- LODE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Comstock (LODE) 8-KRegulation FD Disclosure

Filed: 7 Feb 08, 12:00am

Investor Update

CONFIDENTIAL

February 2008

A Florida Corporation

NASDAQ OTC Bulletin Board

Trading Symbol: GSPG

1200 American Flat Road, PO Box 1118, Virginia City, NV 89440

Tel: 775.847.5272 Fax: 775.847.4762 www.goldspring.us

Cautionary Statements

Certain information or contained or incorporated by reference in this presentation and related material, including any

information as to our future financial or operating performance, constitutes “forward-looking statements”. All

statements other than statements of historical fact, are forwarding looking statements. The words “believe”, “expect”,

“anticipate”, “contemplate”, “target”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may” “will”, “schedule”,

and expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a

number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant

business, economic, and competitive uncertainties and contingencies. Know and unknown factors could cause actual

results to differ materially from the projected in the forward-looking statements. Such factors include, but are not

limited to: fluctuations in the currency markets; fluctuations in the spot and forward price of gold, silver or certain

other commodities (such as diesel fuel and electricity); changes in U.S. dollar interest rates; changes in national or local

legislation, taxation, controls, regulations and political and economic developments in the United States; business

opportunities that may be presented to, or pursued by, us; our ability to successfully integrate acquisitions, operating or

technical difficulties in connection with mining or developmental activities; employee relations; availability and

increasing costs associated with mining inputs and labor; speculative nature of exploration and development, including

the risks of obtaining necessary permits and licenses; diminishing quantities or grade of reserves; and contests over

title to properties. In addition, there are risks associated with the business of exploration, development and mining,

including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, flooding, gold

bullion losses and the risk of inadequate insurance. Many of these uncertainties and contingencies could affect our

actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking

statement made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in this presentation are qualified by these cautionary

statements. Specific reference is made to GoldSpring’s most recent 10-KSB and 10-QSB on file with the SEC for a

discussion of some of the factors underlying forward-looking statements.

We disclaim any intention or obligation to update or revise any forward-looking statement whether as a result of new

information, future events or otherwise, except to the extent required by applicable law.

1

GoldSpring, Inc. (GSPG)

We are a North American precious metals mining company with an operating gold and silver test mine in northern

Nevada. Our Company was formed in mid-2003, and we acquired the Plum property in November 2003. In our

relatively short history, we secured permits, built an infrastructure and brought the Plum exploration project into test

mining production. Beginning in 2005, we started acquiring additional properties around the Plum project in Northern

Nevada, expanding our footprint and creating opportunities for exploration. We are an emerging company, looking to

build on our success through the acquisition of other mineral properties in North America with reserves and

exploration potential that can be efficiently put into near-term production.

Our Short-term Objectives are to:

1.

Consolidate the Comstock District

2.

Complete drilling and metallurgy on the Hartford Complex

3.

Complete Gold and Silver Reserve Report for the Hartford Complex

4.

Complete Detailed Mining Plan for the Hartford Complex

5.

Commence Gold and Silver Production by Open Pit Mining

6.

Begin Deep Exploration Drilling for Underground Targets

2

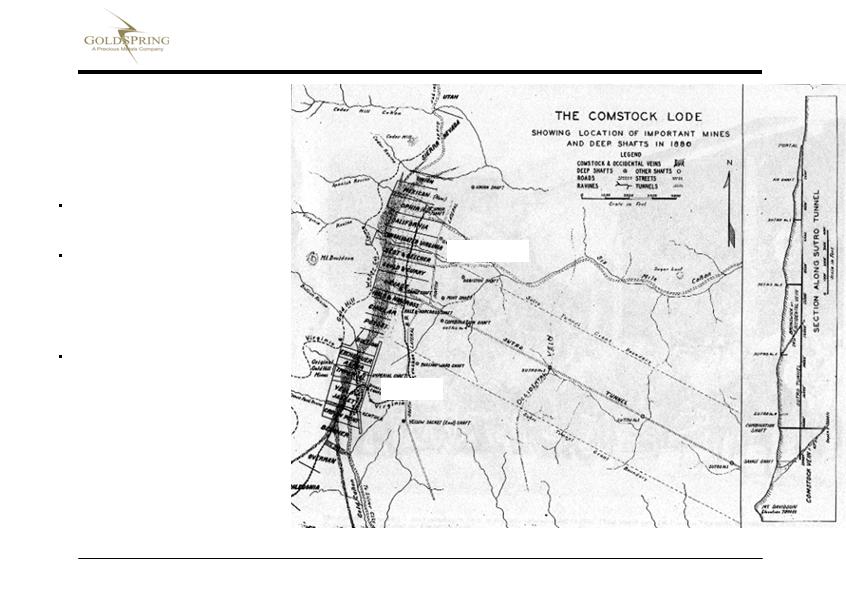

The Comstock

One of Worlds “Giant” Mineral

Districts.

Produced ores containing 15

million ounces of gold and 230

million ounces of silver.

33 Bonanza discoveries

Now One of Nevada’s most under-

explored districts in terms of

Modern Exploration

Abundant remaining exploration

opportunities.

Second largest trend in U.S.(Carlin

Trend is first)

Virginia City

Gold Hill

3

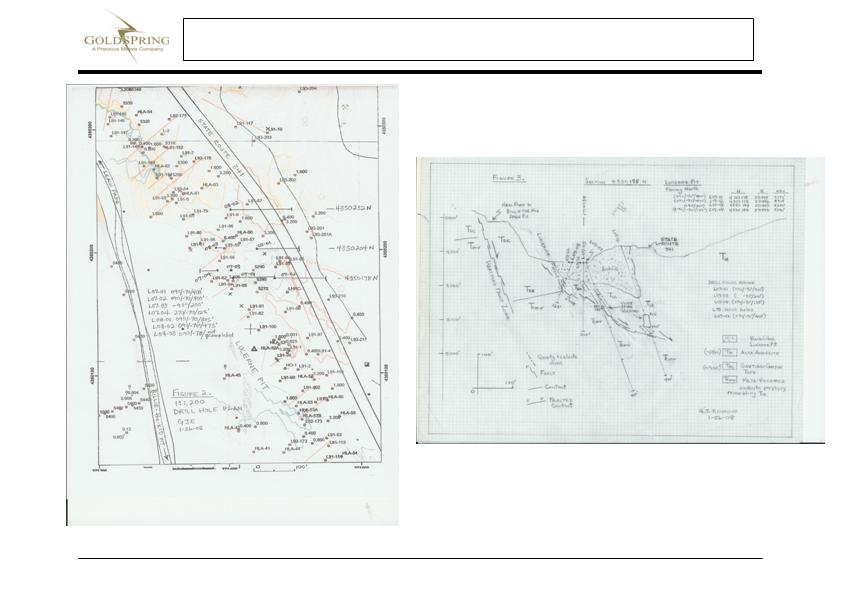

December 2007 Drilling Results

Four exploratory holes were drilled in a line, demonstrating lateral continuity between the drill holes.

The drill results indicate the continuation of the gold and silver mineralization beyond the current

boundaries of the Hartford Complex pit on to the Company's adjoining claims further expanding the

known ore body.

The third party assay results showed ore grades that were 30% greater than the initial grades indicated

by the Company's preliminary in-house assays.

The first exploratory hole encountered 80 feet of precious metals mineralization from a depth of 70' to

150' grading 0.056 opt gold and 0.668 opt silver. The hole is highlighted by 10' grading 0.117 opt gold and

1.611 opt silver.

The second exploratory hole encountered 115' (160' - 275') of precious metals mineralization grading

0.074 opt gold and 0.69 opt silver, highlighted by 15' grading 0.180 opt gold and 0.67 opt silver.

The third and fourth exploratory holes encountered gold values highlighted by 30' of 0.036 opt gold and

1.00 opt silver.

4

December 2007 Drilling Results

5

Reverse Circulation drilling along west to east fences in the Lucerne Pit area

has returned anomalous to ore-grade (up to 0.1 oz/ton) gold values in seven of

seven holes as determined by Goldsprings’ in-house analyses; assays are

pending from a commercial laboratory.

Gold mineralization is hosted in the Santiago Canyon Tuff, the same silicified

tuff that hosts the gold reserve mined earlier in the adjacent Billie-the-Kid open

pit.

The drill pattern covers 200’ strike, across 200’ laterally over three drill fences.

Quartz veining in favorable tuff ranges to 50’ drilled thickness.

Future plans are to expand the drill pattern both east and west along existing

drill fences and to establish new drill fences, both north and south, as gold

mineralization is open in all directions.

Telesco Engineering Report Summary

6

Comstock Lode Mine

Steps to Resume Production

Comprehensive Geological Review in Process

Drilling Program commenced 12/07

Reserve report scheduled to be completed by

5/08

Comprehensive mine plan for the Hartford

Complex

Metallurgical Testing in Process

Add secondary crusher

Add mill (Permitting in Process)

Add haul vehicles and other equipment to

takeover mining process

7

The Comstock Property

Historical Information

Acquired Company in November 2003

Obtained required regulatory and environmental permits:

Air quality control permit

Water Usage

Cyanide Heap Leach Special Use Permit

County special use permit

Reclamation permit

Storm water drainage permit

Water rights

Wildlife permit

Water pollution permit

State mine inspector notice

Federal mine inspector notice

Gold production: 11,536 ounces

Silver production: 45,376 ounces

Tons of ore mined: 340,000

Tons of waste: 659,000

Recovered grade of gold: 0.034

Recovered grade of silver: 0.13

8

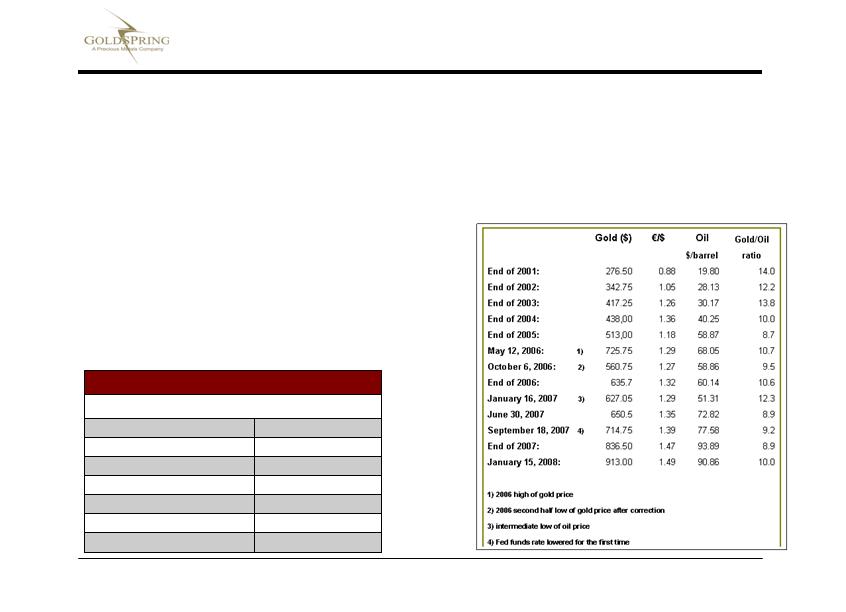

Gold Forecast 2008 (Range $800 to $1,500)

Goldman Sachs $800/oz

Citigroup $1,000/oz

Merrill Lynch $1,000/oz

Morgan Stanley $1,000/oz (Gold Market has a long way to go beyond 2008)

Deutsche Bank $820/oz

JP Morgan Chase $814/oz

Barclays $830/oz

Kitco $1,400/oz

National Bank Financial $1,500/oz

GFMS $1,000/oz

6.00

Prime %

88.41

Oil $/bbl

900.00

Gold $/oz

4.60

Unemployment %

.63

GDP Growth %

4.12

Inflation %

Value

Indicator

Current Economic Indicators

9

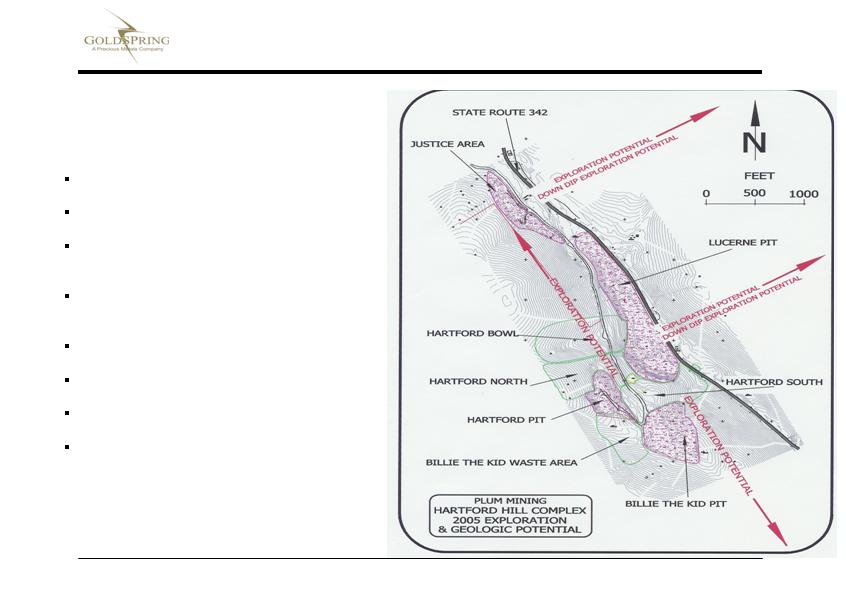

Consolidation of the Comstock District -

Acquired properties at favorable prices

Expanded Comstock footprint through the staking of addition mineral claims – Approx.

1,000 acres

Largest footprint ever held in the Comstock and the ability to acquire additional properties

(Consolidation of the Comstock District)

Fully Permitted Cyanide Heap Leach Mining

Exploration opportunities exist on all properties

Optimistic upside exploration potential – 1 to 3 million additional ounces of gold

December 2007 Stage 1 exploratory Drilling delivered positive results

Stage 2 Exploratory nearly complete and in-house results are encouraging

Ability to accelerate production in near term

Positioned for Growth and Profitability

GoldSpring, Inc. – Investment Overview

10