Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED December 31, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM______TO______.

COMMISSION FILE NO.: 001-35200

COMSTOCK INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 65-0955118 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization | | Identification No.) |

| | | |

| 117 American Flat Road, Virginia City, NV | | 89440 |

| (Address of principal executive offices) | | (Zip Code) |

(775) 847-5272

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.000666 per share | LODE | NYSE American |

Securities registered pursuant to Section 12(g) of the Acts: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | | Yes | ☐ | No | ☒ |

| | | | | | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | | Yes | ☐ | No | ☒ |

| | | | | | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | | Yes | ☒ | No | ☐ |

| | | | | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | | Yes | ☒ | No | ☐ |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| | | | | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | | | | ☐ |

| | | | | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | | | | | ☐ |

| | | | | | |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | | | | | ☐ |

| | | | | | |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-l(b). | | | | | ☐ |

| | | | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | | Yes | ☐ | No | ☒ |

| | | | | | |

| The aggregate market value of the 14,595,845 shares of voting stock held by non-affiliates of the registrant based on the closing price on the NYSE American on June 30, 2024 was $23,937,185. | | | | | |

The number of shares outstanding of Common Stock, $0.000666 par value per share, on March 4, 2025 was 24,238,453.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the definitive proxy statement to be delivered to shareholders in connection with the 2025 Annual Meeting of Shareholders, are incorporated by reference in Part III

This page intentionally left blank.

COMSTOCK INC.

ANNUAL REPORT ON FORM 10K

FOR THE FISCAL YEAR ENDED December 31, 2024

TABLE OF CONTENTS

PART I

DEFINED TERMS USED IN THIS REPORT

The following are defined terms and naming conventions used in this Annual Report on Form 10-K, unless otherwise specified:

| Comstock Inc. and its Subsidiaries: | |

| | |

| Comstock, we, our, us, or the Company | Comstock Inc. and its subsidiaries on a consolidated basis |

| | |

| Comstock Fuels | Comstock Fuels Corporation, Comstock Fuels Oklahoma LLC |

| | |

| Comstock Metals | Comstock Metals LLC |

| | |

| Comstock Mining | Comstock Mining LLC, Comstock Processing LLC, Comstock Northern Exploration LLC (sold December 2024), Comstock Exploration and Development LLC |

| | |

| Comstock Innovations | Comstock Innovations Corporation |

| | |

| Comstock IP Holdings | Comstock IP Holdings LLC |

| | |

| Miscellaneous Defined Terms: | |

| | |

| EPS | Earnings per share |

| | |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| | |

| GAAP | U.S. Generally Accepted Accounting Principles |

| | |

| NYSE | NYSE American LLC |

| | |

| SEC | Securities and Exchange Commission |

| | |

| Securities Act | Securities Act of 1933, as amended |

| | |

| Industry Defined Terms: | |

| | |

| BLM | Bureau of Land Management, an agency of the U.S. Department of Interior |

| | |

| BTC | Federal biodiesel mixture excise tax credit |

| | |

| CI | Carbon intensity, or CI, refers to the relative amount of carbon dioxide (CO2) emissions that are released for a specific activity. |

| | |

| EIA | U.S. Energy Information Administration |

| | |

| EPA | U.S. Environmental Protection Agency |

| | |

| GHG | Greenhouse gas |

| | |

| LCFS | Low Carbon Fuel Standard |

| | |

| RFA | Renewable Fuels Association |

| | |

| RFS or RFS II | Renewable Fuel Standards published by the EPA |

| | |

| RIN | Renewable identification number |

| | |

| RVO | Renewable volume obligation |

| | |

| U.S. | United States of America |

| | |

| Glossary: | |

| | |

| AI | Artificial intelligence |

| | |

| Biomass | renewable organic material produced, in pertinent part, upon conversion of energy from the sun, water, and carbon dioxide into stored chemical energy. |

| | |

| Carbon cycle | biogeochemical cycle by which carbon is exchanged amongst the Earth’s air, water, biomass, soil, crust, mantle, and back again, primarily from biological, geochemical, and industrial processes. |

| | |

| Claim | a mining interest area giving its holder the right to prospect, explore for, and exploit minerals. |

| | |

| Grade | the amount of metal per ton of material. |

| | |

| Indicated Mineral Resource | that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

| | |

| Inferred Mineral Resource | that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic uncertainty. |

| | |

| Intermediate | a product produced from one or more reactants during one conversion step for use in one or more succeeding conversion steps into a final product. |

| | |

| Lode | a vein-like deposit or rich supply of or source of minerals. |

| | |

| Long cycle carbon | long-term carbon cycle operating over millions of years, primarily involving the production and sequestration of biomass in the Earth’s crust and mantle, where it is converted with heat, pressure, and time into fossil hydrocarbons; emissions of long cycle carbon derive, in pertinent part, from previously-sequestered carbon dioxide, and therefore add to and disrupt the Earth’s natural short cycle and climate. |

| | |

| Measured Mineral Resource | that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to probable mineral reserve. |

| | |

| Mineral reserve | an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowance for losses that may occur when the material is mined or extracted. The mineral reserve estimate must be based on at least a preliminary feasibility study. |

| | |

| Mineral resource | a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or part, become economically extractable. |

| | |

| NSR | net smelter return, a frequently used basis for calculating royalties. |

| Ore | mineral-bearing material, which is economically and legally extractable. |

| | |

| Precursor | an initial or intermediate compound that participates in a reaction and/or process that produces another compound. |

| | |

| Probable mineral reserve | the economically mineable part of an indicated, and, in some cases, a measured mineral resource. |

| | |

| Proven mineral reserve | the economically mineable part of a measured mineral resource which can only result from conversion of a measured mineral resource. |

| | |

| Short cycle carbon | short-term carbon cycle operating over months or centuries involving the exchange of carbon above the surface of the Earth, primarily between its air, water, biomass, and soil; emissions of short cycle carbon derive, in pertinent part, from carbon dioxide that was recently photosynthesized into biomass, and therefore have a net zero impact on the carbon content above the Earth’s surface and climate. |

| | |

| Stripping ratio | the ratio of waste tons to ore tons mined. |

| | |

| Tailings | refuse materials resulting from the washing, concentration, or treatment of mineralized material. |

| | |

| TRL | Technology Readiness Levels (TRLs) are a method for understanding the technical maturity of a technology during its nine potential development phases. TRLs allow scientists and engineers to have a consistent datum of reference for understanding technology evolution, regardless of their technical background. |

| | |

| Vein | a deposit of non-sedimentary origin, which may or may not contain minerals. |

REVERSE STOCK SPLIT

On February 24, 2025, the Company effected a one-for-ten (1:10) reverse stock split of its issued and outstanding shares of common stock. In connection with the reverse split, all shares of common stock, stock options, per-share and warrant amounts for all periods presented have been adjusted retrospectively to reflect this reverse stock split. This recast ensures comparability across all periods presented and does not impact previously reported net income (loss), total assets, or total liabilities. The reverse stock split did not impact the total stockholders’ equity, the number of authorized shares of common stock, or the par value per share.

MARKET AND INDUSTRY DATA FORECASTS

This document includes industry data and forecasts prepared by third parties. Third-party industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. We have based much of our discussion on the renewable fuels and solar industries, including government regulation relevant to those industries, and on information published by industry associations, like the RFA. The RFA is a trade organization, and they and other such organizations may present information in a manner that is more favorable than would be presented by independent sources. We have also used data and other information in this document that was published by the EIA and the EPA. Forecasts, in particular, are subject to a high risk of inaccuracy, especially forecasts projected over long periods of time.

CAUTIONARY INFORMATION REGARDING FORWARD LOOKING STATEMENTS

The SEC encourages companies to disclose forward-looking information so that investors can understand a company’s future prospects and make informed investment decisions. This report contains such forward-looking statements. We make certain forward-looking statements in this Annual Report on Form 10-K. These forward-looking statements relate to our outlook or expectations for revenues, expenses, earnings, asset quality or other future financial or business performance, strategies, transactions, or expectations, or the impact of legal, regulatory or supervisory matters on our business, results of operations or financial condition. Specifically, forward-looking statements may include statements preceded by, followed by or that include the words believe, estimate, plan, project, forecast, expect, anticipate, believe, seek, target, intend, should, may, will, would and similar expressions. These statements reflect our management’s judgment based on currently available information and involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Future performance cannot be ensured. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control, and could cause actual results, developments, and business decisions to differ materially from those contemplated by such forward-looking statements. Some factors that could cause our actual results to differ include:

- | sales of, and demand for, our products, services, and/or properties; |

- | industry market conditions, including the volatility and uncertainty of commodity prices; |

- | the speculative nature, costs, regulatory requirements, and hazards of natural and waste resource identification, exploration, development, availability, recycling, extraction, processing, and refining activities, including operational or technical difficulties, and risks of diminishing quantities or insufficiency of grades of qualified resources; |

- | changes in our planning, exploration, research and development, production, and operating activities; |

- | research and development, exploration, production, operating, and other variable and fixed costs; |

- | throughput rates, margins, earnings, debt levels, contingencies, taxes, capital expenditures, net cash flows, and growth; |

- | restructuring activities, including the nature and timing of restructuring charges and the impact thereof; |

- | employment and contributions of personnel, including our reliance on key management personnel; |

- | the costs and risks associated with developing new technologies; |

- | our ability to commercialize existing and new technologies; |

- | the impact of new, emerging, and competing technologies on our business; |

- | the possibility of one or more of the markets in which we compete being impacted by political, legal, and regulatory changes, or other external factors over which we have little or no control; |

- | the effects of mergers, consolidations, and unexpected announcements or developments from others; |

- | the impact of laws and regulations, including permitting and remediation requirements and costs; |

- | changes in or elimination of laws, regulations, tariffs, trade, or other controls or enforcement practices, including the potential that we may not be able to comply with applicable regulations; |

- | changes in generally accepted accounting principles; |

- | adverse effects of climate changes, natural disasters, and health epidemics, such as the COVID-19 outbreak; |

- | global economic and market uncertainties, changes in monetary or fiscal policies or regulations, the impact of terrorism and geopolitical events, volatility in commodity and/or other market prices, and interruptions in delivery of critical supplies, equipment and/or raw materials; |

- | assertion of claims, lawsuits, and proceedings against us; |

- | potential inability to satisfy debt and lease obligations, including because of limitations and restrictions contained in the instruments and agreements governing our indebtedness; |

- | our ability to raise additional capital and secure additional financing; |

- | interruptions in our production capabilities due to equipment failures or capital constraints; |

- | potential dilution from stock issuances, recapitalization, and balance sheet restructuring activities; |

- | potential inability or failure to timely file periodic reports with the SEC; |

- | potential inability to maintain the listing of our securities on any securities exchange or market; |

- | our ability to implement additional financial and management controls, reporting systems and procedures and comply with Section 404 of the Sarbanes-Oxley Act, as amended; and |

- | other risks referenced from time to time in our filings with the SEC and those factors listed in this Annual Report on Form 10-K for the year ended December 31, 2024 under Item 1A, Risk Factors. |

Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows and the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference in this report. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise.

ITEM 1 BUSINESS

OVERVIEW

Comstock innovates and commercializes technologies that extract and convert under-utilized natural resources into clean energy products, including remarkable new technologies that produce renewable fuels from waste and other forms of woody biomass and electrification metals from end-of-life electronics. We are also developing and using artificial intelligence technologies for advanced materials development, and preparing our defined mineral resources for mining and monetization.

Our goal is to build extraordinary shareholder value by using systemic management practices, disciplined frontier scientific discovery, and applied engineering to innovate, develop, and commercialize technologies that facilitate the increased production, storage, distribution, and use of clean energy across entire industries. Our operations primarily involve innovating, developing, deploying, and monetizing clean energy technologies with integrated teams in dedicated lines of business, including renewable fuels, metals, and mining. Our plans to generate revenue and throughput involve using and licensing our technologies, including by creating financial and other incentives to enable and motivate our customers, licensees, and other stakeholders to use their capital, infrastructure, and other resources to accelerate and maximize adoption.

We also make, own and manage investments in related assets to support our businesses, including multiple existing minority equity positions and partnerships in strategic technology developers, two renewable fuels demonstration facilities in Wisconsin, and a metals recycling demonstration facility in Nevada. We additionally own and manage direct investments in northern Nevada real estate comprised of industrial and commercial properties, strategic water rights and approximately twelve square miles of mining claims and related surface parcels that we own, lease and/or have a royalty interest in that also contain measured, indicated and inferred mineral resources of gold and silver.

OPERATING SEGMENTS

We group our business activities into five operating segments to manage performance: Fuels, Metals, Mining, Strategic Investments, and Corporate Services. The Company’s goal is to Accelerate the Commercialization of Hard Technologies for Energy Markets. Once a technology achieves a certain technology readiness or a justifiable critical mass or market distinction, we systemically plan its commercialization and dedicate and integrate resources toward that end. Until then, it is managed with corporate resources.

Corporate Segment

Our Corporate Segment includes our corporate functions and services, including research, development and innovation activities that are ongoing in addition to the business activities related to our Fuels, Metals, Mining and Strategic Investments Segments. Comstock’s innovations group focuses on developments that enhance Comstock’s ongoing commercialization activities, such as by developing further enhancements to Comstock Fuels’ renewable fuels refining yields and profitability to levels approaching parity with fossil fuels.

Fuels Segment

We believe that combustion will continue to be the dominant source of power for transportation for many decades to come. Hydrocarbon fuels are characterized by high energy density, ease of distribution and use, and extensive regional and global supply chains spanning multiple industries and billions of consumers. That infrastructure can be used as a highly scalable pathway for enabling systemic decarbonization and contributing to a net zero carbon objective by sustaining a profitable new balance between the Earth’s natural carbon cycle and humanity’s global uses, wastes, and carbon emissions. Our plans involve innovating, commercializing, and licensing new lignocellulosic fuel technologies that dramatically increase the growth, availability, and use of renewable feedstocks and fuels.

Our Fuels Segment is administered by our subsidiary, Comstock Fuels Corporation (“Comstock Fuels”). Comstock Fuels delivers advanced lignocellulosic biomass refining solutions that set industry benchmarks for production of cellulosic ethanol, gasoline, renewable diesel, sustainable aviation fuel (“SAF”), and other renewable Bioleum™ fuels, with extremely low carbon intensity scores of 15 and market-leading yields of up to 140 gallons per dry metric ton of feedstock (on a gasoline gallon equivalent basis, or “GGE”), depending on feedstock, site conditions, and other process parameters. Comstock Fuels additionally holds the exclusive rights to intellectual properties developed by Hexas Biomass Inc. (“Hexas”) for production of purpose grown energy crops in liquid fuels applications with proven yields exceeding 25 to 30 dry metric tons per acre per year. The combination of Comstock Fuels’ high yield Bioleum refining platform and Hexas’ high yield energy crops allows for the production of enough feedstock to produce upwards of 100 barrels of fuel per acre per year (at 42 gallons per barrel), effectively transforming marginal agricultural lands with regenerative practices into perpetual “drop-in sedimentary oilfields” with the potential to dramatically boost regional energy security and rural economies. Comstock Fuels plans to contribute to domestic energy dominance by directly building, owning, and operating a network of Bioleum Refineries in the U.S. to produce about 200 million barrels of renewable fuel per year by 2035, starting with its planned first 400,000 barrel per year commercial demonstration facility in Oklahoma. Comstock Fuels also licenses its advanced feedstock and refining solutions to third parties for additional production in the U.S. and global markets, including several recently announced and other pending projects. Our Fuels Segment does not currently generate revenue but is anticipated to do so from recently announced agreements for licensing and related engineering services in Australia, New Zealand, Malaysia, Vietnam and Pakistan.

Comstock Fuels operates two pilot facilities, including a feedstock conversion and biointermediate production pilot in Wausau, Wisconsin (“Wausau Facility”), and a biointermediate conversion and renewable fuel production pilot in Madison, Wisconsin (“Madison Facility”). Comstock Fuels is also focused on additional innovations to improve on its existing commercial process by increasing its market-leading yields and carbon intensities while driving costs down in pursuit of fossil parity. To that end, Comstock Fuels’ innovations group has partnered with National Renewable Energy Laboratory (“NREL”), the Massachusetts Institute of Technology (“MIT”), RenFuel K2B AB (“RenFuel”), Emerging Fuels Technologies Inc. (“EFT”), and others with sponsored research, licensing, and other agreements.

We intend to transition Comstock Fuels to directly supporting its continued development with the proceeds of a planned Series A subsidiary preferred equity offering in 2025 (“Series A Financing”) as well as subsidiary project equity and debt financings that includes a recent allocation of $152 million from the State of Oklahoma in project activity bonds for the construction of its planned first 400,000 barrel per year facility in Oklahoma. Effective February 28, 2025, Comstock Fuels entered into a series of definitive agreements with subsidiaries of Marathon Petroleum Corporation (“Marathon”), involving the purchase of $14,000,000 in Comstock Fuels equity as part of Comstock Fuels’ planned Series A Financing, subject to a $700,000,000 valuation cap (“Investment”). The purchase price includes $1,000,000 in cash and $13,000,000 in payment-in-kind assets comprised of equipment, related intellectual properties, and other materials located at Marathon’s former renewable fuel demonstration facility in Madison, Wisconsin (“Payment-In-Kind Assets”) (see Note 21 of the Notes to our Consolidated Financial Statements).

Metals Segment

We believe that the recovery of critical and precious metals from end-of-life solar panels and other electrification products, represents a transformative opportunity to bolster domestic supply chains. With growing demand for these materials to power energy generation for artificial intelligence, advanced manufacturing, and other critical industries, we are committed to reducing reliance on foreign imports while supporting domestic production and economic growth. Comstock Metals aligns with an “America First” philosophy by enabling the recovery of valuable domestic resources to strengthen the nation’s industrial base and energy security.

Our Metals Segment is administered by our wholly owned subsidiary, Comstock Metals LLC. Since early 2024, Comstock Metals has been operating a demonstration-scale solar panel recycling facility, which generates revenue through service fees for decommissioning, tipping fees for receiving and processing end-of-life solar panels, and offtake sales of high-value recycled materials, including aluminum, copper, glass, and concentrated precious metals. This facility has proven our capability to deliver environmentally superior recycling solutions that support domestic industry while reducing landfill waste.

To scale these operations, Comstock Metals has initiated permitting and development of its first industry-scale production facility, located on the same campus as the demonstration facility. This strategically located facility will enable the seamless transition of proven processes from demonstration to full-scale production. Once operational, the industry-scale facility is expected to significantly enhance our ability to meet the growing demand for domestically recovered metals, supporting the needs of American manufacturers and infrastructure projects.

Our mission is to create a robust domestic supply chain for critical materials by innovating and scaling sustainable recycling technologies with initial plans to build three facilities in the U.S. Comstock Metals is advancing a vision of American energy and resource independence while delivering economic and environmental value.

Mining Segment

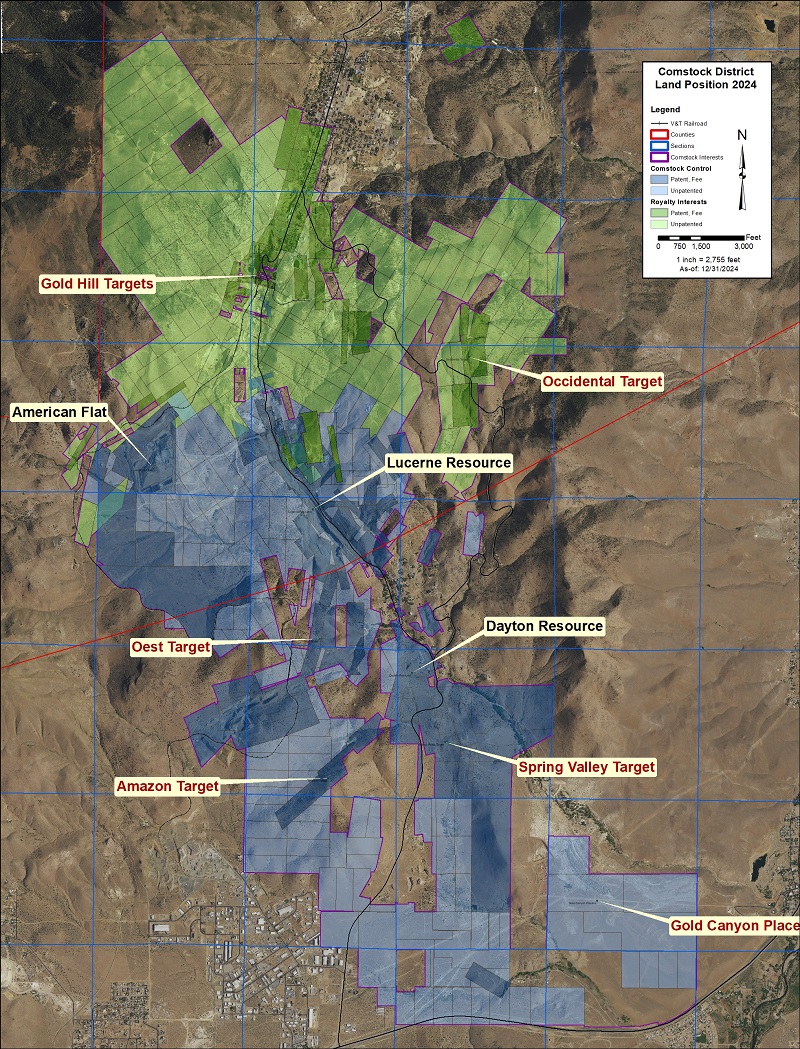

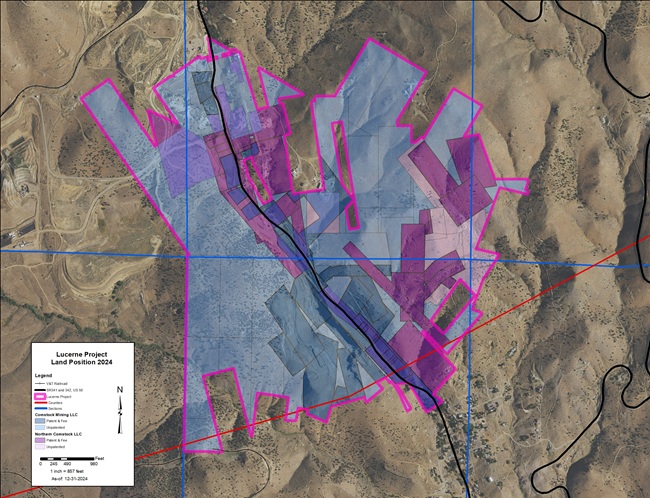

Our Mining Segment is administered by our wholly owned subsidiaries, Comstock Mining LLC, Comstock Processing LLC and various other local subsidiaries that collectively own, control or retains royalty interests on twelve square miles of patented mining claims, unpatented mining claims and surface parcels in Nevada, including six and a half miles of continuous mineralized strike length (the “Comstock Mineral Estate”) and generated approximately $2.6 million in 2024 revenues in the form of leases, licenses, recognized lease initiation and related fees associated with the mineral properties and claims controlled by Comstock Northern Exploration LLC.

On December 18, 2024, the Company executed a binding membership interest purchase agreement (the “Mackay MIPA”), with Mackay Precious Metals Inc. (“Mackay”) pursuant to which the Company sold all of its right, title, and interest in its wholly owned subsidiary Comstock Northern Exploration LLC, and the Company's 25% interest in Pelen LLC (“Pelen”) to Mackay, for an aggregate purchase price of $2,750,000, of which $1,000,000 was paid in cash, with another $750,000 expected to be paid by March 30, 2025 and with the final $1,000,000 to be paid in either cash or stock on or before October 31, 2025 (see Note 4 of the Notes to Consolidated Financial Statements). Pursuant to and as defined in the NSR Royalty Agreement between the Company and Mackay, also dated December 18, 2024 (the “Mackay Royalty Agreement”) the Company is to receive a 1.5% royalty of Net Smelter Returns from metal revenues on these properties. For the year ended December 31, 2024, the Company recognized a gain on sale of these mineral rights of $0.8 million.

As previously disclosed, on June 30, 2023, the Company entered into a binding Mineral Exploration and Mining Lease Agreement (the “Mackay Mining Lease”), with Mackay for certain owned or controlled fee tracts, patented mining claims, and unpatented mining claims located in Nevada and described in the Lease and on December 18, 2024, Comstock and Mackay mutually agreed to terminate the Mackay Mining Lease subject to the terms of a lease termination agreement establishing their relative rights, duties, and obligation under the Mackay Mining Lease up through and including the effective date of the lease termination agreement; and establishing their relative rights, duties, and obligations following the effective date of the lease termination agreement. The final $0.5 million in pro-rata lease expenses are expected to be paid by March 30, 2025 (see Note 4 of the Notes to Consolidated Financial Statements). Upon the termination of the Mackay Mining Lease, the associated deferred lease initiation fee revenue balance of approximately $1.2 million was recognized as revenue during the fourth quarter and the year ended December 31, 2024.

We have completed a third-party technical report summary, compliant with subpart 1300 of Regulation S-K (“S-K 1300”), dated November 30, 2022, focused on just one relatively smaller subsets of our mineral estate (the “Dayton Resource Area”), with measured and indicated mineral resources containing 293,000 ounces of gold and 2,120,000 ounces of silver, and inferred mineral resources containing an additional 90,000 ounces of gold and 480,000 ounces of silver. We plan to expand and upgrade our mineral assets through development and engineering to increase the value of our holdings and ultimately leading to production of gold and silver from these assets.

Strategic Investments Segment

We own and manage several investments and projects that support our plans to produce and maximize throughput in our Fuels, Metals and Mining Segments, but that are not a component of such other segments or otherwise have distinct operating activities. Our Strategic Investments Segment includes our convertible note receivable with RenFuel (advanced biofuel intermediate development and production), minority equity investments in Green Li-ion Pte Limited (“Green Li-ion”) (lithium ion battery recycling and precursor cathode active materials production) and Sierra Springs Opportunity Fund (“SSOF”) (strategic direct investment in industrial northern Nevada real estate), and other strategic equity investments.

RECENT DEVELOPMENTS

From 2021 through 2024, we completed a series of foundational transactions and investments designed to build on our competencies and position us and certain new technologies to address the rapidly growing global demand for energy and to enhance our material development capabilities. Collectively, these transactions added the management, employees, facilities, intellectual properties, and other assets we needed to restructure and transform our company and businesses into leading innovators that commercialize and license technologies that enable the sustainable production of renewable energy, including lignocellulosic fuels, electrification metals and efficient mineral discovery.

The Company is commercializing all three of its lines of business, renewable fuels, renewable metals and sustainable mining, and making strategic investments in other decarbonizing technologies that either complement or enhance the financial, natural and social impacts of our businesses. The Company’s Comstock Fuels subsidiary executed a number of material agreements in 2025, including an exclusive license, development services agreement, and an investment agreement with Hexas Biomass, Inc. (“Hexas”); a series of related agreements for a $3 million incentive grant and $152 million public activity bond allocation with Oklahoma state agencies; an early adopter license agreement with SACL Pte. Limited (“SACL”) for use of the Comstock Fuels technologies in Australia, New Zealand, Vietnam, and Malaysia; an early adopter license agreement with Gresham’s Eastern (Pvt) Ltd (“Gresham’s”) for use of the Comstock Fuels technologies in Pakistan; a series of agreements with subsidiaries of Marathon Petroleum Corporation (“Marathon”) involving the purchase of $14,000,000 in Comstock Fuels equity as part of Comstock Fuels’ planned Series A Financing, subject to a $700,000,000 valuation cap, including $1,000,000 in cash and $13,000,000 in payment-in-kind assets comprised of equipment, related intellectual properties, and other materials located at Marathon’s former renewable fuel demonstration facility in Madison, Wisconsin (“Madison Facility”); and, a term sheet with Marathon to finalize an offtake agreement, a joint development agreement, and a warrant agreement to purchase additional equity in Comstock Fuels on or before June 30, 2025 (see Note 21 of the Notes to our Consolidated Financial Statements)

COMPETITIVE STRENGTHS

Our management team operates systemically and has deep experience in a diverse array of areas and industries, including renewable fuels, agriproducts, graphite, metals, mining, manufacturing, hazardous waste, and intellectual property research, development, and commercialization. We have core competencies in systemic management and innovating and scaling new technologies to commercial maturity, with significant expertise and know-how in the design, engineering, construction, integration, operation, and scaling of facilities based on our patented, patent-pending, and proprietary processes and other technologies and specific management methodologies. Our expertise, know-how, technologies, and patent position collectively comprise our primary competitive strengths, and form the basis for our growth plans and the value-added renewable energy, mineral discovery, process solutions, related services, and client licensing options. Our strategic and tactical plans rely on the commercialization of renewable energy technologies that shift the consumption patterns of industries and populations to support energy abundance, systemic decarbonization and a net zero carbon world.

BUSINESS OVERVIEW

Our Fuels Segment enables energy solutions and systemic decarbonization with proprietary technologies that convert woody and woody-like biomass into the intermediates and precursors needed to produce advanced short cycle fuels, including SAF, renewable diesel, cellulosic ethanol, gasoline, and other co-products.

Our Metals Segment is commercializing technologies that facilitate efficient recycling and reuse of a sustainable source of photovoltaics materials and residuals, thereby increasing the supply of high-demand metals while preventing pervasive environmental contamination.

Our Mining Segment is focused on more efficient, effective, and expedient discovery and development of precious metals and other resources and the sustainable, post productive uses of those properties in a manner that adds financial, environmental, and social value.

Our Strategic Investments Segment makes and manages investments that are prerequisite or enhancing to our technologies and/or system that either sustainably enable, support and/or accelerate the throughput from our Fuels, Metals and Mining Segments.

COMPETITION

We compete with other renewable fuel technologies, electrification metal recycling solutions, clean technology engineering solutions, technology licensing, and mineral exploration companies in connection with the acquisition of properties and assets, feedstock and offtake agreements, clients, financial capital resources, and the attraction and retention of human capital. Those competitors typically have substantially greater financial resources than we do.

Our lignocellulosic fuels technology competes against the well-established and dominant petroleum-based fuel industry and, largely, with the much smaller (yet rapidly growing) biomass-based alternative fuels industry. In the United States and Canadian biomass-based fuels markets, our technology will also compete with independent biomass-based producers. Our cellulosic ethanol technology and customers will compete with ethanol produced by the well-established and highly fragmented U.S. corn ethanol industry, including from plants owned by farmers, cooperatives, oil refiners and retail fuel operators that may continue to operate even when market conditions are not favorable due to the benefits realized from their other operations. In all products and markets, the competition can represent single and multi-product companies that have substantially greater financial resources than we do.

We also face the prospect that petroleum refiners will be increasingly competitive with our technology, either by converting oil refineries to produce renewable diesel or by co-processing renewable feedstock with crude oil. Since 2021, several petroleum refiners in the U.S. have affected conversions of their facilities from crude oil to renewables including but not limited to Sinclair, Phillips 66, Holly Frontier, Marathon, and Exxon. Some of the largest refiners have started co-processing renewable feedstocks or have announced plans to do so. If refinery conversions accelerate or if co-processing expands significantly, the competition we face could increase significantly. We also face competition in the biomass-based diesel RINs compliance market from producers of renewable diesel and in the advanced biofuel RIN compliance market from producers of other advanced biofuels, such as sugarcane ethanol and biogas used in transportation.

We also operate in the solar panel recycling industry, where we face competition primarily from companies that focus on one type of recycling, some of which have more expertise in the recycling of that material than we do. We also compete against companies that have a substantial competitive advantage because of longer operating histories and greater financial and other resources. National or global competitors could enter the market with more substantial financial and workforce resources, stronger existing customer relationships, and greater name recognition, or could choose to target medium to small companies in our markets. Competitors could also focus their substantial resources on developing more efficient recovery solutions than our efficient processes planned for silver, cadmium, and other basic metal and material extraction. Competition can also place downward pressure on contract prices and royalties, which presents significant challenges to maintaining growth rates and sustainable margins.

CUSTOMERS

The Company is commercializing both its Fuels and Metals Segments, with a growing customer profile in each segment, and is not currently, nor does it foresee being dependent on one or a limited number of customers for its sales (see Note 19 of the Notes to our Consolidated Financial Statements).

REGULATORY MATTERS

Our Fuels Segment is sensitive to government programs and policies that affect the supply and demand for SAF, renewable diesel, ethanol, gasoline, other renewable fuels, and their intermediates, precursors, and derivatives, which in turn may impact our throughput.

The demand for cellulosic and carbon neutral fuels is rapidly increasing, and supply is virtually non-existent for the want of recently developed process technologies. RFS II is driving innovation by both requiring and incentivizing use of advanced cellulosic fuels. Under the RFS II, fossil fuel producers are required to purchase renewable fuels to meet RFS II quotas. The EPA assigns individual refiners, blenders, and importers the volume of renewable fuels they are obligated to blend into their fuel supply each year based on their percentage of total fuel sales. The RFS II volume requirements apply to petroleum refiners and petroleum fuel importers in the 48 contiguous states and Hawaii, who are defined as obligated parties in the RFS II regulations. Obligated parties are required to incorporate a certain percentage of renewable fuel into their petroleum-based fuel or purchase credits in the form of renewable identification numbers from those who do. An obligated party’s RVO is based on the volume of petroleum-based fuel they produce or import. The largest U.S. petroleum refining companies, such as British Petroleum, Chevron, Citgo, ExxonMobil, Marathon Petroleum, PBS, Phillips 66, and Valero, represent the majority of the total RVO, with the remainder made up of smaller refiners and importers.

The RFS II requirements are based on two primary categories and two subcategories. The two primary categories are conventional renewable fuel, which is primarily satisfied by corn ethanol, and advanced biofuel, which reduces lifecycle GHG by at least 50% compared to petroleum-based fuel. The advanced biofuel category has two subcategories: cellulosic biofuel and biomass-based diesel, which can be satisfied with ethanol made from woody and woody-like biomass and renewable diesel, respectively. The total advanced biofuel requirement is larger than the combined cellulosic biofuel and biomass-based diesel requirement, thus requiring the use of additional volumes of advanced biofuels. The RFS II requirement for advanced biofuels can be satisfied by any advanced biofuel meeting the 50% GHG reduction requirement, including fuels produced with our leading, carbon reducing Lignocellulosic Fuels technologies.

The advanced biofuel RVO is expressed in terms of ethanol equivalent volumes, or EEV, which is based on the fuel’s renewable energy content compared to ethanol. Renewable diesel typically has an EEV of 1.7, compared to 1.0 for ethanol. Accordingly, it requires less biomass-based diesel than ethanol to meet the required volumes as each gallon of biomass-based diesel counts as more gallons for purposes of fulfilling the advanced biofuel RVO, providing an incentive for refiners and importers to purchase biomass-based diesel to meet their advanced biofuel RVO.

Advanced lignocellulosic and other fuels are salable at higher prices than traditional corn ethanol due to their increased GHG reductions. The market price of detached RINs affects the price of renewable fuels in certain markets and can influence purchasing decisions by obligated parties. The value of RINs can significantly impact the price of renewable fuel.

The BTC provides an additional $1.00 refundable tax credit per gallon to the first blender of biomass-based diesel with petroleum-based diesel fuel. The BTC can then be credited against federal excise tax liabilities, or the blender can obtain a cash refund from the U.S. Treasury for the credit. The BTC was first implemented on January 1, 2005 and has been allowed to lapse multiple times before being retroactively reinstated. The BTC is an incentive shared across the advanced biofuel production and distribution chain through routine, daily trading and negotiation.

Individual states and other governments are also pushing the demand beyond the federal requirements. California, Oregon, Washington and British Columbia all have LCFS that encourage consumption of advanced biofuels by setting annual CI emission standards which reduce over time. According to the U.S. Department of Energy, more than 40 states have implemented various programs that encourage the use of biomass-based diesel through blending requirements as well as various tax incentives.

Our Fuels, Metals, and Mining Segment activities are subject to various and extensive environmental and other regulations. We will be required to obtain and maintain various environmental permits to operate our plants and other facilities. Renewable fuel and metal production will involve the emission of various airborne pollutants, including particulate, carbon dioxide, oxides of nitrogen, hazardous air pollutants and volatile organic compounds.

Our Fuels and Metals Segments hold all licenses currently required in connection with the development of its technologies. We have engaged third-party consultants to work across all projects, supporting us with permitting and regulatory compliance, and keeping us apprised of all relevant regulations and related changes for current and future operations.

Our design, engineering, licensing, installation, commissioning, and maintenance services are subject to various federal, state and local environmental, health and safety laws and regulations, which require a standard of care to control potential pollution and limit actual or potential impacts to the environment and personnel involved. A violation of these laws and regulations, or of permit conditions, can result in substantial fines, natural resource damage, criminal sanctions, permit revocations and/or facility shutdowns. We do not anticipate a material adverse effect on our business or financial condition because of our efforts to comply with these requirements. Operating expenses to meet regulatory requirements, including all environmental permits, will be an integral part of service costs. Costs for compliance with environmental laws include safety and health protection measures, controls limiting air emissions and effluent discharges, emergency response capabilities, storm water management, recordkeeping and training.

Mining operations and exploration activities are subject to various federal, state, and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances, and other matters. We have obtained substantially all licenses, permits, and other authorizations currently required for our mining, exploration and other development programs. We believe that we are complying in all material respects with applicable laws and regulations. Capital expenditures relating to compliance with laws and regulations that regulate the discharge of materials into the environment, or otherwise relating to the protection of the environment, comprise a substantial part of our historical capital expenditures and some of our anticipated future capital expenditures. For example, we incur certain expenses and liabilities associated with our reclamation obligations.

We are generally required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping, and re-vegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts are conducted in accordance with plans reviewed and approved by the appropriate regulatory agencies. The Nevada Revised Statutes (“NRS”) 519A to 519A.280 and Nevada Administrative Code 519A.010 to 519A.415 promulgated by the Nevada State Environmental Commission and the Nevada Division of Environmental Protection (“NDEP”), Bureau of Mining and Reclamation (“BMRR”) require a surety bond to be posted for mining projects so that, after completion of the work on such mining projects, the sites are left safe, stable and capable of providing for a productive post-mining use. Over the past five years, the Company has provided a reclamation surety bond, through the Lexon Surety Group, with the BMRR and the Bond Safeguard Insurance Company. The BMRR, with concurrence from Storey County, has approved our most recent mine reclamation plan, as revised, and our estimated total costs related thereto of approximately $6,663,000, including $6,163,000 for BMRR and $500,000 of additional reclamation surety bonding directly, with Storey County. In addition, the Company has a mine reclamation surety bond with Bond Safeguard Insurance Company of $2,036,072 for a total bonded amount for mining of $8,199,072. As part of the surety agreements, the Company agreed to pay a 2.0% annual bonding fee and signed a corporate guarantee. The Company has total cash collateral held on deposit for bonding of $3,184,804 at December 31, 2024. Comstock Metals also has an irrevocable letter of credit for the benefit of the State of Nevada at Nevada State Bank in the amount of $74,710.

CONTINGENCIES

Under Comstock’s insurance programs, coverage is obtained for catastrophic exposures, and those risks required to be insured by law or contract. Environmental (pollution), general liability and umbrella insurance is carried with policy limits of $2,000,000, $1,000,000 and $5,000,000 per occurrence, respectively. We also carry professional D&O liability, auto and worker’s compensation insurances.

From time to time, we are involved in claims and proceedings that arise in the ordinary course of business. There are no matters pending that we expect to have a material adverse impact on our business, results of operations, financial condition or cash flows.

INTELLECTUAL PROPERTY

We protect our intellectual properties and our freedom to operate these technologies through a combination of patents, patent applications, license agreements, common law copyrights, and trade secrets. Comstock IP Holdings holds our portfolio of patented, patent-pending, and proprietary technologies. The earliest of our patents are scheduled to expire is in 2033, however, we have additional issued and pending patents that are expected to expire at later dates. We have developed and also used trade secrets to protect our know-how in the extraction, valorization, and processing of wasted or used resources.

HUMAN CAPITAL RESOURCES

The foundation of our Company is our employees, and our success begins with the attraction, alignment, retention, and development of our employees. We accomplish this, in part, through our systemic management practices, competitive compensation practices, systemic-based management and leadership training initiatives, and growth opportunities within the Company. We currently have 46 employees and employ sales, engineering, research, geological, regulatory, environmental, operating, financial, and administrative personnel. There is currently no union representation for any of our employees.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

All executive officers serve until such person resigns, is removed or is otherwise disqualified to serve or until such officer's successor is duly elected.

Name | | Age * | | Business Experience in the Past Five Years |

Corrado De Gasperis | | 59 | | 2015 to present | Executive Chairman, Chief Executive and Director |

| | | | | 2011 to 2015 | Chief Executive Officer, President and Director |

Kevin E. Kreisler | | 52 | | 2022 to present | Chief Technology Officer and Director |

| | | | | 2021 to 2022 | President, Chief Financial Officer and Director |

| | | | | 2005 to 2021 | Founder, Chairman and CEO - GreenShift Corp. |

| William J. McCarthy | | 45 | | 2021 to present | Chief Operating Officer |

| | | | | 2020 to 2021 | Co-Founder, Chief Executive Officer - Mana Corp. |

| | | | | 2017 to 2021 | Founder and Principal - Normandy Road Partners |

| David J. Winsness | | 56 | | 2021 to present | President, Comstock Fuels Corporation |

| | | | | 2019 to 2021 | Chief Executive Officer - Plain Sight Innovations |

| Rahul Bobbili | | 48 | | 2021 to present | Chief Engineering Officer, Comstock Fuels Corp. |

| | | | | 2006 to 2021 | CEO - Renewable Process Solutions, Inc. |

| Dr. Fortunato Villamagna | | 67 | | 2023 to present | President, Comstock Metals LLC |

| | | | | 2012 to 2023 | CEO - Paragon Waste Solutions, Paragon SW LLC |

Matthew J. Bieberly | | 45 | | 2024 to present | Chief Accounting Officer |

| | | | | 2023 to 2024 | Director SEC Reporting and Disclosure |

| | | | | 2021 to 2022 | Manager, DWC CPAs and Advisors |

| | | | | 2016 to 2021 | Director SEC Reporting and Corporate Accounting - ONE Gas, Inc. |

* As of January 1, 2025 | | | | | |

AVAILABLE INFORMATION

Comstock maintains a website at www.comstock.inc. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any filed or furnished amendments to those reports pursuant to Section 13(a) of the Exchange Act are made available through our website as soon as practical after we electronically file or furnish the reports to the SEC. Also available on our website are the Company’s Governance Guidelines and Code of Conduct, as well as the charters of the Audit and Finance, Compensation, Environmental, Executive and Nominating Committees of the Board of Directors. Information on our website is not incorporated into this report. Stockholders may request free charter copies from Comstock Inc., P.O. Box 1118, Virginia City, Nevada 89440.

RISK FACTOR SUMMARY

An investment in our securities involves risk. You should carefully consider the risk factors detailed below in Item 1A, Risk Factors, in addition to those discussed elsewhere in this report, in evaluating our Company, its business, its industry and prospects. These risks include, but are not limited to, those described in the following summary:

Business and Operating Risks

- | You may lose all or part of your investment. |

- | We need additional capital, for investing in our business and to finance acquisitions and other strategic transactions. |

- | We have a limited operating history. |

- | We may never earn significant revenues from our operations. |

- | We may be unable to manage our future growth. |

- | We may not be able to successfully implement our growth strategy on a timely basis or at all. |

- | We are exposed to global health, economic, supply chain, and market risks that are beyond our control. |

- | The Renewable Fuel Standard, a federal law requiring the consumption of qualifying renewable fuels, could be repealed. |

- | Loss of or reductions in federal and state government tax incentives for renewable fuel production or consumption may have a material adverse effect on our revenues and operating margins. |

- | We intend to derive a significant portion of our revenues from sales of our renewable fuel in states with LCFS, however, adverse changes in the associated laws or reductions in the value of the applicable credits would harm our revenues and profits. |

- | A decline in the adoption rate of renewable energy or electrification, or a decline in the support by governments for renewable energy and electrification technologies, could materially harm our financial results and ability to grow our business. |

- | Our success will depend on acquiring, maintaining, and increasing feedstock supply commitments, as well as securing new customers and offtake agreements. |

- | Our margins are dependent on the spread between the market prices for our renewable energy and the costs for our feedstocks. |

- | Our operations depend on the availability of sufficient water supplies. |

- | Owning property and water rights and options on property and water rights carries inherent risks. |

- | We do not have proven or probable reserves. |

- | The cost of our exploration, development and acquisition activities is substantial. |

- | Estimated costs and timing are uncertain, which may adversely affect our expected production and profitability. |

- | Resource and other material statements are estimates subject to uncertainty. |

- | Market prices fluctuate and a downturn in our products prices could negatively impact our operations and cash flow. |

- | Risk management transactions could significantly increase our operating costs and may not be effective. |

- | Our results of operations could be significantly affected by the various wasted and unused natural resource feedstocks. |

- | Results of operations or financial condition could be materially adversely affected due to disruptions in operations. |

- | We may experience increased costs or losses resulting from the hazards and uncertainties associated with mining. |

- | Our facilities and our customers' facilities will be subject to risks associated with fire, explosions, leaks, and natural disasters. |

- | Storage and transportation of our renewable energy could cause disruptions in our operations. |

- | Increases in transportation costs or disruptions could have a material adverse effect on our business. |

- | Weather interruptions may affect, and delay proposed operations and impact our business plans. |

- | Supplier disruptions could have an adverse effect on the results of our business operations. |

- | We rely on contractors to conduct a significant portion of our operations and construction projects. |

- | We operate in highly competitive industries and expect that competition will increase. |

- | Technological advances could render some or all our plans obsolete and adversely affect our ability to compete. |

- | Our business could be adversely affected if we are unable to protect our intellectual property, or others assert that our operations violate their intellectual property. |

- | The success of our business depends on our ability to continuously innovate. |

- | The success of our business depends on evolving, highly technical, and uncommonly qualified technical resources. |

- | We may not be successful in developing our new products and services. |

- | If we fail to introduce new products in a timely manner, we may be unable to acquire and/or lose market share and be unable to achieve revenue growth targets. |

- | If we are unable to commercially release products that are accepted in the market or that generate significant revenues, our financial results will continue to suffer. |

- | Product defects or problems with integrating our products with other vendors’ products may seriously harm our business and reputation. |

- | We may encounter manufacturing or assembly problems for products. |

- | Unfavorable economic conditions may have a material adverse effect on our business, results of operations and financial condition. |

- | Natural disasters could materially adversely affect our business, results of operations or financial condition. |

- | Illiquidity of investments could impede our ability to respond to changes in economic and other conditions. |

- | Our business requires substantial capital investment, and we may be unable to raise additional funding. |

| - | Our authorized capital is and may continue to be insufficient for raising additional equity-based funding. |

- | Nevada law and our articles of incorporation and bylaws contain anti-takeover provisions. |

- | Our government grants are subject to uncertainty, which could harm our business and results of operations. |

- | Governmental programs designed to incentivize the production and consumption of low-carbon fuels and carbon capture and utilization, may be implemented in a way that does not include products produced using our novel technology platform and process technologies or could be repealed, curtailed or otherwise changed. |

- | Our industrial waste management services subject us to potential environmental liability. |

- | If we cannot maintain our government permits or cannot obtain any or certain required permits, we may not be able to continue or expand our operations. |

- | Changes in environmental regulations and enforcement policies could subject us to additional liability. |

- | As our operations expand, we may be subject to increased exposure to litigation. |

- | Our business and operations would suffer in the event of IT system failures or a cyber-attack. |

- | We may use artificial intelligence in our business, and challenges with properly managing its use could result in reputational harm, competitive harm, and legal liability, and adversely affect our results of operations. |

- | Our plans to expand our revenue sources through commercializing our market-ready technologies and developing new technology with commercial applicability may not be successful. |

- | We face risks from doing business in international markets. |

- | Our current and future licensing arrangements may not be successful and may make us susceptible to the actions of third parties over whom we have limited control. |

| - | We potentially face risks to our business and proprietary confidential information due to the use of artificial intelligence systems. |

Legal, Regulatory and Compliance Risks

| - | We may be subject to litigation. |

- | Our operations are subject to strict environmental laws and regulations, including regulations and pending legislation governing issues involving climate change, which could result in added costs of operations and operational delays. |

- | Failure to comply with governmental regulations, including EPA requirements relating to RFS II or new laws designed to deal with climate change, could result in the imposition of higher costs, penalties, fines, or restrictions. |

- | Our ability to execute our strategic plans depends upon our success in obtaining a variety of required governmental approvals. |

| - | We are subject to federal and state laws that require environmental assessments and the posting of bonds. |

- | Closure, reclamation, and rehabilitation costs could be higher than expected, and our insurance and surety bonds for environmental-related issues could be limited. |

- | Our operations are subject to certain soil sampling and potential remediation requirements, and we are also potentially subject to further costs as the result of on-going government investigation and future remediation decisions. |

- | Title claims against our properties could require us to compensate parties making such claims. |

- | Mine operators are increasingly required to consider and provide benefits to their local communities. |

Risks Related to Investments in Our Common Stock

- | The price of the Company’s common stock has and may continue to fluctuate significantly. |

- | Our stock has historically been a penny stock with trading restricted by the SEC’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our stock. |

- | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline. |

- | We may be delisted if we are unable to maintain the listing standards of the NYSE American stock exchange. |

- | We do not expect to pay any cash dividends for the foreseeable future. |

- | We may issue additional common stock or other equity securities in the future that could dilute current ownership interest. |

Risks Related to Strategic Transactions

- | We have and may continue to pursue investments in other companies, acquisitions, divestitures, business combinations or other transactions with other companies. |

- | We may undertake joint ventures, investments, projects and other strategic alliances and such undertakings, as well as our existing joint ventures, may be unsuccessful and may have an adverse effect on our business. |

- | If we are unable to maintain existing or future strategic partnerships, or if these strategic partnerships are not successful, our business could be adversely affected. |

- | We have invested capital in high-risk mineral, metals and other natural resource projects where we have not conducted sufficient exploration, development and engineering studies. |

| - | Our success in using AI for materials development in the quantum computing industry depends on our ability to operate without infringing the patents and other proprietary rights of third parties. |

- | If we are unable to develop and commercialize new materials and product candidates based on our AI for materials development investments that are accepted in the market or that generate significant revenues, our financial results will continue to suffer. |

- | Our strategic partnerships rely on the availability of third-party intellectual property. |

- | We rely on third parties for certain cloud-based software platforms. |

General Risk Factors

| - | Our ability to execute our strategic plan depends on many factors, some of which are beyond our control. |

- | Our business depends on a limited number of key personnel, the loss of whom could negatively affect us. |

- | Our business may be adversely affected by information technology disruptions, including materials-based AI. |

- | The Company may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and share price, which could cause you to lose some or all of your investment. |

- | Diversity in application of accounting literature in the mining and renewable industries may impact our reported financial results. |

- | Our indebtedness and payment obligations could adversely affect our operations, financial condition, cash flow, and operating flexibility. |

- | The estimation of mineral reserves and mineral resources is imprecise and depends on subjective factors. |

- | Mineral resources do not have demonstrated economic value. |

ITEM 1A RISK FACTORS

There are many important factors that have affected, and in the future could affect, our business, including, but not limited to the factors discussed below, which should be reviewed carefully together with other information contained in this report. Some of the factors are beyond our control and future trends are difficult to predict.

An investment in our securities involves risk. You should carefully consider the following risk factors, in addition to those discussed elsewhere in this report, in evaluating our Company, its business, its industry and prospects. The risks described below are not the only ones facing us. Additional risks not presently known to us, or that we currently deem immaterial, may also have a material adverse effect on us. The following risks could cause our business, financial condition, results of operations or cash flows to be materially and adversely affected. In that case, the market price of our securities could decline, and you could lose all or part of your investment.

BUSINESS AND OPERATING RISKS

You may lose all or part of your investment.

The shares of our common stock are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the risk factors contained herein relating to our business and prospects. If any of the risks presented herein actually occur, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We need additional capital, which may not be available on acceptable terms or at all, to continue as a going concern and for investing in our business and to finance acquisitions and other strategic transactions.

If we are unable to generate cash flows from our planned operating activities in our Fuels and Metals Segments, then it is unlikely that the cash generated from our Strategic Investments Segment will suffice as a source of the liquidity necessary for anticipated working capital requirements. There is no assurance that the Company’s initiatives to improve its liquidity and financial position will be successful, including increasing and maintaining a sufficient quantity of authorized common stock available for raising equity capital. Accordingly, there would be substantial risk that the Company would be unable to continue as a going concern. In the event of insolvency, liquidation, reorganization, dissolution or other winding up of the Company, the Company’s creditors would be entitled to payment in full out of the Company’s assets before holders of common stock would be entitled to any payment, and the claims on such assets may exceed the value of such assets.

We have a limited operating history.

We have a limited operating history. The success of our Company is significantly dependent on the completion of uncertain future events, including the financing, development, permitting, construction, commissioning, start-up, and initiation of sustainable throughput of our planned lignocellulosic fuels and renewable electrification metals production facilities, the discovery and exploitation of mineralized materials on our properties, selling the rights to exploit those materials, and/or commercializing our other diversified production and processing activities. If our business plan is not successful and we are not able to operate profitably, then our securities may become worthless, and investors may lose all of their investment in our Company.

We may never earn significant revenues from our operations.

If we are unable to generate significant revenues from our planned production and processing activities in the future, then we will not be able to earn profits or continue operations. We have yet to generate positive operating income and there can be no assurance that we will ever operate profitably. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate significant revenues or ever achieve profitability. If we are unsuccessful, our business will fail, and investors may lose all of their investment in our Company.

We may be unable to manage our future growth.

Even if we can successfully implement our growth strategy, any failure to manage our growth effectively could materially and adversely affect our business, results of operations and financial condition. We intend to expand operations significantly by 2030, which will require us to hire and train new employees; accurately forecast supply and demand, production and revenue; control expenses and investments in anticipation of expanded operations; establish new production facilities; and implement and enhance administrative infrastructure, systems and processes. Future growth may also be tied to acquisitions, and we cannot guarantee that we will be able to effectively acquire other businesses or integrate businesses that we acquire. Failure to efficiently manage any of the above could have a material adverse effect on our business, results of operations or financial condition.

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future global growth, results of operations and financial condition depend upon our ability to successfully implement our growth strategy, which, in turn, is dependent upon a number of factors, some of which are beyond our control, including our ability to: economically extract and refine wasted and unused natural resources and meet customers’ business needs; complete the construction of future facilities at a reasonable cost and on a timely basis; invest and keep pace in technology, research and development efforts, and the expansion and defense of our intellectual property portfolio; secure and maintain required strategic supply arrangements; effectively compete in the markets in which we operate; and, attract and retain management or other employees with specialized knowledge and technical skills. There can be no assurance that we can successfully achieve any or all of the above initiatives in the manner or time period that we expect. Further, achieving these objectives will require investments that may result in both short-term and long-term costs without generating any current revenue and therefore may be dilutive to earnings. We cannot provide any assurance that we will realize, in full or in part, the anticipated benefits we expect to generate from our growth strategy. Failure to realize those benefits could have a material adverse effect on our business, results of operations or financial condition.

We are exposed to global health, economic, supply chain, and market risks that are beyond our control, which could adversely affect our financial results and capital requirements.

Uncertainties regarding the global economic and financial environment could lead to an extended national or global economic recession. A slowdown in economic activity caused by a recession would likely reduce demand for assets that we hold for sale and result in lower commodity prices for long periods of time. Costs of exploration, development and production have not yet adjusted to current economic conditions, or in proportion to the significant reduction in product prices. Competition and unforeseen limited sources of supplies needed for our planned developments could result in occasional shortages of supplies of certain products, equipment or materials. There is no guarantee we will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms, if at all. Such delays could affect our anticipated business operations and increase our expenses.

The Renewable Fuel Standard, a federal law requiring the consumption of qualifying renewable fuels, could be repealed, curtailed or otherwise changed, which would have a material adverse effect on our revenues, operating margins and financial condition.