset are those technology providers that serve corporate enterprises. These providers operate beyond data management and include business process and analytics. These systems are often referred to as Translation Management Systems. Technology providers as a whole represent a very small portion of market participants. There has been a trend among the technology solution providers towards new, more nimble entrants embracing software-as-a-service (“SaaS”) architecture over the more traditional enterprise software model.

Technology-Enabled Service Providers. The third segment consists of companies like us that combine both language translation services and comprehensive technology solutions, often referred to as Technology-Enabled Service Providers. The largest such company is publicly-held Lionbridge Technologies, Inc. (“Lionbridge”), with 2012 revenues of $457 million. There are only a few Technology-Enabled Service Providers. Within this group, based on the most recent CSA report, we enjoy the highest ranking for our TMS technology offering.

We believe that only a very small number of the largest LSPs, such as SDL, Transperfect and Lionbridge, provide legitimate full featured TMS technology offerings. Each takes a very different technological approach. SDL has acquired many technology companies, both directly relating to the global multi-lingual content delivery industry and others that are peripheral to the industry. We believe that this has alienated SDL from some buyers and partners, as SDL directly competes with them. Lionbridge promotes a SaaS solution. This solution utilizes a legacy technologyderived through acquisition, which was originally designed as a TM solution. Lionbridge has incorporated some web interface updates to this product. Nearly all of the direct technology competition employs a very common strategy to TM data management. We believe this simplistic approach limits the ability for a customer to maximize reuse of past content and does not permit effective enterprise level integration with high performance business systems, which we believe is inferior to a more robust solution.

We believe the remaining LSPs, while potentially competent in the delivery of language translation service, do not possess significant technology. If they do, they are likely to be using TM tools to achieve some level of content reuse so as to enable them to make some technological value claim.

Marketing and Sales

Substantially all of our revenues have been generated through our internal direct sales force and the efforts of our senior management team. As of March 15, 2013, we had 15 direct sales professionals in the United States and Europe.

Our sales force has developed valuable customer relationships. Our sales approach involves planning for a customer organization’s unique ongoing requirements, including future versions of products, and ongoing support, maintenance, and training, related to both technology products and content. We believe that tailoring our solutions to the customer’s preference will result in gaining a larger portion of their language translation business.

Customers

All of our customers sell products outside the United States and require content such as warnings, instructions, directions, and other information to be translated into a number of languages. Our customers are predominantly Fortune 1000 companies in the technology, medical, industrial, and manufacturing sectors. Most of our customers are located in the United States, with a high concentration located in the Midwest region. We anticipate that the percentage of our customers located outside of the United States will increase as we expand our sales efforts and as Sajan Software hires additional sales personnel.

Major Customers

We derive a significant portion of our revenues from a limited number of customers. For the year ended December 31, 2012, our largest two customers accounted for approximately 18% and 11% of our annual revenues and for the year ended December 31, 2011, our largest customer accounted for 11% of our annual revenues. On a combined basis, our ten largest customers accounted for approximately 57% and 53%, of our revenue for the years ended December 31, 2012 and 2011, respectively.

Geographic Areas of Operations

We generate revenues worldwide. During the year ended December 31, 2012, 70% of our revenues were generated within the United States and 30% were generated internationally. Currently, our largest international market is Spain, which accounted for 38% of our international revenues.

Intellectual Property

The development, utilization, and protection of technology is an important component of our overall operating strategy. During 2011 we received a patent from the U.S. Patent and Trademark Office covering aspects of our GCMS solution which expires in 2021. We have not filed any applications for patent protection in any country other than the United States. As a result, we do not and will not have the right to enforce our rights under any United States patent, if issued to us, in any foreign country, or to prevent others in foreign countries from utilizing our proprietary technology covered by that patent. We may apply for patent protection on our future technology developments to the extent we believe such protection is available and economically warranted. Despite these efforts, others could independently develop technology that is similar to our technology or offer or sell products or services in foreign countries that use our technology.

We have registered and use domain names sajan.com, authoringcoach.com, and sajansoftware.com. We use, or intend to use, and claim rights to various trade names and trademarks to identify our language translation services and products. We have obtained a registered U.S. mark for the Sajan logo. We also use and claim rights to the “Sajan™”, “GCMS™”, “Transplicity”, “X-Content Integration™”, “TMate™”, “Context Intelligence™” and “Authoring Coach™” marks.

We intend to protect our intellectual property to the extent such protection is warranted. In addition to efforts to obtain patent and trademark rights, we rely on a combination of trade secret, license, non-disclosure and other contractual agreements and copyright laws to protect our intellectual property rights. Existing trade secret and copyright laws afford us only limited protection. We enter into confidentiality agreements with our employees and contractors, and limit access to and distribution of our proprietary information. These arrangements may not be adequate to deter misappropriation of our proprietary information and we may not be able to detect unauthorized use and take appropriate steps to enforce our intellectual property rights.

Research and Development

During the years ended December 31, 2012 and 2011, we spent approximately $1.1 million and $1.6 million respectively, on research and development. In addition, in 2012, we capitalized approximately $0.3 million of costs related to software development activities. Research and development expenses consist primarily of wages and benefits for product strategy and development personnel. We have focused our research and development efforts on the industrialization of the Transplicity platform and its component modules for use by the various participants involved in the content globalization process. Functional development has focused on improving ease of use, functionality, scalability and efficiency of Translation Memory processing.

Our research and development primarily occurs in the United States and Ireland. We expect that on an annual basis, the dollar amount of research and development expenses will remain relatively constant with 2012 levels as we continue to enhance and expand our product offerings, but decrease as a percentage of revenues, as we anticipate that our revenues will grow at a faster rate than the growth of research and development spending.

Employees

As of March 15, 2013, we had 99 full-time employees. Our employees include software development engineers, project managers, language specialists, and graphic designers, as well as sales and marketing, quality assurance and administrative team members. We have approximately 72 employees in our River Falls, Wisconsin office, 2 employees that work from their home offices in the United States, 12 employees in our Dublin, Ireland office, 10 employees in our Madrid, Spain office and 3 employees in our Singapore office. None of our employees are covered by a collective bargaining agreement. We consider our relationship with our employees to be good. In addition, we utilize the services of approximately 3,500 human translators, all of whom are independent contractors, and utilize consultants to perform short-term project-based services, which is a more cost-effective strategy than hiring additional full-time employees.

Corporate Information

Our corporate offices are located in River Falls, Wisconsin, which is located approximately 30 miles east of Minneapolis, Minnesota. Our River Falls corporate offices contain our core Global Language Service operations, our administrative, product management, marketing, sales, and professional services functions. Our offices are located at 625 Whitetail Blvd., River Falls, Wisconsin 54022, and our telephone number is (715) 426-9505.

The Company’s fiscal year runs from January 1 through December 31. Neither the Company nor any of its predecessors have been in bankruptcy, receivership or any similar proceeding.

ITEM 1A. RISK FACTORS

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and your investment in us.

The Company’s common stock involves a high degree of risk. Investors and potential investors should carefully consider the following risk factors, together with all of the other information included in this report, before making investment decisions about shares of our common stock. The risks and uncertainties described below are not the only risks and uncertainties facing the Company in the future. Additional risks and uncertainties not presently known or that are currently considered to be immaterial may also materially and adversely affect the Company’s business operations or the stock price of the Company’s common stock. If any of the following risks or uncertainties occurs, the Company’s business, financial condition, operating results and future growth prospects could materially suffer. In that event, the trading price of your securities could decline, and you may lose all or part of your investment.

Risk Related to Our Business and Industry

Our past results may not be indicative of future results, and, therefore, we may be unable to continue to grow at our historical growth rates.

Sajan, Inc. began selling language translation services utilizing its proprietary technology in 2002 and generated only nominal revenues during that year. From 2003 to 2010, however, revenue increased more rapidly. The annual revenues of Sajan, Inc. for the year ended December 31, 2009 were approximately $12.7 million and increased to $16.0 million in the year ended December 31, 2010, and to approximately $20.9 million in the year ended December 31, 2011. Revenues in the year ended December 31, 2012 were approximately $20.5 million. We experienced rapid revenue growth from 2009 through 2011 and revenue in 2012 was essentially the same as in 2011. Increasing revenues by growing our business operation under the Sajan name is a key component of our strategy. These expansion plans have placed and may continue to place significant demands on our management, operational and financial resources. You should not consider revenue growth in 2009-2011 as indicative of our future performance. In future periods, we may not have any revenue growth, or our revenues could decline.

We have incurred operating losses in the past and may incur operating losses in the future.

For the year ended December 31, 2012, Sajan reported a loss from operations of $1.1 million. For the years ended December 31, 2011 and 2010, Sajan reported a loss from operations of $0.4 million and $3.0 million, respectively. Throughout most of our history, we have experienced net losses and negative cash flows from operations. We expect our operating expenses to increase in the future as we expand our operations. Furthermore, as a public company, we incur significant legal, accounting and other expenses. If our revenues do not grow to offset these increased expenses, we may not be profitable. We cannot assure you that we will be able to achieve or maintain profitability.

We may need additional financing in the future, which may not be available, and any such financing will likely dilute our existing stockholders.

In 2012, Sajan entered into a one-year, $1.5 million credit facility with Silicon Valley Bank and had borrowed $400,000 as of December 31, 2012 under that facility. In March 2013, we entered into a two-year $1.5 million credit facility with Silicon Valley Bank, which replaced the original $1.5 million credit facility. We may require additional financing in the future, which could be sought from a number of sources, including, but not limited to, additional sales of equity or debt securities or loans from banks or other financial institutions. There can be no certainty that any such financing will be available to us or, if available, on terms favorable to us. If additional funds are raised by the issuance of our equity securities, such as through the issuance of stock, convertible securities, or the issuance and exercise of warrants, then the ownership interests of our existing stockholders will be diluted and our ability to utilize accumulated net operating loss carryforwards could be impaired or terminated. If we raise additional funds by issuing debt or other instruments, we may become subject to certain operational limitations, and such securities may have rights senior to those of our common stock. If adequate funds are not available on acceptable terms, we may be unable to fund our operations or the expansion of our business. Our failure to obtain any necessary financing in a timely manner and on favorable terms could have a material adverse effect on our business strategy and on our financial performance and stock price, and could require us to delay or abandon our growth strategy.

We do not have long-term contracts with our customers who provide us with recurring revenue, and our success will depend on our ability to maintain a high level of customer satisfaction and a strong reputation in the global multilingual content delivery industry.

Our contracts with our customers who provide us with recurring revenue typically allow the customer to cancel the contract for any reason with 30 days’ prior notice to us. Our continued success therefore depends significantly on our ability to meet or exceed the expectations of these customers because most of such customers do not make long-term commitments to use our solutions. In addition, if our reputation in the global multilingual content delivery industry is harmed or diminished for any reason, this may cause our recurring revenue customers to terminate their relationships with us on short notice and seek alternative globalization and translation solutions. If a significant number of recurring revenue customers terminate their relationships with us, our business, results of operations and financial condition would be adversely affected in a short period of time.

We rely on a limited number of customers, and the loss of or reduction in revenue from a major customer could negatively affect our business, financial condition and operations.

We derive a significant portion of our revenues from a limited number of large customers. For the years ended December 31, 2012 and 2011, our largest customer accounted for approximately 18% and 11%, respectively, of our revenue, and, on a combined basis, our ten largest customers accounted for approximately 57% and 53%, respectively, of our revenue. As a result of the concentration of our revenue to a limited number of customers, we have experienced fluctuations in collection of our revenues. The loss of any major customer or a significant reduction in a large customer’s use of our language translation solutions could materially reduce our revenue and cash flow and adversely affect our business, financial condition and operations.

Continued global economic weakness and uncertainty could adversely affect our revenue, lengthen our sales cycle and make it difficult for us to forecast operating results accurately.

Our revenues depend significantly on general economic conditions and the health of large companies that sell products internationally. Economic weakness and constrained globalization spending may result in slower growth or reductions in our revenues and gross profits in 2013. We have experienced, and may experience in the future, reduced spending in our business due to the current financial turmoil affecting the U.S. and global economy and other macroeconomic factors affecting spending behavior. Uncertainty about future economic conditions makes it difficult for us to forecast operating results and to make decisions about future investments. In addition, economic conditions or uncertainty may cause current and potential customers to reduce or delay globalization expenditures, including purchases of our solutions. Our sales cycle may lengthen if purchasing decisions are delayed as a result of uncertain information technology or contracted development budgets or if contract negotiations become more protracted or difficult as customers institute additional internal approvals for globalization and information technology purchases. Delays or reductions in globalization and information technology spending could have a material adverse effect on demand for our software and services, and consequently on our business, financial condition and results of operations.

If we are unable to attract new customers or sell additional solutions, or if our customers do not increase their use of our solutions, our revenue growth and profitability will be adversely affected.

To increase our revenues and achieve and maintain profitability, we must regularly add new customers and sell additional solutions, and our customers must increase their use of our solutions they currently utilize. We intend to grow our business by hiring additional inside sales personnel and increasing our marketing activities. If we are unable to hire or retain quality sales personnel, convert customer prospects into paying customers, or ensure the effectiveness of our marketing programs, or if our existing or new customers do not perceive our solutions to be of sufficiently high value and quality, we might not be able to increase sales, and our operating results will be adversely affected. In addition, if we fail to sell our new solutions to existing or new customers, we will not generate anticipated revenues from these solutions, our operating results will suffer and we might be unable to grow our revenues or achieve or maintain profitability.

Our strategy includes pursuing acquisitions, and our potential inability to successfully integrate newly-acquired companies, businesses or technologies may adversely affect our financial results.

Late in 2011 we acquired New Global. We believe part of our growth will be driven by acquisitions of other companies or their businesses or technologies. If we complete other acquisitions, we face many risks commonly encountered with growth through acquisitions, including:

| · | incurring significantly higher than anticipated capital expenditures and operating expenses; |

| · | failing to assimilate the operations and personnel of the acquired company or business; |

| · | loss of customers that were obtained in the acquisition; |

| · | disrupting our ongoing business; |

| · | dissipating our management resources; |

| · | failing to maintain uniform standards, controls and policies; and |

| · | impairing relationships with employees and customers as a result of changes in management. |

Fully integrating other acquired companies, business or technology into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions. To the extent we do not successfully avoid or overcome the risks or problems related to any acquisitions, our results of operations and financial condition could be adversely affected. Future acquisitions also could impact our financial position and capital needs, and could cause substantial fluctuations in our quarterly and yearly results of operations. In addition, future acquisitions could include significant goodwill and intangible assets, which may result in future amortization or impairment charges that would reduce our stated earnings.

Our inability to adapt to rapid technological change could impair our ability to remain competitive.

The global multilingual content delivery industry in which we compete is characterized by rapid technological change, introductions of new products and evolving industry standards. Our ability to attract new customers and increase revenues from customers will depend in significant part on our ability to anticipate industry standards and to continue to enhance existing solutions or introduce or acquire new solutions on a timely basis to keep pace with technological developments. The success of any enhancement or new solution depends on several factors, including the timely completion, introduction and market acceptance of any enhancement to our solution. Any new solution we develop or acquire might not be introduced in a timely or cost-effective manner and might not achieve the broad market acceptance necessary to generate significant revenues. If any of our competitors implements new technologies before we are able to implement them, those competitors may be able to provide more effective solutions than ours at lower prices. Any delay or failure in the introduction of new or enhanced solutions could adversely affect our business, results of operations and financial condition.

Our business may be harmed by defects or errors in the services we provide to customers.

Many of the services we provide are critical to the business operations of our customers. While we maintain general liability insurance, including coverage for errors and omissions, defects or errors in the services we provide could interrupt our customers’ abilities to provide products and services to their customers, resulting in delayed or lost revenue. This could damage our reputation through negative publicity, make it difficult to attract new and retain existing customers, and cause customers to terminate our contracts and seek damages. We may incur additional costs to correct errors or defects. There can be no assurance that our general liability and errors and omissions insurance coverage will be available in amounts sufficient to cover one or more large claims, or that the insurer will not disclaim coverage as to any future claims.

An interruption or failure of our information technology and communications systems could impair our ability to effectively provide our services, which could damage our reputation and business.

The provision of our services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our services. Interruptions in our services could reduce our revenues and profits, and the Sajan brand could be damaged if people believe our system is unreliable. Our systems are vulnerable to damage or interruption from terrorist attacks, floods, tornados, fires, power loss, telecommunications failures, computer viruses or attempts to harm our systems. Our data centers may be subject to break-ins, sabotage and intentional acts of vandalism, and to other potential disruptions. Some of our systems may not be fully redundant, and our disaster recovery planning may not be able to account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons, or other unanticipated problems at our data centers could result in lengthy interruptions in our services. Any unscheduled interruption in our service will put a burden on the entire organization and would result in an immediate loss of revenue. If we experience frequent or persistent system failures on our web site, our reputation and the Sajan brand could be permanently harmed. The steps required to increase the reliability and redundancy of our systems are expensive, will reduce our operating margins, and may not be successful in reducing the frequency or duration of unscheduled downtime.

The intellectual property of our customers may be damaged, misappropriated, stolen, or lost while in our possession, subjecting us to litigation and other adverse consequences.

In the course of providing globalization and language translation services to our customers, we take possession of or are granted access to certain intellectual property of our customers. If such intellectual property is damaged, misappropriated, stolen, or lost, we could suffer, among other consequences:

| · | claims under indemnification provisions in customer agreements or other liability for damages; |

| · | delayed or lost revenue due to adverse customer reaction; |

| · | litigation that could be costly and time consuming. |

Any adverse impact attributable to any of the foregoing factors would have a material adverse effect on our business and revenues.

We rely on third parties for key aspects of the process of providing services to our customers, and any failure or interruption in the services provided by these third parties could harm our ability to operate our business and damage our reputation.

We rely on third-party vendors, including data center and bandwidth providers, and we also rely on third parties for key aspects of the process of providing language translation services to our customers. Our revenues and margins are subject to our ability to continue to maintain satisfactory relationships with freelance linguists, who are in high demand worldwide for specific languages. Any disruption in the network access or co-location services provided by these third-party providers or any failure of these third-party providers and freelance linguists to handle current or higher volumes of use could significantly harm our business. Any financial or other difficulties the providers face may have negative effects on our business, the nature and extent of which cannot be predicted. We exercise little control over these third party vendors, which increases our vulnerability to problems with the services they provide. We also license technology and related databases from third parties to facilitate aspects of our translation processes and our data center and connectivity operations including, among others, Internet traffic management and search services. Any errors, failures, interruptions or delays experienced in connection with these third-party technologies and information services could negatively impact our relationships with customers and adversely affect the Sajan brand, and could expose us to liabilities to third parties.

Evolving regulation of the Internet may increase our expenditures related to compliance efforts, which may adversely affect our financial condition.

As Internet commerce continues to evolve, increasing regulation by federal, state or foreign agencies becomes more likely. We are particularly sensitive to these risks because the Internet is a critical component of our on-demand business model. In addition, taxation of services provided over the Internet or other charges imposed by government agencies or by private organizations for accessing the Internet may be imposed. Any regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of Internet-based services, which could harm our business.

We depend on intellectual property rights to protect proprietary technologies, although we may not be able to successfully protect these rights.

We rely on our proprietary technology to enhance our software and service offerings. We use a combination of patent, trademark, trade secret and copyright law in addition to contractual restrictions to protect our technology. Although we have received a patent from the U.S. Patent and Trademark Office covering certain aspects of our technology, there can be no assurance that this patent will adequately protect our technology or provide us with a competitive advantage. We may apply for patent protection on our future technology developments to the extent we believe such protection is available and economically warranted. However, there is no assurance that we will file additional applications for patent protection in the United States or in other countries, that any application that we may file will result in an issued patent, or that any issued patent will provide us with a competitive advantage. We have not filed any applications for patent protection in any country other than the United States. As a result, we do not have the right to enforce our rights under any United States patent, if issued, in any foreign country, or to prevent others in foreign countries from utilizing the proprietary technology covered by our patents. Despite our efforts, there can be no assurance that others will not independently develop technology that is similar to our technology, or offer or sell products or services in foreign countries that utilize our technology. The development by others of technology that is similar to our technology, or the sale of products or services in foreign countries that incorporate our technology, would harm our competitive position and have a material adverse effect on our business, results of operations and financial condition.

We may be involved in disputes from time to time relating to our intellectual property and the intellectual property of third parties.

We may become parties to disputes from time to time over rights and obligations concerning intellectual property, and we may not prevail in these disputes. Third parties may raise claims against us alleging infringement or violation of the intellectual property of that third party. Some third party intellectual property rights may be extremely broad, and it may not be possible for us to conduct our operations in such a way as to avoid violating those intellectual property rights. Any such intellectual property claim could subject us to costly litigation and impose a significant strain on our financial resources and management personnel regardless of whether such claim has merit. Our liability insurance, if any, may not cover potential claims of this type adequately or at all, and we may be required to alter products or pay monetary damages or license fees to third parties, which could have a material adverse affect on our financial condition and results of operations.

Our ability to use our U.S. net operating loss carryforwards might be limited or eliminated.

As of December 31, 2012, we had net operating loss carryforwards of approximately $31.2 million, which are potentially available for U.S. federal tax purposes. These loss carryforwards expire between 2015 and 2030. To the extent these net operating loss carryforwards are available, we intend to use them to reduce any corporate income tax liability associated with our operations. Section 382 of the U.S. Internal Revenue Code generally imposes an annual limitation on the amount of net operating loss carryforwards that may be used to offset taxable income when a corporation has undergone significant changes in stock ownership. As a result, prior or future changes in ownership could put limitations on or eliminate the availability of our net operating loss carryforwards to offset any profit. Rules governing the use of net operating loss carryforwards are complex, and any use of our net operating loss carryforwards could be challenged given our change of control in 2007 and 2010. To the extent our use of net operating loss carryforwards is significantly limited or eliminated, any income generated by us could be subject to corporate income tax earlier than if we were able to use net operating loss carryforwards, which could result in lower profit. Future changes of control may result in additional expiration of a portion of the remaining net operating loss carryforward before it can be used. The use of our carryforward is dependent upon our ability to attain profitable operations in the future.

The markets in which we operate are highly competitive, and our failure to compete successfully would make it difficult for us to add and retain customers and would reduce or impede the growth of our business.

The markets for global multilingual content delivery software and services are increasingly competitive and global. We expect competition to increase in the future both from existing competitors and new companies that may enter our markets. In addition to our existing competitors, we may face competition in the future from companies that do not currently offer globalization or translation services. We may also face competition from internal globalization departments of Fortune 1000 and large emerging companies. Technology companies, information technology services companies, business process outsourcing companies, web consulting firms, technical support call centers, hosting companies and content management providers may choose to broaden their range of services to include globalization or language translation as they expand their operations internationally. Increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. New or established competitors may offer solutions that are superior to or lower in price than ours. We may not have sufficient resources to continue the investments in all areas of software development and marketing needed to maintain our competitive position. In addition, some of our competitors are better capitalized than us, which may provide them with an advantage in developing, marketing or servicing new solutions. Increased competition could reduce our market share, revenues and operating margins, increase our costs of operations and otherwise adversely affect our business.

If we fail to retain our Chief Executive Officer and other key personnel, our business would be harmed and we might not be able to implement our business plan successfully.

Given the complex nature of the technology on which our business is based and the speed with which such technology advances, our future success is dependent, in large part, upon our ability to attract and retain highly qualified managerial, technical and sales personnel. In particular, Shannon Zimmerman, our President, Chief Executive Officer, and Chief Financial Officer, is critical to the management of our business and operations. Competition for talented personnel is intense, and we cannot be certain that we can retain our managerial, technical and sales personnel or that we can attract, assimilate or retain such personnel in the future. Our inability to attract and retain such personnel could have an adverse effect on our business, results of operations and financial condition. In addition, our current President and Chief Executive Officer is also our Chief Financial Officer. While we have a full-time Controller and believe our disclosure controls and procedures and internal control over financial reporting are effective, our lack of a separate full-time Chief Financial Officer could hinder our ability to prepare consolidated financial statements and notes to consolidated financial statements in accordance with US GAAP or to review the financial and other information prepared by external consultants and professionals to ensure accuracy and completeness.

Our continued growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully.

We have experienced a period of rapid growth in our headcount and operations. To the extent that we are able to sustain such growth, it will place a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part upon the ability of our senior management to manage this growth effectively. To do so, we must continue to hire, train and manage new employees as needed. If our new hires perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or if we are not successful in retaining our existing employees, our business would be harmed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. The additional headcount we are adding will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to execute our business plan.

Because our long-term success depends, in part, on our ability to expand the sales of our solutions to customers located outside of the United States, our business will be susceptible to risks associated with international operations.

We have limited experience operating in foreign jurisdictions. In 2009, we opened Sajan Software in Dublin, Ireland, in 2010 we opened Sajan, Spain and in 2011 we opened Sajan, Singapore. Our inexperience in operating our business outside of North America increases the risk that our current and any future international expansion efforts will not be successful. Conducting international operations subjects us to risks that, generally, we have not faced in the United States, including:

| · | fluctuations in currency exchange rates; |

| · | unexpected changes in foreign regulatory requirements; |

| · | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| · | difficulties in managing and staffing international operations; |

| · | potentially adverse tax consequences, including the complexities of foreign value-added tax systems and restrictions on the repatriation of earnings; |

| · | the burdens of complying with a wide variety of foreign laws and different legal standards, including laws and regulations related to privacy; |

| · | increased financial accounting and reporting burdens and complexities; |

| · | political, social and economic instability abroad, and terrorist attacks and security concerns in general; and |

| · | reduced or varied protection for intellectual property rights in some countries. |

The occurrence of any one of these risks could negatively affect our international business and, consequently, our results of operations generally. Additionally, operating in international markets also requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required in establishing, acquiring, operating or integrating operations in other countries will produce desired levels of revenues or profitability.

Our management has limited experience operating as a public company.

The members of our current management have limited experience operating a public company. We may not be able to operate successfully as a public company, even if our business operations are successful. Our inability to successfully operate as a public company could have a material adverse effect on our business, financial condition and operating results and on our ability to obtain equity or debt financing.

Risks Related to Ownership of Our Common Stock

An active trading market in our common stock may not develop or be adequately maintained, and our common stock may be subject to volatile price and volume fluctuations.

An active trading market in our common stock may not develop or be adequately maintained. Shares of our common stock are quoted on the OTC Bulletin Board Market system and are not listed on any stock exchange, which may limit your ability to sell your shares of our common stock. The overall market for securities in recent years has experienced extreme price and volume fluctuations that have particularly affected the market prices of many smaller companies. These fluctuations have been extremely volatile and are often unrelated or disproportionate to operating performance. Consequently, you may not be able to sell our common stock at prices equal to or greater than the price you paid for your shares. In addition to the factors discussed elsewhere in this section, many factors, most of which are outside of our control, could cause the market price of our common stock to decrease significantly, including:

| · | variations in our quarterly operating results; |

| · | decreases in market valuations of similar companies; |

| · | the failure of securities analysts to cover our common stock or changes in financial estimates by analysts who cover us, our competitors or our industry; and |

| · | fluctuations in stock market prices and volumes. |

These broad market fluctuations could result in extreme fluctuations in the price of our common stock, which could cause a decline in the value of our common stock.

Our quarterly results of operations may fluctuate in the future, which could result in volatility in our stock price.

Our quarterly revenues and results of operations have varied in the past and may fluctuate as a result of a variety of factors. If our quarterly revenues or results of operations fluctuate, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including, but not limited to, those listed below and identified throughout this “Risk Factors” section:

| · | our ability to retain and increase sales to current customers and attract new customers, including our ability to maintain and increase our number of recurring revenue customers; |