UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

Amendment No. 2 to

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

________________________________

| Valcent Products Inc. |

|---|

| (Exact Name of Registrant as Specified in its Charter) |

| | | | |

|---|

Province of Alberta, Canada

(State or Other Jurisdiction of

Incorporation or Organization) | | 3990

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(IRS Employer

Identification Number) |

420 - 475 Howe Street,

Vancouver

British Columbia V6C 2B3

Tel: (604) 606-7979

(Address, including zip code, and telephone number, including area code of Registrant's principal executive offices)

F. George Orr

Secretary

Valcent Products Inc.

420 - 475 Howe Street, Vancouver

British Columbia V6C 2B3

Tel: (604) 606-7979

(Name, address, including zip code, and telephone number, including area code of agent for service)

Copies to:

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement until such time as all of the shares of common stock hereunder have been sold.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

[X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434 under the Securities Act of 1933, please check the following box.

[ ]

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered

| Amount To Be

Registered (1)

| Proposed

Maximum

Offering

Price Per

Share

| Proposed

Maximum

Aggregate

Offering

Price

| Amount of Registration

Fee

|

|---|

| | | | | | | | | | | | | | | |

Common Stock

without par value | | | | 1,594,091 (2) | | $ | 0.80 | (3) | $ | 1,275,273 | | $ | 136 | .33 |

Common Stock

without par value | | | | 5,599,150 (4) | | $ | 0.80 | (3) | $ | 4,479,320 | | $ | 478 | .84 |

Common Stock

without par value | | | | 1,648,875 (6) | | $ | 0.40 | (5) | $ | 659,550 | | $ | 70 | .51 |

Common Stock

without par value | | | | 109,600 (8) | | $ | 0.75 | (5) | $ | 82,200 | | $ | 8 | .80 |

Common Stock

without par value | | | | 245,320 (9) | | $ | 0.50 | (5) | $ | 122,660 | | $ | 13 | .12 |

Common Stock

without par value | | | | 408,867 (10) | | $ | 0.75 | (5) | $ | 306,650 | | $ | 32 | .78 |

|

| Total | | | | 11,254,778 | | $ | | | $ | 8,409,641 | | $ | 899 | .02 |

|

| | (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, this registration statement also covers such indeterminate number of additional shares of common stock as may be issuable upon exercise of warrants to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| | (2) | Represents 1,594,091 outstanding shares of our common stock held by our selling shareholders. |

| | (3) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the closing bid and asked prices for our common stock as reported on the OTC Bulletin Board on April 21, 2006. |

| | (4) | Represents 2,397,935 shares of our common stock, of which we are committed, pursuant to the terms of certain registration provisions, to registering 200% of such shares (4,795,870 shares), issuable upon conversion of the principal amount of certain promissory notes, carrying interest at a rate of 8% per annum, held by our selling shareholders, together with 355,666 shares representing accrued interest and 447,614 shares representing accrued penalties through the date of this registration, which shares may be issued upon conversion of any interest or penalties accrued should we elect to pay any such interest in the form of registered, freely-trading common shares, rather than in cash, which determination to do so is entirely at our option in accordance with the terms of such convertible promissory notes. |

| | (5) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(g) of the Securities Act of 1933, as amended, based on the stated exercise price. |

| | (6) | Represents 1,648,875 shares of our common stock issuable upon exercise of certain Class A warrants held by our selling shareholders. |

| | (7) | Represents 1,648,875 shares of our common stock issuable upon exercise of certain Class B warrants held by our selling shareholders. |

| | (8) | Represents 109,600 shares of our common stock issuable upon exercise of certain Class C warrants held by our selling shareholders. |

| | (9) | Represents 245,320 shares of our common stock issuable upon exercise of certain Class A finder’s warrants held by our selling shareholders. |

| | (10) | Represents 408,867 shares of our common stock issuable upon exercise of certain Class B finder’s warrants held by our selling shareholders. |

| | (11) | Represents the registration fee in accordance with Rule 457(g) of the Securities Act of 1933, as amended. $850.77 was paid with the initial filing of Form F-1. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject To Completion, Dated___________, 2006.

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale of these securities is not permitted.

PROSPECTUS

VALCENT PRODUCTS INC.

11,254,778 SHARES OF COMMON STOCK

OFFERED BY THE SELLING SHAREHOLDER

This prospectus relates to the resale of up to 11,254,778 shares of our common stock by certain persons who are either our shareholders, affiliates, holders of promissory notes convertible into shares of our common stock, holders of warrants to purchase shares of our common stock or any combination thereof. All of the shares of common stock are being offered for sale by the selling shareholders at prices established on the OTC Bulletin Board during the term of this offering, as will fluctuate from time to time, or as may otherwise be agreed upon in negotiated transactions. We will not receive any proceeds from the sale of our shares by the selling shareholders or the conversion of any promissory notes held by our shareholders. If the warrants are exercised in full, we would receive proceeds of USD$2,655,048. However, we may never actually receive these proceeds because (i) the warrants carry a “net cashless” exercise feature allowing the holders thereof, under certain limited circumstances, to exercise the warrants without payment of the stated exercise price, and (ii) the exercise price of some or all of the warrants may at any given time be above the current market price of our common stock, and therefore the warrants may never be exercised, or, if they are exercised, but not for some time, it would not be until then that we receive any such proceeds. We will use the proceeds realized from the exercise of any warrants for general working capital purposes consistent with our business strategy.

Our common stock is quoted on the OTC Bulletin Board under the symbol “VCTPF”. On September 13, 2006, the average of the bid and ask prices of our common stock was USD$0.50 per share.

Each of the selling shareholders may be deemed to be an “underwriter,” as such term is defined in the Securities Act of 1933, as amended.

An investment in our common stock involves a high degree of risk. You should only invest in our common stock if you can afford to lose your entire investment, and you should read and consider the “Risk Factors” beginning on page 8 before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____________, 2006.

VALCENT PRODUCTS INC.

420 - 475 Howe Street, Vancouver

British Columbia V6C 2B3

Tel: (604) 606-7979

The following table of contents has been designed to help you find important information contained in this prospectus. We have included subheadings to aid you in searching for particular information you might want to return to. We urge you to read the entire prospectus.

_________________

TABLE OF CONTENTS

| Page

Number |

|---|

| |

|---|

| CONVENTIONS THAT APPLY TO THIS PROSPECTUS | | | | 1 | |

| PROSPECTUS SUMMARY | | | | 2 | |

| ABOUT OUR BUSINESS | | | | 2 | |

| ABOUT OUR COMPANY | | | | 3 | |

| THE OFFERING | | | | 5 | |

| SUMMARY FINANCIAL DATA | | | | 7 | |

| GENERAL BUSINESS RISKS | | | | 7 | |

| RISKS ASSOCIATED WITH OUR BUSINESS AND INDUSTRIES | | | | 8 | |

| RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON STOCK | | | | 11 | |

| CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS | | | | 15 | |

| MARKET INFORMATION | | | | 15 | |

| USE OF PROCEEDS | | | | 16 | |

| DIVIDEND POLICY | | | | 17 | |

| CAPITALIZATION | | | | 17 | |

| DILUTION | | | | 20 | |

| SELECTED FINANCIAL DATA | | | | 20 | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF | | |

| FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | | 22 | |

| BACKGROUND | | | | 22 | |

| OVERVIEW | | | | 22 | |

| PLAN OF OPERATIONS | | | | 24 | |

| QUARTER ENDED JUNE 30, 2006 COMPARED WITH QUARTER | | |

| ENDED JUNE 30, 2005 | | | | 26 | |

| FISCAL YEAR ENDED MARCH 31, 2006 COMPARED WITH FISCAL YEAR | | |

| ENDED MARCH 31, 2005 | | | | 27 | |

| FISCAL YEAR ENDED MARCH 31, 2005 COMPARED WITH FISCAL YEAR | | |

| ENDED MARCH 31, 2004 | | | | 30 | |

| SUBSEQUENT EVENTS | | | | 31 | |

| RELATED PARTY TRANSACTIONS | | | | 32 | |

| OFF-BALANCE SHEET ARRANGEMENTS | | | | 32 | |

| CONTRACTUAL OBLIGATIONS | | | | 32 | |

| BUSINESS | | | | 33 | |

| OUR CORPORATE HISTORY AND DEVELOPMENT | | | | 33 | |

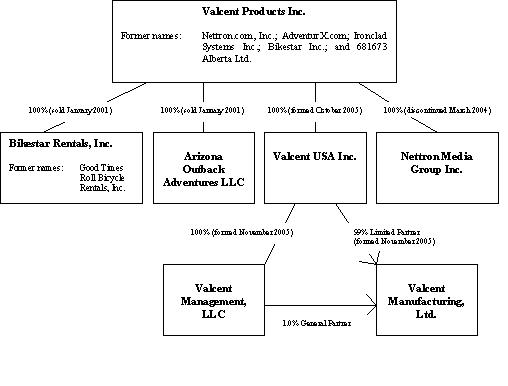

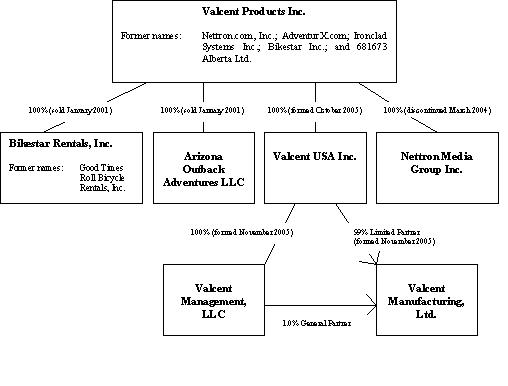

| ORGANIZATIONAL STRUCTURE | | | | 35 | |

| BUSINESS OVERVIEW | | | | 35 | |

| POTENTIAL CONSUMER PRODUCTS | | | | 35 | |

| OUR POTENTIAL MARKETS | | | | 37 | |

| MARKETING AND ADVERTISING | | | | 38 | |

| MANUFACTURING, FULFILLMENT AND SUPPLIERS | | | | 40 | |

| REGULATIONS | | | | 40 | |

| COMPETITION | | | | 41 | |

| |

|---|

| |

|---|

| INTELLECTUAL PROPERTY | | | | 43 | |

| EMPLOYEES | | | | 44 | |

| PROPERTY, PLANT AND EQUIPMENT | | | | 46 | |

| MATERIAL AGREEMENTS | | | | 46 | |

| MK ENTERPRISES LICENSE AND RELATED TRANSACTIONS | | | | 46 | |

| PRIVATE OFFERING TRANSACTIONS | | | | 47 | |

| JULY/AUGUST 2005 AND APRIL 2006 | | | | 47 | |

| APRIL 2006 FOLLOW-ON PRIVATE OFFERING TRANSACTION | | | | 49 | |

| MAY/AUGUST 2006 | | | | 50 | |

| MANAGEMENT | | | | 50 | |

| DIRECTORS AND SENIOR MANAGEMENT | | | | 50 | |

| COMPENSATION | | | | 53 | |

| BOARD PRACTICES | | | | 54 | |

| EMPLOYEES | | | | 54 | |

| SHARE OWNERSHIP | | | | 54 | |

| RELATED PARTY TRANSACTIONS | | | | 56 | |

| MANAGEMENT FEES | | | | 57 | |

| OFFICE LEASE RENT | | | | 57 | |

| LOANS | | | | 57 | |

| PROFESSIONAL FEES | | | | 58 | |

| MK ENTERPRISES LICENSE AND RELATED TRANSACTIONS | | | | 58 | |

| FINDER'S FEES | | | | 59 | |

| PRINCIPAL AND SELLING SHAREHOLDERS | | | | 59 | |

| PLAN OF DISTRIBUTION | | | | 67 | |

| DESCRIPTION OF SECURITIES | | | | 69 | |

| SHARE CAPITAL | | | | 69 | |

| TRANSFER OF SHARES | | | | 69 | |

| CHANGES IN SHARE CAPITAL | | | | 69 | |

| MEMORANDUM AND ARTICLES OF ASSOCIATION | | | | 71 | |

| EXCHANGE CONTROLS | | | | 76 | |

| TAXATION | | | | 76 | |

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES | | | | 76 | |

| MATERIAL CANADIAN FEDERAL INCOME TAX CONSEQUENCES | | | | 80 | |

| DOCUMENTS ON DISPLAY | | | | 82 | |

| LEGAL MATTERS | | | | 82 | |

| EXPERTS | | | | 82 | |

| EXPENSES RELATED TO THE OFFERING | | | | 82 | |

| ADDITIONAL INFORMATION | | | | 82 | |

| INDEX TO FINANCIAL STATEMENTS | | | | F-1 | |

| FINANCIAL STATEMENTS | | | | F-2 | |

| PART II: INFORMATION NOT REQUIRED IN PROSPECTUS | | | | II-2 | |

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Unless otherwise specified, references in this prospectus to:

| | • | "Canadian GAAP" are to generally accepted accounting principles in Canada; |

| | • | "CND" are to Canadian dollars; |

| | • | "Exchange Act" are to the Securities Exchange Act of 1934, as amended; |

| | • | "Securities Act" are to the Securities Act of 1933, as amended; |

| | • | "SEC" are to the United States Securities and Exchange Commission; |

| | • | "USD" are to United States dollars; |

| | • | "U.S. GAAP" are to generally accepted accounting principles in the United States; and |

| | • | "we", "us", "our company", "our" and "Valcent" are to Valcent Products Inc., its predecessor entities and former subsidiaries, including Nettron.com, Inc., Nettron Media Group Inc., AdventurX.com, Ironclad Systems Inc., Bikestar Rentals, Inc., Bikestar Inc., Good Times Roll Bicycle Rentals, Inc., 681673 Alberta Ltd., Arizona Outback Adventures LLC. |

Unless otherwise specified, our financial information presented in this prospectus has been prepared in accordance with Canadian GAAP.

Unless otherwise specified, all dollar amounts are expressed in Canadian dollars.

Unless otherwise specified, the information in this prospectus is set forth as of September 13, 2006, and we anticipate that changes in our affairs will occur after such date. We have not authorized any person to provide you with any information which differs from or to make representations other than those which are contained in this prospectus. Our selling shareholders are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where such offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery or of any sale of our common shares.

1

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information, including the discussion of “Risk Factors” beginning on page 8 and our financial statements and related notes beginning on page F-1, appearing elsewhere throughout this prospectus. We urge you to read this entire prospectus carefully before deciding whether to invest in the common shares offered hereby.

ABOUT OUR BUSINESS

We are a development stage company focused on the refinement and manufacture of three lines of unrelated potential consumer retail products, two of which we anticipate to begin marketing and distributing prior to the conclusion of our current fiscal year, and the third prior to the conclusion of the subsequent fiscal year. Our objective is to become a leading provider of consumer retail products in each of the respective markets for our potential product lines. To that end, we intend to use retail, wholesale, direct-response and online marketing to promote our potential products, initially concentrating on North America and ultimately expanding into European and Asian markets.

Current potential product lines under development include the:

| | • | Nova Skin Care System, which is presently in the production ramp-up phase and for which we anticipate an initial run to be completed in September 2006; |

| | • | Dust WolfTM, which is presently undergoing final engineering reviews and revisions and for which we anticipate an initial run to be completed by December 2006; and |

| | • | Tomorrow GardenTM Kit, which is presently in the very early conceptual, design and development phase and which we anticipate launching in late September 2007. |

To finance the development and manufacture of these potential product lines, and to provide working capital for pursuit of our business plan, during the period of July 25, 2005 through August 5, 2005, we consummated a series of related private offering transactions with and among a syndicated group of institutional and other investors pursuant to which we issued, in the aggregate, USD$1,277,200 in 8% per annum convertible notes and three-year warrants to acquire (i) up to an aggregate of 1,702,924 shares of common stock at prices per share of between USD$0.40 and USD$0.50, and (ii) up to an additional 1,702,924 shares of common stock at prices per share of between USD$0.90 and USD$1.00.

On April 6, 2006, in order to retire certain short-term obligations and existing liabilities and to provide additional general corporate and working capital to pursue our business plan, we consummated a follow-on private offering transaction with and among a syndicated group of institutional investors, pursuant to which we issued, in the aggregate, USD$551,666 in 8% per annum convertible notes and three-year warrants to acquire (i) up to 735,544 shares of our common stock at a price per share of USD$0.40, and (ii) up to an additional 735,544 shares of our common stock at a price per share of USD$0.90.

As part of these financing transactions, we granted certain registration rights to each of the investors pursuant to which we became committed to registering all of the shares issued as part of such transactions, including those issuable upon conversion of the notes and exercise of the warrants, by filing a registration statement on Form F-1 covering such shares within sixty days of the closing date of the July 25, 2005 through August 5, 2005 transactions, and within fourteen days of the closing date of the April 6, 2006 transaction. Under the terms in the registration provisions of the July 25, 2005 through August 5, 2005 transactions, we had until January 25, 2006 to cause such registration statement to be declared effective by the SEC, and under the terms of the registration provisions of the April 6, 2006 transaction, we had until June 5, 2006. In accordance with the terms of the registration provisions of both transactions any delays in meeting our obligations subject us to liability in an amount, payable in cash, at a rate of 2% of the outstanding amount on the convertible notes per thirty day period for the duration of any such delay.

2

On April 6, 2006 we reached a verbal agreement with the syndicated group of institutional and other investors, wherein we agreed to convert the accruing penalties associated with the July 25, 2005 through August 5, 2005 transactions, an aggregate of USD$82,200, into convertible penalty notes carrying terms similar to those notes issued in the original series of private offering transactions, and in addition to issue each investor one three-year penalty warrant for each USD$0.75 of penalties owed to purchase, in the aggregate, up to an additional 109,600 shares of common stock at a price per share of USD$0.75. As part of this verbal agreement we also granted certain additional registration rights to each of the investors pursuant to which we became committed to registering all of the shares issued as part of the July 25, 2005 through August 5, 2005 transactions as well as all of the shares issued in satisfaction of the accruing penalties within fourteen days of the closing date of the April 6, 2006 transaction, or by April 20, 2006, and to cause such registration statement to be declared effective by the SEC by June 5, 2006.

In accordance with both the terms of the registration provisions of the July 25, 2005 through August 5, 2005 transactions, as modified by the verbal agreement, and the April 6, 2006 transaction any delays in meeting our obligation to file a registration statement by April 20, 2006 subject us to liability in the form of a reduction in the exercise price of the Class A and Class B warrants issued as part of such transactions in an amount of USD$0.10 per week for the duration of any such delay.

Our registration statement on Form F-1 was originally filed with the SEC on April 27, 2006, which delay resulted in a reduction in the exercise price of the Class A and Class B warrants issued as part of the July 25, 2005 through August 5, 2005 and April 6, 2006 transactions from USD$0.50 and USD$1.00 to USD$0.40 and USD$0.90, respectively. Moreover, as of the date of this prospectus we are accruing penalties at a rate of 2% per thirty day period for having failed to have our registration statement declared effective by June 5, 2006. As of September 13, 2006, we have accrued up to approximately USD$123,094 in penalties under the terms of the registration provisions of each of the July 25, 2005 through August 5, 2005 and April 6, 2006 transactions, exclusive of those penalties previously converted into convertible penalty notes and warrants. The penalties which we have accumulated to date, and any penalties which we may accumulate for future delays, will negatively affect our business, our financial condition and our results of operations, leading to a corresponding reduction in our net income and the likelihood of a net loss for the year in which they are incurred. The delays in meeting our registration obligations are a consequence, among other reasons, of ongoing delays resulting from our having recently undergone a significant restructuring and change in business direction, and the unavailability of certain information necessary for preparing the filing. Our management is hopeful that we will cause our registration statement to be declared effective in the near future.

ABOUT OUR COMPANY

We were incorporated in accordance with the provisions of the Business Corporations Act (Alberta) on January 19, 1996, as 681673 Alberta Ltd., later changed to Ironclad Systems Inc. Beginning in 1996, following the completion of a public offering, our common shares began trading as a junior capital pool company,—a Canadian corporate structure allowing a company to raise capital and list its shares for trading prior to the establishment of a business—on the Alberta Stock Exchange (later becoming part of the Canadian Venture Exchange, which was thereafter acquired and renamed the TSX Venture Exchange). On June 30, 1998, we acquired all of the outstanding capital stock of Good Times Roll Bicycle Rentals Inc., a bicycle rental business incorporated under the Company Act (British Columbia), and of Arizona Outback Adventures LLC, an Arizona limited liability company which operated guided adventure eco-tours. We also changed our name from Ironclad Systems, Inc. to Bikestar Rentals Inc.

On May 8, 1999, while still operating our bicycle rental and eco-tour businesses through Bikestar Rentals Inc., we incorporated Nettron Media Group Inc., a wholly-owned subsidiary under the laws of the State of Texas, as a marketing enterprise focusing on products and services that could be effectively marketed through internet as well as more traditional business channels. Nettron Media Group Inc.‘s primary focus was Cupid’s Web, an interactive online dating and marketing service. We also changed our name from Bikestar Rentals Inc. to AdventurX.com, Inc., and later to Nettron.com, Inc.

In 2000, and in connection with Cupid’s Web, we signed an agreement in principle to acquire all of the outstanding capital stock of a group of companies operating a worldwide dating service franchise, as well as a collection of dating magazines and websites.

On January 1, 2001, in order to fully focus on our interactive dating and marketing services, we disposed of all of the outstanding capital stock of Arizona Outback Adventures LLC and Bikestar Rentals Inc.

3

On February 18, 2002, due to general weakness in the equity markets, we terminated the agreement in principle to acquire the dating service franchise and related businesses originally entered into in 2000. On March 24, 2004, Nettron Media Group Inc.‘s board of directors resolved to formally cease the operations, allowing the corporation’s status to lapse, after which the corporation began to explore business opportunities that might allow it to restart commercial operations.

By certificate of amendment dated April 15, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc., and on May 3, 2005 we delisted from the TSX Venture Exchange, maintaining only our OTC Bulletin Board listing and changing our symbol to “VCTPF”.

On August 5, 2005 we completed a licensing agreement with MK Enterprises LLC for the exclusive worldwide marketing rights to certain MK Enterprise potential products and a right of first offer on future potential products.

On October 19, 2005 we incorporated Valcent USA, Inc., as a wholly-owned subsidiary under the laws of the State of Nevada. In turn, Valcent USA, Inc. incorporated Valcent Management, LLC, a wholly-owned limited liability company under the laws of the State of Nevada, to serve as the general partner in Valcent Manufacturing Ltd., a limited partnership also formed by Valcent USA, Inc., under the laws of the state of Texas, wherein Valcent USA, Inc. serves as limited partner, in order to conduct operations in Texas and oversee our projects in Mexico and Arizona related to the manufacturing and assembly of our potential consumer retail products.

We are, at present, a development stage company focused on the refinement and manufacture of three lines of unrelated potential consumer retail products, two of which we anticipate to begin marketing and distributing prior to the conclusion of our current fiscal year, and the third prior to the conclusion of the subsequent fiscal year. From inception, we have generated minimal revenues and experienced negative cash flows from operating activities and our history of losses has resulted in our continued dependence on external financing. Any inability to achieve or sustain profitability or otherwise secure additional external financing, will negatively impact our financial condition and raises substantial doubts as to our ability to continue as a going concern.

Our principal executive offices are located at 420 – 475 Howe Street, Vancouver, British Columbia V6C 2B3, telephone (604) 606-7979.

4

THE OFFERING

Common shares being offered by the selling

shareholders

Maximum number of common shares to be

outstanding after this offering

Use of proceeds

Risk factors

OTC Bulletin Board Symbol | Up to 11,254,778 shares (1)

28,073,279 shares (2)

We will receive no proceeds from the resale of our

common stock in this offering. We may, however,

receive proceeds upon the exercise of some or all

of the warrants. If the warrants are exercised in

full, we would receive USD$2,655,048 in proceeds.

However, we may never actually receive these

proceeds because (i) the warrants carry a "net

cashless" exercise feature allowing the holders

thereof, under certain limited circumstances, to

exercise the warrants without payment of the stated

exercise price, and (ii) the exercise price of some

or all of the warrants may at any given time be

above the current market price of our common stock,

and therefore the warrants may never be exercised,

or, if they are exercised, but not for some time,

it would not be until then that we receive any such

proceeds. We will use the proceeds from any

exercise of the warrants for general working

capital purposes consistent with our business

strategy

See "Risk Factors" beginning on page 8 of this

prospectus for a discussion of factors you should

carefully consider before deciding to invest in

shares of our common stock.

VCTPF |

| (1) | Under this prospectus the selling shareholders are offering a total of up to 1,594,091 shares of our common stock, up to an additional 4,795,870 shares of our common stock issuable upon conversion of the principal amount of certain promissory notes, carrying interest at a rate of 8% per annum, held by our selling shareholders, together with up to 803,280 shares representing accrued interest and penalties which shares may be issued upon conversion of any accrued interest and penalties should we elect to pay any such interest and penalties in the form of registered, freely-trading common shares, rather than in cash, which determination to do so is entirely at our option in accordance with the terms of such convertible promissory notes, 1,648,875 shares of our common stock issuable upon exercise of our Class A warrants, 1,648,875 shares of our common stock issuable upon exercise of our Class B warrants, 109,600 shares of our common stock issuable upon exercise of our Class C warrants, 245,320 shares of our common stock issuable upon exercise of our Class A finder’s warrants, and 408,867 shares of our common stock issuable upon exercise of our Class B finder’s warrants. On September 29, 2006, there were 18,412,586 shares of our common stock issued and outstanding. Upon the exercise of the convertible promissory notes, including interest and penalties, and the warrants described above, the number of shares offered by this prospectus represents 61.13% of our total common stock outstanding as of September 29, 2006. |

5

| (2) | All of the shares covered by this prospectus are being registered to permit the selling shareholders and any of their respective successors-in-interest to offer the respective shares for resale from time to time. The selling shareholders are not required to sell their shares, and any sales of our common stock by the selling shareholders are entirely at their own discretion. |

6

SUMMARY FINANCIAL DATA

The following table summarizes our historical financial data, prepared in accordance with Canadian GAAP, for the periods presented. You should read the following information in conjunction with the information under “Selected Financial Data”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Risk Factors” and our audited financial statements and the notes to those financial statements appearing elsewhere in this prospectus. The summary financial data for each of the three years ended March 31, 2006, 2005 and 2004 are derived from our audited financial statements included in this prospectus. The summary financial data for each of the three months ended June 30, 2006 and 2005 are derived from our interim unaudited financial statements included in this prospectus.

| For the Years Ended March 31,

| | For the Three Months Ended June 30,*

| |

|---|

| 2006

| | 2005

| | 2004

| | 2006

| | 2005

| |

|---|

| Statement of | | | | | | | | | | | | | | | | | |

| Operations and Deficit | | |

| Loss from operations | | | $ | 3,710,644 | | $ | 46,922 | | $ | 25,885 | | $ | 2,332,942 | | | 16,442 | |

| Other income expenses | | | $ | 23,955 | | $ | (1,228 | ) | $ | (2,238 | ) | $ | (95,706 | ) | | 355 | |

| Net loss | | | $ | 3,734,599 | | $ | 45,694 | | | 23,647 | | $ | 2,237,236 | | | 16,797 | |

| Net loss (income) per | | |

| share: | | |

| Basic and diluted | | | $ | 0.354 | | $ | 0.007 | | $ | 0.004 | | $ | 0.133 | | | .004 | |

| Weighted average shares | | |

| Outstanding | | | | 10,548,042 | | | 6,435,374 | | | 6,435,374 | | | 16,830,767 | | | 3,750,125 | |

| | | |

| Balance Sheets | | |

| Total Assets | | | $ | 1,392,801 | | $ | 936 | | $ | 2,059 | | $ | 2,343,420 | | | 1,392,801 | |

| Total Liabilities | | | $ | 1,833,900 | | $ | 238,886 | | $ | 194,315 | | $ | 2,353,018 | | | 1,833,900 | |

| Shareholders' equity | | | $ | (441,099 | ) | $ | (237,950 | ) | $ | (192,256 | ) | $ | (9,598 | ) | | (441,099 | ) |

| * | Our unaudited interim financial statements for the three months ended June 30, 2006 and 2005 have been prepared by management in accordance with Canadian GAAP, and have not been reviewed by our independent auditors. |

7

RISK FACTORS

Our business entails a significant degree of risk, and an investment in our securities should be considered highly speculative. An investment in our securities should only be undertaken by persons who can afford the loss of their entire investment. The following is a general description of material risks, which may adversely affect our business, our financial condition, including liquidity and profitability, and our results of operations, ultimately affecting the value of an investment in shares of our common stock.

GENERAL BUSINESS RISKS

We are a development stage company and based on our historical operating losses and negative cash flows from operating activities there is uncertainty as to our ability to continue as a going concern.

We have a history of operating losses and negative cash flows from operating activities, resulting in our continued dependence on external financing arrangements. In the event that we are unable to achieve or sustain profitability or are otherwise unable to secure additional external financing, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our security holders losing their entire investment. Our financial statements, which have been prepared in accordance with Canadian GAAP, contemplate that we will continue as a going concern and do not contain any adjustments that might result if we were unable to continue as a going concern. Changes in our operating plans, our existing and anticipated working capital needs, the acceleration or modification of our expansion plans, lower than anticipated revenues, increased expenses, potential acquisitions or other events will all affect our ability to continue as a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview”.

From inception, we have historically generated minimal revenues while sustaining substantial operating losses and we anticipate incurring continued operating losses and negative cash flows in the foreseeable future resulting in uncertainty of future profitability and limitation on our operations.

From inception, we have generated minimal revenues and experienced negative cash flows from operating losses. We anticipate continuing to incur such operating losses and negative cash flows in the foreseeable future, and to accumulate increasing deficits as we increase our expenditures for (i) technology, (ii) infrastructure, (iii) research and development, (iv) sales and marketing, (v) interest charges and expenses related to previous equity and debt financings, and (v) general business enhancements. Any increases in our operating expenses will require us to achieve significant revenue before we can attain profitability. In the event that we are unable to achieve profitability or raise sufficient funding to cover our losses, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources”.

Our accumulated deficit makes it more difficult to borrow funds.

As of the quarter ended June 30, 2006, and as a result of historical operating losses from prior operations we had a deficit of $3,237,370 and a deficit of $5,971,835 from losses accumulated during our development stage, our total accumulated deficit was $9,209,205. Lenders generally regard an accumulated deficit as a negative factor in assessing creditworthiness, and for this reason, the extent of our accumulated deficit coupled with our historical operating losses will negatively impact our ability to borrow funds if and when required. Any inability to borrow funds, or a reduction in favorability of terms upon which we are able to borrow funds, including the amount available to us, the applicable interest rate and the collateralization required, may affect our ability to meet our obligations as they come due, and adversely affect on our business, financial condition, and results of operations, raising substantial doubts as to our ability to continue as a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview”.

Our having recently undergone a change in business direction and significant restructuring coupled with our limited experience as a publicly traded company with substantial operations in several different industries, may increase our expenses and place significant demands on our management.

8

From inception we have undergone several changes in business direction and consequently have previously had only limited operations. As a result of our most recent change in business direction, significant restructuring and our limited experience as a publicly traded company with substantial operations in several different industries, responding to our regulatory and reporting obligations could increase our general, administrative, legal and auditing costs and place substantial time demands on our management. We anticipate that, due to the increased complexity of our corporate structure and our simultaneous pursuit of various product lines in different industries, our regulatory and reporting obligations will require further expenditures to train additional personnel and retain appropriate legal and accounting professional services. In the event that these expenditures precede or are not subsequently followed by revenues or that we are unable to raise sufficient funding to cover any increase in our expenses, we may not be able to meet our obligations as they come due, and our business, financial condition, and results of operations may be negatively affected, raising substantial doubts as to our ability to continue as a going concern.

RISKS ASSOCIATED WITH OUR BUSINESSES AND INDUSTRIES

We face serious competition in our business segments from new market entrants as well as a number of established companies with greater resources and existing customer bases.

The markets for our potential products rapidly evolve and are intensely competitive as new consumer retail products are regularly introduced. Competition in our market segments is based primarily upon:

| | • | availability of financial resources; |

| | • | the quality of products; |

| | • | reviews received for products from independent reviewers who publish in magazines, websites, newspapers and other industry publications; |

| | • | availability of access to retail shelf space; |

| | • | the price of each product; and |

| | • | the number of products then available. |

We face competition from other consumer retail manufacturers, all of whom generally sell through the same combination of channels as we intend to, including retail, wholesale, direct-response and online marketing sales.

To remain competitive in our market segments we rely heavily upon what we believe to be our superior potential product quality, marketing and sales abilities, proprietary technology, product development capabilities and our management’s experience. However, we may not be able to effectively compete in these intensely competitive markets, as some of our competitors have longer operating histories, larger customer bases and greater financial, marketing, service, support, technical and other resources, affording them the ability to undertake more extensive marketing campaigns and adopt more aggressive pricing policies, than we can. Moreover, we believe that competition from new entrants will increase as the market for each of our potential products expands. If our potential product lines are not successful, our business, financial condition and results of operations will be negatively affected. See “Business—Competition”.

Our intellectual property may not be adequately protected from unauthorized use by others, which could increase our litigation costs and adversely affect our sales.

Our intellectual properties are the most important assets that we possess in our ability to generate revenues and profits and we will rely very significantly on these intellectual property assets in being able to effectively compete in our markets. However, our intellectual property rights may not provide meaningful protection from unauthorized use by others, which could result in an increase in competing products and a reduction in our own sales. Moreover, if we must pursue litigation in the future to enforce or otherwise protect our intellectual property rights, or to determine the validity and scope of the proprietary rights of others, we may not prevail and will likely have to make substantial expenditures and divert valuable resources in any case. We may not have adequate remedies if our proprietary content is appropriated. See “Business—Intellectual Property”.

9

If our potential products infringe upon proprietary rights of others, lawsuits may be brought requiring us to pay large legal expenses and judgments and redesign or discontinue selling one or more of our potential products.

We are not aware of any circumstances under which our potential products infringe upon any valid existing proprietary rights of third parties. Infringement claims, however, could arise at any time, whether or not meritorious, and could result in costly litigation or require us to enter into royalty or licensing agreements. If we are found to have infringed the proprietary rights of others, we could be required to pay damages, redesign our potential products or discontinue their sale. Any of these outcomes, individually or collectively, would negatively affect on our business, financial condition and results of operations. See “Business—Intellectual Property”.

Should our Nova Skin Care System be classified as a medical device and should we fail to obtain and maintain the necessary United States Food and Drug Administration clearances our business will be adversely affected.

Because it is not intended to treat or cure any ailment, we do not believe that our Nova Skin Care System is a medical device as defined by section 201(h) of the United States Federal Food, Drug and Cosmetic Act, however it may nevertheless be classified as such and subject to regulation by the Food and Drug Administration or other federal, state and local authorities. Generally, these regulations relate to the manufacture, labeling, sale, promotion, distribution, import, export and shipping of products that are deemed medical devices. In the United States, before a new medical device may be marketed the manufacturer must first receive, unless there exists an applicable exemption, either clearance under section 510(k) of the Federal Food, Drug and Cosmetic Act or pre-market approval from the Food and Drug Administration. The Food and Drug Administration’s 510(k) clearance process usually takes anywhere from three to twelve months, or longer, while the process of obtaining pre-market approval is much more costly and uncertain and generally takes from one to three years, or longer.

Medical devices may be marketed only for those indications for which they are approved or cleared. Should we be required to seek clearance or pre-market approval, the Food and Drug Administration may not approve or clear indications that are necessary or desirable for successful commercialization of our Nova Skin Care System. Indeed, the Food and Drug Administration may refuse requests for 510(k) clearance or pre-market approval altogether, or, if granted, clearances may be revoked if safety or effectiveness problems were to arise. If this were to occur, our business, financial condition and results of operations will be negatively affected. See “Business—Regulation”.

If we are unable to successfully break into new markets, implement our growth strategy or manage our business asit does grow, our future operating results could suffer.

As a development stage company we face several challenges in entering each of the consumer retail markets for our respective potential products, particularly consumers’ lack of awareness of our company and our potential product lines, competing for market share with established consumer retail product manufacturers and difficulties in competing for, hiring and retaining representative personnel in each of our respective potential markets. In addition, we face several challenges common to any new market entrant, including problems typically associated with unfamiliarity of local market conditions and market demographics. Each new market we enter may also have different competitive conditions, consumer tastes and discretionary spending patterns, which may require us to adjust our growth strategy or modify the way in which we manage our business. To the extent that we are unable to break into or meet the challenges associated with establishing ourselves in a new market, our future operating results could suffer and our financial condition and business may be negatively affected. See “Business—Marketing and Advertising”.

Changes in consumer preferences or discretionary spending may negatively affect our future operating results.

Within the businesses and industries in which we intend to operate—consumer retail products—revenues are largely generated by consumer preferences and discretionary spending. Our success as a potential manufacturer and retailer of consumer products will depend, in part, on the popularity of each of our potential product lines. Any shift in consumer sentiment away from our potential products or product lines could have a negative affect on our ability to achieve future profitability. Our success also depends on a number of factors affecting levels of consumer discretionary income and spending, including, the following, among other, social and economic conditions:

| | • | general business conditions; |

| | • | the availability of consumer credit; |

| | • | fuel prices and electrical power rates; |

| | • | terrorist attacks and acts of war; and |

| | o | other matters that influences consumer confidence and spending. |

Consumer purchases of discretionary items, including our potential products and product lines, could decline during periods in which discretionary income is lower or actual or perceived unfavorable economic conditions exist. Should this occurs, and if we are unable to introduce new products and product lines that consumers find appealing, our business, financial condition and results of operations will be negatively affected. See “Business—Our Potential Markets”.

We may be subject to adverse publicity or claims by consumers arising out of use of our potential product lines.

We may be subject to complaints from or litigation by consumers, whether or not meritorious, relating to quality, health or operational aspects of our potential product lines. Such claims could arise at any time and, should they arise, we may not be successful in defending them. Any litigation, regardless of the outcome, would entail significant costs and use of management time, which could impair our ability to generate revenue and profit. For these reasons or, should we be found liable with regard to a claim arising out of any of our potential product lines, our business, financial condition, and results of operations would be negatively affected.

We face substantial competition in attracting and retaining qualified senior management and key personnel and maybe unable to develop and grow our business if we cannot attract and retain senior management and key personnel as necessary, or if we were to lose our existing senior management and key personnel.

As a development stage company, our success, to a large extent, depends upon our ability to attract, hire and retain highly qualified and knowledgeable senior management and key personnel who possess the skills and experience necessary to satisfy our business and client service needs. Our ability to attract and retain such senior management and key personnel will depend on numerous factors, including our ability to offer salaries, benefits and professional growth opportunities that are comparable with and competitive to those offered by more established consumer retail product manufacturers. We may be required to invest significant time and resources in attracting and retaining, as necessary, additional senior management and key personnel, and many of the companies with which we will compete for any such individuals have greater financial and other resources which afford them the ability to undertake more extensive and aggressive hiring campaigns than we can. Furthermore, an important component to the overall compensation offered to our senior management and key personnel will be equity. If our stock prices do not appreciate over time, it may be difficult for us to attract and retain senior management and key personnel. Moreover, should we lose any members of our senior management or key personnel, we may be unable to prevent the unauthorized disclosure or use of our trade secrets, including our technical knowledge, practices, procedures or client lists by such individuals. The normal running of our operations may be interrupted, and our financial condition and results of operations negatively affected, as a result of any inability on our part to attract or retain the services of qualified and experienced senior management and key personnel, any member of our existing senior management or key personnel leaving and a suitable replacement not found, or should any of our former senior management or key personnel disclose our trade secrets. See “Business—Trade Secrets” and “Business—Employees”.

11

RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON STOCK

We have incurred and continue to face serious financial penalties for our continuing failure to meet our registration obligations under the terms of a recent series of related private offering transactions.

During the period of July 25, 2005 through August 5, 2005 we consummated a series of related private offering transactions with and among a syndicated group of institutional and other investors pursuant to which we agreed to issue, in the aggregate, USD$1,277,200 in 8% per annum convertible notes and three-year warrants to acquire (i) up to 1,702,924 shares of common stock at prices per share of between USD$0.40 and USD$0.50, and (ii) up to an additional 1,702,924 shares of common stock at prices per share of between USD$0.90 and USD$1.00. In conjunction with these private offering transactions we paid a finders’ fees of (i) USD$127,720 in cash, representing 10% of the gross proceeds realized, (ii) 425,735 shares of common stock, (iii) three-year warrants to purchase up to 255,440 shares of common stock at a price per share of USD$0.50, and (iv) three-year warrants to purchase up to 425,733 shares of common stock at a price per share of USD$0.75. As part of the financing transaction, we also granted certain registration rights to each of the investors and finders pursuant to which we became committed to registering all of the shares issued as part of such transactions, including 200% of those shares issuable upon conversion of the notes and all shares issuable upon exercise of the warrants, by filing a registration statement on Form F-1 covering such shares within sixty days of the closing date, or by September 27, 2005. Under the terms of the registration provisions, we had until January 25, 2006 to cause such registration statement to be declared effective by the SEC, with any delays in meeting this obligation subjecting us to liability in an amount, payable in cash, at a rate of 2% of the outstanding amount on the convertible notes per thirty day period for the duration of any such delay. These convertible notes are currently due and payable on demand.

As a consequence, among other reasons, of ongoing delays resulting from our having recently undergone a significant restructuring and change in business direction, and the unavailability of certain information necessary for preparing our filing we experienced delays in meeting our registration obligation under the terms of the series of related private offering transactions. As a result, on April 6, 2006, we reached a verbal agreement with the syndicated group of institutional and other investors, wherein we agreed to convert the accruing penalties associated with the July 25, 2005 through August 5, 2005 transactions, an aggregate of USD$82,200, into convertible penalty notes carrying terms similar to those notes issued in the original series of private offering transactions, and in addition to issue each investor one three-year penalty warrant for each USD$0.75 of penalties owed to purchase, in the aggregate, up to an additional 109,600 shares of common stock at a price per share of USD$0.75. As part of this verbal agreement we also granted certain additional registration rights to each of the investors pursuant to which we became committed to registering all of the shares issued as part of the July 25, 2005 through August 5, 2005 transactions as well as all of the shares issued in satisfaction of the accruing penalties within fourteen days of the April 6, 2006 agreement, or by April 20, 2006, and to cause such registration statement to be declared effective by the SEC by June 5, 2006. Furthermore, in accordance with the verbal agreement, any delays in meeting our obligation to file a registration statement by April 20, 2006 subject us to additional liability in the form of a reduction in the exercise price of the Class A and Class B warrants issued as part of the original series of related private offering transactions in an amount of USD$0.10 per week for the duration of any such delay.

On April 6, 2006, in order to retire certain short-term obligations and existing liabilities and to provide additional general corporate and working capital to pursue our business plan, we consummated a follow-on private offering transaction with and among a syndicated group of institutional investors, pursuant to which we issued, in the aggregate, USD$551,666 in 8% per annum convertible notes and three-year warrants to acquire (i) up to 735,544 shares of our common stock at a price per share of USD$0.40, and (ii) up to an additional 735,544 shares of our common stock at a price per share of USD$0.90. Subject to certain limitations, the principal amount of the

12

notes, together with any accrued interest may be converted into shares of our common stock at the lesser of (i) 70% of the average of the five lowest closing bid prices for our common stock for the ten trading days prior to conversion, or (ii) USD$0.55. The convertible notes carry a redemption feature which allows us to retire them, in whole or in part, for an amount equal to 130% of that portion of the face amount being redeemed, but only in the event that our common shares have a closing price of USD$1.50 per share for at least twenty consecutive trading days and there has otherwise been no default. The common stock purchase warrants carry a “net cashless” exercise feature allowing the holder thereof, under certain limited circumstances, to exercise the warrants without payment of the stated exercise price, but rather solely in exchange for the cancellation of that number of common shares into which such warrants are exercisable. In conjunction with these private offering transactions we also paid a finders’ fees of (i) USD$55,166 in cash, representing 10% of the gross proceeds realized, (ii) 183,886 shares of common stock, (iii) three-year warrants to purchase up to 110,320 shares of common stock at a price per share of USD$0.50, and (iv) three-year warrants to purchase up to 183,867 shares of common stock at a price per share of USD$0.75.

Our registration statement on Form F-1 was originally filed with the SEC on April 27, 2006, which delay resulted in a reduction in the exercise price of the Class A and Class B warrants issued as part of the July 25, 2005 through August 5, 2005 transactions from USD$0.50 and USD$1.00 to USD$0.40 and USD$0.90, respectively. Moreover, as of the date of this prospectus, we are accruing penalties at a rate of 2% per thirty day period for having failed to have our registration statement declared effective by June 5, 2006 in addition to other penalties. As of September 13, 2006, we have accrued $123,094 in penalties related to the registration rights granted and have included in this registration statement up to 447,614 common shares in satisfaction of this amount, exclusive of those penalties previously converted into convertible penalty notes and warrants. Our management is hopeful that we will cause such registration statement to be declared effective in the near future, however, the penalties which we have accumulated to date, and any penalties which we may accumulate for future delays, will negatively affect our business, our financial condition and our results of operations, including a corresponding reduction in our net income and the likelihood of a net loss for the year.

When our registration statement on Form F-1 is declared effective by the SEC, up to 11,254,778 shares of our common stock will become eligible for immediate public sale which is likely to have an adverse affect on the market price of our common stock.

When our registration statement is declared effective by the SEC, 1,594,091 shares of our common stock will become eligible for immediate public sale and up to 9,660,687 shares of our common stock underlying convertible notes, including interest and penalties, and warrants, upon their conversion or exercise, will be eligible for immediate public sale. As a percentage of our total outstanding common stock as of the date of the prospectus, this represents 61.13%. If a significant number of shares are offered for sale simultaneously, which is likely to occur, it would have a depressive effect on the trading price of our common stock on the public market. Any such depressive effect may encourage short positions and short sales, which could place further downward pressure on the price of our common stock. Moreover, all of the shares sold in the offering will be freely transferable thereafter without restriction or further registration under the Securities Act (except for any shares purchased by our “affiliates”, as defined in Rule 144 of the Securities Act), which could place even further downward pressure on the price of our common stock. Furthermore, should a simultaneous sell-off occur, and due to the thinly-traded market for our common stock, shareholders may have difficulty selling shares of our common stock, at or above the price paid, at a fair market value or even at all. See “Principal and Selling Shareholders” and “Plan of Distribution”.

Unless an active trading market develops for our securities, you may not be able to sell your shares.

Although, we are a reporting company and our common shares are listed on the OTC Bulletin Board (owned and operated by the NASDAQ Stock Market, Inc.) under they symbol “VCTPF”, there is not currently an active trading market for our common stock and an active trading market may never develop or, if it does develop, may not be maintained. Failure to develop or maintain an active trading market will have a generally negative affect on the price of our common stock, and you may be unable to sell your common stock or any attempted sale of such common stock may have the affect of lowering the market price and therefore your investment could be a partial or complete loss. See “Market Information”.

13

Under certain circumstances, some of our outstanding common stock purchase warrants may be exercised without our receiving any cash.

We currently have outstanding warrants to purchase up to approximately 7,499,593 shares of our common stock, each of which are exercisable on a “net cashless” basis, which means they can be exercised, without payment of the stated exercise price, solely in exchange for cancellation of that number of common shares into which the warrants are exercisable. The number of shares for which any such warrant would be cancelled under a net cashless exercise would be the number of shares having a then current market value equal to the aggregate exercise price of the warrant, in whole or in part, based on its stated exercise price. In effect, a net cashless exercise of any such warrants would mean that, even though we would receive no cash, we would have to issue additional shares, thereby diluting, potentially significantly, our reportable earnings per share. Although the circumstances under which the net cashless exercise provision may be elected by the holders of our warrants are limited, any such exercise would have a negative affect, indirectly, on the market trading price our common stock. See “Description of Securities”.

Since our common stock is thinly traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Since our common stock is thinly traded its trading price is likely to be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including:

| | • | the trading volume of our shares; |

| | • | the number of securities analysts, market-makers and brokers following our common stock; |

| | • | changes in, or failure to achieve, financial estimates by securities analysts; |

| | • | new products introduced or announced by us or our competitors; |

| | • | announcements of technological innovations by us or our competitors; |

| | • | actual or anticipated variations in quarterly operating results; |

| | • | conditions or trends in our business industries; |

| | • | announcements by us of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | • | additions or departures of key personnel; |

| | • | sales of our common stock; and |

| | • | general stock market price and volume fluctuations of publicly-traded, and particularly microcap, companies. |

You may have difficulty reselling shares of our common stock, either at or above the price you paid, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, securities class action litigation has often been initiated following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTC Bulletin Board and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

14

Trading in our common stock on the OTC Bulletin Board may be limited thereby making it more difficult for you to resell any shares you may own.

Our common stock trades on the OTC Bulletin Board (owned and operated by the NASDAQ Stock Market, Inc.). The OTC Bulletin Board is not an exchange and, because trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a national exchange or on the NASDAQ National Market, you may have difficulty reselling any of the shares of our common stock that you may own. See “Market Information”.

Our common stock is subject to the “penny stock” regulations, which are likely to make it more difficult to sell.

Our common stock is considered a “penny stock,” which generally is a stock trading under $5.00 and not registered on a national securities exchange or quoted on the NASDAQ National Market. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. These rules generally have the result of reducing trading in such stocks, restricting the pool of potential investors for such stocks, and making it more difficult for investors to sell their shares once acquired. Prior to a transaction in a penny stock, a broker-dealer is required to:

| | • | deliver to a prospective investor a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market; |

| | • | provide the prospective investor with current bid and ask quotations for the penny stock; |

| | • | explain to the prospective investor the compensation of the broker-dealer and its salesperson in the transaction; |

| | • | provide investors monthly account statements showing the market value of each penny stock held in the their account; and |

| | • | make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. |

These requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to the penny stock rules. Since our common stock is subject to the penny stock rules, investors in our common stock may find it more difficult to sell their shares.

As a foreign private issuer, we are exempt from certain informational requirements of the Exchange Act to which domestic United States issuers are subject.

As a foreign private issuer we are not required to comply with all of the informational requirements of the Exchange Act. As a result, there may be less information concerning our company publicly available than if we were a domestic United States issuer. In addition, our officers, directors and principal shareholders are exempt from the reporting and short profit provisions of Section 16 of the Exchange Act and the rules promulgated thereunder. Therefore, our shareholders may not know on a timely basis when our officers, directors and principal shareholders purchase or sell shares of our common stock. See “Additional Information”.

As we are a Canadian company with most of our assets and key personnel located outside of the United States, you may have difficulty in acquiring United States jurisdiction or enforcing a United States judgment against us, our key personnel or our assets.

We are a Canadian company organized under the Business Corporations Act (Alberta). Many of our assets and certain of our key personnel, including our directors and officers, reside outside of the United States. As a result, it may be difficult or impossible for you to effect service of process within the United States upon us or any of our key personnel, or to enforce against us or any of our key personnel judgments obtained in United States’ courts, including judgments relating to United States federal securities laws. In addition, Canadian courts may not permit you to bring an original action in Canada or recognize or enforce judgments of United States’ courts obtained against us predicated upon the civil liability provisions of the federal securities laws of the United States or of any state thereof. Furthermore, because many of our assets are located in Canada, it would be extremely difficult to access those assets to satisfy any award entered against us in a United States court. Accordingly, you may have more difficulty in protecting your interests in the face of actions taken by our management, members of our board of directors or our controlling shareholders than you would otherwise as shareholder in a United States public company.

15

We do not intend to pay any common stock dividends in the foreseeable future.

We have never declared or paid a dividend on our common stock and, because we have very limited resources and a substantial accumulated deficit, we do not anticipate declaring or paying any dividends on our common stock in the foreseeable future. Rather, we intend to retain earnings, if any, for the continued operation and expansion of our business. It is unlikely, therefore, that the holders of our common stock will have an opportunity to profit from anything other than potential appreciation in the value of our common shares held by them. If you require dividend income, you should not rely on an investment in our common stock. See “Dividend Policy”.

Future issuances of our common stock may depress our stock price and dilute your interest.

We may issue additional shares of our common stock in future financings or grant stock options to our employees, officers, directors and consultants under our stock incentive plan. Any such issuances could have the affect of depressing the market price of our common stock and, in any case, would dilute the percentage ownership interests in our company by our shareholders. In addition, we could issue serial preferred stock having rights, preferences and privileges senior to those of our common stock, including the right to receive dividends and/or preferences upon liquidation, dissolution or winding-up in excess of, or prior to, the rights of the holders of our common stock. This could depress the value of our common stock and could reduce or eliminate amounts that would otherwise have been available to pay dividends on our common stock (which are unlikely in any case) or to make distributions on liquidation. See “Share Capital”.

16

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

This prospectus, press releases and certain information provided periodically in writing or orally by our officers or our agents contain statements which constitute forward-looking statements. The words “may”, “would”, “could”, “expect”, “estimate”, “anticipate”, “believe”, “intend”, “plan”, “goal”, and similar expressions and variations thereof are intended to specifically identify forward-looking statements. These statements appear in a number of places in this prospectus and include all statements that are not statements of historical fact regarding the intent, belief or current expectations of us, our directors or our officers, with respect to, among other things: (i) our liquidity and capital resources, (ii) our financing opportunities and plans, (iii) our ability to attract customers to generate revenues, (iv) competition in our business segment, (v) market and other trends affecting our future financial condition or results of operations, (vi) our growth strategy and operating strategy, and (vii) the declaration and/or payment of dividends.

Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Factors that may cause such differences include, among others, those discussed in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections. Except as required by law, we undertake no obligation to update any of the forward-looking statements in this prospectus after the date hereof.

MARKET INFORMATION

The following table sets forth certain information regarding the price history of our common shares, including (i) annual high and low market prices for each of the five most recent fiscal years, (ii) quarterly high and low market prices for each full quarter of the two most recent fiscal years, and (iii) monthly high and low market prices for each month of the six most recent months. The prices have been adjusted to reflect a one-for-three common share consolidation effective May 3, 2005.

At present and since May 3, 2005, our common shares are quoted solely on the United States OTC Bulletin Board, under the symbol “VCTPF” (formerly “NTTRF”). Effective May 3, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc. and delisted our common shares from the TSX Venture Exchange, where we had been trading under the symbol “NTT.H”, maintaining only our listing only on the OTC Bulletin Board. Prior to our delisting from the TSX Venture Exchange we had been quoted thereon under the symbol “NTT.H” from August 18, 2003 though May 2, 2005, “NTT.T” from February 18, 2003 to August 17, 2003 and “NTT” prior to February 18, 2003.

| | OTC Bulletin Board

(USD) | | TSX Venture Exchange

(CND) | |

|---|

Period

| High

| Low

| High

| Low

|

|---|

| Fiscal year ended March 31, | | | | | | | | | | | | | | |

| 2002 | | | $ | 0 | .75 | $ | 0 | .03 | $ | 1 | .35 | $ | 0 | .060 |

| 2003 | | | $ | 0 | .30 | $ | 0 | .00 | $ | 1 | .17 | $ | 0 | .030 |

| 2004 | | | $ | 0 | .07 | $ | 0 | .01 | $ | 0 | .09 | $ | 0 | .030 |

| 2005* | | | $ | 0 | .60 | $ | 0 | .03 | $ | 0 | .55 | $ | — | |

| 2006 | | | $ | 0 | .95 | $ | 0 | .25 | $ | — | | $ | — | |

| | | | | |

| Quarter ended | | |

| September 30, 2003 | | | $ | 0 | .07 | $ | 0 | .03 | $ | 0 | .06 | $ | 0 | .030 |

| December 31, 2003 | | | $ | 0 | .07 | $ | 0 | .03 | $ | 0 | .09 | $ | 0 | .060 |

| March 31, 2004 | | | $ | 0 | .06 | $ | 0 | .01 | $ | 0 | .09 | $ | 0 | .090 |

| June 30, 2004 | | | $ | 0 | .03 | $ | 0 | .03 | $ | 0 | .09 | $ | 0 | .075 |

| September 30, 2004* | | | $ | 0 | .03 | $ | 0 | .03 | $ | — | | $ | — | |

| December 31, 2004* | | | $ | 0 | .06 | $ | 0 | .03 | $ | — | | $ | — | |

| March 31, 2005* | | | $ | 0 | .60 | $ | 0 | .03 | $ | — | | $ | — | |

| June 30, 2005 | | | $ | 0 | .65 | $ | 0 | .36 | $ | — | | $ | — | |

| September 30, 2005 | | | $ | 0 | .57 | $ | 0 | .40 | $ | — | | $ | — | |

| | | | |

17

| | | | | |

|---|

|

|

|

|

|

|---|

| December 31, 2005 | | | $ | 0 | .750 | $ | 0 | .410 | $ | — | | $ | — | |

| March 31, 2006 | | | $ | 0 | .600 | $ | 0 | .330 | $ | — | | $ | — | |

| June 30, 2006 | | | $ | 0 | .950 | $ | 0 | .520 | $ | — | | $ | — | |

| | | | | |

| Month ended | | |

| February 28, 2006 | | | $ | 0 | .570 | $ | 0 | .450 | $ | — | | $ | — | |

| March 31, 2006 | | | $ | 0 | .880 | $ | 0 | .520 | $ | — | | $ | — | |

| April 30, 2006 | | | $ | 0 | .409 | $ | 0 | .303 | $ | — | | $ | — | |

| May 31, 2006 | | | $ | 0 | .500 | $ | 0 | .410 | $ | — | | $ | — | |

| June 30, 2006 | | | $ | 0 | .840 | $ | 0 | .700 | $ | — | | $ | — | |

| July 31, 2006 | | | $ | 0 | .740 | $ | 0 | .520 | $ | — | | $ | — | |

| August 31, 2006 | | | $ | 0 | .700 | $ | 0 | .500 | $ | — | | $ | — | |

| | | | |

| * | Historical price information for shares of our common stock traded on the TSX Venture Exchange between September 2004 and May 2005 could not reasonably be obtained. We voluntarily delisted from then TSX Venture Exchange on May 3, 2005. |

USE OF PROCEEDS

We will receive no proceeds from the resale of our common stock in this offering. We may, however, receive proceeds upon the exercise of some or all of the registrable warrants (the “Registration Warrants”) which are warrants that are included in this registration statement and the company is committed to register as such. If the registration warrants are exercised in full, we would receive USD$2,655,048in proceeds. However, we may never actually receive these proceeds because (i) the warrants carry a “net cashless” exercise feature allowing the holders thereof, under certain limited circumstances, to exercise the warrants without payment of the stated exercise price, and (ii) the exercise price of some or all of the warrants may at any given time be above the current market price of our common stock, and therefore the warrants may never be exercised, or, if they are exercised, but not for some time, it would not be until then that we receive any such proceeds.

If all of the warrants are exercised, we would realize approximately USD$2,655,048in net proceeds, and, although subject to adjustment, we intend to use the net proceeds from this offering as follows:

| |

|---|

| Product Development and marketing | | | $ | 2,400,000 | |

| Other Working Capital Needs | | | $ | 255,048 | |

|

| |

| Total Net Proceeds | | | $ | 2,655,048 | |