Exhibit 1.01

CERAGON NETWORKS LTD.

Conflict Minerals Report

For The Year Ended December 31, 2022

A. OVERVIEW

This report has been prepared by Ceragon Networks Ltd. (NASDAQ: CRNT) (herein referred to as “Ceragon,” the “Company,” “we,” “us,” or “our”) pursuant to Rule 13p-1 (the “Rule”) promulgated under the Securities Exchange Act of 1934, as amended. According to the Rule, if a SEC registrant has reason to believe that any of the conflict minerals, including tin, tantalum, tungsten and gold (“Conflict Minerals” or “3TG”), in its supply chain may have originated in the Democratic Republic of the Congo (“DRC”) or an adjoining country (collectively referred to as the “Covered Countries”), or if the registrant is unable to determine the country of origin of those conflict minerals, then the registrant must exercise due diligence on the conflict minerals’ source and chain of custody, and submit a Conflict Minerals Report that includes a description of those due diligence measures.

As part of Ceragon’s commitment to corporate responsibility and respecting human rights in our own operations and global supply chain, Ceragon is committed to complying with the legislation and supports responsible conflict mineral sourcing. Furthermore, due to the potential negative economic and social impacts on the economies of the DRC and the Covered Countries, Ceragon does not seek to completely eliminate sourcing from the DRC or Covered Countries, but rather is dedicated to the responsible sourcing of such minerals, inter alia, as supported by information and/or data from independent third party audits or reports. In addition, it is important to note that, like many other companies, Ceragon does not directly purchase minerals from smelters or other mineral processors, and has several layers removed from these processors within the supply chain. Ceragon also fully recognizes that the minerals supply chain is global and complex, and many product and/or product component suppliers and manufacturers may lack the resources or commercial strength to trace the necessary minerals all the way back to the mine or original source of the ores. Notwithstanding these issues and realities, Ceragon is committed to the responsible sourcing of the necessary Conflict Minerals used in its products, and therefore asks its suppliers to follow the company’s Conflict Minerals Policy, and strives, to a reasonable degree, to conduct a reasonable country of origin inquiry (“RCOI”) on the likely source and chain of custody of the necessary Conflict Minerals used in its products through the resources provided by third party audit bodies, such as (but not necessarily through) the Responsible Minerals Initiative (“RMI”). As such, the company commits resources to ensure compliance with the applicable Conflict Minerals regulations and practices in responsible sourcing of those minerals.

Our Solutions

We are the leading wireless hauling specialist company in terms of unit shipments and global distribution of our business, providing innovative high capacity wireless connectivity solutions to global markets across various industries, mainly wireless (mobile) networks service providers.

Wireless hauling is a means for connecting mobile network sites (e.g. cellular base stations in various architectures) to the rest of the network. It carries information to and from the cellular base stations. It is used when high-speed wireline connectivity to telecom sites (typically fiber optics) is not available or rapid development is required. According to market research, about 45% of global telecom sites are connected to the rest of the network via wireless hauling.

Ceragon’s innovative technology related to the transition from Wireless SDH to Wireless IP, and the further transition to compact multi-core all-outdoor wireless backhaul solutions, assisted in positioning Ceragon as a leader in the global wireless hauling market, and we expect that it would have potentially positioned us to benefit from new wireless generation transitions such as the current 5G evolution.

In preparation for the transition from 4G to 5G technologies, we have begun planning the roll-out of new 5G-supporting products. In 2019, we introduced the market-first “disaggregated wireless hauling” architecture, which allows operators to significantly simplify 5G network deployment and maintenance, as well as reduction of capital and operating expenses. Currently, we are investing in a new chipset which incorporates 8-cores (Octa-core) in a chipset to be incorporated in products expected to be introduced in 2024.

The term ‘wireless hauling’ refers to various types of network connectivity signaling and network protocols which vary in speeds and include (i) backhaul - used in 4G, 5G and earlier generations of mobile networks to send data packets between the network and the base-stations and between the base-stations to other network elements, and (ii) fronthaul - used in 4G and 5G networks to send radio signal values between building blocks of the base station, which can be separated from another across geographic site locations to achieve network efficiencies in some network scenarios.

Wireless hauling offers network operators a cost-efficient alternative to wire-line connectivity between network nodes at different sites, mainly fiber optics. Support for high broadband speeds and very large numbers of devices means that all value-added services can be supported, while the high reliability of wireless systems provide for lower maintenance costs. Because they require no trenching, wireless hauling links can also be set up much faster and at a fraction of the cost of fiber solutions. On the operator’s side, this translates into an increase in operational efficiency and faster time-to-market, as well as a shorter timetable to achieving new revenue streams.

We provide wireless hauling solutions and services that enable cellular operators and other service providers to build new networks and evolve networks towards 4G and 5G services. The services provided over these networks are voice, mobile and fixed broadband, Industrial/Machine-to-Machine (M2M), Internet of Things (IoT) connectivity, public safety and other mission critical services. We also provide our solutions for wireless backhaul to other vertical markets such as Internet service providers, public safety, utilities, oil and gas offshore drilling platforms, as well as maritime communications. Our wireless hauling solutions use microwave and millimeter-wave radio technologies to transfer large amounts of telecommunication traffic between wireless 5G, 4G, 3G and other cellular base station technologies (distributed, or centralized with dispersed remote radio heads) and the core of the service provider’s network. We are also a member of industry consortiums of companies, which attempt to better define future technologies in ICT (Information and Communication Technologies) markets, such as Open Networking Foundation (ONF), Metro Ethernet Forum (MEF), European Telecommunications Standards Institute (ETSI), Telecom Infra Project (TIP) and others.

In addition to providing our solutions, we also offer our customers a comprehensive set of turn-key services, including advanced network and radio planning, site survey, solutions development, network rollout, maintenance, wireless hauling network audit and optimization, and training. To enable delivery of turn-key solutions to our customers, in addition to providing roll-out services, we have partnered with other third party providers of technologies complementary to our own. Our offering includes technologies such as: Unlicensed Point-to-Point, Private LTE, Licensed/unlicensed Point-to-Multipoint, IP/MPLS and others. This allows us to better cover our customers’ end-to-end needs and increases the level of commitment of these customers. Our services include powerful project management tools that streamline deployments of complex wireless networks, thereby reducing time and costs associated with network set-up and allowing a fast time-to-revenue. Our experienced teams can deploy hundreds of wireless hauling links every week, and our rollout project track record includes hundreds of thousands of links already installed and operational with a variety of industry-leading operators.

Designed for any network scenario, including risk-free flexible migration from current and legacy network technologies and architectures to evolving standards and network hauling scenarios, our solutions provide ultra-high speed connectivity at any distance, be it a few kilometers or tens of kilometers, and even longer, over any available spectrum (or combinations of available spectrum bands) and in any site and network architecture. Our solutions support all wireless access technologies, including 5G-NR NSA, 5G-NR SALTE, HSPA, EV-DO, CDMA, W-CDMA, WIFI and GSM as well as Tetra, P.25 and LMR for critical communications. These solutions allow wireless service providers to cost-effectively and seamlessly evolve their networks from a monolithic base-station architecture to an open RAN architecture, utilizing vertical and horizontal disaggregation, allowing them extra flexibility, scalability and efficiency, thereby meeting the increasing demand of a growing number of connections of any type for consumers and enterprises with growing needs for mobile and other multimedia services, and a growing number of machines or IoT devices such as street surveillance devices or meters.

We also provide our solutions to other non-carrier vertical markets such as oil and gas companies, public safety organizations, businesses and public institutions, broadcasters, energy utilities and others that operate their own private communications networks. Our solutions are deployed by more than 460 service providers of all sizes, as well as in more than 1,500 private networks, in more than approximately 155 countries.

Supply Chain

The products that we manufacture are highly complex, typically containing thousands of parts from many suppliers. We have relationships with a vast network of suppliers throughout the world and there are generally multiple tiers in the chain of custody between the 3TG mines or processing facilities, where tungsten, tantalum, tin and gold are extracted and/or processed. Hence, and as per the Organization for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (2016) and related Supplements (the “OECD Due Diligence Guidance”), Ceragon is constituted as a “downstream” company. As such, we must rely on our direct and secondary suppliers to work with their relevant upstream suppliers so that they may provide us with accurate information on the origin of 3TG in the components we purchase, where applicable, by using a template issued by a third party audit body, namely the Responsible Mineral Initiative (“RMI”)’s Conflict Minerals Reporting Template (“CMRT”), of at least version 6.01 or higher, to report on the origin, or likely origin, of the 3TG in the components we purchase that are necessary to the functionality or production of our products.

Reasonable Country of Origin Inquiry (RCOI)

Based on the aforementioned risk-based approach, we surveyed one hundred and nineteen (119) suppliers, out of which we received one hundred and sixteen (116) responses. Out of these 116 responses we received from our supply chain inquiry, we identified one hundred (100) suppliers whose products may contain 3TG (86.2%) and 16 were found not to use 3TG at their supplies (13%). We requested that all identified suppliers provide information to us regarding 3TG existence and relevant smelters or refiners (“SoRs”) with whom they engage, while using the Conflict Minerals Reporting Template (“CMRT”) of at least version 6.01 or higher, developed by independent third party audit body such as the Responsible Minerals Initiative (“RMI”), formerly the Conflict-Free Sourcing Initiative (“CFSI”).

In order to facilitate the implementation of our risk-based approach, Ceragon utilized the services of a third party service provider that assisted in sending relevant communications to our suppliers to explain our expectations regarding compliance and responsible mineral sourcing, while referring suppliers to online training materials, as well as our Conflict Minerals Policy and instructions. We solicited information from suppliers using a template adopted by an independent third-party audit body, the RMI, namely, the CMRT version 6.01 or higher. We received a response rate of 97.48%. We reviewed the responses that we received and followed up on inconsistent, incomplete, and inaccurate responses, sending reminders to suppliers that did not respond to our requests for information. We compared the smelters or refiners identified in the surveys provided by our relevant suppliers against the lists of facilities that have received a conflict-free or audit-in-process designation by the RMI’s Responsible Minerals Assurance Process (“RMAP”), formerly the Conflict Free Smelter Program (“CFSP”). Ceragon is a downstream company as indicated above. As such, we source products and components from suppliers, which, in turn, source materials from their sub-tier suppliers. Our supply chain is extensive and complex with many layers of suppliers positioned between ourselves and 3TG smelters or refiners. Due to our extended supply chain, we expect our suppliers to provide us with accurate information concerning the likely sources and chains of custody of 3TG necessary for the functionality or production of our products.

Efforts to Determine Mine or Location of Origin

We have determined that requesting our suppliers to complete a current version of the CMRT (i.e., 6.01 and above) represents our reasonable best efforts to determine the mines or locations of origin of 3TG in our supply chain.

The Company’s efforts to determine the origin of the Conflict Minerals with the greatest possible accuracy consisted of the due diligence measures described in this Conflict Minerals Report.

Smelters or Refiners (“SoR”) and Countries of Origin of 3TG

The vast majority of suppliers from which we requested information responded and provided information through version 6.01 or higher of the RMI’s CMRT.

The Company has attempted, with reasonable best effort, to determine the smelters or refiners that are part of its mineral supply chain, through information provided by its suppliers that sold products or product components to the company in 2022.

Currently, the Company does not have the sufficient information to determine the exact country of origin of the Conflict Minerals used in our products or the facilities used to process those Conflict Minerals. Therefore, we cannot exclude the possibility that some of these Conflict Minerals may have originated in the DRC or one of the Covered Countries, and do not originate entirely from recycled or scrap sources.

Based on this result, and to mitigate the lack of information, the Company conducted supply chain Conflict Minerals due diligence activities and details those activities in this Conflict Minerals Report.

B. DUE DILIGENCE

Design of Due Diligence

Our supply chain due diligence measures were designed to conform, in all material respects, with the due diligence framework presented by The Organization for Economic Co-operation and Development (OECD) in the publication OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Guidance”) and its related supplements for gold, tin, tantalum and tungsten. We designed our due diligence measures according to the recommendations of the OECD Guidance for downstream companies that have no direct relationships with smelters or refiners of necessary Conflict Minerals.

Due Diligence Performed

OECD Step 1: Strong Company Management Systems

Conflict Minerals Policy

We have adopted a Conflict Minerals Policy that expresses our commitment to responsible sourcing and our expectations of suppliers regarding the sourcing of the necessary 3TG in our products, which is publicly available on our website at: https://www.ceragon.com/investors/corporate-governance.

To the extent required by the SEC, we support increased transparency with regards to our sourcing practices, in particular the sourcing of minerals from areas of on-going conflict, such as the Conflict Minerals from the DRC and Covered Countries. We expect our suppliers to adopt similar policies and meet our expectations regarding responsible sourcing and human rights. As a downstream company, our supply chain is highly complex and our manufacturing process is significantly removed from the mining, smelting or refining of conflict minerals. As a result, we expect our suppliers to cooperate with us to provide: (i) the required supply chain due diligence process, in order to facilitate our compliance with the Rule; and (ii) demonstrate processes in place to reasonably assure the origin, or the likely origin, of the necessary Conflict Minerals contained in the products provided to Ceragon, and that these minerals did not directly or indirectly benefit, to the best of their knowledge, the armed groups in the DRC or one of the Covered Countries.

In addition, our ethical commitment is reflected not only in our Conflict Minerals Policy, but also in our Code of Conduct, which outlines expected behaviors for all of the Company’s stakeholders, as well as our Standards of Business Conduct (see https://www.ceragon.com/investors/corporate-governance) for suppliers that includes our specific approach to human rights, bribery, conflict of interests, insider trading etc. expectations.

Internal Team

We have established an internal team led by the Global Director of Procurement and EVP General Counsel of the Company, responsible for implementing our Conflict Minerals compliance strategy, as well as other team members from our Procurement, Operations and Legal departments. The team assesses progress and discusses further steps regarding implementation of our Conflict Minerals strategy and risk management processes.

Control Systems

As a downstream company, we do not typically have a direct relationship with 3TG smelters or refiners. We do, however, use the RMI standard smelter lists to verify the status of Smelter Original Resources (“SoRs”) that have undergone, or are in the process of undergoing, an independent third-party audit on their labor and human rights practices.

We utilize the RMI’s CMRT reporting template, accepting versions 6.01 or higher for the 2022 reporting year, to collect data and information from our suppliers and to identify the origins, or likely origins, of the 3TG in our supply chain that is necessary to the functionality or production of products that we manufactured or contracted to manufacture in 2022. As mentioned previously in this report, we also engage a third-party service provider to assist us in in engaging in communication with our suppliers to collect information on the smelters or refiners processing the minerals that may ultimately be assimilated into our products.

We communicate the Company’s due diligence efforts to our customers upon request and to senior management on a periodic basis, in addition to the filing of this report with the SEC.

Maintenance of Records

As per the recommendation in the OECD Guidance and Related Supplements, we retain records and relevant materials for a period of five years.

Supplier Engagement

As part of our supply chain due diligence and in engaging our supply chain on responsible sourcing, we sent notifications to relevant suppliers during 2022 requesting them to complete version 6.01 or higher of the RMI’s CMRT. We also provide training and instructions for completing the CMRT to our relevant suppliers. As stated in our Conflict Minerals Policy, suppliers are expected to implement and communicate policies that promote responsible sourcing and that are consistent with our Conflict Minerals Policy and we expect their direct and indirect suppliers do the same. In addition, our suppliers are expected to establish procedures to facilitate the traceability of the necessary Conflict Minerals in our supply chain.

Many of our supplier purchase contracts have terms of three to five years or more or consider the volume purchased as not material (and hence, show less willingness to change their procurement terms), and we may not be able to unilaterally impose new contract terms or flow-down requirements that would otherwise compel these suppliers to support our supply chain due diligence efforts with respect to 3TG content. For suppliers that do not meet our expectations, we reserve the right to contact them and request information regarding the source, or likely source, and chain of custody of the Conflict Minerals in their supply chain, and as we enter into new contracts or renew existing contracts, we negotiate the adding of relevant Conflict Minerals language that requires suppliers to cooperate in identifying the source or the likely source, if any, of 3TG in their supply chain.

Grievance Mechanism

We have internal processes in place that allow all relevant stakeholders to express their concerns about possible improper or unethical business practices or violations of company policies, laws, or regulations. Our Conflict Minerals Policy is available to the public on our website (at https://www.ceragon.com/investors/corporate-governance) and includes a grievance procedure for suppliers and other external parties to contact us should they wish to seek guidance or report concerning Conflict Minerals or responsible sourcing topics.

OECD Step 2: Identifying and Assessing Potential Risks in the Supply Chain

We surveyed 119 suppliers and had a response rate of 97.48%. We surveyed those suppliers to identify the 3TG contained in the products supplied to us, and to request information in the CMRT regarding the smelters or refiners that process the 3TG and the reasonable countries of origin of the 3TG in their supply chains. The survey was conducted by utilizing version 6.01 or higher of the CMRT and the services of a third-party service provider in order to collect the responses.

We reviewed the responses against the risk criteria development by our internal team as well as the correspondence with our responsible sourcing policy to determine the responses that required further engagement and follow-up. The responses included certain incomplete responses as well as inconsistencies within the data reported by those suppliers and we worked with them in an effort to secure revised responses. Smelters or refiners identified by the Company’s suppliers were compared against the list of smelters or refiners that have received a conflict-free or active designation from the RMAP.

OECD Step 3: Design and Implement a Strategy to Respond to Risks

We implemented the following strategy to address the results of our risk assessment described in Step 2 above. The goal of the design and implementation strategy is not to eliminate sourcing from the DRC and Covered Countries, but to encourage participation with the RMI and other third-party audit bodies, where possible.

| • | Our senior management and relevant procurement directors are briefed about our due diligence efforts on a periodic basis. |

| • | We adopted a risk management approach aimed at encouraging responsible sourcing practices, primarily focused on suppliers that may source or process 3TG originating or likely originating in the DRC or Covered Countries. |

| • | The goal of the risk management approach is not to eliminate sourcing from the DRC, but to encourage suppliers to engage in responsible mineral sourcing, as per the Company’s policy. |

| • | We found no instance where it was necessary to escalate risk management efforts, temporarily suspend business or disengage with a supplier due to Conflict Minerals sourcing-related issues. |

| • | We engage in regular ongoing risk assessment through our suppliers’ annual data submissions, as well as by documenting our reported SoRs and likely Countries of Origin (“COO”). |

| • | Our internal team, led by the Company’s EVP General Counsel and Global Director of Procurement, assesses identified risks and determines follow-up actions, if any. |

OECD Step 4: Carry Out Independent Third-Party Audit of Supply Chain Due Diligence at Identified Points in the Supply Chain

We do not typically have a direct relationship with 3TG smelters or refiners reported within our supply chain and therefore do not perform direct audits of these entities. We rely on the efforts of independent Third-Party Audit initiatives, such as the RMI, that conduct validation audits of sourcing and human rights practices among smelters or refiners of the Conflict Minerals.

OECD Step 5: Report on Supply Chain Due Diligence

This Conflict Minerals Report constitutes our annual report on our 3TG due diligence, and is made available on our website at: https://www.ceragon.com/investors/corporate-governance, as well as being filed with the SEC.

C. RESULTS OF ASSESSMENT

The Company sent out 119 survey requests and received 116 responses, amounting to a 97.48% response rate.

Currently, we do not have sufficient information from our suppliers to determine the complete list of the countries of origin of the Conflict Minerals used in our products that were manufactured or that were contracted to manufacture in 2022 or the facilities used to process those Conflict Minerals.

Based on the information provided by the Company’s suppliers and its own due diligence efforts with known smelters or refiners until December 31, 2022, the Company believes that the facilities that may have been used to process the 3TG in the Company products in 2022 include the smelters or refiners listed in Annex I below.

Based on these due diligence efforts, the Company does not have sufficient information to conclusively determine the countries of origin of the 3TG in its products or whether the 3TG in its products originated entirely from recycled or scrap sources. However, based on the information provided by the Company’s relevant direct suppliers, as well as their reported smelters or refiners, which was validated against independent sources such as the statuses of those SoRs in the RMI’s RMAP program and other sources, the Company believes that the countries of origin of the 3TG contained in its products may include the countries listed in Annex II below.

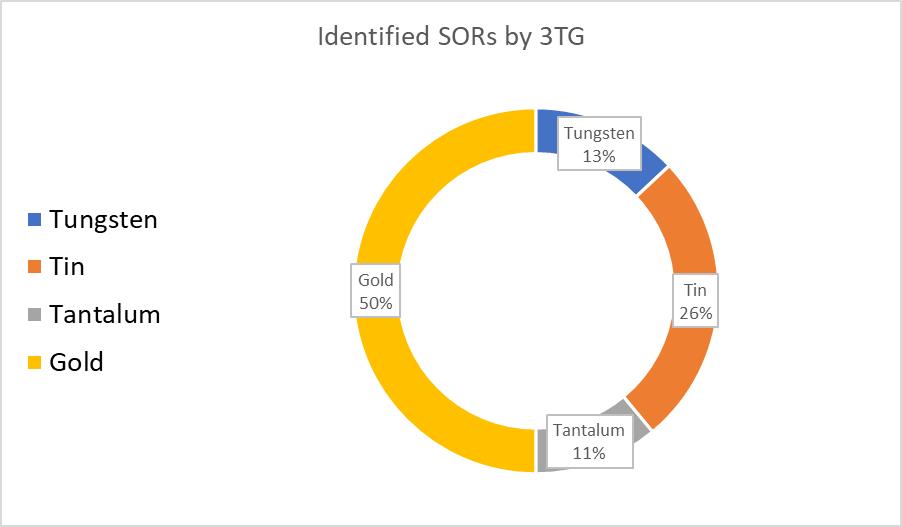

The charts below summarize the 628 operational smelters and/or refiners and their participation status in the RMAP, as indicated in the compiled data from our due diligence efforts:

| % | Quantity | Metal |

| 13% | 79 | Tungsten |

| 26% | 165 | Tin |

| 11% | 67 | Tantalum |

| 50% | 317 | Gold |

| 100% | 628 | Total |

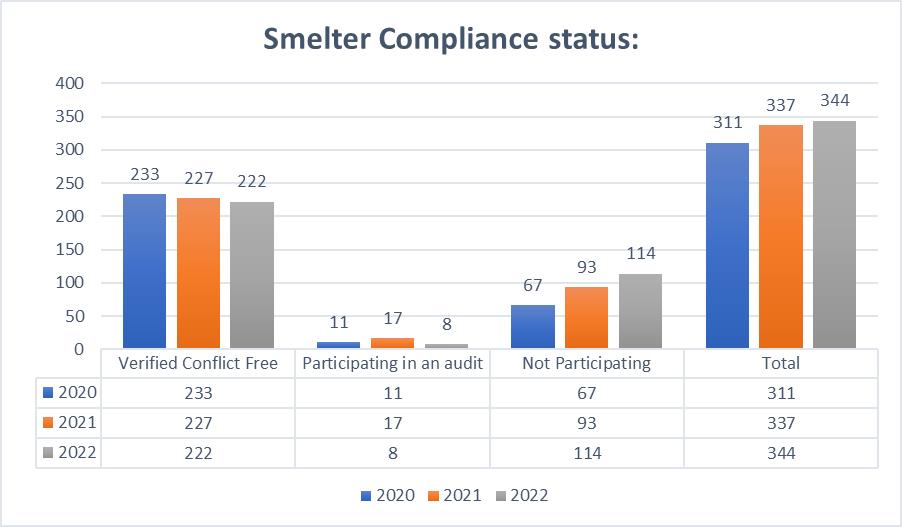

Regarding the chart below, please note that:

| - | “Compliant” refers to SoRs that have received a “conflict-free” designation from an independent third party audit program; |

| - | “Active” refers to SoRs that have begun or are currently participating in an independent third-party audit program; |

| - | “Not Active” refers to SoRs that have not begun participating in an independent third-party audit program. |

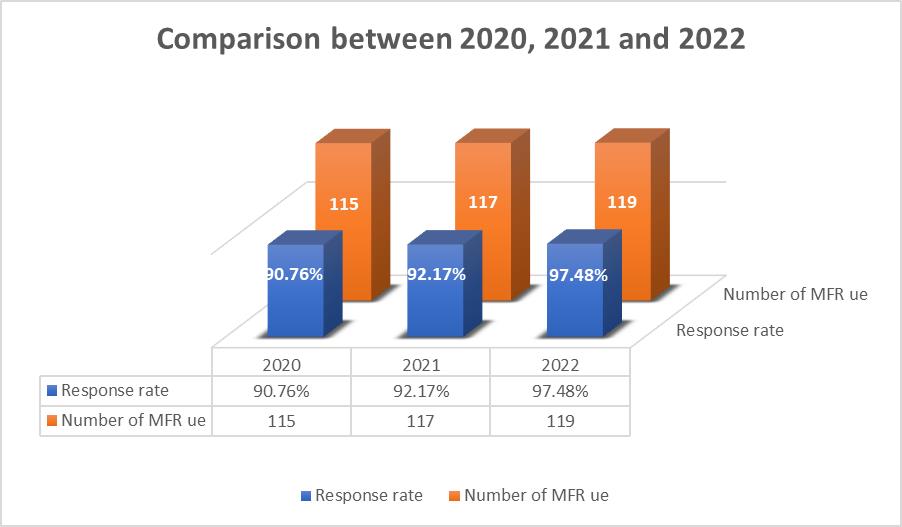

Manufacturer's response rate:

| | 2020 | 2021 | 2022 |

| Response rate | 90.76% | 92.17% | 97.48% |

| Number of MFR ue | 115 | 117 | 119 |

Smelter Compliance status:

| | 2020 | 2021 | 2022 |

| Verified Conflict Free | 233 (75.0%) | 227 (67.4%) | 222 (64.5%) |

| Participating in an audit | 11 (3.5%) | 17 (5.0%) | 8 (2.3%) |

| Not Participating | 67 (21.5%) | 93 (27.6%) | 114 (33.2%) |

| Total | 311 (100%) | 337 (100%) | 344 (100%) |

Please note that information gathered from Ceragon’s suppliers is not collected on a continuous, real-time basis, and, since the information comes from direct and secondary suppliers and independent Third Party Audit programs, Ceragon can only provide reasonable (not absolute) assurance regarding the source and chain of custody of the necessary Conflict Minerals. Nonetheless, the Company continuously strives to improve its processes on an annual basis.

D. ONGOING MITIGATION EFFORTS

Subject to the Rule, we intend to take the following steps to improve the supply chain due diligence and responsible sourcing practices to further mitigate the risk that the 3TG could potentially finance or benefit armed groups in the DRC or Covered Countries:

| • | Ensure that new or renewed supplier contracts adhere to the Conflict Minerals requirement in such contracts. |

| • | Continue to send follow-up letters to non-responsive suppliers and to suppliers that source the necessary conflict minerals from the DRC or Covered Countries, i.e. conflict minerals originating from smelters or refiners that are not compliant with RMAP or other independent Third-Party Audit programs. |

| • | Send surveys to suppliers as an annual routine to assimilate such routines by our suppliers and allow our suppliers to establish a process that will assure providing a complete response. |

| • | Continue to validate supplier responses using information collected via independent conflict free smelter validation programs such as the Responsible Minerals Initiative’s (RMI) RMAP. |

| • | Strengthen communications with suppliers to improve the number of suppliers that respond to the Company’s supply chain surveys, continue to emphasize the importance of this initiative and encourage their participation. |

Caution Concerning Forward- Looking Statements

This report on Form SD contains “forward-looking statements” within the meaning of the Securities Act of 1933, as amended, or the Securities Act, and the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Also, documents that we incorporate by reference into this report or annex to it, including documents that we subsequently file with the SEC, will contain forward-looking statements. Forward-looking statements are those that predict or describe future events, trends and expected results and that do not relate solely to historical matters. We have based these forward-looking statements on our current expectations and projections about future events.

Forward-looking statements can be identified using terminology such as “may,” “will,” “assume,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “potential,” “possible,” “intend,” and similar expressions or negatives of those expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. All statements contained or incorporated by reference in this report on Form SD or other filings with the SEC regarding our future strategy, future expectations, plans and events, future operations, projected financial position, proposed products, estimated future revenues, projected costs, future prospects, the future of our industry and results that might be obtained by pursuing management’s current plans and objectives, projections of results of operations or of financial condition, are “forward-looking statements”.

You should not place undue reliance on our forward-looking statements because the matters they describe are subject to certain risks, uncertainties and assumptions that are difficult to predict, and they involve known and unknown risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Our forward-looking statements are based on the information currently available to us and speak only as of the date on the cover of this report on Form SD, or, in the case of forward-looking statements incorporated by reference, the date of the filing that includes the statement. Over time, our actual results, performance or achievements may differ from those expressed or implied by our forward-looking statements, and such difference might be significant and materially adverse to our security holders. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

We have identified some of the important factors that could cause future events to differ from our current expectations and they are described in our Annual Report on Form 20-F for the fiscal year ended December 31, 2022, including without limitation under the captions “Item 3. Key Information - Risk Factors”, the information about us set forth under Item 4. “Information on the Company” and information related to our financial condition under Item 5. “Operating and Financial Review and Prospects”, in our 2022 Form 20-F generally, and in other documents that we filed or may file with the SEC, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this report.

Annex I – List of Identified Operating SoRs

| Metal | SOR Name | SOR Country |

| Gold | Advanced Chemical Company | UNITED STATES OF AMERICA |

| Gold | Aida Chemical Industries Co., Ltd. | JAPAN |

| Gold | Agosi AG | GERMANY |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | UZBEKISTAN |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | BRAZIL |

| Gold | Argor-Heraeus S.A. | SWITZERLAND |

| Gold | Asahi Pretec Corp. | JAPAN |

| Gold | Asaka Riken Co., Ltd. | JAPAN |

| Gold | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | TURKEY |

| Gold | Aurubis AG | GERMANY |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | PHILIPPINES |

| Gold | Boliden AB | SWEDEN |

| Gold | C. Hafner GmbH + Co. KG | GERMANY |

| Gold | Caridad | MEXICO |

| Gold | CCR Refinery - Glencore Canada Corporation | CANADA |

| Gold | Cendres + Metaux S.A. | SWITZERLAND |

| Gold | Yunnan Copper Industry Co., Ltd. | CHINA |

| Gold | Chimet S.p.A. | ITALY |

| Gold | Chugai Mining | JAPAN |

| Gold | Daye Non-Ferrous Metals Mining Ltd. | CHINA |

| Gold | DSC (Do Sung Corporation) | KOREA, REPUBLIC OF |

| Gold | DODUCO Contacts and Refining GmbH | GERMANY |

| Gold | Dowa | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. East Plant | JAPAN |

| Gold | JSC Novosibirsk Refinery | RUSSIAN FEDERATION |

| Gold | Refinery of Seemine Gold Co., Ltd. | CHINA |

| Gold | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | CHINA |

| Gold | Hangzhou Fuchunjiang Smelting Co., Ltd. | CHINA |

| Gold | LT Metal Ltd. | KOREA, REPUBLIC OF |

| Gold | Heimerle + Meule GmbH | GERMANY |

| Gold | Heraeus Metals Hong Kong Ltd. | CHINA |

| Gold | Heraeus Germany GmbH Co. KG | GERMANY |

| Gold | Hunan Chenzhou Mining Co., Ltd. | CHINA |

| Gold | Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. | CHINA |

| Gold | HwaSeong CJ CO., LTD. | KOREA, REPUBLIC OF |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | CHINA |

| Gold | Ishifuku Metal Industry Co., Ltd. | JAPAN |

| Gold | Istanbul Gold Refinery | TURKEY |

| Gold | Japan Mint | JAPAN |

| Gold | Jiangxi Copper Co., Ltd. | CHINA |

| Gold | Asahi Refining USA Inc. | UNITED STATES OF AMERICA |

| Gold | Asahi Refining Canada Ltd. | CANADA |

| Gold | JSC Ekaterinburg Non-Ferrous Metal Processing Plant | RUSSIAN FEDERATION |

| Gold | JSC Uralelectromed | RUSSIAN FEDERATION |

| Gold | JX Nippon Mining & Metals Co., Ltd. | JAPAN |

| Gold | Kazakhmys Smelting LLC | KAZAKHSTAN |

| Gold | Kazzinc | KAZAKHSTAN |

| Gold | Kennecott Utah Copper LLC | UNITED STATES OF AMERICA |

| Gold | Kojima Chemicals Co., Ltd. | JAPAN |

| Gold | Kyrgyzaltyn JSC | KYRGYZSTAN |

| Gold | L'azurde Company For Jewelry | SAUDI ARABIA |

| Gold | Lingbao Gold Co., Ltd. | CHINA |

| Gold | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | CHINA |

| Gold | LS-NIKKO Copper Inc. | KOREA, REPUBLIC OF |

| Gold | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | CHINA |

| Gold | Materion | UNITED STATES OF AMERICA |

| Gold | Matsuda Sangyo Co., Ltd. | JAPAN |

| Gold | Metalor Technologies (Suzhou) Ltd. | CHINA |

| Gold | Metalor Technologies (Hong Kong) Ltd. | CHINA |

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | SINGAPORE |

| Gold | Metalor Technologies S.A. | SWITZERLAND |

| Gold | Metalor USA Refining Corporation | UNITED STATES OF AMERICA |

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V. | MEXICO |

| Gold | Mitsubishi Materials Corporation | JAPAN |

| Gold | Mitsui Mining and Smelting Co., Ltd. | JAPAN |

| Gold | Moscow Special Alloys Processing Plant | RUSSIAN FEDERATION |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | TURKEY |

| Gold | Navoi Mining and Metallurgical Combinat | UZBEKISTAN |

| Gold | Nihon Material Co., Ltd. | JAPAN |

| Gold | Ohura Precious Metal Industry Co., Ltd. | JAPAN |

| Gold | OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet) | RUSSIAN FEDERATION |

| Gold | PAMP S.A. | SWITZERLAND |

| Gold | Penglai Penggang Gold Industry Co., Ltd. | CHINA |

| Gold | Prioksky Plant of Non-Ferrous Metals | RUSSIAN FEDERATION |

| Gold | PT Aneka Tambang (Persero) Tbk | INDONESIA |

| Gold | PX Precinox S.A. | SWITZERLAND |

| Gold | Rand Refinery (Pty) Ltd. | SOUTH AFRICA |

| Gold | Royal Canadian Mint | CANADA |

| Gold | Sabin Metal Corp. | UNITED STATES OF AMERICA |

| Gold | Samduck Precious Metals | KOREA, REPUBLIC OF |

| Gold | Samwon Metals Corp. | KOREA, REPUBLIC OF |

| Gold | SEMPSA Joyeria Plateria S.A. | SPAIN |

| Gold | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | CHINA |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | CHINA |

| Gold | Sichuan Tianze Precious Metals Co., Ltd. | CHINA |

| Gold | SOE Shyolkovsky Factory of Secondary Precious Metals | RUSSIAN FEDERATION |

| Gold | Solar Applied Materials Technology Corp. | TAIWAN, PROVINCE OF CHINA |

| Gold | Sumitomo Metal Mining Co., Ltd. | JAPAN |

| Gold | Super Dragon Technology Co., Ltd. | TAIWAN, PROVINCE OF CHINA |

| Gold | Tanaka Kikinzoku Kogyo K.K. | JAPAN |

| Gold | Great Wall Precious Metals Co., Ltd. of CBPM | CHINA |

| Gold | Shandong Gold Smelting Co., Ltd. | CHINA |

| Gold | Tokuriki Honten Co., Ltd. | JAPAN |

| Gold | Tongling Nonferrous Metals Group Co., Ltd. | CHINA |

| Gold | Torecom | KOREA, REPUBLIC OF |

| Gold | Umicore S.A. Business Unit Precious Metals Refining | BELGIUM |

| Gold | United Precious Metal Refining, Inc. | UNITED STATES OF AMERICA |

| Gold | Valcambi S.A. | SWITZERLAND |

| Gold | Western Australian Mint (T/a The Perth Mint) | AUSTRALIA |

| Gold | Yamakin Co., Ltd. | JAPAN |

| Gold | Yokohama Metal Co., Ltd. | JAPAN |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | CHINA |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | CHINA |

| Gold | Morris and Watson | NEW ZEALAND |

| Gold | SAFINA A.S. | CZECHIA |

| Gold | Guangdong Jinding Gold Limited | CHINA |

| Gold | Umicore Precious Metals Thailand | THAILAND |

| Gold | Geib Refining Corporation | UNITED STATES OF AMERICA |

| Gold | MMTC-PAMP India Pvt., Ltd. | INDIA |

| Gold | KGHM Polska Miedz Spolka Akcyjna | POLAND |

| Gold | Fidelity Printers and Refiners Ltd. | ZIMBABWE |

| Gold | Singway Technology Co., Ltd. | TAIWAN, PROVINCE OF CHINA |

| Gold | Shandong Humon Smelting Co., Ltd. | CHINA |

| Gold | Shenzhen Zhonghenglong Real Industry Co., Ltd. | CHINA |

| Gold | Al Etihad Gold Refinery DMCC | UNITED ARAB EMIRATES |

| Gold | Emirates Gold DMCC | UNITED ARAB EMIRATES |

| Gold | International Precious Metal Refiners | UNITED ARAB EMIRATES |

| Gold | Kaloti Precious Metals | UNITED ARAB EMIRATES |

| Gold | Sudan Gold Refinery | SUDAN |

| Gold | T.C.A S.p.A | ITALY |

| Gold | REMONDIS PMR B.V. | NETHERLANDS |

| Gold | Fujairah Gold FZC | UNITED ARAB EMIRATES |

| Gold | Industrial Refining Company | BELGIUM |

| Gold | Shirpur Gold Refinery Ltd. | INDIA |

| Gold | Korea Zinc Co., Ltd. | KOREA, REPUBLIC OF |

| Gold | Marsam Metals | BRAZIL |

| Gold | TOO Tau-Ken-Altyn | KAZAKHSTAN |

| Gold | Abington Reldan Metals, LLC | UNITED STATES OF AMERICA |

| Gold | Shenzhen CuiLu Gold Co., Ltd. | CHINA |

| Gold | SAAMP | FRANCE |

| Gold | L'Orfebre S.A. | ANDORRA |

| Gold | 8853 S.p.A. | ITALY |

| Gold | Italpreziosi | ITALY |

| Gold | SAXONIA Edelmetalle GmbH | GERMANY |

| Gold | WIELAND Edelmetalle GmbH | GERMANY |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | AUSTRIA |

| Gold | AU Traders and Refiners | SOUTH AFRICA |

| Gold | GGC Gujrat Gold Centre Pvt. Ltd. | INDIA |

| Gold | Sai Refinery | INDIA |

| Gold | Modeltech Sdn Bhd | MALAYSIA |

| Gold | Bangalore Refinery | INDIA |

| Gold | Kyshtym Copper-Electrolytic Plant ZAO | RUSSIAN FEDERATION |

| Gold | Degussa Sonne / Mond Goldhandel GmbH | GERMANY |

| Gold | Pease & Curren | UNITED STATES OF AMERICA |

| Gold | JALAN & Company | INDIA |

| Gold | SungEel HiMetal Co., Ltd. | KOREA, REPUBLIC OF |

| Gold | Planta Recuperadora de Metales SpA | CHILE |

| Gold | ABC Refinery Pty Ltd. | AUSTRALIA |

| Gold | Safimet S.p.A | ITALY |

| Gold | State Research Institute Center for Physical Sciences and Technology | LITHUANIA |

| Gold | African Gold Refinery | UGANDA |

| Gold | Gold Coast Refinery | GHANA |

| Gold | NH Recytech Company | KOREA, REPUBLIC OF |

| Gold | QG Refining, LLC | UNITED STATES OF AMERICA |

| Gold | Dijllah Gold Refinery FZC | UNITED ARAB EMIRATES |

| Gold | CGR Metalloys Pvt Ltd. | INDIA |

| Gold | Sovereign Metals | INDIA |

| Gold | C.I Metales Procesados Industriales SAS | COLOMBIA |

| Gold | Eco-System Recycling Co., Ltd. North Plant | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. West Plant | JAPAN |

| Gold | Augmont Enterprises Private Limited | INDIA |

| Gold | Kundan Care Products Ltd. | INDIA |

| Gold | Emerald Jewel Industry India Limited (Unit 1) | INDIA |

| Gold | Emerald Jewel Industry India Limited (Unit 2) | INDIA |

| Gold | Emerald Jewel Industry India Limited (Unit 3) | INDIA |

| Gold | Emerald Jewel Industry India Limited (Unit 4) | INDIA |

| Gold | K.A. Rasmussen | NORWAY |

| Gold | Alexy Metals | UNITED STATES OF AMERICA |

| Gold | Sancus ZFS (L’Orfebre, SA) | COLOMBIA |

| Gold | Sellem Industries Ltd. | MAURITANIA |

| Gold | MD Overseas | INDIA |

| Gold | Metallix Refining Inc. | UNITED STATES OF AMERICA |

| Gold | Metal Concentrators SA (Pty) Ltd. | SOUTH AFRICA |

| Gold | WEEEREFINING | FRANCE |

| Gold | Value Trading | BELGIUM |

| Gold | Gold by Gold Colombia | COLOMBIA |

| Gold | Dongwu Gold Group | CHINA |

| Tantalum | Changsha South Tantalum Niobium Co., Ltd. | CHINA |

| Tantalum | Exotech Inc. | UNITED STATES OF AMERICA |

| Tantalum | F&X Electro-Materials Ltd. | CHINA |

| Tantalum | XIMEI RESOURCES (GUANGDONG) LIMITED | CHINA |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | CHINA |

| Tantalum | Jiujiang Tanbre Co., Ltd. | CHINA |

| Tantalum | AMG Brasil | BRAZIL |

| Tantalum | Metallurgical Products India Pvt., Ltd. | INDIA |

| Tantalum | Mineracao Taboca S.A. | BRAZIL |

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | JAPAN |

| Tantalum | NPM Silmet AS | ESTONIA |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | CHINA |

| Tantalum | QuantumClean | UNITED STATES OF AMERICA |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | CHINA |

| Tantalum | Solikamsk Magnesium Works OAO | RUSSIAN FEDERATION |

| Tantalum | Taki Chemical Co., Ltd. | JAPAN |

| Tantalum | Telex Metals | UNITED STATES OF AMERICA |

| Tantalum | Ulba Metallurgical Plant JSC | KAZAKHSTAN |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | CHINA |

| Tantalum | D Block Metals, LLC | UNITED STATES OF AMERICA |

| Tantalum | FIR Metals & Resource Ltd. | CHINA |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | CHINA |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | CHINA |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | CHINA |

| Tantalum | KEMET de Mexico | MEXICO |

| Tantalum | TANIOBIS Co., Ltd. | THAILAND |

| Tantalum | TANIOBIS GmbH | GERMANY |

| Tantalum | H.C. Starck Hermsdorf GmbH | GERMANY |

| Tantalum | H.C. Starck Inc. | UNITED STATES OF AMERICA |

| Tantalum | TANIOBIS Japan Co., Ltd. | JAPAN |

| Tantalum | TANIOBIS Smelting GmbH & Co. KG | GERMANY |

| Tantalum | Global Advanced Metals Boyertown | UNITED STATES OF AMERICA |

| Tantalum | Global Advanced Metals Aizu | JAPAN |

| Tantalum | Resind Industria e Comercio Ltda. | BRAZIL |

| Tantalum | Jiangxi Tuohong New Raw Material | CHINA |

| Tantalum | RFH Yancheng Jinye New Material Technology Co., Ltd. | CHINA |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | CHINA |

| Tin | Alpha | UNITED STATES OF AMERICA |

| Tin | PT Aries Kencana Sejahtera | INDONESIA |

| Tin | Dowa | JAPAN |

| Tin | EM Vinto | BOLIVIA (PLURINATIONAL STATE OF) |

| Tin | Estanho de Rondonia S.A. | BRAZIL |

| Tin | Fenix Metals | POLAND |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | CHINA |

| Tin | Gejiu Zili Mining And Metallurgy Co., Ltd. | CHINA |

| Tin | Gejiu Kai Meng Industry and Trade LLC | CHINA |

| Tin | China Tin Group Co., Ltd. | CHINA |

| Tin | Malaysia Smelting Corporation (MSC) | MALAYSIA |

| Tin | Metallic Resources, Inc. | UNITED STATES OF AMERICA |

| Tin | Mineracao Taboca S.A. | BRAZIL |

| Tin | Minsur | PERU |

| Tin | Mitsubishi Materials Corporation | JAPAN |

| Tin | Jiangxi New Nanshan Technology Ltd. | CHINA |

| Tin | Novosibirsk Processing Plant Ltd. | RUSSIAN FEDERATION |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | THAILAND |

| Tin | Operaciones Metalurgicas S.A. | BOLIVIA (PLURINATIONAL STATE OF) |

| Tin | PT Artha Cipta Langgeng | INDONESIA |

| Tin | PT Babel Inti Perkasa | INDONESIA |

| Tin | PT Babel Surya Alam Lestari | INDONESIA |

| Tin | PT Belitung Industri Sejahtera | INDONESIA |

| Tin | PT Bukit Timah | INDONESIA |

| Tin | PT Mitra Stania Prima | INDONESIA |

| Tin | PT Panca Mega Persada | INDONESIA |

| Tin | PT Prima Timah Utama | INDONESIA |

| Tin | PT Refined Bangka Tin | INDONESIA |

| Tin | PT Sariwiguna Binasentosa | INDONESIA |

| Tin | PT Stanindo Inti Perkasa | INDONESIA |

| Tin | PT Timah Tbk Kundur | INDONESIA |

| Tin | PT Timah Tbk Mentok | INDONESIA |

| Tin | PT Timah Nusantara | INDONESIA |

| Tin | PT Tinindo Inter Nusa | INDONESIA |

| Tin | PT Tommy Utama | INDONESIA |

| Tin | Rui Da Hung | TAIWAN, PROVINCE OF CHINA |

| Tin | Soft Metais Ltda. | BRAZIL |

| Tin | Thaisarco | THAILAND |

| Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | CHINA |

| Tin | VQB Mineral and Trading Group JSC | VIET NAM |

| Tin | White Solder Metalurgia e Mineracao Ltda. | BRAZIL |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | CHINA |

| Tin | Tin Smelting Branch of Yunnan Tin Co., Ltd. | CHINA |

| Tin | CV Venus Inti Perkasa | INDONESIA |

| Tin | Magnu's Minerais Metais e Ligas Ltda. | BRAZIL |

| Tin | PT Tirus Putra Mandiri | INDONESIA |

| Tin | Melt Metais e Ligas S.A. | BRAZIL |

| Tin | PT ATD Makmur Mandiri Jaya | INDONESIA |

| Tin | O.M. Manufacturing Philippines, Inc. | PHILIPPINES |

| Tin | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company | VIET NAM |

| Tin | Nghe Tinh Non-Ferrous Metals Joint Stock Company | VIET NAM |

| Tin | Tuyen Quang Non-Ferrous Metals Joint Stock Company | VIET NAM |

| Tin | PT Cipta Persada Mulia | INDONESIA |

| Tin | An Vinh Joint Stock Mineral Processing Company | VIET NAM |

| Tin | Resind Industria e Comercio Ltda. | BRAZIL |

| Tin | Super Ligas | BRAZIL |

| Tin | Metallo Belgium N.V. | BELGIUM |

| Tin | Metallo Spain S.L.U. | SPAIN |

| Tin | PT Sukses Inti Makmur | INDONESIA |

| Tin | Thai Nguyen Mining and Metallurgy Co., Ltd. | VIET NAM |

| Tin | PT Menara Cipta Mulia | INDONESIA |

| Tin | HuiChang Hill Tin Industry Co., Ltd. | CHINA |

| Tin | Modeltech Sdn Bhd | MALAYSIA |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | CHINA |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | CHINA |

| Tin | PT Bangka Serumpun | INDONESIA |

| Tin | Pongpipat Company Limited | MYANMAR |

| Tin | Tin Technology & Refining | UNITED STATES OF AMERICA |

| Tin | Dongguan CiEXPO Environmental Engineering Co., Ltd. | CHINA |

| Tin | Ma'anshan Weitai Tin Co., Ltd. | CHINA |

| Tin | PT Masbro Alam Stania | INDONESIA |

| Tin | PT Rajawali Rimba Perkasa | INDONESIA |

| Tin | Luna Smelter, Ltd. | RWANDA |

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd. | CHINA |

| Tin | Precious Minerals and Smelting Limited | INDIA |

| Tin | Gejiu City Fuxiang Industry and Trade Co., Ltd. | CHINA |

| Tin | PT Mitra Sukses Globalindo | INDONESIA |

| Tin | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda | BRAZIL |

| Tin | CRM Synergies | SPAIN |

| Tin | Fabrica Auricchio Industria e Comercio Ltda. | BRAZIL |

| Tin | PT Putera Sarana Shakti (PT PSS) | INDONESIA |

| Tungsten | A.L.M.T. Corp. | JAPAN |

| Tungsten | Kennametal Huntsville | UNITED STATES OF AMERICA |

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | CHINA |

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | CHINA |

| Tungsten | CNMC (Guangxi) PGMA Co., Ltd. | CHINA |

| Tungsten | Global Tungsten & Powders Corp. | UNITED STATES OF AMERICA |

| Tungsten | Hunan Chenzhou Mining Co., Ltd. | CHINA |

| Tungsten | Hunan Chunchang Nonferrous Metals Co., Ltd. | CHINA |

| Tungsten | Japan New Metals Co., Ltd. | JAPAN |

| Tungsten | Ganzhou Huaxing Tungsten Products Co., Ltd. | CHINA |

| Tungsten | Kennametal Fallon | UNITED STATES OF AMERICA |

| Tungsten | Wolfram Bergbau und Hutten AG | AUSTRIA |

| Tungsten | Xiamen Tungsten Co., Ltd. | CHINA |

| Tungsten | Jiangxi Minmetals Gao'an Non-ferrous Metals Co., Ltd. | CHINA |

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | CHINA |

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | CHINA |

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | CHINA |

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | CHINA |

| Tungsten | Malipo Haiyu Tungsten Co., Ltd. | CHINA |

| Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | CHINA |

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | CHINA |

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | CHINA |

| Tungsten | Asia Tungsten Products Vietnam Ltd. | VIET NAM |

| Tungsten | Chenzhou Diamond Tungsten Products Co., Ltd. | CHINA |

| Tungsten | H.C. Starck Tungsten GmbH | GERMANY |

| Tungsten | TANIOBIS Smelting GmbH & Co. KG | GERMANY |

| Tungsten | Masan High-Tech Materials | VIET NAM |

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | CHINA |

| Tungsten | Niagara Refining LLC | UNITED STATES OF AMERICA |

| Tungsten | China Molybdenum Tungsten Co., Ltd. | CHINA |

| Tungsten | Ganzhou Haichuang Tungsten Co., Ltd. | CHINA |

| Tungsten | Hydrometallurg, JSC | RUSSIAN FEDERATION |

| Tungsten | Unecha Refractory metals plant | RUSSIAN FEDERATION |

| Tungsten | Philippine Chuangxin Industrial Co., Inc. | PHILIPPINES |

| Tungsten | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. | CHINA |

| Tungsten | ACL Metais Eireli | BRAZIL |

| Tungsten | Moliren Ltd. | RUSSIAN FEDERATION |

| Tungsten | KGETS Co., Ltd. | KOREA, REPUBLIC OF |

| Tungsten | Fujian Ganmin RareMetal Co., Ltd. | CHINA |

| Tungsten | Lianyou Metals Co., Ltd. | TAIWAN, PROVINCE OF CHINA |

| Tungsten | JSC "Kirovgrad Hard Alloys Plant" | RUSSIAN FEDERATION |

| Tungsten | NPP Tyazhmetprom LLC | RUSSIAN FEDERATION |

| Tungsten | Jingmen Dewei GEM Tungsten Resources Recycling Co., Ltd. | CHINA |

| Tungsten | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. | BRAZIL |

| Tungsten | Cronimet Brasil Ltda | BRAZIL |

| Tungsten | Artek LLC | RUSSIAN FEDERATION |

| Tungsten | Fujian Xinlu Tungsten | CHINA |

| Tungsten | OOO “Technolom” 2 | RUSSIAN FEDERATION |

| Tungsten | OOO “Technolom” 1 | RUSSIAN FEDERATION |

Annex II –Reported Country of Origin

Based on our due diligence, the above smelters or refiners may process Conflict Minerals from one or more of the following countries of origin:

| Reported Smelter or Refiner Country |

| ANDORRA |

| AUSTRALIA |

| AUSTRIA |

| BELGIUM |

| BOLIVIA (PLURINATIONAL STATE OF) |

| BRAZIL |

| CANADA |

| CHILE |

| CHINA |

| COLOMBIA |

| CZECHIA |

| ESTONIA |

| FRANCE |

| GERMANY |

| GHANA |

| INDIA |

| INDONESIA |

| ITALY |

| JAPAN |

| KAZAKHSTAN |

| KOREA, REPUBLIC OF |

| KYRGYZSTAN |

| LITHUANIA |

| MALAYSIA |

| MAURITANIA |

| MEXICO |

| MYANMAR |

| NETHERLANDS |

| NEW ZEALAND |

| NORWAY |

| PERU |

| PHILIPPINES |

| POLAND |

| PORTUGAL |

| RUSSIAN FEDERATION |

| RWANDA |

| SAUDI ARABIA |

| SINGAPORE |

| SOUTH AFRICA |

| SPAIN |

| SUDAN |

| SWEDEN |

| SWITZERLAND |

| TAIWAN, PROVINCE OF CHINA |

| THAILAND |

| TURKEY |

| UGANDA |

| UNITED ARAB EMIRATES |

| UNITED STATES OF AMERICA |

| Unknown |

| UZBEKISTAN |

| VIET NAM |

| ZIMBABWE |