Valcent Products Inc.

Management Discussion and Analysis

March 31, 2009

(as Amended October 15, 2009)

The attached March 31, 2009 Management Discussion and Analysis have been updated for a clerical error in that a prior period adjustment was not recorded in the March 31, 2009 financial statements, originally filed on September 30, 2009 in Canada.

The error is a result of incorrect closing balances from the March 31, 2008 financial statements being applied to the March 31, 2009 financial statements. The effect on the previously reported March 31, 2009 financial statements was to increase share capital by $350,452, commitment to issue shares by $329,106 and accumulated deficit during the development stage by $679,558. There was no effect on working capital, shareholders deficiency, net loss and comprehensive loss, loss per share or cash flow.

Certain of the comparative March 31, 2008 information which related to this error has been updated.

Also, as a result of this clerical error the Company has updated and corrected its March 31, 2009 financial statements, originally filed September 30, 2009.

The revised information outlined above had no effect on information filed on the Company's 20-F on October 15, 2009.

VALCENT PRODUCTS INC.

THE ATTACHED AMENDED CONSOLIDATED FINANCIAL STATEMENTS DATED MARCH 31, 2009 FORM AN INTEGRAL PART OF THIS MANAGEMENT DISCUSSION AND ANALYSIS

Management Discussion and Analysis as of September 21, 2009, as amended October 13, 2009

By certificate of amendment dated April 15, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan.

On May 3, 2005 we delisted from the TSX Venture Exchange and effected a consolidation of our common shares on a one-for-three basis. We maintained our OTC Bulletin Board listing, however, our trading symbol was changed to “VCTPF”, which it remained through to July 15, 2009.

Due to economic circumstances and to make our Company more conducive to investment the shareholders of the Company approved a special resolution to reorganize the capital structure of the Company by a share consolidation of its common shares on the basis of one new share for each eighteen old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 our trading symbol changed to “VCTZF” and our CUSIP number changed to 91881 20 2. Our website is located at www.valcent.net

Unless otherwise noted, all references to the number of common shares are stated on a post-consolidation basis.

Our common share authorized share capital remains unlimited.

All amounts are stated in Canadian dollars unless otherwise noted.

We are at present a life sciences targeted, development stage company focused primarily on:

| (i) | the development and commercialization of our “High Density Vertical Growth System” (“VerticropTM” or “HDVG System”) designed to produce vegetables and other plant crops, |

| (ii) | the development of a commercial algae growing technology via Vertigro Algae Technologies LLC (“Vertigro Algae”) with Global Green Solutions, Inc. (“Global Green”), and |

| (iii) | the development and marketing of the Tomorrow GardenTM consumer retail product. |

From inception, we have generated minimal revenues and experienced negative cash flows from operating activities and our history of losses has resulted in our continued dependence on external financing. Any inability to achieve or sustain profitability or otherwise secure additional external financing, will negatively impact our financial condition and raises substantial doubts as to our ability to continue as a going concern.

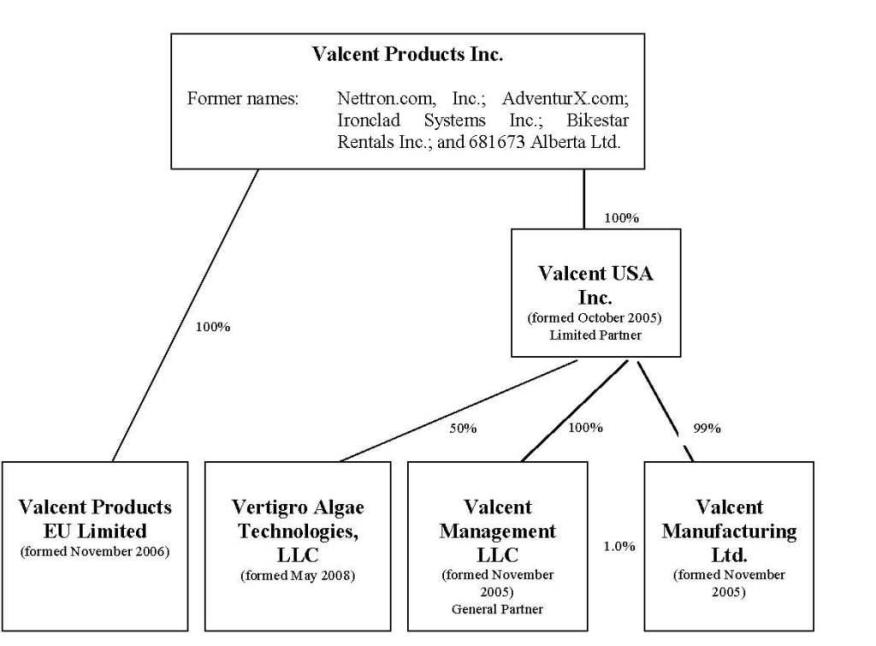

Organizational Structure

The following organizational chart sets forth our current corporate structure and reflects subsidiary interests relating to our various entities.

Corporate History

We were incorporated in accordance with the provisions of the Business Corporations Act (Alberta) on January 19, 1996, as 681673 Alberta Ltd., later changed to Ironclad Systems Inc. Beginning in 1996, following the completion of a public offering, our common shares began trading as a junior capital pool company on the Alberta Stock Exchange (later becoming part of the Canadian Venture Exchange, which was thereafter acquired and renamed the TSX Venture Exchange).

On May 8, 1999, while still operating our bicycle rental and eco-tour businesses through Bikestar Rentals Inc., we incorporated Nettron Media Group Inc., a wholly-owned subsidiary under the laws of the State of Texas, as a marketing enterprise focusing on products and services that could be effectively marketed through internet as well as more traditional business channels. Nettron Media Group Inc.’s primary focus was Cupid’s Web, an interactive online dating and marketing service. We also changed our name from Bikestar Rentals Inc. to AdventurX.com, Inc., and later to Nettron.com, Inc.

In 2000, and in connection with Cupid’s Web, we signed an agreement in principle to acquire all of the outstanding capital stock of a group of companies operating a worldwide dating service franchise, as well as a collection of dating magazines and websites.

On January 1, 2001, in order to fully focus on our interactive dating and marketing services, we disposed of all of the outstanding capital stock of Arizona Outback Adventures LLC and Bikestar Rentals Inc.

On February 18, 2002, due to general weakness in the equity markets, we terminated the agreement in principle to acquire the dating service franchise and related businesses originally entered into in 2000. On March 24, 2004, we disposed of our interest in Nettron Media Group Inc. and began exploring business opportunities that might allow us to restart commercial operations.

By certificate of amendment dated April 15, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan. On May 3, 2005 we delisted our common stock from the TSX Venture Exchange, maintaining only our OTC Bulletin Board listing and changing our symbol to “VCTPF”. Effective May 3, 2005, and in order to render our capital structure more amenable to contemplated financing, we effected a consolidation of our common shares on a one-for-three-basis.

On August 5, 2005, we completed a licensing agreement with Pagic LLP, formerly MK Enterprises LLC, (“Pagic”) for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products.

In order to facilitate the business plan, the Company formed a wholly-owned Nevada corporation, Valcent USA, Inc. to conduct operations in the United States in October 2005. In turn, Valcent USA, Inc. organized Valcent Management, LLC, a wholly-owned limited liability corporation under the laws of Nevada, to serve as the general partner in Valcent Manufacturing Ltd., a limited partnership also formed by Valcent USA, Inc., under the laws of Texas, wherein Valcent USA, Inc. serves as its limited partner.

Also during the year ended March 31, 2007, Valcent Products EU Limited (“Valcent EU”) was incorporated by Valcent Products Inc. in the domicile of England to conduct operations in Europe.

On May 5, 2008, Valcent Vertigro Algae Technologies LLC, a Texas limited liability corporation, was formed as a 50% owned subsidiary to each of Valcent, USA Inc. and Global Green Solutions Inc. to develop algae related technologies.

The shareholders of the Company approved a special resolution on June 22, 2009 to reorganize the capital structure of the Company through a share consolidation of its common shares on the basis of one new share for each eighteen (1:18) old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 our trading symbol changed to “VCTZF” and our CUSIP number changed to 918881 20 2. Unless otherwise noted, all references to the number of common shares and or prices(s) per share are stated on a post-consolidation basis.

Evolution of License Agreements with Pagic

Original Master License Agreements - On July 29, 2005, we entered into five related definitive agreements (the “Pagic Agreements”) with Pagic LP (formerly MK Enterprises LLC), an entity controlled by Malcolm Glen Kertz, our former Chief Executive Officer, and President, including:

| | (i) | a master license agreement for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to three unrelated and proprietary potential consumer retail products that had previously been developed (the “Pagic Master License”), certain of which are patent pending by Pagic, including the Nova Skin Care System, the Dust WolfTM, and the Tomorrow GardenTM Kit (collectively, and together with any improvements thereon, the “Initial Products”); |

| (ii) | the Pagic Master License also included a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Initial Products (the “Initial Ancillaries”); |

| (iii) | a product development agreement pursuant to which we were granted a right for an initial period of five years to acquire a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any new products developed by Pagic (any such products, collectively, the “Additional Products”, and, the agreement itself, the “Pagic Product Development Agreement”); |

| (iv) | the Pagic Product Development Agreement also included a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Additional Products (the “Additional Ancillaries”); and |

| (v) | a related services agreement pursuant to which Pagic shall provide consulting support in connection with the Initial Products, the Initial Ancillaries, the Additional Products and the Additional Ancillaries (the “Pagic Consulting Agreement”), in exchange for the following: |

| 1) | 1,111,112 shares of our common stock which have been issued; |

| 2) | a one-time US$125,000 license fee (paid); |

| 3) | reimbursement for US$125,000 in development costs associated with each of the Initial Products since March 17, 2005 (paid); |

| 4) | consulting fees of US$156,000 per year, payable monthly in advance, which the Company has paid to date; and |

| 5) | the greater of the following, payable annually beginning in the second license year (beginning April 1, 2007): |

| (i) | US$400,000 inclusive of all consulting fees, royalty and other fees; or |

(ii) the aggregate of the following:

a minimum amount of US$37,500 per Initial Product during the second year of the Pagic Master License, and $50,000 US$ each year thereafter, continuing royalties payable quarterly at a rate of:

| Ø | US$10.00 US per Nova Skin Care System unit sold; |

| Ø | US$2.00 per Dust WolfTM unit sold; |

| Ø | 4.5% of annual net sales of the Tomorrow GardenTM Kit; and |

| Ø | 3% of annual net sales of Initial Ancillaries. |

| 6) | a one-time $50,000 US license fee for each Additional Product licensed (except for one pre-identified product); and |

| 7) | subject to a minimum amount of US$50,000 per year commencing with the second year of each corresponding license, continuing royalties of 4.5% of annual net sales and 3% on annual net sales of any Additional Ancillaries. |

As described below these agreements were terminated effective April 1, 2009.

Joint Venture of Algae Related Business Operations - Beginning on October 2, 2006, we granted certain rights to Global Green relating to our joint venture of our high density vertical bio-reactor technology named “Vertigro”, an algae biomass technology initiative. Refer to “PLAN OF OPERATIONS, “High Density Vertical Bio-Reactor and Global Green Joint Venture”, and “Technology License Agreement” between Pagic LP, West Peak Ventures of Canada Ltd. (“West Peak”), and Valcent Products, Inc.

Algae Technology License - On May 5, 2008, the joint venture arrangement pertaining to the development of the algae biomass technology initiative was terminated and Vertigro Algae executed a separate Technology License Agreement (“Technology License”) together with Pagic, and West Peak. The Technology License licenses certain algae biomass technology and intellectual property to Vertigro Algae for purposes of commercialization and exploitation for all industrial, commercial, and retail applications worldwide “Algae Biomass Technology”.

Discontinued Product Development Lines and Settlement of Licensed Technologies - Of the Initial Products under license as defined above, the Company ceased development of Dust Wolf and Nova Skin Care Systems during the year ended March 31, 2009 due to economic conditions, and increased corporate focus on life sciences plant growth technologies. The Company has continued with Tomorrow Garden product development and commercialization though the VerticropTM Technology Purchase Agreement.

VerticropTM Technology Purchase Agreement - Effective April 1, 2009, the Company executed a purchase agreement to acquire all ownership rights and intellectual property relating to its VerticropTM vertical plant growing technology and Tomorrow Garden kit technology (the “Technologies”) from Glen Kertz, Pagic, and West Peak and which provides the Company with all rights and know how to the Technologies (the “Purchase Agreement”). Pursuant to this agreement original master license agreements between the Company and Pagic were terminated and this agreement replaced all financial obligations the Company had with Pagic related to the original master license agreements, including annual payments, royalty burden, and all other associated licensing costs. As noted above, all agreement related to the Algae Biomass Technology are with Vertigro Algae and as such survive the termination of all other agreements.

Pursuant to the Purchase Agreement, the Company agreed to pay a total of US$2,000,000 plus issue 3% of its common stock on conclusion of the purchase agreement. The US$2,000,000 is payable on a cumulative basis as to US$65,000 on signing (paid) plus the greater of 3% of the gross monthly product sales less returns from exploitation of the technologies or US$12,000 per month until US$2,000,000 has been paid. The ownership of the Technologies will remain in escrow until fully paid or if the Company defaults in making payments. The issuance of the 3% of its common stock is payable upon release of the Technologies from escrow to the Company. The Company may at any time elect to pay out the remaining balance due. Should the Company default under this agreement the Technologies will revert back to Glen Kertz and Pagic and the Company’s obligations under the Purchase Agreement will cease. The Company expenses amounts paid under the Purchase Agreement.

From inception we have generated minimal revenues from our business operations and have traditionally met our ongoing obligations by raising capital through external sources of financing, such as convertible notes, promissory notes and director and shareholder advances.

At present, we do not believe that our current financial resources are sufficient to meet our working capital needs in the near term or over the next twelve months and, accordingly, we will need to secure additional external financing to continue our operations. We anticipate raising additional capital though further private equity or debt financings and shareholder loans. If we are unable to secure such additional external financing, we may not be able to meet our obligations as they come due or to fully implement our intended plan of operations, as set forth below, raising substantial doubts as to our ability to continue as a going concern.

In addition, during the year ended March 31, 2009 we reduced staffing at our El Paso offices and research facility, transferring our primary development directives previously located in the United States to our UK offices.

Our plan of operations over the course of the next twelve months, subject to adequate financing, is to focus primarily on the continued development and marketing of our VerticropTM vertical plant growing systems, development and distribution of our lines of potential consumer retail Tomorrow Garden products, and the development of our high density vertical algae growth technology.

Chris Bradford, our Managing Director, of Valcent EU, is responsible for UK business operations and the Company’s “Tomorrow GardenTM” retail plant sales initiative, as well as development of European based VerticropTM market development and sales rollout.

More specifically, our plan of operations with respect to each of our lines of potential retail and commercial products is provided as follows:

Vertigro Algae and the Algae High Density Vertical Bio-Reactor Technology

We are in the development stages of creating technology for a High Density Vertical Bio-Reactor (“Vertigro Project”). The objective of this technology is to produce algae related source products by utilizing the waste gas of carbon dioxide capable of growing micro-algae. Our High Density Vertical Bio-Reactor is configured in a manner intended to promote the rapid growth of various forms of micro-algae which is later processed to remove volatile oils suitable for the production of fuels, and/or other target products for commerce and industry. The design of our technology allows the reactors to be stacked on a smaller foot print of land than traditional growing methods require. We believe secondary potential markets for this technology include industrial, commercial and manufacturing businesses that produce carbon dioxide emissions. Technology development is ongoing and subject to adequate budgets for product development.

On May 5, 2008, the Company and Global Green concurrently organized Vertigro Algae and entered into an operating agreement (“Operating Agreement”). Pursuant to the Operating Agreement, Global Green and the Company each hold a 50% interest in Vertigro Algae and have committed to fund project development costs according to ownership allocation. Global Green will receive 70% of the net cash flow generated by Vertigro Algae until it has received US$3,000,000 in excess of its 50% interest in such cash flow and then thereafter it will be split equally.

Also on May 5, 2008, Vertigro Algae executed a Technology License Agreement (“Technology License”) together with Pagic and West Peak. The Technology License licenses certain algae biomass technology and intellectual property to Vertigro Algae for purposes of commercialization and exploitation for all industrial, commercial, and retail applications worldwide (“Algae Biomass Technology”). As consideration for the Technology License, the Company and Global Green agreed to issue 16,6667 common shares and 300,000 common shares respectively, to Pagic and also pay a one-time commercialization fee of US$50,000 upon the Algae Biomass Technology achieving commercial viability. The Technology License is subject to royalty of 4.5% of gross customer sales receipts for use of the Algae Biomass Technology and aggregate annual royalty minimum amounts of US$50,000 in 2009, US$100,000 in 2010 and US$250,000 in 2011 and each year thereafter in which the Technology License is effective. The Company issued the 16,667 common shares to Pagic on August 18, 2008 at a fair value of $190,746 which has been expensed to product development and has accrued and paid in full via equity debt settlement its share of the US$50,000 payment due on March 31, 2009.

As a result of economic conditions, the Company significantly reduced its staff at its El Paso research facility during the year ended March 31, 2009. The Company is currently negotiating for the continued development of the Company’s algae programs with certain universities.

VerticropTM Commercial Plant Growth Systems

Valcent Products Inc. has also introduced the “VerticropTM” HDVG System intended to grow a wide variety of crop products. The Company initially began experimenting with vegetable crops utilizing the growing system within its greenhouse production facilities in El Paso, Texas, however, during the year ended March 31, 2009 the Company’s development efforts shifted to Valcent EU where it has conducted detailed research and subsequently developed commercial scale growing systems.

HDVG System Technology – Concept and Advantages: The HDVG System technology provides a solution to rapidly increasing food costs caused by transportation/fuel due to the cost of oil. Together with higher cost comes a reduction in availability and nutritional values in the food people consume. The HDVG system is designed to grow vegetables and other plants much more efficiently and with greater food value than in agricultural field conditions.

As the world population increases, agricultural land and water resources rapidly diminish. Alternative and innovative solutions have to be found to feed people and reduce the consumption of water, land, energy, and food miles.

VerticropTM is an innovative and exciting vertical growing system which:

| · | Produces up to 20 times the normal production volume for field crops |

| · | Requires approximately 5% of the normal water requirements for field crops |

| · | Can be built on non arable lands and close to major city markets |

| · | Can work in a variety of environments: urban, suburban, countryside, etc. |

| · | Minimizes or eliminates the need for herbicides and insecticides |

| · | Will have very significant operating and capital cost savings over field agriculture |

| · | Will drastically reduce transportation costs to market, resulting in further savings, higher quality and fresher foods on delivery and less transportation pollution |

| · | Is modular and easily scalable from small to very large food production situations |

The HDVG System grows plants in closely spaced shelves vertically arranged on panels that are moving on an overhead conveyor system. The system is designed to provide maximum sunlight and precisely correct nutrients to each plant. Ultraviolet light and filter systems may exclude the need for herbicides and pesticides. Sophisticated control systems gain optimum growth performance through the correct distribution of nutrients, the accurate balancing of PH and the delivery of the correct amount of heat, light and water.

System Advantages

| | | reduced global transport costs and associated carbon emissions |

| | | food and fuel safety, security and sovereignty |

| | | local food is better for public health |

| | | building local economies |

| | | control of externalities and true costs |

In a rapidly urbanizing world where the majority of people now live in cities, localization requires that food and fuel be produced in an urban context. Urban agriculture presents a number of technological challenges. The main challenge is a lack of growing space.

Vertical growing is a new idea currently emerging in the sustainability discourse which offers great promise for increasing urban production. Vertical growing systems have been proposed as possible solutions for increasing urban food supplies while decreasing the ecological impact of farming. The primary advantage of vertical growing is the high density production it allows using a much reduced physical footprint and fewer resources relative to conventional agriculture. Vertical growing systems can be applied in combination with existing hydroponics, and greenhouse technologies which already address many aspects of the sustainable urban production challenge (i.e., soil-free, organic production, closed loop systems that maximize water and nutrient efficiencies, etc.). Vertical growing, hydroponics and greenhouse production have yet to be combined into an integrated commercial production system, but, such a system would have major potential for the realization of environmentally sustainable urban food and fuel production.

1/8th Acre HDVG System Commercial Production Model: The Company had been recently developing an HDVG System and specification of a 1/8th acre commercial scale plant capable of defining final operating and capital costs to maximize sales return. Completion of this facility located in El Paso is subject to budget allocations in the future. All current development and commercialization efforts relating to the Company’s vertical growing systems are continuing in the Company’s UK offices.

Commercial Deployment of First VerticropTM System – Paignton Zoo, Devon, UK: The Company via its UK subsidiary has in the summer months of 2009 deployed its first commercial test installation of its VerticropTM technology at the Paignton Zoo Environmental Park located in Devon, UK. The Paignton Zoo is one of the largest zoos in the UK. The Zoo is part of South West Environmental Parks Ltd which is owned by the Whitley Wildlife Conservation Trust. It is a combined zoo and botanic garden that welcomes over half a million visitors a year. The VerticropTM System installed at Paignton Zoo is meant to grow more plants in less room using less water and less energy. It will help to reduce food miles and bring down the Zoo’s annual costs for animal feed, which is currently in excess of £200,000 a year. The zoo will grow a whole range of herbs such as parsley and oregano, as well as leaf vegetables like lettuce and spinach, plus a range of fruits such as cherry tomato and strawberry. Reptiles, birds and most of the mammal collection - including primates and big cats -- will benefit from the production of year-round fresh food. The system which was a joint venture between Valcent Products EU Limited and the Paignton Zoo Environmental Park became operational on August 5, 2009, and will supply necessary data to the Company of semi-commercial crop yields, and other data for further commercialization of the VerticropTM System.

Verticrop Warehouse Systems: The Company is also developing a new VerticropTM product line for use in a warehouse environment. Using the latest horticultural lighting technologies, combined with state of the art irrigation and nutrient delivery systems, Valcent EU is in the final stages of developing a commercial application of its VerticropTM HDVG system suitable for installing in industrial type warehouses, as an alternative to polytunnels or glasshouses. A warehouse environment will provide a commercial grower with significant benefits, particularly in areas of climate extremes. Growing crops in a glasshouse or polytunnel can involve high energy costs to maintain stable temperatures suitable for healthy plant growth. Growing in a warehouse environment with a VerticropTM vertical farming system is designed to improve production and lower costs. Valcent EU’s research team has been working with two strategic partners who are acknowledged experts in the field of industrial lighting. This research has lead to the development of a commercially viable eco-friendly system, particularly well suited to application in a warehouse environment. The VerticropTM warehouse growing system will also use a hybrid lighting system, harnessing and channeling heat free natural daylight, complemented by the latest LED horticultural lighting technology.

Nova Skin Care System and Dust Wolf

The Company ceased development of Dust Wolf and Nova Skin Care Systems during the year ended March 31, 2009 due to economic conditions, and increased corporate focus on life sciences plant growth technologies. Any inventory related thereto amounting to raw materials of $314,012 and finished goods inventory of $330,451 were written off product development costs in the fiscal year ended March 31, 2009.

Agreement for Settlement and Reversion of Nova Skin Care System and Dust Wolf: On March 30, 2009, the Company entered into a letter of agreement with Pagic, Glen Kertz, and West Peak to settle royalties and other rights and obligations due under the Pagic Agreements (master license arrangements from July 2005) relating to Nova Skin Care Systems and Dust Wolf products that were discontinued by the Company. Under the settlement agreement, the Company relinquished all rights to the Nova Skin Care Systems and Dust Wolf products to Pagic and Kertz in exchange for a 3% royalty to the Company of future sales of the Nova Skin Care System or Dust Wolf on terms similar to those incurred by the Company under the Pagic Agreements, and the cessation of obligations of the Company under the Pagic Agreements relating to these technologies previously under license. West Peak agreed to forfeit any royalty rights it previously had relating to these technologies. There has been no further development of the Nova Skin Care System or Dust Wolf products that the Company is aware of.

Tomorrow GardenTM

Our Tomorrow GardenTM Kit is an indoor herb garden kit, designed to offer, direct to the consumer, an easy to use kit featuring herbs and plants not otherwise readily available in the marketplace. The Tomorrow GardenTM Kit offers an improved plant lifespan of up to three to six months, as opposed to the traditional shelf life of approximately seven to ten days for fresh herbs, and requires only ambient light, with no watering or other maintenance, to survive. Our Tomorrow GardenTM Plant Kit will be capable of supplying all of the standard herbs traditionally offered in grocery shops today, such as basil, mint, thyme, rosemary, parsley and cilantro, but may, in addition, supply more exotic herbs or pharmaceutical grade plants. Our Tomorrow GardenTM Kit is currently in the design, development, and test sales phase operating out of our offices located in Cornwall, England. First selected retail applications are aimed at children and education channels.

The Tomorrow Garden gift kits offer an easy to use growing system for a range of interesting and attractive plants.

Each Tomorrow Garden kit contains:

| · | a micropropagated plantlet |

| · | a membrane which enables the plants to grow and stay fresh for 3-6 months in normal light without the need for watering |

| · | a coir growing pot and compost |

The official launch of the Tomorrow Garden was premiered at the BBC Gardeners’ World Exhibition at the NEC in Birmingham on June 11 – 14, 2008, with a follow-up at the Royal Horticultural Society’s Hampton Court Flower Show on July 8 -13, 2008.

Currently our kits are aimed at the Junior/Educational market sector. As ferns have been around since pre-historic times, and are known to have provided a large proportion of the diet of the herbivore dinosaurs, the emphasis will be on inviting children in the 7yrs – 14 yrs age group to grow “dino food”. Growing kits have been designed in the appropriate packaging, reflecting the dinosaur theme.

Valcent EU is also culturing a number of more exotic plant species (such as orchids) so that it can both follow-up and compliment its initial products. It is also developing a range of culinary herbs and are reviewing a number of other options for special “Christmas” packs (e.g. the Christmas Rose). Finally, through “in house” expertise, Valcent EU is researching the development of a range of Chinese medicinal herbs, which can be sold in “growing kit” form through “alternate medicine” outlets or (ultimately) to pharmaceutical companies involved in this field of research.

Fluctuations in Results

During the period from March 24, 2004 through the year ended March 31, 2005, we had no meaningful operations and focused exclusively on identifying and adopting a suitable business plan and securing appropriate financing for its execution. As a result of the Company completing a licensing agreement with Pagic for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products during the fiscal year ended March 31, 2006 operating results have fluctuated significantly and past performance should not be used as an indication of future performance.

| Valcent Products Inc. |

| Selected Financial Data [Annual] |

| (Expressed in Canadian Dollars) |

| | 12 months ended |

| | | 2009 | 2008 | 2007 |

| Net Operating Revenues | $ | 0 | 0 | 0 |

| Loss from operations | $ | 15,337,285 | 12,028,222 | 8,171,090 |

| | | | | |

Other Loss (Income) | $ | 2,548,205 | 684,136 | (32,697) |

| Net loss per Canadian GAAP | $ | 17,885,490 | 12,712,358 | 8,138,393 |

| Loss per share | $ | 6.43 | 6.44 | 7.60 |

| | | | | |

| Share capital | $ | 21,957,516 | 16,691,282 | 8,196,982 |

| Common shares issued | | 3,008,977 | 2,459,796 | 1,703,670 |

| Weighted average shares outstanding | | 2,782,284 | 1,974,763 | 1,070,066 |

| Total Assets | $ | 2,351,963 | 4,605,914 | 4,142,485 |

| Net Liabilities | $ | 1,031,226 | 3,068,935 | 24,376 |

| | | | | |

Cash Dividends Declared per Common Shares | $ | 0 | 0 | 0 |

| | | | | |

Exchange Rates (CDN $ to 1 US $) period average | $ | 0.88839 | 0.97084 | 0.87896 |

Exchange Rates (CDN $ to 1 British Pound £) period average | $ | 0.52433 | 0.48368 | n/a |

Restructuring Initiatives

The debt settlements, lockup, and convertible debt restructuring (described below) are a part of the Company’s plan to substantially reduce its debt and restructure the Company’s capital structure as part of the Company’s efforts to further fund its business operations. As part of its restructuring, the Company held a special meeting of its shareholders on June 22, 2009 who approved a stock consolidation of one new share for each eighteen old shares. This share consolidation became effective on July 16, 2009. The Company continues to have obligations pursuant to the four convertible note holders in the aggregate of US$1,323,000, described below - July 2008 Convertible Note Amendments, and in conjunction with its re-organization and funding efforts incurred additional debt also described below – “2009 Debt and Conversion of Debt to Equity”.

Debt Settlement Agreements and Lockup Agreements

Concluding on May 11, 2009, but effective for accounting purposes as of March 31, 2009, Valcent Products, Inc. (the “Company”) entered into agreements with a significant number of the Company’s creditors to settle or restructure a significant portion of the Company’s indebtedness in consideration for shares of the Company’s common stock. The Company settled an aggregate of US$10,806,780 representing these balances was settled in exchange for 29,516,951 common shares issued on May 11, 2009. Included in these shares are 24,232,816 common shares which are subject to pooling restrictions with quarterly equal releases beginning on January 1, 2010, a further 2,634,135 common shares were subject to pooling restrictions until January 1, 2010. Also included in these shares are 1,316,424 shares were issued in settlements of debts involving current officers or directors of the Company, 391,298 were issued to a past director and officer of the Company, all of which are subject to the lockup agreements.

July 2008 Convertible Note Amendments

As part of the overall debt restructuring, the Company also entered into agreements with each of the Company’s secured creditors and amended the terms of the four secured convertible promissory notes issued in July 2008 in the aggregate principal amount of US$2,428,160 (collectively the “Notes”). One of the Notes is held by the Company’s chief financial officer and member of the board of directors (being a Note in the principal amount of US$188,160).

By their original terms the Notes were to be due on or before July 16, 2009, however all of the parties agreed to extend the maturity date of the Notes until December 31, 2009. On June 2, 2009, pursuant to the modified contractual arrangements, the Company paid US$400,000 to certain of the holders of the Notes (with the exception of the Company’s chief financial officer and member of the board of directors) to pay down the principal amount due and owing under the Notes. All holders of the Notes also agreed to provide the Company or its designee an option to purchase on or before December 31, 2009 the Notes and the remaining amounts due under them, being US$1,323,000 as of December 31, 2009. Further, through December 31, 2009 each Note holder has agreed not to effect any conversions of the Notes into shares of our common stock.

In consideration for the amendments and accommodations to the Notes, the Company agreed to pay each holder consideration that was comprised of the prepayment of interest that otherwise would have been due and owing on the Notes through December 31, 2009 and amounts that would have been due under the Notes pursuant to their terms, including the original issuance discount and prepayment premium. This consideration was paid to each Note holder in the form of Company common stock. In total the Company issued 2,892,036 shares of its common stock to the four Note holders. However, each of the holders entered into an agreement whereby each agreed to not sell these shares until January 1, 2010. The Company reserves the right to change lock up arrangements at its discretion.

Each Note holder also agreed to waive any adjustment to the exercise price of the warrants issued to the holders as part of the July 2008 financing that may have resulted from the issuances of shares of Company common stock as part of the Company’s overall debt restructuring and/or from certain other contemplated Company issuances. However, subject to certain exceptions, the Company agreed that if before March 31, 2010 the Company issues shares of its common stock at a price less than the valuation of the shares issued to each Note holder (US$0.40 per share), that the Company would issue each holder additional shares of Company common stock in a number equal to the difference between the number of shares each holder would have received had the consideration paid to the holder been paid in shares at the lower valuation. If the US$1,323,000 face amount required to retire these notes is not paid on or before December 31, 2009, the promissory notes revert to the terms and conditions original secured convertible note transaction documents including security agreement originally executed in July 2008 which remain valid and in effect.

2009 Debt and Conversion of Debt to Equity

On March 26, 2009, the Company entered into a subscription agreement for an investment of up to US$2,000,000 in convertible units with a single subscriber. The subscription funds bear interest at 10% and the issuance of the units are subject to the completion of the Company’s reverse consolidation which occurred on July 18, 2009. The subscription advances and accrued interest are convertible into units at the rate of US$0.125 per unit on the date upon which the Company effects a reverse share consolidation. Each unit will consist of one restricted common share and one-third share purchase warrant with each whole warrant exercisable into one common share at an exercise price of US$0.45 per share for a one year term from the date of issue. The warrants may be exercised on a cashless basis.

As at March 31, 2009, the Company had received US$500,000 ($630,650) which has been reflected as a promissory note payable in the financial statements. During the year ended March 31, 2009, the Company accrued US$685 interest on the principal balance of this advance. On May 22, 2009, the balance of US$1,500,000 was received.

The Company completed the share consolidation on June 22, 2009 and on July 17, 2009, the Company issued 16,303,562 common shares pursuant to the conversion of US$2,000,000 in convertible subscription advances and interest of US$37,945 and also issued 5,434,521 warrants to purchase 5,434,521 common shares at an exercise price of US$0.45 per share until July 17, 2010. The 5,434,521 warrants issued may be exercised on a cashless basis. Any shares issued to this subscriber upon the conversion of the notes would not be subject to lock up arrangements, but the subscriber is deemed an affiliate of the Company owing to shareholdings greater than 20% ownership and as such has certain selling restrictions

In addition, during the period April 1, 2009 through June 22, 2009, the Company received subscriptions to a 10% convertible promissory note in the aggregate of US$176,240. The note and accrued interest have been converted into units at the rate of US$0.40 per unit. Each unit of consists of one restricted common share and one share purchase warrant to purchase an additional restricted common share at an exercise price of US$0.60 per share for a two year term from the date of conversion. On July 17, 2009, the Company issued 458,139 common shares pursuant to the conversion of US$176,240 in convertible notes and interest of US$3,777 and also issued 458,139 warrants to purchase 458,139 common shares at an exercise price of US$0.60 per share until July 17, 2011

Selected Quarterly Financial Data

Valcent Products Inc. Selected Financial data [Unaudited] (Expressed in Canadian Dollars | | | | | | | |

| | | Quarter Ended 03/31/2009 | Quarter Ended 12/31/2008 | Quarter Ended 09/30/2008 | Quarter Ended 06/30/2008 | Quarter Ended 03/31/2008 | Quarter Ended 12/31/07 | Quarter Ended 09/30/07 | Quarter Ended 06/30/07 |

| | | | | | | | | | |

| Net Operating Revenues | $ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Loss from operations | $ | 3,704,702 | 4,547,838 | 4,077,677 | 3,007,068 | 5,140,674 | 3,482,692 | 2,121,037 | 1,283,819 |

| Net loss per Canadian GAAP | $ | 5,297,776 | 5,566,158 | 4,075,475 | 2,916,081 | 6,364,394 | 3,495,735 | 1,921,261 | 930,968 |

| Loss per share from continued operations | $ | 1.78 | 1.96 | 1.49 | 1.12 | 2.73 | 1.808 | 1.05 | 0.52 |

| Share Capital | $ | 21,957,516 | 20,543,236 | 19,482,091 | 18,620,606 | 16,691,282 | 13,322,958 | 9,333,316 | 12,604,100 |

| Common Shares issued | | 3,008,977 | 2,932,718 | 2,793,016 | 2,679,613 | 2,459,795 | 2,234,935 | 1,837,103 | 1,829,344 |

| Weighted average shares outstanding | | 2,982,909 | 2,832,856 | 2,725,336 | 2,590,304 | 2,328,672 | 1,857,651 | 1,835,443 | 1,785,232 |

| Total assets | $ | 2,351,963 | 4,001,862 | 4,230,595 | 4,330,428 | 4,605,914 | 4,434,893 | 3,585,751 | 4,520,482 |

| Net assets (Liabilities) | $ | (1,031,226) | (10,716,836) | (5,984,732) | (4,633,652) | (3,068,935) | (2,329,107) | (3,259,327) | (2,019,941) |

| | | | | | | | | | |

| Cash Dividends Declared Per common Shares | $ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | | | | | | | | | |

| | | | | | | | | | |

YEAR ENDED MARCH 31, 2009 COMPARED WITH YEAR ENDED MARCH 31, 2008

Operating Results

For the year ended March 31, 2009, we focused on the following business initiatives:

| (i) | the development and commercialization of our VerticropTM HDVG System designed to produce vegetables and other plant crops, |

| (ii) | the development of a commercial algae growing technology via Vertigro Algae with Global Green Solutions, Inc., and |

| (iii) | the development and marketing of the Tomorrow GardenTM consumer retail product by Valcent EU. |

For the year ended March 31, 2008, the Company focused on:

| (i) | the development of a commercial algae growing technology via a joint venture with Global Green, |

| (ii) | the development of our VerticropTM HDVG System designed to more efficiently produce certain plant crops, |

| (iii) | the development and test marketing of the Tomorrow Garden TM consumer retail product by Valcent EU, |

| (iv) | the development of product inventories and direct test and sales initiatives and product introduction promotion relating to our Nova Skin Care System, and |

| (v) | ongoing research and development with tissue culture technologies, plant growth stimulation technologies, and other product and technology development initiatives. |

Our reported net loss increased by $5,173,132 to $17,885,490 ($6.43 basic loss per share) for the year ended March 31, 2009 as compared to $12,712,358 ($6.44 basic loss per share) for the same period ending March 31, 2008. The increase during the 2009 fiscal year is largely a result of increased research and development activity related to the discontinuance of the Nova Skin Care System, development of the Company’s Algae technology and the commercialization of the VerticropTM HDVG System. The Company also incurred non recurring costs relating to fixed asset impairment and a loss on settlement of debts related to the valuation of convertible debentures utilized to finance the Company. Finally, owing to changes in the value of the United States dollar, primarily, the Company also incurred a significant foreign exchange loss during the year ended March 31, 2009.

Revenues

For the years ended March 31, 2009 and March 31, 2008, the Company had no revenue.

However, as the Company is in the development stage, test sales are credited to product development costs. During the year ended March 31, 2009, the Company had test sales of $219,483 (2008 - $985,779) related to the Nova Skin Care System. As at March 31, 2009 the Company ceased the development of the Nova Skin Care System.

Operating Expenses

Product development expenses increased by $4,157,564 to $8,238,999 for the year ended March 31, 2009 as compared with the year ended March 31, 2008. The increase is due to write downs relating to, accounts receivable impairment, inventory impairment for the discontinuance of Nova Skin Care Products marketing and product testing, increased research and development costs relating to the commercialization of the VerticropTM System, and the advent of costs relating to the Tomorrow GardenTM product line. Product development expenses were $4,081,435 during the year ended March 2008.

In conjunction with convertible debenture financings the Company incurred $3,213,003 in interest, accretion, and financing on convertible notes in the twelve month period ended March 31, 2009. This represents a $296,045 increase from the $2,916,958 that had been incurred during the year ended March 31, 2008 stemming primarily from amortization and accretion of convertible debenture funding activity during the 2009 and 2008 fiscal years.

The Company incurred a loss on the settlement of debts in the amount of $885,292 during the year ended March 31, 2009 (2008 $0) with respect to the renegotiation and settlement of certain portions of convertible notes issued in July 2008.

Investor relations fees decreased $88,793 to $782,749 (2008 - $871,542) for the year ended March 31, 2009 as a result of the Company employing a decreasing number of third party consultants in advisory, business consulting services, and investor relations activities.

Professional fees increased by $92,946 to $524,216 for the year ended March 31, 2009 from $431,270 for the year ended March 31, 2008. The increase is primarily attributable to costs associated with increased finance activity and costs relating to complex financial accounting issues, as well as intellectual property legal services, and technology acquisition negotiations between the respective years.

Advertising and media development was $448,258 during the year ended March 31, 2009 (2008 $1,953,998) with such decrease reflecting the cessation of marketing development relating to the Nova Skin Care System.

Office and miscellaneous expenses increased $154,311 to $389,128 for the year ended March 31, 2009 from $234,817 for the year ended March 31, 2008. The increase is due to emphasis on project development initiatives in the Company’s UK subsidiary.

As a result of the issuance of options to directors, officers, employees and consultants the Company incurred stock option compensation expenses of $260,530 during the year ended March 31, 2009 (2008 - $990,305).

Travel expenses decreased by $55,024 to $236,441 (2008 - $291,465) for the year ended March 31, 2009 as a result of decreased activity in all of the Company’s operations, decreased number of active development projects, as well as cost streamlining due to global economic circumstances.

Amortization increased $134,155 to $181,618 (2008 - $47,463) for the year ended March 31, 2009 as a result of an increasing asset base and depreciation charges related thereto.

Rent expenses increased $53,120 to $131,038 for the year ended March 31, 2009 from $77,918 for the year ended March 31, 2008. The increase in rent costs incurred relates to our new offices and operations located in the United Kingdom.

Filing and transfer agent expenses decreased $22,350 to $22,150 for the year ended March 31, 2009, from $44,500 for the year ended March 31, 2008. The decrease is primarily attributable to costs associated with the proportionate decrease of financing and business activity during the 2009 fiscal year.

Insurance expense decreased to $19,640 for the year ended March 31, 2009, from $71,071 for the year ended March 31, 2008. The decrease is primarily attributable to the rebate of 2008 insurance costs received in the year ended March 31, 2009 and associated decreased insurance coverage required which was prorated over both 2008 and 2009 fiscal years.

Interest relating to long term debt decreased to $4,223 (2008 - $15,480) due to the payout of all long term debt in July, 2008.

Other Income and Expenses

Interest income for the years ended March 31, 2009 and March 31, 2008 were $19,491 and $10,805 respectively.

As a result of staffing cuts in our El Paso facility and due to the specialized nature of buildings and equipment, the Company impaired the carrying value of certain of its fixed assets relating to our El Paso, Texas operation; the Company’s fixed assets and land were valued at a net book value of $1,070,216 (2008 - $1,135,108) during the year ended March 31, 2009, and a one time write down of assets in the amount of $509,892 was incurred (2008 - $0).

Due primarily to fluctuations in the United States dollar the foreign exchange loss for the year ended March 31, 2009 was $2,027,804. For the year ended March 31, 2008 the Company had a foreign exchange gain of $611,133.

Liquidity and Capital Resources

Because we are organized in Canada, our March 31, 2009 financial statements have been prepared by our management in accordance with Canadian GAAP applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business.

Our accumulated losses during the development stage increased by $17,885,490 to $42,173,129 for the year ended March 31, 2009 from $24,317,639 for the year ended March 31, 2008.

Our working capital deficit decreased to $2,101,443 from $5,094,440 for the year ended March 31, 2009 representing a $2,992,997 decrease over the year ended March 31, 2008. Even though this decrease stemmed primarily from debt settlement and restructuring initiatives, as described in Note 1 to our March 31, 2009 financial statements, these conditions raise substantial doubt as to our ability to continue as a going concern.

The Company’s ability to continue as a going-concern is dependent upon the economic development of its products, the attainment of profitable operations and the Company’s ability to obtain further financing. The Company continues to explore additional funding to finance its operations and obligations. Management is considering all possible financing alternatives, including equity financing, debt financing, joint-venture, corporate collaboration and licensing arrangements. However, there can be no assurance that the Company will be successful in its financing efforts or in the success of its products.

During the year ended March 31, 2009, the Company engaged in a series of private offering transactions with institutional and other investors, pursuant to which we raised US$1,951,600 through private placements of equity comprised of common shares and warrants, US$191,664 from warrant exercises, US$2,168,000 from convertible debentures issuances, and approximately $1,662,578 in promissory notes, and short term advances.

During the year ended March 31, 2008, the Company engaged in a series of private offering transactions with institutional and other investors, pursuant to which we raised US$5,129,636 through private placements of equity comprised of common shares and warrants, US$367,671 from warrant and share option exercises, and US$1,291,000 from convertible debentures, promissory notes, and short term advances.

During the year ended March 31, 2009, we issued 16,667 common shares for technology valued at US$180,000, and issued 275,731 common shares for convertible note conversions received of US$1,422,206 in interest and principal.

Long term debt decreased from $158,612 at March 31, 2008 to $0 at March 31, 2009 as a consequence of freeing a first secured interest in the Company’s El Paso property in favour of holders of our July 2008 convertible note debt financing.

Our advances and amounts due from related parties decreased by $1,303,871 to $186,645 as at March 31, 2009 (2008 - $1,490,516) due to debt settlements made with debt holders on March 31, 2009 for common share equity as part of corporate restructuring initiatives.

Convertible notes decreased as at March 31, 2009 to $11,228 from $5,202,741 at March 31, 2008 due to debt settlements made with debt holders on March 31, 2009 for common share equity as part of corporate restructuring initiatives. Certain remaining principal portions of the notes were optioned to the Company until December 31, 2009 and were reclassified as secured promissory notes.

Promissory notes increased from $270,167 at March 31, 2008 to $2,643,514 at March 31, 2009 owing in part to reclassification of certain remaining principal portions of the July 2008 convertible notes to promissory notes due to renegotiation of these instruments, provisions made by negotiation for the repayment of US$400,000 of the July 2008 convertible notes in cash on June 2, 2009, and the receipt of US$500,000 as part of a private placement with a single investor which was later converted to common shares on July 17, 2009.

Accounts payable and accrued liabilities increased slightly to $541,802 at March 31, 2009 from $536,563 at March 31, 2009.

As a result of the cessation of Nova Skin Care System development certain of our inventories were impaired by $644,463 as at March 31, 2009. As at March 31, 2009, inventories related to the Company’s Tomorrow Garden project in the aggregate of $34,072 (2008 - $nil).

Prepaid expenses as at March 31, 2009 of $102,670 (2008 $2,119,546) include $16,606 (2008 - $2,015,837) related to the deferred portion of business consulting and investor relations services agreements with the balance of $86,064 (2008 - $103,709) consisting of in prepaid insurance and rental deposits.

As at March 31, 2009, accounts receivable of $920,235 consists of $812,048 due from Global Green Solutions, the Company’s joint venture partner in Vertigro Algae, with the balance primarily due from value added tax receivable by the Company’s subsidiary, Valcent Products EU Limited, and goods and services tax receivable by the Company, as well as receivables relating to Tomorrow GardenTM sales. As at March 31, 2008, accounts receivable of $462,156 consisted primarily of amounts due from the Company’s product fulfillment agent, GSI Commerce, Inc. (formerly Accretive Commerce Inc.) from test sales relating to the Company’s Nova Skin Care System, value added tax receivable by the Company’s subsidiary, Valcent Products EU Limited, and goods and services tax receivable by the Company.

Restricted cash as at March 31, 2008 consisted of certificates of deposit and interest earned of $108,471 that were pledged to secure long term debt relating to our purchased lands in El Paso. Restricted cash as at March 31, 2009 was $0 due to long term debt being paid in full in July, 2008 resulting in restricted cash being freed for corporate use.

During the year ended March 31, 2009, the Company determined that certain capital assets were not in use or impaired and accordingly wrote down the carrying value of those assets to their net recoverable amounts. The write-down amounting to $509,892 (2008 $0) was in addition to $181,618 (2008 $47,463) in amortization in the statement of operations for the year ended March 31, 2009.

As at March 31, 2009, we had $224,769 in cash (2008 - $163,437) and we currently have approximately $46,000 in cash as at September 15, 2009.

Due to uncertainty in determining future cash flows related to products under license, the Company, during the year ended March 31, 2008, wrote down the value of the product license by $1,306,074 to $1.

Details of the convertible notes are as follows:

Convertible note continuity:

| | US $ | CDN $ |

| | Balance | 2009 | 2009 | 2009 | 2009 | Balance | Balance |

| | March 31, | Issued | Equity | Interest/ | Conversions/ Conversions/ | March 31, | March 31, |

| Date of Issue | 2008 | Principal | Portion | Penalty | Repayments* | 2009 | 2009 |

| | | | | | | | |

| July/August 2005 | $ 259,825 | $ 0 | $ 0 | $ 15,647 | $ (275,472) | $ 0 | $ 0 |

| April 2006 | 534,442 | 0 | 0 | 29,287 | (563,729) | 0 | 0 |

| April 2006 | 85,542 | 0 | 0 | 4,673 | (90,215) | 0 | 0 |

| December 2006 | 1,659,782 | 0 | 0 | 150,544 | (1,810,326) | 0 | 0 |

| January 2007 | 1,569,183 | 0 | 0 | 468,170 | (2,037,353) | 0 | 0 |

| August 2007 | 678,567 | 0 | 0 | 102,260 | (780,827) | 0 | 0 |

| September 2007 | 297,433 | 0 | 0 | 154,295 | (442,826) | 8,902 | 11,228 |

| July 2008 | 0 | 2,168,000 | (1,315,003) | 1,262,529 | (2,115,526) | 0 | 0 |

| | $5,084,774 | $2,168,000 | $(1,315,003) | $2,187,405 | $(8,116,274) | $ 8,902 | $11,228 |

| | US $ | CDN $ |

| | Balance | 2008 | 2008 | 2008 | 2008 | Balance | Balance |

| | March 31, | Issued | Equity | Interest/ | | March 31, | March 31, |

| Date of Issue | 2007 | Principal | Portion | Penalty | Conversions | 2008 | 2008 |

| | | | | | | | |

| August 2005 | $ 316,957 | $ 0 | $ 0 | $ 22,389 | $ (79,521) | $ 259,825 | $ 265,583 |

| April 2006 | 495,607 | 0 | 0 | 38,835 | 0 | 534,442 | 546,841 |

| April 2006 | 79,115 | 0 | 0 | 6,427 | 0 | 85,542 | 87,527 |

| December 2006 | 670,486 | 0 | 0 | 989,296 | 0 | 1,659,782 | 1,698,289 |

| January 2007 | 813,084 | 0 | 0 | 967,767 | (211,668) | 1,569,183 | 1,605,558 |

| August 2007 | 0 | 650,000 | (230,007) | 258,574 | 0 | 678,567 | 694,310 |

| September 2007 | 0 | 391,000 | (213,249) | 119,682 | 0 | 297,433 | 304,633 |

| | $2,375,249 | $1,041,000 | $(443,256) | $2,402,970 | $ (291,189) | $5,084,774 | $5,202,741 |

* Includes commitments to convert the remaining amounts into common shares

US $1,277,200 July – August 2005 Convertible Note

To provide working capital for product development, during July and August 2005 the Company issued one-year, unsecured US$1,277,200 8% per annum convertible notes and three-year Class A and B warrants to acquire: (i) up to 50,741 common shares of the Company at a price per share of US$9.00; and (ii) up to an additional 50,741 common shares of the Company at a price per share of US$18.00. Under their original terms, the holders of the convertible notes could elect to convert the notes into common shares of the Company at the lesser of: (i) 70% of the average of the five lowest closing bid prices for the common stock for the ten trading days prior to conversion; and (ii) US$9.90. Accrued and unpaid interest may be converted into common shares of the Company at US$9.00 per share. The Company may, subject to notice provisions and the common shares trading above US$27.00 per share for more than twenty consecutive trading days, elect to payout the notes and interest due by paying 130% of the amount due under the notes plus interest. The common stock purchase warrants carry a “net cashless” exercise feature (“Cashless Conversion Feature”) allowing the holder thereof, under certain limited circumstances, to exercise the warrants without payment of the stated exercise price, but rather solely in exchange for the cancellation of that number of common shares into which such warrants are exercisable. As a result of the issuance of the warrants in conjunction with the convertible notes, the Company recorded a non-cash financing expense of $1,328,337. These convertible notes were unsecured and due on demand.

In conjunction with this financing, the Company paid consultants an amount equal to 10% of the gross proceeds, which was included in investor relations during the year ended March 31, 2006 and issued 23,651 common shares at a deemed value of $285,242. There are 14,192 finders’ A warrants outstanding whereby the holders have the right to purchase 14,192 common shares at US$9.00 per share until August 5, 2008 and 23,652 finders’ B warrants whereby the holders shall have the right to purchase 23,652 common shares at US$13.50 per share until August 5, 2008. A total of US$82,200 in registration penalties incurred in the year ended March 31, 2007 were converted to a new convertible debenture in the same amount on April 6, 2007.

During the year ended March 31, 2009, principal of US$92,281 and interest of US$9,423 were converted to 14,845 common shares and interest of US$15,647 (2008 – US$22,389) was accrued on the unconverted principal balance of these convertible notes during the year.

Effective March 27, 2009, the Company agreed to settle the remaining principal, accrued interest and prepayment penalties comprising remaining unpaid elements of this convertible note aggregating US$173,768 for 595,006 common shares that will be restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 595,006 common shares were subsequently issued on May 11, 2009.

US $551,666 April 2006 Convertible Note

On April 6, 2006, the Company consummated a private offering transaction with and among a syndicated group of investors, pursuant to which the Company issued, in the aggregate, US$551,666 in 8% per annum convertible notes and three-year Class A and B warrants to acquire: (i) up to 40,864 shares of the Company’s common stock at a price per share of US$9.00; and (ii) up to an additional 40,864 shares of the Company’s common stock at a price per share of US$18.00. Subject to certain limitations under their original terms, the principal amount of the notes, together with any accrued interest could be converted into shares of the Company’s common stock at the lesser of:

| (i) | 70% of the average of the five lowest closing bid prices for the common stock for the ten trading days prior to conversion; or |

| (ii) | US$9.90. The convertible notes carry a redemption feature, which allows the Company to retire them, in whole or in part, for an amount equal to 130% of that portion of the face amount being redeemed, but only in the event that the common shares have a closing price of US$27.00 per share for at least twenty consecutive trading days and there has otherwise been no default. The common stock purchase warrants carry a Cashless Conversion Feature. |

These convertible notes were unsecured and due on demand.

In conjunction with these private offering transactions, the Company paid consultants: (i) US$55,166 cash, representing 10% of the gross proceeds realized; (ii) 10,216 shares of common stock; (iii) three-year warrants to purchase up to 6,129 shares of common stock at a price per share of US$9.00; and (iv) three-year warrants to purchase up to 10,215 shares of common stock at a price per share of US$13.50.

During the year ended March 31, 2009, convertible notes and interest of US$460,679 were converted to 111,751 common shares and interest of US$21,312 (2008 – US$38,835) was accrued on the unconverted principal balance of these convertible notes.

Effective March 27, 2009, the Company agreed to settle the remaining principal, accrued interest and prepayment penalties comprising remaining unpaid elements of this convertible note aggregating US$103,050 for 473,101 common shares that will be restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 473,101 common shares were subsequently issued on May 11, 2009.

US $82,200 April 2006 penalty Convertible Note

On April 6, 2006, and in conjunction with certain private placements, the Company reached a verbal agreement with investors wherein the Company agreed to convert US$82,200 in accrued penalties associated with the July 25, 2005 through August 5, 2005 convertible notes into US$82,200 convertible penalty notes (Note 10(a)) carrying terms similar to the July 25, 2005 through August 5, 2005 convertible notes and an aggregate of 6,089 warrants. These warrants carry a Cashless Conversion Feature and each warrant entitles the holder to purchase additional common shares for three years at a price of US$13.50 per share. These convertible notes are unsecured and due on demand.

During the year ended March 31, 2009, convertible notes and interest of US$64,410 were converted to 17,994 common shares and interest of US$4,673 (2008 – US$6,427) was accrued on the unconverted principal balance of these convertible notes.

Effective March 27, 2009, the Company agreed to settle the remaining principal, accrued interest and prepayment penalties comprising remaining unpaid elements of this convertible note aggregating US$25,715 for 106,443 common shares that will be restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 106,443 common shares were subsequently issued on May 11, 2009.

Warrant Exercise Price Reduction and Registration Penalty Interest

Certain of the July and August 2005 and the April 6, 2006 convertible notes contained registration rights whereby the Company agreed to pay a penalty of 2% for every thirty day period after which the Company was obligated to file a registration statement and further reduce the warrant price of certain of the warrants issued by US$1.80. As a result of the Company not filing its registration statement until April 27, 2006, the Company incurred penalties, which have been included in interest expense. An aggregate of 189,299 previously issued share purchase warrants relating to certain of the July and August 2005 and the April 6, 2006 convertible notes have reduced exercise prices from US$9.00, US$13.50 and US$18.00 to US$7.20, US$11.70 and US$16.20, respectively. In 2007, the Company recognized $80,102 in interest expense with the corresponding amount to contributed surplus as a result of re-valuation of the warrants upon the change in the pricing.

US $1,500,000 December 2006 Convertible Note

On December 1, 2006, the Company accepted subscriptions of US$1,500,000 towards a private placement of 8% per annum, unsecured, convertible notes and three-year warrants to acquire: (i) up to an aggregate of 111,112 shares of the Company’s common stock at a price per share of US$9.00; and (ii) up to an additional 111,112 shares of the Company’s common stock at a price per share of US$18.00. Subject to certain limitations, the terms of the notes provided that the principal amount of the notes, together with any accrued interest may be converted into shares of the Company’s common stock, at the lesser of: (i) 70% of the average of the five lowest closing bid prices for the Company’s common stock for the ten trading days prior to conversion; or (ii) US$9.90. The convertible notes carried a redemption feature, which allows the Company to retire them, in whole or in part, for an amount equal to 130% of that portion of the face amount being redeemed, but only in the event that the common shares have a closing price of US$27.00 per share for at least twenty consecutive trading days and there has otherwise been no default. These convertible notes are unsecured and due on demand. The common stock purchase warrants may be exercised on a cashless basis. After December 31, 2007, this convertible note began accruing interest at the rate of 15% per annum.

The right of the note holders to convert into the Company’s common stock is subject to the contractual agreement between the parties that any conversion by the note holders may not lead at the date of such conversion to an aggregate equity interest in the common stock of the Company greater than 9.99% inclusive of any derivative securities including options, warrants, convertible debt, any other convertible debt securities or any other financial instruments convertible into common equity.

During the year ended March 31, 2009, the Company accrued US$150,544 (2008 - US$989,296) in interest and accreted interest on the principal balance on the unconverted principal balance of these convertible notes; the principal portion of the notes was increased owing to the accretion of interest expense in the same amount relating to convertible debenture equity conversion component.

Effective March 27, 2009, the Company agreed to settle the remaining principal of US$1,500,000 and accrued interest of US$310,326 comprising remaining unpaid elements of this convertible note aggregating US$1,810,326 for 4,525,807 common shares that are restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 4,525,807 common shares were subsequently issued on May 11, 2009.

US $2,000,000 January 2007 Convertible Note

On January 29, 2007, the Company completed a private placement comprised of $2,000,000 convertible notes. The convertible notes matured on December 11, 2008, and carry interest at 6% per annum and are unsecured. The notes were convertible into “Units” at the note-holders’ discretion at a conversion price of US$9.00 per Unit. Each “Unit” consisted of one common share and one purchase warrant to purchase an additional common share at US$12.60 per share until December 11, 2008. The notes and any accrued interest were callable by the Company at any time after December 11, 2007 by providing thirty days’ written notice to the note-holders. Interest on the notes was compounded annually and cumulative until the earlier of either the date the Company achieves pre-tax earnings or the end of the term. At the discretion of the note-holders, interest on the notes was payable in either cash or units at US$9.00 per unit. In connection with this financing, the Company paid consultants US$108,000 in cash and issued 7,500 units exercisable at US$9.00 per unit, with each unit consisting of one common share and one share purchase warrant to purchase a further common share at US$12.60 per share until December 11, 2008. The Company was obligated to file a resale registration statement on the underlying securities within four months of closing, which it has failed to do.

As a result of the failure to file the registration statement, the Company recorded penalties of US$120,000 during the year ended March 31, 2007 and a further US$289,973 during the year ended March 31, 2008.

During the year ended, March 31, 2009, convertible note principal and accrued interest in the aggregate amount of US$709,995 was converted into 78,888 common shares and convertible note principal and accrued interest in the aggregate amount of US$28,238 was traded for new 10% interest convertible notes that convert automatically into units at a conversion price of US$0.40 per unit on the effective date of the reverse share consolidation where each unit is comprised of one common share and one 2-year share purchase warrant to purchase an additional common shares at $0.60 per share for a two year term from the date of issue of the units.

During the year ended March 31, 2009, the Company accrued US$468,170 (2008 - US$967,767) in interest and accreted interest on the principal balance on the unconverted principal balance of these convertible notes.

Effective March 27, 2009, the Company agreed to settle the remaining principal, and accrued interest comprising remaining unpaid elements of this convertible note aggregating US$1,299,120 for 3,247,797 common shares that will be restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 3,247,797 common shares were subsequently issued on May 11, 2009.

US $650,000 August 2007 Convertible Note

On August 10, 2007, the Company issued an unsecured convertible term promissory note in the amount of US$650,000 to a third party. The convertible note bears interest at 6% with both interest and principal convertible at the option of the lender into units at US$10.80 per unit, with each unit consisting of one common share and one-half share purchase warrant with each whole share purchase warrant exercisable at US$13.50 to purchase an additional common share. After November 25, 2008, this convertible note accrued interest at the rate of 15% per annum.

The Company was required to register for trading the securities underlying the conversion features of this convertible note on a best-efforts basis but failed to do so within terms agreed. A one-time financial penalty of US$28,567 for failure to register the securities underlying this convertible note within 180 days from the date of issuance was incurred in the year ended March 31, 2008.

The right of the note holder to convert into the Company’s common stock was subject to the contractual agreement between parties that any conversion by the note-holder may not lead, at the date of such conversion, to an aggregate equity interest in the common stock of the Company greater than 9.99% inclusive of any derivative securities including options, warrants, convertible debt, any other convertible debt securities or any other financial instruments convertible into common equity.

During the year ended March 31, 2009, the Company accrued US$102,260 (2008 - US$258,574) in interest and accreted interest on the principal balance on the unconverted principal balance of these convertible notes.

Effective March 27, 2009, the Company agreed to settle the remaining principal and accrued interest comprising remaining unpaid elements of this convertible note aggregating US$780,827 for 1,952,066 common shares that are restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 1,952,066 common shares were subsequently issued on May 11, 2009.

US $391,000 September 2007 Convertible Note

On September 27, 2007, the Company issued unsecured one-year term convertible notes bearing interest at 6% per annum in the amount of US$391,000 to third parties. Under the original terms, both interest and principal may be converted at the option of the lender at any time at US$10.80 per unit, with each unit consisting of one common share and one-half share purchase warrant, with each whole share purchase warrant exercisable at US$13.50 to purchase an additional common share for a two-year term from the date of conversion.

The Company was required to register for trading the securities underlying the conversion features of this convertible note on a best efforts basis but has failed to do so within terms agreed. A one-time financial penalty of US$23,460 for failure to register the securities underlying this convertible note within 90 days from the date of issuance has been incurred during the year ended March 31, 2008.

During the year ended March 31, 2009, the Company accrued US$154,295 (2008 - US$119,652) in interest and accreted interest on the principal balance on the unconverted principal balance of these convertible notes.

During the year ended March 31, 2009, the Company repaid US$7,500 of the principal on these convertible notes and, subsequent to year end, paid the balance of US$7,500 in principal and US$1,402 in interest.

Effective March 27, 2009, the Company agreed to settle the remaining principal and accrued interest comprising remaining unpaid elements of this convertible note aggregating US$435,326 for 1,024,667 common shares that will be restricted from trading and pooled with equal quarterly releases beginning in January 2010. The 1,024,667 common shares were subsequently issued on May 11, 2009.

US $2,168,000 July 2008 Convertible Note

On July 21, 2008, the Company closed a financing of zero coupon, 12% interest, senior secured convertible promissory notes in the amount of US$2,428,160 with an aggregate purchase price of US$2,168,000 with four investors, one of which was the Company’s Chief Financial Officer. The debt is convertible into shares of common stock at the lesser of US$9.18 per share (unless the conversion price has been adjusted pursuant to further contract covenants) and 70% of the average of the five lowest closing bid prices for the ten preceding trading days. The Company issued each purchaser in the private placement two warrants - one warrant being redeemable by the Company and the other being non-redeemable. The non-redeemable warrants are exercisable at US$9.90 and permit the holder to purchase shares of common stock equal to 100% of the number of shares issuable upon the conversion of the notes calculated on July 21, 2008. The redeemable warrants are exercisable at US$13.50 and permit the holder to purchase common stock equal to 50% of the number of shares issuable upon the conversion of the notes issued calculated on the closing date. In total, the Company issued redeemable warrants to purchase an aggregate of 264,506 shares of common stock and redeemable warrants to purchase an aggregate of 132,253 shares of common stock. Further, the Company issued 24,401 non-redeemable warrants and 12,201 redeemable warrants and US$160,000 in cash fees to close the transaction. Each non-redeemable warrant is exercisable at US$9.90, and each redeemable warrant is exercisable at US$13.50; warrants carry a term of five years from the date of closing of the financing. The redeemable warrants may be redeemed by the Company only if certain conditions have been satisfied including the Company’s common stock having closed at $27.00 per share for a period of 20 consecutive trading days and the warrant holder being able to resell the shares acquired upon exercise through a resale registration statement or under Rule 144 of the Securities Act.