UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________________ to ___________________

Commission File Number: 001-36600

Sajan, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 41-1881957 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

| | |

| 625 Whitetail Blvd., River Falls, Wisconsin | 54022 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (715) 426-9505

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Name of Each Exchange on which Registered |

| Common Stock, $0.01 par value per share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

The aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant, as of June 30, 2016 was approximately $20,087,521 based on the closing sales price of $4.20 per share as reported on the NASDAQ Capital Market.

As of March 8, 2017, there were 4,796,383 shares of our common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of our definitive proxy statement relating to our 2017 Annual Meeting of Stockholders is incorporated by reference into Part III of this Annual Report on Form 10-K.

2016 Annual Report on Form 10-K

Table of Contents

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements reflect the current view about future events. When used in this Annual Report on Form 10-K the words “anticipate,” “will,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” and similar expressions or the negative of these terms as they relate to Sajan, Inc. (the “Company,” “Sajan,” “we,” “us” or “our”), its subsidiaries or its management identify forward-looking statements. Our forward-looking statements in this report generally relate to: our expectations regarding customer demand, market growth rates and conditions, pricing, our competitive position and strategic opportunities; our expectations regarding our expenses; our beliefs regarding the benefits of our technology and our ability to adapt to changing industry conditions; expectations regarding international sales; our intent with respect to intellectual property protection and research and development activities; our intent to grow organically and through acquisitions; our expectations regarding staffing to support revenue growth; our intent to retain earnings to fund development; our expected growth initiatives; our expectations regarding our deferred tax assets; and our expectations with respect to cash flows and adequacy of capital resources, including with respect to the renewal of our credit facility. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section entitled “Risk Factors” of this Annual Report on Form 10-K) relating to the Company’s industry, its operations and results of operations, and any businesses that may be acquired by it. These factors include:

| · | our rate of growth in the global multilingual content delivery industry; |

| · | our ability to effectively manage our growth; |

| · | lack of acceptance of any existing or new solutions we offer; |

| · | our ability to continue increasing the number of our customers or the revenues we derive from our recurring revenue customers; |

| · | economic weakness and constrained globalization spending by businesses operating in international markets; |

| · | our ability to effectively develop new solutions that compete effectively with the solutions that our current and future competitors offer; |

| · | risk of increased regulation of the Internet and taxes imposed on business conducted via the Internet; |

| · | our ability to identify attractive acquisition opportunities, successfully negotiate acquisition terms and effectively integrate any acquired companies or businesses; |

| · | availability of capital on acceptable terms to finance our operations and growth; |

| · | risks of conducting international commerce, including foreign currency exchange rate fluctuations, changes in government policies or regulations, longer payment cycles, trade restrictions, economic or political instability in foreign countries where we may increase our business and reduced protection of our intellectual property; |

| · | our ability to add sales and marketing, research and development or other key personnel who are able to successfully sell or develop our solutions; and |

| · | other risk factors included under “Risk Factors” in this Annual Report on Form 10–K. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Although our management believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Sajan does not intend to update any of the forward-looking statements to conform these statements to actual results.

PART I

Sajan is a leading provider of language translation solutions. According to research completed by Common Sense Advisory (“CSA”), we were ranked as having the 8th highest revenue out of approximately 4,000 North American translation service providers in 2015. Our customers sell products into global markets and use our solutions to translate sales and marketing materials, packaging, user manuals, technical support and training documents, product manuals, instructions, warnings, and other product information into numerous languages. We combine our internally developed proprietary technology and high quality translation services to provide language translation solutions that are fast, reliable, and user-friendly. By utilizing an integrated technology and service-based approach to language translation, we offer comprehensive solutions that allow customers to rely upon a single provider to meet all of their language translation needs. Our cloud-based technology delivers a secure online solution that can be offered on a modular basis, which makes it attractive in both small business settings and large enterprise environments. Sajan provides language translation services and technology solutions to companies located throughout the world, particularly in the technology, consumer products, medical and life sciences, financial services, manufacturing, and retail industries. We are located in River Falls, Wisconsin and have wholly-owned subsidiaries in Ireland (“Sajan Software”), Spain (“Sajan Spain”) and Singapore (“Sajan Singapore”).

Products and Services

Sajan delivers translated content to its customers for use on their websites and in their software products, training and instruction manuals, marketing materials, legal documents, as well as for many other uses. Our solution does not alter the customer’s content, but creates value for the customer by delivering that content translated in multiple languages. By combining advanced technology, innovative processes and a pronounced commitment to quality, our solutions are built to deliver translated content that meets customers’ quality expectations in a faster timeframe and at a lower overall cost than comparable translation solutions.

Our language translation solution incorporates innovative technology that serves as a single platform to meet the needs of the smallest user to the largest enterprise customer. Our solution is cloud-based and requires no installed software, thus enabling customers to access all of our translation lifecycle components via an internet browser. We combine both language translation services and our own proprietary technology to give customers a single source solution to meet all of their translation needs. We integrate people, processes and data into a service and technology solution that produces measurable value in the form of lower costs, faster turnarounds, improved business process automation, higher quality, integrated version control and an audit trail.

Transplicity is the brand name of Sajan’s unique technology solution. Launched in March 2013, Transplicity provides a high degree of automation from start to finish and delivers complete personalization and flexibility to our customers, all from a complete cloud solution. The Transplicity platform not only incorporates modernized technological capabilities, but also provides a fully personalizable user interface aimed at enhancing customer use and interaction.

Sajan released SiteSyncÔ in late 2014. SiteSync is a technology component that automates global website translation and ongoing management. Simply, it pulls in content from a source language website and, by integrating into Transplicity, it performs the translation of all content. Once published, as source content changes, SiteSync detects this and automatically begins the translation process. This solution results in faster updates to website content and a lower total cost of ownership for any company managing multilingual websites.

We employ a “widget” approach to the work surface of Transplicity’s customer portal. In the context of computing, widgets are discrete applications that can be installed on a website or other user work space that perform specific functions. This approach allows customers to build a customized experience by selecting the features of our product that they wish to employ as visible components on their user interface and enables a degree of personalization not previously found in the market. Users can quickly modify the functional widgets they use on the work surface. This personalization enables customers to modify the visual theme of the website itself, which allows broad enterprise adoption and branding for a specific company. The personalized widget approach also allows us to provide for additional functions and add them to the existing Transplicity platform on either an enterprise or customized basis.

At the core of Transplicity is Sajan’s patented Translation Data Repository. Data storage in the language translation industry is often referred to as Translation Memory (“TM”). TM is intended to reuse previously translated content and is an effective technology used by many in the industry. However, Transplicity differentiates us from our competitors by contextually indexing all data against an information architecture established for each customer, effectively learning how each customer uses language in its business. Multilingual data managed in Transplicity is used in an operational sense, meaning it is used for each new customer translation project, but Transplicity also serves as a central storage repository for multilingual content that is used for such customer’s future translation projects. The data storage technology also provides confidential separation of customer data, serving as an enterprise solution for high volume multilingual content producers.

As the contextualized database of multilingual content is increased for a customer, more content can be reused from one translation project to the next, and the benefit of reuse to the customer results in cost savings. Content reuse, and in particular contextualized content reuse, directly reduces the amount our customers must pay for translation, because Sajan charges a substantially reduced rate to the customer for translated words generated from the system. As such, our content reuse feature encourages customer retention by providing greater and greater value as a customer continues to use our solution over time. Transplicity also improves the contextual accuracy of translation for a particular customer over time. In addition, reducing the number of words requiring human translation results in faster project cycle times, which we believe is becoming more and more important to global companies in today’s market.

With such a robust and flexible technology solution serving as the base for all language translation, Sajan will continue to expand the solution by adding new value-add widgets meant to enhance the customer’s experience and establish a subscription revenue stream.

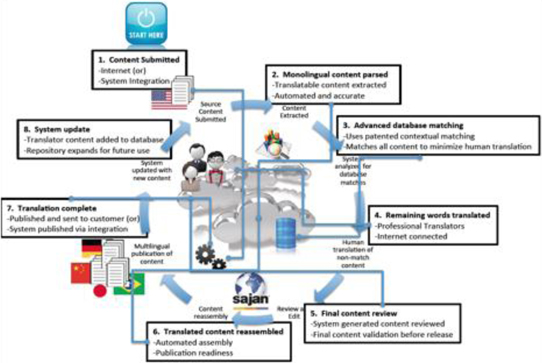

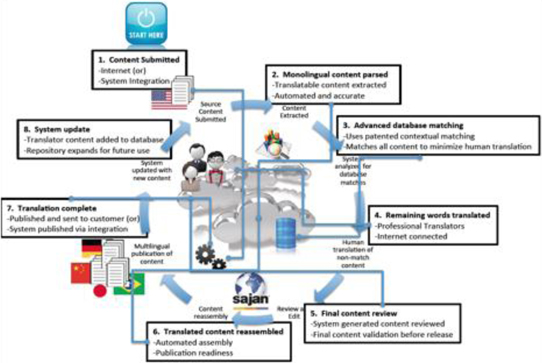

The image below illustrates one example of the high-level language translation process:

In Step 1, customer content is submitted to us over our secure Internet portal. In Step 2, Transplicity automatically parses or separates content from its aesthetic formatting. This enables us to isolate the monolingual content so that, during Step 3, the maximum amount of accurate reuse can be achieved. During Step 3, we use our patented technology to reproduce previously translated content in the desired target languages and minimize the amount of manual translation that a Professional Translator will have to do. As described above, this creates a substantially better cost model and accelerates the translation process. Further, our patented contextual reuse technology, in most cases, will yield better matching when compared to industry offerings. The remaining steps in the process rely on automation, the efficient management of data and the integration of the Professional Translators into the project. In Steps 4 and 5, Professional Translators translate the content that was not translated through database matching and then review the translated content, including the system-generated content, as a whole. In Steps 6 and 7, the translated content is reassembled by Transplicity and then sent to the customer in publish-ready format. Finally, in Step 8, the content translated by the Professional Translators is added to the database to improve future reuse capabilities. Through these steps, Sajan has turned the process of translation into a data management opportunity and designed a start-to-finish workflow to maximize automation. Content is returned to the customer in the same format, now translated, as originally submitted in the source language. This helps the customer by eliminating the need to understand appropriate language or word breaks. It is a turn-key approach.

Upon successful delivery to the customer we have accomplished the following: first, and most importantly, the customer has obtained their translated content in publish-ready format; second, the new translated data has been added to our central TM repository in the cloud, which will enhance the reuse opportunities in connection with that customer’s future content; and third, because the entire process has been managed from start to finish in one cloud-based system, the customer gains transparency and real-time access to information, while also receiving full business intelligence from process detail to linguistic evaluation. This business intelligence allows customers to track patterns and trends of the many individual users of the system to make more informed decisions about their approach to translation. In addition, linguistic quality can be systematically managed to standards set by the customer, thus allowing better management of the human translators involved in the process.

While technology serves as a value-add component to our solution, we also provide our customers with a broad array of supporting solutions for clients. We can provide customers with expert-level consultation. As an example of these consultation services, Sajan provides customers facing large translation challenges with a Localization Assessment, which involves a deep assessment of the presence or absence of all people, processes and technologies relating to the global translation needs of a given customer. Knowing the desired end goal of the customer, Sajan’s consulting professionals are able to develop a data-driven implementation plan for the customer’s localization efforts. Often return-on-investment formulas are included to address the business case for implementing these changes. Other examples of our services include machine translation solutions, multilingual search engine optimization, linguistic quality assessment, internationalization assessments, and interpretation.

We also believe that over time, the market will continue to move towards more technology solutions as language demands increase and greater efficiency is required. Our experience has been that high quality translation service has been offered on the service model and not on a subscription software model. To address this gap in the market, we will continue to expand our technology capabilities in parallel with our core solution offering as we advance forward. In that regard, our March 2013 launch of Transplicity was the first of a multi-phase release. The goal of the first phase was to enhance both performance and customer experience in the context of the translation service model. Later phases of the release have concentrated on further enhancing the customer experience, improving the Company’s productivity and reducing costs in the language translation process. Later versions may offer similar widget-based features and technology components to customers that may prefer to be end-user licensees of Transplicity on a subscription software model. This will differentiate us from currently-available solutions by giving customers the ability to blend the technology and service aspects of the solution as they see fit. By comparison, the few technology-only solution options in the market today are not paired with the availability of services that we offer. The combination of Sajan’s unique technology, expert language skills and customer first philosophy positions us well for future growth in an opportune market.

Market Description

Language is often a barrier in global commerce. The demand for effective language translation continues to grow. The industry has historically been very service-centric, but, as is the case in many service industries, price pressures and other market demands impose the need for innovation and new solution paradigms.

Language translation services, although often treated like a commodity service, have historically been expensive and labor intensive and, as a result, scalability is difficult for the rapidly growing global company. Human translators can typically translate 2,500 words per day on average, although this varies based on the complexity of the subject matter. This creates constraints on the available supply of translation services and, when positioned against growing demand, provides translation technology innovators with an advantage. As a result of the rising demand for translation services and the looming shortage of human translators worldwide, we expect the pricing environment for Language Service Providers (“LSPs”) to be favorable in the coming years.

The market has two distinct components to it. The largest market segment is the LSP component, which consists of companies that provide translation services. The second market component is the technology segment, which consists of companies that develop software to automate the translation process. As measured by industry revenue, the technology segment is currently a substantially smaller part of the total language translation market opportunity.

In theory, the language translation service market should shrink if technology offers improved content reuse. To compete effectively, language translation companies need to obtain translation in an accurate, timely, and cost effective manner. With advances in content management and the growth of the Internet, providers also need to integrate their multilingual content with other enterprise systems to establish a cohesive single repository of global content.

Content is no longer monolingual content; it is multilingual. Industry and general business analysts have indicated that a more integrated solution, often referred to as the Global Content Lifecycle, will be required to be successful in the future for both global enterprises and for the LSPs that support them. As a result, language translation is no longer likely to be treated as an afterthought in the globalization process, but rather as an integral part of an enterprise system. Further, as the annual spending by multinational companies for language translation solutions accelerates over the next several years, we believe a more technology-based solution will be required to keep pace with the rate of growth in the amount of content and increasingly sophisticated content management solutions.

Global website management is an aggressive and expanding area of the market. Often, a website is the first element of a global expansion strategy. There are a few ways to translate websites effectively. For those customers who manage their monolingual web content in a Content Management System (“CMS”), Transplicity can directly connect to automate the flow of content which requires translation.

Alternatively, if a customer does not use a CMS a very effective solution would be Sajan’s SiteSync. SiteSync requires no CMS and, as mentioned in the Product and Services section above, can make the process very easy and efficient for customers adding global websites.

Market Size

Research completed by Common Sense Advisory (“CSA”) confirms that the language translation market continues to grow. According to CSA’s research, the worldwide cost of global multilingual content delivery in 2016 was $40.27 billion and is expected to reach $45 billion by 2020.

The LSP network is extremely fragmented. Approximately two-thirds of the total provider universe employs fewer than five employees. The market consists largely of traditional LSPs, meaning that these language service providers are very good at providing language translation service, but do not necessarily offer technological solutions, which are becoming more and more vital.

The top 100 providers based on revenue accounted for 13% of the total market opportunity at December 31, 2016 In the latest CSA survey, based on 2015 revenue, Sajan is ranked as the 32nd largest provider in the world and 8th largest in North America. LSPs with a worldwide presence also have a distinct advantage in their ability to provide 24/7 services to their international customers. According to CSA’s market research, the breakdown of 2015 language services revenue by geographical region is as follows: Europe 54%, North America 35%, Asia 10%, Other 1%.

The ability of a traditional LSP to compete is growing more challenging. While demand for the service is forecasted to be rising, the buyers currently are demanding that providers hold or reduce prices. Without technological differentiation, traditional LSPs will continue to operate at a severe disadvantage in their ability to manage the cost of their delivered service. Just as importantly they will be challenged to integrate their solutions with content management systems and other enterprise class business systems used by their customers.

Competition

The global multilingual content delivery market is highly competitive and highly fragmented with numerous existing competitors. We believe the principal competitive factors in providing language translation solutions consist of the ability to provide a comprehensive solution to customers, infrastructure that supports cost effective and high quality delivery to customers, project management expertise, quality, speed of service delivery and corporate reputation. We believe that Sajan competes favorably with respect to these factors and that we have developed a strong reputation in our industry.

Categorically speaking, the LSP component is much larger than the technology provider component. As noted previously, we believe that the technology component will rise in coming years as demand rises and the language service model strains as it grows. The competitive market is made up of LSPs who emphasize primarily a service solution, Language Technology providers who offer a variety of tools ranging from workflow automation, project management and database applications and lastly, those companies, like Sajan, that provide a blend of both.

As previously stated, the top 100 providers accounted for approximately 13% of the total market opportunity at December 31, 2015. The level of fragmentation and small concentration of larger providers gives some insight into the broader market’s ability to innovate. In most cases, this larger by quantity, smaller by revenue market segment does not produce the revenue and profit for adequate investment in technology or other forms of innovation. In the face of rising demand, we believe this lack of investment in technology will prove to be a long-term challenge and foster further market consolidation.

We believe that only a very small number of the largest LSPs, such as SDL, Transperfect and Lionbridge, provide legitimate full featured technology offerings and the breadth of solutions to meet the larger, more complex buyer.

Pure technology companies such as XTM International, MemoQ, Across and Smartling provide both the end customer and other LSPs a variety of technology solutions. A challenge that each of these companies face is that many buyers require more than a tool to address one particular area of the process. Two things weigh on this: (1) a technology solution must be broad enough to address an enterprise customer’s needs, and (2) the market for the technology is limited to those customers that have the staff to consider language translation as a core company competency.

We believe that Sajan is well positioned and is unique when compared to those companies noted above. Sajan offers a complete solution and our Transplicity platform spans the full spectrum of business processes. Recent solution additions such as SiteSync have furthered strengthened Sajan’s overall technology solution. This means that customers will not have to adapt or integrate disparate technologies. Sajan’s patented contextual indexing technology enables Sajan to perform in a superior manner by providing customers with reuse of words, speed and quality.

Marketing and Sales

Substantially all of our revenues have been generated through our internal direct sales force and the efforts of our senior management team. As of December 31, 2016, we had 5 marketing professionals, 11 direct sales professionals in the United States and Europe, and 5 employees in our global solutions group.

Our sales force has developed valuable customer relationships. Our sales approach involves planning for a customer organization’s unique ongoing requirements, including future versions of products and ongoing support, maintenance and training related to both technology products and content. We believe that tailoring our solutions to the customer’s preference results in gaining a larger portion of their language translation business.

Customers

All of our customers sell products outside the United States and require content such as warnings, instructions, directions, and other information to be translated into a number of languages. Although our services fit the needs of businesses of all sizes, our customers are predominantly Fortune 1000 companies in the technology, medical, industrial, and manufacturing sectors. Most of our customers are located in the United States. We anticipate that the percentage of our customers located outside of the United States will increase as we expand our sales efforts and as Sajan hires additional sales personnel.

Major Customers

We derive a significant portion of our revenues from a limited number of large customers. Although we did not have any individual customers that accounted for 10% or more of our revenues in 2016 or 2015, 56% of our revenue in 2016 and 53% of our revenue in 2015 came from our ten largest customers on a combined basis.

Geographic Areas of Operations

We generate revenues worldwide. In 2016 and 2015, 77% and 76%, respectively, of our revenues were generated within the United States and 23% and 24%, respectively, were generated internationally. Currently, no foreign country accounts for more than 10% of our revenue.

Intellectual Property

The development, utilization, and protection of technology are an important component of our overall operating strategy. We have a patent from the U.S. Patent and Trademark Office covering aspects of our Transplicity solution which expires in 2021. We have not filed any applications for patent protection in any country other than the United States. As a result, we do not and will not have the right to enforce our rights under our United States patent in any foreign country or to prevent others in foreign countries from utilizing our proprietary technology covered by that patent. We may apply for patent protection on our future technology developments to the extent we believe such protection is available and economically warranted. Despite these efforts, others could independently develop technology that is similar to our technology or offer or sell products or services in foreign countries that use our technology.

We have registered and use domain names sajan.com, authoringcoach.com, and sajansoftware.com. We use, or intend to use, and claim rights to various trade names and trademarks to identify our language translation services and products. We have obtained a registered U.S. mark for the Sajan logo. We also use and claim rights to the “Sajan™”, “GCMS™”, “Transplicity™”, “SiteSync™”, “X-Content Integration™”, “TMate™”, and “Authoring Coach™” marks.

We intend to protect our intellectual property to the extent such protection is warranted. In addition to efforts to obtain patent and trademark rights, we rely on a combination of trade secret, license, and non-disclosure and other contractual agreements and copyright laws to protect our intellectual property rights. Existing trade secret and copyright laws afford us only limited protection. We enter into confidentiality agreements with our employees and contractors, and limit access to and distribution of our proprietary information. These arrangements may not be adequate to deter misappropriation of our proprietary information and we may not be able to detect unauthorized use and take appropriate steps to enforce our intellectual property rights.

Research and Development

Our research and development occurs at our offices in River Falls, Wisconsin and Dublin, Ireland. We spent $1,613,000 in 2016 and $1,688,000 in 2015 on research and development. Research and development expenses consist primarily of wages and benefits, and outside contractor payments for product strategy and development personnel. We have focused our research and development efforts on the industrialization of the Transplicity platform and its component modules for use by the various participants involved in the content globalization process. Functional development has focused on improving ease of use, functionality, scalability and efficiency of Translation Memory processing.

Employees

As of December 31, 2016, we had 129 full-time employees. Our employees include software development engineers, project managers and language specialists, as well as sales and marketing, quality assurance and administrative team members. We have 75 employees in our River Falls, Wisconsin office, 6 employees that work from their home offices in the United States, 28 employees in our Dublin, Ireland office, 2 employees that work from their home offices in France, 1 employee that works from their home office in the Netherlands, 10 employees in our Madrid, Spain office and 7 employees in our Singapore office. None of our employees are covered by a collective bargaining agreement. We consider our relationship with our employees to be good. In addition, we utilize the services of approximately 3,500 human translators, all of whom are either independent contractors or who work for single language vendors or multiple language vendors, and we utilize consultants to perform short-term project-based services, which is a more cost-effective strategy than hiring additional full-time employees.

Corporate Background

Sajan is a Delaware corporation originally incorporated as MathStar, Inc. in June 2005. On February 23, 2010, MathStar, Inc. completed its business combination with Sajan, Inc., a Minnesota corporation, in accordance with the terms of an Agreement and Plan of Merger, dated January 8, 2010. On February 26, 2010, MathStar, Inc. changed its name to Sajan, Inc.

ITEM 1A. RISK FACTORS

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and your investment in us.

Investing in the Company’s common stock involves a high degree of risk. Investors and potential investors should carefully consider the following risk factors, together with all of the other information included in this report, before making investment decisions about shares of our common stock. The risks and uncertainties described below are not the only risks and uncertainties facing the Company in the future. Additional risks and uncertainties not presently known or that are currently considered to be immaterial may also materially and adversely affect the Company’s business operations or the stock price of the Company’s common stock. If any of the following risks or uncertainties occurs, the Company’s business, financial condition, operating results and future growth prospects could materially suffer. In that event, the trading price of our securities could decline, and you may lose all or part of your investment.

Our past results may not be indicative of future results, and, therefore, we may be unable to achieve continued growth.

Our revenues in 2016 totaled $29,219,000 and fell 2% compared to our revenues in 2015. Increasing revenues by growing our business operations is a key component of our strategy. These expansion plans have placed and may continue to place significant demands on our management, operational and financial resources. You should not consider the amount of our 2016 revenue as indicative of our future performance. In future periods, we may have revenue growth or our revenues could decline.

We have incurred operating losses in the past and may incur operating losses in the future.

We had a loss from operations of $525,000 in 2016, income from operations of $209,000 in 2015, $270,000 in 2014 and $256,000 in 2013 and losses from operations in 2012 of $959,000, $423,000 in 2011 and $2,933,000 in 2010. Throughout most of our history we have experienced net losses and negative cash flows from operations. We expect our operating expenses to increase in the future as we expand our operations. Furthermore, as a public company, we incur significant legal, accounting and other expenses. If our revenues do not grow to offset these increasing expenses, we may not be profitable. Additionally, we cannot assure you that we will be able to maintain any profitability that we do achieve.

Rapid growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully.

Our revenues declined by 2% in 2016 and grew by 5% in 2015. If we are able to attain double digit revenue growth, it will place a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part upon the ability of our senior management to manage this growth effectively. To do so, we must continue to hire, train and manage new employees as needed. If our new hires perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or if we are not successful in retaining our existing employees, our business would be harmed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. The additional headcount we are adding will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to execute our business plan.

We may need additional financing in the future, which may not be available, and any such financing would likely dilute our existing stockholders.

We have a $3,000,000 credit facility with Silicon Valley Bank, which is scheduled to expire on March 28, 2017. It is our present intention to have a similar credit facility in place at or around the time the existing credit facility expires. We may require additional financing in the future, which could be sought from a number of sources, including, but not limited to, additional sales of equity or debt securities or loans from banks or other financial institutions. However, there can be no certainty that a renewed facility with Silicon Valley Bank or any other financing will be available to us or, if available, on terms favorable to us. If additional funds are raised by the issuance of our equity securities, such as through the issuance of stock, convertible securities, or the issuance and exercise of warrants, then the ownership interests of our existing stockholders will be diluted. If we raise additional funds by issuing debt or other instruments, we may become subject to certain operational limitations, and such securities may have rights senior to those of our common stock. If adequate funds are not available on acceptable terms, we may be unable to fund our operations or the expansion of our business. Our failure to obtain any necessary financing in a timely manner and on favorable terms could have a material adverse effect on our business strategy and on our financial performance and stock price, and could require us to delay or abandon our growth strategy.

We do not have long-term contracts with our customers who provide us with recurring revenue, and our success will depend on our ability to maintain a high level of customer satisfaction and a strong reputation in the global multilingual content delivery industry.

Our contracts with our customers who provide us with recurring revenue typically allow the customer to cancel the contract for any reason with 30 days’ prior notice to us. Our continued success therefore depends significantly on our ability to meet or exceed the expectations of these customers because most of such customers do not make long-term commitments to use our solutions. In addition, if our reputation in the global multilingual content delivery industry is harmed or diminished for any reason, this may cause our recurring revenue customers to terminate their relationships with us on short notice and seek alternative globalization and translation solutions. If a significant number of recurring revenue customers terminate their relationships with us, our business, results of operations and financial condition would be adversely affected in a short period of time.

We rely on a limited number of customers, and the loss of or reduction in revenue from a major customer could negatively affect our business, financial condition and operations.

We derive a significant portion of our revenues from a limited number of large customers. Although we did not have any individual customers that accounted for 10% or more of our revenues in 2016 or 2015, 56% of our revenue in 2016 and 53% of our revenue in 2015 came from our ten largest customers on a combined basis. The loss of any major customer or a significant reduction in a large customer’s use of our language translation solutions could materially reduce our revenue and cash flow and adversely affect our business, financial condition and operations.

Continued global economic weakness and uncertainty could adversely affect our revenue, lengthen our sales cycle and make it difficult for us to forecast operating results accurately.

Our revenues depend significantly on general economic conditions and the health of large companies that sell products internationally. Economic weakness and constrained globalization spending may result in minimal growth or reductions in our revenue in 2017. We have experienced, and may experience in the future, reduced spending in our business due to the current financial turmoil affecting the U.S. and global economy and other macroeconomic factors affecting spending behavior. Uncertainty about future economic conditions makes it difficult for us to forecast operating results and to make decisions about future investments. In addition, economic conditions or uncertainty may cause current and potential customers to reduce or delay globalization expenditures, including purchases of our solutions. Our sales cycle may lengthen if purchasing decisions are delayed as a result of uncertain information technology or contracted development budgets or if contract negotiations become more protracted or difficult as customers institute additional internal approvals for globalization and information technology purchases. Delays or reductions in globalization and information technology spending could have a material adverse effect on demand for our software and services, and consequently on our business, financial condition and results of operations.

If we are unable to attract new customers or sell additional solutions, or if our customers do not increase their use of our solutions, our revenue growth and profitability will be adversely affected.

To increase our revenues and resume profitability, we must regularly add new customers and sell additional solutions, and our customers must increase their use of our solutions that they currently utilize. If we are unable to hire or retain quality sales personnel, convert customer prospects into paying customers, or ensure the effectiveness of our marketing programs, or if our existing or new customers do not perceive our solutions to be of sufficiently high value and quality, we might not be able to increase revenues, and our operating results will be adversely affected. In addition, if we fail to sell our new solutions to existing or new customers, we will not generate anticipated revenues from these solutions, our operating results will suffer and we might be unable to grow our revenues or achieve or maintain profitability.

Our strategy may include pursuing acquisitions, and our potential inability to successfully integrate newly-acquired companies, businesses or technologies may adversely affect our financial results.

Part of our growth may be driven by acquisitions of other companies or their businesses or technologies. We have in the past and may in the future expend funds and resources on uncompleted acquisitions. If we complete other acquisitions, we face many risks commonly encountered with growth through acquisitions, including:

| · | incurring significantly higher than anticipated capital expenditures and operating expenses; |

| · | failing to assimilate the operations and personnel of the acquired company or business; |

| · | loss of customers that were obtained in the acquisition; |

| · | disrupting our ongoing business; |

| · | dissipating our management resources; |

| · | failing to maintain uniform standards, controls and policies; and |

| · | impairing relationships with employees and customers as a result of changes in management. |

Fully integrating other acquired companies, businesses or technologies into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions. To the extent we do not successfully avoid or overcome the risks or problems related to any acquisitions, our results of operations and financial condition could be adversely affected. Future acquisitions also could impact our financial position and capital needs, and could cause substantial fluctuations in our quarterly and yearly results of operations. In addition, future acquisitions could include significant goodwill and intangible assets, which may result in future amortization or impairment charges that would reduce our stated earnings.

Our inability to adapt to rapid technological change could impair our ability to remain competitive.

The global multilingual content delivery industry in which we compete is characterized by rapid technological change, introductions of new products and evolving industry standards. Our ability to attract new customers and increase revenues from customers will depend in significant part on our ability to anticipate industry standards and to continue to enhance existing solutions or introduce or acquire new solutions on a timely basis to keep pace with technological developments. The success of any enhancement or new solution depends on several factors, including the timely completion, introduction and market acceptance of any enhancement to our solution. Any new solution we develop or acquire might not be introduced in a timely or cost-effective manner and might not achieve the broad market acceptance necessary to generate significant revenues. If any of our competitors implements new technologies before we are able to implement them, those competitors may be able to provide more effective solutions than ours at lower prices. Any delay or failure in the introduction of new or enhanced solutions could adversely affect our business, results of operations and financial condition.

If our solutions are not accepted by the market, our business will not grow and we will not be profitable.

Our market is intensely competitive, and we expect competition to increase in the future from established competitors, consolidations and new market entrants. Competitors’ solutions may in the future perform better or faster, offer better features, or be offered at lower prices than our solutions, including Transplicity, our translation management system, or embody new technologies, which could render our existing solutions obsolete or less attractive to customers. In addition, our competitors have existing relationships with many of the companies that are in our target market. These existing relationships will make it difficult for us to convince such prospective customers to choose our solutions, even if our solutions are competitive with or superior to those of our competitors. In addition, our proposed technology solution approaches translation from a subscription software model, rather than a services model, which is a model that potential customers have not been receptive to in the past and may not be receptive to in the future. If our solutions do not gain broad market acceptance and maintain that acceptance, our business, results of operations and financial condition will be adversely affected.

Our business may be harmed by defects or errors in the services we provide to customers.

Many of the services we provide are critical to the business operations of our customers. While we maintain general liability insurance, including coverage for errors and omissions, defects or errors in the services we provide could interrupt our customers’ abilities to provide products and services to their customers, resulting in delayed or lost revenue. This could damage our reputation through negative publicity, make it difficult to attract new and retain existing customers, and cause customers to terminate our contracts and seek damages. We may incur additional costs to correct errors or defects. There can be no assurance that our general liability and errors and omissions insurance coverage will be available in amounts sufficient to cover one or more large claims, or that the insurer will not disclaim coverage as to any future claims.

An interruption or failure of our information technology and communications systems could impair our ability to effectively provide our services, which could damage our reputation and business.

The provision of our services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our services. Interruptions in our services could reduce our revenues and profits, and the Sajan brand could be damaged if people believe our system is unreliable. Our systems are vulnerable to damage or interruption from terrorist attacks, floods, tornados, fires, power loss, telecommunications failures, cyber security breaches, and computer viruses or attempts to harm our systems. Our data centers may be subject to break-ins, sabotage and intentional acts of vandalism, and to other potential disruptions. Some of our systems may not be fully redundant, and our disaster recovery planning may not be able to account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons, or other unanticipated problems at our data centers could result in lengthy interruptions in our services. Any unscheduled interruption in our service will put a burden on the entire organization and would result in an immediate loss of revenue. If we experience frequent or persistent system failures on our web site, our reputation and the Sajan brand could be permanently harmed. The steps required to increase the reliability and redundancy of our systems are expensive, will reduce our operating margins, and may not be successful in reducing the frequency or duration of unscheduled downtime.

The intellectual property of our customers may be damaged, misappropriated, stolen, or lost while in our possession, subjecting us to litigation and other adverse consequences.

In the course of providing globalization and language translation services to our customers, we take possession of or are granted access to certain intellectual property of our customers. If such intellectual property is damaged, misappropriated, stolen, or lost, we could suffer, among other consequences:

| · | claims under indemnification provisions in customer agreements or other liability for damages; |

| · | delayed or lost revenue due to adverse customer reaction; |

| · | litigation that could be costly and time consuming. |

Any adverse impact attributable to any of the foregoing factors would have a material adverse effect on our business and revenues.

We rely on third parties for key aspects of the process of providing services to our customers, and any failure or interruption in the services provided by these third parties could harm our ability to operate our business and damage our reputation.

We rely on third-party vendors, including data center and bandwidth providers, and we also rely on third parties for key aspects of the process of providing language translation services to our customers. Our revenues and margins are subject to our ability to continue to maintain satisfactory relationships with freelance linguists, who are in high demand worldwide for specific languages. Any disruption in the network access or co-location services provided by these third-party providers or any failure of these third-party providers and freelance linguists to handle current or higher volumes of use could significantly harm our business. Any financial or other difficulties the providers face may have negative effects on our business, the nature and extent of which cannot be predicted. We exercise little control over these third party vendors, which increases our vulnerability to problems with the services they provide. We also license technology and related databases from third parties to facilitate aspects of our translation processes and our data center and connectivity operations including, among others, Internet traffic management and search services. Any errors, failures, interruptions or delays experienced in connection with these third-party technologies and information services could negatively impact our relationships with customers and adversely affect the Sajan brand, and could expose us to liabilities to third parties.

Evolving regulation of the Internet may increase our expenditures related to compliance efforts, which may adversely affect our financial condition.

As Internet commerce continues to evolve, increasing regulation by federal, state or foreign agencies becomes more likely. We are particularly sensitive to these risks because the Internet is a critical component of our on-demand business model. In addition, taxation of services provided over the Internet or other charges imposed by government agencies or by private organizations for accessing the Internet may be imposed. Any regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of Internet-based services, which could harm our business.

We depend on intellectual property rights to protect proprietary technologies, although we may not be able to successfully protect these rights.

We rely on our proprietary technology to enhance our software and service offerings. We use a combination of patent, trademark, trade secret and copyright law in addition to contractual restrictions to protect our technology. Although we have received a patent from the U.S. Patent and Trademark Office covering certain aspects of our technology, there can be no assurance that this patent will adequately protect our technology or provide us with a competitive advantage. We may apply for patent protection on our future technology developments to the extent we believe such protection is available and economically warranted. However, there is no assurance that we will file additional applications for patent protection in the United States or in other countries, that any application that we may file will result in an issued patent, or that any issued patent will provide us with a competitive advantage. We have not filed any applications for patent protection in any country other than the United States. As a result, we do not have the right to enforce our rights under any United States patent, if issued, in any foreign country, or to prevent others in foreign countries from utilizing the proprietary technology covered by our patents. Despite our efforts, there can be no assurance that others will not independently develop technology that is similar to our technology or offer or sell products or services in foreign countries that utilize our technology. The development by others of technology that is similar to our technology, or the sale of products or services in foreign countries that incorporate our technology, would harm our competitive position and have a material adverse effect on our business, results of operations and financial condition.

We may be involved in disputes from time to time relating to our intellectual property and the intellectual property of third parties.

We may become parties to disputes from time to time over rights and obligations concerning intellectual property, and we may not prevail in these disputes. Third parties may raise claims against us alleging infringement or violation of the intellectual property of that third party. Some third party intellectual property rights may be extremely broad, and it may not be possible for us to conduct our operations in such a way as to avoid violating those intellectual property rights. Any such intellectual property claim could subject us to costly litigation and impose a significant strain on our financial resources and management personnel regardless of whether such claim has merit. Our liability insurance, if any, may not cover potential claims of this type adequately or at all, and we may be required to alter products or pay monetary damages or license fees to third parties, which could have a material adverse effect on our financial condition and results of operations.

The markets in which we operate are highly competitive, and our failure to compete successfully would make it difficult for us to add and retain customers and would reduce or impede the growth of our business.

The markets for global multilingual content delivery software and services are increasingly competitive and global. We expect competition to increase in the future both from existing competitors and new companies that may enter our markets. In addition to our existing competitors, we may face competition in the future from companies that do not currently offer globalization or translation services. We may also face competition from internal globalization departments of Fortune 1000 and large emerging companies. Technology companies, information technology services companies, business process outsourcing companies, web consulting firms, technical support call centers, hosting companies and content management providers may choose to broaden their range of services to include globalization or language translation as they expand their operations internationally. Increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. New or established competitors may offer solutions that are superior to or lower in price than ours. We may not have sufficient resources to continue the investments in all areas of software development and marketing needed to maintain our competitive position. In addition, some of our competitors are better capitalized than us, which may provide them with an advantage in developing, marketing or servicing new solutions. Increased competition could reduce our market share, revenues and operating margins, increase our costs of operations and otherwise adversely affect our business.

If we fail to retain our Chief Executive Officer and other key personnel, our business would be harmed and we might not be able to implement our business plan successfully.

Given the complex nature of the technology on which our business is based and the speed with which such technology advances, our future success is dependent, in large part, upon our ability to attract and retain highly qualified managerial, technical and sales personnel. In particular, Shannon Zimmerman, our President and Chief Executive Officer, is critical to the management of our business and operations. Competition for talented personnel is intense, and we cannot be certain that we can retain our managerial, technical and sales personnel or that we can attract, assimilate or retain such personnel in the future. Our inability to attract and retain such personnel could have an adverse effect on our business, results of operations and financial condition.

Because our long-term success depends, in part, on our ability to expand the sales of our solutions to customers located outside of the United States, our business will be susceptible to risks associated with international operations.

We have limited experience operating in foreign jurisdictions. In 2009, we opened Sajan Software in Dublin, Ireland, in 2010 we opened Sajan Spain, and in 2011 we opened Sajan Singapore. Our inexperience in operating our business outside of North America increases the risk that our current and any future international expansion efforts will not be successful. Conducting international operations subjects us to risks that, generally, we have not faced in the United States, including:

| · | fluctuations in currency exchange rates; |

| · | unexpected changes in foreign regulatory requirements; |

| · | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| · | difficulties in managing and staffing international operations; |

| · | potentially adverse tax consequences, including the complexities of foreign value-added tax systems and restrictions on the repatriation of earnings; |

| · | the burdens of complying with a wide variety of foreign laws and different legal standards, including laws and regulations related to privacy; |

| · | increased financial accounting and reporting burdens and complexities; |

| · | political, social and economic instability abroad, and terrorist attacks and security concerns in general; and |

| · | reduced or varied protection for intellectual property rights in some countries. |

The occurrence of any one of these risks could negatively affect our international business and, consequently, our results of operations generally. Additionally, operating in international markets also requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required in establishing, acquiring, operating or integrating operations in other countries will produce desired levels of revenues or profitability.

Compliance with public company regulatory requirements, including those relating to our internal control over financial reporting, have and will likely continue to result in significant expenses and, if we are unable to maintain effective internal control over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock may be negatively affected.

As a public reporting company, we are subject to the Sarbanes-Oxley Act of 2002 as well as to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and other federal securities laws. As a result, we incur significant legal, accounting, and other expenses, including costs associated with our public company reporting requirements and corporate governance requirements. As an example of public reporting company requirements, we evaluate the effectiveness of disclosure controls and procedures and of our internal control over financing reporting in order to allow management to report on such controls. In addition, any updates to our finance and accounting systems, procedures and controls, which may be required as a result of our ongoing analysis of internal controls, or results of testing by our independent auditor, may require significant time and expense. As a company with limited accounting resources, a significant amount of management’s time and attention has been and will continue to be diverted from our business to ensure compliance with these regulatory requirements. This diversion of management’s time and attention may have a material adverse effect on our business, financial condition and results of operations.

Management works to continuously monitor and improve its internal controls over financial reporting. Although we have never had a significant deficiency or material weakness, in the event significant deficiencies or material weaknesses are identified in our internal control over financial reporting that we cannot remediate in a timely manner, investors and others may lose confidence in the reliability of our financial statements and the trading price of our common stock and ability to obtain any necessary equity or debt financing could suffer. This would likely have an adverse effect on the trading price of our common stock and our ability to secure any necessary additional equity or debt financing, and could result in the delisting of our common stock from the NASDAQ Capital Market, which would severely limit the liquidity of our common stock.

An active trading market in our common stock may not develop or be adequately maintained, and our common stock may be subject to volatile price and volume fluctuations.

An active trading market in our common stock may not develop or be adequately maintained. Although our shares are listed on the NASDAQ Capital Market, the overall market for securities in recent years has experienced extreme price and volume fluctuations that have particularly affected the market prices of many smaller companies. These fluctuations have been extremely volatile and are often unrelated or disproportionate to operating performance. Consequently, you may not be able to sell our common stock at prices equal to or greater than the price you paid for your shares. In addition to the factors discussed elsewhere in this section, many factors, most of which are outside of our control, could cause the market price of our common stock to decrease significantly, including variations in our quarterly operating results; decreases in market valuations of similar companies; the failure of securities analysts to cover our common stock or changes in financial estimates by analysts who cover us, our competitors or our industry; and fluctuations in stock market prices and volumes. These broad market fluctuations could result in extreme fluctuations in the price of our common stock, which could cause a decline in the value of our common stock.

We may be unable to continue to list our securities on the NASDAQ Capital Market, which could limit investors’ ability to make transactions in our securities and subject stockholders to additional trading restrictions.

Up until September 4, 2014, our common stock was quoted on the OTCQB Marketplace. Since September 4, 2014, our common stock has been listed on the NASDAQ Capital Market. However, there can be no assurance that we will continue to meet the continued listing requirements of the NASDAQ Capital Market. If we do not meet such requirements, our securities may be re-quoted on the OTCQB Marketplace after delisting from the NASDAQ Capital Market.

If we are unable to cause our securities to continue to be listed on the Nasdaq Capital Market, we and our stockholders could face significant material adverse consequences, including:

| · | a limited availability of market quotations for our securities; |

| · | a determination that our common stock is a “penny stock,” which will require brokers trading in our common stock to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for our common stock; |

| · | a limited amount of news and analyst coverage; and |

| · | a decreased ability to issue additional securities or obtain additional financing in the future. |

Current members of our management own a significant percentage of the outstanding shares of our common stock, which could limit other stockholders’ influence on corporate matters.

Shannon Zimmerman, who is a director and executive officer, and Angela Zimmerman, who is a director, collectively own approximately 27% of the outstanding shares of our common stock. Accordingly, these individuals are able to exert substantial influence over our affairs, including the election and removal of directors and all other matters requiring stockholder approval, including any future merger, consolidation or sale of our company. This concentrated control could discourage others from initiating any potential merger, takeover, or other change-of-control transactions that may otherwise be beneficial to our stockholders. Furthermore, this concentrated control will limit the practical effect of the stockholders’ participation in our corporate matters, through stockholder votes and otherwise. As a result, the return on investment in our common stock through the sale of shares could be adversely affected.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Our primary operations are based in River Falls, Wisconsin, which is located approximately 30 miles east of Minneapolis, Minnesota. We lease approximately 24,000 square feet of office space from River Valley Business Center, LLC (“RVBC”), and the lease will expire in January, 2022. Rent for these facilities was $344,000 in 2016. RVBC is a “related person” as defined in Item 404 of Regulation S-K promulgated by the SEC because it is controlled by Shannon Zimmerman, who is a director and executive officer of the Company, and Angela Zimmerman, who is a director of the Company.

Sajan Software leases approximately 3,300 square feet of office space in Dublin, Ireland. Sajan Spain leases approximately 3,600 square feet of office space in Madrid, Spain. Sajan Singapore leases approximately 1,200 square feet of space in Singapore, Singapore. In 2015, combined rents for these facilities were $126,000. We believe all of our facilities are suitable and adequate for current operating needs.

We may be subject to legal actions, proceedings and claims in the ordinary course of business. As of the date of this report, management is not aware of any undisclosed actual or threatened litigation that would have a material adverse effect on our financial condition or results of operations.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Since September 4, 2014, our common stock has been listed on the NASDAQ Capital Market under the symbol “SAJA”. The last reported sales price for our common stock on March 8, 2017 was $3.74.

The following table shows the high and low sale prices (for all dates subsequent to the Reverse Stock Split) and high and low bid prices (for all dates prior to the Reverse Stock Split) for our common stock for the 2016 and 2015 fiscal quarters. The high and low bid prices reported on the OTCQB Marketplace reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily reflect actual transactions.

On June 16, 2014, we implemented a 1-for-4 Reverse Stock Split. Share and per share information below for periods prior to June 16, 2014 have been adjusted to reflect the impact of the Reverse Stock Split.

| | | Market Price (high/low) | |

| For the Fiscal Year | | 2016 | | | 2015 | |

| First Quarter | | $ | 2.45 – 3.95 | | | $ | 5.21 – 6.40 | |

| Second Quarter | | $ | 3.51 – 5.60 | | | $ | 4.80 – 6.26 | |

| Third Quarter | | $ | 3.78 – 4.80 | | | $ | 4.01 – 6.56 | |

| Fourth Quarter | | $ | 3.08 – 4.19 | | | $ | 3.34 – 5.04 | |

As of March 8, 2017, we had approximately 151 record holders of our common stock, including the nominee of Depository Trust Company which held 3,312,802 shares as the nominee for street name holders.

Dividend Policy

Holders of our common stock are entitled to receive such dividends as are declared by our board of directors out of funds legally available for the payment of dividends. We presently intend to retain any earnings to fund the development of our business and the agreement governing our credit facility restricts our ability to pay dividends. Accordingly, we do not anticipate paying any dividends on our common stock for the foreseeable future. Any future determination as to declaration and payment of dividends will be made at the discretion of our Board of Directors.

Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Company

None.

Equity Compensation Plan Information

See Part III, Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

| ITEM 6. | SELECTED FINANCIAL DATA |

As a smaller reporting company, we are not required to provide disclosure pursuant to this item.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with the financial statements and related notes that appear elsewhere in this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve significant uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed in “Risk Factors” elsewhere in this report. For further information, see the section titled “Cautionary Notice Regarding Forward-Looking Statements” above.

Discussion of Critical Accounting Policies and Estimates

Discussion of the financial condition and results of our operations is based upon our consolidated financial statements, which have been prepared in accordance with United States generally accepted accounting principles (“GAAP”). The preparation of these consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and expenses, and related disclosures. On an ongoing basis, we evaluate our estimates and judgments, including those discussed below. These estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. The results of our analysis form the basis for making assumptions about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions, and the impact of such differences may be material to the consolidated financial statements.

Management believes the following critical accounting policies involve significant judgments and estimates in the preparation of our consolidated financial statements. (Also see Note 2 to our Consolidated Financial Statements included in Part II, Item 8 of this Report, which provides further information on and discussion of our significant accounting policies and the use of estimates.)

Revenue Recognition

We derive revenue primarily from language translation services and professional consulting services. Services include content analysis, translation memory and retrieval, language translation, account management, graphic design services, technical consulting and professional services. Services associated with translation of content are generally billed on a “per word” basis. The price charged per word per language varies depending upon the language, the availability of translator resources and the extent to which our proprietary search algorithm has been applied to reuse prior translation work. In some cases we may generate revenue by allowing customers to utilize our operating system, for which we will also receive revenue on a per word basis similar to our services business model based upon the number of words processed through our Transplicity software platform. Professional services, including technical consulting and project management, are billed on a per hour rate basis.

We consider revenue earned and realizable at the time services are performed and amounts are earned. Revenue for translation services is recognized on a standard “per word” basis at the time the translation is completed. Revenue for professional services is recognized when the services have been completed in accordance with the statement of work.

Revenues recognized in excess of billings are recorded as unbilled services. Billings in excess of revenues recognized and customer prepayments for services are recorded as customer prepayments to the extent cash has been received.

Capitalized Software Development Costs