First-quarter 2022 financial results

Business Net Income2

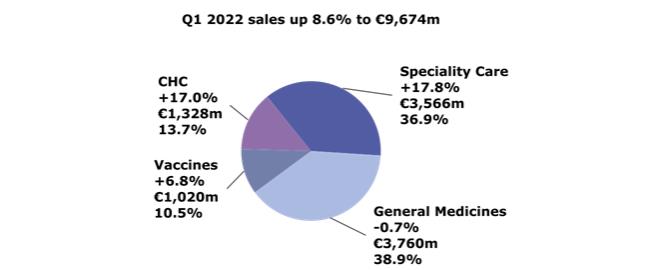

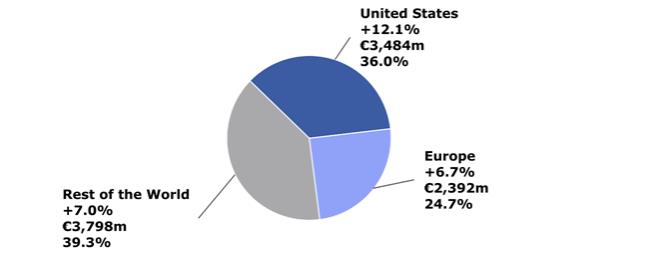

In the first quarter of 2022, Sanofi generated net sales of €9,674 million, an increase of 12.6% (up 8.6% at CER).

First-quarter other revenues increased 28.5% (up 23.7% at CER) to €379 million, including VaxServe sales contribution of non-Sanofi products of €286 million (up 16.7 % at CER).

First-quarter Gross Profit increased 15.7% (up 11.1% at CER) to €7,175 million. The gross margin ratio increased 2.0 percentage points to 74.2% versus the first quarter of 2021, reflecting strong improvement of the Pharmaceuticals gross margin ratio (which increased from 75.2% to 77.9%) driven by favorable impact of growing weight of Specialty Care, efficiency gains in Industrial Affairs and lower royalty expenses. The Vaccines gross margin ratio slightly decreased to 61.6% from 62.0%. CHC gross margin ratio was 67.3%, down 0.7 percentage point.

Research and Development (R&D) expenses increased 17.5% (up 14.0% at CER) to €1,489 million in the first quarter, reflecting increase in priority assets development as well as recent acquisitions.

First-quarter selling general and administrative expenses (SG&A) increased 8.4% to €2,379 million. At CER, SG&A expenses were up 4.3%, reflecting increased commercial investments in Specialty Care growth drivers which were partially offset by continued streamlining initiatives. In the first quarter, the ratio of SG&A to sales decreased 0.9 percentage point to 24.6% compared to the prior year.

First-quarter operating expenses were €3,868 million, an increase of 11.8% and 7.8% at CER.

First-quarter other current operating income net of expenses was -€265 million versus -€101 million in the first quarter of 2021. Other current operating income net of expenses included an expense of €477 million (versus an expense of €279 million in the first quarter of 2021) corresponding to the share of profit to Regeneron of the monoclonal antibodies Alliance, reimbursement of development costs by Regeneron and the reimbursement of commercialization-related expenses incurred by Regeneron. In the first quarter, this line also included €232 million of net capital gains related to General Medicines and CHC portfolio streamlining compared to €56million in the same period of 2021.

The share of profit from associates was €30 million versus €9 million in the first quarter of 2021 and included the share of U.S profit related to Vaxelis®.

First-quarter business operating income2 (BOI) increased. . The ratio of BOI to net sales increased 1.0 percentage point to 31.7% mainly reflecting gross margin ratio improvement.

Net financial expenses were €78 million versus €84 million in the same period of 2021.

First-quarter effective tax rate was 19.0% versus 21.0% in the prior year. Sanofi expects its effective tax rate to be around 19% in 2022.

First-quarter business net income2 increased 20.2% to €2,424 million and increased 16.0% at CER. The ratio of business net income to net sales increased 1.6 percentage point to 25.1% versus the first quarter of 2021.

In the first quarter of 2022, business earnings per share2 (EPS) was €1.94, up 20.5% on a reported basis (up 16.1% at CER). The average number of shares outstanding was 1,249.2 million versus 1,249.3 million in first quarter 2021.

Reconciliation of IFRS net income reported to business net income (see Appendix 4)

2 See Appendix 3 for 2021 first-quarter consolidated income statement; see Appendix 7 for definitions of financial indicators, and Appendix 4 for reconciliation of IFRS net income reported to business net income.

13