EXHIBIT 99.4

THE ENERGY SHIFT IS UNDERWAY Q2 2019 EARNINGS PRESENTATION August 12, 2019

Safe Harbor Statement Certain statements in the Business Update and Order Backlog sections contain forward - looking statements within the meaning of the “safe harbor” provisions of the U . S . Private Securities Litigation Reform Act of 1995 , and under applicable Canadian securities laws . These statements are based on management’s current expectations and actual results may differ from these forward - looking statements due to numerous factors, including : the failure to obtain necessary approvals or satisfy the conditions to closing the Transaction, including the requisite approval from the Shareholders at the special meeting of Shareholders to be held on August 29 , 2019 ; the occurrence of any event, change or other circumstance that could give rise to the termination of the arrangement agreement in respect of the Transaction ; material adverse changes in the business or affairs of Hydrogenics ; either party’s failure to consummate the Transaction when required ; our inability to increase our revenues or raise additional funding to continue operations, execute our business plan, or to grow our business ; our inability to address a slow return to economic growth, and its impact on our business, results of operations and consolidated financial condition ; our limited operating history ; inability to implement our business strategy ; fluctuations in our quarterly results ; failure to maintain our customer base that generates the majority of our revenues ; currency fluctuations ; failure to maintain sufficient insurance coverage ; changes in value of goodwill ; failure of a significant market to develop for our products ; failure of hydrogen being readily available on a cost - effective basis ; changes in government policies and regulations ; failure of uniform codes and standards for hydrogen fueled vehicles and related infrastructure to develop ; liability for environmental damages resulting from our research, development or manufacturing operations ; failure to compete with other developers and manufacturers of products in our industry ; failure to compete with developers and manufacturers of traditional and alternative technologies ; failure to develop partnerships with original equipment manufacturers, governments, systems integrators and other third parties ; inability to obtain sufficient materials and components for our products from suppliers ; failure to manage expansion of our operations ; failure to manage foreign sales and operations ; failure to recruit, train and retain key management personnel ; inability to integrate acquisitions ; failure to develop adequate manufacturing processes and capabilities ; failure to complete the development of commercially viable products ; failure to produce cost - competitive products ; failure or delay in field testing of our products ; failure to produce products free of defects or errors ; inability to adapt to technological advances or new codes and standards ; failure to protect our intellectual property ; our involvement in intellectual property litigation ; exposure to product liability claims ; failure to meet rules regarding passive foreign investment companies ; actions of our significant and principal shareholders ; dilution as a result of significant issuances of our common shares and preferred shares ; inability of US investors to enforce US civil liability judgments against us ; volatility of our common share price ; dilution as a result of the exercise of options ; and failure to meet continued listing requirements of Nasdaq . Readers should not place undue reliance on Hydrogenics’ forward - looking statements . Investors are encouraged to review the section captioned “Risk Factors” in our regulatory filings with the Canadian securities regulatory authorities and the US Securities and Exchange Commission for a more complete discussion of factors that could affect our future performance . Furthermore, the forward - looking statements contained herein are made as of the date of this presentation, and we undertake no obligation to revise or update any forward - looking statements in order to reflect events or circumstances that may arise after the date of this presentation, unless otherwise required by law . The forward - looking statements contained in this presentation are expressly qualified by this paragraph .

© Copyright 2019 HYDROGENICS Page 3 Q2 2019 Highlights Hydrogen rail momentum remains strong in multiple jurisdictions Financials / New Projects New Milestones New Developments / Deployments Backlog at $144M • Q2 revenue $10.4 million, up 37% over Q2 2018 • Gross margin impacted by product mix • Agreement with Halcyon Power to build first hydrogen production facility in New Zealand 4 1 2 3

© Copyright 2019 HYDROGENICS Page 4 • On June 28, 2019, we announced that we had entered into an arrangement agreement with Cummins and its subsidiary to be acquired for $15.00 per share in cash. » Values the Company at just under $300 million • The Hydrogen Company (a subsidiary of Air Liquide) has agreed to exchange its shares for shares of the Cummins subsidiary pursuant to the transaction. • Shareholders of record as of July 15, 2019 will be asked to vote on a special resolution to approve the transaction on August 29, 2019. • Subject to the outcome of this meeting and satisfaction or waiver of all other conditions precedent, the Company expects the transaction to close in September 2019. Cummins Acquisition

© Copyright 2019 HYDROGENICS Page 5 Hydrogen Rail Progress • Highly Publicized Activity • Alstom is consummating orders with customers • +100,000kms of cumulative flawless operations to date • Industry first achievements • Working with Alstom to finalize production arrangements for 81 systems • To be delivered beginning in 2020 per our 2015 exclusive agreement • Additional demand expected in Europe and the UK based o n current RFPs • Positions Hydrogenics as world leader in rail mobility fuel cells

© Copyright 2019 HYDROGENICS Page 6 Outlook for 2019 and Beyond Rail applications now growing rapidly, with Alstom serving as the driver for global adoption escalation China still under development – being impacted by ongoing trade/economic issues . Overall anticipating strong year - over - year revenue growth, with outlook for 2020 even brighter Continued cost discipline and efficiency improvements driving Company towards profitability

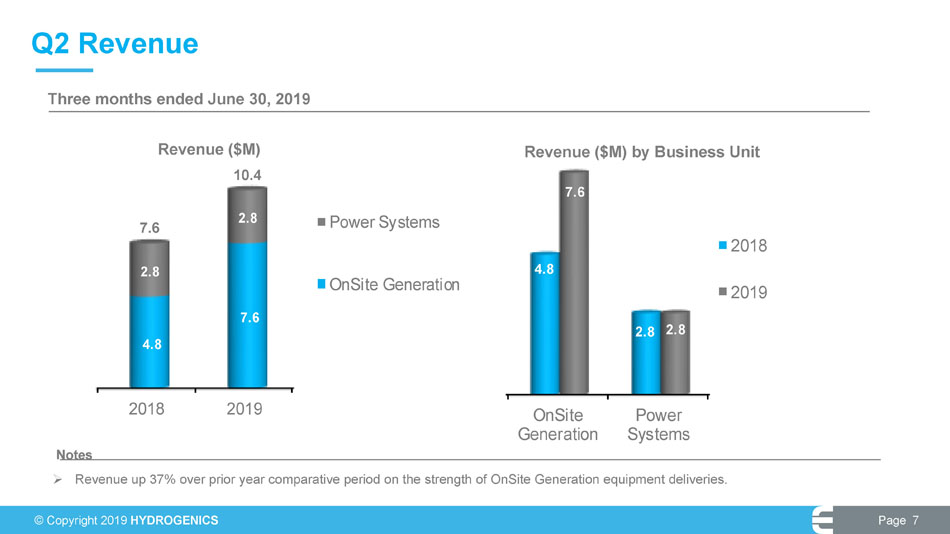

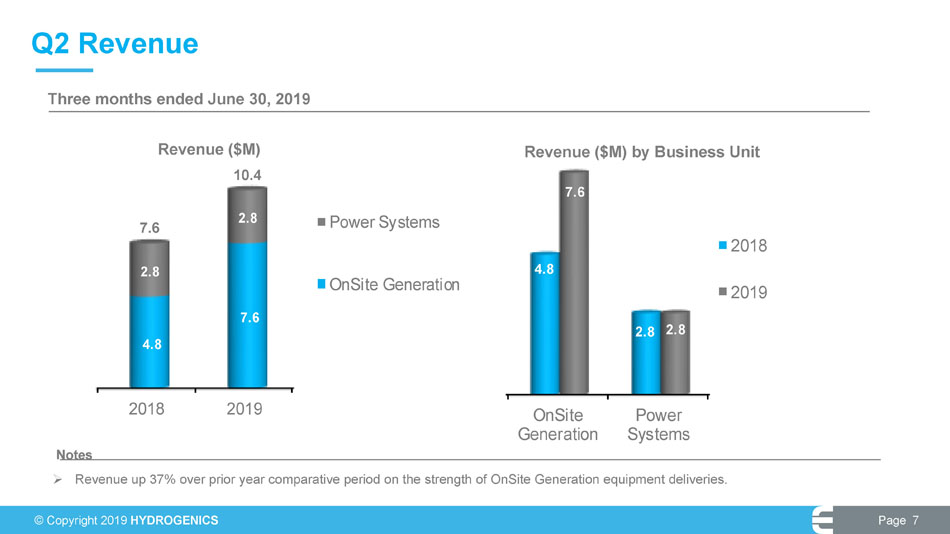

© Copyright 2019 HYDROGENICS Page 7 Notes Three months ended June 30, 2019 2018 2019 4.8 7.6 2.8 2.8 Power Systems OnSite Generation Revenue ($M) 10.4 7.6 Q2 Revenue OnSite Generation Power Systems 4.8 2.8 7.6 2.8 2018 2019 Revenue ($M) by Business Unit » Revenue up 37% over prior year comparative period on the strength of OnSite Generation equipment deliveries.

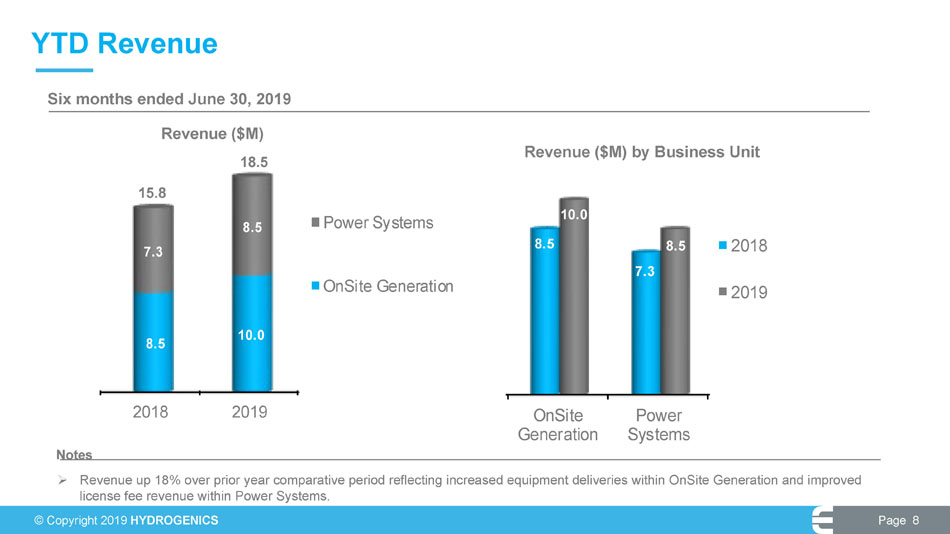

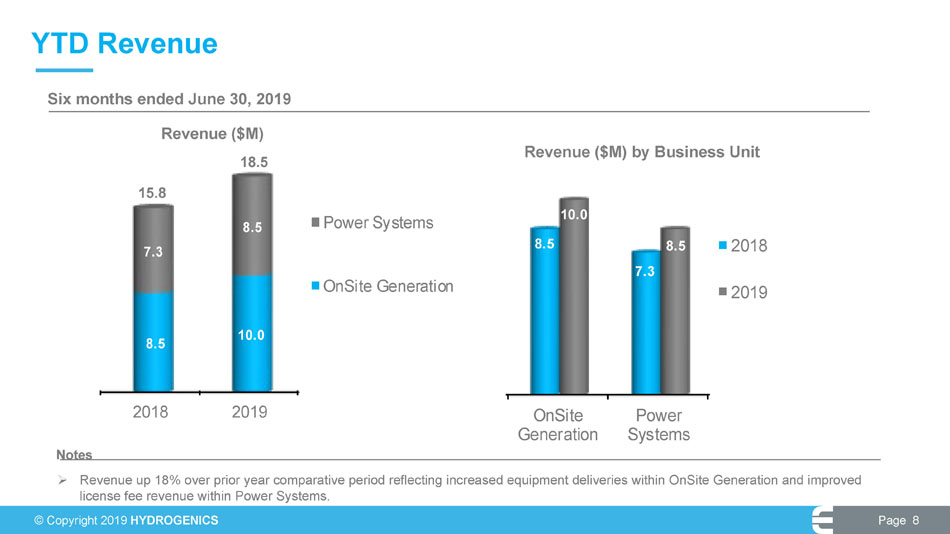

© Copyright 2019 HYDROGENICS Page 8 Notes Six months ended June 30, 2019 2018 2019 8.5 10.0 7.3 8.5 Power Systems OnSite Generation Revenue ($M) 18.5 15.8 YTD Revenue OnSite Generation Power Systems 8.5 7.3 10.0 8.5 2018 2019 Revenue ($M) by Business Unit » Revenue up 18% over prior year comparative period reflecting increased equipment deliveries within OnSite Generation and impr ove d license fee revenue within Power Systems.

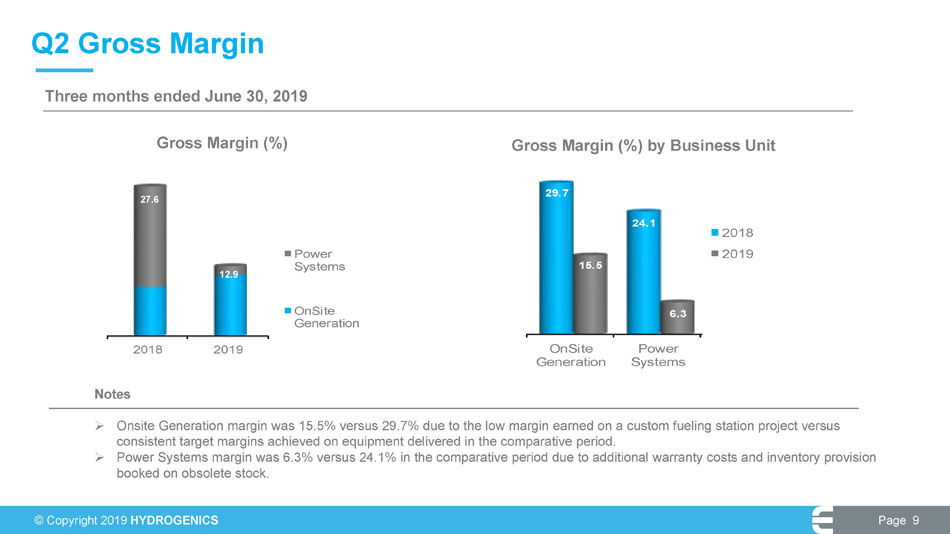

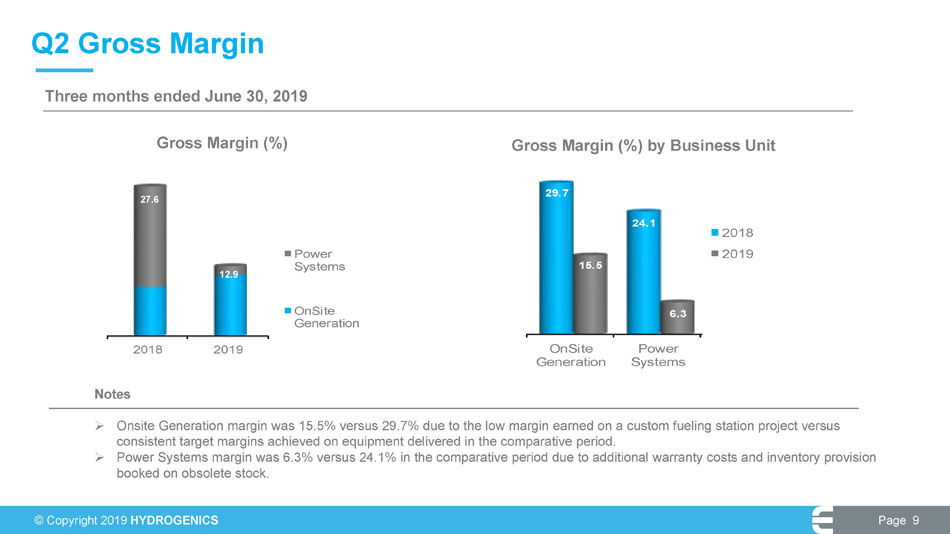

© Copyright 2019 HYDROGENICS Page 9 Notes » Onsite Generation margin was 15.5% versus 29.7% due to the low margin earned on a custom fueling station project versus consistent target margins achieved on equipment delivered in the comparative period. » Power Systems margin was 6.3% versus 24.1% in the comparative period due to additional warranty costs and inventory provision booked on obsolete stock. Three months ended June 30, 2019 Q2 Gross Margin OnSite Generation Power Systems 29.7 24.1 15.5 6.3 2018 2019 Gross Margin (%) by Business Unit 2018 2019 Power Systems OnSite Generation Gross Margin (%) 12.9 27.6

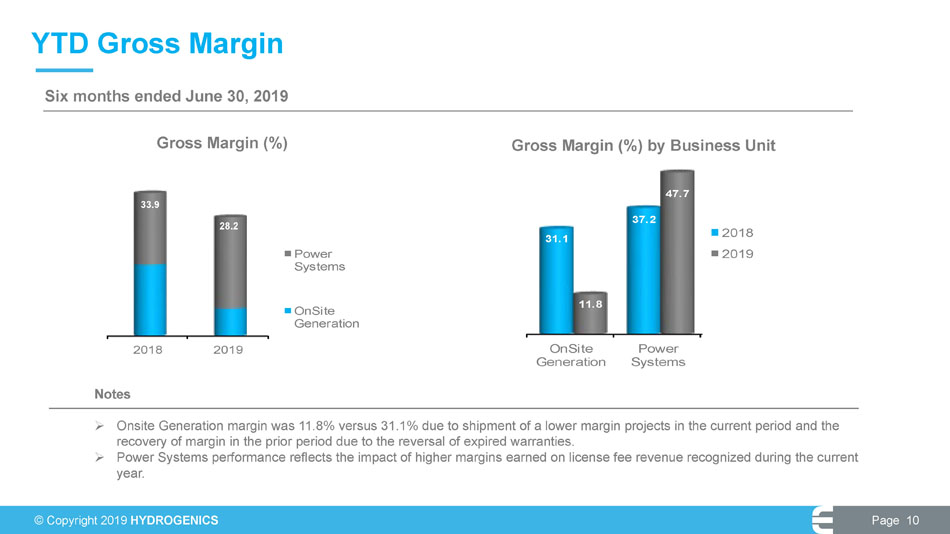

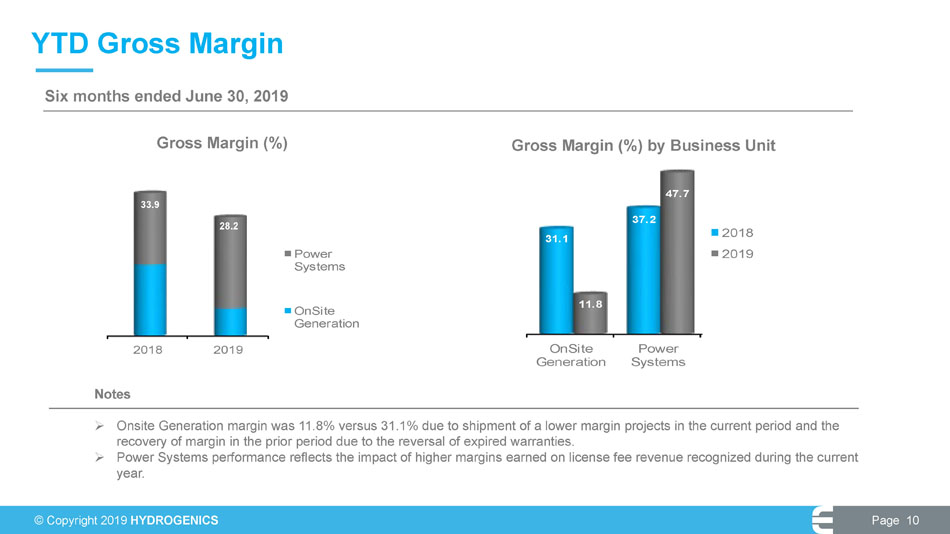

© Copyright 2019 HYDROGENICS Page 10 Notes » Onsite Generation margin was 11.8% versus 31.1% due to shipment of a lower margin projects in the current period and the recovery of margin in the prior period due to the reversal of expired warranties. » Power Systems performance reflects the impact of higher margins earned on license fee revenue recognized during the current year. Six months ended June 30, 2019 YTD Gross Margin OnSite Generation Power Systems 31.1 37.2 11.8 47.7 2018 2019 Gross Margin (%) by Business Unit 2018 2019 Power Systems OnSite Generation Gross Margin (%) 28.2 33.9

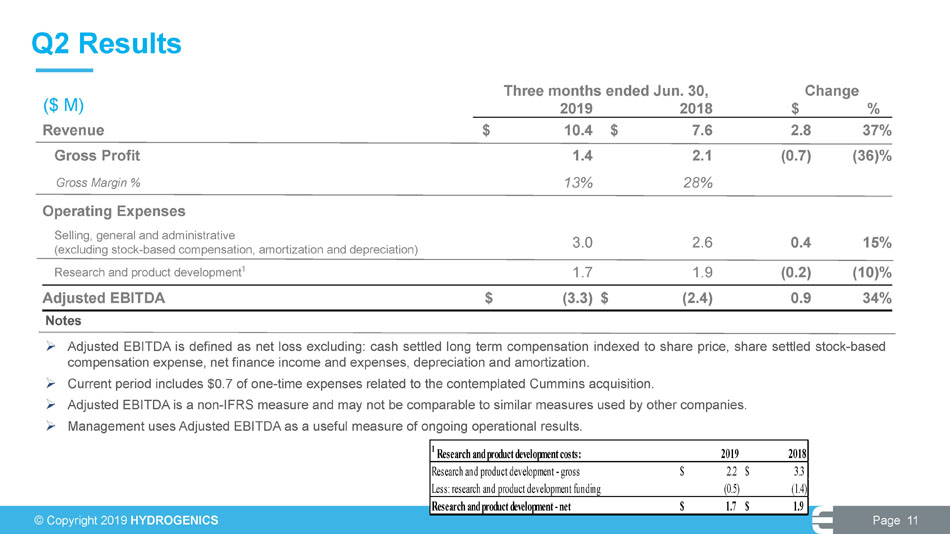

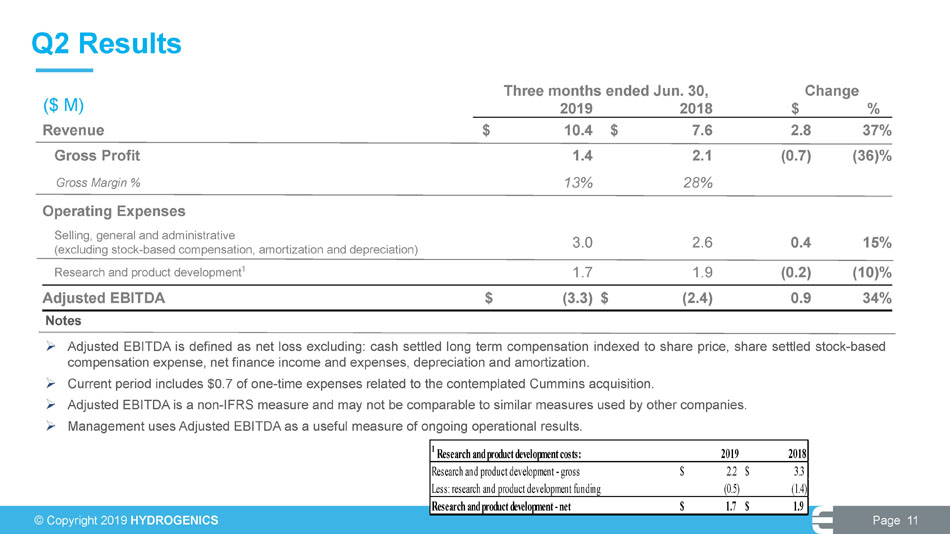

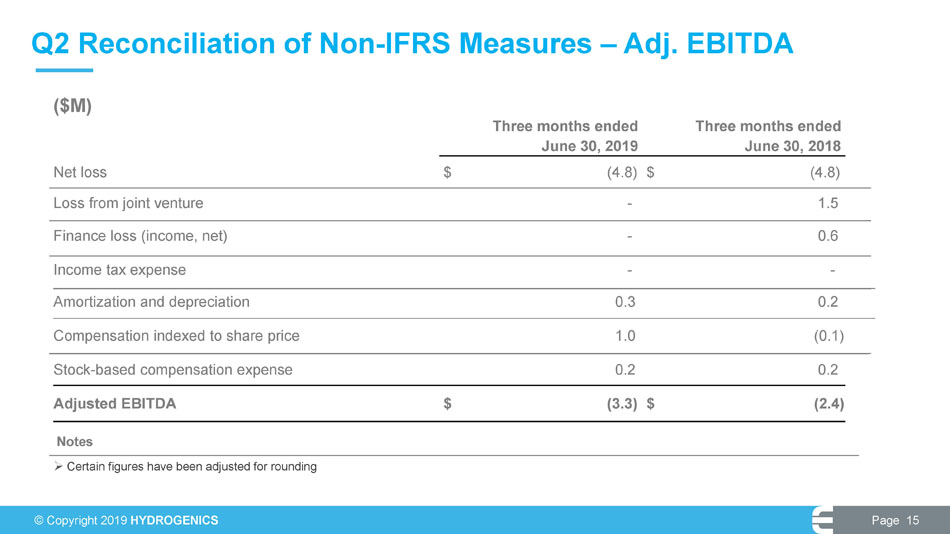

© Copyright 2019 HYDROGENICS Page 11 Notes » Adjusted EBITDA is defined as net loss excluding : cash settled long term compensation indexed to share price, share settled stock - based compensation expense, net finance income and expenses, depreciation and amortization . » Current period includes $ 0 . 7 of one - time expenses related to the contemplated Cummins acquisition . » Adjusted EBITDA is a non - IFRS measure and may not be comparable to similar measures used by other companies . » Management uses Adjusted EBITDA as a useful measure of ongoing operational results . ($ M) Q2 Results Three months ended Jun. 30, Change 2019 2018 $ % Revenue $ 10.4 $ 7.6 2.8 37% Gross Profit 1.4 2.1 (0.7) (36)% Gross Margin % 13% 28% Operating Expenses Selling, general and administrative (excluding stock - based compensation, amortization and depreciation) 3.0 2.6 0.4 15% Research and product development 1 1.7 1.9 (0.2) (10)% Adjusted EBITDA $ (3.3) $ (2.4) 0.9 34% 1 Research and product development costs: 2019 2018 Research and product development - gross 2.2$ 3.3$ Less: research and product development funding (0.5) (1.4) Research and product development - net 1.7$ 1.9$

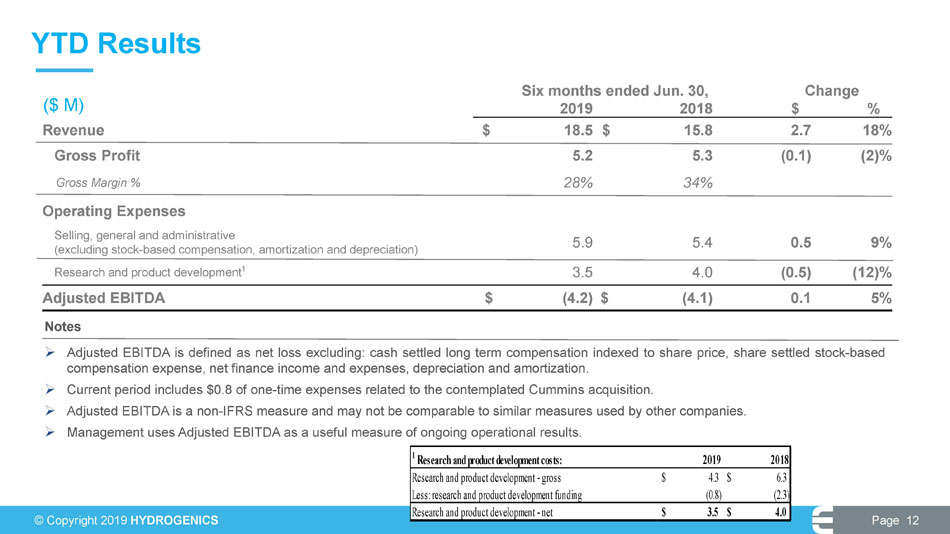

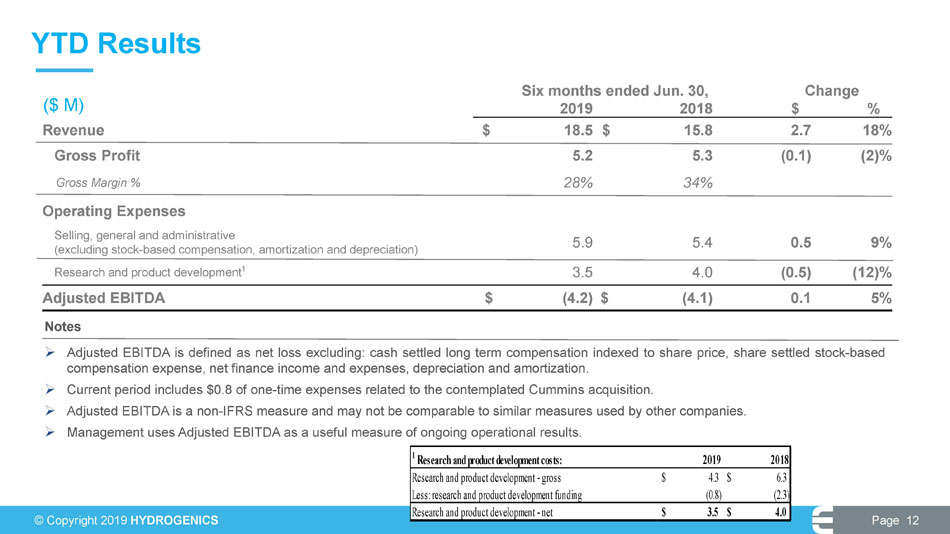

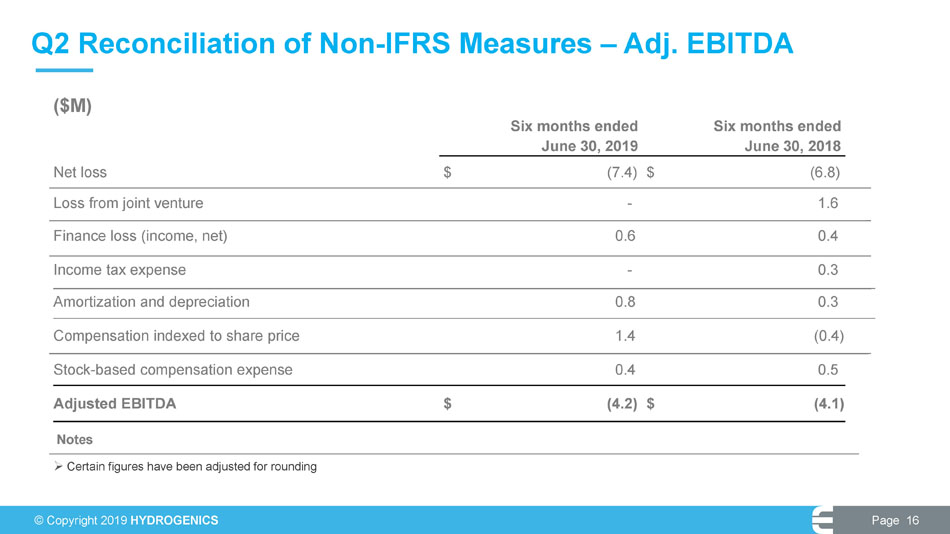

© Copyright 2019 HYDROGENICS Page 12 Notes » Adjusted EBITDA is defined as net loss excluding : cash settled long term compensation indexed to share price, share settled stock - based compensation expense, net finance income and expenses, depreciation and amortization . » Current period includes $ 0 . 8 of one - time expenses related to the contemplated Cummins acquisition . » Adjusted EBITDA is a non - IFRS measure and may not be comparable to similar measures used by other companies . » Management uses Adjusted EBITDA as a useful measure of ongoing operational results . ($ M) YTD Results Six months ended Jun. 30, Change 2019 2018 $ % Revenue $ 18.5 $ 15.8 2.7 18% Gross Profit 5.2 5.3 (0.1) (2)% Gross Margin % 28% 34% Operating Expenses Selling, general and administrative (excluding stock - based compensation, amortization and depreciation) 5.9 5.4 0.5 9% Research and product development 1 3.5 4.0 (0.5) (12)% Adjusted EBITDA $ (4.2) $ (4.1) 0.1 5% 1 Research and product development costs: 2019 2018 Research and product development - gross 4.3$ 6.3$ Less: research and product development funding (0.8) (2.3) Research and product development - net 3.5$ 4.0$

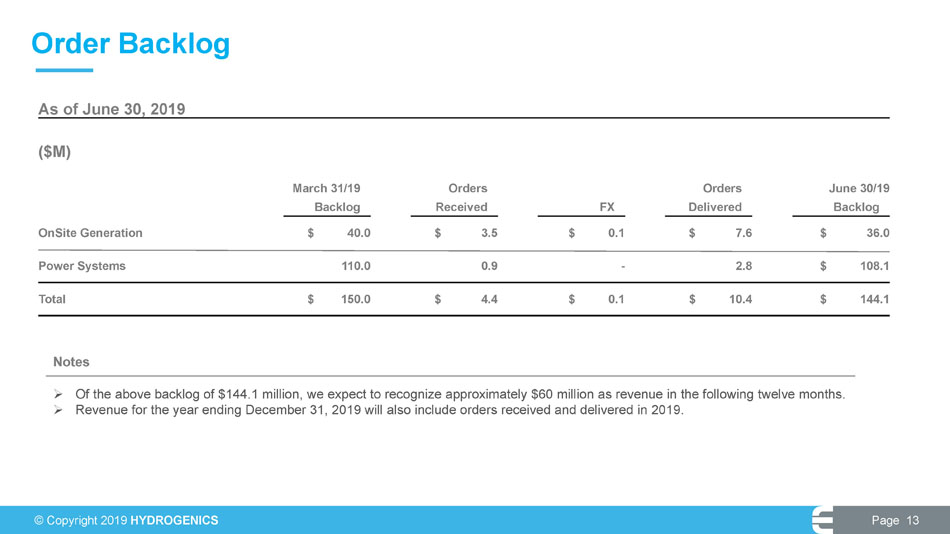

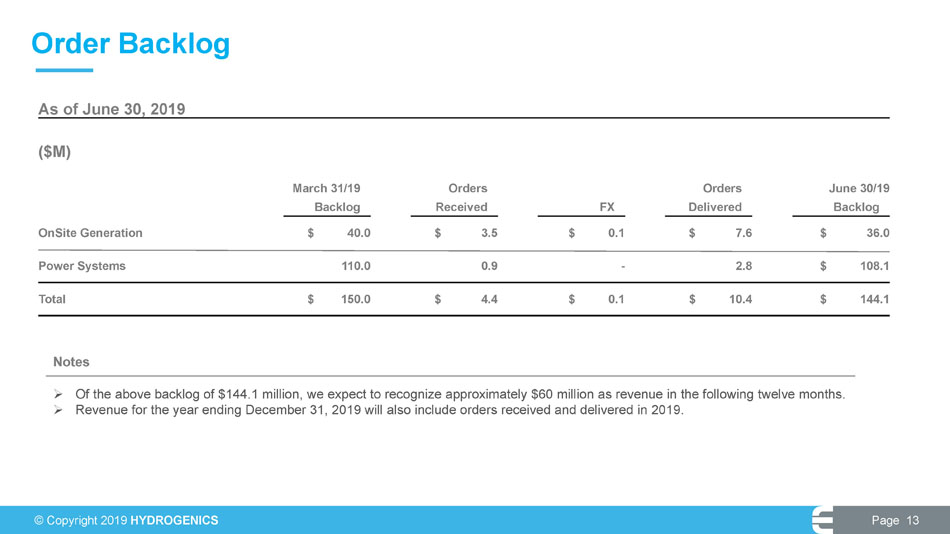

© Copyright 2019 HYDROGENICS Page 13 Order Backlog » Of the above backlog of $ 144 . 1 million, we expect to recognize approximately $ 60 million as revenue in the following twelve months . » Revenue for the year ending December 31 , 2019 will also include orders received and delivered in 2019 . As of June 30, 2019 ($M) March 31/19 Orders Orders June 30/19 Backlog Received FX Delivered Backlog OnSite Generation $ 40.0 $ 3.5 $ 0.1 $ 7.6 $ 36.0 Power Systems 110.0 0.9 - 2.8 $ 108.1 Total $ 150.0 $ 4.4 $ 0.1 $ 10.4 $ 144.1 Notes

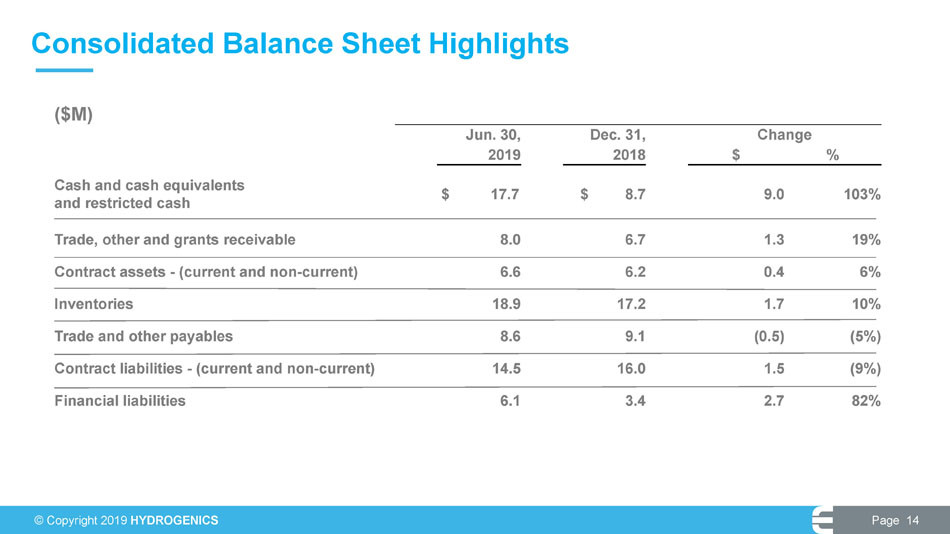

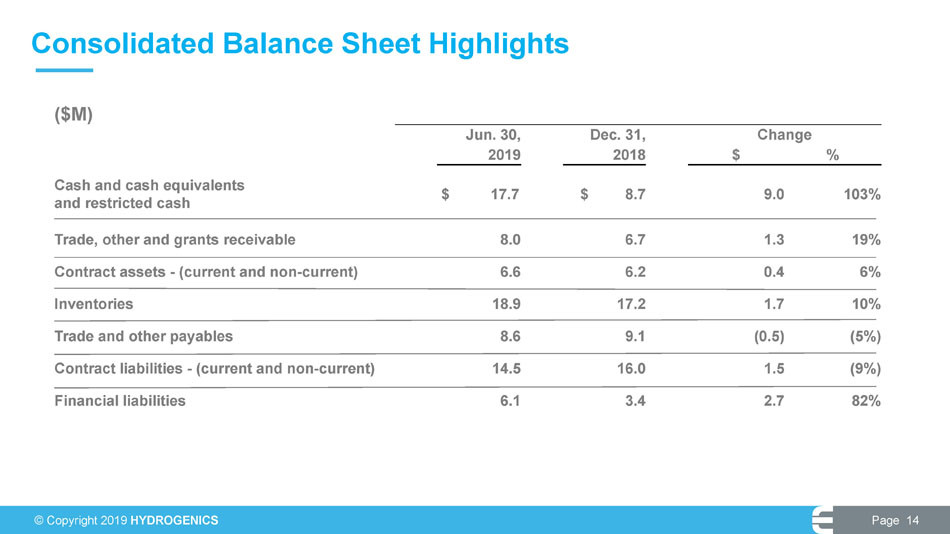

© Copyright 2019 HYDROGENICS Page 14 Consolidated Balance Sheet Highlights ($M) Jun. 30, Dec. 31, Change 2019 2018 $ % Cash and cash equivalents and restricted cash $ 17.7 $ 8.7 9.0 103% Trade, other and grants receivable 8.0 6.7 1.3 19% Contract assets - (current and non - current) 6.6 6.2 0.4 6% Inventories 18.9 17.2 1.7 10% Trade and other payables 8.6 9.1 (0.5) (5%) Contract liabilities - (current and non - current) 14.5 16.0 1.5 (9%) Financial liabilities 6.1 3.4 2.7 82%

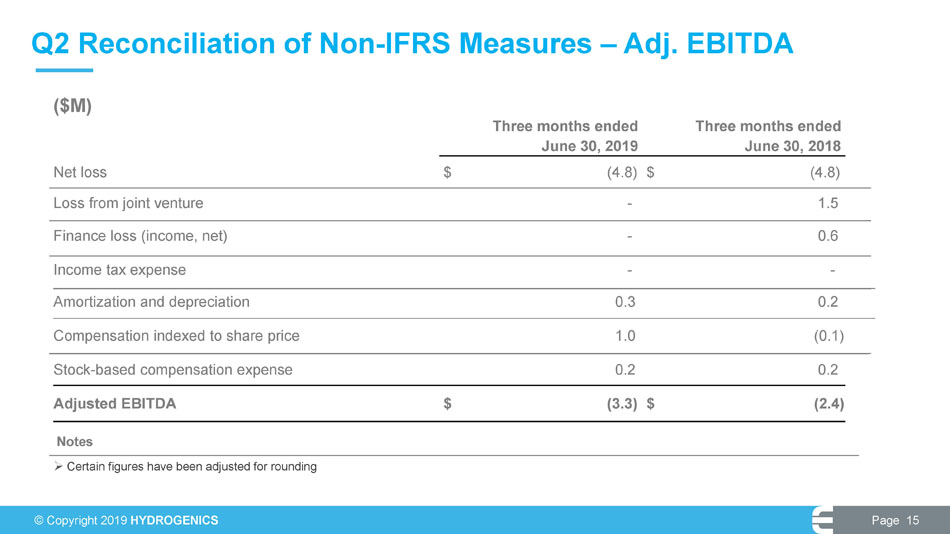

© Copyright 2019 HYDROGENICS Page 15 Q2 Reconciliation of Non - IFRS Measures – Adj. EBITDA ($M) Three months ended Three months ended June 30, 2019 June 30, 2018 Net loss $ (4.8) $ (4.8) Loss from joint venture - 1.5 Finance loss (income, net) - 0.6 Income tax expense - - Amortization and depreciation 0.3 0.2 Compensation indexed to share price 1.0 (0.1) Stock - based compensation expense 0.2 0.2 Adjusted EBITDA $ (3.3) $ (2.4) » Certain figures have been adjusted for rounding Notes

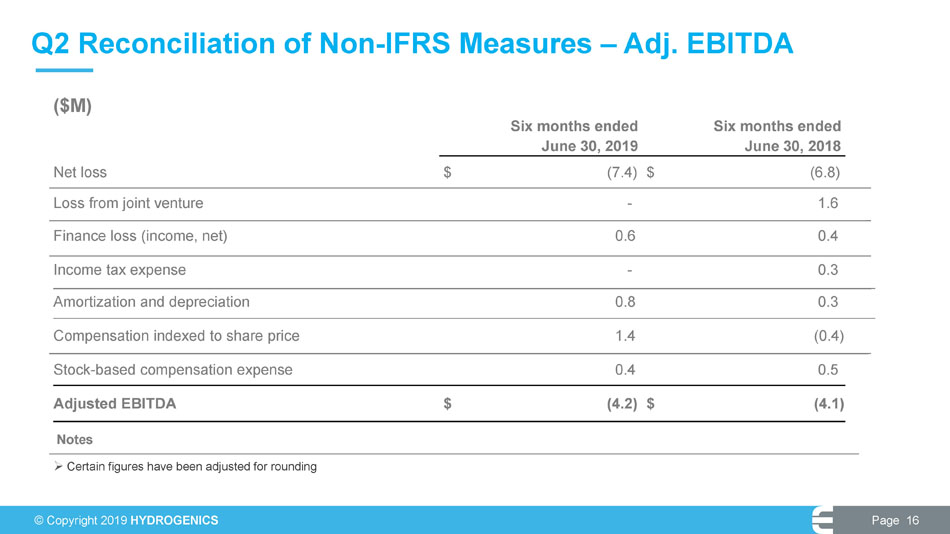

© Copyright 2019 HYDROGENICS Page 16 Q2 Reconciliation of Non - IFRS Measures – Adj. EBITDA ($M) Six months ended Six months ended June 30, 2019 June 30, 2018 Net loss $ (7.4) $ (6.8) Loss from joint venture - 1.6 Finance loss (income, net) 0 . 6 0.4 Income tax expense - 0.3 Amortization and depreciation 0.8 0.3 Compensation indexed to share price 1.4 (0.4) Stock - based compensation expense 0.4 0.5 Adjusted EBITDA $ (4.2) $ (4.1) » Certain figures have been adjusted for rounding Notes

We specialize in helping our customers succeed. Experience / Leadership / Technology The human factor