Filed by The NASDAQ OMX Group, Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: NYSE Euronext Commission File No.: 001-33392

| ||||

| ||||

Filed by The NASDAQ OMX Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: NYSE Euronext

Commission File No.: 001-33392

NASDAQ OMX ®/ Q111 EARNINGS PRESENTATION / 04.20.11

|

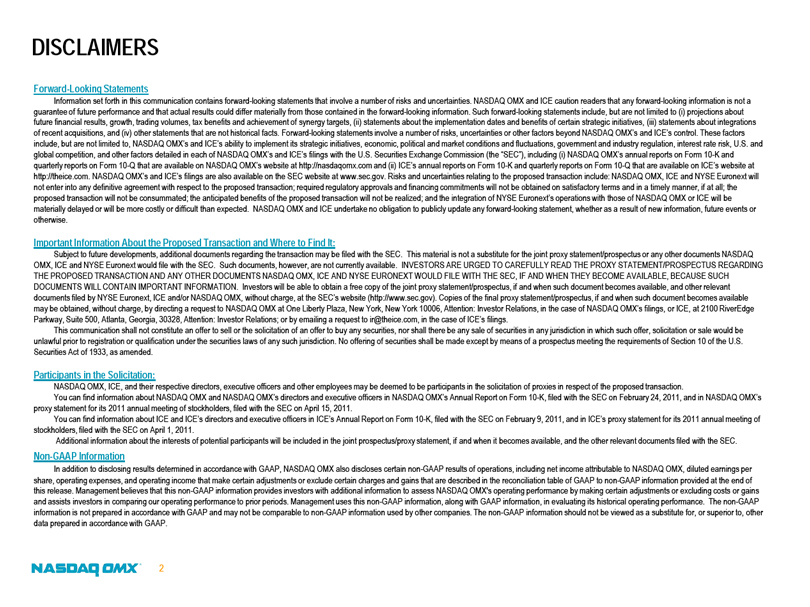

DISCLAIMERS

Forward-Looking Statements

Information set forth in this communication contains forward-looking statements that involve a number of risks and uncertainties. NASDAQ OMX and ICE caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to (i) projections about future financial results, growth, trading volumes, tax benefits and achievement of synergy targets, (ii) statements about the implementation dates and benefits of certain strategic initiatives, (iii) statements about integrations of recent acquisitions, and (iv) other statements that are not historical facts. Forward-looking statements involve a number of risks, uncertainties or other factors beyond NASDAQ OMX’s and ICE’s control. These factors include, but are not limited to, NASDAQ OMX’s and ICE’s ability to implement its strategic initiatives, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors detailed in each of NASDAQ OMX’s and ICE’s filings with the U.S. Securities Exchange Commission (the “SEC”), including (i) NASDAQ OMX’s annual reports on Form 10-K and quarterly reports on Form 10-Q that are available on NASDAQ OMX’s website at http://nasdaqomx.com and (ii) ICE’s annual reports on Form 10-K and quarterly reports on Form 10-Q that are available on ICE’s website at http://theice.com. NASDAQ OMX’s and ICE’s filings are also available on the SEC website at www.sec.gov. Risks and uncertainties relating to the proposed transaction include: NASDAQ OMX, ICE and NYSE Euronext will not enter into any definitive agreement with respect to the proposed transaction; required regulatory approvals and financing commitments will not be obtained on satisfactory terms and in a timely manner, if at all; the proposed transaction will not be consummated; the anticipated benefits of the proposed transaction will not be realized; and the integration of NYSE Euronext’s operations with those of NASDAQ OMX or ICE will be materially delayed or will be more costly or difficult than expected. NASDAQ OMX and ICE undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

Important Information About the Proposed Transaction and Where to Find It:

Subject to future developments, additional documents regarding the transaction may be filed with the SEC. This material is not a substitute for the joint proxy statement/prospectus or any other documents NASDAQ OMX, ICE and NYSE Euronext would file with the SEC. Such documents, however, are not currently available. INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER DOCUMENTS NASDAQ OMX, ICE AND NYSE EURONEXT WOULD FILE WITH THE SEC, IF AND WHEN THEY BECOME AVAILABLE, BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain a free copy of the joint proxy statement/prospectus, if and when such document becomes available, and other relevant documents filed by NYSE Euronext, ICE and/or NASDAQ OMX, without charge, at the SEC’s website (http://www.sec.gov). Copies of the final proxy statement/prospectus, if and when such document becomes available may be obtained, without charge, by directing a request to NASDAQ OMX at One Liberty Plaza, New York, New York 10006, Attention: Investor Relations, in the case of NASDAQ OMX’s filings, or ICE, at 2100 RiverEdge Parkway, Suite 500, Atlanta, Georgia, 30328, Attention: Investor Relations; or by emailing a request to ir@theice.com, in the case of ICE’s filings.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Participants in the Solicitation:

NASDAQ OMX, ICE, and their respective directors, executive officers and other employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction.

You can find information about NASDAQ OMX and NASDAQ OMX’s directors and executive officers in NASDAQ OMX’s Annual Report on Form 10-K, filed with the SEC on February 24, 2011, and in NASDAQ OMX’s proxy statement for its 2011 annual meeting of stockholders, filed with the SEC on April 15, 2011.

You can find information about ICE and ICE’s directors and executive officers in ICE’s Annual Report on Form 10-K, filed with the SEC on February 9, 2011, and in ICE’s proxy statement for its 2011 annual meeting of stockholders, filed with the SEC on April 1, 2011.

Additional information about the interests of potential participants will be included in the joint prospectus/proxy statement, if and when it becomes available, and the other relevant documents filed with the SEC.

Non-GAAP Information

In addition to disclosing results determined in accordance with GAAP, NASDAQ OMX also discloses certain non-GAAP results of operations, including net income attributable to NASDAQ OMX, diluted earnings per share, operating expenses, and operating income that make certain adjustments or exclude certain charges and gains that are described in the reconciliation table of GAAP to non-GAAP information provided at the end of this release. Management believes that this non-GAAP information provides investors with additional information to assess NASDAQ OMX’s operating performance by making certain adjustments or excluding costs or gains and assists investors in comparing our operating performance to prior periods. Management uses this non-GAAP information, along with GAAP information, in evaluating its historical operating performance. The non-GAAP information is not prepared in accordance with GAAP and may not be comparable to non-GAAP information used by other companies. The non-GAAP information should not be viewed as a substitute for, or superior to, other data prepared in accordance with GAAP.

NASDAQ OMX 2

|

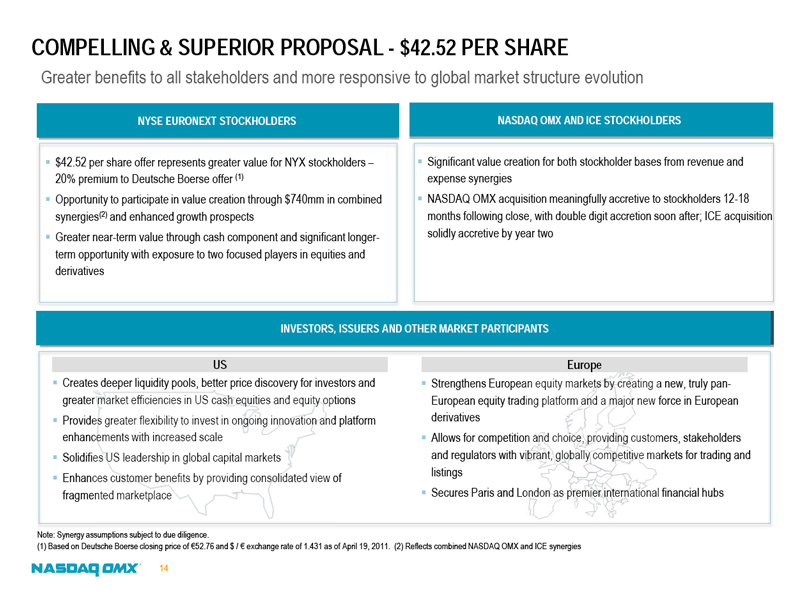

COMPELLING & SUPERIOR PROPOSAL - $42.52 PER SHARE

Greater benefits to all stakeholders and more responsive to global market structure evolution

NYSE EURONEXT STOCKHOLDERS

$42.52 per share offer represents greater value for NYX stockholders – 20% premium to Deutsche Boerse offer (1)

Opportunity to participate in value creation through $740mm in combined synergies(2) and enhanced growth prospects

Greater near-term value through cash component and significant longer-term opportunity with exposure to two focused players in equities and derivatives

NASDAQ OMX AND ICE STOCKHOLDERS

Significant value creation for both stockholder bases from revenue and expense synergies

NASDAQ OMX acquisition meaningfully accretive to stockholders 12-18 months following close, with double digit accretion soon after; ICE acquisition solidly accretive by year two

INVESTORS, ISSUERS AND OTHER MARKET PARTICIPANTS

US

Creates deeper liquidity pools, better price discovery for investors and greater market efficiencies in US cash equities and equity options

Provides greater flexibility to invest in ongoing innovation and platform enhancements with increased scale

Solidifies US leadership in global capital markets

Enhances customer benefits by providing consolidated view of fragmented marketplace

Europe

Strengthens European equity markets by creating a new, truly pan-European equity trading platform and a major new force in European derivatives

Allows for competition and choice, providing customers, stakeholders and regulators with vibrant, globally competitive markets for trading and listings

Secures Paris and London as premier international financial hubs

Note: Synergy assumptions subject to due diligence.

(1) Based on Deutsche Boerse closing price of €52.76 and $ / € exchange rate of 1.431 as of April 19, 2011. (2) Reflects combined NASDAQ OMX and ICE synergies

NASDAQ OMX 14

|

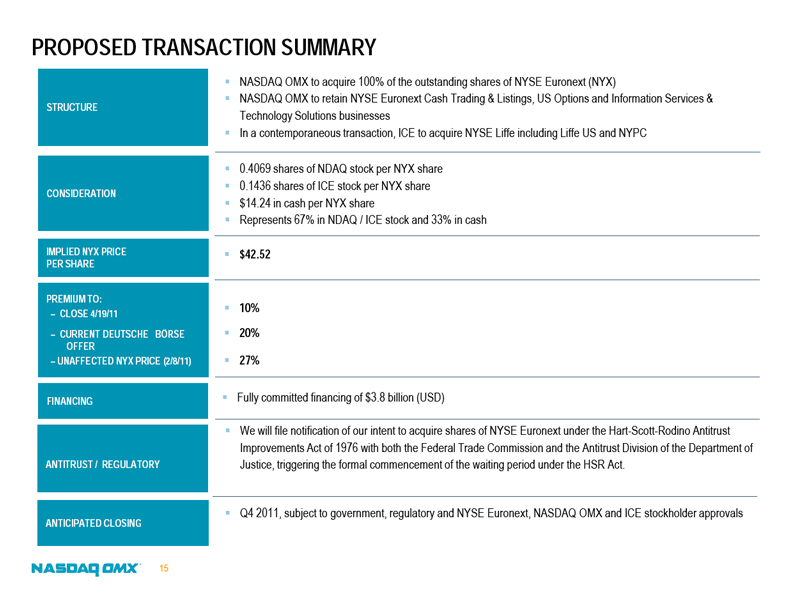

PROPOSED TRANSACTION SUMMARY

STRUCTURE

NASDAQ OMX to acquire 100% of the outstanding shares of NYSE Euronext (NYX)

NASDAQ OMX to retain NYSE Euronext Cash Trading & Listings, US Options and Information Services & Technology Solutions businesses

In a contemporaneous transaction, ICE to acquire NYSE Liffe including Liffe US and NYPC

CONSIDERATION

0.4069 shares of NDAQ stock per NYX share

0.1436 shares of ICE stock per NYX share

$14.24 in cash per NYX share

Represents 67% in NDAQ / ICE stock and 33% in cash

IMPLIED NYX PRICE PER SHARE

$42.52

PREMIUM TO:

– CLOSE 4/19/11

– CURRENT DEUTSCHE BÖRSE

OFFER

– UNAFFECTED NYX PRICE (2/8/11)

10% 20% 27%

FINANCING

Fully committed financing of $3.8 billion (USD)

ANTITRUST / REGULATORY

We will file notification of our intent to acquire shares of NYSE Euronext under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 with both the Federal Trade Commission and the Antitrust Division of the Department of Justice, triggering the formal commencement of the waiting period under the HSR Act.

ANTICIPATED CLOSING

Q4 2011, subject to government, regulatory and NYSE Euronext, NASDAQ OMX and ICE stockholder approvals

NASDAQ OMX 15

|

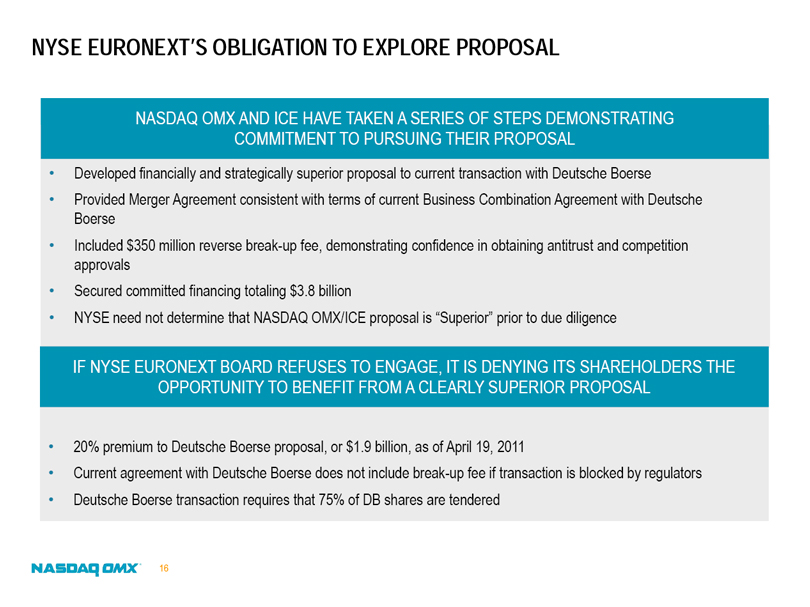

NYSE EURONEXT’S OBLIGATION TO EXPLORE PROPOSAL

NASDAQ OMX AND ICE HAVE TAKEN A SERIES OF STEPS DEMONSTRATING COMMITMENT TO PURSUING THEIR PROPOSAL

Developed financially and strategically superior proposal to current transaction with Deutsche Boerse

Provided Merger Agreement consistent with terms of current Business Combination Agreement with Deutsche Boerse

Included $350 million reverse break-up fee, demonstrating confidence in obtaining antitrust and competition approvals

Secured committed financing totaling $3.8 billion

NYSE need not determine that NASDAQ OMX/ICE proposal is “Superior” prior to due diligence

IF NYSE EURONEXT BOARD REFUSES TO ENGAGE, IT IS DENYING ITS SHAREHOLDERS THE OPPORTUNITY TO BENEFIT FROM A CLEARLY SUPERIOR PROPOSAL

20% premium to Deutsche Boerse proposal, or $1.9 billion, as of April 19, 2011

Current agreement with Deutsche Boerse does not include break-up fee if transaction is blocked by regulators

Deutsche Boerse transaction requires that 75% of DB shares are tendered

NASDAQ OMX 16