APRIL 20, 2011

BY: EDGAR CORRESPONDENCE FILING AND FAX 1-202-772-9220

Securities and Exchange Commission

Washington, D.C. 20549-4631

| Attention: | Terence O’Brien |

Dear Mr. O’Brien:

Re:Valcent Products Inc. (the “Company”) March 31, 2010 audited financial statements |

See below response to your second letter of March 23, 2011.

| 1. | As previously requested in comment 1 in our letter dated February 3, 2011,, please revise your disclosure regarding the dismissal of Smythe Ratcliffe LLP, Chartered Accountants to provide the information required by Item 16(F)(a)(1)(v) of Form 20-F in an amendment to your fiscal year 2010 Form 20-F. Please consider providing us with the disclosure you intend to include in the amendment Form 20-F before filing on Edgar. Please provide Smythe Ratcliffe LLP, Charted Accountants with these additional disclosures in addition to the disclosures originally provided under Item 16F of Form 20-F and request that they provide you with the letter described in Item 16F(a)(3) of 20-F. Please request that Smythe Ratcliffe LLP reference the amended Form 20-F disclosures in their letter. Please file this letter as an exhibit to your amended Form 20-F.e |

The Company has requested the letter from Smythe Ratcliffe LLP and they have responded that on filing of our amended Form 20-F they will review the amended Form 20-F and provide the Company with the letter described in Item 16F(a)(3) of 20-F. A copy of the letter will be provided to you before filing on Edgar.

| 2. | We note your responses to comments 3 and 4 in our letter dated February 3, 2011. As the embedded conversion feature is potentially convertible into a variable number of shares of common stock, please provide us with your analysis that the embedded conversion feature met the requirements for the scope exception in ASC 815-10-15-74 (paragraph 11 (a) of SFAS 133). Specifically, please provide us with your analysis for the second part of the scope exception (i.e. your analysis of ASC 815-40-25-7-25-38, or paragraphs 12-32 of EITF 00-19). |

The Company’s analysis of ASC 815-40-25-7 – 25-38 was as follows:

| The contract permits the company to settle in unregistered shares | | The Company has not had a failed registration statement in the previous 6 months. The Company is required to deliver registered shares to the note holder subject to a cash penalty for failure to do so. The Company relied on the guidance of FSP EITF 00-19-2 that allows for contingent liability accounting rather than liability accounting that would otherwise be required under EITF 00-19. Criteria for equity met. |

| | | |

The company has sufficient authorized and unissued shares available to settle the contract after considering all other commitments that may require the issuance of stock during the maximum period the derivative contract could remain outstanding. | | The Company has authorized share capital of an unlimited number of common shares. Therefore share issuance is within the control of the Company. |

The contract contains an explicit limit on the number of shares to be delivered in a share settlement. | As discussed above, the Company has the ability to deliver an unlimited number of common shares to settle a contract given that the authorized share capital includes an unlimited number of common shares. Therefore share issuance is within the control of the Company Therefore, criteria met |

There are no required cash payments to the counterparty in the event the company fails to make timely filings with the SEC. | Provision not included in the agreement |

There are no required cash payments to the counterparty if the shares initially delivered upon settlement are subsequently sold by the counterparty and the sales proceeds are insufficient to provide the counterparty with full return of the amount due (that is, there are no cash settled "top-off" or "make-whole" provisions). | There are no “make-whole” provisions in the contract. Criteria for equity classification met |

The contract requires net-cash settlement only in specific circumstances in which holders of shares underlying the contract also would receive cash in exchange for their shares. | Provision not included in the agreement |

There are no provisions in the contract that indicate that the counterparty has rights that rank higher than those of a shareholder of the stock underlying the contract | Criteria met |

There is no requirement in the contract to post collateral at any point or for any reason. | Criteria met |

| 3. | We further note that upon the adoption of the guidance in ASC 815-40-15-5 – 15-71, you changed your accounting of the convertible promissory notes and bifurcated the embedded conversion feature during fiscal year 2010. We further note that as of April 1, 2009, you changed your functional currency to the US dollar. Finally, it appears that the convertible promissory notes and the conversion option are also denominated in the US dollar based on the note agreement filed as an exhibit to your Form 6-K filed on July 28, 2008. As such, please explain to us how the adoption of the new literature resulted in change to your accounting for the convertible promissory notes. |

The determination to bifurcate the embedded conversion feature was not driven by consideration of the functional currency. Rather, the Company reviewed the terms of the convertible promissory notes upon the adoption of ASC 815-40-15 (formerly EITF 07-5) and determined that they contained down-round clauses allowing the holders of the notes to have the conversion price reset lower if the Company subsequently issued instruments with an effective lower conversion price. The Company determined that the existence of these clauses violated the fixed for fixed criteria of that guidance.

| 4. | To the extent that you are able to demonstrate that the embedded conversion feature is not required to be bifurcated through the scope exception in ASC 815-40-25-7 (paragraph 11(a)(2) of SFAS 133) based on the authoritative literature effective during fiscal year 2009, please address the following regarding your determination and accounting for the beneficial conversion feature recognized for the US $2,168,000 July 2008 Convertible Note: |

· We note that you issued two warrants to each purchaser of your zero coupon, 12% interest senior secured convertible promissory notes. Please confirm to us that you allocated the proceeds from the transaction to the notes and the two warrants based on each instrument’s relative fair value. Please tell us and disclose in future filings the portion of the proceeds allocated to the convertible promissory notes, the non-redeemable warrants and the redeemable warrants. Please refer to ASC 470-20-25-2 – 25-3 for guidance.

The Company allocated the proceeds of the issuance to the respective instruments on a relative fair value basis as follows:

| | | | | | | | | Relative | |

| | | Fair values | | | | | | fair values | |

| | | | | | | | | | |

| Convertible debt | | $ | 2,675,092 | | | | 48.56 | % | | $ | 1,052,681 | |

| Class A warrants (4,761,098@$0.4033) | | $ | 1,920,151 | | | | 34.85 | % | | $ | 755,602 | |

| Class B warrants (2,380,519@$0.3840) | | $ | 914,120 | | | | 16.59 | % | | $ | 359,717 | |

| Total warrants fair value | | $ | 2,834,271 | | | | | | | $ | 1,115,319 | |

| | | $ | 5,509,363 | | | | 100.00 | % | | $ | 2,168,000 | |

As well, in future filings, we will disclose the aforementioned allocation of proceeds.

| | · | We note that you originally determined the beneficial conversion feature to be $US 2,148,000. In connection with the restatement of your adjustments to arrive at a net loss in accordance with US GAAP for fiscal year 2009, you subsequently determined that the beneficial conversion feature should have been US$ 2,429,365. Please tell us how you determined that amount of the beneficial conversion feature, including the specific authoritative reference that supports your conclusion. Please refer to ASC 470-20-30—3 – 30-8 for guidance. |

Our prior response indicated that the beneficial conversion feature should have been US $2,429,365. This was an error as that balance represents the total amount credited to additional paid-in capital including the beneficial conversion feature and the fair value of the warrants issued in conjunction with these notes.

On the issuance of the notes, we determined that the beneficial conversion feature to be $1,052,681 using the accounting model of EITF 00-27 at the time as follows:

The most favorable conversion price should be used in calculating the beneficial conversion feature if there is no change in circumstances other than the passage of time. Therefore, despite having a fixed conversion price of $0.51 on the issuance date, the conversion price adjusts to the lower of 70% of QMP or $0.51 after six months.

It should also be noted that the notes, on issuance, had a maturity value of $2,428,160 as the Company provided the lenders with a 12% original issuer discount. The effective conversion price of the debt should be calculated as per Issue 1 of EITF 00-27:

| Proceeds allocated to convertible note (from response to prior comment) | (A) | $1,052,681 |

Shares issuable on conversion $2,428,160 / ($0.51 x 70%) | (B) | 6,801,569 |

| Effective conversion price = (A) / (B) | | $0.15 |

| | | |

| Conversion price | | $0.51 |

| | | |

| Intrinsic value | | $0.36 |

| | | |

| Number of shares issuable | | 6,801,569 |

| BCF (6,801,569 x $0.3553) | | $2,416,597 |

| Relative Fair value of debt (after allocation of proceeds) | | $1,052,681 |

| Maximum BCF | | $1,052,681 |

| Allocation to debt | | $ - |

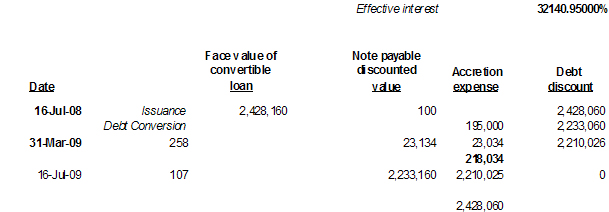

| | · | We note that in connection with the restatement of your US GAAP adjustments for the fiscal year 2009, you determined that you should have recognized US$218,034 of the beneficial conversion feature during fiscal year 2009. Please provide us with your calculation of the accretion for fiscal year 2009. In this regard, we note from the exhibit filed with the 6-K filed on July 25, 2008, that maturity date of these notes is July 16, 2009. Please refer to ASC 470-20-35-7 for guidance. |

The accretion expense of $US 218,034 referred to the accretion in respect of the entire debt discount including the accretion of the discount attributable to beneficial conversion feature as follows:

| 5. | Please provide us with a more comprehensive explanation for each of the following as it relates to the restatement to the adjustments recognized in fiscal year 2009 to reconcile Canadian GAAP to US GAAP: |

| | · | We note that a portion of the interest and accretion expense adjustment is CDN$ 1,292,935 to reverse the amount recorded as shares to be issued for the March 27, 2009 transactions. Please demonstrate for us where this amount is recognized on your Consolidated Statements of Operations and Deficit prepared in accordance with Canadian GAAP. If this amount has not been recognized in your Canadian GAAP financial statements in the determination of net loss, please provide us with a more comprehensive explanation as to why you are recognizing an additional expense for US GAAP purposes. |

The SEC letter dated February 3, 2011 included a comment requesting quantification of the components of the $2,910,223 restatement including an explanation of each of those components. Included in the $2,910,223 restatement was a balance of $(3,465,304) representing the restatement concerning interest and accretion. Our original explanation of the $(3,465,304) interest and accretion restatement included the amount referenced above as a CDN$1,292,935 reversal of shares to be issued was in error. Upon further review of our supporting schedules for the interest and accretion restatement for US GAAP purposes, we have determined the interest and accretion to be summarized as:

| | | US $ | | | CDN $ | |

| | | | | | | |

| Reverse BCF accretion originally recorded for US GAAP | | $ | (2,148,000 | ) | | $ | (2,417,831 | ) |

| BCF accretion recorded on correction | | $ | 218,034 | | | $ | 245,423 | |

| Reversal of amounts recorded in original debt extinguishment transaction: | | | | | | | | |

| -Original issuer discount ($2,168,000 @ 12%) | | $ | (260,160 | ) | | $ | (292,841 | ) |

| -Redemption premium ($2,168,000 + $260,160) @ 30% | | $ | (728,448 | ) | | $ | (819,956 | ) |

| -Financing fees | | $ | (160,000 | ) | | $ | (180,099 | ) |

| | | | | | | | | |

| | | $ | (3,078,574 | ) | | $ | (3,465,304 | ) |

| | | | | | | | | |

In addition, for Canadian GAAP purposes, the amount representing shares to be issued was not recognized in the determination of net loss.

| | · | We note that for Canadian GAAP purposes, you recognized the embedded conversion feature as a derivative liability. Please tell us the amount recognized in the determination of your Canadian GAAP net loss amount for the changes in fair value of the derivative liability. Please demonstrate for us the comparison as to the amount of expense/loss that was recognized for Canadian GAAP purposes versus US GAAP purposes and how you then determined the amount of the reconciling item to interest and accretion expense. |

Under Canadian GAAP, when a company issues conventional convertible debt, it is usually required to separate the equity component of a hybrid instrument from the host debt instrument and record it as a separate component of shareholders’ equity. However, the language included in Canadian GAAP indicates that a contractual amount of a fixed amount that can be settled with a variable number of shares is a financial liability.

Therefore, the Company concluded that the embedded conversion feature was not an equity instrument and, as such, was required to be valued as a liability. The Company further determined that this liability had a fixed fair value that was measured as the difference between the fair value of the shares to be received on conversion and the face value of the debt Given that the shares of the Company were consolidated on a basis of 1 for 18, the conversion price of the promissory notes was adjusted to the lower of $9.18 and 70% of quoted market price. The fair value of this additional accrual does not change unless the market price of the reaches $13.11 ($9.18 / 70%)

For purposes of US GAAP, the Company determined that a derivative liability in respect of the embedded conversion feature arose as at April 1, 2009 upon the application of the guidance of ASC 815-40-15.

Similar to the application of the accounting model of EITF 98-5 and 00-27, prior to applying the derivative accounting model of FAS 133, the Company was first required to allocate the proceeds received from issuing the convertible debt instrument to the host debt contract (including any embedded conversion features) and any other detachable instruments on a relative fair value basis. This relative fair value calculation was performed above and the value attributable to the detachable warrants at issuance was determined to be $1,115,319.

The embedded conversion feature derivative liability was determined to have a fair value of $1,558,239 as at July 16, 2008. Given that the maximum debt discount can only be the maturity value of the debt at issuance date, the journal entry to record the issuance of the notes on July 16, 2008 would have been as follows:

| | | | US $ | | | | | | CDN $ | |

| DR | Cash (2,168,000 - $160,000) | | $ | 2,008,000 | | | | 1.003 | | | $ | 2,014,024 | |

| DR | Deferred financing costs | | $ | 421,465 | | | | 1.003 | | | $ | 422,729 | |

| DR | Derivative liability expense ($260,160+$1,115,319+$1,558,239) - $2,428,160 | | | 505,558 | | | | 1.003 | | | $ | 507,075 | |

| CR | Derivative liability | | $ | (1,558,239 | ) | | | 1.003 | | | $ | (1,562,914 | ) |

| CR | APIC – Warrants ( $1,115,319 + $177,136 + $84,329) | | $ | (1,376,784 | ) | | | 1.003 | | | $ | (1,380,914 | ) |

The Company would not have recorded a BCF had EITF 07-5 been in place as at the date of the issuance of the notes. At April 1, 2009, the Company reversed the balance in APIC recorded in respect of the BCF, being $1,052,681 and reversed the balance of accretion expense incurred in respect of the BCF debt discount totaling $10,417 since the issuance of the notes up to March 31, 2009

The debt discount originally created on bifurcation of the derivative liability is accreted to income over the term of the debt; the discount was calculated to be $2,428,160 – the maximum amount possible and the accretion for the period between the date of the issuance and March 31, 2009 was calculated to be $206,044 after taking into account the debt conversion of $195,000 prior to March 31, 2009.

The embedded conversion feature derivative liability is re-measured at fair value each reporting period. As at March 31, 2009, the fair value of the derivative liability was determined to be $1,515,264 resulting in a credit to opening deficit of $42,975 in respect of the change in the fair value of a derivative liability for the prior year.

The opening adjustment for the cumulative effect of an accounting change as at April 1, 2009 was summarized as follows:

| | | | US $ | |

| DR | Convertible debt | | $ | 11,991 | |

| CR | Derivative liability | | $ | (1,515,264 | ) |

| DR | APIC – BCF | | $ | 1,052,681 | |

| DR | Deficit | | $ | 450,592 | |

The derivative liability was re-measured at March 31, 2010 and its value was determined to be $US1,374,300 for a change in fair value for the period of $US (140,964) = ($US 1,374,300 - $US1,515,264 (value as at March 31, 2009)) For purposes of the reporting currency, this gain resulting from the change in fair value of the derivative totaled $CDN (153,937).

As discussed above, the share price of the Company’s stock remained significantly below $13.11 for the reporting period and thus there was no change to the value accrued in respect of the liability associated with the convertible promissory notes.

| | · | We note that for Canadian GAAP purposes, you recognized a CDN$885,292 loss from the March 27, 2009 transactions. We further note that you determined you should have recognized a gain of $CDN 212,202 for US GAAP purposes related to the March 27, 2009 transactions. Please provide us with a comprehensive explanation as to how you determined a gain should have been reported for these transactions as of March 31, 2009. Please also provide us with the specific references in the authoritative literature that supports your accounting. |

The Company acknowledges, that for Canadian GAAP purposes, there was a loss of $885,292 that was recorded in respect of the accounting for the extinguishment of the zero coupon, 12% interest, senior secured US$ 2,428,160 convertible promissory notes issued in July, 2008. Given the conclusions drawn that the FAS 140 criteria for debt extinguishment were not met at March 27, 2009, there should be neither a gain nor a loss for the year ended March 31, 2009 in respect of the March 27, 2009 transactions for these notes. The gain of $212,202 arises as a result of aggregating the gain on settlement of other debts on March 27, 2009. This will be addressed in future filings.

| | · | For the foreign exchange gain recognized, please provide us with a more comprehensive explanation as to the factors that contributed to determining the amount of the adjustment. |

The transactions in respect of the convertible notes were measured in US dollars, after which they were translated to Canadian dollars, the reporting currency, with the assets and liabilities translated at the rate in effect on the balance sheet date and expenses translated at an average rate for the period. The translation adjustment arising as a result is reflected as an exchange gain or loss in the Company’s Statement of Operations.

| 6. | Please provide us with a comprehensive explanation as to how you recognized each component of the March 27, 2009 transactions in settlement of the zero coupon, 12% interest, senior secured convertible promissory notes during fiscal year 2010. Please include the specific reference to the authoritative literature that supports your accounting. |

The Company and the note holders agreed at the end of March, 2009 to extend the maturity date of the notes to December 31, 2009 and amend the conversion terms such as not to request conversion of the notes prior to December 31, 2009. As consideration, the Company offered to pay, by way of Company shares having a fair value of $0.02222 each, amounts consisting of (i) interest that would be payable on the note from the date of issuance to December 31, 2009, (i) the balance of the original issuer discount inherent in the note and (iii) an amount representing the 30% redemption premium.. As well, the Company agreed with the note-holders to reduce debt principal by an amount of $400,000. The offer and acceptance of the amended terms was simultaneously executed; the settlement agreements were formally executed in early May, 2009.

The settlement terms are summarized as:

Total Debt settled with (pre-consolidation) shares: | | | |

| -Original issuer Discount | | $ | 260,160 | |

| -Interest from July 16, 2008 to December 31, 2009 @ 12% | | $ | 371,770 | |

| -Redemption premiums @ 30% | | $ | 524,884 | |

| | | | | |

| | | $ | 1,156,814 | |

| Number of shares issued: | | | | |

| $1,156,814 / $0.022222 | | | 52,056,654 | |

The required journal entry for the amendment of the convertible debt at May 12, 2009 has been determined as follows:

| | | | US $ | | | | | | CDN $ | |

| DR | Prepaid interest | | $ | 185,322 | | | | 1.2302 | | | $ | 227,983 | |

| DR | Accrued interest | | $ | 186,448 | | | | 1.2302 | | | $ | 229,368 | |

| DR | Convertible debt discount | | $ | 260,160 | | | | 1.2302 | | | $ | 320,048 | |

| CR | Convertible Debt | | $ | (260,160 | ) | | | 1.2302 | | | $ | (320,048 | ) |

| DR | Accretion | | $ | 260,160 | | | | 1.2302 | | | | 320,048 | |

| DR | Share settlement expense | | $ | 524,884 | | | | 1.2302 | | | $ | 645,712 | |

| CR | Share Capital | | $ | (1,156,814 | ) | | | 1.2302 | | | $ | (1,423,111 | ) |

| 7. | We note that you estimate the fair value of the bifurcated embedded conversion option differently under Canadian GAAP versus US GAAP. Please provide us with a comprehensive explanation as to why. |

The Company reviewed the terms of the convertible note agreements and determined that, by virtue of the clause allowing the holder of the note to convert their notes at the lower of $9.18 or 70% of the quoted market price, the conversion feature could be settled with a variable number of shares.

Further, the Company reviewed the Canadian GAAP literature and noted that Canadian GAAP indicates that when an entity has a contractual obligation of a fixed amount “but the entity must, or can, settle the obligation by delivery of its own equity instruments (the number of which depends on the amount of the obligation). Such an obligation is a financial liability of the entity. When the number of an entity's own shares or other equity instruments required to settle the obligation varies with changes in their fair value, so that the total fair value of the equity instruments to be delivered is based solely or predominantly on the amount of the contractual obligation, the counterparty does not hold a residual interest in the entity until it has received the equity instruments. The entity may have to deliver more or fewer of its own equity instruments than would have been the case at the date of entering into the contractual arrangement. Such an obligation is a financial liability of the entity even though the entity must or can settle by delivering its own equity instruments”

Therefore, for Canadian GAAP purposes, the Company recorded a liability in respect of the conversion feature that represented the incremental fair value of settling the debt via conversion. That is, to the extent that the Company’s share price remains below $13.11 ($9.18 / 70%), then this incremental liability represents the difference between the fair value of the shares to be issued on conversion and the carrying value of the debt calculated. Thus the total liability under Canadian GAAP was calculated as: (Debt carrying value X 1.42857) where 1.42857 is determined as 1/70%.

Under US GAAP, the embedded conversion feature was determined to not be indexed to the Company’s stock by virtue of the application of the guidance of ASC 815-40-15 and thus did not qualify for the scope exception of being accounted for as a derivative liability. Thus the embedded conversion feature was bifurcated and it fair value was separately determined through the application of a fair value model whereas, under Canadian GAAP, as explained above, the embedded conversion feature was not bifurcated.

| 8. | We note your response to comment 5 in our letter dated February 3, 2011. Specifically we note that you and your prior auditors believe there was a gradual change in the functional currency to US dollar during fiscal year 2009. We further note that your research activity in 2008 and 2009 was through the US operations, with movement to UK operations in 2010. Finally, we note that your debt offering in fiscal year 2009 was denominated in US dollars. As such, please provide us with a quantitative analysis of your cash transactions by type (i.e., debt securities offerings, equity securities offerings, operating expenses, non-operating expenses, etc.) during fiscal years 2009 and 2010 that support your conclusion that the Canadian dollar is your functional currency for fiscal year 2009 and that the US dollar is your functional currency for fiscal year 2010: |

The analysis of the Company’s cash transactions by type for fiscal years 2009 and 2010 are as follows:

March 31, 2009 | CDN $ % | GBP % | US $ % |

| Operating and Non-Operating Expenses | 30 % | 16% | 54% |

| Proceeds from the issuance of shares, net | | | 100% |

| Investing Activity - Equipment | | 12% | 88% |

| Advances from Related parties | 25% | | 75% |

| Proceeds from promissory notes payable | 22% | | 78% |

| Repayment of long term debt | | | 100% |

| Proceeds from the issuance of convertible notes | | | 100% |

March 31, 2009 | CDN $ % | GBP % | US $ % |

| Operating and Non-Operating Expenses | 34 % | 43% | 34% |

| Proceeds from the issuance of shares, net | | | 100% |

| Investing Activity - Equipment | | 12% | 88% |

| Advances from Related parties | | | 100% |

| Repayment of promissory notes payable | | | 100% |

| Proceeds from promissory notes payable | 22% | | 78% |

| Repayment of convertible notes | | | 100% |

Based on our quantitative analysis of our cash transactions by type during fiscal year 2009, there are quantitative indicators to suggest the functional currency may have been US dollar. However, qualitatively, management in 2009 determined there was no substantive change in the events and conditions in the Company to necessitate a re-assessment of the functional currency in 2009. The qualitative factors considered by management for not re-assessing its functional currency in 2009 were:

| | · | Majority of management and key of strategic, financing and operational decision makers were based out of Vancouver Canada; |

| | · | Such decision makers were actively seeking and meeting with Canadian investors; |

| | · | Majority of shareholders were Canadian residents; |

| | · | Management knew they were re-capitalizing the company and setting its debt in 2010, many of which was foreign denominated in an attempt to attract among others a Canadian investors; and |

| | · | The Company was in the process of winding down its operations in the US and looking at increasing its UK operations. |

Therefore, it was not until recapitalization and debt settlement in 2010 and a current perception that additional financing is more likely to come from a non-Canadian source that management determined there was a substantive change in the events and conditions to necessitate a re-assessment of the functional currency. Based on the management’s reassessment of both the quantitative and qualitative indicators, the US dollar was determined to be the functional currency for fiscal year 2010.

Yours sincerely,

VALCENT PRODUCTS INC.

/s/ John N. Hamilton

John N. Hamilton

CFO