EXHIBIT 99.2

Q4 2018 Earnings Call February 26, 2019

Industry Data and Forward - Looking Statements Disclaimer ▪ Broadwind obtained the industry and market data used throughout this presentation from our own research, internal surveys and st udies conducted by third parties, independent industry associations or general publications and other publicly available informatio n. Independent industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not gu arantee the accuracy or completeness of such information. Forecasts are particularly likely to be inaccurate, especially over long periods of time. W e a re not aware of any misstatements in the industry data we have presented herein, but estimates involve risks and uncertainties and a re subject to change based on various factors beyond our control. ▪ Our forward - looking statements may include or relate to our beliefs, expectations, plans and/or assumptions with respect to the following: ( i ) state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and th e related extension, continuation or renewal of federal tax incentives and grants and state renewable portfolio standards; (ii) our customer relat ion ships and our substantial dependency on a few significant customers and our efforts to diversify our customer base and sector focus and lev era ge relationships across business units; (iii) our ability to continue to grow our business organically and through acquisitions; (iv) our prod uct ion, sales, collections, customer deposits and revenues generated by new customer orders and the resulting cash flows; (v) the sufficiency of our liqu idi ty and alternate sources of funding, if necessary; (vi) our ability to realize revenue from customer orders and backlog; (vii) our ability to ope rate our business efficiently, manage capital expenditures and costs effectively, and generate cash flow; (viii) the economy and the potential imp act it may have on our business, including our customers; (ix) the state of the wind energy market and other energy and industrial markets gener all y and the impact of competition and economic volatility in those markets; (x) the effects of market disruptions and regular market volatility, in clu ding fluctuations in the price of oil, gas and other commodities; (xi) the effects of the change of administrations in the U.S. federal government; (x ii) our ability to successfully integrate and operate the business of Red Wolf Company, LLC and to identify, negotiate and execute future acquis iti ons; and (xiii) the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986, as amended; and (xiv) the impact of future sales of our common stock or securities convertible into our common stock on our stock price. These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors. We are unde r n o duty to update any of these statements. You should not consider any list of such factors to be an exhaustive statement of all of the risks, unce rta inties or other factors that could cause our current beliefs, expectations, plans and/or assumptions to change. ▪ This presentation contains non - GAAP financial information. We believe that certain non - GAAP financial measures may provide users of this financial information with meaningful comparisons between current results and results in prior operating periods. We believe tha t these non - GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a c omp arison of historical information that excludes certain infrequently occurring or non - operational items that impact the overall comparabili ty. Non - GAAP financial measures should be viewed in addition to, and not as an alternative to, our reported results prepared in accordance wi th GAAP. Please see our earnings release dated February 26, 2019 for a reconciliation of certain non - GAAP measures presented in this presentation. February 26, 2019 2

Highlights ▪ Achieved targeted $40M customer diversification in 2018 ▪ Debt reduced 18% in 2018 – credit line expanded and extended post year end ▪ 1 st profitable year for Gearing ▪ Q4 Revenue and EBITDA in line with guidance ▪ Tower order book building despite steel tariffs ▪ 2019 Outlook confirmed – >30% revenue recovery February 26, 2019 3

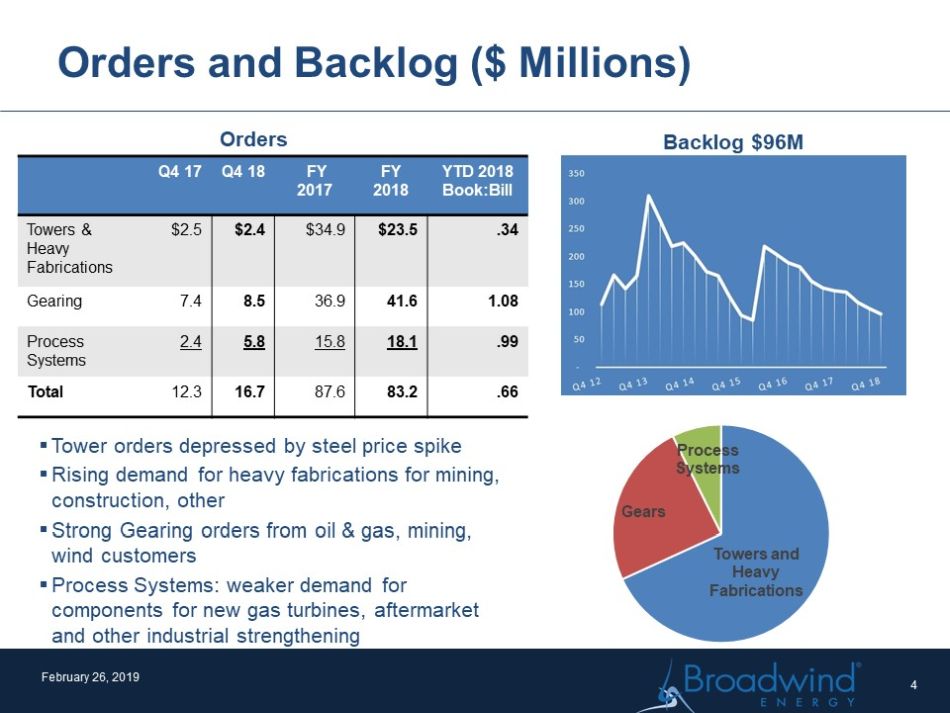

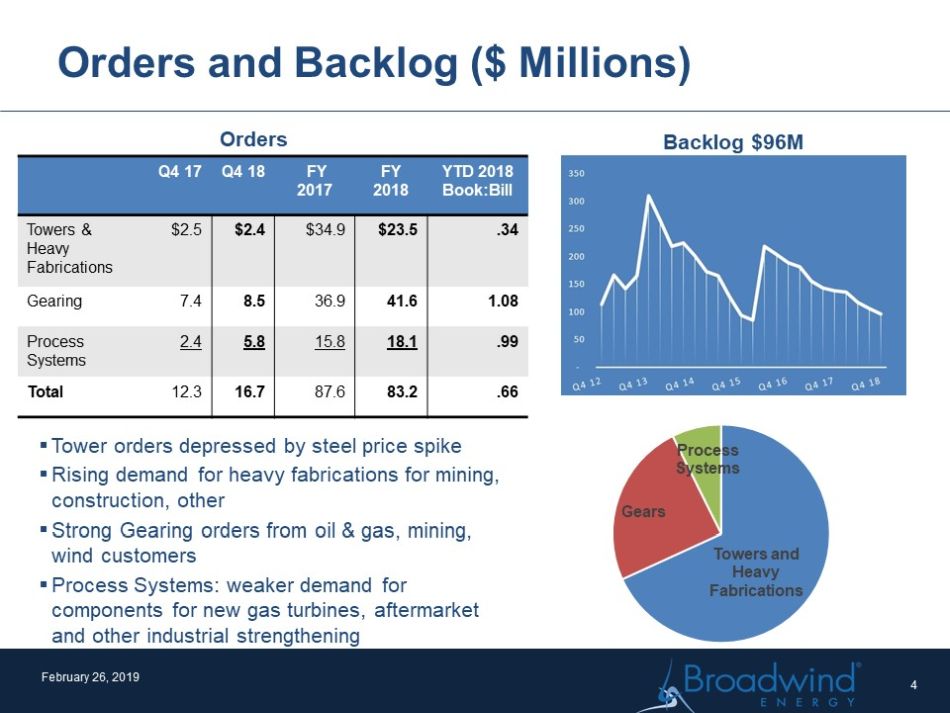

Orders and Backlog ($ Millions) Orders ▪ Tower orders depressed by steel price spike ▪ Rising demand for heavy fabrications for mining, construction, other ▪ Strong Gearing orders from oil & gas, mining, wind customers ▪ Process Systems: weaker demand for components for new gas turbines, aftermarket and other industrial strengthening Backlog $96M February 26, 2019 Q4 17 Q4 18 FY 2017 FY 2018 YTD 2018 Book:Bill Towers & Heavy Fabrications $2.5 $2.4 $34.9 $23.5 .34 Gearing 7.4 8.5 36.9 41.6 1.08 Process Systems 2.4 5.8 15.8 18.1 .99 Total 12.3 16.7 87.6 83.2 .66 4 Towers and Heavy Fabrications Gears Process Systems

Successful Diversification of BWEN Customer Base February 26, 2019 5 ▪ Diversification of customer base met $40M target for 2018 ▪ Oil and gas, mining and other industrial has grown to >$60M annual intake for BWEN $40M target YTD Orders Oth . Industrial Mining YTD Orders $40M target $40M Target Oil & Gas Other Industrial Mining

Market Outlook – US Wind (GW) Source : MAKE Global Wind Market Outlook Update – Q1 2019 Forecast Development Pipeline - GW Source: AWEA Q4 2018 Market Report February 26, 2019 6 ▪ Adv . Development means turbines ordered or utility owned projects or PPA in place • 2018 additions 7.6GW, 78% in Q4, ~ 10% short of forecast • Development pipeline declined as usual with Q4 completions, but remains strong in support of 2019 - 21 projects • 2021 forecast upgraded to near 7.5GW and subsequent outlook improved • 6.6 GW of projects were safe harbored in 2018 Forecast – GW Installations 0 5 10 15 20 25 30 35 40 Q1 16 Q3 16 Q1 17 Q3 17 Q1 18 Q3 18 GW Under construction at QE Adv. Development 0 2 4 6 8 10 12 14 '15 '16 '17 '18 '19e '20e '21e '22e

Market Outlook - U.S. Gearing Production ($ millions) *Excluding automotive Sources: AGMA & IHS 7 February 26, 2019 ▪ Demand for gearing produced in US is expected to rise ~ 4% p.a. through 2020 ▪ I mports are increasingly an issue due to strong USD and steel tariffs ▪ Demand for power and mining is expected to flatten or decline modestly 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2015a 2016a 2017a 2018e 2019e 2020e $M US Gear Shipments 4 .0% CAGR Source: IHS Markit Q4 2018 Markets excluded: farm machinery, aerospace, railroad, shipbuilding and machine tools % market 2015 - 2018 CAGR 2018 - 2021 CAGR Turbines & Power 10% - 1.5% - 2% Oil & Gas 6% +13% +9% Mining & Constuction 6% +3% - 1% Other Industrial 39% +8% flat

2019 Priorities February 26, 2019 8 ▪ Continue focus on customer diversification - $60M target ▪ Restructure systems to support changing sales mix ▪ Continuous improvement to offset margin compression ▪ Adjust steel procurement strategy to support strong 2019 production ▪ Reduce average cash conversion cycle by ~20%

Towers and Heavy Fabrications Q4 2017 Q4 2018 FY 2017 FY 2018 Orders ($M) $2.5 $2.4 $34.9 $23.5 Sections Sold (#) 30 64 820 540 Revenue ($M) 4.2 10.7 103.4 68.8 Operating Inc/(Loss) ($M) (4.5) (2.8) 2.7 (4.3) - % of Sales (107.8%) (26.3%) 2.6% (6.3%) EBITDA* ($M) (3.0) (1.3) 7.8 1.4 - % of Sales (71.4%) (12.1%) 7.5% 2.0% Q4 Results ▪ M ining and industrial demand continues to be strong, Tower quoting activities increasing ▪ Q4 18 tower sections sold up slightly but down FY ▪ Operating loss narrowed comparatively – higher production volumes, better plant utilization Priorities ▪ Diversify tower customer base and grow heavy fabrications business ▪ Cost out to offset margin pressure ▪ Build capabilities and customer base for heavy fabrications ▪ Balance trade - off between near - term tower demand spike and longer term diversification focus February 26, 2019 * Reconciliation to non - GAAP measure included in Appendix 9 356 352 344 387 400 264 126 30 143 201 132 64 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Quarterly Tower Section Sales Capacity

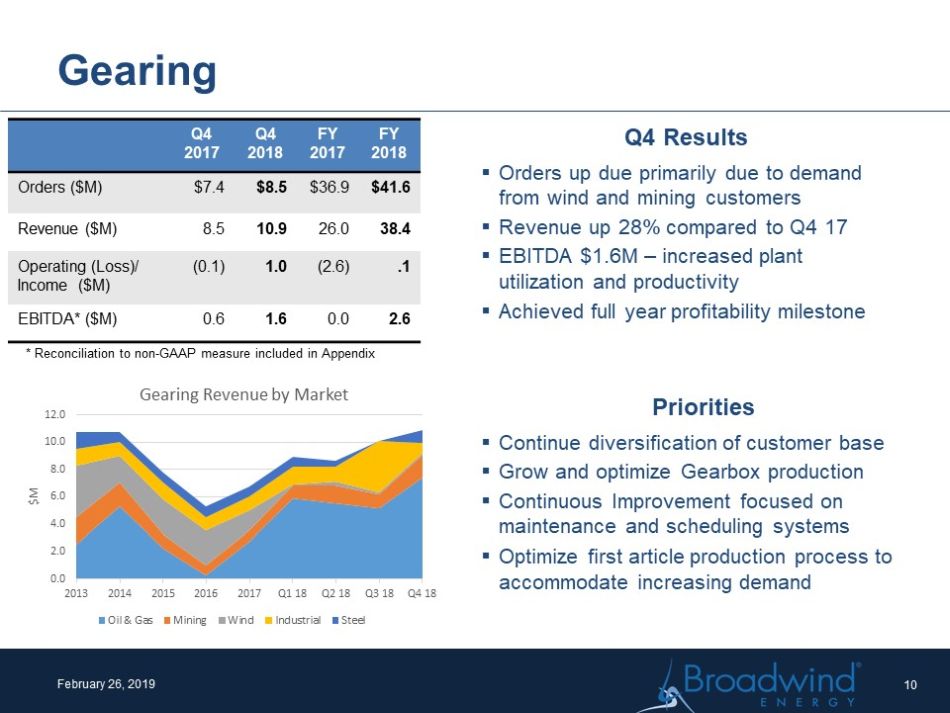

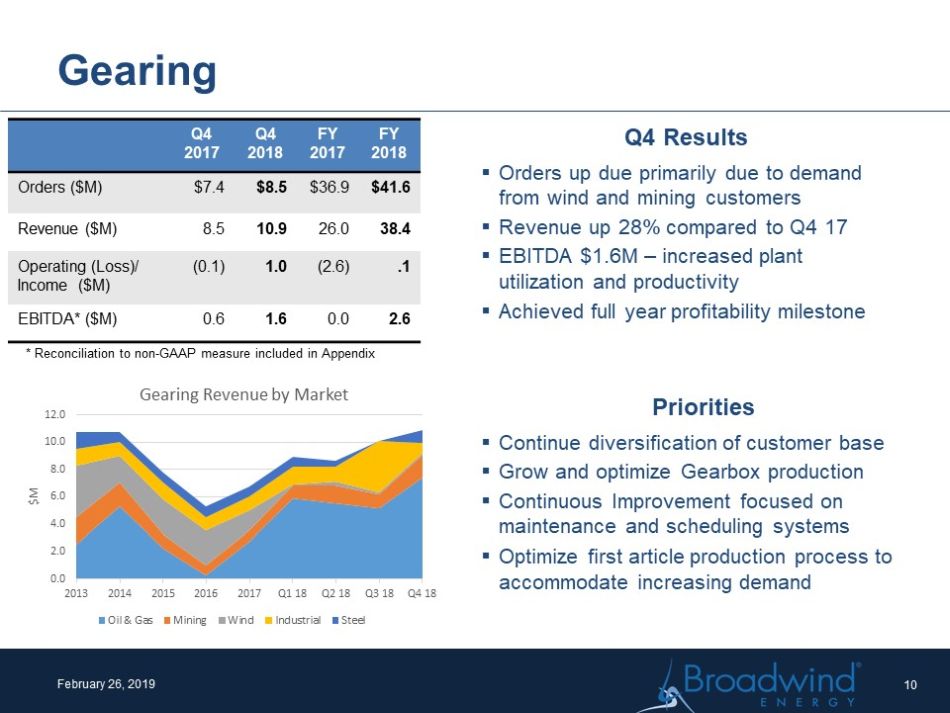

Gearing Q4 2017 Q4 2018 FY 2017 FY 2018 Orders ($M) $7.4 $8.5 $36.9 $41.6 Revenue ($M) 8.5 10.9 26.0 38.4 Operating (Loss)/ Income ($M) (0.1) 1.0 (2.6) .1 EBITDA* ($M) 0.6 1.6 0.0 2.6 Q4 Results ▪ Orders up due primarily due to demand from wind and mining customers ▪ Revenue up 28% compared to Q4 17 ▪ EBITDA $1.6M – increased plant utilization and productivity ▪ Achieved full year profitability milestone February 26, 2019 Priorities ▪ Continue diversification of customer base ▪ Grow and optimize Gearbox production ▪ Continuous Improvement focused on maintenance and scheduling systems ▪ Optimize first article production process to accommodate increasing demand * Reconciliation to non - GAAP measure included in Appendix 10 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2013 2014 2015 2016 2017 Q1 18 Q2 18 Q3 18 Q4 18 $M Gearing Revenue by Market Oil & Gas Mining Wind Industrial Steel

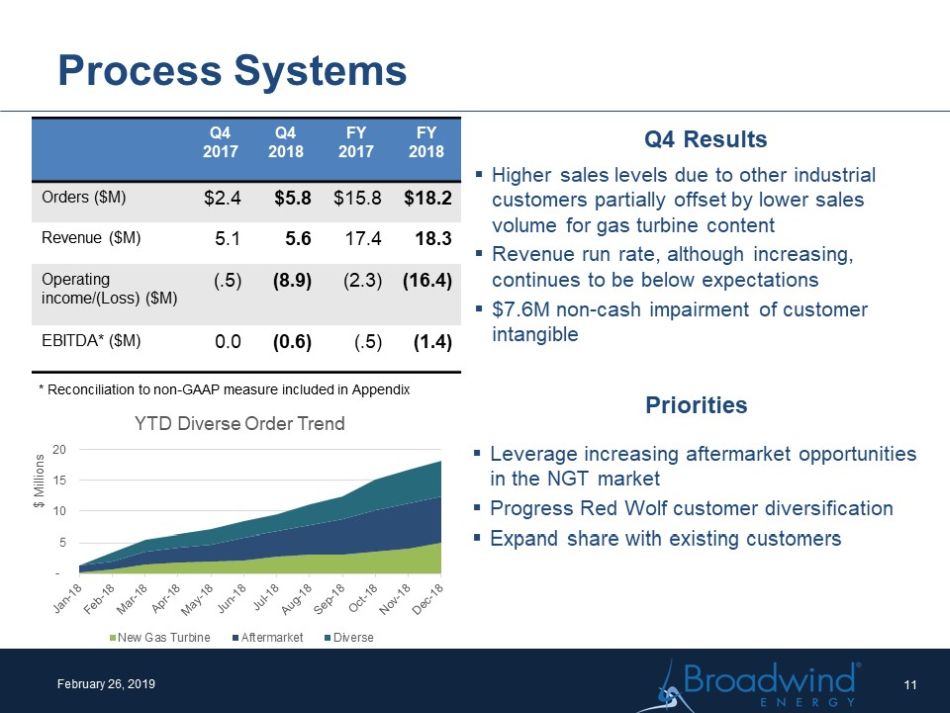

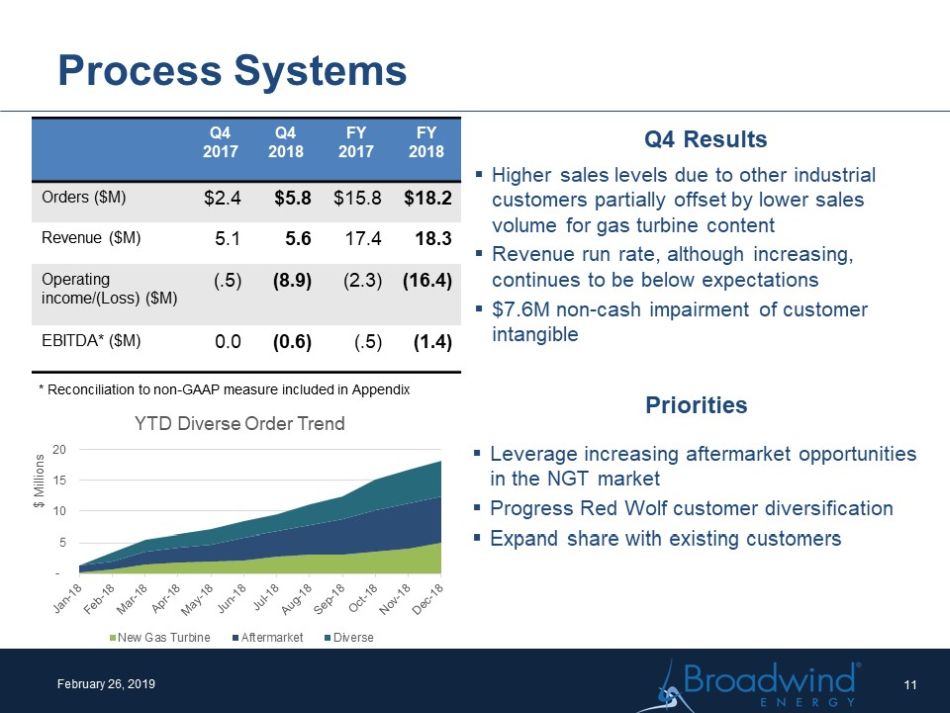

February 26, 2019 Process Systems Q4 2017 Q4 2018 FY 2017 FY 2018 Orders ($M) $2.4 $5.8 $15.8 $18.2 Revenue ($M) 5.1 5.6 17.4 18.3 Operating income/(Loss) ($M) (.5) (8.9) (2.3) (16.4) EBITDA* ($M) 0.0 (0.6) (.5) (1.4) * Reconciliation to non - GAAP measure included in Appendix Q4 Results ▪ Higher sales levels due to other industrial customers partially offset by lower sales volume for gas turbine content ▪ Revenue run rate, although increasing, continues to be below expectations ▪ $7.6M non - cash impairment of customer intangible Priorities ▪ Leverage increasing aftermarket opportunities in the NGT market ▪ Progress Red Wolf customer diversification ▪ Expand share with existing customers 11 - 5 10 15 20 $ Millions YTD Diverse Order Trend New Gas Turbine Aftermarket Diverse

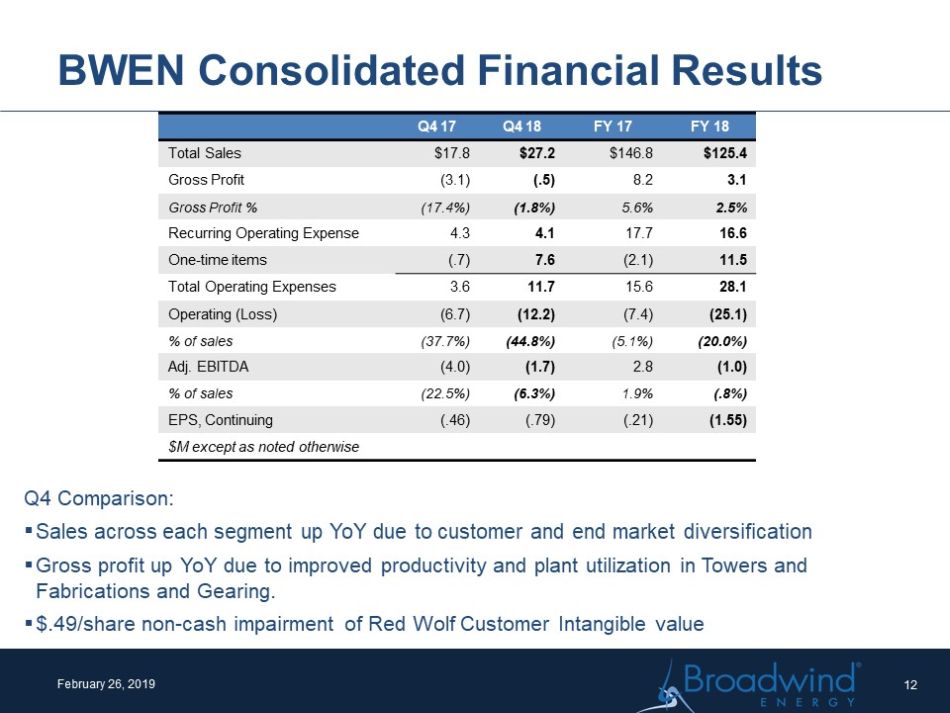

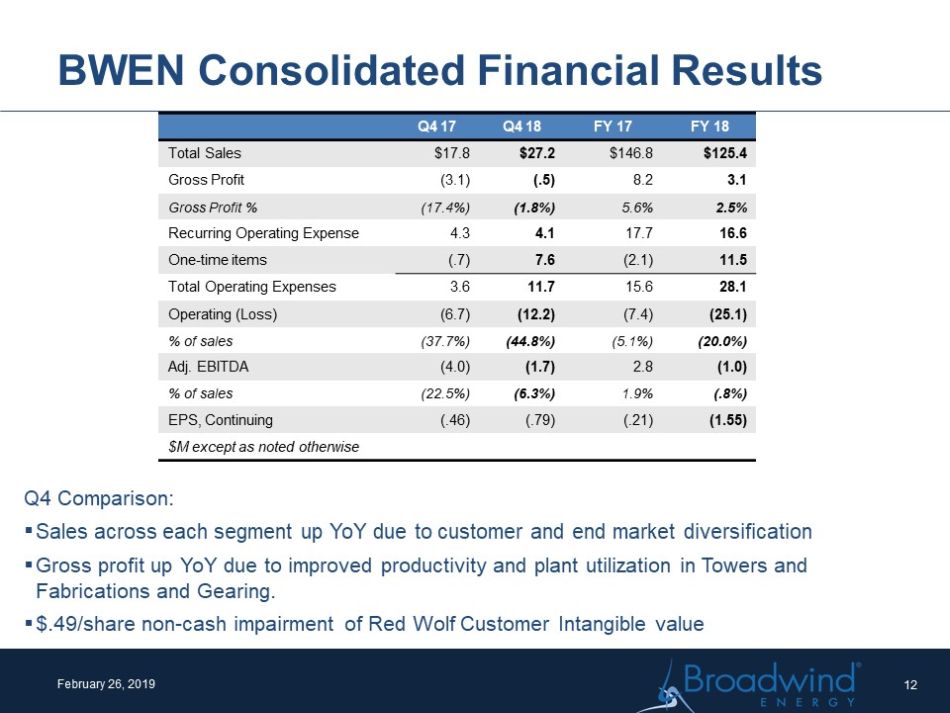

BWEN Consolidated Financial Results February 26, 2019 Q4 Comparison: ▪ S ales across each segment up YoY due to customer and end market diversification ▪ Gross profit up YoY due to improved productivity and plant utilization in Towers and Fabrications and Gearing. ▪ $.49/share non - cash impairment of Red Wolf Customer Intangible value 12 Q4 17 Q4 18 FY 17 FY 18 Total Sales $17.8 $27.2 $146.8 $125.4 Gross Profit (3.1) (.5) 8.2 3.1 Gross Profit % (17.4%) (1.8%) 5.6% 2.5% Recurring Operating Expense 4.3 4.1 17.7 16.6 One - time items (.7) 7.6 (2.1) 11.5 Total Operating Expenses 3.6 11.7 15.6 28.1 Operating (Loss) (6.7) (12.2) (7.4) (25.1) % of sales (37.7%) (44.8%) (5.1%) (20.0%) Adj. EBITDA (4.0) (1.7) 2.8 (1.0) % of sales (22.5%) (6.3%) 1.9% (.8%) EPS, Continuing (.46) (.79) (.21) (1.55) $M except as noted otherwise

Operating Working Capital (OWC) February 26, 2019 ▪ $13M reduction in operating working capital due to deposits received, which will support 2019 production ▪ On February 25, 2019, expanded line of credit, with CIBC, to $35M and extended for three years, offering flexibility for anticipated working capital growth and increased supply chain complexity ▪ Aggressively managing cash conversion cycle * Operating Working Capital = Trade A/R + Inventories – Trade Payables – Customer Deposits 12/31/17 9/30/18 12/31/18 DSO 70 49 58 Inv. Turns 5.0 5.1 4.8 DPO 44 44 39 Cash Conv. (days) 48 54 17 OWC $M 11.4 18.2 5.0 OWC* Historical Trend – cents/$ sales OWC* Management 13 $(0.05) $- $0.05 $0.10 $0.15 $0.20

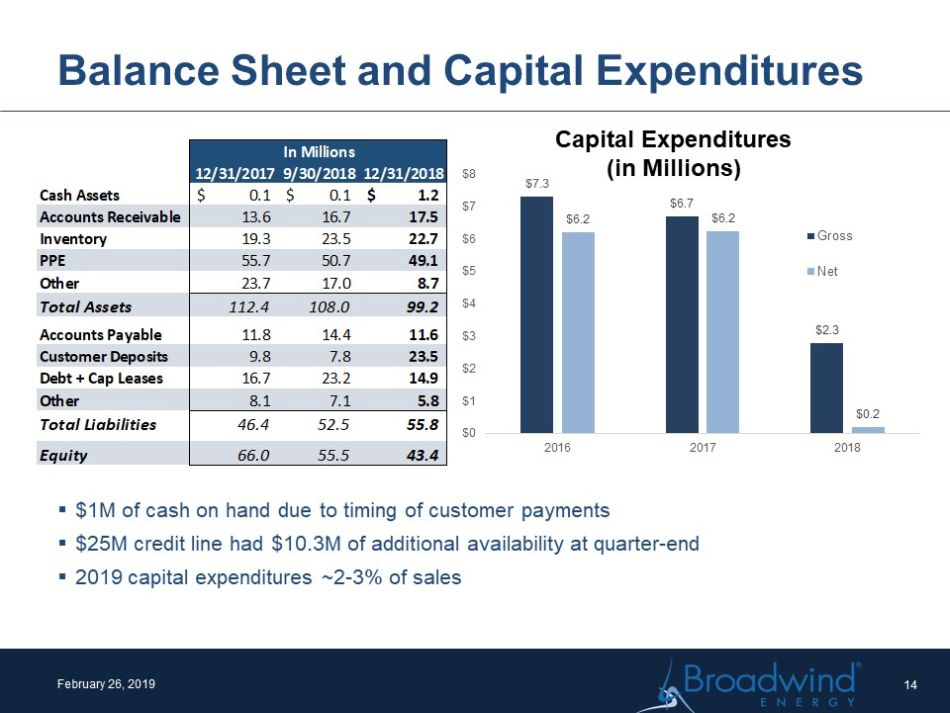

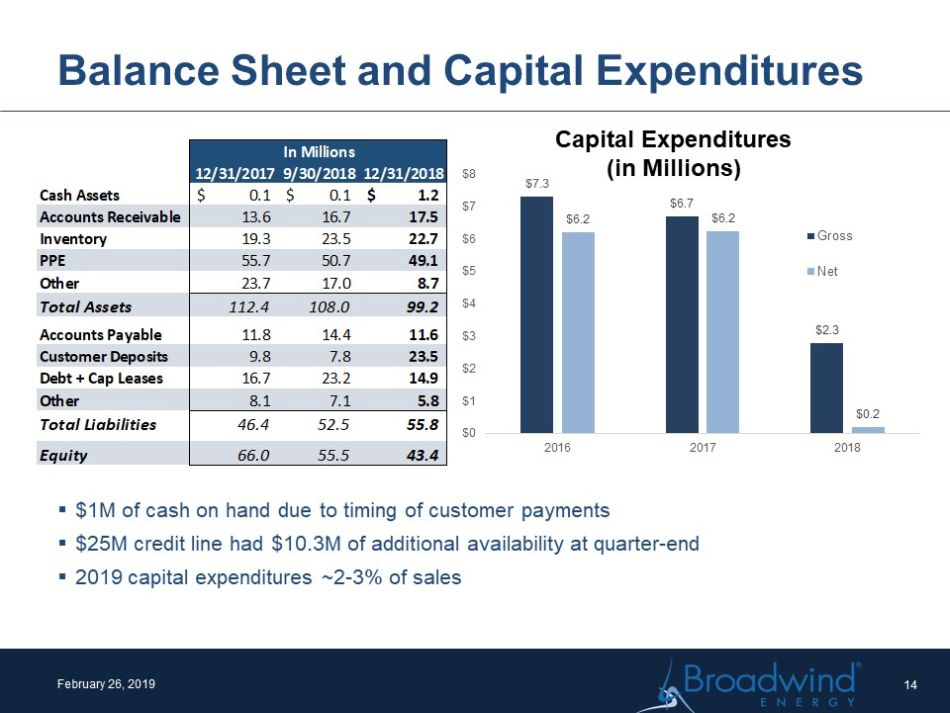

Balance Sheet and Capital Expenditures February 26, 2019 Capital Expenditures (in Millions) ▪ $1M of cash on hand due to timing of customer payments ▪ $25M credit line had $10.3M of additional availability at quarter - end ▪ 2019 capital expenditures ~2 - 3% of sales 14 12/31/20179/30/201812/31/2018 Cash Assets 0.1$ 0.1$ 1.2$ Accounts Receivable 13.6 16.7 17.5 Inventory 19.3 23.5 22.7 PPE 55.7 50.7 49.1 Other 23.7 17.0 8.7 Total Assets 112.4 108.0 99.2 Accounts Payable 11.8 14.4 11.6 Customer Deposits 9.8 7.8 23.5 Debt + Cap Leases 16.7 23.2 14.9 Other 8.1 7.1 5.8 Total Liabilities 46.4 52.5 55.8 Equity 66.0 55.5 43.4 In Millions $7.3 $6.7 $2.3 $6.2 $6.2 $0.2 $0 $1 $2 $3 $4 $5 $6 $7 $8 2016 2017 2018 Gross Net

Q4 Summary and Guidance ▪ Q4 2018: As guided – Gearing progress offset by rescheduled tower production ▪ 2019: Average quarterly revenue >$40M, consistent positive EBITDA ▪ Q1 2019: Gears segment continues to perform…rebuilding Towers, but margin pressures remain - Revenue $40M and EBITDA $1 - 1.5M February 26, 2019 15

Appendix February 26, 2019 16 Consolidated 2018 2017 2018 2017 Net (Loss) from continuing operations……………………………. (12,358)$ (6,928)$ (24,000)$ (3,184)$ Interest Expense…………………….……………………………………. 475 214 1,494 798 Income Tax (Benefit)/Provision……………………………… (184) 11 (204) (5,045) Depreciation and Amortization………………………………………………………………2,193 2,427 9,183 8,999 Share-based Compensation and Other Stock Payments………………………………………………………………290 323 1,504 1,223 Restructuring Costs…………………………………...……………………. 243 - 668 - Impairment Charges…………………………………………………. 7,592 - 12,585 - NMTC Extinguishment Gain……………………………………. - - (2,249) - Adjusted EBITDA (Non-GAAP)…………………………. (1,749)$ (3,953)$ (1,019)$ 2,791$ Three Months Ended December 31, Twelve Months Ended December 31, Towers and Heavy Fabrications Segment 2018 2017 2018 2017 Net (Loss)/Income………...……………………………………. (2,195)$ (4,207)$ (3,273)$ 919$ Interest Expense……………………………..……………………. 66 26 194 89 Income Tax (Benefit)/Provision……………………………… (567) (337) (1,154) 1,666 Depreciation and Amortization………………………………………………………………1,213 1,355 4,986 4,638 Share-based Compensation and Other Stock Payments………………………………………………………………139 127 606 440 Adjusted EBITDA (Non-GAAP)…………………………….. (1,344)$ (3,036)$ 1,359$ 7,752$ Three Months Ended December 31, Twelve Months Ended December 31, Gearing Segment 2018 2017 2018 2017 Net Income/(Loss)…………...……………………………. 915$ (70)$ (34)$ (2,638)$ Interest Expense…………………………………………… 67 3 74 12 Income Tax Provision/(Benefit)……………………………… 10 (4) 11 (6) Depreciation and Amortization………………………………………………………………513 583 2,255 2,430 Share-based Compensation and Other Stock Payments………………………………………………………………66 64 286 178 Adjusted EBITDA (Non-GAAP)……………………….. 1,571$ 576$ 2,592$ (24)$ Three Months Ended December 31, Twelve Months Ended December 31,

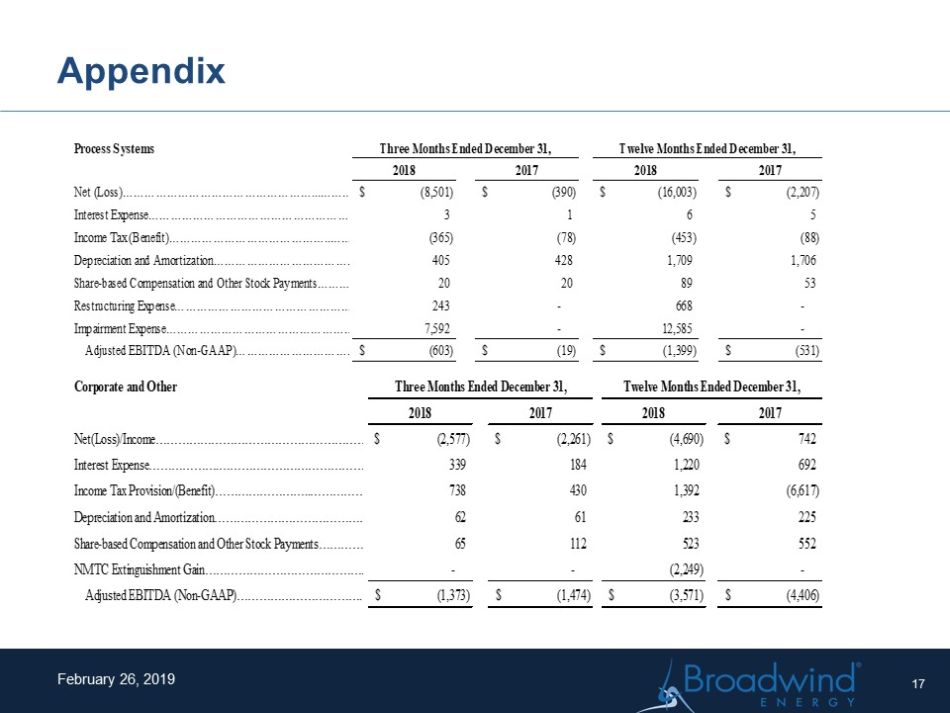

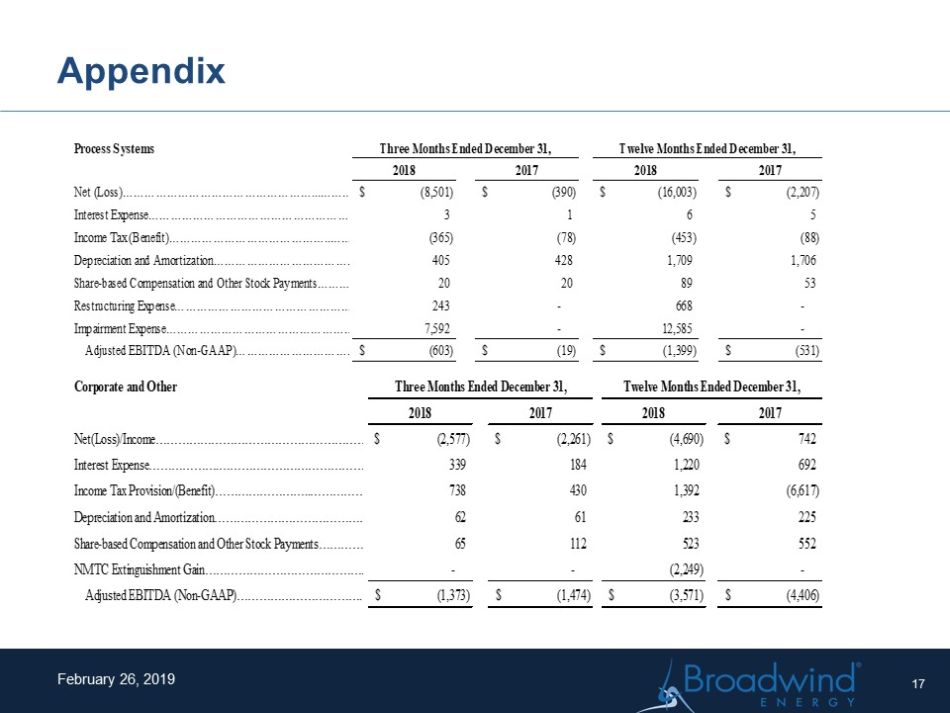

Appendix February 26, 2019 17 Process Systems 2018 2017 2018 2017 Net (Loss)……………………………………………...…………… (8,501)$ (390)$ (16,003)$ (2,207)$ Interest Expense……………………………………………………. 3 1 6 5 Income Tax (Benefit)……………………………………..……… (365) (78) (453) (88) Depreciation and Amortization……………………………………. 405 428 1,709 1,706 Share-based Compensation and Other Stock Payments………… 20 20 89 53 Restructuring Expense……………………………………………. 243 - 668 - Impairment Expense………………………………………………… 7,592 - 12,585 - Adjusted EBITDA (Non-GAAP)……………………………… (603)$ (19)$ (1,399)$ (531)$ Three Months Ended December 31, Twelve Months Ended December 31, Corporate and Other 2018 2017 2018 2017 Net(Loss)/Income………………………………………………….. (2,577)$ (2,261)$ (4,690)$ 742$ Interest Expense……………….…………………………………… 339 184 1,220 692 Income Tax Provision/(Benefit)……………………..…………… 738 430 1,392 (6,617) Depreciation and Amortization………………………………………………………………62 61 233 225 Share-based Compensation and Other Stock Payments………………………………………………………………65 112 523 552 NMTC Extinguishment Gain……………………………………. - - (2,249) - Adjusted EBITDA (Non-GAAP)……………………………. (1,373)$ (1,474)$ (3,571)$ (4,406)$ Three Months Ended December 31, Twelve Months Ended December 31,

Broadwind Energy is a precision manufacturer of structures, equipment & components for clean tech and other specialized applications . www.BWEN.com February 26, 2019 18