STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

IXIA

|

| (Name of Registrant as Specified in its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | (3) | | Filing Party: |

| | |

| | (4) | | Date Filed: |

| | |

IXIA

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 10, 2012

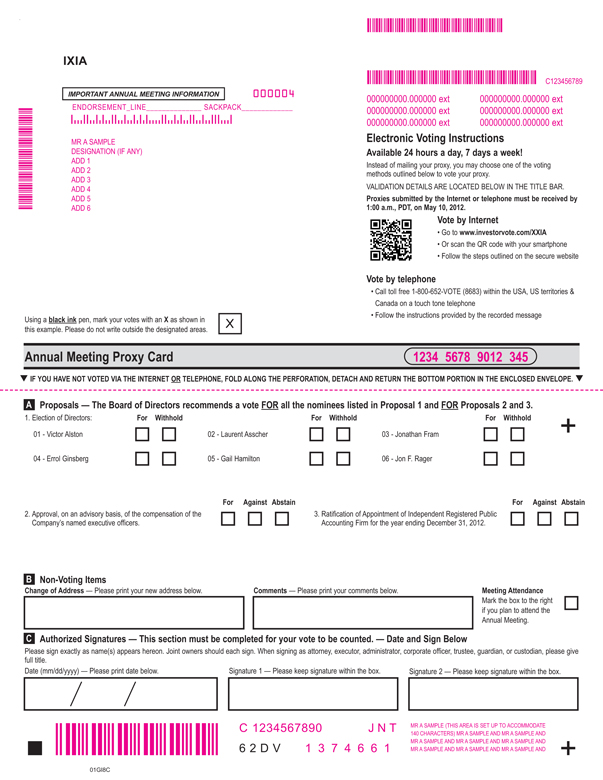

The Annual Meeting of the Shareholders of Ixia, a California corporation (the “Company” or “Ixia”), will be held Thursday, May 10, 2012, at 9:00 a.m., local time, at the Sheraton Agoura Hills Hotel, located at 30100 Agoura Road, Agoura Hills, California 91301. The purposes of the Annual Meeting are:

1. To elect six directors for a one-year term. The names of the nominees intended to be presented for election are: Victor Alston, Laurent Asscher, Jonathan Fram, Errol Ginsberg, Gail Hamilton and Jon F. Rager.

2. To approve an advisory resolution on executive compensation.

3. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

4. To transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

The record date for our Annual Meeting is March 16, 2012. Only record holders of the Company’s Common Stock (“Common Stock”) at the close of business on March 16, 2012 are entitled to receive notice of and to vote at the Annual Meeting.

We cordially invite all shareholders to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting in person, your vote is important to us, and we therefore encourage you to vote as soon as possible. As an alternative to voting in person at the Annual Meeting, you may vote over the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing your proxy card in the enclosed postage-prepaid envelope. Voting by any of these methods will ensure your representation at the Annual Meeting.

We look forward to seeing you at the Annual Meeting.

|

| By Order of the Board of Directors |

|

| Ronald W. Buckly |

| Corporate Secretary |

Calabasas, California

April 4, 2012

PLEASE MARK, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT TO US PROMPTLY IN THE ENCLOSED ENVELOPE. YOUR VOTE IS IMPORTANT TO US.

* * * * *

IMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE

HELD ON MAY 10, 2012

THIS PROXY STATEMENT AND THE 2011 ANNUAL REPORT TO SHAREHOLDERS, INCLUDING OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2011, ARE AVAILABLE FOR VIEWING, PRINTING AND DOWNLOADING AT:

www.ixiacom.com/proxy

INFORMATION ON OUR WEB SITE DOES NOT CONSTITUTE PART OF THIS PROXY STATEMENT OR OUR ANNUAL REPORT ON FORM 10-K.

A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING EXHIBITS, WILL ALSO BE FURNISHED WITHOUT CHARGE TO ANY SHAREHOLDER UPON WRITTEN OR ORAL REQUEST TO IXIA, ATTENTION TOM MILLER, CHIEF FINANCIAL OFFICER, IXIA, 26601 W. AGOURA ROAD, CALABASAS, CA 91302 USA; TELEPHONE 818.871.1800.

TABLE OF CONTENTS

IXIA

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The Board of Directors of Ixia (the “Board”) is furnishing you with this proxy statement to solicit proxies for use at our Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Thursday, May 10, 2012 at 9:00 a.m., local time, for the purposes described in this proxy statement and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at the Sheraton Agoura Hills Hotel which is located at 30100 Agoura Road, Agoura Hills, California 91301.

These proxy materials were first sent on or about April 13, 2012 to shareholders entitled to vote at the Annual Meeting.

Only shareholders of record at the close of business on March 16, 2012, which is the Record Date, are entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, 70,779,851 shares of our Common Stock were issued and outstanding.

Any proxy that you give in response to this proxy solicitation may be revoked by you at any time before its use in one of two ways, either by:

| | • | | delivering to our Corporate Secretary a written notice of revocation or another proxy bearing a later date, or |

| | • | | attending the Annual Meeting and voting in person. |

Voting and Solicitation

Methods of Voting.You may vote by mail, in person at the Annual Meeting, by telephone or over the Internet. If your shares are held in the name of your broker or other nominee (your record holder), you are considered the beneficial owner of shares held in street name, and you should receive instructions from your brokerage firm, bank or other nominee that must be followed in order for the record holder to vote your shares per your instructions. Brokerage firms, banks and other nominees typically have a process for their beneficial holders to provide voting instructions via the Internet or by telephone.

Voting by Mail. If your shares are registered directly in your name, then you are the record holder of the shares. By signing the enclosed proxy card and returning it in the prepaid and addressed envelope enclosed with these proxy materials, you are authorizing the individuals named on the proxy card (known as “proxies”) to vote your shares at the Annual Meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the Annual Meeting so that your shares will be voted even if you later find yourself unable to attend the Annual Meeting. If you receive more than one proxy card, it is an indication that your shares are held in multiple accounts. Please sign and return all proxy cards to ensure that all of your shares are voted.

Voting in Person at the Annual Meeting. If you are the record holder of your shares and you plan to attend the Annual Meeting and vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the shareholder of record and you have the right to vote in person at the Annual Meeting. If you beneficially own your shares and you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

1

Voting by Telephone. To vote by telephone, please follow the instructions included on your proxy card. If you are the beneficial holder of your shares, to vote by telephone, please follow the voting instructions that you receive from your brokerage firm, bank or other nominee. If you are a record holder and you vote by telephone, you do not need to complete and mail your proxy card.

Voting over the Internet.To vote over the Internet, please follow the instructions included on your proxy card. If you are the beneficial holder of your shares, to vote over the Internet, please follow the voting instructions that you receive from your brokerage firm, bank or other nominee. If you are a record holder and you vote over the Internet, you do not need to complete and mail your proxy card.

Voting for Directors. In the election of directors, you may vote “FOR” all or some of the director nominees, or your vote may be “WITHHELD” for one or more of the director nominees. You may also cumulate your votes in the election of directors if you or any other shareholder notifies us at the Annual Meeting prior to voting of an intention to cumulate votes.

Cumulative voting allows you to allocate among the director nominees, as you see fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares you hold. For example, if you own 100 shares of our Common Stock, and there are six directors to be elected at our Annual Meeting, you may allocate 600 “FOR” votes (six times 100) among as few or as many of the six nominees to be voted on at the Annual Meeting as you choose.

If you are a record holder and you sign your proxy card with no further instructions, the proxy holders may cumulate and cast your votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that the proxy holders will not cast your votes for a nominee if you have instructed that votes be “WITHHELD” for that nominee. If you are the beneficial holder of your shares and you do not provide your brokerage firm, bank or other nominee with instructions on how to vote your shares in the election of directors, then your shares will not be voted.

Voting on All Other Matters. Each share of our Common Stock outstanding as of the close of business on the Record Date has one vote. You may vote “FOR,” “AGAINST” or “ABSTAIN” for any proposal other than a proposal relating to the election of directors. Except as otherwise required by law, our Articles of Incorporation or our Bylaws, the affirmative vote of a majority of shares present or represented by proxy and voting at our Annual Meeting is required for the approval of matters other than the election of directors. California state law also requires that the number of shares voting “FOR” any matter must equal at least a majority of the required quorum for the Annual Meeting.

You may vote part of your shares “FOR” any proposal and refrain from voting your remaining shares or you may vote your remaining shares “AGAINST” the proposal. If you are a record holder and you return a signed proxy card but fail to provide voting instructions on a proposal or to specify the number of shares you are voting “FOR” a proposal, then we are allowed to assume that you are voting all of your shares “FOR” the proposal. If you are the beneficial holder of your shares and you fail to provide voting instructions on a proposal, then your shares will not be voted on the proposal unless it is deemed to be a routine matter as described below under “Effect of Broker Non-Votes.”

Effect of Abstentions. Abstentions are included in determining the number of shares present and entitled to vote for purposes of determining the presence of a quorum.

In general, abstentions are not counted either “FOR” or “AGAINST” a proposal being voted on. If, however, the number of abstentions is such that the “FOR” votes, while outnumbering the votes “AGAINST” the proposal, do not equal at least a majority of the quorum required for the meeting, the proposal will be defeated and, in this case, abstentions will have the same effect as a vote “AGAINST”

2

the proposal. In the case of election of directors, however, your abstention will have no effect on the outcome.

For example, if 60% of our outstanding shares are represented in person or by proxy at a meeting at which the required quorum is a majority of the outstanding shares, and the vote on a proposal is 30% in favor, 15% against and 15% abstaining, then the proposal will be adopted. However, if 21% vote in favor, 19% vote against and 20% abstain, then the proposal will be defeated because 21% does not represent a majority of the required quorum, even though the affirmative votes outnumber the negative votes.

Effect of “Broker Non-Votes.” If you hold your shares at the account of a brokerage firm, bank or other nominee, your shares are held in street name. Shares that are held in street name are held in the name of the brokerage firm, bank or other nominee. Brokerage firms, banks and other nominees may exercise their voting discretion without receiving instructions from the beneficial owner of the shares only on proposals that are deemed to be routine matters. Examples of routine matters include proposals to ratify the appointment of a company’s independent registered public accounting firm. If a proposal is not a routine matter, the broker or nominee may not vote the shares with respect to the proposal without receiving instructions from the beneficial owner of the shares. Examples of non-routine matters include the election of directors, and advisory votes on executive compensation. If a broker turns in a proxy card expressly stating that the broker is not voting on a non-routine matter, then such action is referred to as a “broker non-vote.”

The cost of this solicitation will be borne by the Company. We have retained the services of Georgeson Inc. to assist in distributing proxy materials to brokerage houses, banks, custodians and other nominee holders. The estimated cost of such services is $2,000 plus out-of-pocket expenses. We may reimburse brokerage houses and other persons representing beneficial owners of shares for their expenses in forwarding proxy materials to such beneficial owners, although there are no formal agreements in place to that effect. Proxies may be solicited by our directors, officers and regular employees, without additional compensation or reimbursement by the Company.

Voting Confidentiality. Proxies, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed except as required by law.

Deadline for Receipt of Shareholder Proposals

Proposals of shareholders of Ixia which are intended to be presented by such shareholders at the Company’s annual meeting of shareholders to be held in 2013 (the “2013 Annual Meeting”) must be received by the Company no later than December 5, 2012 to be included in the proxy materials relating to that annual meeting. In addition, proxies solicited by management may confer discretionary authority to vote on matters which are not included in the proxy statement but which are raised at the 2013 Annual Meeting, unless we receive written notice of such matters on or before February 9, 2013;provided,however, that if the date of the 2013 Annual Meeting is more than 30 days before or after the anniversary date of the 2012 Annual Meeting, we must receive written notice of such matters not later than the close of business on the 10th day following the day on which notice of the date of the 2013 Annual Meeting is mailed to shareholders or otherwise publicly disclosed. It is recommended that shareholders submitting proposals direct them to the Corporate Secretary of the Company by sending them by certified mail, return receipt requested, in order to ensure timely delivery. No such proposals were received with respect to the 2012 Annual Meeting scheduled for May 10, 2012.

3

PROPOSAL 1 - ELECTION OF DIRECTORS

Our Bylaws provide for Ixia’s Board of Directors to consist of four to seven directors. The number of authorized directors is currently set at six, and a board comprising six directors will be elected at the Annual Meeting. Unless otherwise instructed, proxy holders will vote the proxies received by them for our six nominees named below. All of the nominees, other than Mr. Alston, currently serve as directors of Ixia and were previously elected by our shareholders at their annual meeting held in May 2011. Mr. Alston’s nomination for election as a director was recommended by the Nominating and Corporate Governance Committee of our Board and approved by our Board.

In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, your proxy will be voted for any nominee who is designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in accordance with cumulative voting to assure the election of as many of the nominees listed in this proxy statement as possible and, in this event, the specific nominees to be voted for will be determined by the proxy holders. We do not expect that any of our six nominees will be unable or will decline to serve as a director. The term of office of each person elected as a director will continue until the next annual meeting of our shareholders and such time as his or her successor is duly elected and qualified or until his or her earlier resignation, removal or death.

Nominees

The names of our nominees, and certain information about them as of March 20, 2012, are set forth below:

| | | | | | | | | | |

Name | | Age | | | Position(s) with the Company | | Director Since | |

Errol Ginsberg | | | 56 | | | Chairman of the Board and Chief Innovation Officer | | | 1997 | |

Victor Alston | | | 40 | | | Chief Operating Officer | | | | |

Laurent Asscher | | | 42 | | | Director | | | 2008 | |

Jonathan Fram | | | 55 | | | Director | | | 2005 | |

Gail Hamilton | | | 62 | | | Director | | | 2005 | |

Jon F. Rager | | | 72 | | | Director | | | 1997 | |

Mr. Ginsberg served as the Company’s President from May 1997 until September 2007 and held the additional position of Chief Executive Officer from September 2000 until March 2008 when he assumed his current position as Chief Innovation Officer. Mr. Ginsberg has been a director since May 1997 and became Chairman of the Board in January 2008.

Mr. Alston joined the Company as Vice President, Application Development in August 2004. He became Vice President, Engineering in April 2006 and was appointed as an executive officer in that position in June 2006. Mr. Alston was appointed as Senior Vice President, Product Development in June 2007, and served in that position until he assumed his present position as Chief Operating Officer in March 2012. The Board has appointed Mr. Alston to succeed Atul Bhatnagar as the Company’s President and Chief Executive Officer, effective as of the date of the Annual Meeting.

Mr. Asscher has been a director since October 2008. Since February 2005, he has served as President and Chief Executive Officer of Airtek Capital Group, S.A., a private equity investment firm based in Brussels, Belgium. He currently serves on the boards of directors of several technology companies.

Mr. Fram has been a director of the Company since July 2005. In October 2010, Mr. Fram became Acting Chief Executive Officer of Nularis, a distributor of energy efficient lighting products.

4

From March 2006 until July 2010, Mr. Fram served as a Managing Partner of Maveron III LLC, a venture capital firm, and from August 2007 until July 2010, he served as a Managing Partner of Maveron IV LLC, a venture capital firm. Mr. Fram served as a member of the Board of Directors of Marchex, Inc. until June 2009.

Ms. Hamilton has been a director of the Company since July 2005. Ms. Hamilton also serves as a member of the Board of Directors of Arrow Electronics, Inc., Open Text Corporation and Westmoreland Coal Company. Ms. Hamilton served as a member of the Board of Directors of Washington Group International, Inc. until November 2007.

Mr. Rager has been a director of the Company since May 1997 and served as the Company’s Chief Financial Officer from June 1997 to March 2000. Mr. Rager currently serves on the boards of directors of several privately held technology companies and served as a director of Tekelec from 1986 until his retirement in 2007.

There is no family relationship between any director or executive officer of the Company and any other director or executive officer of the Company.

The Board and the Nominating and Corporate Governance Committee believe that the background and experience of the Company’s Board members provide the Company with the perspectives and judgment needed to provide the necessary guidance and oversight of the Company’s business and strategies. The qualifications of the members of the Board include:

Errol Ginsberg

| | • | | Executive, business and operational experience in technology companies, including as a founder, former President and Chief Executive Officer and current Chairman of the Board and Chief Innovation Officer of Ixia |

| | • | | Outside board experience as a director of several privately held technology companies |

| | • | | Substantial telecommunications industry knowledge |

Victor Alston

| | • | | Executive, business and operational experience in technology companies, including as an executive officer of the Company since June 2006 and Director of Engineering of SAG, AG |

| | • | | Substantial telecommunications industry knowledge |

Laurent Asscher

| | • | | Investor and shareholder in several public and privately held technology companies, including Ixia |

| | • | | Outside board experience as a director in several privately held and public technology companies |

| | • | | Executive, business and operational experience as President and Chief Executive Officer of Airtek Capital Group, S.A. |

Jonathan Fram

| | • | | Private equity experience as a former managing partner of a venture capital funds and as an investor in start-up companies |

| | • | | Outside board experience as a former director of Marchex, Inc. |

| | • | | Former President of Net2Phone |

| | • | | Financial experience as a former securities analyst |

5

Gail Hamilton

| | • | | Executive, business and operational experience as a former senior executive of Symantec Corporation |

| | • | | Outside board experience as a director of public and privately held companies |

| | • | | Audit committee and compensation committee experience, including as Chair of Ixia’s Compensation Committee |

| | • | | Strategic planning and business development experience at public technology companies |

Jon F. Rager

| | • | | Outside board experience as a former director of Tekelec (1986-2007) and as a current director of several privately held technology companies |

| | • | | Broad financial experience, including career as a certified public accountant |

| | • | | Audit committee and compensation committee experience, including as Chair of Ixia’s Audit Committee |

| | • | | Qualifies as an Audit Committee financial expert |

Information Regarding our Board of Directors and its Committees

Our Board of Directors held a total of ten meetings during 2011 and acted six times by unanimous written consent. The Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee and, until March 2011, had a Strategic Planning Committee. Each of these committees has a written charter approved by the Board of Directors, which sets forth the duties and responsibilities of the committee. A copy of each charter is available on our website at www.ixiacom.com.

The members of the committees currently are:

| | | | | | | | | | | | |

Director | | Audit

Committee | | | Compensation

Committee | | | Nominating and Corporate

Governance Committee | |

Laurent Asscher | | | | | | | X | | | | | |

Atul Bhatnagar | | | | | | | | | | | | |

Jonathan Fram | | | X | | | | X | | | | Chair | |

Errol Ginsberg | | | | | | | | | | | | |

Gail Hamilton | | | X | | | | Chair | | | | X | |

Jon F. Rager | | | Chair | | | | | | | | X | |

During 2011, each of our directors attended at least 75% of the total of all Board meetings and meetings of Committees of which he or she was a member.

We strongly encourage our Board members to attend our annual meetings of shareholders. All of our Board members attended our 2011 annual meeting.

Director Independence. Ixia’s directors meet the standards for director independence under listing standards established by The NASDAQ Stock Market LLC (“Nasdaq”) and under the rules of the Securities and Exchange Commission (“SEC” or “Commission”). An “independent director” means a person other than an executive officer or employee of Ixia, or any other individual having a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. For a director to be considered independent and among other criteria, the Board must affirmatively determine that neither the director nor an immediate family member of the director has had any direct or indirect material relationship with Ixia within the last three years.

6

The Board considered relationships, transactions and/or arrangements between the Company and each of our directors and director nominees in determining whether he or she was independent. The Board has affirmatively determined that each current member of the Board, other than Messrs. Ginsberg and Bhatnagar, is an independent director under applicable Nasdaq listing standards and SEC rules. Messrs. Ginsberg and Bhatnagar do not meet the independence standards because each is an executive officer and employee of Ixia. Mr. Alston also does not meet the independence standards because he is an executive officer and employee of Ixia.

The independent directors meet regularly in executive sessions without the presence of Messrs. Ginsberg and Bhatnagar or other members of Ixia’s management in connection with regularly scheduled Board meetings and from time to time as they deem necessary or appropriate.

Board Leadership Structure. We have separated the positions of Chairman of the Board and Chief Executive Officer. Errol Ginsberg serves as our Chairman of the Board in addition to serving as Chief Innovation Officer, while Atul Bhatnagar serves as the Company’s President and Chief Executive Officer. Our Chief Executive Officer is responsible for the leadership, performance and strategic direction of the Company, while the Chairman of the Board provides guidance to the Chief Executive Officer and presides over Board meetings. Our Board determined that it was appropriate for Mr. Ginsberg to serve as Chairman of the Board following his resignation as the Company’s Chief Executive Officer in order to facilitate close cooperation and collaboration between Messrs. Ginsberg and Bhatnagar and because Mr. Ginsberg’s knowledge and experience with the Company as a founder and former Chief Executive Officer would be valuable in his role as Chairman.

The Board’s Role in Risk Oversight. As described in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2011, as filed with the Securities and Exchange Commission (the “SEC”) in March 2012, we are subject to a number of significant risks. Management is responsible for the day-to-day assessment, monitoring and management of these risks, while the Board of Directors, as a whole and through its several committees, has responsibility for the oversight of risk management. Our Board of Directors and its committees work with our senior management to manage the various risks we face. As a part of its oversight role, our Board periodically reviews and discusses, both with and without management present, the assessment and management of the risks that our Company faces and the importance and integral nature of risk management to the Company’s business strategy.

To facilitate its oversight of our Company, our Board has delegated certain functions (including the oversight of risks related to these functions) to various Board committees. Our Audit Committee generally evaluates the risks related to our financial reporting process and oversees our general risk management processes. Our Compensation Committee evaluates the risks presented by our compensation programs and takes into account these risks when making compensation decisions. Our Nominating and Corporate Governance Committee evaluates whether our Board has the requisite core competencies to respond to the risks that we face. Following the dissolution of the Strategic Planning Committee in March 2011, our Board assumed the functions of that Committee and is responsible for evaluating the risks associated with strategic transactions, such as mergers and acquisitions, under consideration by the Company. The roles and responsibilities of these committees are discussed in more detail below. Although the Board has delegated certain functions to various committees, each of these committees periodically reports to and solicits input from the full Board regarding its activities.

Audit Committee. The Board has determined that each member of the Audit Committee is independent under current Nasdaq listing standards and SEC rules. In addition, the Board has determined that each member of the Audit Committee is financially literate for purposes of the Nasdaq listing standards, and that Mr. Rager qualifies as an audit committee financial expert within the meaning of applicable SEC regulations. During 2011, the Audit Committee met 14 times.

7

The Audit Committee assists the Board in fulfilling its oversight responsibilities for financial matters. Specifically, the Audit Committee assists the Board in overseeing:

| | • | | the integrity of our financial statements, |

| | • | | the qualifications and independence of our independent registered public accounting firm, |

| | • | | the performance of our independent registered public accounting firm, |

| | • | | the integrity of our systems of internal accounting and financial controls, and |

| | • | | our compliance with legal and regulatory requirements. |

The Audit Committee has sole authority for selecting, evaluating and, when appropriate, replacing our independent registered public accounting firm. The Committee periodically meets privately, outside the presence of management, with our independent registered public accounting firm to discuss, among other matters, our internal accounting control policies and procedures. The Committee also reviews and approves in advance the services provided and fees charged by our independent registered public accounting firm.

As part of its oversight role with respect to our financial statements and the public disclosure of our financial results, our Audit Committee regularly reviews and discusses with our management the financial statements included in our annual reports on Form 10-K and quarterly reports on Form 10-Q, our quarterly earnings releases and the financial guidance we provide. Our Audit Committee also regularly meets in separate executive sessions with our Chief Executive Officer, our Chief Financial Officer, other members of our management team and key employees.

Compensation Committee. The Board has determined that each member of the Compensation Committee is independent under current Nasdaq listing standards. During 2011, the Compensation Committee met ten times and acted twice by unanimous written consent.

The Compensation Committee is responsible for overseeing and advising the Board with respect to our compensation and employee benefit plans and practices, including our executive compensation plans and our incentive compensation and equity-based plans. The Compensation Committee:

| | • | | determines the compensation paid to our executive officers, including our President and Chief Executive Officer, |

| | • | | approves our executive officer and employee bonus plans, |

| | • | | administers our Amended and Restated 2008 Equity Incentive Plan, as amended, including determining the persons to whom equity awards are granted and the terms of those awards, and |

| | • | | recommends to the Board the cash and equity incentive compensation paid to non-employee directors for Board and committee service. |

The Compensation Committee has the authority in its discretion to retain independent compensation consultants and outside advisors to assist the Committee in carrying out its duties and responsibilities. Since November 2009, the Compensation Committee has retained Frederic W. Cook Co., Inc. as an independent compensation consultant to render advisory services with respect to the Company’s executive officer compensation program, including executive compensation matters for 2011. See “Compensation Discussion and Analysis” below.

The Company’s Chief Executive Officer participates in decisions and discussions of the Board and in discussions of the Compensation Committee and makes recommendations to the Board and to the Committee with respect to compensation matters generally and the compensation of executive officers other than himself. See “Compensation Discussion and Analysis” below.

8

Nominating and Corporate Governance Committee. The Board has determined that each member of the Nominating and Corporate Governance Committee is independent under current Nasdaq listing standards. The Nominating and Corporate Governance Committee met once during 2011. The Nominating and Corporate Governance Committee also from time to time met informally to review Board and committee composition and related matters.

The Nominating and Corporate Governance Committee is responsible for:

| | • | | recommending to the Board individuals qualified to serve as directors and as members of committees of the Board, |

| | • | | advising the Board with respect to Board composition, procedures, committees and related matters, and |

| | • | | overseeing the review and evaluation of the Board’s performance. |

The Nominating and Corporate Governance Committee is authorized to retain advisors and consultants, but did not retain any such advisors or consultants during 2011.

The Nominating and Corporate Governance Committee recommends to the Board the slate of directors to be elected at our annual meetings of shareholders. The Nominating and Corporate Governance Committee considers candidates for director nominees recommended by our directors, officers and shareholders. The Nominating and Corporate Governance Committee discusses the required selection criteria and qualifications of director nominees based upon our Company’s needs at the time nominees are considered. Although there are no stated minimum criteria for director nominees, in evaluating director candidates, including nominees recommended by the Company’s shareholders, the Nominating and Corporate Governance Committee considers factors that are in the best interests of our Company and our shareholders, including, among others:

| | • | | the knowledge, experience, integrity and judgment of possible candidates for nomination as directors, |

| | • | | the potential contribution of each candidate to the diversity of backgrounds, experience and competencies which we desire to have represented on the Board, and |

| | • | | each candidate’s ability to devote sufficient time and effort to his or her duties as a director. |

The Nominating and Corporate Governance Committee believes that the Board should reflect a diversity of expertise, experiences, backgrounds and individuals. Our Board is composed of qualified individuals who possess a diverse mix of attributes and backgrounds that allows the Board to fulfill its responsibilities to the Company’s shareholders. Members of our Board and Mr. Alston have diverse educational and career backgrounds with broad experience in technology, finance, business and other areas of importance to the operations of the Company. We believe that our Board members and Mr. Alston have skills, experience and competencies that are relevant to our business, and that they are willing to devote the time and effort necessary to be effective directors.

If you wish to recommend a director candidate, please send the following information to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Ixia, 26601 West Agoura Road, Calabasas, California 91302:

| | • | | name of the candidate and a summary of the candidate’s background and qualifications, |

| | • | | contact information for the candidate and a document showing the candidate’s willingness to serve as a director if elected, and |

9

| | • | | a signed statement in which you give your current status as an Ixia shareholder and in which you indicate the number of shares of Ixia Common Stock that you beneficially own. |

The Nominating and Corporate Governance Committee makes a preliminary assessment of each proposed nominee based upon the candidate’s background and qualifications, an indication of the individual’s willingness to serve and other information. The Nominating and Corporate Governance Committee evaluates this information against the criteria described above and Ixia’s specific needs at that time. Based upon a preliminary assessment of the candidates, those who appear best suited to meet our needs may be invited to participate in a series of interviews, which are used as a further means of evaluating potential candidates. On the basis of information learned during this process, the Nominating and Corporate Governance Committee determines which nominees to recommend to the Board to submit for election at the next annual meeting of shareholders. The Nominating and Corporate Governance Committee uses the same process for evaluating all nominees, regardless of the original source of the nomination.

Strategic Planning Committee. In March 2011, the Board dissolved and disbanded the Strategic Planning Committee and assumed the responsibilities of that Committee. Although the Strategic Planning Committee did not meet formally during 2011 prior to its dissolution, the Board as a whole during several of their regular meetings reviewed and discussed potential strategic initiatives then under consideration by the Company.

Compensation of Directors

The following table shows compensation information for Ixia’s non-employee directors for 2011:

Director Compensation for 2011

| | | | | | | | | | | | | | | | |

Name(1) | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) (2) | | | Option Awards ($) (2) | | | Total ($) | |

Laurent Asscher | | $ | 52,250 | | | $ | 60,005 | | | $ | 58,911 | | | $ | 171,166 | |

Jonathan Fram | | | 68,500 | | | | 60,005 | | | | 58,911 | | | | 187,416 | |

Gail Hamilton | | | 76,250 | | | | 60,005 | | | | 58,911 | | | | 195,166 | |

Jon F. Rager | | | 76,125 | | | | 60,005 | | | | 58,911 | | | | 195,041 | |

| (1) | Only non-employee members of the Board are eligible to receive compensation for serving on the Board. Because Messrs. Ginsberg and Bhatnagar served concurrently as executive officers of the Company and members of the Board in 2011, they did not receive any additional compensation as members of the Board. Information concerning the compensation paid to Messrs. Ginsberg and Bhatnagar as executive officers is set forth in the “Summary Compensation Table” below. |

| (2) | Amounts shown reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 of the restricted stock units and the nonstatutory stock options granted to such directors upon their re-election to the Board at the 2011 annual shareholders meeting and are not necessarily indicative of the compensation that our directors will actually realize. The grant date fair value of each stock award is measured based on the closing sales price of our Common Stock on the date of grant as reported on the Nasdaq Global Select Market (i.e., $16.07 per share). The grant date fair value of each option grant is estimated based on the fair market value on the date of grant and using the Black-Scholes option pricing model. The assumptions used to calculate the fair value of our options are set forth in Note 11 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2011 as filed with the SEC on March 5, 2012. As of December 31, 2011, each of our then serving non-employee directors held RSUs covering 1,867 shares and nonstatutory stock options to purchase 5,000 shares. |

10

The table below sets forth the amounts we paid to our non-employee directors as quarterly retainers and meeting attendance fees in the first quarter of 2011.

Non-Employee Director Retainer and Meeting Attendance Fees for 2011 First Quarter

| | | | | | | | | | | | | | | | | | | | |

Retainers and Fees | | Board of Directors | | | Audit

Committee | | | Compensation

Committee | | | Nominating and

Corporate Governance

Committee | | | Strategic

Planning

Committee | |

Quarterly Retainer (non-Chair) | | $ | 8,750 | | | $ | 2,500 | | | $ | 2,250 | | | $ | 1,250 | | | $ | 1,250 | |

Quarterly Retainer (Chair) | | | N/A | * | | | 5,000 | | | | 3,000 | | | | 1,750 | | | | N/A | * |

Meeting Attendance Fees | | | 2,000 | | | | 1,500 | | | | 1,000 | | | | 1,000 | | | | 1,000 | |

| * | Mr. Ginsberg currently serves as Chairman of the Board and served as Chair of the Strategic Planning Committee until its dissolution in March 2011, but did not receive any retainer or meeting attendance fees because he is also an officer and employee of the Company. |

Effective April 1, 2011, the Board made certain adjustments to the compensation payable to non-employee directors. The changes included the elimination of attendance fees for meetings of the Board, Audit Committee and Compensation Committee and the quarterly retainer for the Nominating and Corporate Governance Committee. The table below sets forth the amounts that were paid to non-employee directors commencing April 1, 2011 and that we currently pay to our non-employee directors as quarterly retainers and meeting attendance fees.

Non-Employee Director Retainer and Meeting Attendance Fees Effective April 1, 2011

| | | | | | | | | | | | | | | | |

Retainers and Fees | | Board of Directors | | | Audit

Committee | | | Compensation

Committee | | | Nominating and

Corporate Governance

Committee | |

Quarterly Retainer (non-Chair) | | $ | 8,750 | | | $ | 2,500 | | | $ | 2,250 | | | $ | 0 | |

Quarterly Retainer (Chair) | | | N/A | * | | | 5,875 | | | | 4,750 | | | | 0 | |

Meeting Attendance Fees | | | 0 | | | | 0 | | | | 0 | | | | 1,500 | |

| * | Mr. Ginsberg currently serves as Chairman of the Board, but does not receive any retainer or other compensation as Chairman of the Board because he is also an officer and employee of the Company. |

No fees are payable to Committee members for attending a Committee meeting that is held on the same day as a Board meeting except in the case of meetings of the Nominating and Corporate Governance Committee held after March 31, 2011 because members of such Committee are not paid a retainer.

The total amount of cash compensation paid to all non-employee directors for 2011 was $273,125. We also reimburse all directors for reasonable expenses incurred in connection with attending Board and Committee meetings.

Commencing in 2010, our non-employee directors became eligible to be awarded equity incentives under our Amended and Restated 2008 Equity Incentive Plan, as amended. Following the 2011 Annual Meeting, the Board awarded each non-employee director 3,734 restricted stock units and 10,000 nonstatutory stock options. The restricted stock units vest and the shares covered thereby are automatically issued in four equal quarterly installments over one year as long as the director remains a member of the Board. The nonstatutory stock options have an exercise price per share of $16.07, vest and

11

become exercisable in four equal quarterly installments as long as the director remains a member of the Board, and have a term of seven years. The Board will consider and is expected to approve the award of additional equity incentives to its non-employee directors at the Board meeting following the Annual Meeting.

Stock Ownership Guidelines

In March 2011, the Board adopted stock ownership guidelines to more closely align the interests of our directors with those of our shareholders. The guidelines require each non-employee director to acquire and hold shares of Ixia Common Stock having a value not less than five times the value of his or her annual Board retainer (i.e., five times $35,000, or $175,000). The Company does not currently have any equity ownership requirements for its executive officers or its employee directors. As of March 1, 2012, all of our directors, including both our non-employee directors and employee directors, met the stock ownership guidelines. There is no requirement that a director, officer or any employee hold any shares acquired upon the exercise of a stock option or issued upon the vesting of an RSU for any specified period of time following such exercise or vesting.

Shareholder Communications with the Board of Directors

We have implemented a process by which our shareholders may send written communications to the Board’s attention. Any shareholder wishing to communicate with the Board, any of its Committees or one or more of its individual directors, may do so by sending a letter addressed to the Ixia Board of Directors, the particular Committee or the individual director(s), c/o Corporate Secretary, Ixia, 26601 West Agoura Road, Calabasas, California 91302. We have instructed the Corporate Secretary to promptly forward all communications so received directly to the full Board, the Committee or the individual Board member(s) specifically addressed in the communication.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate it by reference in such filing.

All members of the Audit Committee are independent directors under current Nasdaq listing standards and SEC rules and meet applicable financial experience requirements. The duties, responsibilities and operation of the Audit Committee are governed by a charter, a copy of which is available on our website at www.ixiacom.com.

The Audit Committee is responsible for overseeing management’s financial reporting practices and internal controls. Our management has the primary responsibility for Ixia’s financial statements and the financial reporting process, including internal controls, and is responsible for reporting on the effectiveness of our internal control over financial reporting. Our management is responsible for the preparation, presentation and integrity of our consolidated financial statements and financial reporting and control processes and procedures, including our system of internal control over financial reporting and our disclosure controls and procedures. PricewaterhouseCoopers LLP, our independent registered public accounting firm, is responsible for auditing our consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States. In addition, PricewaterhouseCoopers LLP is responsible for expressing an opinion on the effectiveness of our internal control over financial reporting.

12

In the performance of our oversight function, we have reviewed and discussed the Company’s audited consolidated financial statements with our management and PricewaterhouseCoopers LLP. We discussed with our management and with PricewaterhouseCoopers LLP their judgments as to both the quality and the acceptability of our accounting principles, the reasonableness of significant judgments reflected in the consolidated financial statements and the clarity of the disclosures in such financial statements. During 2011, we continued to monitor the progress and results of the testing pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 of our internal control over financial reporting. As part of our oversight responsibilities, we met periodically with PricewaterhouseCoopers LLP, separately and with management present, to discuss the adequacy and effectiveness of the Company’s internal control over financial reporting and the quality of its financial reporting process.

We have also discussed with PricewaterhouseCoopers LLP the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. We have also discussed with PricewaterhouseCoopers LLP the other matters that are required to be discussed by an independent registered public accounting firm with an audit committee under the standards of the Public Company Accounting Oversight Board. We have also received the written disclosures and the letter from PricewaterhouseCoopers LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the communications of PricewaterhouseCoopers LLP with the Audit Committee concerning independence, and we have discussed with PricewaterhouseCoopers LLP its independence from Ixia.

Our management and PricewaterhouseCoopers LLP have more resources and time, and more detailed knowledge and information regarding our accounting, auditing, internal controls and financial reporting practices, than we do. We rely without independent verification on the information provided to us and on the representations made by our management and by PricewaterhouseCoopers LLP. Accordingly, our oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, our considerations and discussions referred to above do not assure that the audit of our consolidated financial statements has been carried out in accordance with generally accepted auditing standards, that the consolidated financial statements are presented in conformity with generally accepted accounting principles, or that PricewaterhouseCoopers LLP is in fact “independent.”

Based upon the review and discussions described in this report, and subject to the limitations on our role and responsibilities described above and in our Charter, we recommended to the Board of Directors that Ixia’s audited consolidated financial statements be included in Ixia’s Annual Report on Form 10-K for the year ended December 31, 2011 as filed with the SEC in March 2012.

|

| AUDIT COMMITTEE |

|

| Jon F. Rager, Chairman |

| Jonathan Fram |

| Gail Hamilton |

13

COMMON STOCK OWNERSHIP OF

PRINCIPAL SHAREHOLDERS AND MANAGEMENT

The following table summarizes information regarding beneficial ownership of our Common Stock as of March 1, 2012 by: (a) each person who is known to own beneficially more than 5% of the outstanding shares of our Common Stock, (b) each of our directors, (c) each of the executive officers named in the Summary Compensation Table below, and (d) all of our current executive officers and directors as a group. Unless otherwise indicated below, each beneficial owner named in the table may be reached c/o Ixia, 26601 West Agoura Road, Calabasas, California 91302.

| | | | | | | | |

Name of Beneficial Owner | | Shares Beneficially Owned (1) | | | Percent of Class | |

Laurent Asscher | | | 13,138,967 | (2) | | | 18.6 | % |

| | |

Addington Hills Ltd. Bayside Executive Park, Building No. 1 West Bay Street, P.O. Box N-4837 Nassau, Bahamas C5 | | | 9,533,541 | (3) | | | 13.5 | |

| | |

T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, Maryland 21202 | | | 6,838,220 | (4) | | | 9.7 | |

| | |

Errol Ginsberg | | | 5,293,567 | (5) | | | 7.4 | |

| | |

Columbia Wanger Asset Management, LLC 227 West Monroe Street, Suite 3000 Chicago, Illinois 60606 | | | 3,939,000 | (6) | | | 5.6 | |

| | |

Atul Bhatnagar | | | 793,497 | (7) | | | 1.1 | |

| | |

Jon F. Rager | | | 271,300 | (8) | | | * | |

| | |

Alan Grahame | | | 184,657 | (9) | | | * | |

| | |

Thomas B. Miller | | | 183,118 | (10) | | | * | |

| | |

Victor Alston | | | 130,686 | (11) | | | * | |

| | |

Jonathan Fram | | | 31,300 | (12) | | | * | |

| | |

Gail Hamilton | | | 28,800 | (13) | | | * | |

| | |

Executive officers and directors as a group (13 persons) | | | 21,355,264 | (14) | | | 29.4 | |

| (1) | Such persons have sole voting and investment power with respect to all shares of Common Stock shown as being beneficially owned by them, subject to community property laws, where applicable, and the information contained in the footnotes to this table. |

| (2) | Based on an Amendment No. 1 to Schedule 13D filed on April 12, 2011, wherein Katelia Capital Group Ltd. (“Katelia Capital”), as the record owner of the shares, The Katelia Trust, as the beneficial owner of Katelia Capital, Butterfield Trust (Switzerland) Limited, as trustees of The Katelia Trust, and Laurent Asscher, as an advisor to Katelia Capital, reported that, as of April 7, 2011, they shared voting and dispositive power as to 13,108,000 of such shares. Also includes 23,467 shares owned by Mr. Asscher as to which he has sole voting and dispositive power and 7,500 shares subject to options held by Mr. Asscher which vest within 60 days after March 1, 2012. Mr. Asscher is a director of the Company. The address of Katelia Capital is Trident Chambers, P.O. Box 146, Road Town, Tortola, British Virgin Islands. |

(footnotes continue on next page)

14

| (3) | Based on (i) an Amendment No. 2 to Schedule 13G filed on February 10, 2012, wherein Addington Hills Ltd. (“Addington”), as the record owner of the shares, The Tango Trust (“Tango”), as the beneficial owner of the equity interest in Addington, and Rhone Trustees (Bahamas) Ltd. (the “Trustee”), as trustees of The Tango Trust, reported that as of December 31, 2011, they shared voting and dispositive power as to 9,752,894 shares and (ii) a review of multiple Statements of Changes in Beneficial Ownership on Form 4 (the “Form 4s”) filed after December 31, 2011. Based on a Form 4 filed on January 31, 2012, Addington, Tango and The Trustee reported ownership of 9,533,541 shares as of such date. |

| (4) | Based on an Amendment No. 3 to Schedule 13G filed on February 10, 2012 by T. Rowe Price Associates, Inc. (“T. Rowe Price”), wherein T. Rowe Price reported that, as of December 31, 2011, it had sole voting power as to 1,328,920 of such shares and sole dispositive power as to 6,838,220 of such shares. These shares are owned by various individual and institutional investors for whom T. Rowe Price serves as investment advisor with power to direct investments and/or sole power to vote the shares. For purposes of the reporting requirements of the Securities Exchange Act of 1934, as amended, T. Rowe Price is deemed to be a beneficial owner of such shares; however, T. Rowe Price expressly disclaims that it is the beneficial owner of such shares. |

| (5) | Includes 4,827,986 shares held by the Errol Ginsberg and Annette R. Michelson Family Trust, of which Mr. Ginsberg and Annette R. Michelson (Mr. Ginsberg’s spouse) are trustees and as to which shares they share voting and investment power. Also includes 366,624 shares subject to options held by Mr. Ginsberg which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (6) | Based on a Schedule 13G filed on February 10, 2012 by Columbia Wanger Asset Management, LLC (“Columbia Wanger”) wherein Columbia Wanger reported that, as of December 31, 2011, it had sole voting power as to 3,445,000 of such shares and sole dispositive power as to 3,939,000 shares. |

| (7) | Includes 742,649 shares subject to options held by Mr. Bhatnagar which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (8) | Includes 263,800 shares held by the Rager Family Trust, of which Mr. Rager and his wife are trustees and as to which shares they share voting and investment power. Also includes 7,500 shares subject to options held by Mr. Rager which vest within 60 days after March 1, 2012. |

| (9) | Includes 166,598 shares subject to options held by Mr. Grahame which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (10) | Includes 75,348 shares subject to options held by Mr. Miller which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (11) | Includes 83,000 shares subject to options held by Mr. Alston which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (12) | Includes 7,500 shares subject to options held by Mr. Fram which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (13) | Includes 7,500 shares subject to options held by Ms. Hamilton which are exercisable or become exercisable within 60 days after March 1, 2012. |

| (14) | Includes 2,052,112 shares subject to options held by current executive officers and directors as a group, which options are exercisable or become exercisable within 60 days after March 1, 2012. |

15

EXECUTIVE OFFICERS

Our executive officers and certain information about them as of March 20, 2012 are described below:

| | | | | | |

Name | | Age | | | Position(s) |

Errol Ginsberg | | | 56 | | | Chairman of the Board and Chief Innovation Officer |

Atul Bhatnagar | | | 54 | | | President, Chief Executive Officer and a Director |

Thomas B. Miller | | | 56 | | | Chief Financial Officer |

Victor Alston | | | 40 | | | Chief Operating Officer |

Ronald W. Buckly | | | 60 | | | Senior Vice President, Corporate Affairs and General Counsel |

Alan Grahame | | | 59 | | | Senior Vice President, Worldwide Sales |

Walker H. Colston, II | | | 51 | | | Vice President, Global Customer Delight |

Raymond de Graaf | | | 45 | | | Vice President, Operations |

Christopher L. Williams | | | 51 | | | Vice President, Human Resources |

The Board appoints our executive officers, who then serve at the discretion of the Board. For information concerning Messrs. Ginsberg and Alston, see “Election of Directors - Nominees” above.

Mr. Bhatnagar joined the Company as President and Chief Operating Officer and as a director in September 2007 and became President and Chief Executive Officer in March 2008. From July 2006 until August 2007, Mr. Bhatnagar served as Vice President, Products of Divatas Networks, a developer of enterprise network solutions that provide voice and data mobility over disparate networks. Mr. Bhatnagar and the Company have mutually agreed that Mr. Bhatnagar will resign as President and Chief Executive Officer of the Company effective as of the date of the Annual Meeting and will not stand for reelection to the Board at the Annual Meeting.

Mr. Miller has served as Chief Financial Officer of the Company since March 2000.

Mr. Buckly joined the Company as Senior Vice President, Corporate Affairs and General Counsel in April 2007. He has also served as the Company’s Corporate Secretary since its formation in May 1997.

Mr. Grahame joined the Company as Senior Vice President, Worldwide Sales in November 2007. From November 1999 until joining the Company, Mr. Grahame held a number of senior sales positions at Agilent Technologies, where he most recently served as Worldwide Vice President for Customer Operations for Agilent’s Operational Support Systems Group and was responsible for that group’s worldwide sales, services and support.

Mr. Colston joined the Company as Senior Director, Engineering Operations in June 2003. He served as Vice President, Engineering Operations from June 2004 until November 2010 and was appointed an executive officer in that position in June 2006. In November 2010, he assumed his present position as Vice President, Global Customer Delight.

Mr. de Graaf joined the Company as Vice President, Operations in January 2008. From June 2004 until joining the Company, Mr. de Graaf served as Vice President and General Manager of Precision Communications, a vendor of telecommunications network products and services.

Mr. Williams joined the Company as Vice President, Human Resources in August 2008. From March 2007 until joining the Company, Mr. Williams served as Vice President, Human Capital of Helio, LLC, a wireless telecommunications carrier.

16

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the principles and objectives of our executive compensation program and contains a discussion and analysis of the compensation, both cash and equity, paid to our executive officers, including the compensation paid to our five most highly paid executive officers (the “named executive officers”) identified in the Summary Compensation Table at page 37 of this proxy statement. For 2011, our named executive officers were Atul Bhatnagar, President and Chief Executive Officer; Thomas Miller, Chief Financial Officer; Errol Ginsberg, Chief Innovation Officer; Victor Alston, Chief Operating Officer and former Senior Vice President, Product Development; and Alan Grahame, Senior Vice President, Worldwide Sales.

Fiscal 2011 Highlights

Ixia delivered a solid financial performance in 2011 with strong revenue growth and profitability in spite of an uncertain global economic and political environment and a sluggish United States economic recovery. In 2011, Ixia successfully executed its strategy of growing its core business, leveraging its acquisitions (including its acquisition of VeriWave, Inc. in July 2011) and expanding its global operations, while maintaining discipline over its operating expenses.

Ixia’s fiscal 2011 revenue grew to a record $308.4 million, an increase of 11% over fiscal 2010 revenue of $276.8 million. On a GAAP basis, the Company experienced significant improvement in operating income and recorded net income for fiscal 2011 of $23.8 million, or $0.33 per diluted share, compared with fiscal 2010 net income of $11.2 million, or $0.17 per diluted share. The Company generated $61.3 million in cash flows from operations in 2011 and ended the year with approximately $385 million in cash and investments compared with $339 million at 2010 fiscal year end.

On March 19, 2012, the Company announced that Atul Bhatnagar would be leaving the Company as its President and Chief Executive Officer effective May 10, 2012 (i.e., the date of the Annual Meeting) and would not stand for reelection to the Board at the Annual Meeting. The Company also announced concurrently that Victor Alston was appointed as Chief Operating Officer and would stand for election to the Board of Directors (the “Board”) at the Annual Meeting. In addition, the Board appointed Mr. Alston as President and Chief Executive Officer to succeed Mr. Bhatnagar following Mr. Bhatnagar’s departure from the Company in May.

Overview

Our Board has delegated to our Compensation Committee (“Committee”) the responsibility for determining, administering and overseeing the compensation program for our executive officers, including our compensation and benefit plans and practices. Under our Compensation Committee Charter, the Committee is responsible for approving the base salaries, bonus opportunities and other terms of each executive officer’s employment with the Company, approving and administering cash bonus plans, recommending to our Board the terms of our equity-based incentive plans and severance plans, and administering our equity incentive plans and approving the equity incentive grants thereunder to our executive officers and other employees. The Committee periodically reports to our Board on executive officer compensation matters, and Board members and executive officers, including our President and Chief Executive Officer and other officers when appropriate, are invited from time to time to attend Committee meetings.

The members of our Compensation Committee currently are Ms. Hamilton (Chair), and Messrs. Asscher and Fram, all of whom qualify as independent directors under the listing standards of The NASDAQ Stock Market LLC and satisfy applicable standards of independence under federal securities and tax laws. Our Compensation Committee meets quarterly on a regular basis and also meets

17

bi-monthly (typically on the first Thursday of every other calendar month), to perform its duties and from time to time as needed.

Although Atul Bhatnagar is our President and Chief Executive Officer and also serves as a member of our Board, he does not participate in discussions or decisions of our Board or of the Committee regarding the setting of his salary or other compensation, the award of any bonus or the grant of any equity incentives to him or other compensation matters that may directly affect him. As a director and the Chief Executive Officer of Ixia, Mr. Bhatnagar participates in decisions and discussions of the Board and in discussions of the Committee and makes recommendations to the Board and to the Committee with respect to compensation matters generally and the compensation of executive officers other than himself.

The philosophy and principal objectives of our executive officer compensation program are to:

| | • | | provide competitive compensation to ensure our success in attracting, motivating and retaining highly qualified, experienced individuals to manage and lead our Company, |

| | • | | link our executives’ short-term cash incentives to the achievement of measurable Company financial performance goals and Company and individual objectives, |

| | • | | link our executives’ long-term incentives to our stock price performance and to the achievement of measurable Company financial performance goals, |

| | • | | align our executives’ interests with the long-term interests of our shareholders, |

| | • | | reward our executives for creating shareholder value, including by improving our stock price performance, and |

| | • | | support Ixia’s core values. |

In carrying out its duties and responsibilities, the Committee has the authority in its discretion and at the Company’s expense to retain independent compensation consultants and outside advisors to assist the Committee.

In November 2009, the Compensation Committee retained Frederic W. Cook Co., Inc. (“FWC”) as an independent compensation consultant to render advisory services to the Committee with respect to the Company’s executive officer compensation program. Specifically, the Committee retained FWC to conduct an independent review and assessment of the Company’s executive officer compensation program, to advise the Committee regarding the competitiveness of our executive officer compensation program, to provide industry and peer group compensation information for executive officers and to advise the Committee with respect to executive compensation practices, trends, regulatory matters and external market factors. FWC assisted the Committee in evaluating and structuring compensation packages for the Company’s executive officers, in providing information concerning competitive compensation levels and mix (for example, the proportion of salary, bonus and equity compensation included in an officer’s total compensation package) and in setting compensation levels for our executive officers in 2011. The Compensation Committee and the Board have also consulted with FWC in connection with the design of our 2011 Executive Officer Bonus Plan which was adopted in March 2011, and in connection with the grant of equity incentives to our named executive officers in February 2011. No member of the Board or any named executive officer has an affiliation with FWC, and FWC does not provide any services directly to the Company or its management.

Although the Committee considers the advice of our independent compensation consultants to be an important factor in the review and determination of executive compensation and in the review and establishment of executive compensation programs and plans, the Committee is not bound by and may not always accept the recommendations of our independent consultants.

18

In determining the appropriate levels of compensation with respect to each component of our compensation program for 2011, our Committee considered executive compensation survey information (e.g., the Radford Global Technology Survey (January 2011) which included compensation information for companies in the network products/services and telecommunications sectors with annual revenues comparable to Ixia’s) and also considered and compared aspects of our executive compensation program to the executive compensation practices and programs of members of the applicable peer group. The use of surveys and peer group information helps the Committee evaluate the competitive positioning of our compensation arrangements for our named executive officers, assists the Committee in establishing certain compensation targets and helps to serve as a point of reference in structuring our officer compensation packages. For purposes of our 2011 compensation program, our peer group comprised 17 companies in the high technology industry (i.e., U.S.-based networking, software and communications equipment companies) with comparable revenues and/or market capitalization and includes many companies with which Ixia competes for executive talent. For 2011, our Committee selected the following companies to comprise our peer group:

| | | | |

| Acme Packet | | Emulex | | Oplink Communications |

| ADTRAN | | F5 Networks | | Riverbed Technology |

| Aruba Networks | | Harmonic | | Shore Tel |

| Blue Coat Systems | | Interdigital | | Sonus Networks |

| Cohu | | JDS Uniphase | | Tekelec |

| Digi International | | NetScout Systems | | |

We typically review our peer group companies annually and from time to time add or delete members of our peer group to take into account changes in revenues, operating income and market capitalization of our peer group companies and Ixia and other relevant factors. For 2012, we reviewed the companies comprising our peer group and decided to remove Acme, F5 Networks, JDS Uniphase and Riverbed Technology based primarily on their then substantially larger market capitalizations as compared to Ixia’s, and we deleted Tekelec because it ceased to be a public company. For 2012, we also added Calix, Infinera, Opnet Technologies, Powerwave Technologies, and Quest Software to our peer group principally because we considered their market capitalizations and other relevant financial metrics to be more in line with Ixia’s market capitalization and financial metrics (e.g., revenues and/or operating income) and found these new peer group companies on balance to be more comparable to Ixia.

Although we do not believe that it is appropriate to establish compensation levels based solely on peer group or survey comparisons, we do believe that peer group data and compensation survey information are among the many relevant factors we should consider in determining the competitiveness and reasonableness of the elements of our executive compensation program. We recognize that our executive compensation program must compare favorably with the compensation programs of those companies with which we compete for employees. The Committee reviews and considers this information when making decisions regarding executive compensation. We believe that the nature of the Company’s business and the environment in which it operates require us to retain flexibility in setting compensation based on a consideration of all facts and circumstances relating to our business and each executive officer.

For each named executive officer, our goal is to fairly compensate the officer with a guaranteed base salary and then to accomplish motivational and retention objectives with annual bonus opportunities and meaningful long-term equity incentive compensation. Therefore, we draw a distinction between the potential compensation opportunity for achieving performance-based goals and the actual compensation delivered based on performance.

19

As a guiding principle, our Compensation Committee believes that the executive officers should be compensated for performance (i.e., a substantial portion of their cash and equity compensation should be at risk, performance-based compensation linked to the achievement of measurable Company and individual objectives). Our Compensation Committee also believes that a mix of cash and equity incentive compensation is appropriate to reward and incent our executive officers for near-term financial performance, to support the business goals of the Company and to increase shareholder value in the longer term. As an executive officer’s level of responsibilities increases, generally the proportion of at risk, performance-based compensation as a percentage of total direct compensation will also increase.

In determining and recommending compensation for our executive officers, including our named executive officers, and in addition to peer group and compensation survey information, our Committee considers an executive officer’s individual responsibilities and performance, how those responsibilities compare to those of our other executive officers and whether, based on responsibilities and performance, there is internal relative pay equity among our executive officers.

For 2011, our Compensation Committee sought as a general rule to position the total annual compensation (consisting of annual base salary, target bonus opportunity and the value of time-vested equity incentives, but excluding the value of performance-based stock options) for the Company’s executive officers, including our named executive officers (other than Mr. Bhatnagar, the President and Chief Executive Officer), at or slightly above the median of such compensation payable to executive officers at comparable companies according to survey and peer group information. Although Mr. Bhatnagar was the Company’s highest paid executive officer for 2011, he was positioned below the median primarily as a result of his prior limited experience as a chief executive officer of a public company. In addition, our executive officers were provided with an opportunity to earn total annual direct compensation (consisting of annual base salary, target bonus opportunity and the value ofboth time-vested and performance-based equity incentives) at approximately the 75thpercentile if all of their performance-based stock options awarded in February 2011 are earned. The Chief Executive Officer’s total potential annual direct compensation (including his performance-based equity incentives) was positioned between the median and the 75th percentile.

Our Committee periodically meets with our Chief Executive Officer and other members of management to discuss and obtain recommendations with respect to our Company’s compensation practices and programs for our executive officers and employees, but the Committee does not discuss with our Chief Executive Officer matters involving or affecting his own compensation. Although our management may make recommendations and proposals to the Committee for its consideration regarding the base salaries, short-term incentives, long-term equity incentives, severance benefits and other benefits for our executives, neither the Board nor the Committee is bound by or always accepts management’s recommendations and proposals. The Compensation Committee from time to time also seeks the advice of our independent compensation consultants regarding certain management compensation-related proposals and periodically meets in executive session without members of management present.

The principal components of our executive compensation program continue to be:

| | • | | short-term or annual incentives in the form of cash bonuses, |

| | • | | long-term equity incentives in the form of stock options and/or restricted stock units, |

| | • | | severance and change-in-control benefits, and |

| | • | | other benefits, such as health and disability insurance, 401(k) Plan and life insurance. |

20

Our executive compensation program incorporates these components because our Committee considers the combination of these components to be necessary and effective in order to provide a fair and competitive total compensation package to our executive officers and to meet the other principal objectives of our executive compensation program.