VALCENT PRODUCTS INC.

THE ATTACHED UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS DATED SEPTEMBER 30, 2009 FORM AN INTEGRAL PART OF THIS MANAGEMENT DISCUSSION AND ANALYSIS AND ARE HEREBY INCLUDED BY REFERENCE

Management Discussion and Analysis as of November 30, 2009

By certificate of amendment dated April 15, 2005, we changed the Company’s name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan.

On May 3, 2005 we delisted from the TSX Venture Exchange and effected a consolidation of the Company’s common shares on a one-for-three basis. We maintained the Company’s OTC Bulletin Board listing, however, the Company’s trading symbol was changed to “VCTPF”, which it remained through to July 15, 2009.

Due to economic circumstances and to make the Company’s Company more conducive to investment the shareholders of the Company approved a special resolution to reorganize the capital structure of the Company by a share consolidation of its common shares on the basis of one new share for each eighteen old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 the Company’s trading symbol changed to “VCTZF” and the Company’s CUSIP number changed to 918881202. The Company’s website is located at www.valcent.net

Unless otherwise noted, all references to the number of common shares are stated on a post-consolidation basis.

The Company’s common share authorized share capital remains unlimited.

All amounts are stated in Canadian dollars unless otherwise noted.

We are at present a life sciences targeted, development stage company focused primarily on:

| (i) | the development and commercialization of the Company’s “High Density Vertical Growth System” (“VerticropTM”) designed to produce vegetables and other plant crops, and |

| (ii) | the development and marketing of the Tomorrow GardenTM consumer retail products. |

From inception, we have generated minimal revenues and experienced negative cash flows from operating activities and the Company’s history of losses has resulted in the Company’s continued dependence on external financing. Any inability to achieve or sustain profitability or otherwise secure additional external financing, will negatively impact the Company’s financial condition and raises substantial doubts as to the Company’s ability to continue as a going concern.

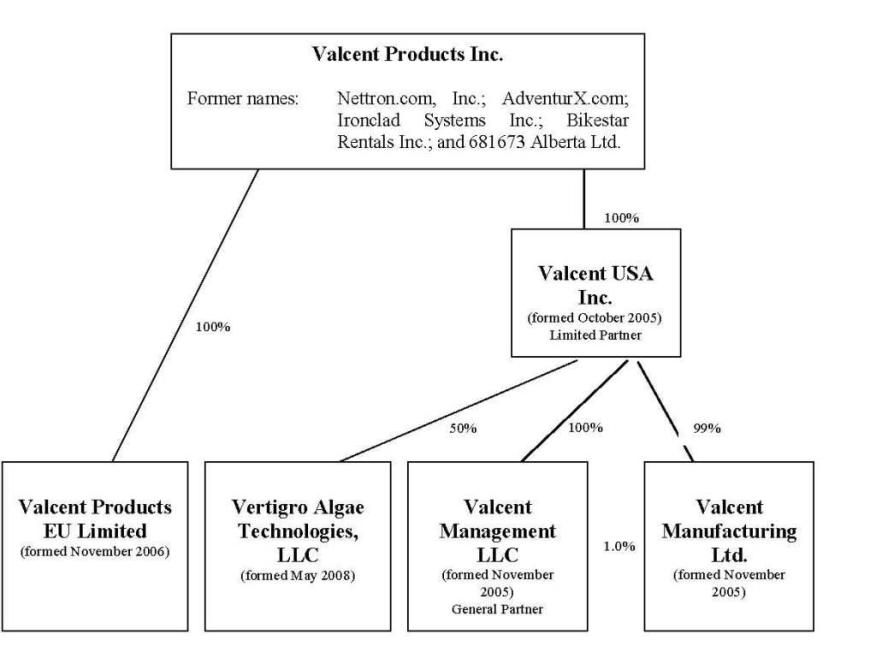

Organizational Structure

The following organizational chart sets forth the Company’s current corporate structure and reflects subsidiary interests relating to the Company’s various entities.

Corporate History

We were incorporated in accordance with the provisions of the Business Corporations Act (Alberta) on January 19, 1996, as 681673 Alberta Ltd., later changed to Ironclad Systems Inc. Beginning in 1996, following the completion of a public offering, the Company’s common shares began trading as a junior capital pool company on the Alberta Stock Exchange (later becoming part of the Canadian Venture Exchange, which was thereafter acquired and renamed the TSX Venture Exchange).

On May 8, 1999, while still operating the Company’s bicycle rental and eco-tour businesses through Bikestar Rentals Inc., we incorporated Nettron Media Group Inc., a wholly-owned subsidiary under the laws of the State of Texas, as a marketing enterprise focusing on products and services that could be effectively marketed through internet as well as more traditional business channels. Nettron Media Group Inc.’s primary focus was Cupid’s Web, an interactive online dating and marketing service. We also changed the Company’s name from Bikestar Rentals Inc. to AdventurX.com, Inc., and later to Nettron.com, Inc.

In 2000, and in connection with Cupid’s Web, we signed an agreement in principle to acquire all of the outstanding capital stock of a group of companies operating a worldwide dating service franchise, as well as a collection of dating magazines and websites.

On January 1, 2001, in order to fully focus on the Company’s interactive dating and marketing services, we disposed of all of the outstanding capital stock of Arizona Outback Adventures LLC and Bikestar Rentals Inc.

On February 18, 2002, due to general weakness in the equity markets, we terminated the agreement in principle to acquire the dating service franchise and related businesses originally entered into in 2000. On March 24, 2004, we disposed of the Company’s interest in Nettron Media Group Inc. and began exploring business opportunities that might allow us to restart commercial operations.

By certificate of amendment dated April 15, 2005, we changed the Company’s name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan. On May 3, 2005 we delisted the Company’s common stock from the TSX Venture Exchange, maintaining only the Company’s OTC Bulletin Board listing and changing the Company’s symbol to “VCTPF”. Effective May 3, 2005, and in order to render the Company’s capital structure more amenable to contemplated financing, we effected a consolidation of the Company’s common shares on a one-for-three-basis.

On August 5, 2005, we completed a licensing agreement with Pagic LLP, formerly MK Enterprises LLC, (“Pagic”) for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products.

In order to facilitate the business plan, the Company formed a wholly-owned Nevada corporation, Valcent USA, Inc. to conduct operations in the United States in October 2005. In turn, Valcent USA, Inc. organized Valcent Management, LLC, a wholly-owned limited liability corporation under the laws of Nevada, to serve as the general partner in Valcent Manufacturing Ltd., a limited partnership also formed by Valcent USA, Inc., under the laws of Texas, wherein Valcent USA, Inc. serves as its limited partner.

Also during the year ended March 31, 2007, Valcent Products EU Limited (“Valcent EU”) was incorporated by Valcent Products Inc. in the domicile of England to conduct operations in Europe.

On May 5, 2008, Valcent Vertigro Algae Technologies LLC, a Texas limited liability corporation, was formed as a 50% owned subsidiary to each of Valcent, USA Inc. and Global Green Solutions Inc. to develop algae related technologies.

The shareholders of the Company approved a special resolution on June 22, 2009 to reorganize the capital structure of the Company through a share consolidation of its common shares on the basis of one new share for each eighteen (1:18) old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 Valcent’s trading symbol changed to “VCTZF” and Valcent’s CUSIP number changed to 918881202. Unless otherwise noted, all references to the number of common shares and or prices(s) per share are stated on a post-consolidation basis.

Evolution of License Agreements with Pagic

Original Master License Agreements - On July 29, 2005, we entered into five related definitive agreements (the “Pagic Agreements”) with Pagic LP (formerly MK Enterprises LLC), an entity controlled by Malcolm Glen Kertz, the Company’s former Chief Executive Officer, and President, including:

| | (i) | a master license agreement for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to three unrelated and proprietary potential consumer retail products that had previously been developed (the “Pagic Master License”), certain of which are patent pending by Pagic, including the Nova Skin Care System, the Dust WolfTM, and the Tomorrow GardenTM Kit (collectively, and together with any improvements thereon, the “Initial Products”); |

| (ii) | the Pagic Master License also included a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Initial Products (the “Initial Ancillaries”); |

| (iii) | a product development agreement pursuant to which we were granted a right for an initial period of five years to acquire a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any new products developed by Pagic (any such products, collectively, the “Additional Products”, and, the agreement itself, the “Pagic Product Development Agreement”); |

| (iv) | the Pagic Product Development Agreement also included a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Additional Products (the “Additional Ancillaries”); and |

| (v) | a related services agreement pursuant to which Pagic shall provide consulting support in connection with the Initial Products, the Initial Ancillaries, the Additional Products and the Additional Ancillaries (the “Pagic Consulting Agreement”), in exchange for the following: |

| 1) | 1,111,112 shares of the Company’s common stock which have been issued; |

| 2) | a one-time US$125,000 license fee (paid); |

| 3) | reimbursement for US$125,000 in development costs associated with each of the Initial Products since March 17, 2005 (paid); |

| 4) | consulting fees of US$156,000 per year, payable monthly in advance, which the Company has paid to date; and |

| 5) | the greater of the following, payable annually beginning in the second license year (beginning April 1, 2007): |

| (i) | US$400,000 inclusive of all consulting fees, royalty and other fees; or |

(ii) the aggregate of the following:

a minimum amount of US$37,500 per Initial Product during the second year of the Pagic Master License, and $50,000 US$ each year thereafter, continuing royalties payable quarterly at a rate of:

| Ø | US$10.00 US per Nova Skin Care System unit sold; |

| Ø | US$2.00 per Dust WolfTM unit sold; |

| Ø | 4.5% of annual net sales of the Tomorrow GardenTM Kit; and |

| Ø | 3% of annual net sales of Initial Ancillaries. |

| 6) | a one-time $50,000 US license fee for each Additional Product licensed (except for one pre-identified product); and |

| 7) | subject to a minimum amount of US$50,000 per year commencing with the second year of each corresponding license, continuing royalties of 4.5% of annual net sales and 3% on annual net sales of any Additional Ancillaries. |

As described below these agreements were terminated effective April 1, 2009.

Vertigro Algae - Beginning on October 2, 2006, we granted certain rights to Global Green relating to a joint venture of the Company’s high density vertical bio-reactor technology named “Vertigro”, an algae biomass technology initiative. On May 5, 2008, the joint venture arrangement pertaining to the development of the algae biomass technology initiative was terminated and Vertigro Algae executed a separate Technology License Agreement (“Technology License”) together with Pagic, and West Peak. The Technology License licenses certain algae biomass technology and intellectual property to Vertigro Algae for purposes of commercialization and exploitation for all industrial, commercial, and retail applications worldwide “Algae Biomass Technology”. Vertigro Algae is currently assessing its continued involvement in the Technology License and has undertaken further negotiations with Pagic in this regard.

Discontinued Product Development Lines and Settlement of Licensed Technologies - Of the Initial Products under license as defined above, the Company ceased development of Dust Wolf and Nova Skin Care Systems during the year ended March 31, 2009 due to economic conditions, and increased corporate focus on life sciences plant growth technologies. The Company has continued with Tomorrow Garden product development and commercialization though the VerticropTM Technology Purchase Agreement.

VerticropTM Technology Purchase Agreement - Effective April 1, 2009, the Company executed a purchase agreement to acquire all ownership rights and intellectual property relating to its VerticropTM vertical plant growing technology and Tomorrow Garden kit technology (the “Technologies”) from Glen Kertz, Pagic, and West Peak and which provides the Company with all rights and know how to the Technologies (the “Purchase Agreement”). Pursuant to this agreement original master license agreements between the Company and Pagic were terminated and this agreement replaced all financial obligations the Company had with Pagic related to the original master license agreements, including annual payments, royalty burden, and all other associated licensing costs. As noted above, all agreements related to the Algae Biomass Technology are with Vertigro Algae and as such survive the termination of all other agreements.

Pursuant to the Purchase Agreement, the Company agreed to pay a total of US$2,000,000 plus issue 3% of its common stock on conclusion of the purchase agreement. The US$2,000,000 is payable on a cumulative basis as to US$65,000 on signing (paid) plus the greater of 3% of the gross monthly product sales less returns from exploitation of the technologies or US$12,000 per month until US$2,000,000 has been paid. The ownership of the Technologies will remain in escrow until fully paid or if the Company defaults in making payments. The issuance of the 3% of its common stock is payable upon release of the Technologies from escrow to the Company. The Company may at any time elect to pay out the remaining balance due. Should the Company default under this agreement the Technologies will revert back to Glen Kertz and Pagic and the Company’s obligations under the Purchase Agreement will cease. The Company expenses amounts paid under the Purchase Agreement. Under the Purchase Agreement an aggregate of $189,295 has been paid to Pagic during the six months ended September 30, 2009. As at November 30, 2009, the Company is in arrears in payments to be made under the Purchase Agreement in the aggregate amount of US$24,000.

PLAN OF OPERATIONS

From inception we have generated minimal revenues from the Company’s business operations and have traditionally met the Company’s ongoing obligations by raising capital through external sources of financing, such as private placement, convertible notes, promissory notes, and director and shareholder advances.

At present, we do not believe that Valcent’s current financial resources are sufficient to meet the Company’s working capital needs in the near term or over the next twelve months and, accordingly, we will need to secure additional external financing to continue the Company’s operations. We anticipate raising additional capital though further private equity or debt financings and shareholder loans. If we are unable to secure such additional external financing, we may not be able to meet the Company’s obligations as they come due or to fully implement the Company’s intended plan of operations, as set forth below, raising substantial doubts as to the Company’s ability to continue as a going concern.

The Company’s primary business development directives are currently being carried out through the Company’s UK offices. Chris Bradford, the Managing Director, of Valcent Products EU Limited, and now President and Director of the Company, is responsible for UK business operations and the Company’s “Tomorrow GardenTM” retail plant sales initiative, as well as development of VerticropTM market development and sales rollout.

The Company’s plan of operations over the course of the next twelve months, subject to adequate financing, is to focus primarily on the continued development and marketing of the Company’s VerticropTM vertical plant growing systems, development and distribution of the Company’s lines of potential consumer retail Tomorrow Garden products. The Company’s continued involvement with Vertigro Algae is currently under review and negotiation but is not currently a primary focus of the Company.

More specifically, the Company’s plan of operations with respect to each of the Company’s lines of potential retail and commercial products is provided as follows:

VerticropTM Commercial Plant Growth Systems

Valcent Products Inc. has introduced its “VerticropTM” vertical farming system which grows a wide variety of crop products. The Company initially began experimenting with vegetable crops and urban agriculture growing system within its greenhouse production facilities in El Paso, Texas, however, during the year ended March 31, 2009, the Company’s development efforts shifted to Valcent EU where it conducted detailed research and subsequently developed commercial scale growing system.

VertiCrop™ Technology – Concept and Advantages: The VertiCrop™ technology provides a solution to rapidly increasing food costs caused by transportation/fuel due to the cost of oil. Together with higher cost comes a reduction in availability and nutritional values in the food people consume. The VertiCrop™ is designed to grow vegetables and other plants much more efficiently and with greater food value than in agricultural field conditions.

As the world population increases, agricultural land and water resources rapidly diminish. Alternative and innovative solutions have to be found to feed people and reduce the consumption of water, land, energy, and food miles.

VerticropTM is an innovative and exciting vertical growing system which:

| · | Produces up to 20 times the normal production volume for field crops |

| · | Requires approximately 5% of the normal water requirements for field crops |

| · | Can be built on non arable lands and close to major city markets |

| · | Can work in a variety of environments: urban, suburban, countryside, etc. |

| · | Minimizes or eliminates the need for herbicides and insecticides |

| · | Will have very significant operating and capital cost savings over field agriculture |

| · | Will drastically reduce transportation costs to market, resulting in further savings, higher quality and fresher foods on delivery and less transportation pollution |

| · | Is modular and easily scalable from small to very large food production situations |

The VertiCrop™ grows plants in closely spaced shelves vertically arranged on panels that are moving on an overhead conveyor system. The system is designed to provide maximum sunlight and precisely correct nutrients to each plant. Ultraviolet light and filter systems may exclude the need for herbicides and pesticides. Sophisticated control systems gain optimum growth performance through the correct distribution of nutrients, the accurate balancing of PH and the delivery of the correct amount of heat, light and water.

System Advantages

| | | reduced global transport costs and associated carbon emissions |

| | | food and fuel safety, security and sovereignty |

| | | local food is better for public health |

| | | building local economies |

| | | control of externalities and true costs |

In a rapidly urbanizing world where the majority of people now live in cities, localization requires that food and fuel be produced in an urban context. Urban agriculture presents a number of technological challenges. The main challenge is a lack of growing space.

Vertical growing is a new idea currently emerging in the sustainability discourse which offers great promise for increasing urban production. Vertical growing systems have been proposed as possible solutions for increasing urban food supplies while decreasing the ecological impact of farming. The primary advantage of vertical growing is the high density production it allows using a much reduced physical footprint and fewer resources relative to conventional agriculture. Vertical growing systems can be applied in combination with existing hydroponics, and greenhouse technologies which already address many aspects of the sustainable urban production challenge (i.e., soil-free, organic production, closed loop systems that maximize water and nutrient efficiencies, etc.). Vertical growing, hydroponics and greenhouse production have yet to be combined into an integrated commercial production system, but, such a system would have major potential for the realization of environmentally sustainable urban food and fuel production.

Commercial Deployment of First VerticropTM System – Paignton Zoo, Devon, UK: The Company via its UK subsidiary has in the summer months of 2009 deployed its first commercial test installation of its VerticropTM technology at the Paignton Zoo Environmental Park located in Devon, UK. The Paignton Zoo is one of the largest zoos in the UK. The Zoo is part of South West Environmental Parks Ltd which is owned by the Whitley Wildlife Conservation Trust. It is a combined zoo and botanic garden that welcomes over half a million visitors a year. The VerticropTM System installed at Paignton Zoo is meant to grow more plants in less room using less water and less energy. It will help to reduce food miles and bring down the Zoo’s annual costs for animal feed, which is currently in excess of £200,000 a year. The zoo will grow a whole range of herbs such as parsley and oregano, as well as leaf vegetables like lettuce and spinach, plus a range of fruits such as cherry tomato and strawberry. Reptiles, birds and most of the mammal collection - including primates and big cats -- will benefit from the production of year-round fresh food. The system which was a joint venture between Valcent Products EU Limited and the Paignton Zoo Environmental Park became operational on August 5, 2009, and will supply necessary data to the Company of semi-commercial crop yields, and other data for further commercialization of the VerticropTM System.

Verticrop Warehouse Systems: The Company is also developing a new VerticropTM product line for use in a warehouse environment. Using the latest horticultural lighting technologies, combined with state of the art irrigation and nutrient delivery systems, Valcent EU is in the final stages of developing a commercial application of its VerticropTM system suitable for installing in industrial type warehouses, as an alternative to polytunnels or glasshouses. A warehouse environment will provide a commercial grower with significant benefits, particularly in areas of climate extremes. Growing crops in a glasshouse or polytunnel can involve high energy costs to maintain stable temperatures suitable for healthy plant growth. Growing in a warehouse environment with a VerticropTM vertical farming system is designed to improve production and lower costs. Valcent EU’s research team has been working with two strategic partners who are acknowledged experts in the field of industrial lighting. This research has lead to the development of a commercially viable eco-friendly system, particularly well suited to application in a warehouse environment. The VerticropTM warehouse growing system will also use a hybrid lighting system, harnessing and channeling heat free natural daylight, complemented by the latest LED horticultural lighting technology.

Tomorrow GardenTM

Valcent’s Tomorrow GardenTM Kit is an indoor herb garden kit, designed to offer, direct to the consumer, an easy to use kit featuring herbs and plants not otherwise readily available in the marketplace. The Tomorrow GardenTM Kit offers an improved plant lifespan of up to three to six months, as opposed to the traditional shelf life of approximately seven to ten days for fresh herbs, and requires only ambient light, with no watering or other maintenance, to survive. The Company’s Tomorrow GardenTM Plant Kit will be capable of supplying all of the standard herbs traditionally offered in grocery shops today, such as basil, mint, thyme, rosemary, parsley and cilantro, but may, in addition, supply more exotic herbs or pharmaceutical grade plants. The Company’s Tomorrow GardenTM Kit is currently in the design, development, and test sales phase operating out of the Company’s offices located in Cornwall, England. First selected retail applications are aimed at children and education channels.

The Tomorrow Garden gift kits offer an easy to use growing system for a range of interesting and attractive plants.

Each Tomorrow Garden kit contains:

| · | a micropropagated plantlet |

| · | a membrane which enables the plants to grow and stay fresh for 3-6 months in normal light without the need for watering |

| · | a coir growing pot and compost |

The official launch of the Tomorrow Garden was premiered at the BBC Gardeners’ World Exhibition at the NEC in Birmingham on June 11 – 14, 2008, with a follow-up at the Royal Horticultural Society’s Hampton Court Flower Show on July 8 -13, 2008.

Currently our kits are aimed at the Junior/Educational market sector. As ferns have been around since pre-historic times, and are known to have provided a large proportion of the diet of the herbivore dinosaurs, the emphasis will be on inviting children in the 7yrs – 14 yrs age group to grow “dino food”. Growing kits have been designed in the appropriate packaging, reflecting the dinosaur theme.

Valcent EU is also culturing a number of more exotic plant species (such as orchids) so that it can both follow-up and compliment its initial products. It is also developing a range of culinary herbs and are reviewing a number of other options. Finally, through “in house” expertise, Valcent EU is researching the development of a range of Chinese medicinal herbs, which can be sold in “growing kit” form through “alternate medicine” outlets or (ultimately) to pharmaceutical companies involved in this field of research.

Fluctuations in Results

During the period from March 24, 2004 through the year ended March 31, 2005, we had no meaningful operations and focused exclusively on identifying and adopting a suitable business plan and securing appropriate financing for its execution. During the fiscal year ended March 31, 2006, operating results have fluctuated significantly and past performance should not be used as an indication of future performance.

| Valcent Products Inc. |

| Selected Financial Data [Annual] |

| (Expressed in Canadian Dollars) |

| | 12 months ended |

| | | 2009 | 2008 | 2007 |

| Net Operating Revenues | $ | 0 | 0 | 0 |

| Loss from operations | $ | 15,337,285 | 12,028,222 | 8,171,090 |

| | | | | |

Other Loss (Income) | $ | 2,548,205 | 684,136 | (32,697) |

| Net loss per Canadian GAAP | $ | 17,885,490 | 12,712,358 | 8,138,393 |

| Loss per share | $ | 6.43 | 6.44 | 7.60 |

| | | | | |

| Share capital | $ | 21,957,516 | 16,691,282 | 8,196,982 |

| Common shares issued | | 3,008,977 | 2,459,796 | 1,703,670 |

| Weighted average shares outstanding | | 2,782,284 | 1,974,763 | 1,070,066 |

| Total Assets | $ | 2,351,963 | 4,605,914 | 4,142,485 |

| Net Liabilities | $ | 1,031,226 | 4,009,472 | 24,376 |

| | | | | |

Cash Dividends Declared per Common Shares | $ | 0 | 0 | 0 |

| | | | | |

Exchange Rates (US $ = CDN $1) period average | $ | 0.88839 | 0.97084 | 0.87896 |

Exchange Rates (British Pound £ = CDN $1) period average | $ | 0.52433 | 0.48368 | n/a |

Restructuring Initiatives

The debt settlements, lockup, and convertible debt restructuring (described below) are a part of the Company’s plan to substantially reduce its debt and restructure the Company’s capital structure to enable further funding initiatives pursuant to its business operations. As part of its restructuring, the Company held a special meeting of its shareholders on June 22, 2009 who approved a stock consolidation of one new share for each eighteen old shares. This share consolidation became effective on July 16, 2009. The Company continues to have obligations pursuant to the four convertible note holders in the aggregate of US$1,323,000, described below - July 2008 Convertible Note Amendments, and in conjunction with its re-organization and funding efforts incurred additional debt also described below – “2009 Debt and Conversion of Debt to Equity”.

Debt Settlement Agreements and Lockup Agreements

Concluding on May 11, 2009, but effective for accounting purposes as of March 31, 2009, Valcent Products, Inc. (the “Company”) entered into agreements with a significant number of the Company’s creditors to settle or restructure a significant portion of the Company’s indebtedness in consideration for shares of the Company’s common stock. The Company settled an aggregate of US$10,806,780 representing these balances in exchange for 29,516,955 common shares issued on May 11, 2009. Included in these shares are 24,232,816 common shares which are subject to pooling restrictions with quarterly equal releases beginning on January 1, 2010, a further 2,634,135 common shares were subject to pooling restrictions until January 1, 2010. Also included in these shares are 1,316,424 shares issued in settlements of debts involving current officers or directors of the Company, and 391,298 were issued to a past director and officer of the Company, all of which are subject to the lockup agreements.

July 2008 Convertible Note Amendments

As part of the overall debt restructuring, the Company also entered into agreements with each of the Company’s secured creditors and amended the terms of the four secured convertible promissory notes issued in July 2008 in the aggregate principal amount of US$2,428,160 (collectively the “Notes”). One of the Notes is held by the Company’s chief financial officer and member of the board of directors (being a Note in the principal amount of US$188,160).

By their original terms the Notes were to be due on or before July 16, 2009, however all of the parties agreed to extend the maturity date of the Notes until December 31, 2009. On June 2, 2009, pursuant to the modified contractual arrangements, the Company paid US$400,000 to certain of the holders of the Notes (with the exception of the Company’s chief financial officer and member of the board of directors) to pay down the principal amount due and owing under the Notes. All holders of the Notes also agreed to provide the Company or its designee an option to purchase on or before December 31, 2009 the Notes and the remaining amounts due under them, being US$1,323,000 as of December 31, 2009. Further, through December 31, 2009 each Note holder has agreed not to effect any conversions of the Notes into shares of the Company’s common stock.

In consideration for the amendments and accommodations to the Notes, the Company agreed to pay each holder consideration that was comprised of the prepayment of interest that otherwise would have been due and owing on the Notes through December 31, 2009 and amounts that would have been due under the Notes pursuant to their terms, including the original issuance discount and prepayment premium. This consideration was paid to each Note holder in the form of Company common stock. In total the Company issued 2,892,036 shares of its common stock to the four Note holders. However, each of the holders entered into an agreement whereby each agreed to not sell these shares until January 1, 2010. The Company reserves the right to change lock up arrangements at its discretion.

Each Note holder also agreed to waive any adjustment to the exercise price of the warrants issued to the holders as part of the July 2008 financing that may have resulted from the issuances of shares of Company common stock as part of the Company’s overall debt restructuring and/or from certain other contemplated Company issuances. However, subject to certain exceptions, the Company agreed that if before March 31, 2010 the Company issues shares of its common stock at a price less than the valuation of the shares issued to each Note holder (US$0.40 per share), that the Company would issue each holder additional shares of Company common stock in a number equal to the difference between the number of shares each holder would have received had the consideration paid to the holder been paid in shares at the lower valuation. If the US$1,323,000 face amount required to retire these notes is not paid on or before December 31, 2009, the promissory notes revert to the terms and conditions original secured convertible note transaction documents including security agreement originally executed in July 2008 which remain valid and in effect. The repayment of the US$1,323,000 face amount required to retire these notes is subject to financing.

2009 Financing, and 2009 Debt Conversion to Equity

On March 26, 2009, the Company entered into a subscription agreement for an investment of up to US$2,000,000 in convertible units with a single subscriber. The subscription funds bear interest at 10% and the issuance of the units are subject to the completion of the Company’s reverse consolidation which occurred on July 16, 2009. The subscription advances and accrued interest were converted into units of common securities at the rate of US$0.125 per unit on July 17, 2009, the date upon which the Company effected a reverse share consolidation. Each unit consisted of one restricted common share and one-third share purchase warrant with each whole warrant exercisable into one common share at an exercise price of US$0.45 per share until July 17, 2010. The warrants may be exercised on a cashless basis.

As at March 31, 2009, the Company had received US$500,000 ($630,650) which has been reflected as a promissory note payable in the financial statements. During the year ended March 31, 2009, the Company accrued US$685 interest on the principal balance of this advance. On May 22, 2009, the balance of US$1,500,000 was received.

The Company completed the reverse share consolidation on July 16, 2009 and on July 17, 2009, the Company issued 16,303,562 common shares pursuant to the conversion of US$2,000,000 in convertible subscription advances and interest of US$37,945 and also issued 5,434,521 warrants to purchase 5,434,521 common shares at an exercise price of US$0.45 per share until July 17, 2010. Any shares issued to this subscriber upon the conversion of the notes would not be subject to lock up arrangements, but the subscriber is deemed an affiliate of the Company owing to shareholdings greater than 20% ownership and as such is subject to certain selling restrictions.

During the period April 1, 2009 through June 22, 2009, the Company received subscriptions to a 10% convertible promissory note in the aggregate of US$176,240. The note and accrued interest have been converted into units at the rate of US$0.40 per unit. Each unit consists of one restricted common share and one share purchase warrant to purchase an additional restricted common share at an exercise price of US$0.60 per share for a two year term from the date of conversion. On July 17, 2009, the Company issued 458,139 common shares pursuant to the conversion of US$176,240 in convertible notes and interest of US$3,777 and also issued 458,139 warrants to purchase 458,139 common shares at an exercise price of US$0.60 per share until July 17, 2011.

During September, 2009, the Company received subscriptions to a 10% promissory note in the aggregate of US$210,000. These promissory notes were settled subsequent to September 30, 2009 through the issuance of 528,492 units at US$0.40 per unit. Each unit consisted of one restricted common share and one share purchase warrant to purchase an additional restricted common share at an exercise price of US$0.60 per share until October 22, 2011.

On October 26, 2009 through November 19, 2009, the Company issued an aggregate of 825,000 common shares and 825,000 warrants to purchase 825,000 common shares at an exercise price of US$0.60 per share until October 26, 2011 for US$330,000. The Company issued 35,000 finders warrants on like terms to those warrants issued in connection with 500,000 shares and 500,000 warrants issued.

During November, 2009, the Company received subscriptions of US$220,000 for private placement units comprised of 550,000 common shares and 550,000 warrants to purchase 550,000 common shares at an exercise price of US$0.60 per share for a two year term from the date of closing. As at November 30, 2009, these shares and warrants had not been issued.

Services Agreements

The Company has agreed to issue 200,000 shares during the fiscal year ended March 31, 2010 in connection with a public relations services agreement, subject to cancellation. The Company issued 50,000 shares under this agreement during the six months ended September 30, 2009, and a further 50,000 shares have been issued subsequent to September 30, 2009. The Company also issued 25,000 shares in connection with an internet services agreement during the six months ended September 30, 2009.

Selected Quarterly Financial Data

Valcent Products Inc. Selected Financial Data [Unaudited] (Expressed in Canadian Dollars) | | | | | | | |

| | | Quarter Ended 09/30/2009 | Quarter Ended 06/30/2009 | Quarter Ended 03/31/2009 | Quarter Ended 12/31/2008 | Quarter Ended 09/30/2008 | Quarter Ended 06/30/2008 | Quarter Ended 03/31/2008 | Quarter Ended 12/31/07 |

| | | | | | | | | | |

| Net operating revenues | $ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Loss from operations | $ | 1,198,609 | 1,323,493 | 3,704,702 | 4,547,838 | 4,077,677 | 3,007,068 | 5,140,674 | 3,482,692 |

| Net loss per canadian GAAP | $ | 1,170,536 | 996,043 | 5,297,776 | 5,566,158 | 4,075,475 | 2,916,081 | 6,364,394 | 3,495,735 |

| Loss per share from continued operations | $ | 0.03 | 0.05 | 1.78 | 1.96 | 1.49 | 1.12 | 2.73 | 1.81 |

| Share capital | $ | 41,113,440 | 38,233,186 | 21,957,516 | 20,543,236 | 19,482,091 | 18,620,606 | 16,691,282 | 13,322,958 |

| Common shares issued | | 49,675,133 | 32,838,591 | 3,008,977 | 2,932,718 | 2,793,016 | 2,679,613 | 2,459,795 | 2,234,935 |

| Weighted average shares outstanding | | 46,552,598 | 19,408,871 | 2,982,909 | 2,832,856 | 2,725,336 | 2,590,304 | 2,328,672 | 1,857,651 |

| Total assets | $ | 2,178,450 | 2,500,313 | 2,351,963 | 4,001,862 | 4,230,595 | 4,330,428 | 4,605,914 | 4,434,893 |

| Net assets (Liabilities) | $ | (414,136) | 487,424 | (1,031,226) | (10,716,836) | (5,984,732) | (4,633,652) | (3,068,935) | (2,329,107) |

| | | | | | | | | | |

| Cash dividends declared per common shares | $ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | | | | | | | | | |

| | | | | | | | | | |

SIX MONTHS ENDED SEPTEMBER 30, 2009

COMPARED WITH THE SIX MONTHS ENDED SEPTEMBER 30, 2008

OVERVIEW OF THE SIX MONTHS’ ACTIVITIES:

During the six months ended September 30, 2009, the Company focused on the following business initiatives:

| (i) | the development and commercialization of Valcent’s “High Density Vertical Growth System” (“VerticropTM” designed to produce vegetables and other plant crops, |

| (ii) | the development and marketing of the Tomorrow GardenTM consumer retail product in Valcent’s UK based subsidiary, |

| (iii) | restructuring activities as noted above, and |

| (iv) | an assessment and rationalization of the development of a commercial algae growing technology via Vertigro Algae. |

During the six months ended September 30, 2008, we focused on the following business initiatives:

| (i) | the development of a commercial algae growing technology via Vertigro Algae, |

| (ii) | the development of Valcent’s VerticropTM High Density Vertical Growth System designed to more efficiently produce certain plant crops, |

| (iii) | the development and test marketing of the Tomorrow Garden TM consumer retail product in the Company’s UK based subsidiary, |

| (iv) | the development of product inventories and direct test and sales initiatives and product introduction promotion relating to the Company’s Nova Skin Care System, |

| (v) | ongoing research and development with tissue culture technologies, plant growth stimulation technologies, and other product and technology development initiatives, |

Operating Results

We incurred net losses of $2,166,368 for the six months ended September 30, 2009, compared to $6,991,556 for the six months ended September 30, 2008. The decrease during the six months ended September 30, 2009 over the same quarter in the previous year is largely a result of the discontinuance of Nova Skin Care Products marketing and product testing, decreased number of active development projects, cost streamlining due to global economic circumstances, and decreased research and development costs relating to the Vertigro Algae in the United States.

For the six months ended September 30, 2009 and September 30, 2008, the Company had no revenue.

Operating Expenses

Product development expenses decreased by $2,435,780 to $1,218,687 for the six months ended September 30, 2009 as compared with the six months ended September 30, 2008. The decrease is due to financial constraints which resulted in the scaling back Vertigro Algae operations in the Company’s El Paso research facility. During the six months ended September 30, 2009, the Company’s primary product development expenses were directed towards the commercialization of the Company’s VerticropTM System and Tomorrow GardenTM product lines operated out of Valcent’s UK operating offices only. Product development expenses were $3,654,467 during the six months ended September 30, 2008, and were primarily focused on the development of the Vertigro Algae technologies and the marketing of the Nova Skincare system, the development of which was terminated March 2009.

In conjunction with convertible debenture financings during the year ended 2009 and in the first quarter of fiscal 2010, the Company incurred $315,420 in interest, accretion, and financing on convertible and promissory notes in the six months ended September 30, 2009. This represents a $1,124,871 decrease from the $1,440,291 that had been incurred during the six months ended September 30, 2008. The large decrease over the previous period in the prior year is due to the settlement as at March 31, 2009 of most debt instruments for equity as part of reorganization initiatives initiated during the last six months

Professional fees increased by $98,026 to $170,262 for the three six months ended September 30, 2009 from $272,131 for the six months ended September 30, 2008. The increase is primarily attributable to costs associated with increased volume of transactions and complex financial accounting issues relating to restructuring initiatives undertaken including audit fees and accounting charges, as well as intellectual property legal services, and technology acquisition negotiations between the respective years.

Office and miscellaneous expenses decreased $90,511 to $148,212 for the six months ended September 30, 2009 from $238,723 for the six months ended September 30, 2008. The decrease is primarily due to the scale back of activity in the Company’s US subsidiary and cost streamlining in the current period.

Filing and transfer agent expenses increased $32,929 to $44,792 for the six months ended September 30, 2009, from $11,864 for the six months ended September 30, 2008. The increase is primarily attributable to costs associated with the increase in activity relating to the Company’s restructuring initiatives and shareholder meeting costs incurred in the current period.

Investor relations fees decreased $500,952 to $89,769 (2008 - $590,721) for the six months ended September 30, 2009 as a result of a decreasing number of third party consultants in advisory, business consulting services, and investor relations activities.

Travel expenses decreased by $48,579 to $115,774 (2008 - $164,353) for the six months ended September 30, 2009 as a result of decreased activity in all of the Company’s operations, decreased number of active development projects, as well as cost streamlining due to global economic circumstances.

Rent expenses decreased $11,602 to $60,749 for the six months ended September 30, 2009 from $72,351 for the six months ended September 30, 2008, owing to foreign currency fluctuations.

Advertising and media development was $79,630 during the six months ended September 30, 2009 and was significantly lower by $291,323 than for the same period in 2008 ($370,953) owing to the cessation of marketing costs related to the Nova Skin Care System.

There were no options issued to directors, officers, employees and consultants of the Company and thus the Company did not incur stock option compensation expenses during the six months ended September 30, 2009 (2008 - $0).

Non-cash financing expense was $0 during the six months ended September 30, 2009 as compared to $181,258 during the six months ended September 30, 2008. The decrease was due to financing charges related to a convertible note financing undertaken in July, 2008.

Other Income

Due to fluctuations, primarily, in the United States dollar in relation to the Canadian dollar, the Company incurred a foreign exchange gain of $355,734 during the six months ended September 30, 2009 as compared to a gain of $93,189 during the six months ended September 30, 2008.

Liquidity and Capital Resources

Because we are organized in Canada, the Company’s September 30, 2009 financial statements have been prepared by the Company’s management in accordance with Canadian GAAP applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business.

The Company’s accumulated losses during the development stage increased by $2,166,368 to $44,339,497 for the six months ended September 30, 2009.

The Company’s working capital deficit as at September 30, 2009 was $1,483,306 which was down from $2,101,443 as at March 31, 2009. This decrease was primarily achieved through debt settlement and restructuring initiatives, but there still remains substantial doubt as to the Company’s ability to continue as a going concern.

The Company’s ability to continue as a going-concern is dependent upon the economic development of its products, the attainment of profitable operations and the Company’s ability to obtain further financing. The Company is currently seeking additional funding to finance its operations and obligations. Management is considering all possible financing alternatives, including equity financing, debt financing, joint-venture, corporate collaboration and licensing arrangements. However, there can be no assurance that the Company will be successful in its financing efforts or in the success of its products.

During the six months ended September 30, 2009, the Company issued 29,516,955 common shares in settlement of $13,662,915 of debt, 312,500 common shares on the conversion of $315,882 in convertible notes, 16,761701 common shares for private placement of $2,147,730, and 75,000 common shares for services received in the amount of $56,966. The Company’s issued and outstanding shares as at September 30, 2009 were 49,675,133.

As at September 30, 2009, accounts receivable of $860,929 consists of $720,756 due from Global Green Solutions Inc., the Company’s Joint Venture partner in Vertigro Algae product development, with the balance primarily due from value added tax receivable by the Company’s subsidiary, Valcent Products EU Limited, and goods and services tax receivable by the Company.

During the six months ended September 30, 2009, the Company used a total of $1,883,069 in cash related to its operations. This cash was funded from the proceeds of private placements as to $1,736,250, related party advances as to $352,791 and share subscriptions as to $229,598. The Company also acquired $77,864 in property and equipment and repaid $445,851 in debt during the six months ended September 30, 2009. In total the Company used a total of $88,145 more cash than it raised during the six months ended September 30, 2009 leaving it with a cash and cash equivalents balance of $136,624.

We currently have approximately $150,000 in cash as at November 25, 2009.

SUBSEQUENT EVENTS TO SEPTEMBER 30, 2009

Unless otherwise noted in Management’s Discussion and Analysis, the following events occurred after September 30, 2009:

| · | During September, 2009, the Company received subscriptions to a 10% promissory note in the aggregate of US$210,000. These promissory notes were settled on subsequent to September 30, 2009 through the issuance of 528,492 units at US$0.40 per unit. Each unit consisted of one restricted common share and one share purchase warrant to purchase an additional restricted common share at an exercise price of US$0.60 per share until October 22, 2011. |

| · | The Company issued an aggregate of 825,000 common shares and 825,000 warrants to purchase 825,000 common shares at an exercise price of US$0.60 per share until October 26, 2011 for US$330,000. In conjunction with these issuances the Company issued 35,000 finders warrants on like terms. |

| · | The Company also issued 50,000 common shares pursuant to obligations under a public relations agreement |

| · | During November, 2009, the Company received subscriptions of US$220,000 for private placement units comprised of 550,000 common shares and 550,000 warrants to purchase 550,000 common shares at an exercise price of US$0.60 per share for a two year term from the date of closing. To date these securities have not been issued. |

RISKS

The business of the Company entails significant risks, and an investment in the securities of the Company should be considered highly speculative. An investment in the securities of the Company should only be undertaken by persons who have sufficient financial resources to enable them to assume such risks. The following is a general description of some of the material risks, which can adversely affect the business and in turn the financial results, ultimately affecting the value of an investment the Company.

We Have A History Of Operating Losses And We May Have Operating Losses And A Negative Cash Flow In the Future

We Need Additional Financing To Meet The Company’s Current And Future Capital Needs And We May Not Be Able To Secure That Financing

We Have Only Limited Experience As A Public Reporting Company Which May Place Significant Demands On The Company’s Operations

The Company’s Inability To Attract And Retain New Personnel Could Inhibit The Company’s Ability To Grow Or Maintain The Company’s Operations

There Is Only A Limited Market For The Company’s Common Shares

The Price Of The Company’s Common Shares May Be Volatile Which Could Result In Substantial Losses For Individual Shareholders

As Of The Date Of This Report The Company Is Not Carrying Any Insurance On Its EL Paso Facilities Which Could Result In A Significant Loss

The Company operates in the United States and the United Kingdom as well as Canada and as such is subject to foreign currency fluctuations which can significantly impact on its financial results. The Company does not engage in any hedging arrangements to mitigate these risks.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a material adverse affect on the Company’s financial condition or results of operations.

CONTRACTUAL OBLIGATIONS

As of September 30, 2009, we had the following contractual obligations not otherwise noted in this Management’s Discussion and Analysis:

The Company leases office and development space in Launceston, Cornwall, UK under a ten-year lease ending on November 15, 2017 at a quarterly cost of $22,662 (GB£12,550). Remaining commitments as at September 30, 2009 are as follows:

| 2010 | $ 45,324 |

| 2011 | 90,649 |

| 2012 | 90,649 |

| 2013 | 90,649 |

| 2014 | 90,649 |

| Thereafter | 328,601 |

| | $ 736,521 |

The Company has agreed to issue 200,000 shares during the fiscal year ended March 31, 2010 in connection with a public relations services agreement, subject to cancellation. The Company issued 50,000 shares under this agreement during the six months ended September 30, 2009, and a further 50,000 shares have been issued subsequent to September 30, 2009.

RELATED PARTY TRANSACTIONS DURING THE SIX MONTHS ENDED SEPTEMBER 30, 2009 COMPARED WITH THE SIX MONTHS ENDED SEPTEMBER 30, 2008

| | | Sep. 30, 2009 | | Sep. 30, 2008 |

(a) Pagic | | | $ - | | $ 153,480 | |

(b) CFO | | | 22,000 | | 15,014 | |

| (c) Consulting services and unsecured loan advances | | | 7,434 | | 57,364 | |

| (d) Consulting services and unsecured loan advances | | | 448,715 | | 1,357,545 | |

(e) Operational management consulting | | | 61,287 | | 61,638 | |

(f) Unsecured loan advances | | | - | | - | |

| | | | $ 539,436 | | $ 1,645,041 |

Amounts due to related parties have no specific terms of repayment and are non interest bearing unless advanced as short term debt. Due to related parties includes the following amounts at September 30 in respect to certain of the above transactions:

Related party transactions are in the ordinary course of business and are measured at the exchange amount at the time the agreement is entered into or services are provided. Related party transactions not disclosed elsewhere in these financial statements are as follows:

| | For the six months ended | | For the six months ended | |

| | Sep. 30, 2009 | | Sep. 30, 2008 | |

(a) Pagic, a company related by a past common officer and director for: | | | | |

(i) Net payments for Verticrop technology purchase agreement in 2009; product development expenses including royalties during 2008 | $ | 189,295 | | $ | 129,410 | |

(ii) Exchange of amounts settled at March 31, 2009 for issuance 391,298 common shares for US$156,519 | shares issued | | | - | |

(iii) Issued 16,667 common shares to Pagic under Technology License Agreement for $190,746 | | - | | shares issued | |

(b) The Company’s Chief Financial Officer (“CFO”) and director for: | | | | | | |

(i) Charges for professional fees | $ | 18,000 | | $ | 9,000 | |

(ii) Net short-term advances, at 8-10% interest per annum | $ | 4,000 | | $ | 2,138 | |

(iii) Exchange of amounts settled at March 31, 2009 for issuance 1,085,690 common shares for US$336,585 | shares issued | | | - | |

(iv) Repayment of loan advances | $ | 19,105 | | | - | |

(c) Charges from private companies with CFO and director in common for: | | | | | | |

(i) Office rent | $ | 15,000 | | $ | 15,000 | |

(ii) Consulting fees | $ | 57,000 | | $ | 75,000 | |

(iii) Repayments of advances and charges | $ | 107,355 | | $ | 10,000 | |

(iv) Exchange of amounts settled at March 31, 2009 for issuance of 114,826 common shares for US$45,930 | shares issued | | | - | |

(d) West Peak and its principal shareholder, a beneficial owner of more than 5% of the Company’s common shares: | | | | | | |

(i) Unsecured net loan advances, 8% interest per annum | $ | 294,661 | | $ | 314,250 | |

(ii) Consulting fees | $ | 182,054 | | | - | |

(iii) Exchange of amounts settled at March 31, 2009 for issuance of 4,722,204 common shares for US$1,491,754 | shares issued | | | - | |

(e) Two directors for: | | | | | | |

(i) Operational management consulting and investor relations services and a related company | $ | 54,864 | | $ | 80,250 | |

(ii) Exchange of amounts settled at March 31, 2009 for issuance of 46,875 common shares for US$18,750 | shares issued | | | - | |

(iii) Payments inclusive of expenses | $ | 54,083 | | | - | |

(f) A director for: | | | | | | |

(i) Loans received with 8% interest | | - | | $ | 105,242 | |

| | | | | | | |

There are no legal actions either in process or pending and we are not aware of any contemplated, legal, governmental or arbitration proceedings, including those related to bankruptcy, receivership or those involving a third party which have, or may have, significant effects on the Company’s financial position or profitability.

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking information and statements including opinions, assumptions, estimates and expectations of future production, cash flows and exploration results. Forward-looking statements include information that does not relate strictly to historical or current facts. When used in this document, the words “anticipate”, “believe”, estimate”, “expect”, “forecast”, “intent”, “may”, “project”, “plan”, “potential”, “should” and similar expressions are intended to be among the statements that indentify forward-looking statements.

Forward-looking statements are not guarantees of future performance and are subject to a wide range of known and unknown risks and uncertainties, and although the Company believes that the expectations represented by such forward-looking statements are reasonable, there can be no assurance that such expectations will be realized. Any number of important factors could cause actual results, future actions, conditions or events to differ materially from those in the forward-looking statements, including, but not limited to, the ability to implement corporate strategies, the state of domestic capital markets, the ability to obtain financing, operating risks, changes in general economic conditions, and other factors. Undue reliance should not be placed on forward-looking statements as the Company can give no assurance that they will prove to be correct.

The forward-looking statements contained in this MD&A are made as of the date hereof. While the Company acknowledges that subsequent events and developments may cause the views expressed herein to change, the Company has no intention and undertakes no obligation to update, revise or correct such forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities law.

The Company believes that the expectations reflected in the forward-looking statements and information contained herein are reasonable, but no assurance can be given that these expectations, or the assumptions underlying these expectations, will prove to be correct and such forward-looking statements and information included in this document should not be unduly relied upon. The forward-looking information included herein represents the Company’s views as of the date of this document and such information should not be relied upon as representing the Company’s views as of any date subsequent to the date of this document. We have attempted to identify important factors that could cause actual results, performance or achievements to vary from those current expectations or estimates expressed or implied by the forward-looking information. However, these factors are not intended to represent a complete list of the factors that could affect us and there may be other factors that cause results, performance or achievements not to be as expected or estimated and that could cause actual results, performance or achievements to differ materially from current expectations. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those expected or estimated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

The risks and uncertainties that could affect future events or the Company's future financial performance are more fully described in the Company's annual reports (on Form 20-F filed in the U.S. and Canada) and the other recent filings in the U.S. and Canada. These filings are available at www.sec.gov in the U.S. and www.sedar.com in Canada.

COMPANY INFORMATION

Additional information related to Valcent Products, Inc. is available on SEDAR’s website at www.sedar.com and EDGAR’s website at www.sec.gov.