Exhibit 99.4

THE ENERGY SHIFT IS UNDERWAY Q1 2019 EARNINGS PRESENTATION May 14th 2019

Safe Harbor Statement Certain statements in the Business Update and Order Backlog sections contain forward - looking statements within the meaning of the “safe harbor” provisions of the U . S . Private Securities Litigation Reform Act of 1995 , and under applicable Canadian securities laws . These statements are based on management’s current expectations and actual results may differ from these forward - looking statements due to numerous factors, including : our inability to increase our revenues or raise additional funding to continue operations, execute our business plan, or to grow our business ; our inability to address a slow return to economic growth, and its impact on our business, results of operations and consolidated financial condition ; our limited operating history ; inability to implement our business strategy ; fluctuations in our quarterly results ; failure to maintain our customer base that generates the majority of our revenues ; currency fluctuations ; failure to maintain sufficient insurance coverage ; changes in value of goodwill ; failure of a significant market to develop for our products ; failure of hydrogen being readily available on a cost - effective basis ; changes in government policies and regulations ; failure of uniform codes and standards for hydrogen fueled vehicles and related infrastructure to develop ; liability for environmental damages resulting from our research, development or manufacturing operations ; failure to compete with other developers and manufacturers of products in our industry ; failure to compete with developers and manufacturers of traditional and alternative technologies ; failure to develop partnerships with original equipment manufacturers, governments, systems integrators and other third parties ; inability to obtain sufficient materials and components for our products from suppliers ; failure to manage expansion of our operations ; failure to manage foreign sales and operations ; failure to recruit, train and retain key management personnel ; inability to integrate acquisitions ; failure to develop adequate manufacturing processes and capabilities ; failure to complete the development of commercially viable products ; failure to produce cost - competitive products ; failure or delay in field testing of our products ; failure to produce products free of defects or errors ; inability to adapt to technological advances or new codes and standards ; failure to protect our intellectual property ; our involvement in intellectual property litigation ; exposure to product liability claims ; failure to meet rules regarding passive foreign investment companies ; actions of our significant and principal shareholders ; dilution as a result of significant issuances of our common shares and preferred shares ; inability of US investors to enforce US civil liability judgments against us ; volatility of our common share price ; dilution as a result of the exercise of options ; and failure to meet continued listing requirements of Nasdaq . Readers should not place undue reliance on Hydrogenics’ forward - looking statements . Investors are encouraged to review the section captioned “Risk Factors” in our regulatory filings with the Canadian securities regulatory authorities and the US Securities and Exchange Commission for a more complete discussion of factors that could affect our future performance . Furthermore, the forward - looking statements contained herein are made as of the date of this presentation, and we undertake no obligation to revise or update any forward - looking statements in order to reflect events or circumstances that may arise after the date of this presentation, unless otherwise required by law . The forward - looking statements contained in this presentation are expressly qualified by this .

© Copyright 2019 HYDROGENICS Page 3 Q1 2019 Highlights Alstom Train Application Approaches 100,000km of Service Financials / New Projects New Milestones New Deployments Class A Trucks Backlog at $150M Q1 revenue $8.1 million Gross margin 47.9% Closed Air Liquide placement of $20.5 million 20MW electrolysis reference site in Canada First project in New Zealand 4 1 2 3

© Copyright 2019 HYDROGENICS Page 4 Reference Sites Accelerate Growth Importance and impact of strong reference sites is evident in our history The succession of E.ON > Enbridge > Air Liquide enhances the bankability of scale up offerings • Credible execution on successively larger projects speaks well of Hydrogenics’ organization • Now at full industrial scale potential with Air Liquide • We have projects quoted in backlog at this size and larger 2.5MW Project 2018 2MW Project 2014 20MW Project 2019

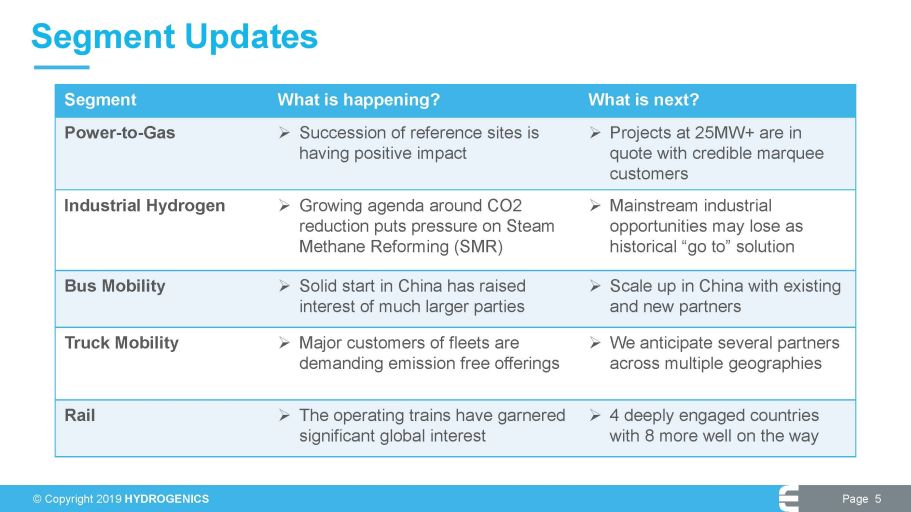

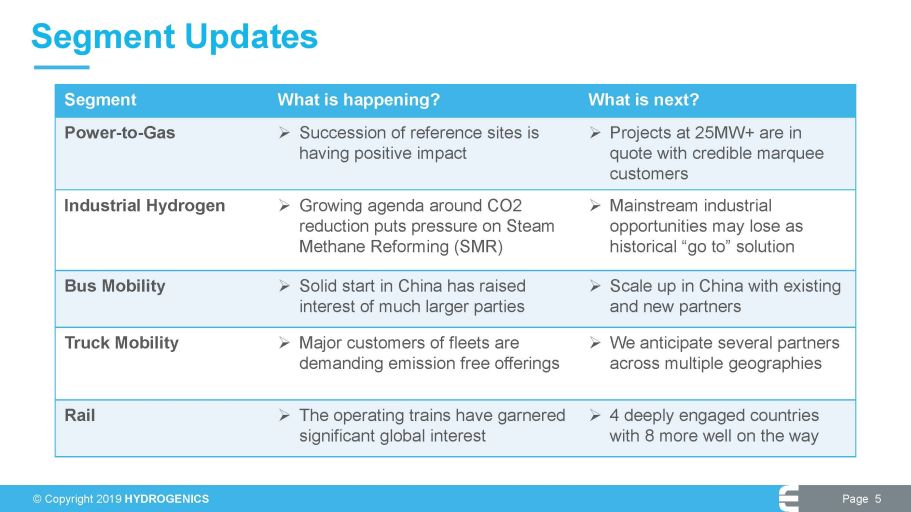

© Copyright 2019 HYDROGENICS Page 5 Segment Updates Segment What is happening? What is next? Power - to - Gas » Succession of reference sites is having positive impact » Projects at 25MW+ are in quote with credible marquee customers Industrial Hydrogen » Growing agenda around CO2 reduction puts pressure on Steam Methane Reforming (SMR) » Mainstream industrial opportunities may lose as historical “go to” solution Bus Mobility » Solid start in China has raised interest of much larger parties » Scale up in China with existing and new partners Truck Mobility » Major customers of fleets are demanding emission free offerings » We anticipate several partners across multiple geographies Rail » The operating trains have garnered significant global interest » 4 deeply engaged countries with 8 more well on the way

© Copyright 2019 HYDROGENICS Page 6 » Integrated in the most popular Daimler Freightliner Chassis » Ready for demonstration in Los Angeles, California » Reached 1000 miles no fault testing » Ready for demonstration in Palm Springs, California North American Fleet Offerings on the Move

© Copyright 2019 HYDROGENICS Page 7 Positive Momentum in 2019 While slower than expected to start, rail opportunities are much larger than anticipated China momentum expected to pick up through 2019 Overall, anticipating strong year - over - year revenue growth Continued cost discipline and efficiency improvements driving Company forward on path to profitability

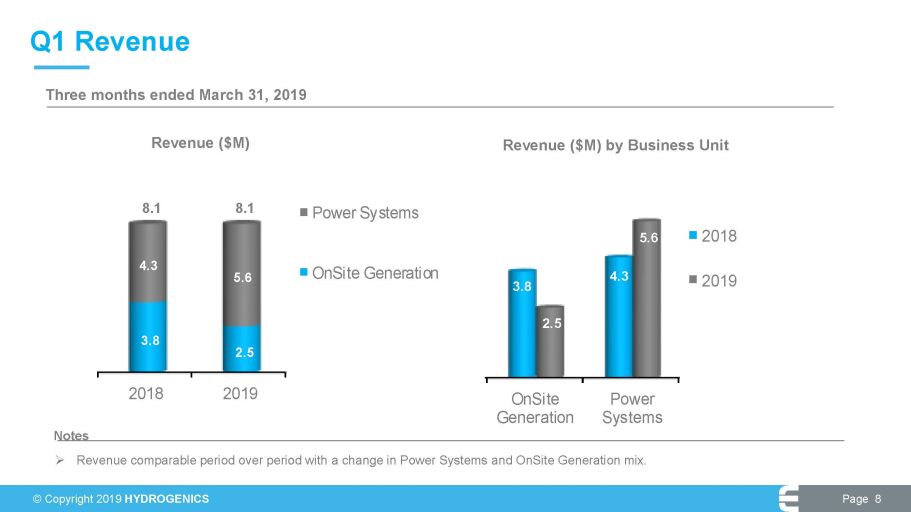

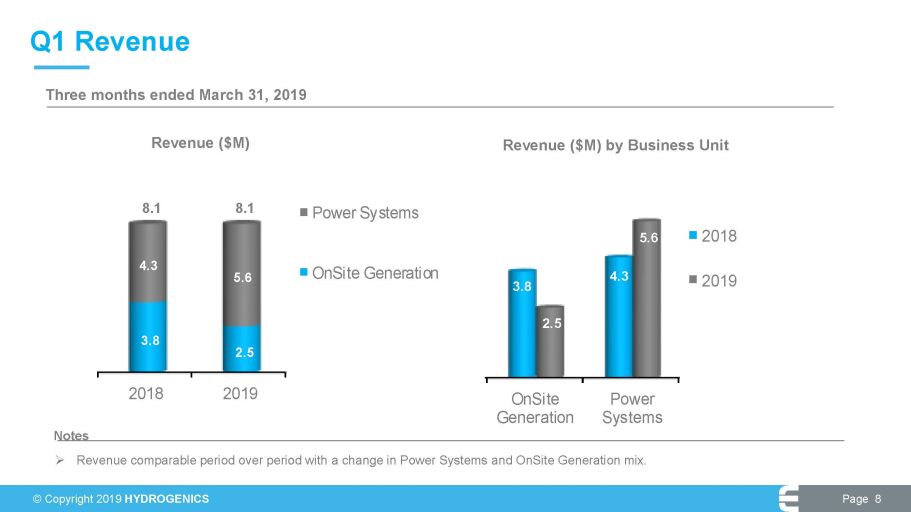

© Copyright 2019 HYDROGENICS Page 8 Notes Three months ended March 31, 2019 2018 2019 3.8 2.5 4.3 5.6 Power Systems OnSite Generation Revenue ($M) 8.1 8.1 Q1 Revenue OnSite Generation Power Systems 3.8 4.3 2.5 5.6 2018 2019 Revenue ($M) by Business Unit » Revenue comparable period over period with a change in Power Systems and OnSite Generation mix.

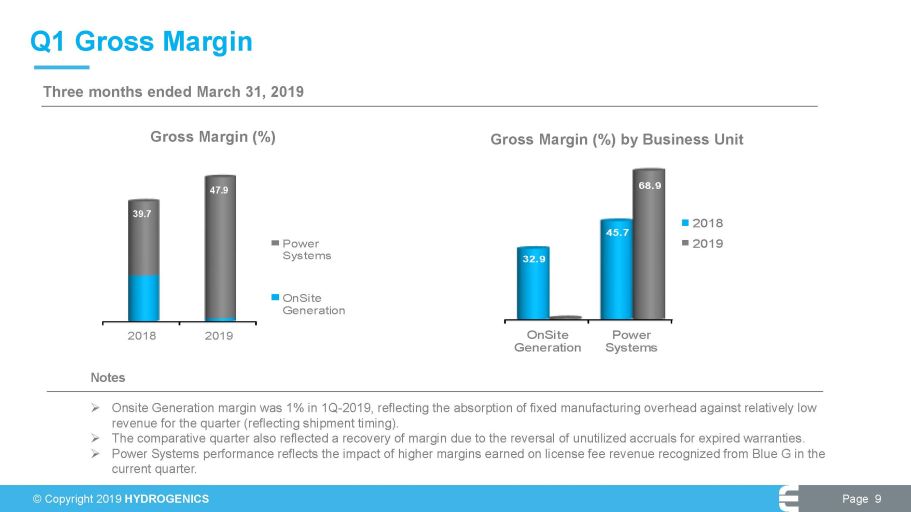

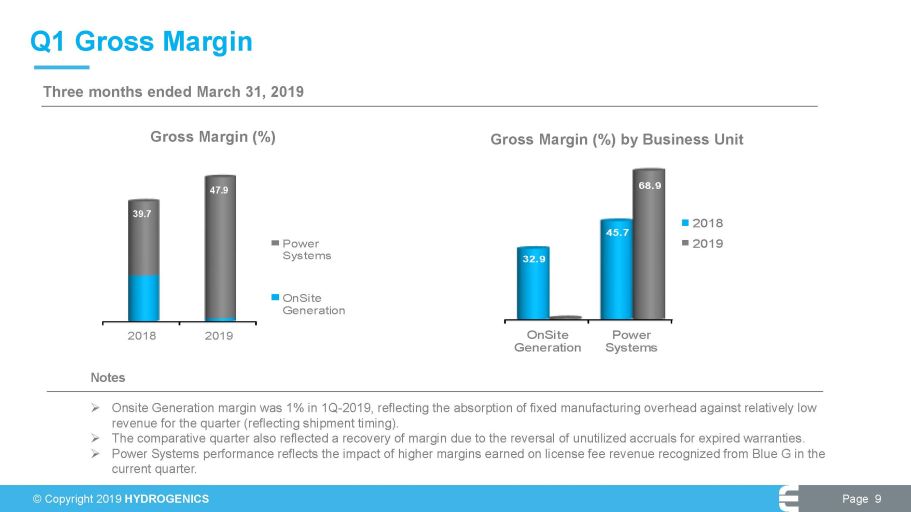

© Copyright 2019 HYDROGENICS Page 9 Notes » Onsite Generation margin was 1% in 1Q - 2019, reflecting the absorption of fixed manufacturing overhead against relatively low revenue for the quarter (reflecting shipment timing). » The comparative quarter also reflected a recovery of margin due to the reversal of unutilized accruals for expired warranties . » Power Systems performance reflects the impact of higher margins earned on license fee revenue recognized from Blue G in the current quarter. Three months ended March 31, 2019 Q1 Gross Margin OnSite Generation Power Systems 32.9 45.7 0.7 68.9 2018 2019 Gross Margin (%) by Business Unit 2018 2019 Power Systems OnSite Generation Gross Margin (%) 47.9 39.7

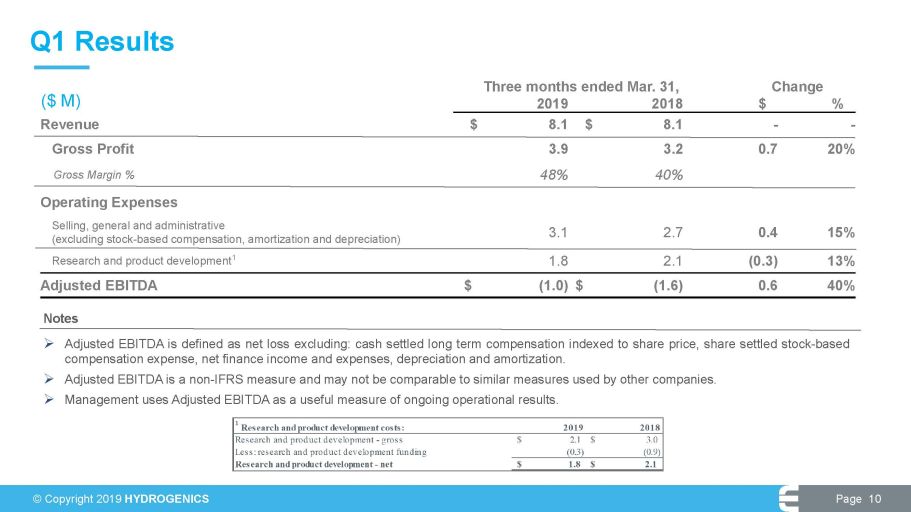

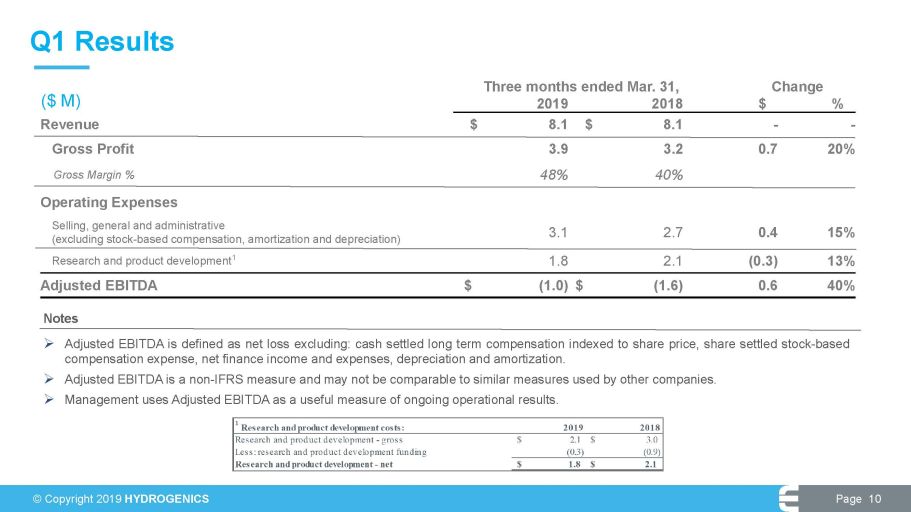

© Copyright 2019 HYDROGENICS Page 10 Notes » Adjusted EBITDA is defined as net loss excluding : cash settled long term compensation indexed to share price, share settled stock - based compensation expense, net finance income and expenses, depreciation and amortization . » Adjusted EBITDA is a non - IFRS measure and may not be comparable to similar measures used by other companies . » Management uses Adjusted EBITDA as a useful measure of ongoing operational results . ($ M) Q1 Results Three months ended Mar. 31, Change 2019 2018 $ % Revenue $ 8.1 $ 8.1 - - Gross Profit 3.9 3.2 0.7 20% Gross Margin % 48% 40% Operating Expenses Selling, general and administrative (excluding stock - based compensation, amortization and depreciation) 3.1 2.7 0.4 15% Research and product development 1 1.8 2.1 (0.3) 13% Adjusted EBITDA $ (1.0) $ (1.6) 0.6 40%

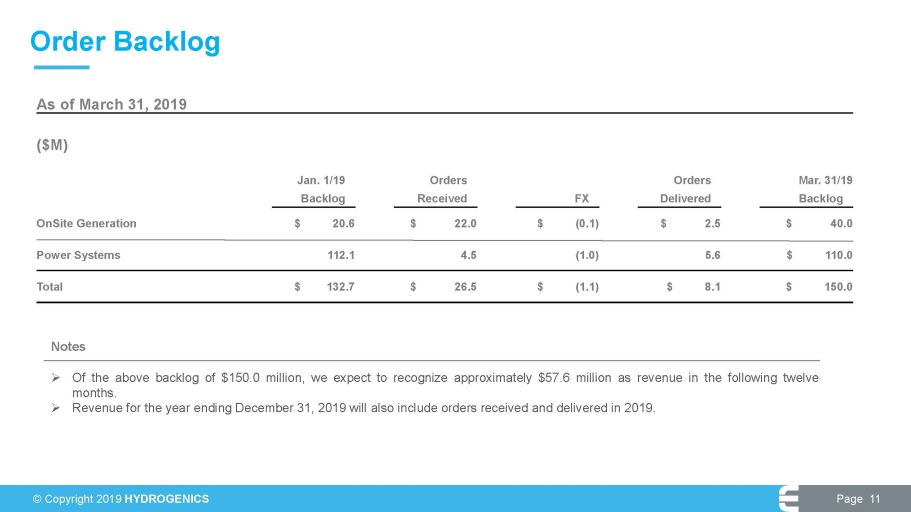

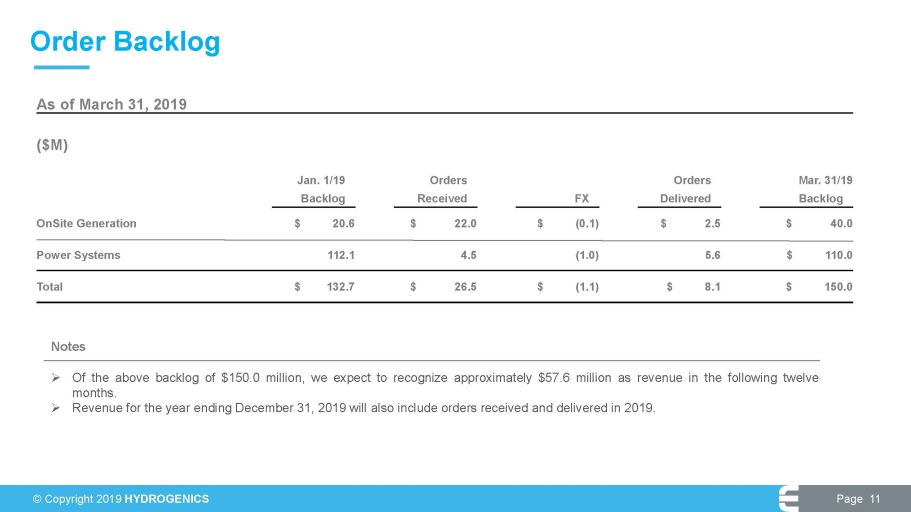

© Copyright 2019 HYDROGENICS Page 11 Order Backlog » Of the above backlog of $ 150 . 0 million, we expect to recognize approximately $ 57 . 6 million as revenue in the following twelve months . » Revenue for the year ending December 31 , 2019 will also include orders received and delivered in 2019 . As of March 31, 2019 ($M) Jan. 1/19 Orders Orders Mar. 31/19 Backlog Received FX Delivered Backlog OnSite Generation $ 20.6 $ 22.0 $ (0.1) $ 2.5 $ 40.0 Power Systems 112.1 4.5 (1.0) 5.6 $ 110.0 Total $ 132.7 $ 26.5 $ (1.1) $ 8.1 $ 150.0 Notes

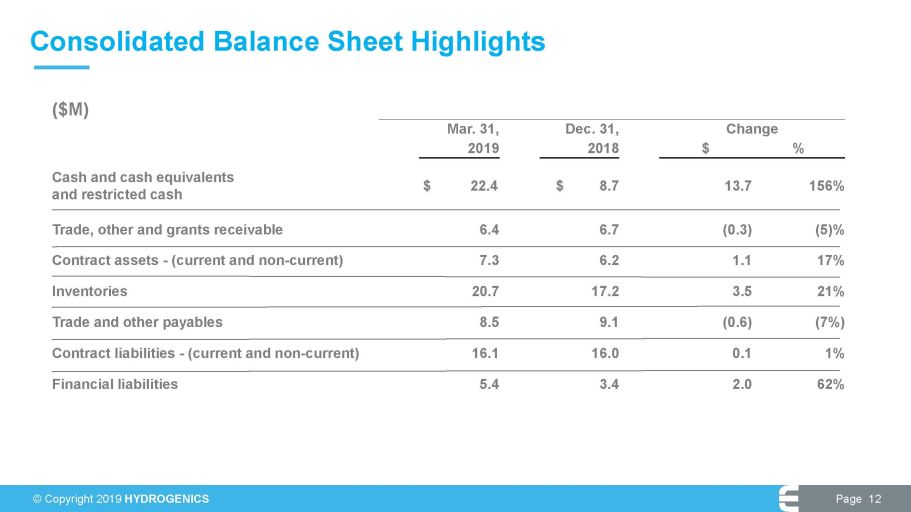

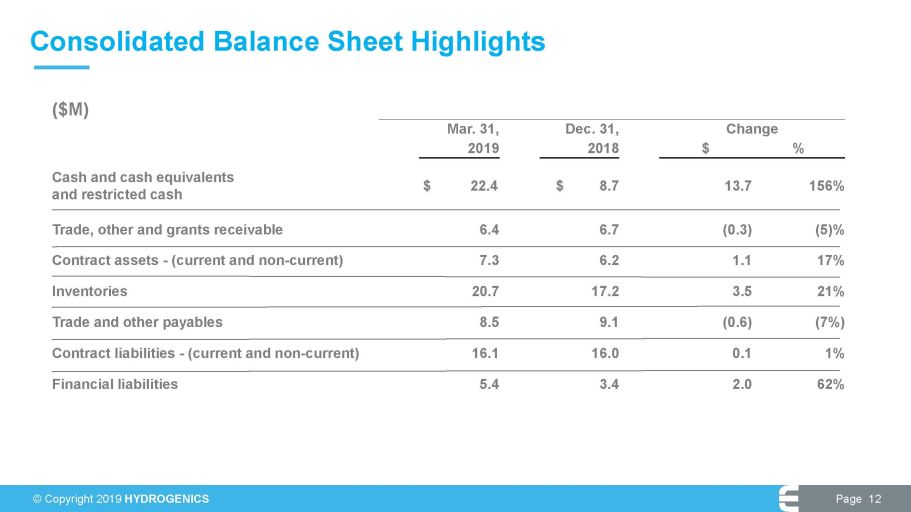

© Copyright 2019 HYDROGENICS Page 12 Consolidated Balance Sheet Highlights ($M) Mar. 31, Dec. 31, Change 2019 2018 $ % Cash and cash equivalents and restricted cash $ 22.4 $ 8.7 13.7 156% Trade, other and grants receivable 6.4 6.7 (0.3) (5)% Contract assets - (current and non - current) 7.3 6.2 1.1 17% Inventories 20.7 17.2 3.5 21% Trade and other payables 8.5 9.1 (0.6) (7%) Contract liabilities - (current and non - current) 16.1 16.0 0.1 1% Financial liabilities 5.4 3.4 2.0 62%

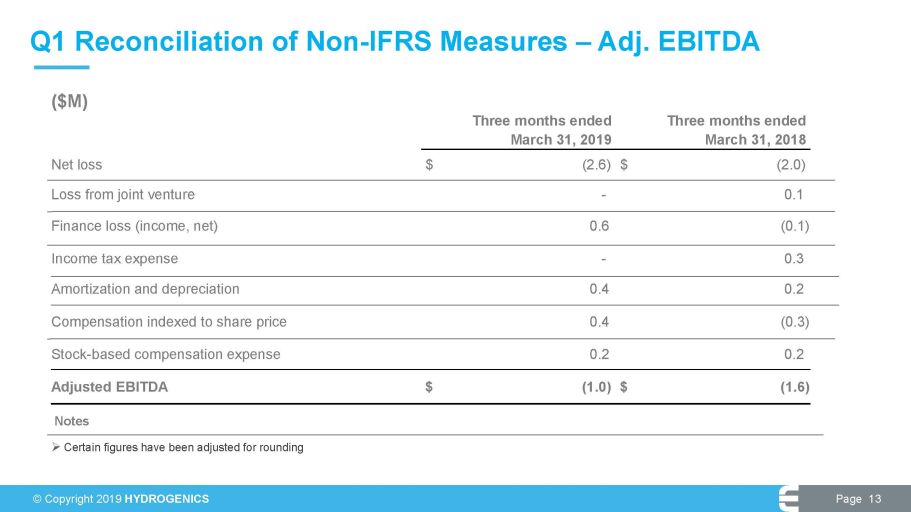

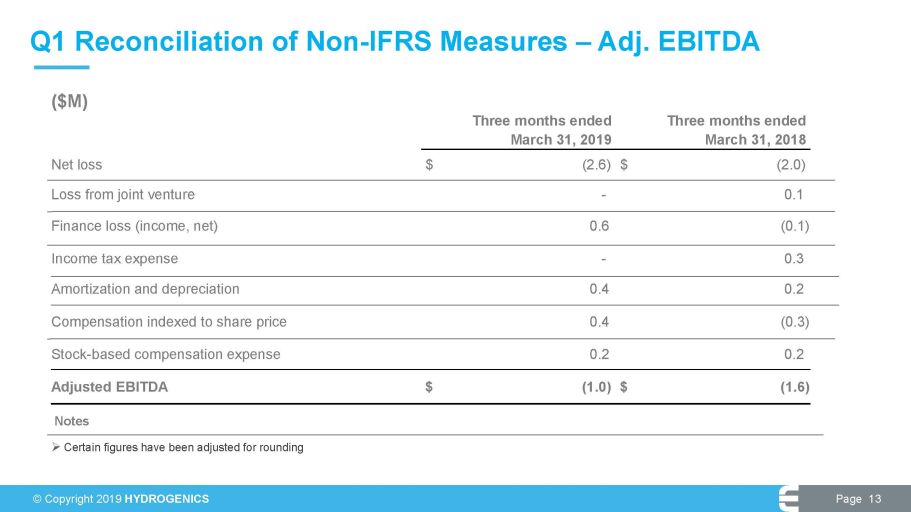

© Copyright 2019 HYDROGENICS Page 13 Q1 Reconciliation of Non - IFRS Measures – Adj. EBITDA ($M) Three months ended Three months ended March 31, 2019 March 31, 2018 Net loss $ (2.6) $ (2.0) Loss from joint venture - 0.1 Finance loss (income, net) 0 . 6 (0.1) Income tax expense - 0.3 Amortization and depreciation 0.4 0.2 Compensation indexed to share price 0.4 (0.3) Stock - based compensation expense 0.2 0.2 Adjusted EBITDA $ (1.0) $ (1.6) » Certain figures have been adjusted for rounding Notes

We specialize in helping our customers succeed. Experience / Leadership / Technology The human factor