- GRMN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Garmin (GRMN) PRE 14APreliminary proxy

Filed: 11 Apr 14, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. _____)

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Materials under §240.14a-12 |

GARMIN LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

GARMIN LTD.

NOTICE AND PROXY STATEMENT

FOR

THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD

FRIDAY, JUNE 6, 2014

YOUR VOTE IS IMPORTANT!

Please mark, date and sign the enclosed proxy card

and promptly return it in the enclosed envelope.

If you reviewed your materials electronically or through a broker

or other nominee,

please follow the instructions provided.

THIS NOTICE AND PROXY STATEMENT, THE ACCOMPANYING PROXY CARD,

THE 2013 ANNUAL REPORT AND THE 2013 ANNUAL REPORT ON FORM 10-K ARE FIRST BEING FURNISHED

ON APRIL[•], 2014.

Garmin Ltd.

Mühlentalstrasse 2

8200 Schaffhausen

Switzerland

Invitation to Annual General

Meeting of Shareholders

June 6, 2014

To the Shareholders of Garmin Ltd.:

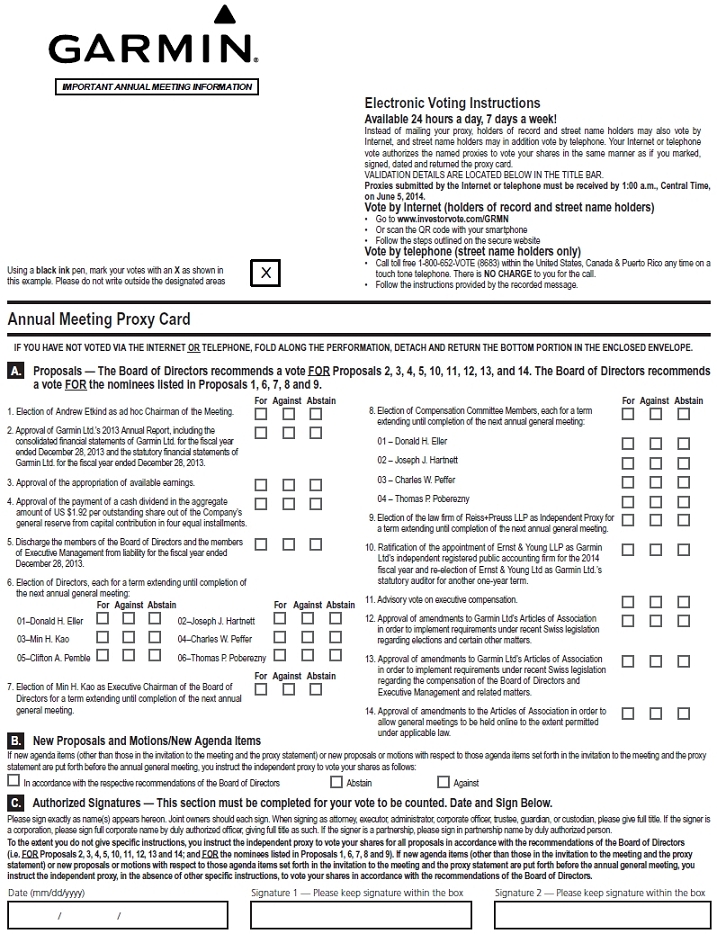

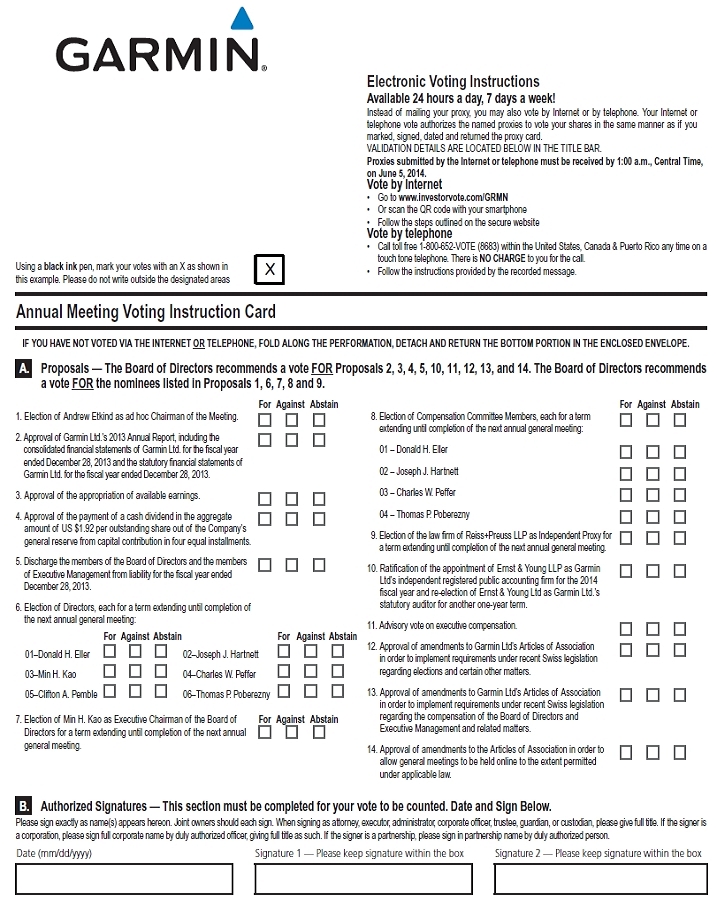

We cordially invite you to attend the Annual General Meeting (the “Annual Meeting”) of Shareholders of Garmin Ltd., a Swiss company (“Garmin” or the “Company”), to be held simultaneously at the offices of the law firm of Homburger AG, Prime Tower, Hardstrasse 201, 8005 Zurich, Switzerland and at the offices of Garmin International Inc., 1200 East 151stStreet, Olathe, Kansas, 66062, USA, at 5:00 p.m. Central European Time (10:00 a.m., U.S. Central Daylight Time) on Friday, June 6, 2014. The two locations will be linked via a live video and audio link. The purpose of the meeting is to consider and vote upon the following matters:

PROPOSALS

| 1. | Election of Andrew Etkind as the ad hoc Chairman of the Meeting |

The Board of Directors proposes to the Annual Meeting that Andrew Etkind, Garmin’s Vice President and General Counsel, be elected as the ad hoc Chairman of the Meeting.

| 2. | Approval of Garmin’s 2013 Annual Report, including the consolidated financial statements of Garmin for the fiscal year ended December 28, 2013 and the statutory financial statements of Garmin for the fiscal year ended December 28, 2013 |

The Board of Directors proposes to the Annual Meeting to approve Garmin’s 2013 Annual Report, including the consolidated financial statements of Garmin for the fiscal year ended December 28, 2013 and the statutory financial statements of Garmin for the fiscal year ended December 28, 2013.

| 3. | Approval of the appropriation of available earnings |

The Board of Directors proposes to the Annual Meeting to approve the appropriation of available earnings as follows:

| Proposed Appropriation of Available Earnings: | ||||

| Balance brought forward from previous years | CHF | (39,244,000) | ||

| Net loss for the period (on a stand-alone unconsolidated basis): | CHF | (8,946,000) | ||

| Total net loss: | CHF | (48,190,000) | ||

| Resolution proposed by the Board of Directors: | ||||

| - RESOLVED, that the net loss for the period of CHF 8,946,000 shall be carried forward. |

GARMIN LTD. - 2014 Proxy Statement 3

| 4. | Approval of the payment of a cash dividend in the aggregate amount of $1.92 per outstanding share out of Garmin’s general reserve from capital contribution in four equal installments |

The Board of Directors proposes to the Annual Meeting that Garmin pay a cash dividend in the amount of $1.92 per outstanding share as follows:

| General Reserve from Capital Contribution as per December 28, 2013 | CHF | 5,858,865,000 | |||

| Resolutions proposed by the Board of Directors: | |||||

| • | RESOLVED, that Garmin, out of, and limited at a maximum to the amount of, the Dividend Reserve (as defined below), pay a cash dividend in the amount of US$1.92 per outstanding share1out of Garmin’s general legal reserve from capital contribution payable in four equal installments at the dates determined by the Board of Directors in its discretion, the record date and payment date for each such installment to be announced in a press release2at least ten calendar days prior to the record date; and further | ||||

| • | RESOLVED, that the cash dividend shall be made with respect to the outstanding share capital of Garmin on the record date for the applicable installment, which amount will exclude any shares of Garmin held by Garmin or any of its direct or indirect subsidiaries; and further | ||||

| • | RESOLVED, that CHF 407,749,0003be allocated to dividend reserves from capital contribution (the“Dividend Reserve”) from the general reserve from capital contribution in order to pay such dividend of US$1.92 per outstanding share with a nominal value of CHF 10.00 each (assuming a total of 208,077,418 shares4eligible to receive the dividend); and further | CHF | 407,749,000 | ||

| • | RESOLVED that if the aggregate dividend payment is lower than the Dividend Reserve, the relevant difference will be allocated back to the general reserve from capital contribution; and further | ||||

| • | RESOLVED, that to the extent that any installment payment, when converted into Swiss francs, at a USD/CHF exchange rate prevailing at the relevant record date for the relevant installment payment, would exceed the Dividend Reserve then remaining, the U.S. dollar per share amount of that installment payment shall be reduced on a pro rata basis, provided, however, that the aggregate amount of that installment payment shall in no event exceed the then remaining Dividend Reserve. | CHF | 5,451,116,000 | ||

| (1) | In no event will the dividend payment exceed a total of US$1.92 per share. |

| (2) | The announcements will not be published in the Swiss Official Gazette of Commerce. |

| (3) | Based on the currency conversion rate as at December 28, 2013. With a total of shares eligible for payout (based on the number of shares outstanding as at December 28, 2013), the aggregate dividend total would be CHF shares eligible for payout (based on the number of shares outstanding as at December 28, 2013), the aggregate dividend total would be CHF . The amount of the Dividend Reserve, calculated on the basis of the Company’s issued shares as at December 28, 2013, includes a 15% margin to accommodate (i) unfavorable currency fluctuation and (ii) new share issuance (see fn 4 below) that may occur between the time that the dividend is approved by shareholders and when the last installment payment is made. Unused dividend reserves will be returned to the general reserve from capital contribution after the last installment payment. . The amount of the Dividend Reserve, calculated on the basis of the Company’s issued shares as at December 28, 2013, includes a 15% margin to accommodate (i) unfavorable currency fluctuation and (ii) new share issuance (see fn 4 below) that may occur between the time that the dividend is approved by shareholders and when the last installment payment is made. Unused dividend reserves will be returned to the general reserve from capital contribution after the last installment payment. |

| (4) | This number is based on the registered share capital at December 28, 2013. The number of shares eligible for dividend payments may change due to the repurchase of shares, the sale of treasury shares or the issuance of new shares, including (without limitation) from the conditional share capital reserved for the employee profit sharing program. |

| 5. | Discharge of the members of the Board of Directors and the Executive Management from liability for the fiscal year ended December 28, 2013 |

| The Board of Directors proposes to the Annual Meeting that the members of the Board of Directors and the Executive Management be discharged from personal liability for the fiscal year ended December 28, 2013. | |

| 6. | Re-election of directors |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting that each of Donald H. Eller, Joseph J. Hartnett, Min H. Kao, Charles W. Peffer, Clifton A. Pemble and Thomas P. Poberezny be re-elected as directors, each for a term extending until completion of the next annual general meeting. | |

| 7. | Election of Chairman |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting that Min H. Kao be elected as Executive Chairman of the Board of Directors for a term extending until completion of the next annual general meeting. | |

| 8. | Election of Compensation Committee members |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting that each of Donald H. Eller, Joseph J. Hartnett, Charles W. Peffer, and Thomas P. Poberezny be elected as members of the Compensation Committee, each for a term extending until completion of the next annual general meeting. | |

| 9. | Election of the independent voting rights representative |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting that the law firm of Reiss + Preuss LLP be elected as the independent voting rights representative for a term extending until completion of the next annual general meeting, including any extraordinary general meeting of shareholders prior to the 2015 annual meeting | |

| 10. | Ratification of the appointment of Ernst & Young LLP as Garmin’s Independent Registered Public Accounting Firm for the fiscal year ending December 27, 2014 and re-election of Ernst & Young Ltd as Garmin’s statutory auditor for another one-year term |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting that the appointment of Ernst & Young LLP as Garmin’s Independent Registered Public Accounting Firm for the fiscal year ending December 27, 2014 be ratified and that Ernst & Young Ltd be re-elected as Garmin’s statutory auditor for another one-year term. | |

| 11. | Advisory vote on executive compensation |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting to approve an advisory resolution approving the compensation of Garmin’s Named Executive Officers, as disclosed in Garmin’s proxy statement for the Annual Meeting pursuant to the executive compensation disclosure rules promulgated by the Securities and Exchange Commission. |

GARMIN LTD. - 2014 Proxy Statement 4

| 12. | Approval of amendments to the Articles of Association to implement requirements under recent Swiss legislation regarding elections and certain other matters |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting to approve amendments to our Articles of Association to implement the requirements of the Swiss Federal Ordinance Against Excessive Remuneration at Listed Corporations (the “Swiss Ordinance”), which became effective on January 1, 2014, regarding the election of the Board of Directors, the Chairman of the Board of Directors, the members of the Compensation Committee and the independent voting rights representative, and certain other matters. The text of the proposed amendments is contained in Annex 1. | |

| 13. | Approval of amendments to the Articles of Association to implement requirements under recent Swiss legislation regarding the compensation of the Board of Directors and Executive Management and related matters |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting to approve amendments to our Articles of Association to implement the requirements of the Swiss Ordinance regarding the compensation of the Board of Directors and the Executive Management and certain related matters. The text of the proposed amendments is contained in Annex 2. | |

| 14. | Approval of amendment to the Articles of Association to allow general meetings to be held online to the extent permitted under applicable law |

| Proposal of the Board of Directors | |

| The Board of Directors proposes to the Annual Meeting to approve an amendment to Article 13 of the Articles of Association in order to allow general meetings to be held online to the extent permitted under applicable law. The text of the proposed amendment is contained in Annex 3. | |

| Information concerning the matters to be acted upon at the Annual Meeting is contained in the accompanying Proxy Statement. |

A proxy card is being sent with this proxy statement to each holder of shares registered in Garmin’s share register with voting rights at the close of business, U.S. Eastern Time, on April 11, 2014. In addition, a proxy card will be sent with this proxy statement to each additional holder of shares who is registered with voting rights in Garmin’s share register as of the close of business, U.S. Eastern Time, on May 27, 2014. Shareholders registered in Garmin’s share register with voting rights as of the close of business, U.S. Eastern Time, on May 27, 2014 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. A shareholder entitled to attend and to vote at the Annual Meeting is entitled to appoint a proxy to attend and vote on each of the proposals described in this proxy statement.

We are pleased to again take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their shareholders on the Internet. We are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our beneficial owners of shares held in “street name” through a broker or other nominee as of April 11, 2014, and we are mailing our proxy materials to shareholders whose shares are held directly in their names with our transfer agent, Computershare Trust Company, N.A. as of May 27, 2014, and to participants in the Garmin International, Inc. 401(k) and Pension Plan with a beneficial interest in our shares as of April 11, 2014. We believe these rules allow us to provide our shareholders with the information they need, while lowering costs of delivery and reducing the environmental impact of our Annual Meeting. Garmin’s 2013 Annual Report, Garmin’s Annual Report on Form 10-K for the fiscal year ended December 28, 2013 which contains the consolidated financial statements of Garmin for the fiscal year ended December 28, 2013, the Swiss statutory financial statements of Garmin for the fiscal year ended December 28, 2013 and the Auditor’s Reports are available in the Investor Relations section of Garmin’s websitewww.garmin.comand will also be available for physical inspection by the shareholders at Garmin’s registered office at Mühlentalstrasse 2, 8200 Schaffhausen, Switzerland, as of May 16, 2014. Copies of the 2013 Annual Report, the Annual Report on Form 10-K for the fiscal year ended December 28, 2013, the Swiss statutory financial statements of Garmin for the fiscal year ended December 28, 2013 and the Auditor’s Reports may also be obtained without charge by contacting Garmin’s Investor Relations department at +1 (913) 397-8200.

If you received the Notice, you can access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a printed copy by mail may be found in the Notice.

Please vote your shares regardless of whether you plan to attend the Annual Meeting. If you received these proxy materials through the mail, please use the enclosed proxy card to direct the vote of your shares, regardless of whether you plan to attend the Annual Meeting. Please date the proxy card, sign it and promptly return it in the enclosed envelope, which requires no postage if mailed in the United States, or you may vote by Internet or telephone using the instructions provided on the proxy card. If you received the Notice and reviewed the proxy materials on the Internet, please follow the instructions included in the Notice.

Please note that under the current rules of the New York Stock Exchange, your broker will not be able to vote your shares at the Annual Meeting on the election of directors or on certain other proposals described in the attached proxy statement if you have not given your broker instructions on how to vote. Please be sure to give voting instructions to your broker so that your vote can be counted on the election and such proposals.

Any shareholder who may need special assistance or accommodation to participate in the Annual Meeting because of a disability should contact Garmin’s Corporate Secretary at the above address or call +1 (913) 440-1355. To provide Garmin sufficient time to arrange for reasonable assistance, please submit all such requests by May 30, 2014.

April [•], 2014

By Order of the Board of Directors,

Andrew R. Etkind

Vice President, General Counsel and Secretary

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 6, 2014

This Proxy Statement, the 2013 Annual Report and Garmin’s Annual

Report on Form 10-K for the fiscal year ended December 28, 2013, are available athttp://materials.proxyvote.com/H2906T

GARMIN LTD. - 2014 Proxy Statement 5

This page intentionally left blank.

GARMIN LTD. - 2014 Proxy Statement 6

The accompanying proxy is solicited by the Board of Directors (“Board”) of Garmin Ltd., a Swiss company (“Garmin” or the “Company”), for use at the Annual General Meeting of Shareholders (the “Annual Meeting”) to be held at 5:00 p.m. Central European Time (10:00 a.m., U.S. Central Daylight Time), on Friday, June 6, 2014, simultaneously at the offices of the law firm of Homburger AG, Prime Tower, Hardstrasse 201, 8005 Zurich, Switzerland and at the offices of Garmin International Inc., 1200 East 151stStreet, Olathe, Kansas, 66062, USA, and at any adjournment(s) or postponement(s) thereof for the purposes set forth herein and in the accompanying Invitation to Annual General Meeting of Shareholders. The two locations will be linked via a live video and audio link. This Proxy Statement and the accompanying proxy card are first being furnished to shareholders on or about April[•], 2014.

INFORMATION CONCERNING SOLICITATION AND VOTING

We are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our beneficial owners of shares held in “street name” through a broker or other nominee (“Broker Customers”), and we are mailing our proxy materials to shareholders whose shares are held directly in their names with our transfer agent, Computershare Trust Company, N.A. (“Record Holders”), and to participants in the Garmin International, Inc. 401(k) and Pension Plan with a beneficial interest in our shares (“Plan Participants”).

Proposals

At the Annual Meeting, the Board intends to ask you to vote on:

| 1. | Election of Andrew Etkind as the ad hoc Chairman of the Annual Meeting; |

| 2. | Approval of Garmin’s 2013 Annual Report, including the consolidated financial statements of Garmin for the fiscal year ended December 28, 2013 and the statutory financial statements of Garmin for the fiscal year ended December 28, 2013; |

| 3. | Approval of the appropriation of available earnings; |

| 4. | Approval of the payment of a cash dividend in the aggregate amount of $1.92 per outstanding share out of Garmin’s general reserve from capital contribution in four equal installments; |

| 5. | Discharge of the members of the Board and the Executive Management from liability for the fiscal year ended December 28, 2013; |

| 6. | Re-election of directors; |

| 7. | Election of Chairman; |

| 8. | Election of Compensation Committee members; |

| 9. | Election of the independent voting rights representative; |

| 10. | Ratification of the appointment of Ernst & Young LLP as Garmin’s Independent Registered Public Accounting Firm for the fiscal year ending December 27, 2014 and re-election of Ernst & Young Ltd as Garmin’s statutory auditor for another one-year term; |

| 11. | Advisory vote on executive compensation; |

| 12. | Approval of amendments to the Articles of Association to implement requirements under the Swiss Ordinance regarding elections and certain other matters; |

| 13. | Approval of amendments to the Articles of Association to implement requirements under the Swiss Ordinance regarding the compensation of the Board and the Executive Management and related matters; and |

| 14. | Approval of amendments to the Articles of Association to allow general meetings to be held online to the extent permitted under applicable law. |

Shareholders Entitled to Vote

April 11, 2014 is the record date (the “Record Date”) for the Annual Meeting. On the Record Date there were[•]shares (excluding shares held directly or indirectly in treasury) outstanding and entitled to vote at the Annual Meeting. Shareholders registered in our share register at the close of business, U.S. Eastern Time, on the Record Date are entitled to vote at the Annual Meeting, except as provided below. Any additional shareholders who are registered in Garmin’s share register on May 27, 2014 will receive a copy of the proxy materials after May 27, 2014 and are entitled to attend and vote, or grant proxies to vote, at the Annual Meeting. Shareholders not registered in Garmin’s share register as of May 27, 2014, will not be entitled to attend, vote or grant proxies to vote at, the Annual Meeting. No shareholder will be entered in Garmin’s share

GARMIN LTD. - 2014 Proxy Statement 9

register as a shareholder with voting rights between the close of business on May 27, 2014 and the opening of business on the day following the Annual Meeting. Computershare Trust Company, N.A., which maintains Garmin’s share register, will, however, continue to register transfers of Garmin’s shares in the share register in its capacity as transfer agent during this period. Shareholders who are registered in Garmin’s share register on May 27, 2014 but have sold their shares before the meeting date are not entitled to attend, vote or grant proxies to vote at, the Annual Meeting.

Solicitation of Proxies

The cost of soliciting proxies will be borne by Garmin. In addition to soliciting shareholders by mail and through its regular employees not specifically engaged or compensated for that purpose, Garmin will request banks and brokers, and other custodians, nominees and fiduciaries to solicit their customers who have shares of Garmin registered in the names of such persons and, if requested, will reimburse them for their reasonable, out-of-pocket costs. Garmin may use the services of its officers, directors and others to solicit proxies, personally or by telephone, facsimile or electronic mail, without additional compensation.

Voting

Each shareholder is entitled to one vote on each proposal presented in this Proxy Statement for each share held. There is no cumulative voting in the election of directors. The required presence quorum for the transaction of business at the Annual Meeting is the presence in person or by proxy of shareholders holding not less than a majority of the shares entitled to vote at the meeting with abstentions, invalid ballots and broker non-votes regarded as present for purposes of establishing the quorum.

A shareholder who purchases shares from a registered holder after the Record Date but before May 27, 2014, and who wishes to vote his or her shares at the Annual Meeting must ask to be registered as a shareholder with respect to such shares in our share register prior to May 27, 2014. Registered holders of our shares (as opposed to beneficial shareholders) on May 27, 2014 who sell their shares prior to the Annual Meeting will not be entitled to vote those shares at the Annual Meeting.

Each of the proposals requires the affirmative vote of a majority of the share votes cast (in person or by proxy) at the Annual Meeting, excluding unmarked, invalid and non-exercisable votes and abstentions.

Members of our Board and members of Executive Management are not allowed to vote on the proposal to discharge the members of the Board and the Executive Management from liability for the fiscal year ended December 28, 2013.

Shareholder ratification of the appointment of Ernst & Young LLP as Garmin’s Independent Registered Public Accounting Firm for the fiscal year ending December 27, 2014 is not legally required, but your views are important to the Audit Committee and the Board. If shareholders do not ratify the appointment of Ernst & Young LLP, our Audit Committee will reconsider the appointment of Ernst & Young LLP as Garmin’s independent auditor.

The proposal relating to the advisory vote on executive compensation is advisory and non-binding on Garmin. However, the Compensation Committee of our Board will review voting results on this proposal and will give consideration to such voting.

Abstentions and Broker Non-Votes

Pursuant to Garmin’s Articles of Association and Swiss law, (i) shares represented at the Annual Meeting which are not voted on any matter and (ii) shares which are represented by “broker non-votes” (i.e., shares held by brokers or nominees which are represented at the Annual Meeting but with respect to which the broker or nominee is not empowered to vote on a particular proposal pursuant to applicable New York Stock Exchange rules) are not included in the determination of the shares voting on such matter. Therefore, shares represented at the Annual Meeting which are not voted on any matter and shares represented by “broker non-votes” will not be counted toward the determination of the majority required to approve the proposals submitted to the Annual Meeting and, therefore, will not have the effect of a vote against such proposals.

Although brokers have discretionary authority to vote shares of Broker Customers on “routine” matters, they do not have authority to vote shares of Broker Customers on “non-routine” matters under New York Stock Exchange (“NYSE”) rules. We believe that the following proposals to be voted on at the Annual Meeting will be considered to be “non-routine” under NYSE rules and, therefore, brokers will not be able to vote shares owned by Broker Customers with respect to these proposals unless the broker receives instructions from such customers: Proposal No. 6 (re-election of directors); Proposal No. 7 (election of Chairman); Proposal No. 8 (election of Compensation Committee members); Proposal No. 11 (advisory vote on executive compensation); Proposal No. 12 (approval of amendments to the Articles of Association to implement requirements under recent Swiss legislation regarding elections and certain other matters); Proposal No. 13 (approval of amendments to the Articles of Association to implement requirements under recent Swiss legislation regarding the compensation of the Board and the Executive Management and certain other matters; and Proposal No. 14 (approval of amendments to the Articles of Association to allow general meetings to be held online to the extent permitted under applicable law).

GARMIN LTD. - 2014 Proxy Statement 10

How Shareholders Vote

Shareholders, Plan Participants and Broker Customers may vote (or in the case of Plan Participants, may direct the trustee of the Garmin International, Inc. 401(k) and Pension Plan to vote) their shares as follows:

Shares of Record

Shareholders may only vote their shares if they or their proxies are present at the Annual Meeting. Shareholders may appoint as their proxy the independent voting rights representative, the law firm of Reiss + Preuss LLP, 1350 Avenue of the Americas, Suite 2900, New York, NY 10019, USA to vote their shares by checking the appropriate box on the enclosed proxy card and the independent voting rights representative will vote all shares for which it is the proxy as specified by the shareholders on the proxy card. A registered shareholder desiring to name as proxy someone other than the independent representative voting rights representative may do so by crossing out the name of the independent voting rights representative on the proxy card and inserting the full name of such other person. In that case, the shareholder must sign the proxy card and deliver it to the person named, and the person named must be present, present appropriate identification and vote at the Annual Meeting.

Shares owned by shareholders who have timely submitted a properly executed proxy card and specifically indicated their votes will be voted as indicated. Shares owned by shareholders who have timely submitted a properly executed proxy card and have not specifically indicated their votes instruct the independent voting rights representative to vote in the manner recommended by the Board. If any modifications to agenda items or proposals identified in the Invitation to the Annual Meeting or other matters on which voting is permissible under Swiss law are properly presented at the Annual Meeting for consideration, you instruct the independent voting rights representative, in the absence of other specific instructions, to vote in accordance with the recommendations of the Board.

We urge you to return your proxy card by the close of business, U.S. Central Time on June 2, 2014 to ensure that your proxy can be timely submitted.

Shares Held Under the 401(k) Plan

On the voting instructions card, Plan Participants may instruct the trustee of our 401(k) Plan how to vote the shares allocated to their respective participant accounts. The trustee will vote all allocated shares accordingly. Shares for which inadequate or no voting instructions are received generally will be voted by the trustee in the same proportion as those shares for which instructions were actually received from Plan Participants. The trustee of our 401(k) Plan may vote shares allocated to the accounts of the 401(k) Plan participants either in person or through a proxy.

Shares Held Through a Broker or Other Nominee

Each broker or nominee must solicit from the Broker Customers directions on how to vote the shares, and the broker or nominee must then vote such shares in accordance with such directions. Brokers or nominees are to forward the Notice to the Broker Customers, at the reasonable expense of Garmin if the broker or nominee requests reimbursement. See “Abstentions and Broker Non-Votes”.

Revoking Proxy Authorizations or Instructions

Until the polls for a particular proposal on the agenda close (or in the case of Plan Participants, until the trustee of the 401(k) Plan votes), voting instructions or votes of Record Holders and voting instructions of Plan Participants may be revoked or recast with a later-dated, properly executed and delivered proxy card or, in the case of Plan Participants, a voting instruction card. Otherwise, shareholders may not revoke a vote, unless: (a) in the case of a Record Holder, the Record Holder either (i) attends the Annual Meeting and casts a ballot at the meeting or (ii) delivers a written revocation to the independent voting rights representative at any time before the Chairman of the Annual Meeting closes the polls for a particular proposal on the agenda; (b) in the case of a Plan Participant, the revocation procedures of the trustee of the 401(k) Plan are followed; or (c) in the case of a Broker Customer, the revocation procedures of the broker or nominee are followed.

Attendance and Voting in Person at the Annual Meeting

Attendance at the Annual Meeting is limited to Record Holders or their properly appointed proxies, beneficial owners of shares having evidence of such ownership, and guests of Garmin. Plan Participants and Broker Customers, absent special direction to Garmin from the respective 401(k) Plan trustee, broker or nominee, may only vote by instructing the trustee, broker or nominee and may not cast a ballot at the Annual Meeting. Record Holders may vote by casting a ballot at the Annual Meeting.

GARMIN LTD. - 2014 Proxy Statement 11

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of April 11, 2014, Garmin had outstanding[•]shares (excluding shares held directly or indirectly in treasury). The following table contains information as of April 11, 2014 concerning the beneficial ownership of shares by: (i) beneficial owners of shares who have publicly filed a report acknowledging ownership of more than 5% of the number of outstanding shares; (ii) the directors and the executive officers who are named in the Summary Compensation Table; and (iii) all of the directors and the named executive officers as a group. Beneficial ownership generally means either the sole or shared power to vote or dispose of the shares. Except as otherwise noted, to Garmin’s knowledge, the holders listed below have sole voting and dispositive power. No officer or director of Garmin owns any equity securities of any subsidiary of Garmin.

| Name and Address | Shares | (1) | Percent of Class | (2) | ||||

| Danny J. Bartel | ||||||||

| Vice President, Worldwide Sales of Garmin International, Inc. | 151,140 | (3) | * | |||||

| Gary L. Burrell(4) | ||||||||

| Shareholder | 27,876,000 | (5) | [•] | % | ||||

| Capital Research Global Investors | ||||||||

| Shareholder | 7,518,000 | (6) | [•] | % | ||||

| Donald H. Eller, Ph.D | ||||||||

| Director | 532,927 | (7) | * | |||||

| Andrew R. Etkind | ||||||||

| Vice President, General Counsel and Corporate Secretary | 113,918 | (8) | * | |||||

| Joseph J. Hartnett | ||||||||

| Director | 957 | (9) | * | |||||

| Min H. Kao, Ph.D(10) | ||||||||

| Director and Executive Chairman | 33,734,756 | (11) | [•] | % | ||||

| Ruey-Jeng Kao(12) | ||||||||

| Shareholder | 10,377,962 | (13) | [•] | % | ||||

| Matthew Munn | ||||||||

| Vice President and Managing Director, Automotive OEM | 1,322 | (14) | * | |||||

| Charles W. Peffer | ||||||||

| Director | 26,712 | (15) | * | |||||

| Clifton A. Pemble | ||||||||

| Director, President and CEO | 201,337 | (16) | * | |||||

| Thomas P. Poberezny | ||||||||

| Director | 10,840 | (17) | * | |||||

| Kevin Rauckman | ||||||||

| Chief Financial Officer and Treasurer | 130,346 | (18) | * | |||||

| Directors and Named Executive Officers as a Group | ||||||||

| (9 persons) | 34,902,933 | (19) | [•] | % | ||||

| * | Less than 1% of the outstanding shares |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”). In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares subject to options or stock appreciation rights held by that person that are currently exercisable as of April 11, 2014 or within 60 days of such date, and shares of restricted stock units that will be released to that person within 60 days of April 11, 2014 upon vesting of restricted stock unit awards, are deemed outstanding. The holders may disclaim beneficial ownership of any such shares that are owned by or with family members, trusts or other entities. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, to Garmin’s knowledge, each shareholder named in the table has sole voting power and dispositive power with respect to the shares set forth opposite such shareholder’s name. |

| (2) | The percentage is based upon the number of shares outstanding as of April 11, 2014 (excluding shares held directly or indirectly in treasury) and computed as described in footnote (1) above. |

| (3) | Mr. Bartel’s beneficial ownership includes 88,500 shares that may be acquired through stock options and stock appreciation rights that are currently exercisable or will become exercisable within 60 days of April 11, 2014. In addition to the 151,140 shares, 1,400 shares are held in an account on which Mr. Bartel’s spouse has signing authority, over which Mr. Bartel does not have any voting or dispositive power. Mr. Bartel disclaims beneficial ownership of the 1,400 shares held in the account on which his spouse has signing authority. |

| (4) | Mr. Burrell’s address is c/o Garmin International, Inc., 1200 East 151stStreet, Olathe, Kansas 66062. |

| (5) | The 27,876,000 shares are held by a revocable trust established by Mr. Burrell, over which shares Mr. Burrell shares voting and dispositive power with his son, Jonathan Burrell, who is Mr. Burrell’s attorney-in-fact. In addition to these 27,876,000 shares, 863,570 shares are held by a revocable trust established by Mr. Burrell’s wife, over which shares Mr. Burrell does not have any voting or dispositive power. Mr. Burrell disclaims beneficial ownership of these 863,570 shares owned by his wife’s revocable trust. |

| (6) | The information is based on Amendment No. 4 dated February 6, 2014 to a Schedule 13G filed by Capital Research Global Investors. According to the Schedule 13G, Capital Research Global Investors’ address is 333 South Hope Street, Los Angeles, California 90071. |

| (7) | Dr. Eller’s beneficial ownership includes 24,540 shares that may be acquired through options that are currently exercisable or will become exercisable within 60 days of April 11, 2014 and 2,757 shares that will be released to him within 60 days of April 11, 2014 upon vesting of restricted stock units awards. |

GARMIN LTD. - 2014 Proxy Statement 12

| (8) | Mr. Etkind’s beneficial ownership includes 85,000 shares that may be acquired through stock appreciation rights that are currently exercisable or will become exercisable within 60 days of April 11, 2014. |

| (9) | Mr. Hartnett’s beneficial ownership includes 957 shares that will be released to him within 60 days of April 11, 2014 upon vesting of restricted stock units awards. |

| (10) | Dr. Kao’s address is c/o Garmin International, Inc., 1200 East 151stStreet, Olathe, Kansas 66062. |

| (11) | Of the 33,734,756 shares, (i) 9,291,188 shares are held by the Min-Hwan Kao Revocable Trust 9/28/95, over which Dr. Kao has sole voting and dispositive power, and (ii) 24,443,568 shares are held by revocable trusts established by Dr. Kao’s children over which Dr. Kao has shared voting and dispositive power. In addition to the 33,734,756 shares, 5,207,824 shares are held by a revocable trust established by Dr. Kao’s wife, over which Dr. Kao does not have any voting or dispositive power. Dr. Kao disclaims beneficial ownership of the 5,207,824 shares held by the revocable trust established by his wife. |

| (12) | Mr. Kao’s address is c/o Fortune Land Law Offices, 8thFloor, 132, Hsinyi Road, Section 3, Taipei, Taiwan. |

| (13) | The 10,377,962 shares are held by Karuna Resources Ltd. Mr. Kao owns 100% of the voting power of Karuna Resources Ltd. The information is based on Amendment No. 8 dated January 15, 2013 to a Schedule 13G dated February 9, 2001. Mr. Kao is the brother of Dr. Min Kao. |

| (14) | Mr. Munn’s beneficial ownership includes 293 shares that will be released to him within 60 days of April 11, 2014 upon vesting of restricted stock units awards. |

| (15) | Mr. Peffer’s beneficial ownership includes 13,653 shares that may be acquired through options that are currently exercisable or will become exercisable within 60 days of April 11, 2014 and 2,757 shares that will be released to him within 60 days of April 11, 2014 upon vesting of restricted stock units awards. |

| (16) | Mr. Pemble’s beneficial ownership includes 157,340 shares that may be acquired through stock options and stock appreciation rights that are currently exercisable or will become exercisable within 60 days of April 11, 2014. Of the 201,337 shares, 1,000 shares are held by children of Mr. Pemble who share the same household. |

| (17) | Mr. Poberezny’s beneficial ownership includes 5,981 shares that may be acquired through options that are currently exercisable or will become exercisable within 60 days of April 11, 2014 and 2,757 shares that will be released to him within 60 days of April 11, 2014 upon vesting of restricted stock units awards. |

| (18) | Mr. Rauckman’s beneficial ownership includes 105,839 shares that may be acquired through stock options and stock appreciation rights that are currently exercisable or will become exercisable within 60 days of April 11, 2014. Of the 130,346 shares, 300 shares are held by revocable trusts established by Mr. Rauckman’s children over which Mr. Rauckman has shared voting and dispositive power. In addition to the 130,346 shares, 2,850 shares are held by a revocable trust established by Mr. Rauckman’s wife, over which Mr. Rauckman does not have any voting or dispositive power. Mr. Rauckman disclaims beneficial ownership of the 2,850 shares owned by the revocable trust established by his wife. |

| (19) | The number includes 480,853 shares that may be acquired through stock options and stock appreciation rights that are currently exercisable or will become exercisable within 60 days of April 11, 2014, and 9,228 shares that will be released upon vesting of restricted stock unit awards within 60 days of April 11, 2014. Individuals in the group have disclaimed beneficial ownership as to a total of 6,075,644 of the shares listed. |

GARMIN LTD. - 2014 Proxy Statement 13

| PROPOSAL ONE | Election of Andrew Etkind as the ad hoc Chairman of the Annual Meeting |

The proposals to be voted on at the Annual Meeting include amendments to Garmin’s Articles of Association. In order for these amendments to take effect they must be carried out before a Swiss notary public and authenticated by such notary public in the form of a public deed (öffentliche Urkunde) and then registered with the Commercial Register (Handelsregister) of the Canton of Schaffhausen, Switzerland. A Swiss notary public can act only within the territory of the Swiss Canton where he or she is licensed as a notary public. Therefore, it is necessary for this Annual Meeting to be held in Switzerland. To facilitate attendance at the Annual Meeting by shareholders resident in the USA, we are holding the Annual Meeting simultaneously in Zurich, Switzerland and Olathe, Kansas with a live video and audio link between the two locations. Since the chairman of the meeting and the notary public are both required to be at the Zurich location, the Board proposes that Mr. Andrew Etkind, Garmin’s Vice President and General Counsel, who is based at Garmin’s headquarters in Switzerland, be elected as ad hoc Chairman of this Annual Meeting for the purpose of complying with all the necessary formalities under Swiss law.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF ANDREW ETKIND AS THE AD HOC CHAIRMAN OF THE MEETING

GARMIN LTD. - 2014 Proxy Statement 14

The consolidated financial statements of Garmin for the fiscal year ended December 28, 2013 and the Swiss statutory financial statements of Garmin for the fiscal year ended December 28, 2013 are contained in the 2013 Annual Report of Garmin on Form 10-K which was mailed to all registered shareholders with this proxy statement. A copy of this Annual Report on Form 10-K is available in the Investor Relations section of Garmin’s website atwww.garmin.com. The 2013 Annual Report on Form 10-K also contains the reports of Ernst & Young Ltd, Garmin’s auditors pursuant to the Swiss Code of Obligations, and information on our business activities and financial situation.

Under Swiss law, the 2013 Annual Report on Form 10-K and the consolidated financial statements and Swiss statutory financial statements must be submitted to shareholders for approval at each annual general meeting.

Ernst & Young Ltd, as Garmin’s statutory auditor, has issued a recommendation to the Annual Meeting that the statutory financial statements of Garmin for the fiscal year ended December 28, 2013 be approved. As Garmin’s statutory auditor, Ernst & Young Ltd has expressed its opinion that such statutory financial statements and the proposed appropriation of available earnings comply with Swiss law and Garmin’s Articles of Association.

Ernst & Young Ltd has also issued a recommendation to the Annual Meeting that the consolidated financial statements of Garmin for the fiscal year ended December 28, 2013 be approved. As Garmin’s statutory auditor, Ernst & Young Ltd has expressed its opinion that such consolidated financial statements present fairly, in all material respects, the consolidated financial position of Garmin, the consolidated results of operations and cash flows in accordance with accounting principles generally accepted in the United States (US GAAP) and comply with Swiss law.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE 2013 ANNUAL REPORT, THE CONSOLIDATED FINANCIAL STATEMENTS OF GARMIN FOR THE FISCAL YEAR ENDED DECEMBER 28, 2013 AND THE STATUTORY FINANCIAL STATEMENTS OF GARMIN FOR THE FISCAL YEAR ENDED DECEMBER 28, 2013

GARMIN LTD. - 2014 Proxy Statement 15

| PROPOSAL THREE | Appropriation of available earnings |

Under Swiss law, the appropriation of available earnings as set forth in Garmin’s statutory financial statements must be submitted to shareholders for approval at each annual general meeting. The Board proposes the following appropriation of available earnings:

| Proposed Appropriation of Available Earnings: | ||||||||

| Balance brought forward from previous years | CHF | (39,244,000 | ) | |||||

| Net loss for the period (on a stand-alone unconsolidated basis): | CHF | (8,946,000 | ) | |||||

| Total net loss: | CHF | (48,190,000 | ) | |||||

| Resolution proposed by the Board of Directors: | ||||||||

| - RESOLVED, that the net loss for the period of CHF 8,946,000 shall be carried forward. | ||||||||

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROPRIATION OF AVAILABLE EARNINGS

GARMIN LTD. - 2014 Proxy Statement 16

| PROPOSAL FOUR | Payment of a cash dividend in the aggregate amount of $1.92 per outstanding share out of Garmin’s general reserve from capital contribution in four equal installments |

Under Swiss law, the shareholders must approve the payment of any dividend at an annual general meeting. The Board proposes to the Annual Meeting that Garmin pay a cash dividend in the amount of $1.92 per outstanding share out of Garmin’s general legal reserve from capital contribution payable in four equal installments at the dates determined by the Board in its discretion, as further specified in the proposed shareholder resolution set forth below. The Board currently expects that the dividend payment and record dates will be as follows:

| Dividend Date | Record Date | $ per share | |||

| June 30, 2014 | June 17, 2014 | $ | 0.48 | ||

| September 30, 2014 | September 15, 2014 | $ | 0.48 | ||

| December 31, 2014 | December 15, 2014 | $ | 0.48 | ||

| March 31, 2015 | March 16, 2015 | $ | 0.48 |

The Board’s dividend proposal has been confirmed to comply with Swiss law and Garmin’s Articles of Association by Garmin’s statutory auditor, Ernst & Young Ltd, a state-supervised auditing enterprise, representatives of which will be present at the Annual Meeting.

The Board proposes the following resolutions with respect to the dividend:

| General Reserve from Capital Contribution as per December 28, 2013 | CHF | 5,858,865,000 | |||

| Resolutions proposed by the Board: | |||||

| • | RESOLVED, that Garmin, out of, and limited at a maximum to the amount of, the Dividend Reserve (as defined below), pay a cash dividend in the amount of US$1.92 per outstanding share(1)out of Garmin’s general legal reserve from capital contribution payable in four equalinstallments at the dates determined by the Board of Directors in its discretion, the record date and payment date for each such installment tobe announced in a press release(2)at least ten calendar days prior to the record date; and further | ||||

| • | RESOLVED, that the cash dividend shall be made with respect to the outstanding share capital of Garmin on the record date for the applicable installment, which amount will exclude any shares of Garmin held by Garmin or any of its direct or indirect subsidiaries; and further | ||||

| • | RESOLVED, that CHF 407,749,000(3)be allocated to dividend reserves from capital contribution (the“Dividend Reserve”) from the generalreserve from capital contribution in order to pay such dividend of US$1.92 per outstanding share with a nominal value of CHF 10.00 each(assuming a total of 208,077,418 shares(4)eligible to receive the dividend); and further | CHF | 407,749,000 | ||

| • | RESOLVED that if the aggregate dividend payment is lower than the Dividend Reserve, the relevant difference will be allocated back to thegeneral reserve from capital contribution; and further | ||||

| • | RESOLVED, that to the extent that any installment payment, when converted into Swiss francs, at a USD/CHF exchange rate prevailing at the relevant record date for the relevant installment payment, would exceed the Dividend Reserve then remaining, the U.S. dollar per shareamount of that installment payment shall be reduced on a pro rata basis, provided, however, that the aggregate amount of that installmentpayment shall in no event exceed the then remaining Dividend Reserve. | CHF | 5,451,116,000 | ||

| (1) | In no event will the dividend payment exceed a total of US$1.92 per share. |

| (2) | The announcements will not be published in the Swiss Official Gazette of Commerce. |

| (3) | Based on the currency conversion rate as at December 28, 2013. With a total of shares eligible for payout (based on the number of shares outstanding as at December 28, 2013), the aggregate dividend total would be CHF shares eligible for payout (based on the number of shares outstanding as at December 28, 2013), the aggregate dividend total would be CHF . The amount of the Dividend Reserve, calculated on the basis of the Company’s issued shares as at December 28, 2013, includes a 15% margin to accommodate (i) unfavorable currency fluctuation and (ii) new share issuance (see fn 4 below) that may occur between the time that the dividend is approved by shareholders and when the last installment payment is made. Unused dividend reserves will be returned to the general reserve from capital contribution after the last installment payment. . The amount of the Dividend Reserve, calculated on the basis of the Company’s issued shares as at December 28, 2013, includes a 15% margin to accommodate (i) unfavorable currency fluctuation and (ii) new share issuance (see fn 4 below) that may occur between the time that the dividend is approved by shareholders and when the last installment payment is made. Unused dividend reserves will be returned to the general reserve from capital contribution after the last installment payment. |

| (4) | This number is based on the registered share capital at December 28, 2013. The number of shares eligible for dividend payments may change due to the repurchase of shares, the sale of treasury shares or the issuance of new shares, including (without limitation) from the conditional share capital reserved for the employee profit sharing program. |

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PAYMENT OF A CASH DIVIDEND IN THE AGGREGATE AMOUNT OF $1.92 PER OUTSTANDING SHARE OUT OF GARMIN’S GENERAL RESERVE FROM CAPITAL CONTRIBUTION IN FOUR EQUAL INSTALLMENTS

GARMIN LTD. - 2014 Proxy Statement 17

| PROPOSAL FIVE | Discharge of the members of the Board of Directors and the Executive Management from liability for the fiscal year ended December 28, 2013 |

In accordance with Article 698, subsection 2, item 5 of the Swiss Code of Obligations it is customary for Swiss companies to request shareholders at the annual general meeting to discharge the members of the board of directors and the Executive Management from personal liability for their activities during the preceding fiscal year. This discharge is only effective with respect to facts that have been disclosed to shareholders and only binds shareholders who either voted in favor of the proposal or who subsequently acquired shares with knowledge that shareholders have approved this proposal. In addition, shareholders who vote against this proposal, abstain from voting on this proposal, do not vote on this proposal, or acquire their shares without knowledge of the approval of this proposal, may bring, as a plaintiff, any claims in a shareholder derivative suit within six months after the approval of the proposal. After the expiration of the six-month period, such shareholders will generally no longer have the right to bring, as a plaintiff, claims in shareholder derivative suits against the directors and the management.

Pursuant to Article 23.1 of the Organizational Regulations of Garmin Ltd., the Executive Management is defined to mean the Chief Executive Officer and such other officers expressly designated by the Board to be members of the Executive Management. The Board has designated the Chief Executive Officer and the Chief Financial Officer to be the members of Executive Management.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE DISCHARGE OF THE MEMBERS OF THE BOARD AND THE EXECUTIVE MANAGEMENT FROM LIABILITY FOR THE FISCAL YEAR ENDED DECEMBER 28, 2013

GARMIN LTD. - 2014 Proxy Statement 18

| PROPOSAL SIX | Re-election of directors |

Pursuant to the Swiss Ordinance Against Excessive Remuneration at Listed Corporations (Verordnung gegen übermässige Vergütungen bei börsenkotierten Aktiengesellschaften) (the “Swiss Ordinance”), commencing in 2014 all directors of a Swiss company that is listed on a stock exchange are required to be elected annually and individually by the shareholders for a term extending until completion of the next annual general meeting.

The Board has nominated the following persons, each of whom is currently a director of Garmin, to stand for re-election for a term extending until completion of the annual general meeting in 2015: Donald H. Eller, Joseph J. Hartnett, Min H. Kao, Charles W. Peffer, Clifton A. Pemble and Thomas P. Poberezny.

References to the length of time during which (and, in the case of persons who are employees of Garmin, the positions in which they have served) the nominees for election and the existing directors have served as directors and/or employees of Garmin in their biographies included in this section of this Proxy Statement refer to their service as directors and/or officers of both (i) Garmin Ltd., a Cayman Islands company (“Garmin Cayman”) which was the ultimate parent holding company of the Garmin group of companies until June 27, 2010 and (ii) Garmin Ltd., a Swiss company, which became the ultimate parent holding company of the Garmin group of companies on June 27, 2010 pursuant to a scheme of arrangement under Cayman Islands law that was approved by the shareholders of Garmin Cayman on May 20, 2010.

Dr. Eller, Mr. Hartnett, Dr. Kao, Mr. Peffer, Mr. Pemble and Mr. Poberezny have each indicated that they are willing and able to continue to serve as directors if re-elected and have consented to being named as nominees in this Proxy Statement.

|

Donald H. Eller, age 71, has served as a director of Garmin since March 2001. Dr. Eller has been a private investor since January 1997. From September 1979 to November 1982 he served as the Manager of Navigation System Design for a division of Magnavox Corporation. From January 1984 to December 1996, he served as a consultant on Global Positioning Systems and other navigation technology to various U.S. military agencies and U.S. and foreign corporations. Dr. Eller holds B.S., M.S. and Ph.D. degrees in Electrical Engineering from the University of Texas. Dr. Eller has not been a member of the board of directors of any other entity during the last five years. The Board has concluded that Dr. Eller should be nominated for re-election as a director of Garmin because: (1) his significant experience in the navigation and GPS fields provides the Board with valuable experience in the technology utilized by Garmin and its potential applications; (2) he meets the requirements to be an independent director as defined in the listing standards for the NASDAQ Global Select Market; and (3) he satisfies the general criteria described below under “Nominating and Corporate Governance Committee”.

|

Joseph J. Hartnett, age 58, has been a director of Garmin since June 2013. Mr. Hartnett served as President and Chief Executive Officer of Ingenient Technologies, Inc., a multimedia software development company headquartered in Rolling Meadows, Illinois, from April 2008 through November 2010. He joined Ingenient as Chief Operating Officer in September 2007. Mr. Hartnett left Ingenient following the sale of the company and completion of post-sale activities. Prior to Ingenient, Mr. Hartnett served as President and Chief Executive Officer of U.S. Robotics Corporation, a global Internet communications product company headquartered in Schaumburg, Illinois, from May 2001 through October 2006. He was Chief Financial Officer of U.S. Robotics from June 2000 to May 2001. Prior to U.S. Robotics, Mr. Hartnett was a partner with Grant Thornton LLP where he served for over 20 years in various leadership positions at the regional, national and international level. Mr. Hartnett is a licensed Certified Public Accountant in the State of Illinois and holds a Bachelor’s degree in Accounting from the University of Illinois at Chicago. Mr. Hartnett has been a director of Sparton Corporation (NYSE: SPA) since September 2008. Mr. Hartnett was a director of Crossroads Systems, Inc. (NASDAQ: CRDS) from March 2011 to June 2013. He currently serves as a member of the audit committee of Sparton. He is a past chairman of the audit committee, past member of the compensation committee and past member of the nominating and corporate governance committee of Sparton. Mr. Hartnett previously served as chairman of the audit committee at Crossroads and as a member of the compensation committee and of the nominating and corporate governance committee. He is also a former director of both U.S. Robotics Corporation and Ingenient Technologies, Inc.

The Board has concluded that Mr. Hartnett should be-nominated for reelection as a director of Garmin because: (1) his 20 years of experience as a Certified Public Accountant with Grant Thornton LLP and his experience as the chairman of the audit committee of two other public companies gives him strong qualifications to be a member of the Audit Committee of the Board, and he qualifies as an “audit committee financial expert” as defined by the SEC regulations implementing Section 407 of the Sarbanes-Oxley Act of 2002; (2) he has significant industry experience as a senior executive in the areas of international business, operations management, executive leadership, strategic planning and finance, as well as extensive corporate governance, executive compensation and financial experience; (3) he meets the requirements to be an independent director as defined in the listing standards for the NASDAQ Global Select Market; and (4) he satisfies the general criteria described below under “Nominating and Corporate Governance Committee”.

GARMIN LTD. - 2014 Proxy Statement 19

|

Min H. Kao, age 65, has served as Executive Chairman of Garmin since January 2013. Dr. Kao served as Chairman of Garmin from September 2004 to December 2012 and was previously Co-Chairman of Garmin from August 2000 to August 2004. He served as Chief Executive Officer of Garmin from August 2002 to December 2012 and previously served as Co-Chief Executive Officer from August 2000 to August 2002. Dr. Kao has served as a director and officer of various subsidiaries of Garmin since August 1990. Dr. Kao holds Ph.D. and MS degrees in Electrical Engineering from the University of Tennessee and a BS degree in Electrical Engineering from National Taiwan University. Dr. Kao has not been a member of the board of directors of any entity other than Garmin or various subsidiaries of Garmin during the last five years.

The Board of has concluded that Dr. Kao should be nominated for re-election as a director of Garmin because: (1) he is one of the co-founders of Garmin and its various subsidiaries; (2) he possesses 24 years of experience in Garmin’s operations and has a high level of relevant technical and business knowledge and experience; (3) he is uniquely positioned to understand Garmin’s vision and values; and (4) he satisfies the general criteria described below under “Nominating and Corporate Governance Committee”.

|

Charles W. Peffer, age 66, has been a director of Garmin since August 2004. Mr. Peffer was a partner in KPMG LLP and its predecessor firms from 1979 to 2002 when he retired. He served in KPMG’s Kansas City office as Partner in Charge of Audit from 1986 to 1993 and as Managing Partner from 1993 to 2000. Mr. Peffer is a director of Sensata Technologies Holding N.V., NPC International, Inc., HDSupply Holdings, Inc. and of the Commerce Funds, a family of seven mutual funds.

The Board has concluded that Mr. Peffer should be nominated for re-election as a director of Garmin because: (1) his significant experience with KPMG and its predecessor firms gives him strong qualifications to be a member of the Audit Committee of the Board, and he qualifies as an “audit committee financial expert” as defined by the SEC regulations implementing Section 407 of the Sarbanes-Oxley Act of 2002; (2) he meets the requirements to be an independent director as defined in the listing standards for the NASDAQ Global Select Market; and (3) he satisfies the general criteria described below under “Nominating and Corporate Governance Committee”.

|

Clifton A. Pemble, age 48, has served as a director of Garmin since August 2004 and has been President and Chief Executive Officer of Garmin since January 2013. Mr. Pemble served as President and Chief Operating Officer of Garmin from October 2007 to December 2012. He has served as a director and officer of various subsidiaries of Garmin since August 2003. He has been President and Chief Executive Officer of Garmin International, Inc. since January 2013. Previously he served as Chief Operating Officer of Garmin International, Inc. from October 2007 to December 2012 and he was Vice President, Engineering of Garmin International, Inc. from 2005 to October 2007, Director of Engineering of Garmin International, Inc. from 2003 to 2005, Software Engineering Manager of Garmin International, Inc. from 1995 to 2002, and a Software Engineer with Garmin International, Inc. from 1989 to 1995. Garmin International, Inc. is a subsidiary of Garmin. Mr. Pemble holds BA degrees in Mathematics and Computer Science from MidAmerica Nazarene University. Mr. Pemble has not been a member of the board of directors of any entity other than Garmin and various subsidiaries of Garmin during the last five years.

The Board has concluded that Mr. Pemble should be nominated for re-election as a director of Garmin because: (1) he has served Garmin and its various operating subsidiaries in many important roles for over 20 years; (2) he has a high level of relevant technical and business knowledge and experience; (3) he has a keen understanding of Garmin’s vision and values; and (4) he satisfies the general criteria described below under “Nominating and Corporate Governance Committee”.

|

Thomas P. Poberezny, age 67, has been a director of Garmin since May 2010. Mr. Poberezny has served as Chairman Emeritus of the Experimental Aircraft Association, Inc. (“EAA”) since 2011. He was President of the EAA from 1989 to 2011, and Chairman of the Board of the EAA from 2009 to 2011. The EAA is a non-profit corporation with approximately 160,000 members. The EAA’s mission is to promote and grow general aviation while facilitating innovation. As part of its activities, the EAA organizes the annual EAA AirVenture at Oshkosh, Wisconsin, one of the world’s largest aviation events. Mr. Poberezny has been Chairman of EAA AirVenture since 1975. Mr. Poberezny holds a bachelor’s degree in Industrial Engineering from Northwestern University and also received an honorary degree from the Milwaukee School of Engineering. Mr. Poberezny is an experienced pilot and was the 1973 U.S. National Unlimited Aerobatic Champion and was a member of the 1970-1972 Aerobatic Teams that represented the United States in world competitions. Mr. Poberezny was also a pilot member of the Red Devils/Eagles Aerobatic Team from 1971 to 1995. Mr. Poberezny was a member of the board of directors of the Oshkosh branch of US Bank from 1985 to 2006.

The Board has concluded that Mr. Poberezny should be nominated for re-election as a director of Garmin because: (1) his significant experience and relationships in the field of general aviation provide the Board and Garmin with valuable experience and contacts in one of Garmin’s principal business segments; (2) his 20 years of experience as President of the EAA, an organization with approximately 200 employees, provided him with significant hands-on experience as a chief executive; (3) he meets the requirements to be an independent director as defined in the listing standards for the NASDAQ Global Select Market; and (4) he satisfies the general criteria described below under “Nominating and Corporate Governance Committee”.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THESE NOMINEES

Director Independence

The Board has determined that Dr. Eller, Mr. Hartnett, Mr. Peffer and Mr. Poberezny, who constitute a majority of the Board, are independent directors as defined in the listing standards for the NASDAQ Global Select Market.

GARMIN LTD. - 2014 Proxy Statement 20

Board Meetings and Standing Committee Meetings

Meetings

The Board held five meetings and took action by unanimous written consent five times during the fiscal year ended December 28, 2013. Four executive sessions of the independent directors were held in 2013. The Board has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee (the “Nominating Committee”). During the 2013 fiscal year, the Audit Committee held four meetings and took action by unanimous written consent twice, the Compensation Committee held five meetings and took action by unanimous written consent once, and the Nominating Committee held one meeting. Each director attended at least 75% of the aggregate of: (1) the total number of meetings of the Board and (2) the total number of meetings held by all committees on which such director served. It is Garmin’s policy to encourage directors to attend Garmin’s annual general meeting. Five of the six directors of Garmin attended the 2013 annual general meeting.

Audit Committee

Messrs. Peffer (Chairman), Hartnett and Poberezny serve as the members of the Audit Committee. The Board has adopted a written charter for the Audit Committee, a copy of which is available on Garmin’s website atwww.garmin.com. The functions of the Audit Committee include overseeing Garmin’s financial reporting processes on behalf of the Board, and appointing, and approving the fee arrangement with Ernst & Young LLP, Garmin’s independent registered public accounting firm and Ernst & Young Ltd, Garmin’s statutory auditor. The Board has determined that Mr. Hartnett and Mr. Peffer are “audit committee financial experts” as defined by the SEC regulations implementing Section 407 of the Sarbanes-Oxley Act of 2002. The Board of has determined that all the members of the Audit Committee are independent (as defined by the listing standards of the NASDAQ Global Stock Market).

Compensation Committee

Messrs. Poberezny (Chairman), Eller, Hartnett and Peffer serve as the members of the Compensation Committee. The Board has adopted a written charter for the Compensation Committee, a copy of which is available on Garmin’s website atwww.garmin.com. The primary responsibilities of the Compensation Committee are to (a) review, approve and oversee Garmin’s compensation philosophy, policies and objectives for executives and principal senior officers, as well as the programs, plans, practices and procedures for their implementation in a manner that is consistent with corporate strategies and goals, (b) ensure that Garmin’s compensation programs and practices are effective in attracting, retaining and motivating highly qualified personnel, (c) with respect to compensation of the Executive Chairman, Chief Executive Officer (“CEO”) and other principal senior officers, annually: (i) review and approve the corporate goals and objectives that are aligned with the achievement of the Company’s long-term strategic plans, (ii) evaluate their performance in light of those goals and objectives; (iii) determine the CEO’s compensation level, as well as the components and structure of his or her compensation package, based on his or her performance evaluation, recent compensation history, and the application of any policies and procedures established by the Compensation Committee; (iv) oversee and approve the respective compensation levels, as well as the components and structure of the respective compensation packages as recommended by the CEO of the other principal senior officers based on their respective performance evaluations, recent compensation history, and the application of any policies or procedures established by the Compensation Committee; and (v) review and approve any employment, change of control, termination or other agreements with the CEO, as well as other principal senior officers, and any amendments to such agreements (d) with respect to compensation policies for all employees, including non-executive officers, to: (i) periodically determine whether such policies and practices create risks that are reasonably likely to have a material adverse effect on the Company; (ii) consider modifying, or directing Garmin to modify, policies and practices that the Compensation Committee deems to create such risks; and (iii) approve disclosures required to be included in Garmin’s annual meeting proxy statement (e) review and discuss with management the proposed Compensation Discussion and Analysis section (“CD&A”) of Garmin’s annual meeting proxy statement and, based on such review and discussion, make a recommendation to the Board regarding inclusion of the CD&A in the proxy statement; and produce the annual disclosures required by applicable SEC rules and regulations and the relevant listing authority (f) recommend to the Board changes in the amount, components and structure of compensation paid to the non-employee members of the Board for their service on the Board or its committees; (g) serve as the committee administering any equity-based compensation plans adopted by the Company; (h) approve, or, if required, submit for approval by shareholders, all new equity-based plans and any amendments to such plans; (i) review the design and oversee the administration of Garmin’s broad based employee compensation and benefit programs in a manner that is consistent with the Garmin’s compensation philosophy and long-term strategic plan; and (j) with input from the Board, annually review with management the plans for the orderly development and succession of all principal senior officers. The Board has determined that all the members of the Compensation Committee are independent (as defined by the listing standards of the NASDAQ Global Select Stock Market). The processes and procedures for considering and determining executive compensation, including the Compensation Committee’s authority and role in the process, its delegation of authority to others, and the roles of Garmin executives and third-party executive compensation consultants in making decisions or recommendations on executive compensation, are described in “Executive Compensation Matters – Compensation Discussion and Analysis” below. Pursuant to the Swiss Ordinance the members of the Compensation Committee will be elected annually and individually by the shareholders at the annual general meeting commencing with this Annual Meeting.

GARMIN LTD. - 2014 Proxy Statement 21

Nominating and Corporate Governance Committee

Messrs. Eller (Chairman), Hartnett, Peffer and Poberezny serve as the members of the Nominating Committee. The Board has adopted a written charter for the Nominating Committee. A copy of the Nominating Committee Charter is available on Garmin’s website atwww.garmin.com. The primary responsibilities of the Nominating Committee are to (a) evaluate the current composition, size, role and functions of the Board and its committees to oversee successfully the business and affairs of Garmin and make recommendations to the Board for approval; (b) determine director selection criteria and conduct searches for prospective directors whose skills and attributes reflect these criteria, (c) recommend and evaluate nominees for election to the Board; (d) evaluate and make recommendations to the Board concerning the appointment of directors to serve on each standing committee and the selection of Board committee chairpersons; (e) evaluate prior to each annual general meeting, and report to the Board on, the financial literacy of the Audit Committee members and whether the Audit Committee has at least one Audit Committee Financial Expert and one Audit Committee member who has accounting or related financial management expertise; (f) evaluate prior to each annual general meeting, and report to the Board on, the independence of director nominees and Board members under applicable laws, regulations, and stock exchange listing standards; (g) create and implement a process for the Board to annually evaluate its own performance; (h) oversee a Company orientation program for new directors and a continuing education program for current directors; (i) recommend to the Board Corporate Governance Guidelines; (j) review periodically the Corporate Governance Guidelines and recommend such modifications to the Board as the Governance Committee deems appropriate; (k) oversee Garmin’s corporate governance practices, including reviewing and recommending to the Board for approval any changes to the other documents and policies in the Company’s corporate governance framework, including its articles of association and organizational regulations; (l) verify that the Board and each Board committee has annually evaluated its own performance; (m) review and/or investigate any matters pertaining to the integrity of management or the Board or any committee thereof; (n) annually evaluate the Governance Committee’s own performance and periodically evaluate the adequacy of this Charter; and (o) report to the Board on Nominating Committee actions (other than routine or administrative actions). The Board has determined that all the members of the Nominating Committee are independent (as defined by the listing standards of the NASDAQ Global Select Stock Market).

In selecting candidates for nomination at the annual meeting of Garmin’s shareholders, the Nominating Committee begins by determining whether the incumbent directors whose terms expire at the meeting desire and are qualified to continue their service on the Board. The Nominating Committee is of the view that the continuing service of qualified incumbents promotes stability and continuity in the board room, giving the Board the familiarity and insight into Garmin’s affairs that its directors have accumulated during their tenure, while contributing to their work as a collective body. Accordingly, it is the policy of the Nominating Committee, absent special circumstances, to nominate qualified incumbent directors who continue to satisfy the Nominating Committee’s criteria for membership on the Board, whom the Nominating Committee believes will continue to make a valuable contribution to the Board and who consent to stand for reelection and, if reelected, to continue their service on the Board. If there are Board vacancies and the Nominating Committee does not re-nominate a qualified incumbent, the Nominating Committee will consider and evaluate director candidates recommended by the Board, members of the Nominating Committee, management and any shareholder owning one percent or more of Garmin’s outstanding shares.