UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. ____)

| Filed by the Registrant | [X] | |

| Filed by a Party other than the Registrant | [ ] | |

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Rule 14a-12 |

EXCELSIOR MULTI-STRATEGY HEDGE FUND OF FUNDS, LLC

|

| (Name of Registrants as Specified in Charter) |

| |

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrants) |

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: | | |

| | (2) | Aggregate number of securities to which transaction applies: | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated | |

| | | and state how it was determined): | | |

| | (4) | Proposed maximum aggregate value of transaction: | | |

| | (5) | Total fee paid: | | |

| | | | | | | | | |

| [ ] | Fee previously paid with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: | | |

| | (2) | Form, schedule or registration statement no.: | | |

| | (3) | Filing party: | | |

| | (4) | Date filed: | | |

| | | | | | | |

EXCELSIOR MULTI-STRATEGY HEDGE FUND OF FUNDS, LLC

(the "Fund")

One Bryant Park

New York, NY 10036

February [ ], 2015

Dear Member:

I am writing to inform you of a Special Meeting (the "Meeting") of Members of the Fund ("Members") that will be held on March 25, 2015 at the offices of the Fund, One Bryant Park, [10th Floor], New York, NY 10036, at [11:00 a.m.] (Eastern Time). The formal notice of the Meeting and related materials are enclosed. At the Meeting, Members will vote on a proposal to approve a new investment advisory agreement between the Fund and Pine Grove Asset Management LLC (as renamed in the near term to highlight that it forms part of the Man FRM investment division of Man Group plc, "FRM USA"), an indirect wholly-owned subsidiary of Man Group plc ("Man Group"), pursuant to which FRM USA would replace Merrill Lynch Alternative Investments LLC ("MLAI") as the investment adviser of the Fund (the "New Advisory Agreement").

On December 8, 2014, MLAI entered into an Asset Purchase Agreement (the "Purchase Agreement") with Man Principal Strategies Corp. ("MPSC"), a wholly-owned subsidiary of Man Group. Man Group is a global alternative asset manager with $72.3 billion in total funds under management as of September 30, 2014. Under the Purchase Agreement, MLAI agreed to sell to MPSC certain assets relating to the management and operation of various funds of hedge funds currently managed by MLAI, including assets relating to the management and operations of the Fund, subject to the satisfaction of certain conditions (the "Transaction"). MLAI's decision to sell these assets was based on its determination that serving as the investment adviser of funds of hedge funds is no longer consistent with MLAI's primary business focus. Man Group was selected by MLAI as the purchaser of MLAI's funds of hedge funds management business based on Man Group's interest in purchasing that business and following a due diligence process that assessed the investment expertise of Man Group, the quality of Man Group's personnel and investment process and its ability to service investors.

In November 2014, MLAI advised the Board of Managers of the Fund (the "Board") of its decision to sell its funds of hedge funds business and of its belief that it would be in the best interests of the Fund and Members for FRM USA to assume the role of investment adviser of the Fund. This proposal was thereafter carefully considered by the Board, and at a meeting of the Board held on February 10, 2015, the Board approved a new investment advisory agreement for the Fund with FRM USA pursuant to which FRM USA would serve as the Fund's investment adviser (the "New Advisory Agreement"). To become effective, the New Advisory Agreement must be approved by Members in accordance with the requirements of the Investment Company Act of 1940 (the "1940 Act").

The Board approved the New Advisory Agreement after giving consideration to all relevant factors and based, in part, on its review of the nature, scope and quality of services that are expected to be provided to the Fund by FRM USA. The New Advisory Agreement will become effective only if it is approved by the vote of a "majority of the outstanding voting securities" of the Fund, as defined by the 1940 Act. The terms of the New Advisory Agreement are materially the same as those of the Fund's current investment advisory agreement with MLAI (the "Current Advisory Agreement"), except for the dates of its effectiveness and expiration of its initial two-year term and except for the fact that FRM USA (rather than MLAI) will serve as the Fund's investment adviser.There will be no change in the investment advisory fee payable by the Fund, nor any expected increase in the expenses of the Fund as a result of the New Advisory Agreement. In addition, FRM USA has advised the Board that it does not expect to propose any change to the investment objective or investment policies of the Fund or otherwise to implement any material changes in the Fund's investment program.

If the New Advisory Agreement is approved at the Meeting (or any adjournment thereof), it will become effective upon consummation of the Transaction. In the event that Members do not approve the New Advisory Agreement, MLAI will continue to serve as the Fund's investment adviser in accordance with the Current Advisory Agreement and, in such event, MLAI and the Board will consider other options with respect to the management of the Fund.

The enclosed Proxy Statement, which you should read carefully, provides more detailed information about the proposal that will be acted upon at the Meeting and solicits your proxy to be voted at the Meeting.

The Board unanimously recommends that you vote "For" approval of the New Advisory Agreement.

You may vote at the Meeting if you were a Member of record of the Fund as of the close of business on February 2, 2015. Whether or not you plan to attend the Meeting, you can vote in one of three ways: (i) by marking, signing and returning the enclosed proxy card in the enclosed prepaid envelope; (ii) via the Internet at www.proxyvote.com and following the on-screen directions; or (iii) by using your touch-tone telephone. (Please see the enclosed information, as well as your proxy card, for additional instructions on how to vote.) You may also vote in person at the Meeting. Please call (855) 928-4484 for directions if you are planning to attend the Meeting. If you vote by Internet or by telephone, you do not need to mail your proxy card. If after voting you want to change your vote, you may do so by submitting a new proxy card, by submitting a new vote by touch-tone telephone or the Internet, or by revoking your proxy and voting in person at the Meeting.

Please call us at (866) 637-2587 if you have any questions regarding voting procedures.

It is important that your vote be represented. Please mark, sign and date the enclosed proxy card and return it in the envelope provided by mail or vote using the Internet or touch-tone telephone.

Thank you for your confidence and support.

| | Very truly yours, | |

| | | |

| | /s/ Marina Belaya | |

| | Name: | Marina Belaya | |

| | Title: | Secretary | |

EXCELSIOR MULTI-STRATEGY HEDGE FUND OF FUNDS, LLC

(the "Fund")

One Bryant Park

New York, NY 10036

NOTICE OF SPECIAL MEETING OF MEMBERS

To be Held on March 25, 2015

To Members:

A Special Meeting of Members of the Fund ("Members") will be held on March 25, 2015 at [11:00 a.m.] (Eastern Time) at the offices of the Fund, One Bryant Park, [10th Floor], New York, NY 10036 (the "Meeting").

The Meeting has been called to approve a new Investment Advisory Agreement (the "New Advisory Agreement") between the Fund and Pine Grove Asset Management LLC (as renamed in the near term to highlight that it forms part of the Man FRM investment division of Man Group plc, "FRM USA"). This proposal is discussed in greater detail in the accompanying Proxy Statement.

You may vote at the Meeting if you were a Member of record of the Fund as of the close of business on February 2, 2015. If you attend the Meeting, you may vote in person. If you would like to attend the Meeting in person, please obtain directions by calling (855) 928-4484. Members who do not expect to attend the Meeting are urged to vote in one of three ways: (i) by marking, signing and returning the enclosed proxy card in the enclosed prepaid envelope; (ii) via the Internet at www.proxyvote.com and following the on-screen directions; or (iii) by using your touch-tone telephone. Signed but unmarked proxy cards will be counted in determining whether a quorum is present at the Meeting and will be voted "For" approval of the New Advisory Agreement and, in the discretion of the persons named as proxies, in connection with any other matters that may properly come before the Meeting or any adjournment thereof.

The Proxy Statement accompanying this Notice is also available along with the proxy card and any other proxy materials at www.proxyvote.com by entering the control number that appears on your proxy card.

The Fund will furnish, without charge, copies of its most recent annual and semi-annual reports to Members upon request. To request copies of these reports, please call (866) 637-2587 or write to Merrill Lynch Alternative Investments LLC, One Bryant Park, New York, NY 10036. You may also view or obtain these reports from the Securities and Exchange Commission (the "SEC"): (i) in person: at the SEC's Public Reference Room in Washington, D.C.; (ii) by phone: 1-800-SEC-0330; (iii) by mail: Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549 (duplicating fee required); (iv) by e-mail: publicinfo@sec.gov; or (v) by Internet: www.sec.gov.

If you have any questions, please call the Fund at (866) 637-2587.

By Order of the

Board of Managers

Each Member's vote is important. The Meeting may be adjourned without conducting any business if a quorum is not present. In the event that a quorum is not present at the Meeting or if a quorum is present but sufficient votes to approve the New Advisory Agreement are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies.

Your vote could be critical to enable the Fund to hold the Meeting as scheduled, so please vote in one of three ways: (i) by marking, signing and returning the enclosed proxy card in the enclosed prepaid envelope; (ii) via the Internet at www.proxyvote.com and following the on-screen directions; or (iii) by using your touch-tone telephone. Please see your proxy card for additional instructions on how to vote.

EXCELSIOR MULTI-STRATEGY HEDGE FUND OF FUNDS, LLC

(the "Fund")

One Bryant Park

New York, NY 10036

SPECIAL MEETING OF MEMBERS

To Be Held on March 25, 2015

PROXY STATEMENT

This Proxy Statement is being furnished to members of the Fund ("Members") by the Board of Managers of the Fund (the "Board"). The Board is requesting your proxy for use at a Special Meeting of Members (the "Meeting") to be held at the offices of the Fund, One Bryant Park, 10th Floor, New York, NY 10036, on March 25, 2015 at [11:00 a.m.] (Eastern Time). Your proxy may also be voted at any adjournment of the Meeting.

At the Meeting, Members will vote on a proposal (the "Proposal") to approve a new investment advisory agreement for the Fund (the "New Advisory Agreement") with [Pine Grove Asset Management LLC] (as renamed in the near term to highlight that it forms part of the Man FRM investment division of Man Group plc, "FRM USA"), an indirect wholly-owned subsidiary of Man Group plc ("Man Group"). In addition to soliciting proxies by mail, officers of Merrill Lynch Alternative Investments LLC ("MLAI"), the Fund's current investment adviser, and personnel of MLAI's affiliates may solicit proxies by telephone or in person, without special compensation. MLAI has retained Broadridge Financial Solutions, Inc. ("Broadridge"), a third-party solicitor, to solicit proxies from Members. Broadridge may solicit proxies in person, by Internet or by telephone. The fees and expenses of the proxy solicitor (which are expected to be approximately $5,000), as well as all other costs associated with the solicitation and preparation of the Proxy Statement and with the Meeting, are being paid by both Man Group and MLAI.]

All properly executed proxies received before the Meeting will be voted at the Meeting and any adjournment thereof in accordance with the instructions marked thereon or otherwise as provided therein.If no instructions are marked, proxies will be voted "For" the Proposal and will be voted in accordance with the judgment of the persons appointed as proxies on any other matters that may properly come before the Meeting or any adjournment thereof.Members who execute proxies retain the right to revoke them in person at the Meeting or by written notice received by the Fund at any time before they are voted. Proxies given by telephone or over the Internet may be revoked at any time before they are voted in the same manner that proxies submitted by mail may be revoked. In addition, you may revoke your proxy by voting in person at the Meeting. See "Voting Information – Revocation of Proxies and Abstentions."

If a quorum is not present at the Meeting or if a quorum is present but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. See "Voting Information – Adjournments."

The close of business on February 2, 2015 has been fixed as the record date (the "Record Date") for the determination of Members entitled to notice of and to vote at the Meeting and any adjournment thereof.

Members are entitled to onevote with respect to each unit of limited liability company interest of the Fund (a "Unit") held by the Member as of the Record Date (and a proportionate fractional vote in the case of fractional Units).As of the close of business on the Record Date, the Fund had 170,723.98 outstanding Units.

This Proxy Statement is first being mailed to Members on or about February [ ], 2015.

Copies of the Fund's most recent annual report and semi-annual report are available upon request, without charge, by calling (866) 637-2587 or by writing to MLAI, One Bryant Park, New York, NY 10036. You may also view or obtain these reports from the Securities and Exchange Commission (the "SEC"): (i) in person: at the SEC's Public Reference Room in Washington, D.C.; (ii) by phone: 1-800-SEC-0330; (iii) by mail: Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549 (duplicating fee required); (iv) by e-mail: publicinfo@sec.gov; or (v) by Internet: www.sec.gov.

Information regarding persons known to own five percent or more of Units and information regarding the ownership of Units by persons serving on the Board ("Managers") is contained in Exhibit 1.

Important Notice Regarding the Availability of Proxy Materials for Special Meeting of Members To Be Held on March 25, 2015

The following materials and information relating to this Proxy Statement are available at www.proxyvote.com by entering the control number that appears on your proxy card: (i) the Proxy Statement and accompanying Notice of Special Meeting of Members; (ii) proxy cards and any other proxy materials; (iii) information on how to obtain directions to attend the Meeting in person; and (iv) a copy of the Fund's Annual Report to Members for the fiscal year ended March 31, 2014 and a copy of the Fund's Semi-Annual Report to Members for the semi-annual period ended September 30, 2014.

Table of Contents

Page

| I. | Proposal: Approval of a New Investment Advisory Agreement | 1 |

| | | |

| II. | Voting Information | 8 |

| | | |

| III. | Other Matters and Additional Information | 9 |

I.Proposal: Approval of a New Investment Advisory Agreement.

After a review of the nature and goals of its business, MLAI recently determined to limit the focus of its alternative investments business on providing advice, guidance and distribution services relating to hedge funds and funds of hedge funds, and to cease providing investment advice to or managing funds of hedge funds. Following that determination, MLAI sought to identify a buyer for its assets relating to the management and operation of funds of hedge funds. Man Group was selected by MLAI as the purchaser of MLAI's funds of hedge funds management business based on Man Group's interest in purchasing that business and following a due diligence process that assessed the investment expertise of Man Group, the quality of Man Group's personnel and investment process and its ability to service investors. Thereafter, on December 8, 2014, MLAI entered into an Asset Purchase Agreement with Man Principal Strategies Corp. ("MPSC"), an indirect, wholly-owned subsidiary of Man Group, pursuant to which MLAI agreed to sell to MPSC certain assets relating to the management and operation of various funds of hedge funds, including the Fund, subject to the satisfaction of certain conditions (the "Transaction").

In November 2014, MLAI advised the Board of its decision to sell its funds of hedge funds business and of its belief that it would be in the best interests of the Fund and Members for FRM USA to assume the role of investment adviser of the Fund. This proposal was thereafter carefully considered by the Board, and at a meeting of the Board held on February 10, 2015, the Board approved the New Advisory Agreement pursuant to which FRM USA would provide the Fund with investment advisory services. To become effective, the New Advisory Agreement must be approved by Members in accordance with the requirements of the Investment Company Act of 1940 (the "1940 Act"). The terms of the New Advisory Agreement are materially the same as those of the Fund's current investment advisory agreement with MLAI (the "Current Advisory Agreement"), except for the dates of its effectiveness and expiration of its initial two-year term and except for the fact that FRM USA (rather than MLAI) will serve as the Fund's investment adviser. A copy of the New Advisory Agreement is contained in Exhibit 2 to this Proxy Statement.

There will be no change in the investment advisory fee payable by the Fund, nor any expected increase in the expenses of the Fund as a result of the New Advisory Agreement. In addition, FRM USA has advised the Board that it does not expect to propose any change to the investment objective or investment policies of the Fund or otherwise to implement any material changes in the Fund's investment program. FRM USA expects to propose that the Board approve a change in the name of the Fund and appoint new officers for the Fund, effective upon the effectiveness of the New Advisory Agreement.

The New Advisory Agreement was considered by the Board at meetings held on December 18, 2014 and February 10, 2015. At those meetings, the Board reviewed information relating to FRM USA and Man Group, including materials relating to FRM USA's business, personnel and financial resources, and met with and asked questions of senior personnel of FRM USA. The Board also reviewed the terms of the New Advisory Agreement.

The Board is currently comprised solely of persons who are not "interested persons," as defined by the 1940 Act, of the Fund or MLAI (the "Independent Managers"), and in connection with its deliberations regarding matters relating to the New Advisory Agreement and the Transaction, the Independent Managers were represented and assisted by independent legal counsel.

After careful consideration of various matters, and evaluation of all factors deemed relevant, which are described below under "Board Consideration of New Advisory Agreement," the New Advisory Agreement was unanimously approved by the Board at an in-person meeting held on February 10, 2015. The Board also approved the termination of the Current Advisory Agreement, effective upon the effectiveness of the New Advisory Agreement. If approved by Members, the New Advisory Agreement will become effective upon consummation of the Transaction, which is expected to occur on April 1, 2015 or as soon as practicable thereafter.

1940 Act Requirements.

Section 15(a) of the 1940 Act prohibits any person from serving as an investment adviser of a registered investment company, such as the Fund, except pursuant to a written contract that has been approved by the vote of a majority of the outstanding voting securities of the investment company. Therefore, the approval of the New Advisory Agreement by Members is required. If Members do not approve the New Advisory Agreement, MLAI will continue to serve as the Fund's investment adviser in accordance with the Current Advisory Agreement and, in such event, MLAI and the Board will consider other options with respect to the management of the Fund.

If the New Advisory Agreement is approved by Members, it will become effective and will have an initial term expiring two years from the date of its execution. The New Advisory Agreement may continue in effect from year to year after its initial term, provided that each such continuance is approved by: (i) the Board; or (ii) the vote of a majority of the outstanding voting securities (as defined by the 1940 Act) of the Fund; and that, in either event, such continuance also is approved by a majority of the Independent Managers, by vote cast in person at a meeting called for the purpose of voting on such approval.

FRM USA.

FRM USA was founded in 1994 as Pine Grove Associates, Inc., the predecessor entity to Pine Grove Asset Management LLC. Its first fund offering was incepted in January 1995. Since that date, FRM USA has launched a number of fund products, including the recently launched Pine Grove Alternative Fund family, which are closed-end management investment companies registered under the 1940 Act. Since inception, FRM USA has managed relative value and event driven fund of hedge fund portfolios.

On August 1, 2014, FRM USA was acquired by Man Group, creating one of the industry's largest hedge fund solution providers. FRM USA is now one of the principal entities that forms part of the Man FRM investment division of Man Group ("Man FRM"). Man FRM was founded in 1991 as a hedge fund research consultancy and in 1997 began managing outside capital in funds of hedge funds, with a focus on institutional clients. On July 17, 2012, Man FRM was acquired by Man Group. Today, Man FRM is one of the largest independent fund of hedge fund managers outside of the U.S., managing approximately $11.7 billion of assets (as of September 30, 2014) in multi-manager hedge fund portfolios. Man FRM services a large number of world-wide institutional quality investors and distribution partners. The offices of FRM USA are located at [25 Deforest Ave, Summit, NJ 07901]. [FRM USA is wholly-owned by MPSC, which is a wholly-owned subsidiary of Man Group plc.] Additional information about FRM USA is set forth in FRM USA's Form ADV.

The following chart sets forth the name, address and principal occupation of the senior professionals of FRM USA:

| Name* | Principal Occupation |

| Matthew Stadtmauer | President, FRM USA |

| Tom Williams | Chief Investment Officer, FRM USA |

| Nadine Le Gall | Chief Compliance Officer, Americas, FRM USA |

| Shiraz Kajee | Treasurer, FRM USA |

| Solomon Kuckelman | Secretary, FRM USA |

*The address of each individual listed is 452 Fifth Avenue, 27th Floor, New York, NY 10018.

Description of the New Advisory Agreement and Current Advisory Agreement.

MLAI (or a predecessor or affiliate of MLAI) has served as investment adviser of the Fund since commencement of the Fund's operations on October 1, 2000. The Current Advisory Agreement was approved by the Board at a meeting held on June 28, 2012 and by Members at a meeting held on December 27, 2012 in connection with a reorganization of the Fund and other feeder funds that had been investing substantially all of their assets into the Fund. The Current Advisory Agreement was continued in effect for an additional one-year term by action of the Board at a meeting held on June 19, 2014, prior to the expiration of its initial two-year term. Prior to December 31, 2013, Bank of America Capital Advisors LLC ("BACA"), which along with MLAI is an indirect wholly-owned subsidiary of Bank of America Corporation, served as the investment adviser of the Fund. As the successor of BACA, MLAI assumed all responsibilities for serving as the investment adviser of the Fund under the terms of the Current Advisory Agreement. The transfer of the advisory agreement from BACA to MLAI was not deemed to constitute an "assignment" of the Current Advisory Agreement.

The terms of the Current Advisory Agreement and the New Advisory Agreement are described generally below.

Advisory Services.Under the Current Advisory Agreement, MLAI is responsible for managing the investment activities of the Fund, subject to the supervision of the Board, in a manner consistent with the Fund's investment objective, policies and restrictions, and for determining the investments to be purchased, sold or otherwise disposed of by the Fund. The Current Advisory Agreement also requires MLAI to provide various other management, administrative and other services, including, among others: to supervise the entities retained to provide accounting, custody and other services to the Fund; to respond to inquiries of Members regarding their investments and account balances; to assist in the preparation and mailing of subscription materials to prospective investors and of reports and other information to Members; to assist in the preparation of regulatory filings; to monitor compliance with regulatory requirements; to review the accounting records of the Fund and to assist in the preparation of and review financial reports of the Fund; to review and arrange for the payment of Fund expenses; to coordinate and organize meetings of the Board and meetings of Members, and to prepare materials and reports for use at meetings of the Board; to assist the Fund in conducting repurchase offers; and to review subscription documents and to assist in the processing of subscriptions for Units. In addition, pursuant to the terms of the Current Advisory Agreement, MLAI provides the services of persons employed by MLAI to serve as officers of the Fund and assists the Fund in routine regulatory examinations and in responding to any litigation, investigations or regulatory matters. The New Advisory Agreement requires that FRM USA provide these same services.

Advisory Fee. In consideration of services provided by MLAI under the Current Advisory Agreement, the Fund pays MLAI a quarterly advisory fee (the "Advisory Fee") computed at the annual rate of 1.50% of the Fund's net assets determined as of the start of business on the first business day of each calendar quarter, after adjustment for any subscriptions effective on such date. The Advisory Fee is payable in arrears and will be pro rated in the event capital contributions or withdrawals of capital are made other than at the beginning or end of the quarter. The same fee will be payable to FRM USA under the New Advisory Agreement. For the fiscal year ended March 31, 2014, MLAI received $4,796,063.54 in advisory fees from the Fund.

Liability and Indemnification.The Current Advisory Agreement requires that MLAI use its best efforts in the supervision and management of the investment activities of the Fund and in providing services, but provides that, in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations, MLAI (and its directors, officers and employees and its affiliates, successors or other legal representatives) shall not be liable to the Fund for any error of judgment, for any mistake of law, for any act or omission by MLAI or any of its affiliates or for any loss suffered by the Fund. In addition, the Current Advisory Agreement requires that the Fund indemnify MLAI and its directors, officers or employees and their respective affiliates, executors, heirs, assigns, successors or other legal representatives against any and all costs, losses, claims, damages or liabilities, joint or several, including, without limitation, reasonable attorneys' fees and disbursements, resulting in any way from the performance or non-performance of any their duties with respect to the Fund, except those resulting from their willful malfeasance, bad faith or gross negligence or their reckless disregard of such duties, and in the case of criminal proceedings, unless they had reasonable cause to believe their actions unlawful. The provisions of the New Advisory Agreement relating to liability and indemnification are substantially the same as those of the Current Advisory Agreement.

Effective Date and Term. The Current Advisory Agreement had an initial term that expired on December 31, 2014, and continues in effect from year to year thereafter; provided that such continuance is approved at least annually (i) by the Board or by vote of a majority of the outstanding voting securities of the Fund, and (ii) by vote of a majority of the Independent Managers, cast in person at a meeting called for the purpose of voting on such approval. The provisions of the New Advisory Agreement relating to the term of effectiveness of the New Advisory Agreement are the same as those of the Current Advisory Agreement, except that the New Advisory Agreement will become effective upon consummation of the Transaction and will have an initial term expiring two years from the date of its execution.

Termination.The Fund has the right, at any time and without payment of any penalty, to terminate the Current Advisory Agreement upon sixty days' prior written notice to MLAI, either by majority vote of the Board or by the vote of a majority of the outstanding voting securities of the Fund (as defined by the 1940 Act). MLAI has a similar right to terminate the Current Advisory Agreement upon sixty days' prior written notice to the Fund. In addition, the Current Advisory Agreement provides for its automatic termination in the event of its assignment (to the extent required by the 1940 Act and the rules thereunder) unless such automatic termination is prevented by an exemptive order or rule of the SEC. The New Advisory Agreement has the same termination provisions.

Board Consideration of New Advisory Agreement.

In determining whether to approve the New Advisory Agreement and to recommend its approval by Members, the Board requested, received and considered all information it deemed reasonably necessary to evaluate and to assess the terms of the New Advisory Agreement and the qualifications and ability of FRM

USA to provide all necessary services to the Fund and to provide services of a quality comparable to the quality of services now provided to the Fund by MLAI. The Board, which is comprised solely of the Independent Managers, reviewed various materials furnished to it by FRM USA, including information regarding FRM USA, its affiliates and personnel, its experience in providing investment advisory services to funds of hedge funds (including those registered under the 1940 Act), its operations and its financial condition and resources. The Board also reviewed written evaluations from MLAI representatives, including from the Fund's chief compliance officer, of FRM USA's operational, legal and compliance capabilities, as well as other due diligence reports prepared by MLAI representatives initially for the review of MLAI's senior management. The Board held two in-person meetings and two telephonic conferences during which it discussed and considered the proposal to approve the New Advisory Agreement and to retain FRM USA as the investment adviser of the Fund. In connection with these deliberations, the Independent Managers were advised by and received assistance from independent counsel. They also met in executive sessions with their independent counsel to review the Proposal and to receive the advice of such counsel on various matters relating to the Proposal.

At its meetings to consider this matter, the Board met with representatives of FRM USA and discussed with them various matters relating to the operations of the Fund and FRM USA, including the plans of FRM USA relating to the management of the Fund's investment program and its intentions regarding the allocation of appropriate financial, operational and personnel resources to assure the quality of services provided to the Fund. The representatives of FRM USA provided information to the Independent Managers regarding and reviewed the experience and qualifications of FRM USA's key personnel who would be responsible for providing investment, accounting and compliance related services to the Fund and involved in the Fund's day-to-day operations, and those individuals made presentations to the Board. They advised the Board that, although changes in the Fund's investment portfolio are expected to be made to increase the diversification of the Fund's assets by adding alternative investment strategies which are currently not included in the portfolio and to reflect FRM USA's due diligence conclusions, FRM USA does not contemplate material changes to the Fund's multi-strategy investment program. Representatives of FRM USA responded to questions of the Independent Managers regarding these matters and the plans of FRM USA relating to the staffing and the resources that would be available to support the various functions required in connection with the Fund's operations (including investment selection, portfolio construction, operational due diligence, financial accounting and reporting, and regulatory and tax compliance).

The Board also met with representatives of MLAI who had conducted due diligence reviews of the operations of FRM USA and reviewed with such representatives their observations and findings regarding the experience, operations, systems, compliance infrastructure and staffing of FRM USA and the qualifications of FRM USA to serve as investment adviser of the Fund. The MLAI representatives responded to questions of the Independent Managers with respect to these matters.

Based on its review, which included consideration of the written materials provided to the Board, consideration of various commitments and assurances provided by representatives of FRM USA and MLAI, including, as described below, to add an experienced senior officer and undertake a comprehensive review to enhance operations and compliance capabilities in connection therewith and consideration of all other pertinent factors, including, but not limited to, those discussed in this Proxy Statement, the Board unanimously approved the New Advisory Agreement. In approving the New Advisory Agreement, the Board determined that at the time the transaction closes, if the commitments and assurances are fulfilled, FRM USA can be expected to provide all necessary investment advisory services to the Fund and to provide services of appropriate quality and also determined that the New Advisory Agreement will enable the Fund to continue to receive investment advisory and related services at a cost that is reasonable and appropriate. No single factor was considered in isolation in making this determination, nor was any single factor considered to be determinative to the Board's decision to

approve the New Advisory Agreement. The Board advised FRM USA and MLAI, and each agreed, that until the commitments and assurances are fulfilled, FRM USA will not assume its role replacing MLAI as the investment adviser to the Fund.

In considering the New Advisory Agreement, the Board evaluated the nature, extent and expected quality of operations and services to be provided by FRM USA to the Fund. The Board determined, in this regard, that FRM USA (as part of Man Group) and its personnel had significant experience in serving as the investment adviser of funds of hedge funds that pursue investment programs similar to that of the Fund. The Board carefully considered the fact that FRM USA has had more limited experience in providing investment advisory and other services to a 1940 Act registered fund of hedge funds, such as the Fund, and in operating a fund of hedge funds that is subject to 1940 Act regulatory and financial reporting requirements and to the provisions of the Internal Revenue Code applicable to "regulated investment companies." For this reason, the Board sought and obtained FRM USA's commitment to retain a chief financial officer for the Fund who is experienced in the financial reporting and tax requirements that apply to registered funds of hedge funds (which commitment has recently been fulfilled), and also the commitment of FRM USA to conduct reviews of its "regulated investment company" compliance and 1940 Act compliance program, which reviews will be conducted with the assistance of the Fund's proposed chief financial officer and chief compliance officer, respectively, together with Fund counsel, and to implement, prior to assuming the functions of investment adviser to the Fund, such additional policies and procedures as may be necessary to assure that the Fund continues to operate in compliance with all applicable regulatory and tax requirements. The Board also sought and obtained the assurance of MLAI that its personnel would be made available to FRM USA to provide appropriate assistance in the implementation of various procedures and controls relating to the Fund's operations and compliance similar to those currently employed by MLAI and requested that it be provided with a report, prior to the effectiveness of the New Advisory Agreement, confirming that FRM USA's commitments have been satisfied. After consideration of relevant information, and based on the commitments and assurances that have been provided by FRM USA and MLAI, the Board concluded that it was satisfied with the nature, expected quality and extent of services to be provided by FRM USA and determined that, subject to FRM USA fulfilling its commitments, the Fund can expect to receive the appropriate quality of services from FRM USA under the New Advisory Agreement.

The Board also considered the terms of the New Advisory Agreement and noted that the Current Advisory Agreement and the New Advisory Agreement are the same in all material respects and that there will be no change in the fees payable by the Fund for investment advisory services. In this regard, the Board compared the advisory fee payable by the Fund and overall expense level of the Fund to those of similar funds, including other funds of hedge funds advised by FRM USA and its affiliates ("FRM USA Funds"). Based on this review, the Board determined that the fees and expense ratio of the Fund can be expected to continue to be within the range of the fees and expense ratios of similar registered funds of hedge funds (giving consideration to both the management and performance-based fees and allocations paid by other funds).

The investment performance of FRM USA Funds that have investment programs similar to that of the Fund was also considered by the Board, and the historical performance of these funds was deemed to be acceptable. The anticipated costs of services to be provided and an estimate of the profits likely to be realized by FRM USA from its relationship with the Fund were also considered. The Board concluded in this regard that, given the scope of services required to be provided under the New Advisory Agreement and the estimates of the costs of providing such services provided to the Board by FRM USA, the expected profitability to FRM USA from its relationship with the Fund would not be so disproportionately large that it would bear no reasonable relationship to the services rendered. In addition, the Board considered the extent to which economies of scale in costs of providing services would be realized as the Fund grows and whether the fees payable to FRM USA pursuant to the New Advisory Agreement properly reflect these economies of scale for

the benefit of Members, although it concluded that such a determination can better be made by reviewing the profits realized by FRM USA from fees attributable to the Fund when, and if, there is significant growth in the total net assets of the Fund from the current level of net assets. The potential benefits to FRM USA of its relationship with the Fund were also considered. The Board also considered information relating to the financial condition and financial resources of FRM USA and Man Group and determined it relevant that, as part of Man Group, FRM USA can be expected to have the financial resources necessary to support and assure the quality of services provided to the Fund.

Based on its consideration of and determinations with respect to the foregoing information and factors, the Board unanimously determined to approve the New Advisory Agreement and determined to recommend that it be approved by Members.

Required Vote.

Approval of the New Advisory Agreement by Members requires the affirmative vote of a "majority of the outstanding voting securities" of the Fund, which, for this purpose, means the affirmative vote: (1) of 67% or more of Units present (in person or represented by proxy) at the Meeting, if the holders of more than 50% of outstanding Units are present or represented by proxy at the Meeting, or (2) more than 50% of outstanding Units, whichever is less. In the event that Members do not approve the New Advisory Agreement, MLAI will continue to serve as the Fund's investment adviser in accordance with the Current Advisory Agreement and, in such event, MLAI and the Board will consider other options with respect to the management of the Fund.

Additional Information.

Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPFS"), an affiliate of MLAI, serves as the Fund's placement agent and, in such capacity, offers Units to investors in a private placement. It is contemplated that, subject to approval by the Board and the Independent Managers, the Fund will enter into a new placement agent agreement with MLPFS which would become effective on or about the same time as of which the New Advisory Agreement becomes effective. The new placement agent agreement will be similar to agreements that MLPFS has entered into with other funds similar to the Fund that are registered under the 1940 Act that are managed by investment advisers that are not affiliates of MLPFS. It is expected that, under the new placement agent agreement, FRM USA will be obligated to pay from its own resources compensation to MLPFS that is comparable to the compensation paid to MLPFS by the investment advisers of other funds similar to the Fund that are registered under the 1940 Act. Generally, such compensation will be based on the value of Units held by customers and clients of MLPFS and its affiliates (including Bank of America and US Trust) in addition to post closing payments from MPSC based on the value of Units held by customers and clients of MLPFS and its affiliates. MLPFS is not compensated by the Fund for its services as placement agent. However, in connection with initial and additional investments, investors may be charged a placement fee (sales load) of up to 2.50% on Units placed by MLPFS. The new placement agreement is not subject to approval by Members.

THE BOARD UNANIMOUSLY RECOMMENDS THAT MEMBERS VOTE "FOR" THE PROPOSAL TO APPROVE THE NEW ADVISORY AGREEMENT.

II.Voting Information.

Proxy Solicitation

If you properly authorize your proxy through the Internet or telephonically, or by marking, executing and returning the enclosed proxy card, and your proxy is not subsequently revoked, your vote will be cast at the Meeting. If you give instructions, your votes will be cast in accordance with your instructions. If you return your signed proxy card without instructions, your vote will be castFOR the approval of the New Advisory Agreement. Your vote will be cast in the discretion of the proxy holders on any other matters that may properly come before the Meeting, including, but not limited to, proposing and/or voting on any adjournment of the Meeting.

Revocation of Proxies and Abstentions

A Member giving a proxy may revoke it at any time before it is exercised by: (i) submitting a written notice of revocation; (ii) submitting a subsequently executed proxy in writing or via the Internet; (iii) attending the Meeting and voting in person; or (iv) providing notice of revocation via the Internet or by touch-tone telephone.

If a proxy (i) is properly executed and returned marked with an abstention or (ii) represents a nominee "non-vote" (that is, a proxy from a broker or nominee indicating that such person has not received instructions from the beneficial owner or other person entitled to vote on a particular matter with respect to which the broker or nominee does not have discretionary power to vote) (collectively, "abstentions"), the Units represented thereby will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. If a proxy is properly executed and returned and is marked with an abstention, the proxy will not be voted on the Proposal. Abstentions will have the same effect as a vote "Against" the Proposal.

Quorum Requirements

A quorum of Members is necessary to properly convene the Meeting. The presence in person or by proxy of Members holding a majority of the Units outstanding as of the Record Date constitutes a quorum.

Adjournments

If a quorum is not present at the Meeting or if a quorum is present but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. The Meeting may be adjourned by action of Members present at such meeting in person or by proxy holding a majority of the Units eligible to be cast by such Members. If a quorum is present and an adjournment is proposed, the persons named as proxies will vote those all proxies they are entitled to vote in favor of such adjournment, except that proxies required to be voted "Against" the Proposal will be voted against such adjournment. At any adjourned Meeting at which a quorum is present, any business may be transacted that might have been transacted at the Meeting originally called.

III.Other Matters and Additional Information.

Investment Adviser, Placement Agent and Administrator

MLAI is a Delaware limited liability company and is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. MLAI is an indirect wholly-owned subsidiary of Bank of America Corporation, a financial holding company, which has its principal executive offices at 101 North Tryon Street, Charlotte, NC 28255. MLAI currently serves as the manager or investment adviser of registered investment companies and private investment companies. The offices of MLAI are located at Merrill Lynch Alternative Investments LLC, 250 Vesey Street, New York, NY 10080, and its telephone number is (646) 855-2180.

MLPFS serves as the placement agent for Units. Its offices are located at 4 World Financial Center, 250 Vesey Street, New York, New York 10080. UMB Fund Services, Inc. (the "Administrator") provides accounting and certain administrative and investor services to the Fund. The offices of the Administrator are located at 2225 Washington Blvd, Suite 300, Ogden, UT 84401.

Other Business at the Meeting

The Board does not intend to bring any matters before the Meeting other than as stated in this Proxy Statement and is not aware that any other matters will be presented for action at the Meeting. If any other matters properly come before the Meeting, it is the intention of the persons named as proxies to vote on such matters in accordance with their best judgment, unless specific restrictions have been given.

Future Member Proposals

Pursuant to rules adopted by the SEC under the Securities Exchange Act of 1934 (the "1934 Act"), Members may request inclusion in the Fund's proxy statement for a meeting of Members certain proposals for action that they intend to introduce at such meeting. Any Member proposals must be presented a reasonable time before the proxy materials for the next meeting of Members are sent to Members. The submission of a proposal does not guarantee its inclusion in the proxy statement and is subject to limitations under the 1934 Act. Because the Fund does not hold regular meetings of Members, no anticipated date for the next meeting of Members can be provided. Any Member wishing to present a proposal for inclusion in the proxy materials for the next meeting of Members should submit such proposal to the Fund's Secretary.

Communication with the Board

Members wishing to submit written communications to the Board should send their communications to the Secretary of the Fund at the principal office of the Fund. Any such communications received will be reviewed by the Board at its next regularly scheduled meeting.

Appraisal Rights

Members do not have any appraisal rights in connection with the Proposal.

Results of Voting

Members will be informed of the results of voting at the Meeting in the 2015 annual report of the Fund, which will be sent to Members on or before May 30, 2015.

Contacting the Fund

Members may contact the Fund by calling (866) 637-2587.

MEMBERS ARE REQUESTED TO MARK, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. ADDITIONAL PROCEDURES YOU MAY USE TO VOTE ARE DESCRIBED ON THE ENCLOSED PROXY CARD.

| | By Order of the Board of Managers | |

| | | |

| | /s/ Marina Belaya | |

| | Name: | Marina Belaya | |

| | Title: | Secretary | |

| | | | |

| | Dated: | February [ ], 2015 | |

EXHIBIT 1

To the knowledge of the Fund, the following are the only persons who owned of record or beneficially, five percent or more of outstanding Units, as of the Record Date:

| Name and Address of Owner | Amount of Outstanding Units | Percentage of Outstanding Units |

Mr. Sean Neary CO TUW FAY M SLOVER Bank of America One Commercial Place, 7th Floor Norfolk, VA 23510 | [ ] | 12.75% |

| | | |

Brian O'Donnel UW EUGENE HIGGINS CHAR TRUST NMA Bank of America 114 W 47th St NY8-114-08-05 New York, NY 10036-0000 | [ ] | 7.97% |

| | | |

As of the Record Date, the officers and Managers of the Fund as a group beneficially owned less than 1% of the outstanding Units.

EXHIBIT 2

FORM OF NEW ADVISORY AGREEMENT

INVESTMENT ADVISORY AGREEMENT

THIS INVESTMENT ADVISORY AGREEMENT (this "Agreement") is made and executed as of [●], by and between Excelsior Multi-Strategy Hedge Fund of Funds, LLC, a Delaware limited liability company (the "Fund"), and [Pine Grove Asset Management LLC], a Delaware limited liability company (the "Adviser").

WHEREAS, the Fund intends to continue to engage in business as a closed-end, non-diversified management investment company and is registered as such under the Investment Company Act of 1940, as amended (the "1940 Act");

WHEREAS, the Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and engages in the business of acting as an investment adviser;

WHEREAS, the Fund desires to retain the Adviser to render investment advisory services and to provide certain administrative services to the Fund in the manner and on the terms and conditions hereinafter set forth; and

WHEREAS, the Adviser desires to be retained to perform such services on said terms and conditions;

NOW, THEREFORE, in consideration of the terms and conditions hereinafter contained, the Fund and the Adviser agree as follows:

1. The Fund hereby retains the Adviser to:

(a) act as its investment adviser and, subject to the supervision and control of the Board of Managers of the Fund (the "Board"), manage the investment activities of the Fund as hereinafter set forth. Without limiting the generality of the foregoing, the Adviser shall: obtain and evaluate such information and advice relating to the economy, securities markets, and securities as it deems necessary or useful to discharge its duties hereunder; continuously manage the assets of the Fund in a manner consistent with the investment objective, policies and restrictions of the Fund, as set forth in the Confidential Memorandum of the Fund and as may be adopted from time to time by the Board, and applicable laws and regulations; determine the securities to be purchased, sold or otherwise disposed of by the Fund and the timing of such purchases, sales and dispositions; invest discrete portions of the Fund's assets (which may constitute, in the aggregate, all of the Fund's assets) in unregistered investment funds or other investment vehicles and registered investment companies ("Investment Funds"), which are managed by investment managers ("Investment Managers"), including Investment Managers for which separate investment vehicles have been created in which the Investment Managers serve as general partners or managing members and the Fund is the sole investor ("Sub-Funds") and Investment Managers who are retained to manage the Fund's assets directly through separate managed accounts (Investment Managers of Sub-Funds and of managed accounts are collectively referred to as "Subadvisors"), and take such further action, including the placing of purchase and sale orders and the voting of securities on behalf of the Fund, as the Adviser shall deem necessary or appropriate. The Adviser shall furnish to or place at the disposal of the Fund such of the information, evaluations, analyses and opinions formulated or obtained by the Adviser in the discharge of its duties as the Fund may, from time to time, reasonably request; and

(b) provide, and the Adviser hereby agrees to provide, certain management, administrative and other services to the Fund. Notwithstanding the appointment of the Adviser to provide such services hereunder, the Board shall remain responsible for supervising and controlling the management, business and affairs of the Fund. The management, administrative and other services to be provided by the Adviser shall include:

| (i) | the provision of office space, telephone and utilities; |

| (ii) | the provision of administrative and secretarial, clerical and other personnel as necessary to provide the services required to be provided under this Agreement; |

| (iii) | the general supervision of the entities which are retained by the Fund to provide administration, custody and other services to the Fund; |

| (iv) | the handling of investor inquiries regarding the Fund and providing them with information concerning their investments in the Fund and capital account balances; |

| (v) | monitoring relations and communications between investors and the Fund; |

| (vi) | assisting in the drafting and updating of disclosure documents relating to the Fund and assisting in the preparation of offering materials; |

| (vii) | maintaining and updating investor information, such as change of address and employment; |

| (viii) | assisting in the preparation and mailing of investor subscription documents and confirming the receipt of such documents and funds; |

| (ix) | assisting in the preparation of regulatory filings with the Securities and Exchange Commission and state securities regulators and other Federal and state regulatory authorities; |

| (x) | preparing reports to and other informational materials for members and assisting in the preparation of proxy statements and other member communications; |

| (xi) | monitoring compliance with regulatory requirements and with the Fund's investment objective, policies and restrictions as established by the Board; |

| (xii) | reviewing accounting records and financial reports of the Fund, assisting with the preparation of the financial reports of the Fund and acting as liaison with the Fund's accounting agent and independent auditors; |

| (xiii) | assisting in preparation and filing of tax returns; |

| (xiv) | coordinating and organizing meetings of the Board and meetings of the members of the Fund, in each case when called by such persons; |

| (xv) | preparing materials and reports for use in connection with meetings of the Board; |

| (xvi) | maintaining and preserving those books and records of the Fund not maintained by any subadvisers of the Fund or the Fund's administrator, accounting agent or custodian (which books and records shall be the property of the Fund and maintained and preserved as required by the 1940 Act and the rules thereunder and shall be surrendered to the Fund promptly upon request); |

| (xvii) | reviewing and arranging for payment of the expenses of the Fund; |

| (xviii) | assisting the Fund in conducting offers to members of the Fund to repurchase member interests; |

| (xix) | reviewing and approving all regulatory filings of the Fund required under applicable law; |

| (xx) | reviewing investor qualifications and subscription documentation and otherwise assisting in administrative matters relating to the processing of subscriptions for interests in the Fund; |

| (xxi) | providing the services of persons employed by the Adviser or its affiliates who may be appointed as officers of the Fund by the Board; and |

| (xxii) | assisting the Fund in routine regulatory examinations, and working closely with any counsel retained to represent the members of the Board who are not "interested persons," as defined by the 1940 Act and the rules thereunder (the ''Independent Managers") of the Fund in response to any litigation, investigations or regulatory matters. |

(c) invest excess cash of the Fund as the Adviser, in its discretion and subject to the investment objective and policies of the Fund and such policies as established by the Board, deems appropriate in short-term money market securities.

(d) borrow money as the Adviser, in its discretion and subject to the investment objective and policies of the Fund and such policies as established by the Board, deems necessary and appropriate for purposes of cash management.

2. Without limiting the generality of paragraph 1 hereof, the Adviser shall be authorized to open, maintain and close accounts in the name and on behalf of the Fund with brokers and dealers as it determines are appropriate; to select and place orders with brokers, dealers or other financial intermediaries for the execution, clearance or settlement of any transactions on behalf of the Fund on such terms as the Adviser considers appropriate and that are consistent with the policies of the Fund; and, subject to any policies adopted by the Board and to the provisions of applicable law, to agree to such commissions, fees and other charges on behalf of the Fund as it shall deem reasonable in the circumstances taking into account all such factors as it deems relevant (including the quality of research and other services made available to it even if such services are not for the exclusive benefit of the Fund and the cost of such services does not represent the lowest cost available) and shall be under no obligation to combine or arrange orders so as to obtain reduced charges unless otherwise required under the federal securities laws; to pursue and implement the investment policies and strategies of the Fund using a multi-manager strategy whereby some or all of the Fund's assets may be committed from time to time by the Adviser to the discretionary management of one or more Subadvisors, the selection of which shall be subject to the approval of the Board of Managers in accordance with requirements of the 1940 Act and the approval of a majority (as defined in the 1940 Act) of the Fund's outstanding voting securities, unless the Fund receives an exemption from the provisions of the 1940 Act requiring such approval by security holders; and to identify appropriate Subadvisors, assess the most appropriate investment vehicles (general or limited partnerships, separate managed accounts or other investment vehicles (pooled or otherwise), and determine the assets to be committed to each Subadvisor. The Adviser may, subject to such procedures as may be adopted by the Board, use affiliates of the Adviser as brokers to effect the Fund's securities transactions and the Fund may pay such commissions to such brokers in such amounts as are permissible under applicable law.

3.Management Fee; Expenses; Administrative Fee

(a) In consideration for the provision by the Adviser of its services hereunder and the Adviser's bearing of certain expenses, the Fund will pay the Adviser a quarterly fee of 0.375% (1.50% on an annualized basis) of the Fund's "Net Assets" (the "Management Fee"). "Net Assets" shall equal the total value of all assets of the Fund, less an amount equal to all accrued debts, liabilities and obligations of the Fund calculated before giving effect to any repurchases of interests.

(b) The Management Fee will be computed based on the Net Assets as of the start of business on the first business day of each calendar quarter, after adjustment for any subscriptions effective on such date, and will be due and payable in arrears within five business days after the end of such calendar quarter. In the event that the Management Fee is payable in respect of a partial quarter, or in the event of contributions or withdrawals of capital to the Fund other than at the beginning or end of a quarter, such fee will be appropriatelypro-rated.

(c) The Adviser is responsible for all costs and expenses associated with the provision of its services hereunder including, but not limited to: expenses relating to the selection and monitoring of Investment Managers; fees of consultants retained by the Adviser; and expenses relating to qualifying potential investors and reviewing subscription documents. The Adviser shall, at its own expense, maintain such staff and employ or retain such personnel and consult with such other persons as may be necessary to render the services required to be provided by the Adviser or furnished to the Fund under this Agreement. Without limiting the generality of the foregoing, the staff and personnel of the Adviser shall be deemed to include persons employed or otherwise retained by the Adviser (including personnel of affiliated companies of the Adviser) or made available to the Adviser.

4. The Fund will, from time to time, furnish or otherwise make available to the Adviser such financial reports, proxy statements, policies and procedures and other information relating to the business and affairs of the Fund as the Adviser may reasonably require in order to discharge its duties and obligations hereunder.

5. Except as provided herein or in another agreement between the Fund and the Adviser, the Fund shall bear all of its own expenses, including: all investment related expenses (including, but not limited to, fees paid directly or indirectly to Investment Managers, all costs and expenses directly related to portfolio transactions and positions for the Fund's account such as direct and indirect expenses associated with the Fund's investments, including its investments in Investment Funds, transfer taxes and premiums, taxes withheld on foreign dividends and, if applicable in the event the Fund utilizes a Subadvisor, brokerage commissions, interest and commitment fees on loans and debit balances, borrowing charges on securities sold short, dividends on securities sold but not yet purchased and margin fees); all costs and expenses associated with the establishment of Investment Funds managed by Subadvisors; any non-investment related interest expense; attorneys' fees and disbursements associated with updating the Fund's Confidential Memorandum and subscription documents; fees and disbursements of any attorneys and accountants engaged by the Fund; expenses related to the annual audit of the Fund; tax preparation fees; fees paid to the Fund's administrator; custody and escrow fees and expenses; the costs of an errors and omissions/directors and officers liability insurance policy and a fidelity bond; the fee payable to the Adviser; fees and travel-related expenses of Managers (as defined below) who are not employees of the Adviser or any affiliated person of the Adviser; all costs and charges for equipment or services used in communicating information regarding the Fund's transactions among the Adviser and any custodian or other agent engaged by the Fund; and any extraordinary expenses; and such other expenses as may be approved from time to time by the Board.

6. The compensation provided to the Adviser pursuant to paragraph 3(a) hereof shall be full compensation for the services provided to the Fund and the expenses assumed by the Adviser under this Agreement.

7. The Adviser will use its best efforts in the supervision and management of the investment activities of the Fund and in providing services hereunder, but in the absence of willful misfeasance, bad faith, or gross negligence on the part of the Adviser or its personnel, or reckless disregard of the Adviser's obligations hereunder, the Adviser, its affiliates and their respective directors, officers, employees, personnel, successors or other legal representatives (collectively, the "Affiliates") shall not be liable to the Fund for any error of judgment, for any mistake of law, for any act or omission by the Adviser or any of the Affiliates or for any loss suffered by the Fund.

8. (a) The Fund shall indemnify the Adviser and its directors, officers or employees and their respective affiliates, executors, heirs, assigns, successors or other legal representatives (each an "Indemnified Person") against any and all costs, losses, claims, damages or liabilities, joint or several, including, without limitation, reasonable attorneys' fees and disbursements, resulting in any way from the performance or non-performance of any Indemnified Person's duties with respect to the Fund, except those resulting from the willful malfeasance, bad faith or gross negligence of an Indemnified Person or the Indemnified Person's reckless disregard of such duties, and in the case of criminal proceedings, unless such Indemnified Person had reasonable cause to believe its actions unlawful (collectively, "disabling conduct"). Indemnification shall be made following: (i) a final decision on the merits by a court or other body before which the proceeding was brought that the Indemnified Person was not liable by reason of disabling conduct or (ii) a reasonable determination, based upon a review of the facts and reached by (A) the vote of a majority of the members of the Board (the "Managers") who are not parties to the proceeding or (B) legal counsel selected by a vote of a majority of the Board in a written advice, that the Indemnified Person is entitled to indemnification hereunder. The Fund shall advance to an Indemnified Person (to the extent that it has available assets and need not borrow to do so) reasonable attorneys' fees and other costs and expenses incurred in connection with defense of any action or proceeding arising out of such performance or non-performance. The Adviser agrees, and each other Indemnified Person will agree as a condition to any such advance, that in the event the Indemnified Person receives any such advance, the Indemnified Person shall reimburse the Fund for such fees, costs and expenses to the extent that it shall be determined that the Indemnified Person was not entitled to indemnification under this paragraph 8.

(b) Notwithstanding any of the foregoing to the contrary, the provisions of paragraph 7 and this paragraph 8 shall not be construed so as to relieve the Indemnified Person of, or provide indemnification with respect to, any liability (including liability under Federal Securities laws, which, under certain circumstances, impose liability even on persons who act in good faith) to the extent (but only to the extent) that such liability may not be waived, limited or modified under applicable law or that such indemnification would be in violation of applicable law, but shall be construed so as to effectuate the provisions of paragraph 7 and this paragraph 8 to the fullest extent permitted by law.

9. Nothing contained in this Agreement shall prevent the Adviser or any affiliated person of the Adviser from acting as investment adviser or manager for any other person, firm or corporation and, except as required by applicable law (including Rule 17j-l under the 1940 Act), shall not in any way bind or restrict the Adviser or any such affiliated person from buying, selling or trading any securities or commodities for their own accounts or for the account of others for whom they may be acting. Nothing in this Agreement shall limit or restrict the right of any member, officer or employee of the Adviser to engage in any other business or to devote his or her time and attention in part to the management or other aspects of any other business whether of a similar or dissimilar nature.

10. This Agreement shall become effective as of the date first noted above, shall remain in effect for an initial term expiring two years thereafter, and shall continue in effect from year to year thereafter provided such continuance is approved at least annually by the vote of a majority of the outstanding voting securities of the Fund, as defined by the 1940 Act and the rules thereunder, or by the Board; and provided that in either event such continuance is also approved by a majority of the Independent Managers, by vote cast in person at a meeting called for the purpose of voting on such approval. The Fund may at any time, without payment of any penalty, terminate this Agreement upon sixty days' prior written notice to the Adviser, either by majority vote of the Board or by the vote of a majority of the outstanding voting securities of the Fund (as defined by the 1940 Act and the rules thereunder). The Adviser may at any time, without payment of penalty, terminate this Agreement upon sixty days' prior written notice to the Fund. This Agreement shall automatically terminate in the event of its assignment (to the extent required by the 1940 Act and the rules thereunder) unless such automatic termination shall be prevented by an exemptive order or rule of the Securities and Exchange Commission.

11. Any notice under this Agreement shall be given in writing and shall be deemed to have been duly given when delivered by hand or facsimile or five days after mailed by certified mail, post-paid, by return receipt requested to the other party at the principal office of such party.

12. This Agreement may be amended only by the written agreement of the parties. Any amendment shall be required to be approved by the Board and by a majority of the Independent Managers in accordance with the provisions of Section 15(c) of the 1940 Act and the rules thereunder. If required by the 1940 Act, any amendment shall also be required to be approved by such vote of members of the Fund as is required by the 1940 Act and the rules thereunder.

13. This Agreement shall be construed in accordance with the laws of the State of New York and the applicable provisions of the 1940 Act. To the extent the applicable law of the State of New York, or any of the provisions herein, conflict with the applicable provisions of the 1940 Act, the latter shall control.

14. The Fund represents that this Agreement has been duly approved by the Board, including the vote of a majority of the Independent Managers, and by such vote of members of the Fund as is required by the 1940 Act and the rules thereunder.

15. The parties to this Agreement agree that the obligations of the Fund under this Agreement shall not be binding upon any of the Managers, members of the Fund or any officers, employees or agents, whether past, present or future, of the Fund, individually, but are binding only upon the assets and property of the Fund.

16. This Agreement embodies the entire understanding of the parties.

{The remainder of this page has been intentionally left blank}

IN WITNESS WHEREOF, the parties hereto have executed and delivered this Agreement on the day and year first above written.

| | EXCELSIOR MULTI-STRATEGY HEDGE FUND OF FUNDS, LLC |

| | | |

| | | |

| | By: | | |

| | | Name: | |

| | | Title: | |

| | | | | |

| | [PINE GROVE ASSET MANAGEMENT LLC] |

| | | |

| | | |

| | By: | | |

| | | Name: | |

| | | Title: | |

| | | | | |

PROXY TABULATOR P.O. BOX 9112 | | |

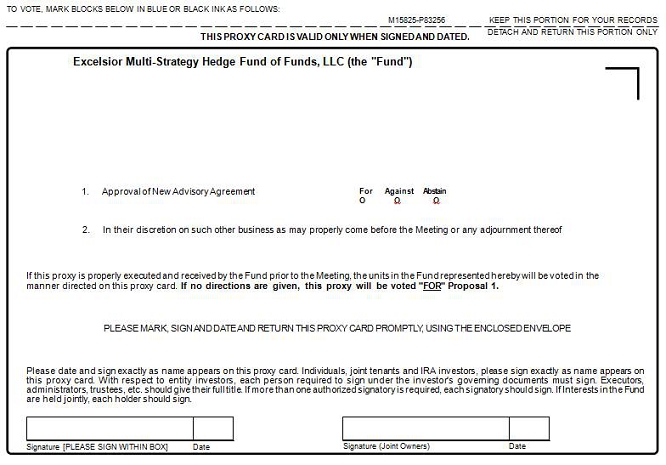

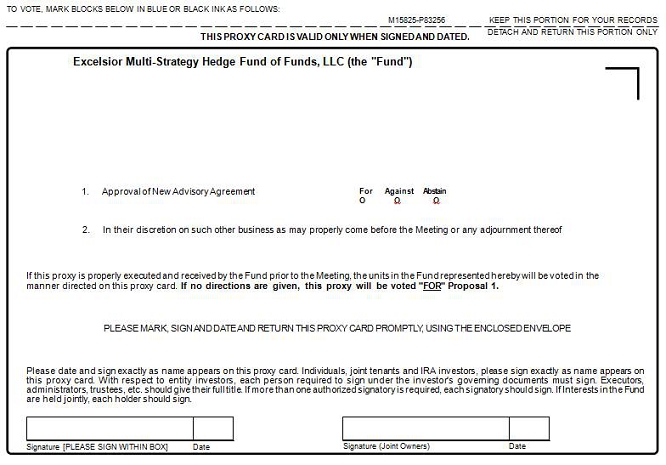

| FARMINGDALE, NY 11735 | | To vote by internet 1) Read the Proxy Statement and have the proxy card below at hand. 2) Go to websitewww.proxyvote.com 3) Follow the instructions provided on the website. To vote by Telephone 1) Read the Proxy Statement and have the proxy card below at hand. 2) Call1-855 928-4484 3) Follow the instructions. To vote by Mail 1) Read the Proxy Statement. 2) Check the appropriate boxes on the proxy card below. 3) Sign and date the proxy card. 4) Return the proxy card in the envelope provided. PLEASE DO NOT VOTE USING MORE THAN ONE METHOD DO NOT MAIL YOUR PROXY CARD IF YOU VOTE BY

INTERNET OR TELEPHONE |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

The Proxy Statement is available at www.proxyvote.com.