VALCENT PRODUCTS INC.

THE ATTACHED UNAUDITED INTERIM FINANCIAL STATEMENTS FORM AN INTEGRAL PART OF THIS MANAGEMENT DISCUSSION AND ANALYSIS AND ARE HEREBY INCLUDED BY REFERENCE

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

By certificate of amendment dated April 15, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan. On May 3, 2005 we delisted from the TSX Venture Exchange, maintaining only our OTC Bulletin Board listing and changing our symbol to “VCTPF”. Effective May 3, 2005, and in order to render our capital structure more amenable to contemplated financing, we effected a consolidation of our common shares on a one-for-three-basis. Unless otherwise noted, all references to the number of common shares are stated on a post-consolidation basis. All amounts are stated in Canadian dollars unless otherwise noted.

Fundamental Transaction

On August 5, 2005, we completed a licensing agreement with Pagic LLP, formerly MK Enterprises LLC, (“Pagic”) for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products.

On October 19, 2005, we incorporated Valcent USA, Inc., as a wholly-owned subsidiary under the laws of the State of Nevada. In turn, Valcent USA, Inc. incorporated Valcent Management, LLC, a wholly-owned limited liability company under the laws of the State of Nevada, to serve as the general partner in Valcent Manufacturing Ltd., a limited partnership also formed by Valcent USA, Inc., under the laws of the state of Texas, wherein Valcent USA, Inc. serves as limited partner, in order to conduct operations in Texas and oversee our projects in Mexico and Arizona related to the manufacturing and assembly of our potential consumer retail products.

During the year ended March 31, 2007, the Company incorporated Valcent Products EU Limited in England to conduct future anticipated operations in Europe.

We are, at present, a development stage company focused primarily (i) the development of a commercial biodiesel feed stock technology via a joint venture with Global Green Solutions, Inc. (“Global Green”), (ii) the development of and direct sales initiatives relating to our Nova Skin Care System, and (iii) the development and anticipated marketing of the Tomorrow GardenTM consumer retail product in our UK based subsidiary. From inception, we have generated minimal revenues and experienced negative cash flows from operating activities and our history of losses has resulted in our continued dependence on external financing. Any inability to achieve or sustain profitability or otherwise secure additional external financing, will negatively impact our financial condition and raises substantial doubts as to our ability to continue as a going concern.

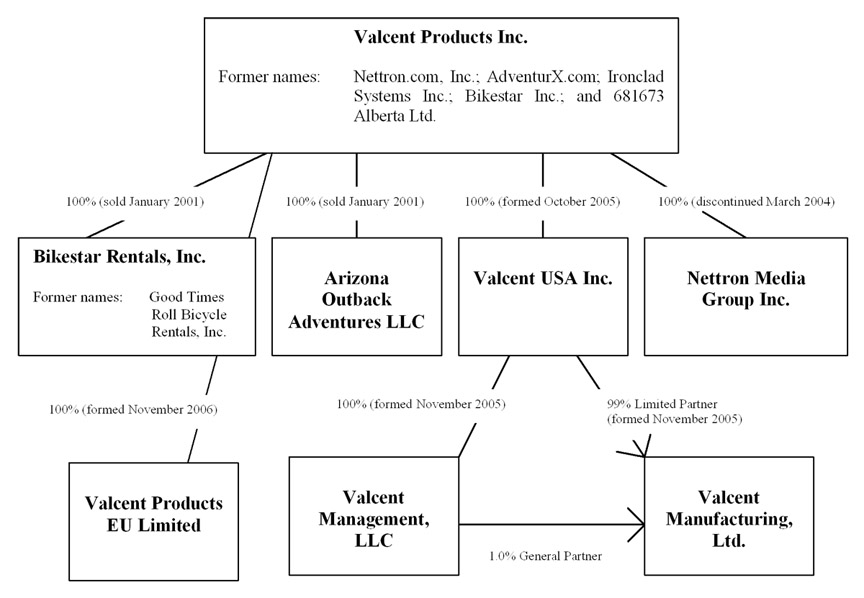

Organizational Structure

The following organizational chart sets forth our corporate structure and reflects historical changes in our corporate name and the names of our various entities.

Corporate History

We were incorporated in accordance with the provisions of the Business Corporations Act (Alberta) on January 19, 1996, as 681673 Alberta Ltd., later changed to Ironclad Systems Inc. Beginning in 1996, following the completion of a public offering, our common shares began trading as a junior capital pool company on the Alberta Stock Exchange (later becoming part of the Canadian Venture Exchange, which was thereafter acquired and renamed the TSX Venture Exchange). On June 30, 1998, we acquired all of the outstanding capital stock of Good Times Roll Bicycle Rentals Inc., a bicycle rental business incorporated under the Company Act (British Columbia), and of Arizona Outback Adventures LLC, an Arizona limited liability company which operated guided adventure eco-tours. We also changed our name from Ironclad Systems, Inc. to Bikestar Rentals Inc.

On May 8, 1999, while still operating our bicycle rental and eco-tour businesses through Bikestar Rentals Inc., we incorporated Nettron Media Group Inc., a wholly-owned subsidiary under the laws of the State of Texas, as a marketing enterprise focusing on products and services that could be effectively marketed through internet as well as more traditional business channels. Nettron Media Group Inc.’s primary focus was Cupid’s Web, an interactive online dating and marketing service. We also changed our name from Bikestar Rentals Inc. to AdventurX.com, Inc., and later to Nettron.com, Inc.

Corporate History (continued)

In 2000, and in connection with Cupid’s Web, we signed an agreement in principle to acquire all of the outstanding capital stock of a group of companies operating a worldwide dating service franchise, as well as a collection of dating magazines and websites.

On January 1, 2001, in order to fully focus on our interactive dating and marketing services, we disposed of all of the outstanding capital stock of Arizona Outback Adventures LLC and Bikestar Rentals Inc.

On February 18, 2002, due to general weakness in the equity markets, we terminated the agreement in principle to acquire the dating service franchise and related businesses originally entered into in 2000. On March 24, 2004, we disposed of our interest in Nettron Media Group Inc. and began exploring business opportunities that might allow us to restart commercial operations.

By certificate of amendment dated April 15, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan. On May 3, 2005 we delisted from the TSX Venture Exchange, maintaining only our OTC Bulletin Board listing and changing our symbol to “VCTPF”. Effective May 3, 2005, and in order to render our capital structure more amenable to contemplated financing, we effected a consolidation of our common shares on a one-for-three-basis. Unless otherwise noted, all references to the number of common shares are stated on a post-consolidation basis.

On August 5, 2005, we completed a licensing agreement with Pagic LLP for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products.

CurrentLicense Agreements

On July 29, 2005, we entered into five related definitive agreements (the “Pagic Agreements”) with Pagic LP (formerly MK Enterprises LLC), an entity controlled by Malcolm Glen Kertz, our current Chief Executive Officer, acting President, Chairman and a member of our board of directors, including:

| (i) | a master license agreement for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to three unrelated and proprietary potential consumer retail products that had previously been developed (the “Pagic Master License”), certain of which are patent pending by Pagic, including the Nova Skin Care System, the Dust WolfTM, and the Tomorrow Garden TM Kit (collectively, and together with any improvements thereon, the “Initial Products”); |

| (ii) | the Pagic Master License also includes a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Initial Products (the “Initial Ancillaries”); |

| (iii) | a product development agreement pursuant to which we were granted a right for an initial period of five years to acquire a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any new products developed by Pagic (any such products, collectively, the “Additional Products”, and, the agreement itself, the “Pagic Product Development Agreement”); |

| (iv) | the Pagic Product Development Agreement also includes a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Additional Products (the “Additional Ancillaries”); and |

| (v) | a related services agreement pursuant to which Pagic shall provide consulting support in connection with the Initial Products, the Initial Ancillaries, the Additional Products and the Additional Ancillaries (the “Pagic Consulting Agreement”), in exchange for the following: |

| 1) | 20,000,000 shares of our common stock which have been issued; |

| 2) | a one-time US$125,000 license fee (paid); |

| 3) | reimbursement for US$125,000 in development costs associated with each of the Initial Products since March 17, 2005 (paid); |

Corporate History (continued)

| 4) | consulting fees of US$156,000 per year, payable monthly in advance, which the Company has paid to date; and |

| 5) | the greater of the following, payable annually beginning in the second license year (beginning April 1, 2007): |

(i) US$400,000 inclusive of all consulting fees, royalty and other fees; or

(ii) the aggregate of the following:

| 6) | subject to a minimum amount of US$37,500 per Initial Product during the second year of the Pagic Master License, and $50,000 US$ each year thereafter, continuing royalties payable quarterly at a rate of: |

| Ø | US$10.00 US per Nova Skin Care System unit sold; |

| Ø | US$2.00 per Dust WolfTM unit sold; |

| Ø | 4.5% of annual net sales of the Tomorrow GardenTM Kit; and |

| Ø | 3% of annual net sales of Initial Ancillaries. |

| 7) | a one-time $50,000 US license fee for each Additional Product licensed (except for one pre-identified product); and |

| 8) | subject to a minimum amount of US$50,000 per year commencing with the second year of each corresponding license, continuing royalties of 4.5% of annual net sales and 3% on annual net sales of any Additional Ancillaries. |

Global Green Joint Venture and License Arrangements

Beginning on October 2, 1006, we granted certain rights to Global Green relating to our joint venture of our high density vertical bio-reactor technology named “Vertigro”, an algae based biodiesel feedstock initiative. Refer to “PLAN OF OPERATIONS, High Density Vertical Bio-Reactor and Global Green Joint Venture”.

PLAN OF OPERATIONS

From inception we have generated minimal revenues from our business operations and have traditionally met our ongoing obligations by raising capital through external sources of financing.

At present, we do not believe that our current financial resources are sufficient to meet our working capital needs in the near term or over the next twelve months and, accordingly, we will need to secure additional external financing to continue our operations. We anticipate raising additional capital though further private equity or debt financings and shareholder loans. If we are unable to secure such additional external financing, we may not be able to meet our obligations as they come due or to fully implement our intended plan of operations, as set forth below, raising substantial doubts as to our ability to continue as a going concern.

Our plan of operations over the course of the next twelve months is to focus primarily on the continued development, marketing and distribution of each of our lines of potential consumer retail products and the development via joint venture of our high density vertical bioreactor technology named “Vertigro”, an algae based biodiesel feedstock initiative. In connection therewith and for each of our potential product lines:

• Jack Potts, our Vice President, Sales and Marketing - Consumer Products Division, Valcent Manufacturing Ltd., is responsible for formulating, managing and overseeing all aspects our consumer products marketing strategies, including our retail, infomercial and cable television shopping network strategies and sales. He is also be responsible for working with our advertising agency contracts in facilitating our entry and sustainability in the direct-response, online and consumer retail marketing segments; and

• Forrest Ely, our Chief Operating Officer (effective January 1, 2007), Valcent Manufacturing Ltd., under the direction of M. Glen Kertz, our acting President and Chief Executive Officer, is responsible for overseeing all aspects of our manufacturing, production and product fulfillment activities. He will also aid in the design and engineering of overall Vertigro development, including the procurement of certain materials and components necessary for manufacture and assembly of our existing potential products, and build out of our research facility being developed via joint venture.

PLAN OF OPERATIONS(continued)

More specifically, our plan of operations with respect to each of our lines of potential consumer retail products and commercial biodiesel feed stock initiative is provided as follows:

High Density Vertical Bio-Reactor and Global Green Joint Venture

We are in the development stages of creating technology for a High Density Vertical Bio-Reactor. The objective of this technology is to produce a renewable source of biodiesel by utilizing the waste gas of carbon dioxide capable of growing micro-algae. Our High Density Vertical Bio-Reactor is configured in a manner intended to promote the rapid growth of various forms of micro-algae which is later processed to remove volatile oils suitable for the production of biodiesel. The design of our technology allows the reactors to be stacked on a smaller foot print of land than traditional growing methods require. We believe a secondary potential markets for this technology include industrial, commercial and manufacturing businesses that produce carbon dioxide emissions. We hope to launch this technology by December 2007, however, this date may be delayed for several reasons, including but not limited to the availability of financing and delays in the successful or economically viable development of the technology.

On October 2, 2006, the Company entered into a letter agreement with Pagic, West Peak Ventures of Canada Limited (“West Peak”) and Global Green whereby Global Green agreed to fund the next phase of the development of our High Density Vertical Bio-Reactor technology (the “GGS Agreement”). Pursuant to the GGS Agreement, Valcent and Global Green established a commercial joint venture, named “Vertigro,” in which Global Green has agreed to provide up to US$3,000,000 in funding to continue the research and development of the Bio-Reactor technology, construct a working prototype of the Bio-Reactor and develop the technology for commercial uses. The Company is obligated to provide product support, research and development, and the non-exclusive use of our warehouse and land near El Paso, Texas, as necessary for which Global Green has agreed to reimburse the Company as part of its US$3,000,000 commitment. Until such time as the joint venture has fully repaid the US$3,000,000, Global Green will have an 80% joint venture interest, leaving the Company with a 20% carried joint venture interest, both subject to an aggregate product license royalty of 0.9% to Pagic and West Peak. Once the joint venture has repaid Global Green the US$3,000,000, Global Green’s interest will be reduced to 70% and the Company will retain a 30% non-carried interest, both subject to an aggregate product license royalty of 4.5% to Pagic and West Peak.

In conjunction with the GGS Agreement, the Company acquired approximately six acres of land in Anthony, Texas for approximately $275,240.

As at June 30, 2007, Global Green had incurred and paid a total of US$3,000,000 in costs related to the GGS Agreement and at that date, the Joint venture had also further incurred an additional $409,520. Joint venture related costs exceeding the aggregate of US$3,000,000 are funded on a 50/50% basis by Global Green and the Company. As a result, the Company’s portion of amounts it has contributed in the amount of $204,760 has been capitalized.

On July 9, 2007, effective June 25, 2007, the parties to the Global Green Agreement entered into the Vertigro Algae Stakeholders Letter of Agreement (the “Global Green Joint Venture”) which replaced the Global Green Agreement. Pursuant to the new agreement each of Global Green and the Company will hold a 50% interest in the Global Green Joint Venture, subject to an aggregate 4.5% royalty to Pagic and West Peak. The Global Green Joint Venture covers the Bio-Reactor and any subsequent related technologies for the commercial scale products of algae based biomass for all industrial commercial and retail applications including but not limited to biofuel, food, and health, pharmaceutical, animal and agricultural feeds.

Nova Skin Care System

Our Nova Skin Care System is presently in the early production and initial sales phase. We finalized an agreement with Solid Integrations, LLC, located in the city of Ciudad Juarez, Chihuahua, Mexico, for the manufacture and assembly of our Nova Skin Care System. All of the raw material components, tooling and fixtures, as well as the packaging and the associated creams and lotions that will be included with the Nova Skin Care System have been procured. We have retained Arizona Natural Resources, Inc., a private label and contract cosmetic manufacturing firm, located in Phoenix, Arizona, to formulate and manufacture the creams and lotions to our specifications which are included with our Nova Skin Care System; all of the finished creams and lotions have been shipped to our contracted warehouse and distribution points in El Paso, Texas, and will be exported to Solid Integrations, LLC in Chihuahua, Mexico, for final assembly and packaging. During the year ended March 31, 2007, we have received our initial raw material component shipments, have exported such components to Solid Integrations, LLC with some 16,000+ units of the Nova Skin Care System assembled and packaged for resale, with up to 20,000 total units to be assembled as part of the initial production order.

PLAN OF OPERATIONS(continued)

Nova Skin Care System(continued)

During the year ended March 31, 2007, we developed an infomercial to introduce and sell Nova Skin Care System. We continue to test market an infomercial revenue driver which aired in late December 2006 and has been subsequently modified for commercial with increasing media purchases to air throughout the 2007 calendar year. We have engaged Hawthorne Direct, Inc., a full service direct response television advertising agency, for this purpose. We have entered into a contract with InPulse Response Group of Scottsdale, Arizona to provide telemarketing services related to the Nova infomercial. We have also engaged Wells Fargo Bank, N.A. to provide merchant processing services for credit card transactions. We have also entered into an agreement with Accretive Commerce of Huntersville, North Carolina to provide order entry, data processing, customer service, and product fulfillment services.

We anticipate that the revenue derived from our infomercial presence will represent our first revenue from operations. We are also in the beginning stages of developing contacts with and introducing our Nova Skin Care System line of products to several cable television shopping networks and retail outlets in the United States. We hope to negotiate a sales package with one such shopping network and to begin showcasing our Nova Skin Care System line of products thereon sometime within the next three to six months. Based on the consumer dictated sales response from such activities, factory production will be modified to meet such any demand, and to regulate our “on-hand” inventory threshold.

Tomorrow GardenTM

Our Tomorrow GardenTM Kit is an indoor herb garden kit, designed to offer, direct to the consumer, an easy to use kit featuring herbs and plants not otherwise readily available in the marketplace. Glen Kertz, our President, has conducted twelve (12) years of research in the development, processes and techniques underlying the technology in the Tomorrow GardenTM and based on his research believes that the Tomorrow GardenTM Kit offers an improved plant lifespan of three to six months, as opposed to the traditional shelf life of approximately seven to ten days for fresh herbs, and requires only ambient light, with no watering or other maintenance, to survive. Our Tomorrow GardenTM Kit will be capable of supplying all of the standard herbs traditionally offered in grocery shops today, such as basil, mint, thyme, rosemary, parsley and cilantro, but may, in addition, supply more exotic herbs or pharmaceutical grade plants. Our Tomorrow GardenTM Kit is currently in the early conceptual, design and development phase operating out of our offices located in London, England.

Dust WolfTM

Due to the Company’s focus on it other products and subject to an internal engineering review, the Company has no immediate plans to further the development and marketing of the Dust WolfTM blind cleaning vacuum system at this time. Reassessment and evaluation of this project will be undertaken during the next 12 months.

PLAN OF OPERATIONS(continued)

Fluctuations in Results

During the period from March 24, 2004 through the year ended March 31, 2005, we had no meaningful operations and focused exclusively on identifying and adopting a suitable business plan and securing appropriate financing for its execution. As a result of the Company completing a licensing agreement with Pagic for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products during the fiscal year ended March 31, 2006 operating results have fluctuated significantly and past performance should not be used as an indication of future performance.

Valcent Products Inc. [formerly Nettron.Com, Inc.] | |

| Selected Financial Data [Annual] | |

| (Expressed in Canadian Dollars) | |

| | | 12 months ended | |

| | | 2007 | | | 2006 | | | 2005 | |

| Net Operating Revenues | | $ | | | | | 0 | | | | 0 | |

| Loss from operations | | $ | 10,939,571 | | | | 3,734,599 | | | | 45,694 | |

| Loss from prior operations | | $ | 0 | | | | 0 | | | | 45,694 | |

| Loss from development stage | | $ | 10,939,571 | | | | 3,734,599 | | | | 0 | |

| Net loss per Canadian GAAP | | $ | 10,939,571 | | | | 3,734,599 | | | | 45,694 | |

| Loss per share | | $ | 0.57 | | | | 0.35 | | | | 0.01 | |

| | | | | | | | | | | | | |

| Share capital | | $ | 7,836,903 | | | | 4,099,870 | | | | 2,999,420 | |

| Common shares issued | | | 30,666,068 | | | | 15,787,835 | | | | 6,435,374 | |

| Weighted average shares outstanding | | | 19,261,192 | | | | 10,548,042 | | | | 6,435,374 | |

| Total Assets | | $ | 4,071,414 | | | | 1,392,801 | | | | 936 | |

| Total Liabilities | | $ | (6,725,528 | ) | | | (1,833,900 | ) | | | (237,950 | ) |

| | | | | | | | | | | | | |

| Cash Dividends Declared per Common Shares | | $ | 0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | |

Exchange Rates (CDN $ to US $) yearly average | | $ | 0.8783 | | | | 0.8385 | | | | 0.7824 | |

Selected Quarterly Financial Data

Valcent Products Inc. [formerly Nettron.com, Inc.] | |

Selected Financial Data [Quarterly - unaudited] | |

(Expressed in Canadian Dollars) | |

| | | Quarter Ended | |

| | | 06/30/07 | | | 03/31/07 | | | 12/31/06 | | | 09/30/06 | | | 06/30/06 | | | 03/31/2006 | | | 12/31/2005 | | | 9/30/2005 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Operating Revenues | | $ | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Loss from operations | | $ | 1,283,819 | | | | 5,809,377 | | | | 1,640,079 | | | | 1,072,871 | | | | 2,332,942 | | | | 2,352,734 | | | | 553,653 | | | | 787,815 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss per Canadian GAAP | | $ | 930,968 | | | | 5,893,679 | | | | 1,640,079 | | | | 1,072,871 | | | | 2,332,942 | | | | 2,366,470 | | | | 563,517 | | | | 787,815 | |

| Loss per share from | | $ | 0.03 | | | | 0.30 | | | | 0.08 | | | | 0.06 | | | | 0.13 | | | | 0.23 | | | | 0.04 | | | | 0.07 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share capital | | $ | 9,263,342 | | | | 7,836,903 | | | | 6,248,788 | | | | 5,310,532 | | | | 5,020,096 | | | | 4,099,870 | | | | 4,099,870 | | | | 4,021,337 | |

| Common shares issued | | | 32,928,193 | | | | 30,666,068 | | | | 20,490,118 | | | | 18,412,586 | | | | 17,982,586 | | | | 15,787,835 | | | | 15,787,835 | | | | 14,217,177 | |

| Weighted average shares outstanding | | | 32,134,177 | | | | 20,845,592 | | | | 20,154,165 | | | | 18,183,564 | | | | 16,830,767 | | | | 10,289,200 | | | | 15,361,026 | | | | 10,690,235 | |

| Total Assets | | $ | 4,520,482 | | | | 4,071,414 | | | | 4,754,333 | | | | 2,871,702 | | | | 2,343,420 | | | | 1,392,801 | | | | 1,588,598 | | | | 2,028,815 | |

| Net assets (liabilities) | | $ | (-2,019,941 | ) | | | (2,654,114 | ) | | | (785,974 | ) | | | (664,990 | ) | | | (1,387,527 | ) | | | (449,114 | ) | | | (26,228 | ) | | | 477,289 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Dividends Declared per Common Shares | | $ | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

QUARTER ENDED JUNE 30, 2007 COMPARED WITH QUARTER ENDED JUNE 30, 2006

OVERVIEW OF THE QUARTER’S ACTIVITIES:

During the quarter ended June 30, 2007, we focused (i) the development of a commercial biodiesel feed stock technology via a joint venture with Global Green, (ii) the development of product inventories and direct sales initiatives relating to our Nova Skin Care System, (iii) the development and anticipated marketing of the Tomorrow GardenTM consumer retail product in our UK based subsidiary and, (iv) on a series of private offering transactions with institutional and other investors, pursuant to which we raised $1,268,000 through the issuance of units of private placement comprised of common shares and warrants.

Operating Results

We incurred losses of $930,968 for the quarter ended June 30, 2007, as compared to $2,237,236 for the quarter ended June 30, 2006. The decrease in loss when comparing the two periods is largely a result of the increase in expenses associated with $186,801 and $1,084,194 in non-cash charges for convertible note issuance and non-cash financing expenditures incurred respectively during the three months ended June 30, 2006 which did not happen in 2007.

Revenues

For the quarters ended June 30, 2007 and June 30, 2006, we had no revenues.

Operating Expenses

Product development expenses decreased by $186,287 to $444,260 for the quarter ended June 30, 2007 as compared with $630,547 the quarter ended June 30, 2006. The decrease is due to the concentration of effort on the Company’s Global Green joint venture project and recoveries of expenditures made by Global Green according to the GGS Agreement. For the quarter ended June 30, 2007, recoveries of approximately $107,290 in connection with Nova Skin Care Systems product sales testing was netted against product development costs.

The Company incurred $0 in non-cash financing expense in the three month period ended June 30, 2007, as compared with $1,084,194 that had been incurred during the quarter ended June 30, 2006 due to the convertible debenture funding activity incurred during the first fiscal quarter of 2007 fiscal year.

Advertising and media development was $339,895 during the quarter ended June 30, 2007 (2006 $0) in connection with the development of marketing systems that include infomercial media purchases in connection with the sales launch of our Nova Skin Care System that commenced in January, 2007.

As a result of the vesting of options to directors, officers, employees and consultants the Company under the Company’s stock option plan and contractual issuances of common shares for the provision of services rendered to the Company, the Company incurred stock based compensation expenses of $87,425 during the three month period ended June 30, 2007 (2006 - $50,605).

Professional fees decreased by $80,847 to $54,788 for the quarter ended June 30, 2007 from $135,635 for the quarter ended June 30, 2006. The decrease is primarily attributable to costs associated with funding initiatives conducted during the quarter ended June 30, 2006.

Travel expenses increased by $10,103 to $37,483 (2006 - $27,380) for the quarter ended June 30, 2007 as a result of increased activity in the Company’s operations, product development, as well as contract manufacturing located in Mexico, and increase marketing media development.

Rent expenses increased $6,919 to $21,266 for the three months ended June 30, 2007 from $14,347 for the three months ended June 30, 2006. The increase is due to costs incurred relates to increasing product development expenditure affecting our warehouse and distribution center space in El Paso, Texas.

Office and miscellaneous expenses increased $13,606 to $38,845 for three months ended June 30, 2007 from $25,239 for the three months ended June 30, 2006. The increase is due to costs incurred in relation to the increasing scale and scope of our administrative operations relating to our El Paso, Texas office, and increased administrative resources in Vancouver, B.C. Canada.

QUARTER ENDED JUNE 30, 2007 COMPARED WITH QUARTER ENDED JUNE 30, 2006 (continued)

Operating Expenses (continued)

Filing and transfer agent expenses increased approximately $3,771 to $10,847 for the three months ended June 30, 2007, from $7,076 for the three months ended June 30, 2006. The increase is primarily attributable to costs associated with increasing scale and scope of business activity and regulatory filings required in the circumstances.

Investor relations fees increased $57,939 to $159,017 (2006 - $101,078) for the three months ended June 30, 2007 as a result of the amortization of three separate investor and public relations contract amounts paid in common shares.

Interest expense increased $18,351 to $81,986 (2006 - $63,635) for the three months ended June 30, 2007 as a result of an increasing number of debt instruments issued from ongoing financing activity, and long term debt incurred for our Texas located lands acquired for research relating to the Company’s development of its “Vertigro” algae based biodiesel feedstock joint venture initiative and its “Tomorrow Garden” consumer product development. Interest on long term debt increased to $1,869 (2006 - $0).

The Company did not incur any charges for convertible note issuance and non-cash financing expenditures during the three months ended June 30, 2007. The Company incurred $186,801 and $1,084,194 in charges for convertible note issuance and non-cash financing expenditures incurred respectively during the three months ended June 30, 2006 in connection with convertible note financings undertaken in the 2007 fiscal year.

As a result of increasing operating capacity at our El Paso, Texas operation, the Company purchased $310,619 (2006 - $72,709) in fixed assets during the year ended March 31, 2007 and incurred a depreciation and amortization charge of $8009 in the three months ended June 30, 2007 (2006 - $6,405).

Due to fluctuations in the United States dollar in relation to the Canadian dollar, the Company incurred a foreign exchange gain of $352,851 (2006 – $96,706) during the three months ended June 30, 2007.

Net Loss

Our reported loss increased by $930,968 ($0.03 basic loss per share) during the three months ended June 30, 2007 as compared to an increase of $2,237,236 ($0.13 basic loss per share) for the same quarter ending June 30, 2006. The decrease in loss when comparing the two periods is largely a result of the increase in expenses associated with $186,801 and $1,084,194 in non-cash charges for convertible note issuance and non-cash financing expenditures incurred respectively during the three months ended June 30, 2006 which did not happen in 2007. Cash costs rose in aggregate during the three months ended June 30, 2007 when compared to the same interval in 2006 in most other cost categories due to increasing scale and scope of business operations especially as they relate to the Company’s Nova Skin Care System and marketing initiatives under deployment. Certain costs however such as product development were partially reimbursed by Global Green in the development its Vertigro algae based bio-diesel initiative leading to lower product development expenditures during the three months ended June 30, 2007 when comparing the same three month interval in 2006.

Liquidity and Capital Resources

Because we are organized in Canada, our June 30, 2007 financial statements have been prepared by our management in accordance with Canadian GAAP (generally accepted accounting principles) applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business.

Our accumulated losses during the development stage increased by $930,968 to $15,605,138 during the three months ended June 30, 2007. This loss is largely due to the increase in expenses associated with product development and marketing initiatives, and Company consulting arrangements relating to increasing scale and scope of business operations. Our working capital deficit decreased by $414,484 to $3,815,856 as at June 30, 2007 compared to $1,387,527 as at June 30, 2006. As described in Note 1 to our June 30, 2007 interim consolidated financial statements, these conditions raise substantial doubt as to our ability to continue as a going concern.

We raised $0 and $1,415,436 in net cash proceeds from the issuance of convertible debentures and the issuance of common shares respectively during the three months ended June 30, 2007, as compared to $646,783 and $737,828 in net cash proceeds from the issuance of convertible debentures and the issuance of common shares respectively during the three months ended June 30, 2006. In addition, the Company received $51,277 during the thee months ended June 30, 2007 from subscriptions received for common shares not issued in the period.

QUARTER ENDED JUNE 30, 2007 COMPARED WITH QUARTER ENDED JUNE 30, 2006 (continued)

Net Loss (continued)

In connection with a unit offering private placement of $1,415,436 in net cash proceeds received during the three months ended June 30, 2007, the Company paid consultants US$6,160 in cash. The unit offering consisted of $0.60 units with each unit consisting of one common share and one-half share purchase warrant with each whole warrant exercisable at $0.75 to purchase an additional common share for a two year term.

Our advances from related parties was $0 during the quarter ended June 30, 2007 as compared to $369,997 during the quarter ended June 30, 2006.

As a result of the Nova Skin Care System our inventories were $1,302,256 at June 30, 2007 (2006 - $0). Accounts Receivable of $304,153 as at June 30, 2007 (2006 - $48,158) were primarily due from Global Green, our joint venture partner for the development of our Vertigro joint venture, and were collected subsequent to year end as well as some trade receivables.

We purchased $19,480 (2006 - $14,932) in fixed assets during the quarter ended June 30, 2007.

As at June 30, 2007, we had $759,613 in cash and cash equivalents (2006 - $320,790) and we currently have cash of, approximately, $440,000.

During the year ended March 31, 2007, we incurred long term debt in connection with a land purchase. As at June 30, 2007, we owed an aggregate of $189,702 relating to this debt (2006 - $0). The Company repaid approximately $2,728 in long term debt during the quarter ended June 30, 2007 (2006 - $0).

As at June 30, 2007, Global Green had incurred and paid a total of US$3,000,000 in costs related to the GGS Agreement and further incurred an additional $204,760 (US$187,253). Joint venture related costs exceeding the aggregate of US$3,000,000 are funded on a 50/50% basis by Global Green and the Company. As a result, the Company’s portion of amounts it has contributed to the joint venture in the amount of $198,357 (US$187,253) has been capitalized. As at June 30, a total of US$187,253 was owed to the Company by Global Green and is included in accounts receivable, the total of which has been subsequently collected.

Convertible Note Continuity:

| | | US $ | | | CND $ | |

| | | Balance | | | | | | Balance | | | Balance | |

| | | March 31, | | | Interest | | | June 30, | | | June 30, | |

| Date of Issue | | 2007 | | | | | | 2007 | | | 2007 | |

| | | | | | | | | | | | | |

| July/August 2005 | | $ | 316,957 | | | $ | 3913 | | | $ | 320,870 | | | $ | 339,898 | |

| April 2006 | | | 509,641 | | | | 10,473 | | | | 520,114 | | | | 550,957 | |

| April 2006 | | | 81,169 | | | | 1,598 | | | | 82,767 | | | | 87,675 | |

| December 2006 | | | 1,539,229 | | | | 29,918 | | | | 1,569,147 | | | | 1,662,197 | |

| January 2007 | | | 2,144,316 | | | | 29,918 | | | | 2,174,234 | | | | 2,303,166 | |

| | | $ | 4,591,312 | | | $ | 75,820 | | | $ | 4,667,132 | | | $ | 4,943,893 | |

The Company issued 111,293 common shares of a total of 329,728 common shares relating to a convertible debenture conversion pertaining to a prior period converting principle and interest of $111,563.

EVENTS SUBSEQUENT TO JUNE 30, 2007

On July 11, 2007, the Company issued 105,000 common shares and 52,500 common share purchase warrants relating to US$63,000 private placement for US$0.60 units. Each warrant allows the holder to purchase an additional common at US$0.75 per share for a 24 month term.

On August 10, 2007, the Company issued a convertible term promissory note in the amount of $650,000 to a third party. The convertible notes is due November 15, 2007 with interest at the rate of 6% with both interest and principle convertible at the option of the lender at the end of term into units at the US$0.60 per unit, with each unit convertible into one common share and one half share purchase warrant with each whole share purchase warrant exercisable at US$0.75 to purchase an additional common shares. The Company is required to register for trading the securities underlying the conversion features of this convertible note by February 10, 2008.

EVENTS SUBSEQUENT TO JUNE 30, 2007(continued)

Pursuant to an April 1, 2007 agreement with a third party to provide investor relations and financial services through December, 2007, on August 15, 2007, the Company issued, 9,677 common shares a price of $0.62 per share (Note 11).

On August 15, 2007, the Company issued 25,000 common shares at US$0.45 per common share pursuant to a January, 2007 contract for public relations services for a term of one year (Note 11).

On April 1, 2007, the Company entered into an agreement with a third party to provide investor relations and financial services for an eight month term from April 1, 2007 through December 31, 2007. The agreement provides for a) a single payment of US$15,000 b) US$3,000 in compensation per month payable quarterly, c) a further US$2,000 payable monthly in common shares, d) share options to purchase 500,000 shares at US$.60 exercise price that vest quarterly over a two year period, and e) the issuance of 12,500 common shares at a deemed price of US$0.80 per share.

CONTRACTUAL OBLIGATIONS

As of March 31, 2007, we had the following known contractual obligations:

On June 28, 2005, Valcent Manufacturing, Ltd. leased office and development space in El Paso, Texas, under a three-year lease at a cost of US$3,170 per month. There are 14 months remaining on the lease as at March 31, 2007.

On December 12, 2006, the Company entered into a Public Relations Agreement with a third party to provide public relations services to the Company. The agreement requires the Company to issue 25,000 restricted common shares in advance of each quarter during the course of the agreement’s one year term for a total of 100,000 restricted common shares at a deemed price of US$0.45 per common share, the payment of approved expenses, and monthly fees ranging from US$4,250 to US$5,250 per month. During the year ended March 31, 2007, 25,000 shares were issued pursuant to this agreement and an additional 25,000 have been issued subsequently.

On April 1, 2007, the Company entered into an agreement with a third party to provide investor relations and financial services for an eight month term from April 1, 2007 through December 31, 2007. The agreement provides for a) a single payment of US$15,000 b) US$3,000 in compensation per month payable quarterly, c) a further US$2,000 payable monthly in common shares, d) share options to purchase 500,000 shares at US$.60 exercise price that vest quarterly over a two year period, and e) the issuance of 12,500 common shares at a deemed price of US$0.80 per share.

At June 30, 2007, the Company’s long-term debt outstanding was as follows:

| | | 2007 | |

| Prime plus 0.25% (2007 - 8.50%) bank loan repayable in monthly instalments of US $2,336 including interest, due September 28, 2011, secured by a first charge on land and $107,643 of cash | | $ | 189,702 | |

| Less: Current portion | | | 13,584 | |

| | | $ | 176,118 | |

RELATED PARTY TRANSACTIONSDURING THE THREE MONTHS ENDED JUNE 30, 2007

a) During the period ended June 30, 2007, the Company paid or accrued $74,652 (2006 $92,718) for product development, research, and consulting services provided by the Company’s President and director to his related company and incurred royalties payable of $4,027 (2006 - $0) pertaining to product sales;

b) During the three months ended June 30, 2007, the Company accrued $9,000 (2006 - $6,000) for professional fees provided by the Company’s Chief Financial Officer and director and owed a total of $52,500 to this director as at June 30, 2007.

At June 30, 2007, the Company also owed $57,364 to a company with this director in common;

c) As of June 30, 2007 we have obtained aggregate unsecured loan advances in an amount totaling $749,578 from West Peak and its principal shareholder, who beneficially owns greater than 5% of our common shares;

d) During the three months ended June 30, 2007, the Company incurred approximately $67,802 (2006 - $0) in fees and expenses to a private advertising firm with a director in common; and

e) During the three months ended June 30, 2007, the Company paid $18,113 (2006 - $0) to a director of the Company for consulting services rendered.