Beckman, Lieberman & Barandes, llp ATTORNEYS AT LAW 116 John Street, New York, NY 10038 | TELEPHONE (212) 608-3500 TELECOPIER (212) 608-9687 |

| Long Island Office 100 Jericho Quadrangle, Jericho, NY 11753 Ext. 127 Direct Fax (212) 608-9687 E-Mail: RBarandes@BLBLLP.com |

January 3, 2008

Securities and Exchange Commission

Station Place

100 F Street, N.E.

Washington, D.C. 20549 - 7010

Attn: Edward N. Kelly, Senior Counsel

| | Re: | Versadial, Inc., formerly Carsunlimited.com, Inc. |

| | | Registration Statement on Form SB-2, as amended Filed October 24, 2007, - File# 333-141365 |

Ladies and Gentlemen:

On behalf of Versadial, Inc. (“Company”) or (“Versadial”), the following are our responses, including supplemental information, to the comments of the Securities and Exchange Commission (“SEC”) set forth in its letter dated November 7, 2007 with respect to the above referenced documents filed by the Company. Supplemental information provided to you in this letter is based upon information and/or documentation provided by the Company. The numbers of our responses parallel the numbers in your November 7, 2007 letter. We are providing a hard copy red-lined version of the Registration Statement to facilitate your review.

| 1. | Please be advised supplementally that we have revised the Registration Statement to delete the references to cancellation of the initial warrants. |

| 2. | Please be advised supplementally that we have revised the Registration Statement to identify the related party that provided the advances to Versadial. |

| 3. | Please be advised supplementally that we did not file the credit memo with Avon as an exhibit to the current reports on Form 8K dated September 29, 2006 and May 14, 2007 and filed on October 4, 2006 and May 18, 2007, respectively, for the reason that we do not believe the credit memo was a material contract requiring filing under item 601 (b) (10) of Regulation S-B. As noted in the current report on Form 8K dated September 29, 2006, Versadial received $700,000 from Avon in exchange for its commitment to deliver pre-production samples of a specially designed dual chamber dispensing pump to Avon. The current report on Form 8K dated May 14, 2007 disclosed that Versadial satisfied Avon’s requirements for the specially designed dispensing pump, and consequently Avon advanced an additional $1,000,000 to Versadial to fund pre-production tooling and equipment expenses. Versadial believes its only material contract with Avon is the Master Supply Agreement entered into on July 10, 2007 and set forth as an exhibit to its current report on Form 8K dated July 10, 2007 and filed on July 16, 2007. The credit memo merely allocates how the previously advanced $1.7 million will be applied as a credit against purchases made by Avon pursuant to the Master Supply Agreement. |

| Beckman, Lieberman & Barandes, llp | | |

| Re: Versadial, Inc., formerly Carsunlimited.com, Inc. | | January 3, 2008 |

| | | Page -2- |

| 4. | Please be advised supplementally that we have revised the Registration Statement to identify the amount of firm commitments for initial production of Versadial’s 40 millimeter and 49 millimeter dual chambered dispensing pumps. The development projects that Versadial are involved in are in preliminary testing and validation stages with several customers and will be disclosed as required when any material contracts or commitments are finalized. |

| 5. | Please be advised supplementally that we have revised the Registration Statement to set forth the extension of the maturity date of the $1.5 million due to shareholders to February 28, 2008. |

| 6. | Please be advised supplementally that the address of counsel has been set forth in the Registration Statement. |

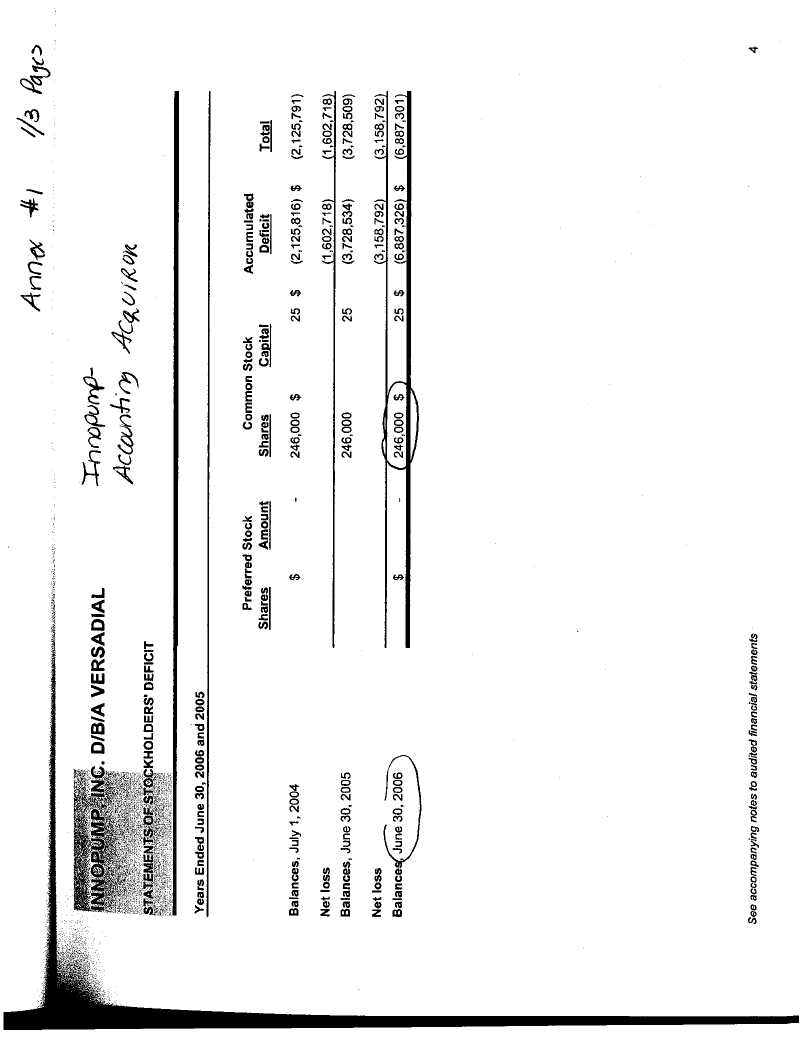

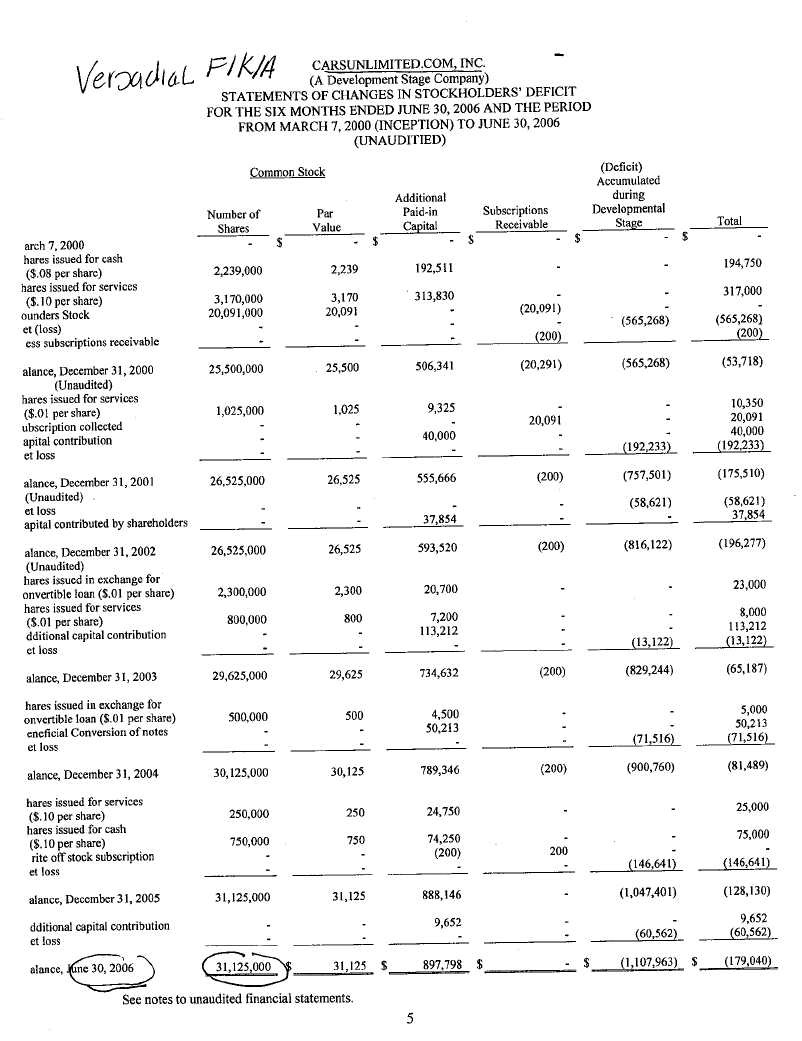

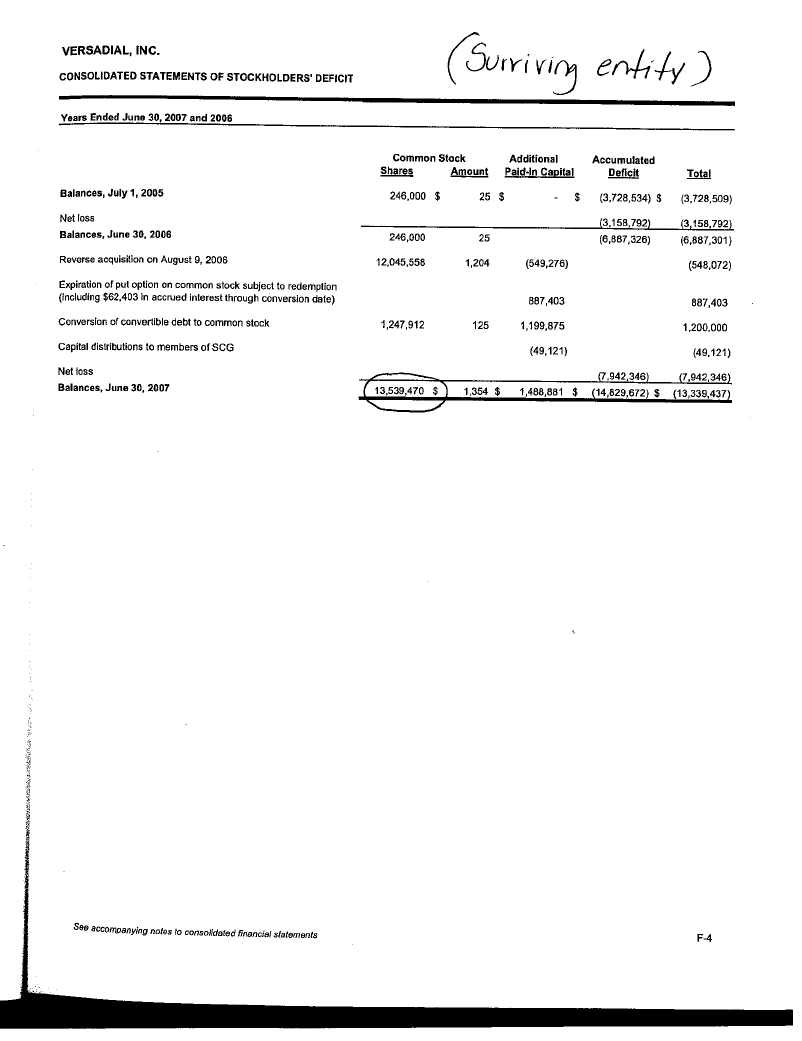

| 7. | Versadial showed the historical balance of common shares of Innopump as of the last fiscal year (June 30, 2006) and recast the statement of stockholders’ deficit as of the merger date for the equivalent number of shares received in the merger. The effect on the fiscal year end balances at June 30, 2007 is the same as if Versadial had retroactively restated the beginning balances. Below please find a reconciliation of the common shares prior to and as a result of the merger of both entities. In addition, attached as Annex 1 to this letter, we have set forth the statements of stockholders’ deficit of both Versadial f/k/a Carsunlimited.com, Inc. (“Cars”) (or the accounting target), and Innopump (the accounting acquiror) as of June 30, 2006, the last reporting period prior to the merger on August 9, 2006. Also as part of Annex 1 is the statement of stockholders’ deficit for the year ended June 30, 2007 which was included in Versadial’s 10-KSB filing. |

| Beckman, Lieberman & Barandes, llp | | |

| Re: Versadial, Inc., formerly Carsunlimited.com, Inc. | | January 3, 2008 |

| | | Page -3- |

| Reconciliation: | | | | | |

| | | Innopump | | Versadial (f/k/a/ Cars) | |

| | Common Shares | | Common Shares | |

| | | | | | | | |

| Outstanding June 30, 2006 | | | 246,000 | | | 31,125,000 | |

| | | | | | | | |

| Conversion of shareholder debt to equity August 8, 2006 | | | | | | 10,000,000 | |

| | | | | | | | |

Shares subject to put option prior to merger (included in liabilities at June 30, 2006) | | | 16,500 | | | -- | |

| | | | | | | | |

| Conversion of debt to equity at time of merger ($1,200,000) | | | 28,792 | | | -- | |

| | | | | | | | |

| Total outstanding at merger date: | | | 291,292 | | | 41,125,000 | |

| | | | | | | | |

| Reversal of Innopump common shares at merger | | | (291,292 | ) | | -- | |

| | | | | | | | |

| Shares issued on merger | | | | | | | |

| (approximately 1,950 Versadial for each Innopump) | | | 568,134,259 | | | -- | |

| | | | | | | | |

| Reverse split March 2, 2007 (1/45) | | | (568,134,259 | ) | | (41,125,000 | ) |

| Shares issued on reverse split (as rounded up) | | | 12,625,243 | | | 914,227 | |

| | | | | | | | |

| Total outstanding at June 30, 2007: | | | 12,625,243 | | | 914,227 | |

| | | | | |

| Aggregate outstanding at June 30, 2007: | | | 13,539,470 | |

| 8. | We do understand that whenever a public shell with no operations and no major assets completes a reverse merger with an operating company, it should be accounted for as a recapitalization of the operating company. However, the Versadial (formerly Carsunlimited) public shell raised $7.5 million prior to the reverse merger, as a condition of completing the merger, and also had some current payable obligations, therefore the public shell had $7.5 million in cash and debt and approximately $120,000 in other current liabilities on August 9, 2006 (pre-reverse merger). As a result, we believe that Versadial’s accounting for the reverse merger was correct. We would like to add that fair value was the same as book value on the date of the reverse merger. |

| 9. | Please be advised that the Capital Lease Obligation described in Note 11 of the financial statements discloses the future minimum lease payments in the aggregate and for each of the succeeding fiscal years as the long-term portion of $84,016 is disclosed to be due by March 2009. The long-term portion is all due in fiscal year ending June 30, 2009 and the current portion is due in fiscal year ending June 30, 2008. |

| Beckman, Lieberman & Barandes, llp | | |

| Re: Versadial, Inc., formerly Carsunlimited.com, Inc. | | January 3, 2008 |

| | | Page -4- |

| 10. | Please be advised supplementally that we have revised the exhibit index in the manner requested in the November 7, 2007 letter. |

| 11. | Please be advised supplementally that the critical accounting policies and MD&A has been removed from exhibit 99.1. |

| 12. | Please be advised supplementally that the Safe Harbor text is not included in the Registration Statement. |

| 13. | Please be advised supplementally that Versadial has addressed the comments noted in the staff’s letter of November 7, 2007 above and amended the Registration Statement (Amendment No. 3) as required in response to the comments where applicable. We do not believe any of these comments or the supplemental responses would require an amendment of the annual report on Form 10-KSB. |

| 14. | In accordance with the procedure set forth in Rule 406 adopted by the Commission under the Securities Act of 1933, as amended, Versadial has requested confidential treatment as to a certain section and annexes of the contract set forth, in redacted form, as Exhibit 10.10 to the Registration Statement. |

| | | |

| | Very truly yours, Beckman, Lieberman & Barandes, LLP |

| | | |

| | | |

| | By: | /s/ Robert Barandes |

| | | Robert Barandes |

RB/cr